by Adam Hartung | Jul 14, 2020 | Disruptions, Innovation, Leadership, Marketing, real estate, Retail, Trends

TRENDS: Covid-19 has accelerated a lot of trends. Few more than retail. Oddly some people have taken the view that Covid-19 changed retail. Actually, it didn’t. The pandemic has merely accelerated trends that have been driving industry change for almost two decades.

Back in 2004, Eddie Lampert bought all the bonds of defunct Kmart and used those assets to do a merger with Sears – creating Sears Holdings that encompassed both brands. The day of announcement Chicago Tribune asked for my opinion, and famously I predicted the merger would be a disaster. Clearly both Kmart and Sears were far, far off trends in retail, both were already struggling – and neither had a clue about emerging e-commerce.

Why in 2004 would I predict Sears would fail? The #1 trend in retail was e-commerce, which was all about individualized customer experience, problem solving for customer needs — and only, finally fulfillment. By increasing “scale” – primarily owning a lot more real estate – this new organization would NOT be more competitive. Walmart was already falling behind the growth curve, and everyone in retail was ignoring the elephant in the room – Amazon.com. Loading up on a lot more real estate, more inventory, more employees, more supplier relationships and more community commitments – old ideas about how to succeed related to fulfillment – would hurt more than help. Retail was an industry in transition. All of these factors were boat anchors on future success, which relied on aggressively moving to greater internet use.

Unfortunately, Eddie Lampert as CEO was like most CEOs. He thought success would come from doing more of what worked in the past. Be better, faster, cheaper at what you used to do. In 2011 Sears asked its HQ town (Hoffman Estates) and the state (Illinois) for tax subsidies to keep the HQ there. Sears had built what was once the world’s once tallest building, named the Sears Tower. But many years earlier Sears left, the building was renamed, and Sears was becoming a ghost of itself. I pleaded with government officials to “let Sears go” since the money would be wasted. And it was clear by 2016, that Lampert and his team’s bias toward old retail approaches had only served to hurt Sears more and guarantee its failure. Now – in 2020 – Hoffman Estates has taken the embarrassing act of removing the Sears name from the town’s arena, admitting Sears is washed up.

****

It was with a multi-year observation of trends that I told people in 2/2017 that retail real estate values would crumble . Now mall vacancies are at an 8 year high and 50% of mall department stores will permanently close within a year. We are “over-stored” and nothing will change the fast decline in retail real estate values. Who knows what will happen to all this empty space?

Trends led me in March 2017 to advise investors they should own NO traditional retail equities. Shortly after Sears filed bankruptcy Radio Shack and storied ToysRUs followed. And with the pandemic acting as gasoline fueling change, we’ve now seen the bankruptcies of Neiman Marcus, JCPenney, J Crew, Forever 21, GNC and Chuck e Cheese (but, really, weren’t you a bit surprised the last one was still even in business?) After 3 years of pre-Covid store closings, Industry pundits are finally predicting “record numbers of store closings”. And, after 15 years of predictions, I’m being asked by radio hosts to explain the impact of widespread failures of both local and national retailers ( ). Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

As we move forward, what will happen to your business? Will you build on trends to create a new future where growth abounds? Will you align your strategy with the future so you “skate to where the puck will be?” Or will you – like Sears and so many others – find an ignominious end to your organization? Will the signs change, or will the signs come down? The trends have never been stronger, the markets have never moved faster and the rewards have never been greater. It’s time to plan for the future, and build your strategy on trends (not what worked in the past.)

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Feb 28, 2017 | E-Commerce, Employment, real estate, Retail

(Photo: JOHN MACDOUGALL/AFP/Getty Images)

Amazon.com has become an important part of the American economy, and the lives of people globally. But, far too few people still understand the repercussions of Amazon’s success on retailers, consumer goods manufacturers, real estate – and ultimately everyone’s lives. The implications are enormous. Smart leaders, and investors, will plan for these implications and take advantage of the market shift.

Invest in ecommerce, divest traditional retailers.

