by Adam Hartung | May 22, 2018 | Innovation, Investing, Marketing, Software, Web/Tech

(Image: Troy Strange.)

Facebook’s CEO recently took a drubbing by America’s Congresspeople. And some thought it bode poorly for the internet giant. There were rumors of customer defections, and fears that privacy issues would sink the company. The stock dropped from a February high of $193 to a March low of $152 – down more than 20%.

But by mid-May Facebook had recovered to $186, and the concerns seemed largely ignored. As they should have been.

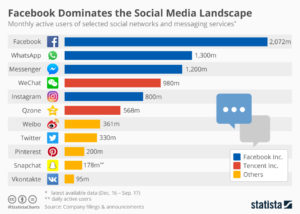

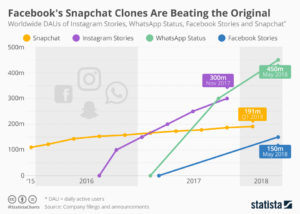

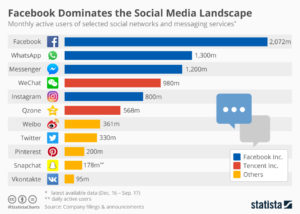

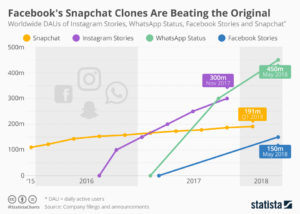

Facebook is much more than Facebook. As of January, 2018 Facebook had 2.1M monthly active users (MAUs,)  the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

Facebook paid $1B for Instagram in 2012 though it had no revenues. Today, 1/3 of ALL USA mobile users use Instagram. 15 million businesses are registered on Instagram. In 2017 Instagram had $3.6B revenues, and projections for 2018 are $6.8B.

Facebook expands globally

Facebook paid $19B for WhatsApp in 2014, when it had just $15M in revenues. In 2015, WhatsApp had 1 billion users. It is the most used app on the planet – even though not a top app in the USA where mobile texting is generally free. Where texting is expensive, like India, over 90% of mobile users utilize WhatsApp, and users typically send over 1,000 messages/month. In 2017, WhatsApp revenue rose to $1B, and in 2018 it will cross over $2B.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Unless you somehow think time will go backward, you have to recognize that social media – like all other personal technology – is constantly becoming more useful. It is gaining greater adoption, and more usage. And businesses are using social media to reach customers, thus paying for access, like they once did for newspapers, radio, television and then web sites.

Just the beginning…

Facebook is just getting started, sort of like Amazon did 20 years ago. That’s the Amazon that dominates on-line e-commerce sales. If you bought Amazon on the IPO 21 years ago (May, 2017) your investment would have risen from $18/share to $1,700 – a nearly 1,000-fold increase. Facebook’s IPO was 6 years ago (May, 2012) at $38 – 6 years later it is worth $185, almost a 5-fold increase. Not bad. But if Facebook performs like Amazon in the next 14 years it could rise to $3,600 – an almost 20x gain.

And that’s why you should ignore short–term blips like the Congressional investigation and realize that you, and everyone else, is a Facebook customer. And you want to share in that growth by being a Facebook shareholder.

(Featured image adapted from Troy Strange.)

by Adam Hartung | May 8, 2018 | Computing, Growth Stall, Innovation, Investing, Software, Trends, Web/Tech

One in five American homes with wifi now has an Amazon Alexa. And the acceptance rate is growing. To me that seems remarkable. I remember when we feared Google keeping all those searches we did. Then the fears people seemed to have about Facebook knowing our friends, families and what we talked about. Now it appears that people have no fear of “big brother” as they rapidly adopt a technology into their homes which can hear pretty near everything that is said, or that happens.

It goes to show that for most people, convenience is still incredibly important. Give us mobile phones and we let land-lines go, because mobile is so convenient – even if more expensive and lower quality. Give us laptops we let go of the traditional office, taking our work everywhere, even at a loss of work-life balance. Give us e-commerce and we start letting retailers keep our credit card information, even if it threatens our credit security. Give us digital documents via Kindle, or a smart device on the web grabbing short articles and pdf files, and we get rid of paper books and magazines. Give us streaming and we let go of physical entertainment platforms, choosing to download movies for one-time use, even though we once thought “owning” our entertainment was important.

With each new technology we make the trade-off between convenience and something we formerly thought was important. Such as quality, price, face-to-face communications, shopping in a store, owning a book or our entertainment – and even security and privacy. For all the hubbub that regulators, politicians and the “old guard” throws up about how important these things were, it did not take long for these factors to not matter as convenience outweighed what we used to think we wanted.

Now, voice activation is becoming radically important. With Google Assistant and Alexa we no longer have to bother with a keyboard interface (who wants to type?) or even a small keypad – we can just talk to our smart device. There is no doubt that is convenient. Especially when that device learns from what we say (using augmented intelligence) so it increasingly is able to accurately respond to our needs with minimal commands. Yes, this device is invading our homes, our workplaces and our lives – but it is increasingly clear that for the convenience offered we will make that trade-off. And thus what Alexa can do (measured in number of skills) has grown from zero to over 45,000 in just under 3 years.

