by Adam Hartung | Nov 2, 2019 | Disruptions, Food and Drink, Innovation, Marketing, Strategy, Trends

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Mighty Oaks from Tiny Acorns Grow – Beyond Meat

TREND: Beyond Meat (BYND, NASDAQ)

A big, new trend is emerging. Sales of plant based protein products may be small, but growth is remarkable. Could Beyond Meat be the next Netflix?

In Q3 2019, Beyond Meat’s revenue is up 2.5x (250%) vs Q3 2018 — which was up 2.5x (250%) over Q3 2017. Yes, you can say this growth is on a small base, given that last quarter was $100M revenue.

Imagine what it’s like growing that fast. Imagine the exhilaration of solving problems – like funding your accounts receivable that’s growing with accelerating orders. Or amping up production faster than ever imagined. Or meeting needs of your customers, retailers and restaurants. Or paying out big bonuses due to beating all your planned metrics.

It’s not that much fun to work at Cargill. Or Tyson Foods. Or Smithfield. Or any other traditional company producing beef, or pork, or chicken. Those are huge companies, with lots of people. But they aren’t maxing out sales and profits – and bonuses – like Beyond Meat.

It’s easy to ignore a start up. But one has to look at the relative growth of a company to judge its future. There were cracks in the growth rate at Blockbuster 6 years before it failed. And during that time, Blockbuster kept saying Netflix was a nit that didn’t matter. But Netflix was growing like the proverbial weed. Netflix wasn’t even half the size of Blockbuster when Blockbuster filed for bankruptcy.

With growth like Beyond Meat it didn’t take long to upset an entire industry biz model. Amazon still doesn’t sell as much as WalMart, but it wiped out a significant number of retailers by changing volumes enough to erase their profits. Think about the changes wrought on the advertising industry by Google, which has pretty much killed print ads. Look at what’s happened to other media ad models, like TV and radio, by Facebook’s growth. And entertainment has been entirely changed – where today the onetime distributor is one of the biggest content producers – Netflix.

In traditional marketing theory, Beyond Meat, like Netflix, is selling new products to existing markets.

Most disruptors enter the markets in the new product/new market quadrant of the Ansoff matrix. They create the new market just by entering. If they even see them as competitors, established businesses dismiss these potential disruptors because of established focus on current markets/current products with sustaining innovations. Selling new products to existing customers is the first step companies take as they start to innovate.

Kraft was on this path when they acquired a new productc with its purchase of Boca Burger in 2000. Kellogg’s and General Foods jumped into the alternative meat products at about the same time. Vegetarian burger substitutes threatened the success formula of meat products and were relegated to niche products. In 2018, Kraft’s incubator tried to relaunch Boca, but the smaller, more nimble start-ups had already captured consumers’ attention and reframed the market.

Beyond Meat had morphed quickly into a direct competitor to the meat industry by selling this new product to existing meat customers!

Riding the trends of climate change, sustainability and organic foods, Beyond Meat is starting to look like a true game changer. It may be small, but those other companies were too (along with Tesla, don’t forget, considered immaterial by GM, et.al.) Those who are in the traditional protein market (beef especially) had better pay attention – their profit model is already under attack!!

“The creation of a thousand forests is in one acorn.”

What’s on your company’s radar today?

Spark Partners is here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Let us do an opportunity assessment for your organization. For less than your annual gym cost, or auto insurance premium, we could likely identify some good opportunities your blinders are hiding. Read my Assessment Page to learn more.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my

Status Quo Risk Management Playbook.

Give us a

call today, or send an email, so we can talk about how you can be a leader, rather than follower. Or check out the rest of the

website to read up on what we do so we can create the right level of engagement for you.

Hartung Recent Blog Posts on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | May 2, 2018 | Entrepreneurship, Food and Drink, Innovation, Marketing, Strategy

Execution – Implementation – Delivering — These are table stakes today. If you can’t do them you don’t get a seat at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

Take for example a small company named NakedWine.com that created a potential death trap for its business by implementing one crucial execution mis-step.

The NakedWine value proposition is simple. They will find wines you never heard of and skip the costs of distributors and retailers by matching the customer and winemaker. Customers ostensibly get wines far cheaper because the winemaker’s cost of marketing and sales are avoided. Decent value proposition for both the customer, and the manufacturer.

The NakedWine strategy is to convince people that the NakedWine wines will be good, month after month. The NakedWine brand is crucial, as customer trust is now not in the hands of the winemaker, nor wine aficionados that rate known wines on a point scale, or even the local retail shop owner or employee. Customers must trust NakedWine to put a good product in their hands. Customers who most likely know little or nothing about wines. NakedWines wants customers to trust them so much they will buy the company’s boxed selections month after month, delivered to their home. These customers likely don’t know what they are getting, and don’t much care, because they trust NakedWine to give them a pleasurable product at a price point which makes them happy. When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

But, NakedWines blew the whole strategy with one simple execution mistake.

Not everyone lives where they can accept a case of wine, due to weather. As northern Californians, maybe NakedWine leaders just forget how cold it is in Minneapolis, Chicago, Buffalo and Boston. Or how hot it is in Tucson, Phoenix, Houston, Palm Springs and Las Vegas. In these climates a case of wine left on a truck for a day – or 2 if the first delivery is missed – spells the end of that wine. Ruined by the temperature. Especially heat, as everyone who drinks beer or wine knows that a couple of hours at 90 degrees can kill those products completely.

The only time the customer finally connects with NakedWine is when that wine enters the house, and over the lips. But that step, that final step of getting the perishable wine to the customer safely, in good quality, and aligned with customer expectations was not viewed as part of the brand-building strategy. Instead, leadership decided at this step NakedWines should instead focus on costs. They would view delivery as completely generic – divorced from the brand-building effort. They would use the low–cost vendor, regardless of the service provided.

NakedWine decided to use Fedex Ground, even though Fedex has a terrible package tracking system. Fedex is unwilling to make sure (say, by drivers using a cell phone) that customers will be there to receive a shipment. The driver rings a bell – no answer and he’s on the run in seconds to make sure he’s meeting Fedex efficiency standards, even if the customer was delayed to the door by a phone call or other issue. When the customer requests Fedex send the driver back around again, Fedex is unwilling to attempt a second delivery within short time, or even any time that same day, after delivery fails. If a customer calls about a missed delivery, Fedex is unwilling to route a failed delivery to a temperature local Fedex Office location for customer pick-up. Or to tell the customer where they can meet the driver along his route to accept delivery. Despite a range of good options, the NakedWine product is forced to sit on that Fedex truck, bouncing around all day in the heat, or cold, being ruined. Fedex uses its lowest cost approach to delivery to offer the lowest cost bid, regardless of the impact on the product and/or customer experience, and NakedWine didn’t think about the impact choosing that bid would have on its brand building.

