by Adam Hartung | Jul 14, 2020 | Disruptions, Innovation, Leadership, Marketing, real estate, Retail, Trends

TRENDS: Covid-19 has accelerated a lot of trends. Few more than retail. Oddly some people have taken the view that Covid-19 changed retail. Actually, it didn’t. The pandemic has merely accelerated trends that have been driving industry change for almost two decades.

Back in 2004, Eddie Lampert bought all the bonds of defunct Kmart and used those assets to do a merger with Sears – creating Sears Holdings that encompassed both brands. The day of announcement Chicago Tribune asked for my opinion, and famously I predicted the merger would be a disaster. Clearly both Kmart and Sears were far, far off trends in retail, both were already struggling – and neither had a clue about emerging e-commerce.

Why in 2004 would I predict Sears would fail? The #1 trend in retail was e-commerce, which was all about individualized customer experience, problem solving for customer needs — and only, finally fulfillment. By increasing “scale” – primarily owning a lot more real estate – this new organization would NOT be more competitive. Walmart was already falling behind the growth curve, and everyone in retail was ignoring the elephant in the room – Amazon.com. Loading up on a lot more real estate, more inventory, more employees, more supplier relationships and more community commitments – old ideas about how to succeed related to fulfillment – would hurt more than help. Retail was an industry in transition. All of these factors were boat anchors on future success, which relied on aggressively moving to greater internet use.

Unfortunately, Eddie Lampert as CEO was like most CEOs. He thought success would come from doing more of what worked in the past. Be better, faster, cheaper at what you used to do. In 2011 Sears asked its HQ town (Hoffman Estates) and the state (Illinois) for tax subsidies to keep the HQ there. Sears had built what was once the world’s once tallest building, named the Sears Tower. But many years earlier Sears left, the building was renamed, and Sears was becoming a ghost of itself. I pleaded with government officials to “let Sears go” since the money would be wasted. And it was clear by 2016, that Lampert and his team’s bias toward old retail approaches had only served to hurt Sears more and guarantee its failure. Now – in 2020 – Hoffman Estates has taken the embarrassing act of removing the Sears name from the town’s arena, admitting Sears is washed up.

****

It was with a multi-year observation of trends that I told people in 2/2017 that retail real estate values would crumble . Now mall vacancies are at an 8 year high and 50% of mall department stores will permanently close within a year. We are “over-stored” and nothing will change the fast decline in retail real estate values. Who knows what will happen to all this empty space?

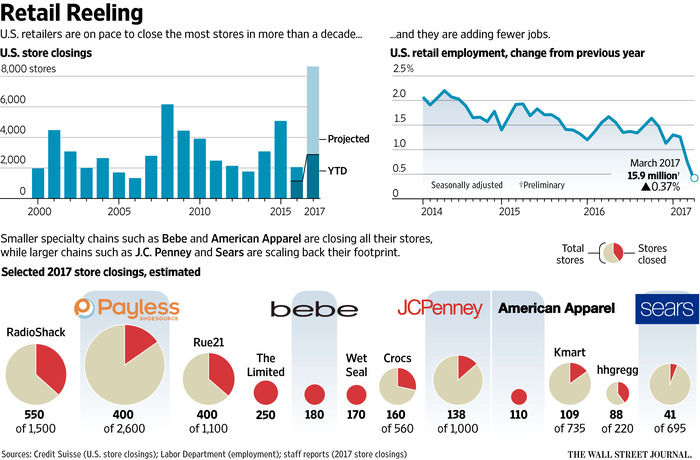

Trends led me in March 2017 to advise investors they should own NO traditional retail equities. Shortly after Sears filed bankruptcy Radio Shack and storied ToysRUs followed. And with the pandemic acting as gasoline fueling change, we’ve now seen the bankruptcies of Neiman Marcus, JCPenney, J Crew, Forever 21, GNC and Chuck e Cheese (but, really, weren’t you a bit surprised the last one was still even in business?) After 3 years of pre-Covid store closings, Industry pundits are finally predicting “record numbers of store closings”. And, after 15 years of predictions, I’m being asked by radio hosts to explain the impact of widespread failures of both local and national retailers ( ). Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

As we move forward, what will happen to your business? Will you build on trends to create a new future where growth abounds? Will you align your strategy with the future so you “skate to where the puck will be?” Or will you – like Sears and so many others – find an ignominious end to your organization? Will the signs change, or will the signs come down? The trends have never been stronger, the markets have never moved faster and the rewards have never been greater. It’s time to plan for the future, and build your strategy on trends (not what worked in the past.)

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jun 5, 2018 | Investing, Retail, Strategy, Trends, Web/Tech

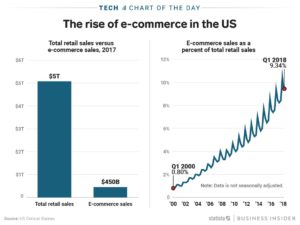

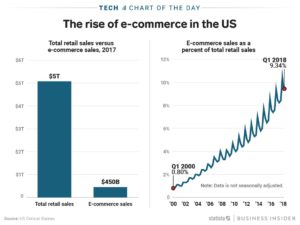

The US e-commerce market is just under 10% the size of entire retail market. On the face of it this would indicate that the game is far from over for big traditional retail. After all, how could such a small segment kill profits for such a huge industry based on enormous traditional players?

Yet, Sears – once a Dow Jones component and the world’s most powerful retailer – has announced it will close 100 more stores. The Kmart/Sears chain is now only 894 stores – down from thousands at its peak and 1,275 just last year. Revenue dropped 30% versus a year ago, and quarterly losses of $424M were almost 15% of revenues.

But, that ignores marginal economics. It often doesn’t take a monster change in one factor to have a huge impact on the business model. Let’s say Sales are $100. Less Cost of Goods sold of $75. That leaves a Gross Margin of $25. Selling, General and Administrative costs are 20%, so Operating Income is only $5. The Net Margin before Interest and Taxes is 5%. (BTW, these are the actual percentages of Walmart from 1/31/18.)