And now, Amazon is going to explode the things Alexa can do for us. Historically Amazon controlled Alexa’s Skills market, allowing very few companies to make money off Alexa transactions. But going forward Amazon is monetizing Alexa, and developers can keep 70% of the in-skill purchase revenues customers make. Buy a product or service via Alexa and developers can now make a lot of money. And, simultaneously, Amazon is offering a “code-free” skills developer, expanding the group of people who can write skills in just minutes. In other words, Amazon is setting off a gold rush for Alexa skills development, while simultaneously making the products remarkably cheap to own.

This is horrible news for Apple. Apple’s revenue stagnated in 2016, declining year over year for 3 consecutive quarters. I warned folks then that this was a Growth Stall, which often implies a gap is developing between the company and the market. While Apple revenues have recovered, we can now see that gap. Apple still relies on iPhone and iPad sales, coupled with the stuff people buy from iTunes, for most of its revenue and growth. But many analysts think smartphone sales may have peaked. And while focusing on that core, Apple has NOT invested heavily in Siri, its voice platform. Today, Siri lags all other voice platforms in quality of recognition, quality of understanding, and number of services. And Apple’s smart speaker sales are a drop in the ocean of Amazon Echo and Echo Dot sales.

By all indications the market for a lot of what we use our mobile devices for is shifting to voice interactivity. And Apple is far behind the leader Amazon, and the strong #2 Google. Even Microsoft’s Cortana quality is considered significantly better than Siri. If this market moves as fast as the smartphone market grew it will rob sales of smartphones and iTunes, and Apple could be in a lot of trouble faster than most people think. Relevancy is a currency quickly lost in the competitive personal technology business.

by Adam Hartung | May 2, 2018 | Entrepreneurship, Food and Drink, Innovation, Marketing, Strategy

Execution – Implementation – Delivering — These are table stakes today. If you can’t do them you don’t get a seat at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

Take for example a small company named NakedWine.com that created a potential death trap for its business by implementing one crucial execution mis-step.

The NakedWine value proposition is simple. They will find wines you never heard of and skip the costs of distributors and retailers by matching the customer and winemaker. Customers ostensibly get wines far cheaper because the winemaker’s cost of marketing and sales are avoided. Decent value proposition for both the customer, and the manufacturer.

The NakedWine strategy is to convince people that the NakedWine wines will be good, month after month. The NakedWine brand is crucial, as customer trust is now not in the hands of the winemaker, nor wine aficionados that rate known wines on a point scale, or even the local retail shop owner or employee. Customers must trust NakedWine to put a good product in their hands. Customers who most likely know little or nothing about wines. NakedWines wants customers to trust them so much they will buy the company’s boxed selections month after month, delivered to their home. These customers likely don’t know what they are getting, and don’t much care, because they trust NakedWine to give them a pleasurable product at a price point which makes them happy. When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

But, NakedWines blew the whole strategy with one simple execution mistake.

Not everyone lives where they can accept a case of wine, due to weather. As northern Californians, maybe NakedWine leaders just forget how cold it is in Minneapolis, Chicago, Buffalo and Boston. Or how hot it is in Tucson, Phoenix, Houston, Palm Springs and Las Vegas. In these climates a case of wine left on a truck for a day – or 2 if the first delivery is missed – spells the end of that wine. Ruined by the temperature. Especially heat, as everyone who drinks beer or wine knows that a couple of hours at 90 degrees can kill those products completely.

The only time the customer finally connects with NakedWine is when that wine enters the house, and over the lips. But that step, that final step of getting the perishable wine to the customer safely, in good quality, and aligned with customer expectations was not viewed as part of the brand-building strategy. Instead, leadership decided at this step NakedWines should instead focus on costs. They would view delivery as completely generic – divorced from the brand-building effort. They would use the low–cost vendor, regardless of the service provided.

NakedWine decided to use Fedex Ground, even though Fedex has a terrible package tracking system. Fedex is unwilling to make sure (say, by drivers using a cell phone) that customers will be there to receive a shipment. The driver rings a bell – no answer and he’s on the run in seconds to make sure he’s meeting Fedex efficiency standards, even if the customer was delayed to the door by a phone call or other issue. When the customer requests Fedex send the driver back around again, Fedex is unwilling to attempt a second delivery within short time, or even any time that same day, after delivery fails. If a customer calls about a missed delivery, Fedex is unwilling to route a failed delivery to a temperature local Fedex Office location for customer pick-up. Or to tell the customer where they can meet the driver along his route to accept delivery. Despite a range of good options, the NakedWine product is forced to sit on that Fedex truck, bouncing around all day in the heat, or cold, being ruined. Fedex uses its lowest cost approach to delivery to offer the lowest cost bid, regardless of the impact on the product and/or customer experience, and NakedWine didn’t think about the impact choosing that bid would have on its brand building.

