by Adam Hartung | Jul 26, 2017 | Regulations, Scenario Planning, Trends

Leaders like to be deciders. Most leaders think of themselves as decision makers. In 2006 President George Bush, defending Donald Rumsfeld as his Defense Secretary said “I am the Decider. I decide what’s best.” It earned him the nickname “Decider-in-Chief.” Most CEOs echo this sentiment. Most leaders like to define themselves by their decisions.

But whether a decision is good or not is open to interpretation. Often immediately after a decision things may look great. It might appear as if that decision was obvious. And often decisions quickly make a lot of people happy.

As we enter the most intense part of the U.S. presidential election, both candidates are eager to tell potential voters what decisions they have made – and what decisions they will make if elected. And most people will look no further than the immediate expected impact of those decisions.

AP Photo/Chuck Burton, File

It takes time to determine the quality of any decision.

However, the quality of most decisions is not based on the immediate, or obvious, first implications. Rather, the quality of a decision is discovered over time, as the consequences are revealed – intended and unintended. Because quite often, what looked good at first can turn out to be very, very bad.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All-Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100 million.

That action by the NBA is what’s called

unintended consequences. Lawmakers didn’t really consider that the NBA might decide to take its

business elsewhere due to this state legislation. It’s what some people call, “Oops. I didn’t think about

that when I made my decision.”

Often unintended consequences are more important than first reactions to decisions.

Robert Reich, Secretary of Labor for President Clinton, was a staunch supporter of unions. In his book Locked in the Cabinet, he tells the story of visiting an auto plant in Oklahoma supporting the local union. He thought his support would incent the company’s leaders to negotiate more favorably. Instead, the company closed the plant. Laid-off everyone. Oops. The unintended consequences of what he thought was obvious support led to the worst possible worker outcome.

President Obama worked Congress hard to create the Affordable Care Act, or Obamacare, for everyone in America. One intention was to make sure employers covered all their workers, so the law required that if an employer had health care for any workers he had to offer that health care to all employees who worked over 30 hours per week. So almost all employers of part time workers suddenly said that none could work more than 30 hours. Those that worked 32 (four days per week) or 36 suddenly had their hours cut. Now those lower-income people not only had no health care, but less money in their pay envelopes. Oops. Unintended consequence.

President Reagan and his First Lady launched the “War on Drugs.” How could that be a bad thing? Illegal drugs are dangerous, as is the supply chain. But now, some 30 years later, the Federal Bureau of Prisons reports that almost half (46.3% or over 85,000) of inmates are there on drug charges. The U.S. now spends $51 billion annually on this drug war, which is about 20% more than is spent on the real war being waged with Afghanistan, Iraq and ISIS. There are now over 1.5 million arrests each year, with 83% of those merely for possession. Oops. Unintended consequences. It seemed like such a good idea at the time.

This is why it is so important leaders take their time to make thoughtful decisions, often with the input of many other people. Because the quality of a decision is not measured by how one views it immediately. Rather, the value is decided over time as the opportunity arises to observe the unintended consequences, and their impact. The best decisions are those in which the future consequences are identified, discussed and made part of the planning – so they aren’t unintended and the “decider” isn’t running around saying “oops.”

Think hard about the long-term complications of any decision.

As you listen to the politicians this cycle, keep in mind what could be the unintended consequences of implementing what they say:

- What would be the social impact, and transfer of wealth, from suddenly forgiving all student loans?

- What would be the consequences on trade, and jobs, of not supporting historical government trade agreements?

- What would be the consequences on national security of not supporting historically allied governments?

- What would be the long-term consequence of not allowing visitors based on race, religion or sexual orientation?

- What would be the consequence of not repaying the government’s bonds?

- What would be the long-term impact on economic growth of higher regulations on banks – that already have seen dramatic increases in regulation slowing the recovery?

- What would be the long-term consequences on food production, housing and lifestyles of failing to address global warming?

Business leaders should be very aware of the long-term consequences of their decisions. Every time a decision is necessary, is the best effort made to obtain all the information available on the topic? Are inputs and expectations obtained from detractors, as well as admirers? Is there a balance between not only what is popular, but what will happen months into the future? Did you consider the potential reaction by customers? Employees? Suppliers? Competitors?

There are very few “perfect decisions.” All decisions have consequences. Often, there is a trade-off between the good outcomes, and the bad outcomes. But the key is to know them all, and balance the interests and outcomes. Consider the consequences, good and bad, and plan for them. Only by doing that can you avoid later saying “oops.”

by Adam Hartung | May 20, 2017 | In the Rapids, Innovation, Investing, Trends

Writing on trends, I frequently profile tech companies that use trends to outperform competitors. But using trends is not restricted to tech companies.

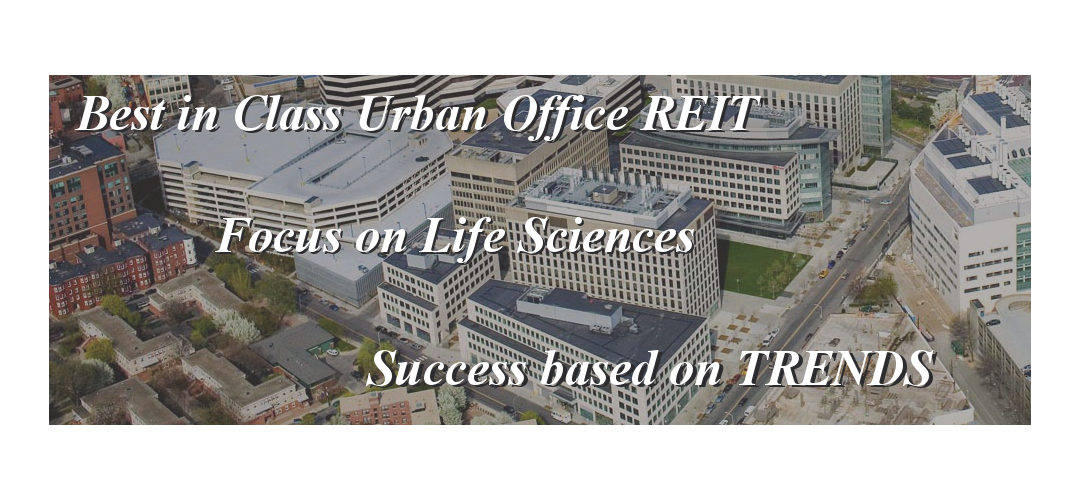

By following trends, since 1998 Alexandria Real Estate Equities has tripled the performance of the NASDAQ, quadrupled returns of the S&P 500, and quintupled the Russell 2000. Alexandria has even outperformed technology stalwart Microsoft, and investment guru Berkshire Hathaway by 230%.

