by Adam Hartung | Feb 28, 2017 | E-Commerce, Employment, real estate, Retail

(Photo: JOHN MACDOUGALL/AFP/Getty Images)

Amazon.com has become an important part of the American economy, and the lives of people globally. But, far too few people still understand the repercussions of Amazon’s success on retailers, consumer goods manufacturers, real estate – and ultimately everyone’s lives. The implications are enormous. Smart leaders, and investors, will plan for these implications and take advantage of the market shift.

Invest in ecommerce, divest traditional retailers.

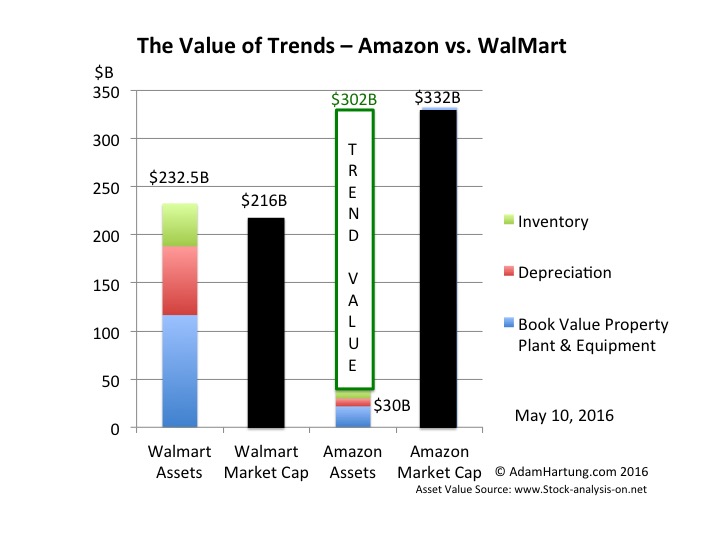

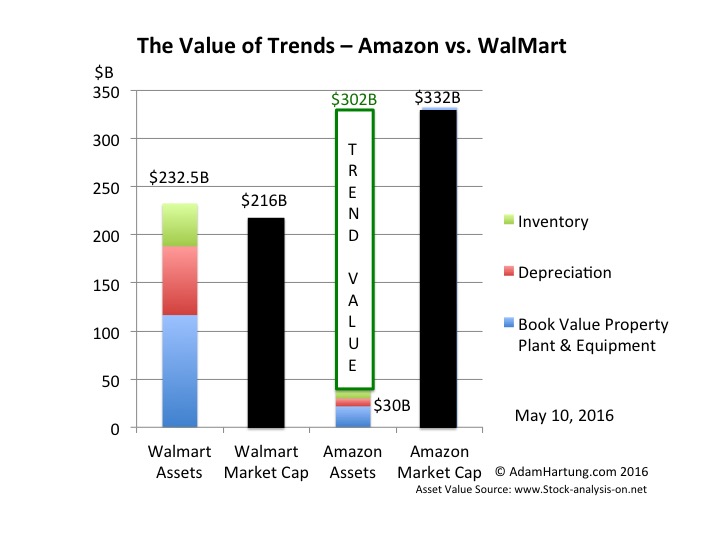

The first implication is just thinking about investing in Amazon and/or its competitors in retail. In May, 2016 I compared the market value of Wal-Mart, the world’s largest retailer, with Amazon. At the time Wal-Mart was worth $216 billion, and Amazon was worth $332 billion. The difference could be explained by realizing that Wal-Mart was the leader at brick-and-mortar sales, which were shrinking, while Amazon was the leader in e-commerce, which is growing. Since then Wal-Mart’s value has increased to $222 billion – up $6 billion, 2.8%. Meanwhile Amazon’s value has increased to $403 billion- up $71 billion, 21.4%. Over three years (starting 3/3/14) Wal-Mart’s per share value has declined from $74 to $71 (down 4%,) while Amazon’s has risen from $370 to $845 (up 128%.)

To put it mildly, investing in Amazon, which is the leader in e-commerce, has created a great return. Contrastingly that value increase has been fueled by declines in traditional retailers. The Amazon Effect has caused shares in companies like Sears Holdings, JCPenney, Kohl’s, Macy’s and many other stalwarts of the bygone era to be crushed. Over the last year investors in XRT (the retail industry spider) have increased 1.6%, while the S&P 500 spider has jumped 22%. The number of retailers with debt rated at Moody’s most distressed level has tripled since 2009 – and Moody’s predicts this list will worsen over the next five years.

There is vastly too much retail space, and nobody knows what to do with it.

And this has an impact on real estate. As online sales come to over 11% of all holiday sales in 2016, and Amazon accounts for 40% of all those sales, it is clear people just don’t go to stores any more anywhere near the way they once did. Historically prime retail real estate was considered valuable – and in 2007 many people thought Sears real estate was worth more than Sears as a retailer. But no longer. According to Morningstar, Sears store closings alone could cause 200 malls to close.

It is apparent the Amazon Effect has left America with far more storefronts than needed. Stand-alone stores are being shuttered, with no alternative use for most buildings. Malls and shopping centers go begging as traffic drops, tenants leave, lease rates collapse and the facilities end up wholly or nearly empty. This means you don’t want to invest in retail real estate REITs. But it also means that neighborhoods, and sometimes entire towns, will be impacted as these empty buildings reduce interest in housing and push down residential prices.

Tax receipts will fall, and nobody knows how to replace them.

For a long time governments gave handouts to retailers in the form of tax breaks to build stores or locate their headquarters. But as stores close the property tax receipts decline, putting a greater burden on homeowners to pay for schools and infrastructure. Same with sales taxes which disappear from the local government coffers. And tax breaks once given to hold onto jobs – like the ones the village of Hoffman Estates and state of Illinois, gave Sears in 2011 to not move its headquarters, look far less justified. In short, the Amazon Effect has an enormous impact on the local tax base – and those missing dollars will inevitably have to come from residents – or a significant curtailing of services.

The impact on job eliminations will be staggering.

The Amazon Effect also has an impact on jobs. Amazon’s growth keeps escalating, from 19% in 2014 to 20% in 2015 to 28% in 2016, which takes the jobs away from traditional retailers. Macy’s plans to shed 10,000 workers as it shrinks and streamlines. JCPenney will eliminate 6,000 employees via early retirement completely separate from its store closings, and HHGregg is shedding 1,500 jobs as stores close. And thousands more are being lost across traditional retail in stores, supply chain positions and headquarters facilities.

Traditional retail employs about 16.5 million Americans – nearly 10% of the entire workforce. 6.2 million are in the prime product lines targeted by e-commerce (GAFO – General, Apparel, Furniture and Other.) The Amazon Effect will continue to eliminate these positions. Over the next five years it is not unlikely that the decline of brick-and-mortar will cause 16% of GAFO jobs to disappear, which is almost 1 million jobs. Simultaneously this could easily cause 10% of the non-GAFO jobs (10.3 million) to disappear – which is another 1 million. This likely scenario would cause the loss of 2 million jobs in just five years, which is the entirety of all lost manufacturing jobs to China. The Trump administration has more employment concerns to face than just the return of manufacturing.

The Amazon Effect is changing grocery shopping, without even being a major competitor in that sector. Because Wal-Mart has lost so much general merchandise sales to e-commerce, the company has amped up grocery sales – which are now 56% of total revenue. To continue growing groceries Wal-Mart is undertaking a massive price war pitting itself against the long-running low cost grocer Aldi. This is creating even more intense profit pressure on Wal-Mart, which last year saw gross margins drop by eight points, as net income fell 18%. Such intense price competition is creating the need for even more cost cutting among all grocers – which means investors beware – and we can expect even more job cutting as the spiral downward continues.

