by Adam Hartung | Jun 10, 2021 | Entrepreneurship, In the Rapids, Innovation, Strategy, Transportation, Trends

The Slow Decline of Two Famous Brands

Demographics have been causing the slow death of 2 very famous brands. Radio Flyer and Harley-Davidson. Now they are reacting, and maybe it won’t be too little too late for them. Here’s the story and a small dose of innovation theory for you to implement in your business.

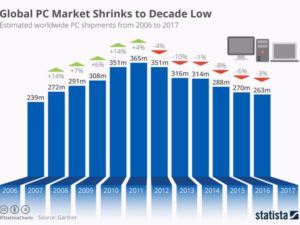

Radio Flyer for 100 years has been famous for its little red wagons. Since before the Great Depression, children have enjoyed these wagons (and scooters, etc.) for recreation. But family formation has fallen precipitously the last decade, and the birth rate has fallen even faster. Further, lots of competitors have entered the market for small pull wagons and scooters. The net impact is fewer babies, and a big drop in demand for the traditional metal wagons. For a company manufacturing in Chicago, it looked like another slow slide into irrelevancy and failure.

But now, Radio Flyer has announced its new e-bike and e-scooter products. This opens the door to an entirely new market and new customers. People of all ages have started purchasing e-bikes. They ride for pleasure, to run errands and even commuting. In some cities, electric scooter ride sharing rentals have soared faster than bicycle rentals. Sales have skyrocketed. Seeing the underlying trend in demographics, and the changing consumer behavior Radio Flyer is entering the market with new products – priced squarely in the market sweet spot – which just might make the company relevant again.

An even older company is Harley-Davidson. For years, Harley has dominated the market for large engine cruiser style motorcycles. In the 1970s and 1980s, this served the company well as motorcycle sales grew and customers would up-size to Harley bikes from smaller Japanese manufacturers. But the brand image wore old a long time ago. Images of “Hells Angels”, “Easy Rider” and accountants turned HOG (for Harley Owners Group) were not attractive to younger buyers. The average age of Harley buyers kept rising, until now it is almost 60 years old! The reality is that Harley’s market simply started dying off, aging out of buying new motorcycles (or any motorcycle for that matter.) And younger buyers were far less interested in the old-style cruiser in favor of the smaller sized, easier handling and mostly faster sport bikes made in Japan.

For years Harley-Davidson ignored the demographic trends and the impact on its business. Harley made an effort to update its product, and image, introducing the V-Rod with a Porsche manufactured engine. But dealers didn’t like it, and Harley never put in the promotion to bring in the new, younger rider the bike was designed to attract. Now, Harley-Davidson has launched its own e-bike, called the Serial 1. At $5,000 it’s a top-priced e-bike, I guess aligned with the company reputation for premium pricing. But the Serial 1 has garnered good reviews, and like the Radio Flyer e-bike it gives Harley a new technology and a new market with new customers. And most important, a chance to slow its slide into irrelevancy.

Will these products turn these companies around?

It’s hard to say. They aren’t creating a new market like Netflix did in streaming, or Apple did with apps on iPhones. They aren’t early to market. One could say they are a late entry into a crowded marketplace. And neither appear to be introducing any new technology, or enhanced functionality not already available. And the brands are outdated, loaded with nostalgia – which might be good, or bad. But at least they are reacting to trends.

Innovation Theory in Practice

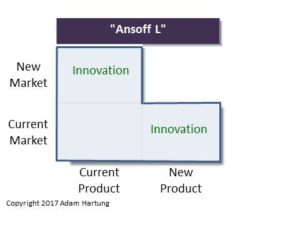

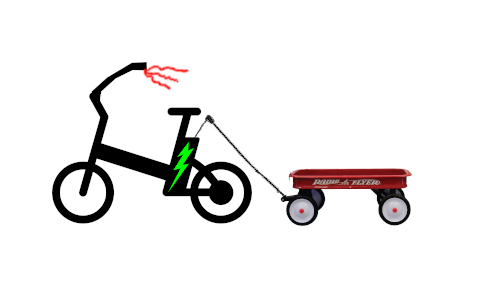

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

The second issue is that the market for electric personal transportation is past Early Adopters and into the Growth stage which is when new brands jump in and the market starts to fragment. There is plenty of market share for both Radio Flyer and Harley-Davidson to become established. One key question is- Can these brands offer the products and brand desire to make the jump to segments of new customers?

Are the Brands Structured to Succeed?

To succeed, they must COMMIT resources and focus to these new markets, and create new developments. I wish they would have launched with White Space teams that had permission to develop a new brand image, new distribution, new ad campaigns – an entirely new approach designed to seek out market leadership. Harley-Davidson did create a version of a “skunkworks” with the spinoff of Serial 1, LLC. For now the PR sounds more like they are doing it “on the sly” as something they aren’t really sure will succeed. So it’s really up to senior leadership now. They either commit to a new future allowing product teams to build on the e-bike opportunity to develop new technology, new customers and new markets – or they can slip back into the slide downward. We’ll have to wait and see if they can jump the re-invention gap.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | May 7, 2021 | Growth Stall, Innovation, Investing, Strategy, Telecom, Trends

Do you have any idea how powerful AOL and Yahoo once were, and how much they were once worth? Do you know how much shareholder value has been destroyed in these 2 companies in just 20 years? $221 Billion of destroyed wealth.

AOL pioneered the web as we know it today. Long before wireless, or broadband, there was “dial up service.” For young readers, that meant using a physical modem to connect your computer to a land-line telephone in order to literally dial up a connection to an internet service provider. AOL pioneered using the internet, and was the #1 connection with almost the entire marketplace. The phrase that made AOL famous back then was when you connected to AOL and it gave us the now iconic “You’ve got mail.” After connecting America, in 2000 AOL merged with Time Warner media in a deal valuing AOL at $111B.