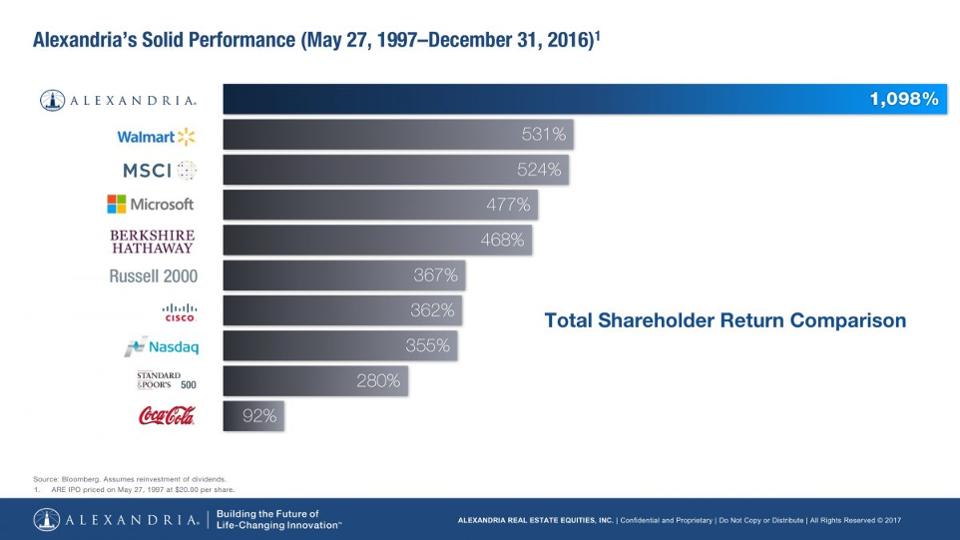

Although you probably never heard of it, Alexandria has trounced its real estate peers. Over the last three years Alexandria has returned double the FTSE NAREIT Equity Office Index, and double the SNL US REIT Office Index. Alexandria’s value has almost doubled during this time, and produced returns 2.3 times better than such well known competitors as Vornado Realty Trust and Boston Properties.

In 1983, Joel Marcus was a lawyer in the IPO market when he noticed the high value launch of biotech firms like Amgen and Genentech. He began tracking the growth of biotechs to see what kind of opportunity might appear to serve these high growth companies.

By 1994 Marcus realized that these companies were struggling to find appropriate real estate to serve their unique needs for laboratory space, and the infrastructure these labs require. It was a classic under-served market, and it was growing fast.

Jacobs Engineering (NYSE:JEC) was serving some of these companies’ needs, including erecting structures for them. But Jacobs did not own any buildings or consider itself a real estate developer. So Marcus approached Jacobs about starting a company to meet the real estate needs of this high growth biotech industry. Marcus put up some money, Jacobs put up some money, and other friends/associates combined to raise $19 million. There was no professionally managed money involved – and no real estate developers.

Focusing on the rapidly expanding biotech scene in San Diego, the newly created Alexandria bought 4 buildings. They refocused the buildings on the unserved needs of local biotech companies and did a quick flip, breaking even on the transaction. With just a bit of money Alexandria had proven that the market existed, the trend was real and users were under-served.

But, like any idea based on an emerging trend, growing was not easy. Using their first transaction as “proof of concept” CEO Marcus and his team set out to raise $100 million. Quickly Paine Webber (now UBS) secured $75 million in debt financing. But moving forward required raising $25 million in equity.

Over the next few weeks Alexandria pitched a slew of nay-sayers. From GE Capital to CALPERS investors felt that their first deal was a “1-trick pony,” and this “niche market” was not a sustainable business. Finally, after 29 failed pitches, the AEW pension fund, an early stage real estate investor, saw the trend and invested.

The Alexandria team realized that fast client growth meant there was no time to develop from ground up. They focused on high growth geographies for biotech, places where the trend was more pronounced, and bought 11 existing properties:

- In Seattle they found a cancer center they could buy, improve and do a sale-leaseback

- In San Francisco they identified a portfolio of properties in Alameda they could improve, lease to biotech companies and even suit the needs of the FDA as a tenant

- In Maryland they identified opportunities to support the lab needs of the Army Corps of Engineers forensic research lab, and ATF testing lab for imported vodka, and a medical testing lab near Dulles – which is now leased to Quest Diagnostics

Realizing that companies needing labs tended to cluster, leadership focused on finding locations where clusters were likely to emerge. They bought land in San Francisco, San Diego, New York and Worcester, MA. What looked like risky locations to others looked like profitable opportunities to Alexandria due to their superior trend research.

Historically pharma companies built their headquarters, and labs, in suburban locations where development was easy, and labs were welcome. Alexandria realized the new trend for emerging companies was to be near universities in urban environments, and although land was costly — and development more difficult — this was the right place to leverage the trend.

Today Alexandria is the bona fide market leader in labs and tech facilities in the USA. By seeing the trend early they bought land which is now so expensive it is practically untouchable – even for $1 billion. Their development pipeline includes Mission Bay, Kendall Square, the Manhattan borough of New York City and RTP (Research Triangle Park.) Today companies want to be where the lab is — and frequently the lab space is now owned, or being developed, by Alexandria.

This didn’t happen by accident. Not at the beginning nor as Alexandria plans its future growth. The company maintains a team of 13 researchers studying market trends in technology, and under-served real estate needs. They constantly track employers of tech/research people, competitors, historical and emerging customers — and identify prospective tech tenants who will need specialized real estate. A few of the leading trends Alexandria follows include:

- Urbanization — The siloed campuses set in bucolic suburbs is the past

- Innovation externalization — Over 50% of innovation in big pharma is now outsourced. And universities are spinning out innovations faster than ever into development centers for testing and commercialization

- Nutrition and disease management — These are emerging markets ripe with new products making their way to commercialization, and needing space to grow

Alexandria’s historical and ongoing successes relied first and foremost on using trends to understand underserved markets where needs will soon be the greatest. This is an important lesson for all businesses. No matter what you do, what you sell, or your industry you can generate higher returns, outperform your peers, and outperform the market rewarding investors by identifying trends and investing in them.

Thanks to Joel Marcus for providing an interview to explain the history and current practices at Alexandria.

by Adam Hartung | Feb 7, 2017 | Investing, Trends

The vast majority of individual investors have no idea how to pick stocks. So they often let someone else invest for them, and pay a hefty fee of anywhere from 1% to 5% of their assets annually. Or they buy some sort of fund or portfolio index, where they pay the fund manager usually more than 1% of assets for managing the fund. In the worst case, they pay the financial advisor their fee, and then the advisor buys a fund for the investor – which has that investor paying anywhere from 2% to 8% or even 10% of assets annually for investment advice.