Brand Building at Every Step

Simply put, in addition to flyers, advertising and product discounts, NakedWine should have followed through on its brand building strategy at every step. It must source wines its customers will enjoy. And it must deliver that perishable product in a way that builds the brand – not put it at risk. For example, NakedWine should screen all orders for delivery location, in order to make sure there are no delivery concerns. If there are, someone at NakedWine should contact the customer to discuss with them issues related to shipping, such as temperature. If it is to be too hot or cold, they could highly recommend using a temperature controlled pick-up location so as not to put the product at risk. And they should build in fail-safe’s with the shipping company to handle delivery problems. That is implementing a brand building strategy all the way from value-proposition to delivery.

Leaders Execute Plans

Too often leaders will work hard on a strategy, and create a good value proposition. But then, for some unknown reason, they turn over “execution” to people who don’t really understand the strategy. Worse, leadership often makes the egregious error of pushing those who create the value delivery system to largely to focus on costs, or other wrong metrics, with little concern for the value proposition and strategy. The result is a great idea that goes off the rails. Because the value delivery system simply does not live up to expectations of the value proposition.

by Adam Hartung | Apr 25, 2018 | Entertainment, Film, Innovation, Investing, Retail

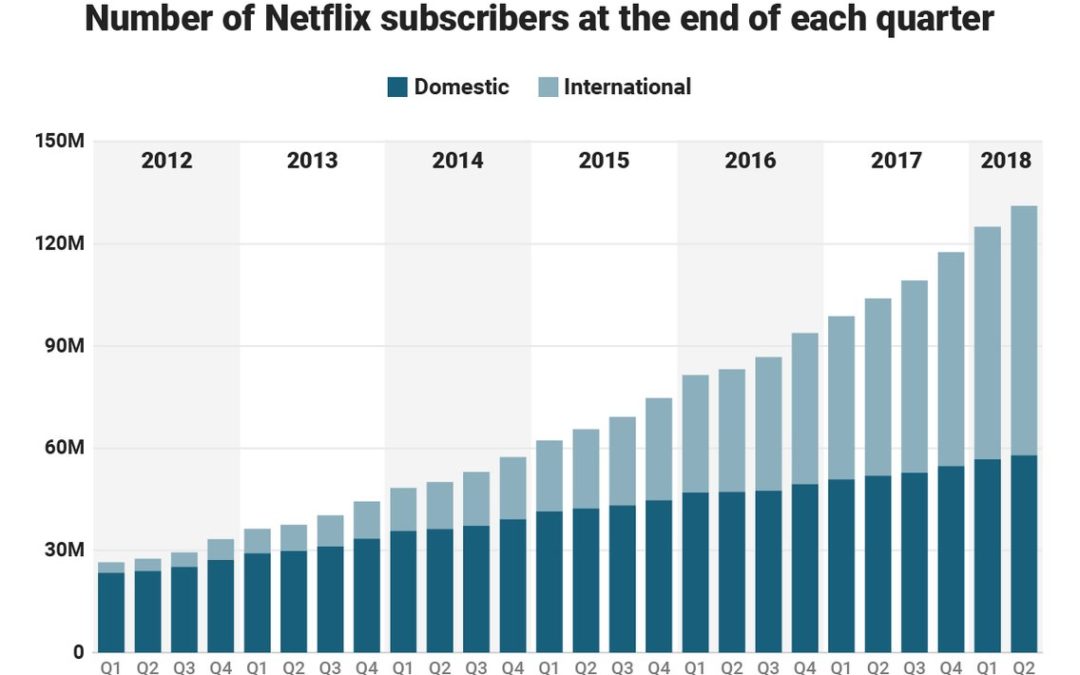

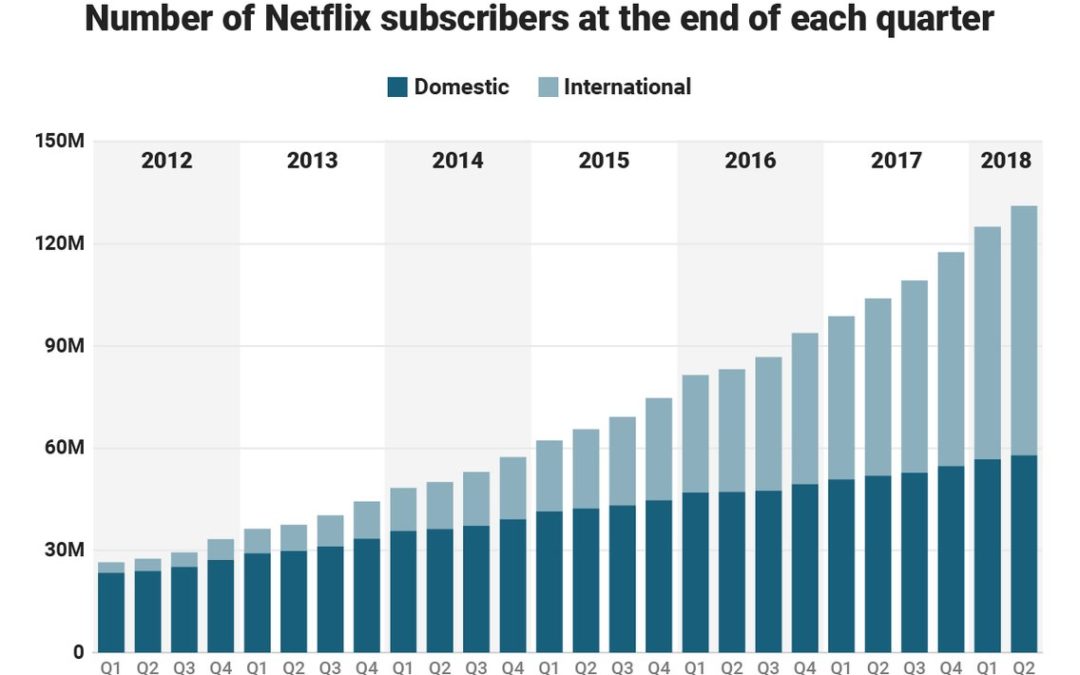

Netflix announced new subscriber numbers last week – and it exceeded expectations. Netflix now has over 130 million worldwide subscribers. This is up 480% in just the last 6 years – from under 30 million. Yes, the USA has grown substantially, more than doubling during this timeframe. But international growth has been spectacular, growing from almost nothing to 57% of total revenues. International growth the last year was 70%, and the contribution margin on international revenues has transitioned from negative in 2016 to over 15% – double the 4th quarter of 2017.

Accomplishing this is a remarkable story. Most companies grow by doing more of the same. Think of Walmart that kept adding stores. Then adding spin-off store brand Sam’s Club. Then adding groceries to the stores. Walmart never changed its strategy, leaders just did “more” with the old strategy. That’s how most people grow, by figuring out ways to make the Value Delivery System (in their case retail stores, warehouses and trucks) do more, better, faster, cheaper. Walmart never changed its strategy.

But Netflix is a very different story. The company started out distributing VHS tapes, and later DVDs, to homes via USPS, UPS and Fedex. It was competing with Blockbuster, Hollywood Video, Family Video and other traditional video stores. It won that battle, driving all of them to bankruptcy. But then to grow more Netflix invested far outside its “core” distribution skills and pioneered video streaming, competing with companies like DirecTV and Comcast. Eventually Netflix leaders raised prices on physical video distribution, cannibalizing that business, to raise money for investing in streaming technology. Streaming technology, however, was not enough to keep growing subscribers. Netflix leadership turned to creating its own content, competing with moviemakers, television and documentary producers, and broadcast television. The company now spends over $6B annually on content.