Yahoo pioneered giving internet users news. It accumulated news from around the world on Sports, Economy and many other topics, making the news available to readers for free because it sold ads to pay the bills. In 2000 a publicly traded Yahoo was valued at $125B.

So in 2000, amidst a very extended NASDAQ internet hype, AOL and Yahoo were valued at $226B.

Image Source

This week Verizon agreed to sell the two companies to a private equity firm for $5B. That’s a loss in value of $221B in 21 years.

How does a loss of this magnitude happen? A lot of focusing on tactics, ignoring market trends and failing to adapt the company strategy to meet changing competitive dynamics. Broadband and wireless eventually made dial-up irrelevant. And despite buying some media company to try and add new content to AOL, it lost all meaning. Time Warner spun it out to the public at a value of $3.5B in 2009.

Then, Verizon thought it could build a proprietary content company to get more Verizon customers so it bought AOL in 2015 for $4.4B. Only, nobody needed another content provider by then. Google served up general content just fine, Facebook gave us content we looked at frequently, and specialized content sites like Finance (Marketwatch) and Sports (ESPN) made it impossible that late in the game to launch a general purpose content accumulator and reposter. It was a strategy for 2005, not 2015. Meanwhile, Yahoo made one tactical decision after another to shore up its old model that didn’t work. Google became vastly better at search, and vastly better at delivering content. Tactical oriented CEOs Carol Bartz and Marissa Mayer had no strategy to meet emerging needs of the 2010 decade and beyond – leading Yahoo into complete irrelevancy.

Undeterred, the Verizon owned AOL bought Yahoo in 2017 for $4.5B. After all, it seemed cheap compared to its once $125B value – right? The idea was to merge the two companies, create “cost synergies” and “scale” in users to sell more advertising. Only, neither platform had enough original content to stop the user bleed to other sites. Netflix and Google’s YouTube took everyone who wanted new content away, and there was nothing left for AOL/Yahoo to deliver. It became the internal combustion engine repair shop in a world full of EVs

Now, after spending $9.9B on the entities plus much more in acquisitions, Verizon is selling both entities to Apollo Global Management private equity for $5B – a loss of $4.4B. And Apollo thinks this is a good deal because “a high tide raises all boats” and it will win merely because the world is increasingly using the internet. Really? More people are using the web, and more often, but they’ve already shown not via AOL nor Yahoo. Facebook, Instagram, Google, Pinterest, Twitter, and a raft of other sites are gaining the traffic. What was once irrelevant remains irrelevant.

It is crucial to understand why these to GIANTS of the internet are now part of history’s dustbin. While they pioneered the market, gaining huge revenues, share and valuation, they did NOT keep their eyes on disruptive innovators who could change the market they pioneered. Broadband killed dial-up, and because AOL moved too late it died. Google overtook search, delivering more content faster and better, and Yahoo simply waited too long to react. Not unlike how Research in Motion (Blackberry) failed to see the “app wave” in mobile coming and lost its enormous lead in mobile phones to Apple and Samsung. All thought their strength in pioneering was enough – and failed to keep their eyes on external trends and new market shifts that would change competition.

I wrote a raft of columns about the mistakes made by these company CEOs from 2009 through 2017 – constantly telling readers not to buy the stocks (just search the blogs my website adamhartung.com for AOL or Yahoo.) It is extremely rare for a corporation locked into its business model and cost cutting to adjust to a rapidly shifting market. When a company does so – like Jobs turned around Apple and Nadella at Microsoft – it is the exception to be well applauded. But that is very, very rare.

And this is NOT what PE companies do. They aren’t visionary investors who put in lots of money to change companies. They cut costs, streamline operations, and add debt to get their investment back. Apollo is no different. It has no vision of the internet future that will slow Facebook, Apple, Netflix, Alphabet/Google or even Amazon. It has purchased two irrelevant brands with outdated business models, no new technology, no new market approaches and no new insight to future unmet needs. There is no doubt Apollo will not turn these around. Apollo will unload this newest Yahoo! over-leveraged to a public debt market dominated by pension funds and it will soon enough file bankruptcy, finishing the coffin.

Do you think you could turn these around? First, are you ready to turn around your own business? Are you focused on how market shifts, happening today, will change your market? Are you seeing trends, and changing your business model and technology to adjust? Are you building a business around future scenarios you’ve created to compete in 2025 and beyond with different competitors offering different solutions? Or are you relying on past strengths to carry you through the future? If you’re planning with your eyes firmly in the rear view mirror I highly recommend you learn the lesson from AOL and Yahoo – that approach will not work.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | Jan 29, 2021 | Growth Stall, Innovation, Investing, Strategy, Trends

On Friday, January 22, 2021 IBM announced sales and earnings results. Revenues had fallen 6.5%. The stock dropped 11%. IBM alone caused an otherwise up Dow Jones Industrial Average to decline. And, as the NASDAQ rose, largely due to tech stock improvement, IBM was the lone loser. The new CEO, in his role only 1 quarter, predictably asked for more time and investor confidence that the future would look better than the past. Investors justifiably lost confidence a long time ago.

Unfortunately, IBM’s recent performance was just a continuation of its long-term trend. Since 2000, IBM stock has gone nowhere – up a mere 5.7% in 21 years – while Apple (for example) is up some 14,000%. IBM was the 7th largest company on the S&P500 in 1976 when Apple was born. Now Apple’s revenues are 3x IBM’s, and its market capitalization is 20x higher!

A lot of blame must be laid on the former CEO, Virginia (Ginny) Rometty.  CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!

CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!

In 2012, just as Rometty was settling into her new desk, I said Steve Ballmer was the worst CEO in America (link 1). Little did I know he would be replaced with a new CEO that would turn around Microsoft and save the company, while Rometty would replace Ballmer as absolutely the worst CEO in the tech world – and tie herself with Immelt of GE as the worst CEO in all of America.