Yet, we know that few asset managers can beat “the market,” whether measured by the DJIA (Dow Jones Industrial Average) or the S&P 500. A study in Europe showed no active manager beat their benchmark over 10 years, and in the U.S. 80% to 90% of fund managers failed to do as well as their benchmarks. And there are studies showing that even if a manager beats their index, after accounting for management fees and costs the investors almost never beat the market.

Any individual could buy the market index by simply opening an on-line account at any discount brokerage, for a very small cost, and buying the exchange traded fund (ETF) for the Dow (DIA – often called “Diamonds”) or the S&P (SPDR – often called “Spiders”). Thus, individual investors can do as well as the “market” at very, very low cost. Most academics will tell investors to not try and beat the market, because the market is wildly inefficient and investors are always without full knowledge of the company, and thus buy these indices.

But most investors are lured by the notion of “beating the market” so they pay the high fees in order to – hopefully – have someone do a better job of investing. And they end up disappointed.

Investors can “beat the market,” but it requires a different approach to investing than fund managers use. And it is far more suited to individuals, with long-term horizons – and it avoids paying those outrageous financial services fees. To be a long-term high-return investor individuals simply need to invest in trends.

247wallst.com published an article stating the editors had seen a report published by Jefferies, sent to them by Bloomberg, which claimed that 20% of all the gains in the total stock market since 1924 (some 93 years) were created by a mere 14 stocks. This sort of blows up all academic theories about investing in portfolios, as it drives home that most market returns are driven by a small collection of companies. Individuals would be better off if they invested in just a few stocks, rather than all stocks. But this means you have to know which stocks to own.

You would think this might be hard, until you look at the list of 14. There is a striking pattern. All were simply the biggest, most powerful companies leading an important, large trend. So if you identified the trend, and invested in the largest company creating that trend, you would do really well. And because these are large companies, investors aren’t carrying the risk of small companies that could be competitively destroyed by larger players. Interestingly, identifying these trends and the large players really isn’t that hard. Nor is it hard to recognize when the trend is ending, and it is time to sell.

We can understand this by looking at the list of 14 not by how much market gain they created, but rather historically when the majority of those gains occurred.

People have enjoyed smoking tobacco since at least the 1500s. Long before anyone knew about the chemical affects and shortened lifespan people simply enjoyed the practice of smoking and the impact nicotine had on them. As tobacco spread from France to England, eventually it moved to the U.S. and was the first ever cash crop – grown in America for sale in Europe. For literally hundreds of years the trend toward tobacco consumption grew. So, it is easy to understand why investing in Phillip Morris, which was renamed Altria, was a good move. As long as people kept buying more cigarettes investing in the largest cigarette company was a good way to increase your returns.

For hundreds of years people used whale oil and similar animal products for candles and lanterns. Wood and coal were used for cooking. But then in 1859 oil was successfully found, and it changed the world. Oil was far cheaper to produce than animal or vegetable oils and burned more consistently at a higher temperature than those products, wood or coal. And that unleashed a trend toward hydrocarbon production leading to the birth of countless new products. It would not have been hard to see that this trend was going to be very valuable. Thus two other names on the list pop up, Exxon and Chevron. These companies are successors of the original Standard Oil founded by John Rockefeller – which created tremendous returns for investors for many years as oil consumption, and production, grew.

Hydrocarbons were a tremendous contributor to the industrial revolution, allowing manufacturers to use engines in new products, and to improve their manufacturing. One of the earliest, and soon biggest, manufacturers was General Electric, another big value producer on the list of 14. And one of the biggest industrial revolution gains was the automobile, where General Motors became by far the largest producer. Investors who put money into the industrial revolution and the trend toward making things – especially cars – came out very well by buying shares in these two companies.

As the industrial revolution grew the middle class emerged, enjoying a vast improvement in quality of life. This led to the trend of consumerism, as it was possible to make things much cheaper and distribute them wider. Three of the biggest companies that promoted this consumer trend were Johnson & Johnson, Proctor & Gamble and Coca-Cola. All were in different product markets, but all were very big leaders in the growth of consumer products for a 1900s world (especially post-WWII) where people had more money – and the desire to buy things. And all three did very well for their investors.

Soon a new trend emerged with the capability of electronics. First came the advent of instant, modern communications as the telephone emerged. Regardless the cost, there was high value in being able to communicate with someone “now” even if they were in a distant location. Investors in Alexander Bell’s AT&T did quite well as phones made their way across America and around the world.

Soon thereafter mechanical adding machines were greatly improved by using electronics – initially relays – to make tabulations and computations. IBM was an early developer of these machines for commercial use, and very quickly came to dominate the market for computers. It was not long before every company needed a computer, or at least access to use one, in order to compete. Investors in IBM were well rewarded for spotting this trend.

As the market for consumer goods exploded Sam Walton recognized the inefficiency of retail product distribution. He discovered that by owning more stores he could negotiate better with consumer goods manufacturers, purchase products more cheaply and sell them more cheaply. He created the trend toward mass retailing driven by efficiency, and he rapidly demonstrated the ability to drive competitors completely out of many retail markets. Investors who identified this trend toward low-cost retailing of a wide product array made considerable gains by purchasing Wal-Mart shares.

As computers became smaller the market expanded, leading to the development of ever smaller computers. Microsoft created software allowing multiple manufacturers to build machines with interoperability, allowing it to take a dominant position in the trend to computers so small every single person could have one – and indeed eventually felt they could not live without one. Microsoft investors made huge gains as the company practically monopolized this trend and created the personal compute marketplace.

It was Apple that first recognized the trend toward mobility being created by ever faster connection speeds. Mobility would allow for radical changes in how many product markets behaved, and investors who saw this mobility trend were amply rewarded for investing in Apple – the company that became synonymous with internet-enabled products.

And as computing mobility improved it created a trend toward buying at home rather than going to a store. Mail order had almost entirely disappeared, due to lack of timely product fulfillment. But with the internet as the interface, coupled with modern, highly efficient transportation services, Amazon was able to give a rebirth to shopping from home and the e-commerce trend exploded. Investors that recognized Amazon’s vastly lower cost retail model, coupled with the infinite prospects for product variety, have been rewarded for investing in the large on-line retailer.

These 14 companies created 20% of all stock market gains across nearly a century. And each was the dominant competitor in a major trend. Several are no longer on the trend, and even a couple have filed bankruptcy (like AT&T and GM), thus it is easy to recognize why some have done far less well the last decade. The world changed and their business model which once produced excellent returns no longer does. But savvy investors should recognize when a trend has run its course, and drop that company in favor of investing in the leader of a major, new trend.