Think about those decisions. Netflix “pivoted” its strategy 3 times in one decade. Its “core” skill for growth changed from physical product distribution to network technology to content creation. From a “skills” perspective none of these have anything in common.

Could you do that? Would you do that?

How did Netflix do that? By focusing on its Value Proposition. By realizing that it’s Value Proposition was “delivering entertainment” Netflix realized it had to change its skill set 3 times to compete with market shifts. Had Netflix not done so, its physical distribution would have declined due to the emergence of Amazon.com, and eventually disappeared along with tapes and DVDs. Netflix would have followed Blockbuster into history. And as bandwidth expanded, and global networks grew, and dozens of providers emerged streaming purchased content profits would have become a bloodbath. Broadcasters who had vast libraries of content would sell to the cheapest streaming company, stripping Netflix of its growth. To continue growing, Netflix had to look at where markets were headed and redirect the company’s investments into its own content.

This is not how most companies do strategy. Most try to figure out one thing they are good at, then optimize it. They examine their Value Delivery System, focus all their attention on it, and entirely lose track of their Value Proposition. They keep optimizing the old Value Delivery System long after the market has shifted. For example, Walmart was the “low cost retailer.” But e-commerce allows competitors like Amazon.com to compete without stores, without advertising and frequently without inventory (using digital storefronts to other people’s inventory.) Walmart leaders were so focused on optimizing the Value Delivery System, and denying the potential impact of e-commerce, that they did not see how a different Value Delivery System could better fulfill the initial Walmart Value Proposition of “low cost.” The Walmart strategy never took a pivot – and now they are far, far behind the leader, and rapidly becoming obsolete.

Do you know your Value Proposition? Is it clear – written on the wall somewhere? Or long ago did you stop thinking about your Value Proposition in order to focus your intention on optimizing your Value Delivery System?

That fundamental strategy flaw is killing companies right and left – Radio Shack, Toys-R-Us and dozens of other retailers. Who needs maps when you have smartphone navigation? Smartphones put an end to Rand McNally. Who needs an expensive watch when your phone has time and so much more? Apple Watch sales in 2017 exceeded the entire Swiss watch industry. Who needs CDs when you can stream music? Sony sales and profits were gutted when iPods and iPhones changed the personal entertainment industry. (Anyone remember “boom boxes” and “Walkman”?)

