by Adam Hartung | Jan 12, 2022 | Boards of Directors, Leadership, Medical, Strategy, Trends

I was happy to end 2021 on a very high note. Kaiser Health Network interviewed me on the future of pharmacies, based on my historically accurate forecasts for retailers. READ MORE I was delighted when this went semi-viral, being picked up by Yahoo!News, Salon, Washington Post and about a dozen other publications.

I’ve had a nearly 2 decade relationship with Vistage and its global network of CEOs. I was delighted to be interviewed about the best short-term and long-term goal setting process, giving all Vistage members my insights for success and how to use their planning processes to build a road to greater profitable growth.

READ MORE I’m looking forward to working with more Vistage groups and individual members in 2022 as their ambition for success continues growing.

I kicked off 2022 with a live webcast interview with International Market & Competitive Intelligence

magazine, hosted by its Chief Editor Rom Gayoso. As the changing world remains in fast-shifting overdrive leaders are increasingly looking for insights about the future. I’m delighted more keep asking how they can use my 30+ years of trend tracking to help them find the right stars to follow. Let me know by email or phone if you’d like to talk about how I can help your business grow stronger every year, despite the seeming chaos around us. Here’s my

interview with Rom Gayoso.

Lesson – You are either growing, or you are dying. There is no “maintenance, status quo.”

For 2022, Spark Partners is offering its Master Class on strategic planning and innovation for HALF OFF! That’s right, for just $495 you can get this 28 module course that shows you how to identify and follow trends, then build plans that leverage those trends for faster, more profitable growth. There’s no similar tool in the marketplace. A year in the making, this course provides an overview of the process I’ve used to build successful forecasts for investors and business leaders across companies of all sizes.

https://www.sparkpartners.com/business-master-class-think-innovation-course

Respond to this email and I can arrange your limited time discount to get started building a stronger, more successful organization.

Are you on “cruise control” running your business?

Ask yourself, Are you trying to defend and extend what you’ve always done? Or are you meeting unmet customer needs, helping customers to grow and in turn growing yourself? If you’re the former, get ready for a rude awakening.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | Jul 19, 2021 | Entertainment, Entrepreneurship, Innovation, Strategy, Trends

Netflix Redefines The Pivot

Last week Netflix announced it was going to enter gaming . Interestingly, the analyst reaction was, at best, mixed. Most didn’t think it was a great idea. My favorite is this quote in AdAge came from a pair of Bernstein analysts.

“Bernstein analysts Todd Juenger and Gini Zhang said in a note that they were “tepid” about Netflix getting into gaming, partly because it would mean a lesser focus on the core business. They worry about creating a distraction.”

These untalented analysts went on to say:

“It’s hard not to imagine that if Netflix were to launch its own video games, the majority of the company’s energy would be focused on the success of that new, different, exciting thing (even among employees who aren’t involved in it),” according to the note. It’s also unclear how the company can capitalize on the video-game content without raising prices—and potentially turning away some users unwilling to pay extra, they said.”

A History of Pivoting to Meet Customer Needs

Wow, I’ve heard that before. Remember how Netflix started? Back when we all went to Blockbuster or another video store to rent a tape or dvd overnight, Netflix offered to send them to our house. And let us keep them as long as we wanted. This convenience was so powerful Netflix drove Blockbuster, Family Video and all other traditional video rental stores bankrupt.

After this big win analysts thought that Netflix should take on Amazon in general merchandise e-commerce. After all, Netflix was the largest customer of UPS, USPS and Fedex at the time. Most analysts thought Netflix had the infrastructure to ship things, so they wanted to build on that infrastructure. But Netflix didn’t to that at all. Keeping its eyes on its Value Proposition of “Delivering Entertainment” Netflix instead went headlong into video streaming. And the stock tumbled dramatically as analysts said streaming wasn’t the “core” of Netflix. Netflix wasn’t a tech company, or a telecom or cable company and streaming would be a huge distraction for people lacking proper skills. Netflix’ Value Delivery System was dominated by logistics expertise, and the analysts were focused on milking more out of the Value Delivery System.

Of course Netflix knew its value was in keeping customers happy, not milking its invested assets. Netflix’ “core” was in knowing entertainment, so it had to develop the skills in streaming, or its customers would drift away. Further, Netflix knew it had nowhere near the savvy of Amazon for general merchandise marketing and sales. If it followed Amazon it would fritter away its Value Proposition, and probably never make any money chasing Amazon by trying to devote more energy to its logistics Value Delivery System.

Of course, Netflix was right. Leadership jettisoned the physical distribution Value Delivery System and built a new one around streaming technology. Just as the Bernstein analysts feared, Netflix had to raise prices. Which it did on physical distribution in order to raise the money to invest in streaming, which turned out to be the shot allowing Netflix to dominate globally, not just in the USA. It was enormous win for gaining customers, selling more stuff, and making more money.

About 5 years ago, Netflix realized it yet again had to change its Value Delivery System if it was to maintain its customer Value Proposition. So it scaled back investing in streaming, as that technology was becoming available to everyone. And it invested heavily in content production. Even though it had long distributed other people’s content, Netflix saw that to be a leader in “Delivering Entertainment” it had to create its own. So the money was shifted into making “House of Cards,” which was a huge hit, and “Orange is the New Black.” Now Netflix is the most prolific video content creator in North America. So much good content Netflix has jeopardized the future of TV networks, major movie studios and even entire theatre chains.

Where once the big employment center, and resource hog, in Netflix was logistics, Netflix leadership pivoted its Value Delivery System into streaming technology. Then it pivoted again into content creation. And now, as gaming has become “the next big thing” Netflix is once again pivoting its resources — into fast growing gaming.

Given this is the third pivot, and 4th Value Delivery System, in Netflix, would you bet against CEO Reed Hastings and his leadership team? The negative analysts are as dead wrong now as they were before. Netflix has demonstrated a keen understanding of their Value Proposition, and demonstrated the skill set to adapt their Value Delivery System to meeting emerging customer needs. I believe it is almost a certainty Netflix will find its way in on-line gaming as the trend keeps growing exponentially. And like all the other pivots, they’ll attract even more customers, and sell more product, and make more money.

Are you adaptable to new Value Delivery Systems as technology makes them available?

Do you clearly know your Value Proposition, and are you focused on it — or are you focused on running your Value Delivery System. Are you trying to maximize your old business, or are you seeing how emerging trends are creating new opportunities to grow by entering new businesses, with new Value Delivery Systems? Netflix has demonstrated how to grow very large, very fast. Are your eyes open to Trends and Market Shifts – and are you adaptable to take advantage of emerging market needs? Now is a good time to learn from Netflix.

My calls on Netflix have historically been quite good. Check out these links to previous articles:

How Netflix became the King of Strategic Pivots, 4/2018

Predicting Netflix Would Dominate Entertainment Content, 4/2016

Explaining Why and How Netflix content creation would be good for investors, 3/2015

Explaining why investors should buy Netflix stock when it crashed after announcing its move into streaming, 10/2011

Explaining why you should buy Netflix, predicting it would be the next Apple or Google, 11/2010

Netflix ended last week at $530/share. Had you bought it when I recommended in 11/2010 the stock was $25. You would have had a 25X gain. Had you added to your position in October, 2011 the stock was $16.75. You would have a gain of 31.6X. Had you added in 3/2015 when I recommended higher valuation for investors from content you would have bought at $62, for a gain of 8.5X in 6 years.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | Jun 2, 2021 | Economy, Innovation, Scenario Planning, Strategy, Trends