By 2014, it was clear that Rometty was altogether wrong as CEO, and I told investors to avoid IBM altogether. In 2 years, revenues had begun their declining trend, and she was constantly on the defensive. Instead of investing in cloud computing and other emerging technology solutions, Rometty was selling IBM’s business in China (because we all know that China was not a growth market – except someone forget to tell Apple and Facebook,) and the PC business. Simultaneously Rometty was cutting R&D spending. And she took on more debt. Where was all the money going? Not into growth investments – but rather into stock buybacks where IBM had become the poster child for financial machinations and share manipulation in order to enhance executive bonuses.

Despite IBM bragging about its one-off supercomputers and interesting artificial intelligence uses, there were no new commercial products helping customers build out trends. So IBM partnered with Apple to build “enterprise apps” in iOS in late 2014. This was doomed. IBM brought nothing to this game. IBM was now wholesale saying its development would be on platforms driving revenue growth for Apple – not IBM. IBM was admitting it had a lot of resources (still) and customers, but no idea where the marketplace was headed. So IBM would help Apple grow its user base. This was great for Apple, bad for Microsoft Surface sales, but absolutely horrible for IBM.

So by 2017, IBM was in an irrecoverable Growth Stall. Twenty quarters into the job, and twenty quarters of declining sales meant IBM was in a Growth Stall which predicted a horrible future. But despite the horrific sales and earnings performance, and the resulting horrific stock performance which in no way kept up with the overall market or industry leaders, Rometty was being granted ever more compensation by a ridiculously out of touch Board of Directors. She was being rewarded for manipulating the financials, not running a good business. She clearly needed to be fired. I said so, and told investors not to expect any gains as IBM continued to shrink.

By 2018, even the most long-term of long-term investors, Warren Buffet of Berkshire Hathaway, had given up on Rometty and IBM. As I said then the writing was on the wall by 2014, so why it took him so long was hard to understand. But it was quite clear, falling revenues would lead to lower valuations, regardless how much effort CEO Rometty put into “managing earnings.” The big shock was it took the Board 2 more years to finally get rid of her — one of the 2 worst performing CEOs in American’ capitalism.

Why do I bring up all these old blogs of mine? First, to demonstrate that it IS possible to make accurate business predictions. It is straightforward, once the key trends are identified, to see what companies are building out trends, and which are not. Those who ignore trends are doomed to do poorly, and you don’t want to own their stock. If you are running your business looking internally, and thinking about how to squeeze out a few more dimes of cost you are NOT doing the right thing. You must look externally and build on trends to GROW YOUR REVENUE!

2nd, I have long preached that the #1 indicator of companies that are likely to succeed or fail lies in charting revenue growth. If revenues aren’t growing at 8-10%/year, then as an investor or company leader you need to worry. The company isn’t keeping up with inflation and general economic activity. Too few CEOs (and investors) pay enough attention to revenues. They are happy with lackluster sales while paying too much attention to expenses and managing earnings. That is never a winning strategy. If you don’t grow revenues you can’t grow cash.

3rd, you must consistently invest in innovation and new solutions that build on trends. All solutions become obsolete over time. It is imperative to constantly invest in new products, new offerings, that build on trends in order to keep revenues flowing your way. No company can succeed long unless it invests in innovation to keep itself current, and relevant with customers.

Along with Steve Ballmer and Jeffrey Immelt, Virginia Rometty will go down in history as one of the worst CEOs of this era. Like Immelt’s crushing of GE, Rometty led the demise of the once mighty IBM. You can do better. Keep your eyes on trends, focus on revenues and never stop innovating.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. [email protected] 847-726-8465.

by Adam Hartung | Jul 30, 2020 | In the Whirlpool, Innovation, Leadership, Marketing, Strategy, Trends

Yesterday (7/28/20), President Trump surprised a LOT of people announcing that via the Defense Production Act (DPA) the US government is going to give Kodak $765 million to make pharmaceuticals. The tie to current COVID-19 pandemic issues, for which the Act was invoked, is at best tenuous. Somehow the announcement seems to be more about moving pharma production back to the USA. Which is why it left me, and a lot of others, asking “why would you pick Kodak?”

Everyone knows the Kodak story. Great innovator, makes the Brownie and creates an entirely new market called “amateur photography.” From an era when almost nobody had a picture of themselves, Kodak made pictures commonplace. And the company was a wild success. The US Department of Defense asked Kodak to help them develop a way to send photos digitally from satellites to earth, and after spending a lot of taxpayer money Kodak invents digital photography. A very happy DOD allowed Kodak to keep the civilian rights to digital photography. Locked into the profits from film sales, Kodak never develops the products or market and licensed away the technology. Which doomed Kodak to the world of business history books as one of the classic business screw-ups of all time, riding film sales to death and missing the next big market wave.

Over the last 20 years there’s been nothing new to excite anyone about Kodak. They tried launching a blockchain technology-based business for photographers to manage picture rights. Way too late and poorly conceived, and lacking any demand, that went nowhere. Lacking any new ideas leadership grabbed the lightest “shiny new thing” and launched Kodak’s own cryptocurrency “KodakCoin.” Missed it? So did everyone else. In a word, Kodak was going nowhere.

I always recommend watching trends, and then pivoting your strategy to be on trend. So why didn’t the blockchain and cryptocurrency “pivots” work? Simply, Kodak brought nothing to the marketplace. They didn’t identify an un-met or under-met need and try to fill it with a better solution. Kotak just tried to jump into some shiny technology and throw it onto the marketplace hoping someone would think they needed it. They didn’t. So those pivots failed.

Big companies can pivot. IBM pivoted from a mainframe hardware company into a software and services company. And that worked because IBM understood customers had un-met and under-met needs for enterprise applications and Software-As-A-Service (SAAS) use. IBM moved from making expensive, over-developed hardware to meeting a very real customer need, and the pivot revitalized a nearly obsolete company.

