by Adam Hartung | May 8, 2018 | Computing, Growth Stall, Innovation, Investing, Software, Trends, Web/Tech

One in five American homes with wifi now has an Amazon Alexa. And the acceptance rate is growing. To me that seems remarkable. I remember when we feared Google keeping all those searches we did. Then the fears people seemed to have about Facebook knowing our friends, families and what we talked about. Now it appears that people have no fear of “big brother” as they rapidly adopt a technology into their homes which can hear pretty near everything that is said, or that happens.

It goes to show that for most people, convenience is still incredibly important. Give us mobile phones and we let land-lines go, because mobile is so convenient – even if more expensive and lower quality. Give us laptops we let go of the traditional office, taking our work everywhere, even at a loss of work-life balance. Give us e-commerce and we start letting retailers keep our credit card information, even if it threatens our credit security. Give us digital documents via Kindle, or a smart device on the web grabbing short articles and pdf files, and we get rid of paper books and magazines. Give us streaming and we let go of physical entertainment platforms, choosing to download movies for one-time use, even though we once thought “owning” our entertainment was important.

With each new technology we make the trade-off between convenience and something we formerly thought was important. Such as quality, price, face-to-face communications, shopping in a store, owning a book or our entertainment – and even security and privacy. For all the hubbub that regulators, politicians and the “old guard” throws up about how important these things were, it did not take long for these factors to not matter as convenience outweighed what we used to think we wanted.

Now, voice activation is becoming radically important. With Google Assistant and Alexa we no longer have to bother with a keyboard interface (who wants to type?) or even a small keypad – we can just talk to our smart device. There is no doubt that is convenient. Especially when that device learns from what we say (using augmented intelligence) so it increasingly is able to accurately respond to our needs with minimal commands. Yes, this device is invading our homes, our workplaces and our lives – but it is increasingly clear that for the convenience offered we will make that trade-off. And thus what Alexa can do (measured in number of skills) has grown from zero to over 45,000 in just under 3 years.

And now, Amazon is going to explode the things Alexa can do for us. Historically Amazon controlled Alexa’s Skills market, allowing very few companies to make money off Alexa transactions. But going forward Amazon is monetizing Alexa, and developers can keep 70% of the in-skill purchase revenues customers make. Buy a product or service via Alexa and developers can now make a lot of money. And, simultaneously, Amazon is offering a “code-free” skills developer, expanding the group of people who can write skills in just minutes. In other words, Amazon is setting off a gold rush for Alexa skills development, while simultaneously making the products remarkably cheap to own.

This is horrible news for Apple. Apple’s revenue stagnated in 2016, declining year over year for 3 consecutive quarters. I warned folks then that this was a Growth Stall, which often implies a gap is developing between the company and the market. While Apple revenues have recovered, we can now see that gap. Apple still relies on iPhone and iPad sales, coupled with the stuff people buy from iTunes, for most of its revenue and growth. But many analysts think smartphone sales may have peaked. And while focusing on that core, Apple has NOT invested heavily in Siri, its voice platform. Today, Siri lags all other voice platforms in quality of recognition, quality of understanding, and number of services. And Apple’s smart speaker sales are a drop in the ocean of Amazon Echo and Echo Dot sales.

By all indications the market for a lot of what we use our mobile devices for is shifting to voice interactivity. And Apple is far behind the leader Amazon, and the strong #2 Google. Even Microsoft’s Cortana quality is considered significantly better than Siri. If this market moves as fast as the smartphone market grew it will rob sales of smartphones and iTunes, and Apple could be in a lot of trouble faster than most people think. Relevancy is a currency quickly lost in the competitive personal technology business.

by Paul F | Feb 20, 2018 | Entrepreneurship, Innovation, Investing, Science, Trends

Tesla has stuck a deal to put solar panels and Powerwall batteries on 50,000 homes in Southern Australia. The homeowners will not pay for the equipment. They won’t even own it. Instead the equipment will be owned by the utility company, and the 50,000 homes will become a “virtual” power plant – operating as independent pieces of a giant grid. For everyone in the system this will lower power costs by over 30%, and improve the performance where outages are a big problem.

This is really, really smart. The old way of thinking about power generation was a big plant, usually coal, gas or oil powered. Or, a giant group of solar panels in a desert, or a giant group of windmills. Or, a nuclear-powered plant. This centralized generation is then shipped over power lines to homes and businesses.

The problem is that transmission can lose anywhere from 20% to 80% of the power. Thus, the bigger the plant in theory the lower the power cost – but that is only for generation. After factoring in the cost of transmission losses, and the cost of building and maintaining transmission lines, the cost can be quite high. And thus the resulting never-ending increases in electricity prices even as traditional feedstocks go down in cost. Decentralized power generation, in a grid of small production, nearly eliminates transmission losses and uses renewable sources in the most favorable way.

