by Adam Hartung | Jul 22, 2020 | Disruptions, Innovation, Leadership, Marketing, Trends

As the pandemic dropped on the USA with full force mid-April the price of oil dropped to less than $0. OK, it was something of a fluke. Demand dropped so fast that supply couldn’t fall fast enough, so oil was flowing into refineries and tanks and pipelines so fast that nobody knew where to put it – and that resulted in suppliers having to pay someone to take their oil.

But… the point was very real. Oil prices depend on demand – every bit as much as supply. Even though for a generation we’ve taken growing oil demand for granted, and focused on how to create additional supply, it is a fact that NOW declining demand will limit the value of oil and gas (which is, after all, a commodity.) The TREND has changed course, with demand in the USA barely, or not, growing – and globally demand growth primarily all in Asia (mostly China.) Overall, supply growth has beaten demand growth by a wide margin, and prices are not only low now – they will likely go lower. Even oil company CEOs are predicting US production will decline – but to lower demand

In 2015, I predicted that Tesla could put a big hurt on Exxon. Most people thought that was a joke. Tesla was a fraction the size of GM, and “small potatoes” in the car industry. Meanwhile Exxon was one of the world’s largest oil producers and refiners. That really would be a very small David smacking a very big Goliath – and with a very small rock. But what I pointed out in 2015 was that traditional analysts predicted a very gradual growth in electric cars, and a continued growth in petroleum powered cars, and pretty much constant growth in oil & gas consumption with economic growth. In other words,analysts were using old assumptions all around and expecting only a tiny impact from a few weirdos buying electric cars.

But I asked, what if those assumptions were wrong? In 2015, the world was awash in oil, inventories were then at record levels, and electric car sales were taking off. And the truth was, a lot was happening to reduce demand for oil. Renewable energy programs, conservation, and a change in economic activity from basic manufacturing and commodity processing to a knowledge economy. These trends were all putting big dampers on oil demand. And electric auto sales were poised for a big boom. I predicted demand for oil would drop substantially, inventories would skyrocket and industry problems would worsen as prices cratered.

Uh-hum – what was the price of oil in April?

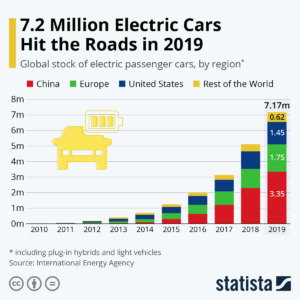

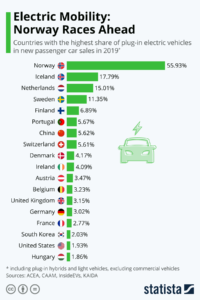

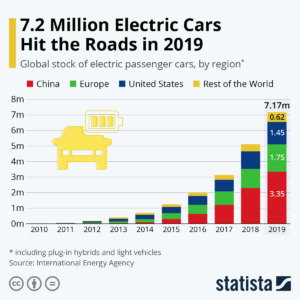

In 2009, I made the case that electric cars were a small base, but that geometric demand growth would make them an important economic impact . Today, most Americans still think that’s the case. In 2009 less than 100,000 new cars were electric. But by 2015, over 1 million electric cars had been sold. Then, with the help of game changers like the Tesla Model 3 in 2019 sales exceeded 7 million! A 7-fold increase in 5 years, or nearly 50%/year market growth!!

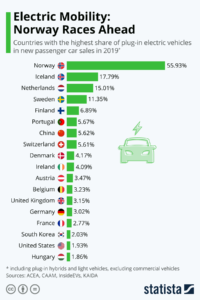

Americans aren’t aware of this phenomenon largely because the big growth centers are outside the USA. Where electrics are ~2% of US car sales, in some European countries they are well over 10% of the market. Even in China they represent over 5% of sales!

Remember what I said above about demand growth depending on China? Look again at who’s buying the most electric cars.

Lessons:

1 – Never think your product is beyond attack by market forces. Be paranoid.

2 – Very small, fringe competition can sneak up and steal your market faster than you think.

3 – Fringe changers don’t have to take a huge market share to make a BIG impact on your market and pricing.

4 – Disruptive events favor the upstarts, who are on trend, and hurt big incumbents, who depend on “business as usual.”

5 – Don’t expect markets to “return to normal.” Markets always move forward, with trends.

6 – Don’t plan from the past, plan for the future – and pay attention to disruptions, they can break you.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jul 14, 2020 | Disruptions, Innovation, Leadership, Marketing, real estate, Retail, Trends

TRENDS: Covid-19 has accelerated a lot of trends. Few more than retail. Oddly some people have taken the view that Covid-19 changed retail. Actually, it didn’t. The pandemic has merely accelerated trends that have been driving industry change for almost two decades.

Back in 2004, Eddie Lampert bought all the bonds of defunct Kmart and used those assets to do a merger with Sears – creating Sears Holdings that encompassed both brands. The day of announcement Chicago Tribune asked for my opinion, and famously I predicted the merger would be a disaster. Clearly both Kmart and Sears were far, far off trends in retail, both were already struggling – and neither had a clue about emerging e-commerce.

