by Adam Hartung | Jul 28, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Web/Tech

Over the last couple of weeks big announcements from Apple, IBM and Microsoft have set the stage for what is likely to be Microsoft’s last stand to maintain any sense of personal technology leadership.

Custer Tries Holding Off An Unstoppable Native American Force

To many consumers the IBM and Apple partnership probably sounded semi-interesting. An app for airplane fuel management by commercial pilots is not something most people want. But what this announcement really amounted to was a full assault on regaining dominance in the channel of Value Added Resellers (VARs) and Value Added Dealers (VADs) that still sell computer “solutions” to thousands of businesses. Which is the last remaining historical Microsoft stronghold.

Think about all those businesses that use personal technology tools for things like retail point of purchase, inventory control, loan analysis in small banks, restaurant management, customer data collection, fluid control tracking, hotel check-in, truck routing and management, sales force management, production line control, project management — there is a never-ending list of business-to-business applications which drive the purchase of literally millions of devices and applications. Used by companies as small as a mom-and-pop store to as large as WalMart and JPMorganChase. And these solutions are bundled, sold, delivered and serviced by what is collectively called “the channel” for personal technology.

This “channel” emerged after Apple introduced the Apple II running VisiCalc, and businesses wanted hundreds of these machines. Later, bundling educational software with the Apple II created a near-monopoly for Apple channel partners who bundled solutions for school systems.

But, as the PC emerged this channel shifted. IBM pioneered the Microsoft-based PC, but IBM had long used a direct sales force. So its foray into personal computing did a very poor job of building a powerful sales channel. Even though the IBM PC was Time magazine’s “Man of the Year” in 1982, IBM lost its premier position largely because Microsoft took advantage of the channel opportunity to move well beyond IBM as a supplier.

Microsoft focused on building a very large network of developers creating an enormous variety of business-to-business applications on the Windows+Intel (Wintel) platform. Microsoft created training programs for developers to use its operating system and tools, while simultaneously cultivating manufacturers (such as Dell and Compaq) to build low cost machines to run the software. “Solution selling” was where VARs bundled what small businesses – and even many large businesses – needed by bringing together developer applications with manufacturer hardware.

It only took a few years for Microsoft to overtake Apple and IBM by dominating and growing the VAR channel. Apple did a poor job of creating a powerful developer network, preferring to develop everything users should want itself, so quickly it lacked a sufficient application base. IBM constantly tried to maintain its direct sales model (and upsell clients from PCs to more expensive hardware) rather than support the channel for developing applications or selling solutions based on PCs.

But, over the last several years Microsoft played “bet the company” on its launch of Windows 8. As mobile grew in hardware sales exponentially, and PC sales flattened (then declined,) Microsoft was tepid regarding any mobile offering. Under former CEO Steve Ballmer, Microsoft preferred creating an “all-in-one” solution via Win8 that it hoped would keep PC sales moving forward while slowly allowing its legions of Microsoft developers to build Win8 apps for mobile Surface devices — and what it further hoped would be other manufacturer’s tablets and phones running Win8.

This flopped. Horribly. Apple already had the “installed base” of users and mobile developers, working diligently to create new apps which could be released via its iTunes distribution platform. As a competitive offering, Google had several years previously launched the Android operating system, and companies such as HTC and Samsung had already begun building devices. Developers who wanted to move beyond Apple were already committed to Android. Microsoft was simply far too late to market with a Win8 product which gave developers and manufacturers little reason to invest.

Now Microsoft is in a very weak position. Despite much fanfare at launch, Microsoft was forced to take a nearly $1B write-off on its unsellable Surface devices. In an effort to gain a position in mobile, Microsoft previously bought phone maker Nokia, but it was simply far too late and without a good plan for how to change the Apple juggernaut.

Apple is now the dominant player in mobile, with the most users, developers and the most apps. Apple has upended the former Microsoft channel leadership position, as solution sellers are now offering Apple solutions to their mobile-hungry business customers. The merger with IBM brings even greater skill, and huge resources, to augmenting the base of business apps running on iOS and its devices (presently and in the future.) It provides encouragement to the VARs that a future stream of great products will be coming for them to sell to small, medium and even large businesses.