Nobody should be surprised that Tesla is a leader in this program. Back in September, 2016 when Tesla took over (or merged) with Solar City I strongly made the case that this would be a good move. The ability to make solar shingles, solar panels and store large power amounts in whole-building batteries is a game changer for how we make, and consume, electricity. As utility commissions keep realizing the problems with building ever-larger centralized plants, decentralized systems that truly utilize grid management are simply a smarter, cheaper, better way to power our homes and offices.

Most people think of Solar City as “just another home solar system.” That would be wrong. Solar City has the ability to power entire towns and regions with their system of production, storage and grid management. And that is great for Tesla shareholders. Tesla has shown it is a game changer with products like the Model 3, and the combination with Solar City actually creates a utility industry game changer, as well as auto industry game changer, that could put a hurt on companies like Exxon. Now, like when I recommended buying Tesla in January, 2015, you should be thinking long term about the opportunity for outsized returns a game-changing company like Tesla provides.

by Adam Hartung | Jan 30, 2018 | Culture, Sports, Trends

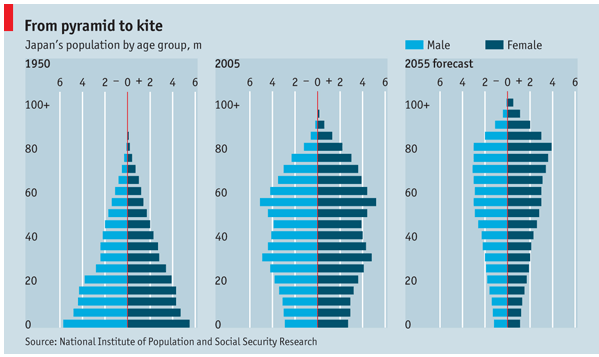

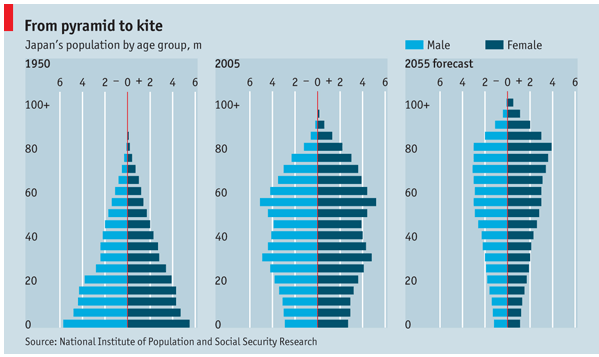

“Business Insider says Japan has become “a demographic time bomb.” I guess it’s about time somebody realized that demographic trends are important, and that they can be effective for planning!

It was September, 2016 that I pointed out how important using demographic trends was for planning – and made it clear that Japan was facing a huge problem due to an aging population and unwillingness to allow immigrants. In January, 2017 I reiterated the importance of incorporating demographic trends into planning, demonstrating how they can be important for predicting workforce availability, cost of living, taxation and other critical business issues.

Take for example the NFL. In 2017 the league took another big ratings decline. The second consecutive year. But this was not hard to predict. In September, as the season started, I made it clear that kneeling players were not the problem for the NFL – the demographics of its primary viewers was the big problem. And I predicted that ratings would take a hit in 2017. Demographics have been clearly working against the league, and unless they find a way to bring in younger viewers – probably through rules changes – things are going to get a lot worse, affecting revenues and thus owner profits and even player salaries.

Are you incorporating demographics in your planning? If not, why not? Don’t know which demographic trends are important, or how to apply demographic trends to your business? If you’re stuck, not understanding this critical trend and how it will impact your business, why not give us a call?”

by Adam Hartung | Jan 23, 2018 | Disruptions, Investing, Retail, Trends

Business Insider is projecting a “tsunami” of retail store closings in 2018 — 12,000 (up from 9,000 in 2017.) Also, the expect several more retailers will file bankruptcy, including Sears.

Duh. Nothing surprising about those projections. In mid-2016, Wharton Radio interviewed me about Sears, and I made sure everyone clearly understood I expect it to fail. Soon. In December, 2016 I overviewed Sears’ demise, predicted its inevitable failure, and warned everyone that all traditional retail was going to get a lot smaller. I again recommended dis-investing your portfolio of retail. By March, 2017 the handwriting was so clear I made sure investors knew that there were NO traditional retailers worthy of owning, including Walmart. By October, 2017 I wrote about the Waltons cashing out their Walmart ownership, indicating nobody should be in the stock – or any other retailer.

The trend is unmistakable, and undeniable. The question is – what are you going to do about it? In July, 2015 Amazon became more valuable than Walmart, even though much smaller. I explained why that made sense – because the former is growing and the latter is shrinking. Companies that leverage trends are always worth more. And that fact impacts YOU! As I wrote in February, 2017 the “Amazon Effect” will change not only your investments, but how you shop, the value of retail real estate (and thus all commercial real estate,) employment opportunities for low-skilled workers, property and sales tax revenues for all cities impacting school and infrastructure funding, and all supply chain logistics. These trends are far-reaching, and no business will be untouched.

