by Adam Hartung | Oct 17, 2017 | Defend & Extend, In the Swamp, Investing, Leadership, Retail

The Waltons Are Cashing Out Of Walmart — And You Should Be, Too

Employees restock shelves of school supplies at a Walmart Stores Inc. location in Burbank, CA. Bloomberg

Last week there was a lot of stock market excitement regarding WalMart. After a “favorable” earnings report analysts turned bullish and the stock jumped 4% in one day, WMT’s biggest rally in over a year, making it a big short-term winner. But the leadership signals indicate WalMart is probably not the best place to put your money.

WalMart has limited growth plans

WalMart is growing about 3%/year. But leadership acknowledged it was not growing its traditional business in the USA, and only has plans to open 25 stores in the next year. It hopes to add about 225 internationally, predominantly in Mexico and China, but unfortunately those markets have been tough places for WalMart to grow share and make profits. And the company has been plagued with bribery scandals, particularly in Mexico.

And, while WalMart touts its 40%+ growth rate on-line, margins online (including the free delivery offer) are even lower than in the traditional Wal-Mart stores, causing the company’s gross margin percentage to decline. The $11.5 billion on-line revenue projection for next year is up, but it is 2.5% of Walmart’s total, and a mere 7-8% of Amazon’s retail sales. Amazon remains the clear leader, with 62% of U.S. households having visited the company in the second quarter. And it is not a good sign that WalMart’s greatest on-line growth is in groceries, which amount to 26% of on-line salesalready. WalMart is investing in 1,000 additional at-store curb-side grocery pick-uplocations, but this effort to defend traditional store sales is in the products where margins are clearly the lowest, and possibly nonexistent.

It is not clear that WalMart has a strategy for competing in a shrinking traditional brick-and-mortar market where Costco, Target, Dollar General, et.al. are fighting for every dollar. And it is not clear WalMart can make much difference in Amazon’s giant on-line market lead. Meanwhile, Amazon continues to grow in valuation with very low profits, even as it grows its presence in groceries with the Whole Foods acquisition. In the 17 months from May 10, 2016 through October 10, 2017 WalMart’s market cap grew by $24 billion (10%,) while Amazon’s grew by $174 billion (57%.)

Even after recent gains for WalMart, its market capitalization remains only 53% of its much smaller on-line competitor. This creates a very difficult pricing problem for WalMart if it has to make traditional margins in order to keep analysts, and investors, happy.

Leadership is not investing to compete, but rather cashing out the business

To understand just how bad this growth problem is, investors should take a look at where WalMart has been spending its cash. It has not been investing in growing stores, growing sales per store, nor really even growing the on-line business. From 2007-2016 WalMart spent a whopping $67.3 billion in share buybacks. That is over 20 times what it spent on Jet.com. And it was 45% of total profits during that timeframe. Additionally WalMart paid out $51.2 billion in dividends, which amounted to 34% of profits. Altogether that is $118.5 billion returned to shareholders in the last decade. And a staggering 79% of profits. It shows that WalMart is really not investing in its future, but rather cashing out the company by returning money to shareholders.

So very large investors, who control huge voting blocks, recognize that things are not going well at WalMart. But, because of the enormity of the share buybacks, the Walton family now controls over half of WalMart stock. That makes it tough for an activist to threaten shaking up the company, and lets the Waltons determine the company’s future.

There will be marginal enhancements. But the vast majority of the money is being returned to them, via $20 billion in share repurchases and $1.5 billion in cash dividends annually.

Amazon spends nothing on share repurchases. Nor does it distribute cash to shareholders via dividends. Amazon’s largest shareholder, Jeff Bezos, invests all the company money in new growth opportunities. These nearly cover the retail landscape, and increasingly are in other growth markets like cloud services, software-as-a-service and entertainment. Comparing the owners of these companies, quite clearly Bezos has faith in Amazon’s ability to invest money for profitable future growth. But the Waltons are far less certain about the future success of WalMart, so they are pulling their money off the table, allowing investors to put their money in ventures outside WalMart.

