by Adam Hartung | Feb 6, 2018 | Innovation, Mobile, Software, Web/Tech

InvestorPlace.com declared Snap stock will be a big disappointment in 2018. Bad news for investors, because SNAP was an enormous disappointment in 2017. After going public at $27/share in early March, the stock dropped to $20 by mid-March, then just kept dropping until it bottomed at just under $12 in August. Since then the stock has largely gone sideways at $15.

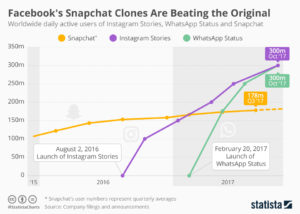

This was not unexpected. As I wrote in April, Snapchat was not without competition and was unlikely to be a long-term winner. Even though Snapchat and its Stories feature grew popular with teenagers 14 to 19, in August, 2016 Facebook launched Instagram Stories as a direct competitor. In just 7 months – just as SNAP went public – Instagram Stories had more users than Snapchat. It was clear then if you wanted to make money on the photo and video sharing trends, investors were better off to own Facebook stock and avoid the newly available SNAP shares (stock, not pix!)

Now the situation is far worse. Facebook launched WhatsApp Status as another competitive product in February, 2017 and it took less than 3 months for its user base to exceed Snapchat. As the chart below shows, by October, 2017 Stories and Status each had 300 million users, while Snapchat was mired at 180 million users. With only 30% the users of Facebook, Snapchat has little chance to succeed against the social media powerhouse.

Statista

Facebook is now a very large company. But, it has shown it is adaptable. Rather than sticking to its original market, Facebook went mobile and has launched new products as fast as competitors tried to carve out niches. The question is, are you constantly scanning the horizon for new products and adapting – fast – to keep your customers and grow? Or are you stuck trying to defending your old business while upstarts carve up your market?”

by Adam Hartung | Dec 9, 2017 | Advertising, Investing, Television, Trends, Web/Tech

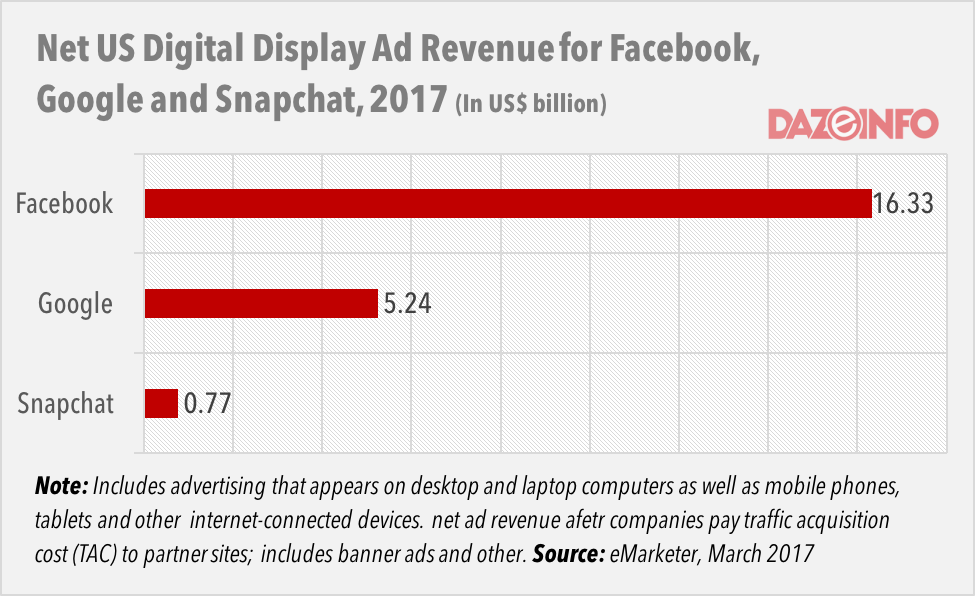

Facebook shareholders should be cheering. And if you don’t own FB, you should be asking yourself why not. The company’s platform investments continue to draw users, and advertisers, in unprecedented numbers.

With permission: Statista

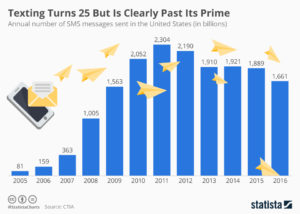

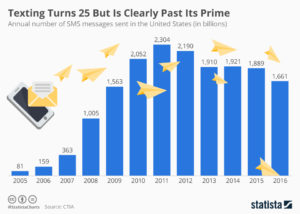

People over 40 still might text. But for most younger people, messaging happens via FB Messenger or WhatsApp. Text messages have thus been declining in the USA. Internationally, where carriers still frequently charge for text messages, the use of both Facebook products dominates over texting. Both Facebook products now are leaders in internet usage.

And as their use grows, so do the ad dollars.

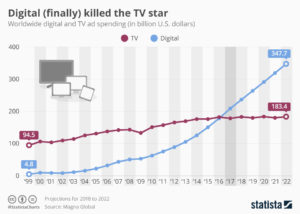

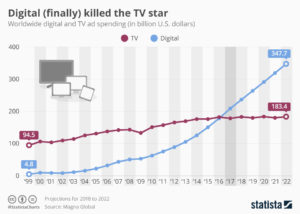

With permission: Statista

As this chart shows, in 2017 ad spending on digital outpaced money spent on TV ads. And TV spending, like print and radio, is flat to declining. While digital spending accelerates. And the big winner here is the platform getting the most eyeballs – which would be Facebook (and Google.)

Looking at the trends, Facebook investors should feel really good about future returns. And if you don’t own Facebook shares, why not?

by Adam Hartung | Nov 17, 2017 | Finance, Investing, Leadership, Web/Tech

What Business Leaders Can Learn From Bitcoin Fanatics

On August 15, Bitcoin rose to $4,000, I wrote a column about the crypto-currency. At the time, I thought Bitcoin was reasonably obscure, and I doubted there would be many readers. I was amazed when the column went semi-viral, and it has had almost 350,000 reads. But even more amazing was that the column generated an enormous amount of feedback. From email responses to Facebook remarks and Tweets I was inundated with people who, largely, wanted my head.

I found this confounding and fascinating. Why would an article that simply said a crypto-currency was speculative draw such an enormous response? And why such hostility? Just as I had not anticipated much readership, I certainly did not anticipate the reaction. These factors led me to research Bitcoin owners, and develop some theories on why Bitcoin is such a big deal to its enthusiasts.

1 – Bitcoin owners want the value to increase

I made the mistake of thinking of Bitcoins as a form of cash. Something to be spent. But I discovered most owners are holding Bitcoins as an asset. Because there are technical limits on how many Bitcoins can be created, and how quickly, these owners see the possibility of Bitcoin value increasing. As “investors” in Bitcoins, they don’t want anything (like a negative column) to put a damper on Bitcoin’s ability to rise.

Such speculation is not uncommon. Many people buy land, gold, silver and diamonds because they expect limited supply, and growing demand, to cause the value to rise. Other people buy Andy Warhol prints, vintage automobiles, signatures of historical people or baseball cards for the same reason. I prefer to call this speculation, but these people refer to themselves as investors in rare assets. Bitcoin investors see themselves in this camp, only they think Bitcoins are less risky than the other assets.

