by Adam Hartung | Jun 30, 2020 | Culture, Leadership, Marketing, Politics, Web/Tech

In my recent “Rebooting Business” on-line conference I was asked if Black Lives Mattered and other protests should affect strategy. I said “of course!!” These demonstrations clearly show a segment of the marketplace with unserved and under-served needs. Needs so badly served people have taken to the streets!

Every organization needs to assess its strategy to determine if it is on this trend toward inclusion. Are you sensitive to the needs of these under-served segments? Or are you sloppily still out there with old stereo-tropes like the Aunt Jemima syrup – which Quaker Oats finally pulled. Do you know if your organization, products, suppliers, customers and communities are meeting market needs for inclusion? Or are you just assuming you’ll be OK?

Amazingly one of the biggest trend creating companies has demonstrated the cost of missing trends. Facebook is a remarkable company. Where MySpace failed, and countless others never created a marketplace, Facebook used its initial platform, then added Instagram, then Messenger, then WhatsApp to take an enormous lead in social media. Facebook built on trends in our desire to be mobile, and to communicate asynchronously, to attract billions of people to its platform – and as a result advertisers.

But…. Inexplicably…. the CEO Mark Zuckerberg and his leadership team have been tone-deaf to the events since George Floyd was killed. And they were remarkably blindsided, showing they truly weren’t prepared. Zuckerberg has long refused to even look for false information on Facebook – and never really considered removing it. Lies, falsehoods, misstatements – Facebook let people of all stripes (good, and very often bad) say anything they wanted on the platform. This wasn’t inclusion, it was allowing loud voices to present harmful content – and it was clearly disturbing a whole lot of people.

Now is the comeuppance. Advertisers have decided not to advertise on Facebook. They realize that their ads, presented next to false, and sometimes truly hateful, content gives the impression that they support this content. So, in droves, they have said their ad dollars will go somewhere else. Giant consumer goods companies Honda, Unilever, Proctor & Gamble, Coca-Cola, Diageo and Hershey as well as one of the world’s largest mobile providers Verizon, and mercantile suppliers North Face and Patagonia have joined retailers like Starbucks and REI as just some of the larger boycotters – out of over 100 on the growing list. So serious is this problem that some advertisers are “pausing” social media ads all together, suggesting another possible trend

Nobody can fight trends and hope to win. Nobody. No matter how big. And this is a sharp rebuke for one of the trendiest companies on the planet. That the leadership team didn’t see this coming is astonishing. In a late reversal, Facebook has made new efforts to identify hate content (including harmful posts by politicians), but that they didn’t react much quicker is just absurd. That they appeared to think they could platform political ads, and political content, and not have viewers associate Facebook with politics is downright bizarre. This has been the dumbest self-inflicted move by a big company in a very long time. And all they had to do to avoid this nightmare was admit that inclusion was a very big global trend that they had to build into their offering.

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business https://adamhartung.com/assessments/

by Adam Hartung | Jun 24, 2020 | Finance, Manufacturing, Politics, Web/Tech

Americans take it for granted that all currencies are measured against the US Dollar. It’s been that way since WWII, so they just expect it will always be that way. But, things have a way of changing.

In this pandemic the US Federal Reserve is printing money as fast as possible to help prop up the economy. That’s better than the alternative, which would be another Great Depression. But, eventually we have to create value via goods and services to put value in those dollars, or they will be worth a whole lot less. In other words, if we don’t change our fiscal policy to improve production of goods and services, the US Dollar will fall in value – maybe a lot – and it could even lose its status as the world’s “reserve currency.”

Back in 2008, I wrote that there was no inherent reason the US Dollar would be the benchmark for all currencies. It gained that position as the dominant economy after WWII. American’s like to assume superiority, and therefore the US Dollar will always reign supreme. But as I also said in 2008, that’s an assumption that can easily be changed – especially regarding currencies. Lots of factors could cause the US Dollar to suddenly lose a whole lot of value – creating inflation rates that make the 1980s (>18%/year) seem tame.

Since WWII, a lot has happened. Economies in Europe grouped into the Economic Union (EU) making the Euro more powerful. And the economy of China has grown enormously. (China’s economy will be bigger than the USA economy sometime in 2020 or 2021.) Simultaneously, isolationism has hurt growth in America, and caused the EU to lose the UK. What’s rapidly happening is a shift in economic power away from the US and Europe to China.

Additionally, the largest holder of US debt is China. As I pointed out in 2009, this policy of supporting US debt has aided China’s desire to grow. But, as China becomes larger it will no longer need to prop up the US Dollar by purchasing Treasuries. Once bigger than the USA, China could demand that its trade be in Yuan and the value of the dollar could fall very far, very fast.