Consumer Goods manufacturers, and their suppliers, will be stressed.

Of course this pushes the Amazon Effect onto consumer goods companies that supply grocery retailers. Wal-Mart has held meetings with P&G, Unilever, Conagra, Coca-Cola and other big name companies demanding across-the-board 15% price reductions at wholesale. And Wal-Mart expects these suppliers to help Wal-Mart beat its head-to-head competitors on price 8o% of the time. This will cause consumer goods manufacturers to cut their own costs, including jobs, as well as pressure their raw material suppliers to further reduce their costs – leading to an ongoing spiral of cost cutting, job eliminations and additional pressures for change.

The internet gave us e-commerce, and that birthed Amazon.com. Few predicted the enormous implications this would have on retail, and society. Every single American is affected by the Amazon Effect, which is now inescapable. The only remaining question is whether your business, your government leaders and you are planning for this and preparing for the inevitable changes which will continue coming?

by Adam Hartung | Feb 15, 2017 | Marketing, Mobile, Retail, Web/Tech

(Photo by Andrew Burton/Getty Images)

Apple’s stock is on a tear. After languishing for well over a year, it is back to record high levels. Once again Apple is the most valuable publicly traded company in America, with a market capitalization exceeding $700 billion. And pretty overwhelmingly, analysts are calling for Apple’s value to continue rising.

But today’s Apple, and the Apple emerging for the future, is absolutely not the Apple which brought investors to this dance. That Apple was all about innovation. That Apple identified big trends – specifically mobile – then created products that turned the trend into enormous markets. The old Apple knew that to create those new markets required an intense devotion to product development, bringing new capabilities to products that opened entirely new markets where needs were previously unmet, and making customers into devotees with really good quality and customer service.

That Apple was built by Steve Jobs. Today’s Apple has been remade by Tim Cook, and it is an entirely different company.

Today’s Apple – the one today’s analysts love – is all about making and selling more iPhones. And treating those iPhone users as a “loyal base” to which they can sell all kinds of apps/services. Today’s Apple is about using the company’s storied position, and brand leadership, to milk more money out of customers that own their devices, and expanding into adjacent markets where the installed base can continue growing.

UBS likes Apple because they think the services business is undervalued. After noting that it today would stand alone as a Fortune 100 company, they expect those services to double in four years. Bernstein notes services today represents 11% of revenue, and should grow at 22% per year. Meanwhile they expect the installed base of iPhones to expand by 27% – largely due to offshore sales – adding further to services growth.

Analysts further like Apple’s likely expansion into India – a previously almost untapped market. CEO Cook has led negotiations to have Foxxcon and Wistron, the current Chinese-based manufacturers, open plants in India for domestic production of iPhones. This expansion into a new geographic market is anticipated to produce tremendous iPhone sales growth. Do you remember when, just before filing for bankruptcy, Krispy Kreme was going to keep up its valuation by expanding into China?

Of course, with so many millions of devices, it is expected that the apps and services to be deployed on those devices will continue growing. Likely exponentially. The iOS developer community has long been one of Apple’s great strengths. Developers like how quickly they can deploy new apps and services to the market via Apple’s sales infrastructure. And with companies the size of IBM dedicated to building enterprise apps for iOS the story heard over and again is about expanding the installed base, then selling the add-ons.

Gee, sounds a lot like the old “razors lead to razor blade sales” strategy – business innovation circa 1966.

Overall, doesn’t this sound a lot like Microsoft? Bill Gates founded a company that revolutionized computing with low-cost software on low-cast hardware that did just about anything you would want. Windows made life easy. Microsoft gave users office automation, databases and all the basic work tools. And when the internet came along Microsoft connected everyone with Internet Explorer – for free! Microsoft created a platform with Windows upon which hordes of developers could build special applications for dedicated markets.

Once this market was created, and pretty much monopolized by Microsoft CEO Gates turned the reigns over to CEO Steve Ballmer. And Mr. Ballmer maximized these advantages. He invested constantly in developing updates to Windows and Office which would continue to insure Microsoft’s market share against emerging competitors like Unix and Linux. The money was so good that over a decade money was poured into gaming, even though that business lost more money than it made in revenue – but who cared? There were occasional investments in products like tablets, hand-helds and phones, but these were merely attractions around the main show. These products came and went and, again, nobody really cared.

Ballmer optimized the gains from Microsoft’s installed base. And a lot – a lot – of money was made doing this. nvestors appreciated the years of ongoing profits, dividends – and even occasional special dividends – as the money poured in. Microsoft was unstoppable in personal computing. The only thing that slowed Microsoft down was the market shift to mobile, which caused the PC market to collapse as unit sales have declined for six straight years (PC sales in 2016 barely managed levels of 2006). But, for a goodly while, it was a great ride!

Today all one hears about at Apple is growing the installed base. Maximizing sales of iPhones. And then selling everyone services. Oh yeah, the Apple Watch came out. Sort of flopped. Nobody really seemed to care much. Not nearly as much as they cared about 2 quarters of sales declines in iPhones. And whatever happened to AppleTV? ApplePay? iBeacons? Beats? Weren’t those supposed to be breakthrough innovations to create new markets? Oh well, nobody seems to much care about those things any longer. Attractions around the main event – iPhones!

So now analysts today aren’t put in the mode of evaluating breakthrough innovations and trying to guess the size of brand new, never before measured markets. That was hard. Now they can be far more predictable forecasting smartphone sales and services revenue, with simulations up and down. And that means they can focus on cash flow. After all, Apple makes more cash than it makes profit! Apple has a $246 billion cash hoard. Most people think Berkshire Hathaway, led by famed investor Warren Buffett, spent $6.6 billion on Apple stock in 2016 because Berkshire sees Apple as a cash generation machine – sort of like a railroad! And if those meetings between CEO Cook and President Trump can yield a tax change allowing repatriation at a low rate then all that cash could lead to a big one time dividend!

And, most likely, the stock will go up. Most likely, a lot. Because for at least a while Apple’s iPhone business is going to be pretty good. And the services business is going to grow. It will be a lot like Microsoft – at least until mobile changed the business. Or, maybe like Xerox giving away copiers to obtain toner sales – until desktop publishing and email cratered the need for copiers and large printers. Or, going all the way back into the 1950s and 60s, when Multigraphics and AB Dick practically gave away small printers to get the ink and plate sales – until xerography crushed that business. Of course you couldn’t go wrong investing in Sears for years, because they had the store locations, they had the brands (Kenmore, Craftsman, et.al.,) they had the credit card services – until Wal-Mart and Amazon changed that game.

You see, that’s the problem with all of these sort of “milk the base” businesses. As the focus shifts to grow the base and add-on sales the company loses sight of customer needs. Innovation declines, then evaporates as everything is poured into maximizing returns from the “core” business. Optimization leads to a focus on costs, and price reductions. Arrogance, based on market leadership, emerges and customer service starts to wane. Quality falters, but is not considered as important because sales are so large.

These changes take time, and the business looks really good as profits and cash flow continue, so it is easy to overlook these cultural and organizational changes, and their potential negative impact. Many applaud cost reductions – remember the glee with which analysts bragged about the cost savings when Dell moved its customer service to India some 20 years ago?

