by Paul F | Sep 26, 2018 | eBooks, Innovation, Investing, Marketing, Software, Web/Tech

In the recently published, “Facebook- The Making of a Great Company”, Adam Hartung analyzes the rise of Facebook and its impact on the financial community, business marketing and innovation.

Adam’s posts over the years have predicted key milestones in Facebook’s growth and its transformation into a driver of social trends. He tells the story of this company that has overcome negativity and skepticism in the financial community and has adapted to its users.

“So last week, when Facebook reported that its user base hadn’t grown like the

past, investors fled. Facebook recorded the largest one day drop in valuation in

history; about $120B of market value disappeared. Just under 20%.

No other statistic mattered. The storyline was that people didn’t trust Facebook

any longer, so people were leaving the platform. Without the record growth numbers

of the past, many felt that it was time to sell. That Facebook was going to be

the next MySpace.”

“That was a serious over-reaction.”

Adam Hartung, “Facebook-The Making of a Great Company”

by Adam Hartung | Jul 30, 2018 | Innovation, Investing, Software, Strategy, Trends, Web/Tech

On July 26, 2018 Facebook set a record for the most value lost in one day by a single company. An astonishing $119B of market value was destroyed as the shares sank more than $40. For many investors, it was the sky falling.

As most of you know, I’ve followed Facebook closely since it went public in 2012. And, I’ve long been an admirer. I said buy it at the IPO, and I’m saying buy it now. Click on the title of any of the posts to read the full content.

To summarize, Facebook may be under attack, but it is barely wounded. And it is not in the throes of demise. The long-term trends all favor the social media’s ongoing growth, and higher values in the future. Below I’ll offer some of my previous blogs that are well worth revisiting amidst the current Facebook angst.

FANG (Facebook, Amazon, Netflix and Google) investing is still the best bet in the market. They have outperformed for years, and will continue to do so. Why? Because they are growing revenues and profits faster than any other major companies in the market. And “Growth is Good” (paraphrasing Gordon Gekko.) If you have any doubts about the importance of growth, go talk to Immelt of GE or Lampert of Sears.

Don’t forget, for years now Facebook is more than Facebook.com. It’s smart acquisition programs have dramatically increased the platform’s reach with video, messaging, texting and eventually peer-to-peer video. Facebook’s leadership has built a very adaptable company, able to change the product to meet growing user (and customer) needs.

Facebook is on a path toward significant communication domination. Facebook today is sort of the New York Times, Washington Post, Los Angeles Times and about 90% of the rest of the nation’s newspapers all in one. Nobody is close to challenging Facebook’s leadership in news distribution, and all news is increasingly going on-line.

For all these reasons, you really do want to own Facebook. Especially at this valuation. It’s getting a chance to buy Facebook at its value when the year started, and Facebook is that much bigger, stronger, and adapted to changing privacy regulations that were still a mystery back then.

Oh, one last thing (paraphrasing Steve Jobs.) Facebook actually isn’t the biggest one day drop in stock valuation, despite what you’ve read.

Stocks are priced in dollars, and dollars are subject to inflation. So we should look at historical drops in inflation adjusted dollars. Even though inflation has been mostly below 3% since the 1990s, from 2000 to today the dollar has inflated by 46%. So inflation-adjusted, the biggest one day value destruction actually belongs to Intel, which lost $131B in September, 2000. And Microsoft is only slightly in third place, having lost $117B in April, 2000. So keep this in mind when you think about the long-term opportunity for Facebook.

Now Published! “Facebook- The Making of a Great Company” ebook by Adam Hartung.

by Adam Hartung | Jul 19, 2018 | Entrepreneurship, In the Rapids, Innovation, Marketing, Medical

USA health care is ridiculously expensive. It’s good, but no statistics show that US healthcare is better than any other developed country. Nor any better than accredited facilities in large, developing countries. Look at these comparisons according to Medicaltourism.com:

Procedure USA cost India cost in accredited facility

Heart Bypass $123,000 $7,900

Heart Valve Replacement $170,000 $10,450

Hip Replacement $40,364 $7,200

Knee Replacement $35,000 $6,600

Spinal Fusion $110,000 $10,300

Hysterectomy $15,400 $3,200

Cornea Replacement $17,500 $2,800

Over 1/3 of Americans live with the myth that if they need medical care, somehow it will magically happen at no cost. The Affordable Care Act tried to fix that myth by making everyone buy health insurance. But Congress removed that government mandate. So most Americans that don’t have company-sponsored health insurance don’t buy insurance. Their primary source of health insurance is hope. When illness or accident happens these folks end up with extra-ordinary debt. And they can’t eliminate this debt because health care debt doesn’t go away in bankruptcy. So every year more and more people learn that an unexpected health incident means they will spend the rest of their lives paying for medical services that were 10x or 100x what they expected.

This is a trend that will not end soon. Costs keep going up. The political sides are too divided on what to do. And health insurance companies spend literally billions annually to make sure insurance for all (referred to as Medicare for all) never becomes reality.

This trend means there is opportunity. And that has become medical tourism. Literally, flying to foreign countries for medical procedures.