China has developed enormous inroads into the global economy, across dozens of countries, with its “Belt and Road Initiative” created in 2013. China has quietly become more important to the economy of 70 countries than the USA. Instead of supplying countries guns, China gave them infrastructure and facilities – and jobs – and economic growth. In most of these countries, the USA is more feared than adored, while the Chinese are seen as a very good friend. Meanwhile, the USA “put America first” policies, including trade wars and social justice, have isolated the USA from not only rivals but its global friends – including Europe (threats to kill NATO, for example.)

Now, we are in a pandemic. The Chinese are very determined to control its impact. Meanwhile the USA, UK and many other democracies are being far less careful. If this plays out with a full pandemic recession in the USA, China could stop buying American bonds and the value of the dollar could disintegrate in weeks. Disintegrate as in $1 could be worth 1 penny. It would take bushels of dollars to buy imported goods in stores.

In this election year, the biggest concern is, do those leading the USA realize the peril? Do business leaders? Do you?

by Adam Hartung | Jan 16, 2020 | Boards of Directors, Defend & Extend, Leadership, Software, Web/Tech

People who follow my speaking and writing – including my over 400 Forbes columns – know that I preach the importance of growth. Successful organizations are agile – and agility is the sum of learning + adaptability. Smart organizations are constantly looking externally, gathering data, learning about markets and shifts – then structured to adopt those learnings into their business model and adapt the organization to new market needs.

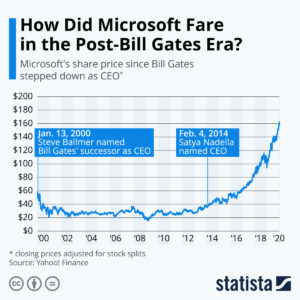

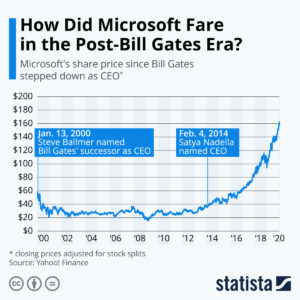

Steve Ballmer was the antithesis of agility. For his entire career he knew only that  Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

So as the market went mobile, Ballmer kept over-investing. He spent billions launching Windows 8, which I predicted was obviously going to fail at growing the Windows market as early as 2012. And it was easy to predict that Win8 tablets were going to be a bust when launched in 2012 as well. But Ballmer was “all-in” on Windows and Office. He was completely locked-in, and unwilling to even consider any data indicating that the PC market was dying – effectively driving Microsoft over a cliff.

It was not hard to identify Steve Ballmer as the worst CEO in America in 2012. When Ballmer took over Microsoft it was worth $60/share. He drove that value down to $20. And the company valuation was almost unchanged his entire 14 years as CEO. He remained locked-in to trying to Defend & Extend PC sales, and it did Microsoft no good. But when the Board replaced Ballmer with Nadella the company moved quickly into growth in gaming, and especially cloud services. In just 6 years Nadella has improved the company’s value by 400%!!!

Success is NOT about defending the past. Success IS about growth. Don’t be locked in to what worked before. Focus on what markets want and need – learn how to understand these needs – and then adapt to giving customers new solutions. Don’t make the mistakes of Ballmer – be a Nadella to lead your organization into growth opportunities!