Now, in comes a new competitor – like Amazon.com. They have no stores, no store clerks, and minimal inventory due to “e-storefront” selling. So, they are able to lower prices by 5%. That seems pretty small – just a 5% discount compared to typical sales of 20%, 30% even 50% (BOGO) in retail stores. Amazon’s 5% price reduction seems like no big deal to established firms.

But, Walmart has to lower prices by 5% in response, which lowers revenues to $95. But the stores, clerks, inventory, distribution centers and trucks all largely remain. With Cost of Goods Sold still $75, Gross Margin falls to $20. Fixed headquarters costs, general and administrative costs don’t change, so they remain at $20. This leaves Operating Income of …$0.

(For more detailed analysis see “Bigger is Not Always Better – Why Amazon is Worth More than Walmart” from July, 2015.)

How can Walmart survive with no profits? It can’t. To get some margin back, Walmart has to start shutting stores, selling assets, cutting pay, using automation to cut headcount, beating on vendors to offer them better prices. This earns praise as “a low cost operation.” When in fact, this makes Walmart a less competitive company, because it’s footprint and service levels decline, which encourages people to do more shopping on-line. A vicious circle begins of trying to recapture lost profitability, while sales are declining rather than growing.

Walmart was (and is) huge. Even Sears was much bigger than Amazon.com at the beginning. But to compete with Amazon.com both had to lower prices on ALL of their products in ALL of their stores. So the hit to Walmart’s, and Sears’, revenue is a huge number. Though Amazon.com was a much, much smaller company, its impact explodes on the larger competitor P&L’s.

This disruption is felt across the entire industry: ALL traditional retailers are forced to match Amazon and other e-commerce companies, even though there is no way they can cut costs enough to compete. Thus, Toys-R-Us, Radio Shack, Claire’s and Bon-Ton have declared bankruptcy in 2018, and the once great, dominant Sears is on the precipice of extinction.

All of which is good news for Amazon.com investors. Amazon.com has 40% market share of the entire e-commerce business. The fact that e-commerce is only 10% of all retail is great news for Amazon investors. That means there is still an enormously large market of traditional retail available to convert to on-line sales.

The shift to e-commerce will not be stopping, or even slowing. Since January, 2010 the future has been easily predictable for traditional retail’s decline. The next few years will see a transition of an additional $2.5 trillion on-line, which is 5X the size of the existing e-commerce market!

As stores close new competitors will emerge in the e-commerce market. But undoubtedly the big winner will be the company with 40% market share today – Amazon.com. So what will Amazon’s stock be worth when sales are 5x larger (or more) and Amazon can increase profits by making leveraging its infrastructure and slow future investments?

Twenty years ago, Amazon was a retail ant. And retail elephants ignored it. But that was foolish, because Amazon had a different business model with an entirely different cost of operations. And now the elephants are falling fast, due to their inability to adapt to new market conditions and maintain their growth.

_________________________________________________________________________

Author’s Note: In June, 2007 I was asked to predict WalMart’s future. Here are the predictions I made 11 years ago:

- “In 5 years (2012) Walmart would not have succeeded internationally” [True: Mexico, China, Germany all failed]

- “In 5 years (2012) Walmart would no new businesses, and its revenue will be stalled” [True]

- In 5 years (2012) Walmart would be spending more on stock repurchases then investing in its own stores or distribution” [True – and the Walton’s were moving money out of Walmart to other investments]

- “In 10 years (2017) Walmart would take a dramatic act, and make an acquisition” [True: Jet.com]

- “In 10 years (2017 Walmart’s value would not keep up with the stock market” [from 6/2007 to 6/2017 WMT went from $48 to $75 up 56.25%, DIA went from $134 to $180 up 34.3%, AMZN went from $70 to $1,000 up 1,330% or 13.3x]

- “In 30 years (2037) Walmart will only be known as “a once great company, like General Motors”

by Adam Hartung | Apr 25, 2018 | Entertainment, Film, Innovation, Investing, Retail