You may say “not me.” But if you have no money in the bank, and you let your health insurance lapse when you lost your last corporate job ended and you entered the gig economy, you could face a very tough situation. The same one almost all farmers face, and most small business owners, since their insurance is unaffordable. And most 1099 contract employees. When you have an unexpected heart attack at age 41 you wake up to hear a hospital admin say “you are alive, but you need surgery. If you want to live, we can do a heart bypass. Just sign this document and you’ll wake up somewhere north of $123,000 in debt.” Which means you’ll lose your house, for sure. Your kids won’t go to college. And you’ll never again buy a new car.

Or you blow out a hip, or knee,playing that Sunday basketball pick-up game – or golf. You’re 50-55, so too young for Medicare. But you lost health insurance years ago. Or you have a minimalistic plan which will cover a fraction of the cost. Finding the cost is $35,000 to $40,000 (or more likely $60,000 at a for-profit US hospital) are you really able to afford this? Or will you spend your life using crutches, or in a wheelchair? Or start an on–line begging campaign from your friends to cover the cost?

Suddenly, being a medical tourist doesn’t sound so unlikely. Saving $30,000 to $100,000 could determine your financial future. This trend was pretty clear back in 2010 when I pointed out that US medical tourists grew from 700,000 in 2007 to 1.2 million in just 3 years. The trend was actually obvious in 2005, when most people laughed at the idea of medical tourism – because they refused to look at the demographic and cost trends.

That’s why medical tourism is already a $20B business. And growing at 18% annually. Some analysts estimate the global market at almost $80B. Demographics are all in favor of future growth. The developed world population is aging. Health care costs are going up. Government ability to pay is going down. Insurers are charging outrageous rates. Fewer people are buying health care, and even fewer are buying “gold plated plans” that match the average plan in 1990. And American health care policies, in particular, keep driving up costs. It is EASY to see that as people can’t afford care at home, so they WILL be making more trips overseas.

There are already companies making the plunge. Some are matching services between patients and medical facilities. Some are building certified medical facilities in places like India, Singapore, Brazil, Malaysia, Thailand, Costa Rica and Mexico. The opportunities are as big as the health industry.

And this trend affects every business. Are you still stuck in the status quo thinking of extremely expensive insurance for employees, or none? Medical tourism offers a plethora of other opportunities. You can offer a bare-bones domestic plan, with augmented insurance to be a medical tourist. Or even a company sponsored plan, with the opportunity for employees to build a health-care bank, and a relationship with a medical tourism company to help employees find providers offshore. And gig-economy employees can drop the idea of domestic coverage (other than bare bones) for a mixed program including offshore insurance.

Fighting the health cost trend in the USA is foolish. Doing nothing hurts your competitiveness. Given the opportunities in medical tourism, are you thinking about how to build on this trend as a new business? Or a way to offer more to full time and 1099 contractors?

by Adam Hartung | Jul 11, 2018 | Computing, Growth Stall, Innovation, Investing, Software

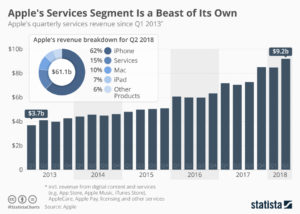

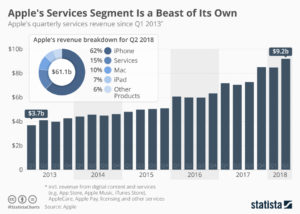

The last few quarters sales growth has not been as good for Apple as it once was. The iPhone X didn’t sell as fast as they hoped, and while the Apple Watch outsells the entire Swiss watch industry it does not generate the volumes of an iPhone. And other new products like Apple Pay and iBeacon just have not taken off.

Amidst this slowness, the big winner has been “Apple Services” revenue. This is largely sales of music, videos and apps from iTunes and the App store. In Q2, 2018 revenues reached $9.2B, 15% of total revenues and second only to iPhone sales. Although Apple does not have a majority of smartphone users, the user base it has spends a lot of money on things for Apple devices. A lot of money.

In a bit of “get them the razor so they will buy the razor blades” CEO Tim Cook’s Apple is increasingly relying upon farming the “installed base” of users to drive additional revenues. Leveraging the “installed base” of users is now THE primary theme for growing Apple sales. And even old-tech guys like Warren Buffett at Berkshire Hathaway love it, as they gobble up Apple shares. As do many analysts, and investors. Apple has paid out over $100B to developers for its services, and generated over $40B in revenues for itself – and with such a large base willing to buy things developers are likely to keep providing more products and working to grow sales.

In a bit of “get them the razor so they will buy the razor blades” CEO Tim Cook’s Apple is increasingly relying upon farming the “installed base” of users to drive additional revenues. Leveraging the “installed base” of users is now THE primary theme for growing Apple sales. And even old-tech guys like Warren Buffett at Berkshire Hathaway love it, as they gobble up Apple shares. As do many analysts, and investors. Apple has paid out over $100B to developers for its services, and generated over $40B in revenues for itself – and with such a large base willing to buy things developers are likely to keep providing more products and working to grow sales.

But the risks here should not be taken lightly. At one time Apple’s Macintosh was the #1 selling PC. But it was “closed” and required users buy their applications from Apple. Microsoft offered its “open architecture” and suddenly lots of new applications were available for PCs, which were also cheaper than Macs. Over a few years that “installed base” strategy backfired for Apple as PC sales exploded and Mac sales shrank until it became a niche product with under 10% market share.

Today, Android phones are the #1 smartphone market share platform, and Android devices (like the PC) are much cheaper. Even cheaper are Chinese made products. Although there are problems, the risk exists that someday apps, etc for Android and/or other platforms could become more standard and the larger Android base could “flip” the market.