Regardless the nomenclature, anyone who is buying and holding Bitcoins would be unhappy to hear that the asset is risky, or potentially a bad holding. But unlike all those other items I mentioned, Bitcoins are not physical. To some extent merely owning the other assets has a certain amount of its own reward. One can enjoy a diamond ring, or a Warhol print on the wall while waiting to learn if its value goes up or down. But Bitcoins are just computer 1s and 0s, and really a new kind of asset (crypto-currency.) These investors are considerably younger on average, a bit more skittish, and considerably more outspoken regarding the future of their investment – and those who would be negative on Bitcoins.

While wanting their asset value to rise makes sense, it is rare that speculators have been as passionate as those who responded on Bitcoin. I’ve written about many companies I feared would lose value, and thus were speculative, but those columns did not create the fervor with responses like those regarding Bitcoin

2 – Confusion between Bitcoin and Blockchain technology

Blockchain is the underlying technology upon which Bitcoins are created. I have now read a few hundred articles on Bitcoins and Blockchain.

I was struck at just how confusing authors on these topics can be. They will say the two are very different, but then go on at great length that if you believe in Blockchain you should believe in Bitcoins. Few columns on Blockchain don’t talk about Bitcoins. And all Bitcoin authors talk about the wonders of Blockchain.

There is no doubt that Blockchain technology is new to the scene, and shows dramatic promise. Many large organizations are investigating using Blockchain for uses from financial transaction clearing to medical record retention. This is serious technology, and as it matures there are a great many people working to make it as trustworthy as (no, more trustworthy than) the internet. Just as the web requires some rules about URLs, domain naming, page serving, data accumulation, site direction, etc. there are serious people thinking about how to make Blockchain consistent in its application and use – which could open the door for many opportunities to streamline the digital world and make our lives better, and possibly more secure.

There were many, many people who disliked my skeptical view of Bitcoins, and based their entire argument for Bitcoinvalue on their belief in Blockchain. I was schooled over and again on the strength of Blockchain and its many future applications. And I was told that Blockchain technology inherently meant that Bitcoins have to go up in value. Buying Bitcoins was frequently referred to as investing in “Internet 2.0” due to the Blockchain technology.

It is clear that without Blockchain you could not have Bitcoins. But the case demanding one owns Bitcoin because it is built on Blockchain (“the technology of the future” as it is referred to by many) is still being developed. To them I was the one who was confused, unable to see the future they saw built on Blockchain. There were hoards of people who were almost religious in their Bitcoin faith, indicating that there was yet still more underlying their passion.

3 – As trust in government declines, there is growing trust in technology

More than ever in modern history, people have little faith in their government. In the USA, favorable opinions of Congress and its leaders are nearly non-existent. And favorable opinions for the current President started out below normal, and have gotten considerably worse. It is reported now with some regularity that Americans have little trust in the President, Congress, Courts – and the Federal Reserve.

There were, literally, hundreds of people who sent messages talking about the failure of government based currencies. Most of these examples were South American, but still these people made the point, loudly and clearly, that governments can affect the value of their currency. Thus, these Bitcoin investors had lost faith in all government backed securities, including the U.S. dollar, euro, yen, etc. They believed, fervently, that only a currency based on technology, without any government involvement, could ever maintain its value.

Today if someone is asked to give personal information for a census on their city, county, state or country they will often refuse. They want nothing to do with giving additional information to their government.

But these same people allow Facebook, Google and Amazon to watch their most private communications. Facebook records their emotions, their personal interactions, friends, complaints and a million other things going on in users’ lives to develop profiles of what is interesting to them in order to send along newsfeeds, information and ads. Google has recorded every search everyone has ever done, and analyzes those to develop profiles of each person’s interests, concerns, desires and hundreds of other categories to match each with the right ad. Amazon watches every product search made, and everything purchased to profile each person in order to push them the right products, entertainment, news and ads. And they all sell these profiles, and a lot of other personal information, to a host of other companies who do credit ratings, develop credit card offerings and push their own items for sale.

People who have no faith at all in government, and don’t believe government entities can make their lives better, leave their cookies on because they trust these tech companies to use technology to make their lives better. They believe in technology. Are these folks losing privacy? Maybe, but they see a direct benefit to what the technology operated by these tech companies can do for their lives.

For them, Bitcoin represents a future without government. And that clearly drives passion. Blockchain is a bias free, regulator free technology platform. Bitcoin is a government free form of currency, unable to be manipulated by the Federal Reserve, Exchequer of the currency, European Central Bank, Congress, Presidents, the G7, or anyone else. For the vocal Bitcoin owners, they see in Bitcoin a new future with far less government involvement, based on Blockchain technology. And they trust technology far more than they trust the current systems. They claim to not be anarchists, but rather believers in technology over human government, and in some instances even religion.

Leadership lessons from my Bitcoin journey

Often we try to explain away feedback, especially negative feedback or feedback that is hard to interpret, with easy answers. Such as, “they just want their asset to go up in value.” That is a big mistake. If the feedback is strong, it is really worth digging harder to understand why there is passion. Never forget that every piece of negative feedback is a chance to learn and grow. It is almost always worth taking the time to really understand not only what is being said, but why it is being said. There could be a lot more to the issue than face value.

If things are confusing, it is important to sort out the source of the confusion. If I’m talking about a currency, why do they keep talking about the technology? Saying “they don’t get it” misses the point that maybe “you don’t get it.” It is worth digging into the confusion to try and really understand what motivates someone. Only by listening again and again and again, and trying to really see their point of view, can you come to understand that what you think is confusing, to them is not. They aren’t confused, they see you as confused. Until you resolve this issue, both parties will keep talking right past each other.

You cannot lead if you do not understand what other people value. Their belief system may not match yours, and thus they are reaching very different conclusions when looking at the same “facts.” While I may trust the Fed and the ECB, and even banks, if others don’t then they may well have a very different view of the future.

When leaders lose the faith of those they are supposedly leading, unexpected outcomes will occur. Leaders cannot lead people who don’t trust them. Using the power of their office to force their will on others, and forcing conformance to existing processes, methods and systems can often lead to strong negative reactions. People may have no choice short-term but to do as instructed, but they may well be plotting (investing) longer term in a very different future. Failing to see the passion with which they are seeking that different future will only cause the leadership gap to widen, and shorten the time to a disruptive event.

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Aug 29, 2017 | Innovation, Leadership, Marketing, Mobile, Web/Tech

For most consumers an Android-based phone from one of the various manufacturers, most likely bought through a wireless provider if in the USA, does pretty much everything the consumer wants. Developers of most consumer apps, such as games, navigation, shopping, etc. make sure their products work on all phones. For that reason, the bulk of consumers are happy to buy their phone for $200 or less, and most don’t even care what version of Android it runs. As a stand-alone tool an Android phone does pretty much everything they want, and they can afford to replace it every year or two.

But the business community has different requirements.