Don’t just say “oh my, retailers are crumbling” and go to the next web page. You need to make sure your strategy is leveraging the “Amazon Effect” in ways that will help you grow revenues and profits. Because your competition is making plans to use these trends to hurt your business if you don’t make the first move. Need help?

by Adam Hartung | Dec 22, 2017 | Advertising, Film, Innovation, Marketing, Trends

Here in late 2017, the biggest trends are: the 24 hour news cycle, animosity in broadcast and online media, fatigue from constant connection and interaction, international threats and our political climate. The holiday season is in the background struggling for attention.

How are people tuning out of this cacophony to get in the mood for the holidays?

The answer: Christmas movies! And which channel has 75% share of the new movies in 2017? If you have watched any TV since October, you’d know that it’s The Hallmark Channel. THC has produced over 20 original movies for the 2017 Christmas season and has seen viewership grow by 6.7% per year since 2013. THC is on track to surpass the 2016 season in viewership and its brand image is solidly wholesome.

Starting in October, THC runs seasonal programming with its successful “The Good Witch” series (no vampires!) and continues with “Countdown to Christmas” featuring original Hallmark-produced content.

Hallmark spent decades preparing to capture the benefits of these trends. It had become a source of family oriented, holiday-themed programming especially popular in recent years. Once only an ink and paper company, Hallmark expanded strategically in the 1970s with ornaments and cultural greeting cards and again in 1984 with its acquisition of Crayola drawing products. The company moved into direct retail in 1986 and ecommerce in the mid-1990s. Hallmark eCards was launched in 2005.

Hallmark capitalized on branded media content originally to support the core business and it now generates profits as a standalone business. In 2001, the Hallmark Channel was launched. The Hallmark Movie Channel was developed in 2004 which became Hallmark Movies and Mysteries in 2014. This year, the Hallmark Drama channel was launched further leveraging the brand.

Many companies sponsored radio shows in the 1920s through the war years. Serials featuring one company’s products appeared in 1928 on radio. In 1952, Proctor and Gamble sponsored the first TV soap opera featuring one company (“The Guiding Light”). But The Hallmark Hall of Fame was there first on Christmas Eve in 1951 sponsoring a made-for-TV opera, “Amahl and the Night Visitors.”

Written by Gian Carlo Menotti in less than two months and timed for a one hour TV slot, “Amahl” has become, probably, the most performed opera in history.

Hallmark wasn’t the first mover in sponsored media content, but it had learned to experiment with new media. The company was positioned to take advantage of the trend toward family friendly broadcast content and this year was ready to give the nation a place to rest and escape from the chaos. A bit like the story of Amahl and Christmas itself.

Once just a card company, Hallmark followed market trends to expand its business and become a leader in content marketing which is now one of the hottest areas in all marketing. And both the new video content and large library were ready for the current trend- streaming video!

by Adam Hartung | Dec 9, 2017 | Advertising, Investing, Television, Trends, Web/Tech

Facebook shareholders should be cheering. And if you don’t own FB, you should be asking yourself why not. The company’s platform investments continue to draw users, and advertisers, in unprecedented numbers.

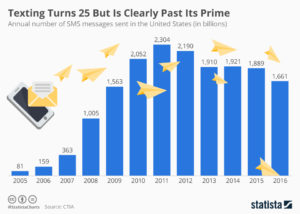

With permission: Statista

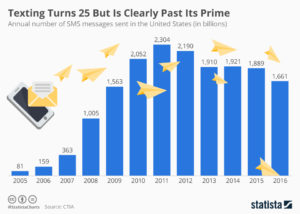

People over 40 still might text. But for most younger people, messaging happens via FB Messenger or WhatsApp. Text messages have thus been declining in the USA. Internationally, where carriers still frequently charge for text messages, the use of both Facebook products dominates over texting. Both Facebook products now are leaders in internet usage.

And as their use grows, so do the ad dollars.

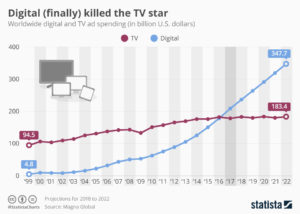

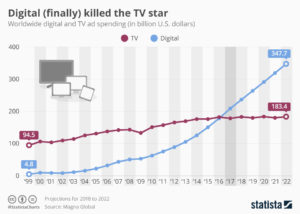

With permission: Statista

As this chart shows, in 2017 ad spending on digital outpaced money spent on TV ads. And TV spending, like print and radio, is flat to declining. While digital spending accelerates. And the big winner here is the platform getting the most eyeballs – which would be Facebook (and Google.)

Looking at the trends, Facebook investors should feel really good about future returns. And if you don’t own Facebook shares, why not?

by Paul F | Nov 30, 2017 | Boards of Directors, Trends

As a Fellow with NACD, I have spoken at meetings and met members around the US. I’ve heard the comments echoing the sentiments of this year’s study. I’ve written at length about how to reduce the risk and how to see unexpected trends while there is still time to react.