The history of companies relying on an installed base to grow their company has not gone well. Going back 30 years, AM Multigraphics an ABDick sold small printing presses to schools, government agencies and businesses. After the equipment sale these companies made most of their growth on the printing supplies these presses used. But competitors whacked away at those sales, and eventually new technologies displaced the small presses. The installed base shrank, and both companies disappeared.

Xerox would literally give companies a copier if they would just pay a “per click” charge for service on the machine, and use Xerox toner. Xerox grew like the proverbial weed. Their service and toner revenue built the company. But then people started using much cheaper copiers they could buy, and supply with cheaper consumables. And desktop publishing solutions caused copier use to decline. So much for Xerox growth – and the company rapidly lost relevance. Now Xerox is on the verge of disappearing into Fuji.

HP loved to sell customers cheap ink-jet printer so they bought the ink. But now images are mostly transferred as .jpg, .png or .pdf files and not printed at all. The installed base of HP printers drove growth, until the need for any printing started disappearing.

The point? It is very risky to rely on your installed platform base for your growth. Why? Because competitors with cheaper platforms can come along and offer cheaper consumables, making your expensive platform hard to keep forefront in the market. That’s the classic “innovator’s dilemma” – someone comes along with a less-good solution but it’s cheaper and people say “that’s good enough” thus switching to the cheaper platform. This leaves the innovator stuck trying to defend their expensive platform and aftermarket sales as the market switches to ever better, cheaper solutions.

It’s great that Apple is milking its installed base. That’s smart. But it is not a viable long-term strategy. That base will, someday, be overtaken by a competitor or a new technology. Like, maybe, smart speakers. They are becoming ubiquitous. Yes, today Siri is the #1 voice assistant. But as Echo and Google speaker sales proliferate, can they do to smartphones what smartphones did to PCs? What if one of these companies cooperates with Microsoft to incorporate Cortana, and link everything on the network into the Windows infrastructure? If these scenarios prevail, Apple could/will be in big trouble.

I pointed out in October, 2016 that Apple hit a Growth Stall. When that happens, maintaining 2% growth long-term happens only 7% of the time. I warned investors to be wary of Apple. Why? Because a Growth Stall is an early indicator of an innovation gap developing between the company’s products and emerging products. In this case, it could be a gap between ever enhanced (beyond user needs) mobile devices and really cheap voice activated assistant devices in homes, cars, offices, everywhere. Apple can milk that installed base for a goodly while, but eventually it needs “the next big thing” if it is going to continue being a long-term winner.

by Adam Hartung | Jun 27, 2018 | In the Swamp, Innovation, Investing, Manufacturing, Transportation, Trends

On Monday, Harley Davidson, America’s leading manufacturer of motorcycles, announced it was going to open a plant in Europe.

Ostensibly this is to counter tariffs the EU will be imposing on its products if imported from the USA. President Trump reacted vociferously on Tuesday, threatening much bigger taxes on Harley if it brings to the USA any parts or motorcycles from its offshore plants in Brazil, Australia, India or Thailand. He also intimated that Harley Davidson was likely to collapse.

Lots of heat, not much light. The issues for Harley Davidson are far worse than an EU tariff.

Harley Davidson has about 1/3 of the US motorcycle market. But in “heavy motorcycles,” those big bikes that are heavier and generally considered for longer riding, Harley has half the market. Which sounds great, until you realize that until the 1970s, Harley had 100% of that market. Ever since then, Harley has been losing share – to imports and to its domestic competitor Polaris.

It was 2006 when I first wrote about Harley Davidson’s big demographic problem. Basically, its customers were all aging. Younger people were buying other motorcycles, so the “core” Harley customer was getting older every year. From mid-30s in the 1980s, by the year 2000 the average buyer was well into their mid-40s. In 2007, I pointed out that Harley had made a stab at changing this dynamic by introducing a new motorcycle with an engine made by Porsche, and a far more modern design (the V-Rod.) But Harley wasn’t committed to building a new customer base, so when dealers complained that the V-Rod “wasn’t really a Harley” the company backed off the marketing and went back to all its old ways of doing business.

Simultaneously, Harley Davidson motorcycle prices were rising faster than inflation, while Japanese manufacturers were not. Thus, as I also pointed out in 2007, it was struggling to maintain market share. Slower sales caused a lay-off that year, and despite the brand driving huge sales of after-market products like jackets and T-shirts, which had grown as big as bike sales, it was unclear how Harley would slow the aging of its customer base and find new, younger buyers. Harley simply eschewed the trend toward selling smaller, lighter, cheaper bikes that had more appeal to more people – and in more markets.

Globally, the situation is far more bleak than the USA. America has one of the lowest motorcycle ridership percentages on the globe. Americans love cars. But in more congested countries like across Europe or Japan and China, and in much poorer countries like India, Korea, and across South America motorcycles are more popular than automobiles. And in those countries Harley has done poorly. Because Harley doesn’t even have the smaller 100cc,200cc, 400cc and 600cc bikes that dominate the market. For example, in 2006 (I know, old, but best data I could find) Harley Davidson sold 349,200 bikes globally. Honda sold 10.3 million. Yamaha sold 4.4 million. Even Suzuki sold 3.1 million – or 10 times Harley’s production.