And because iOS has superior features, Apple continues to dominate the enterprise environment:

- All iPhones are encrypted, giving a security advantage to iOS. Due to platform fragmentation (a fancy way of saying Android is not the same on all platforms, and some Android phones run pretty old versions) most Android phones are not encrypted. That leads to more malware on Android phones. And, Android updates are pushed out by the carrier, compared to Apple controlling all iOS updates regardless of carrier. When you’re building an enterprise app, these security issues are very important.

- iOS is seamless with Macs, and can be pretty well linked to Windows if necessary for an apps’ purpose. Android plays well with Chromebooks, but is far less easy to connect with established PC platforms. So if you want the app to integrate across platforms, such as in a corporation, it’s easier with iOS.

- iPhones come exactly the same, regardless of the carrier. Not true for Android phones. Almost all Androids come with various “junkware.” These apps can conflict with an enterprise app. For enterprise app developers to make things work on an Android phone they really need to “wipe” the phone of all apps, make sure each phone has the same version of Android and then make sure users don’t add anything which can cause a user conflict with the enterprise app. Much easier to just ask people to use an iPhone.

- iOS backs up to iCloud or via iTunes. Straightforward and simple. And if you need to restore, or change devices, it is a simple process. But in the Android world companies like Verizon and Samsung integrate their own back-up tools, which are inconsistent and can be quite hard for a developer to integrate into the app. Enterprise apps need back-ups, and making that difficult can be a huge problem for enterprise developers who have to support thousands of end users. And the fact that Android restores are not consistent, or reliable, makes this a tough issue.

- Search is built-in with iOS. Simple. But Android does not have a clean and simple search feature. And the old cross-platform inconsistencies plague the various search functions offered in the Android world. When using an enterprise app, which may well have considerable complexity, accessing an easy search function is a great benefit.

Most of these issues are no big deal for the typical smartphone consumer who just uses their phone independently of their work. But when someone wants to create an enterprise app, these become really important issues. To make sure the app works well, meeting corporate and end user needs, it is much easier, and better, to build it on iOS.

This allows Apple to price well above the market average

Today Apple charges around $800 for an iPhone 7, and expectations are for the iPhone 8 to be priced around $1,000. Because Apple’s pricing is some 4-5x higher, it allows Apple’s iOS revenue to actually exceed the revenue of all the Android phones sold! And because Android phone manufacturers compete on price, rather than features and capabilities, Apple makes almost ALL the profit in the smartphone hardware business. Even as iPhone unit volume has struggled of late, and some analysts have challenged Apple’s leadership given its under 20% market share, profits keep rolling in, and up, for the iPhone.

By taking the lead with enterprise app developers Apple assures itself of an ongoing market. Three years ago I pointed out the importance of winning the developer war when IBM made its huge commitment to build enterprise apps on iOS. This decision spelled doom for Windows phone and Blackberry — which today have inconsequential market shares of .1% and .0% (yes, Blackberry’s share is truly a rounding error in the marketplace.) Blackberry has become irrelevant. And having missed the mobile market Microsoft is now trying to slow the decline of PC sales by promoting hybrid devices like the Surface tablet as a PC replacement. But, lacking developers for enterprise mobile apps on Microsoft O/S it will be very tough for Microsoft to keep the mobile trend from eventually devastating Windows-based device sales.

As the world goes mobile, devices become smaller and more capable. The need for two devices, such as a phone and a PC, is becoming smaller with each day. Those who predicted “nobody can do real work on a smartphone” are finding out that an incredible amount of work can be done on a wirelessly connected smartphone. As the number of enterprise apps grows, and Apple remains the preferred developer platform, it bodes well for future sales of devices and software for Apple — and creates a dark cloud over those with minimal share like Blackberry and Microsoft.

by Adam Hartung | Aug 15, 2017 | Disruptions, Web/Tech

Even though most people don’t even know what they are, Bitcoins increased in value from about $570 to more than $4,300 — an astounding 750% — in just the last year. Because of this huge return, more people, hoping to make a fast fortune, are becoming interested in possibly owning some Bitcoins. That would be very risky.

Bitcoins are a crypto-currency. That means they can be used like a currency, but don’t physically exist like dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

Being virtual is not inherently a bad thing. The dollars on our financial institution statement, viewed online, are considered real money, even though those are just digital dollars. The fact that Bitcoins aren’t available in physical form is not really a downside, any more than the numbers on your financial statement are not available as physical currency either. Just like we use credit cards or debit cards to transfer value, Bitcoins can be spent in many locations, just like dollars.

What makes Bitcoins unique, versus other currencies, is that there is no financial system, like the U.S. Federal Reserve, managing their existence and value. Instead Bitcoins are managed by a bunch of users who track them via blockchain technology. And blockchain technology itself is not inherently a problem; there are folks figuring out all kinds of uses, like accounting, using blockchain. It is the fact that no central bank controls Bitcoin production that makes them a unique currency. Independent people watch who buys and sells, and owns, Bitcoins, and in some general fashion make a market in Bitcoins. This makes Bitcoins very different from dollars, euros or rupees. There is no “good faith and credit” of the government standing behind the currency.

Why are currencies different from everything else?

Currencies are sort of magical things. If we didn’t have them we would have to do all transactions by barter. Want some gasoline? Without currency you would have to give the seller a chicken or something else the seller wants. That is less than convenient. So currencies were created to represent the value of things. Instead of saying a gallon of gas is worth one chicken, we can say it is worth $2.50. And the chicken can be worth $2.50. So currency represents the value of everything. The dollar, itself, is a small piece of paper that is worth nothing. But it represents buying power. Thus, it is stored value. We hold dollars so we can use the value they represent to obtain the things we want.

Currencies are not the only form of stored value. People buy gold and lock it in a safe because they believe the demand for gold will rise, increasing its value, and thus the gold is stored value. People buy collectible art or rare coins because they believe that as time passes the demand for such artifacts will increase, and thus their value will increase. The art becomes a stored value. Some people buy real estate not just to live on, but because they think the demand for that real estate will grow, and thus the real estate is stored value.

But these forms of stored value are risky, because the stored value can disappear. If new mines suddenly produce vast new quantities of gold, its value will decline. If the art is a fake, its value will be lost. If demand for an artist or for ancient coins cools, its value can fall. The stored value is dependent on someone else, beyond the current owner, determining what that person will pay for the item.

Assets held as stored value can crash

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

But there were no controls on tulip bulb production. Eventually it became clear that more tulip bulbs were being created, and the value was much, much greater than one could ever get for the tulips once planted and flowered. Even though it took many months for the value of tulip bulbs to become so high, their value crashed in a matter of two months. When tulip bulb holders realized there was nobody guaranteeing the value of their tulip bulbs, everyone wanted to sell them as fast as possible, causing a complete loss of all value. What people thought was stored value evaporated, leaving the tulip bulb holders with worthless bulbs.

While a complete collapse is unlikely, people should approach owning Bitcoins with great caution. There are other risks. Someone could hack the exchange you are using to trade or store Bitcoins. Also, cryptocurrencies are subject to wild swings of volatility, so large purchases or sales of Bitcoin can move prices 30% or more in a single day.

Be an investor, not a speculator, and avoid Bitcoins

There are speculators and traders who make markets in things like Bitcoins. They don’t care about the underlying value of anything. All they care about is the value right now, and the momentum of the pricing. If something looks like it is going up they buy it, simply on the hope they can sell it for more than they paid and take a profit on the trade. They don’t see the things they trade as having stored value because they intend to spin the transaction very quickly in order to make a fast buck. Even if value falls they sell, taking a loss. That’s why they are speculators.