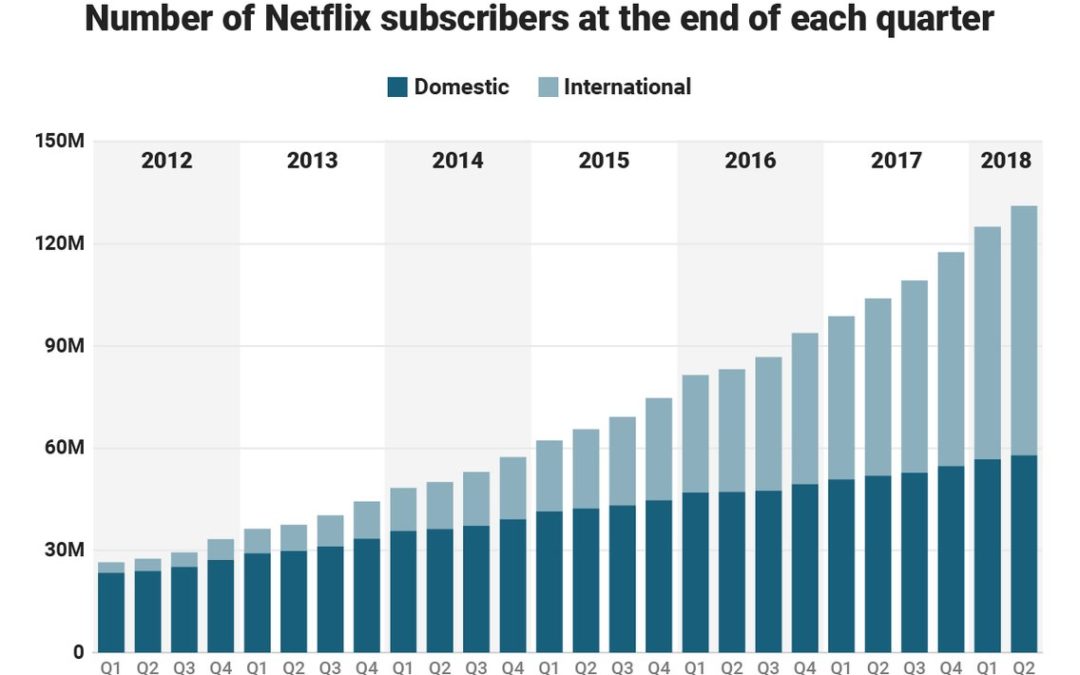

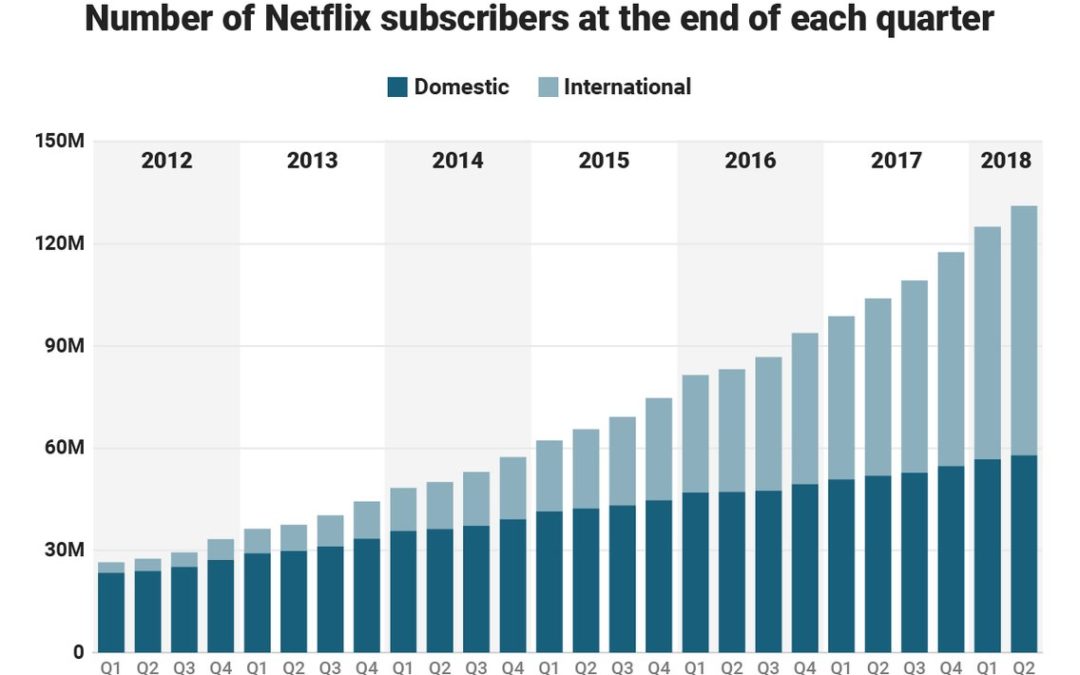

Netflix announced new subscriber numbers last week – and it exceeded expectations. Netflix now has over 130 million worldwide subscribers. This is up 480% in just the last 6 years – from under 30 million. Yes, the USA has grown substantially, more than doubling during this timeframe. But international growth has been spectacular, growing from almost nothing to 57% of total revenues. International growth the last year was 70%, and the contribution margin on international revenues has transitioned from negative in 2016 to over 15% – double the 4th quarter of 2017.

Accomplishing this is a remarkable story. Most companies grow by doing more of the same. Think of Walmart that kept adding stores. Then adding spin-off store brand Sam’s Club. Then adding groceries to the stores. Walmart never changed its strategy, leaders just did “more” with the old strategy. That’s how most people grow, by figuring out ways to make the Value Delivery System (in their case retail stores, warehouses and trucks) do more, better, faster, cheaper. Walmart never changed its strategy.

But Netflix is a very different story. The company started out distributing VHS tapes, and later DVDs, to homes via USPS, UPS and Fedex. It was competing with Blockbuster, Hollywood Video, Family Video and other traditional video stores. It won that battle, driving all of them to bankruptcy. But then to grow more Netflix invested far outside its “core” distribution skills and pioneered video streaming, competing with companies like DirecTV and Comcast. Eventually Netflix leaders raised prices on physical video distribution, cannibalizing that business, to raise money for investing in streaming technology. Streaming technology, however, was not enough to keep growing subscribers. Netflix leadership turned to creating its own content, competing with moviemakers, television and documentary producers, and broadcast television. The company now spends over $6B annually on content.

Think about those decisions. Netflix “pivoted” its strategy 3 times in one decade. Its “core” skill for growth changed from physical product distribution to network technology to content creation. From a “skills” perspective none of these have anything in common.

Could you do that? Would you do that?

How did Netflix do that? By focusing on its Value Proposition. By realizing that it’s Value Proposition was “delivering entertainment” Netflix realized it had to change its skill set 3 times to compete with market shifts. Had Netflix not done so, its physical distribution would have declined due to the emergence of Amazon.com, and eventually disappeared along with tapes and DVDs. Netflix would have followed Blockbuster into history. And as bandwidth expanded, and global networks grew, and dozens of providers emerged streaming purchased content profits would have become a bloodbath. Broadcasters who had vast libraries of content would sell to the cheapest streaming company, stripping Netflix of its growth. To continue growing, Netflix had to look at where markets were headed and redirect the company’s investments into its own content.

This is not how most companies do strategy. Most try to figure out one thing they are good at, then optimize it. They examine their Value Delivery System, focus all their attention on it, and entirely lose track of their Value Proposition. They keep optimizing the old Value Delivery System long after the market has shifted. For example, Walmart was the “low cost retailer.” But e-commerce allows competitors like Amazon.com to compete without stores, without advertising and frequently without inventory (using digital storefronts to other people’s inventory.) Walmart leaders were so focused on optimizing the Value Delivery System, and denying the potential impact of e-commerce, that they did not see how a different Value Delivery System could better fulfill the initial Walmart Value Proposition of “low cost.” The Walmart strategy never took a pivot – and now they are far, far behind the leader, and rapidly becoming obsolete.

Do you know your Value Proposition? Is it clear – written on the wall somewhere? Or long ago did you stop thinking about your Value Proposition in order to focus your intention on optimizing your Value Delivery System?

