by Adam Hartung | Jul 14, 2020 | Disruptions, Innovation, Leadership, Marketing, real estate, Retail, Trends

TRENDS: Covid-19 has accelerated a lot of trends. Few more than retail. Oddly some people have taken the view that Covid-19 changed retail. Actually, it didn’t. The pandemic has merely accelerated trends that have been driving industry change for almost two decades.

Back in 2004, Eddie Lampert bought all the bonds of defunct Kmart and used those assets to do a merger with Sears – creating Sears Holdings that encompassed both brands. The day of announcement Chicago Tribune asked for my opinion, and famously I predicted the merger would be a disaster. Clearly both Kmart and Sears were far, far off trends in retail, both were already struggling – and neither had a clue about emerging e-commerce.

Why in 2004 would I predict Sears would fail? The #1 trend in retail was e-commerce, which was all about individualized customer experience, problem solving for customer needs — and only, finally fulfillment. By increasing “scale” – primarily owning a lot more real estate – this new organization would NOT be more competitive. Walmart was already falling behind the growth curve, and everyone in retail was ignoring the elephant in the room – Amazon.com. Loading up on a lot more real estate, more inventory, more employees, more supplier relationships and more community commitments – old ideas about how to succeed related to fulfillment – would hurt more than help. Retail was an industry in transition. All of these factors were boat anchors on future success, which relied on aggressively moving to greater internet use.

Unfortunately, Eddie Lampert as CEO was like most CEOs. He thought success would come from doing more of what worked in the past. Be better, faster, cheaper at what you used to do. In 2011 Sears asked its HQ town (Hoffman Estates) and the state (Illinois) for tax subsidies to keep the HQ there. Sears had built what was once the world’s once tallest building, named the Sears Tower. But many years earlier Sears left, the building was renamed, and Sears was becoming a ghost of itself. I pleaded with government officials to “let Sears go” since the money would be wasted. And it was clear by 2016, that Lampert and his team’s bias toward old retail approaches had only served to hurt Sears more and guarantee its failure. Now – in 2020 – Hoffman Estates has taken the embarrassing act of removing the Sears name from the town’s arena, admitting Sears is washed up.

****

It was with a multi-year observation of trends that I told people in 2/2017 that retail real estate values would crumble . Now mall vacancies are at an 8 year high and 50% of mall department stores will permanently close within a year. We are “over-stored” and nothing will change the fast decline in retail real estate values. Who knows what will happen to all this empty space?

Trends led me in March 2017 to advise investors they should own NO traditional retail equities. Shortly after Sears filed bankruptcy Radio Shack and storied ToysRUs followed. And with the pandemic acting as gasoline fueling change, we’ve now seen the bankruptcies of Neiman Marcus, JCPenney, J Crew, Forever 21, GNC and Chuck e Cheese (but, really, weren’t you a bit surprised the last one was still even in business?) After 3 years of pre-Covid store closings, Industry pundits are finally predicting “record numbers of store closings”. And, after 15 years of predictions, I’m being asked by radio hosts to explain the impact of widespread failures of both local and national retailers ( ). Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

As we move forward, what will happen to your business? Will you build on trends to create a new future where growth abounds? Will you align your strategy with the future so you “skate to where the puck will be?” Or will you – like Sears and so many others – find an ignominious end to your organization? Will the signs change, or will the signs come down? The trends have never been stronger, the markets have never moved faster and the rewards have never been greater. It’s time to plan for the future, and build your strategy on trends (not what worked in the past.)

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jun 24, 2020 | Finance, Manufacturing, Politics, Web/Tech

Americans take it for granted that all currencies are measured against the US Dollar. It’s been that way since WWII, so they just expect it will always be that way. But, things have a way of changing.

In this pandemic the US Federal Reserve is printing money as fast as possible to help prop up the economy. That’s better than the alternative, which would be another Great Depression. But, eventually we have to create value via goods and services to put value in those dollars, or they will be worth a whole lot less. In other words, if we don’t change our fiscal policy to improve production of goods and services, the US Dollar will fall in value – maybe a lot – and it could even lose its status as the world’s “reserve currency.”