All investors should be long-term investors. Trying to be a market timer, and a trader, is a fool’s errand. To make high investment returns requires taking a long-term (multi-year) view – not monthly or quarterly. Therefore it is important that when investing in trends they be big trends. Trends that will have a large impact on every business – every person. Trends that can generate tremendous returns for many years.

Not everyone can be a stock picker. Therefore, most investors should probably have a goodly chunk of their money in an ETF. That can be done easily enough as described above. But, if you want to increase your returns to beat the market the key is to invest in companies that are large, and the leaders in a major trend.

What are the big trends today? There is no doubt “social” is a huge trend. How every business and person interacts is changing as the use of social tools increases. This is a global phenomenon, and it is a trend with many years left to extend its impact. Investing in the market leader – Facebook – shows good likelihood of obtaining the kind of returns created by the 14 companies discussed above.

What other trends can you identify that have years yet to go? If you can spot them, and invest in a dominant, large leader then you just may outperform nearly every active fund manager trying to get you to pay their fees.

by Adam Hartung | Jan 28, 2017 | Immigration, Leadership, Politics, Trends

(Photo: NICHOLAS KAMM/AFP/Getty Images)

“Get the assumptions wrong and nothing else matters” – Peter F. Drucker

President Donald Trump made it very clear last week that his administration intends to build a border wall between the U.S. and Mexico. And he intends to make Mexico pay for it. He is so adamant he is willing to risk U.S./Mexican relations, canceling a meeting with the Mexican president.

Unfortunately, this tempest is all because of a really bad idea. The wall is a bad idea because the assumptions behind this project are entirely false. Like far too many executives, President Trump is building a plan based on bad assumptions rather than obtaining the facts – even if they belie his assumptions – and developing a good solution. Making decisions, and investing, on bad assumptions is simply bad leadership.

The stated claim is Mexico is sending illegal immigrants across the border in droves. These illegal immigrants are Mexican ne’er do wells who are coming to America to live off government subsidies and/or commit criminal activity. The others are coming to steal higher paying jobs from American workers. America will create a h

Unfortunately, almost everything in that line of logic is untrue. And thus the purported conclusion will not happen.

1. Although it cannot be proven, analysts believe the majority (possibly vast majority) of illegal immigrants enter America by air. There are two kinds of illegal immigration. President Trump’s rhetoric focuses on “entries without inspection.” But most illegal immigrants actually arrive in America with a visa – and then simply don’t leave. These are called “overstays.” They come from Mexico, India, Canada, Europe, Asia, South America, Africa – all over the world. If you want to identify and reduce illegal immigration, you need to focus on identifying likely overstays and making sure they return. The wall does not address this.

3. More non-Mexicans than Mexicans were apprehended at the U.S. border – and the the number of Mexicans has been declining. From 1.6 million in 2000, by 2014 the number dwindled to 229,000 (a decline of 85%). If you want to stop illegal border immigrants into the U.S., the best (and least costly) policy would be to cooperate with Mexico to capture these immigrants as they flee Central America and find a solution for either housing them in Mexico or returning them to their country of origin. It is ridiculous to expect Mexico to pay for a wall when it is not Mexico’s citizens creating the purported illegal immigration problem on the border.

4. In 2015 over 43,000 Cubans illegally immigrated to the U.S. – about 20% as many as from Mexico. The cost of a wall is rather dramatically high given the weighted number of illegal immigrants from other countries.

5. The number of illegal immigrants living in the U.S. is actually declining. There are more Mexicans returning to live in Mexico than are illegally entering the U.S. Between 2009 and 2014 over 1 million illegal Mexican immigrants willingly returned to Mexico where working conditions had improved and they could be with family. In other words, there were more American jobs created by Mexicans returning to Mexico than “stolen” by new illegal immigrants entering the country. If the administration would like to stop illegal immigration the best way is to help Mexico create more high-paying jobs (say with a trade deal like NAFTA) so they don’t come to America, and those in America simply choose to go to Mexico.

6. Illegal immigrants are not “stealing” more jobs every year. Since 2006, the number of illegal immigrants working in the U.S. has stabilized at about 8 million. All the new job growth over the last decade has gone to legitimate American workers or legal immigrants working with proper papers. Illegal immigration is not the reason some Americans do not have jobs, and blaming illegal immigrants is a ruse for people who simply don’t want to work – or refuse to upgrade their skills to make themselves employable.

7. Illegal immigrants in the U.S. is not a rising group – in fact most illegal immigrants have been in the U.S. for over 10 years. In 2014, over 66% of all illegal immigrants had been in the U.S. for 10 years or more. Only 14% have been in the U.S. for 5 years or less. We don’t have a problem needing to stop new illegal immigrants (the ostensible reason for a wall). Rather, we have a need to reform immigration so all these long-term immigrants already in the workforce can be normalized and make sure they pay the necessary taxes.

8. The states where illegal immigration is growing are not on the Mexican border. The states with rising illegal immigration are Washington, Pennsylvania, New Jersey, Virginia, Massachusetts and Louisiana. Texas, New Mexico and Arizona have seen no significant, measurable increase in illegal immigrants. And California, Nevada, Illinois, Alabama, Georgia and South Carolina have seen their illegal immigrant population decline. A border wall does not address the growth of illegal immigrants, as to the extent illegal immigrants are working in the U.S. they are clearly not in the border states.

Good leaders get all the facts. They sift through the facts to determine problems, and develop solutions which address the problem.

Bad leaders jump to conclusions. They base their actions on outdated assumptions. They invest in the wrong places because they think they know everything, rather than making sure they know the situation as it really exists.

America’s “flood of illegal immigrants” problem is wildly overblown. Most illegal immigrants are people from advanced countries, often with an education, who overstay their visa limits. But few Americans seem to think they are a problem.

Most border crossing illegal immigrants today are minors from Central America simply trying to stay alive. They aren’t Mexican criminals, stealing jobs, or creating a crime spree. They are mostly starving.

President Trump has “whipped up” a lot of popular anxiety with his claims about illegal Mexican immigrants and the need to build a border wall. Interestingly, the state with the longest Mexican border is Texas – and of its 38 congressional members (36 in Congress, 2 in the Senate and 25 Republican) not one (not one) supports building the wall. The district with the longest border (800 miles) is represented by Republican Will Hurd, who said “building a wall is the most expensive and least effective way to secure the border.”

Good leaders do not make decisions on bad assumptions. Good leaders don’t rely on “alternative facts.” Good leaders carefully study, dig deeply to find facts, analyze those facts to determine if there is a problem – and then understand that problem deeply. Only after all that do they invest resources on plans that address problems most effectively for the greatest return.

by Adam Hartung | Jan 16, 2017 | Economy, Politics, Trends

Trend analysis is the most critical part of planning.