by Adam Hartung | Nov 25, 2018 | Innovation, Investing, Trends, Web/Tech

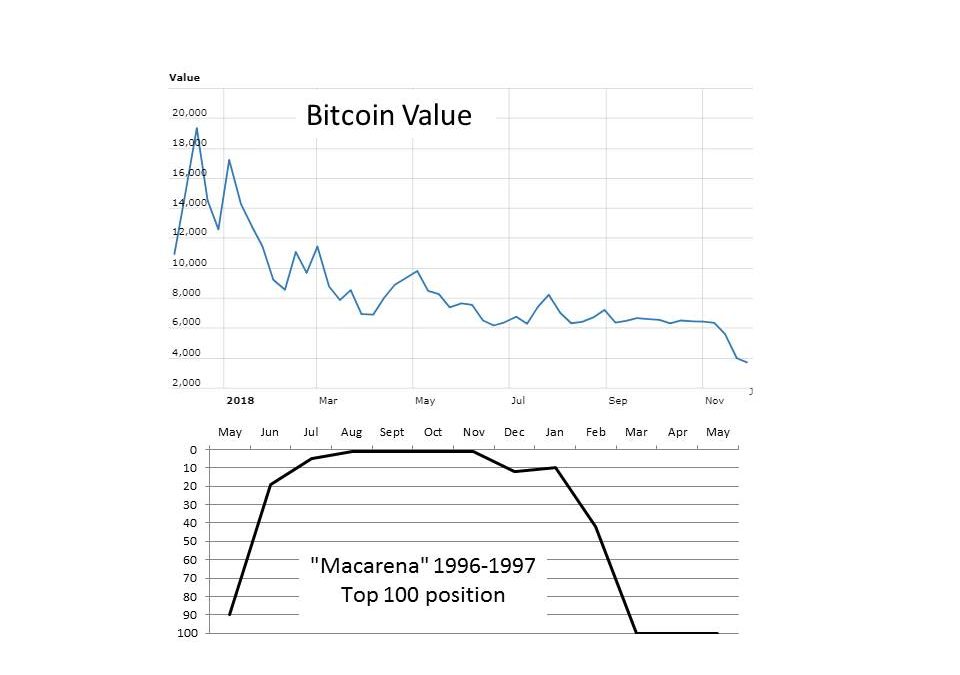

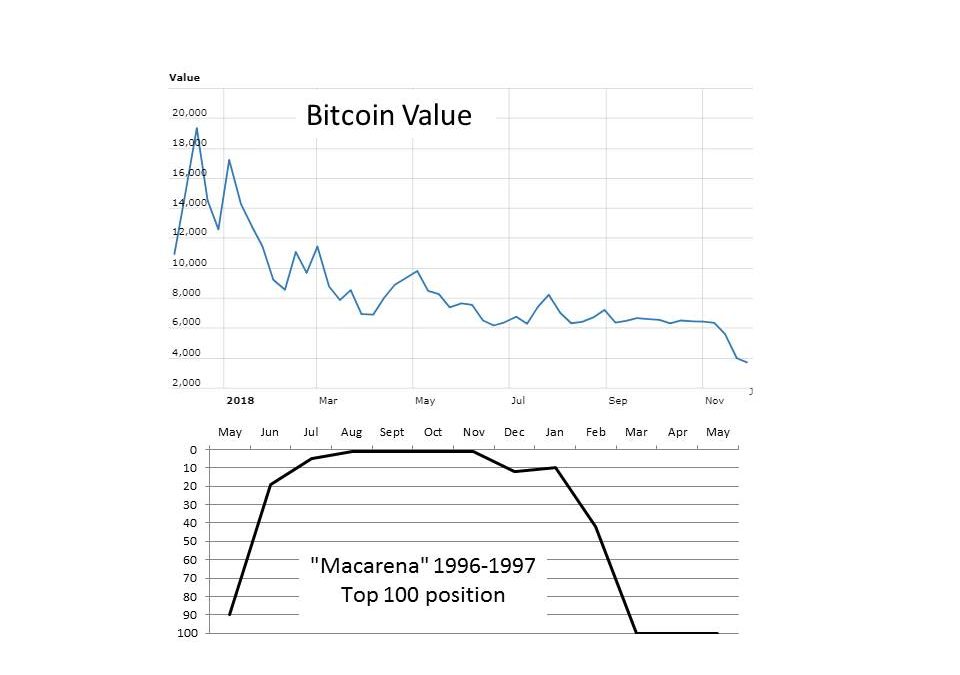

It was August 15, 2017 when I wrote the column “A Bitcoin Is Worth $4,000 – Why You Probably Should Not Own One.” At the time Bitcoin’s value had increased in value by 750% in just one year, and some investors were becoming very excited about Bitcoins. Journal articles were nearly all bullish, with some big Bitcoin owners projecting they would increase in value to over $250,000 each – or possibly into the millions!

But I was far more pragmatic. I pointed out that Bitcoins had no inherent value – unlike a Picasso painting, for example. There will be no more original Picasso’s, and no more signed Picasso prints. The supply is completely known, and the price is determined by what people will pay for the artistic history of them. But anybody can make a Bitcoin. And even though there was some theoretical limit of 21 million, why anybody would want to own these non-physical data bits was unclear. Were people going to say “come, look at this hard drive. It contains 400,000 Bitcoins. Isn’t it cool?” Bitcoins were a lot more like Pokemon cards. There are a LOT of them, more coming all the time, and their value was only to people who wanted to play the Bitcoin game.

And I had a very low opinion of the necessity of Bitcoins as a currency. Everyone is pretty happy to use dollars, yen, euros, etc. And if you fear inflation there is an open market to exchange any currency for any other, so you can quickly keep your savings in the currency of your choice. The only valuable use of Bitcoins was as a currency for illegal activity you don’t want traced – such as sex trafficking, drug trafficking or gun running. While the outlaws in those occupations my enjoy a non-government currency, those folks are relatively few and far between, and the need for such currency is therefore pretty weak. Not to mention illegal.