That fundamental strategy flaw is killing companies right and left – Radio Shack, Toys-R-Us and dozens of other retailers. Who needs maps when you have smartphone navigation? Smartphones put an end to Rand McNally. Who needs an expensive watch when your phone has time and so much more? Apple Watch sales in 2017 exceeded the entire Swiss watch industry. Who needs CDs when you can stream music? Sony sales and profits were gutted when iPods and iPhones changed the personal entertainment industry. (Anyone remember “boom boxes” and “Walkman”?)

I’ve been a huge fan of Netflix. In 2010, I predicted it was the next Apple or Google. When the company shifted strategy from delivering physical entertainment to streaming in 2011, and the stock tanked, I made the case for buying the stock. In 2015 when the company let investors know it was dumping billions into programming I again said it was strategically right, and recommended Netflix as a good investment. And I redoubled my praise for leadership when the “double pivot” to programming was picking up steam in 2016. You don’t have to be mystical to recognize a winner like Netflix, you just have to realize the company is using its strategy to deliver on its Value Proposition, and is willing to change its Value Delivery System because “core strength” isn’t important when its time to change in order to meet new market needs.

by Paul F | Apr 12, 2018 | E-Commerce, Ecommerce, Investing, Retail

President Trump has been bashing Amazon of late. And Amazon is down about 12.5% since peaking on March 12, 2018. Simultaneously the DJIA fell 10% from 1/26/18 thru 4/3/18, so it is hard to discern if Amazon’s pullback has more to do with market conditions and trade war fears or Presidential bashing. Amazon’s performance has been only slightly worse than the Dow. Anyway, one would think that if the President is right and Amazon plays unfairly, the future would bode well for Walmart.

That is very unlikely. Since peaking on January 29, just after the Dow, Walmart crashed 32% by April 3. Over the last month the stock has stabilized, but unfortunately the signs are not good for Walmart investors.

Walmart leadership has never shown a keen understanding of e-commerce, nor a commitment to making Walmart a leading market competitor. You might counter that Walmart’s acquisition of Jet.com showed a strong commitment. But we now know that amidst the minimalistic hype, Walmart actually cheated when providing its e-commerce results. And when Walmart hired a former Tesco executive to lead Jet.com’s grocery sales effort, the news was not splashed front page. Rather it was hidden in an internal email discovered by Reuters and given almost no coverage. Like Walmart was afraid to let people know it was incompetent and hiring an outsider.

Walmart leadership has never shown a keen understanding of e-commerce, nor a commitment to making Walmart a leading market competitor. You might counter that Walmart’s acquisition of Jet.com showed a strong commitment. But we now know that amidst the minimalistic hype, Walmart actually cheated when providing its e-commerce results. And when Walmart hired a former Tesco executive to lead Jet.com’s grocery sales effort, the news was not splashed front page. Rather it was hidden in an internal email discovered by Reuters and given almost no coverage. Like Walmart was afraid to let people know it was incompetent and hiring an outsider.

Investors, and customers, need to admit that it is a LOT easier for Amazon to learn about traditional store operations by purchasing Whole Foods than it is for Walmart to learn how to succeed in e-commerce. Traditional grocery “excellence” is easy to come by, after all there are thousands of experienced grocery store executives. So Amazon can buy Whole Foods and gain what knowledge it needs overnight, while adapting Whole Foods to the tremendous e-commerce insight embedded in Amazon. But Walmart is struggling to add compete with Amazon in e-commerce, where knowledge is a lot, lot tougher to come by.

Telltale’s are strips of cloth used by sailors to provide early tips about wind direction and speed. Good sailors “read” the telltale strips to plot their sail use for maximum performance. We can read the “telltales” in business as well. The “telltales” at Walmart have long been bad signals for investors. After 3 years of recovery from a 2014 collision created by an overworked Walmart driver, comedian Tracy Morgan recently returned to television with a new show. The overworked driver was a worrisome telltale of how Walmart pressured its employees to attempt competing against much lower cost e-commerce. By February, 2016 there were 10 very obvious telltales of Walmart’s inability to cope with Amazon and the market shift to e-commerce.

Understanding e-commerce is worth a whole lot more than being good at running a tight retail operation. As I pointed out in May, 2016, knowing that trend is what makes Amazon worth so much more than the much bigger, and asset rich, Walmart. And the Walton family knows this, that’s why it became clear by October, 2017 that they were cashing out of the traditional Walmart business. As I’ve said before, if the Walton’s aren’t putting their money in Walmart (or shopping in the stores) why should you?

by Adam Hartung | Mar 6, 2018 | In the Swamp, Investing, Retail, Scenario Planning

On February 20, 2018 Walmart’s stock had its biggest price drop ever. And the second biggest percentage decline ever. Even though same store sales improved, investors sold off the stock in droves. And after a pretty healthy recent valuation run-up.

What happened? Simply put, Walmart said its on-line sales slowed and its cost of operations rose, slowing growth and cramping margins. In other words, even though it bought Jet.com Walmart is still a long, long way from coming close to matching the customer relationship and growth of Amazon.com. And (surprise, surprise) margins in on-line aren’t an easy thing — as Amazon’s thin margins for 15 years have demonstrated.

In other words, this was completely to be expected. Walmart is a behemoth with no adaptability. For decades the company has been focused on how to operate its warehouses and stores, and beat up its suppliers. Management had to be drug, kicking and screaming, into e-commerce. And failing regularly it finally made an acquisition. But to think that Jet.com was going to change WalMart’s business model into a growing, high profit operation any time soon was foolish. Management still wants people in the store, first and foremost, and really doesn’t understand how to do anything else.

All the way back in 2005, I wrote that Walmart was too big to learn, and was unwilling to create white space teams to really explore growing e-commerce (hence the belated Jet-com acquisition.) In 2007, I wrote that calling Walmart a “mature” competitor with huge advantages was the wrong way to view the company already under attack by all the e-commerce players. In July, 2015 Amazon’s market cap exceeded Walmart’s, showing the importance of retail transformation on investor expectations. By February, 2016 there were 10 telltale signs Walmart was in big trouble by a changing retail market. And by October, 2017 it was clear the Waltons were cashing out of Walmart, questioning why any investor should remain holding the stock.

