by Adam Hartung | Jan 12, 2022 | Boards of Directors, Leadership, Medical, Strategy, Trends

I was happy to end 2021 on a very high note. Kaiser Health Network interviewed me on the future of pharmacies, based on my historically accurate forecasts for retailers. READ MORE I was delighted when this went semi-viral, being picked up by Yahoo!News, Salon, Washington Post and about a dozen other publications.

I’ve had a nearly 2 decade relationship with Vistage and its global network of CEOs. I was delighted to be interviewed about the best short-term and long-term goal setting process, giving all Vistage members my insights for success and how to use their planning processes to build a road to greater profitable growth.

READ MORE I’m looking forward to working with more Vistage groups and individual members in 2022 as their ambition for success continues growing.

I kicked off 2022 with a live webcast interview with International Market & Competitive Intelligence

magazine, hosted by its Chief Editor Rom Gayoso. As the changing world remains in fast-shifting overdrive leaders are increasingly looking for insights about the future. I’m delighted more keep asking how they can use my 30+ years of trend tracking to help them find the right stars to follow. Let me know by email or phone if you’d like to talk about how I can help your business grow stronger every year, despite the seeming chaos around us. Here’s my

interview with Rom Gayoso.

Lesson – You are either growing, or you are dying. There is no “maintenance, status quo.”

For 2022, Spark Partners is offering its Master Class on strategic planning and innovation for HALF OFF! That’s right, for just $495 you can get this 28 module course that shows you how to identify and follow trends, then build plans that leverage those trends for faster, more profitable growth. There’s no similar tool in the marketplace. A year in the making, this course provides an overview of the process I’ve used to build successful forecasts for investors and business leaders across companies of all sizes.

https://www.sparkpartners.com/business-master-class-think-innovation-course

Respond to this email and I can arrange your limited time discount to get started building a stronger, more successful organization.

Are you on “cruise control” running your business?

Ask yourself, Are you trying to defend and extend what you’ve always done? Or are you meeting unmet customer needs, helping customers to grow and in turn growing yourself? If you’re the former, get ready for a rude awakening.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | Aug 17, 2021 | Defend & Extend, Leadership, Politics, Strategy, Trends

Afghanistan’s Fall Was Foreseeable

After 20 years of American occupation, the Taliban retook Afghanistan in a matter of days. Pundits across the news channels are expressing extreme surprise. But they should not be surprised, this speed of change was entirely predictable. The chaos in Afghanistan may seem a world away, but this unfortunate situation can offer 2 significant lessons for business.

Lesson #1 – Failure (change) always happens faster than we expect.

It took 35 years to build the infrastructure for VHS tapes, then DVDs, to become a big market. We had to open a lot of stores, and put a lot of machines in homes. Then that all became pretty much worthless in 18 months when streaming came along. We used travel agents to book air flights and hotels for 40 years, but they practically all disappeared in a year when we could book on-line. We were ardent radio listeners until iTunes and streaming services pushed radio further toward obsolescence in 6 months when the pandemic magnified these trends. Radio consumption in cars came to an abrupt halt when commuting stopped.

Fringe competitors are constantly trying to become mainstream. They never give up. Innovators keep trying new ways to serve our customers. Then, when there’s a shift in technology, regulation or another major market component they leap forward in a huge step overtaking the marketplace. The Taliban never went away. They kept getting better and waited until the USA announced its planned withdrawal. That created the opportunity and in one big step they leapt forward. Business leaders continually believe that markets will shift gradually. Leaders underestimate how well fringe competitors are prepared to move forward, and leaders fail to anticipate how quickly customers will shift buying patterns (like Afghan troops dropping their guns and fleeing.)

It’s not gradual. Change happens fast. If you see a change on the horizon, don’t think it’ll come slowly. Think like the fellow pushed off a 20 story building. At the twelfth story it’s not “so far so good,” but rather “we better prepare for disaster.” When change is going to happen, pack your parachute. Figure out how you’ll keep pushing forward. Or you’ll find a swift, hard landing.

Lesson #2 – You are either growing, or you are dying. There is no “maintenance, status quo.”

Despite two decades fighting in Afghanistan, by no measure was America becoming more popular. America’s image, trade, world standing were not improving in Afghanistan. America was fighting merely to maintain. Watch “Charlie Wilson’s War” and it’s evident America had no plans to “heap any love” on Afghanistan. No schools, agricultural assistance, preservation of mosques or other religious sites, family assistance programs, immigration. America just kept working to preserve the situation after killing Osama bin Laden. The relationship wasn’t growing, improving, becoming something beneficial to both sides. Without growth in the relationship it was deteriorating. Afghans were increasingly weary of occupation, and in a great sense ready for change.

Too often, business leaders think they don’t need to focus on growth. According to recent Gartner research only 56% of chief executives see Growth as the top priority for their firms. They don’t think they need to think about how to launch new solutions, new services, new opportunities to please their customers. They drift into preserving the status quo business, perhaps working on doing things a little faster, a little better, a little cheaper. But as time passes needs change. New needs emerge. Markets don’t stay the same, new competitors challenge old norms – challenge the status quo. The customer relationship deteriorates as new unmet needs aren’t addressed. If we aren’t helping the customer to grow, and thus growing ourselves, the market becomes dull, and ready for a major shift. Poised to be overtaken by something new.

We used to think we could create a market, then erect entry barriers to keep out competitors. Things like scale advantages, control of distribution, control of technology, regulatory limitations became the “moats” that would protect the business. And we thought with those protections we had “competitive advantage” allowing revenues, and profits, to go on infinitely. But that simply isn’t true. Fringe competitors are constantly attacking the “moat.” Things happen in the world creating opportunities for new solutions. A “reinvention gap” emerges as the old business becomes stale and customers are looking for something new. And fringe competitors are waiting for the opportunity to take action – and market share.