Back in 2008, I wrote that there was no inherent reason the US Dollar would be the benchmark for all currencies. It gained that position as the dominant economy after WWII. American’s like to assume superiority, and therefore the US Dollar will always reign supreme. But as I also said in 2008, that’s an assumption that can easily be changed – especially regarding currencies. Lots of factors could cause the US Dollar to suddenly lose a whole lot of value – creating inflation rates that make the 1980s (>18%/year) seem tame.

Since WWII, a lot has happened. Economies in Europe grouped into the Economic Union (EU) making the Euro more powerful. And the economy of China has grown enormously. (China’s economy will be bigger than the USA economy sometime in 2020 or 2021.) Simultaneously, isolationism has hurt growth in America, and caused the EU to lose the UK. What’s rapidly happening is a shift in economic power away from the US and Europe to China.

Additionally, the largest holder of US debt is China. As I pointed out in 2009, this policy of supporting US debt has aided China’s desire to grow. But, as China becomes larger it will no longer need to prop up the US Dollar by purchasing Treasuries. Once bigger than the USA, China could demand that its trade be in Yuan and the value of the dollar could fall very far, very fast.

China has developed enormous inroads into the global economy, across dozens of countries, with its “Belt and Road Initiative” created in 2013. China has quietly become more important to the economy of 70 countries than the USA. Instead of supplying countries guns, China gave them infrastructure and facilities – and jobs – and economic growth. In most of these countries, the USA is more feared than adored, while the Chinese are seen as a very good friend. Meanwhile, the USA “put America first” policies, including trade wars and social justice, have isolated the USA from not only rivals but its global friends – including Europe (threats to kill NATO, for example.)

Now, we are in a pandemic. The Chinese are very determined to control its impact. Meanwhile the USA, UK and many other democracies are being far less careful. If this plays out with a full pandemic recession in the USA, China could stop buying American bonds and the value of the dollar could disintegrate in weeks. Disintegrate as in $1 could be worth 1 penny. It would take bushels of dollars to buy imported goods in stores.

In this election year, the biggest concern is, do those leading the USA realize the peril? Do business leaders? Do you?

by Adam Hartung | Jan 16, 2020 | Boards of Directors, Defend & Extend, Leadership, Software, Web/Tech

People who follow my speaking and writing – including my over 400 Forbes columns – know that I preach the importance of growth. Successful organizations are agile – and agility is the sum of learning + adaptability. Smart organizations are constantly looking externally, gathering data, learning about markets and shifts – then structured to adopt those learnings into their business model and adapt the organization to new market needs.

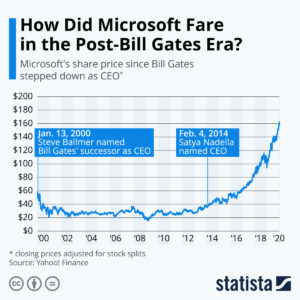

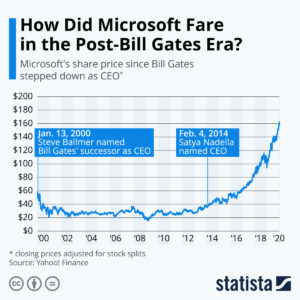

Steve Ballmer was the antithesis of agility. For his entire career he knew only that  Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

So as the market went mobile, Ballmer kept over-investing. He spent billions launching Windows 8, which I predicted was obviously going to fail at growing the Windows market as early as 2012. And it was easy to predict that Win8 tablets were going to be a bust when launched in 2012 as well. But Ballmer was “all-in” on Windows and Office. He was completely locked-in, and unwilling to even consider any data indicating that the PC market was dying – effectively driving Microsoft over a cliff.

It was not hard to identify Steve Ballmer as the worst CEO in America in 2012. When Ballmer took over Microsoft it was worth $60/share. He drove that value down to $20. And the company valuation was almost unchanged his entire 14 years as CEO. He remained locked-in to trying to Defend & Extend PC sales, and it did Microsoft no good. But when the Board replaced Ballmer with Nadella the company moved quickly into growth in gaming, and especially cloud services. In just 6 years Nadella has improved the company’s value by 400%!!!

