by Adam Hartung | Apr 3, 2018 | Computing, Growth Stall, Innovation, Investing, Mobile, Music

Do you still have a pile of compact discs? If so, why? When was the last time you listened to one? Like almost everyone else, you probably stream your music today. If you are just outdated, you listen to music you bought from iTunes or GooglePlay and store on your mobile device. But it would be considered prehistoric to tell people you carry around CDs for listening in your car – because you surely don’t own a portable CD player.

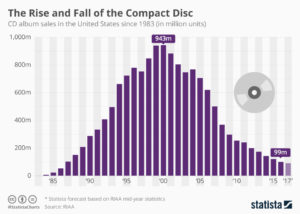

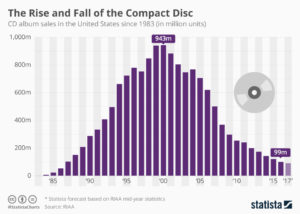

As the chart shows, CD sales exploded from nothing in 1983 to nearly 1B units in 2000. Now sales are less than 1/10th that number, due to the market shift expanded bandwidth allowed.

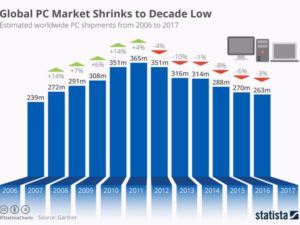

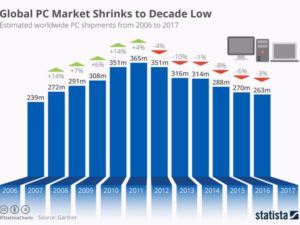

Do you still carry a laptop? If so, you are a dying minority. As PCs became more portable they became indispensable. Nobody left the office, or attended a meeting, without their laptop. That trend exploded until 2011, when PC sales peaked at 365M units. As the chart shows, in the 6 years since, PC sales have dropped by over 100M units, a 30% decline. The advent of mobile devices (smartphones and tablets) coupled with expanded connectivity and growing cloud services allowed mobility to reach entirely new levels – and people stopped carrying their PCs. And just like CDs are disappearing, so will PCs.

These charts dramatically show how quickly a new technology, or package of technologies, can change the way we behave. Simultaneously, they change the competitive landscape. Sony dominated the music industry, as a producer and supplier of hardware, when CDs dominated. But, as I wrote in 2012, the shift to more portable music caused Sony to fall into a rapid decline, and the company suffered 6 consecutive years (24 quarters) of falling sales and losses. The one-time giant was crippled by a technology shift they did not adopt. And they weren’t alone, as big box retailers such as Best Buy and Circuit City also faltered when these sales disappeared.

Once, Microsoft was synonymous with personal technology. Nobody maximized the value in PC growth more than Microsoft. But changing technology altered the competitive landscape, with Apple, Google, Samsung and Amazon emerging as the leaders. Microsoft, as the almost unnoticed launch of Windows 10 demonstrated, is struggling to maintain relevancy.

Too often we discount trends. Like Sony and Microsoft we think historical growth will continue, unabated. We find ways to discount market shifts, saying the products are “niche” and denigrating their quality. We will express our view that the market has “hiccuped” and will return to growth again. By the time we admit the shift is permanent new competitors have overtaken the lead, and we risk becoming totally obsolete. Like Toys-R-Us, Radio Shack, Sears and Motorola.

Aircraft stalls when not enough power to climb

The time for action is when the very first signs of shift happened. I’ve written a lot about “Growth Stalls” and they occur in just 2 quarters. 93% of the time a stalled company never again grows at a mere 2%/year. Look at how fast GE went from the best company in America to the worst. It is incredibly important that leadership react FAST when trends push customers toward new solutions, because it often takes very little time for the trend to make dying markets completely untenable.

by Adam Hartung | Jan 19, 2011 | Current Affairs, Disruptions, Games, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Music, Openness, Web/Tech

The Wall Street Journal headlined Monday, “Apple Chief to Take Leave.” Forbes.com Leadership editor Fred Allen quickly asked what most folks were asking “Where does Steve Jobs Leave Apple Now?” as he led multiple bloggers covering the speculation about how long Mr. Jobs would be absent from Apple, or if he would ever return, in “What They Are Saying About Steve Jobs.” The stock took a dip as people all over raised the question covered by Steve Caulfield in Forbes’ “Timing of Steve Jobs Return Worries Investors, Fans.”

