by Paul F | Feb 20, 2018 | Entrepreneurship, Innovation, Investing, Science, Trends

Tesla has stuck a deal to put solar panels and Powerwall batteries on 50,000 homes in Southern Australia. The homeowners will not pay for the equipment. They won’t even own it. Instead the equipment will be owned by the utility company, and the 50,000 homes will become a “virtual” power plant – operating as independent pieces of a giant grid. For everyone in the system this will lower power costs by over 30%, and improve the performance where outages are a big problem.

This is really, really smart. The old way of thinking about power generation was a big plant, usually coal, gas or oil powered. Or, a giant group of solar panels in a desert, or a giant group of windmills. Or, a nuclear-powered plant. This centralized generation is then shipped over power lines to homes and businesses.

The problem is that transmission can lose anywhere from 20% to 80% of the power. Thus, the bigger the plant in theory the lower the power cost – but that is only for generation. After factoring in the cost of transmission losses, and the cost of building and maintaining transmission lines, the cost can be quite high. And thus the resulting never-ending increases in electricity prices even as traditional feedstocks go down in cost. Decentralized power generation, in a grid of small production, nearly eliminates transmission losses and uses renewable sources in the most favorable way.

Nobody should be surprised that Tesla is a leader in this program. Back in September, 2016 when Tesla took over (or merged) with Solar City I strongly made the case that this would be a good move. The ability to make solar shingles, solar panels and store large power amounts in whole-building batteries is a game changer for how we make, and consume, electricity. As utility commissions keep realizing the problems with building ever-larger centralized plants, decentralized systems that truly utilize grid management are simply a smarter, cheaper, better way to power our homes and offices.

Most people think of Solar City as “just another home solar system.” That would be wrong. Solar City has the ability to power entire towns and regions with their system of production, storage and grid management. And that is great for Tesla shareholders. Tesla has shown it is a game changer with products like the Model 3, and the combination with Solar City actually creates a utility industry game changer, as well as auto industry game changer, that could put a hurt on companies like Exxon. Now, like when I recommended buying Tesla in January, 2015, you should be thinking long term about the opportunity for outsized returns a game-changing company like Tesla provides.

by Adam Hartung | Feb 13, 2018 | Entertainment, Innovation, Investing, Television, Web/Tech

On January 23 Netflix’ value rose to $100B. The stock is now trading north of $250/share. A year ago it was $139/share. An 80% increase in just 12 months. And long-term investors have done very well. Five years ago (January, 2013) the stock was trading at $24/share – so the valuation has increased 10-fold in 5 years! A decade ago it was trading for $3/share – so if you got in early (NFLX went public in June, 2002) you are up 83X your initial investment (meaning $1,000 would be worth $83,000.)

Back in 2004 I wrote that Blockbuster was dead meat – because by going after streaming Netflix would make Blockbuster obsolete. Netflix was using external data to project its future, and thus its strategy was not to defend & extend its DVD rental business but to spend strongly to grow the replacement. In 2010 I wrote that Netflix had projected the complete demise of DVDs by 2013, and was thus investing all its resources into streaming in order to be the market leader. At the time NFLX was $15.68. Over the next year it took off, tripling in value to $42.16. By cannibalizing DVDs it’s strategy was to leave its competition in a dying marketplace.

But, investors weren’t as sure of the Netflix strategy as I was. They feared cannibalizing DVDs would cut out the “core” of Netflix and kill the company. By October, 2011 the stock had tumbled to $12 (a drop of over 70%.) But, with the stock at new lows after a year of declines I optimistically wrote “The Case for Buying Netflix. Really.” I told readers the stock analysts were wrong, and the Netflix strategy was spot-on.

Netflix went nowhere for the next year, trading between $9 and $12. But then in December, 2012 investors started seeing the results of Netflix strategy, with fast growing streaming subscriber rates. By January, 2014 the stock was trading north of $52, so those who bought when my article published made a 400% return in just over 2 years! By March, 2015 NFLX was up another 23%, to $62 when I told readers “Netflix Valuation Was Not a House of Cards.” The Netflix strategy to dominate streaming by offering its own content may have shocked a lot of people, due to the investment size, but it was the strategy that would allow Netflix to grow subscribers globally. That has driven the last jump, to $250 in just under 3 years – another 400%+ return!