But, being as fair as possible, let’s focus on Europe – where the new Harley plant is to be built. And let’s look exclusively at “heavy motorcycles” (thus excluding the huge market in which Harley has no products.) In 2006, Harley was 6th in market share. BMW 16%, Honda 15%, Yamaha 15%, Suzuki 15%, Kawasaki 11% and Harley Davidson 9%. Wow, that is simply terrible.

Clearly, Harley has already become marginalized globally. Outside the USA, Harley isn’t even relevant. The Japanese and Germans have been much more successful everywhere outside the USA, and every one of those other markets is bigger than the USA. Harley was simply relying on its core product (big bikes) in its core market (USA) and seriously failing everywhere else.

Oh, but even that story isn’t as good as it sounds. Because in the USA sales of Harley motorcycles has been declining for a decade! Experts estimate that every year which passes, Harley’s customer base ages by 6 months. The average rider age is now well into their 50s. Since Q3, 2014 Harley’s sales growth has been negative! In Q2 and Q3 2017 sales declines were almost 10%/quarter!

As its customer demographic keeps working against it, new customers for big bikes are buying BMWs from Germany – and Victory and Indian motorcycles made by Polaris, out of Minnesota (Polaris discontinued the Victory brand end of 2017.) BMW sales have increased for 7 straight quarters, and their European sales are growing stronger than ever – directly in opposition to Harley’s sales problems. Every quarter Indian is growing at 16-20%, taking all of its sales out of Harley Davidson USA share.

Going back to my 2016 column, when I predicted Harley was in for a hard time. Shares hit an all-time high in 2006 of $75. They have never regained that valuation. They plummeted during the Great Recession, but bailout funds from Berkshire Hathaway and the US government saved Harley from bankruptcy. Shares made it back to $70 by 2014, but fell back to $40 by 2016. Now they are trading around $40. Simply put, as much as people love to talk about the Harley brand, the company is rapidly becoming irrelevant. It is losing share in all markets, and struggling to find new customers for a product that is out-of-date, and sells almost exclusively in one market. Its move to manufacture in Europe is primarily a Hail-Mary pass to find new sales, paid for by corporate tax cuts in the USA and tariff tax avoidance in Europe.

But it won’t likely matter. Like I said in 2006, Harley Davidson is a no-growth story, and that’s not a story where anyone should invest.

by Adam Hartung | May 22, 2018 | Innovation, Investing, Marketing, Software, Web/Tech

(Image: Troy Strange.)

Facebook’s CEO recently took a drubbing by America’s Congresspeople. And some thought it bode poorly for the internet giant. There were rumors of customer defections, and fears that privacy issues would sink the company. The stock dropped from a February high of $193 to a March low of $152 – down more than 20%.

But by mid-May Facebook had recovered to $186, and the concerns seemed largely ignored. As they should have been.

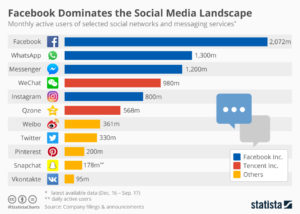

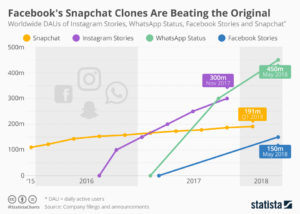

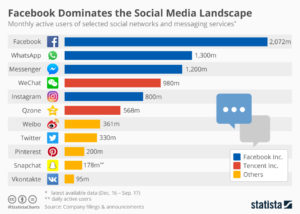

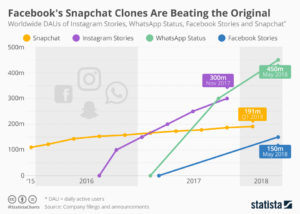

Facebook is much more than Facebook. As of January, 2018 Facebook had 2.1M monthly active users (MAUs,)  the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

Facebook paid $1B for Instagram in 2012 though it had no revenues. Today, 1/3 of ALL USA mobile users use Instagram. 15 million businesses are registered on Instagram. In 2017 Instagram had $3.6B revenues, and projections for 2018 are $6.8B.

Facebook expands globally

Facebook paid $19B for WhatsApp in 2014, when it had just $15M in revenues. In 2015, WhatsApp had 1 billion users. It is the most used app on the planet – even though not a top app in the USA where mobile texting is generally free. Where texting is expensive, like India, over 90% of mobile users utilize WhatsApp, and users typically send over 1,000 messages/month. In 2017, WhatsApp revenue rose to $1B, and in 2018 it will cross over $2B.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Unless you somehow think time will go backward, you have to recognize that social media – like all other personal technology – is constantly becoming more useful. It is gaining greater adoption, and more usage. And businesses are using social media to reach customers, thus paying for access, like they once did for newspapers, radio, television and then web sites.

Just the beginning…

Facebook is just getting started, sort of like Amazon did 20 years ago. That’s the Amazon that dominates on-line e-commerce sales. If you bought Amazon on the IPO 21 years ago (May, 2017) your investment would have risen from $18/share to $1,700 – a nearly 1,000-fold increase. Facebook’s IPO was 6 years ago (May, 2012) at $38 – 6 years later it is worth $185, almost a 5-fold increase. Not bad. But if Facebook performs like Amazon in the next 14 years it could rise to $3,600 – an almost 20x gain.