Why in 2004 would I predict Sears would fail? The #1 trend in retail was e-commerce, which was all about individualized customer experience, problem solving for customer needs — and only, finally fulfillment. By increasing “scale” – primarily owning a lot more real estate – this new organization would NOT be more competitive. Walmart was already falling behind the growth curve, and everyone in retail was ignoring the elephant in the room – Amazon.com. Loading up on a lot more real estate, more inventory, more employees, more supplier relationships and more community commitments – old ideas about how to succeed related to fulfillment – would hurt more than help. Retail was an industry in transition. All of these factors were boat anchors on future success, which relied on aggressively moving to greater internet use.

Unfortunately, Eddie Lampert as CEO was like most CEOs. He thought success would come from doing more of what worked in the past. Be better, faster, cheaper at what you used to do. In 2011 Sears asked its HQ town (Hoffman Estates) and the state (Illinois) for tax subsidies to keep the HQ there. Sears had built what was once the world’s once tallest building, named the Sears Tower. But many years earlier Sears left, the building was renamed, and Sears was becoming a ghost of itself. I pleaded with government officials to “let Sears go” since the money would be wasted. And it was clear by 2016, that Lampert and his team’s bias toward old retail approaches had only served to hurt Sears more and guarantee its failure. Now – in 2020 – Hoffman Estates has taken the embarrassing act of removing the Sears name from the town’s arena, admitting Sears is washed up.

****

It was with a multi-year observation of trends that I told people in 2/2017 that retail real estate values would crumble . Now mall vacancies are at an 8 year high and 50% of mall department stores will permanently close within a year. We are “over-stored” and nothing will change the fast decline in retail real estate values. Who knows what will happen to all this empty space?

Trends led me in March 2017 to advise investors they should own NO traditional retail equities. Shortly after Sears filed bankruptcy Radio Shack and storied ToysRUs followed. And with the pandemic acting as gasoline fueling change, we’ve now seen the bankruptcies of Neiman Marcus, JCPenney, J Crew, Forever 21, GNC and Chuck e Cheese (but, really, weren’t you a bit surprised the last one was still even in business?) After 3 years of pre-Covid store closings, Industry pundits are finally predicting “record numbers of store closings”. And, after 15 years of predictions, I’m being asked by radio hosts to explain the impact of widespread failures of both local and national retailers ( ). Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

As we move forward, what will happen to your business? Will you build on trends to create a new future where growth abounds? Will you align your strategy with the future so you “skate to where the puck will be?” Or will you – like Sears and so many others – find an ignominious end to your organization? Will the signs change, or will the signs come down? The trends have never been stronger, the markets have never moved faster and the rewards have never been greater. It’s time to plan for the future, and build your strategy on trends (not what worked in the past.)

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Dec 27, 2019 | Advertising, Disruptions, Innovation, Television, Trends

In 2020, internet ads will represent over 50% of all advertising money spent. Think about that factoid. An ad medium that wasn’t even important to the ad industry a decade ago now accounts for half of the industry. It took three years after the Dot Com bubble burst for internet advertising to hit bottom, but then it took off and hasn’t stopped growing.

An example of rapid, disruptive change. A market shift of tremendous proportions that has forever changed the media industry, and how we all consume both entertainment and news. Did you prepare for this shift? And is it helping you sell more stuff and make more money?

This was easy to predict. Seven years ago (12/10/12), I wrote “The Day TV Died.” The trend was unmistakable – eyeballs were going to the internet. And as eyeballs went digital, so did ads. These new, low cost ads were “democratizing” brand creation and allowing smaller companies to go direct to consumers with products and solutions like never before in history. It was ushering in a “golden age” for small businesses that took advantage.

However, small businesses – and large businesses – largely failed to adjust to these trends effectively. By 3/21/13 I pointed out in “Small Business Leaders Missing Digital/Mobile Revolution” that small businesses were continuing to rely on the least economical forms of media outreach – direct mail and print! They were biased toward what they knew how to do, and old metrics for media, instead of seizing the opportunity. Likewise, by 12/11/14 in “TV is Dying Yet Marketers Overspend on TV” I was able to demonstrate that the only thing keeping TV alive were ad price increases so big they made up for declining audiences. The leaders of big companies were biased toward the TV they knew, instead of the better performing and lower cost new internet media capabilities.

Three years ago (1/6/17), I pointed out in “Four Trends That Will Forever Change Media… and You” it was obvious that digital social media advertising was making a huge impact on everyone. Fast shifting eyeballs were being tracked by new technology, so ads were being purchased by robots to catch those eyeballs – and this meant fake news would be rampant as media sites sought eyeballs by any means. And Netflix was well on its way to becoming the Amazon of media with its own programs and competitive lead.

So the point? It was predictable all the way back in 2012 that digital media would soon dominate. This would change advertising, distribution and content. Now digital advertising is bigger than all other advertising COMBINED. Those who acted early would get a huge benefit (think Facebook/Instagram Path to Media Domination) while those who didn’t react would feel a huge hurt (newspapers, radio, broadcast TV, brick and mortar retail, large consumer goods companies that rely on high priced TV.) But did you take action? Did you take advantage of these trends to make your business bigger, stronger, more profitable, more relevant? Or are you still reacting to the market, struggling to understand changes and how they will impact your business?