Success is NOT about defending the past. Success IS about growth. Don’t be locked in to what worked before. Focus on what markets want and need – learn how to understand these needs – and then adapt to giving customers new solutions. Don’t make the mistakes of Ballmer – be a Nadella to lead your organization into growth opportunities!

by Adam Hartung | Dec 27, 2019 | Advertising, Disruptions, Innovation, Television, Trends

In 2020, internet ads will represent over 50% of all advertising money spent. Think about that factoid. An ad medium that wasn’t even important to the ad industry a decade ago now accounts for half of the industry. It took three years after the Dot Com bubble burst for internet advertising to hit bottom, but then it took off and hasn’t stopped growing.

An example of rapid, disruptive change. A market shift of tremendous proportions that has forever changed the media industry, and how we all consume both entertainment and news. Did you prepare for this shift? And is it helping you sell more stuff and make more money?

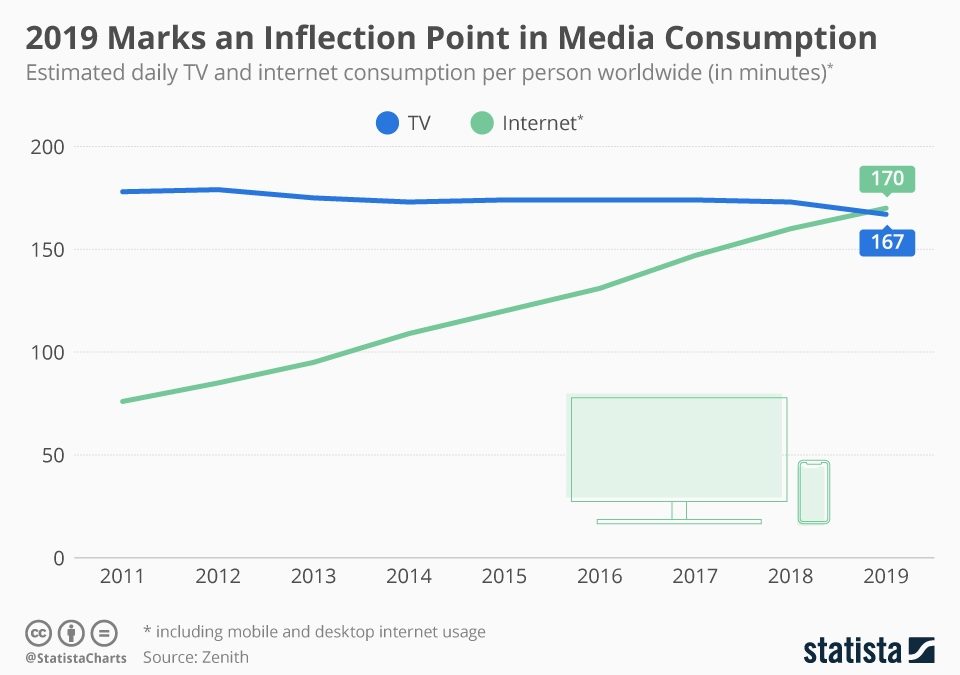

This was easy to predict. Seven years ago (12/10/12), I wrote “The Day TV Died.” The trend was unmistakable – eyeballs were going to the internet. And as eyeballs went digital, so did ads. These new, low cost ads were “democratizing” brand creation and allowing smaller companies to go direct to consumers with products and solutions like never before in history. It was ushering in a “golden age” for small businesses that took advantage.

However, small businesses – and large businesses – largely failed to adjust to these trends effectively. By 3/21/13 I pointed out in “Small Business Leaders Missing Digital/Mobile Revolution” that small businesses were continuing to rely on the least economical forms of media outreach – direct mail and print! They were biased toward what they knew how to do, and old metrics for media, instead of seizing the opportunity. Likewise, by 12/11/14 in “TV is Dying Yet Marketers Overspend on TV” I was able to demonstrate that the only thing keeping TV alive were ad price increases so big they made up for declining audiences. The leaders of big companies were biased toward the TV they knew, instead of the better performing and lower cost new internet media capabilities.