The only way you can remain vital is to constantly grow. You have to keep up with economic growth (3%/yr) and overall inflation (3%/year) just to remain even – without any return to shareholders. Add on 3 more points of growth to keep investors and you need to grow 9-10%/year just to sustain. Leaders too often take for granted that customers are happy, their particular market is “low growth” and they focus on the bottom line. Wrong, and deadly. Instead focus on the top line. You have to constantly grow revenues. It’s the only way you can remain vital with your customers, and the only route to success.

This analogy is not to belittle the catastrophic circumstances in Afghanistan. Under the Taliban most people will be denied the things I personally hold dear. It is a human tragedy.

But the story is one told all too often. Focusing on the bottom line, forgetting the need to grow your organization and your relationship with customers. And then thinking that any transition will take some time, providing ample room to react. I see these errors regularly. Think of Sears, ToysRUs, Hostess Baking, Sun Microsystems, Wang, GM/Ford/Chrysler, Motorola….. it’s a very long list of companies that made these two mistakes. As the newscasters harp on how fast Afghanistan fell, remember that this was a failure many years in the making. Lots of defend and extend behavior (military might) by America, far too little innovation and not meeting unmet needs (food, shelter, clean water, education, protection from harm.)

Are you on “cruise control” running your business?

Ask yourself, Are you trying to defend and extend what you’ve always done? Or are you meeting unmet customer needs, helping customers to grow and in turn growing yourself? If you’re the former, get ready for a rude awakening.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | May 20, 2021 | Computing, Innovation, Investing, Leadership, Software, Strategy, Trends

Stuck on the Core

This week, to almost no fanfare, a Microsoft Vice President issued a statement saying that Windows 10X (planned for 2019) would not ship in 2021. In fact, it would never ship. The technology enhancements would be integrated into existing Windows, and other products. While this gained little press, it is great news for customers and investors.

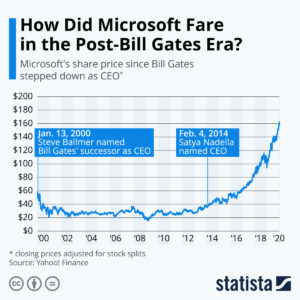

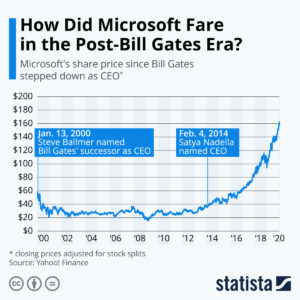

CEO Satya Nadella has officially changed the course of Microsoft. Under former CEO Ballmer the behemoth kept pouring money into Windows and Office. While the world was moving from PCs and PC servers to mobile devices and the cloud, Ballmer just kept pouring billions into old products. His slavish insistence on trying to defend & extend an old “core product line,” which every year was losing importance as PC sales slowed, was killing Microsoft — leading me to call Mr. Ballmer the worst CEO in America (my Forbes column that was by far the most read of any I ever penned.) After more than a decade as CEO, Ballmer had spent a lot of Microsoft money on new versions of its ancient product and bad acquisitions like Skype and Nokia, but he entirely missed the market shift in his customer base. In my blog post, “Microsoft, What Next?”, I described the challenges ahead to pull Microsoft out of the Growth Stall.

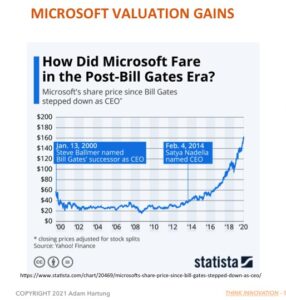

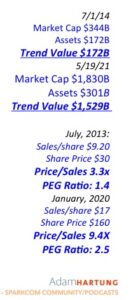

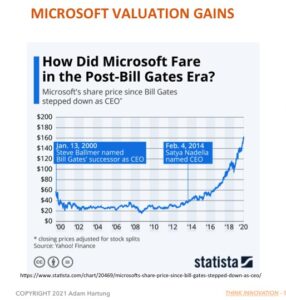

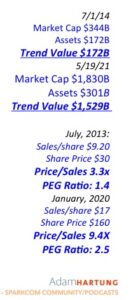

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!!

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!!

In the years leading up to Ballmer’s firing I was a very loud critic of Microsoft. In multiple Forbes columns, (republished as blogs on my web site) I pushed for his ouster. But even more importantly I gave the company little hope of long term viability. By over-investing in outdated products it seemed most likely Microsoft would go the way of Hostess Baking, Sears, DEC and Sun Microsystems – irrelevant leading to failure. I rabidly recommended not owning Microsoft.

Microsoft Stock

2014-2021

The Impossible Just Takes a little Longer…

But Nadella achieved the improbable. Much like Jobs when he retook the reigns at Apple, Nadella quit looking (and investing) in the rear view mirror. Like Jobs, he dropped investing in PC’s. Instead he focused on the future, and where Jobs invested in mobility, Nadella has invested in the cloud. Very few companies make this kind of radical shift in resourcing projects, even when it is the obviously right thing to do. And Nadella deserves the credit for making this radical change in Microsoft, saving the company from near-oblivion while creating a very viable, valuable company in a short time. Where once I saw a company heading for infamy, now Microsoft shows all signs of leadership toward the next technology wave and longevity. Quietly saying the company has no plans for a new Windows version, which nobody cares about anyway, is a tremendous demonstration of looking forward rather than backward.

Jump the Re-Invention Gap

Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.

Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | Aug 25, 2020 | Economy, Innovation, Leadership, Regulations, Strategy, Trends

In 2019, the California legislature passed Assembly Bill, AB5 “The Gig Economy Law.” It redefined “employee” in an effort to try and dramatically reduce “contract workers.” This law is intended to force people who work to become ”employees” (of someone), and thereby receive more rights. Simultaneously it forces those who pay for work to become “employers” covering additional costs forced onto them by the legal definition of an “employee”. In other words, AB5 attempts to set back the advancement of the Gig Economy 30+ years. Last week, that law was put on hold by a California court, and California citizens will vote in November on whether requirements of AB5 should remain, or be repealed.