Strategy matters- to company performance, and thus long-term investor returns. Netflix has been a volatile stock, and it has had plenty of naysayers. These were people looking only short-term, and fearful of strategic pivots that have proven highly valuable. If you want your company, and your investment portfolio, to succeed it is imperative you understand external trends and use them to develop the right strategy. And heed my forecasts.

by Adam Hartung | Feb 6, 2018 | Innovation, Mobile, Software, Web/Tech

InvestorPlace.com declared Snap stock will be a big disappointment in 2018. Bad news for investors, because SNAP was an enormous disappointment in 2017. After going public at $27/share in early March, the stock dropped to $20 by mid-March, then just kept dropping until it bottomed at just under $12 in August. Since then the stock has largely gone sideways at $15.

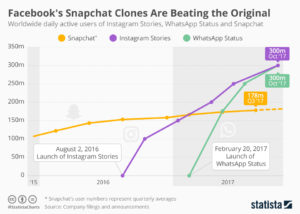

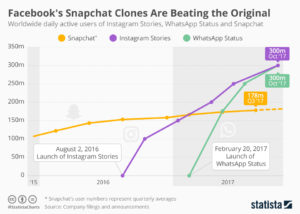

This was not unexpected. As I wrote in April, Snapchat was not without competition and was unlikely to be a long-term winner. Even though Snapchat and its Stories feature grew popular with teenagers 14 to 19, in August, 2016 Facebook launched Instagram Stories as a direct competitor. In just 7 months – just as SNAP went public – Instagram Stories had more users than Snapchat. It was clear then if you wanted to make money on the photo and video sharing trends, investors were better off to own Facebook stock and avoid the newly available SNAP shares (stock, not pix!)

Now the situation is far worse. Facebook launched WhatsApp Status as another competitive product in February, 2017 and it took less than 3 months for its user base to exceed Snapchat. As the chart below shows, by October, 2017 Stories and Status each had 300 million users, while Snapchat was mired at 180 million users. With only 30% the users of Facebook, Snapchat has little chance to succeed against the social media powerhouse.

Statista

Facebook is now a very large company. But, it has shown it is adaptable. Rather than sticking to its original market, Facebook went mobile and has launched new products as fast as competitors tried to carve out niches. The question is, are you constantly scanning the horizon for new products and adapting – fast – to keep your customers and grow? Or are you stuck trying to defending your old business while upstarts carve up your market?”

by Adam Hartung | Jan 30, 2018 | Culture, Sports, Trends

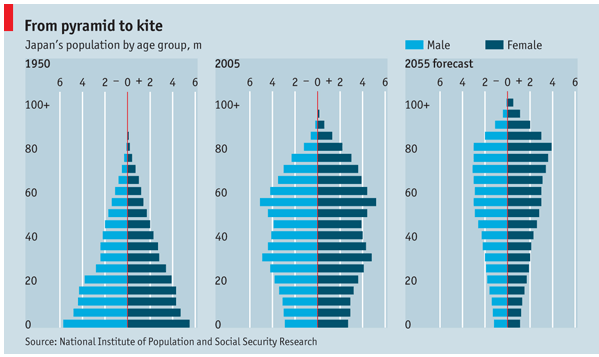

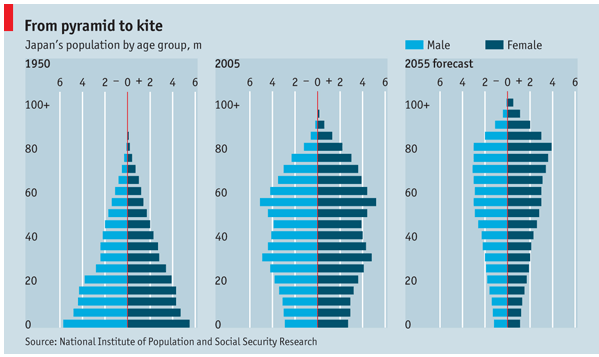

“Business Insider says Japan has become “a demographic time bomb.” I guess it’s about time somebody realized that demographic trends are important, and that they can be effective for planning!

It was September, 2016 that I pointed out how important using demographic trends was for planning – and made it clear that Japan was facing a huge problem due to an aging population and unwillingness to allow immigrants. In January, 2017 I reiterated the importance of incorporating demographic trends into planning, demonstrating how they can be important for predicting workforce availability, cost of living, taxation and other critical business issues.

Take for example the NFL. In 2017 the league took another big ratings decline. The second consecutive year. But this was not hard to predict. In September, as the season started, I made it clear that kneeling players were not the problem for the NFL – the demographics of its primary viewers was the big problem. And I predicted that ratings would take a hit in 2017. Demographics have been clearly working against the league, and unless they find a way to bring in younger viewers – probably through rules changes – things are going to get a lot worse, affecting revenues and thus owner profits and even player salaries.