Nomadland art … IS Life

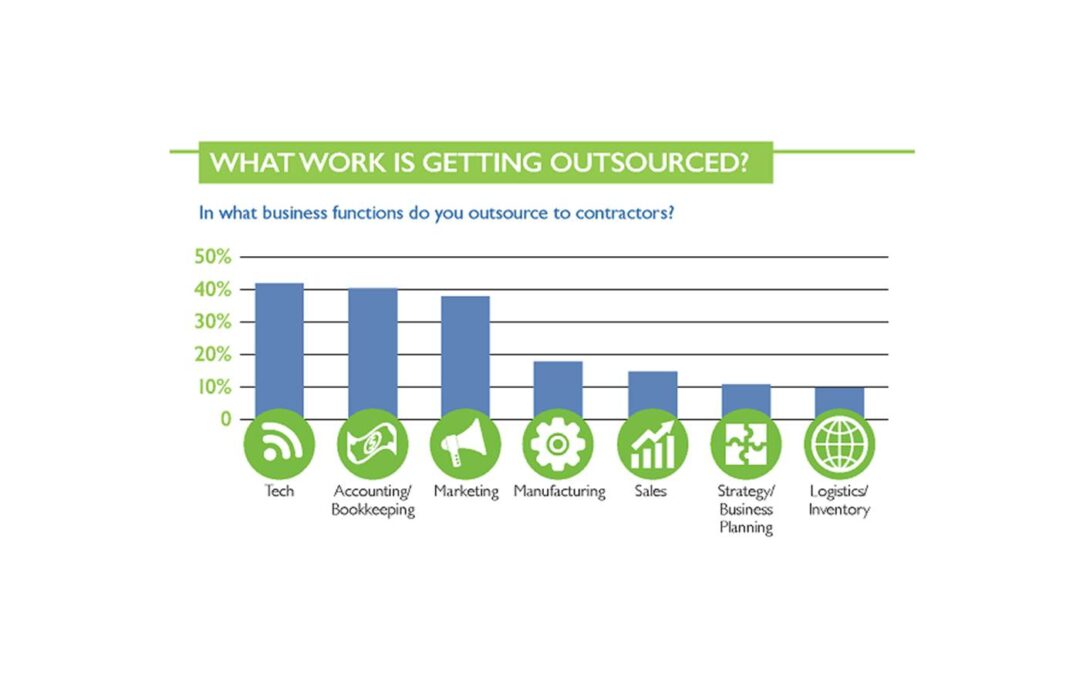

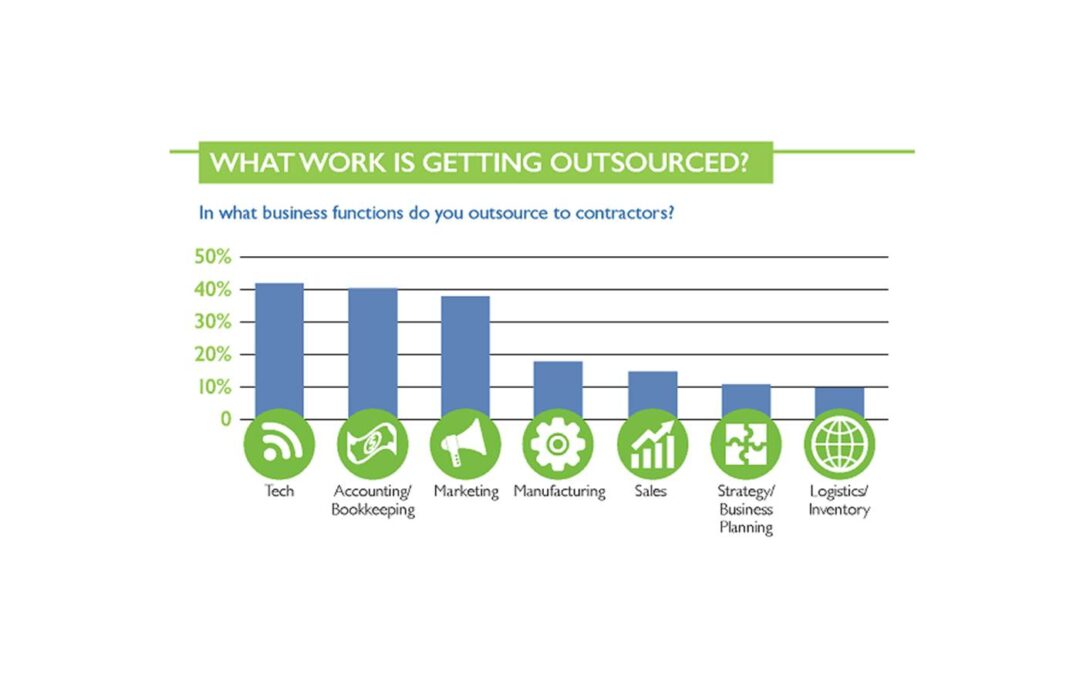

The Academy Award winning movie “Nomadland” portrays a woman whose town is decimated when its largest employer leaves. No jobs means homes go valueless, and people are forced to leave. Not only the economy, but lives are wrecked without money, healthcare and any sense of economic future. What follows is a pretty bleak overview of living in one’s vehicle, hustling for jobs of any kind and building networks of other nomads who give encouragement to each other – but not a lot of help. During the movie, the lead character is offered at least two very solid opportunities to move into a more stable situation (one with her family, and one with the family of another nomad.) Yet, she turns down both. Despite living what the filmmakers portray as a very difficult, lonely and economically bleak situation she chooses to continue the nomad lifestyle.Today’s Gig Workers, or Digital Nomads, are often thought of as bleak, lonely people. No permanent job, no permanent employer, no “corporate” home. The view is often of people who are on the stark edges of the economy, struggling to survive in an uncertain future. And that view would largely be wrong.

The Gig Economy, and its self-employed Digital Nomads, represented HALF the U.S. Workforce before the pandemic hit. The World Economic Forum, Ernst & Young and the U.S. Federal Reserve all said that the emergence of the self-employed Gig Economy Digital Nomad represented the largest single economic shift in several generations. All have said this trend for business is as big as the emergence of mobile and internet technologies. It is characterized as a fundamental change in how people work, and a dramatic change in the outdated Industrial Era “contract” between companies and employees.

Digital Nomads are NOT merely a pandemic artifact.

They are members of an enormous mega-Trend: (1)

- The gig economy is growing so fast its job creation alone can account for all the jobs created in the USA from 2005 through 2016 (corporate hirings/firings were a net no gain)

- In the last 40 years the employer/employee compact has disintegrated, leading fewer people to trust their employers, so they seek alternative cash flow sources

- It is estimated half of gig workers maintained full time jobs – but are actively seeking entrepreneurship. Thus the resulting unwillingness to return to low-pay jobs as the pandemic ends.

- The Gig workforce of Digital Nomads is growing 5x faster than growth in traditional jobs

- 63% of Gig workers say they started not due to economic requirements, but as a choice

- In 2017, 53 million Americans participated in gig work (36% of all employees)

- By 2027, trends project over half of all Americans will be involved in gig work. This pre-pandemic statistic is likely to understate the likely results due to pandemic changes.

- Prior to the pandemic at least 40% of the American work force made at least 40% of their income from Gig Economy work

- Digital Nomads cross all age groups? 44% of Boomers, 59% of GenX, 63% of Millennials

Digital Nomads mostly CHOOSE this work approach. In a fast-paced, quickly shifting world the idea that an employer can “protect” its employees is a façade. With the average corporation lifespans now a mere 8 years, no job and no employee can be protected. Neither pay nor benefits are ever a given in markets where companies acquire, merge, are acquired or fail with such regularity.

Employees Empower Themselves In Gig Work

Employees Empower Themselves In Gig Work

Being a Gig Worker actually fulfills the corporate goal, sought for 35 years, of “empowering employees.” Despite what managers said, organizations operate today in the militaristic style of the last 100 years. Unless you’re the CEO (dictating your own pay and terms) someone is your boss. And your #1 job is to please the boss. Success is less about results, and a lot more about politics, corporate behavior and luck. But as a Digital Nomad you are your own boss. You contract to do something, at a rate, on a timeline and then you deliver. You are empowered to do the work you want, when you want it. To lead the lifestyle you choose, making as much as you desire. Doing your own training, building your own skills, selling your services and reaping the rewards.

Corporate Nomadland is much, much bigger than the Nomadland of the movie. And it is largely comprised of people who want to work like Digital Nomads. It’s not bleak. Rather, in many ways it is the future of work. Especially for people who provide services — from accounting to marketing to sales to planning, to education, workshops, security, etc. It is a world built on networking, connectivity, individual accountability, and entrepreneurial behavior as it existed prior to the Industrial Era.