Even before IBM, Singer was once a manufacturer of sewing machines. As the 1960s ended home sewing was in a tailspin, and commercial sewing was all going to Asia. Singer had nothing new to offer, while it’s primary competition (Brother) was innovating gobs of new features to make sewing better, faster, easier and cheaper. So Singer sold (all its products, manufacturing, brand name, etc) to Brother. Leadership studied the marketplace and identified a very big, growing and under-met need for defense electronics suppliers. Leadership carefully acquired leading companies with new technologies in forward looking infrared, heads up displays and others to build a leading-edge defense contractor. Note, they first identified an under-met need. Second, (via acquisition) they brought to market a lot of product innovation to improve customer performance in ways not previously utilized. The pivot was built on under-met needs and innovation.

So what is the plan for Kodak? Kodak knows nothing about pharmaceuticals, and their understanding of “chemistry” (to the extent it still exists) has NO application in pharma. (Ever heard of a joint venture called DuPont/Merck designed to apply DuPont chemistry expertise to pharma? I didn’t think so. It didn’t survive.) The plan is to build a company to make the most generic “pharmaceutical ingredients.” Not blockbuster pharmaceuticals. Literally, the very most generic ingredients. Not better ingredients. Not cheaper ingredients. Just make what already exists – and almost assuredly at a higher cost.

These Kodak ingredients are not innovative. Making them is not innovative. The reason “big pharma” doesn’t make these is because they are GENERIC products of low value, and production has moved to China and India where costs are lower. There is no innovation in these products. And Kodak has NO PLAN to add any innovation. None. Not in products, not in manufacturing process, not in markets served or customer service. Nope. Kodak plans to take 3 to 4 YEARS (any idea how fast markets move these days) to develop a plant to make a generic product that is sold on the basis of cost.

The only way this works, at all, is if the government forces, by regulation, U.S. pharma companies to buy from Kodak (in 3 to 4 years when they supposedly can make the stuff.) Otherwise, why pay the higher price? Today, American politicians constantly decry the high U.S. drug prices. So we are to expect that $765 million of taxpayer money will be spent on a plant, to make a generic compound, readily available in the world today, at a higher price, that will then be forced into American pharma products making them EVEN MORE EXPENSIVE! This is exactly how America ended up with the Bath Iron Works to make Navy ships which are the MOST expensive in the world – and thus wholly non-competitive in commercial ship production.

Does this not sound …… problematic? If we need U.S. based manufacturing for these products every single pharma company in the USA could open a plant faster, manufacturing at lower cost than Kodak, and with no quality or other regulatory concerns. There literally is no need for Kodak to become a supplier in this supply chain. And – absolutely no reason the U.S. taxpayer should be expected to teach Kodak how to “pivot” into becoming a new company. If the White House wants to use the D.P.A. to make more generic pharma compounds then it can push [insert any pharma company name you like here] to do it like they pushed G.M. to make ventilators!

Net/net – this is a pivot, and Kodak desperately needs to pivot. But this will not be a successful pivot. Because it is not targeting an unmet or under-met need. It is not utilizing innovation to create a better solution for meeting customer needs. This is making a generic product, that is readily available, at a higher cost than it is available today. Who wants this?

I’m sure Kodak shareholders are happy. Today. But this is a train wreck. Don’t expect this plant to ever make it to fruition, as the pharma companies will unwind this deal long before Kodak makes anything. And if we’re lucky, taxpayers will get some of their money back. But who knows, because this is a really stupid idea.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. [email protected]

by Adam Hartung | Jul 19, 2018 | Entrepreneurship, In the Rapids, Innovation, Marketing, Medical

USA health care is ridiculously expensive. It’s good, but no statistics show that US healthcare is better than any other developed country. Nor any better than accredited facilities in large, developing countries. Look at these comparisons according to Medicaltourism.com:

Procedure USA cost India cost in accredited facility

Heart Bypass $123,000 $7,900

Heart Valve Replacement $170,000 $10,450

Hip Replacement $40,364 $7,200

Knee Replacement $35,000 $6,600

Spinal Fusion $110,000 $10,300

Hysterectomy $15,400 $3,200

Cornea Replacement $17,500 $2,800

Over 1/3 of Americans live with the myth that if they need medical care, somehow it will magically happen at no cost. The Affordable Care Act tried to fix that myth by making everyone buy health insurance. But Congress removed that government mandate. So most Americans that don’t have company-sponsored health insurance don’t buy insurance. Their primary source of health insurance is hope. When illness or accident happens these folks end up with extra-ordinary debt. And they can’t eliminate this debt because health care debt doesn’t go away in bankruptcy. So every year more and more people learn that an unexpected health incident means they will spend the rest of their lives paying for medical services that were 10x or 100x what they expected.

This is a trend that will not end soon. Costs keep going up. The political sides are too divided on what to do. And health insurance companies spend literally billions annually to make sure insurance for all (referred to as Medicare for all) never becomes reality.

This trend means there is opportunity. And that has become medical tourism. Literally, flying to foreign countries for medical procedures.

You may say “not me.” But if you have no money in the bank, and you let your health insurance lapse when you lost your last corporate job ended and you entered the gig economy, you could face a very tough situation. The same one almost all farmers face, and most small business owners, since their insurance is unaffordable. And most 1099 contract employees. When you have an unexpected heart attack at age 41 you wake up to hear a hospital admin say “you are alive, but you need surgery. If you want to live, we can do a heart bypass. Just sign this document and you’ll wake up somewhere north of $123,000 in debt.” Which means you’ll lose your house, for sure. Your kids won’t go to college. And you’ll never again buy a new car.

Or you blow out a hip, or knee,playing that Sunday basketball pick-up game – or golf. You’re 50-55, so too young for Medicare. But you lost health insurance years ago. Or you have a minimalistic plan which will cover a fraction of the cost. Finding the cost is $35,000 to $40,000 (or more likely $60,000 at a for-profit US hospital) are you really able to afford this? Or will you spend your life using crutches, or in a wheelchair? Or start an on–line begging campaign from your friends to cover the cost?