Three years ago (1/6/17), I pointed out in “Four Trends That Will Forever Change Media… and You” it was obvious that digital social media advertising was making a huge impact on everyone. Fast shifting eyeballs were being tracked by new technology, so ads were being purchased by robots to catch those eyeballs – and this meant fake news would be rampant as media sites sought eyeballs by any means. And Netflix was well on its way to becoming the Amazon of media with its own programs and competitive lead.

So the point? It was predictable all the way back in 2012 that digital media would soon dominate. This would change advertising, distribution and content. Now digital advertising is bigger than all other advertising COMBINED. Those who acted early would get a huge benefit (think Facebook/Instagram Path to Media Domination) while those who didn’t react would feel a huge hurt (newspapers, radio, broadcast TV, brick and mortar retail, large consumer goods companies that rely on high priced TV.) But did you take action? Did you take advantage of these trends to make your business bigger, stronger, more profitable, more relevant? Or are you still reacting to the market, struggling to understand changes and how they will impact your business?

The world continues to be a fast changing place. Mobile phones and social media will not go away – no matter what Congress, the UN or the EU regulators do. Global competition will grow, regardless what politicians say. Those who understand how these big trends create opportunities will find themselves more successful. Those who focus on the past, try to execute better with their old “core,” and rely on historical biases will find themselves slowly made irrelevant by those who use new technologies and solutions to offer customers greater need satisfaction. Which will you be? A laggard? Or a leader? Will you build on trends to grow – or slump off into obsolescence? The choice is yours.

by Adam Hartung | Dec 7, 2019 | Entertainment, Innovation, Marketing, Strategy, Television, Trends

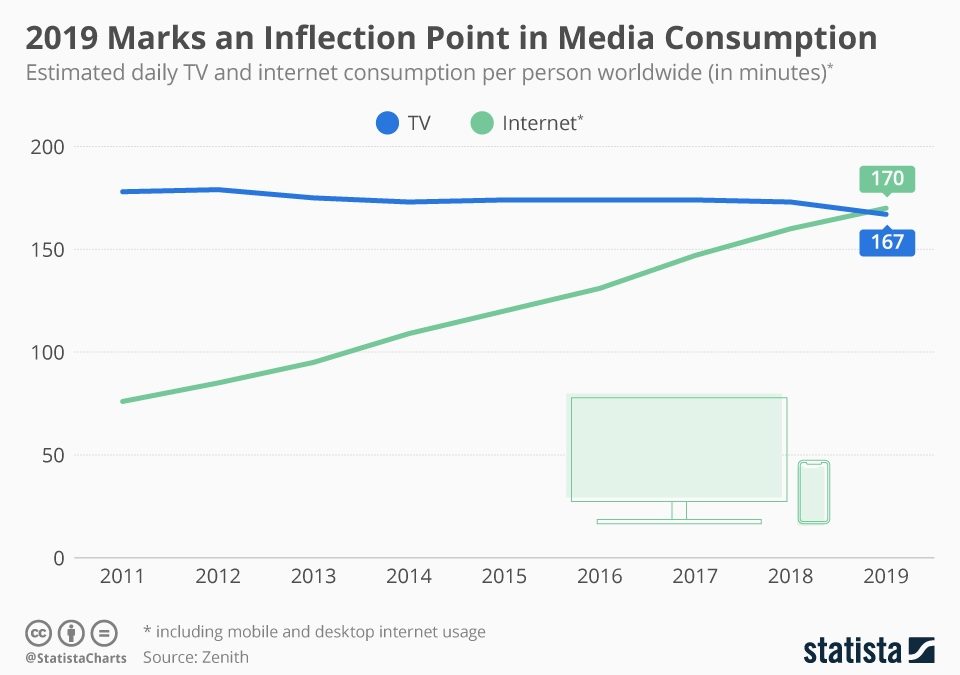

Seven years ago (12 December, 2012) I said it was “The Day TV Died.” There were a LOT of skeptics. At the time, TV was by far still the dominant medium. But the trends were absolutely clear – ad revenues were quickly moving toward on-line opportunities. Print was already well into the grave, and radio was sputtering along with no growth at all. Eyeball momentum had shifted on-line, and thus ads moved on-line, and it was obvious that programming dollars would soon follow – meaning that TV programming was already in Stage 4 termination.