Brand Building at Every Step

Simply put, in addition to flyers, advertising and product discounts, NakedWine should have followed through on its brand building strategy at every step. It must source wines its customers will enjoy. And it must deliver that perishable product in a way that builds the brand – not put it at risk. For example, NakedWine should screen all orders for delivery location, in order to make sure there are no delivery concerns. If there are, someone at NakedWine should contact the customer to discuss with them issues related to shipping, such as temperature. If it is to be too hot or cold, they could highly recommend using a temperature controlled pick-up location so as not to put the product at risk. And they should build in fail-safe’s with the shipping company to handle delivery problems. That is implementing a brand building strategy all the way from value-proposition to delivery.

Leaders Execute Plans

Too often leaders will work hard on a strategy, and create a good value proposition. But then, for some unknown reason, they turn over “execution” to people who don’t really understand the strategy. Worse, leadership often makes the egregious error of pushing those who create the value delivery system to largely to focus on costs, or other wrong metrics, with little concern for the value proposition and strategy. The result is a great idea that goes off the rails. Because the value delivery system simply does not live up to expectations of the value proposition.

by Adam Hartung | Oct 30, 2017 | Food and Drink, Growth Stall, Investing, Leadership, Retail

Understand Growth Stalls So You Can Avoid GM, JCPenney and Chipotle

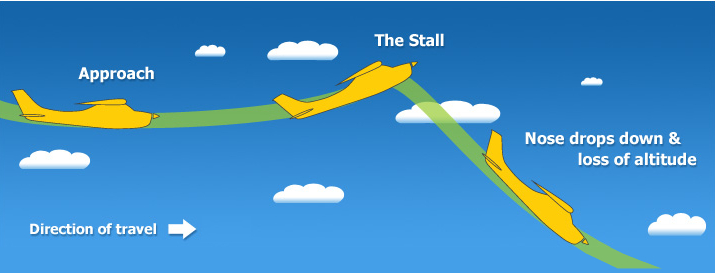

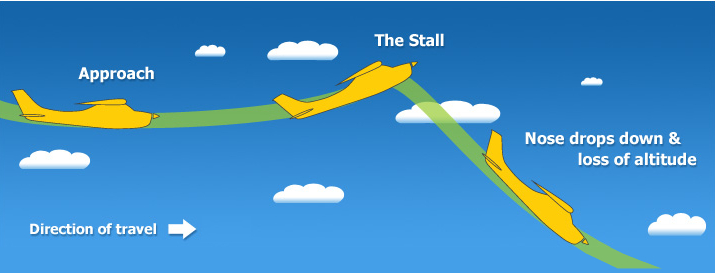

Companies, like aircraft, stall when they don’t have enough “power” to continue to climb.

Everybody wants to be part of a winning company. As investors, winners maximize portfolio returns. As employees winners offer job stability and career growth. As communities winners create real estate value growth and money to maintain infrastructure. So if we can understand how to avoid the losers, we can be better at picking winners.

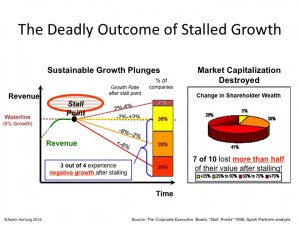

It has been 20 years since we recognized the predictive power of Growth Stalls. Growth Stalls are very easy to identify. A company enters a Growth Stall when it has 2 consecutive quarters, or 2 successive quarters vs the prior year, of lower revenues or profits. What’s powerful is how this simple measure indicates the inability of a company to ever grow again.

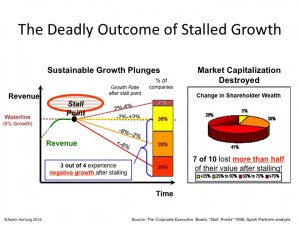

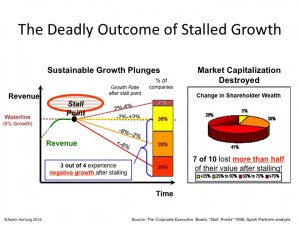

Only 7% of the time will a company that has a Growth Stall ever grow at greater than 2%/year. 93% of these companies will never achieve even this minimal growth rate. 38% will trudge along with -2% to 2% growth, losing relevancy as it develops no growth opportunities. But worse, 55% of companies will go into decline, with sales dropping at 2% or more per year. In fact 20% will see sales drop at 6% or more per year. In other words, 93% of companies that have a Growth Stall simply will not grow, and 55% will go into immediate decline.

Growth Stalls happen because the company is somehow “out of step” with its marketplace. Often this is a problem with the product line becoming less desirable. Or it can be an increase in new competitors. Or a change in technology either within the products or in how they are manufactured. The point is, something has changed making the company less competitive, thus losing sales and/or profits.

Unfortunately, leadership of most companies react to a Growth Stall by doubling down on what they already do. They vow to cut costs in order to regain lost margin, but this rarely works because the market has shifted. They also vow to make better products, but this rarely matters because the market is moving toward a more competitive product. So the company in a Growth Stall keeps doing more of the same, and fortunes worsen.

But, inevitably, this means someone else, some company who is better aligned with market forces, starts doing considerably better.

This week analysts at Goldman Sachs lowered GM to a sell rating. This killed a recent rally, and the stock is headed back to $40/share, or lower, values it has not maintained since recovering from bankruptcy after the Great Recession. GM is an example of a company that had a Growth Stall, was saved by a government bailout, and now just trudges along, doing little for employees, investors or the communities where it has plants in Michigan.

Tesla- enough market power to gain share “uphill”?

By understanding that GM, Ford and Chrysler (now owned by Fiat) all hit Growth Stalls we can start to understand why they have simply been a poor place to invest one’s resources. They have tried to make cars cheaper, and marginally better. But who has seen their fortunes skyrocket? Tesla. While GM keeps trying to make a lot of cars using outdated processes and technologies Tesla has connected with the customer desire for a different auto experience, selling out its capacity of Model S sedans and creating an enormous backlog for Model 3. Understanding GM’s Growth Stall would have encouraged you to put your money, career, or community resources into the newer competitor far earlier, rather than the no growth General Motors.

This week, JCPenney’s stock fell to under $3/share. As JCPenney keeps selling real estate and clearing out inventory to generate cash, analysts now say JCPenney is the next Sears, expecting it to eventually run out of assets and fail. Since 2012 JCP has lost 93% of its market value amidst closing stores, laying off people and leaving more retail real estate empty in its communities.

In 2010 JCPenney entered a Growth Stall. Hoping to turn around the board hired Ron Johnson, leader of Apple’s retail stores, as CEO. But Mr. Johnson cut his teeth at Target, and he set out to cut costs and restructure JCPenney in traditional retail fashion. This met great fanfare at first, but within months the turnaround wasn’t happening, Johnson was ousted and the returning CEO dramatically upped the cost cutting.

The problem was that retail had already started changing dramatically, due to the rapid growth of e-commerce. Looking around one could see Growth Stalls not only at JCPenney, but at Sears and Radio Shack. The smart thing to do was exit those traditional brick-and-mortar retailers and move one’s career, or investment, to the huge leader in on-line sales, Amazon.com. Understanding Growth Stalls would have helped you make a good decision much earlier.