It really is possible to watch trends and predict future markets. And that can lead to good predictions about the fates of companies. The signs were all there that Walmart shouldn’t be going up in value. Hope had too many investors thinking that Walmart was too big to stumble – or fail. But hope is not how you should invest. Not for your portfolio, and not for your business. Walmart should have dedicated huge sums to e-commerce 15 years ago, now it is playing catch up with Amazon.com, and that’s a race it simply won’t win. Are you making the right investment decisions for your business early enough? Or will you stumble like Walmart?

by Adam Hartung | Jan 23, 2018 | Disruptions, Investing, Retail, Trends

Business Insider is projecting a “tsunami” of retail store closings in 2018 — 12,000 (up from 9,000 in 2017.) Also, the expect several more retailers will file bankruptcy, including Sears.

Duh. Nothing surprising about those projections. In mid-2016, Wharton Radio interviewed me about Sears, and I made sure everyone clearly understood I expect it to fail. Soon. In December, 2016 I overviewed Sears’ demise, predicted its inevitable failure, and warned everyone that all traditional retail was going to get a lot smaller. I again recommended dis-investing your portfolio of retail. By March, 2017 the handwriting was so clear I made sure investors knew that there were NO traditional retailers worthy of owning, including Walmart. By October, 2017 I wrote about the Waltons cashing out their Walmart ownership, indicating nobody should be in the stock – or any other retailer.

The trend is unmistakable, and undeniable. The question is – what are you going to do about it? In July, 2015 Amazon became more valuable than Walmart, even though much smaller. I explained why that made sense – because the former is growing and the latter is shrinking. Companies that leverage trends are always worth more. And that fact impacts YOU! As I wrote in February, 2017 the “Amazon Effect” will change not only your investments, but how you shop, the value of retail real estate (and thus all commercial real estate,) employment opportunities for low-skilled workers, property and sales tax revenues for all cities impacting school and infrastructure funding, and all supply chain logistics. These trends are far-reaching, and no business will be untouched.

Don’t just say “oh my, retailers are crumbling” and go to the next web page. You need to make sure your strategy is leveraging the “Amazon Effect” in ways that will help you grow revenues and profits. Because your competition is making plans to use these trends to hurt your business if you don’t make the first move. Need help?

by Adam Hartung | Oct 30, 2017 | Food and Drink, Growth Stall, Investing, Leadership, Retail

Understand Growth Stalls So You Can Avoid GM, JCPenney and Chipotle

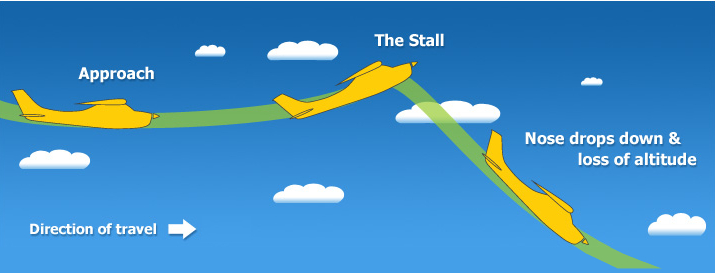

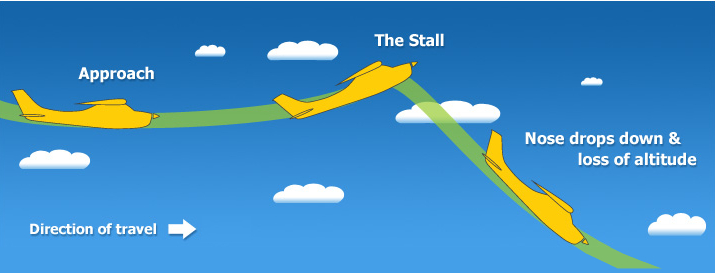

Companies, like aircraft, stall when they don’t have enough “power” to continue to climb.

Everybody wants to be part of a winning company. As investors, winners maximize portfolio returns. As employees winners offer job stability and career growth. As communities winners create real estate value growth and money to maintain infrastructure. So if we can understand how to avoid the losers, we can be better at picking winners.

It has been 20 years since we recognized the predictive power of Growth Stalls. Growth Stalls are very easy to identify. A company enters a Growth Stall when it has 2 consecutive quarters, or 2 successive quarters vs the prior year, of lower revenues or profits. What’s powerful is how this simple measure indicates the inability of a company to ever grow again.

Only 7% of the time will a company that has a Growth Stall ever grow at greater than 2%/year. 93% of these companies will never achieve even this minimal growth rate. 38% will trudge along with -2% to 2% growth, losing relevancy as it develops no growth opportunities. But worse, 55% of companies will go into decline, with sales dropping at 2% or more per year. In fact 20% will see sales drop at 6% or more per year. In other words, 93% of companies that have a Growth Stall simply will not grow, and 55% will go into immediate decline.

Growth Stalls happen because the company is somehow “out of step” with its marketplace. Often this is a problem with the product line becoming less desirable. Or it can be an increase in new competitors. Or a change in technology either within the products or in how they are manufactured. The point is, something has changed making the company less competitive, thus losing sales and/or profits.

Unfortunately, leadership of most companies react to a Growth Stall by doubling down on what they already do. They vow to cut costs in order to regain lost margin, but this rarely works because the market has shifted. They also vow to make better products, but this rarely matters because the market is moving toward a more competitive product. So the company in a Growth Stall keeps doing more of the same, and fortunes worsen.

But, inevitably, this means someone else, some company who is better aligned with market forces, starts doing considerably better.

This week analysts at Goldman Sachs lowered GM to a sell rating. This killed a recent rally, and the stock is headed back to $40/share, or lower, values it has not maintained since recovering from bankruptcy after the Great Recession. GM is an example of a company that had a Growth Stall, was saved by a government bailout, and now just trudges along, doing little for employees, investors or the communities where it has plants in Michigan.

Tesla- enough market power to gain share “uphill”?

By understanding that GM, Ford and Chrysler (now owned by Fiat) all hit Growth Stalls we can start to understand why they have simply been a poor place to invest one’s resources. They have tried to make cars cheaper, and marginally better. But who has seen their fortunes skyrocket? Tesla. While GM keeps trying to make a lot of cars using outdated processes and technologies Tesla has connected with the customer desire for a different auto experience, selling out its capacity of Model S sedans and creating an enormous backlog for Model 3. Understanding GM’s Growth Stall would have encouraged you to put your money, career, or community resources into the newer competitor far earlier, rather than the no growth General Motors.