The world continues to be a fast changing place. Mobile phones and social media will not go away – no matter what Congress, the UN or the EU regulators do. Global competition will grow, regardless what politicians say. Those who understand how these big trends create opportunities will find themselves more successful. Those who focus on the past, try to execute better with their old “core,” and rely on historical biases will find themselves slowly made irrelevant by those who use new technologies and solutions to offer customers greater need satisfaction. Which will you be? A laggard? Or a leader? Will you build on trends to grow – or slump off into obsolescence? The choice is yours.

by Adam Hartung | Nov 2, 2019 | Disruptions, Food and Drink, Innovation, Marketing, Strategy, Trends

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Mighty Oaks from Tiny Acorns Grow – Beyond Meat

TREND: Beyond Meat (BYND, NASDAQ)

A big, new trend is emerging. Sales of plant based protein products may be small, but growth is remarkable. Could Beyond Meat be the next Netflix?

In Q3 2019, Beyond Meat’s revenue is up 2.5x (250%) vs Q3 2018 — which was up 2.5x (250%) over Q3 2017. Yes, you can say this growth is on a small base, given that last quarter was $100M revenue.

Imagine what it’s like growing that fast. Imagine the exhilaration of solving problems – like funding your accounts receivable that’s growing with accelerating orders. Or amping up production faster than ever imagined. Or meeting needs of your customers, retailers and restaurants. Or paying out big bonuses due to beating all your planned metrics.

It’s not that much fun to work at Cargill. Or Tyson Foods. Or Smithfield. Or any other traditional company producing beef, or pork, or chicken. Those are huge companies, with lots of people. But they aren’t maxing out sales and profits – and bonuses – like Beyond Meat.

It’s easy to ignore a start up. But one has to look at the relative growth of a company to judge its future. There were cracks in the growth rate at Blockbuster 6 years before it failed. And during that time, Blockbuster kept saying Netflix was a nit that didn’t matter. But Netflix was growing like the proverbial weed. Netflix wasn’t even half the size of Blockbuster when Blockbuster filed for bankruptcy.

With growth like Beyond Meat it didn’t take long to upset an entire industry biz model. Amazon still doesn’t sell as much as WalMart, but it wiped out a significant number of retailers by changing volumes enough to erase their profits. Think about the changes wrought on the advertising industry by Google, which has pretty much killed print ads. Look at what’s happened to other media ad models, like TV and radio, by Facebook’s growth. And entertainment has been entirely changed – where today the onetime distributor is one of the biggest content producers – Netflix.

In traditional marketing theory, Beyond Meat, like Netflix, is selling new products to existing markets.

Most disruptors enter the markets in the new product/new market quadrant of the Ansoff matrix. They create the new market just by entering. If they even see them as competitors, established businesses dismiss these potential disruptors because of established focus on current markets/current products with sustaining innovations. Selling new products to existing customers is the first step companies take as they start to innovate.

Kraft was on this path when they acquired a new productc with its purchase of Boca Burger in 2000. Kellogg’s and General Foods jumped into the alternative meat products at about the same time. Vegetarian burger substitutes threatened the success formula of meat products and were relegated to niche products. In 2018, Kraft’s incubator tried to relaunch Boca, but the smaller, more nimble start-ups had already captured consumers’ attention and reframed the market.

Beyond Meat had morphed quickly into a direct competitor to the meat industry by selling this new product to existing meat customers!

Riding the trends of climate change, sustainability and organic foods, Beyond Meat is starting to look like a true game changer. It may be small, but those other companies were too (along with Tesla, don’t forget, considered immaterial by GM, et.al.) Those who are in the traditional protein market (beef especially) had better pay attention – their profit model is already under attack!!

“The creation of a thousand forests is in one acorn.”

What’s on your company’s radar today?

Spark Partners is here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Let us do an opportunity assessment for your organization. For less than your annual gym cost, or auto insurance premium, we could likely identify some good opportunities your blinders are hiding. Read my Assessment Page to learn more.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my

Status Quo Risk Management Playbook.

Give us a

call today, or send an email, so we can talk about how you can be a leader, rather than follower. Or check out the rest of the

website to read up on what we do so we can create the right level of engagement for you.

Hartung Recent Blog Posts on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | May 1, 2019 | Disruptions, Innovation, Marketing, Strategy

Find Opportunities Out of the Box

If your company is like most businesses, your list of new product or service ideas looks like a sales wish list- new features at a lower cost. Marketing or product management may go a step further and group the ideas into product line extensions or possibly entries into new market segments. Unfortunately, while generating revenue in the short run, this process leaves the company vulnerable to competition and missing opportunities in the long run.

Well, you are not alone. Since about 2012, the pace of innovation has slowed even in the popular market of social media. According to KeyMedia, “What was once a world of diversity and originality has slowly started to look like a bad case of déjà vu… (as platforms are) becoming more similar to each other…”

Most companies devote resources to a quadrant on the innovation matrix known as “sustaining innovation.” They improve existing products sold to existing customers. It’s low risk, true, but it’s also low return. Why do companies follow this death spiral? It’s because “innovation” has gotten a bad reputation.

According to Inc. magazine, “…many (business) people have come to equate the idea of innovation with disruptive innovation. But the fact is that for most businesses, placing big bets on high-risk ideas is not only unfeasible, it’s unwise.”

The Ansoff matrix of new and existing markets and products is usually interpreted as 4 quadrants. It is much more than that: it is a continuum between sustaining and disruptive innovation. .