For Full image: JDP Employee Screening

Unfortunately, a lot of old-school employers and government officials still don’t understand this mega-Trend. They keep trying to force Digital Nomads into becoming employees, by altering work rules and regulations and promoting old-school style unions. Efforts attempting to force employers to do what they can’t – operate their business like it’s 1966. Business people today must be adaptable to market shifts, changing competition and fast moving customer needs. They can’t afford full-time employees and incumbent overhead costs on roles that simply are not economically suited to their needs. Trying to force this behavior hurts the Digital Nomads even worse than the employers, because they don’t want these changes. That’s why the effort to change laws making Gig Workers employees failed in California. That’s why employees failed to unionize an Amazon facility in Alabama. Even President Biden favors unions, “The policy of our government is to encourage union organizing.” (POTUS tweet 4 Feb 21) Those are not the right answers to today’s problems.

We are living a mega-Trend, accelerated by the pandemic

We now know we can work asynchronously and mobile. We know the results of our work are more important than physically attending meetings, or office politics. We know that we can be more efficient, and capable, when empowered to focus on results and not outdated policies, procedures and processes. And this trend will continue to grow. Despite the CEOs and other leaders that want to force everyone back in offices, in large droves people are choosing not to go.

That’s not to say the government couldn’t be a lot more effective if it accepted this mega-Trend and attempted to assist its citizenry with new approaches. There need to be entirely new approaches for implementing and regulating safety nets – like unemployment, health care and retirement programs. There need to be new regulations for contract negotiations and dispute resolutions between large corporate entities and Gig workers. New approaches for Digital Nomads to network in ways to set output standards, work standards, pricing standards for effectively working with their much bigger customers. There need to be new approaches for bringing on and eliminating transition teams for large projects. Basically, new approaches which support the adaptability and flexibility needed by both employees and Gig Digital Nomads. Digital Nomads are here to stay. Speaking of mega-Trends, have you seen the new AI-controlled, EV camper?

(1) Section reference

(2) Additional references

-MegaTrends by HP “The Future of Work – The Gig Economy”

-World Economic Forum – “The MegaTrend that Will Shape Our Working Future” the Gig Economy

-EY MegaTrends – “The Future of Work” the Gig Economy

-Supermoney – “The Growing Importance of the Gig Economy”

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | May 26, 2021 | Innovation, Investing, Software, Strategy, Trends

Free Trend Money!

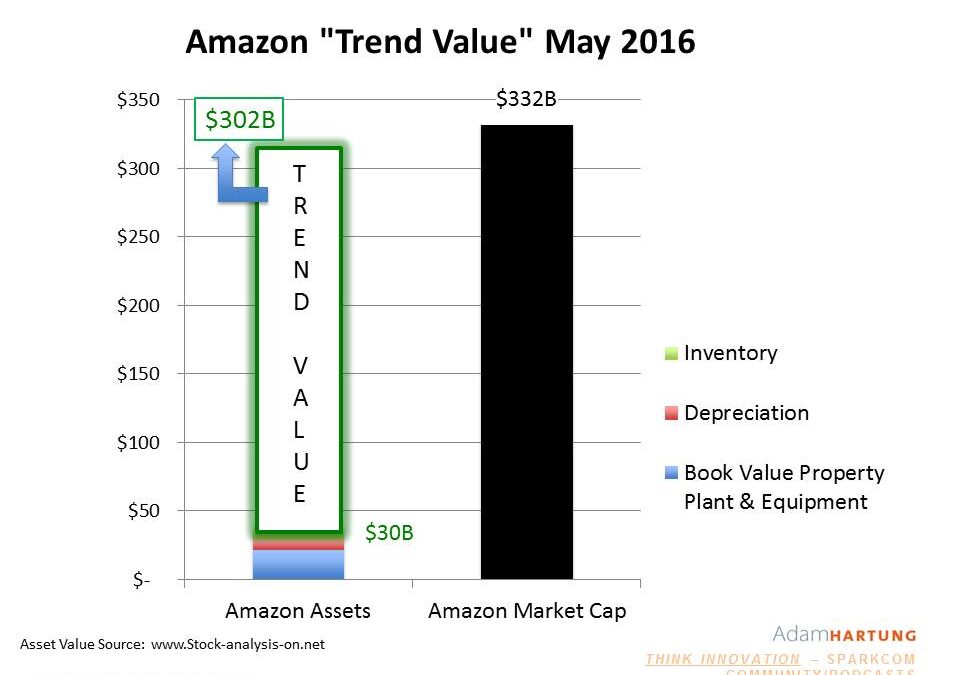

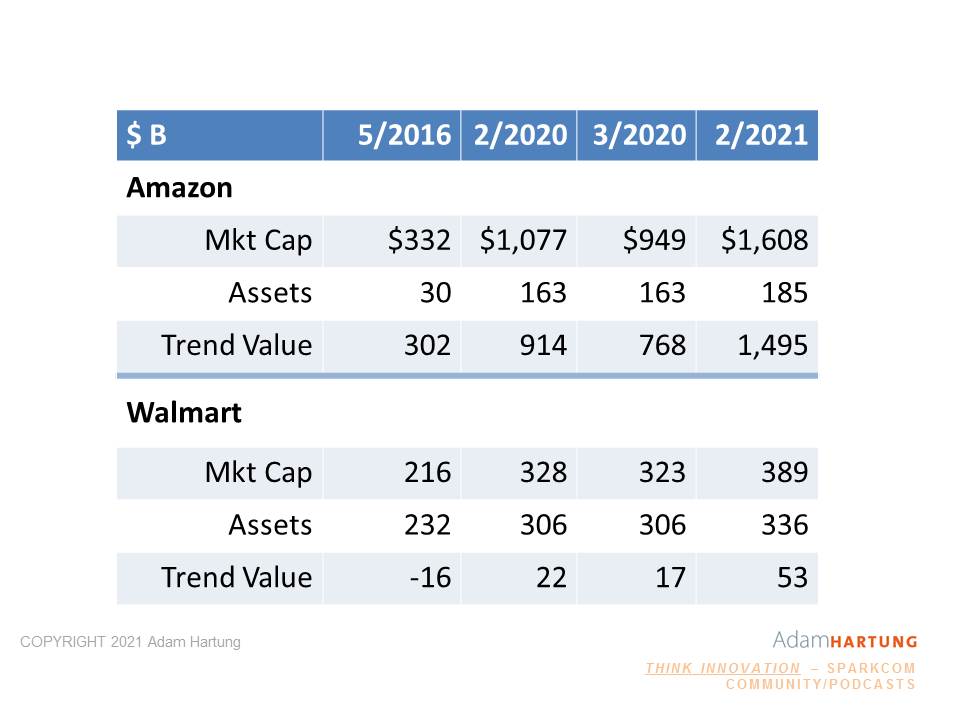

Amazon is buying MGM film studios for something less than $9 B. Sounds like a lot of money. But since Amazon can make its own money, effectively this transaction is free. Now you must be wondering, how can Amazon make its own money? By creating “Trend Value.”

