by Adam Hartung | Apr 10, 2017 | Leadership, Transportation

Most readers of this column will already know that on Sunday, April 9, 2017 United Airlines forcibly removed a 69-year-old passenger from a flight, over his objections. United employees had Chicago Aviation Police board the plane, grab the passenger (who had a valid boarding pass) and drag him off the plane as if he were a hijacker. In the process the police banged his head on an armrest, leaving him battered and bloodied. When the passenger returned to the plane the police again forcibly manhandled him, restrained him and took him off the plane strapped onto a stretcher.

All so the airline could board a flight attendant that needed to reach the plane’s destination in order to make her next working flight. In other words, United’s front line management chose to not only inconvenience a paying customer, but physically abuse that customer so the airline would maintain its operating crew schedule.

After, the company CEO Oscar Munoz apologized for “re-accomodating” customers. Since about 40,000 people are “re-accomodated” — or bumped from oversold flights — annually, the CEO’s apology covers the 3,675 United customers bumped in 2016. But, he did not apologize for United employees taking action that directly led to the physical abuse of a customer.

Most of us would not believe this story if it were part of a fictional movie. How could it be possible for a front-line employee to think it is acceptable to forcibly eject a paying customer already on the plane?How could it be possible that a CEO would be so uncaring as to not apologize for a clear, horrific lapse in judgement by someone on his management team? Whatever the situation, every action taken by United merely served to make the situation worse. How could a company so large be so mismanaged — from the bottom to the top?

Blame “Operational Excellence”

That is the problem with CEOs, and leadership teams, that focus on “operational excellence” as a strategy. They become so focused on efficiency, cost cutting and business operations that they forget about customers — or anything else. All that matters is keeping the business operating, while trying to keep costs as low as absolutely possible. Management, from bottom to top, is rewarded for operational performance, while all other metrics are ignored. Including customer satisfaction.

In “operationally excellent” companies the focus on low costs is driven by a desire to keep prices low. The perception among management is that customers care only about price, so there is no reason to track anything other than costs. If they keep costs (and prices) low customers will be happy, regardless of anything else in the customer’s experience.

United Has Abused Customers For Years

This is not the first time United has had this kind of problem. In 2009 Canadian musician Dave Carroll became a sensation after producing a series of YouTube videos that chronicled his experience after United baggage handlers destroyed his guitar. The baggage handlers clearly did not care about his guitar. Nor did the gate agents, the baggage department or the customer service department. After many, many calls United personnel simply decided Mr. Caroll’s broken guitar would not be compensated — even though they broke it — and he should just “get over it.”

In 2013, United came in dead last in the Airline Quality Rating. United’s response (as I detailed in a 2013 Forbes column) was simply that “they did not care.” Quite literally, lowering cost was more important that being dead last in customer satisfaction.

In 2016, United fired its CEO after discovering he was bribing government officials to obtain favorable treatment at New Jersey and New York airports. The pressure to lower cost in the “operationally excellent” strategy was so paramount that judgement falters not only at low levels, but all the way up to the CEO.

Operational Excellence Hurt WalMart As Well As United

United isn’t alone in its failures due to operational excellence focus. WalMart has been the victim of bad management judgment for the same reason. Remember in July, 2014 when a WalMart truck driver who had been awake for 24 hours hit a car in New Jersey killing comedian James McNair and seriously injuring comedian Tracy Morgan? That driver had been on the road longer than he should, with insufficient sleep, in his effort to meet operational deadlines – and was charged with aggravated manslaughter, second-degree vehicular homicide and 8 counts of third-degree aggravated assault charges.

This happened just two years after investors learned WalMart was accused of bribing Mexican government officials to keep costs low there — bribery that caused the departure of the WalMart Mexico president, and eventually Walmart’s CEO. In both cases, at the top and at the front line, judgment was impaired by leadership’s focus on operational efficiency.

Unfortunately, too many business leaders put too much energy into operational excellence. They focus on cutting costs, improving operations, and trying to offer low price as the primary reason customers should do business with them. They quickly lose sight of customer needs, wants and wishes as they overly simplify their business’ offering into price. And this leads to bad decision-making all the way from the CEO to the front line manager — who will drive customers away in his effort to meet operational metrics and goals.

Once Locked In Operational Excellence Is A Hard Strategy, And Culture, To Change

United clearly needs a cultural change. But will it make one? Given the CEO’s reaction to this incident, it appears highly unlikely. Locked in to viewing his company operationally, Munoz appears to have lost common sense when it comes to customers – and running the business in a way that can lead to long-term profitability. Herb Kelleher, founder of Southwest Airlines, and Richard Branson, founder of Virgin Airlines, knew there was more to a successful airline than flight schedules and cheap fuel purchases. So far United’s leadership has failed to see the obvious.

by Adam Hartung | Apr 8, 2017 | Economy, Employment

The Labor Department March jobs report came out last week, and it disappointed a lot of people. At 98,000 new jobs, the number was about half what economists predicted. Simultaneously, the report revised January and February down a combined 38,000 jobs. Retail workers lost 30,000 jobs in March, which combined with February means 56,000 retailers lost jobs in just two months. There was ample disappointment to go around.

But, if we take a longer-term view the trend is much more pronounced, and we can easily see that overall the jobs market is very, very healthy – forcing employers to raise wages.

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

As the chart above indicates, America has recreated almost all the jobs lost in the Great Recession (chart courtesy of Kriston McIntosh of The Hamilton Project – Brookings). Almost 10 million jobs were lost between 2008 and 2010 as the financial crisis wiped out banks, and lending. That was a staggering decline of about 420,000 jobs per month.

Because businesses were loath to re-invest following the economic meltdown, the rate of job creation has been considerably slower than the speed with which executives laid off employees. However, since the end of 2011 the U.S. has been adding jobs at the rate of over 200,000 per month – a dramatic growth in job creation over an extraordinarily long-term period. Literally, unprecedented.

And, if we average the job creation rate the first three months of 2017 it comes to 178,000 per month. At this lower pace the jobs market will have fully recovered within the next four months (by August, 2017). This jobs growth rate may be less than the last six years, but it is far more than is necessary to maintain employment rates – including population gains.

We see this very healthy improvement in the jobs situation in other statistics. Those in part-time positions seeking full-time positions fell to the lowest in several years at 8.9%. And, unemployment declined to 4.5% from 4.7% – a clear indication that there were more people finding work than losing work, pulling more people into the workforce for yet another month. At 4.5%, this is the lowest unemployment rate in a decade.

Net/net, America is rapidly approaching “

full employment” – a term that means everyone who wants a job either has one, or is intentionally looking for a job and reasonably expects to find one in three months. Or, in other words, if you know somebody complaining they can’t find a job it is either because they aren’t really trying, or they are picky about what they want to do, or they can find a job but won’t take it because they want higher pay.

And hourly pay continues to rise, increasing 2.7% versus March, 2016. This is less than in good times, when pay tends to rise at 3-4%/year – but the fact that pay is going up means the labor market is tightening. And as the economy reaches higher levels of employment, and lower levels of unemployment, companies will have to pay more to find new workers – and increase wages on current workers to keep them from leaving. Thus, it is a surety that pay will rise throughout 2017, and probably into the foreseeable future.

Whether you liked President Obama or not, the policies of the last six years allowed America to escape the Great Recession. Today 78.5% of all working age people are in the workforce – that is the highest labor participation rate of working age people since 2008 – indicating a complete recovery from the job collapse.