This recent quarter Chipotle Mexican Grill saw analysts downgrade the company, and the stock took another hit, now trading at a value not seen since the end of 2012. Chipotle leadership blamed bad results on higher avocado prices, temporary store closings due to hurricanes, paying out damages due to a “one time event” of hacking, and public relations nightmares from rats falling out of a store ceiling in Texas and a norovirus outbreak in Virginia. But this is the typical “things will all be OK soon” sorts of explanations from a leadership team that failed to recognize Chipotle’s Growth Stall.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

But ever since that problem was discovered, management has failed to recognize its Growth Stall required a significant set of changes at Chipotle. They have attacked each problem like it was something needing individualized attention, and could be rectified quickly so they could “get back to normal.” And they hoped to turn around public opinion by launching nationwide a new cheese dip product in 2017, despite less than good social media feedback on the product from early customers. They kept attempting piecemeal solutions when the Growth Stall indicated something much bigger was engulfing the company.

What’s needed at Chipotle is a recognition of the wholesale change required to meet customer demands amidst a shift to more growth in independent restaurants, and changing millennial tastes. From the menu options, to app ordering and immediate delivery, to the importance of social media branding programs and customer testimonials as well as demonstrating commitment to social causes and healthier food Chipotle has fallen out-of-step with its marketplace. The stock has now lost 66% of its value in just 2 years amidst sales declines and growth stagnation.

We don’t like to study losers. But understanding the importance of Growth Stalls can be very helpful for your career and investments. If you identify who is likely to do poorly you can avoid big negatives. And understanding why the market shifted can lead you to finding a job, or investing, where leadership is headed in the right direction.

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Oct 27, 2017 | Food and Drink, Growth Stall, Investing, Leadership, Retail

The Three Steps GE Should Take Now – And The Lessons For Your Business

Monitor displays General Electric Co. (GE) at the New York Stock Exchange (NYSE) October, 2017. Photographer: Michael Nagle/Bloomberg

For years I have been negative on GE’s leadership. CEO Immelt led the dismantling of the once-great GE, making it a smaller company and one worth quite a bit less. The process has been devastating to many employees who lost their jobs, pensioners who have seen their benefits shrivel, communities with GE facilities that have suffered from investment atrophy, suppliers that have been squeezed out or displaced and investors that have seen the value of GE shares plummet.

But now there is a new CEO, a new leadership team and even some new faces on the Board of Directors. Some readers have informed me that it is easier to attack a weak leader than recommend a solution, and they have inquired as to what I think GE should do now. I do not see the GE situation as hopeless. The company still has an enormous revenue base, and vast assets it can use to fund a directional shift. And that’s what GE must do – make a serious shift in how it allocates resources.

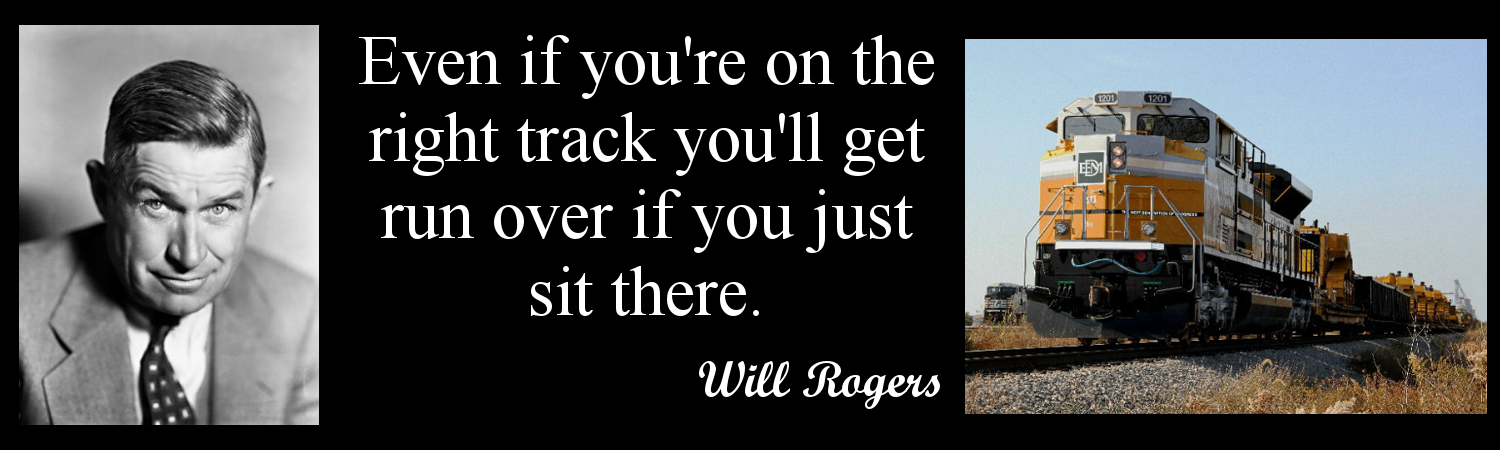

Step 1 – Apply the First Rule of Holes

The first rule of holes is “when you find yourself in a hole, stop digging.” (Will Rogers, 1911) This seems simple. But far too many companies have their resourcing process on auto-pilot. Businesses that have not been growing, and often are not producing good returns on investment, continue to receive funding. Possibly because they are a legacy business that nobody wants to stop. Or possibly because leadership remains ever hopeful that tomorrow will somehow look like yesterday and the next round of money, or hiring, will change things to the way they were.

In fact, these businesses are in a hole, and spending more on them is continuing to dig. The investment hole just keeps getting bigger. The smart thing to do is just stop. Quit adding resources to a business that’s not adding value to the market capitalization. Just stop investing.

When Steve Jobs took over Apple he discontinued several Macintosh models, and cut funding for Macintosh development. The Mac was not going to save Apple’s declining fortunes. Apple needed new products for new markets, and the only way to make that happen was to stop putting so much money into the Mac business.

When streaming emerged CEO Reed Hastings of Netflix quit spending money on the traditional DVD/Video distribution business even though Netflix dominated it. He even raised the price. Only by stopping investments in traditional distribution could he turn the company toward streaming.

Step 2 – Identify the Trend that will Guide Your Strategy

All growth strategies build on trends. After receiving funding from Microsoft to avoid bankruptcy in 2000, Apple spent a year deciding its future lied in building on the trend to mobile. Once the trend was identified, all product development, and new product introductions, were targeted at being a leader in the mobile trend.

When the internet emerged GE CEO Jack Welch required all business units to create “DestroyYourBusiness.com” teams. This forced every business to look at the impact the internet would have on their business, including business model changes and emergence of new competitors. By focusing on the internet trend GE kept growing even in businesses not inherently thought of as “internet” businesses.

GE has to decide what trend it will leverage to guide all new growth projects. Given its large positions in manufacturing and health care it would make sense to at least start with IoT opportunities, and new opportunities to restructure America’s health care system. But even if not these trends, GE needs to identify the trend that it can build upon to guide its investments and grow.

Step 3 – Place Your Bets and Monetize

When Facebook CEO Mark Zuckerberg realized the trend in communications was toward pictures and video he took action to keep users on the company platform. First he bought Instagram for $1 billion, even though it had no revenues. Two years later he paid $19 billion for WhatsApp, gaining many new users as well as significant OTT technology. Both seemed very expensive acquisitions, but Facebook rapidly moved to increase their growth

and monetize their markets. Leaders of the acquired companies were given important roles in Facebook to help guide growth in users, revenues and profits.