Today we’re hearing more stories about long-term Apple customers who aren’t as happy as they once were.

Genius bar experiences aren’t always great. In a telling AdAge column one long-time Apple user discusses how he had two iPhones fail, and Apple could not replace them leaving the customer with no phone for two weeks – demonstrating a lack of planning for product failures and a lack of concern for customer service. And the same issues were apparent when his corporate Macbook Pro failed. This same corporate customer bemoans design changes that have led to incompatible dongles and jacks, making interoperability problematic even within the Apple line.

Meanwhile, over the last four years Apple has spent lavishly on a new corporate headquarters befitting the country’s most valuable publicly traded company. And Apple leaders have been obsessive about making sure this building is built right! Which sounds well and good, except this was a company that once put customers – and unearthing their hidden needs, wants and wishes – first. Now, a lot of attention is looking inward. Looking at how they are spending all that money from milking the installed base. Putting some of the best managers on building the building – rather than creating new markets.

Who was that retailer that was so successful that it built what was, at the time, the world’s tallest building? Oh yeah, that was Sears.

Markets always shift. Change happens. Today it happens faster than ever in history. And nowhere does change happen faster than in technology and consumer electronics. CEO Cook is leading like CEO Ballmer. He is maximizing the value, and profitability, of the Apple’s core product – the iPhone. And analysts love it. It would be wise to disavow yourself of any thoughts that Apple will be the innovative market creating Jobs/Ives organization it once was.

How long will this be a winning strategy? Your answer to that should determine how long you would like to be an Apple investor. Because some day something new will come along.

by Adam Hartung | Dec 17, 2016 | Defend & Extend, Investing, Retail, Trends

Sears recently announced it is closing another big batch of stores. Yawn. Who cares? Sears losses since 2010 are nearly $10 billion, with a $.75 billion loss in just the third quarter. As revenue fell another 13% overall and comparable store sales declined 7.4% investors have fled the stock for years.

Five years ago Sears had 3,510 stores. Now it has 1,687. It has 750 with leases expiring in the next five years and CFO Jason Hollar has said 550 of those are short-term enough they will let those close.

What’s striking about this statement is that Sears is a perfect candidate to file bankruptcy, renegotiate those leases, and start with a new plan for the future. Unless it has no plan. Lacking a plan to make its business successful and return those stores to profitability, the CFO is admitting the company has no choice but to keep shrinking assets as Sears simply disappears. Investors should view Sears as a microcosm of trends in traditional brick-and-mortar retailing across the industry. The business is shrinking. Fast

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

Just look at retail employment. Amidst another strong jobs report for November, retail employment actually shrank. This previously only happened in recessions – and 2016 is definitely not a recession year. And all the losses were in traditional store retailing. Kohl’s said it is hiring almost 13% fewer seasonal workers, and Macy’s says it is hiring 2.4% fewer.

Of course, Amazon seasonal hiring is up 20%.

In January, 2015 I wrote how the trend to e-commerce had taken hold, and traditional retailing would never again be the same. For the 2014 holiday season online retail grew 17%, but brick-and-mortar sales actually declined. This was a pivotal event. It clearly indicated a sea change in the marketplace, and it was clear valuations would be shifting accordingly. Surprising many, but not those who really understood the trends and market shifts, six months later (July, 2015) Amazon’s market cap exceeded that of much larger Wal-Mart.

ALL trends (including mobile use) reinforce on-line growth, brick and mortar decline.

The 2016 holiday season is further reinforcing this trend. The National Retail Federation reported that on black Friday 99 million people went to stores. 108.5million shopped online. Black Friday online sales jumped 21.6%.

And this . E-commerce apps are making the on-line experience constantly better. On Thanksgiving day 70% of all on-line retail traffic was mobile, and for the first time ever 53% of on-line orders were from mobile devices – exceeding the orders placed on PCs. With this kind of access, and easy shopping, the need to travel to physical stores accelerates their decline.

Sears is beyond rescue. Unfortunately, there are a number of retailers already so challenged by the on-line competition that they are “the walking dead.” They will falter, and fail, just like the former Dow Jones Industrial retailing giant. They will not make the shift to on-line effectively. They are unwilling to dramatically change their business model, unwilling to cannibalize store sales to create an aggressively competitive on-line business. Expect bad things at JCPenney, Kohl’s, Pier 1 – and weakness at giants Wal-Mart and even Target.

Christmas used to be the time when investors in traditional retail cheered. Results for the quarter could create great gains in stock values. But that time is long gone – passed during the 2014 inflection when traditional started declining while e-commerce continued double digit growth. One can understand the Scrooge-like mentality of those investors, who dread seeing the shift in customers, and valuation, away from their companies and toward the Amazon’s who embrace trends and market shifts.

by Adam Hartung | Dec 6, 2016 | Disruptions, Innovation, Investing, Leadership, Retail

(Photo by Spencer Platt/Getty Images)

But, is it right to hand-wring over Schultz’s departure as CEO? After all, things have not been pretty for investors since Mr. Jobs turned over Apple to his hand-picked successor Tim Cook. However, could this change mean something better is in store for shareholders?

First, let’s address the very – and Starbucks was saved only by Mr. Schultz returning with his tremendous creativity and servant leadership. While it is great propaganda for making the Schultz as hero story more appealing, it isn’t exactly accurate.

Starting in 1982, Howard Schultz built Starbucks from four stores to over 2,800 (and over $2 billion revenue) in 16 years. That was a tremendous success. And he is to be lauded. But when he left,

Starbucks had only 35o stores outside the USA. It was an American phenomenon, a place to buy and drink coffee, with every store company owned, every employee company trained, and not an ounce of variability in the business model. Not exactly diversified. At the time, the stock traded for roughly (split adjusted) $4 per share.

His successor, Orin Smith, far outperformed Mr. Schultz, more than tripling the chain to over 9,000 stores and expanding revenue to over $5 billion in just four years! He expanded the original model internationally, began adding many new varieties of coffee and other drinks, and even added food. These enhancements were tremendously successful at bringing in additional revenue, even if the average store revenue fell as smaller stores were added in places like airports, hotels and entertainment venues.

In 2005, Jim Donald replaced Mr. Smith. By 2007 (in just teo years) he added a staggering additional 4,000 stores. He expanded the menu. And he even branched out to selling branded Starbucks coffee on airplanes, in hotels and even retailed in grocery stores. Further, he launched a successful international coffee liqueur under the Starbucks brand. And he moved the company into entertainment, creating an artist representation company and even producing movies (Akeelah and the Bee) which won multiple awards.

In 2007 Starbucks fourth quarter saw 22% revenue increase, and for the year 21% growth. Comparable store sales grew 5%. International margins expanded, and net earnings grew over 19% from $564 million to $673 million.

Starbucks’ stock, from 2000 when Mr. Schultz departed into 2006 rose 375%, from $4 to just under $19 per share. Not the ruination that some seem to think was happening.

But Mr. Schultz did not like the diversification, even if it produced more revenue and profit. He joined the chorus of analysts that beat down the P/E ratio, and the stock price, as the company expanded beyond its “core” coffee store business.

When the Great Recession hit, and people realized they could live without $4 per cup of coffee and a $50 per day habit, revenues plummeted, as they did for many restaurants and retailers. Mr. Schultz seized the opportunity to return to his old job as CEO. That the downturn in Starbucks had far more to do with the greatest economic debacle since the 1930s was overlooked as Mr. Schultz blamed everything on the previous CEO and his leadership team – firing them all.