Trends and Tech drove Netflix growth

Meanwhile, Netflix and its brethren were poised to have a fabulous, furious growth. These same trends led me to a full-throated pitch to buy Netflix nine years ago (Nov. 2010.) After Netflix made the decision to raise prices for DVD distribution in order to push people toward streaming the stock crashed, but trends indicated that customer preferences would lead Netflix to be the content winner so despite widespread despair, I called for people to buy the stock in Oct. 2011. In Jan. 2012, I made Netflix one of my top 4 picks for the year. So by Jan. 2013, I was making it clear that TV was has-been, and Netflix was the company to own.

Now, Statista has produced the numbers showing that in 2019 internet media consumption exceeded TV consumption – for the first time ever. And this trend will not stop. It was wholly predictable years ago – and the trends all say this will only accelerate. Where once the competition for entertainment was Netflix, now there is Amazon Prime, Disney+, Comcast Peacock, AT&T HBO Max and Apple TV+. The traditional networks simply don’t have a chance.

Impact of Trends

These trends are having an enormous impact on how we behave, how advertisers behave, what technology we buy, what entertainment we watch, how we use other technology like social media, how we absorb news — and more. So the question is, did you see the trends 7,8,9 years ago? Have you adjusted your strategy? Are you sure where trends are headed, and are you prepared for the future? Will you be a winner as the world changes – in a pretty predictable way – or will you lose out and say “you know, way back when……”

by Adam Hartung | Dec 11, 2018 | eBooks, Investing, social media

Since 2012, I’ve been a huge fan of Facebook, Apple, Amazon, Netflix and Google. And they have dramatically outperformed the market. In the last few weeks their values have fallen dramatically, and I’ve heard grumblings that these are no longer the stocks to own.

I virulently disagree. Great companies are where you should invest. If you don’t think these are great companies, you would be right to sell them (such as GE, Sears, and many others.) But despite complaints about privacy, usage rates, nefarious users, and other attacks on technology, the reality is that we love the convenience these companies gave us. We may not think things are perfect, but we are a lot happier than we used to be, and we are pretty happy with how these companies respond to product concerns.

- These companies are still global leaders in some of the biggest and most powerful trends everywhere

- The shift to e-commerce from traditional retail continues unabated

- The movement to mobile devices continues

- Using the cloud to replace device storage and network storage will not slow

- Entertainment continues to move to streaming from TV and other sources

- Ad growth remains firmly on the internet and mobile devices

- Platform usage (such as social networks) keeps growing as more uses are developed

These mega-trends are the foundation of the FAANG companies. These companies became great by understanding these trends, then developing products for these trends that have attracted billions of customers. Their revenue growth continues, just as their product development continues. And their profits keep growing as well. Nobody ever saved their way to prosperity. To increase value you must increase profitable revenues. And that capability has not left these companies.

Some of these company’s leaders have recently been called to Washington to testify. Will they be attacked, split up, further regulated? Will the government kill the golden goose? Given that the US House of Representatives has not firmly moved to the Democrats, I see almost no sign of that happening. Democrats like happy constituents, and given how happy consumers are with these companies the Democrats are very unlikely to intervene. There has long been a deep friendship, built on significant campaign financing and lobbyist involvement, between these companies and Democrats. The change in government almost insures that the actions in Washington will prove to just be a lot of short-term heat, with little change in the overall lighting.

I don’t know when these stocks will reach a short-term bottom. Just like nobody can predict market highs, it is impossible to predict lows. But the one thing I feel very strongly about is that in a year these companies will be worth more than they are valued today.