Some trends are hard to spot, because people think they are just a fad. Many folks think electric cars fit that category.

Other trends are hard to accept because they imply a big shift in how we live or work – or how we run our business. Scores of IT people who have written me over the years saying mobile devices on common networks (telecom to AWS) will never replace PCs connected to server farms. The implications of this trend are severely negative related to demand for their skills, so they ignore it.

But every plan should be built on trends, because these forecasts are critical for decision-making. It’s the future that matters, not the past. Too often plans are built on history, when trends clearly indicate that things are going to change, and old assumptions are outdated.

Demographic trends are easy to forecast, and important.

While some trends are hard to forecast, some trends are really easy to spot and forecast. And the easiest trend to understand is demographics. If you don’t use any other trends in your planning, you should have demographic trends at the core of your assumptions.

Take for example the movement of people across the United States. Ever since the wagon train people have been moving west. And, like my friend Buckley Brinkman (executive director and CEO of the Wisconsin Center for Manufacturing and Productivity) likes to say, “ever since the invention of air conditioning people have been moving south.” Yet, I’m startled how few organizations plan for this shift and adjust their strategies and tactics to be more successful.

From July 1, 2015 to July 1, 2016 the seven fastest growing states were western. And of 50 states, only eight lost population.

Growth is sublime, decline is disastrous.

Bruce Henderson, founder of the Boston Consulting Group, used to say that if you want to hunt or farm you’re far better off in the Amazon than you are in the Arctic. Basically, where there are resources, and lots of growth, it’s a lot easier to succeed.

For business, this means that if you want to grow your business – whether you’re installing HVAC systems or building a state-of-the-art battery manufacturing plant – you’ll find it relatively easier in faster growing states. It doesn’t mean there is no competition, but it does mean that growth makes it easier for competitors to succeed.

Contrastingly, there were eight states that lost population in this same 12 months.

This means that competition is intensifying in these states. As people move out there are fewer customers to buy what each business sells, so these companies have to fight harder, and price lower, to grow – or even maintain. As the population declines taxes have to go up because there are fewer taxpayers to cover government costs. These states become less desirable places for business.

The businesses in Illinois, for example, are in the middle of a bare-knuckle brawl over the state budget that has gone on for two years. The Governor and the legislature cannot agree on how to manage costs, or revenues. Bond ratings have been slashed as costs to borrow have gone up. Several services have been shut down, and student costs at universities have gone up while programs have been gutted or discontinued.

Governor Rauner (R – IL) has repeatedly said he wants Illinois to be more like Indiana, its neighbor to the east. Perversely people apparently are listening, because Illinois is shrinking, while Indiana grew a healthy 0.31%. For residents remaining in Illinois this worsens a host of maladies:

• the state’s jobs situation struggles as the number of paying jobs declines, making it harder to recruit new talent, or even keep its own university graduates;

• Illinois’ pension problems worsen, as there are fewer people paying into the pension funds while those drawing out funds keep increasing;

• Illinois is unable to fund schools properly, especially Chicago, due to less income – forcing up property taxes;

• taxes keep rising due to fewer people and businesses (when adding property taxes, sales taxes and income taxes Illinois is now the highest tax state in the country);

• new highways are being built with federal funds, but other infrastructure is in trouble, as city, county and state roads are pothole ridden. Trains and subways become outdated and fall into disrepair. And one-time budget Hail Mary’s, like Chicago selling its parking structures and meters in order to balance the budget for one year, strip citizens of future revenues while they watch parking (and other) service costs skyrocket;

• and Chicago has suffered the lowest real estate recovery rate of the top 30 major U.S. cities –not even returning to prices in 2008.

Growth solves a multitude of sins.

Just like a rising tide raises all boats, growth creates more growth. More people increases demand for everything, which increases business sales, which increases jobs and wages, which increases the value of real estate and household wealth, which increases tax revenue, which allows offering more services to make a state even more appealing.

On the other hand, shrinking can become like the whirlpool over a drain. As the problems increase more people decide to leave, making the problems worsen. As more people go, there are fewer people left behind to make things better. Jobs go away, wages fall, demand drops, real estate prices drop, infrastructure projects stop, services stop and yet taxes have to be raised on the fewer remaining residents.

Few trends are more important for planning than understanding demographics. Demographics affect demand for everything, and planning for changes offers businesses the opportunity to be in the right place, at the right time, to be more successful. And, demographic trends are some of the easiest to predict:

• population size

• average age, and sizes of age groups

• average income, and sizes of income groups

• ethnicity

• religion

Plans should be based on trends, not history. Understanding trends, and their trajectory, can help you be in the right market, at the right time, with the right product in order to succeed. There are lots of trends, but one that is fairly obvious, and incredibly important, is simply understanding demographics. Is this built into your planning system?

by Adam Hartung | Jan 6, 2017 | Advertising, Innovation, Marketing, Mobile, Trends, Web/Tech

It’s been over a decade since the Internet transformed print media.

Very quickly the web’s ability to rapidly disseminate news, and articles, made newspapers and magazines obsolete. Along with their demise went the ability for advertisers to reach customers via print. What was once an “easy buy” for the auto or home section of a paper, or for magazines targeting your audience, simply disappeared. Due to very clear measuring tools, unlike print, Internet ads were far cheaper and more appealing to advertisers – so that’s where at least some of the money went.

In 2012 Google surpassed all print media in generating ad revenue. Source Statista courtesy of NewspaperDeathWatch.com

While this trend was easy enough to predict, few expected the unanticipated consequences.

1. First was the trend to automated ad buying. Instead of targeting the message to groups, programmatic buying tools started targeting individuals based upon how they navigated the web. The result was a trolling of web users, and ad placements in all kinds of crazy locations.

Heaven help the poor soul who looks for a credenza without turning off cookies. The next week every site that person visits, whether it be a news site, a sports site, a hobby site – anywhere that is ad supported – will be ringed with ads for credenzas. That these ads in no way connect to the content is completely lost. Like a hawker who won’t stop chasing you down the street to buy his bad watches, the web surfer can’t avoid the onslaught of ads for a product he may well not even want.

2. Which led to the next unanticipated consequence, the rising trend of bad – and even fake – journalism.

Now anybody, without any credentials, could create their own web site and begin publishing anything they want. The need for accuracy is no longer as important as the willingness to do whatever is necessary to obtain eyeballs. Learning how to “go viral” with click-bait keywords and phrases became more critical than fact checking. Because ads are bought by programs, the advertiser is no longer linked to the content or the publisher, leaving the world awash in an ocean of statements – some accurate and some not. Thus, what were once ads that supported noteworthy journals like the New York Times now support activistpost.com.