Thus, it is time for changes in economic policy. To keep calling for job creation is, classically, “fighting the last war.” Even as government is reducing employment, and some industries (like traditional retail) are collapsing employment, there are other parts of the economy growing jobs. Amazon.com, for example, has announced it will be adding 100,000 U.S. jobs by the middle of 2018.

For President Trump to claim there are 100 million people in the USA looking for work is an impossibility. There are only 325 million people in America, and 26.4% of those are between under the age of 17 and over 65 – so 86 million. That only leaves 239 million people of working age in the country. We know that of those at least 78.5% are employed – which is 188 million. Thus, at its maximum, there are only 51 million people who could be looking for work. But we know that many are not because of ill-health, or simply choice. According to the Labor Department, there are about 5 million people looking for work in the U.S. at this time, which is just about the same number of job openings.

It’s time to get over the constant complaining about a job shortage. And here’s what this means for you:

1. After a long decade of stagnation, we can expect everyone to receive higher pay.

2. Job mobility will improve. If you don’t like your current job you can probably find another one.

3. Employers will have to stop burning out employees and do more to keep them as unemployment rates decline.

4. Immigration will be less of an issue, because America will need people to fill jobs (many employers are already complaining about changes to H1-B visa rules).

5. Employers will pay more for employee training and retraining.

6. People 30 and younger have struggled to build careers and start families during the recovery. Expect that situation to reverse.

7. More jobs, more money, a faster growing economy is better for tax receipts. This will relieve stress on government budgets.

8. Higher real estate prices. Some markets are already back to pre-recession levels, yet others have languished. Expect across the board increases.

9. Interest rates will go up (from record lows). Lock-in your mortgage now. Adjust your portfolio from bonds to stocks.

10. Expect the dollar to remain strong, so imports will be cheap and exporting will continue to be more difficult. It’s a good time to visit foreign destinations, and it will be a struggle to attract international tourists.

Look beyond short-term numbers. Month-to-month, even quarter-to-quarter, numbers often yield little analytical value. Look at the long-term trend. Then make sure you, and your business, are ready. Don’t keep fighting the last war, prepare to capture the next opportunity.

by Adam Hartung | Mar 30, 2017 | Boards of Directors, Disruptions, Investing, Leadership

(Photo: CEO of Amazon.com, Inc. Jeff Bezos, TOMMASO BODDI/AFP/Getty Images)

Amazon.com is now worth about the same as Berkshire Hathaway. Amazon has had an amazing run-up in value. The stock is up 17% year to date, and 46% over the last 12 months. By comparison, Berkshire has risen 3.1% this year and Microsoft has risen 5.6% —while the S&P 500 is up 5.8%. Due to this greater value increase, Jeff Bezos has become the second richest man in the world, jumping past Warren Buffett while Bill Gates remains No. 1.

Obviously, it wouldn’t take much of a slip in Amazon, or a jump in Berkshire, to reverse the positions of the companies and their CEOs. But it is important to recognize what is happening when a barely profitable company that sells general merchandise, technology products (Kindles, Fires and Echos) and technology services (AWS) eclipses one of the most revered financial minds and successful investment managers of all time.

Warren Buffett (Photo by Paul Morigi/Getty Images for Fortune/Time Inc)

Berkshire Hathaway was a financial pioneer for the Industrial Era. Warren Buffett bought a down-and-out textile company and created enormous value by turning it into a financial powerhouse. At the time America, and the world, was still in the Industrial Revolution. Making things – manufacturing – was the biggest industry of all. Buffett and his colleagues recognized that capital for these companies was deployed very inefficiently. Often too much capital was invested in poor ways, while insufficient capital was invested in good opportunities. If Berkshire could build a capital base it could deploy that capital into high-return opportunities, and make above-average rates of return.

When Buffett started his magical machine he realized that capital was often in short supply. Companies had to ration capital, unable to build the means of production they desired. Banks were unwilling to lend when they perceived any risk, even when the risk was not that great. Simultaneously investment banks were highly inefficient. The industry was unwilling to support companies prior to going public, often uninterested in taking companies public, and poor at allocating additional capital to the highest return opportunities. By the time you were big enough to use an investment bank you really didn’t need them to raise capital – they just organized the transactions.

This inefficiency in capital allocation meant that an investor with capital could create tremendous gains by deploying it in high return opportunities that often had minimal risk – or at least risk that could be offset with other investments.

Berkshire Hathaway was a big winner at mastering finance during the industrial era. By putting money in the right place, at the right time, tremendous gains could be made. Berkshire didn’t have to be a manufacturer, it could make a higher rate of return by understanding how to deploy capital to industrial companies in a marketplace where capital was rationed. In other words, give people money when they need it and Berkshire could generate outsized returns.

It was a great strategy for supporting companies in the Industrial Age. And a great way to make money when capital was hard to come by.

But the world has changed. Two important things happened First, capital became a lot easier to acquire. Deregulation and a vast expansion of financial services led to a greater willingness to lend by banks, larger secondary markets for bank-originated products that carried risk, the creation of venture capital and private equity firms willing to invest in riskier opportunities, and a dramatic growth in investment banking globally making it far easier to go public and raise equity. Capital became vastly more available, and the cost of capital dropped dramatically.

This made finding opportunities for outsized returns just based on investing considerably more difficult. And thus every year it has become harder for Berkshire Hathaway to find investment opportunities that exceed market rates of return. Berkshire isn’t doing poorly, but it now competes in a world of many competitors who have driven down returns for everyone. Thus, Berkshire’s returns increasingly move toward the market norm.

The Industrial Era is dead — usher in the Information Era. Second, we are no longer in the Industrial Age. Sometime in the 1990s (economic historians will pin it to a specific date eventually) the world transitioned into the Information Age. In the Information Age assets are no longer worth as much as they previously were. Instead, information has become much more valuable. What a business knows about customers, markets and supply chains is worth more than the buildings, machines and trucks that actually make up the physical economy. The value from having information has become much higher than the value of things — or of providing capital to purchase things.

In the Information Era, few companies have mastered the art of information management better than Amazon.com. Amazon doesn’t succeed because it has great retail stores, or great product inventory or even great computers. Amazon’s success is based on knowing things about markets and its customers. Amazon has piles and piles of data, and Amazon monetizes that information into sales.

By studying customer habits, every time they buy something, Amazon has been able to make the company more valuable to customers. Often Amazon is able to tell a customer what they need before they realize they need it. And Amazon is able to predict the flow of new product introductions, and predict sales for manufacturers with great accuracy. Amazon is able to understand what media customers want, and when they’ll want it. Amazon is able to predict a business’ “cloud needs” before that business knows – and predict the customer’s likely future services needs long before the customer knows.

In the Information Age, Amazon is one of the very, very best information companies out there. It knows how to obtain information, analyze those mounds of “big data” to determine and predict needs, then connect customers with things they want to buy. Being great at information means that Amazon, even with its relatively poor current profits, is positioned to capitalize on its intellectual property for years to come. Not without competition. But with a tremendous competitive lead.

So, how is your portfolio allocated? Are you invested in assets, or information? Accumulating assets is a very hard way to make high rates of return. But creating sales, and profits, out of information is far easier today. The relative change in the value of Amazon and Berkshire is telling investors that it is now smarter to be long information rich companies than asset rich companies.