For insight into my strong favorability for these companies, take a look at the infographic I’ve provided regarding Facebook. Despite the Facebook stock ups-and-downs, this infographic explains why long-term it has been very smart to buy Facebook. Despite how people have “felt” about the company, it is a GREAT company built on powerful trends. To understand even better, buy the ebook “Facebook, The Making of a Great Company” on Amazon for 99 cents.

by Adam Hartung | Oct 10, 2018 | eBooks, Innovation, Investing, social media, Software, Trends

As all readers know, I am a fan of owning Facebook’s stock. For years I have pointed out that Facebook has been incredibly innovative at bringing people together. First, it was Facebook.com, but then leadership added WhatsApp and Messenger to expand the ability to communicate, and after that, Instagram which augmented communications via pictures and video. These capabilities, largely asynchronous, have expanded how easily we can communicate with friends, colleagues and business connections. It is this capability that made Facebook a success, because it brought people to the platforms – and as the audience grew advertising dollars grew as well.

(Watch my 2 minute video on Facebook the Innovation Engine)

Now, Facebook has launched “Portal.” It’s a piece of hardware, similar to a tablet in size. It has a speaker and a microphone, like a smart speaker on steroids, or like an enhanced tablet designed for communicating. Built on Android, it supports a plethora of apps, and it integrates with Alexa so you can not only talk to up to 7 people at the same time, but you can all listen to music via Spotify or Pandora, etc., and you can use it to make purchases on Amazon.com

At first you’d probably say this doesn’t sound very exciting. After all, aren’t we awash in hardware from smart phones to tablets to laptops to smart speakers and connected home devices? Why would we want another piece of hardware, when we already have so many that do so many different things? And didn’t Amazon infamously try to launch a enhanced smartphone (Fire Phone) and enhanced tablet (Fire Tablet) targeted at shopping, only to fail miserably? You could say Portal is likely to follow Fire into the tech archives.

And, on top of this, aren’t people paranoid about Facebook and privacy? After Cambridge Analytica manipulated Facebook data in the last election, and then the recent breach which could have revealed information on 50 million users, aren’t people going to quit using Facebook products?

There really isn’t much data to indicate people care about these breaches, or possibly illegal uses of data. Almost everyone now realizes that whatever they post on any Facebook platform, the information is public. And the reality is that by putting their information out there it actually makes users’ lives easier. Users get connections they want, information they want, and products they want that much faster, and easier. These platforms make their lives more convenient, and billions of people have no problem exchanging somewhat personal information for the convenience it provides. The more Facebook knows about them, the easier their lives are, and the richer their network communications.

That is why I’m optimistic that Portal will have an audience. Facebook Messenger has 400 million users. Those users generated 17 billion messages in 2017. Now, imagine if those users could use Portal to make those messages clearer, more powerful. And, as of June, 2018 Instagram has 1 billion monthly active users. If you have Portal it makes Instagram connecting much easier and more interesting.

Portal doesn’t have to replace an existing smartphone or tablet. It merely has to help the people who use Facebook platforms have a deeper, more powerful connection with those in their network. If it does that, there is an enormous installed base of users who could find Portal helpful, in many ways. More helpful than a stand-alone, limited use Echo (or Dot) speaker, for example, which have sold over 47 million units so far.

Facebook is good at understanding its value proposition which is connecting people in powerful ways. Facebook has shelved products that didn’t augment this value proposition – like a generalized smart phone. But Portal has the ability to further enhance user experiences, and that gives it a decent chance of being successful. And when Facebook adds its Oculus technology to Portal, allowing for 3D communications, Portal could become a one-of-a-kind product for communicating with your network.