Adam Hartung often tells clients, “Get out of the box, then think!” This applies directly to the Ansoff model. Once a company sees the matrix, not as fixed “boxes” but as a spectrum of opportunities, markets are viewed not as filled with risk, but filled with opportunities!

Consider Ricoh’s new “clickable paper” that combines the print channel, with an app and that integrates to social media or a website. Not disruptive in the classical sense, but an adjacent product and adjacent market segment that makes print relevant to tech savvy consumers. Or Dr. Dre’s Beats headphones that combine pre-equalized sound with noise cancellation and style- a clever and highly successful blend of existing technologies, vigorously marketed.

Uncovering these market opportunities that can deliver improved returns at a manageable risk for the firm. New products will also generate an increasing percentage of revenue leading to continued growth. Companies that master this process have a long range radar to identify potential opportunities in a process called, “continuous innovation”.

What’s on your company’s radar today?

We are here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Go the website and view the Assessment Page. Send me a reply to this email, or call me today, and let’s start talking about what trends will impact your organization and what you’ll need to do to pivot toward greater success.

by Adam Hartung | Jan 23, 2018 | Disruptions, Investing, Retail, Trends

Business Insider is projecting a “tsunami” of retail store closings in 2018 — 12,000 (up from 9,000 in 2017.) Also, the expect several more retailers will file bankruptcy, including Sears.

Duh. Nothing surprising about those projections. In mid-2016, Wharton Radio interviewed me about Sears, and I made sure everyone clearly understood I expect it to fail. Soon. In December, 2016 I overviewed Sears’ demise, predicted its inevitable failure, and warned everyone that all traditional retail was going to get a lot smaller. I again recommended dis-investing your portfolio of retail. By March, 2017 the handwriting was so clear I made sure investors knew that there were NO traditional retailers worthy of owning, including Walmart. By October, 2017 I wrote about the Waltons cashing out their Walmart ownership, indicating nobody should be in the stock – or any other retailer.

The trend is unmistakable, and undeniable. The question is – what are you going to do about it? In July, 2015 Amazon became more valuable than Walmart, even though much smaller. I explained why that made sense – because the former is growing and the latter is shrinking. Companies that leverage trends are always worth more. And that fact impacts YOU! As I wrote in February, 2017 the “Amazon Effect” will change not only your investments, but how you shop, the value of retail real estate (and thus all commercial real estate,) employment opportunities for low-skilled workers, property and sales tax revenues for all cities impacting school and infrastructure funding, and all supply chain logistics. These trends are far-reaching, and no business will be untouched.

Don’t just say “oh my, retailers are crumbling” and go to the next web page. You need to make sure your strategy is leveraging the “Amazon Effect” in ways that will help you grow revenues and profits. Because your competition is making plans to use these trends to hurt your business if you don’t make the first move. Need help?

by Adam Hartung | Aug 15, 2017 | Disruptions, Web/Tech

Even though most people don’t even know what they are, Bitcoins increased in value from about $570 to more than $4,300 — an astounding 750% — in just the last year. Because of this huge return, more people, hoping to make a fast fortune, are becoming interested in possibly owning some Bitcoins. That would be very risky.

Bitcoins are a crypto-currency. That means they can be used like a currency, but don’t physically exist like dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

Being virtual is not inherently a bad thing. The dollars on our financial institution statement, viewed online, are considered real money, even though those are just digital dollars. The fact that Bitcoins aren’t available in physical form is not really a downside, any more than the numbers on your financial statement are not available as physical currency either. Just like we use credit cards or debit cards to transfer value, Bitcoins can be spent in many locations, just like dollars.

What makes Bitcoins unique, versus other currencies, is that there is no financial system, like the U.S. Federal Reserve, managing their existence and value. Instead Bitcoins are managed by a bunch of users who track them via blockchain technology. And blockchain technology itself is not inherently a problem; there are folks figuring out all kinds of uses, like accounting, using blockchain. It is the fact that no central bank controls Bitcoin production that makes them a unique currency. Independent people watch who buys and sells, and owns, Bitcoins, and in some general fashion make a market in Bitcoins. This makes Bitcoins very different from dollars, euros or rupees. There is no “good faith and credit” of the government standing behind the currency.

Why are currencies different from everything else?

Currencies are sort of magical things. If we didn’t have them we would have to do all transactions by barter. Want some gasoline? Without currency you would have to give the seller a chicken or something else the seller wants. That is less than convenient. So currencies were created to represent the value of things. Instead of saying a gallon of gas is worth one chicken, we can say it is worth $2.50. And the chicken can be worth $2.50. So currency represents the value of everything. The dollar, itself, is a small piece of paper that is worth nothing. But it represents buying power. Thus, it is stored value. We hold dollars so we can use the value they represent to obtain the things we want.

Currencies are not the only form of stored value. People buy gold and lock it in a safe because they believe the demand for gold will rise, increasing its value, and thus the gold is stored value. People buy collectible art or rare coins because they believe that as time passes the demand for such artifacts will increase, and thus their value will increase. The art becomes a stored value. Some people buy real estate not just to live on, but because they think the demand for that real estate will grow, and thus the real estate is stored value.