If you want to make money investing, this is what’s called a “buying opportunity.” As Forbes’ Eric Savitz reported “Apple is More Than Just Steve Jobs.” Just look at the most recent results, as reported in Ad Age “Apple Posts ‘Record Quarter’ on Strong iPhone, Mac, iPad Sales:”

- Quarterly revenue is up 70% vs. last year to $26.7B (Apple is a $100B company!)

- Quarterly earnings rose 77% vs last year to $6B

- 15 million iPads were sold in 2010, with 7.3 million sold in the last quarter

- Apple has $50B cash on hand to do new product development, acquisitions or pay dividends

ZDNet demonstrated Apple’s market resiliency headlining “Apple’s iPad Represents 90% of All Tablets Shipped.” While it is true that Droid tablets are now out, and we know some buyers will move to non-Apple tablets, ZDNet predicts the market will grow more than 250% in 2011 to over 44 million units, giving Apple a lot of room to grow even with competitors bringing out new products.

Apple is a tremendously successful company because it has a very strong sense of where technology is headed and how to apply it to meet user needs. Apple is creating market shifts, while many other companies are reacting. By deeply understanding its competitors, being willing to disrupt historical markets and using White Space to expand applications Apple will keep growing for quite a while. With, or without Steve Jobs.

On the other hand, there’s the stuck-in-the-past management team at Microsoft. Tied to all those aging, outdated products and distribution plans built on PC technology that is nearing end of life. But in the midst of the management malaise out of Seattle Kinect suddenly showed up as a bright spot! SFGate reported that “Microsoft’s Xbox Kinect beond hackers, hobbyists.” Seems engineers around the globe had started using Kinect in creative ways that were way beyond anything envisioned by Microsoft! Put into a White Space team, it was possible to start imagining Kinect could be powerful enough to resurrect innovation, and success, at the aging monopolist!

But, unfortunately, Microsoft seems far too stuck in its old ways to take advantage of this disruptive opportunity. Joel West at SeekingAlpha.com tells us “Microsoft vs. Open Kinect: How to Miss a Significant Opportunity.” Microsoft is dedicated to its plan for Kinect to help the company make money in games – and has no idea how to create a White Space team to exploit the opportunity as a platform for myriad uses (like Apple did with its app development approach for the iPhone.)

In the end, ZDNet joined my chorus looking to oust Ballmer (possibly a case study in how to be the most misguided CEO in corporate America) by asking “Ballmer’s 11th Year as Microsoft’s CEO – Is it Time for Him to Go?” Given Ballmer’s massive shareholding, and thus control of the Board, it’s doubtful he will go anywhere, or change his management approach, or understand how to leverage a breakthrough innovation. So as the Cloud keeps decreasing demand for traditional PCs and servers, Brett Owens at SeekingAlpha concludes in “A Look at Valuations of Google, Apple, Microsoft and Intel” that Microsoft has nowhere to go but down! Given the amazingly uninspiring ad program Microsoft is now launching (as described in MediaPost “Microsoft Intros New Corporate Tagline, Strategy“) we can see management has no idea how to find, or sell, innovation.

We often hear advice to buy shares of a company. Rarely recommendations to sell. But Apple is the best positioned company to maintain growth for several more years, while Microsoft has almost no hope of moving beyond its Lock-in to old products and markets which are declining. Simplest trade of 2011 is to sell Microsoft and buy Apple. Just read the headlines, and don’t get suckered into thinking Apple is nothing more than Steve Jobs. He’s great, but Apple can remain great in his absence.

by Adam Hartung | Sep 22, 2010 | Current Affairs, Defend & Extend, Film, In the Whirlpool, Leadership, Lifecycle, Lock-in, Music, Web/Tech

Summary:

- Video retailer Blockbuster (and competitor Hollywood Video) are now bankrupt

- Video rentals/sales are at an all time high – but via digital downloads not DVDs

- Nokia, once the cell phone industry leader, is in deep trouble and risk of failure

- Yet mobile use (calls, texts, internet access, email) is at an all time high

- These companies are victims of locking-in to old business models, and missing a market shift

- Commitment to defending your old business can cause failure, even when participating in high growth markets, if you don’t anticipate, embrace and participate in market shifts

- Lock-in is deadly. It can cause you to ignore a market shift.

According to YahooNews, “Blockbuster Video to File Chapter 11.” In February, Movie Gallery – the owner of primary in-kind competitor Hollywood Video – filed for bankruptcy. It’s now decided to liquidate.