Since 2012 Starbucks has returned to doing what it did prior to 2000 – opening more stores. Growing from 17,000 to 25,000 stores. Refocused on its very easy to understand, if dated, business model analysts loved the simpler company and bid up the P/E to over 30 – creating a trough (2008) to peak (2016) increase in adjusted stock price from $4 to $60 – an incredible 15 times!

But, more realistically one should compare the price today to that of 2006, before the entire market crashed and analysts turned negative on the profitable Starbucks diversification and business model expansion. That gain is a more modest 300% – basically a tripling over a decade – far less a gain for investors than happened under the 2000-2006 era of Mr. Schultz’s successors.

Mr. Schultz succeeded in returning Starbucks to its “core.” But now he’s leaving a much more vulnerable company. As my fellow Forbes contributor Richard Kestenbaum has noted, retail success requires innovation. Starbucks is now almost everywhere, leaving little room for new store expansion. Yet it has abandoned other revenue opportunities pioneered under Messrs. Smith and Donald. And competition has expanded dramatically – both via direct coffee store competitors and the emergence of new gathering spots like smoothie stores, tech stores and fast casual restaurants that are attracting people away from a coffee addiction.

At some point Starbucks and its competition will saturate the market. And tastes will change. And when that happens, growth will be a lot harder to find. As McDonald’s and WalMart have learned, . Exciting new competitors emerge, like Starbucks once was, and Amazon.com is increasingly today.

Mr. Schultz has said he is vastly more confident in this change of leadership than he was the last time he left – largely because he feels this hand-picked team (as if he didn’t pick the last team, by the way) will continue to remain tightly focused on defending and extending Starbucks “core” business. This approach sounds all too familiar – like Jobs selection of Cook – and the risks for investors are great.

A focus on the core has real limits. Diminishing returns do apply. And P/E compression (from the very high 30+ today) could cause Starbucks to lose any investor upside, possibly even cause the stock to decline. If Mr. Schultz’s departure was opening the door for more innovation, new business expansion and a change to new trends that sparked growth one could possibly be excited. But there is real reason for concern – just as happened at Apple.

by Adam Hartung | Aug 26, 2016 | In the Swamp, Investing, Retail, Trends

Photographer: Luke Sharrett/Bloomberg

Walmart is in more trouble than its leadership wants to acknowledge. Investors

need to realize that it is up to Jet.com to turn around the ailing giant. And

that is a big task for the under $1 billion company.

Relevancy Is Hard To Keep – Look At Sears

Nobody likes to think their business can disappear. What CEO wants to tell his investors or employees “we’re no longer relevant, and it looks like our customers are all going somewhere else for their solutions”? Unfortunately, most leadership teams become entrenched in the business model and deny serious threats to longevity, thus leading to inevitable failure as customers switch.

Gallery: “Walmart Goes Small”

In early September the Howard Johnson’s in Bangor, Maine will close. This will leave just one remaining HoJo in the USA. What was once an iconic brand with hundreds of outlets strung along the fast growing interstate highway system is now nearly dead. People still drive the interstate, but trends changed, fast food became a good substitute, and unable to update its business model this once great brand died.

AP Photo/Elise Amendola

Sears announced another $350 million quarterly loss this week. That makes $9 billion in accumulated losses the last several quarters. Since Chairman and CEO Ed Lampert took over, Sears and Kmart have seen same store sales decline every single quarter except one. Unable to keep its customers Mr. Lampert has been closing stores and selling assets to stem the cash drain. But to keep the company afloat his hedge fund, ESL, is loaning Sears Holdings SHLD -2.94% another $300 million. On top of the $500 million the company borrowed last quarter. That the once iconic company, and Dow Jones Industrial Average component, is going to fail is a foregone conclusion.

But most people still think this fate cannot befall the nearly $500 billion revenue behemoth Walmart. It’s simply too big to fail in most people’s eyes.

Walmart’s Crime Problem Is Another Telltale Sign Of Problems In The Business Model

Yet, the primary news about Walmart is not good. Bloomberg this week broke the news that one of the most crime-ridden places in America is the local Walmart store. One store in Tulsa, Oklahoma has had 5,000 police visits in the last five years, and four local stores have had 2,000 visits in the last year alone. Across the system, there is one violent crime in a Walmart every day. By constantly promoting its low cost strategy Walmart has attracted a class of customer that simply is more prone to committing crime. And policies implemented to hang onto customers, like letting them camp out overnight in the parking lots, serve to increase the likelihood of poverty-induced crime.

But this outcome is also directly related to Walmart’s business model and strategy. To promote low prices Walmart has automated more operations, and cut employees like greeters. Thus leadership brags about a 23% increase in sales/employee the last decade. But that has happened as the employment shrank by 400,000. Fewer employees in the stores encourages more crime.

In a real way Walmart has “outsourced” its security to local police departments. Experts say the cost to eliminate this security problem are about $3.2 billion – or about 20% of Walmart’s total profitability. Ouch! In a world where Walmart’s net margin of 3% is fully one-third lower than Target’s 4.6% the money just isn’t there any longer for Walmart to invest in keeping its stores safe.

With each passing month Walmart is becoming the “retailer of last resort” for people who cannot shop online. People who lack credit cards, or even bank accounts. People without the means, or capability, of shopping by computer, or paying electronically. People who have nowhere else to go to shop, due to poverty and societal conditions. Not exactly the ideal customer base for building a growing, profitable business.

Competitors Relentlessly Pick Away At Walmart’s Sales And Profits

To maintain revenues the last several years Walmart has invested heavily in transitioning to superstores which offer a large grocery section. But now Kroger KR -0.5%, Walmart’s no. 1 grocery competitor, is taking aim at the giant retailer, slashing prices on 1,000 items. Just like competition from the “dollar stores” has been attacking Walmart’s general merchandise aisles. Thus putting even more pressure on thinning margins, and leaving less money available to beef up security or entice new customers to the stores.

And the pressure from e-commerce is relentless. As detailed in the Wall Street Journal, Walmart has been selling online for about 15 years, and has a $14 billion online sales presence. But this is only 3% of total sales. And growth has been decelerating for several quarters. Last quarter Walmart’s e-commerce sales grew 7%, while the overall market grew 15% and Amazon ($100 billion revenues) grew 31%. It is clear that Walmart.com simply is not attracting enough customers to grow a healthy replacement business for the struggling stores.

Thus the acquisition of Jet.com.

The hope is that this extremely unprofitable $1 billion online retailer will turn around Walmart’s fortunes. Imbue it with much higher growth, and enhanced profitability. But will Walmart make this transition. Is leadership ready to cannibalize the stores for higher electronic sales? Are they willing to make stores smaller, and close many more, to shift revenues online? Are they willing to suffer Amazon-like profits (or losses) to grow? Are they willing to change the Walmart brand to something different, while letting Jet.com replace Walmart as the dominant brand? Are they willing to give up on the past, and let new leadership guide the company forward?

If they do then Walmart could become something very different in the future. If they really realize that the market is shifting, and that an extreme change is necessary in strategy and tactics then Walmart could become something very different, and remain competitive in the highly segmented and largely online retail future. But if they don’t, Walmart will follow Sears into the whirlpool, and end up much like Howard Johnson’s.

by Adam Hartung | May 20, 2016 | E-Commerce, Investing, Retail, Trends

WalMart announced 1st quarter results on Thursday, and the stock jumped almost 10% on news sales were up versus last year. It was only $1.1B on $115B, about 1%, but it was UP! Same store sales were also up 1%, but analysts pointed out that was largely due to lower prices to hold competitors at bay.