If you’re long GE, GM, 3M and Walmart how well will you do in an economy where information is more valuable than assets? If you don’t own data rich, analytically intensive companies like Amazon, Facebook, Alphabet/Google and Netflix how would you expect to make above-average rates of return?

And where is your business investing? Are you still putting most of your attention on how you allocate capital, in a world where capital is abundant and cheap? Are you focusing your attention on getting the most out of what you know about markets, customers and suppliers, or just making and selling more stuff? Do you invest in projects to give you insights competitors don’t have, or in making more of the products you have — or launching product version X?

And are you being smart about how you manage your most important information tool — your talented employees? Information is worthless without insight. It is critical companies today do all they can to help employees develop insights, and then rapidly deploy those insights to grow sales. If you spend a few hours pouring over expenses to find dimes, consider letting that activity go in order to spend hours brainstorming how to find new markets and new product opportunities that can generate a lot more revenue dollars.

by Adam Hartung | Mar 30, 2017 | Newsletter Post

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Are You Lost in the Innovation Gap?

Copyright Adam Hartung, 2017

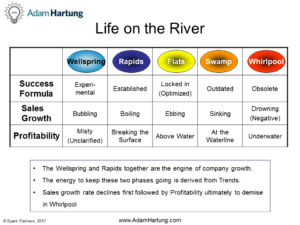

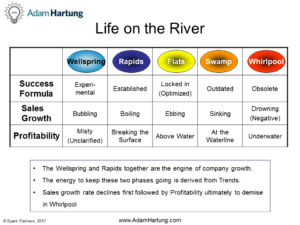

In the Wellspring of the product lifecycle river, organizations are creating innovations (see last month’s newsletter on the Lifecycle River here.) In the Rapids it’s all about finding customers for those innovations.

As volume grows organizations start focusing on optimizing operations, thereby “locking in” the Success Formula. Unfortunately, this decision – which seems obvious – almost always leads to decline!

Optimization causes an organizational shift away from focusing on the marketplace, toward focusing internally. More controls are implemented to insure standardization – and “process management” affects all parts of the company. The byword is “focus” as parts of the business are jettisoned, product lines dropped, assets sold and headcount lowered. These actions move the company from the Rapids of growth to the Flats of business model optimization – which produces short-term profit improvements, but cuts ties to market inputs necessary for long-term growth.

As CEO from 1981 to 2001 Neutron Jack expanded GE into multiple businesses from media (NBC/Universal) to financial services (GE Capital.) In the growth Rapids GE’s value (adjusted for splits, etc.) rose from $1.30/share to $46.75 – 35x or 3,500%. As CEO Jeff Immelt has“refocused” GE on its “core,” selling multiple businesses as he moved to grow profitability. Since 2001 GE’s value has fallen to $29.05/share – a decline of 38% (meanwhile the DJIA has almost doubled in value.)

In the Flats investments for low risk projects improving the existing business are approved rather than grander investments in new innovations. Although profits improve,the further the company (or product line) travels from the Rapids of customer focus into the optimization Flats, the greater the chance it will miss the next cycle of innovation and slip into the Swamp of decline.

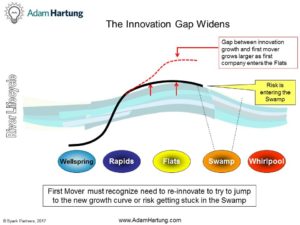

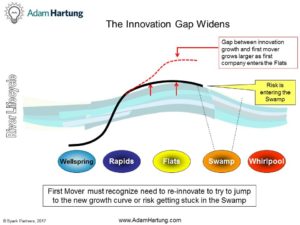

As other companies continue innovating, market growth continues (often with substitutes) but the former leader does not participate. “First Mover” advantage disappears because innovators leapfrog the creator. This gap between market growth and company growth is called the Innovation Gap. The longer the company focuses on optimization, and profit maximization, the larger the Innovation Gap becomes.

As other companies continue innovating, market growth continues (often with substitutes) but the former leader does not participate. “First Mover” advantage disappears because innovators leapfrog the creator. This gap between market growth and company growth is called the Innovation Gap. The longer the company focuses on optimization, and profit maximization, the larger the Innovation Gap becomes.

To avoid becoming stuck in the Flats it is crucial to maintain a growth focus and avoid a profit focus. Like Amazon.com, you must track trends and competition and never hesitate to keep innovating. Investments in Wellspring projects must be maintained, and the lure of constantly investing to improve the old must be held at bay.

Next month we’ll discuss how you can track your resources in order to keep investing in the Rapids.

“You’ve got to keep reinventing. You’ll have new competitors. You’ll have new customers all around you.”

Ginni Rometty

Chairman, President and CEO of IBM

Don’t hesitate to ask for help in making your organization more adaptable, and your strategy embedded with options based on market shifts. You could start with an underperforming product or brand. Audit your company’s market sensing process at least twice a year. Does the process look outside the customer base and known competitors? What technologies might put the product line at risk?

Our two decades of helping organizations identify and implement innovations gives us keen insight into how sustaining, expanding and disruptive innovations can be identified, evaluated for risk and cost, and managed for successful market growth. Our experience and processes will help you grow via innovation with more confidence, less time investment, lower cost and faster, greater returns.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Give us a call today, or send an email, so we can talk about how you can be a leader, rather than follower, in 2017 and beyond. Or check out the rest of the website to read up on what we do so we can create the right level of engagement for you.

Forbes Posts- Hartung on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Mar 28, 2017 | In the Rapids, Innovation, Investing, Leadership

(Photo: General Electric CEO Jeffrey Immelt, ERIC PIERMONT/AFP/Getty Images)

General Electric stock had a small pop recently when investors thought CEO Jeffrey Immelt might be pushed out. Obviously more investors hope the CEO leaves than stays. And it appears clear that activist investor Nelson Peltz of Trian Partners thinks it is time for a change in CEO atop the longest running member of the Dow Jones Industrial Average (DJIA.)

You can’t blame investors, however. Since he took over the top job at General Electric in 2001 (16 years ago) GE’s stock value has dropped 38%. Meanwhile, the DJIA has almost doubled. Over that time, GE has been the greatest drag on the DJIA, otherwise the index would be valued even higher! That is terrible performance — especially as CEO of one of America’s largest companies.

But, after 16 years of Immelt’s leadership, there’s a lot more wrong than just the CEO at General Electric these days. As the JPMorgan Chase analyst Stephen Tusa revealed in his analysis, these days GE is actually overvalued, “cash is weak, margins/share of customer wallet are already at entitlement, the sum of the parts valuation points to a low 20s stock price.” He goes on to share his pessimism in GE’s ability to sell additional businesses, or create cost lowering synergies or tax strategies.

Former Chairman and CEO of General Electric Jack Welch. (AP Photo/Richard Drew)

What went so wrong under Immelt? Go back to 1981. GE installed Jack Welch as its new CEO. Over the next 20 years there wasn’t a business Neutron Jack wouldn’t buy, sell or trade. CEO Welch understood the importance of growth. He bought business after business, in markets far removed from traditional manufacturing, building large positions in media and financial services. He expanded globally, into all developing markets. After businesses were acquired the pressure was relentless to keep growing. All had to be no. 1 or no. 2 in their markets or risk being sold off. It was growth, growth and more growth.