Investing your money, do you think it is better to invest where the owner believes in the future of his company?

Or where the owners are cashing out?

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Sep 29, 2017 | Entertainment, Politics, Sports, Trends

LANDOVER, MD – SEPTEMBER 24: Washington Redskins players link arms during the national anthem before their game against the Oakland Raiders at FedExField on September 24, 2017 in Landover, Maryland. (Photo by Patrick Smith/Getty Images)

A recent top news story has been NFL players kneeling during the national anthem. The controversy was amplified when President Trump weighed in with objections to this behavior, and his recommendation that the NFL pass a rule disallowing it. This kind of controversy doesn’t make life easier for NFL leaders, but it really isn’t their biggest problem. Ratings didn’t start dropping recently, viewership has been declining since 2015.

NFL ratings stalled in 2015

NFL viewership had a pretty steady climb through 2014. But in 2015 ratings leveled. Then in 2016 viewership fell a whopping 9%. During the first 6 weeks of the 2016 regular season (into early October)viewership was down 11%. Through the first 9 weeks of 2016 ratings were down 14% before things finally leveled off. Although nobody had a clear explanation why viewership declined so markedly, there was widespread agreement that 2016 was a ratings crash for the league. Fox had its worst NFL viewership since 2008, and ESPN had its worst since 2005.

Interestingly, later analysis showed that overall people were watching 5% more games. But they were watching less of each game. In other words, fans had become more casual about their viewership. People were watching less TV, watching less cable, and that included live sports. And those who stream games almost never streamed the entire game.

And this behavior change wasn’t limited to the NFL. As reported at Politifact.com, Paulsen, editor in chief of Sports Media Watch said, “it’s really important to note the NFL is not declining while other leagues are increasing. NASCAR ratings are in the cellar right now. The NBA had some of its lowest rated games ever on network television last year… It’s an industry-wide phenomenon and the NFL isn’t immune to it anymore.” So the declining viewership problem is widespread, and much older than the recent national anthem controversy.

Live sports is not attracting new, younger viewers

Magna Global recently released its 2017 U.S. Sports Report. According to Radio + Television Business Report (RBR.com) the age of live sports viewers is scewing older. Much older. Today the average NFL viewer is at least 50. Similar to tennis, and college basketball and football. That’s second only to baseball at 57 – which was 50 as recently as 2000. But no sport is immune. NHL viewers are now typically 49. They were 33 in 2000. As simple arithmetic shows, the same folks are watching hockey but few new viewers are being attracted. Based on recent trends, Magna projects viewership for the Sochi Olympics and 2018 World Cup will both decline.

I’ve written before about the importance of studying demographic trends when planning. These trends are highly reliable, even if boring. And they provide a lot of insight. In the case of live sports watching, younger people simply don’t sit down and watch a complete game. Younger people have different behaviors. They watch an entire season of shows in one day. They multi-task, doing many things at once. And they prefer information in short bursts – like weekly blogs rather than a book. And they are more interested in outcomes, the final result, than watching how it happened. Where older people watch a game play-by-play, younger people simply want to know the major events and the final score.

To understand what’s happening with NFL ratings we really don’t have to look much further than simple demographics — the aging of the U.S. population — and the change in viewing behavior from older groups to younger groups.

Unfortunately, according to a recent CNN poll, while 56% of people under age 45 think the recent demonstrations are the right thing to do, 59% of those over 45 say the demonstrations are wrong. In its “core” NFL viewership folks don’t like the kneeling, so it would appear the NFL should heed the President’s advice. But, looking down the road, the NFL won’t succeed unless it finds a way to attract a younger audience. With younger people approving the demonstrations NFL leadership risks throwing the baby out with the bathwater if they knee-jerk control player behavior.