Most of us work hard to put a few dollars, euros, pounds, rupees or other currencies into our bank accounts. Most of those dollars we spend on consumption, buying food, utilities, entertainment and everything else we enjoy. If we have extra money and want the value to grow we invest that money in assets that have an underlying value, like real estate or machinery or companies that put assets to work making things people want. We expect our investment to grow because the assets yield a return. We invest our money for the long-term, hoping to create a nest egg for future consumption.

Unless you are a professional trader, or you simply want to gamble, stay away from Bitcoins. They have no inherent value, because they are a currency which represents value rather than having value themselves. The Bitcoin currency is not managed by any government agency, nor is it backed by any government. Bitcoin values are purely dependent upon holders having faith they will continue to have value. Right now the market looks a lot more like tulip mania than careful investing.

by Adam Hartung | Aug 10, 2017 | Entrepreneurship, Leadership, Web/Tech

Recently, I wrote a column about 10 young entrepreneurs. Originally I titled it “10 under 20” but the Forbes editors thought that was too close to their “30 under 30” column so they changed it to “10 Great Lessons From Millennial Entrepreneurs.” I didn’t like that title, because it implied these were “great” entrepreneurs, and I really didn’t think they were all that great. Now that some time has gone by, I really regret having written the column.

I’ve written this column at Forbes for almost 7 years. So I am pitched for unsolicited columns every day by PR firms. On average, about 10 pitches every day. But nothing compared with the onslaught of emails I received after the millenial column. Firm after firm, and even individuals, contacted me by email, on Facebook, Linked-in, and Twitter to tell me about some incredible young person who just absolutely needed to be written about. You would think that every high school, and small university, in America had at least one, if not multiple, young prodigies all of which were destined to change the world. It was an avalanche of pitches, from which I could not even begin to fully read, much less respond.

But, almost universally these businesses were not that fantastic. Most were the modern day equivalent of someone opening a lawn service in 1960. Simple businesses that had little to distinguish them. Many had no revenues, and many were little more than somebody’s idea of a business they would like to build. Those that had revenues were so small as to be meaningless, and almost none made any impact on their industry or competition.

The pitches were, without a doubt, the most hyped pitches I have ever received. Over and over I kept asking “why would anyone think this is in the slightest interesting?

The only reason this is being pitched is because it involves someone under the age of 25. And usually that someone lacks any credentials and offers no new insight to the industry or product.”

2 -Not a sustainable business

Writing an app is not a business. Even if it sold a few thousand copies. Nor is trading baseball cards, or selling someone else’s stuff on eBay. Nor is buying bitcoins. By and large, 99% of the pitches were for one-product opportunities that clearly lacked any sense of being a sustainable business which could produce recurring revenue over multiple years. Almost none had any employees, and those that did had a mere handful with no plans to scale any larger.

At best most were simply a single shot situation which generated some revenue for the millennial founder. And most could only pay the founder because the business had no overhead and a highly subsidized cost structure due to support from parents. Many had no, or little, profits and there was nowhere near enough cash to repay traditional investors. Because there was no cost for financing, overhead or even variable activities like payroll, these businesses could not be considered a success in any traditional sense.

3 – These were not really entrepreneurs

French economist Jean-Baptiste Say coined the term entrepreneur. He used it to describe people who seek out inefficient uses of resources and capital then redeployed them into more productive, higher-profit uses. None of the pitched businesses actually redeployed any resources. And none really developed a new industry that created greater productivity. These were just ideas that manifested into a product that fit an immediate need. Most used an existing infrastructure, such as an app store, to do one thing – like sell an app. Maybe someday they’ll write another – but there was no indication any research was happening, customer analysis or market testing to create a long-term business.

Additionally, for entrepreneurs there is some element of risk-taking. For taking risk, by investing in something where others won’t invest, there is the opportunity for outsized returns. But these folks didn’t take any risk at all. It wasn’t their money they invested, but rather their family’s. Most either lived at home, or lived in housing paid for by family (such as a college dorm room.) Most had nothing invested in their “business” other than personal time, and if this failed there was almost nothing lost. And most had minimal gains relative to the size of the risk they undertook with other people’s resources.

And they all lacked any sense of a business plan. Now I’m all for innovation and trying new things, but business success requires the ability to generate ongoing revenue for a prolonged period that covers all costs and creates returns for investors. These folks simply promoted ideas with no description of how this was to be a long-term profitable venture that succeeded for customers, suppliers and financial backers. I found that I would not have been an investor in hardly any of these “businesses” and surely would not recommend readers to back them.

4 – These folks were big self-promoters, not business promoters

Almost to a pitch every story was about some individual – not a business success. I was told over and over and over about how some 17, 18, 19 or 20 year old was absolutely a genius; a modern miracle of incredible business insight. Yet, there was little to back-up these claims. In the end, these were just young folks who had some sense of ambition and fortitude that were doing a few experiments and had (in some instances, not all) sold a few things. But their stories really weren’t that interesting.

One young fellow washed vehicles. He got a contract to wash trucks. And he had expanded his truck washing capability to multiple trucking companies. OK, ambitious and hard working. But nothing fantastic. No technology breakthrough. Just a basic service that he sold cheaply enough to win some contracts. But, he was unwilling to discuss his margins, how much he paid himself or others and how he financed the company or paid a return to his backers. Yet, he was certain that he could franchise his truck washing business and soon enough he would be the next Ray Kroc. He, and his PR person (and it was unclear who paid her) failed to realize that his story might be interesting in 20 years after he proved he could build the next McDonald’s making himself, his investors and his franchisees rich.

Add onto this the fact that almost all of these people had nothing good to say about anyone older. For some reason I was informed over and again that nobody over 40 could really understand how brilliant this person is, and how guaranteed was future success. These people universally had no value for advice from people older than them,  no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

I kept saying to myself “get over yourself kid. You are working hard, but so are a lot of other people. You really haven’t accomplished anything of merit yet. And there’s not really anything here that indicates you will achieve great things. You may win awards for just showing up at school, or at the soccer match, but in business you have a LOT more to prove than you can show up and possibly accomplish some of the basics. Once..”

5 – No sense of how to build something, or even engage in quid pro quo

Bill Gates built a company that produced software millions of people wanted. Steve Jobs built a company that made devices (computers initially) that millions wanted. Henry Ford made cheap cars that millions of people wanted. Mark Zuckerberg created an interaction engine that millions of people wanted (and advertisers would pay to reach.) These founders understood that building a successful business meant combining multiple resources into an organization that functions capably to build products and markets.

If you asked them “why should I write about you?” they would answer, “to tell folks about the improvement in their life from my company’s products.”

When I asked these millennial entrepreneurs why I should write about them, the answer was “because I’m young and great and going places.”

Worse, when I pointed out that in today’s world columnists rely on readers, and therefore columnists want to know the topic will generate reads, they were without even a good idea of how a column on them would generate reads. When I asked “will you promote this through a large social media conduit to drive readers to the column?” they responded with “but isn’t that what Forbes does, bring in readers? I think you should write about me so Forbes readers can become enlightened. Why should I be asked to promote your column, isn’t that what you and Forbes do?”