The cause is market shift. Netflix made it possible to rent DVDs without the cost of a store – as has the kiosk competitor Red Box. But everyone knows that is just a stopgap, because Netflix and Hulu are leading us all toward a future where there is no physical product at all. We’ll download the things we want to watch. The market is shifting from physical items – video cassettes then DVDs – to downloads. And both Blockbuster and Hollywood Video missed the shift.

Blockbuster (or Hollywood) could have gotten into on-line renting, or kiosks, like its competition. It even could have used profits to be an early developer of downloadable movies. Nothing stopped Blockbuster from investing in YouTube. Except it’s commitment to its Success Formula – as a brick-and-mortar retailer that rented or sold physically reproduced entertainment. Lock-in. And for that commitment to its historical Success Formula the investors now will get a great big goose egg – and employees will get to be laid off – and the thousands of landlords will be left in the lurch, unprepared.

As predictable as Blockbuster was, we can be equally sure about the future of former powerhouse Nokia. Details are provided in the BusinessWeek.com article “How Nokia Fell from Grace.” As the cell phone business exploded in the 1990s Nokia was a big winner. Revenues grew fivefold between 1996 and 2001 as people around the globe gobbled up the new devices. Another example of the fact that when you enter a high growth market you don’t have to be good – just in the right market at the right time.

But the cell phone business has become the mobile device business. And Nokia didn’t anticipate, prepare for or participate in the market shift. From market dominance, it has become an also-ran. The article author blames the failure, and decline, on complacent management. Weak explanation. You can be sure the leadership and management at Nokia was doing all it possibly could to Defend & Extend its cell phone business. The problem is that D&E management doesn’t work when customers simply walk away to a new technology. It may take a few years, and government subsidies may extend Nokia’s life even longer, but Nokia has about as much chance of surviving its market shift as Blockbuster did.

When companies stumble management sees the problems. They know results are faltering. But for decades management has been trained to think that the proper response is to “knuckle down, cut costs, defend the current business at all cost.” Yet, there are more movies rented now than ever – and Blockbuster is failing despite enormous market growth. There are more mobile telephony minutes, text messages, remote emails and mobile internet searches than ever in history – yet Nokia is doing remarkably poorly. It’s not a market problem, it’s a problem of Lock-in to a solution that is now outdated. When the old supplier didn’t give the market what it wanted, the customers went elsewhere. And unwillingness to go with them has left these companies in tatters.

These markets are growing, yet the purveyors of old solutions are failing primarily because they stuck to defending their old business too long. They did not embrace the market shift, and cannibalize historical product sales to enter the new, higher growth markets. Because they chose to protect their “core,” they failed. New victims of Lock-in.

by Adam Hartung | Jun 7, 2010 | Defend & Extend, In the Swamp, Innovation, Leadership, Music

I was born in 1957. That year, a 3 bedroom track home in Wichita, KS sold for the same price as that very same track home in Palo Alto, CA – about $10,000. Of course, things have changed hugely since then. Agriculture value had declined markedly, and automation has allowed for dramatic productivity improvements, robbing the heartland states of hundreds of thousands of agricultural jobs. Without people on the farms, the need for agricultural cities supporting the farms declined. No growth, and values decline. Today that home in Wichita is worth something like $50,000.

The land where the track home once sat in Palo Alto is worth $500,000. Because the explosion of technology jobs in Silicon Valley made demand for housing much greater, and as the value of technology soared those employed in the industry saw their incomes rise, allowing for higher home values.

It all comes down to growth. Geographic areas are like businesses in that growth leads to all kinds of good things – including higher home values. People go where the jobs are. Especially good paying jobs. And that comes from investing in innovation, and the companies that develop new solutions aligned with market needs.

According to Forbes magazine in "Houston: Model City" Illinois has lost 260,000 jobs in the last decade. No wonder home values in Chicago never soared like San Jose. But it's also no mystery why the 15-20% decline in Chicago real estate seems never to be improving. When a city stops growing – well – look at Detroit.

Today Crain's Chicago Business reported "Chicago Economy Sees Signs of Life, But Rocky Recovery is Forecast." Why? Little has been done to improve job growth. Once an agricultural center (the famous stockyards of The Jungle fame) Chicago became a powerhouse manufacturing center. But over the last 15 years the city and state have done almost nothing to drive more jobs related to information or the coming biological growth wave.