While investors cheered the news, at the higher valuation WalMart is still only worth what it was in June, 2012 (just under $70/share.) From then through August, 2015 WalMart traded at a higher valuation – peaking at $90 in January, 2015. Subsequent fears of slower sales had driven the stock down to $56.50 by November, 2015. So this is a recovery for crestfallen investors the last year, but far from new valuation highs.

Unfortunately, this is likely to be just a blip up in a longer-term ongoing valuation decline for WalMart. And that value will be captured by those who understand the most important, undeniable trend in retail.

(c) AdamHartung.com Data Sources: Yahoo Finance and www.trend-stock-analysis-on.net

Although the numbers for WalMart’s valuation are a bit better than when the associated chart was completed last week, as you can see WalMart’s assets are greater than the company’s total valuation. This is because the return on its assets, today and projected, are so low that WalMart must borrow money in order to make them overall worthwhile. And the fact that on the balance sheet, at book value, the assets appear to be some $50B lower due to depreciation, and the difference be cost and market value.

This is because WalMart competes almost entirely in the intensely competitive and asset-dense market of traditional brick-and-mortar retail. This requires a lot of land, buildings, shelves and inventory. And that market is barely growing. Maybe 1-2%/year.

Compare t his with Amazon. Amazon has about $30B of assets. Yet its valuation is over $330B. So Amazon captures an extra value of $300B by competing in the asset sparse market of on-line retailing where it needs little land, few buildings, far less shelving and a lot less inventory. And it is competing in a market the Commerce Department says is growing at 15%/year.

The trend to on-line sales is extremely important, as it has entirely different customer acquisition and retention requirements, and very different ways of competing. Amazon understands those trends, and continues to lead its rivals. Today on-line retail is 10.5% of all non-restaurant, non-bar retail. And that 15% growth rate accounts for 60% of ALL the growth in this retail segment. Amazon keeps advancing, growing as fast (or faster) than the industry average, especially in key categories. Meanwhile, despite its vast resources and best efforts WalMart admitted its on-line sales growth is only 7% – half the segment growth rate – and its growth is decelerating.

By understanding this one trend – a very big, important, powerful trend – Amazon captures more value than the current value of ALL the Walmart stores, distribution centers and their contents. With all those assets WalMart can only convince investors it is worth about $200B. With about 13% of the assets used by WalMart, Amazon convinces investors it is worth 33% more than WalMart – over $330B. That’s $300B of value created just by knowing where the market is headed, and how to deliver for customers in that future market.

Yes, Amazon has other businesses, such as AWS cloud services and tech products in tablets, smartphones and smart speakers. But these too (some not nearly as successful as others, mind you) are very much on trends. WalMart once dominated retail technology with its massive computer systems and enormous databases. But WalMart limited itself to using its technology to defend & extend its core traditional retail business via store forecasts, optimized distribution and extensive pricing schemes. Amazon is monetizing its technology prowess by, again, leveraging trends and making its services and products available to others.

How does this apply to you? When someone asks “If you could have anything you want, what would you ask for?” most of us would start with health, happiness, peace and similar intangibles for us, our families and mankind. But if forced to make a tangible selection, we would ask for an asset. Buildings, equipment, cash. Yet, as WalMart and Amazon show us, those assets are only as valuable as what you do with them. And thus, it is more valuable to understand the trends, and how to use assets wisely for greatest value, than it is to own a pile of assets.

So the really important question is “Do you know what trends are going to be important to your business, and are you implementing a strategy to leverage those key trends?” If you are trying to protect your assets, you will likely be overwhelmed by the trend leader. But if you really understand the trends and are ready to act on them, you could be the one to capture the most value in your marketplace, and likely without adding a lot more costly assets.