It was completely unclear to me who was paying for these PR firms. But to them, and to the hundreds of millennials who sent me Facebook, Linked-in and Twitter messages:

- Quit focusing on yourself and actually accomplish something. Don’t be proud you’re a drop-out, go finish school.

- Listen more and talk less. You really don’t have much that’s interesting to say. Pay attention to those who are older, wiser and could help you reach your goals. You need them, and most of them don’t need you. You’re really not as interesting as you think you are.

- Get some education. Bill Gates and Steve Jobs are my age – not yours. Every generation needs more skills than the one before it. Mark Zuckerberg is THE exception, not the rule. Dropping out of Harvard did not make him great. Before you decide you have all the answers, go learn what the questions are. Learn how to think, how to reason, before you decide you know all that’s needed to take action.

- Quit living on subsidies. If your parents or grandparents or aunts and uncles are paying for your rent, or car, or supplies then you still don’t understand basic economics. Become self-sufficient. Make enough money to buy your own new car, buy your own house, and pay 100% of your bills – and even enough that you could afford to raise children. Until you are self-reliant it is very hard to take you seriously as a business leader.

- Life is NOT a one-round event. You are very likely to live 100 years. Do you have the skills to maintain your lifestyle for that full 100 years? Quit crowing about the 1 success (by your definition) you’ve had so far and instead figure out how you’ll lead a productive 100 year existence. You’re only 20% of the way there.

I hear folks say we need to advance millennials onto boards of directors for public companies. Or fund their new ventures without business plans or traditional benchmarks. Or put them into highly placed positions of major corporations. I can’t agree with that. From what I observed, millennials are similar to all other young people. They don’t know what they don’t know. And only time, failures, successes, education (formal and informal) and hard work will prepare them to be tomorrow’s leaders.

I started my entrepreneurial life while a college junior. I was lucky enough to hook up with several people at least a decade older, and they found investors that were a generation older. The company made computer hardware, and largely due to good luck as well as hard work the company was successfull, and was sold for a great return to the investors and some money for the founders. Simultaneously I completed my undergraduate degree in 4 years, summa cum laude. What made me most excited about that experience was not trying to be featured in any journal, but rather that the folks at the Harvard Business School felt this experience was good enough to admit me to their institution to complete an MBA. And there is no doubt in my mind that what I learned in college, and grad school, was incredibly important to generating a lifetime of ongoing business accomplishments – long after that first company disappeared into the dustbin of obsolete technology.

by Adam Hartung | May 26, 2017 | Disruptions, Marketing, Web/Tech

The words “search” and “Google” are practically synonymous. We’ve even turned the name of the ubiquitous web application into a verb by telling people to “Google it.” And that’s good, because Alphabet’s revenue (that’s Google’s parent company) soared more than 25% in the last quarter, and over 90% of Alphabet’s revenue comes from Google AdWords. The more people search using Google, the more money Alphabet makes.

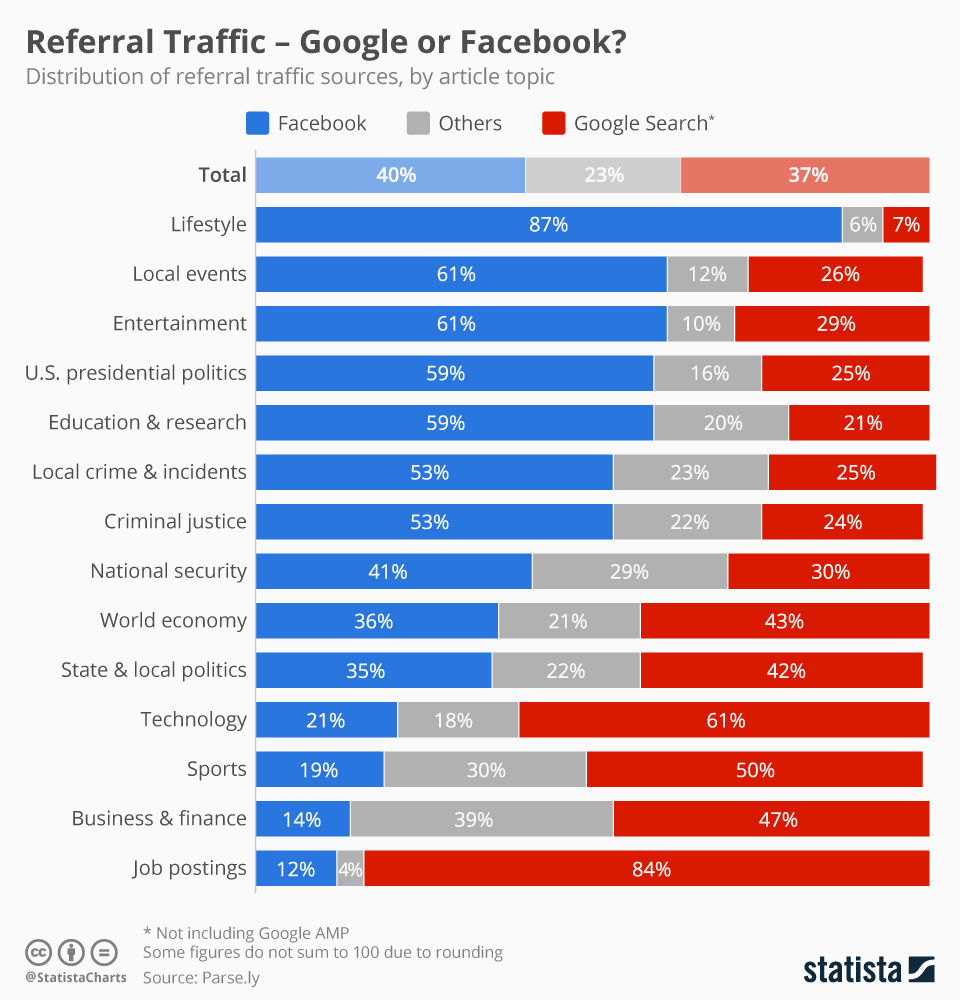

Chart courtesy of Martin Armstrong at Statista.com

But ever since Facebook came along, a new trend has started emerging. People often want answers to their questions within the context of their community. So “searches” are changing. People are going back to what they did before Google existed – they are asking for information from their friends. But online. And primarily using Facebook.

There is no doubt Google dominates keyword searching. But that type of searching has its shortcomings. How often have you found yourself doing multiple searches — adding words, adding phrases, dropping words, etc. trying to find what you were seeking? It’s a common problem, and we all know people who are better “Googlers” than others because of their skill at putting together key words to actually find what we want. And how often do we find ourselves lost in the initial batch of ads, but not finding the link we want? Or going through several pages of links in search of what we seek?

Context often matters. Take the classic problem of finding a place to eat. Googling an answer requires we enter the location, type of food, price point, and other info — which often doesn’t lead us to the desired information, but instead puts us into some kind of web site, or article, with restaurant review. What seems an easy question can be hard to answer when relying on key words.