Understanding customer demographic trends, and adapting, is crucial to success

The demonstrations are interesting as an expression of American ideals. And they are gathering a lot of discussion. But they are not what’s plaguing NFL viewership. Today the NFL has a much bigger task of making changes to attract young people as viewers. Should leaders shorten the game’s length? Should they change rules to increase scoring and create more excitement during the game? Should they invest in more apps to engage viewers in play-by-play activity? Should they seek out ways to allow more gambling during the game? Whatever leadership does, the traditions of the NFL need to be tested and altered in order to attract new people to watching the game if they want to preserve the advertising dollars that make it a success.

When your business falters, do you look at long-term trends, or react to a short-term event? It’s easy for politicians and newscasters to focus on the short-term, creating headlines and controversy. But business leaders have an obligation to look much deeper, and longer term. It is critical we move beyond “that’s the way the game is played” to looking at how the game may need to change in order to remain relevant and engage new customers.

Note how boxing recently brought in a mixed martial arts fighter to take on the world champion. The outcome was nearly a foregone conclusion, but nobody cared because it brought in people to a boxing match that otherwise would not have been there. If you don’t recognize demographic shifts, and take actions to meet emerging trends you risk becoming as left behind as cricket, badminton, horseshoes, bocce ball and darts.

by Adam Hartung | Sep 28, 2017 | Entertainment, Leadership, Politics, Trends

Photo: NEW YORK, NY – FEBRUARY 19: Writers and crew of ‘The Late Show with Stephen Colbert’ attend 69th Writers Guild Awards New York Ceremony at Edison Ballroom on February 19, 2017 in New York City. (Photo by Nicholas Hunt/Getty Images)

The Late Show hosted by Stephen Colbert is now the #1 program in late night television. This come-from-far-behind change in market leadership, overtaking The Tonight Show hosted by Jimmy Fallon, is not about politics. It is about understanding trends and using them to create value.

Back in February, 2014 there was real concern about the future of late night television. Audiences had peaked decades before, when Nightline was huge and competed with The Tonight Show hosted by legend Johnny Carson. By 2014 many wondered if American programming after the late news was all shifting to cable TV as audiences continued shrinking. Producers replaced Jay Leno with Jimmy Fallon in order to revitalize viewers. Jimmy Kimmel was moved up in time as ABC killed Nightline, hoping he could carve out a growing niche. And David Letterman, late night’s senior statesman, was about to be replaced by cable satirist Stephen Colbert. But these changes gathered little industry interest, because the time slots simply were not doing well for broadcasters – or advertisers.

Fallon maintained a dominant lead in the time slot as Colbert’s first year was a yawner.

As

TheWrap.com reported in September, 2016, despite the fanfare of Colbert taking over hosting, he “posed no threat whatsoever to Jimmy Fallon.” Fallon’s show maintained a huge lead. With 3.65 million viewers it bested

The Late Show by over 800,000. Colbert, with 2.82 million viewers seemed mostly trying to keep a lead over Kimmel’s 2.3 million viewers.

ANDREW LIPOVSKY/NBC/NBCU PHOTO BANK VIA GETTY IMAGES

Meanwhile the producers at The Late Show kept their eyes on the mood of the electorate.

They had largely let Colbert promote Democrat Clinton, and even though she lost the election noted she had won the popular vote. As Colbert continued to criticize the President, his audience grew. Soon, Colbert was beating Fallon in total audience – something nobody predicted just a few months earlier. It was quite a surprise when the 2016-2017 September to May season drew to a close and it was discovered that Colbert actually won the time slot, producing a larger total audience than Fallon. It was only about 20,000 – but it was a win few saw coming.

The Late Show writers and producers noted the historic and growing unpopularity of President Trump, and the public interest in ongoing investigations, and built the headlines into the show. Variety headlined on 7/25/17 “Stephen Colbert’s Russia Week Lofts Late Show to Biggest Weekly Win Ever.” Using audience trends The Late Showdevoted a week to a comical look at Russia, which saw it generate a 2.87million total audience in comparison to The Tonight Show‘s 2.42million – a beat of a whopping 450,000 viewers.