3. The next big trend is the continuing rise of paid entertainment sites that are displacing broadcast and cable TV.

Netflix is now spending $6 billion per year on original content. According to SymphonyAM’s measurement of viewership, which includes streaming as well as time-shifted viewing, Netflix had the no. 1 most viewed show (Orange is the New Black) and three of the top four most viewed shows in 2016.

Increasingly, purchased streaming services (Netflix, Hulu, et.al.) are displacing broadcast and cable, making it harder for advertisers to reach their audience on TV. As Barry Diller, founder of Fox Broadcasting, said at the Consumer Electronics Show, people who can afford it will buy content – and most people will be able to afford it as prices keep dropping. Soon traditional advertisers will “be advertising to people who can’t afford your goods.”

4. And, lastly, there is the trend away from radio.

Radio historically had an audience of people who listened to their favorite programming at home or in their car. But according to BuzzAngle that too is changing quickly. Today the trend is to streaming audio programming, which jumped 82.6% in 2016, while downloading songs and albums dropped 15-24%. With Apple, Amazon and Google all entering the market, streaming audio is rapidly displacing real-time radio.

Declining free content will affect all consumers and advertisers.

Thus, the assault on advertisers which began with the demise of print continues. This will impact all consumers, as free content increasingly declines. Because of these trends, users will have a lot more options, but simultaneously they will have to be much more aware of the source of their content, and actively involved in selecting what they read, listen to and view. They can’t rely on the platforms (Facebook, etc.) to manage their content. It will require each person select their sources.

Meanwhile, consumer goods companies and anyone who depends on advertising will have to change their success formulas due to these trends. Built-in audiences – ready made targets – are no longer a given. Costs of traditional advertising will go up, while its effectiveness will go down. As the old platforms (print, TV, radio) die off these companies will be forced to lean much, much heavier on social media (Facebook, Snapchat, etc.) and sites like YouTube as the new platforms to push their product message to potential customers.

There will be big losers, and winners, due to these trends.

These market shifts will favor those who aggressively commit early to new communications approaches, and learn how to succeed. Those who dally too long in the old approach will lose awareness, and eventually market share. Lack of ad buying scale benefits, which once greatly favored the very large consumer goods companies (Kraft, P&G, Nestle, Coke, McDonalds) means it will be harder for large players to hold onto dominance. Meanwhile, the easy access and low cost of new platforms means more opportunities will exist for small market disrupters to emerge and quickly grow.

And these trends will impact the fortunes of media and tech companies for investors The decline in print, radio and TV will continue, hurting companies in all three media. When Gannet tried to buy Tronc the banks balked at the price, killing the deal, fearing that forecasted revenues would not materialize.

Just as print distributors have died off, cable’s role as a programming distributor will decline as customers opt for bandwidth without buying programming. Thus trends put the growth prospects of companies such as Comcast and DirecTV/AT&T at peril, as well as their valuations.

Privatized content will benefit Netflix, Amazon and other original content creators. While traditionalists question the wisdom of spending so much on original content, it is clearly the trend and attracts customers. And these trends will benefit streaming services that deliver paid content, like Apple, Amazon and Google. It will benefit social media networks (Facebook and Alphabet) who provide the new platforms for reaching audiences.

Media has changed dramatically from the business it was in 2000. And that change is accelerating. It will impact everyone, because we all are consumers, altering what we consume and how we consume it. And it will change the role, placement and form of advertising as the platforms shift dramatically. So the question becomes, is your business (and your portfolio) ready?

by Adam Hartung | Dec 23, 2016 | Advertising, Marketing, Trends, Web/Tech

‘Tis the season of holiday giving. We hunt for just the right gift, for just the right person, to make sure they know we care about them. This act of matching a gift to the person has tremendous importance, because it demonstrates care from the giver about the recipient.

Once advertising was like that. Marketers built brands with loving care. They worked very hard to know the target for their brand (and product) and they carefully crafted every nuance of the brand – imagery, typography, colors, images, sounds – even spokespeople (famous or created) to project that brand properly for the intended customers. We’ve seen great brand images over time, from Tony the Tiger promoting cereal to start your day to Ronald McDonald bringing a family together.

SAUL LOEB/AFP/Getty Images

Ad placement delivered the brand’s gift to the customer.

And, once upon a time, how that brand was placed in front of targeted customers was every bit as crafted as the brand itself. Marketers worked with ad agencies to make sure newspaper, magazine, billboard location, radio show or TV program matched the brand. The brand was considered linked not just to the medium, but to the message that medium projected. Want to sell a muscle car, you promoted it via media focused on sports, DIY projects, men’s health – a positive connection between the media’s message/content and the advertiser’s goal for the brand.

And marketers knew that if they put their brand with the right media content, in front of their targets, it would lead to brand identification, brand enhancement, and sales growth. The objective wasn’t how many people saw the ads, but putting the ad in front of the right people, associated with the right content, to build on the brand’s value, and make the products more appealing to target buyers. Placement led to sales.

Just like finding the right gift is important for the holidays, matching the gift to the recipient, finding the right ad placement was very important to the customer. It was an act of diligence on the part of the advertiser to demonstrate to target customers “hey, I know you. I get where you’re coming from. I connect with you.”

Then the internet changed everything.

In the old days marketers really didn’t know how many people connected with their ads post-placement. There were raw numbers on readers/listeners/viewers, but nothing specific. There was a lot of trust by the marketer that “owned” brand placed in working with the ad agencies to link the brand to the right media – the right content – so that brand would flourish and product sales would grow.

Yes, ads were measured for their appeal, how well they were remembered and audience coverage. But these metrics, and especially raw volume numbers, were each just one piece of how to craft the brand and deliver the message. It was reaching the right people that mattered, and that required people to make media decisions – and that required really knowing the content tied to the ad being placed.

Marketers clearly understood that customers knew the product paid for those ads to promote that content. Customers linked the brand and the content, and thus it was important to make sure they matched. The content had to be right for the ad to have its intended affect.

But in the internet age, all that caring about customers, branding and links to the right content began disappearing. Instead, ad decisions were dominated by metrics – “how many placements did my ad receive?” “how many people saw my ad?” “how many people clicked on my ad?” “how many page views does this web site generate?” “how many page views does this writer/blogger generate?” The brand was being lost – the customer was being lost – in identifying how many people saw the ad, and whether or not they clicked on it, and where they went after the ad was presented on the web page.

And, the worst of all, “Do we have the information to know who this internet surfer is, follow them, and deliver ads to them as they cross pages and web sites?” At this point, content no longer mattered. If some page viewer was known to be looking for a desk, ads for desks would be placed on page after page the reader (potential customer) visited — regardless the content!