It was pretty clear that Bitcoin was a fad. Like the famous Dutch Tulip Bulb fad that drove the price of a Tulip bulb higher than a house. While a fad the value went up, but because there was no inherent value to the bulb greater than a flower, it’s value was sure to collapse. And the same would happen to Bitcoins. To a long-term trend watcher, and person skilled at understanding trends for planning, Bitcoin had all the signs of a fad.

I remember this well because when I published this column in Forbes there was a Bitcoin editor that went ballistic. This person had no background in economics, banking, currency, stock markets, or art; the editor was a journalist who had decided Bitcoin was “the next big thing.” Bitcoin was going to overtake traditional currencies, and save the world from central banks dead-set on destroying free trade and economic growth.

Honestly, I never understood the argument. Baseless, and senseless. Bitcoin was a fad, I said clearly, and no investor should be buying them – especially small investors. And it was a fools folly to spend money becoming a Bitcoin miner. Simply invest somewhere else where trends supported growth.

But the editorial staff at Forbes landed on me like a herd of elephants coming down the Himalayas. Apparently Forbes was buying into the Bitcoin craze, and they didn’t want anyone writing bad things about Bitcoin. I pointed out that in 9 years my predictions about the future of Netflix, Amazon, Tesla – and GE, Sears, and Windows 8 and 10 – had all turned out to be accurate.

I tended to be very early with my predictions, and quite contrarian, but within 2 years I was proven right. I knew the difference between a trend and a fad, and it was important to help readers understand the difference. Bitcoins had no inherent value, and they were/are not an investment vehicle.

In the end the rancor about my Bitcoin prediction, and my unwillingness to reverse my position, caused a break between myself and Forbes. Even as Bitcoins soared in value to $19,000 by December, 2017 I held firm to the position that no sound, long-term investor should touch them. If Forbes couldn’t understand my surety, then it was their problem.

This week Bitcoins traded for $4,400. Where they traded on August 20, 2017 just as my prediction went public. Bitcoins were/are a fad. Now, there are a slew of authors writing about the lack of any reason for Bitcoins to exist. Almost all are predicting the value will continue eroding, as more and more people see there was never any value in them to begin with. Many predict this will not end until Bitcoins are worth nothing, or possibly a few cents, and all the Bitcoin miners disappear.

The important lesson is that it is not impossible to know the difference between a trend and a fad. Trends are based upon behaviors that have a basis in gain. We trended away from physical stores and toward e-commerce because the latter was more convenient, and sometimes cheaper. We trended away from PC’s with hard drives and toward mobile devices connected to the cloud because they made our lives more convenient, and often cheaper. We are watching more entertainment via on-line downloads, and less on television, because it is more convenient, and often better. These are trends. They are observable, measurable and good trends generate a better outcome for people, while bad trends are due to consumer movement toward new solutions.

When you work a job all week trying to get more done better, faster, cheaper you may not have time to study trends. When you see something new it can seem hard to know whether it is a fad, or trend. Or if a trend, how fast it will “take hold” and alter behavior. That is understandable.

And that’s where people like me make a difference. I focus on trends. Demographics, regulations, technology – all kinds of trends. I watch them, measure them, and project outcomes for the trend, and those who adopt the trend. I build scenarios that stretch out the trend, and look for when more people are following a trend than doing things the “old way.” And because I do that all day, every day, for 20 years it is possible to forecast with high accuracy what the future will look like.

Almost always it takes a bit longer than I think, but likewise it almost always takes a lot less time than almost everyone else thinks. I didn’t think it would take 5 quarters for Bitcoins to peak and then fall back to $4,400. But most people were projecting the value of Bitcoins would go up for YEARS. They couldn’t visualize the peak. Even though it happened just 4 months after I said “don’t buy Bitcoins.” Only a very, very lucky trader would have bought in August, and sold in December. For true investors, this was a roller coaster ride with an unhappy ending.

I don’t meet many company executives that do future scenario planning. They are too busy running their business to do trend analysis, projections and make long-term forecasts. But that doesn’t mean these things aren’t important. It just means you need to look for outsiders, who specialize in trend analysis and long-term scenario planning, to help you guide your business in the right direction. Because you’d much rather be Microsoft, shifting from PC’s to cloud and holding onto your value, than GE or Sears. You need a partner to help you forecast – and grow.

by Paul F | Sep 26, 2018 | eBooks, Innovation, Investing, Marketing, Software, Web/Tech

In the recently published, “Facebook- The Making of a Great Company”, Adam Hartung analyzes the rise of Facebook and its impact on the financial community, business marketing and innovation.