Welch’s focus on growth led to a bigger, more successful GE. Adjusted for splits, GE stock rose from $1.30 per share to $46.75 per share during the 20 year Welch leadership. That is an improvement of 35 times – or 3,500%. And it wasn’t just due to a great overall stock market. Yes, the DJIA grew from 973 to 10,887 — or about 10.1 times. But GE outperformed the DJIA by 3.5 times (350%). Not everything went right in the Welch era, but growth hid all sins — and investors did very, very, very well.

Under Welch, GE was in the rapids of growth. Welch understood that good operating performance was not enough. GE had to grow. Investors needed to see a path to higher revenues in order to believe in long term value creation. Immediate profits were necessary but insufficient to create value, because they could be dissipated quickly by new competitors. So Welch kept the headquarters team busy evaluating opportunities, including making some 600 acquisitions. They invested in things that would grow, whether part of historical GE, or not.

Jeff Immelt as CEO took a decidedly different approach to leadership. During his 16 year leadership GE has become a significantly smaller company. He sold off the plastics, appliances and media businesses — once good growth providers — in the name of “refocusing the company.” Plans currently exist to sell off the electrical distribution/grid business (Industrial Solutions) and water businesses, eliminating another $5 billion in annual revenue. He has dismantled the entire financial services and real estate businesses that created tremendous GE value, because he could not figure out how to operate in a more regulated environment. And cost cutting continues. In the GE Transportation business, which is supposed to remain, plans have been announced to double down on cost cutting, eliminating another 2,900 jobs.

Under Immelt GE has focused on profits. Strategy turned from looking outside, for new growth markets and opportunities, to looking inside for ways to optimize the company via business sales, asset sales, layoffs and other cost cutting. Optimizing the business against some sense of an historical “core” caused nearsighted — and shortsighted — quarterly actions, financial gyrations and transactions rather than building a sustainable, growing revenue stream. Under Immelt sales did not just stagnate, sales actually declined while leadership pursued higher margins.

By focusing on the “core” GE business (as defined by Immelt) and pursuing short term profit maximization, leadership significantly damaged GE. Nobody would have ever imagined an activist investor taking a position in Welch’s GE in an effort to restructure the company. Its sales growth was so good, its prospects so bright, that its P/E (price to earnings) multiple kept it out of activist range.

But now the vultures see the opportunity to do an even bigger, better job of whacking up GE — of tearing it into small bits while killing off all R&D and innovation — like they did at DuPont. Over 16 years Immelt has weakened GE’s business — what was the most omnipresent industrial company in America, if not the world – to the point that it can be attacked by outsiders ready to chop it up and sell it off in pieces to make a quick buck.

Thomas Edison, one of the world’s great inventors, innovators and founder of GE, would be appalled. That GE needs now, more than ever, is a leader who understands you cannot save your way to prosperity, you have to invest in growth to create future value and increase your equity valuation.

In May, 2012 (five years ago) I warned investors that Immelt was the wrong CEO. I listed him as the fourth worst CEO of a publicly traded company in America. While he steered GE out of trouble during the financial crisis, he also simply steered the company in circles as it used up its resources. Then was the time to change CEOs, and put in place someone with the fortitude to develop a growth strategy that would leverage the resources, and brand, of GE. But, instead, Immelt remained in place, and GE became a lot smaller, and weaker.

At this point, it is probably too late to save GE. By losing sight of the need to grow, and instead focusing on optimizing the old business while selling assets to raise cash for reorganizations, Immelt has destroyed what was once a great innovation engine. Now that the activists have GE in their sites it is unlikely they will let it ever return to the company it once was – creating whole new markets by developing new technologies that people never before imagined. The future looks a lot more like figuring out how to maximize the value of each piece of meat as it’s carved off the GE carcass.

by Adam Hartung | Mar 22, 2017 | In the Whirlpool, Investing, Retail

(Photo by Scott Olson/Getty Images)

Traditional retailers just keep providing more bad news. Payless Shoes said it plans to file bankruptcy next week, closing 500 of its 4,000 stores. Most likely it will follow the path of Radio Shack, which hasn’t made a profit since 2011. Radio Shack filed bankruptcy and shut a gob of stores as part of its “turnaround plan.” Then in February Radio Shack filed its second bankruptcy — most likely killing the chain entirely this time.

Sears Holdings finally admitted it probably can’t survive as a going concern this week. Sears has lost over $10 billion since 2010 — when it last showed a profit — and owes over $4 billion to its creditors. Retail stocks cratered Monday as the list of retailers closing stores accelerated: Sears, KMart, Macy’s, Radio Shack, JCPenney, American Apparel, Abercrombie & Fitch, The Limited, CVS, GNC, Office Depot, HHGregg, The Children’s Place and Crocs are just some of the household names that are slowly (or not so slowly) dying.

None of this should be surprising. By the time CEO Ed Lampert merged KMart with Sears the trend to e-commerce was already pronounced. Anyone could build an excel spreadsheet that would demonstrate as online retail grew, brick-and-mortar retail would decline. In the low margin world of retail, profits would evaporate. It would be a blood bath. Any retailer with any weakness simply would not survive this market shift — and that clearly included outdated store concepts like Sears, KMart and Radio Shack which long ago were outflanked by on-line shopping and trendier storefronts.

Yet, not everyone is ready to give up on some retailers. Walmart, for example, still trades at $70 per share, which is higher than it traded in 2015 and about where it traded back in 2012. Some investors still think that there are brick-and-mortar outfits that are either immune to the trends, or will survive the shake-out and have higher profits in the future.

And that is why we have to be very careful about business myths. There are a lot of people that believe as markets shrink the ultimate consolidation will leave one, or a few, competitors who will be very profitable. Capacity will go away, and profits will return. In the end, they believe if you are the last buggy whip maker you will be profitable — so investors just need to pick who will be the survivor and wait it out. And, if you believe this, then you have justified owning Walmart.

Only, markets don’t work that way. As industries consolidate they end up with competitors who either lose money or just barely eke out a small profit. Think about the auto industry, airlines or land-line telecom companies.

Two factors exist which effectively forces all the profits out of these businesses and therefore make it impossible for investors to make money long-term.

First, competitive capacity always remains just a bit too much for the market need. Management, and often investors, simply don’t want to give up in the face of industry consolidation. They keep hoping to reach a rainbow that will save them. So capacity lingers and lingers — always pushing prices down even as costs increase. Even after someone fails, and that capacity theoretically goes away, someone jumps in with great hopes for the future and boosts capacity again. Therefore, excess capacity overhangs the marketplace forcing prices down to break-even, or below, and never really goes away.

Given the amount of retail real estate out there and the bargains being offered to anyone who wants to open, or expand, stores this problem will persist for decades in retail.

Second, demand in most markets keeps declining. Hopefuls project that demand will “stabilize,” thus balancing the capacity and allowing for price increases. Because demand changes aren’t linear, there are often plateaus that make it appear as if demand won’t go down more. But then something changes — an innovation, regulatory change, taste change — and demand takes another hit. And all the hope goes away as profits drop, again.

It is not a successful strategy to try being the “last man standing” in any declining market. No competitor is immune to these forces when markets shift. No matter how big, when trends shift and new forms of competition start growing every old-line company will be negatively affected. Whether fast, or slow, the value of these companies will continue declining until they eventually become worthless.