Suddenly, being a medical tourist doesn’t sound so unlikely. Saving $30,000 to $100,000 could determine your financial future. This trend was pretty clear back in 2010 when I pointed out that US medical tourists grew from 700,000 in 2007 to 1.2 million in just 3 years. The trend was actually obvious in 2005, when most people laughed at the idea of medical tourism – because they refused to look at the demographic and cost trends.

That’s why medical tourism is already a $20B business. And growing at 18% annually. Some analysts estimate the global market at almost $80B. Demographics are all in favor of future growth. The developed world population is aging. Health care costs are going up. Government ability to pay is going down. Insurers are charging outrageous rates. Fewer people are buying health care, and even fewer are buying “gold plated plans” that match the average plan in 1990. And American health care policies, in particular, keep driving up costs. It is EASY to see that as people can’t afford care at home, so they WILL be making more trips overseas.

There are already companies making the plunge. Some are matching services between patients and medical facilities. Some are building certified medical facilities in places like India, Singapore, Brazil, Malaysia, Thailand, Costa Rica and Mexico. The opportunities are as big as the health industry.

And this trend affects every business. Are you still stuck in the status quo thinking of extremely expensive insurance for employees, or none? Medical tourism offers a plethora of other opportunities. You can offer a bare-bones domestic plan, with augmented insurance to be a medical tourist. Or even a company sponsored plan, with the opportunity for employees to build a health-care bank, and a relationship with a medical tourism company to help employees find providers offshore. And gig-economy employees can drop the idea of domestic coverage (other than bare bones) for a mixed program including offshore insurance.

Fighting the health cost trend in the USA is foolish. Doing nothing hurts your competitiveness. Given the opportunities in medical tourism, are you thinking about how to build on this trend as a new business? Or a way to offer more to full time and 1099 contractors?

by Adam Hartung | Jul 11, 2018 | Computing, Growth Stall, Innovation, Investing, Software

The last few quarters sales growth has not been as good for Apple as it once was. The iPhone X didn’t sell as fast as they hoped, and while the Apple Watch outsells the entire Swiss watch industry it does not generate the volumes of an iPhone. And other new products like Apple Pay and iBeacon just have not taken off.

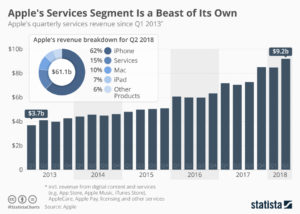

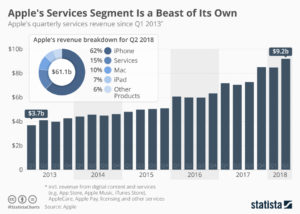

Amidst this slowness, the big winner has been “Apple Services” revenue. This is largely sales of music, videos and apps from iTunes and the App store. In Q2, 2018 revenues reached $9.2B, 15% of total revenues and second only to iPhone sales. Although Apple does not have a majority of smartphone users, the user base it has spends a lot of money on things for Apple devices. A lot of money.

In a bit of “get them the razor so they will buy the razor blades” CEO Tim Cook’s Apple is increasingly relying upon farming the “installed base” of users to drive additional revenues. Leveraging the “installed base” of users is now THE primary theme for growing Apple sales. And even old-tech guys like Warren Buffett at Berkshire Hathaway love it, as they gobble up Apple shares. As do many analysts, and investors. Apple has paid out over $100B to developers for its services, and generated over $40B in revenues for itself – and with such a large base willing to buy things developers are likely to keep providing more products and working to grow sales.

In a bit of “get them the razor so they will buy the razor blades” CEO Tim Cook’s Apple is increasingly relying upon farming the “installed base” of users to drive additional revenues. Leveraging the “installed base” of users is now THE primary theme for growing Apple sales. And even old-tech guys like Warren Buffett at Berkshire Hathaway love it, as they gobble up Apple shares. As do many analysts, and investors. Apple has paid out over $100B to developers for its services, and generated over $40B in revenues for itself – and with such a large base willing to buy things developers are likely to keep providing more products and working to grow sales.

But the risks here should not be taken lightly. At one time Apple’s Macintosh was the #1 selling PC. But it was “closed” and required users buy their applications from Apple. Microsoft offered its “open architecture” and suddenly lots of new applications were available for PCs, which were also cheaper than Macs. Over a few years that “installed base” strategy backfired for Apple as PC sales exploded and Mac sales shrank until it became a niche product with under 10% market share.

Today, Android phones are the #1 smartphone market share platform, and Android devices (like the PC) are much cheaper. Even cheaper are Chinese made products. Although there are problems, the risk exists that someday apps, etc for Android and/or other platforms could become more standard and the larger Android base could “flip” the market.

The history of companies relying on an installed base to grow their company has not gone well. Going back 30 years, AM Multigraphics an ABDick sold small printing presses to schools, government agencies and businesses. After the equipment sale these companies made most of their growth on the printing supplies these presses used. But competitors whacked away at those sales, and eventually new technologies displaced the small presses. The installed base shrank, and both companies disappeared.

Xerox would literally give companies a copier if they would just pay a “per click” charge for service on the machine, and use Xerox toner. Xerox grew like the proverbial weed. Their service and toner revenue built the company. But then people started using much cheaper copiers they could buy, and supply with cheaper consumables. And desktop publishing solutions caused copier use to decline. So much for Xerox growth – and the company rapidly lost relevance. Now Xerox is on the verge of disappearing into Fuji.

HP loved to sell customers cheap ink-jet printer so they bought the ink. But now images are mostly transferred as .jpg, .png or .pdf files and not printed at all. The installed base of HP printers drove growth, until the need for any printing started disappearing.

The point? It is very risky to rely on your installed platform base for your growth. Why? Because competitors with cheaper platforms can come along and offer cheaper consumables, making your expensive platform hard to keep forefront in the market. That’s the classic “innovator’s dilemma” – someone comes along with a less-good solution but it’s cheaper and people say “that’s good enough” thus switching to the cheaper platform. This leaves the innovator stuck trying to defend their expensive platform and aftermarket sales as the market switches to ever better, cheaper solutions.