Caught in a situation of diminishing resources, after betting the company’s future on Windows 8 development and launch, and then seeing PC sales falter, Microsoft has now been forced to announce it is laying off 18,000 employees. Representing 14% of total staff, this is Microsoft’s largest reduction ever. Costs for the downsizing will be a massive loss of $1.1-$1.6B – just one year (almost to the day) after the huge Surface write-off.

Recognizing its extraordinarily weak market position, and that it’s acquisition of Nokia did little to build strength with developers while putting it at odds with manufacturers of other mobile devices, the company is taking some 12,000 jobs out of its Nokia division – ostensibly the acquisition made at a cost of $7.2B to blunt iPhone sales. Every other division is also suffering headcount reductions as Microsoft is forced to “circle the wagons” in an effort to find some way to “hold its ground” with historical business customers.

Today Apple is very strong in the developer community, already has a distribution capability with iTunes to which it is adding mobile payments, and is building a strong channel of VARs seeking mobile solutions. The IBM partnership strengthens this position, adds to Apple’s iOS developers, guarantees a string of new solutions for business customers and positions iOS as the platform of choice for VARs and VADs who will use iBeacon and other devices to help businesses become more capable by utilizing mobile/cloud technology.

Meanwhile, Microsoft is looking like the 7th Cavalry at the Little Bighorn. Microsoft is surrounded by competitors augmenting iOS and Android (and serious cloud service suppliers like Amazon,) resources are depleting as sales of “core” products stagnate and decline and write-offs mount, and watching as its “supply line” developer channel abandons Windows 8 for the competitive alternatives.

CEO Nadella keeps saying that that cloud solutions are Microsoft’s future, but how it will effectively compete at this late date is as unclear as the email announcement on layoffs Nokia’s head Stephen Elop sent to employees. Keeping its channel, long the source of market success for Microsoft, from leaving is Microsoft’s last stand. Unfortunately, Nadella’s challenge puts him in a position that looks a lot like General Custer.

by Tim | Feb 14, 2014

PRESS AND MEDIA Press and Articles featuring Adam Hartung: 2021 Articles and Interviews My Money Planet selected Adam’s Blog as a top Focused Investment Blog. “Steve Ballmer just joined the $100 billion club. Here are his career hits and misses”,...

by Adam Hartung | Jul 14, 2017 | In the Rapids, Innovation, Marketing

Amazon is working toward dominance in the voice-activated assistant market by stimulating app development through lower prices and wide distribution. Apple has a huge base of smartphones on which to build. Google is on almost every device. Have you heard of “Viv”? Here are the major strategic issues of this dynamic and disruptive industry as the players navigate “The Rapids” of growth.

by Adam Hartung | Feb 15, 2017 | Marketing, Mobile, Retail, Web/Tech

(Photo by Andrew Burton/Getty Images)

Apple’s stock is on a tear. After languishing for well over a year, it is back to record high levels. Once again Apple is the most valuable publicly traded company in America, with a market capitalization exceeding $700 billion. And pretty overwhelmingly, analysts are calling for Apple’s value to continue rising.

But today’s Apple, and the Apple emerging for the future, is absolutely not the Apple which brought investors to this dance. That Apple was all about innovation. That Apple identified big trends – specifically mobile – then created products that turned the trend into enormous markets. The old Apple knew that to create those new markets required an intense devotion to product development, bringing new capabilities to products that opened entirely new markets where needs were previously unmet, and making customers into devotees with really good quality and customer service.

That Apple was built by Steve Jobs. Today’s Apple has been remade by Tim Cook, and it is an entirely different company.

Today’s Apple – the one today’s analysts love – is all about making and selling more iPhones. And treating those iPhone users as a “loyal base” to which they can sell all kinds of apps/services. Today’s Apple is about using the company’s storied position, and brand leadership, to milk more money out of customers that own their devices, and expanding into adjacent markets where the installed base can continue growing.

UBS likes Apple because they think the services business is undervalued. After noting that it today would stand alone as a Fortune 100 company, they expect those services to double in four years. Bernstein notes services today represents 11% of revenue, and should grow at 22% per year. Meanwhile they expect the installed base of iPhones to expand by 27% – largely due to offshore sales – adding further to services growth.