The first implication is just thinking about investing in Amazon and/or its competitors in retail. In May, 2016 I compared the market value of Wal-Mart, the world’s largest retailer, with Amazon. At the time Wal-Mart was worth $216 billion, and Amazon was worth $332 billion. The difference could be explained by realizing that Wal-Mart was the leader at brick-and-mortar sales, which were shrinking, while Amazon was the leader in e-commerce, which is growing. Since then Wal-Mart’s value has increased to $222 billion – up $6 billion, 2.8%. Meanwhile Amazon’s value has increased to $403 billion- up $71 billion, 21.4%. Over three years (starting 3/3/14) Wal-Mart’s per share value has declined from $74 to $71 (down 4%,) while Amazon’s has risen from $370 to $845 (up 128%.)

To put it mildly, investing in Amazon, which is the leader in e-commerce, has created a great return. Contrastingly that value increase has been fueled by declines in traditional retailers. The Amazon Effect has caused shares in companies like Sears Holdings, JCPenney, Kohl’s, Macy’s and many other stalwarts of the bygone era to be crushed. Over the last year investors in XRT (the retail industry spider) have increased 1.6%, while the S&P 500 spider has jumped 22%. The number of retailers with debt rated at Moody’s most distressed level has tripled since 2009 – and Moody’s predicts this list will worsen over the next five years.

There is vastly too much retail space, and nobody knows what to do with it.

And this has an impact on real estate. As online sales come to over 11% of all holiday sales in 2016, and Amazon accounts for 40% of all those sales, it is clear people just don’t go to stores any more anywhere near the way they once did. Historically prime retail real estate was considered valuable – and in 2007 many people thought Sears real estate was worth more than Sears as a retailer. But no longer. According to Morningstar, Sears store closings alone could cause 200 malls to close.

It is apparent the Amazon Effect has left America with far more storefronts than needed. Stand-alone stores are being shuttered, with no alternative use for most buildings. Malls and shopping centers go begging as traffic drops, tenants leave, lease rates collapse and the facilities end up wholly or nearly empty. This means you don’t want to invest in retail real estate REITs. But it also means that neighborhoods, and sometimes entire towns, will be impacted as these empty buildings reduce interest in housing and push down residential prices.

Tax receipts will fall, and nobody knows how to replace them.

For a long time governments gave handouts to retailers in the form of tax breaks to build stores or locate their headquarters. But as stores close the property tax receipts decline, putting a greater burden on homeowners to pay for schools and infrastructure. Same with sales taxes which disappear from the local government coffers. And tax breaks once given to hold onto jobs – like the ones the village of Hoffman Estates and state of Illinois, gave Sears in 2011 to not move its headquarters, look far less justified. In short, the Amazon Effect has an enormous impact on the local tax base – and those missing dollars will inevitably have to come from residents – or a significant curtailing of services.

The impact on job eliminations will be staggering.

The Amazon Effect also has an impact on jobs. Amazon’s growth keeps escalating, from 19% in 2014 to 20% in 2015 to 28% in 2016, which takes the jobs away from traditional retailers. Macy’s plans to shed 10,000 workers as it shrinks and streamlines. JCPenney will eliminate 6,000 employees via early retirement completely separate from its store closings, and HHGregg is shedding 1,500 jobs as stores close. And thousands more are being lost across traditional retail in stores, supply chain positions and headquarters facilities.

Traditional retail employs about 16.5 million Americans – nearly 10% of the entire workforce. 6.2 million are in the prime product lines targeted by e-commerce (GAFO – General, Apparel, Furniture and Other.) The Amazon Effect will continue to eliminate these positions. Over the next five years it is not unlikely that the decline of brick-and-mortar will cause 16% of GAFO jobs to disappear, which is almost 1 million jobs. Simultaneously this could easily cause 10% of the non-GAFO jobs (10.3 million) to disappear – which is another 1 million. This likely scenario would cause the loss of 2 million jobs in just five years, which is the entirety of all lost manufacturing jobs to China. The Trump administration has more employment concerns to face than just the return of manufacturing.

The Amazon Effect is changing grocery shopping, without even being a major competitor in that sector. Because Wal-Mart has lost so much general merchandise sales to e-commerce, the company has amped up grocery sales – which are now 56% of total revenue. To continue growing groceries Wal-Mart is undertaking a massive price war pitting itself against the long-running low cost grocer Aldi. This is creating even more intense profit pressure on Wal-Mart, which last year saw gross margins drop by eight points, as net income fell 18%. Such intense price competition is creating the need for even more cost cutting among all grocers – which means investors beware – and we can expect even more job cutting as the spiral downward continues.