But, we know how incredibly easy it is for a friend to answer this question. So when seeking a place to eat we use Facebook to ask our friends “hey, any ideas on where I should eat dinner?” Because they know us, and where we are, they fire back specific answers like “the Mexican place two blocks north is just for you,” or “spend the money to eat at that place across the street – pricey but worth it.” Your friends are loaded with context about you, your habits, your favorites and they can give great answers much faster than Google.

Think of these kind of referrals – for food, entertainment, directions, quick facts, local info — as “context based searches” rather than referrals. Instead of making a query with a string of key words, we use context to derive the answer — and our friends. Most people undertake far more of these kind of “searches” than keywords every day.

Even though Google is still growing incredibly fast, context searching — or referrals — pose a threat. People will use their network to answer questions. The web birthed on-line data, and we all quickly wanted engines to help us find that data. We were excited to use Excite, Lycos, InfoSeek, AltaVista and Ask Jeeves to name just a few of the early search engines. We gravitated toward Google because it was simply better. But with the growth of Facebook today we can ask our friends a question faster, and easier, than Google — and often we obtain better results.

Both Google and Facebook rely on ads for most of their revenue. But if consumer goods companies, event promoters, apparel manufacturers and other “core advertisers” realize that people are using Facebook to ask for information, rather than searching Google, where do you think they will spend their on-line ad dollars? Isn’t it better to have an ad for diapers on the screen when someone asks “what diapers do you like best?” than relying on someone to search for diaper reviews?

This is why Google+ with its Groups and Google Hangouts was such a big deal. Google+ allows users to come together in discussions much like Facebook. But Plus, Groups and Hangouts never really caught on, and Plus isn’t nearly as popular as Facebook discussions, or Instagram picture sharing or WhatsApp messaging. Today, when it comes to referral traffic Facebook has eclipsed Google. Five years ago most people would have guessed this would never happen.

I’m not saying that Google searches will decline, nor am I saying Google will stop growing, nor am I saying that Google’s other revenue generators, like YouTube, won’t grow. I am saying that Facebook as a platform is growing incredibly fast, and becoming an ever more powerful tool for users and advertisers. Possibly a lot more powerful than Google as people use it for more and more information gathering — and referrals. The more people make referrals on Facebook, the more it will attract advertisers, and potentially take searches away from Google.

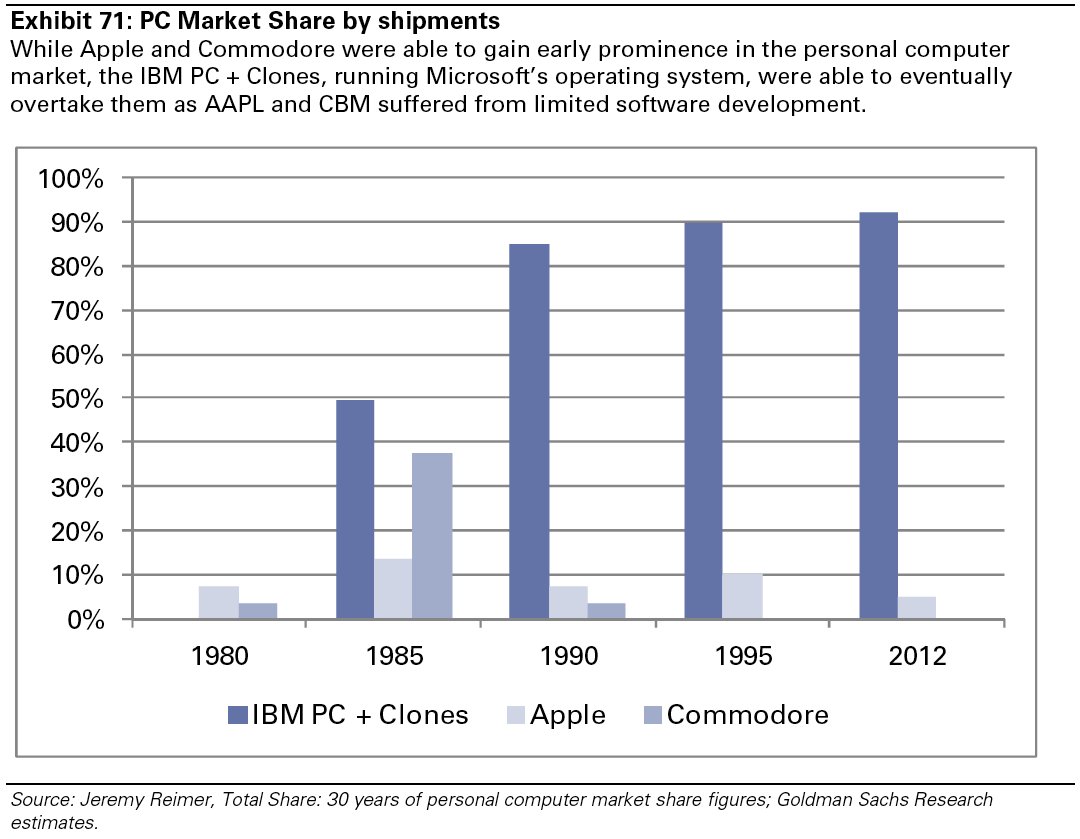

By comparison, this moment may be like the late 1980s when PC sales finally edged ahead of Apple Mac sales. At the time it didn’t look deadly for Apple. But it didn’t take long for the Wintel platform to dominate the market, and the Mac began its slide toward being a submarket favorite.

by Adam Hartung | Apr 27, 2017 | Investing, Mobile, Web/Tech

People love to watch tech stocks, because there is so much volatility. Just today (April 27, 2017) Alphabet beat expectations and its shares rose $34 (about 4%) after hours. GOOG is up 15.5% in 2017, and 31% for the year. But not all tech stocks do this well. Twitter, for example, had a nice increase of late — but TWTR is down 33% since peaking in early October, and it is down 69% from 10/2014 highs.

So how is an investor to know which tech stocks to own, and which to eschew?

They key, of course, is to watch trends. And to recognize who absolutely dominates those trends. When it comes to the rapidly growing world of social media, it is increasingly clear there is only one Goliath — and that is Facebook.

Felix Richter, Statista

Felix Richter, Statista

Snapchat created a lot of interest when it hit the scene. A darling of the most youthful set, it was growing very fast and had exceeded 100 million users by January 2016. By January 2017 Snapchat added another 60 million users — growing 60%. But since going public the stock has dropped about 10%. And according to Marketwatch only 12 analysts rank it a “buy” while 23 rank it a “hold,” “underweight” or “sell.”

Should you buy Snapchat? After all, Facebook dropped after its IPO

As the chart from Statista shows, in just eight months Instagram Stories has blown way past the user base of Snapchat. In April 2012 Facebook paid $1 billion for Instagram, then a popular photo-sharing app, which had no revenues. The idea was to leverage Facebook’s installed base to grow the app. Since September, 2013 Instagram has been adding 50 million users per quarter. Instagram now has 600 million active users and became one of the five most popular mobile apps in the world.

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

The Facebook App Ecosystem Totally Dominates Mobile. Chart reproduced courtesy of Felix Richter at Statista

Looking at Facebook, one has to marvel at how the company has kept users in its ecosystem. As the Statista chart shows, since 2016 Facebook has had four of the top five mobile app downloads. Now that Instagram Stories has blown past Snapchat, Facebook holds all four top positions.