Few realize that the University of Illinois is ranked as the 4th best engineering school in the world. Yet, most graduates end up "going coastal" in order to find high paying jobs. Worse, innovators who want seed money or venture capital find none from the state, as it continues struggling to support the costs of jobs and pensions related to the now-gone manufacturing economy! Spending money trying to Defend & Extend the old manufacturing base. And there is almost no angel or venture private financing, which has grown considerably on both coasts, because that is targeted largely in non-manufacturing industries. And the large companies in Chicago – from Kraft to Sara Lee to Motorola to Lucent – to even Boeing – invest nearly nothing in spin-off companies and innovators in their own back yard. Many start-ups report they have to move either west or east in order to obtain financing for their ideas and rapid growth.

For cities and states, growth is the key. It is OK that once all the cowboys ended their cattle drives in Wichita. And that the world's largest grain elevator is just southeast of town. When agriculture was the center of the universe that was a good thing. But because the leaders did not transition toward new job growth as the economy shifted, Wichita is now a backwater. It is so hard to recruit talent to Wichita that Pepsi moved the headquarters of Pizza Hut to Dallas, and most of the decisions for Beech aircraft are made at Raytheon Headquarters in suburban Boston. Face it, do you want to live in Wichita?

How quickly will people say the same thing about Chicago? Already, nobody wants to live in Detroit. If Chicago city leaders, and Illinois state leaders, can't get out of old Lock-ins to manufacturing mind sets we all may be surprised how quickly Chicago follows its sister cities into unattractive outcomes. For politicians, and corporate leaders, a focus on growth is extremely important if they want to keep their city vibrant.

For residents of Chicago, there is ample reason to be worried about the future of their infrastructure and home values.

by Adam Hartung | Apr 13, 2010 | Defend & Extend, In the Swamp, Leadership, Lock-in, Music, Web/Tech

"Microsoft's Dismal Future" is the title of my most recent column on Forbes.com. In it I compare Microsoft with such formerly great, but now struggling, companies as Xerox and Kodak. Looking at all the Lock-in at Microsoft, Balmer's complete unwillingness to Disrupt traditional Lock-ins, and the total lack of White Space for new market projects – Microsoft is a very likely candidate to follow Silicon Graphics. Sun Microsystems, DEC and a host of other formerly great technology companies into the history books. And it could well happen in less than a decade. Don't forget, in 2000 Sun was worth $200billion – and now the company no longer exists!

If I gave you $1,000 and told you keeping it required you invest it all in Microsoft or Apple, which would you pick? For followers of this blog, there can be only one answer – it has to be Apple. While Microsoft has a great past, it has not been using White Space to exploit technology developments in new markets. All go-to-market projects have been around Defending & Extending the traditional PC market. With products like Vista, OS 7 and now Office 10. But reality is that all of us are using PCs a lot less these days. Increasingly we use smart mobile devices to get out work done – eschewing even the laptop – much less the desktop machine. Increasingly we are happy with PDF files and HTML text – not needing elaborate Excel Spreadsheets, or Word documents or flashy Powerpoint files.

Meanwhile Apple is a major participant in the new markets being developed! It's iPhone is a leader in smartphones, where its mere 5% market share has allowed the company to sell 2 billion downloaded applications in the first 18 months! And although digital music is becoming the norm as CDs disappear, iTunes maintains a very healthy 70% market share of digital music downloads. And Apple is moving forward into digital publishing with the iPad launch, as well as hundreds of new applications for low-cost but highly functional tablets (a market Microsoft pioneered but exited.)

Many people invest by looking in the rear view mirror. But Microsoft increasingly looks like a "has been" story. Looking out the windshield, it's hard to place Microsoft on the future horizon. Give the Forbes article a read and let me know what you think!

by Adam Hartung | Nov 5, 2009 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership, Music, Web/Tech

$150billion. That's a lot of money. And that's how much shareholder value has increased at Apple since Steve Jobs returned as CEO. Can you think of any other CEO that has aided shareholder wealth so much? Do any of the cost cutting CEOs in manufacturing companies, financial services firms, or media companies see their share prices rising like Apple's?

Fortune has declared this "The Decade of Steve" in its latest publication at Money.CNN.com. Such over-the-top statements are by nature intended to sell magazines (or draw page hits). But the writer makes the valid point that very few leaders impact their industry like Apple has the computer industry, under Jobs leadership (but not under other leaders.) Yet, under his leadership Apple has also had a dramatic impact on the restructuring of two other industries – music and mobile phones/computing. And a company Mr. Jobs founded, Pixar, had a major impact on restructuring the movie business (Pixar was sold to Disney, and has played a significant role in the value increase of that company.) So with Mr. Jobs as leader, no less than 4 industries have been dramatically changed – and huge value created for shareholders.