by Adam Hartung | May 15, 2016 | In the Swamp, Investing, real estate, Retail

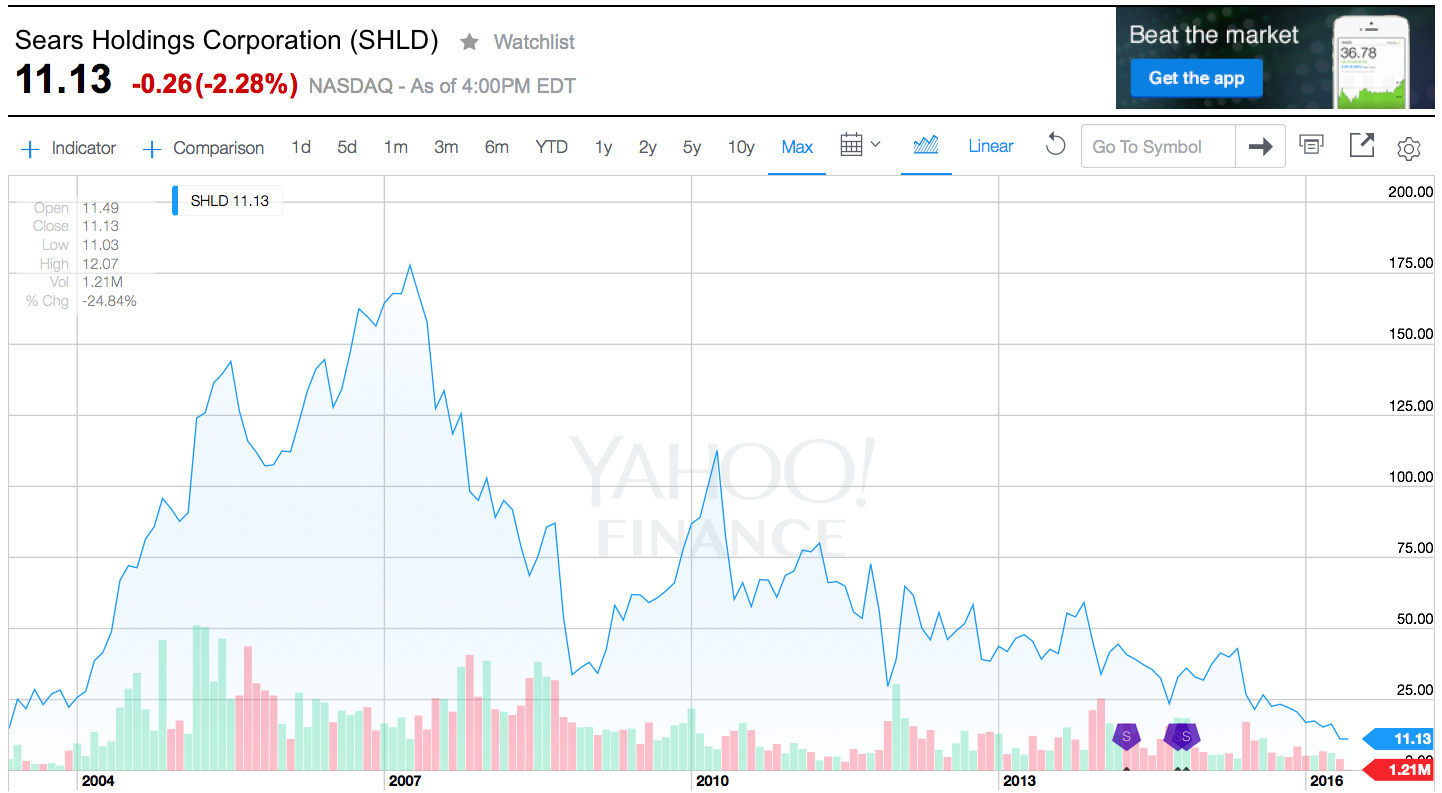

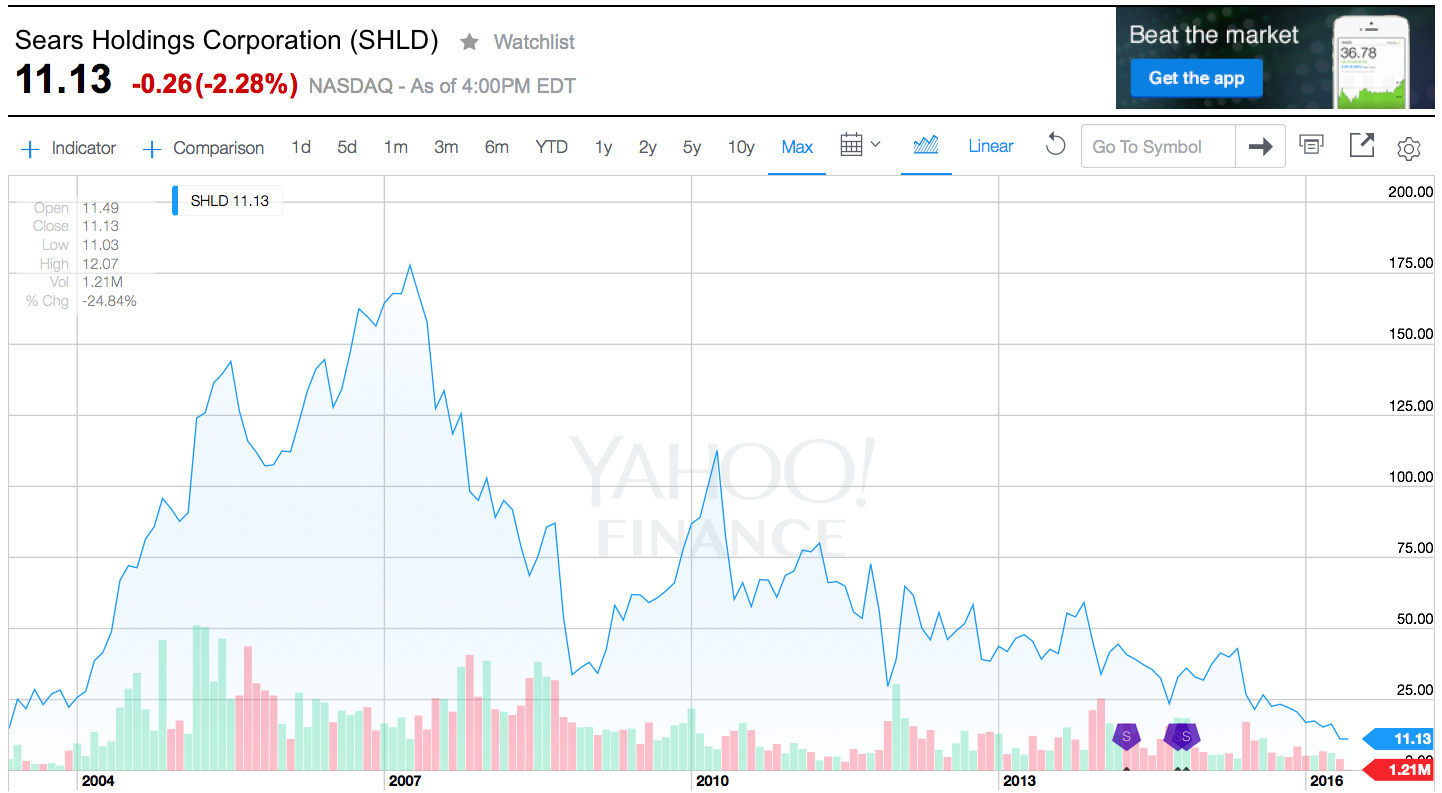

Last week Sears announced sales and earnings. And once again, the news was all bad. The stock closed at a record, all time low. One chart pretty much sums up the story, as investors are now realizing bankruptcy is the most likely outcome.

Chart Source: Yahoo Finance 5/13/16

Quick Rundown: In January, 2002 Kmart is headed for bankruptcy. Ed Lampert, CEO of hedge fund ESL, starts buying the bonds. He takes control of the company, makes himself Chairman, and rapidly moves through proceedings. On May 1, 2003, KMart begins trading again. The shares trade for just under $15 (for this column all prices are adjusted for any equity transactions, as reflected in the chart.)

Lampert quickly starts hacking away costs and closing stores. Revenues tumble, but so do costs, and earnings rise. By November, 2004 the stock has risen to $90. Lampert owns 53% of Kmart, and 15% of Sears. Lampert hires a new CEO for Kmart, and quickly announces his intention to buy all of slow growing, financially troubled Sears.

In March, 2005 Sears shareholders approve the deal. The stock trades for $126. Analysts praise the deal, saying Lampert has “the Midas touch” for cutting costs. Pumped by most analysts, and none moreso than Jim Cramer of “Mad Money” fame (Lampert’s former roommate,) in 2 years the stock soars to $178 by April, 2007. So far Lampert has done nothing to create value but relentlessly cut costs via massive layoffs, big inventory reductions, delayed payments to suppliers and store closures.

Homebuilding falls off a cliff as real estate values tumble, and the Great Recession begins. Retailers are creamed by investors, and appliance sales dependent Sears crashes to $33.76 in 18 months. On hopes that a recovering economy will raise all boats, the stock recovers over the next 18 months to $113 by April, 2010. But sales per store keep declining, even as the number of stores shrinks. Revenues fall faster than costs, and the stock falls to $43.73 by January, 2013 when Lampert appoints himself CEO. In just under 2.5 years with Lampert as CEO and Chairman the company’s sales keep falling, more stores are closed or sold, and the stock finds an all-time low of $11.13 – 25% lower than when Lampert took KMart public almost exactly 13 years ago – and 94% off its highs.

What happened?

Sears became a retailing juggernaut via innovation. When general stores were small and often far between, and stocking inventory was precious, Sears invented mail order catalogues. Over time almost every home in America was receiving 1, or several, catalogues every year. They were a major source of purchases, especially by people living in non-urban communities. Then Sears realized it could open massive stores to sell all those things in its catalogue, and the company pioneered very large, well stocked stores where customers could buy everything from clothes to tools to appliances to guns. As malls came along, Sears was again a pioneer “anchoring” many malls and obtaining lower cost space due to the company’s ability to draw in customers for other retailers.

To help customers buy more Sears created customer installment loans. If a young couple couldn’t afford a stove for their new home they could buy it on terms, paying $10 or $15 a month, long before credit cards existed. The more people bought on their revolving credit line, and the more they paid Sears, the more Sears increased their credit limit. Sears was the “go to” place for cash strapped consumers. (Eventually, this became what we now call the Discover card.)

In 1930 Sears expanded the Allstate tire line to include selling auto insurance – and consumers could not only maintain their car at Sears they could insure it as well. As its customers grew older and more wealthy, many needed help with financia advice so in 1981 Sears bought Dean Witter and made it possible for customers to figure out a retirement plan while waiting for their tires to be replaced and their car insurance to update.