Does anyone remember when Facebook purchased Beluga in 2011 for about $20 million? That is now Messenger, and it opened the door for sending pictures and video. Do you remember the $19 billion acquisition of WhatsApp — which had only $10 million in revenues? Both have added multiple capabilities, and now Messenger has 1 billion active users, and WhatsApp has 1.2 billion users.

In fiscal 2012 Facebook hit $1 billion in quarterly revenue, and ended the year with just over $4 billion in annual revenues. Q4 2016 exceeded $8.8 billion, and for the year $27.6 billion.

It is for good reason that almost twice as many analysts are skeptical of Snapchat’s future value as those who think it will go up.

Snapchat is competing with Facebook, a company that has shown time and again it can watch the trends and put in place products that initially meet, but then eventually exceed customer expectations. One might like to think Snapchat is a good David, putting up a good fight. But this time, investors are likely to be much better off betting on Goliath. Facebook still has a lot of opportunity to grow.

by Adam Hartung | Feb 15, 2017 | Marketing, Mobile, Retail, Web/Tech

(Photo by Andrew Burton/Getty Images)

Apple’s stock is on a tear. After languishing for well over a year, it is back to record high levels. Once again Apple is the most valuable publicly traded company in America, with a market capitalization exceeding $700 billion. And pretty overwhelmingly, analysts are calling for Apple’s value to continue rising.

But today’s Apple, and the Apple emerging for the future, is absolutely not the Apple which brought investors to this dance. That Apple was all about innovation. That Apple identified big trends – specifically mobile – then created products that turned the trend into enormous markets. The old Apple knew that to create those new markets required an intense devotion to product development, bringing new capabilities to products that opened entirely new markets where needs were previously unmet, and making customers into devotees with really good quality and customer service.

That Apple was built by Steve Jobs. Today’s Apple has been remade by Tim Cook, and it is an entirely different company.

Today’s Apple – the one today’s analysts love – is all about making and selling more iPhones. And treating those iPhone users as a “loyal base” to which they can sell all kinds of apps/services. Today’s Apple is about using the company’s storied position, and brand leadership, to milk more money out of customers that own their devices, and expanding into adjacent markets where the installed base can continue growing.

UBS likes Apple because they think the services business is undervalued. After noting that it today would stand alone as a Fortune 100 company, they expect those services to double in four years. Bernstein notes services today represents 11% of revenue, and should grow at 22% per year. Meanwhile they expect the installed base of iPhones to expand by 27% – largely due to offshore sales – adding further to services growth.

Analysts further like Apple’s likely expansion into India – a previously almost untapped market. CEO Cook has led negotiations to have Foxxcon and Wistron, the current Chinese-based manufacturers, open plants in India for domestic production of iPhones. This expansion into a new geographic market is anticipated to produce tremendous iPhone sales growth. Do you remember when, just before filing for bankruptcy, Krispy Kreme was going to keep up its valuation by expanding into China?

Of course, with so many millions of devices, it is expected that the apps and services to be deployed on those devices will continue growing. Likely exponentially. The iOS developer community has long been one of Apple’s great strengths. Developers like how quickly they can deploy new apps and services to the market via Apple’s sales infrastructure. And with companies the size of IBM dedicated to building enterprise apps for iOS the story heard over and again is about expanding the installed base, then selling the add-ons.

Gee, sounds a lot like the old “razors lead to razor blade sales” strategy – business innovation circa 1966.

Overall, doesn’t this sound a lot like Microsoft? Bill Gates founded a company that revolutionized computing with low-cost software on low-cast hardware that did just about anything you would want. Windows made life easy. Microsoft gave users office automation, databases and all the basic work tools. And when the internet came along Microsoft connected everyone with Internet Explorer – for free! Microsoft created a platform with Windows upon which hordes of developers could build special applications for dedicated markets.

Once this market was created, and pretty much monopolized by Microsoft CEO Gates turned the reigns over to CEO Steve Ballmer. And Mr. Ballmer maximized these advantages. He invested constantly in developing updates to Windows and Office which would continue to insure Microsoft’s market share against emerging competitors like Unix and Linux. The money was so good that over a decade money was poured into gaming, even though that business lost more money than it made in revenue – but who cared? There were occasional investments in products like tablets, hand-helds and phones, but these were merely attractions around the main show. These products came and went and, again, nobody really cared.

Ballmer optimized the gains from Microsoft’s installed base. And a lot – a lot – of money was made doing this. nvestors appreciated the years of ongoing profits, dividends – and even occasional special dividends – as the money poured in. Microsoft was unstoppable in personal computing. The only thing that slowed Microsoft down was the market shift to mobile, which caused the PC market to collapse as unit sales have declined for six straight years (PC sales in 2016 barely managed levels of 2006). But, for a goodly while, it was a great ride!

Today all one hears about at Apple is growing the installed base. Maximizing sales of iPhones. And then selling everyone services. Oh yeah, the Apple Watch came out. Sort of flopped. Nobody really seemed to care much. Not nearly as much as they cared about 2 quarters of sales declines in iPhones. And whatever happened to AppleTV? ApplePay? iBeacons? Beats? Weren’t those supposed to be breakthrough innovations to create new markets? Oh well, nobody seems to much care about those things any longer. Attractions around the main event – iPhones!

So now analysts today aren’t put in the mode of evaluating breakthrough innovations and trying to guess the size of brand new, never before measured markets. That was hard. Now they can be far more predictable forecasting smartphone sales and services revenue, with simulations up and down. And that means they can focus on cash flow. After all, Apple makes more cash than it makes profit! Apple has a $246 billion cash hoard. Most people think Berkshire Hathaway, led by famed investor Warren Buffett, spent $6.6 billion on Apple stock in 2016 because Berkshire sees Apple as a cash generation machine – sort of like a railroad! And if those meetings between CEO Cook and President Trump can yield a tax change allowing repatriation at a low rate then all that cash could lead to a big one time dividend!

And, most likely, the stock will go up. Most likely, a lot. Because for at least a while Apple’s iPhone business is going to be pretty good. And the services business is going to grow. It will be a lot like Microsoft – at least until mobile changed the business. Or, maybe like Xerox giving away copiers to obtain toner sales – until desktop publishing and email cratered the need for copiers and large printers. Or, going all the way back into the 1950s and 60s, when Multigraphics and AB Dick practically gave away small printers to get the ink and plate sales – until xerography crushed that business. Of course you couldn’t go wrong investing in Sears for years, because they had the store locations, they had the brands (Kenmore, Craftsman, et.al.,) they had the credit card services – until Wal-Mart and Amazon changed that game.

You see, that’s the problem with all of these sort of “milk the base” businesses. As the focus shifts to grow the base and add-on sales the company loses sight of customer needs. Innovation declines, then evaporates as everything is poured into maximizing returns from the “core” business. Optimization leads to a focus on costs, and price reductions. Arrogance, based on market leadership, emerges and customer service starts to wane. Quality falters, but is not considered as important because sales are so large.