No cost-cutting CEO, no "focus on the core" CEO, no "execution" CEO can claim to have made the kind of industry changes that have occurred through businesses led by Steve Jobs. And none of those CEO profiles can say they have created the shareholder value Mr. Jobs has created. Not even Bill Gates or Steve Ballmer can claim to have added any value this decade – as Microsoft's value is now less than it was when the millenia turned. Despite the relative size difference between the market for PCs and Macs (about 10 to 1) today Apple has more cash and marketable securities than the entire value of the historically supply-chain driven Dell Corporation.

Mr. Jobs is constantly pushing his organization to focus on the future, about what the markets will want, rather than the past and what the company has made. It was a decade ago that Apple created its "digital lifestyle" scenario of the future, which opened Apple's organization to being much more than Macs. Jobs obsesses about competitors and forces his employees to do the same, to make sure Apple doesn't grow complacent he pushes all products to have leading edge components. Mr. Jobs embraces Disruption, doesn't fear seeing it in his company, doesn't mind it amongst his people, and works to create it in his markets. And he makes sure Apple constantly keeps White Space projects open and working to see what works with customers – testing and trying new things all the time in the marketplace.

Following these practices, Apple pulled itself away from the Whirlpool and returned to the Rapids of Growth. Almost bankrupt, it wasn't financial re-engineering that saved Apple it was launching new products that met emerging needs. Apple showed any company can turn itself around if it follows the right steps.

As companies are struggling with value, people should look to Apple (and Google). Value is not created by cost cutting and waiting for the recession to end. Value is created by seeking innovations and creating an organization that can implement them. Especially Disruptive ones. Whether he's the CEO of the decade or not I can't answer. But saying he's one heck of a good role model for what leaders should be doing to create value in their companies is undoubtfully true.

by Adam Hartung | Oct 23, 2009 | Current Affairs, Defend & Extend, eBooks, In the Swamp, Leadership, Lock-in, Music

If you try standing in the way of a market shift you are going to get treated like the poor cowboy who stands in front of a cattle stampede. The outcome isn't pretty. Yet, we still have lots of leaders trying to Defend & Extend their business with techniques that are detrimental to customers. And likely to have the same impact on customers as the cowpoke shooting a pistol over the head of the herd.

Book publishers have a lot to worry about. Honestly, when did you last read a book? Every year the demand for books declines as people switch reading habits to shorter formats. And book readership becomes more concentrated in the small percentage of folks that read a LOT of books. And those folks are moving faster and faster to Kindle type digital e-book devices. So the market shift is pretty clear.

Yet according to the Wall Street Journal Scribner (division of Simon & Schuster) is delaying the release of Stephen King's latest book in e-format ("Publisher Delays Stephen King eBook"). They want to sell more printed books, so they hope to force the market to buy more paper copies by delaying the ebook for 6 weeks. They think that people will want to give this book as a gift, so they'll buy the paper copy because the ebook won't be out until 12/24.

So what will happen? Kindle readers I know don't want a paper book. They wait. Giving them a paper copy would create a reaction like "Oh, you shouldn't have. I mean, really, you shouldn't have." So the idea that this gets more printed books to e-reader owners is faulty. That also means that the several thousand copies which would get sold for e-readers don't. So you end up with lots of paper inventory, and unsatisfactory sales of both formats. That's called "lose-lose." And that's the kind of outcome you can expect when trying to Defend & Extend an outdated Success Formula.

Simultaneously, as book sales become fewer and more concentrated a higher percent of volume falls onto fewer titles. And that is exactly where WalMart, Target and Amazon compete. High volume, and for 2 of the 3 companies, limited selection. This gives the reseller more negotiating clout against the publisher. So as the big retailers look for ways to get people in the store, they are willing to sell books at below cost – loss leaders.

So now publishers are joining with the American Booksellers Association to seek an anti-trust case against the big retailers according to the Wall Street Journal again in "Are Amazon, WalMart and Target acting like Predators?" . Publishers want to try Defending their old pricing models, and as that crumbles in the face of market shifts they try using lawyers to stop the shift. That will probably work just as well as the lawsuits music publishers tried using to stop the distribution of MP3 tunes. Those lawsuits ended up making no difference at all in the shift to digital music consumption and distribution.

"Movie Fans Might Have to Wait To Rent New DVD Releases" is the Los Angeles Times headline. The studios like 20th Century Fox, Universal and Warner Brothers want individuals to buy more DVDs. So their plan is to refuse to sell DVDs to rental outfits like Netflix, Redbox and Blockbuster. Just like Scribner with its Stephen King book, they are hoping that people won't wait for the rental opportunity and will feel forced to go buy a copy. Like that's the direction the market is heading – right?