But these forms of stored value are risky, because the stored value can disappear. If new mines suddenly produce vast new quantities of gold, its value will decline. If the art is a fake, its value will be lost. If demand for an artist or for ancient coins cools, its value can fall. The stored value is dependent on someone else, beyond the current owner, determining what that person will pay for the item.

Assets held as stored value can crash

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

But there were no controls on tulip bulb production. Eventually it became clear that more tulip bulbs were being created, and the value was much, much greater than one could ever get for the tulips once planted and flowered. Even though it took many months for the value of tulip bulbs to become so high, their value crashed in a matter of two months. When tulip bulb holders realized there was nobody guaranteeing the value of their tulip bulbs, everyone wanted to sell them as fast as possible, causing a complete loss of all value. What people thought was stored value evaporated, leaving the tulip bulb holders with worthless bulbs.

While a complete collapse is unlikely, people should approach owning Bitcoins with great caution. There are other risks. Someone could hack the exchange you are using to trade or store Bitcoins. Also, cryptocurrencies are subject to wild swings of volatility, so large purchases or sales of Bitcoin can move prices 30% or more in a single day.

Be an investor, not a speculator, and avoid Bitcoins

There are speculators and traders who make markets in things like Bitcoins. They don’t care about the underlying value of anything. All they care about is the value right now, and the momentum of the pricing. If something looks like it is going up they buy it, simply on the hope they can sell it for more than they paid and take a profit on the trade. They don’t see the things they trade as having stored value because they intend to spin the transaction very quickly in order to make a fast buck. Even if value falls they sell, taking a loss. That’s why they are speculators.

Most of us work hard to put a few dollars, euros, pounds, rupees or other currencies into our bank accounts. Most of those dollars we spend on consumption, buying food, utilities, entertainment and everything else we enjoy. If we have extra money and want the value to grow we invest that money in assets that have an underlying value, like real estate or machinery or companies that put assets to work making things people want. We expect our investment to grow because the assets yield a return. We invest our money for the long-term, hoping to create a nest egg for future consumption.

Unless you are a professional trader, or you simply want to gamble, stay away from Bitcoins. They have no inherent value, because they are a currency which represents value rather than having value themselves. The Bitcoin currency is not managed by any government agency, nor is it backed by any government. Bitcoin values are purely dependent upon holders having faith they will continue to have value. Right now the market looks a lot more like tulip mania than careful investing.

by Adam Hartung | Jul 28, 2017 | Disruptions, Leadership

The news was filled this week with stories about President Trump’s “unorthodox” management style. From tweeting his thoughts on replacing Attorney General Jeff Sessions, to tweeting his multiple positions on healthcare law changes, to hiring a new communications director who lets loose with expletive-laden rants, people have been left questioning what sort of leadership style President Trump is trying to display.

Donald Trump promised to be a “disruptive leader”

Donald Trump ran for office as an outsider who pledged to disrupt Washington politics. This was a message well received by many people. They felt that “business as usual” in national politics was not serving them well, so they wanted change. To them a disruptor could find a way to steer national politics back onto a course that was more aligned with the conservative middle Americans. These voters felt that a businessman entrepreneur just might be the kind of leader who could disrupt the status quo in order to get something done for them.

Unfortunately, things have not worked out that way. And largely this can be traced to the leadership style of President Trump. Rather than a dedicated disruptor, ready to implement change, President Trump has proven to be a chaos generator that has stymied progress on pretty nearly all issues. Disruptions can lead to positive change. Chaos leads to stagnation and degradation as the system searches for homeostasis and a path forward.

From early age, we are taught not to be disruptive. Disrupting someone during school, religious ceremonies, entertainment events leads to distractions and an inability to remain focused on the goal. Thus, we are mostly taught to listen, learn and do what we’re told. However, we also recognize there is a time to be disruptive, because the act of intervening in the process at times can lead to far more positive outcomes than maintaining the course.

But it takes good judgement, and reasoned action, to be a positive disruptive influence. If you are in a crowded theater and you recognize a blaze it is time to disrupt the stage presentation. But you have a choice. If you jump up and yell “fire” you will create chaos. Everyone suddenly realizes a problem, but with no idea how to deal with it a thousand different solutions emerge simultaneously. Everyone starts looking out for their own interest, and they trample those around them in an effort to implement their own plans. Many people get hurt, and frequently the goal of saving everyone by disrupting the presentation is lost in carnage created by the bad disruption leading to chaos.

What is successful disruptive leadership?

So, if you sense a pending fire you are far smarter to develop a plan, such as activating the evacuation notices and opening the exits, prior to making an alert. And then, instead of yelling “fire” you say to folks “an issue has developed, please make your way down the evacuation routes to the open exits while we deal with the situation. Please remain calm so everyone can exit safely.” Your disruption can lead to successful outcome, rather than chaos.

I’ve spent over 20 years focusing on how disruptions can lead to positive change. And it is clear that with disruptive innovations, and disruptive business models, their success relies on leaders that understand how to implement disruptions effectively. Leadership matters.