Netflix leads the streaming war, but it has tough competition. So Netflix has committed spending over $6billion on new original content to keep customers from going to Amazon Prime, Hulu and others. This large expenditure is intended to allow ongoing subscriber growth domestically and internationally, as well as raise subscription prices.

This week CVS announced it is planning to acquire Aetna Health for $66 billion. On the surface it is easy to ask “why?” But quickly analysts offered support for the deal, ranging from fighting off Amazon in prescription sales to restructuring how health care costs are paid and how care is delivered. The fact that analysts see this acquisition as building on industry trends gives support to the deal and expectations for better future returns for CVS.

During the Immelt era, there were attempts to grow, such as in the “water business.” But the investments were not consistent, and there was insufficient effort placed on understanding how to monetize the business short- and long-term. Leadership did not offer a compelling vision for how the trends would turn into revenues and profits. Acquisitions were made, but lacking a strong vision of how to grow revenues, and an outsider’s perspective on how to lead the trend, very quickly short-term financial metrics built into GE’s review process led to bad decisions crippling these opportunities for growth. And today the consensus is that GE will likely sell its healthcare businessrather than make the necessary investments to grow it as CVS is doing.

Successful leadership means moving beyond traditional financial management to invest for growth

In the Welch era, GE made dozens of acquisitions. These were driven by a desire to build on trends. Welch did not fear investing in growth businesses, and he held leaders’ feet to the fire to produce successful results. If they didn’t achieve goals he let the people and/or the business go. Hence his nickname “Neutron Jack.”

For example, although GE had no background in entertainment, GE bought NBC at a time when viewership was growing and ad prices were growing even faster. This led to higher revenues and market cap for GE. On the other hand, when leaders at CALMA did not anticipate the shift in CAD/CAM from dedicated workstations to PCs, Welch saw them overly tied to old technology and unable to recognize the trend, so he immediately sold the business. He invested in businesses that added to valuation, and sold businesses that lacked a clear path to building on trends for higher value.

Being a caretaker, or steward, is no longer sufficient for business leadership. Competitors, and markets, shift too quickly. Leaders must anticipate trends, reduce investments in products, services and projects that are off the trend, and put resources to work where growth can create higher returns.

This is all possible at GE – if the new leadership has a vision for the future and starts allocating resources effectively. For now, all we can do is wait and see……

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Nov 17, 2016 | Food and Drink, In the Swamp, Innovation, Marketing, Trends

(PAUL J. RICHARDS/AFP/Getty Images)

McDonald’s has been trying for years to re-ignite growth. But, unfortunately for customers and investors alike, leadership keeps going about it the wrong way. Rather than building on new trends to create a new McDonald’s, they keep trying to defend extend the worn out old strategy with new tactics.

Recently McDonald’s leadership tested a new version of the Big Mac,first launched in 1967. They replaced the “special sauce” with Sriracha sauce in order to make the sandwich a bit spicier. They are now rolling it out to a full test market in central Ohio with 128 stores. If this goes well – a term not yet defined – the sandwich could roll out nationally.

This is a classic sustaining innovation. Take something that exists, make a minor change, and offer it as a new version. The hope is that current customers keep buying the original version, and the new version attracts new customers. Great idea, if it works. But most of the time it doesn’t.

Unfortunately, most people who buy a product like it the way it is. Slower Big Mac sales aren’t due to making bad sandwiches. They’re due to people changing their buying habits to new trends. Fifty years ago a Big Mac from McDonald’s was something people really wanted. Famously, in the 1970s a character on the TV series Good Times used to become very excited about going to eat his weekly Big Mac.

People who are still eating Big Macs know exactly what they want. And it’s the old Big Mac, not a new one. Thus the initial test results were “mixed” – with many customers registering disgust at the new product. Just like the failure of New Coke, a New Big Mac isn’t what customers are seeking.

After 50 years, times and trends have changed. Fewer people are going to McDonald’s, and fewer are eating Big Macs. Many new competitors have emerged, and people are eating at Panera, Panda Express, Zaxby’s, Five Guys and even beleaguered Chipotle. Customers are looking for a very different dining experience, and different food. While a version two of the Big Mac might have driven incremental sales in 1977, in 2017 the product has grown tired and out of step with too many people and there are too many alternative choices.

Similarly, McDonald’s CEO’s effort to revitalize the brand by adding ordering kiosks and table service in stores, in a new format labeled the “Experience of the Future,” will not make much difference. Due to the dramatic reconfiguration, only about 500 stores will be changed – roughly 3.5% of the 14,500 McDonald’s. It is an incremental effort to make a small change when competitors are offering substantially different products and experiences.

When a business, brand or product line is growing it is on a trend. Like McDonald’s was in the 1960s and 1970s, offering quality food, fast and at a consistent price nationwide at a time when customers could not count on those factors across independent cafes. At that time, offering new products – like a Big Mac – that are variations on the theme that is riding the trend is a good way to expand sales.

But over time trends change, and adding new features has less and less impact. These sustaining innovations, as Clayton Christensen of Harvard calls them, have “diminishing marginal returns.” That’s an academic’s fancy way of saying that you have to spend ever greater amounts to create the variations, but their benefits keep having less and less impact on growing, or even maintaining, sales. Yet, most leaders keep right on trying to defend & extend the old business by investing in these sustaining measures, even as returns keep falling.

Over time a re-invention gap is created between the customer and the company. Customers want something new and different, which would require the business re-invent itself. But the business keeps trying to tweak the old model. And thus the gap. The longer this goes on, the bigger the re-invention gap. Eventually customers give up, and the product, or company, disappears.

Think about portable hand held AM radios. If someone gave you the best one in the world you wouldn’t care. Same for a really good portable cassette tape player. Now you listen to your portable music on a phone. Companies like Zenith were destroyed, and Sony made far less profitable, as the market shifted from radios and cathode-ray televisions to more portable, smarter, better products.

Motorola, one of the radio pioneers, survived this decline by undertaking a “strategic pivot.” Motorola invested in cell phone technology and transformed itself into something entirely new and different – from a radio maker into a pioneer in mobile phones. (Of course leadership missed the transition to apps and smart phones, and now Motorola Solutions is a ghost of the former company.)

McDonald’s could have re-invented itself a decade ago when it owned Chipotle’s. Leadership could have stopped investing in McDonald’s and poured money into Chipotle’s, aiding the cannibalization of the old while simultaneously capturing a strong position on the new trend. But instead of pivoting, leadership sold Chipotle’s and used the money to defend & extend the already tiring McDonald’s brand.

Strategic pivots are hard. Just look at Netflix, which pivoted from sending videos in the mail to streaming, and is pivoting again into original content. But, they are a necessity if you want to keep growing. Because eventually all strategies become out of step with changing trends, and sustaining innovations fail to keep customers.