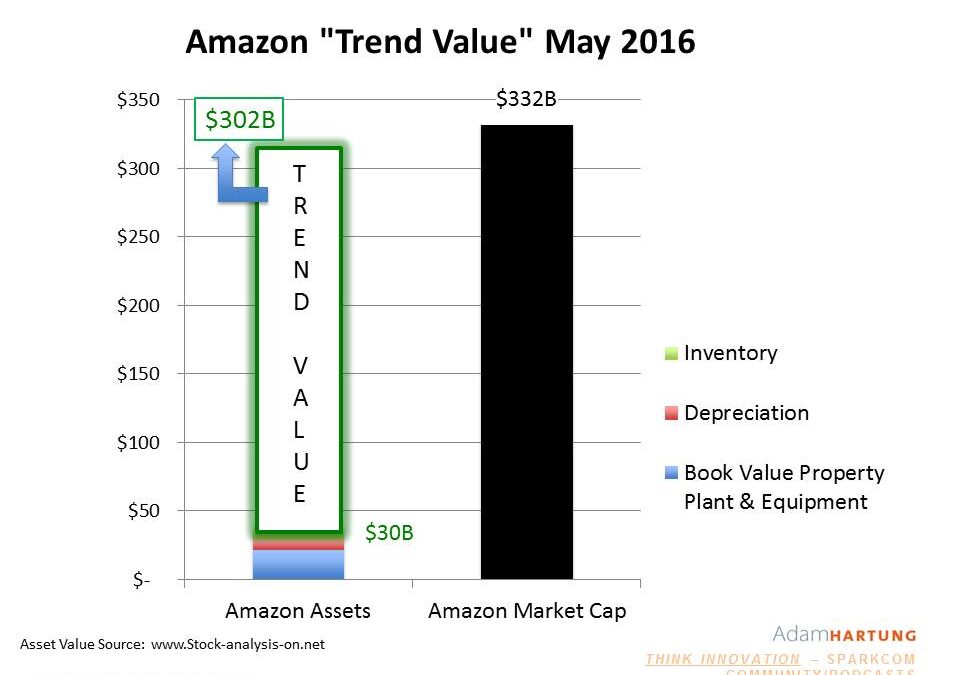

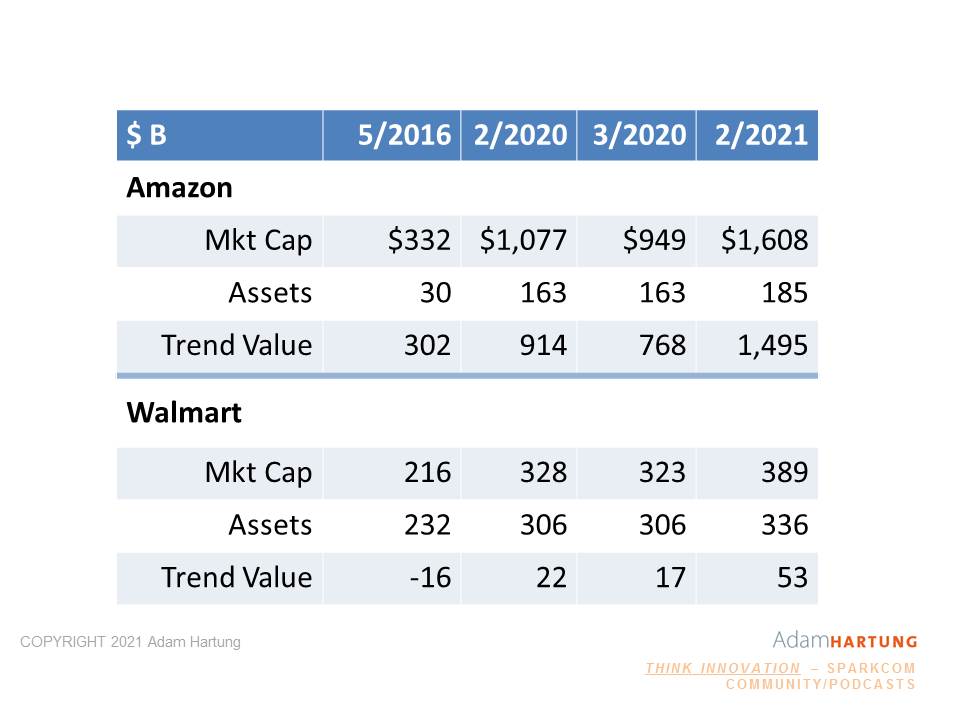

Back in 2016, before Amazon started making acquisitions like Whole Foods, its valuation (or market capitalization) was $332 B. But its assets were only worth $30 B. And remember, Amazon was not, and still isn’t, very profitable. Net income was only about $2 B at that time. That extra $300 B of valuation (10x the assets) wasn’t from earnings, but rather because Amazon was a global leader in e-commerce with about 40% market share in the USA. Because e-commerce and cloud computing were growing trends, investors gave Amazon an additional $300 B in value as a Trend Leader.

Because Amazon was riding the big trends to e-commerce it created $300 B of very real value. This very high share price allowed Amazon to keep investing in ways to grow, including making acquisitions.

Because Amazon was riding the big trends to e-commerce it created $300 B of very real value. This very high share price allowed Amazon to keep investing in ways to grow, including making acquisitions.

Compare with Walmart. In 2016 before, Walmart bought Jet, it had almost no e-commerce. Walmart had $232 B of assets (7 times the assets of Amazon,) but it’s valuation was only $216 B (2/3 Amazon’s.) Because Walmart’s assets (and business) were concentrated in the no-growth retail world of brick-and-mortar stores its value was less than its assets! Investors were basically saying that to create value Walmart would have to sell its assets – not grow its revenues. As a result, Walmart’s Trend Value was a NEGATIVE $16 B

Six years (and a pandemic) later, and the world of e-commerce has exploded. WalMart bought Jet, eschewing adding traditional stores and instead investing in e-commerce. As a result its assets grew very little, but its market valuation improved to $399 B, an 85% enhancement. And it’s Trend Value went up to $60 B. A good thing, but still only 1/5 the 2016 Trend Value of Amazon. A $9 B acquisition would be a very notable acquisition for Walmart using up over 50% of its cash. And taking out a 2.5% chunk of its market cap, and a whopping 15% of its enhanced Trend Value. Meanwhile, since 2016 Amazon has purchased an entire grocery chain (Whole Foods) and made enormous investments in distribution centers, trucks, and other supply chain assets. That has increased Amazon’s asset base 10-fold, to about $320B. But now Amazon’s publicly traded shares are worth $1.62 TRILLION. That’s right, with a “T.” By investing in Trends (e-commerce and cloud computing services [AWS]) Amazon’s Trend Value has risen to a whopping $1,300 Billion. Amazon’s Trend Value is 21.5x Walmart’s.

Meanwhile, since 2016 Amazon has purchased an entire grocery chain (Whole Foods) and made enormous investments in distribution centers, trucks, and other supply chain assets. That has increased Amazon’s asset base 10-fold, to about $320B. But now Amazon’s publicly traded shares are worth $1.62 TRILLION. That’s right, with a “T.” By investing in Trends (e-commerce and cloud computing services [AWS]) Amazon’s Trend Value has risen to a whopping $1,300 Billion. Amazon’s Trend Value is 21.5x Walmart’s.

By investing in Trends, Amazon created a cache of value

They used that value to make more acquisitions. Even though it made huge investments in assets – far beyond WalMart’s – its Trend Value grew even more. Now Amazon could purchase MGM for $9 B and use only 10% of its cash. But it won’t. It will use shares. But that $9 B is now only .55% of Amazon’s value – and only .7% of its Trend Value. Negligible on the balance sheet, but opening up tremendous revenue growth for Prime Video.

If you want to create money, invest in trends. Walmart was the renowned leader in retail, and computing for retail, until trends shifted the market. Now it is an also-ran compared to Amazon. And because Amazon is leading in the Trending markets of e-commerce and cloud computing it has created the money to buy MGM. Again, not with profits (which are still only $20 B) but with the Trend Value created by proper market selection and investing.

So are you creating money by investing in trends? You can literally create your own money, usable for all kinds of investments, when you invest in trends. Or are you grinding out the business, like Walmart with all those stores, but creating almost no value in the vast majority of what you do? The choice is really up to you.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | May 20, 2021 | Computing, Innovation, Investing, Leadership, Software, Strategy, Trends

Stuck on the Core

This week, to almost no fanfare, a Microsoft Vice President issued a statement saying that Windows 10X (planned for 2019) would not ship in 2021. In fact, it would never ship. The technology enhancements would be integrated into existing Windows, and other products. While this gained little press, it is great news for customers and investors.

CEO Satya Nadella has officially changed the course of Microsoft. Under former CEO Ballmer the behemoth kept pouring money into Windows and Office. While the world was moving from PCs and PC servers to mobile devices and the cloud, Ballmer just kept pouring billions into old products. His slavish insistence on trying to defend & extend an old “core product line,” which every year was losing importance as PC sales slowed, was killing Microsoft — leading me to call Mr. Ballmer the worst CEO in America (my Forbes column that was by far the most read of any I ever penned.) After more than a decade as CEO, Ballmer had spent a lot of Microsoft money on new versions of its ancient product and bad acquisitions like Skype and Nokia, but he entirely missed the market shift in his customer base. In my blog post, “Microsoft, What Next?”, I described the challenges ahead to pull Microsoft out of the Growth Stall.