Go back to 1900 and there were very few “employees.” Most people just worked. But the industrial economy boomed, and with it the need to put people into factories. Showing up on time, doing a job, was crucial to the industrial economy – whether you were making car parts or pushing invoices around. We’ve all seen pictures of assembly lines in factories making shirts or lawn mowers, and assembly lines of gray steel desks where people manually processed documentation. Being an “employee” meant showing up and was central to developing the industrial economy, where lots of cogs were needed for the machine to work.

There is one thing stronger than all the armies in the world, and that is an Idea whose time has come.

Victor Hugo

But we’re not in an industrial economy any more. Since 1990 we’ve been transforming into the information economy (or the knowledge economy, pick your preferred term.) Automation has replaced labor, with robots making trucks while computers process documents. People don’t stand in assembly lines – machines do. Work doesn’t happen with our hands, it happens with our brains – and machines do the manual labor. Managers don’t manage people, they manage processes. As a result, companies have been realizing they need a lot fewer people.

No longer can employers consider employees for life. Rather, companies need flexibility to adjust to the fast paced marketplace. Owning resources, including labor, can feel like dragging an anchor along with your business. Yes, people are needed people to do things. But every business leader knows that the brainpower needed today is probably not what was needed yesterday and not what will be needed tomorrow. Businesses need to access the knowledge workers they need quickly and shift their resources fast in order to meet changing market conditions- agility not stability. Relationships are transactional, not societal.

This is actually good for everyone. A hundred years ago studios controlled everything about movie making, including actor salaries. Many actors (i.e. Judy Garland & Mickey Rooney) made dozens of movies, yet had very little money. But that lock was broken, and it allowed actors to sell their services to the highest bidder – leading to today’s “star economy” where actors make what they can get producers to pay. There is a set scale to employment, but every actor is a free agent able to negotiate their terms of “employment” for each project.

This is actually good for everyone. A hundred years ago studios controlled everything about movie making, including actor salaries. Many actors (i.e. Judy Garland & Mickey Rooney) made dozens of movies, yet had very little money. But that lock was broken, and it allowed actors to sell their services to the highest bidder – leading to today’s “star economy” where actors make what they can get producers to pay. There is a set scale to employment, but every actor is a free agent able to negotiate their terms of “employment” for each project.

Major league sports is the same. Where once club owners dictated pay, today players negotiate across teams for the best contracts. It allows for negotiating the best price for the best service in an open, flexible economy. If you’re good at playing, or coaching, you negotiate with the teams to get your best price for your services.

Uber and Lyft aren’t much different from studios and sports franchisees. Once, taxi companies controlled the market. All of us spent time standing in lines, waiting on cabs, that too often were dirty and broken. Market access was controlled by taxi tokens, and so was pricing. So service deteriorated to as low as possible, while customers stood in line on Friday night hoping to get a cab home from the theatre. But Uber unleashed the market. Resources could be added, or removed, by market participants. Pricing was determined by the buyers and sellers. And pricing variability allowed for quality variations as drivers tried to acquire repeat business. Surge pricing meant you could get a ride on New Year’s eve, meeting the customer needs and with pricing to meet the supplier’s need for expanding short-term capacity.

Uber and Lyft aren’t much different from studios and sports franchisees. Once, taxi companies controlled the market. All of us spent time standing in lines, waiting on cabs, that too often were dirty and broken. Market access was controlled by taxi tokens, and so was pricing. So service deteriorated to as low as possible, while customers stood in line on Friday night hoping to get a cab home from the theatre. But Uber unleashed the market. Resources could be added, or removed, by market participants. Pricing was determined by the buyers and sellers. And pricing variability allowed for quality variations as drivers tried to acquire repeat business. Surge pricing meant you could get a ride on New Year’s eve, meeting the customer needs and with pricing to meet the supplier’s need for expanding short-term capacity.

You might not think of Kim Kardashian, Tom Brady and an Uber driver as gig workers. But they are. And this hasn’t been lost on most of us. As publishers have disappeared, writers now must sell their research and writing independently, no longer expecting a set salary and benefits from newspaper owners. Virtual office assistants abound. For almost 30 years we’ve been building a flourishing economy of “gig workers” who are looking to match their skills with market needs. Uber and Lyft are just platforms created to help match the sellers and buyers (as is FiveRR for graphics and other office services.) Their success has been due to meeting a very real market need.

Uber and Lyft have helped the trend toward individual economic independence grow, not created the trend. When you see managers, who work for a set wage, working 24x7x365 on their iPhone or other mobile device, what’s the difference between them and a “gig worker?” When it comes to getting the work done, nothing. Just how they are paid – and some serious illusions about the employee/employer compact that are wholly out of date. Increasingly, we are recognizing we are better off to maximize the value of our services working independently, and seeking out projects that can use our services as contractors, rather than going through the burden of “hiring” and “firing” across “employers” in a fast changing world. Uber didn’t put people out of work, the knowledge economy redefined work. Uber doesn’t create low pay, it just offers a market that allows for flexible capacity and variable pricing. Uber offers a platform matching buyers and sellers. And that’s something we need MORE as adaptability demands keep rising.

California legislators can see that work has changed. But their approach was backward. They are trying to push everyone – both workers and business people – into an outdated model. An industrial model of employment. That will never work. It won’t work because the economy has changed, the world has changed, needs have changed, and these trends will not reverse. Trying to rewind the clock will only cause employers to abandon markets, as Uber and Lyft did when they said they would leave California. Solutions must address trends for independence and accessibility, not try to apply 100 year old definitions to a modern problem.

Contract work is here to stay. It’s been growing for 30 years. What’s needed are better Gig Marketplace tools to help business people find the resources they need, for workers to find projects that fit their skills and that meet their societal needs.