Excerpt from NACD website:

This year’s survey offers great insight into how directors and boards view the next 12 months. Which major business trends do they expect will have the greatest impact on their companies? What are the areas where they hope to improve board performance next year? Which topics are the ones on which directors want to spend more time during board meetings? In addition, we assess how boards are currently engaging with management on the increasingly complex challenge of formulating strategy and drill down on the growing board imperative of corporate-culture oversight.

With permission from NACD, you can download this year’s study here:

by Adam Hartung | Sep 29, 2017 | Entertainment, Politics, Sports, Trends

LANDOVER, MD – SEPTEMBER 24: Washington Redskins players link arms during the national anthem before their game against the Oakland Raiders at FedExField on September 24, 2017 in Landover, Maryland. (Photo by Patrick Smith/Getty Images)

A recent top news story has been NFL players kneeling during the national anthem. The controversy was amplified when President Trump weighed in with objections to this behavior, and his recommendation that the NFL pass a rule disallowing it. This kind of controversy doesn’t make life easier for NFL leaders, but it really isn’t their biggest problem. Ratings didn’t start dropping recently, viewership has been declining since 2015.

NFL ratings stalled in 2015

NFL viewership had a pretty steady climb through 2014. But in 2015 ratings leveled. Then in 2016 viewership fell a whopping 9%. During the first 6 weeks of the 2016 regular season (into early October)viewership was down 11%. Through the first 9 weeks of 2016 ratings were down 14% before things finally leveled off. Although nobody had a clear explanation why viewership declined so markedly, there was widespread agreement that 2016 was a ratings crash for the league. Fox had its worst NFL viewership since 2008, and ESPN had its worst since 2005.

Interestingly, later analysis showed that overall people were watching 5% more games. But they were watching less of each game. In other words, fans had become more casual about their viewership. People were watching less TV, watching less cable, and that included live sports. And those who stream games almost never streamed the entire game.

And this behavior change wasn’t limited to the NFL. As reported at Politifact.com, Paulsen, editor in chief of Sports Media Watch said, “it’s really important to note the NFL is not declining while other leagues are increasing. NASCAR ratings are in the cellar right now. The NBA had some of its lowest rated games ever on network television last year… It’s an industry-wide phenomenon and the NFL isn’t immune to it anymore.” So the declining viewership problem is widespread, and much older than the recent national anthem controversy.

Live sports is not attracting new, younger viewers

Magna Global recently released its 2017 U.S. Sports Report. According to Radio + Television Business Report (RBR.com) the age of live sports viewers is scewing older. Much older. Today the average NFL viewer is at least 50. Similar to tennis, and college basketball and football. That’s second only to baseball at 57 – which was 50 as recently as 2000. But no sport is immune. NHL viewers are now typically 49. They were 33 in 2000. As simple arithmetic shows, the same folks are watching hockey but few new viewers are being attracted. Based on recent trends, Magna projects viewership for the Sochi Olympics and 2018 World Cup will both decline.

I’ve written before about the importance of studying demographic trends when planning. These trends are highly reliable, even if boring. And they provide a lot of insight. In the case of live sports watching, younger people simply don’t sit down and watch a complete game. Younger people have different behaviors. They watch an entire season of shows in one day. They multi-task, doing many things at once. And they prefer information in short bursts – like weekly blogs rather than a book. And they are more interested in outcomes, the final result, than watching how it happened. Where older people watch a game play-by-play, younger people simply want to know the major events and the final score.

To understand what’s happening with NFL ratings we really don’t have to look much further than simple demographics — the aging of the U.S. population — and the change in viewing behavior from older groups to younger groups.

Unfortunately, according to a recent CNN poll, while 56% of people under age 45 think the recent demonstrations are the right thing to do, 59% of those over 45 say the demonstrations are wrong. In its “core” NFL viewership folks don’t like the kneeling, so it would appear the NFL should heed the President’s advice. But, looking down the road, the NFL won’t succeed unless it finds a way to attract a younger audience. With younger people approving the demonstrations NFL leadership risks throwing the baby out with the bathwater if they knee-jerk control player behavior.

Understanding customer demographic trends, and adapting, is crucial to success

The demonstrations are interesting as an expression of American ideals. And they are gathering a lot of discussion. But they are not what’s plaguing NFL viewership. Today the NFL has a much bigger task of making changes to attract young people as viewers. Should leaders shorten the game’s length? Should they change rules to increase scoring and create more excitement during the game? Should they invest in more apps to engage viewers in play-by-play activity? Should they seek out ways to allow more gambling during the game? Whatever leadership does, the traditions of the NFL need to be tested and altered in order to attract new people to watching the game if they want to preserve the advertising dollars that make it a success.

When your business falters, do you look at long-term trends, or react to a short-term event? It’s easy for politicians and newscasters to focus on the short-term, creating headlines and controversy. But business leaders have an obligation to look much deeper, and longer term. It is critical we move beyond “that’s the way the game is played” to looking at how the game may need to change in order to remain relevant and engage new customers.