Consumer Goods manufacturers, and their suppliers, will be stressed.

Of course this pushes the Amazon Effect onto consumer goods companies that supply grocery retailers. Wal-Mart has held meetings with P&G, Unilever, Conagra, Coca-Cola and other big name companies demanding across-the-board 15% price reductions at wholesale. And Wal-Mart expects these suppliers to help Wal-Mart beat its head-to-head competitors on price 8o% of the time. This will cause consumer goods manufacturers to cut their own costs, including jobs, as well as pressure their raw material suppliers to further reduce their costs – leading to an ongoing spiral of cost cutting, job eliminations and additional pressures for change.

The internet gave us e-commerce, and that birthed Amazon.com. Few predicted the enormous implications this would have on retail, and society. Every single American is affected by the Amazon Effect, which is now inescapable. The only remaining question is whether your business, your government leaders and you are planning for this and preparing for the inevitable changes which will continue coming?

by Adam Hartung | May 15, 2016 | In the Swamp, Investing, real estate, Retail

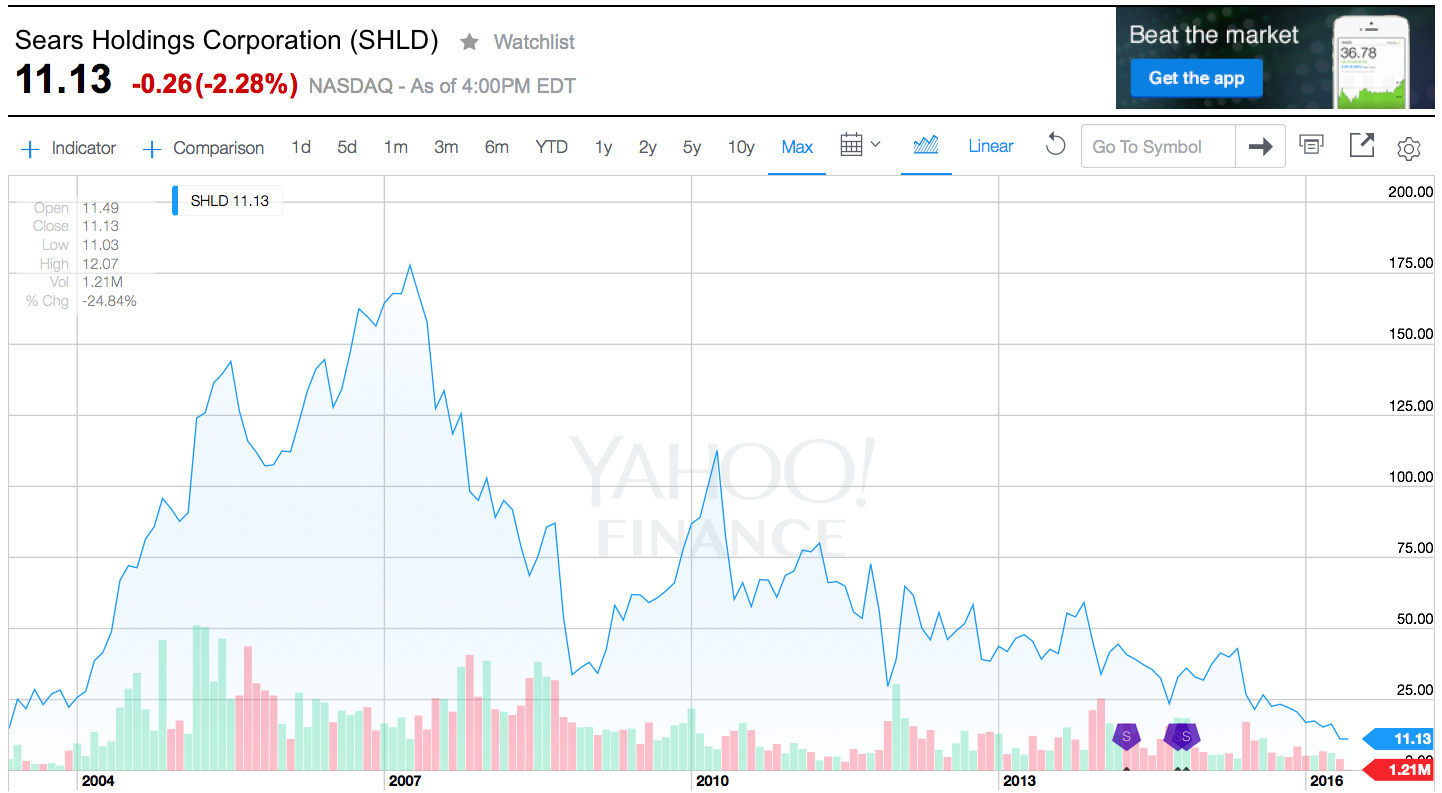

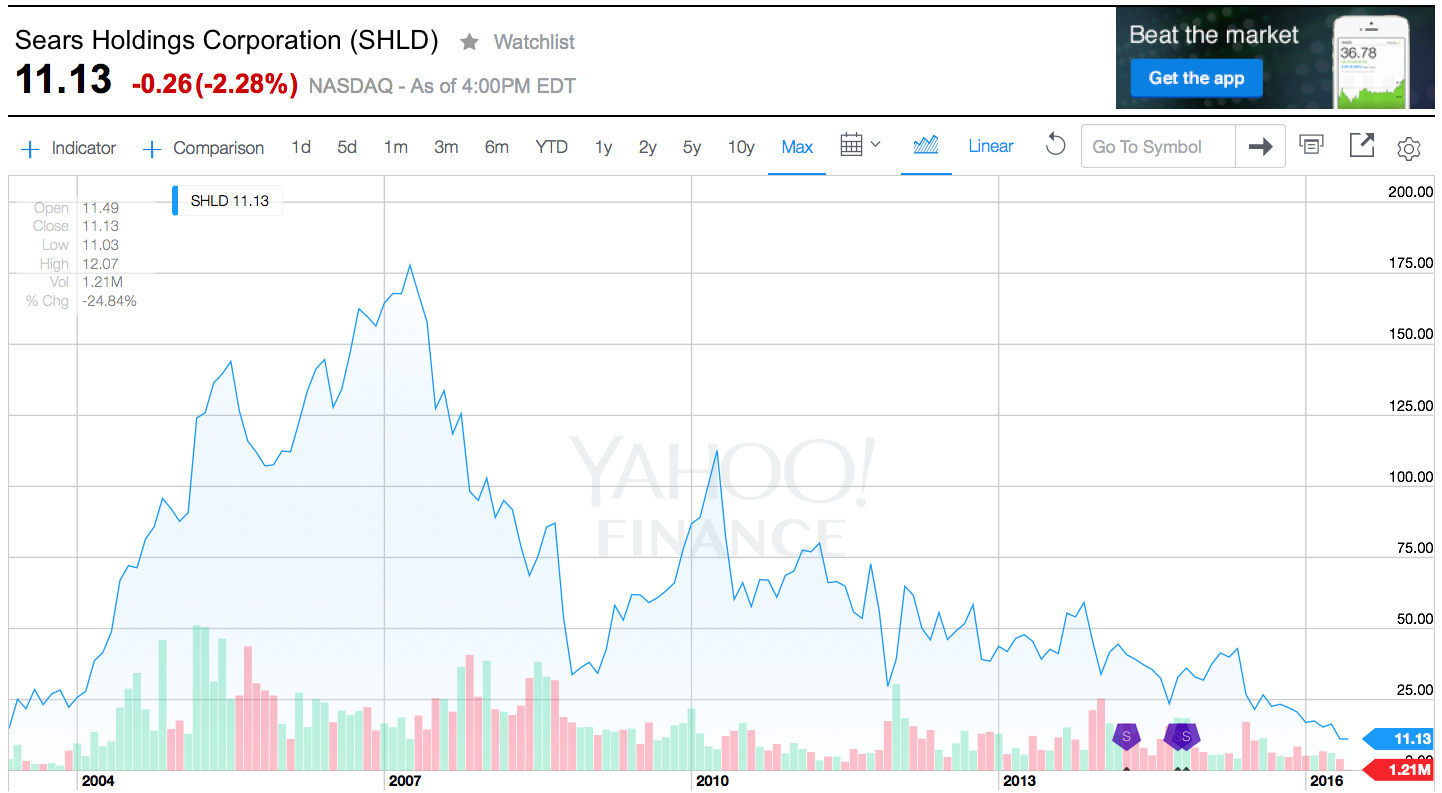

Last week Sears announced sales and earnings. And once again, the news was all bad. The stock closed at a record, all time low. One chart pretty much sums up the story, as investors are now realizing bankruptcy is the most likely outcome.

Chart Source: Yahoo Finance 5/13/16

Quick Rundown: In January, 2002 Kmart is headed for bankruptcy. Ed Lampert, CEO of hedge fund ESL, starts buying the bonds. He takes control of the company, makes himself Chairman, and rapidly moves through proceedings. On May 1, 2003, KMart begins trading again. The shares trade for just under $15 (for this column all prices are adjusted for any equity transactions, as reflected in the chart.)