This week, JCPenney’s stock fell to under $3/share. As JCPenney keeps selling real estate and clearing out inventory to generate cash, analysts now say JCPenney is the next Sears, expecting it to eventually run out of assets and fail. Since 2012 JCP has lost 93% of its market value amidst closing stores, laying off people and leaving more retail real estate empty in its communities.

In 2010 JCPenney entered a Growth Stall. Hoping to turn around the board hired Ron Johnson, leader of Apple’s retail stores, as CEO. But Mr. Johnson cut his teeth at Target, and he set out to cut costs and restructure JCPenney in traditional retail fashion. This met great fanfare at first, but within months the turnaround wasn’t happening, Johnson was ousted and the returning CEO dramatically upped the cost cutting.

The problem was that retail had already started changing dramatically, due to the rapid growth of e-commerce. Looking around one could see Growth Stalls not only at JCPenney, but at Sears and Radio Shack. The smart thing to do was exit those traditional brick-and-mortar retailers and move one’s career, or investment, to the huge leader in on-line sales, Amazon.com. Understanding Growth Stalls would have helped you make a good decision much earlier.

This recent quarter Chipotle Mexican Grill saw analysts downgrade the company, and the stock took another hit, now trading at a value not seen since the end of 2012. Chipotle leadership blamed bad results on higher avocado prices, temporary store closings due to hurricanes, paying out damages due to a “one time event” of hacking, and public relations nightmares from rats falling out of a store ceiling in Texas and a norovirus outbreak in Virginia. But this is the typical “things will all be OK soon” sorts of explanations from a leadership team that failed to recognize Chipotle’s Growth Stall.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

But ever since that problem was discovered, management has failed to recognize its Growth Stall required a significant set of changes at Chipotle. They have attacked each problem like it was something needing individualized attention, and could be rectified quickly so they could “get back to normal.” And they hoped to turn around public opinion by launching nationwide a new cheese dip product in 2017, despite less than good social media feedback on the product from early customers. They kept attempting piecemeal solutions when the Growth Stall indicated something much bigger was engulfing the company.

What’s needed at Chipotle is a recognition of the wholesale change required to meet customer demands amidst a shift to more growth in independent restaurants, and changing millennial tastes. From the menu options, to app ordering and immediate delivery, to the importance of social media branding programs and customer testimonials as well as demonstrating commitment to social causes and healthier food Chipotle has fallen out-of-step with its marketplace. The stock has now lost 66% of its value in just 2 years amidst sales declines and growth stagnation.

We don’t like to study losers. But understanding the importance of Growth Stalls can be very helpful for your career and investments. If you identify who is likely to do poorly you can avoid big negatives. And understanding why the market shifted can lead you to finding a job, or investing, where leadership is headed in the right direction.

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Oct 27, 2017 | Food and Drink, Growth Stall, Investing, Leadership, Retail

The Three Steps GE Should Take Now – And The Lessons For Your Business

Monitor displays General Electric Co. (GE) at the New York Stock Exchange (NYSE) October, 2017. Photographer: Michael Nagle/Bloomberg

For years I have been negative on GE’s leadership. CEO Immelt led the dismantling of the once-great GE, making it a smaller company and one worth quite a bit less. The process has been devastating to many employees who lost their jobs, pensioners who have seen their benefits shrivel, communities with GE facilities that have suffered from investment atrophy, suppliers that have been squeezed out or displaced and investors that have seen the value of GE shares plummet.

But now there is a new CEO, a new leadership team and even some new faces on the Board of Directors. Some readers have informed me that it is easier to attack a weak leader than recommend a solution, and they have inquired as to what I think GE should do now. I do not see the GE situation as hopeless. The company still has an enormous revenue base, and vast assets it can use to fund a directional shift. And that’s what GE must do – make a serious shift in how it allocates resources.

Step 1 – Apply the First Rule of Holes

The first rule of holes is “when you find yourself in a hole, stop digging.” (Will Rogers, 1911) This seems simple. But far too many companies have their resourcing process on auto-pilot. Businesses that have not been growing, and often are not producing good returns on investment, continue to receive funding. Possibly because they are a legacy business that nobody wants to stop. Or possibly because leadership remains ever hopeful that tomorrow will somehow look like yesterday and the next round of money, or hiring, will change things to the way they were.

In fact, these businesses are in a hole, and spending more on them is continuing to dig. The investment hole just keeps getting bigger. The smart thing to do is just stop. Quit adding resources to a business that’s not adding value to the market capitalization. Just stop investing.

When Steve Jobs took over Apple he discontinued several Macintosh models, and cut funding for Macintosh development. The Mac was not going to save Apple’s declining fortunes. Apple needed new products for new markets, and the only way to make that happen was to stop putting so much money into the Mac business.

When streaming emerged CEO Reed Hastings of Netflix quit spending money on the traditional DVD/Video distribution business even though Netflix dominated it. He even raised the price. Only by stopping investments in traditional distribution could he turn the company toward streaming.

Step 2 – Identify the Trend that will Guide Your Strategy

All growth strategies build on trends. After receiving funding from Microsoft to avoid bankruptcy in 2000, Apple spent a year deciding its future lied in building on the trend to mobile. Once the trend was identified, all product development, and new product introductions, were targeted at being a leader in the mobile trend.

When the internet emerged GE CEO Jack Welch required all business units to create “DestroyYourBusiness.com” teams. This forced every business to look at the impact the internet would have on their business, including business model changes and emergence of new competitors. By focusing on the internet trend GE kept growing even in businesses not inherently thought of as “internet” businesses.

GE has to decide what trend it will leverage to guide all new growth projects. Given its large positions in manufacturing and health care it would make sense to at least start with IoT opportunities, and new opportunities to restructure America’s health care system. But even if not these trends, GE needs to identify the trend that it can build upon to guide its investments and grow.