The old model created the term “benefits” for societal needs comprised of unemployment pay, retirement pay, hazard compensation, health care, etc. and forced those costs onto the “employer.” In much of the world today these costs are born by the government, but in the USA they are still borne by “employers”. In a contractor relationship, no one is required to cover the costs of those benefits. In most businesses now, “employer” is a term with a lot less meaning since businesses need much more agility than they did in an industrial economy. During this transition from industrial to gig economy, those societal needs are not being met effectively, leading to individual suffering and much, much higher costs to society.

New solutions are required to meet these needs – instead of forcing the old model onto a new economy. Legislators and regulators need to recognize that old approaches need to be revamped. All of these problems need new solutions – not some effort to force the industrial model onto platform providers that do little more than match needs with skills.

And this requirement for change applies to labor representation as well. The Department of Labor is an industrial era dinosaur that has little to no value in a world of work-from-home employees, outsourced manufacturing plants and easily available offshore production. Industrial era labor unions make no sense when we don’t work on assembly lines. Yet, unions are a very important part of entertainment and professional sports. Because in the latter markets leaders have adapted the union’s services to meet modern needs. Whether they realize it or not, gig workers need help with representation. But that representation must be a lot more sophisticated at helping workers than the throngs of attorneys at the AFL-CIO.

Californians would be suffer negative impacts if Uber and Lyft leave the market. And they realize that. But the solution is not the blunt axe of AB5. Thus, the law will almost surely be reversed in the next election. Then, hopefully, California will step up to the challenge of leading the country with new approaches that meet gig worker needs – expanding their markets and opportunities while building social solutions to every day needs.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. [email protected]

by Adam Hartung | Jul 30, 2020 | In the Whirlpool, Innovation, Leadership, Marketing, Strategy, Trends

Yesterday (7/28/20), President Trump surprised a LOT of people announcing that via the Defense Production Act (DPA) the US government is going to give Kodak $765 million to make pharmaceuticals. The tie to current COVID-19 pandemic issues, for which the Act was invoked, is at best tenuous. Somehow the announcement seems to be more about moving pharma production back to the USA. Which is why it left me, and a lot of others, asking “why would you pick Kodak?”

Everyone knows the Kodak story. Great innovator, makes the Brownie and creates an entirely new market called “amateur photography.” From an era when almost nobody had a picture of themselves, Kodak made pictures commonplace. And the company was a wild success. The US Department of Defense asked Kodak to help them develop a way to send photos digitally from satellites to earth, and after spending a lot of taxpayer money Kodak invents digital photography. A very happy DOD allowed Kodak to keep the civilian rights to digital photography. Locked into the profits from film sales, Kodak never develops the products or market and licensed away the technology. Which doomed Kodak to the world of business history books as one of the classic business screw-ups of all time, riding film sales to death and missing the next big market wave.

Over the last 20 years there’s been nothing new to excite anyone about Kodak. They tried launching a blockchain technology-based business for photographers to manage picture rights. Way too late and poorly conceived, and lacking any demand, that went nowhere. Lacking any new ideas leadership grabbed the lightest “shiny new thing” and launched Kodak’s own cryptocurrency “KodakCoin.” Missed it? So did everyone else. In a word, Kodak was going nowhere.

I always recommend watching trends, and then pivoting your strategy to be on trend. So why didn’t the blockchain and cryptocurrency “pivots” work? Simply, Kodak brought nothing to the marketplace. They didn’t identify an un-met or under-met need and try to fill it with a better solution. Kotak just tried to jump into some shiny technology and throw it onto the marketplace hoping someone would think they needed it. They didn’t. So those pivots failed.

Big companies can pivot. IBM pivoted from a mainframe hardware company into a software and services company. And that worked because IBM understood customers had un-met and under-met needs for enterprise applications and Software-As-A-Service (SAAS) use. IBM moved from making expensive, over-developed hardware to meeting a very real customer need, and the pivot revitalized a nearly obsolete company.

Even before IBM, Singer was once a manufacturer of sewing machines. As the 1960s ended home sewing was in a tailspin, and commercial sewing was all going to Asia. Singer had nothing new to offer, while it’s primary competition (Brother) was innovating gobs of new features to make sewing better, faster, easier and cheaper. So Singer sold (all its products, manufacturing, brand name, etc) to Brother. Leadership studied the marketplace and identified a very big, growing and under-met need for defense electronics suppliers. Leadership carefully acquired leading companies with new technologies in forward looking infrared, heads up displays and others to build a leading-edge defense contractor. Note, they first identified an under-met need. Second, (via acquisition) they brought to market a lot of product innovation to improve customer performance in ways not previously utilized. The pivot was built on under-met needs and innovation.

So what is the plan for Kodak? Kodak knows nothing about pharmaceuticals, and their understanding of “chemistry” (to the extent it still exists) has NO application in pharma. (Ever heard of a joint venture called DuPont/Merck designed to apply DuPont chemistry expertise to pharma? I didn’t think so. It didn’t survive.) The plan is to build a company to make the most generic “pharmaceutical ingredients.” Not blockbuster pharmaceuticals. Literally, the very most generic ingredients. Not better ingredients. Not cheaper ingredients. Just make what already exists – and almost assuredly at a higher cost.

These Kodak ingredients are not innovative. Making them is not innovative. The reason “big pharma” doesn’t make these is because they are GENERIC products of low value, and production has moved to China and India where costs are lower. There is no innovation in these products. And Kodak has NO PLAN to add any innovation. None. Not in products, not in manufacturing process, not in markets served or customer service. Nope. Kodak plans to take 3 to 4 YEARS (any idea how fast markets move these days) to develop a plant to make a generic product that is sold on the basis of cost.