McDonald’s needs a very different strategy. It has hit a growth stall, and has a very low probability of ever growing consistently at even 2%. The company needs a lot more than sriracha sauce on a Big Mac if it is to spice up revenue and profit growth.

by Adam Hartung | Jul 27, 2016 | Food and Drink, Growth Stall, In the Swamp, Leadership, Web/Tech

Growth Stalls are deadly for valuation, and both Mcdonald’s and Apple are in one.

August, 2014 I wrote about McDonald’s Growth Stall. The company had 7 straight months of revenue declines, and leadership was predicting the trend would continue. Using data from several thousand companies across more than 3 decades, companies in a Growth Stall are unable to maintain a mere 2% growth rate 93% of the time. 55% fall into a consistent revenue decline of more than 2%. 20% drop into a negative 6%/year revenue slide. 69% of Growth Stalled companies will lose at least half their market capitalization in just a few years. 95% will lose more than 25% of their market value. So it is a long-term concern when any company hits a Growth Stall.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

McDonald’s stock languished around $94/share from 8/2014 through 8/2015 – but then broke out to $112 in 2 months on investor hopes for a turnaround. At the time I warned investors not to follow the herd, because there was nothing to indicate that trends had changed – and McDonald’s still had not altered its business in any meaningful way to address the new market realities.

Yet, hopes remained high and the stock peaked at $130 in May, 2016. But since then, the lack of incremental revenue growth has become obvious again. Customers are switching from lunch food to breakfast food, and often switching to lower priced items – but these are almost wholly existing customers. Not new, incremental customers. Thus, the company trumpets small gains in revenue per store (recall, the number of stores were cut) but the growth is less than the predicted 2%. The only incremental growth is in China and Russia, 2 markets known for unpredictable leadership. The stock has now fallen back to $120.

Given that the realization is growing as to the McDonald’s inability to fundamentally change its business competitively, the prognosis is not good that a turnaround will really happen. Instead, the common pattern emerges of investors hoping that the Growth Stall was a “blip,” and will be easily reversed. They think the business is fundamentally sound, and a little management “tweaking” will fix everything. Small changes will lead to the classic hockey-stick forecast of higher future growth. So the stock pops up on short-term news, only to fall back when reality sets in that the long-term doesn’t look so good.

Unfortunately, Apple’s Q3 2016 results (reported yesterday) clearly show the company is now in its own Growth Stall. Revenues were down 11% vs. last year (YOY or year-over-year,) and EPS (earnings per share) were down 23% YOY. 2 consecutive quarters of either defines a Growth Stall, and Apple hit both. Further evidence of a Growth Stall exists in iPhone unit sales declining 15% YOY, iPad unit sales off 9% YOY, Mac unit sales down 11% YOY and “other products” revenue down 16% YOY.

This was not unanticipated. Apple started communicating growth concerns in January, causing its stock to tank. And in April, revealing Q2 results, the company not only verified its first down quarter, but predicted Q3 would be soft. From its peak in May, 2015 of $132 to its low in May, 2016 of $90, Apple’s valuation fell a whopping 32%! One could say it met the valuation prediction of a Growth Stall already – and incredibly quickly!

But now analysts are ready to say “the worst is behind it” for Apple investors. They are cheering results that beat expectations, even though they are clearly very poor compared to last year. Analysts are hoping that a new, lower baseline is being set for investors that only look backward 52 weeks, and the stock price will move up on additional company share repurchases, a successful iPhone 7 launch, higher sales in emerging countries like India, and more app revenue as the installed base grows – all leading to a higher P/E (price/earnings) multiple. The stock improved 7% on the latest news.

So far, Apple still has not addressed its big problem. What will be the next product or solution that will replace “core” iPhone and iPad revenues? Increasingly competitors are making smartphones far cheaper that are “good enough,” especially in markets like China. And iPhone/iPad product improvements are no longer as powerful as before, causing new product releases to be less exciting. And products like Apple Watch, Apple Pay, Apple TV and IBeacon are not “moving the needle” on revenues nearly enough. And while experienced companies like HBO, Netflix and Amazon grow their expanding content creation, Apple has said it is growing its original content offerings by buying the exclusive rights to “Carpool Karaoke“ – yet this is very small compared to the revenue growth needs created by slowing “core” products.

Like McDonald’s stock, Apple’s stock is likely to move upward short-term. Investor hopes are hard to kill. Long-term investors will hold their stock, waiting to see if something good emerges. Traders will buy, based upon beating analyst expectations or technical analysis of price movements. Or just belief that the P/E will expand closer to tech industry norms. But long-term, unless the fundamental need for new products that fulfill customer trends – as the iPad, iPhone and iPod did for mobile – it is unclear how Apple’s valuation grows.

by Adam Hartung | Apr 27, 2016 | Food and Drink, In the Rapids, In the Swamp, Retail, Software, Web/Tech

Growth fixes a multitude of sins. If you grow revenues enough (you don’t even need profits, as Amazon has proven) investors will look past a lot of things. With revenue growth high enough, companies can offer employees free meals and massages. Executives and senior managers can fly around in private jets. Companies can build colossal buildings as testaments to their brand, or pay to have thier names on public buildings. R&D budgets can soar, and product launches can fail. Acquisitions are made with no concerns for price. Bonuses can be huge. All is accepted if revenues grow enough.

Just look at Facebook. Today Facebook announced today that for the quarter ended March, 2016 revenues jumped to $5.4B from $3.5B a year ago. Net income tripled to $1.5B from $500M. And the company is basically making all its revenue – 82% – from 1 product, mobile ads. In the last few years Facebook paid enormous premiums to buy WhatsApp and Instagram – but who cares when revenues grow this fast.

Anticipating good news, Facebook’s stock was up a touch today. But once the news came out, after-hours traders pumped the stock to over $118//share, a new all time high. That’s a price/earnings (p/e) multiple of something like 84. With growth like that Facebook’s leadership can do anything it wants.

But, when revenues slide it can become a veritable poop puddle. As Apple found out.

Rumors had swirled that Apple was going to say sales were down. And the stock had struggled to make gains from lows earlier in 2016. When the company’s CEO announced Tuesday that sales were down 13% versus a year ago the stock cratered after-hours, and opened this morning down 10%. Breaking a streak of 51 straight quarters of revenue growth (since 2003) really sent investors fleeing. From trading around $105/share the last 4 days, Apple closed today at ~$97. $40B of equity value was wiped out in 1 day, and the stock trades at a p/e multiple of 10.

The new iPhone 6se outsold projections, iPads beat expectations. First year Apple Watch sales exceeded first year iPhone sales. Mac sales remain much stronger than any other PC manufacturer. Apple iBeacons and Apple Pay continue their march as major technologies in the IoT (Internet of Things) market. And Apple TV keeps growing. There are about 13M users of Apple’s iMusic. There are 1.5M apps on the iTunes store. And the installed base keeps the iTunes store growing. Share buybacks will grow, and the dividend was increased yet again. But, none of that mattered when people heard sales growth had stopped. Now many investors don’t think Apple’s leadership can do anything right.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Which leads us to Chipotle. Chipotle announced that same store sales fell almost 30% in Q1, 2016. That was after a 15% decline in Q4, 2015. And profits turned to losses for the quarter. That is a growth stall. Chipotle shares were $750/share back in early October. Now they are $417 – a drop of over 44%.