Disruptive leaders think very hard about their desired outcomes, and they go to great lengths to describe what those future, better outcomes will look like. They then create a plan of action before they do anything. While the innovation might well be known, they are very, very careful to think through how that innovation will be adopted, then nurtured to gain acceptance and hopefully become mainstream. These leaders are very careful about their language choices, and where they communicate, in order to encourage people to accept their vision and join with their plan. They seek adoption rather than confrontation, and they discuss the desired outcomes rather than the disruption itself. They gain trust and build a consensus for change, and then they systematically roll out their plan, which they adjust as necessary to meet unexpected market conditions. They gradually move people along the implementation route by relentlessly focusing on the better outcome and reducing the fear inherent in accepting the disruption.

Five ways Donald Trump fails as a successful disruptive leader:

- The President has not portrayed a superior outcome which he can use to rally people to his viewpoint. Despite talking about “making America great again” there is no picture of what that looks like. What is this future “great” America he envisions and wants us to buy into? What are the poor outcomes of today that he will greatly improve, leading to vastly superior future outcomes? Without a clear description of the future, it is hard to gain supporters. For example, will changes in health care improve care? Lower the cost? What are the benefits, the better outcomes, of change? What is the benefit of replacing the sitting attorney general?

- The President has not laid out his plan for bringing people on board to his future. Look at the recent effort to implement new health care legislation. At times the President has said there is a need to repeal current legislation and replace it, but he has offered no description of what the replacement should look like. At other times he has said to repeal current legislation, but he has offered no insight into how that would lead to better outcomes than the current legislation provides. At yet other times he has said to do nothing, and he expressed his hope that current legislation would fail even though he admitted this would lead to an outcome far worse than the status quo. By not creating a plan, and bringing people on board to his plan, he has created chaos in the legislative process.

- President’s Trumps messages are built on negative language, not positive language about the future. His messages are long on how some person or current situation is weak, rather than explaining what a strong future would look like. He frequently attacks his predecessor, or his former electoral opponent, but does little to say what is good about his Presidency or recommendations or what he is specifically going to do that will create better outcomes. He frequently talks about firing people in his administration, but talks little about the specifics of what good work people in his administration are doing. These language choices are exclusive, not inclusive, and they create chaos among those who work in his administration, and members of Congress. Instead of understanding the President’s goals and objectives people are wondering “what will he say next?” And by appointing a communications director who uses outrageous, unacceptable and incendiary language he further exacerbates the problem of everyone losing any insight to his message because we are stunned and amazed at the choice of language.

- President Trump has the ability to communicate from the most Presidential locations. He can provide TV, radio and internet addresses from the oval office, or the White House platform. He can invite media in for press conferences or interviews to discuss his goals and ambitions, plans and pending decisions. Or he can make himself, or his staff, available for press interviews. And while he does some of this, we all spend every day wondering what Tweet he will send over the Twitter social network next. Several million people use Twitter. It is for social exchange. For the President to announce policy positions (such as banning transgenders from military service) or evaluations of key subordinates (such as referring to the attorney general as weak) or military policy (such as opining on the potential retribution toward North Korea) via Twitter belies the nature of the office and his role. His selection of communication venues only serves to make his comments less valuable, rather than more important.

- President Trump neither remains consistent in his communications, nor does he exert loyalty. Changes on health care and denouncing his own staff does not create trust. How are people in the legislature, regulatory agencies or military going to become advocates for his goals when they don’t know if he can be trusted to support their actions, or support them as employees? If you want people to take a different course of action, to let go of the status quo, they have to trust you. Disruptive leaders time and again must state their positions with clarity and demonstrate support for those who do their best to promote the disruptive agenda. They battle fear of the future with clarity around their support for future outcomes those who help describe how the future will be better.

There are times for disruptive leadership. Status quo models become outdated, and outcomes decline as a result. Change offers the opportunity for better outcomes, and helping people migrate to new innovations helps them toward a better future. But implementing innovation and change requires skill at being a disruptive leader. If the process is bungled, you can look like the guy who started a deadly rampage by yelling “fire” when a more reasoned approach would have prevailed. If you don’t follow the best practices of disruptive leadership, you will create chaos.

by Adam Hartung | Jun 27, 2017 | Disruptions, Employment, Finance

Photo by Spencer Platt/Getty Images

I’m a believer in Disruptive Innovation. For almost 100 years economists have written about “Creative Destruction,” in which new technologies come along making old technologies — and the companies built on them — obsolete. In the last 20 years, largely thanks to the insights of faculty at the Harvard Business School, we’ve seen a dramatic increase in understanding how new companies use new technologies to disrupt markets and wipe out the profitability of companies that were once clearly successful. In a large way, we’ve come to accept that Disruptive Innovation is good, and the concomitant Creative Destruction of the old players leads to more rapid growth for the economy, increasing jobs and the wherewithal of everyone. Creative Destruction, in the pursuit of progress, is good because it helps economies to grow.

But, not really everyone benefits from Creative Destruction. The trickle down benefits to lots of people can be a long time coming. When market shifts happen, and people lose jobs to new competitors — domestic or offshore — they only know that their life, at least short term, is a lot worse. As they struggle to pay a mortgage, and find a new job, they often learn their skills are outdated. There are new jobs, but these folks are often not qualified. As they take lesser jobs, their incomes dwindle, and they may well lose their homes. And their healthcare.

Economists call this workplace transition “temporary economic dislocation.” Fancy term. They claim that eventually folks do enter the workplace who are properly trained, and those folks make more money than the workers associated with the previous, now inferior, technology. And, eventually, everyone finds new work – at something.