Nor is it successful long-term to try and segment the business into small groupings which management thinks can be protected. When Xerox brought to market photocopying, small offset press manufacturers (ABDick and Multigraphics ) said not to worry. Xeroxing might be OK in some office installations, but there were customer segments that would forever use lithography. Even as demand shrunk, well into the 1990s, they said that big corporations, industrial users, government entities, schools and other segments would forever need the benefits of lithography, so investors were safe. Today the small offset press market is a tiny fraction of its size in the 1960s. ABDick and Multigraphics both went through rounds of bankruptcies before disappearing. Xerography, its child desktop publishing, and its grandchild electronic screens, killed offset for almost all applications.

So don’t be lured into false hopes by retailers who claim their segment is “protected.” Short-term things might not look bad. But the market has already shifted to e-commerce and this is just round one of change. More and more innovations are coming that will make the need for traditional stores increasingly unnecessary.

Many readers have expressed their disappointment in my chronic warnings about Walmart. But those warnings are no different than my warnings about Sears Holdings. It’s just that the timing may be different. Both companies have been over-investing in assets (brick-and-mortar stores) that are declining in value as they have attempted to defend and extend their old business model. Both radically under-invested in new markets which were cannibalizing their old business. And, in the end, both will end up with the same results.

And this is true for all retailers that depend on traditional brick-and-mortar sales for their revenues and profits — it’s only a matter of when things will go badly, not if. So traditional retail is nowhere that any investor wants to be.

by Adam Hartung | Mar 10, 2017 | Books, Defend & Extend, Employment, Leadership

Harvard Business Review Press just published an insightful new book by two senior partners at Bain & Company, one of the world’s three leading strategy consulting firms, entitled Time Talent Energy. The book’s great insight is that companies utilize a plethora of tools to manage money and financials to the nth degree, but that approach is less successful than putting a greater focus on managing employee time, talent and energy.

Harvard Business Review Press

Harvard Business Review Press

Time Talent Energy jacket cover

While managing financials is required in the modern organization, it is insufficient for success. Mankins and Garton discovered that organizations which focus more heavily on managing how employees spend their time and how they thoughtfully place people in their roles, create companies where employees are inspired and 40% more productive than their competition. And this pays off, with profit margins which are 30-50% higher than their industry average. The improvement is so great from focusing on employees that in today’s low cost and easily accessible capital world it is better to waste some cash in the process of better managing time and talent.

In most companies 25% of all productive time is wasted and can reach as high as 40% in complex organizations. Think of all the emails, texts, voice mails and meetings that absorb vast amounts of time. Yet, as the authors are fond of pointing out, nobody can create a 25 hour day. So if you can recapture that time, productivity will soar. The results are far greater than squeezing another 1% (or even 10%) out of your cost structure. If instead of spending so much time managing costs we spent more time eliminating complexity and unneeded tasks, competitiveness will soar.

Some people think that the best companies hire better people. Surprisingly, this is not true. About 15-16% of employees in every company are “A” players. But most companies squander this talent by spreading it around the organization. To achieve higher productivity and greater success, leading companies cluster their “A” players into teams focused on the most critical, important parts of the business. Thus, the best talent is working side-by-side on the most important challenges which can lead to the greatest gains. This talent clustering energizes the best workers, increasing productivity by 44%. But more than that, as the culture is inspired from building on its own gains productivity soars as much as 125%.

But in most organizations the focus still remains on finance. The CFO is frequently the second most powerful individual, behind only the CEO. The head of Human Resources (Chief Human Resources Officer — CHRO) rarely has the clout of a CFO. And the CFO job is seen as the route to CEO — far more CFOs than CHROs become CEOs. Simultaneously, organizations spend exorbitantly on financial control tools, such as ERP (Enterprise Resource Planning) from companies like Oracle and SAP — while very few have any kind of tool set for effectively managing employee time or talent deployment. The authors conclude it is apparent business leaders have significantly overshot on managing financial resources, while allowing their organization to be woefully incapable of managing its human resources.

I had the opportunity to interview Michael Mankins to obtain some additional insight about managing time, talent and energy:

Adam Hartung: Do businesses need to lessen the CFO role, and heighten the CHRO role?

Michael Mankins: The reality is that most human resource decisions, those that determine how people spend their time, and how talent is deployed, are made by line managers. Made within the bowels of the organization, with little more than senior leadership guidelines. There needs to be significantly more involvement by senior leadership in collecting and reviewing data on critical skills for the organization, “A” player performance and leadership development. If as much time was spent by senior leadership teams discussing human resources as spent on budgets there would be a tremendous improvement in productivity.

The CFO and CHRO should definitely be peers. To do that requires a cultural change from being an organization focused on preserving the status quo, reducing mistakes and keeping leadership out of jail to one that is far more future oriented. This can be done and in the book we highlight companies such as ABInBev, Ford, Nordstrom, Starbucks, IKEA, Netflix and others who have accomplished this.

Hartung: Companies spent enormous sums installing ERP systems and they spend a lot to maintain them. Yet, from reading your book it seems like this may have been misguided.

Mankins: All companies need to be able to change their business model as markets shift. ERP frequently creates a wiring that makes it hard to change with the competitive landscape, or as changes in capability are required. ERP locks in the business model at a point in time — but great performers develop ways to adapt.

All companies need a great general ledger. ERP goes far beyond the general ledger and in doing so can make a company too inflexible for today’s rate of change. There needs to be a flexible ERP system —which just doesn’t seem to exist right now. The ERP market seems ripe for a marketplace disrupter!

Simultaneously there aren’t any great tools out there for collecting data that can help a company reduce complexity and eliminate time wasters. Nor are there great tools for managing the performance of “A” players. The top performing companies do create a discipline around these tasks, collecting and analyzing data. Many companies would be helped by a tool that would do for time and talent management what we’ve done for financial management.

Hartung: You demonstrate that clustering “A” players creates dramatic improvement in productivity and company performance. Do great companies focus these clusters on improving the company as it is, or looking for the next “big thing?”

Mankins: We discovered that by and large the greatest gains come from focusing on the latter. Almost all MBA programs are maniacal about training managers to improve the existing business. For many years corporate planning systems have focused almost entirely on improving the operating model. The result is that in many, many industries leadership has almost no hope of improving operating margins by even 1%. There simply is nothing left to improve which can achieve significant results.

Simultaneously, 1% growth has a far, far greater return on investment than 1% operating margin improvement. So if companies focus their best talent on breakthroughs, in whole new ways of running the business, or creating new markets, the results are significantly greater.

Hartung: Many companies have clustered their top performers into “all star teams.” But this has been met by demotivation of employees not on these teams – feeling like “also rans” or “bench warmers.” And often there is a compensation difference between the all-star team members and others that is demotivating. How do leaders manage this conundrum?

Mankins: If this demotivation is driven by internal competitiveness — by ambition to move up the organization — there is a culture problem. Everyone is not on the same page about company needs and the talent to address those needs. Internal competitiveness should be addressed so everyone wants the company to succeed, so everyone individually can succeed. Rewards, compensation and non-compensation, need to be geared for groups to be motivated, not just individuals.

In the organization, leadership should work hard to make sure everyone knows they are important. There should be an effort to reward the “supporting cast” and not just the main characters. It is true that in today’s world many people have an exaggerated view of their own performance. We address this in the book with recommendations for how to give people feedback so they know the reality of their role and their performance in order to grow and do better. Today most companies have a very poorly performing review and training process, because they tie it to the compensation cycle thus limiting feedback to once per year and, unfortunately, doing feedback at the same time (often the same meeting) as compensation and bonus decisions. Addressing the performance feedback process can go a long way to avoid the demotivation problem.