Lampert quickly starts hacking away costs and closing stores. Revenues tumble, but so do costs, and earnings rise. By November, 2004 the stock has risen to $90. Lampert owns 53% of Kmart, and 15% of Sears. Lampert hires a new CEO for Kmart, and quickly announces his intention to buy all of slow growing, financially troubled Sears.

In March, 2005 Sears shareholders approve the deal. The stock trades for $126. Analysts praise the deal, saying Lampert has “the Midas touch” for cutting costs. Pumped by most analysts, and none moreso than Jim Cramer of “Mad Money” fame (Lampert’s former roommate,) in 2 years the stock soars to $178 by April, 2007. So far Lampert has done nothing to create value but relentlessly cut costs via massive layoffs, big inventory reductions, delayed payments to suppliers and store closures.

Homebuilding falls off a cliff as real estate values tumble, and the Great Recession begins. Retailers are creamed by investors, and appliance sales dependent Sears crashes to $33.76 in 18 months. On hopes that a recovering economy will raise all boats, the stock recovers over the next 18 months to $113 by April, 2010. But sales per store keep declining, even as the number of stores shrinks. Revenues fall faster than costs, and the stock falls to $43.73 by January, 2013 when Lampert appoints himself CEO. In just under 2.5 years with Lampert as CEO and Chairman the company’s sales keep falling, more stores are closed or sold, and the stock finds an all-time low of $11.13 – 25% lower than when Lampert took KMart public almost exactly 13 years ago – and 94% off its highs.

What happened?

Sears became a retailing juggernaut via innovation. When general stores were small and often far between, and stocking inventory was precious, Sears invented mail order catalogues. Over time almost every home in America was receiving 1, or several, catalogues every year. They were a major source of purchases, especially by people living in non-urban communities. Then Sears realized it