That’s great for economists. But terrible for the folks who lost their jobs. As someone once said “a recession is when your neighbor loses his job. A depression is when you lose your job.” And for a lot of people, the market shift from an industrial economy to an information economy has created severe economic depression in their lives.

A person learns to be a printer, or a printing plate maker, in the 1970s when they are 20-something. Good job, makes a great wage. Secure work, since printing demand just keeps rising. But then along comes the internet with PDF and JPEG documents that people read on a screen, and folks simply quit needing, or wanting, printed documents. In 2016, now age 50-something, this printer or plate-maker no longer has a job. Demand is down, and its really easy to send the printing to some offshore market like Thailand, Brazil or India where printing is cheaper.

What’s he or she to do now? Go back to school you may say. But to learn how to do what? Say it’s online (or digital) document production. OK, but since everyone in the 20s has been practicing this for over a decade it takes years to actually be skilled enough to be competitive. And then, what’s the pay for a starting digital graphic artist? A lot less than what they made as a printer. And who’s going to hire the 58-62 year old digital graphic artist, when there are millions of well trained 20-somethings who seem to be quicker, and more attuned to what the publishers want (especially when the boss ordering the work is 35-42, and really uncomfortable giving orders and feedback to someone her parents’ age.) Oh, and when you look around there are millions of immigrants who are able to do the work, and willing to do it for a whole lot less than anyone native born to your country.

In England last week these disaffected people made it a point to show their country’s leadership that their livelihoods were being “creatively destroyed.” How were they to keep up their standard of living with the flood of immigrants? And with the wealth of the country constantly shifting from the middle class to the wealthy business leaders and bankers? And with work going offshore to less developed countries? While folks who have done well the last 25 years voted overwhelmingly to remain in the EU (such as those who live in what’s called “The City”), those in the suburbs and outlying regions voted overwhelmingly to leave the EU. Sort of like their income gains, and jobs, left them.

A whole lot of anger. To paraphrase the famous line from the movie Network, they were mad as Hell and they weren’t going to take it any longer. Simply put, if they couldn’t participate in the wonderful economic growth of EU participation, they would take it away from those who did. The point wasn’t whether or not the currency might fall 10% or more, or whether stocks on the UK exchange would be routed. After all, these folks largely don’t go to Europe or America, so they don’t care that much what the Euro or dollar costs. And they don’t own stocks, because they aren’t rich enough to do so, so what does it hurt them if equities fall? If this all puts a lot of pain on the wealthy – well just maybe that is what they really wanted.

America is seeing this as well. It’s called the Donald Trump for president campaign. While unemployment is a remarkably low 5%, there are a lot of folks who are working for less money, or simply out of work entirely, because they don’t know how to get a job. They may laugh at Robert De Niro as a retired businessman now working for free in The Intern. But they really don’t think it’s funny. They can’t afford to work for free. They need more income to pay higher property taxes, sales taxes, health care and the costs of just about everything else. And mostly they know they are rapidly being priced out of their lifestyle, and their homes, and figuring they’ll be working well into their 70s just to keep from falling into poverty.

These people hate President Obama. They don’t care if the stock market has soared during his presidency – they don’t own stocks (and if they do in a 401K or similar program they don’t care because it does them no good today). They don’t care that he’s created more jobs than anyone since Reagan or Roosevelt, because they see their jobs gone, and they blame him if their recent college graduate doesn’t have a well-paying job. They don’t care if America is closing in on universal health care, because all they see is that health care is becoming ever more expensive – and often beyond their ability to pay. For them, their personal America is not as good as they expected it to be – and they are very, very angry. And the President is a very identifiable symbol they can blame.

Creative Destruction, and disruptive innovations, are great for the winners. But they can be wildly painful to the losers. And when the disruptive innovations are as big, and frequent, as what’s happened the last 30 years – globalized economy, nationwide and international super banks, outsourcing, offshoring and the entirety of the Internet of Things – it has left a lot of people really concerned about their future. As they see the top 1% live opulent lifestyles, they struggle to keep a 12 year old car running and pay the higher license plate fees. They really don’t care if the economy is growing, or the dollar is strong, or if unemployment is at near-record lows. They feel they are on the losing end of the stick. For them, well, America really isn’t all that great anymore.

So, hungry for revenge, they are happy to kill the goose for dinner that laid the golden eggs. They will take what they can, right now, and they don’t care if the costs are astronomical. They will let tomorrow sort out itself, in a bit of hyper-ignorance to evaluate the likely outcome of their own actions.

Despite their hard times, does this not sound at the least petty, and short-sighted? Doesn’t it seem rather selfish to damn everyone just because your situation isn’t so good? Is it really in the interest of your fellow man to create bad outcomes just because you’ve not done well?

by Adam Hartung | Jun 23, 2017 | Disruptions, Innovation

People like to discuss “strategic pivots” in tech companies. The term refers to changing a company’s strategy dramatically in reaction to market shifts. Like when Apple pivoted in 2000 from being the Mac company to its focus on mobile, which lead to the iPod, iPhone, and other mobile products. But everyone needs to know how to pivot, and some of the most important pivots haven’t even been in tech.