Analysts further like Apple’s likely expansion into India – a previously almost untapped market. CEO Cook has led negotiations to have Foxxcon and Wistron, the current Chinese-based manufacturers, open plants in India for domestic production of iPhones. This expansion into a new geographic market is anticipated to produce tremendous iPhone sales growth. Do you remember when, just before filing for bankruptcy, Krispy Kreme was going to keep up its valuation by expanding into China?

Of course, with so many millions of devices, it is expected that the apps and services to be deployed on those devices will continue growing. Likely exponentially. The iOS developer community has long been one of Apple’s great strengths. Developers like how quickly they can deploy new apps and services to the market via Apple’s sales infrastructure. And with companies the size of IBM dedicated to building enterprise apps for iOS the story heard over and again is about expanding the installed base, then selling the add-ons.

Gee, sounds a lot like the old “razors lead to razor blade sales” strategy – business innovation circa 1966.

Overall, doesn’t this sound a lot like Microsoft? Bill Gates founded a company that revolutionized computing with low-cost software on low-cast hardware that did just about anything you would want. Windows made life easy. Microsoft gave users office automation, databases and all the basic work tools. And when the internet came along Microsoft connected everyone with Internet Explorer – for free! Microsoft created a platform with Windows upon which hordes of developers could build special applications for dedicated markets.

Once this market was created, and pretty much monopolized by Microsoft CEO Gates turned the reigns over to CEO Steve Ballmer. And Mr. Ballmer maximized these advantages. He invested constantly in developing updates to Windows and Office which would continue to insure Microsoft’s market share against emerging competitors like Unix and Linux. The money was so good that over a decade money was poured into gaming, even though that business lost more money than it made in revenue – but who cared? There were occasional investments in products like tablets, hand-helds and phones, but these were merely attractions around the main show. These products came and went and, again, nobody really cared.

Ballmer optimized the gains from Microsoft’s installed base. And a lot – a lot – of money was made doing this. nvestors appreciated the years of ongoing profits, dividends – and even occasional special dividends – as the money poured in. Microsoft was unstoppable in personal computing. The only thing that slowed Microsoft down was the market shift to mobile, which caused the PC market to collapse as unit sales have declined for six straight years (PC sales in 2016 barely managed levels of 2006). But, for a goodly while, it was a great ride!

Today all one hears about at Apple is growing the installed base. Maximizing sales of iPhones. And then selling everyone services. Oh yeah, the Apple Watch came out. Sort of flopped. Nobody really seemed to care much. Not nearly as much as they cared about 2 quarters of sales declines in iPhones. And whatever happened to AppleTV? ApplePay? iBeacons? Beats? Weren’t those supposed to be breakthrough innovations to create new markets? Oh well, nobody seems to much care about those things any longer. Attractions around the main event – iPhones!

So now analysts today aren’t put in the mode of evaluating breakthrough innovations and trying to guess the size of brand new, never before measured markets. That was hard. Now they can be far more predictable forecasting smartphone sales and services revenue, with simulations up and down. And that means they can focus on cash flow. After all, Apple makes more cash than it makes profit! Apple has a $246 billion cash hoard. Most people think Berkshire Hathaway, led by famed investor Warren Buffett, spent $6.6 billion on Apple stock in 2016 because Berkshire sees Apple as a cash generation machine – sort of like a railroad! And if those meetings between CEO Cook and President Trump can yield a tax change allowing repatriation at a low rate then all that cash could lead to a big one time dividend!

And, most likely, the stock will go up. Most likely, a lot. Because for at least a while Apple’s iPhone business is going to be pretty good. And the services business is going to grow. It will be a lot like Microsoft – at least until mobile changed the business. Or, maybe like Xerox giving away copiers to obtain toner sales – until desktop publishing and email cratered the need for copiers and large printers. Or, going all the way back into the 1950s and 60s, when Multigraphics and AB Dick practically gave away small printers to get the ink and plate sales – until xerography crushed that business. Of course you couldn’t go wrong investing in Sears for years, because they had the store locations, they had the brands (Kenmore, Craftsman, et.al.,) they had the credit card services – until Wal-Mart and Amazon changed that game.

You see, that’s the problem with all of these sort of “milk the base” businesses. As the focus shifts to grow the base and add-on sales the company loses sight of customer needs. Innovation declines, then evaporates as everything is poured into maximizing returns from the “core” business. Optimization leads to a focus on costs, and price reductions. Arrogance, based on market leadership, emerges and customer service starts to wane. Quality falters, but is not considered as important because sales are so large.