All of this is very good news for CBS.

NBC (NBC/Universal is a division of Comcast) is not losing money on The Tonight Show. And in the desirable segment of those age 18-49 Fallon still has the largest audience. But, it is a good thing for CBS to have so many new viewers. It brings in more advertisers, and higher revenues for each ad. This leads to more profits.

One might say that this is all about the hosts, and their political leanings. Maybe the content is driven by host opinions. But CBS is winning viewers because it is following trends, and matching its programming to trends. This is growing its late night audience, while NBC’s is shrinking.

Steve Burke, chief executive of NBC Universal was quoted in the New York Times saying “I think the answer is for Jimmy to be Jimmy.” Sounds like what a father might say about his son when the boy finds himself in a rough patch. But I’m not so sure its the position a company CEO should take regarding a very expensive employee in the lead of a major project.

Maybe NBC’s producers should spend more time looking at trends, and figuring out how to program content that will improve The Tonight Show‘s competitiveness. The show was upended in just one year. What will total audience look like next May when the 2017-2018 season ends? Will revenues and profits be unaffected if NBC’s audience keeps falling while CBS’s keeps growing?

For the rest of us, the lesson should be clear. Nobody is relegated to always being #2. Regardless the leader’s size, if you study trends and figure out how to leverage them you can grow, and you can become #1.

Understanding trends and applying them to your business is the best way to invigorate growth and improve your competitiveness.

by Adam Hartung | Jun 27, 2017 | Disruptions, Employment, Finance

Photo by Spencer Platt/Getty Images

I’m a believer in Disruptive Innovation. For almost 100 years economists have written about “Creative Destruction,” in which new technologies come along making old technologies — and the companies built on them — obsolete. In the last 20 years, largely thanks to the insights of faculty at the Harvard Business School, we’ve seen a dramatic increase in understanding how new companies use new technologies to disrupt markets and wipe out the profitability of companies that were once clearly successful. In a large way, we’ve come to accept that Disruptive Innovation is good, and the concomitant Creative Destruction of the old players leads to more rapid growth for the economy, increasing jobs and the wherewithal of everyone. Creative Destruction, in the pursuit of progress, is good because it helps economies to grow.

But, not really everyone benefits from Creative Destruction. The trickle down benefits to lots of people can be a long time coming. When market shifts happen, and people lose jobs to new competitors — domestic or offshore — they only know that their life, at least short term, is a lot worse. As they struggle to pay a mortgage, and find a new job, they often learn their skills are outdated. There are new jobs, but these folks are often not qualified. As they take lesser jobs, their incomes dwindle, and they may well lose their homes. And their healthcare.

Economists call this workplace transition “temporary economic dislocation.” Fancy term. They claim that eventually folks do enter the workplace who are properly trained, and those folks make more money than the workers associated with the previous, now inferior, technology. And, eventually, everyone finds new work – at something.

That’s great for economists. But terrible for the folks who lost their jobs. As someone once said “a recession is when your neighbor loses his job. A depression is when you lose your job.” And for a lot of people, the market shift from an industrial economy to an information economy has created severe economic depression in their lives.

A person learns to be a printer, or a printing plate maker, in the 1970s when they are 20-something. Good job, makes a great wage. Secure work, since printing demand just keeps rising. But then along comes the internet with PDF and JPEG documents that people read on a screen, and folks simply quit needing, or wanting, printed documents. In 2016, now age 50-something, this printer or plate-maker no longer has a job. Demand is down, and its really easy to send the printing to some offshore market like Thailand, Brazil or India where printing is cheaper.