Hartung: How do companies find “A” players?

Mankins: Search firms are the antithesis of finding “A” players. Their approach, their process, is not designed to deliver “A” candidates. To build a good group of “A” players requires the CEO, CHRO and senior leadership team understand what constitutes an “A” player in their organization. Then they can use the entire organization to seek out people with this behavioral signature in order to recruit them.

It is unfortunate that most company HR processes would not recognize an “A” player if one submitted a resume and would not hire one if they arrived for an interview. Most current processes focus too much on relationships (who candidates know,) narrow skills and prior specific experiences and not enough on what is needed for future success. And hiring decisions are often made by the wrong people; people too low in the organization and people who don’t know the desired behavioral signature. Google is one role model for knowing how to find and develop “A” players.

Unfortunately there is enormous ageism in hiring today. Especially in technology. Employers lack awareness of the value of generalizable experience they can bring into their company. The search for very specific experiences often leads to a very limited list of candidates with narrow experience and too often they do not perform at the “A” level when placed in the context of the new company and new competitive market requirements. Looking more broadly at candidates with great experience, even if not seemingly directly applicable (including candidates in their 50s and 60s) could lead to far greater success.

by Adam Hartung | Feb 28, 2017 | E-Commerce, Employment, real estate, Retail

(Photo: JOHN MACDOUGALL/AFP/Getty Images)

Amazon.com has become an important part of the American economy, and the lives of people globally. But, far too few people still understand the repercussions of Amazon’s success on retailers, consumer goods manufacturers, real estate – and ultimately everyone’s lives. The implications are enormous. Smart leaders, and investors, will plan for these implications and take advantage of the market shift.

Invest in ecommerce, divest traditional retailers.

The first implication is just thinking about investing in Amazon and/or its competitors in retail. In May, 2016 I compared the market value of Wal-Mart, the world’s largest retailer, with Amazon. At the time Wal-Mart was worth $216 billion, and Amazon was worth $332 billion. The difference could be explained by realizing that Wal-Mart was the leader at brick-and-mortar sales, which were shrinking, while Amazon was the leader in e-commerce, which is growing. Since then Wal-Mart’s value has increased to $222 billion – up $6 billion, 2.8%. Meanwhile Amazon’s value has increased to $403 billion- up $71 billion, 21.4%. Over three years (starting 3/3/14) Wal-Mart’s per share value has declined from $74 to $71 (down 4%,) while Amazon’s has risen from $370 to $845 (up 128%.)

To put it mildly, investing in Amazon, which is the leader in e-commerce, has created a great return. Contrastingly that value increase has been fueled by declines in traditional retailers. The Amazon Effect has caused shares in companies like Sears Holdings, JCPenney, Kohl’s, Macy’s and many other stalwarts of the bygone era to be crushed. Over the last year investors in XRT (the retail industry spider) have increased 1.6%, while the S&P 500 spider has jumped 22%. The number of retailers with debt rated at Moody’s most distressed level has tripled since 2009 – and Moody’s predicts this list will worsen over the next five years.

There is vastly too much retail space, and nobody knows what to do with it.

And this has an impact on real estate. As online sales come to over 11% of all holiday sales in 2016, and Amazon accounts for 40% of all those sales, it is clear people just don’t go to stores any more anywhere near the way they once did. Historically prime retail real estate was considered valuable – and in 2007 many people thought Sears real estate was worth more than Sears as a retailer. But no longer. According to Morningstar, Sears store closings alone could cause 200 malls to close.

It is apparent the Amazon Effect has left America with far more storefronts than needed. Stand-alone stores are being shuttered, with no alternative use for most buildings. Malls and shopping centers go begging as traffic drops, tenants leave, lease rates collapse and the facilities end up wholly or nearly empty. This means you don’t want to invest in retail real estate REITs. But it also means that neighborhoods, and sometimes entire towns, will be impacted as these empty buildings reduce interest in housing and push down residential prices.

Tax receipts will fall, and nobody knows how to replace them.

For a long time governments gave handouts to retailers in the form of tax breaks to build stores or locate their headquarters. But as stores close the property tax receipts decline, putting a greater burden on homeowners to pay for schools and infrastructure. Same with sales taxes which disappear from the local government coffers. And tax breaks once given to hold onto jobs – like the ones the village of Hoffman Estates and state of Illinois, gave Sears in 2011 to not move its headquarters, look far less justified. In short, the Amazon Effect has an enormous impact on the local tax base – and those missing dollars will inevitably have to come from residents – or a significant curtailing of services.

The impact on job eliminations will be staggering.

The Amazon Effect also has an impact on jobs. Amazon’s growth keeps escalating, from 19% in 2014 to 20% in 2015 to 28% in 2016, which takes the jobs away from traditional retailers. Macy’s plans to shed 10,000 workers as it shrinks and streamlines. JCPenney will eliminate 6,000 employees via early retirement completely separate from its store closings, and HHGregg is shedding 1,500 jobs as stores close. And thousands more are being lost across traditional retail in stores, supply chain positions and headquarters facilities.

Traditional retail employs about 16.5 million Americans – nearly 10% of the entire workforce. 6.2 million are in the prime product lines targeted by e-commerce (GAFO – General, Apparel, Furniture and Other.) The Amazon Effect will continue to eliminate these positions. Over the next five years it is not unlikely that the decline of brick-and-mortar will cause 16% of GAFO jobs to disappear, which is almost 1 million jobs. Simultaneously this could easily cause 10% of the non-GAFO jobs (10.3 million) to disappear – which is another 1 million. This likely scenario would cause the loss of 2 million jobs in just five years, which is the entirety of all lost manufacturing jobs to China. The Trump administration has more employment concerns to face than just the return of manufacturing.

The Amazon Effect is changing grocery shopping, without even being a major competitor in that sector. Because Wal-Mart has lost so much general merchandise sales to e-commerce, the company has amped up grocery sales – which are now 56% of total revenue. To continue growing groceries Wal-Mart is undertaking a massive price war pitting itself against the long-running low cost grocer Aldi. This is creating even more intense profit pressure on Wal-Mart, which last year saw gross margins drop by eight points, as net income fell 18%. Such intense price competition is creating the need for even more cost cutting among all grocers – which means investors beware – and we can expect even more job cutting as the spiral downward continues.

Consumer Goods manufacturers, and their suppliers, will be stressed.

Of course this pushes the Amazon Effect onto consumer goods companies that supply grocery retailers. Wal-Mart has held meetings with P&G, Unilever, Conagra, Coca-Cola and other big name companies demanding across-the-board 15% price reductions at wholesale. And Wal-Mart expects these suppliers to help Wal-Mart beat its head-to-head competitors on price 8o% of the time. This will cause consumer goods manufacturers to cut their own costs, including jobs, as well as pressure their raw material suppliers to further reduce their costs – leading to an ongoing spiral of cost cutting, job eliminations and additional pressures for change.