These changes take time, and the business looks really good as profits and cash flow continue, so it is easy to overlook these cultural and organizational changes, and their potential negative impact. Many applaud cost reductions – remember the glee with which analysts bragged about the cost savings when Dell moved its customer service to India some 20 years ago?

Today we’re hearing more stories about long-term Apple customers who aren’t as happy as they once were.

Genius bar experiences aren’t always great. In a telling AdAge column one long-time Apple user discusses how he had two iPhones fail, and Apple could not replace them leaving the customer with no phone for two weeks – demonstrating a lack of planning for product failures and a lack of concern for customer service. And the same issues were apparent when his corporate Macbook Pro failed. This same corporate customer bemoans design changes that have led to incompatible dongles and jacks, making interoperability problematic even within the Apple line.

Meanwhile, over the last four years Apple has spent lavishly on a new corporate headquarters befitting the country’s most valuable publicly traded company. And Apple leaders have been obsessive about making sure this building is built right! Which sounds well and good, except this was a company that once put customers – and unearthing their hidden needs, wants and wishes – first. Now, a lot of attention is looking inward. Looking at how they are spending all that money from milking the installed base. Putting some of the best managers on building the building – rather than creating new markets.

Who was that retailer that was so successful that it built what was, at the time, the world’s tallest building? Oh yeah, that was Sears.

Markets always shift. Change happens. Today it happens faster than ever in history. And nowhere does change happen faster than in technology and consumer electronics. CEO Cook is leading like CEO Ballmer. He is maximizing the value, and profitability, of the Apple’s core product – the iPhone. And analysts love it. It would be wise to disavow yourself of any thoughts that Apple will be the innovative market creating Jobs/Ives organization it once was.

How long will this be a winning strategy? Your answer to that should determine how long you would like to be an Apple investor. Because some day something new will come along.

by Adam Hartung | Feb 3, 2016 | Current Affairs, Leadership, Lifecycle, Web/Tech

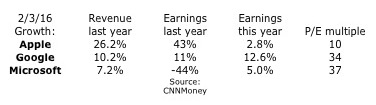

The three highest valued publicly traded companies today (2/3/16) are Google/Alphabet, Apple and Microsoft. All 3 are tech companies, and they compete – although with different business models – in multiple markets. However, investor views as to their futures are wildly different. And that has everything to do with how the leadership teams of these 3 companies have explained their recent results, and described their futures.

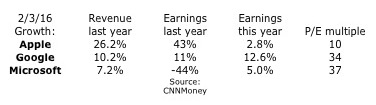

Looking at the financial performance of these companies, it is impossible to understand the price/earnings multiple assigned to each. Apple clearly had better revenue and earnings performance in all but the most recent year. Yet, both Alphabet and Microsoft have price to earnings (P/E) multiples that are 3-4 times that of Apple.

Much was made this week about Alphabet’s valuation exceeding that of Apple’s. But the really big story is the difference in multiples. If Apple had a multiple even half that of Alphabet or Microsoft it’s value would be much, much higher.

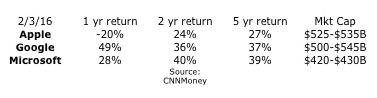

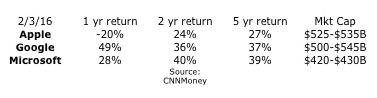

But, as we can see, investors did the best over both 2 years and 5 years by investing in Microsoft. And Apple investors have fared the poorest of all 3 companies regardless of time frame. Looking at investment performance, one would think that the revenue and earnings performance of these companies would be the reverse of what’s seen in the first chart.

The missing piece, of course, is future expectations. In this column a few days ago, I pointed out that Apple has done a terrible job explaining its future. In that column I pointed out how Facebook and Amazon both had stratospheric P/E multiples because they were able to keep investors focused on their future growth story, even more than their historical financial performance.