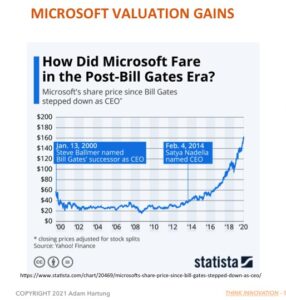

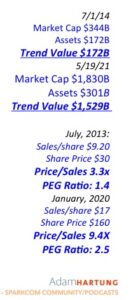

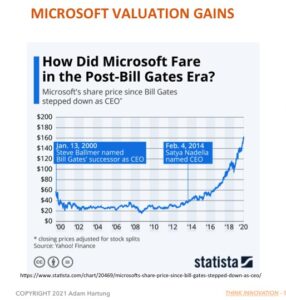

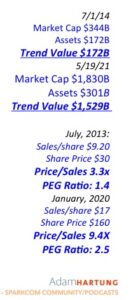

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!!

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!!

In the years leading up to Ballmer’s firing I was a very loud critic of Microsoft. In multiple Forbes columns, (republished as blogs on my web site) I pushed for his ouster. But even more importantly I gave the company little hope of long term viability. By over-investing in outdated products it seemed most likely Microsoft would go the way of Hostess Baking, Sears, DEC and Sun Microsystems – irrelevant leading to failure. I rabidly recommended not owning Microsoft.

Microsoft Stock

2014-2021

The Impossible Just Takes a little Longer…

But Nadella achieved the improbable. Much like Jobs when he retook the reigns at Apple, Nadella quit looking (and investing) in the rear view mirror. Like Jobs, he dropped investing in PC’s. Instead he focused on the future, and where Jobs invested in mobility, Nadella has invested in the cloud. Very few companies make this kind of radical shift in resourcing projects, even when it is the obviously right thing to do. And Nadella deserves the credit for making this radical change in Microsoft, saving the company from near-oblivion while creating a very viable, valuable company in a short time. Where once I saw a company heading for infamy, now Microsoft shows all signs of leadership toward the next technology wave and longevity. Quietly saying the company has no plans for a new Windows version, which nobody cares about anyway, is a tremendous demonstration of looking forward rather than backward.

Jump the Re-Invention Gap

Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.

Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | May 12, 2021 | Employment, Immigration, Scenario Planning, Strategy, Trends

Demographics is Destiny

Planning is all about the future. And the future is easiest to predict when we look at demographics. Population trends are easy to spot, and long-lived. So the recent U.S. census, which built on previous trends, gives us great insights for planning our investments. Let’s focus here on the two biggest demographic trends.

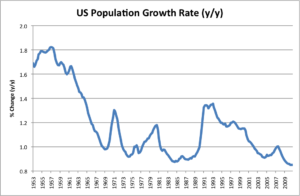

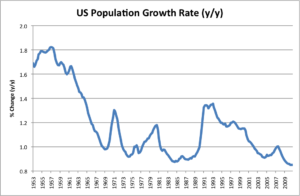

First, the U.S. population growth rate is terrible. Less than 1%/year. Its the 2nd worst decade  since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

In 2018, I wrote about the Japanese demographic “trend bomb.” Low birthrates and anti-immigration meant there were only 2 working people to support each retiree. And the situation was worsening. It’s time America starts considering what it will do if we don’t let immigrants return to spark growth. Growth can hide a multitude of sins, Source: Avondale Asset Management

because it creates demand for more goods and services – thus creating economic growth. People in China and

India aren’t starving any longer, because they’ve grown their economies out of poverty.

As wrote in 2017, it was America’s population growth – driven by immigration – that made 1800s and 1900s America the jewel of the world. Despite horrors at Ellis Island, those boatloads of immigrants created the agricultural and industrial America with its flourishing economy. Like I observed in 2016, unless we re–invigorate growth through immigration, the woes Trumpers complain about will get much, much worse. Soon Pakistan and Indonesia will have more people than the USA! China and India, with their growing populations, growing economies and growing diaspora are making an ever–bigger imprint on the global economy. Meanwhile, America is on its way to stagnant performance like most European countries.

U.S. Population is Mobile, Despite the Pandemic

Second, the trend south and west continues unabated. In 1970, the South and West accounted for less than half the population. Now they account for 62%. The Northeast is losing people rapidly, with 48 of 62 New York counties losing people. And Illinois has seen the problem in spades. Chicago and Illinois are already in a world of hurt due to declining population causing a declining economy causing real estate prices to fall and taxes to rise. (Though the pent-up pandemic housing demand is temporarily increasing housing prices, masking the long term trend.) When population trends down, it becomes a whirlpool of problems – just look at what’s happened in Detroit! You must have the people to build a strong economy.

Looking at both these trends, do you see the unabashed irony? We see no problem with cities and states competing for migrants from other cities and states. Local and state governments lure in companies and people with tax breaks, subsidies and other allowances. We think immigration within our country is good – and recognize losing people from our local area is bad. But at a national level, we still have people who object to immigration. They want the borders closed, and no new entries. We have politicians who want to freeze the economy in place. Yet we know from our past that the only solution to getting our economy to grow REQUIRES immigration. It is the #1 reason the economy was so sluggish coming out of the Great Recession – we cut immigration to unprecedented levels under Obama and continued the decline under Trump. We are unlikely to birth our way to growth, given trends in lifestyles and gender equality. But, we can bring in immigrants who can help the economy grow. We need to get over this hypocrisy and move toward greater immigration as a pro-America policy!

What does this mean for your business?

First – are you sure you want to do business only in the USA? The growth markets are elsewhere. Have you considered selling in China, India, Indonesia, Micronesia, Thailand, South America and Africa? These are growing markets where Chinese businesses (in particular) are making big investments. By going where the population is growing they are able to grow their revenues, and their influence. America isn’t the dominant international player it once was, and there’s never been a better time to look outside America for your next growth market.

Second – Take your business where you see the growth in America. Lots of businesses are going to Texas (and Nevada, Utah, Idaho and Arizona) because lots of people are going there! If you open a restaurant in a town losing people, to succeed you have to entice people to drive to your town and restaurant. You better be really good, and you’ll probably have to make price allowances to have repeat business. But if you have a restaurant in a locality where people are immigrating in large numbers you can do well even if your food is mediocre. Growth hides a multitude of sins!! Your food need not be fantastic, and you can price higher, and you can even have shorter hours because you’re where the people are! It’s simply a lot easier to succeed when you are in a growing marketplace. Are you planning to be someplace because that’s where you started, have family, or went to college? Or are you planning to be someplace where the people, and money, are?

Have you taken into account changes in demographics when making your plans? It is undoubtedly the #1 trend you should use for planning (Fleeing Illinois) . It is highly predictable, and has a lot to do with success. Simply going where the people are will help you succeed. There’s nothing more important to your scenario planning than obtaining a copy of the latest census and studying it really, really hard. It’ll jump start you on the road to greater sales and more success!

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465

by Adam Hartung | May 7, 2021 | Growth Stall, Innovation, Investing, Strategy, Telecom, Trends

Do you have any idea how powerful AOL and Yahoo once were, and how much they were once worth? Do you know how much shareholder value has been destroyed in these 2 companies in just 20 years? $221 Billion of destroyed wealth.

AOL pioneered the web as we know it today. Long before wireless, or broadband, there was “dial up service.” For young readers, that meant using a physical modem to connect your computer to a land-line telephone in order to literally dial up a connection to an internet service provider. AOL pioneered using the internet, and was the #1 connection with almost the entire marketplace. The phrase that made AOL famous back then was when you connected to AOL and it gave us the now iconic “You’ve got mail.” After connecting America, in 2000 AOL merged with Time Warner media in a deal valuing AOL at $111B.

Yahoo pioneered giving internet users news. It accumulated news from around the world on Sports, Economy and many other topics, making the news available to readers for free because it sold ads to pay the bills. In 2000 a publicly traded Yahoo was valued at $125B.

So in 2000, amidst a very extended NASDAQ internet hype, AOL and Yahoo were valued at $226B.