The internet gave us e-commerce, and that birthed Amazon.com. Few predicted the enormous implications this would have on retail, and society. Every single American is affected by the Amazon Effect, which is now inescapable. The only remaining question is whether your business, your government leaders and you are planning for this and preparing for the inevitable changes which will continue coming?

by Adam Hartung | Feb 22, 2017 | Immigration, Leadership, Politics

(Photo by Olivier Douliery-Pool/Getty Images)

There is a lot of excitement about President Donald Trump’s planned new executive order on immigration. Before the order is even public, the press has been grilling White House Press Secretary Sean Spicer about its contents. People are preparing to object before the document is even read.

Given that we know the order deals only with immigrants from seven countries, and that people from those countries do not constitute anywhere near a meaningful minority of immigrants (or tourists), one could make a case that in and of itself the executive order should not receive anywhere near this much attention.

But simultaneously, President Trump’s secretary of state and secretary of homeland security are visiting Mexico on Thursday — which is creating its own a firestorm of media coverage. The Mexican government leadership has already come out swinging, before the meeting, saying that the Trump administration policies are unacceptable. Not only is the wall construction unacceptable, but plans to deport illegal immigrants to Mexico — including illegal immigrants that are not Mexican — will not be tolerated. They want to know why should Mexico be forced to take Guatemalans, Hondurans and other non-Mexicans?

All of this controversy is being driven by the U.S. leadership, the president and his cabinet, failing to offer a clear policy on immigration. These executive orders, impending demands and vitriolic statements from the administration are like rifle shots aimed at something. But because nobody has a clue what the administrations real immigration policy is, it is impossible to understand the context from which these shots are fired. Nobody really knows what these shots are aimed at achieving.

So everyone, including the media, is left guessing, “what is the target of these actions? What is the overall goal? What is the administration’s immigration policy into which these actions fit?”

The administration says these actions are driven by “national security.” But it is impossible to understand that claim lacking any context. How are these specific actions supposed to improve national security, when every day people come to the U.S. from Europe and Asia with Muslim backgrounds and training? People cross the Canadian border daily who started in another country, yet they are not seen as the same threats as those who cross the southern border — why not?

Thus, each rifle shot looks an awful lot like an attack against the narrow interest being targeted — specifically middle eastern Muslims and Mexicans. And a lot of people are left scratching their heads as to why these folks are being attacked, other than they are simply easy targets for a part of the U.S. population that is horribly xenophobic.

Everyone — and I literally mean everyone — knows that America is a nation of immigrants. Last Labor Day I wrote about the benefits America has enjoyed by opening its doors to immigration. Recently Ryan McCready of Venngage put together a detailed infographic describing how over half of America’s billion dollar start-ups were founded by immigrants, how 33,000 permanent jobs were created by immigrants, how 76% of patents from top universities were filed by immigrants, and how 100% of America’s 2016 Nobel Prize recipients were immigrants. Nobody really doubts that immigrants have been good for America.

But, everyone also knows all immigrants are not the target of the Trump administration rhetoric, travel restrictions or executive orders. On January 28, in an editor’s pick column, I detailed how the border wall does not even address the problem of illegal immigrants that might be stealing jobs or committing crimes. If it was easy for me to produce the data that it is not illegal Mexican immigrants stealing jobs or creating crime, no doubt the people atop our government have even better data.

Another, possibly more obscure, example of an unaddressed immigration issue was brought to my attention in a recent BBC column (thanks to my cousin Susan Froebel from Austin, TX). Developers are planning for a large migration of retired Chinese to the U.S. These Chinese will enter America with no income, and no job prospects. They are escaping China, where the aged population is growing so fast there is great concern the workforce cannot care for them. They will increase the aged population in American, putting greater strains on all social services — housing, food, medicine. This will increase demands on the remaining American workers, as the U.S.’s own baby boomer generation retires, creating the worst imbalance of non-workers to workers in American history.

If there is any demographic you do not want immigrating to the U.S. it is a bunch of retired people. As I pointed out in my September 16 column, as any country’s population ages it creates a demand for more young immigrants to create economic productivity, growth and the resources to take care of the non-productive retirees. Rather than retirees, what America needs are young, productive immigrants who create and fill jobs — growing the economic base and paying taxes to support the rising retiree class.

But, I’d bet almost nobody who reads this column even knows about the impending explosion of retired Chinese planning to permanently enter the U.S. Even though the economic impact could be disastrous — far, far worse than a few million undocumented workers from Mexico or the middle east. Instead the focus is on two very targeted groups — Muslims and Mexicans.

The Elephant In The Room

Unfortunately, we all remember the infamous voter who attended a John McCain rally in 2007 and said that then-candidate Barack Obama was a Muslim born in Africa. In that moment that woman put forward the fears of so many Americans — that you cannot trust a dark skinned person. You cannot trust anyone who is not Christian. You cannot trust anyone who is not born within the U.S. Everyone else is someone to fear.

Lacking a well drafted, and at least somewhat comprehensive immigration policy, the immediate actions of the U.S. president sound a lot like, Stop the Muslims. Stop the Mexicans. After all, everyone knows they cannot be trusted. They are bad hombres.

Does the U.S. need more border protection? Does the U.S. need to crack down on illegal immigrants?Does the U.S. need to limit immigration? Perhaps yes — perhaps no. And if so, by how much? Right now nobody knows what the Trump administration immigration policy is. All the administration has put forward are rifle shots that appear to be pointed at the easiest targets of hatred in America today — Muslims and Mexicans. Whether these groups deserve to be targeted, or not.

Good leaders develop their vision first. The leadership team puts together the vision, mission and goals for the organization. Then this is developed into a strategy which guides investment and decision-making. The policy platform provides the context so the leaders, and all constituents, can identify the goals of the organization and the planned route to achieve those goals. After that is in place independent actions (decisions) can be evaluated as to their fit with the vision, mission and overall strategy.

As business leaders, President Trump and Secretary Tillerson (former ExxonMobile CEO) should know these first principles of leadership. Yet, they have failed to provide this vision. They have failed to describe their strategy to accomplish their mission. They have failed to tie their words and actions to a plan for achieving their goals (goals which are also still quite vague — such as “a safer America” or “a greater America”). So their actions are being interpreted by their constituents from each constituent’s perspective.

No wonder everyone has an opinion about what’s happening — and no wonder so many people are full of angst. There is a reason leaders take time in their early days to put develop their platform, and discuss it with constituents. Successful leaders make sure the people they depend upon know their vision, goals and strategy (in this case not only voters but Senators, members of Congress, the judiciary, law enforcement, military and regulators). Only after this do they take action — action clearly aligned with their vision, supported in the strategy and directed at achieving their goals.

For now, lacking the proper context, most Americans are interpreting short-term immigration actions as attacks on Muslims and Mexicans. Those who like these actions do so thinking it is proper, and those who dislike these actions think it is unfair targeting. But people will continue to make their own interpretations until a comprehensive policy is offered that explains a different context. As long as that policy is unclear, these poorly explained actions are examples of bad leadership.

by Adam Hartung | Feb 15, 2017 | Marketing, Mobile, Retail, Web/Tech

(Photo by Andrew Burton/Getty Images)

Apple’s stock is on a tear. After languishing for well over a year, it is back to record high levels. Once again Apple is the most valuable publicly traded company in America, with a market capitalization exceeding $700 billion. And pretty overwhelmingly, analysts are calling for Apple’s value to continue rising.