The only way this works, at all, is if the government forces, by regulation, U.S. pharma companies to buy from Kodak (in 3 to 4 years when they supposedly can make the stuff.) Otherwise, why pay the higher price? Today, American politicians constantly decry the high U.S. drug prices. So we are to expect that $765 million of taxpayer money will be spent on a plant, to make a generic compound, readily available in the world today, at a higher price, that will then be forced into American pharma products making them EVEN MORE EXPENSIVE! This is exactly how America ended up with the Bath Iron Works to make Navy ships which are the MOST expensive in the world – and thus wholly non-competitive in commercial ship production.

Does this not sound …… problematic? If we need U.S. based manufacturing for these products every single pharma company in the USA could open a plant faster, manufacturing at lower cost than Kodak, and with no quality or other regulatory concerns. There literally is no need for Kodak to become a supplier in this supply chain. And – absolutely no reason the U.S. taxpayer should be expected to teach Kodak how to “pivot” into becoming a new company. If the White House wants to use the D.P.A. to make more generic pharma compounds then it can push [insert any pharma company name you like here] to do it like they pushed G.M. to make ventilators!

Net/net – this is a pivot, and Kodak desperately needs to pivot. But this will not be a successful pivot. Because it is not targeting an unmet or under-met need. It is not utilizing innovation to create a better solution for meeting customer needs. This is making a generic product, that is readily available, at a higher cost than it is available today. Who wants this?

I’m sure Kodak shareholders are happy. Today. But this is a train wreck. Don’t expect this plant to ever make it to fruition, as the pharma companies will unwind this deal long before Kodak makes anything. And if we’re lucky, taxpayers will get some of their money back. But who knows, because this is a really stupid idea.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. [email protected]

by Adam Hartung | Jul 22, 2020 | Disruptions, Innovation, Leadership, Marketing, Trends

As the pandemic dropped on the USA with full force mid-April the price of oil dropped to less than $0. OK, it was something of a fluke. Demand dropped so fast that supply couldn’t fall fast enough, so oil was flowing into refineries and tanks and pipelines so fast that nobody knew where to put it – and that resulted in suppliers having to pay someone to take their oil.

But… the point was very real. Oil prices depend on demand – every bit as much as supply. Even though for a generation we’ve taken growing oil demand for granted, and focused on how to create additional supply, it is a fact that NOW declining demand will limit the value of oil and gas (which is, after all, a commodity.) The TREND has changed course, with demand in the USA barely, or not, growing – and globally demand growth primarily all in Asia (mostly China.) Overall, supply growth has beaten demand growth by a wide margin, and prices are not only low now – they will likely go lower. Even oil company CEOs are predicting US production will decline – but to lower demand

In 2015, I predicted that Tesla could put a big hurt on Exxon. Most people thought that was a joke. Tesla was a fraction the size of GM, and “small potatoes” in the car industry. Meanwhile Exxon was one of the world’s largest oil producers and refiners. That really would be a very small David smacking a very big Goliath – and with a very small rock. But what I pointed out in 2015 was that traditional analysts predicted a very gradual growth in electric cars, and a continued growth in petroleum powered cars, and pretty much constant growth in oil & gas consumption with economic growth. In other words,analysts were using old assumptions all around and expecting only a tiny impact from a few weirdos buying electric cars.

But I asked, what if those assumptions were wrong? In 2015, the world was awash in oil, inventories were then at record levels, and electric car sales were taking off. And the truth was, a lot was happening to reduce demand for oil. Renewable energy programs, conservation, and a change in economic activity from basic manufacturing and commodity processing to a knowledge economy. These trends were all putting big dampers on oil demand. And electric auto sales were poised for a big boom. I predicted demand for oil would drop substantially, inventories would skyrocket and industry problems would worsen as prices cratered.

Uh-hum – what was the price of oil in April?

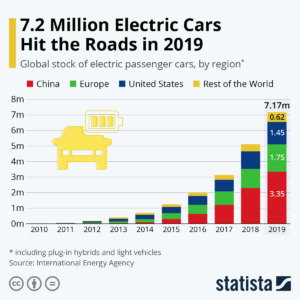

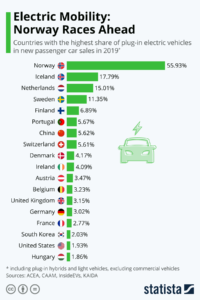

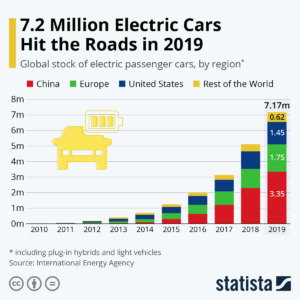

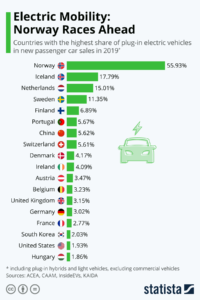

In 2009, I made the case that electric cars were a small base, but that geometric demand growth would make them an important economic impact . Today, most Americans still think that’s the case. In 2009 less than 100,000 new cars were electric. But by 2015, over 1 million electric cars had been sold. Then, with the help of game changers like the Tesla Model 3 in 2019 sales exceeded 7 million! A 7-fold increase in 5 years, or nearly 50%/year market growth!!

Americans aren’t aware of this phenomenon largely because the big growth centers are outside the USA. Where electrics are ~2% of US car sales, in some European countries they are well over 10% of the market. Even in China they represent over 5% of sales!

Remember what I said above about demand growth depending on China? Look again at who’s buying the most electric cars.

Lessons:

1 – Never think your product is beyond attack by market forces. Be paranoid.

2 – Very small, fringe competition can sneak up and steal your market faster than you think.

3 – Fringe changers don’t have to take a huge market share to make a BIG impact on your market and pricing.

4 – Disruptive events favor the upstarts, who are on trend, and hurt big incumbents, who depend on “business as usual.”

5 – Don’t expect markets to “return to normal.” Markets always move forward, with trends.