And that’s why you should ignore short–term blips like the Congressional investigation and realize that you, and everyone else, is a Facebook customer. And you want to share in that growth by being a Facebook shareholder.

(Featured image adapted from Troy Strange.)

by Adam Hartung | May 8, 2018 | Computing, Growth Stall, Innovation, Investing, Software, Trends, Web/Tech

One in five American homes with wifi now has an Amazon Alexa. And the acceptance rate is growing. To me that seems remarkable. I remember when we feared Google keeping all those searches we did. Then the fears people seemed to have about Facebook knowing our friends, families and what we talked about. Now it appears that people have no fear of “big brother” as they rapidly adopt a technology into their homes which can hear pretty near everything that is said, or that happens.

It goes to show that for most people, convenience is still incredibly important. Give us mobile phones and we let land-lines go, because mobile is so convenient – even if more expensive and lower quality. Give us laptops we let go of the traditional office, taking our work everywhere, even at a loss of work-life balance. Give us e-commerce and we start letting retailers keep our credit card information, even if it threatens our credit security. Give us digital documents via Kindle, or a smart device on the web grabbing short articles and pdf files, and we get rid of paper books and magazines. Give us streaming and we let go of physical entertainment platforms, choosing to download movies for one-time use, even though we once thought “owning” our entertainment was important.

With each new technology we make the trade-off between convenience and something we formerly thought was important. Such as quality, price, face-to-face communications, shopping in a store, owning a book or our entertainment – and even security and privacy. For all the hubbub that regulators, politicians and the “old guard” throws up about how important these things were, it did not take long for these factors to not matter as convenience outweighed what we used to think we wanted.

Now, voice activation is becoming radically important. With Google Assistant and Alexa we no longer have to bother with a keyboard interface (who wants to type?) or even a small keypad – we can just talk to our smart device. There is no doubt that is convenient. Especially when that device learns from what we say (using augmented intelligence) so it increasingly is able to accurately respond to our needs with minimal commands. Yes, this device is invading our homes, our workplaces and our lives – but it is increasingly clear that for the convenience offered we will make that trade-off. And thus what Alexa can do (measured in number of skills) has grown from zero to over 45,000 in just under 3 years.

And now, Amazon is going to explode the things Alexa can do for us. Historically Amazon controlled Alexa’s Skills market, allowing very few companies to make money off Alexa transactions. But going forward Amazon is monetizing Alexa, and developers can keep 70% of the in-skill purchase revenues customers make. Buy a product or service via Alexa and developers can now make a lot of money. And, simultaneously, Amazon is offering a “code-free” skills developer, expanding the group of people who can write skills in just minutes. In other words, Amazon is setting off a gold rush for Alexa skills development, while simultaneously making the products remarkably cheap to own.

This is horrible news for Apple. Apple’s revenue stagnated in 2016, declining year over year for 3 consecutive quarters. I warned folks then that this was a Growth Stall, which often implies a gap is developing between the company and the market. While Apple revenues have recovered, we can now see that gap. Apple still relies on iPhone and iPad sales, coupled with the stuff people buy from iTunes, for most of its revenue and growth. But many analysts think smartphone sales may have peaked. And while focusing on that core, Apple has NOT invested heavily in Siri, its voice platform. Today, Siri lags all other voice platforms in quality of recognition, quality of understanding, and number of services. And Apple’s smart speaker sales are a drop in the ocean of Amazon Echo and Echo Dot sales.

By all indications the market for a lot of what we use our mobile devices for is shifting to voice interactivity. And Apple is far behind the leader Amazon, and the strong #2 Google. Even Microsoft’s Cortana quality is considered significantly better than Siri. If this market moves as fast as the smartphone market grew it will rob sales of smartphones and iTunes, and Apple could be in a lot of trouble faster than most people think. Relevancy is a currency quickly lost in the competitive personal technology business.

by Adam Hartung | May 2, 2018 | Entrepreneurship, Food and Drink, Innovation, Marketing, Strategy

Execution – Implementation – Delivering — These are table stakes today. If you can’t do them you don’t get a seat at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

Take for example a small company named NakedWine.com that created a potential death trap for its business by implementing one crucial execution mis-step.

The NakedWine value proposition is simple. They will find wines you never heard of and skip the costs of distributors and retailers by matching the customer and winemaker. Customers ostensibly get wines far cheaper because the winemaker’s cost of marketing and sales are avoided. Decent value proposition for both the customer, and the manufacturer.

The NakedWine strategy is to convince people that the NakedWine wines will be good, month after month. The NakedWine brand is crucial, as customer trust is now not in the hands of the winemaker, nor wine aficionados that rate known wines on a point scale, or even the local retail shop owner or employee. Customers must trust NakedWine to put a good product in their hands. Customers who most likely know little or nothing about wines. NakedWines wants customers to trust them so much they will buy the company’s boxed selections month after month, delivered to their home. These customers likely don’t know what they are getting, and don’t much care, because they trust NakedWine to give them a pleasurable product at a price point which makes them happy. When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

But, NakedWines blew the whole strategy with one simple execution mistake.

Not everyone lives where they can accept a case of wine, due to weather. As northern Californians, maybe NakedWine leaders just forget how cold it is in Minneapolis, Chicago, Buffalo and Boston. Or how hot it is in Tucson, Phoenix, Houston, Palm Springs and Las Vegas. In these climates a case of wine left on a truck for a day – or 2 if the first delivery is missed – spells the end of that wine. Ruined by the temperature. Especially heat, as everyone who drinks beer or wine knows that a couple of hours at 90 degrees can kill those products completely.