It’s great that Apple is milking its installed base. That’s smart. But it is not a viable long-term strategy. That base will, someday, be overtaken by a competitor or a new technology. Like, maybe, smart speakers. They are becoming ubiquitous. Yes, today Siri is the #1 voice assistant. But as Echo and Google speaker sales proliferate, can they do to smartphones what smartphones did to PCs? What if one of these companies cooperates with Microsoft to incorporate Cortana, and link everything on the network into the Windows infrastructure? If these scenarios prevail, Apple could/will be in big trouble.

I pointed out in October, 2016 that Apple hit a Growth Stall. When that happens, maintaining 2% growth long-term happens only 7% of the time. I warned investors to be wary of Apple. Why? Because a Growth Stall is an early indicator of an innovation gap developing between the company’s products and emerging products. In this case, it could be a gap between ever enhanced (beyond user needs) mobile devices and really cheap voice activated assistant devices in homes, cars, offices, everywhere. Apple can milk that installed base for a goodly while, but eventually it needs “the next big thing” if it is going to continue being a long-term winner.

by Adam Hartung | Jun 27, 2018 | In the Swamp, Innovation, Investing, Manufacturing, Transportation, Trends

On Monday, Harley Davidson, America’s leading manufacturer of motorcycles, announced it was going to open a plant in Europe.

Ostensibly this is to counter tariffs the EU will be imposing on its products if imported from the USA. President Trump reacted vociferously on Tuesday, threatening much bigger taxes on Harley if it brings to the USA any parts or motorcycles from its offshore plants in Brazil, Australia, India or Thailand. He also intimated that Harley Davidson was likely to collapse.

Lots of heat, not much light. The issues for Harley Davidson are far worse than an EU tariff.

Harley Davidson has about 1/3 of the US motorcycle market. But in “heavy motorcycles,” those big bikes that are heavier and generally considered for longer riding, Harley has half the market. Which sounds great, until you realize that until the 1970s, Harley had 100% of that market. Ever since then, Harley has been losing share – to imports and to its domestic competitor Polaris.

It was 2006 when I first wrote about Harley Davidson’s big demographic problem. Basically, its customers were all aging. Younger people were buying other motorcycles, so the “core” Harley customer was getting older every year. From mid-30s in the 1980s, by the year 2000 the average buyer was well into their mid-40s. In 2007, I pointed out that Harley had made a stab at changing this dynamic by introducing a new motorcycle with an engine made by Porsche, and a far more modern design (the V-Rod.) But Harley wasn’t committed to building a new customer base, so when dealers complained that the V-Rod “wasn’t really a Harley” the company backed off the marketing and went back to all its old ways of doing business.

Simultaneously, Harley Davidson motorcycle prices were rising faster than inflation, while Japanese manufacturers were not. Thus, as I also pointed out in 2007, it was struggling to maintain market share. Slower sales caused a lay-off that year, and despite the brand driving huge sales of after-market products like jackets and T-shirts, which had grown as big as bike sales, it was unclear how Harley would slow the aging of its customer base and find new, younger buyers. Harley simply eschewed the trend toward selling smaller, lighter, cheaper bikes that had more appeal to more people – and in more markets.

Globally, the situation is far more bleak than the USA. America has one of the lowest motorcycle ridership percentages on the globe. Americans love cars. But in more congested countries like across Europe or Japan and China, and in much poorer countries like India, Korea, and across South America motorcycles are more popular than automobiles. And in those countries Harley has done poorly. Because Harley doesn’t even have the smaller 100cc,200cc, 400cc and 600cc bikes that dominate the market. For example, in 2006 (I know, old, but best data I could find) Harley Davidson sold 349,200 bikes globally. Honda sold 10.3 million. Yamaha sold 4.4 million. Even Suzuki sold 3.1 million – or 10 times Harley’s production.

But, being as fair as possible, let’s focus on Europe – where the new Harley plant is to be built. And let’s look exclusively at “heavy motorcycles” (thus excluding the huge market in which Harley has no products.) In 2006, Harley was 6th in market share. BMW 16%, Honda 15%, Yamaha 15%, Suzuki 15%, Kawasaki 11% and Harley Davidson 9%. Wow, that is simply terrible.

Clearly, Harley has already become marginalized globally. Outside the USA, Harley isn’t even relevant. The Japanese and Germans have been much more successful everywhere outside the USA, and every one of those other markets is bigger than the USA. Harley was simply relying on its core product (big bikes) in its core market (USA) and seriously failing everywhere else.

Oh, but even that story isn’t as good as it sounds. Because in the USA sales of Harley motorcycles has been declining for a decade! Experts estimate that every year which passes, Harley’s customer base ages by 6 months. The average rider age is now well into their 50s. Since Q3, 2014 Harley’s sales growth has been negative! In Q2 and Q3 2017 sales declines were almost 10%/quarter!

As its customer demographic keeps working against it, new customers for big bikes are buying BMWs from Germany – and Victory and Indian motorcycles made by Polaris, out of Minnesota (Polaris discontinued the Victory brand end of 2017.) BMW sales have increased for 7 straight quarters, and their European sales are growing stronger than ever – directly in opposition to Harley’s sales problems. Every quarter Indian is growing at 16-20%, taking all of its sales out of Harley Davidson USA share.

Going back to my 2016 column, when I predicted Harley was in for a hard time. Shares hit an all-time high in 2006 of $75. They have never regained that valuation. They plummeted during the Great Recession, but bailout funds from Berkshire Hathaway and the US government saved Harley from bankruptcy. Shares made it back to $70 by 2014, but fell back to $40 by 2016. Now they are trading around $40. Simply put, as much as people love to talk about the Harley brand, the company is rapidly becoming irrelevant. It is losing share in all markets, and struggling to find new customers for a product that is out-of-date, and sells almost exclusively in one market. Its move to manufacture in Europe is primarily a Hail-Mary pass to find new sales, paid for by corporate tax cuts in the USA and tariff tax avoidance in Europe.