If they wanted to make a lot of money, the studios would be working hard to find a way to deliver digital format movies as fast as possible to people's PCs – the equivalent of iTunes for movies – not trying to limit distribution! That the market is shifting away from DVD sales is just like the shift away from music CD sales, and will not be fixed by making it harder to rent movies. Although it might increase the amount of piracy – just like similar actions backfired on the music studios 8 years ago.

Defending & Extending a business only works when it is in the Rapids of market growth. When growth slows, the market is moving on. Trying to somehow stop that shift never works. Only an arrogant internally-focused manager would think that the company can keep markets from shifting in a globally connected digital world. Consumers will move fast to what they want, and if they see a block they just run right over it – or go where you least want them to go (like to pirates out of China or Korea.)

They only way to deal with market shifts is to get on board. "Skate to where the puck will be" is the over-used Wayne Gretzsky quote. Be first to get there, and you can create a new Success Formula that captures value of new growth markets. And that's a lot more fun than getting trampled under a herd of shifting customers that you simply cannot control.

by Adam Hartung | Aug 24, 2009 | Current Affairs, General, In the Rapids, In the Whirlpool, Leadership, Lifecycle, Lock-in, Music, Openness

"Sears Axes Ad Budget As Sales Slide" is the latest Crain's article. Revenues have been falling at Sears ever since Mr. Ed Lampert took control of the venerable Chicago retailer. His initial actions were to cut costs in order to prop up profits. Which worked for about 8 quarters. But then the impact of cost cutting cracked back like a bullwhip, shredding profits. Mr. Lampert reacted by further cutting costs to "bring them in line with sales." And the whirlpool started. Cut costs, revenue falls, cut costs, revenue falls, cut costs…… And now he largely blames the recession for Sears poor performance. As if his Lock-in, and that of the management, to old approaches had nothing to do with the dismal results now at Sears.

There are those who think these actions are smart, to bring costs "in alignment with retail trends" as Morningstar put it. But reality is Sears is now in the Whirlpool of failure. Looking at the lifecycle, they've gone past the point of no return – out of the Swamp of slow growth – and into the last stage - failure. The stores would be closed and sold to other retailers, except there's a dearth of retail buyers out there these days. Thus shareholders are stuck with underperforming real estate, constantly declining revenues and falling cash flow.

Not all retailers are seeing declining revenues. Bloomberg.com reported today "Apple May Be Highest Grossing Fifth Avenue Retailer." While Sears and others are watching sales go down, Apple's retail store revenues rose 2.5% this year – and it's Fifth Avenue store has seen traffic increase 22% this last quarter. In a town where tourists often put an emphasis on shopping, they used to ask locals how to find Bloomingdales or Saks. Now they want to know where to find the Apple store.

Markets shift. When they do, you have to change your Success Formula or your results decline. When customers change their behavior, you have to change as well or your sales and profits go down. But most leaders react to market shifts by trying to do the same thing they've always done, only faster, better and cheaper. Oops. That only leaves you chasing your tail – just like Sears. You keep working harder and harder but results don't improve. Then eventually something happens that throws you into bankruptcy, or an acquisition for your assets, and it's "game over." Meanwhile, all the time you're watching returns shrink shareholders watch value decline, employees grow disgruntled as you whittle away bonuses, benefits, pay and jobs, and vendors grow tired of the impossible negotiations for lower costs while waiting to get paid on strung-out terms. Nobody is having a good time. Just go ask the folks at Sears.

But there are always businesses that catch the market shift and use it to propel their growth. Like Apple. Once a niche and low-profit computer manufacturer, they've turned into a producer of music players, music distributor and mobile phone supplier as well as computer manufacturer. And when everyone would have said that retail is a terrible investment, they've turned into a surprisingly successful retailer as well. Appple keeps throwing itself back into the Rapids of growth, rather than slipping into the Swamp of stagnation and Whirlpool of failure.

Apple keeps going toward the market shifts. Apple's CEO (and increasingly other executives) Disrupts the company's Success Formula, always challenging the company to do new things. And White Space is constantly created where permission is given to operate outside old Lock-ins and resources are provided for the opportunity to grow. Apple could have done a half-hearted job of retailing, trying to act like Best Buy or Nike with its stores and merchandise, or only funding stores in suburban malls instead of tier 1 retail space on the very best (and most expensive) retail avenues.