Are you incorporating demographics in your planning? If not, why not? Don’t know which demographic trends are important, or how to apply demographic trends to your business? If you’re stuck, not understanding this critical trend and how it will impact your business, why not give us a call?”

by Adam Hartung | Jan 23, 2018 | Disruptions, Investing, Retail, Trends

Business Insider is projecting a “tsunami” of retail store closings in 2018 — 12,000 (up from 9,000 in 2017.) Also, the expect several more retailers will file bankruptcy, including Sears.

Duh. Nothing surprising about those projections. In mid-2016, Wharton Radio interviewed me about Sears, and I made sure everyone clearly understood I expect it to fail. Soon. In December, 2016 I overviewed Sears’ demise, predicted its inevitable failure, and warned everyone that all traditional retail was going to get a lot smaller. I again recommended dis-investing your portfolio of retail. By March, 2017 the handwriting was so clear I made sure investors knew that there were NO traditional retailers worthy of owning, including Walmart. By October, 2017 I wrote about the Waltons cashing out their Walmart ownership, indicating nobody should be in the stock – or any other retailer.

The trend is unmistakable, and undeniable. The question is – what are you going to do about it? In July, 2015 Amazon became more valuable than Walmart, even though much smaller. I explained why that made sense – because the former is growing and the latter is shrinking. Companies that leverage trends are always worth more. And that fact impacts YOU! As I wrote in February, 2017 the “Amazon Effect” will change not only your investments, but how you shop, the value of retail real estate (and thus all commercial real estate,) employment opportunities for low-skilled workers, property and sales tax revenues for all cities impacting school and infrastructure funding, and all supply chain logistics. These trends are far-reaching, and no business will be untouched.

Don’t just say “oh my, retailers are crumbling” and go to the next web page. You need to make sure your strategy is leveraging the “Amazon Effect” in ways that will help you grow revenues and profits. Because your competition is making plans to use these trends to hurt your business if you don’t make the first move. Need help?

by Adam Hartung | Jan 5, 2018 | Defend & Extend, Innovation, Leadership

Fast Company just published 3 common behaviors that kill innovation. Congratulations! The editors reinforce that most management behavior and best practices are lethal to innovation.

All the way back in November, 2009, my Forbes column explained that organizations approach innovation entirely wrong- trying far too hard to build on historical company strengths, which leads to weak extensions that fail to generate sustainable growth. In November, 2011, my Forbes column identified the “killer comments” that leaders used to stop innovation. Fast Company’s list is remarkably similar to that 2011 column, though it is a shorter list. In June, 2015, my Forbes column described how HR best practices are designed to limit diversity in thinking- and always lead to killing innovation projects. Factually, as I wrote in February, 2011, almost nobody would hire the next Steve Jobs if he applied for a job!

Quite simply, we have built organizations that rigidly adhere to continuing past processes, and are hard wired to resist innovation. This phenomenon has been around for a long time, even though Fast Company just discovered it, and I’ve been writing about it for 9 years. Give my past columns a read and you’ll be forewarned of the risks to brainstorming, or throwing together innovation teams, without a system of new thinking.

Fortunately, smart leaders today see that by focusing on external data and cleverly using outside thinkers, innovation can create a high-growth future. The approach I’ve been teaching organizations for years. Only by overcoming outdated, historical management practices can a modern organization thrive. You can do it- if you smartly use trends and new approaches.

by Adam Hartung | Dec 22, 2017 | Advertising, Film, Innovation, Marketing, Trends

Here in late 2017, the biggest trends are: the 24 hour news cycle, animosity in broadcast and online media, fatigue from constant connection and interaction, international threats and our political climate. The holiday season is in the background struggling for attention.

How are people tuning out of this cacophony to get in the mood for the holidays?

The answer: Christmas movies! And which channel has 75% share of the new movies in 2017? If you have watched any TV since October, you’d know that it’s The Hallmark Channel. THC has produced over 20 original movies for the 2017 Christmas season and has seen viewership grow by 6.7% per year since 2013. THC is on track to surpass the 2016 season in viewership and its brand image is solidly wholesome.

Starting in October, THC runs seasonal programming with its successful “The Good Witch” series (no vampires!) and continues with “Countdown to Christmas” featuring original Hallmark-produced content.

Hallmark spent decades preparing to capture the benefits of these trends. It had become a source of family oriented, holiday-themed programming especially popular in recent years. Once only an ink and paper company, Hallmark expanded strategically in the 1970s with ornaments and cultural greeting cards and again in 1984 with its acquisition of Crayola drawing products. The company moved into direct retail in 1986 and ecommerce in the mid-1990s. Hallmark eCards was launched in 2005.