But it won’t likely matter. Like I said in 2006, Harley Davidson is a no-growth story, and that’s not a story where anyone should invest.

by Adam Hartung | Jun 20, 2018 | Boards of Directors, Growth Stall, Investing, Manufacturing, Strategy

An American epoch has ended. General Electric was part of the first ever Dow Jones Index in 1896. When the Dow Jones Industrial Average was formed in 1907 GE was a participant. GE has been the only company to remain on the index. All other original companies long ago completely disappeared.

GE did so well because its leadership had been able to constantly change the company to keep it relevant, and growing. During the century prior to hiring Jeff Immelt as CEO GE went from light bulbs to generating electricity and making all kinds of electrical infrastructure equipment, electric locomotives, mainframe computers, medical equipment, computer services, financial services, entertainment…. The list is very long.

Although not all GE CEOs were great, the Board was able to place CEOs in office who could sense market shifts and make good decisions. GE leadership thoughtfully analyzed markets, and made investment decisions to sell businesses that were not growing. And they made investment decisions to invest in trends which created growth. One of the best of these was Jack Welch, who developed the nickname “Neutron Jack” for his willingness to jettison businesses that were not growing and leading their industry, while willingly investing in entirely new growth markets where trends showed high rates of return like financial services and entertainment – wildly “non-industrial” markets.

But CEO Immelt was completely tone-deaf to the outside world. He was wholly unable to understand how to lead a team that could make good investments. Instead under Immelt’s leadership GE over-invested in historical products where they were losing advantage but trying to “keep up.” Selling businesses that were growing but faced stiff competition, rather than investing in growth. And refusing to invest in new external growth opportunities that could keep revenues increasing – and drive a higher GE market capitalization.

All the way back in 2009 I pointed out that GE was in a Growth Stall, and had only a 7% chance of consistently growing at 2%. I warned investors. At the time I said GE had to go all-out on a growth strategy, or things would turn ugly. But a lot of investors, employees – and apparently the Board of Directors – were ready to blame the Growth Stall on the economy. And blame it on Welch, who had been gone for 8 years. And say GE was lucky Immelt saved the company from bankruptcy with a loan from Warren Buffett’s Berkshire Hathaway.

Say what? Saved the company? Why did Immelt, and the Board, let GE get into such terrible shape? It was time to replace the CEO, not double down on his failed strategy.

Six years ago, May, 2012, I published in Forbes “5 CEOs that Should Have Already Been Fired.” At the time I said Immelt was the 4th worst CEO in America. I cited the 2009 column, and pointed out things really weren’t any better in 2012 than in 2009. That column had well over 1million reads. There was no way GE’s board was not aware of the column, and the realization that Immelt was a horrible CEO.

The Board of #3 (Walmart) fired Mike Duke. And the Board of #1 (Microsoft) fired Steve Ballmer. There is no real board at #2 Sears (which will file bankruptcy soon enough) because the CEO is also the largest shareholder (via his hedge fund) and he controls all board decisions. He should have fired himself, but had too much ego. But the board of GE – well it did nothing. Even though GE almost went bankrupt under Immelt, and its value was being destroyed quarter after quarter it left him in place.

I revisited the performance of these five CEOs and their companies in August, 2014 and reminded hundreds of thousands of readers – which I’m sure included GE’s Board of Directors – that company revenues had declined every year since 2009. And this string of failures had caused the company’s value to decline by 2/3. Yet, the board did nothing to replace this horrific CEO.

By March, 2017 I was so exasperated I finally titled my column “GE Needs a New Strategy and a New CEO.” Again, I detailed all the things that went wrong. It took 7 more months before the Board pushed Immelt out. But the new CEO failed to offer a better strategy, continuing to promote the notion of selling businesses to raise cash to “fix” the broken businesses – without identifying any growth strategy at all.

The only thing that can “fix” GE – save it from being dismembered and sold off – is a growth strategy. I offered how the new CEO could undertake this effort in October, 2017. But the Board, still wholly incompetent, still isn’t listening. Nobody should be surprised that GE is now removed from the Dow, and the new CEO is clearly without a clue how to find a path back to relevancy.

Too bad for investors, employees, suppliers, customers and the communities where the GE businesses reside. This didn’t have to happen. But due to an incompetent Board of Directors, which did nothing to properly govern an incompetent CEO, it did. And there’s little doubt it won’t be long before GE meets the same end as DuPont.

by Adam Hartung | May 8, 2018 | Computing, Growth Stall, Innovation, Investing, Software, Trends, Web/Tech

One in five American homes with wifi now has an Amazon Alexa. And the acceptance rate is growing. To me that seems remarkable. I remember when we feared Google keeping all those searches we did. Then the fears people seemed to have about Facebook knowing our friends, families and what we talked about. Now it appears that people have no fear of “big brother” as they rapidly adopt a technology into their homes which can hear pretty near everything that is said, or that happens.

It goes to show that for most people, convenience is still incredibly important. Give us mobile phones and we let land-lines go, because mobile is so convenient – even if more expensive and lower quality. Give us laptops we let go of the traditional office, taking our work everywhere, even at a loss of work-life balance. Give us e-commerce and we start letting retailers keep our credit card information, even if it threatens our credit security. Give us digital documents via Kindle, or a smart device on the web grabbing short articles and pdf files, and we get rid of paper books and magazines. Give us streaming and we let go of physical entertainment platforms, choosing to download movies for one-time use, even though we once thought “owning” our entertainment was important.

With each new technology we make the trade-off between convenience and something we formerly thought was important. Such as quality, price, face-to-face communications, shopping in a store, owning a book or our entertainment – and even security and privacy. For all the hubbub that regulators, politicians and the “old guard” throws up about how important these things were, it did not take long for these factors to not matter as convenience outweighed what we used to think we wanted.