The only time the customer finally connects with NakedWine is when that wine enters the house, and over the lips. But that step, that final step of getting the perishable wine to the customer safely, in good quality, and aligned with customer expectations was not viewed as part of the brand-building strategy. Instead, leadership decided at this step NakedWines should instead focus on costs. They would view delivery as completely generic – divorced from the brand-building effort. They would use the low–cost vendor, regardless of the service provided.

NakedWine decided to use Fedex Ground, even though Fedex has a terrible package tracking system. Fedex is unwilling to make sure (say, by drivers using a cell phone) that customers will be there to receive a shipment. The driver rings a bell – no answer and he’s on the run in seconds to make sure he’s meeting Fedex efficiency standards, even if the customer was delayed to the door by a phone call or other issue. When the customer requests Fedex send the driver back around again, Fedex is unwilling to attempt a second delivery within short time, or even any time that same day, after delivery fails. If a customer calls about a missed delivery, Fedex is unwilling to route a failed delivery to a temperature local Fedex Office location for customer pick-up. Or to tell the customer where they can meet the driver along his route to accept delivery. Despite a range of good options, the NakedWine product is forced to sit on that Fedex truck, bouncing around all day in the heat, or cold, being ruined. Fedex uses its lowest cost approach to delivery to offer the lowest cost bid, regardless of the impact on the product and/or customer experience, and NakedWine didn’t think about the impact choosing that bid would have on its brand building.

Brand Building at Every Step

Simply put, in addition to flyers, advertising and product discounts, NakedWine should have followed through on its brand building strategy at every step. It must source wines its customers will enjoy. And it must deliver that perishable product in a way that builds the brand – not put it at risk. For example, NakedWine should screen all orders for delivery location, in order to make sure there are no delivery concerns. If there are, someone at NakedWine should contact the customer to discuss with them issues related to shipping, such as temperature. If it is to be too hot or cold, they could highly recommend using a temperature controlled pick-up location so as not to put the product at risk. And they should build in fail-safe’s with the shipping company to handle delivery problems. That is implementing a brand building strategy all the way from value-proposition to delivery.

Leaders Execute Plans

Too often leaders will work hard on a strategy, and create a good value proposition. But then, for some unknown reason, they turn over “execution” to people who don’t really understand the strategy. Worse, leadership often makes the egregious error of pushing those who create the value delivery system to largely to focus on costs, or other wrong metrics, with little concern for the value proposition and strategy. The result is a great idea that goes off the rails. Because the value delivery system simply does not live up to expectations of the value proposition.

by Adam Hartung | Apr 25, 2018 | Entertainment, Film, Innovation, Investing, Retail