Image Source

This week Verizon agreed to sell the two companies to a private equity firm for $5B. That’s a loss in value of $221B in 21 years.

How does a loss of this magnitude happen? A lot of focusing on tactics, ignoring market trends and failing to adapt the company strategy to meet changing competitive dynamics. Broadband and wireless eventually made dial-up irrelevant. And despite buying some media company to try and add new content to AOL, it lost all meaning. Time Warner spun it out to the public at a value of $3.5B in 2009.

Then, Verizon thought it could build a proprietary content company to get more Verizon customers so it bought AOL in 2015 for $4.4B. Only, nobody needed another content provider by then. Google served up general content just fine, Facebook gave us content we looked at frequently, and specialized content sites like Finance (Marketwatch) and Sports (ESPN) made it impossible that late in the game to launch a general purpose content accumulator and reposter. It was a strategy for 2005, not 2015. Meanwhile, Yahoo made one tactical decision after another to shore up its old model that didn’t work. Google became vastly better at search, and vastly better at delivering content. Tactical oriented CEOs Carol Bartz and Marissa Mayer had no strategy to meet emerging needs of the 2010 decade and beyond – leading Yahoo into complete irrelevancy.

Undeterred, the Verizon owned AOL bought Yahoo in 2017 for $4.5B. After all, it seemed cheap compared to its once $125B value – right? The idea was to merge the two companies, create “cost synergies” and “scale” in users to sell more advertising. Only, neither platform had enough original content to stop the user bleed to other sites. Netflix and Google’s YouTube took everyone who wanted new content away, and there was nothing left for AOL/Yahoo to deliver. It became the internal combustion engine repair shop in a world full of EVs

Now, after spending $9.9B on the entities plus much more in acquisitions, Verizon is selling both entities to Apollo Global Management private equity for $5B – a loss of $4.4B. And Apollo thinks this is a good deal because “a high tide raises all boats” and it will win merely because the world is increasingly using the internet. Really? More people are using the web, and more often, but they’ve already shown not via AOL nor Yahoo. Facebook, Instagram, Google, Pinterest, Twitter, and a raft of other sites are gaining the traffic. What was once irrelevant remains irrelevant.

It is crucial to understand why these to GIANTS of the internet are now part of history’s dustbin. While they pioneered the market, gaining huge revenues, share and valuation, they did NOT keep their eyes on disruptive innovators who could change the market they pioneered. Broadband killed dial-up, and because AOL moved too late it died. Google overtook search, delivering more content faster and better, and Yahoo simply waited too long to react. Not unlike how Research in Motion (Blackberry) failed to see the “app wave” in mobile coming and lost its enormous lead in mobile phones to Apple and Samsung. All thought their strength in pioneering was enough – and failed to keep their eyes on external trends and new market shifts that would change competition.

I wrote a raft of columns about the mistakes made by these company CEOs from 2009 through 2017 – constantly telling readers not to buy the stocks (just search the blogs my website adamhartung.com for AOL or Yahoo.) It is extremely rare for a corporation locked into its business model and cost cutting to adjust to a rapidly shifting market. When a company does so – like Jobs turned around Apple and Nadella at Microsoft – it is the exception to be well applauded. But that is very, very rare.

And this is NOT what PE companies do. They aren’t visionary investors who put in lots of money to change companies. They cut costs, streamline operations, and add debt to get their investment back. Apollo is no different. It has no vision of the internet future that will slow Facebook, Apple, Netflix, Alphabet/Google or even Amazon. It has purchased two irrelevant brands with outdated business models, no new technology, no new market approaches and no new insight to future unmet needs. There is no doubt Apollo will not turn these around. Apollo will unload this newest Yahoo! over-leveraged to a public debt market dominated by pension funds and it will soon enough file bankruptcy, finishing the coffin.

Do you think you could turn these around? First, are you ready to turn around your own business? Are you focused on how market shifts, happening today, will change your market? Are you seeing trends, and changing your business model and technology to adjust? Are you building a business around future scenarios you’ve created to compete in 2025 and beyond with different competitors offering different solutions? Or are you relying on past strengths to carry you through the future? If you’re planning with your eyes firmly in the rear view mirror I highly recommend you learn the lesson from AOL and Yahoo – that approach will not work.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | Nov 3, 2020 | Finance, Investing, Strategy, Trends

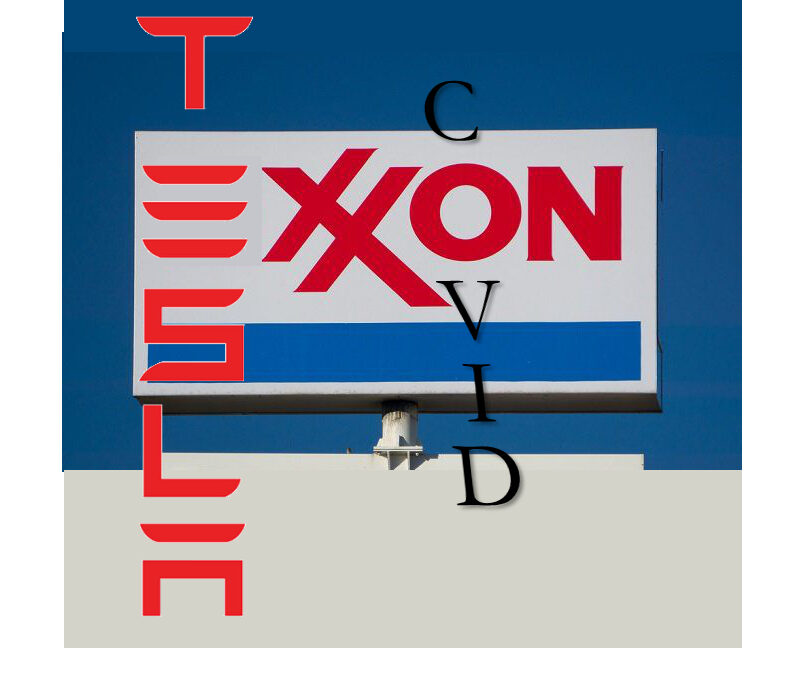

In September, 2015 (5 years ago) I wrote that Tesla was going to change global oil demand. Why? Because Tesla had proven there was a market shift toward electric vehicles (EV’s). Yes, the market was small. But every major auto company had seen the trend emerge, and all had EV’s on the drawing tables. Simultaneously, this was showing a shift to “electrification” at the same time that solar energy costs were dropping in price similar to computer chips in the 1990s.

The combination of shifts away from internal combustion engine (ICE) automobiles operating on petroleum, and the growth in renewable energy production from solar and wind was becoming obvious. In sailing, there are small lengths of cloth attached to the sails specifically to obtain an early read on wind direction. These are called “telltales.” Looking at Tesla and growing renewable electricity generation, the telltales gave me confidence to specifically predict it would

really hurt Exxon.

Now, 5 years later, most pundits think the world has reached “peak oil” usage, and demand for oil will only fall.Since 2015 Exxon’s equity value (XOM) has declined 65%. Due to declining demand, the company is being forced to restructure and possibly

cut its dividend as the company shrinks.

Some would look only at short-term issues like the pandemic, but the economy in China has fully recovered – yet its demand for oil has not. Or some might say that oil prices are down only because Saudi Arabia and Russia are battling over market share – but this only portends more bad news for Exxon because 2 giants with the lowest cost battling for share will only make it harder for Exxon to sell products, even at a lower price and little or no margin.

Unfortunately, the pandemic has created an acceleration in the trends that are dooming profits for oil companies like Exxon. Once business happened in physical meetings where we transported ourselves by auto or plane fueled by oil. Now, meetings are being held on-line, virtually. Increasingly individuals, and companies, have learned not only how to use this technology but that they are more productive. Less wasted commuting time, less wasted hallway conversation time, fewer interruptions, and a recognition that it is possible to cut meeting time allowing attendees to better streamline work and decision-making. Speaking of work, virtual meetings are leading to better employee concentration due to better scheduling of time for meetings, and scheduling time for individual work.