Note how boxing recently brought in a mixed martial arts fighter to take on the world champion. The outcome was nearly a foregone conclusion, but nobody cared because it brought in people to a boxing match that otherwise would not have been there. If you don’t recognize demographic shifts, and take actions to meet emerging trends you risk becoming as left behind as cricket, badminton, horseshoes, bocce ball and darts.

by Adam Hartung | Sep 28, 2017 | Entertainment, Leadership, Politics, Trends

Photo: NEW YORK, NY – FEBRUARY 19: Writers and crew of ‘The Late Show with Stephen Colbert’ attend 69th Writers Guild Awards New York Ceremony at Edison Ballroom on February 19, 2017 in New York City. (Photo by Nicholas Hunt/Getty Images)

The Late Show hosted by Stephen Colbert is now the #1 program in late night television. This come-from-far-behind change in market leadership, overtaking The Tonight Show hosted by Jimmy Fallon, is not about politics. It is about understanding trends and using them to create value.

Back in February, 2014 there was real concern about the future of late night television. Audiences had peaked decades before, when Nightline was huge and competed with The Tonight Show hosted by legend Johnny Carson. By 2014 many wondered if American programming after the late news was all shifting to cable TV as audiences continued shrinking. Producers replaced Jay Leno with Jimmy Fallon in order to revitalize viewers. Jimmy Kimmel was moved up in time as ABC killed Nightline, hoping he could carve out a growing niche. And David Letterman, late night’s senior statesman, was about to be replaced by cable satirist Stephen Colbert. But these changes gathered little industry interest, because the time slots simply were not doing well for broadcasters – or advertisers.

Fallon maintained a dominant lead in the time slot as Colbert’s first year was a yawner.

As

TheWrap.com reported in September, 2016, despite the fanfare of Colbert taking over hosting, he “posed no threat whatsoever to Jimmy Fallon.” Fallon’s show maintained a huge lead. With 3.65 million viewers it bested

The Late Show by over 800,000. Colbert, with 2.82 million viewers seemed mostly trying to keep a lead over Kimmel’s 2.3 million viewers.

ANDREW LIPOVSKY/NBC/NBCU PHOTO BANK VIA GETTY IMAGES

Meanwhile the producers at The Late Show kept their eyes on the mood of the electorate.

They had largely let Colbert promote Democrat Clinton, and even though she lost the election noted she had won the popular vote. As Colbert continued to criticize the President, his audience grew. Soon, Colbert was beating Fallon in total audience – something nobody predicted just a few months earlier. It was quite a surprise when the 2016-2017 September to May season drew to a close and it was discovered that Colbert actually won the time slot, producing a larger total audience than Fallon. It was only about 20,000 – but it was a win few saw coming.

The Late Show writers and producers noted the historic and growing unpopularity of President Trump, and the public interest in ongoing investigations, and built the headlines into the show. Variety headlined on 7/25/17 “Stephen Colbert’s Russia Week Lofts Late Show to Biggest Weekly Win Ever.” Using audience trends The Late Showdevoted a week to a comical look at Russia, which saw it generate a 2.87million total audience in comparison to The Tonight Show‘s 2.42million – a beat of a whopping 450,000 viewers.

All of this is very good news for CBS.

NBC (NBC/Universal is a division of Comcast) is not losing money on The Tonight Show. And in the desirable segment of those age 18-49 Fallon still has the largest audience. But, it is a good thing for CBS to have so many new viewers. It brings in more advertisers, and higher revenues for each ad. This leads to more profits.

One might say that this is all about the hosts, and their political leanings. Maybe the content is driven by host opinions. But CBS is winning viewers because it is following trends, and matching its programming to trends. This is growing its late night audience, while NBC’s is shrinking.

Steve Burke, chief executive of NBC Universal was quoted in the New York Times saying “I think the answer is for Jimmy to be Jimmy.” Sounds like what a father might say about his son when the boy finds himself in a rough patch. But I’m not so sure its the position a company CEO should take regarding a very expensive employee in the lead of a major project.

Maybe NBC’s producers should spend more time looking at trends, and figuring out how to program content that will improve The Tonight Show‘s competitiveness. The show was upended in just one year. What will total audience look like next May when the 2017-2018 season ends? Will revenues and profits be unaffected if NBC’s audience keeps falling while CBS’s keeps growing?

For the rest of us, the lesson should be clear. Nobody is relegated to always being #2. Regardless the leader’s size, if you study trends and figure out how to leverage them you can grow, and you can become #1.