Adam’s posts over the years have predicted key milestones in Facebook’s growth and its transformation into a driver of social trends. He tells the story of this company that has overcome negativity and skepticism in the financial community and has adapted to its users.

“So last week, when Facebook reported that its user base hadn’t grown like the

past, investors fled. Facebook recorded the largest one day drop in valuation in

history; about $120B of market value disappeared. Just under 20%.

No other statistic mattered. The storyline was that people didn’t trust Facebook

any longer, so people were leaving the platform. Without the record growth numbers

of the past, many felt that it was time to sell. That Facebook was going to be

the next MySpace.”

“That was a serious over-reaction.”

Adam Hartung, “Facebook-The Making of a Great Company”

by Adam Hartung | Jul 30, 2018 | Innovation, Investing, Software, Strategy, Trends, Web/Tech

On July 26, 2018 Facebook set a record for the most value lost in one day by a single company. An astonishing $119B of market value was destroyed as the shares sank more than $40. For many investors, it was the sky falling.

As most of you know, I’ve followed Facebook closely since it went public in 2012. And, I’ve long been an admirer. I said buy it at the IPO, and I’m saying buy it now. Click on the title of any of the posts to read the full content.

To summarize, Facebook may be under attack, but it is barely wounded. And it is not in the throes of demise. The long-term trends all favor the social media’s ongoing growth, and higher values in the future. Below I’ll offer some of my previous blogs that are well worth revisiting amidst the current Facebook angst.

FANG (Facebook, Amazon, Netflix and Google) investing is still the best bet in the market. They have outperformed for years, and will continue to do so. Why? Because they are growing revenues and profits faster than any other major companies in the market. And “Growth is Good” (paraphrasing Gordon Gekko.) If you have any doubts about the importance of growth, go talk to Immelt of GE or Lampert of Sears.

Don’t forget, for years now Facebook is more than Facebook.com. It’s smart acquisition programs have dramatically increased the platform’s reach with video, messaging, texting and eventually peer-to-peer video. Facebook’s leadership has built a very adaptable company, able to change the product to meet growing user (and customer) needs.

Facebook is on a path toward significant communication domination. Facebook today is sort of the New York Times, Washington Post, Los Angeles Times and about 90% of the rest of the nation’s newspapers all in one. Nobody is close to challenging Facebook’s leadership in news distribution, and all news is increasingly going on-line.

For all these reasons, you really do want to own Facebook. Especially at this valuation. It’s getting a chance to buy Facebook at its value when the year started, and Facebook is that much bigger, stronger, and adapted to changing privacy regulations that were still a mystery back then.

Oh, one last thing (paraphrasing Steve Jobs.) Facebook actually isn’t the biggest one day drop in stock valuation, despite what you’ve read.

Stocks are priced in dollars, and dollars are subject to inflation. So we should look at historical drops in inflation adjusted dollars. Even though inflation has been mostly below 3% since the 1990s, from 2000 to today the dollar has inflated by 46%. So inflation-adjusted, the biggest one day value destruction actually belongs to Intel, which lost $131B in September, 2000. And Microsoft is only slightly in third place, having lost $117B in April, 2000. So keep this in mind when you think about the long-term opportunity for Facebook.

Now Published! “Facebook- The Making of a Great Company” ebook by Adam Hartung.

by Adam Hartung | Jun 5, 2018 | Investing, Retail, Strategy, Trends, Web/Tech

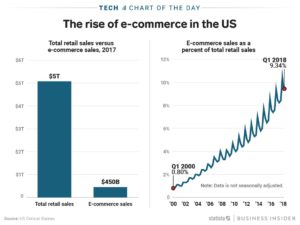

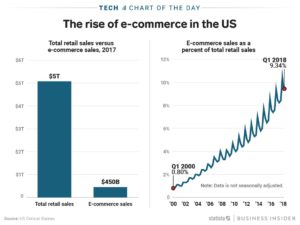

The US e-commerce market is just under 10% the size of entire retail market. On the face of it this would indicate that the game is far from over for big traditional retail. After all, how could such a small segment kill profits for such a huge industry based on enormous traditional players?

Yet, Sears – once a Dow Jones component and the world’s most powerful retailer – has announced it will close 100 more stores. The Kmart/Sears chain is now only 894 stores – down from thousands at its peak and 1,275 just last year. Revenue dropped 30% versus a year ago, and quarterly losses of $424M were almost 15% of revenues.