Recall 2010 and the effort put into driving to work, or flying to meetings. Exxon, GM, Ford, Boeing, United Airlines and American Airlines were economic leaders, reflecting the work methods of the Industrial Era. Exxon was one of the 30 stocks on the Dow Jones Industrial Average. But the Great Recession had taken GM off the Dow, and now declining oil demand has removed Exxon – following the path I previously predicted.

Look at current 11/2020 market capitalizations:

Exxon – $133B

General Motors – $49B

Ford – $31B

Boeing – $83B

United Airlines – $10B

American Airlines – $6B

The world has changed. Trends have prevailed. We are now more mobile-oriented, work more asynchronously and use

more gig resources. Now we connect by Zoom and travel on electrons.

REUTERS/Lucy Nicholson

Zoom market cap – $146B

Tesla market cap – $380BWhy this walk down the path of recent history? Markets shift – often a lot faster than we would like to imagine. The economic hurt on those left behind is enormous. The opportunity for new leaders even more enormous. On the back end of trends is a LOT of pain. On the front end of trends is a lot of happy, happy. It is incredibly important to pick out the telltales and incorporate them into your planning. Earlier rather than later.Let trends direct your investments and your business decisions – look forward not backward. You want to be Zoom or Tesla (or own the stocks,) not Exxon, GM or Boeing (nor own those stocks.)

If you don’t have a clear line of sight to the future, ask for help – it’s my job. Do you remember anyone else predicting this enormous shift back in 2015? Back then oil was $100/barrel and Exxon was trading at $100/share. More pundits were expecting the future to look like the past than to make a radical shift. But we are always looking at the early telltales, always developing new scenarios, always preparing for market shifts and their implications.

Did you see the trends, and were you expecting the changes that would happen to oil demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, maybe you should contact us!! We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.comTRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info.

Give us a call or send an email. [email protected] 847-331-6384

by Adam Hartung | Sep 1, 2020 | Finance, Investing, Strategy, Trends

On 8/31/20, the Dow Jones Industrial Average went through a change in composition. Out went Exxon, Pfizer and Raytheon. In came Salesforce.com, Amgen and Honeywell. This is the 8th time the Index components have changed this decade, the 13th time since 2000 and the 55th change since created in 1896. So changes are not uncommon. But, are they meaningful? Ask any academic and you’ll get a resounding “NO.” There is no stated criteria for selection, no metrics for inclusion, no breadth to the number of companies (which has changed significantly over time,) and not even a weighting for market capitalization! The DJIA has no relationship to “the market,” which could well be measured better by the S&P 500, or the Russell 3000. And it doesn’t even link to any specific industry! To academics, “the Dow” is just a random number that reflects nothing worth measuring!!

The DJIA is (currently) a group of 30 stocks selected by the editors of Dow Jones (publisher of the Wall Street Journal, owned by News Corp – which also owns Fox News – and controlled by Rupert Murdock). Despite its lack of respect by academics and money managers, because of its age – and the prestige of being selected by these editors – being on the DJIA has been considered somewhat revered. Think of it as an “editorial award of achievement” for size, profitability and perceived stability. For these reasons, over time many investors have believed the index represents a low–risk way to invest in corporations and grow their wealth.

So the daily value of the DJIA is pretty much meaningless. And being on the DJIA is also pretty much meaningless. But, investors have followed this index every trading day for 124 years. So, it is at least interesting. And that’s because it is a track on what these editors think are important very long-term economic trends.

The original Index composition looks NOTHING like 2020. American Cotton Oil Company, American Spirits Manufacturing Company, American Sugar Refining Company, American Tobacco Company, Chicago Gas Light and Coke, General Electric, Leclede Gas, National Lead, Pacific Mail Steamship Company, Tennessee Coal Iron and Railroad Company, United State Cordage Company and United States Leather Company. Familiar household names? This initial list represents the era in 1896 – an agrarian economy just on the cusp of coming into the industrial age. Not forward looking, but rather somewhat reflective of what were the biggest parts of the economy historically with a not forward.

Over 124 years lots of companies left the DJIA — were replaced – and many replacements left. Some came on, went off, and came back on again – such as AT&T, Exxon (formerly Standard Oil of New Jersey) and Chevron (formerly Standard Oil of California.) Even the vaunted GE was inducted in 1899, only to be removed in 1901 – then added back in 1907 where it stayed until CEO Jeff Immelt imploded the company and it was removed for good in 2018.

But, there has been a theme to the changes. Originally, the index was largely agricultural companies. As the economy changed, the Index rotated into commodity companies like gas, coal, copper and nickel – the materials leading to a new era of tools. This gave way to component manufacturers, dominated by the big steel companies, which created the industrial era. Which, of course, led to big manufacturing companies like 3M and IBM. And, along the way, there was recognition for growth in new parts of the economy, by adding consumer goods companies like P&G, Coca-Cola, McDonald’s, Kraft (since removed,) and Nike along with retailers like Sears (later removed,) Walmart, Home Depot and Walgreens. The massively important role of financial services to the economy was reflected by including Travelers, JPMorgan Chase, American Express, Visa and Goldman Sachs. And as health care advanced, the Index added pharmaceutical companies like Pfizer, Johnson & Johnson and Merck.

Obviously, the word “industrial” no longer has any meaning in the Dow Jones Industrial Index.

Reading across the long history of the DJIA one recognizes the editors’ willingness to try and reflect what was growing in the American economy. But in a laggard way. Not selecting companies too early, preferring instead to see that they make a big difference and remain important for many years. And a tendency to keep them on the index long after the bloom is off the rose – like retaining Kraft until 2008 and still holding onto P&G and Coke today.

The bias has always been to be careful about adding companies, lest they not be sustainable. And not judge too hastily the demise of once great companies. Disney wasn’t added until 1991, long after it was an established entertainment leader. Boeing was added in 1987, after pioneering aviation for 30 years. Microsoft added in 1999, well after it had won the PC war. Thus, the index is a “lagging index.” It reflects a big chunk of what was great, while slowly adding what has recently been great – and never moving too quickly to add companies that just might be tomorrow’s leaders.

Sears added in 1924, wasn’t removed until 1999 when its viability is questionable. Phillip Morris Tobacco (became Altria) was added in 1985, and hung around until 2008 — long after we knew cigarettes were deadly and leadership didn’t know how to do anything else. Even today we see that United Aircraft was added in 1939, which became United Technologies in 1976 and then via merger Raytheon in 2020 – before it is now removed, as all things aircraft are screeching to a pandemic halt. And Boeing is still on the Index despite the 737 fiasco and plunging sales. IBM was added in 1939, and through the 1970s it was a leader in office equipment creating the computer industry. But IBM after years of declining sales and profits isn’t really relevant any longer, yet it is still on the Index.

As for adding growing stars, GM stays on the Index until it goes bankrupt, but Tesla is yet to make consideration (largely due to lack of profit history.) Likewise, Walmart remains even though the “big gun” in retail is obviously Amazon.com (another lacking the size and longevity of profits the editors like.) McDonald’s stays on the list, despite no growth for years and even as the Board investigates its HR department for hiding abhorrent leadership behavior – while Starbucks is eschewed. And Cisco is there, while we all use Zoom for pandemic-driven virtual meetings.

So what can we take away from today’s changes? First, the Index has changed dramatically over 20 years to reflect electronic technology. IBM, Microsoft and Apple are now joined by Salesforce. Pharma company Pfizer is being replaced by bio-pharma company Amgen in a nod to the future, although almost 40 years after Genentech went public. Exxon disappears as oil prices fall to sub-zero, demand declines globally and electric cars are on the cusp of taking market leadership. And conglomerate Honeywell is added just to show the editors still think conglomerates matter – even if GE has nearly disintegrated.

Is any of this meaningful? I don’t really think so. As an award for past performance, it’s a nice token to make the list. As business leaders, however, we need to be a LOT more concerned about developing businesses for the future, based on trends, than is indicated by the components of the DJIA. Driving revenue growth and higher margins comes from doing the next big thing, not the last big thing. And, as investors, if you want to make outsized returns you have to know that a basket of largely laggards (Apple, Microsoft and Salesforce excepted) is not the way to build your retirement nest. Instead, you have to invest in companies that are creating the future, making the trends a reality for businesses and consumers. Think FAANG.