Step 3 – Place Your Bets and Monetize

When Facebook CEO Mark Zuckerberg realized the trend in communications was toward pictures and video he took action to keep users on the company platform. First he bought Instagram for $1 billion, even though it had no revenues. Two years later he paid $19 billion for WhatsApp, gaining many new users as well as significant OTT technology. Both seemed very expensive acquisitions, but Facebook rapidly moved to increase their growth

and monetize their markets. Leaders of the acquired companies were given important roles in Facebook to help guide growth in users, revenues and profits.

Netflix leads the streaming war, but it has tough competition. So Netflix has committed spending over $6billion on new original content to keep customers from going to Amazon Prime, Hulu and others. This large expenditure is intended to allow ongoing subscriber growth domestically and internationally, as well as raise subscription prices.

This week CVS announced it is planning to acquire Aetna Health for $66 billion. On the surface it is easy to ask “why?” But quickly analysts offered support for the deal, ranging from fighting off Amazon in prescription sales to restructuring how health care costs are paid and how care is delivered. The fact that analysts see this acquisition as building on industry trends gives support to the deal and expectations for better future returns for CVS.

During the Immelt era, there were attempts to grow, such as in the “water business.” But the investments were not consistent, and there was insufficient effort placed on understanding how to monetize the business short- and long-term. Leadership did not offer a compelling vision for how the trends would turn into revenues and profits. Acquisitions were made, but lacking a strong vision of how to grow revenues, and an outsider’s perspective on how to lead the trend, very quickly short-term financial metrics built into GE’s review process led to bad decisions crippling these opportunities for growth. And today the consensus is that GE will likely sell its healthcare businessrather than make the necessary investments to grow it as CVS is doing.

Successful leadership means moving beyond traditional financial management to invest for growth

In the Welch era, GE made dozens of acquisitions. These were driven by a desire to build on trends. Welch did not fear investing in growth businesses, and he held leaders’ feet to the fire to produce successful results. If they didn’t achieve goals he let the people and/or the business go. Hence his nickname “Neutron Jack.”

For example, although GE had no background in entertainment, GE bought NBC at a time when viewership was growing and ad prices were growing even faster. This led to higher revenues and market cap for GE. On the other hand, when leaders at CALMA did not anticipate the shift in CAD/CAM from dedicated workstations to PCs, Welch saw them overly tied to old technology and unable to recognize the trend, so he immediately sold the business. He invested in businesses that added to valuation, and sold businesses that lacked a clear path to building on trends for higher value.

Being a caretaker, or steward, is no longer sufficient for business leadership. Competitors, and markets, shift too quickly. Leaders must anticipate trends, reduce investments in products, services and projects that are off the trend, and put resources to work where growth can create higher returns.

This is all possible at GE – if the new leadership has a vision for the future and starts allocating resources effectively. For now, all we can do is wait and see……

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Oct 17, 2017 | Defend & Extend, In the Swamp, Investing, Leadership, Retail

The Waltons Are Cashing Out Of Walmart — And You Should Be, Too

Employees restock shelves of school supplies at a Walmart Stores Inc. location in Burbank, CA. Bloomberg

Last week there was a lot of stock market excitement regarding WalMart. After a “favorable” earnings report analysts turned bullish and the stock jumped 4% in one day, WMT’s biggest rally in over a year, making it a big short-term winner. But the leadership signals indicate WalMart is probably not the best place to put your money.

WalMart has limited growth plans

WalMart is growing about 3%/year. But leadership acknowledged it was not growing its traditional business in the USA, and only has plans to open 25 stores in the next year. It hopes to add about 225 internationally, predominantly in Mexico and China, but unfortunately those markets have been tough places for WalMart to grow share and make profits. And the company has been plagued with bribery scandals, particularly in Mexico.

And, while WalMart touts its 40%+ growth rate on-line, margins online (including the free delivery offer) are even lower than in the traditional Wal-Mart stores, causing the company’s gross margin percentage to decline. The $11.5 billion on-line revenue projection for next year is up, but it is 2.5% of Walmart’s total, and a mere 7-8% of Amazon’s retail sales. Amazon remains the clear leader, with 62% of U.S. households having visited the company in the second quarter. And it is not a good sign that WalMart’s greatest on-line growth is in groceries, which amount to 26% of on-line salesalready. WalMart is investing in 1,000 additional at-store curb-side grocery pick-uplocations, but this effort to defend traditional store sales is in the products where margins are clearly the lowest, and possibly nonexistent.

It is not clear that WalMart has a strategy for competing in a shrinking traditional brick-and-mortar market where Costco, Target, Dollar General, et.al. are fighting for every dollar. And it is not clear WalMart can make much difference in Amazon’s giant on-line market lead. Meanwhile, Amazon continues to grow in valuation with very low profits, even as it grows its presence in groceries with the Whole Foods acquisition. In the 17 months from May 10, 2016 through October 10, 2017 WalMart’s market cap grew by $24 billion (10%,) while Amazon’s grew by $174 billion (57%.)

Even after recent gains for WalMart, its market capitalization remains only 53% of its much smaller on-line competitor. This creates a very difficult pricing problem for WalMart if it has to make traditional margins in order to keep analysts, and investors, happy.

Leadership is not investing to compete, but rather cashing out the business

To understand just how bad this growth problem is, investors should take a look at where WalMart has been spending its cash. It has not been investing in growing stores, growing sales per store, nor really even growing the on-line business. From 2007-2016 WalMart spent a whopping $67.3 billion in share buybacks. That is over 20 times what it spent on Jet.com. And it was 45% of total profits during that timeframe. Additionally WalMart paid out $51.2 billion in dividends, which amounted to 34% of profits. Altogether that is $118.5 billion returned to shareholders in the last decade. And a staggering 79% of profits. It shows that WalMart is really not investing in its future, but rather cashing out the company by returning money to shareholders.

So very large investors, who control huge voting blocks, recognize that things are not going well at WalMart. But, because of the enormity of the share buybacks, the Walton family now controls over half of WalMart stock. That makes it tough for an activist to threaten shaking up the company, and lets the Waltons determine the company’s future.

There will be marginal enhancements. But the vast majority of the money is being returned to them, via $20 billion in share repurchases and $1.5 billion in cash dividends annually.