But, that ignores marginal economics. It often doesn’t take a monster change in one factor to have a huge impact on the business model. Let’s say Sales are $100. Less Cost of Goods sold of $75. That leaves a Gross Margin of $25. Selling, General and Administrative costs are 20%, so Operating Income is only $5. The Net Margin before Interest and Taxes is 5%. (BTW, these are the actual percentages of Walmart from 1/31/18.)

Now, in comes a new competitor – like Amazon.com. They have no stores, no store clerks, and minimal inventory due to “e-storefront” selling. So, they are able to lower prices by 5%. That seems pretty small – just a 5% discount compared to typical sales of 20%, 30% even 50% (BOGO) in retail stores. Amazon’s 5% price reduction seems like no big deal to established firms.

But, Walmart has to lower prices by 5% in response, which lowers revenues to $95. But the stores, clerks, inventory, distribution centers and trucks all largely remain. With Cost of Goods Sold still $75, Gross Margin falls to $20. Fixed headquarters costs, general and administrative costs don’t change, so they remain at $20. This leaves Operating Income of …$0.

(For more detailed analysis see “Bigger is Not Always Better – Why Amazon is Worth More than Walmart” from July, 2015.)

How can Walmart survive with no profits? It can’t. To get some margin back, Walmart has to start shutting stores, selling assets, cutting pay, using automation to cut headcount, beating on vendors to offer them better prices. This earns praise as “a low cost operation.” When in fact, this makes Walmart a less competitive company, because it’s footprint and service levels decline, which encourages people to do more shopping on-line. A vicious circle begins of trying to recapture lost profitability, while sales are declining rather than growing.

Walmart was (and is) huge. Even Sears was much bigger than Amazon.com at the beginning. But to compete with Amazon.com both had to lower prices on ALL of their products in ALL of their stores. So the hit to Walmart’s, and Sears’, revenue is a huge number. Though Amazon.com was a much, much smaller company, its impact explodes on the larger competitor P&L’s.

This disruption is felt across the entire industry: ALL traditional retailers are forced to match Amazon and other e-commerce companies, even though there is no way they can cut costs enough to compete. Thus, Toys-R-Us, Radio Shack, Claire’s and Bon-Ton have declared bankruptcy in 2018, and the once great, dominant Sears is on the precipice of extinction.

All of which is good news for Amazon.com investors. Amazon.com has 40% market share of the entire e-commerce business. The fact that e-commerce is only 10% of all retail is great news for Amazon investors. That means there is still an enormously large market of traditional retail available to convert to on-line sales.

The shift to e-commerce will not be stopping, or even slowing. Since January, 2010 the future has been easily predictable for traditional retail’s decline. The next few years will see a transition of an additional $2.5 trillion on-line, which is 5X the size of the existing e-commerce market!

As stores close new competitors will emerge in the e-commerce market. But undoubtedly the big winner will be the company with 40% market share today – Amazon.com. So what will Amazon’s stock be worth when sales are 5x larger (or more) and Amazon can increase profits by making leveraging its infrastructure and slow future investments?

Twenty years ago, Amazon was a retail ant. And retail elephants ignored it. But that was foolish, because Amazon had a different business model with an entirely different cost of operations. And now the elephants are falling fast, due to their inability to adapt to new market conditions and maintain their growth.

_________________________________________________________________________

Author’s Note: In June, 2007 I was asked to predict WalMart’s future. Here are the predictions I made 11 years ago:

- “In 5 years (2012) Walmart would not have succeeded internationally” [True: Mexico, China, Germany all failed]

- “In 5 years (2012) Walmart would no new businesses, and its revenue will be stalled” [True]

- In 5 years (2012) Walmart would be spending more on stock repurchases then investing in its own stores or distribution” [True – and the Walton’s were moving money out of Walmart to other investments]

- “In 10 years (2017) Walmart would take a dramatic act, and make an acquisition” [True: Jet.com]

- “In 10 years (2017 Walmart’s value would not keep up with the stock market” [from 6/2007 to 6/2017 WMT went from $48 to $75 up 56.25%, DIA went from $134 to $180 up 34.3%, AMZN went from $70 to $1,000 up 1,330% or 13.3x]

- “In 30 years (2037) Walmart will only be known as “a once great company, like General Motors”

by Adam Hartung | May 22, 2018 | Innovation, Investing, Marketing, Software, Web/Tech

(Image: Troy Strange.)

Facebook’s CEO recently took a drubbing by America’s Congresspeople. And some thought it bode poorly for the internet giant. There were rumors of customer defections, and fears that privacy issues would sink the company. The stock dropped from a February high of $193 to a March low of $152 – down more than 20%.

But by mid-May Facebook had recovered to $186, and the concerns seemed largely ignored. As they should have been.