Nonetheless, after 124 years it is still sort of interesting. I guess most of us do still care what the editors of big news companies think.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. [email protected]

by Adam Hartung | Aug 25, 2020 | Economy, Innovation, Leadership, Regulations, Strategy, Trends

In 2019, the California legislature passed Assembly Bill, AB5 “The Gig Economy Law.” It redefined “employee” in an effort to try and dramatically reduce “contract workers.” This law is intended to force people who work to become ”employees” (of someone), and thereby receive more rights. Simultaneously it forces those who pay for work to become “employers” covering additional costs forced onto them by the legal definition of an “employee”. In other words, AB5 attempts to set back the advancement of the Gig Economy 30+ years. Last week, that law was put on hold by a California court, and California citizens will vote in November on whether requirements of AB5 should remain, or be repealed.

Go back to 1900 and there were very few “employees.” Most people just worked. But the industrial economy boomed, and with it the need to put people into factories. Showing up on time, doing a job, was crucial to the industrial economy – whether you were making car parts or pushing invoices around. We’ve all seen pictures of assembly lines in factories making shirts or lawn mowers, and assembly lines of gray steel desks where people manually processed documentation. Being an “employee” meant showing up and was central to developing the industrial economy, where lots of cogs were needed for the machine to work.

There is one thing stronger than all the armies in the world, and that is an Idea whose time has come.

Victor Hugo

But we’re not in an industrial economy any more. Since 1990 we’ve been transforming into the information economy (or the knowledge economy, pick your preferred term.) Automation has replaced labor, with robots making trucks while computers process documents. People don’t stand in assembly lines – machines do. Work doesn’t happen with our hands, it happens with our brains – and machines do the manual labor. Managers don’t manage people, they manage processes. As a result, companies have been realizing they need a lot fewer people.

No longer can employers consider employees for life. Rather, companies need flexibility to adjust to the fast paced marketplace. Owning resources, including labor, can feel like dragging an anchor along with your business. Yes, people are needed people to do things. But every business leader knows that the brainpower needed today is probably not what was needed yesterday and not what will be needed tomorrow. Businesses need to access the knowledge workers they need quickly and shift their resources fast in order to meet changing market conditions- agility not stability. Relationships are transactional, not societal.

This is actually good for everyone. A hundred years ago studios controlled everything about movie making, including actor salaries. Many actors (i.e. Judy Garland & Mickey Rooney) made dozens of movies, yet had very little money. But that lock was broken, and it allowed actors to sell their services to the highest bidder – leading to today’s “star economy” where actors make what they can get producers to pay. There is a set scale to employment, but every actor is a free agent able to negotiate their terms of “employment” for each project.

This is actually good for everyone. A hundred years ago studios controlled everything about movie making, including actor salaries. Many actors (i.e. Judy Garland & Mickey Rooney) made dozens of movies, yet had very little money. But that lock was broken, and it allowed actors to sell their services to the highest bidder – leading to today’s “star economy” where actors make what they can get producers to pay. There is a set scale to employment, but every actor is a free agent able to negotiate their terms of “employment” for each project.

Major league sports is the same. Where once club owners dictated pay, today players negotiate across teams for the best contracts. It allows for negotiating the best price for the best service in an open, flexible economy. If you’re good at playing, or coaching, you negotiate with the teams to get your best price for your services.

Uber and Lyft aren’t much different from studios and sports franchisees. Once, taxi companies controlled the market. All of us spent time standing in lines, waiting on cabs, that too often were dirty and broken. Market access was controlled by taxi tokens, and so was pricing. So service deteriorated to as low as possible, while customers stood in line on Friday night hoping to get a cab home from the theatre. But Uber unleashed the market. Resources could be added, or removed, by market participants. Pricing was determined by the buyers and sellers. And pricing variability allowed for quality variations as drivers tried to acquire repeat business. Surge pricing meant you could get a ride on New Year’s eve, meeting the customer needs and with pricing to meet the supplier’s need for expanding short-term capacity.

Uber and Lyft aren’t much different from studios and sports franchisees. Once, taxi companies controlled the market. All of us spent time standing in lines, waiting on cabs, that too often were dirty and broken. Market access was controlled by taxi tokens, and so was pricing. So service deteriorated to as low as possible, while customers stood in line on Friday night hoping to get a cab home from the theatre. But Uber unleashed the market. Resources could be added, or removed, by market participants. Pricing was determined by the buyers and sellers. And pricing variability allowed for quality variations as drivers tried to acquire repeat business. Surge pricing meant you could get a ride on New Year’s eve, meeting the customer needs and with pricing to meet the supplier’s need for expanding short-term capacity.

You might not think of Kim Kardashian, Tom Brady and an Uber driver as gig workers. But they are. And this hasn’t been lost on most of us. As publishers have disappeared, writers now must sell their research and writing independently, no longer expecting a set salary and benefits from newspaper owners. Virtual office assistants abound. For almost 30 years we’ve been building a flourishing economy of “gig workers” who are looking to match their skills with market needs. Uber and Lyft are just platforms created to help match the sellers and buyers (as is FiveRR for graphics and other office services.) Their success has been due to meeting a very real market need.

Uber and Lyft have helped the trend toward individual economic independence grow, not created the trend. When you see managers, who work for a set wage, working 24x7x365 on their iPhone or other mobile device, what’s the difference between them and a “gig worker?” When it comes to getting the work done, nothing. Just how they are paid – and some serious illusions about the employee/employer compact that are wholly out of date. Increasingly, we are recognizing we are better off to maximize the value of our services working independently, and seeking out projects that can use our services as contractors, rather than going through the burden of “hiring” and “firing” across “employers” in a fast changing world. Uber didn’t put people out of work, the knowledge economy redefined work. Uber doesn’t create low pay, it just offers a market that allows for flexible capacity and variable pricing. Uber offers a platform matching buyers and sellers. And that’s something we need MORE as adaptability demands keep rising.

California legislators can see that work has changed. But their approach was backward. They are trying to push everyone – both workers and business people – into an outdated model. An industrial model of employment. That will never work. It won’t work because the economy has changed, the world has changed, needs have changed, and these trends will not reverse. Trying to rewind the clock will only cause employers to abandon markets, as Uber and Lyft did when they said they would leave California. Solutions must address trends for independence and accessibility, not try to apply 100 year old definitions to a modern problem.

Contract work is here to stay. It’s been growing for 30 years. What’s needed are better Gig Marketplace tools to help business people find the resources they need, for workers to find projects that fit their skills and that meet their societal needs.

The old model created the term “benefits” for societal needs comprised of unemployment pay, retirement pay, hazard compensation, health care, etc. and forced those costs onto the “employer.” In much of the world today these costs are born by the government, but in the USA they are still borne by “employers”. In a contractor relationship, no one is required to cover the costs of those benefits. In most businesses now, “employer” is a term with a lot less meaning since businesses need much more agility than they did in an industrial economy. During this transition from industrial to gig economy, those societal needs are not being met effectively, leading to individual suffering and much, much higher costs to society.

New solutions are required to meet these needs – instead of forcing the old model onto a new economy. Legislators and regulators need to recognize that old approaches need to be revamped. All of these problems need new solutions – not some effort to force the industrial model onto platform providers that do little more than match needs with skills.

And this requirement for change applies to labor representation as well. The Department of Labor is an industrial era dinosaur that has little to no value in a world of work-from-home employees, outsourced manufacturing plants and easily available offshore production. Industrial era labor unions make no sense when we don’t work on assembly lines. Yet, unions are a very important part of entertainment and professional sports. Because in the latter markets leaders have adapted the union’s services to meet modern needs. Whether they realize it or not, gig workers need help with representation. But that representation must be a lot more sophisticated at helping workers than the throngs of attorneys at the AFL-CIO.

Californians would be suffer negative impacts if Uber and Lyft leave the market. And they realize that. But the solution is not the blunt axe of AB5. Thus, the law will almost surely be reversed in the next election. Then, hopefully, California will step up to the challenge of leading the country with new approaches that meet gig worker needs – expanding their markets and opportunities while building social solutions to every day needs.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. [email protected]