Now, voice activation is becoming radically important. With Google Assistant and Alexa we no longer have to bother with a keyboard interface (who wants to type?) or even a small keypad – we can just talk to our smart device. There is no doubt that is convenient. Especially when that device learns from what we say (using augmented intelligence) so it increasingly is able to accurately respond to our needs with minimal commands. Yes, this device is invading our homes, our workplaces and our lives – but it is increasingly clear that for the convenience offered we will make that trade-off. And thus what Alexa can do (measured in number of skills) has grown from zero to over 45,000 in just under 3 years.

And now, Amazon is going to explode the things Alexa can do for us. Historically Amazon controlled Alexa’s Skills market, allowing very few companies to make money off Alexa transactions. But going forward Amazon is monetizing Alexa, and developers can keep 70% of the in-skill purchase revenues customers make. Buy a product or service via Alexa and developers can now make a lot of money. And, simultaneously, Amazon is offering a “code-free” skills developer, expanding the group of people who can write skills in just minutes. In other words, Amazon is setting off a gold rush for Alexa skills development, while simultaneously making the products remarkably cheap to own.

This is horrible news for Apple. Apple’s revenue stagnated in 2016, declining year over year for 3 consecutive quarters. I warned folks then that this was a Growth Stall, which often implies a gap is developing between the company and the market. While Apple revenues have recovered, we can now see that gap. Apple still relies on iPhone and iPad sales, coupled with the stuff people buy from iTunes, for most of its revenue and growth. But many analysts think smartphone sales may have peaked. And while focusing on that core, Apple has NOT invested heavily in Siri, its voice platform. Today, Siri lags all other voice platforms in quality of recognition, quality of understanding, and number of services. And Apple’s smart speaker sales are a drop in the ocean of Amazon Echo and Echo Dot sales.

By all indications the market for a lot of what we use our mobile devices for is shifting to voice interactivity. And Apple is far behind the leader Amazon, and the strong #2 Google. Even Microsoft’s Cortana quality is considered significantly better than Siri. If this market moves as fast as the smartphone market grew it will rob sales of smartphones and iTunes, and Apple could be in a lot of trouble faster than most people think. Relevancy is a currency quickly lost in the competitive personal technology business.

by Adam Hartung | Apr 3, 2018 | Computing, Growth Stall, Innovation, Investing, Mobile, Music

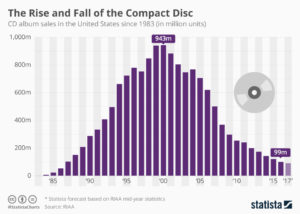

Do you still have a pile of compact discs? If so, why? When was the last time you listened to one? Like almost everyone else, you probably stream your music today. If you are just outdated, you listen to music you bought from iTunes or GooglePlay and store on your mobile device. But it would be considered prehistoric to tell people you carry around CDs for listening in your car – because you surely don’t own a portable CD player.

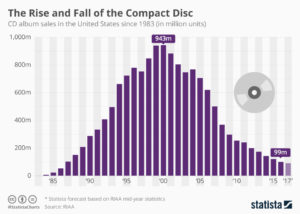

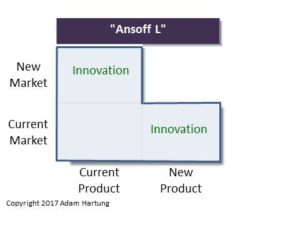

As the chart shows, CD sales exploded from nothing in 1983 to nearly 1B units in 2000. Now sales are less than 1/10th that number, due to the market shift expanded bandwidth allowed.

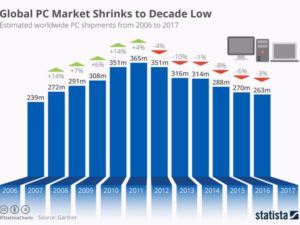

Do you still carry a laptop? If so, you are a dying minority. As PCs became more portable they became indispensable. Nobody left the office, or attended a meeting, without their laptop. That trend exploded until 2011, when PC sales peaked at 365M units. As the chart shows, in the 6 years since, PC sales have dropped by over 100M units, a 30% decline. The advent of mobile devices (smartphones and tablets) coupled with expanded connectivity and growing cloud services allowed mobility to reach entirely new levels – and people stopped carrying their PCs. And just like CDs are disappearing, so will PCs.

These charts dramatically show how quickly a new technology, or package of technologies, can change the way we behave. Simultaneously, they change the competitive landscape. Sony dominated the music industry, as a producer and supplier of hardware, when CDs dominated. But, as I wrote in 2012, the shift to more portable music caused Sony to fall into a rapid decline, and the company suffered 6 consecutive years (24 quarters) of falling sales and losses. The one-time giant was crippled by a technology shift they did not adopt. And they weren’t alone, as big box retailers such as Best Buy and Circuit City also faltered when these sales disappeared.

Once, Microsoft was synonymous with personal technology. Nobody maximized the value in PC growth more than Microsoft. But changing technology altered the competitive landscape, with Apple, Google, Samsung and Amazon emerging as the leaders. Microsoft, as the almost unnoticed launch of Windows 10 demonstrated, is struggling to maintain relevancy.

Too often we discount trends. Like Sony and Microsoft we think historical growth will continue, unabated. We find ways to discount market shifts, saying the products are “niche” and denigrating their quality. We will express our view that the market has “hiccuped” and will return to growth again. By the time we admit the shift is permanent new competitors have overtaken the lead, and we risk becoming totally obsolete. Like Toys-R-Us, Radio Shack, Sears and Motorola.

Aircraft stalls when not enough power to climb

The time for action is when the very first signs of shift happened. I’ve written a lot about “Growth Stalls” and they occur in just 2 quarters. 93% of the time a stalled company never again grows at a mere 2%/year. Look at how fast GE went from the best company in America to the worst. It is incredibly important that leadership react FAST when trends push customers toward new solutions, because it often takes very little time for the trend to make dying markets completely untenable.

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.