could open massive stores to sell all those things in its catalogue, and the company pioneered very large, well stocked stores where customers could buy everything from clothes to tools to appliances to guns. As malls came along, Sears was again a pioneer “anchoring” many malls and obtaining lower cost space due to the company’s ability to draw in customers for other retailers.

To help customers buy more Sears created customer installment loans. If a young couple couldn’t afford a stove for their new home they could buy it on terms, paying $10 or $15 a month, long before credit cards existed. The more people bought on their revolving credit line, and the more they paid Sears, the more Sears increased their credit limit. Sears was the “go to” place for cash strapped consumers. (Eventually, this became what we now call the Discover card.)

In 1930 Sears expanded the Allstate tire line to include selling auto insurance – and consumers could not only maintain their car at Sears they could insure it as well. As its customers grew older and more wealthy, many needed help with financia advice so in 1981 Sears bought Dean Witter and made it possible for customers to figure out a retirement plan while waiting for their tires to be replaced and their car insurance to update.

To put it mildly, Sears was the most innovative retailer of all time. Until the internet came along. Focused on its big stores, and its breadth of products and services, Sears kept trying to sell more stuff through those stores, and to those same customers. Internet retailing seemed insignificantly small, and unappealing. Heck, leadership had discontinued the famous catalogues in 1993 to stop store cannibalization and push people into locations where the company could promote more products and services. Focusing on its core customers shopping in its core retail locations, Sears leadership simply ignored upstarts like Amazon.com and figured its old success formula would last forever.