I’ve been a huge fan of Netflix. In 2010, I predicted it was the next Apple or Google. When the company shifted strategy from delivering physical entertainment to streaming in 2011, and the stock tanked, I made the case for buying the stock. In 2015 when the company let investors know it was dumping billions into programming I again said it was strategically right, and recommended Netflix as a good investment. And I redoubled my praise for leadership when the “double pivot” to programming was picking up steam in 2016. You don’t have to be mystical to recognize a winner like Netflix, you just have to realize the company is using its strategy to deliver on its Value Proposition, and is willing to change its Value Delivery System because “core strength” isn’t important when its time to change in order to meet new market needs.

by Paul F | Apr 12, 2018 | E-Commerce, Ecommerce, Investing, Retail

President Trump has been bashing Amazon of late. And Amazon is down about 12.5% since peaking on March 12, 2018. Simultaneously the DJIA fell 10% from 1/26/18 thru 4/3/18, so it is hard to discern if Amazon’s pullback has more to do with market conditions and trade war fears or Presidential bashing. Amazon’s performance has been only slightly worse than the Dow. Anyway, one would think that if the President is right and Amazon plays unfairly, the future would bode well for Walmart.

That is very unlikely. Since peaking on January 29, just after the Dow, Walmart crashed 32% by April 3. Over the last month the stock has stabilized, but unfortunately the signs are not good for Walmart investors.

Walmart leadership has never shown a keen understanding of e-commerce, nor a commitment to making Walmart a leading market competitor. You might counter that Walmart’s acquisition of Jet.com showed a strong commitment. But we now know that amidst the minimalistic hype, Walmart actually cheated when providing its e-commerce results. And when Walmart hired a former Tesco executive to lead Jet.com’s grocery sales effort, the news was not splashed front page. Rather it was hidden in an internal email discovered by Reuters and given almost no coverage. Like Walmart was afraid to let people know it was incompetent and hiring an outsider.

Walmart leadership has never shown a keen understanding of e-commerce, nor a commitment to making Walmart a leading market competitor. You might counter that Walmart’s acquisition of Jet.com showed a strong commitment. But we now know that amidst the minimalistic hype, Walmart actually cheated when providing its e-commerce results. And when Walmart hired a former Tesco executive to lead Jet.com’s grocery sales effort, the news was not splashed front page. Rather it was hidden in an internal email discovered by Reuters and given almost no coverage. Like Walmart was afraid to let people know it was incompetent and hiring an outsider.

Investors, and customers, need to admit that it is a LOT easier for Amazon to learn about traditional store operations by purchasing Whole Foods than it is for Walmart to learn how to succeed in e-commerce. Traditional grocery “excellence” is easy to come by, after all there are thousands of experienced grocery store executives. So Amazon can buy Whole Foods and gain what knowledge it needs overnight, while adapting Whole Foods to the tremendous e-commerce insight embedded in Amazon. But Walmart is struggling to add compete with Amazon in e-commerce, where knowledge is a lot, lot tougher to come by.

Telltale’s are strips of cloth used by sailors to provide early tips about wind direction and speed. Good sailors “read” the telltale strips to plot their sail use for maximum performance. We can read the “telltales” in business as well. The “telltales” at Walmart have long been bad signals for investors. After 3 years of recovery from a 2014 collision created by an overworked Walmart driver, comedian Tracy Morgan recently returned to television with a new show. The overworked driver was a worrisome telltale of how Walmart pressured its employees to attempt competing against much lower cost e-commerce. By February, 2016 there were 10 very obvious telltales of Walmart’s inability to cope with Amazon and the market shift to e-commerce.

Understanding e-commerce is worth a whole lot more than being good at running a tight retail operation. As I pointed out in May, 2016, knowing that trend is what makes Amazon worth so much more than the much bigger, and asset rich, Walmart. And the Walton family knows this, that’s why it became clear by October, 2017 that they were cashing out of the traditional Walmart business. As I’ve said before, if the Walton’s aren’t putting their money in Walmart (or shopping in the stores) why should you?

by Adam Hartung | Apr 3, 2018 | Computing, Growth Stall, Innovation, Investing, Mobile, Music

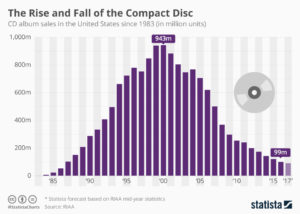

Do you still have a pile of compact discs? If so, why? When was the last time you listened to one? Like almost everyone else, you probably stream your music today. If you are just outdated, you listen to music you bought from iTunes or GooglePlay and store on your mobile device. But it would be considered prehistoric to tell people you carry around CDs for listening in your car – because you surely don’t own a portable CD player.

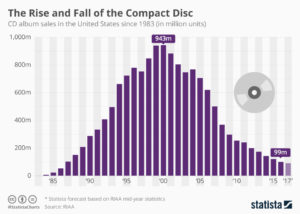

As the chart shows, CD sales exploded from nothing in 1983 to nearly 1B units in 2000. Now sales are less than 1/10th that number, due to the market shift expanded bandwidth allowed.