Understanding trends and applying them to your business is the best way to invigorate growth and improve your competitiveness.

by Adam Hartung | Sep 21, 2017 | Investing, Trends

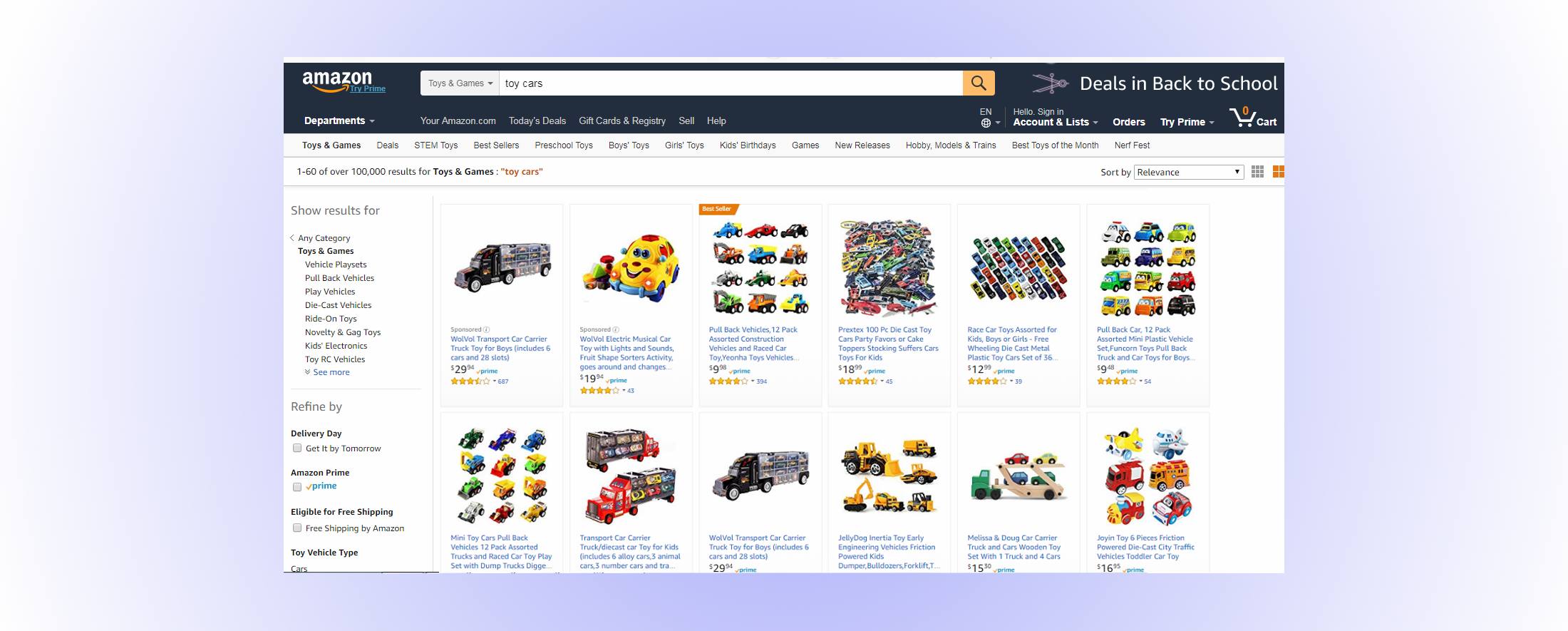

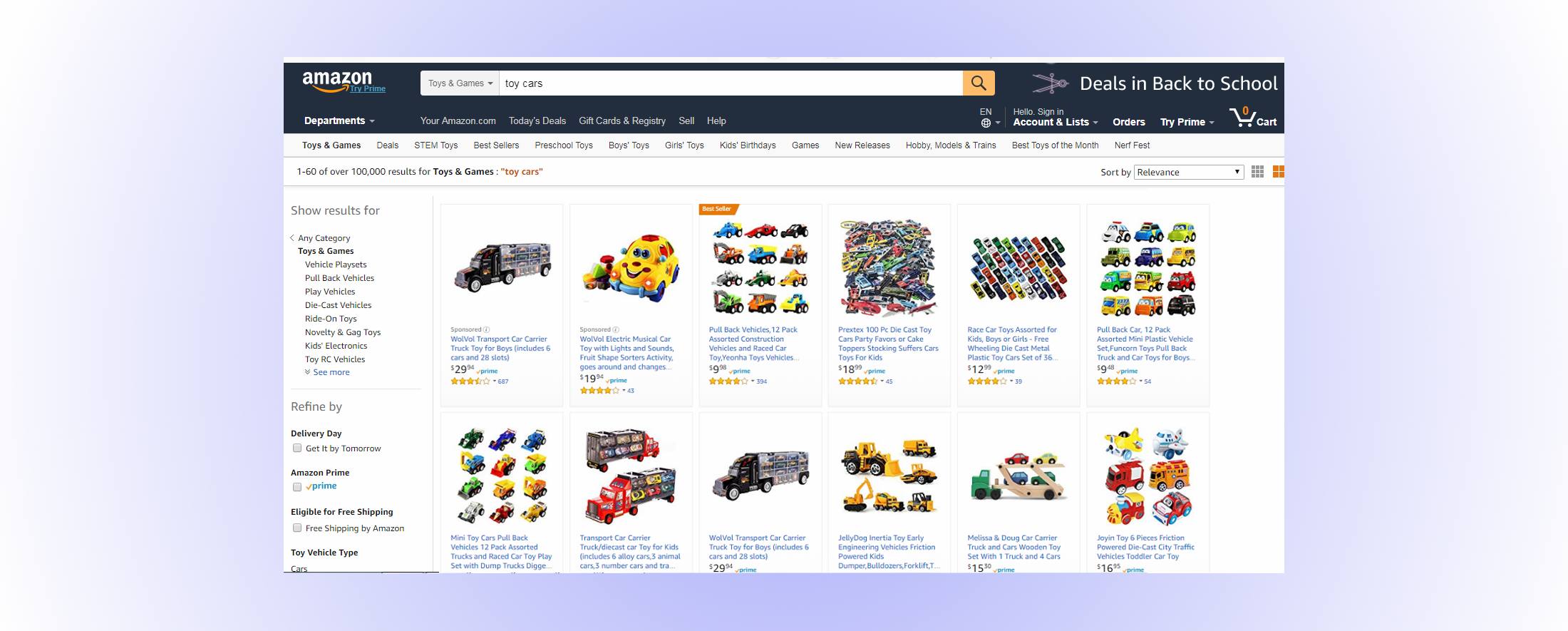

Toys R Us filed for bankruptcy this week. And the obvious response was “another retailer slaughtered by Amazon and on-line retailing.” But this conclusion comes short of describing why Toys R Us leadership did not do the obvious things to keep Toys R Us relevant.

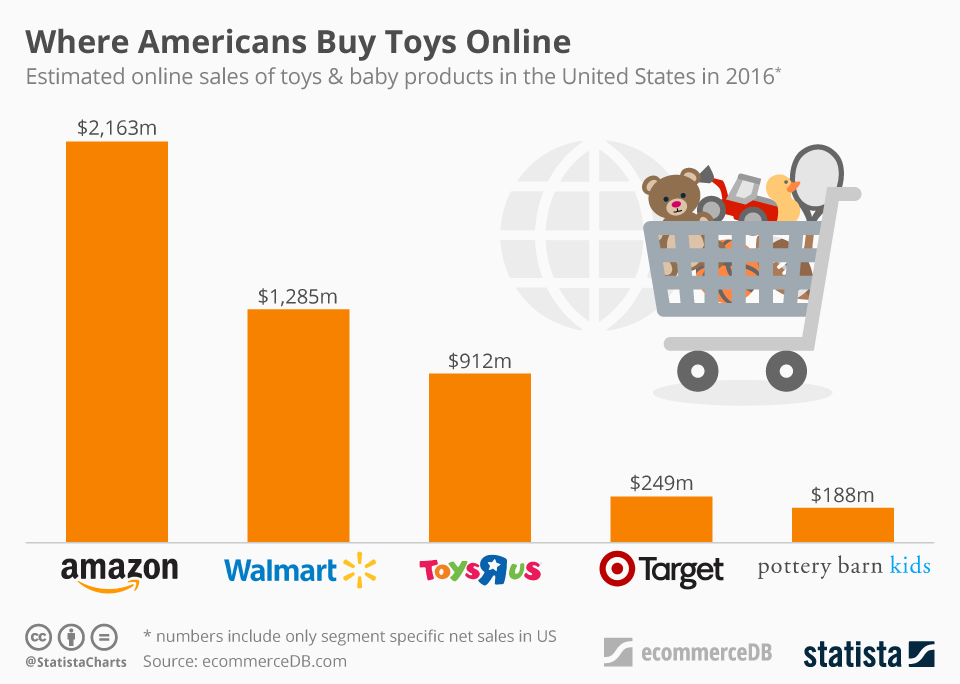

Amazon and WalMart both eclipsed Toys R Us in toy retail sales.

Chart courtesy of Felix Richter, Statista

Everyone, and I mean everyone, knew over the last decade that customers were buying more stuff on-line, including toys. And everyone also knew that WalMart was pushing extremely hard to keep customers going to their stores by offering products like toys at low prices. And, it was clear that customers were shifting to buying more toys from both these retailers. If this was so obvious to everyone, why didn’t Toys R Us leadership do something? After all, Toys R Us is a multi-billion dollar revenue company.

It was over 30 years ago when financiers discovered they could buy a company, sell off some assets and otherwise increase the company’s cash, then convince banks and bondholders to load the company with debt. These financiers would then pull out the cash for themselves, and leave the company with a ton of debt. The LBO (leveraged buy out) was born, invented by investment bankers like KKR (named for founders Kohlberg, Kravis & Roberts.) They would use a small bit of private equity, and then use the company’s own assets to raise debt money (leverage) to buy the company. By “restructuring” the company to a lower cost of operations, usually with draconian reductions, they would increase cash flow to make higher debt repayments. Then they would either take the money out directly, or take the company public where they could sell their shares, and make themselves rich. This form of deal making birthed what we now call the Private Equity business.