Marketers allowed their brands to be disconnected from the content entirely – ouch.

In the era of programmatic ad buying, content no longer matters. Follow the target, hammer on them with ads, even if the brand is positioned first next to information on weather, and next on a site about buying inexpensive baby clothes, and next on a site about high end power tools.

The care and crafting of ad buying, which was crucial to brand building and demonstrating customers really mattered to those who created and crafted the products, and brand, was lost.

In 2016, we saw the ultimate in forgetting brand value while programmatically placing ads. “Fake news” emerged. And marketers started to see their ads next to those fake (often invented and totally false) stories, just like they would be placed next to legitimate information. The breakdown between content and brand was complete. In the unbridled pursuit of “eyeballs” brands were paying for the worst any media could offer – not journalism or legitimate content, but outright crap.

The election served to demonstrate this in an entirely new way. People went to websites, formerly considered “fringe,” such as Breitbart, to find out information on candidates and their supporters. And there would be ads. The ad was following the eyeballs, no longer the content. Family product ads, such as for cereal, were suddenly appearing next to content that was in no way associated with the marketer’s goal for that brand image.

And by being content independent, these programmatic ads were not just harming the brands – they supported bad journalism, and bad content.

“Click bait” became ever more important. With no people involved in ad buying, ads were no longer were tied to content so there was no “editorial” management of how the ad was placed. What those smart ad buyers once did, helping to build the brand, was lost. Now, any writer who could figure out how to use the right key words – and often outrageous content (of any kind) – was able to pull eyeballs. If s/he could pull eyeballs – regardless of the content – they pulled ads. And that pulled dollars.

Media brand value was dramatically lost – and journalism suffered.

In other words, you no longer needed the credibility of a brand like NBC, Wall Street Journal, ESPN, Forbes, etc. to obtain ads. Those old media brands worked hard to make edited content, reliable content, available to readers – and something a brand marketer could understand and use to build her customer base. But now all a publisher/producer needed was something that brought in eyeballs – and often the more outrageous, more salacious, more demeaning, more hostile, more ridiculous the content the more eyeballs were attracted (like watching a train wreck).

And the more this pulled ad money to non-journalistic, bad content, and away from legitimate content providers that focused on building their brand, the more it hurt journalism and marketing. What a decade ago seemed like a possible fear came true in 2016. Unharnessed media access by everyone was proven to lead to the growth of bad journalism as funds for good research, writing, editing and masthead curating was lost to those who demonstrated merely the ability to pull eyeballs.

Those who have benefited from this shift think programmatic ad buying is great. To them if people want to read from their site, look at their photos, cartoons and other images, or watch videos then these site owners claim there is no reason that advertisers should complain. “If people want this content, then why shouldn’t we be paid to create it. This is a monetized democracy of the media putting the customer in control.”

But that is simply not true. Customers link the brand message to the content on the screen. And there should be care taken to make sure that content and the brand message link. And that’s where programmatic ad buying is failing everyone.

Net/net, we need people involved in ad placement. Just as we care about the gifts we give at holidays, it takes a personal touch to make that selection work. It takes people to craft the delivery of ads.

Hopefully in 2017, the lessons of 2016 will become very clear, causing marketers and advertisers to rely far less on programmatic, and get people involved in ad placement once again. For the good of brands and for decent content.

Happy Holidays!

by Adam Hartung | Dec 22, 2016 | Newsletter Post, Trends

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Happy Holidays and gifts for my loyal readers!

This is my last newsletter of 2016 and I have seen a strong growth in new subscribers to the email newsletter, follows on my Forbes blog and in visits to my website.

Thank you!

We have covered many topics around my passion- business growth through innovation. In my presentations around the world this year, there has been one common challenge to growth- how to best target limited resources to maximize returns. The best answer to identifying opportunities for disruptive innovation has been to look beyond the past internal and even industry trends and watch the trends outside the company, its current competitors and even the industry.

Disruptive innovation is so named because it often exists quietly on the fringes of the market, deep inside customers or in another market until it is suddenly “discovered.” Mountain bikes, snowboarding, Walkman, etc. are examples of the technology curve meeting the market demand curve to produce an “overnight success”. In celebrity circles it’s a performer perfecting his or her craft for years until preparation meets opportunity and just the right role catapults them to fame.

Here are the gifts:

Start the new year with a better insight on your Trend IQ, and a good understanding on how prepared you are to grow in 2017.

Click this link taking you to my web site. Then take the Poll on what trends you are following, and how you obtain trend information. Next, download the TrendIQ Evaluation. Fill out the questions and use that as a mini audit on your use of trends in planning.

Happy Holidays to you and your families! And we wish you a Merry Christmas!

Adam Hartung

“Ships go sailing far across the sea,

Trusting starlight to get where they need to be…

When it seems we have lost our way,

We find ourselves again on Christmas Day! Believe….”

“Believe”, Josh Groban, Polar Express

Don’t hesitate to ask for help in making your organization more adaptable, and your strategy embedded with options to change based on market shifts. Forecasting those key trends will help tell you plan your innovation allocations for the next year.

We are your experts at identifying trends, creating scenarios and building external, market monitoring systems. We’ve done this kind of work for over 20 years, and bring a wealth of experience, and tools, to the task. You don’t have to go into scenario planning alone; we can be your coach and mentor to speed learning, and success.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Give us a

call today, or send an email, so we can talk about how you can be a leader, rather than follower, in 2017 and beyond. Or check out the rest of the

website to read up on what we do so we can create the right level of engagement for you.

Forbes Posts- Hartung on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Dec 17, 2016 | Defend & Extend, Investing, Retail, Trends

Sears recently announced it is closing another big batch of stores. Yawn. Who cares? Sears losses since 2010 are nearly $10 billion, with a $.75 billion loss in just the third quarter. As revenue fell another 13% overall and comparable store sales declined 7.4% investors have fled the stock for years.

Five years ago Sears had 3,510 stores. Now it has 1,687. It has 750 with leases expiring in the next five years and CFO Jason Hollar has said 550 of those are short-term enough they will let those close.

What’s striking about this statement is that Sears is a perfect candidate to file bankruptcy, renegotiate those leases, and start with a new plan for the future. Unless it has no plan. Lacking a plan to make its business successful and return those stores to profitability, the CFO is admitting the company has no choice but to keep shrinking assets as Sears simply disappears. Investors should view Sears as a microcosm of trends in traditional brick-and-mortar retailing across the industry. The business is shrinking. Fast

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

Just look at retail employment. Amidst another strong jobs report for November, retail employment actually shrank. This previously only happened in recessions – and 2016 is definitely not a recession year. And all the losses were in traditional store retailing. Kohl’s said it is hiring almost 13% fewer seasonal workers, and Macy’s says it is hiring 2.4% fewer.