6 – Don’t plan from the past, plan for the future – and pay attention to disruptions, they can break you.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jul 14, 2020 | Disruptions, Innovation, Leadership, Marketing, real estate, Retail, Trends

TRENDS: Covid-19 has accelerated a lot of trends. Few more than retail. Oddly some people have taken the view that Covid-19 changed retail. Actually, it didn’t. The pandemic has merely accelerated trends that have been driving industry change for almost two decades.

Back in 2004, Eddie Lampert bought all the bonds of defunct Kmart and used those assets to do a merger with Sears – creating Sears Holdings that encompassed both brands. The day of announcement Chicago Tribune asked for my opinion, and famously I predicted the merger would be a disaster. Clearly both Kmart and Sears were far, far off trends in retail, both were already struggling – and neither had a clue about emerging e-commerce.

Why in 2004 would I predict Sears would fail? The #1 trend in retail was e-commerce, which was all about individualized customer experience, problem solving for customer needs — and only, finally fulfillment. By increasing “scale” – primarily owning a lot more real estate – this new organization would NOT be more competitive. Walmart was already falling behind the growth curve, and everyone in retail was ignoring the elephant in the room – Amazon.com. Loading up on a lot more real estate, more inventory, more employees, more supplier relationships and more community commitments – old ideas about how to succeed related to fulfillment – would hurt more than help. Retail was an industry in transition. All of these factors were boat anchors on future success, which relied on aggressively moving to greater internet use.

Unfortunately, Eddie Lampert as CEO was like most CEOs. He thought success would come from doing more of what worked in the past. Be better, faster, cheaper at what you used to do. In 2011 Sears asked its HQ town (Hoffman Estates) and the state (Illinois) for tax subsidies to keep the HQ there. Sears had built what was once the world’s once tallest building, named the Sears Tower. But many years earlier Sears left, the building was renamed, and Sears was becoming a ghost of itself. I pleaded with government officials to “let Sears go” since the money would be wasted. And it was clear by 2016, that Lampert and his team’s bias toward old retail approaches had only served to hurt Sears more and guarantee its failure. Now – in 2020 – Hoffman Estates has taken the embarrassing act of removing the Sears name from the town’s arena, admitting Sears is washed up.

****

It was with a multi-year observation of trends that I told people in 2/2017 that retail real estate values would crumble . Now mall vacancies are at an 8 year high and 50% of mall department stores will permanently close within a year. We are “over-stored” and nothing will change the fast decline in retail real estate values. Who knows what will happen to all this empty space?

Trends led me in March 2017 to advise investors they should own NO traditional retail equities. Shortly after Sears filed bankruptcy Radio Shack and storied ToysRUs followed. And with the pandemic acting as gasoline fueling change, we’ve now seen the bankruptcies of Neiman Marcus, JCPenney, J Crew, Forever 21, GNC and Chuck e Cheese (but, really, weren’t you a bit surprised the last one was still even in business?) After 3 years of pre-Covid store closings, Industry pundits are finally predicting “record numbers of store closings”. And, after 15 years of predictions, I’m being asked by radio hosts to explain the impact of widespread failures of both local and national retailers ( ). Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

As we move forward, what will happen to your business? Will you build on trends to create a new future where growth abounds? Will you align your strategy with the future so you “skate to where the puck will be?” Or will you – like Sears and so many others – find an ignominious end to your organization? Will the signs change, or will the signs come down? The trends have never been stronger, the markets have never moved faster and the rewards have never been greater. It’s time to plan for the future, and build your strategy on trends (not what worked in the past.)

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jun 30, 2020 | Culture, Leadership, Marketing, Politics, Web/Tech

In my recent “Rebooting Business” on-line conference I was asked if Black Lives Mattered and other protests should affect strategy. I said “of course!!” These demonstrations clearly show a segment of the marketplace with unserved and under-served needs. Needs so badly served people have taken to the streets!

Every organization needs to assess its strategy to determine if it is on this trend toward inclusion. Are you sensitive to the needs of these under-served segments? Or are you sloppily still out there with old stereo-tropes like the Aunt Jemima syrup – which Quaker Oats finally pulled. Do you know if your organization, products, suppliers, customers and communities are meeting market needs for inclusion? Or are you just assuming you’ll be OK?