Take for example Netflix. Netflix won the war in video distribution, annihilating Blockbuster. But then, when it seemed Netflix owned video distribution, CEO Reed Hastings pivoted from distribution to streaming. He cut investment in distribution assets, and raised prices. Then he spent the money learning how to become a tech company that could lead the world in streaming services. It was a big bet that cannibalized the old business in order to position Netflix for future success.

Analysts hated the idea, and the stock price sank. But CEO Hastings was proven right. By investing heavily in the next wave of technology and market growth Netflix soared toward far greater success than had it kept spending money in lower cost distribution of cassettes and DVDs.

(From L to R) Philippe Dauman, US actress and singer Selena Gomez, MTV President Stephen Friedman and US director Jon Chu attend a Viacom seminar during the 59th International Festival of Creativity – Cannes Lions 2012, on June 21, 2012 in Cannes, southeastern France. The Cannes Lions International Advertising Festival, running from June 17 to 23, is a world’s meeting place for professionals in the communications industry. (VALERY HACHE/AFP/GettyImages)

This week Arthur Sadoun, the CEO of the world’s third largest advertising agency (Publicis) announced he was betting on a strategic pivot. And most in the industry questioned if he made a good decision.

Simply put, CEO Sadoun announced at the largest ad agency awards conference, the Cannes International Festival of Creativity, that Publicis would no longer participate in Cannes. Nor would it participate in several other conferences including the very large South by Southwest (SXSW) and Consumer Electronics Show (CES.) Instead, he would save those costs to invest in AR (artificial or augmented reality.)

In an industry long dominated by highly creative people who love mixing with other agency folks and clients, this was an enormous shock. These conferences were where award winners marketed their creative capability, showing off how much they were admired by peers. And they wined and dined clients seeking to build on awards to gain new business. No one would expect any major agency to drop out, and most especially not an agency as large as Publicis.

In changing markets strategic pivots make sense.

And strategically this pivot makes a lot of sense. The ad industry was once dominated by ads placed in newspaper, magazines and on TV. But today print journalism is almost dead. The demand for print ads is a fraction of 20 years ago. And TV is no longer as prevalent as before. Today, people spend more time looking at their smartphone than they do their TV. The days of thinking high creativity would lead to high sales are in the past. Fewer and fewer big advertisers care about who wins awards, and fewer are going to these conferences to decide who they would like to hire.

Today advertising is going “programmatic.” Increasingly ads are placed by computers, on web and mobile sites. Advertising is about finding the right eyeballs, at the right time, next to the right content in order to find a buyer. Advertisers no longer spend money lavishly on mass media hoping for good results. Instead ads are targeted, measured for response and evaluated for ROI based on media, location, user and a raft of other metrics.

And the industry has changed. There still is an advertising agency business. But it is under attack from tech companies like Google, Facebook, Twitter and Snap that promote to advertisers their ability to target the right clients for high returns on money spent. The content is important, but today almost everyone in the industry will tell you success depends on your budget and how you spend it, not the creative. And that is a lot more about understanding how we’re all interconnected, knowing how to measure device usage, profiling user behavior and programming the computers to put those ads in the right place, at the right time.

To pivot you must stop doing the old to start doing the new

Publicis has something like $10B in revenue. Thus, dropping $20M on filing award applications at events like Cannes, and sending a contingent of employees to receive awards, meet people and have fun doesn’t sound like a lot. But multiple that across the year and the total amount could well come to $100M-$200M. That’s still only 2% of revenues – at most. It would seem like not that much money given what has been a core part of historical marketing.

But, if Publicis is to compete in the future with the tech leaders, and emerging digital-oriented agencies, it has to develop technology that will make it a leader. Publicis can’t invent money out of thin air, so it has to stop doing something to create the funds for investing in what’s coming next. And stopping investing in something as “old school” as Cannes actually sounds really smart. As boomer ad execs retire the newer generation is not going to conventions to find agencies, they are looking under the hood at the technology engines these companies provide.

In new strategic areas a little money can go a long way

And while $100M to $200M may not sound like a lot, it is enough money to make a difference in creating a tech team that can work on future-oriented technology like AI. If spent wisely, that could truly move the needle. If Publicis could demonstrate an ability to use proprietary AI technology to better place ads and manage the budget for higher returns it can survive, and perhaps thrive, in a digitally dominated ad industry future. At the very least it can find its place next to Facebook and Google.

WPP, Omnicom and Interpublic should take serious notice. Will they succeed in 2025 if they keep marketing the way they did in 1985? Will this spending grow revenues if customers really don’t care about creative awards? Will they remain relevant if they lack their own technology to develop ads, campaigns and demonstrate positive rates of return on ad dollars spent?

CEO Sadoun’s approach to make the announcement without a lot of preliminary employee discussion shocked a lot of folks. And it shocked the festival owners who now have to wonder what the future of their business will be. But strategic pivots are shocking. They demonstrate a dramatic shift in how resources are deployed to position a company for the future, rather than simply trying to defend and extend the past.

It’s a lot smarter to try what you don’t know than hope everything will stay the same.

Will this work? There is no way to know if the Publicis leadership team can maneuver through the technology maze toward something great. But, at least they are trying. And that alone gives them a lot better shot at longevity than if they simply decided to do in 2018 what they have always done. Is your company ready to reassess its preparation for the future and address your strategy like you’re a tech company? Are you spending money on market shifts, or simply doing the same thing you’ve always done?

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web. In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.