Alphabet stole the show, and at least briefly the #1 valuation spot, from Apple by convincing investors they will see significant, profitable growth. Starting even before earnings announcements the company was making sure investors knew that revenues and profits would be up. But even more they touted the notion that Alphabet has a lot of growth in non-monetized assets. For example, vastly greater ad sales should be expected from YouTube and Google Maps, as well as app sales for Android phones through Google Play. And someday on the short horizon profits will emerge from Fiber transmission revenues, smart home revenues via Nest, and even auto market sales now that the company has logged over 1million driverless miles.

This messaging clearly worked, as Alphabet’s value shot up. Even though 99% of the company’s growth was in “core” products that have been around for a decade! Yes, ad revenue was up 15%, but most of that was actually on the company’s own web sites. And most was driven by further price erosion. The number of paid clicks were up 30%, but price/click was actually down yet another 15% – a negative price trend that has been happening for years. Eventually prices will erode enough that volume will not make up the difference – and what will investors do then? Rely on the “moonshot” projects which still have almost no revenue, and no proven market performance!

But, the best performer has been Microsoft. Investors know that PC sales have been eroding for years, that PC sales will continue eroding as users go mobile, and that PC’s are the core of Microsoft’s revenue. Investors also knows that Microsoft missed the move to mobile, and has practically no market share in the war between Apple’s iOS and Google’s Android. Further, investors have known forever that gaming (xBox,) search and entertainment products have always been a money-loser for Microsoft. Yet, Microsoft investors have done far better than Apple investors, and long-term better than Google investors!

Microsoft has done an absolutely terrific job of constantly trumpeting itself as a company with a huge installed base of users that it can leverage into the future. Even when investors don’t know how that eroding base will be leveraged, Microsoft continually makes the case that the base is there, that Microsoft is the “enterprise” brand and that those users will stay loyal to Microsoft products.

Forget that Windows 8 was a failure, that despite the billions spent on development Win8 never reached even 10% of the installed base and the company is even dropping support for the product. Forget that Windows 10 is a free upgrade (meaning no revenue.) Just believe in that installed base.

Microsoft trumpeted that its Surface tablet sales rose 22% in the last quarter! Yay! Of course there was no mention that in just the last 6 weeks of the quarter Apple’s newly released iPad Pro actually sold more units than all Surface tablets did for the entire quarter! Or that Microsoft’s tablet market share is barely registerable, not even close to a top 5 player, while Apple still maintains 25% share. And investors are so used to the Microsoft failure in mobile phones that the 49% further decline in sales was considered acceptable.

Instead Microsoft kept investors focused on improvements to Windows 10 (that’s the one you can upgrade to for free.) And they made sure investors knew that Office 365 revenue was up 70%, as 20million consumers now use the product. Of course, that is a cumulative 20million – compared to the 75million iPhones Apple sold in just one quarter. And Azure revenue was up 140% – to something that is almost a drop in the bucket that is AWS which is over 10 times the size of all its competitors combined.

To many, this author included, the “growth story” at Microsoft is more than a little implausible. Sales of its core products are declining, and the company has missed the wave to mobile. Developers are writing for iOS first and foremost, because it has the really important installed base for today and tomorrow. And they are working secondarily on Android, because it is in some flavor the rest of the market. Windows 10 is a very, very distant third and largely overlooked. xBox still loses money, and the new businesses are all relatively quite small. Yet, investors in Microsoft have been richly rewarded the last 5 years.

Meanwhile, investors remain fearful of Apple. Too many recall the 1980s when Apple Macs were in a share war with Wintel (Microsoft Windows on Intel processors) PCs. Apple lost that war as business customers traded off the Macs ease of use for the lower purchase cost of Windows-based machines. Will Apple make the same mistake? Will iPad sales keep declining, as they have for 2 years now? Will the market shift to mobile favor lower-priced Android-based products? Will app purchases swing from iTunes to Google Play as people buy lower cost Android-based tablets? Have iPhone sales really peaked, and are they preparing to fall? What’s going to happen with Apple now? Will the huge Apple mobile share be eroded to nothing, causing Apple’s revenues, profits and share price to collapse?

This would be an interesting academic discussion were the stakes not so incredibly high. As I said in the opening paragraph, these are the 3 highest valued public companies in America. Small share price changes have huge impacts on the wealth of individual and institutional investors. It is rather quite important that companies tell their stories as good as possible (which Apple clearly has not, and Microsoft has done extremely well.) And likewise it is crucial that investors do their homework, to understand not only what companies say, but what they don’t say.