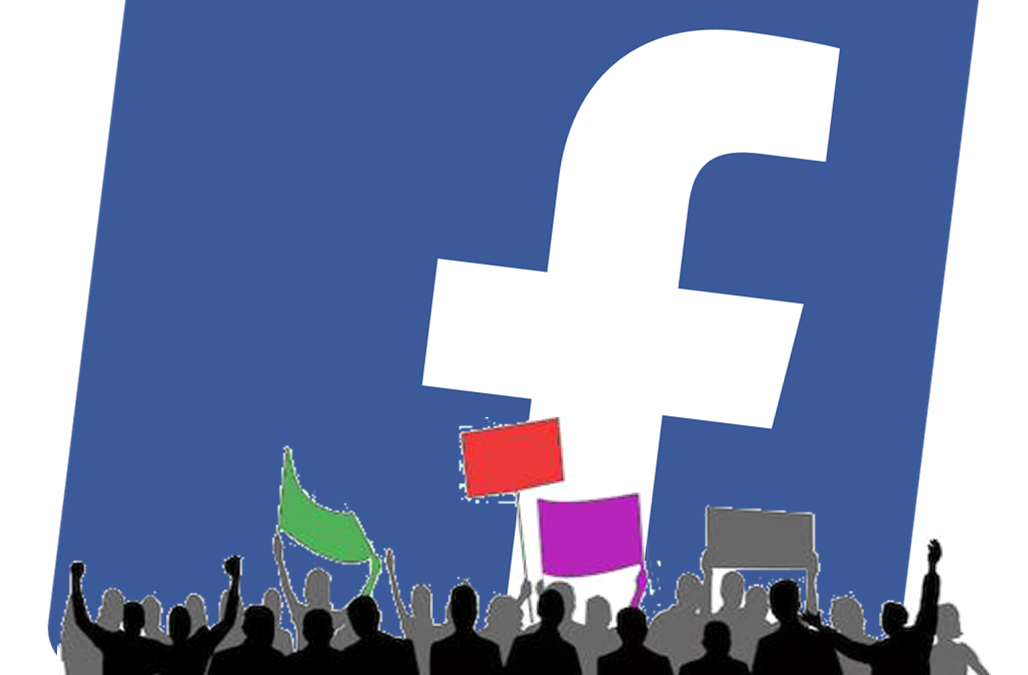

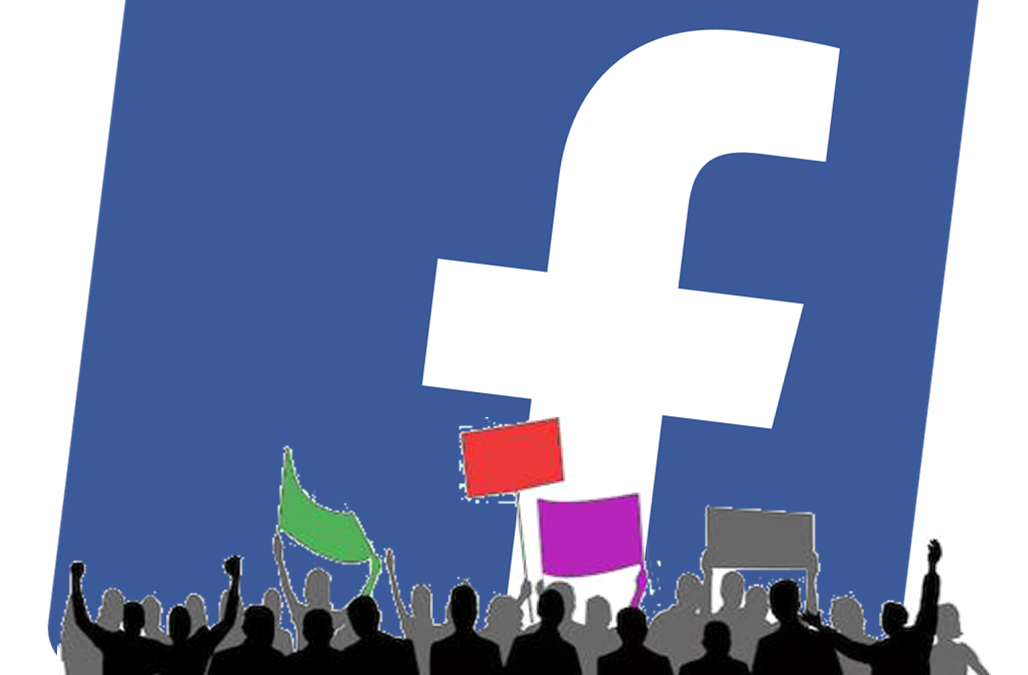

Amazingly one of the biggest trend creating companies has demonstrated the cost of missing trends. Facebook is a remarkable company. Where MySpace failed, and countless others never created a marketplace, Facebook used its initial platform, then added Instagram, then Messenger, then WhatsApp to take an enormous lead in social media. Facebook built on trends in our desire to be mobile, and to communicate asynchronously, to attract billions of people to its platform – and as a result advertisers.

But…. Inexplicably…. the CEO Mark Zuckerberg and his leadership team have been tone-deaf to the events since George Floyd was killed. And they were remarkably blindsided, showing they truly weren’t prepared. Zuckerberg has long refused to even look for false information on Facebook – and never really considered removing it. Lies, falsehoods, misstatements – Facebook let people of all stripes (good, and very often bad) say anything they wanted on the platform. This wasn’t inclusion, it was allowing loud voices to present harmful content – and it was clearly disturbing a whole lot of people.

Now is the comeuppance. Advertisers have decided not to advertise on Facebook. They realize that their ads, presented next to false, and sometimes truly hateful, content gives the impression that they support this content. So, in droves, they have said their ad dollars will go somewhere else. Giant consumer goods companies Honda, Unilever, Proctor & Gamble, Coca-Cola, Diageo and Hershey as well as one of the world’s largest mobile providers Verizon, and mercantile suppliers North Face and Patagonia have joined retailers like Starbucks and REI as just some of the larger boycotters – out of over 100 on the growing list. So serious is this problem that some advertisers are “pausing” social media ads all together, suggesting another possible trend

Nobody can fight trends and hope to win. Nobody. No matter how big. And this is a sharp rebuke for one of the trendiest companies on the planet. That the leadership team didn’t see this coming is astonishing. In a late reversal, Facebook has made new efforts to identify hate content (including harmful posts by politicians), but that they didn’t react much quicker is just absurd. That they appeared to think they could platform political ads, and political content, and not have viewers associate Facebook with politics is downright bizarre. This has been the dumbest self-inflicted move by a big company in a very long time. And all they had to do to avoid this nightmare was admit that inclusion was a very big global trend that they had to build into their offering.

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business https://adamhartung.com/assessments/

by Adam Hartung | Jan 16, 2020 | Boards of Directors, Defend & Extend, Leadership, Software, Web/Tech

People who follow my speaking and writing – including my over 400 Forbes columns – know that I preach the importance of growth. Successful organizations are agile – and agility is the sum of learning + adaptability. Smart organizations are constantly looking externally, gathering data, learning about markets and shifts – then structured to adopt those learnings into their business model and adapt the organization to new market needs.

Steve Ballmer was the antithesis of agility. For his entire career he knew only that  Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

So as the market went mobile, Ballmer kept over-investing. He spent billions launching Windows 8, which I predicted was obviously going to fail at growing the Windows market as early as 2012. And it was easy to predict that Win8 tablets were going to be a bust when launched in 2012 as well. But Ballmer was “all-in” on Windows and Office. He was completely locked-in, and unwilling to even consider any data indicating that the PC market was dying – effectively driving Microsoft over a cliff.