Of course, Amazon seasonal hiring is up 20%.

In January, 2015 I wrote how the trend to e-commerce had taken hold, and traditional retailing would never again be the same. For the 2014 holiday season online retail grew 17%, but brick-and-mortar sales actually declined. This was a pivotal event. It clearly indicated a sea change in the marketplace, and it was clear valuations would be shifting accordingly. Surprising many, but not those who really understood the trends and market shifts, six months later (July, 2015) Amazon’s market cap exceeded that of much larger Wal-Mart.

ALL trends (including mobile use) reinforce on-line growth, brick and mortar decline.

The 2016 holiday season is further reinforcing this trend. The National Retail Federation reported that on black Friday 99 million people went to stores. 108.5million shopped online. Black Friday online sales jumped 21.6%.

And this . E-commerce apps are making the on-line experience constantly better. On Thanksgiving day 70% of all on-line retail traffic was mobile, and for the first time ever 53% of on-line orders were from mobile devices – exceeding the orders placed on PCs. With this kind of access, and easy shopping, the need to travel to physical stores accelerates their decline.

Sears is beyond rescue. Unfortunately, there are a number of retailers already so challenged by the on-line competition that they are “the walking dead.” They will falter, and fail, just like the former Dow Jones Industrial retailing giant. They will not make the shift to on-line effectively. They are unwilling to dramatically change their business model, unwilling to cannibalize store sales to create an aggressively competitive on-line business. Expect bad things at JCPenney, Kohl’s, Pier 1 – and weakness at giants Wal-Mart and even Target.

Christmas used to be the time when investors in traditional retail cheered. Results for the quarter could create great gains in stock values. But that time is long gone – passed during the 2014 inflection when traditional started declining while e-commerce continued double digit growth. One can understand the Scrooge-like mentality of those investors, who dread seeing the shift in customers, and valuation, away from their companies and toward the Amazon’s who embrace trends and market shifts.

by Adam Hartung | Nov 17, 2016 | Food and Drink, In the Swamp, Innovation, Marketing, Trends

(PAUL J. RICHARDS/AFP/Getty Images)

McDonald’s has been trying for years to re-ignite growth. But, unfortunately for customers and investors alike, leadership keeps going about it the wrong way. Rather than building on new trends to create a new McDonald’s, they keep trying to defend extend the worn out old strategy with new tactics.

Recently McDonald’s leadership tested a new version of the Big Mac,first launched in 1967. They replaced the “special sauce” with Sriracha sauce in order to make the sandwich a bit spicier. They are now rolling it out to a full test market in central Ohio with 128 stores. If this goes well – a term not yet defined – the sandwich could roll out nationally.

This is a classic sustaining innovation. Take something that exists, make a minor change, and offer it as a new version. The hope is that current customers keep buying the original version, and the new version attracts new customers. Great idea, if it works. But most of the time it doesn’t.

Unfortunately, most people who buy a product like it the way it is. Slower Big Mac sales aren’t due to making bad sandwiches. They’re due to people changing their buying habits to new trends. Fifty years ago a Big Mac from McDonald’s was something people really wanted. Famously, in the 1970s a character on the TV series Good Times used to become very excited about going to eat his weekly Big Mac.

People who are still eating Big Macs know exactly what they want. And it’s the old Big Mac, not a new one. Thus the initial test results were “mixed” – with many customers registering disgust at the new product. Just like the failure of New Coke, a New Big Mac isn’t what customers are seeking.

After 50 years, times and trends have changed. Fewer people are going to McDonald’s, and fewer are eating Big Macs. Many new competitors have emerged, and people are eating at Panera, Panda Express, Zaxby’s, Five Guys and even beleaguered Chipotle. Customers are looking for a very different dining experience, and different food. While a version two of the Big Mac might have driven incremental sales in 1977, in 2017 the product has grown tired and out of step with too many people and there are too many alternative choices.

Similarly, McDonald’s CEO’s effort to revitalize the brand by adding ordering kiosks and table service in stores, in a new format labeled the “Experience of the Future,” will not make much difference. Due to the dramatic reconfiguration, only about 500 stores will be changed – roughly 3.5% of the 14,500 McDonald’s. It is an incremental effort to make a small change when competitors are offering substantially different products and experiences.

When a business, brand or product line is growing it is on a trend. Like McDonald’s was in the 1960s and 1970s, offering quality food, fast and at a consistent price nationwide at a time when customers could not count on those factors across independent cafes. At that time, offering new products – like a Big Mac – that are variations on the theme that is riding the trend is a good way to expand sales.

But over time trends change, and adding new features has less and less impact. These sustaining innovations, as Clayton Christensen of Harvard calls them, have “diminishing marginal returns.” That’s an academic’s fancy way of saying that you have to spend ever greater amounts to create the variations, but their benefits keep having less and less impact on growing, or even maintaining, sales. Yet, most leaders keep right on trying to defend & extend the old business by investing in these sustaining measures, even as returns keep falling.

Over time a re-invention gap is created between the customer and the company. Customers want something new and different, which would require the business re-invent itself. But the business keeps trying to tweak the old model. And thus the gap. The longer this goes on, the bigger the re-invention gap. Eventually customers give up, and the product, or company, disappears.

Think about portable hand held AM radios. If someone gave you the best one in the world you wouldn’t care. Same for a really good portable cassette tape player. Now you listen to your portable music on a phone. Companies like Zenith were destroyed, and Sony made far less profitable, as the market shifted from radios and cathode-ray televisions to more portable, smarter, better products.

Motorola, one of the radio pioneers, survived this decline by undertaking a “strategic pivot.” Motorola invested in cell phone technology and transformed itself into something entirely new and different – from a radio maker into a pioneer in mobile phones. (Of course leadership missed the transition to apps and smart phones, and now Motorola Solutions is a ghost of the former company.)

McDonald’s could have re-invented itself a decade ago when it owned Chipotle’s. Leadership could have stopped investing in McDonald’s and poured money into Chipotle’s, aiding the cannibalization of the old while simultaneously capturing a strong position on the new trend. But instead of pivoting, leadership sold Chipotle’s and used the money to defend & extend the already tiring McDonald’s brand.

Strategic pivots are hard. Just look at Netflix, which pivoted from sending videos in the mail to streaming, and is pivoting again into original content. But, they are a necessity if you want to keep growing. Because eventually all strategies become out of step with changing trends, and sustaining innovations fail to keep customers.

McDonald’s needs a very different strategy. It has hit a growth stall, and has a very low probability of ever growing consistently at even 2%. The company needs a lot more than sriracha sauce on a Big Mac if it is to spice up revenue and profit growth.

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)