Amazon spends nothing on share repurchases. Nor does it distribute cash to shareholders via dividends. Amazon’s largest shareholder, Jeff Bezos, invests all the company money in new growth opportunities. These nearly cover the retail landscape, and increasingly are in other growth markets like cloud services, software-as-a-service and entertainment. Comparing the owners of these companies, quite clearly Bezos has faith in Amazon’s ability to invest money for profitable future growth. But the Waltons are far less certain about the future success of WalMart, so they are pulling their money off the table, allowing investors to put their money in ventures outside WalMart.

Investing your money, do you think it is better to invest where the owner believes in the future of his company?

Or where the owners are cashing out?

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Mar 22, 2017 | In the Whirlpool, Investing, Retail

(Photo by Scott Olson/Getty Images)

Traditional retailers just keep providing more bad news. Payless Shoes said it plans to file bankruptcy next week, closing 500 of its 4,000 stores. Most likely it will follow the path of Radio Shack, which hasn’t made a profit since 2011. Radio Shack filed bankruptcy and shut a gob of stores as part of its “turnaround plan.” Then in February Radio Shack filed its second bankruptcy — most likely killing the chain entirely this time.

Sears Holdings finally admitted it probably can’t survive as a going concern this week. Sears has lost over $10 billion since 2010 — when it last showed a profit — and owes over $4 billion to its creditors. Retail stocks cratered Monday as the list of retailers closing stores accelerated: Sears, KMart, Macy’s, Radio Shack, JCPenney, American Apparel, Abercrombie & Fitch, The Limited, CVS, GNC, Office Depot, HHGregg, The Children’s Place and Crocs are just some of the household names that are slowly (or not so slowly) dying.

None of this should be surprising. By the time CEO Ed Lampert merged KMart with Sears the trend to e-commerce was already pronounced. Anyone could build an excel spreadsheet that would demonstrate as online retail grew, brick-and-mortar retail would decline. In the low margin world of retail, profits would evaporate. It would be a blood bath. Any retailer with any weakness simply would not survive this market shift — and that clearly included outdated store concepts like Sears, KMart and Radio Shack which long ago were outflanked by on-line shopping and trendier storefronts.

Yet, not everyone is ready to give up on some retailers. Walmart, for example, still trades at $70 per share, which is higher than it traded in 2015 and about where it traded back in 2012. Some investors still think that there are brick-and-mortar outfits that are either immune to the trends, or will survive the shake-out and have higher profits in the future.

And that is why we have to be very careful about business myths. There are a lot of people that believe as markets shrink the ultimate consolidation will leave one, or a few, competitors who will be very profitable. Capacity will go away, and profits will return. In the end, they believe if you are the last buggy whip maker you will be profitable — so investors just need to pick who will be the survivor and wait it out. And, if you believe this, then you have justified owning Walmart.

Only, markets don’t work that way. As industries consolidate they end up with competitors who either lose money or just barely eke out a small profit. Think about the auto industry, airlines or land-line telecom companies.

Two factors exist which effectively forces all the profits out of these businesses and therefore make it impossible for investors to make money long-term.

First, competitive capacity always remains just a bit too much for the market need. Management, and often investors, simply don’t want to give up in the face of industry consolidation. They keep hoping to reach a rainbow that will save them. So capacity lingers and lingers — always pushing prices down even as costs increase. Even after someone fails, and that capacity theoretically goes away, someone jumps in with great hopes for the future and boosts capacity again. Therefore, excess capacity overhangs the marketplace forcing prices down to break-even, or below, and never really goes away.

Given the amount of retail real estate out there and the bargains being offered to anyone who wants to open, or expand, stores this problem will persist for decades in retail.

Second, demand in most markets keeps declining. Hopefuls project that demand will “stabilize,” thus balancing the capacity and allowing for price increases. Because demand changes aren’t linear, there are often plateaus that make it appear as if demand won’t go down more. But then something changes — an innovation, regulatory change, taste change — and demand takes another hit. And all the hope goes away as profits drop, again.

It is not a successful strategy to try being the “last man standing” in any declining market. No competitor is immune to these forces when markets shift. No matter how big, when trends shift and new forms of competition start growing every old-line company will be negatively affected. Whether fast, or slow, the value of these companies will continue declining until they eventually become worthless.

Nor is it successful long-term to try and segment the business into small groupings which management thinks can be protected. When Xerox brought to market photocopying, small offset press manufacturers (ABDick and Multigraphics ) said not to worry. Xeroxing might be OK in some office installations, but there were customer segments that would forever use lithography. Even as demand shrunk, well into the 1990s, they said that big corporations, industrial users, government entities, schools and other segments would forever need the benefits of lithography, so investors were safe. Today the small offset press market is a tiny fraction of its size in the 1960s. ABDick and Multigraphics both went through rounds of bankruptcies before disappearing. Xerography, its child desktop publishing, and its grandchild electronic screens, killed offset for almost all applications.

So don’t be lured into false hopes by retailers who claim their segment is “protected.” Short-term things might not look bad. But the market has already shifted to e-commerce and this is just round one of change. More and more innovations are coming that will make the need for traditional stores increasingly unnecessary.

Many readers have expressed their disappointment in my chronic warnings about Walmart. But those warnings are no different than my warnings about Sears Holdings. It’s just that the timing may be different. Both companies have been over-investing in assets (brick-and-mortar stores) that are declining in value as they have attempted to defend and extend their old business model. Both radically under-invested in new markets which were cannibalizing their old business. And, in the end, both will end up with the same results.

And this is true for all retailers that depend on traditional brick-and-mortar sales for their revenues and profits — it’s only a matter of when things will go badly, not if. So traditional retail is nowhere that any investor wants to be.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Walmart leadership has never shown a keen understanding of e-commerce, nor a commitment to making Walmart a leading market competitor. You might counter that Walmart’s acquisition of Jet.com showed a strong commitment. But we now know that amidst the minimalistic hype,

Walmart leadership has never shown a keen understanding of e-commerce, nor a commitment to making Walmart a leading market competitor. You might counter that Walmart’s acquisition of Jet.com showed a strong commitment. But we now know that amidst the minimalistic hype,

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.