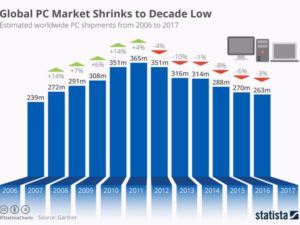

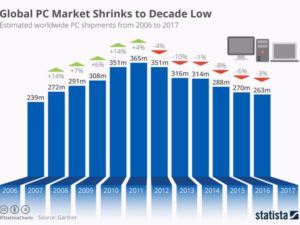

Do you still carry a laptop? If so, you are a dying minority. As PCs became more portable they became indispensable. Nobody left the office, or attended a meeting, without their laptop. That trend exploded until 2011, when PC sales peaked at 365M units. As the chart shows, in the 6 years since, PC sales have dropped by over 100M units, a 30% decline. The advent of mobile devices (smartphones and tablets) coupled with expanded connectivity and growing cloud services allowed mobility to reach entirely new levels – and people stopped carrying their PCs. And just like CDs are disappearing, so will PCs.

These charts dramatically show how quickly a new technology, or package of technologies, can change the way we behave. Simultaneously, they change the competitive landscape. Sony dominated the music industry, as a producer and supplier of hardware, when CDs dominated. But, as I wrote in 2012, the shift to more portable music caused Sony to fall into a rapid decline, and the company suffered 6 consecutive years (24 quarters) of falling sales and losses. The one-time giant was crippled by a technology shift they did not adopt. And they weren’t alone, as big box retailers such as Best Buy and Circuit City also faltered when these sales disappeared.

Once, Microsoft was synonymous with personal technology. Nobody maximized the value in PC growth more than Microsoft. But changing technology altered the competitive landscape, with Apple, Google, Samsung and Amazon emerging as the leaders. Microsoft, as the almost unnoticed launch of Windows 10 demonstrated, is struggling to maintain relevancy.

Too often we discount trends. Like Sony and Microsoft we think historical growth will continue, unabated. We find ways to discount market shifts, saying the products are “niche” and denigrating their quality. We will express our view that the market has “hiccuped” and will return to growth again. By the time we admit the shift is permanent new competitors have overtaken the lead, and we risk becoming totally obsolete. Like Toys-R-Us, Radio Shack, Sears and Motorola.

Aircraft stalls when not enough power to climb

The time for action is when the very first signs of shift happened. I’ve written a lot about “Growth Stalls” and they occur in just 2 quarters. 93% of the time a stalled company never again grows at a mere 2%/year. Look at how fast GE went from the best company in America to the worst. It is incredibly important that leadership react FAST when trends push customers toward new solutions, because it often takes very little time for the trend to make dying markets completely untenable.

by Adam Hartung | Mar 20, 2018 | Investing, Leadership, Lock-in, Marketing, Strategy, Transportation

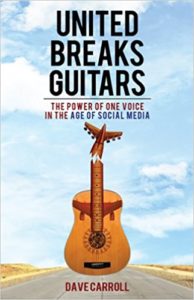

Do you remember the songs, and videos, from 2008 “United Breaks Guitars?” After United Airlines destroyed musician Dave Carroll’s guitar he chronicled the months-long journey he took trying to replace it. In the end, United told him “F**k you” as customer service blew him off completely. He went on to make a few million dollars with his songs and parody about the horrible experience. Because so many people felt they were abused like Mr. Carroll.

“United Breaks Guitars” was a hit because so many people related to the terrible customer experience on United.  “The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction.

“The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction.

Things certainly haven’t changed. In 2017, United ejected a 69 year old physician from a plane, breaking his nose, knocking out his teeth and giving him a concussion. That created an uproar. Yet within a week United killed the world’s largest bunny rabbit in an airplane holding bin. But, even worse, last week United actually killed a puppy by forcing it be placed in an overhead bin. At least the dog United sent on a 1,000 mile unexpected flight to Japan survived, and the interviewed owner said he felt lucky the airline hadn’t killed his pet. Of course United refunded their money – which as you can imagine was a slap in the face to all these people who were so abused.

Unfortunately, United is just the worst of a bunch of bad airlines. Customer service really isn’t any better on Delta, American, JetBlue or Southwest. Saying these other airlines are better is just picking out a less heinous member of the Khmer Rouge Army.

STRATEGY MATTERS

This all goes back to deregulation. When President Carter allowed the airlines to charge as they like the industry really had no idea what it was going to do. There was chaos for years. But eventually consolidation kicked-in, and cutting cost was the only thing all 3 majors agreed upon. Buy more market share, as opposed to winning it with customer service, then slash the costs. This did the wonderfulness of leading all of them to file bankruptcy! Some twice! What a grand industry strategy!

Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he ordered olives removed from the first class meals. He was cheered for saving $100K. But what folks missed was that he, and his peers leading the airlines, were systematically trying to figure out “how do we offer the least possible service.” By focusing on a strategy of lowering cost, and being doggedly determined in that strategy, soon nothing else mattered.

Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he ordered olives removed from the first class meals. He was cheered for saving $100K. But what folks missed was that he, and his peers leading the airlines, were systematically trying to figure out “how do we offer the least possible service.” By focusing on a strategy of lowering cost, and being doggedly determined in that strategy, soon nothing else mattered.

Today, there are no free meals in coach, and terrible meals in first class. Management angered employees into strikes and multi-year negotiations, beating down compensation and eliminating benefits leading to unhappiness so bad that in 2010 a Jet Blue flight attendant pulled the emergency exit and jumped out of the plane as he quit.