Customer illnesses have pointed to a company that grew fast, but apparently didn’t have its act together for safe sourcing of local ingredients, and safe food handling by employees. What seemed like a tactical problem has plagued the company, as more customers became ill in March.

Whether that is all that’s wrong at Chipotle is less clear, however. There is a lot more competition in the fast casual segment than 2 years ago when Chipotle seemed unable to do anything wrong. And although the company stresses healthy food, the calorie count on most portions would add pounds to anyone other than an athlete or construction worker – not exactly in line with current trends toward dieting. What frequently looks like a single problem when a company’s sales dip often turns out to have multiple origins, and regaining growth is nearly always a lot more difficult than leadership expects.

Growth is magical. It allows companies to invest in new products and services, and buoy’s a stock’s value enhancing acquisition ability. It allows for experimentation into new markets, and discovering other growth avenues. But lack of growth is a vital predictor of future performance. Companies without growth find themselves cost cutting and taking actions which often cause valuations to decline.

Right now Facebook is in a wonderful position. Apple has investors rightly concerned. Will next quarter signal a return to growth, or a Growth Stall? And Chipotle has investors heading for the exits, as there is now ample reason to question whether the company will recover its luster of yore.

by Adam Hartung | Jan 23, 2016 | Current Affairs, Ethics, Food and Drink, Web/Tech

Cheating in sports is now officially prevalent. The World Anti-Doping Agency (WADA) last week issued its report, and confirmed that across the International Association of Athletics Federation (IAAF) athletes were cheating. And very frequently doing so under the supervision of those leading major sports operations at a national, and international level.

Quite simply, those responsible for the future of various sports were responsible for organizing and enabling the illegal doping of athletes. This behavior is now so commonplace that corruption is embedded in the IAAF, making cheating by far the norm rather than the exception.

Wow, we all thought that after Lance Armstrong was found guilty of doping this had all passed. Sounds like, to the contrary, Lance was just the poor guy who got caught. Perhaps he was pilloried because he was an early doping innovator, at a time when few others lacked access. As a result of his very visible take-down for doping, today’s competitors, their coaches and sponsors have become a lot more sophisticated about implementation and cover-ups.

Accusations of steroid use for superior performance have been around a long time. Major league baseball held hearings, and accused several players of doping. The long list of MLB players accused of cheating includes several thought destined for the Hall of Fame including Barry Bonds, Jose Conseco, Roger Clemens, Mark McGwire, Manny Ramirez, Alex Rodriguez, and Sammy Sosa. Even golf has had its doping accusations, with at least one top player, Vijay Sing, locked in a multi-year legal battle due to admitting using deer antler spray to improve his performance.

The reason is, of course, obvious. The stakes are, absolutely, so incredibly high. If you are at the top the rewards are in the hundreds of millions of dollars (or euros.) Due to not only enormously high salaries, but also the incredible sums paid by manufacturers for product endorsements, being at the top of all sports is worth 10 to 100 times as much as being second.

For example – name any other modern golfer besides Tiger Woods. Bet you even know his primary sponsor – Nike. Yet, he didn’t even play much in 2015. Name any other Tour de France rider other than Lance Armstrong. And he made the U.S. Postal Service recognizable as a brand. I travel the world and people ask me, often in their native language or broken English, where I live. When I say “Chicago” the #1 response – by a HUGE margin is “Michael Jordan.” And everyone knows Air Nike.

We know today that some competitors are blessed with enormous genetic gifts. Regardless of what you may have heard about practicing, in reality it is chromosomes that separate the natural athletes from those who are merely extremely good. Practicing does not hurt, but as the good doctor described to Lance Armstrong, if he wanted to be great he had to overcome mother nature. And that’s where drugs come in. Regardless of the sport in which an athlete competes, greatness simply requires very good genes.

If the payoff is so huge why wouldn’t you cheat? If mother nature didn’t give you the perfect genes, why not alter them? It is not hard to imagine anyone realizing that they are very, very, very good – after years of competing from childhood through their early 20s – but not quite as good as the other guy. The lifetime payoff between the other guy and you could be $1Billion. A billion dollars! If someone told you that they could help, and it might take a few years off your life some time in the distant future, would you really hesitate? Would the daily pain of drugs be worse than the pain of constant training?

The real question is, should we call it cheating? If lots and lots of people are doing it, as the WADA report and multiple investigations tell us, is it really cheating?

The real question is, should we call it cheating? If lots and lots of people are doing it, as the WADA report and multiple investigations tell us, is it really cheating?

After all, isn’t this a personal decision? Where should regulators draw the line?

We allow athletes to drink sports drinks. Once there was only Gatorade, and it was only available to Florida athletes. Because they didn’t dehydrate as quickly as other teams these athletes performed better. But obviously sports drinks were considered OK. How many cups of coffee should be allowed? How about taking vitamins?

Exactly who should make these decisions? And why? Why “outlaw” some products, and not others? How do you draw the line?

After watching “The Program” about Lance Armstrong’s doping routine it was clear to me I would never do it, and I would hope those I love would never do it. But I also hope they don’t smoke cigarettes, drink too much liquor or make a porno movie. Yet, those are all personal decisions we allow. And the first two can certainly lead to an early grave. As painful as doping was to biker Armstrong and his team, it was their decision to do it. As bad as it was, why isn’t it their decision? Why is someone put in a position to say it is cheating?

After all, we love winners. When Lance was winning the Tour de France he was very, very popular. Even as allegations swirled around him fans, and sponsors, pretty much ignored them. Even the reporter who chased the story was shunned by his colleagues, and degraded by his publisher, as he systematically built the undeniable case that Armstrong was cheating. Nobody wanted to hear that Lance was cheating – even if he was.

Fans and sponsors really don’t care how athletes win, just that they win. If athletes do something wrong fans pretty much just hope they don’t get caught. Just look at how fans overwhelming supported Armstrong for years. Or how football fans have overwhelming supported Patriots quarterback Tom Brady, and ridiculed the NFL’s commissioner Roger Goodall, over the Deflategate cheating charges and investigation. Fans support a winner, regardless how they win.

So, now we know performance enhancing drugs are endemic in professional sports. Why do we still make them against the rules? If they are common, should we be trying to change behavior, or change the rules?

Go back 150 years in sports and frequently the best were those born to upper middle class families. They had the luck to receive good, healthy food. They had time to actually practice. So when these athletes were able to be paid for their play, we called them professionals. As professionals we would not allow them to compete with the local amateurs. Nor could they compete in international competitions, such as the Olympics.

Jim Thorpe won 2 Olympic gold medals in 1912, received a ticker-tape Broadway parade for his performance and was considered “the greatest athlete of all time.” He was also stripped years later of his medals because it was determined he had been paid to play in a couple of professional baseball games. He was considered a cheater because he had the luxury of practicing, as a professional, while other Olympic athletes did not. Today we consider this preposterous, as professional athletes compete freely in the Olympics. But what really changed? Primarily the rules.