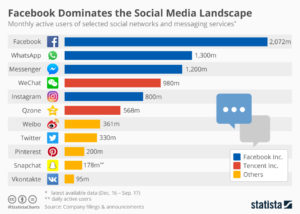

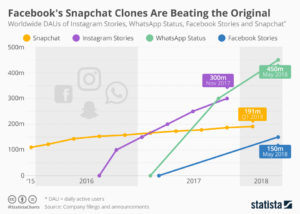

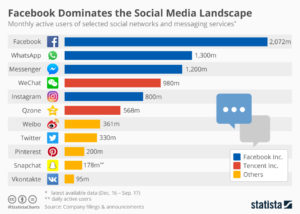

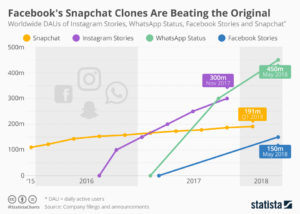

Facebook is much more than Facebook. As of January, 2018 Facebook had 2.1M monthly active users (MAUs,)  the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

Facebook paid $1B for Instagram in 2012 though it had no revenues. Today, 1/3 of ALL USA mobile users use Instagram. 15 million businesses are registered on Instagram. In 2017 Instagram had $3.6B revenues, and projections for 2018 are $6.8B.

Facebook expands globally

Facebook paid $19B for WhatsApp in 2014, when it had just $15M in revenues. In 2015, WhatsApp had 1 billion users. It is the most used app on the planet – even though not a top app in the USA where mobile texting is generally free. Where texting is expensive, like India, over 90% of mobile users utilize WhatsApp, and users typically send over 1,000 messages/month. In 2017, WhatsApp revenue rose to $1B, and in 2018 it will cross over $2B.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Unless you somehow think time will go backward, you have to recognize that social media – like all other personal technology – is constantly becoming more useful. It is gaining greater adoption, and more usage. And businesses are using social media to reach customers, thus paying for access, like they once did for newspapers, radio, television and then web sites.

Just the beginning…

Facebook is just getting started, sort of like Amazon did 20 years ago. That’s the Amazon that dominates on-line e-commerce sales. If you bought Amazon on the IPO 21 years ago (May, 2017) your investment would have risen from $18/share to $1,700 – a nearly 1,000-fold increase. Facebook’s IPO was 6 years ago (May, 2012) at $38 – 6 years later it is worth $185, almost a 5-fold increase. Not bad. But if Facebook performs like Amazon in the next 14 years it could rise to $3,600 – an almost 20x gain.

And that’s why you should ignore short–term blips like the Congressional investigation and realize that you, and everyone else, is a Facebook customer. And you want to share in that growth by being a Facebook shareholder.

(Featured image adapted from Troy Strange.)

by Adam Hartung | May 8, 2018 | Computing, Growth Stall, Innovation, Investing, Software, Trends, Web/Tech

One in five American homes with wifi now has an Amazon Alexa. And the acceptance rate is growing. To me that seems remarkable. I remember when we feared Google keeping all those searches we did. Then the fears people seemed to have about Facebook knowing our friends, families and what we talked about. Now it appears that people have no fear of “big brother” as they rapidly adopt a technology into their homes which can hear pretty near everything that is said, or that happens.

It goes to show that for most people, convenience is still incredibly important. Give us mobile phones and we let land-lines go, because mobile is so convenient – even if more expensive and lower quality. Give us laptops we let go of the traditional office, taking our work everywhere, even at a loss of work-life balance. Give us e-commerce and we start letting retailers keep our credit card information, even if it threatens our credit security. Give us digital documents via Kindle, or a smart device on the web grabbing short articles and pdf files, and we get rid of paper books and magazines. Give us streaming and we let go of physical entertainment platforms, choosing to download movies for one-time use, even though we once thought “owning” our entertainment was important.

With each new technology we make the trade-off between convenience and something we formerly thought was important. Such as quality, price, face-to-face communications, shopping in a store, owning a book or our entertainment – and even security and privacy. For all the hubbub that regulators, politicians and the “old guard” throws up about how important these things were, it did not take long for these factors to not matter as convenience outweighed what we used to think we wanted.

Now, voice activation is becoming radically important. With Google Assistant and Alexa we no longer have to bother with a keyboard interface (who wants to type?) or even a small keypad – we can just talk to our smart device. There is no doubt that is convenient. Especially when that device learns from what we say (using augmented intelligence) so it increasingly is able to accurately respond to our needs with minimal commands. Yes, this device is invading our homes, our workplaces and our lives – but it is increasingly clear that for the convenience offered we will make that trade-off. And thus what Alexa can do (measured in number of skills) has grown from zero to over 45,000 in just under 3 years.