The next time you're asking yourself "when will this recession end?" think about Sears and Apple. If your business acts like Sears your recession won't be anytime soon. If you keep doing more of the same, cutting costs and hoping to hold on for a recovery, your doing nothing to end the recession and it's unlikely you'll find much improvement in your business. But if you develop scenarios about the future which allow you to attack competitors, using Disruptions to change your approach and the market, then using White Space to develop new solutions you can bring this recession to an end sooner than you think. People in your business will have chances to grow, and so will your revenues and profits.

For more about how we set ourselves up for failure, and how to avoid the traps download the free ebook The Fall of GM: What Went Wrong and How To Avoid Its Mistakes.

by Adam Hartung | Aug 14, 2009 | Innovation, Investing, Music

This weekend marks the 40th anniversary of Woodstock, the rock concert that everyone remembers – even though almost none of us were there. Amidst all the tributes this weekend, I was taken by how much the music industry has changed during those 40 years – and how this industry can help us realize the need we all have to be adaptable.

When Woodstock occurred most music was listened to an a long-playing vinyl album, sold through a record store. Wow, have things changed. From albums to 8-tracks to cassettes to CDs and now MP-3 players. In just 40 years we went through 4 different technologies, and made at least 2 (8-tracks and cassettes) obsolete. Nobody at Woodstock was thinking about that, but it's made a huge difference in who makes money.

When you bought music in 1969 you went to an independent record store. Or Musicland, a retailer with over 1,000 stores in shopping centers that exclusively sold records – and 8-tracks. Now we buy almost all our music on-line. Either ordering a CD from someplace like Amazon, or downloading the music directly into a player with no physical item being shipped. Mass merchandisers like KMart and WalMart eventually made record shops obsolete, and increasingly the mass merchandisers are of less importance. Musicland went bankrupt.

In 1969 the artists made practically nothing from a concert. Concerts existed as promotional events for the records. An artist signed a multi-album deal with a record label – like EMI. The label offered a studio and put together the album. They then packaged it, and shipped it to record stores. For this, the band members got almost nothing. Only if the album sold well did they get any cash. So the record label told the musicians to go on the road and play. The objective was to do concerts so people got turned on to your tunes and went to buy them at the store. The musician didn't make anything until the album sold – in high volume.

In 1969 promoters paid the record label for the musician to pay, and the record label paid the musician. A promoter could not hire a musician, even if the musician wanted to play, unless the label agreed. Any performance fees were deducted from album royalties, so from the label's point of view the event fee was irrelevant. Headliners – a band that was already famous and trying to stay that way – usually took a big fee, but it was just an advance on royalties. There would be lesser known bands, and the label barely gave them enough money for gas because they didn't know if the album would ever sell enough to be profitable. "On the road" was a bad thing as far as musicians were concerned.

Tickets to Woodstock cost $18, and the promoters lost money (of course, about 90% of the attendees didn't pay). That's about $100 in today's money. Most promoters lived a grand life, but in reality made little money. Some events profited, but a lot didn't. The fee to the labels were high, and audiences were often not large enough. Not to mention bands that no-showed or arrived stoned because they didn't care — remember they got paid little to nothing. So eventually a couple of bad concerts in a row sent the promoter to bankruptcy court once too often and he ended up snorting cocaine in trailer-park-city.

Today, going to a 3 day event costs over $250 for tickets – and the promoters expect to profit in the millions. The labels get a lot less, as many musicians negotiate their own contracts. But the prices are high enough that the musician is guaranteed a rate of return, and the promoter is as well. And the promoter usually insures all events just in case the musician no-shows are turns up stoned. Unprofitable events are rare.

Labels no longer run the show. Musicians now can negotiate much better single-album deals because distribution is far easier. Musicians can self-publish if they like, selling their own tunes off their own websites. This has meant that top performers make unbelievable sums – far more than their counterparts in 1969. The Carpenters used to have to beg for money for a new car, while their albums sold millions. Now, because they can guarantee the big audiences, all that money the label used to take, the musicians get. So tens of millions flow their way. If you have any doubt, look at the private jets and helicopters owned and flown by the lead drummer for Pink Floyd. Or about any rapper on late night MTV. It would make a corporate CEO envious.

And the company that makes the most money of all in music is Apple. They have the biggest distribution system, and sell the most music. They don't have any artists on contract, don't produce any music, and don't carry any inventory. They just run a server farm that collects money and sends out digital files.