To put it mildly, Sears was the most innovative retailer of all time. Until the internet came along. Focused on its big stores, and its breadth of products and services, Sears kept trying to sell more stuff through those stores, and to those same customers. Internet retailing seemed insignificantly small, and unappealing. Heck, leadership had discontinued the famous catalogues in 1993 to stop store cannibalization and push people into locations where the company could promote more products and services. Focusing on its core customers shopping in its core retail locations, Sears leadership simply ignored upstarts like Amazon.com and figured its old success formula would last forever.

But they were wrong. The traditional Sears market was niched up across big box retailers like Best Buy, clothiers like Kohls, tool stores like Home Depot, parts retailers like AutoZone, and soft goods stores like Bed, Bath & Beyond. The original need for “one stop shopping” had been overtaken by specialty retailers with wider selection, and often better pricing. And customers now had credit cards that worked in all stores. Meanwhile, for those who wanted to shop for many things from home the internet had taken over where the catalogue once began. Leaving Sears’ market “hollowed out.” While KMart was simply overwhelmed by the vast expansion of WalMart.

What should Lampert have done?

There was no way a cost cutting strategy would save KMart or Sears. All the trends were going against the company. Sears was destined to keep losing customers, and sales, unless it moved onto trends. Lampert needed to innovate. He needed to rapidly adopt the trends. Instead, he kept cutting costs. But revenues fell even faster, and the result was huge paper losses and an outpouring of cash.

To gain more insight, take a look at Jeff Bezos. But rather than harp on Amazon.com’s growth, look instead at the leadership he has provided to The Washington Post since acquiring it just over 2 years ago. Mr. Bezos did not try to be a better newspaper operator. He didn’t involve himself in editorial decisions. Nor did he focus on how to drive more subscriptions, or sell more advertising to traditional customers. None of those initiatives had helped any newspaper the last decade, and they wouldn’t help The Washington Post to become a more relevant, viable and profitable company. Newspapers are a dying business, and Bezos could not change that fact.

Mr. Bezos focused on trends, and what was needed to make The Washington Post grow. Media is under change, and that change is being created by technology. Streaming content, live content, user generated content, 24×7 content posting (vs. deadlines,) user response tracking, readers interactivity, social media connectivity, mobile access and mobile content — these are the trends impacting media today. So that was where he had leadership focus. The Washington Post had to transition from a “newspaper” company to a “media and technology company.”

So Mr. Bezos pushed for hiring more engineers – a lot more engineers – to build apps and tools for readers to interact with the company. And the use of modern media tools like headline testing. As a result, in October, 2015 The Washington Post had more unique web visitors than the vaunted New York Times. And its lead is growing. And while other newspapers are cutting staff, or going out of business, the Post is adding writers, editors and engineers. In a declining newspaper market The Washington Post is growing because it is using trends to transform itself into a company readers (and advertisers) value.

CEO Lampert could have chosen to transform Sears Holdings. But he did not. He became a very, very active “hands on” manager. He micro-managed costs, with no sense of important trends in retail. He kept trying to take cash out, when he needed to invest in transformation. He should have sold the real estate very early, sensing that retail was moving on-line. He should have sold outdated brands under intense competitive pressure, such as Kenmore, to a segment supplier like Best Buy. He then should have invested that money in technology. Sears should have been a leader in shopping apps, supplier storefronts, and direct-to-customer distribution. Focused entirely on defending Sears’ core, Lampert missed the market shift and destroyed all the value which initially existed in the great retail merger he created.

Impact?

Every company must understand critical trends, and how they will apply to their business. Nobody can hope to succeed by just protecting the core business, as it can be made obsolete very, very quickly. And nobody can hope to change a trend. It is more important than ever that organizations spend far less time focused on what they did, and spend a lot more time thinking about what they need to do next. Planning needs to shift from deep numerical analysis of the past, and a lot more in-depth discussion about technology trends and how they will impact their business in the next 1, 3 and 5 years.

Sears Holdings was a 13 year ride. Investor hope that Lampert could cut costs enough to make Sears and KMart profitable again drove the stock very high. But the reality that this strategy was impossible finally drove the value lower than when the journey started. The debacle has ruined 2 companies, thousands of employees’ careers, many shopping mall operators, many suppliers, many communities, and since 2007 thousands of investor’s gains. Four years up, then 9 years down. It happened a lot faster than anyone would have imagined in 2003 or 2004. But it did.

And it could happen to you. Invert your strategic planning time. Spend 80% on trends and scenario planning, and 20% on historical analysis. It might save your business.

by Adam Hartung | Apr 27, 2016 | Food and Drink, In the Rapids, In the Swamp, Retail, Software, Web/Tech

Growth fixes a multitude of sins. If you grow revenues enough (you don’t even need profits, as Amazon has proven) investors will look past a lot of things. With revenue growth high enough, companies can offer employees free meals and massages. Executives and senior managers can fly around in private jets. Companies can build colossal buildings as testaments to their brand, or pay to have thier names on public buildings. R&D budgets can soar, and product launches can fail. Acquisitions are made with no concerns for price. Bonuses can be huge. All is accepted if revenues grow enough.

Just look at Facebook. Today Facebook announced today that for the quarter ended March, 2016 revenues jumped to $5.4B from $3.5B a year ago. Net income tripled to $1.5B from $500M. And the company is basically making all its revenue – 82% – from 1 product, mobile ads. In the last few years Facebook paid enormous premiums to buy WhatsApp and Instagram – but who cares when revenues grow this fast.

Anticipating good news, Facebook’s stock was up a touch today. But once the news came out, after-hours traders pumped the stock to over $118//share, a new all time high. That’s a price/earnings (p/e) multiple of something like 84. With growth like that Facebook’s leadership can do anything it wants.

But, when revenues slide it can become a veritable poop puddle. As Apple found out.

Rumors had swirled that Apple was going to say sales were down. And the stock had struggled to make gains from lows earlier in 2016. When the company’s CEO announced Tuesday that sales were down 13% versus a year ago the stock cratered after-hours, and opened this morning down 10%. Breaking a streak of 51 straight quarters of revenue growth (since 2003) really sent investors fleeing. From trading around $105/share the last 4 days, Apple closed today at ~$97. $40B of equity value was wiped out in 1 day, and the stock trades at a p/e multiple of 10.

The new iPhone 6se outsold projections, iPads beat expectations. First year Apple Watch sales exceeded first year iPhone sales. Mac sales remain much stronger than any other PC manufacturer. Apple iBeacons and Apple Pay continue their march as major technologies in the IoT (Internet of Things) market. And Apple TV keeps growing. There are about 13M users of Apple’s iMusic. There are 1.5M apps on the iTunes store. And the installed base keeps the iTunes store growing. Share buybacks will grow, and the dividend was increased yet again. But, none of that mattered when people heard sales growth had stopped. Now many investors don’t think Apple’s leadership can do anything right.

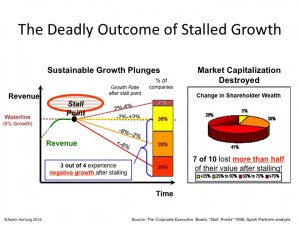

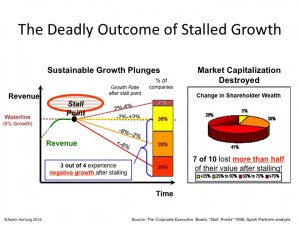

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Which leads us to Chipotle. Chipotle announced that same store sales fell almost 30% in Q1, 2016. That was after a 15% decline in Q4, 2015. And profits turned to losses for the quarter. That is a growth stall. Chipotle shares were $750/share back in early October. Now they are $417 – a drop of over 44%.