And now, Amazon is going to explode the things Alexa can do for us. Historically Amazon controlled Alexa’s Skills market, allowing very few companies to make money off Alexa transactions. But going forward Amazon is monetizing Alexa, and developers can keep 70% of the in-skill purchase revenues customers make. Buy a product or service via Alexa and developers can now make a lot of money. And, simultaneously, Amazon is offering a “code-free” skills developer, expanding the group of people who can write skills in just minutes. In other words, Amazon is setting off a gold rush for Alexa skills development, while simultaneously making the products remarkably cheap to own.

This is horrible news for Apple. Apple’s revenue stagnated in 2016, declining year over year for 3 consecutive quarters. I warned folks then that this was a Growth Stall, which often implies a gap is developing between the company and the market. While Apple revenues have recovered, we can now see that gap. Apple still relies on iPhone and iPad sales, coupled with the stuff people buy from iTunes, for most of its revenue and growth. But many analysts think smartphone sales may have peaked. And while focusing on that core, Apple has NOT invested heavily in Siri, its voice platform. Today, Siri lags all other voice platforms in quality of recognition, quality of understanding, and number of services. And Apple’s smart speaker sales are a drop in the ocean of Amazon Echo and Echo Dot sales.

By all indications the market for a lot of what we use our mobile devices for is shifting to voice interactivity. And Apple is far behind the leader Amazon, and the strong #2 Google. Even Microsoft’s Cortana quality is considered significantly better than Siri. If this market moves as fast as the smartphone market grew it will rob sales of smartphones and iTunes, and Apple could be in a lot of trouble faster than most people think. Relevancy is a currency quickly lost in the competitive personal technology business.

by Adam Hartung | Feb 13, 2018 | Entertainment, Innovation, Investing, Television, Web/Tech

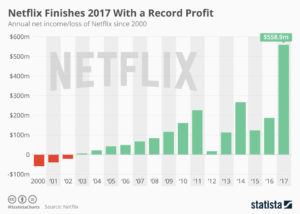

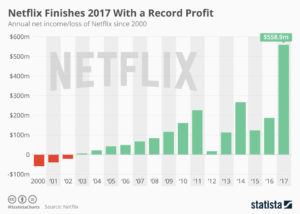

On January 23 Netflix’ value rose to $100B. The stock is now trading north of $250/share. A year ago it was $139/share. An 80% increase in just 12 months. And long-term investors have done very well. Five years ago (January, 2013) the stock was trading at $24/share – so the valuation has increased 10-fold in 5 years! A decade ago it was trading for $3/share – so if you got in early (NFLX went public in June, 2002) you are up 83X your initial investment (meaning $1,000 would be worth $83,000.)

Back in 2004 I wrote that Blockbuster was dead meat – because by going after streaming Netflix would make Blockbuster obsolete. Netflix was using external data to project its future, and thus its strategy was not to defend & extend its DVD rental business but to spend strongly to grow the replacement. In 2010 I wrote that Netflix had projected the complete demise of DVDs by 2013, and was thus investing all its resources into streaming in order to be the market leader. At the time NFLX was $15.68. Over the next year it took off, tripling in value to $42.16. By cannibalizing DVDs it’s strategy was to leave its competition in a dying marketplace.

But, investors weren’t as sure of the Netflix strategy as I was. They feared cannibalizing DVDs would cut out the “core” of Netflix and kill the company. By October, 2011 the stock had tumbled to $12 (a drop of over 70%.) But, with the stock at new lows after a year of declines I optimistically wrote “The Case for Buying Netflix. Really.” I told readers the stock analysts were wrong, and the Netflix strategy was spot-on.

Netflix went nowhere for the next year, trading between $9 and $12. But then in December, 2012 investors started seeing the results of Netflix strategy, with fast growing streaming subscriber rates. By January, 2014 the stock was trading north of $52, so those who bought when my article published made a 400% return in just over 2 years! By March, 2015 NFLX was up another 23%, to $62 when I told readers “Netflix Valuation Was Not a House of Cards.” The Netflix strategy to dominate streaming by offering its own content may have shocked a lot of people, due to the investment size, but it was the strategy that would allow Netflix to grow subscribers globally. That has driven the last jump, to $250 in just under 3 years – another 400%+ return!

Strategy matters- to company performance, and thus long-term investor returns. Netflix has been a volatile stock, and it has had plenty of naysayers. These were people looking only short-term, and fearful of strategic pivots that have proven highly valuable. If you want your company, and your investment portfolio, to succeed it is imperative you understand external trends and use them to develop the right strategy. And heed my forecasts.