For a look back at Facebook’s history, and my forecasts for the company, read my new ebook, “Facebook – The Making of a Great Company.” (At Amazon.com for just 99 cents!) It will help you take a longer look at Facebook’s leadership, and give you a different view on Facebook’s future than the current negative press is providing. With the stock $70 off its high, and trading at the same price it was a year ago, you just might think this is a buying opportunity.

by Paul F | Sep 26, 2018 | eBooks, Innovation, Investing, Marketing, Software, Web/Tech

In the recently published, “Facebook- The Making of a Great Company”, Adam Hartung analyzes the rise of Facebook and its impact on the financial community, business marketing and innovation.

Adam’s posts over the years have predicted key milestones in Facebook’s growth and its transformation into a driver of social trends. He tells the story of this company that has overcome negativity and skepticism in the financial community and has adapted to its users.

“So last week, when Facebook reported that its user base hadn’t grown like the

past, investors fled. Facebook recorded the largest one day drop in valuation in

history; about $120B of market value disappeared. Just under 20%.

No other statistic mattered. The storyline was that people didn’t trust Facebook

any longer, so people were leaving the platform. Without the record growth numbers

of the past, many felt that it was time to sell. That Facebook was going to be

the next MySpace.”

“That was a serious over-reaction.”

Adam Hartung, “Facebook-The Making of a Great Company”

by Adam Hartung | Jul 30, 2018 | Innovation, Investing, Software, Strategy, Trends, Web/Tech

On July 26, 2018 Facebook set a record for the most value lost in one day by a single company. An astonishing $119B of market value was destroyed as the shares sank more than $40. For many investors, it was the sky falling.

As most of you know, I’ve followed Facebook closely since it went public in 2012. And, I’ve long been an admirer. I said buy it at the IPO, and I’m saying buy it now. Click on the title of any of the posts to read the full content.

To summarize, Facebook may be under attack, but it is barely wounded. And it is not in the throes of demise. The long-term trends all favor the social media’s ongoing growth, and higher values in the future. Below I’ll offer some of my previous blogs that are well worth revisiting amidst the current Facebook angst.

FANG (Facebook, Amazon, Netflix and Google) investing is still the best bet in the market. They have outperformed for years, and will continue to do so. Why? Because they are growing revenues and profits faster than any other major companies in the market. And “Growth is Good” (paraphrasing Gordon Gekko.) If you have any doubts about the importance of growth, go talk to Immelt of GE or Lampert of Sears.

Don’t forget, for years now Facebook is more than Facebook.com. It’s smart acquisition programs have dramatically increased the platform’s reach with video, messaging, texting and eventually peer-to-peer video. Facebook’s leadership has built a very adaptable company, able to change the product to meet growing user (and customer) needs.

Facebook is on a path toward significant communication domination. Facebook today is sort of the New York Times, Washington Post, Los Angeles Times and about 90% of the rest of the nation’s newspapers all in one. Nobody is close to challenging Facebook’s leadership in news distribution, and all news is increasingly going on-line.

For all these reasons, you really do want to own Facebook. Especially at this valuation. It’s getting a chance to buy Facebook at its value when the year started, and Facebook is that much bigger, stronger, and adapted to changing privacy regulations that were still a mystery back then.

Oh, one last thing (paraphrasing Steve Jobs.) Facebook actually isn’t the biggest one day drop in stock valuation, despite what you’ve read.

Stocks are priced in dollars, and dollars are subject to inflation. So we should look at historical drops in inflation adjusted dollars. Even though inflation has been mostly below 3% since the 1990s, from 2000 to today the dollar has inflated by 46%. So inflation-adjusted, the biggest one day value destruction actually belongs to Intel, which lost $131B in September, 2000. And Microsoft is only slightly in third place, having lost $117B in April, 2000. So keep this in mind when you think about the long-term opportunity for Facebook.