These changes take time, and the business looks really good as profits and cash flow continue, so it is easy to overlook these cultural and organizational changes, and their potential negative impact. Many applaud cost reductions – remember the glee with which analysts bragged about the cost savings when Dell moved its customer service to India some 20 years ago?

Today we’re hearing more stories about long-term Apple customers who aren’t as happy as they once were.

Genius bar experiences aren’t always great. In a telling AdAge column one long-time Apple user discusses how he had two iPhones fail, and Apple could not replace them leaving the customer with no phone for two weeks – demonstrating a lack of planning for product failures and a lack of concern for customer service. And the same issues were apparent when his corporate Macbook Pro failed. This same corporate customer bemoans design changes that have led to incompatible dongles and jacks, making interoperability problematic even within the Apple line.

Meanwhile, over the last four years Apple has spent lavishly on a new corporate headquarters befitting the country’s most valuable publicly traded company. And Apple leaders have been obsessive about making sure this building is built right! Which sounds well and good, except this was a company that once put customers – and unearthing their hidden needs, wants and wishes – first. Now, a lot of attention is looking inward. Looking at how they are spending all that money from milking the installed base. Putting some of the best managers on building the building – rather than creating new markets.

Who was that retailer that was so successful that it built what was, at the time, the world’s tallest building? Oh yeah, that was Sears.

Markets always shift. Change happens. Today it happens faster than ever in history. And nowhere does change happen faster than in technology and consumer electronics. CEO Cook is leading like CEO Ballmer. He is maximizing the value, and profitability, of the Apple’s core product – the iPhone. And analysts love it. It would be wise to disavow yourself of any thoughts that Apple will be the innovative market creating Jobs/Ives organization it once was.

How long will this be a winning strategy? Your answer to that should determine how long you would like to be an Apple investor. Because some day something new will come along.

by Adam Hartung | Jan 6, 2017 | Advertising, Innovation, Marketing, Mobile, Trends, Web/Tech

It’s been over a decade since the Internet transformed print media.

Very quickly the web’s ability to rapidly disseminate news, and articles, made newspapers and magazines obsolete. Along with their demise went the ability for advertisers to reach customers via print. What was once an “easy buy” for the auto or home section of a paper, or for magazines targeting your audience, simply disappeared. Due to very clear measuring tools, unlike print, Internet ads were far cheaper and more appealing to advertisers – so that’s where at least some of the money went.

In 2012 Google surpassed all print media in generating ad revenue. Source Statista courtesy of NewspaperDeathWatch.com

While this trend was easy enough to predict, few expected the unanticipated consequences.

1. First was the trend to automated ad buying. Instead of targeting the message to groups, programmatic buying tools started targeting individuals based upon how they navigated the web. The result was a trolling of web users, and ad placements in all kinds of crazy locations.

Heaven help the poor soul who looks for a credenza without turning off cookies. The next week every site that person visits, whether it be a news site, a sports site, a hobby site – anywhere that is ad supported – will be ringed with ads for credenzas. That these ads in no way connect to the content is completely lost. Like a hawker who won’t stop chasing you down the street to buy his bad watches, the web surfer can’t avoid the onslaught of ads for a product he may well not even want.

2. Which led to the next unanticipated consequence, the rising trend of bad – and even fake – journalism.

Now anybody, without any credentials, could create their own web site and begin publishing anything they want. The need for accuracy is no longer as important as the willingness to do whatever is necessary to obtain eyeballs. Learning how to “go viral” with click-bait keywords and phrases became more critical than fact checking. Because ads are bought by programs, the advertiser is no longer linked to the content or the publisher, leaving the world awash in an ocean of statements – some accurate and some not. Thus, what were once ads that supported noteworthy journals like the New York Times now support activistpost.com.

3. The next big trend is the continuing rise of paid entertainment sites that are displacing broadcast and cable TV.

Netflix is now spending $6 billion per year on original content. According to SymphonyAM’s measurement of viewership, which includes streaming as well as time-shifted viewing, Netflix had the no. 1 most viewed show (Orange is the New Black) and three of the top four most viewed shows in 2016.

Increasingly, purchased streaming services (Netflix, Hulu, et.al.) are displacing broadcast and cable, making it harder for advertisers to reach their audience on TV. As Barry Diller, founder of Fox Broadcasting, said at the Consumer Electronics Show, people who can afford it will buy content – and most people will be able to afford it as prices keep dropping. Soon traditional advertisers will “be advertising to people who can’t afford your goods.”

4. And, lastly, there is the trend away from radio.

Radio historically had an audience of people who listened to their favorite programming at home or in their car. But according to BuzzAngle that too is changing quickly. Today the trend is to streaming audio programming, which jumped 82.6% in 2016, while downloading songs and albums dropped 15-24%. With Apple, Amazon and Google all entering the market, streaming audio is rapidly displacing real-time radio.

Declining free content will affect all consumers and advertisers.

Thus, the assault on advertisers which began with the demise of print continues. This will impact all consumers, as free content increasingly declines. Because of these trends, users will have a lot more options, but simultaneously they will have to be much more aware of the source of their content, and actively involved in selecting what they read, listen to and view. They can’t rely on the platforms (Facebook, etc.) to manage their content. It will require each person select their sources.

Meanwhile, consumer goods companies and anyone who depends on advertising will have to change their success formulas due to these trends. Built-in audiences – ready made targets – are no longer a given. Costs of traditional advertising will go up, while its effectiveness will go down. As the old platforms (print, TV, radio) die off these companies will be forced to lean much, much heavier on social media (Facebook, Snapchat, etc.) and sites like YouTube as the new platforms to push their product message to potential customers.

There will be big losers, and winners, due to these trends.

These market shifts will favor those who aggressively commit early to new communications approaches, and learn how to succeed. Those who dally too long in the old approach will lose awareness, and eventually market share. Lack of ad buying scale benefits, which once greatly favored the very large consumer goods companies (Kraft, P&G, Nestle, Coke, McDonalds) means it will be harder for large players to hold onto dominance. Meanwhile, the easy access and low cost of new platforms means more opportunities will exist for small market disrupters to emerge and quickly grow.

And these trends will impact the fortunes of media and tech companies for investors The decline in print, radio and TV will continue, hurting companies in all three media. When Gannet tried to buy Tronc the banks balked at the price, killing the deal, fearing that forecasted revenues would not materialize.

Just as print distributors have died off, cable’s role as a programming distributor will decline as customers opt for bandwidth without buying programming. Thus trends put the growth prospects of companies such as Comcast and DirecTV/AT&T at peril, as well as their valuations.

Privatized content will benefit Netflix, Amazon and other original content creators. While traditionalists question the wisdom of spending so much on original content, it is clearly the trend and attracts customers. And these trends will benefit streaming services that deliver paid content, like Apple, Amazon and Google. It will benefit social media networks (Facebook and Alphabet) who provide the new platforms for reaching audiences.

Media has changed dramatically from the business it was in 2000. And that change is accelerating. It will impact everyone, because we all are consumers, altering what we consume and how we consume it. And it will change the role, placement and form of advertising as the platforms shift dramatically. So the question becomes, is your business (and your portfolio) ready?

Felix Richter, Statista

Felix Richter, Statista

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web. In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/