So, all the airlines in America stink. And, many domestic airlines in Europe, such as Ryan Air, have followed suit. The execs keep saying “all customers care about is price.” They use that excuse to create a culture so hostile to employees, and customers, that pretty soon employees are beating up customers and killing family pets (after charging extra to take the pet on the plane) and actually not caring.

Employees have become gestapos for the leadership – which has created a culture in which nobody wins. So flight attendants do as little as possible, because they don’t care about customers any more than leadership does. In 2017, a JetBlue attendant threw a family off flight because their toddler kicked the seat. When a woman complains about a child in seat next to her a Delta attendant throws her off the plane. And just last week when a 2 year old cries during boarding a Southwest attendant throws the child and her father off the plane.

Deregulation led to an oligopoly. Now, customers have no choice. Some of us fly almost every week on business, and it is pure hell. Nobody we deal with, from TSA to airport vendors to airline staff like customers. The culture has become “I’m abused, so you will be abused.” To fly is to succumb to being obsequious to ALL employees in your effort to not anger anyone, for fear they will deny you service. Or, worse, beat you up or kill your pet. But, honestly, there is nothing customers can do about it.

STRATEGY MATTERS

The leadership of the airlines, lacking regulation, implemented a strategy of “be low cost.” The result was creating a culture where employees routinely abuse customers in the process of trying to save a few dimes. If the next Mark Zuckerberg, Elon Musk or Reed Hastings showed up, do you think HR would hire them? Would the Board of Directors, so focused on the wrong strategy, consider any of them as CEO? The wrong strategy has led to the ruination of an entire industry, miserable employees, unhappy customers and marginal returns. It is a terrible culture.

So what is your strategy? Is your strategy creating the culture you want? Are you headed toward happy customers who want more of your product or service, and create growth? Or are you letting your lack of a forward-thinking strategy default you into operational cost cutting, and the movement toward a culture of misery that drives away employees, vendors and eventually customers?

by Adam Hartung | Mar 13, 2018 | Defend & Extend, Growth Stall, Innovation, Investing, Software

In February, Berkshire Hathaway revealed it had dumped its IBM position. Good riddance to a stock that has gone down for 5 years while the S&P went up! What did Buffett do with the money? He loaded up on Apple – making that high-flyer Berkshire’s #1 holding. So, isn’t the smart thing now to buy Apple?

First, don’t confuse your investing goals with Berkshire Hathaway’s. It may seem that everyone has the same objective, to buy stocks that go up. But Berkshire is a very special case. As I pointed out in 2014, we mere mortals can’t invest like Buffett, and shouldn’t try. Berkshire Hathaway has the opportunity to make investments in special situations with tremendous return potential that we don’t have. Berkshire’s investment strategy is to invest where it can create cash to prepare for special situations, or to park money where it can make a decent return, and hopefully generate cash while it waits.

Apple is the #1 most cash-rich company on the planet, and with the new tax laws it can repatriate that cash. This is an opportunity for a “special dividend” to investors, and that is the kind of thing that Buffett loves. He isn’t a venture capitalist looking for a 10x price appreciation. He wants a decent 5% rate of return, and hopefully dividends, so he can grow cash for his special situation opportunities. Apple, the most valuable company on any exchange, is exactly the kind of company where he can place a few billion dollars without driving up the price and let it sit making a solid 5-6%, collect dividends and maybe get a few kickers from things like the cash repatriation.

Second, let’s not forget that Buffett’s IBM buying spree lost money. If he was a great tech investor, he never would have bought IBM. He bought it for the same reason he’s buying Apple, only he was wrong about what was going to happen to IBM as it continued to lose relevancy.

I pointed out in May, 2016 that Apple was showing us all a lot of sustaining innovations, with new rev levels of existing products, but almost no new disruptive innovations. The company that once gave us iPods, iTunes, iPhones and iPads was increasingly relying on the next version of everything to drive sales. Lots of incremental improvement. But little discussion about any breakthrough products, like iBeacon, ApplePay or even the Apple Watch. In a real way, Apple was looking a lot more like the old Microsoft with its Windows and Office fascination than the old Apple.

By October, 2016 Apple hit a Growth Stall. While this may have seemed like “no big deal,” recall that only 7% of the time do companies maintain a 2% growth rate after stalling. Is Apple going to be in that 7%? With the launch of the less-than-overwhelming iPhone X, and the actual drop in iPhone sales in Q4, 2017 it looks increasingly like Apple is on the same road as all other stalled companies.

In the short term Apple has said it is milking its installed base. By constantly bringing out new apps it has raised iTunes sales to over $30B/quarter. And it has a dedicated cadre of developers making over $25B/year creating new apps. So Apple is doing its best to get as much revenue out of that installed base of iPhones as it can, even if device sales slow (or decline.) For Buffett, this is no big deal. After all, he’s parking cash and hoping to get dividends. Milking the base is a cash generation strategy he would love – like a railroad, or Coca-Cola.