It is impossible to think that we will ever roll back the great rewards given to modern athletes. Too many people love their top athletes, and relish in seeing them earn superstar incomes. Too many people love to buy products these athletes endorse, and too many companies obtain brand advantage with those highly paid endorsements. In other words, the huge prize will never go away.

What is next? Genetic engineering, of course. The good geneticists will continue to figure out how to build stronger bodies, and their results will be out there for athletes to use. Splice a gorilla gene into a wrestler, or a gazelle gene into a long-distance runner. It’s not pure fantasy. This will likely be illegal. But, over time, won’t those gene-altering programs become as common to professional athletes as steroids and human growth hormone are today? Exactly when does anyone think performance enhancement will stop?

And if the drugs keep becoming better, and athletes have such a huge incentive to use them, how are we ever to think a line can be drawn — or ever enforced?

Thus, the effort to stop doping would appear, at best, Quixotic.

Instead, why not simply say that at the professional level, anything goes? No more testing. If you are a pro, you can do whatever you want to win. “It’s your life brother and sister,” the decision is up to you.

If you are an amateur then you will be subjected to intense testing, and you will be caught. Testing will go up dramatically, and you will be caught if you cross any line we draw. And banned from competition for life. If you want to go that extra mile, just go pro.

Of course, one could imagine that there could be 2 pro circuits. One that allows all performance enhancing drugs, and one that does not. But we all know that will fail. Like minor league competition, nobody really cares about the second stringers. Fans want to see real amateurs, often competing locally and reinforcing pride. And they like to see pros — the very best of the very best. And in this latter category, the fans consistently tell us via their support and dollars, they don’t really care how those folks made it to the top.

So a difficult ethical dilemma now confronts sports fans – and those who monitor athletics:

1 – Do we pretend doping doesn’t exist and keep lying about it, but realize what we’re doing is a sham and waste of time?

2 – Do we spend millions of dollars in an upgraded “war on drugs” that is surely going to fail (and who will pay for this increased vigilance, by the way?)

3 – Do we realize that with the incentives that exist today, we need to change the rules on doping? Allow it, educate about its use, but give up trying to stop it. Just like pros now compete in the Olympics, enhancement drugs would no longer be banned.

This one’s above my pay grade. What do you readers think?

by Adam Hartung | Oct 25, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership, Web/Tech

This week McDonald’s and Microsoft both reported earnings that were higher than analysts expected. After these surprise announcements, the equities of both companies had big jumps. But, unfortunately, both companies are in a Growth Stall and unlikely to sustain higher valuations.

McDonald’s profits rose 23%. But revenues were down 5.3%. Leadership touted a higher same store sales number, but that is completely misleading.

McDonald’s leadership has undertaken a back to basics program. This has been used to eliminate menu items and close “underperforming stores.” With fewer stores, loyal customers were forced to eat in nearby stores – something not hard to do given the proliferation of McDonald’s sites. But some customers will go to competitors. By cutting stores and products from the menu McDonald’s may lower cost, but it also lowers the available revenue capacity. This means that stores open a year or longer could increase revenue, even though total revenues are going down.

Profits can go up for a raft of reasons having nothing to do with long-term growth and sustainability. Changing accounting for depreciation, inventory, real estate holdings, revenue recognition, new product launches, product cancellations, marketing investments — the list is endless. Further, charges in a previous quarter (or previous year) could have brought forward costs into an earlier report, making the comparative quarter look worse while making the current quarter look better.

Confusing? That’s why accounting changes are often called “financial machinations.” Lots of moving numbers around, but not necessarily indicating the direction of the business.

McDonald’s asked its “core” customers what they wanted, and based on their responses began offering all-day breakfast. Interpretation – because they can’t attract new customers, McDonald’s wants to obtain more revenue from existing customers by selling them more of an existing product; specifically breakfast items later in the day.

Sounds smart, but in reality McDonald’s is admitting it is not finding new ways to grow its customer base, or sales. The old products weren’t bringing in new customers, and new products weren’t either. As customer counts are declining, leadership is trying to pull more money out of its declining “core.” This can work short-term, but not long-term. Long-term growth requires expanding the sales base with new products and new customers.

Perhaps there is future value in spinning off McDonald’s real estate holdings in a REIT. At best this would be a one-time value improvement for investors, at the cost of another long-term revenue stream. (Sort of like Chicago selling all its future parking meter revenues for a one-time payment to bail out its bankrupt school system.) But if we look at the Sears Holdings REIT spin-off, which ostensibly was going to create enormous value for investors, we can see there were serious limits on the effectiveness of that tactic as well.

MIcrosoft also beat analysts quarterly earnings estimate. But it’s profits were up a mere 2%. And revenues declined 12% versus a year ago – proving its Growth Stall continues as well. Although leadership trumpeted an increase in cloud-based revenue, that was only an 8% improvement and obviously not enough to offset significant weakness in other markets:

It is a struggle to see the good news here. Office 365 revenues were up, but they are cannibalizing traditional Office revenues – and not fast enough to replace customers being lost to competitive products like Google OfficeSuite, etc.

Azure sales were up, but not fast enough to replace declining Windows sales. Further, Azure competes with Amazon AWS, which had remarkable results in the latest quarter. After adding 530 new features, AWS sales increased 15% vs. the previous quarter, and 78% versus the previous year. Margins also increased from 21.4% to 25% over the last year. Azure is in a growth market, but it faces very stiff competition from market leader Amazon.

We build our companies, jobs and lives around successful products and services. We want these providers to succeed because it makes our lives much easier. We don’t like to hear about large market leaders losing their strength, because it signals potentially difficult change. We want these companies to improve, and we will clutch at any sign of improvement.

As investors we behave similarly. We were told large companies have vast customer bases, strong asset bases, well known brands, high switching costs, deep pockets – all things Michael Porter told us in the 1980s created “moats” protecting the business, keeping it protected from market shifts that could hurt sales and profits. As investors we want to believe that even though the giant company may slip, it won’t fall. Time and size is on its side we choose to believe, so we should simply “hang on” and “ride it out.” In the future, the company will do better and value will rise.

As a result we see that Growth Stall companies show a common valuation pattern. After achieving high valuation, their equity value stagnates. Then, hopes for a turn-around and recovery to new growth is stimulated by a few pieces of good news and the value jumps again. Only after a few years the short-term tactics are used up and the underlying business weakness is fully exposed. Then value crumbles, frequently faster than remaining investors anticipated.

McDonald’s valuation rose from $62/share in 2008 to reach record $100/share highs in 2011. But valuation then stagnated. It is only this last jump that has caused it to reach new highs. But realize, this is on a smaller number of stores, fewer products and declining revenues. These are not factors justifying sustainable value improvement.

Microsoft traded around $25/share from March, 2003 through November, 2011 – 8.5 years. When the CEO was changed value jumped to $48/share by October, 2014. After dipping, now, a year later Microsoft stock is again reaching that previous valuation ($50/share). Microsoft is now valued where it was in December, 2002 (which is half its all-time high.)