But they were wrong. The traditional Sears market was niched up across big box retailers like Best Buy, clothiers like Kohls, tool stores like Home Depot, parts retailers like AutoZone, and soft goods stores like Bed, Bath & Beyond. The original need for “one stop shopping” had been overtaken by specialty retailers with wider selection, and often better pricing. And customers now had credit cards that worked in all stores. Meanwhile, for those who wanted to shop for many things from home the internet had taken over where the catalogue once began. Leaving Sears’ market “hollowed out.” While KMart was simply overwhelmed by the vast expansion of WalMart.

What should Lampert have done?

There was no way a cost cutting strategy would save KMart or Sears. All the trends were going against the company. Sears was destined to keep losing customers, and sales, unless it moved onto trends. Lampert needed to innovate. He needed to rapidly adopt the trends. Instead, he kept cutting costs. But revenues fell even faster, and the result was huge paper losses and an outpouring of cash.

To gain more insight, take a look at Jeff Bezos. But rather than harp on Amazon.com’s growth, look instead at the leadership he has provided to The Washington Post since acquiring it just over 2 years ago. Mr. Bezos did not try to be a better newspaper operator. He didn’t involve himself in editorial decisions. Nor did he focus on how to drive more subscriptions, or sell more advertising to traditional customers. None of those initiatives had helped any newspaper the last decade, and they wouldn’t help The Washington Post to become a more relevant, viable and profitable company. Newspapers are a dying business, and Bezos could not change that fact.

Mr. Bezos focused on trends, and what was needed to make The Washington Post grow. Media is under change, and that change is being created by technology. Streaming content, live content, user generated content, 24×7 content posting (vs. deadlines,) user response tracking, readers interactivity, social media connectivity, mobile access and mobile content — these are the trends impacting media today. So that was where he had leadership focus. The Washington Post had to transition from a “newspaper” company to a “media and technology company.”

So Mr. Bezos pushed for hiring more engineers – a lot more engineers – to build apps and tools for readers to interact with the company. And the use of modern media tools like headline testing. As a result, in October, 2015 The Washington Post had more unique web visitors than the vaunted New York Times. And its lead is growing. And while other newspapers are cutting staff, or going out of business, the Post is adding writers, editors and engineers. In a declining newspaper market The Washington Post is growing because it is using trends to transform itself into a company readers (and advertisers) value.

CEO Lampert could have chosen to transform Sears Holdings. But he did not. He became a very, very active “hands on” manager. He micro-managed costs, with no sense of important trends in retail. He kept trying to take cash out, when he needed to invest in transformation. He should have sold the real estate very early, sensing that retail was moving on-line. He should have sold outdated brands under intense competitive pressure, such as Kenmore, to a segment supplier like Best Buy. He then should have invested that money in technology. Sears should have been a leader in shopping apps, supplier storefronts, and direct-to-customer distribution. Focused entirely on defending Sears’ core, Lampert missed the market shift and destroyed all the value which initially existed in the great retail merger he created.

Impact?

Every company must understand critical trends, and how they will apply to their business. Nobody can hope to succeed by just protecting the core business, as it can be made obsolete very, very quickly. And nobody can hope to change a trend. It is more important than ever that organizations spend far less time focused on what they did, and spend a lot more time thinking about what they need to do next. Planning needs to shift from deep numerical analysis of the past, and a lot more in-depth discussion about technology trends and how they will impact their business in the next 1, 3 and 5 years.

Sears Holdings was a 13 year ride. Investor hope that Lampert could cut costs enough to make Sears and KMart profitable again drove the stock very high. But the reality that this strategy was impossible finally drove the value lower than when the journey started. The debacle has ruined 2 companies, thousands of employees’ careers, many shopping mall operators, many suppliers, many communities, and since 2007 thousands of investor’s gains. Four years up, then 9 years down. It happened a lot faster than anyone would have imagined in 2003 or 2004. But it did.

And it could happen to you. Invert your strategic planning time. Spend 80% on trends and scenario planning, and 20% on historical analysis. It might save your business.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.