But if you’re interested in maintaining high returns in your portfolio, be aware of what’s happening. Apple is changing. It’s not going to falter and fail any time soon. But don’t be lulled by Berkshire’s big purchases into thinking Apple in 2018 is anything like it was in 2012 – or through 2014. Instead, keep your eyes on game changers like Netflix, Tesla and Amazon.

by Adam Hartung | Mar 6, 2018 | In the Swamp, Investing, Retail, Scenario Planning

On February 20, 2018 Walmart’s stock had its biggest price drop ever. And the second biggest percentage decline ever. Even though same store sales improved, investors sold off the stock in droves. And after a pretty healthy recent valuation run-up.

What happened? Simply put, Walmart said its on-line sales slowed and its cost of operations rose, slowing growth and cramping margins. In other words, even though it bought Jet.com Walmart is still a long, long way from coming close to matching the customer relationship and growth of Amazon.com. And (surprise, surprise) margins in on-line aren’t an easy thing — as Amazon’s thin margins for 15 years have demonstrated.

In other words, this was completely to be expected. Walmart is a behemoth with no adaptability. For decades the company has been focused on how to operate its warehouses and stores, and beat up its suppliers. Management had to be drug, kicking and screaming, into e-commerce. And failing regularly it finally made an acquisition. But to think that Jet.com was going to change WalMart’s business model into a growing, high profit operation any time soon was foolish. Management still wants people in the store, first and foremost, and really doesn’t understand how to do anything else.

All the way back in 2005, I wrote that Walmart was too big to learn, and was unwilling to create white space teams to really explore growing e-commerce (hence the belated Jet-com acquisition.) In 2007, I wrote that calling Walmart a “mature” competitor with huge advantages was the wrong way to view the company already under attack by all the e-commerce players. In July, 2015 Amazon’s market cap exceeded Walmart’s, showing the importance of retail transformation on investor expectations. By February, 2016 there were 10 telltale signs Walmart was in big trouble by a changing retail market. And by October, 2017 it was clear the Waltons were cashing out of Walmart, questioning why any investor should remain holding the stock.

It really is possible to watch trends and predict future markets. And that can lead to good predictions about the fates of companies. The signs were all there that Walmart shouldn’t be going up in value. Hope had too many investors thinking that Walmart was too big to stumble – or fail. But hope is not how you should invest. Not for your portfolio, and not for your business. Walmart should have dedicated huge sums to e-commerce 15 years ago, now it is playing catch up with Amazon.com, and that’s a race it simply won’t win. Are you making the right investment decisions for your business early enough? Or will you stumble like Walmart?

by Adam Hartung | Feb 27, 2018 | Growth Stall, Innovation, Investing, Software

This February, Warren Buffett admitted he had no faith in IBM. After accumulating a huge position, by 4th quarter of 2017 he sold out almost the entire Berkshire Hathaway position. He lost faith in the IBM CEO Virginia (Ginni) Rometty, who talked big about a turnaround, but it never happened.

Mr. Buffett would have been wise to stopped having “faith” long ago. All the way back in May, 2014 I wrote that IBM was not going to be a turnaround. CEO Rommetty was spending ALL its money on share buybacks, rather than growing its business. The Washington Post made IBM the “poster child” for stupid share buybacks, pointing out that spending over $8B on repurchases had maintained earnings-per-share, and propped up the stock price, but giving IBM the largest debt-to-equity ratio of comparable companies.

IBM was already in a Growth Stall, something about which I’ve written often. Once a company stalls, its odds  of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

By April, 2017 it was clear IBM was a disaster. By then we had 20 consecutive quarters of declining revenue. Amazing. How Rometty kept her job was completely unclear. Five years of shrinkage, while all investments were in buying the stock of its shrinking enterprise – intended to hide the shrink! CEO Rometty continued promising a turnaround, with vague references to the “wonderful” Watson program. But it was clear, Buffett (and everyone else) needed to get out in 2014. So Berkshire ate its losses, took the money and ran.

Have you learned your lesson? As an investor are you holding onto stocks long after leadership has shown they have no idea how to grow revenues? If so, why? Hope is not a strategy.

As a leader, are you still forecasting hockey stick turnarounds, while continuing to invest in outdated products and businesses? Are you hoping your past will somehow create your future, even though competitors and markets have moved on? Are you leading like Rometty, hoping you can hide your failures with financial machinations and Powerpoint presentations about how things will turn your way in the future – even though those assumptions are made out of hole cloth?

It’s time to get real about your investments, and your business. When revenues are challenged, something bad is happening. It’s time to do something. Fast. Before a bad quarter becomes 20, and everyone is giving up.

the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace. Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition. When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

Walmart leadership has never shown a keen understanding of e-commerce, nor a commitment to making Walmart a leading market competitor. You might counter that Walmart’s acquisition of Jet.com showed a strong commitment. But we now know that amidst the minimalistic hype,

Walmart leadership has never shown a keen understanding of e-commerce, nor a commitment to making Walmart a leading market competitor. You might counter that Walmart’s acquisition of Jet.com showed a strong commitment. But we now know that amidst the minimalistic hype,

“The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction.

“The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction. Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he

Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he

of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.