The jump in value of McDonald’s and Microsoft happened on short-term news regarding beating analysts earnings expectations for one quarter. The underlying businesses, however, are still suffering declining revenue. They remain in Growth Stalls, and the odds are overwhelming that their values will decline, rather than continue increasing.

by Adam Hartung | May 8, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership

McDonald’s just had another lousy quarter. All segments saw declining traffic, revenues fell 11%. Profits were off 33%. Pretty well expected, given its established growth stall.

A new CEO is in place, and he announced is turnaround plan to fix what ails the burger giant. Unfortunately, his plan has been panned by just about everyone. Unfortunately, its a “me too” plan that we’ve seen far too often – and know doesn’t work:

- Reorganize to cut costs. By reshuffling the line-up, and throwing out a bunch of bodies management formerly said were essential, but now don’t care about, they hope to save $300M/year (out of a $4.5B annual budget.)

- Sell off 3,500 stores McDonald’s owns and operate (about 10% of the total.) This will further help cut costs as the operating budgets shift to franchisees, and McDonald’s book unit sales creating short-term, one-time revenues into 2018.

- Keep mucking around with the menu. Cut some items, add some items, try a bunch of different stuff. Hope they find something that sells better.

- Try some service ideas in which nobody really shows any faith, like adding delivery and/or 24 hour breakfast in some markets and some stores.

Needless to say, none of this sounds like it will do much to address quarter after quarter of sales (and profit) declines in an enormously large company. We know people are still eating in restaurants, because competitors like 5 Guys, Meatheads, Burger King and Shake Shack are doing really, really well. But they are winning primarily because McDonald’s is losing. Even though CEO Easterbrook said “our business model is enduring,” there is ample reason to think McDonald’s slide will continue.

Needless to say, none of this sounds like it will do much to address quarter after quarter of sales (and profit) declines in an enormously large company. We know people are still eating in restaurants, because competitors like 5 Guys, Meatheads, Burger King and Shake Shack are doing really, really well. But they are winning primarily because McDonald’s is losing. Even though CEO Easterbrook said “our business model is enduring,” there is ample reason to think McDonald’s slide will continue.

Possibly a slide into oblivion. Think it can’t happen? Then what happened to Howard Johnson’s? Bob’s Big Boy? Woolworth’s? Montgomery Wards? Size, and history, are absolutely no guarantee of a company remaining viable.

In fact, the odds are wildly against McDonald’s this time. Because this isn’t their first growth stall. And the way they saved the company last time was a “fire sale” of very valuable growth assets to raise cash that was all spent to spiffy up the company for one last hurrah – which is now over. And there isn’t really anything left for McDonald’s to build upon.

Go back to 2000 and McDonald’s had a lot of options. They bought Chipotle’s Mexican Grill in 1998, Donato’s Pizza in 1999 and Boston Market in 2000. These were all growing franchises. Growing a LOT faster, and more profitably, than McDonald’s stores. They were on modern trends for what people wanted to eat, and how they wanted to be served. These new concepts offered McDonald’s fantastic growth vehicles for all that cash the burger chain was throwing off, even as its outdated yellow stores full of playgrounds with seats bolted to the floors and products for 99cents were becoming increasingly not only outdated but irrelevant.

But in a change of leadership McDonald’s decided to sell off all these concepts. Donato’s in 2003, Chipotle went public in 2006 and Boston Market was sold to a private equity firm in 2007. All of that money was used to fund investments in McDonald’s store upgrades, additional supply chain restructuring and advertising. The “strategy” at that time was to return to “strategic focus.” Something that lots of analysts, investors and old-line franchisees love.

But look what McDonald’s leaders gave up via this decision to re-focus. McDonald’s received $1.5B for Chipotle. Today Chipotle is worth $20B and is one of the most exciting fast food chains in the marketplace (based on store growth, revenue growth and profitability – as well as customer satisfaction scores.) The value of all of the growth gains that occurred in these 3 chains has gone to other people. Not the investors, employees, suppliers or franchisees of McDonald’s.

We have to recognize that in the mid-2000s McDonald’s had the option of doing 180degrees opposite what it did. It could have put its resources into the newer, more exciting concepts and continued to fidget with McDonald’s to defend and extend its life even as trends went the other direction. This would have allowed investors to reap the gains of new store growth, and McDonald’s franchisees would have had the option to slowly convert McDonald’s stores into Donato’s, Chipotle’s or Boston Market. Employees would have been able to work on growing the new brands, creating more revenue, more jobs, more promotions and higher pay. And suppliers would have been able to continue growing their McDonald’s corporate business via new chains. Customers would have the benefit of both McDonald’s and a well run transition to new concepts in their markets. This would have been a win/win/win/win/win solution for everyone.

But it was the lure of “focus” and “core” markets that led McDonald’s leadership to make what will likely be seen historically as the decision which sent it on the track of self-destruction. When leaders focus on their core markets, and pull out all the stops to try defending and extending a business in a growth stall, they take their eyes off market trends. Rather than accepting what people want, and changing in all ways to meet customer needs, leaders keep fiddling with this and that, and hoping that cost cutting and a raft of operational activities will save the business as they keep focusing ever more intently on that old core business. But, problems keep mounting because customers, quite simply, are going elsewhere. To competitors who are implementing on trends.

The current CEO likes to describe himself as an “internal activist” who will challenge the status quo. But he then proves this is untrue when he describes the future of McDonald’s as a “modern, progressive burger company.” Sorry dude, that ship sailed years ago when competitors built the market for higher-end burgers, served fast in trendier locations. Just like McDonald’s 5-years too late effort to catch Starbucks with McCafe which was too little and poorly done – you can’t catch those better quality burger guys now. They are well on their way, and you’re still in port asking for directions.

McDonald’s is big, but when a big ship starts taking on water it’s no less likely to sink than a small ship (i.e. Titanic.) And when a big ship is badly steered by its captain it flounders, and sinks (i.e. Costa Concordia.) Those who would like to think that McDonald’s size is a benefit should recognize that it is this very size which now keeps McDonald’s from doing anything effective to really change the company. Its efforts (detailed above) are hemmed in by all those stores, franchisees, commitment to old processes, ingrained products hard to change due to installed equipment base, and billions spent on brand advertising that has remained a constant even as McDonald’s lost relevancy. It is now sooooooooo hard to make even small changes that the idea of doing more radical things that analysts are requesting simply becomes impossible for existing management.

And these leaders, frankly, aren’t even going to try. They are deeply wedded, committed, to trying to succeed by making McDonald’s more McDonald’s. They are of the company and its history. Not the CEO, or anyone on his team, reached their position by introducing a revolutionary new product, much less a new concept – or for that matter anything new. They are people who “execute” and work to slowly improve what already exists. That’s why they are giving even more decision-making control to franchisees via selling company stores in order to raise cash and cut costs – rather than using those stores to introduce radical change.

These are not “outside thinkers” that will consider the kinds of radical changes Louis V. Gerstner, a total outsider, implemented at IBM – changing the company from a failing mainframe supplier into an IT services and software company. Yet that is the only thing that will turn around McDonald’s. The Board blew it once before when it sold Chipotle, et.al. and put in place a core-focused CEO. Now McDonald’s has fewer resources, a lot fewer options, and the gap between what it offers and what the marketplace wants is a lot larger.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition. When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also