Now Published! “Facebook- The Making of a Great Company” ebook by Adam Hartung.

by Adam Hartung | Jul 19, 2018 | Entrepreneurship, In the Rapids, Innovation, Marketing, Medical

USA health care is ridiculously expensive. It’s good, but no statistics show that US healthcare is better than any other developed country. Nor any better than accredited facilities in large, developing countries. Look at these comparisons according to Medicaltourism.com:

Procedure USA cost India cost in accredited facility

Heart Bypass $123,000 $7,900

Heart Valve Replacement $170,000 $10,450

Hip Replacement $40,364 $7,200

Knee Replacement $35,000 $6,600

Spinal Fusion $110,000 $10,300

Hysterectomy $15,400 $3,200

Cornea Replacement $17,500 $2,800

Over 1/3 of Americans live with the myth that if they need medical care, somehow it will magically happen at no cost. The Affordable Care Act tried to fix that myth by making everyone buy health insurance. But Congress removed that government mandate. So most Americans that don’t have company-sponsored health insurance don’t buy insurance. Their primary source of health insurance is hope. When illness or accident happens these folks end up with extra-ordinary debt. And they can’t eliminate this debt because health care debt doesn’t go away in bankruptcy. So every year more and more people learn that an unexpected health incident means they will spend the rest of their lives paying for medical services that were 10x or 100x what they expected.

This is a trend that will not end soon. Costs keep going up. The political sides are too divided on what to do. And health insurance companies spend literally billions annually to make sure insurance for all (referred to as Medicare for all) never becomes reality.

This trend means there is opportunity. And that has become medical tourism. Literally, flying to foreign countries for medical procedures.

You may say “not me.” But if you have no money in the bank, and you let your health insurance lapse when you lost your last corporate job ended and you entered the gig economy, you could face a very tough situation. The same one almost all farmers face, and most small business owners, since their insurance is unaffordable. And most 1099 contract employees. When you have an unexpected heart attack at age 41 you wake up to hear a hospital admin say “you are alive, but you need surgery. If you want to live, we can do a heart bypass. Just sign this document and you’ll wake up somewhere north of $123,000 in debt.” Which means you’ll lose your house, for sure. Your kids won’t go to college. And you’ll never again buy a new car.

Or you blow out a hip, or knee,playing that Sunday basketball pick-up game – or golf. You’re 50-55, so too young for Medicare. But you lost health insurance years ago. Or you have a minimalistic plan which will cover a fraction of the cost. Finding the cost is $35,000 to $40,000 (or more likely $60,000 at a for-profit US hospital) are you really able to afford this? Or will you spend your life using crutches, or in a wheelchair? Or start an on–line begging campaign from your friends to cover the cost?

Suddenly, being a medical tourist doesn’t sound so unlikely. Saving $30,000 to $100,000 could determine your financial future. This trend was pretty clear back in 2010 when I pointed out that US medical tourists grew from 700,000 in 2007 to 1.2 million in just 3 years. The trend was actually obvious in 2005, when most people laughed at the idea of medical tourism – because they refused to look at the demographic and cost trends.

That’s why medical tourism is already a $20B business. And growing at 18% annually. Some analysts estimate the global market at almost $80B. Demographics are all in favor of future growth. The developed world population is aging. Health care costs are going up. Government ability to pay is going down. Insurers are charging outrageous rates. Fewer people are buying health care, and even fewer are buying “gold plated plans” that match the average plan in 1990. And American health care policies, in particular, keep driving up costs. It is EASY to see that as people can’t afford care at home, so they WILL be making more trips overseas.

There are already companies making the plunge. Some are matching services between patients and medical facilities. Some are building certified medical facilities in places like India, Singapore, Brazil, Malaysia, Thailand, Costa Rica and Mexico. The opportunities are as big as the health industry.

And this trend affects every business. Are you still stuck in the status quo thinking of extremely expensive insurance for employees, or none? Medical tourism offers a plethora of other opportunities. You can offer a bare-bones domestic plan, with augmented insurance to be a medical tourist. Or even a company sponsored plan, with the opportunity for employees to build a health-care bank, and a relationship with a medical tourism company to help employees find providers offshore. And gig-economy employees can drop the idea of domestic coverage (other than bare bones) for a mixed program including offshore insurance.

Fighting the health cost trend in the USA is foolish. Doing nothing hurts your competitiveness. Given the opportunities in medical tourism, are you thinking about how to build on this trend as a new business? Or a way to offer more to full time and 1099 contractors?

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.