Hallmark capitalized on branded media content originally to support the core business and it now generates profits as a standalone business. In 2001, the Hallmark Channel was launched. The Hallmark Movie Channel was developed in 2004 which became Hallmark Movies and Mysteries in 2014. This year, the Hallmark Drama channel was launched further leveraging the brand.

Many companies sponsored radio shows in the 1920s through the war years. Serials featuring one company’s products appeared in 1928 on radio. In 1952, Proctor and Gamble sponsored the first TV soap opera featuring one company (“The Guiding Light”). But The Hallmark Hall of Fame was there first on Christmas Eve in 1951 sponsoring a made-for-TV opera, “Amahl and the Night Visitors.”

Written by Gian Carlo Menotti in less than two months and timed for a one hour TV slot, “Amahl” has become, probably, the most performed opera in history.

Hallmark wasn’t the first mover in sponsored media content, but it had learned to experiment with new media. The company was positioned to take advantage of the trend toward family friendly broadcast content and this year was ready to give the nation a place to rest and escape from the chaos. A bit like the story of Amahl and Christmas itself.

Once just a card company, Hallmark followed market trends to expand its business and become a leader in content marketing which is now one of the hottest areas in all marketing. And both the new video content and large library were ready for the current trend- streaming video!

by Adam Hartung | Dec 9, 2017 | Advertising, Investing, Television, Trends, Web/Tech

Facebook shareholders should be cheering. And if you don’t own FB, you should be asking yourself why not. The company’s platform investments continue to draw users, and advertisers, in unprecedented numbers.

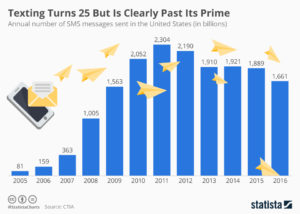

With permission: Statista

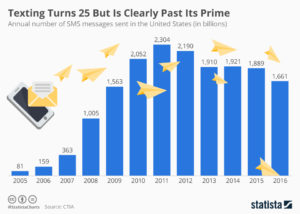

People over 40 still might text. But for most younger people, messaging happens via FB Messenger or WhatsApp. Text messages have thus been declining in the USA. Internationally, where carriers still frequently charge for text messages, the use of both Facebook products dominates over texting. Both Facebook products now are leaders in internet usage.

And as their use grows, so do the ad dollars.

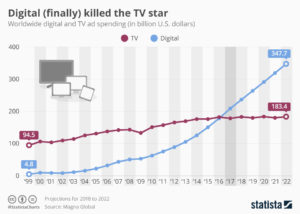

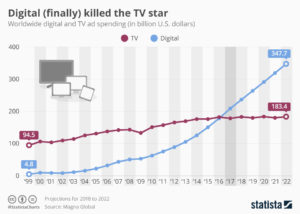

With permission: Statista

As this chart shows, in 2017 ad spending on digital outpaced money spent on TV ads. And TV spending, like print and radio, is flat to declining. While digital spending accelerates. And the big winner here is the platform getting the most eyeballs – which would be Facebook (and Google.)

Looking at the trends, Facebook investors should feel really good about future returns. And if you don’t own Facebook shares, why not?

by Paul F | Nov 30, 2017 | Boards of Directors, Trends

As a Fellow with NACD, I have spoken at meetings and met members around the US. I’ve heard the comments echoing the sentiments of this year’s study. I’ve written at length about how to reduce the risk and how to see unexpected trends while there is still time to react.

Excerpt from NACD website:

This year’s survey offers great insight into how directors and boards view the next 12 months. Which major business trends do they expect will have the greatest impact on their companies? What are the areas where they hope to improve board performance next year? Which topics are the ones on which directors want to spend more time during board meetings? In addition, we assess how boards are currently engaging with management on the increasingly complex challenge of formulating strategy and drill down on the growing board imperative of corporate-culture oversight.

With permission from NACD, you can download this year’s study here:

by Adam Hartung | Nov 22, 2017 | Newsletter Post

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Watch Your Markets to Innovate

Our 20 years of research has shown that consistent success at innovation is the result of carefully applying four factors. Firms can win sometimes with only 2 or 3, but that risks costly mistakes. Worse, they don’t know what went wrong.

The Four Stages of Good Innovation Management are:

- Market Sensing- Gathering the right data

- Data Collection- Gathering data the right way

- Data Analysis- Hearing the market story

- Response- Doing the right things

This newsletter will focus on the first stage, which lays the foundation for the entire innovation process.