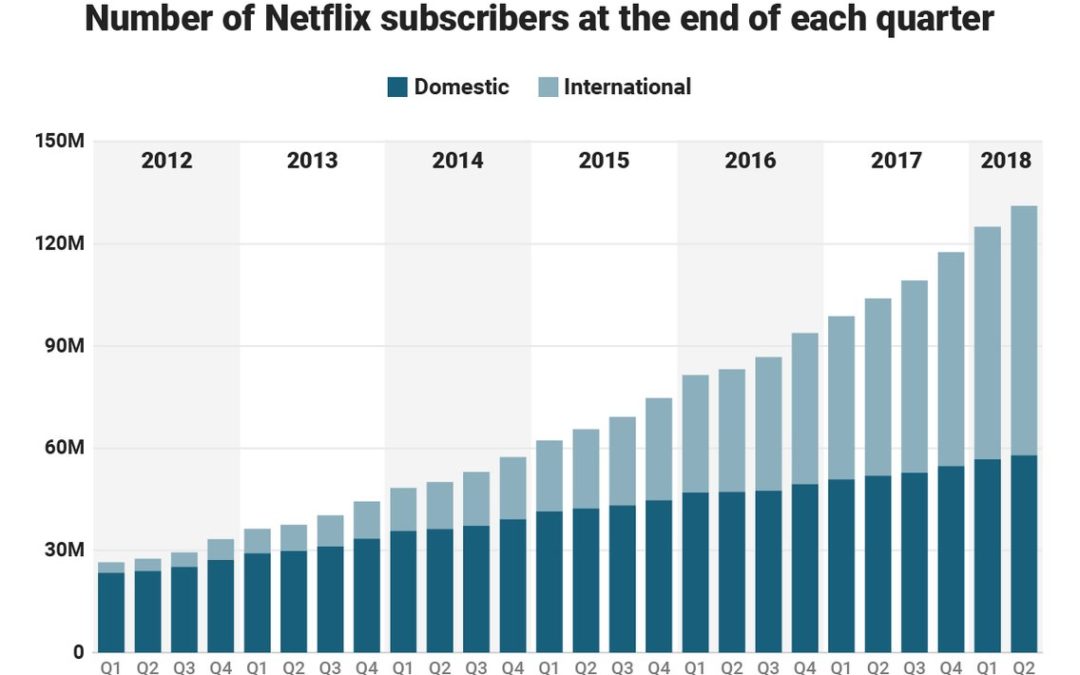

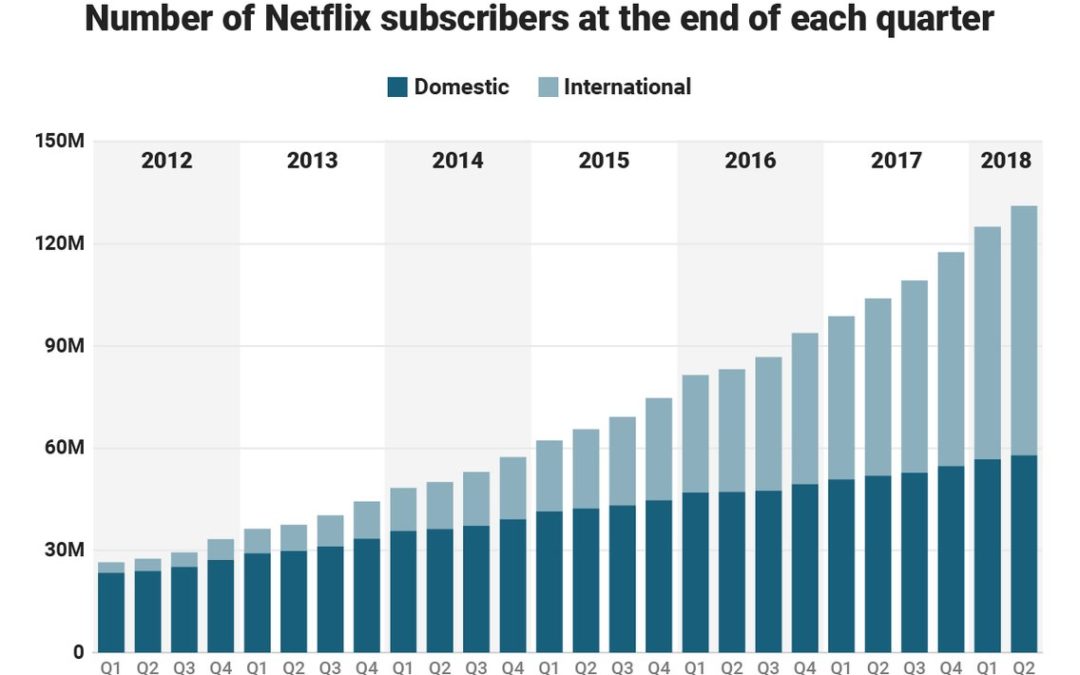

Netflix announced new subscriber numbers last week – and it exceeded expectations. Netflix now has over 130 million worldwide subscribers. This is up 480% in just the last 6 years – from under 30 million. Yes, the USA has grown substantially, more than doubling during this timeframe. But international growth has been spectacular, growing from almost nothing to 57% of total revenues. International growth the last year was 70%, and the contribution margin on international revenues has transitioned from negative in 2016 to over 15% – double the 4th quarter of 2017.

Accomplishing this is a remarkable story. Most companies grow by doing more of the same. Think of Walmart that kept adding stores. Then adding spin-off store brand Sam’s Club. Then adding groceries to the stores. Walmart never changed its strategy, leaders just did “more” with the old strategy. That’s how most people grow, by figuring out ways to make the Value Delivery System (in their case retail stores, warehouses and trucks) do more, better, faster, cheaper. Walmart never changed its strategy.

But Netflix is a very different story. The company started out distributing VHS tapes, and later DVDs, to homes via USPS, UPS and Fedex. It was competing with Blockbuster, Hollywood Video, Family Video and other traditional video stores. It won that battle, driving all of them to bankruptcy. But then to grow more Netflix invested far outside its “core” distribution skills and pioneered video streaming, competing with companies like DirecTV and Comcast. Eventually Netflix leaders raised prices on physical video distribution, cannibalizing that business, to raise money for investing in streaming technology. Streaming technology, however, was not enough to keep growing subscribers. Netflix leadership turned to creating its own content, competing with moviemakers, television and documentary producers, and broadcast television. The company now spends over $6B annually on content.

Think about those decisions. Netflix “pivoted” its strategy 3 times in one decade. Its “core” skill for growth changed from physical product distribution to network technology to content creation. From a “skills” perspective none of these have anything in common.

Could you do that? Would you do that?

How did Netflix do that? By focusing on its Value Proposition. By realizing that it’s Value Proposition was “delivering entertainment” Netflix realized it had to change its skill set 3 times to compete with market shifts. Had Netflix not done so, its physical distribution would have declined due to the emergence of Amazon.com, and eventually disappeared along with tapes and DVDs. Netflix would have followed Blockbuster into history. And as bandwidth expanded, and global networks grew, and dozens of providers emerged streaming purchased content profits would have become a bloodbath. Broadcasters who had vast libraries of content would sell to the cheapest streaming company, stripping Netflix of its growth. To continue growing, Netflix had to look at where markets were headed and redirect the company’s investments into its own content.

This is not how most companies do strategy. Most try to figure out one thing they are good at, then optimize it. They examine their Value Delivery System, focus all their attention on it, and entirely lose track of their Value Proposition. They keep optimizing the old Value Delivery System long after the market has shifted. For example, Walmart was the “low cost retailer.” But e-commerce allows competitors like Amazon.com to compete without stores, without advertising and frequently without inventory (using digital storefronts to other people’s inventory.) Walmart leaders were so focused on optimizing the Value Delivery System, and denying the potential impact of e-commerce, that they did not see how a different Value Delivery System could better fulfill the initial Walmart Value Proposition of “low cost.” The Walmart strategy never took a pivot – and now they are far, far behind the leader, and rapidly becoming obsolete.