But today’s Apple, and the Apple emerging for the future, is absolutely not the Apple which brought investors to this dance. That Apple was all about innovation. That Apple identified big trends – specifically mobile – then created products that turned the trend into enormous markets. The old Apple knew that to create those new markets required an intense devotion to product development, bringing new capabilities to products that opened entirely new markets where needs were previously unmet, and making customers into devotees with really good quality and customer service.

That Apple was built by Steve Jobs. Today’s Apple has been remade by Tim Cook, and it is an entirely different company.

Today’s Apple – the one today’s analysts love – is all about making and selling more iPhones. And treating those iPhone users as a “loyal base” to which they can sell all kinds of apps/services. Today’s Apple is about using the company’s storied position, and brand leadership, to milk more money out of customers that own their devices, and expanding into adjacent markets where the installed base can continue growing.

UBS likes Apple because they think the services business is undervalued. After noting that it today would stand alone as a Fortune 100 company, they expect those services to double in four years. Bernstein notes services today represents 11% of revenue, and should grow at 22% per year. Meanwhile they expect the installed base of iPhones to expand by 27% – largely due to offshore sales – adding further to services growth.

Analysts further like Apple’s likely expansion into India – a previously almost untapped market. CEO Cook has led negotiations to have Foxxcon and Wistron, the current Chinese-based manufacturers, open plants in India for domestic production of iPhones. This expansion into a new geographic market is anticipated to produce tremendous iPhone sales growth. Do you remember when, just before filing for bankruptcy, Krispy Kreme was going to keep up its valuation by expanding into China?

Of course, with so many millions of devices, it is expected that the apps and services to be deployed on those devices will continue growing. Likely exponentially. The iOS developer community has long been one of Apple’s great strengths. Developers like how quickly they can deploy new apps and services to the market via Apple’s sales infrastructure. And with companies the size of IBM dedicated to building enterprise apps for iOS the story heard over and again is about expanding the installed base, then selling the add-ons.

Gee, sounds a lot like the old “razors lead to razor blade sales” strategy – business innovation circa 1966.

Overall, doesn’t this sound a lot like Microsoft? Bill Gates founded a company that revolutionized computing with low-cost software on low-cast hardware that did just about anything you would want. Windows made life easy. Microsoft gave users office automation, databases and all the basic work tools. And when the internet came along Microsoft connected everyone with Internet Explorer – for free! Microsoft created a platform with Windows upon which hordes of developers could build special applications for dedicated markets.

Once this market was created, and pretty much monopolized by Microsoft CEO Gates turned the reigns over to CEO Steve Ballmer. And Mr. Ballmer maximized these advantages. He invested constantly in developing updates to Windows and Office which would continue to insure Microsoft’s market share against emerging competitors like Unix and Linux. The money was so good that over a decade money was poured into gaming, even though that business lost more money than it made in revenue – but who cared? There were occasional investments in products like tablets, hand-helds and phones, but these were merely attractions around the main show. These products came and went and, again, nobody really cared.

Ballmer optimized the gains from Microsoft’s installed base. And a lot – a lot – of money was made doing this. nvestors appreciated the years of ongoing profits, dividends – and even occasional special dividends – as the money poured in. Microsoft was unstoppable in personal computing. The only thing that slowed Microsoft down was the market shift to mobile, which caused the PC market to collapse as unit sales have declined for six straight years (PC sales in 2016 barely managed levels of 2006). But, for a goodly while, it was a great ride!

Today all one hears about at Apple is growing the installed base. Maximizing sales of iPhones. And then selling everyone services. Oh yeah, the Apple Watch came out. Sort of flopped. Nobody really seemed to care much. Not nearly as much as they cared about 2 quarters of sales declines in iPhones. And whatever happened to AppleTV? ApplePay? iBeacons? Beats? Weren’t those supposed to be breakthrough innovations to create new markets? Oh well, nobody seems to much care about those things any longer. Attractions around the main event – iPhones!

So now analysts today aren’t put in the mode of evaluating breakthrough innovations and trying to guess the size of brand new, never before measured markets. That was hard. Now they can be far more predictable forecasting smartphone sales and services revenue, with simulations up and down. And that means they can focus on cash flow. After all, Apple makes more cash than it makes profit! Apple has a $246 billion cash hoard. Most people think Berkshire Hathaway, led by famed investor Warren Buffett, spent $6.6 billion on Apple stock in 2016 because Berkshire sees Apple as a cash generation machine – sort of like a railroad! And if those meetings between CEO Cook and President Trump can yield a tax change allowing repatriation at a low rate then all that cash could lead to a big one time dividend!

And, most likely, the stock will go up. Most likely, a lot. Because for at least a while Apple’s iPhone business is going to be pretty good. And the services business is going to grow. It will be a lot like Microsoft – at least until mobile changed the business. Or, maybe like Xerox giving away copiers to obtain toner sales – until desktop publishing and email cratered the need for copiers and large printers. Or, going all the way back into the 1950s and 60s, when Multigraphics and AB Dick practically gave away small printers to get the ink and plate sales – until xerography crushed that business. Of course you couldn’t go wrong investing in Sears for years, because they had the store locations, they had the brands (Kenmore, Craftsman, et.al.,) they had the credit card services – until Wal-Mart and Amazon changed that game.

You see, that’s the problem with all of these sort of “milk the base” businesses. As the focus shifts to grow the base and add-on sales the company loses sight of customer needs. Innovation declines, then evaporates as everything is poured into maximizing returns from the “core” business. Optimization leads to a focus on costs, and price reductions. Arrogance, based on market leadership, emerges and customer service starts to wane. Quality falters, but is not considered as important because sales are so large.

These changes take time, and the business looks really good as profits and cash flow continue, so it is easy to overlook these cultural and organizational changes, and their potential negative impact. Many applaud cost reductions – remember the glee with which analysts bragged about the cost savings when Dell moved its customer service to India some 20 years ago?

Today we’re hearing more stories about long-term Apple customers who aren’t as happy as they once were.

Genius bar experiences aren’t always great. In a telling AdAge column one long-time Apple user discusses how he had two iPhones fail, and Apple could not replace them leaving the customer with no phone for two weeks – demonstrating a lack of planning for product failures and a lack of concern for customer service. And the same issues were apparent when his corporate Macbook Pro failed. This same corporate customer bemoans design changes that have led to incompatible dongles and jacks, making interoperability problematic even within the Apple line.

Meanwhile, over the last four years Apple has spent lavishly on a new corporate headquarters befitting the country’s most valuable publicly traded company. And Apple leaders have been obsessive about making sure this building is built right! Which sounds well and good, except this was a company that once put customers – and unearthing their hidden needs, wants and wishes – first. Now, a lot of attention is looking inward. Looking at how they are spending all that money from milking the installed base. Putting some of the best managers on building the building – rather than creating new markets.

Who was that retailer that was so successful that it built what was, at the time, the world’s tallest building? Oh yeah, that was Sears.

Markets always shift. Change happens. Today it happens faster than ever in history. And nowhere does change happen faster than in technology and consumer electronics. CEO Cook is leading like CEO Ballmer. He is maximizing the value, and profitability, of the Apple’s core product – the iPhone. And analysts love it. It would be wise to disavow yourself of any thoughts that Apple will be the innovative market creating Jobs/Ives organization it once was.

How long will this be a winning strategy? Your answer to that should determine how long you would like to be an Apple investor. Because some day something new will come along.

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Harvard Business Review Press

Harvard Business Review Press