Market Sensing is often viewed as gathering traditional industry data such as existing customers, existing competitors and existing technology evolution. Unfortunately, that information is woefully incomplete. Case studies and product failure analyses are filled with stories of how an upstart company, on nobody’s radar, created a new product, category or even a new market obsoleting the existing industry and changing key metrics.

Market Sensing is often viewed as gathering traditional industry data such as existing customers, existing competitors and existing technology evolution. Unfortunately, that information is woefully incomplete. Case studies and product failure analyses are filled with stories of how an upstart company, on nobody’s radar, created a new product, category or even a new market obsoleting the existing industry and changing key metrics.

Companies try to overcome the myopia by holding brainstorming sessions. But….

“Ok, we’ve got 6 months to make the numbers,” exhorts the VP. “We’ll watch this video on brainstorming and then break into small groups. Each group will generate ideas on how we can improve. No idea is too crazy at this stage!” But the VP adds, “Oh, by the way, we can’t hire any new people, spend any more money or move our resources around, so let’s work within those guidelines. Off you go; present after lunch!”

The Right Way to Market Sense

There are three types of questions for brainstorming:

1. What is happening now? What is considered the status quo?

2. What could happen that would destroy our business?

3. What could happen that would allow us to destroy our competition?

Once you answer these questions, identify what trends are driving each scenario. What trend can be leveraged to really do something different? What trend, taken to a greater extent, could change the status quo? Disregard existing beliefs, accept that “maybe pigs could fly,” and figure out what trend could make that happen. Then identify the data you could track.

For example, no one was considering delivering packages via drones, until news reported drones hovering over prisons to drop items. Next, DHL and Amazon said they were testing the idea for packages, and suddenly the competition for home and medical delivery changed dramatically. But few affected companies looked hard at this trend and were tracking drone size payload capacity, operational distance, navigation technology, etc.

For example, no one was considering delivering packages via drones, until news reported drones hovering over prisons to drop items. Next, DHL and Amazon said they were testing the idea for packages, and suddenly the competition for home and medical delivery changed dramatically. But few affected companies looked hard at this trend and were tracking drone size payload capacity, operational distance, navigation technology, etc.

Once the opportunity for changing the status quo happens, it is incumbent on every competitor to brainstorm how to track that trend and incorporate this trend into innovation plan. It was about 100 years since the first air mail planes but it took less than 5 years from prototype to drone delivery.

“In the field of observation chance favors only the prepared mind.”

Most companies simply continue planning as if the future will look like the past, without sensing potential market shifts. They are forced to react when trends change the basis of competition, often late and with no insight into the look of future markets and competition. Try Market Sensing to more out of ideation sessions on products and services.

Stay tuned to my next newsletter, when we delve into data collection.

If you can’t wait, give me a call or drop me an email so we can discuss your needs.

Our two decades of helping organizations identify and implement innovations gives us keen insight into how sustaining, expanding and disruptive innovations can be identified, evaluated for risk and cost, and managed for successful market growth. Our experience and processes will help you grow via innovation with more confidence, less time investment, lower cost and faster, greater returns.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Give us a call today, or send an email, so we can talk about how you can be a leader, rather than follower, in 2017 and beyond. Or check out the rest of the website to read up on what we do so we can create the right level of engagement for you.

Forbes Posts- Hartung on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

Market Sensing is often viewed as gathering traditional industry data such as existing customers, existing competitors and existing technology evolution. Unfortunately, that information is woefully incomplete. Case studies and product failure analyses are filled with stories of how an upstart company, on nobody’s radar, created a new product, category or even a new market obsoleting the existing industry and changing key metrics.

Market Sensing is often viewed as gathering traditional industry data such as existing customers, existing competitors and existing technology evolution. Unfortunately, that information is woefully incomplete. Case studies and product failure analyses are filled with stories of how an upstart company, on nobody’s radar, created a new product, category or even a new market obsoleting the existing industry and changing key metrics. For example, no one was considering delivering packages via drones, until news reported drones hovering over prisons to drop items. Next, DHL and Amazon said they were testing the idea for packages, and suddenly the competition for home and medical delivery changed dramatically. But few affected companies looked hard at this trend and were tracking drone size payload capacity, operational distance, navigation technology, etc.

For example, no one was considering delivering packages via drones, until news reported drones hovering over prisons to drop items. Next, DHL and Amazon said they were testing the idea for packages, and suddenly the competition for home and medical delivery changed dramatically. But few affected companies looked hard at this trend and were tracking drone size payload capacity, operational distance, navigation technology, etc.