Do you know your Value Proposition? Is it clear – written on the wall somewhere? Or long ago did you stop thinking about your Value Proposition in order to focus your intention on optimizing your Value Delivery System?

That fundamental strategy flaw is killing companies right and left – Radio Shack, Toys-R-Us and dozens of other retailers. Who needs maps when you have smartphone navigation? Smartphones put an end to Rand McNally. Who needs an expensive watch when your phone has time and so much more? Apple Watch sales in 2017 exceeded the entire Swiss watch industry. Who needs CDs when you can stream music? Sony sales and profits were gutted when iPods and iPhones changed the personal entertainment industry. (Anyone remember “boom boxes” and “Walkman”?)

I’ve been a huge fan of Netflix. In 2010, I predicted it was the next Apple or Google. When the company shifted strategy from delivering physical entertainment to streaming in 2011, and the stock tanked, I made the case for buying the stock. In 2015 when the company let investors know it was dumping billions into programming I again said it was strategically right, and recommended Netflix as a good investment. And I redoubled my praise for leadership when the “double pivot” to programming was picking up steam in 2016. You don’t have to be mystical to recognize a winner like Netflix, you just have to realize the company is using its strategy to deliver on its Value Proposition, and is willing to change its Value Delivery System because “core strength” isn’t important when its time to change in order to meet new market needs.

by Adam Hartung | Apr 3, 2018 | Computing, Growth Stall, Innovation, Investing, Mobile, Music

Do you still have a pile of compact discs? If so, why? When was the last time you listened to one? Like almost everyone else, you probably stream your music today. If you are just outdated, you listen to music you bought from iTunes or GooglePlay and store on your mobile device. But it would be considered prehistoric to tell people you carry around CDs for listening in your car – because you surely don’t own a portable CD player.

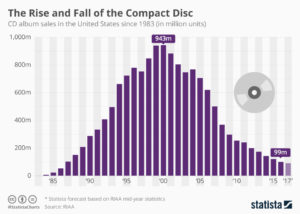

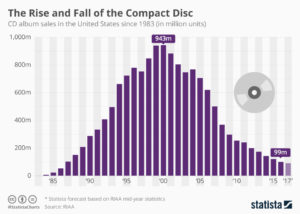

As the chart shows, CD sales exploded from nothing in 1983 to nearly 1B units in 2000. Now sales are less than 1/10th that number, due to the market shift expanded bandwidth allowed.

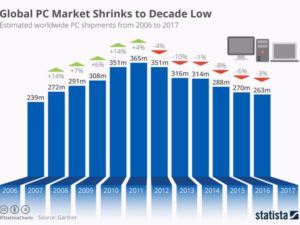

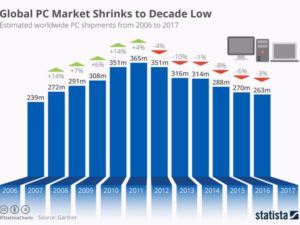

Do you still carry a laptop? If so, you are a dying minority. As PCs became more portable they became indispensable. Nobody left the office, or attended a meeting, without their laptop. That trend exploded until 2011, when PC sales peaked at 365M units. As the chart shows, in the 6 years since, PC sales have dropped by over 100M units, a 30% decline. The advent of mobile devices (smartphones and tablets) coupled with expanded connectivity and growing cloud services allowed mobility to reach entirely new levels – and people stopped carrying their PCs. And just like CDs are disappearing, so will PCs.

These charts dramatically show how quickly a new technology, or package of technologies, can change the way we behave. Simultaneously, they change the competitive landscape. Sony dominated the music industry, as a producer and supplier of hardware, when CDs dominated. But, as I wrote in 2012, the shift to more portable music caused Sony to fall into a rapid decline, and the company suffered 6 consecutive years (24 quarters) of falling sales and losses. The one-time giant was crippled by a technology shift they did not adopt. And they weren’t alone, as big box retailers such as Best Buy and Circuit City also faltered when these sales disappeared.

Once, Microsoft was synonymous with personal technology. Nobody maximized the value in PC growth more than Microsoft. But changing technology altered the competitive landscape, with Apple, Google, Samsung and Amazon emerging as the leaders. Microsoft, as the almost unnoticed launch of Windows 10 demonstrated, is struggling to maintain relevancy.

Too often we discount trends. Like Sony and Microsoft we think historical growth will continue, unabated. We find ways to discount market shifts, saying the products are “niche” and denigrating their quality. We will express our view that the market has “hiccuped” and will return to growth again. By the time we admit the shift is permanent new competitors have overtaken the lead, and we risk becoming totally obsolete. Like Toys-R-Us, Radio Shack, Sears and Motorola.

Aircraft stalls when not enough power to climb

The time for action is when the very first signs of shift happened. I’ve written a lot about “Growth Stalls” and they occur in just 2 quarters. 93% of the time a stalled company never again grows at a mere 2%/year. Look at how fast GE went from the best company in America to the worst. It is incredibly important that leadership react FAST when trends push customers toward new solutions, because it often takes very little time for the trend to make dying markets completely untenable.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition. When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.