Customer illnesses have pointed to a company that grew fast, but apparently didn’t have its act together for safe sourcing of local ingredients, and safe food handling by employees. What seemed like a tactical problem has plagued the company, as more customers became ill in March.

Whether that is all that’s wrong at Chipotle is less clear, however. There is a lot more competition in the fast casual segment than 2 years ago when Chipotle seemed unable to do anything wrong. And although the company stresses healthy food, the calorie count on most portions would add pounds to anyone other than an athlete or construction worker – not exactly in line with current trends toward dieting. What frequently looks like a single problem when a company’s sales dip often turns out to have multiple origins, and regaining growth is nearly always a lot more difficult than leadership expects.

Growth is magical. It allows companies to invest in new products and services, and buoy’s a stock’s value enhancing acquisition ability. It allows for experimentation into new markets, and discovering other growth avenues. But lack of growth is a vital predictor of future performance. Companies without growth find themselves cost cutting and taking actions which often cause valuations to decline.

Right now Facebook is in a wonderful position. Apple has investors rightly concerned. Will next quarter signal a return to growth, or a Growth Stall? And Chipotle has investors heading for the exits, as there is now ample reason to question whether the company will recover its luster of yore.

by Adam Hartung | Jan 14, 2015 | Investing, Retail, Trends

Retail sales fell .9% in December. Even excluding autos and gasoline, retail sales fell .3%. Further, November retail sales estimates were revised downward from an initial .7% gain to a meager .4%, and October sales advances were revised downward from a .5% gain to a mere .3%. Sales were down at electronic stores, clothing stores and department stores – all places we anticipated gains due to an improving economy, more jobs and more cash in consumer pockets.

Whoa, what’s happening? Wasn’t lower gasoline pricing going to free up cash for people to go crazy buying holiday gifts? Weren’t we all supposed to feel optimistic about our jobs, higher future wages and more money to spend after that horrible Great Recession thus leading us to splurge this holiday?

There were early signals that conventional wisdom was going to be wrong. Back on Black Friday (so named because it is supposedly the day when retailers turn a profit for the year) we learned sales came in a disappointing 11% lower than 2013. Barron’s analyzed press releases from Wal-Mart, and discerned that 2014 was a weaker Black Friday than 2013 and probably 2012. Simply put, fewer people went shopping on Black Friday than before, despite longer store hours, and they bought less.

So was this really a horrible holiday?

Retail store sales are only part of the picture. Increasingly, people are shopping on-line – and we all know it. According to ComScore, on-line sales made to users of PCs (this excludes mobile devices) were up 17% on Cyber Monday, in stark contrast to traditional brick-and-mortar. Exceeding $2B, it was the largest on-line retail day in history. The Day after Cyber Monday sales were up 27%, and the Green Monday (one week after Cyber Monday) sales were up 15% (all compared to year ago.) Overall, the week after Thanksgiving on-line sales rose 14%, and on Thanksgiving Day itself sales were up a whopping 32%. The week before Christmas (16th-21st) on-line sales surged 18%. According to IBM Digital Analytics the on-line November-December sales were up 13.9% vs. 2013.

The trend has never been more pronounced. Regardless of how much people are going to spend, they are spending less of it in traditional brick-and-mortar retail, and more of it on-line.

So, what about Wal-Mart? The chain remains mired in its traditional way of doing business. Even though same-store sales have been flat-to-down most of the last 2 years, and the number of full-line stores has declined in the USA, the chain remains committed quarter after quarter to defending its outdated success formula. Even in China, where Alibaba has demonstrated it can grow on-line ecommerce revenues more than 50%/year, Wal-Mart continues to try growing with a physical presence – even though it has been a tough, unsuccessful slog.

Yet, despite its bribery scandal in Mexico undertaken to prop up revenues, lawsuits due to over-worked, stressed truck drivers having accidents on double shifts killing and injuring people, and an inability to grow, Wal-Mart’s stock trades at near all-time highs. The stock has nearly doubled since 2011, even though the company is at odds with the primary retail, and demographic, trends.

On the other end of the spectrum is Amazon.com. Amazon is still growing revenues at over 20%/year. And introducing successful new publishing and internet service businesses, expanding same day delivery (and even one hour delivery) in urban markets like New York City, as well as expansion of its Prime service to include more original programming with famed director Woody Allen after winning the Golden Globe award for its original series Transparent.

However, several analysts were trash talking Amazon in 2014. 20% growth has them worried, given that the company once grew at 40%. Even though Amazon’s growth is a serious reason companies like Wal-Mart cannot grow. And there is the perennial lack of profitability – including a larger than expected loss in the second quarter ; a loss which included a $170M write-off on FirePhones which never really found a customer base. The latter item led to a Fast Company brutal lambasting of CEO Jeff Bezos as a micro-manager out-of-touch with customers.

This lack of analyst support has seriously hurt Amazon.com share performance. From 2010 to early 2014 the stock quadrupled in value from $100 to $400. But over the past year the stock has fallen back 25%. After dropping to $300/share in April, the stock has rallied but then retrenched no less than 3 times, and is now trading very close to its 52 week low. And, it shows no momentum, trading below its moving average.

Which is why investors in Wal-Mart should sell, and reinvest in Amazon.com.

All the trends point to Wal-Mart being overvalued. Its revenues show no signs of achieving any substantial growth. And, despite its sheer size, all retail trends are working against the behemoth. It has been trying to find a growth engine for 10 years, but nothing has come to fruition – including big investments in offshore markets. The company keeps trying to defend & extend its old success formula, thus creating a bigger and bigger gap between itself and future market success.

Simultaneously, Amazon.com continues to invest in major developing trends. From publishing to television programming to cloud/web services and even general retail, everything into which Amazon invests is growing. And even though this is a company with $100B in revenues, it is still growing at a remarkable 20%. While some analysts may wish the investment rate would slow, and that Amazon would never make mistakes (like Firephone,) the truth is that Amazon is putting money into projects which have pretty good odds of making sizable money as it helps change the game in multiple markets.

Think of investing like paddling a canoe. When you are investing against trends, it’s like paddling up the river. You can make progress, but it is hard. And, one little mistake and you easily slip backward. Lose any momentum at all and you could completely turn around and disappear (like happened to Circuit City, and now both Sears and JCPenney.) When you invest with the trends it is like paddling down the river. The trend, like a current, keeps you moving in the right direction. You can still make mistakes, but the odds are quite a lot higher you will make your destination easily, and with resources to spare. That’s why the sales results for December are important. The show traditional retailers are paddling up river, while on-line retailers are paddling down-river.

I don’t know if Wal-Mart’s stock value has peaked, but it is hard to understand why anybody would expect it to go higher. It could continue to rise, but there are ample reasons to expect investors will figure out how tough future profits will be for Wal-Mart and dispose of their positions. On the other hand, even though Amazon.com could continue to slide down further there are even more reasons to expect it will have great future quarters with revenue gains and – eventually – those long-sought-after profits that some analysts seek. Meanwhile, Amazon is investing in projects with internal rates of return far higher than most other companies because they are following major trends. Odds are pretty good that in a few years the trends will make investors happy they own Amazon, and dropped out of Wal-Mart.

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.