Of course, it's still tough to be a new musician. But you no longer have to sell your soul to a label. You can produce your own music, using affordable gear in your basement that's better than Joan Baez had in 1969 at the EMI studio. And you can sell the tunes yourself. If you work hard at promotion, including working those promoters to give you a warm-up slot, you can capture all the revenue from your songs from your own web site, and sign up your own distribution groups. It's much more in your own hands. Of course, that also means the labels don't have the money they once did to create an Elvis, or Beatles, or Rare Earth. So it's a lot more up to you to earn that money, rather than hope you get lucky and lots of label backing.

I doubt Jimi Hendrix would recognize anything about the music industry today. Of course, given how stoned he liked to get it's hard to imagine Jimi Hendrix being alive today.

Things change. We sometimes don't see them, because it's like watching the grass grow. You don't notice differences unless you compare two snapshots in time. Then we can see just how much things change. If you want to be a winner, you have to learn to shift with these changes. Only those who make the shifts survive. Just ask Barry Gordy, the one-time founder of Motown who saw his billion dollar business disappear. Now a footnote in history. For all of us to avoid becoming similar footnotes, the moral is to be ever vigilant about identifying and adapting to market shifts.

by Adam Hartung | Aug 7, 2009 | Defend & Extend, Disruptions, Food and Drink, General, Leadership, Lock-in, Music, Openness, Television

"Pepsi Launches Own Music Label in China" is the BusinessWeek headline. Clearly, the Pepsi staff has some new ideas. Recently Pepsi's Chairperson, Ms. Nooyi, made a trip to China for 10 days. Apparently frustrated, she commented to the Wall Street Journal in July that she didn't see enough Disruptive thinking on the part of her folks in China. She indicated the market was robust, but it was different and would take a different approach. It now sounds like her China leadership got the message.

In addition to launching a music label, Pepsi is producing a "Battle of the Bands" show in China. It's almost like a reformatted page from the aggressive growth years of Starbucks. Instead of just expanding into a new geography (China) with the same old playbook (like the floundering WalMart), Pepsi is figuring out how to be a big success. And that may mean producing television, producing music and making people into stars. China's culture is unlike anything in the U.S. or Europe. So doing new and different things will be critical to success. When you see a business developing its own scenarios about the future, taking actions its competitors (Coke) are too hide-bound to try, acting Disruptively to compete and using White Space projects to test new ideas you simply have to be excited!

On the other hand, "Tide Turns 'Basic" for P&G in Slump" is the Wall Street Journal headline about the latest "new" product at P&G. Please remember, the departing P&G CEO was lauded for creating an innovative culture at P&G. But it appears the legacy is a culture of sustaining innovations intended to do nothing more than Defend & Extend the old P&G brands. Now slumping, P&G needs to identify market shifts more than ever, and create new solutions that help it move with market trends. Instead, the company is rushing into reverse! Management not only seem to be driving the bus looking in the rear-view mirror, but actually driving it that way as well!

Tide has been around a long time. Ostensibly a very good product. For reasons explained in the article, managers at P&G felt the best way to sell more product was to make it less good. Really. They removed some of the chemicals that help you get clothes clean, renamed it "Basic" and launched the product at a lower price. It's not "new and improved." It's not even "better." It's literally less good – but cheaper. Sort of like store brands, or private label – only maybe not as good? Doesn't that sort of obviate the whole notion of branding?

People don't ever like to go backward. We like to grow. To learn and get more out of life. When we find a product that works, why would we want a product that works less well? And the folks at P&G missed this. Only by being insanely internally focused, terribly Locked-in, can you think this is a good idea. Looking inside a person could say "well, we want to jam the shelves with more of our branded product. We want to have the word 'Tide' smeared everywhere we can. We think people so identify with 'Tide' that they'll take a worse product just to get the name brand. We're willing to create a less good product thinking that we will get sales simply because it's cheaper than the stuff people really want to buy." Seem a little mixed up to you?

When you want to grow you figure out new ways to Disrupt the marketplace. You develop new solutions, new entry points, new connections with shifting market trends. You figure out how to be the best at the right price. You don't try to give people less, and tell them they are cheap. And Pepsi clearly gets it. They are willing to expand into music recording and TV production. Stuff P&G did when it was really creative and innovative – after all, that's why we call daytime TV "soaps", because P&G produced them just to sell soap. Now we see Pepsi applying that kind of scenario planning and competitive obsession, along with White Space, to develop new market approaches. Unfortunately we can't say the same for P&G — clearly stuck on trying to cram more stuff with the word "Tide" on it through distribution.