It was not hard to identify Steve Ballmer as the worst CEO in America in 2012. When Ballmer took over Microsoft it was worth $60/share. He drove that value down to $20. And the company valuation was almost unchanged his entire 14 years as CEO. He remained locked-in to trying to Defend & Extend PC sales, and it did Microsoft no good. But when the Board replaced Ballmer with Nadella the company moved quickly into growth in gaming, and especially cloud services. In just 6 years Nadella has improved the company’s value by 400%!!!

Success is NOT about defending the past. Success IS about growth. Don’t be locked in to what worked before. Focus on what markets want and need – learn how to understand these needs – and then adapt to giving customers new solutions. Don’t make the mistakes of Ballmer – be a Nadella to lead your organization into growth opportunities!

by Adam Hartung | Mar 20, 2018 | Investing, Leadership, Lock-in, Marketing, Strategy, Transportation

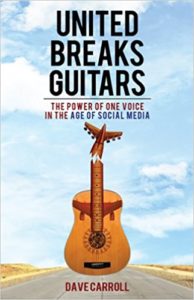

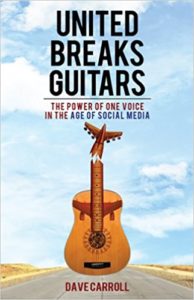

Do you remember the songs, and videos, from 2008 “United Breaks Guitars?” After United Airlines destroyed musician Dave Carroll’s guitar he chronicled the months-long journey he took trying to replace it. In the end, United told him “F**k you” as customer service blew him off completely. He went on to make a few million dollars with his songs and parody about the horrible experience. Because so many people felt they were abused like Mr. Carroll.

“United Breaks Guitars” was a hit because so many people related to the terrible customer experience on United.  “The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction.

“The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction.

Things certainly haven’t changed. In 2017, United ejected a 69 year old physician from a plane, breaking his nose, knocking out his teeth and giving him a concussion. That created an uproar. Yet within a week United killed the world’s largest bunny rabbit in an airplane holding bin. But, even worse, last week United actually killed a puppy by forcing it be placed in an overhead bin. At least the dog United sent on a 1,000 mile unexpected flight to Japan survived, and the interviewed owner said he felt lucky the airline hadn’t killed his pet. Of course United refunded their money – which as you can imagine was a slap in the face to all these people who were so abused.

Unfortunately, United is just the worst of a bunch of bad airlines. Customer service really isn’t any better on Delta, American, JetBlue or Southwest. Saying these other airlines are better is just picking out a less heinous member of the Khmer Rouge Army.

STRATEGY MATTERS

This all goes back to deregulation. When President Carter allowed the airlines to charge as they like the industry really had no idea what it was going to do. There was chaos for years. But eventually consolidation kicked-in, and cutting cost was the only thing all 3 majors agreed upon. Buy more market share, as opposed to winning it with customer service, then slash the costs. This did the wonderfulness of leading all of them to file bankruptcy! Some twice! What a grand industry strategy!

Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he ordered olives removed from the first class meals. He was cheered for saving $100K. But what folks missed was that he, and his peers leading the airlines, were systematically trying to figure out “how do we offer the least possible service.” By focusing on a strategy of lowering cost, and being doggedly determined in that strategy, soon nothing else mattered.

Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he ordered olives removed from the first class meals. He was cheered for saving $100K. But what folks missed was that he, and his peers leading the airlines, were systematically trying to figure out “how do we offer the least possible service.” By focusing on a strategy of lowering cost, and being doggedly determined in that strategy, soon nothing else mattered.

Today, there are no free meals in coach, and terrible meals in first class. Management angered employees into strikes and multi-year negotiations, beating down compensation and eliminating benefits leading to unhappiness so bad that in 2010 a Jet Blue flight attendant pulled the emergency exit and jumped out of the plane as he quit.

So, all the airlines in America stink. And, many domestic airlines in Europe, such as Ryan Air, have followed suit. The execs keep saying “all customers care about is price.” They use that excuse to create a culture so hostile to employees, and customers, that pretty soon employees are beating up customers and killing family pets (after charging extra to take the pet on the plane) and actually not caring.

Employees have become gestapos for the leadership – which has created a culture in which nobody wins. So flight attendants do as little as possible, because they don’t care about customers any more than leadership does. In 2017, a JetBlue attendant threw a family off flight because their toddler kicked the seat. When a woman complains about a child in seat next to her a Delta attendant throws her off the plane. And just last week when a 2 year old cries during boarding a Southwest attendant throws the child and her father off the plane.

Deregulation led to an oligopoly. Now, customers have no choice. Some of us fly almost every week on business, and it is pure hell. Nobody we deal with, from TSA to airport vendors to airline staff like customers. The culture has become “I’m abused, so you will be abused.” To fly is to succumb to being obsequious to ALL employees in your effort to not anger anyone, for fear they will deny you service. Or, worse, beat you up or kill your pet. But, honestly, there is nothing customers can do about it.

STRATEGY MATTERS

The leadership of the airlines, lacking regulation, implemented a strategy of “be low cost.” The result was creating a culture where employees routinely abuse customers in the process of trying to save a few dimes. If the next Mark Zuckerberg, Elon Musk or Reed Hastings showed up, do you think HR would hire them? Would the Board of Directors, so focused on the wrong strategy, consider any of them as CEO? The wrong strategy has led to the ruination of an entire industry, miserable employees, unhappy customers and marginal returns. It is a terrible culture.

So what is your strategy? Is your strategy creating the culture you want? Are you headed toward happy customers who want more of your product or service, and create growth? Or are you letting your lack of a forward-thinking strategy default you into operational cost cutting, and the movement toward a culture of misery that drives away employees, vendors and eventually customers?

“The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction.

“The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction. Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he

Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he