In 2005, KKR and Bain Capital (which included former Presidential candidate Mitt Romney) bought Toys R Us for about $6.6billion, plus assuming just under $1B of debt, for a total valuation of $7.5billion. But the private equity guys didn’t buy the company with equity. They only put in $1.3billion, and used the company’s assets to raise $5.3billion in additional debt, making total debt a whopping $6.2B. Total debt was now a remarkable 82.7% of total capital! At the time of the deal interest rates on that debt were around 7.25%, creating a cash outflow of $450million/year just to pay interest on the loans. At the time Toys R Us was barely making a profit of 2% – so the debt was double company net profits.

Debt led to bad management decisions and ultimately bankruptcy of the U.S. company

The biggest assumption behind a debt-financed takeover is that the company can cut costs to improve cash flow and thus pay the interest. But behind that assumption is an even bigger assumption. That the marketplace won’t change dramatically. The KKR and Bain Capital leaders assumed they could shrink Toys R Us in a way that would lower operating costs. They also assumed they could sell some under-utilized assets to raise cash. They did not assume they would need contingency money if competition, and the marketplace, changed in some unplanned way.

eCommerce was pretty new in 2005. Amazon was an $8.5 billion company, but it didn’t make any profits and very few predicted then it would become today’s $100 billion behemoth. Because the financiers didn’t anticipate a big market shift to ecommerce, they focused on the war with Walmart and Target. Their plans were to lower operating costs, close some stores that were underperforming, license some offshore stores, and sell some assets (like real estate owned or leases) to raise cash and repay the debt.

But they weren’t prepared to take on another, entirely different competitor on-line. As Amazon’s growth affected all retailers, Toys R Us simply did not have the resources to fight the traditional discount and dollar brick-and-mortar retailers, and build a major on-line presence, and keep paying that debt. While it is easy to sit on the sidelines and say that Toys R Us should have spent more money building its on-line presence in order to remain relevant, the fact is that the deal in 2005 left the company with insufficient cash flow to do so. Regardless of what leadership might have wanted to do, simply keeping the lights on was a tough challenge when having to pay out so much cash to bondholders.

And the investors simply did not expect that the growth of on-line retailing would stall traditional retail stores, thus creating a major loss of value for retail real estate. U.S. retail real estate value had increased in value for decades. The assumption was that the real estate, whether owned or leased, would continue to go up in value. Real estate was a “hard” asset that KKR and Bain Capital could bank on for raising cash to repay the debt. But as on-line retail grew, and traditional retail declined, America became “over stored” with far too much retail space. Prices were shattered in many markets, and it was not possible for Toys R Us to sell those assets for a gain that would meet the debt obligations.

With $400 million of debt coming due next year, Toys R Us simply doesn’t have the cash flow, or assets, to repay those bondholders

Old assumptions about finance are a big problem for companies today. Assumptions about “leveraging” hard assets, and intangibles like brand value, are no longer true. Competitors emerge, markets change, and old assets can lose value very fast. Assumptions about business model stability are no longer true, as new competitors using newer technology create new ways to sell, and often at lower cost than was ever expected. Assumptions about customer loyalty, and market share stability, are no longer true as new competitors appeal to customers differently and cause big shifts in buying behavior very fast. The speed with which technology, competitors, markets and customers shift now requires companies have the funds available to invest in change.

This story isn’t just about debt. The very popular activity of “returning money to shareholders by repurchasing stock” is a terrible idea. Stock repurchases do not make a company more valuable, nor a stronger competitor. Instead they burn through cash to reduce the company’s capitalization, and manipulate ratios like EPS (earnings per share) and P/E (price/earnings) multiple. Stock repurchases hurt companies, and make them less competitive. Good companies return money to shareholders by investing in growth, which raises sales, profits and increases the stock price making the company truly more valuable.

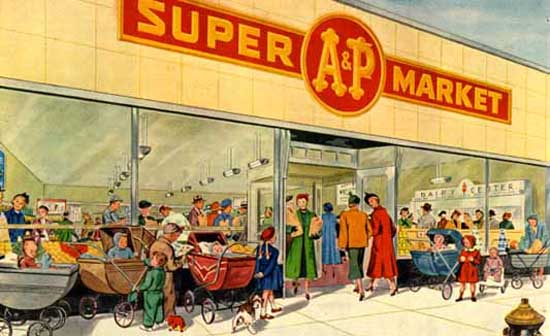

Toys R Us isn’t a story about Amazon, or eCommerce, taking out another retailer

Toys R Us isn’t a story about Amazon, or eCommerce, taking out another retailer

The important part of the Toys R Us story is realizing that the wrong financial decisions can doom your organization. You can have a great vision, and even great ideas about new ways to compete. But if you don’t have the money to invest in growth, it won’t happen. If leaders don’t have the money to spend on new projects and new markets, because they’re sending it all to bondholders or using it to repurchase shares in hopes of propping up a stock price, eventually there will be a market shift that will doom the old business model and leave it unable to compete.

To succeed today leaders need the money to invest in change, and they have to constantly invest it in change, or their companies will lose relevancy and end up like Toys R Us, Radio Shack, Circuit City, Aeropostale, The Limited, Payless Shoes, Gander Mountain, Golfsmith, Sports Authority, Borders Books and the great, original American retailer A&P.