What’s he or she to do now? Go back to school you may say. But to learn how to do what? Say it’s online (or digital) document production. OK, but since everyone in the 20s has been practicing this for over a decade it takes years to actually be skilled enough to be competitive. And then, what’s the pay for a starting digital graphic artist? A lot less than what they made as a printer. And who’s going to hire the 58-62 year old digital graphic artist, when there are millions of well trained 20-somethings who seem to be quicker, and more attuned to what the publishers want (especially when the boss ordering the work is 35-42, and really uncomfortable giving orders and feedback to someone her parents’ age.) Oh, and when you look around there are millions of immigrants who are able to do the work, and willing to do it for a whole lot less than anyone native born to your country.

In England last week these disaffected people made it a point to show their country’s leadership that their livelihoods were being “creatively destroyed.” How were they to keep up their standard of living with the flood of immigrants? And with the wealth of the country constantly shifting from the middle class to the wealthy business leaders and bankers? And with work going offshore to less developed countries? While folks who have done well the last 25 years voted overwhelmingly to remain in the EU (such as those who live in what’s called “The City”), those in the suburbs and outlying regions voted overwhelmingly to leave the EU. Sort of like their income gains, and jobs, left them.

A whole lot of anger. To paraphrase the famous line from the movie Network, they were mad as Hell and they weren’t going to take it any longer. Simply put, if they couldn’t participate in the wonderful economic growth of EU participation, they would take it away from those who did. The point wasn’t whether or not the currency might fall 10% or more, or whether stocks on the UK exchange would be routed. After all, these folks largely don’t go to Europe or America, so they don’t care that much what the Euro or dollar costs. And they don’t own stocks, because they aren’t rich enough to do so, so what does it hurt them if equities fall? If this all puts a lot of pain on the wealthy – well just maybe that is what they really wanted.

America is seeing this as well. It’s called the Donald Trump for president campaign. While unemployment is a remarkably low 5%, there are a lot of folks who are working for less money, or simply out of work entirely, because they don’t know how to get a job. They may laugh at Robert De Niro as a retired businessman now working for free in The Intern. But they really don’t think it’s funny. They can’t afford to work for free. They need more income to pay higher property taxes, sales taxes, health care and the costs of just about everything else. And mostly they know they are rapidly being priced out of their lifestyle, and their homes, and figuring they’ll be working well into their 70s just to keep from falling into poverty.

These people hate President Obama. They don’t care if the stock market has soared during his presidency – they don’t own stocks (and if they do in a 401K or similar program they don’t care because it does them no good today). They don’t care that he’s created more jobs than anyone since Reagan or Roosevelt, because they see their jobs gone, and they blame him if their recent college graduate doesn’t have a well-paying job. They don’t care if America is closing in on universal health care, because all they see is that health care is becoming ever more expensive – and often beyond their ability to pay. For them, their personal America is not as good as they expected it to be – and they are very, very angry. And the President is a very identifiable symbol they can blame.

Creative Destruction, and disruptive innovations, are great for the winners. But they can be wildly painful to the losers. And when the disruptive innovations are as big, and frequent, as what’s happened the last 30 years – globalized economy, nationwide and international super banks, outsourcing, offshoring and the entirety of the Internet of Things – it has left a lot of people really concerned about their future. As they see the top 1% live opulent lifestyles, they struggle to keep a 12 year old car running and pay the higher license plate fees. They really don’t care if the economy is growing, or the dollar is strong, or if unemployment is at near-record lows. They feel they are on the losing end of the stick. For them, well, America really isn’t all that great anymore.

So, hungry for revenge, they are happy to kill the goose for dinner that laid the golden eggs. They will take what they can, right now, and they don’t care if the costs are astronomical. They will let tomorrow sort out itself, in a bit of hyper-ignorance to evaluate the likely outcome of their own actions.

Despite their hard times, does this not sound at the least petty, and short-sighted? Doesn’t it seem rather selfish to damn everyone just because your situation isn’t so good? Is it really in the interest of your fellow man to create bad outcomes just because you’ve not done well?

by Adam Hartung | Apr 8, 2017 | Economy, Employment

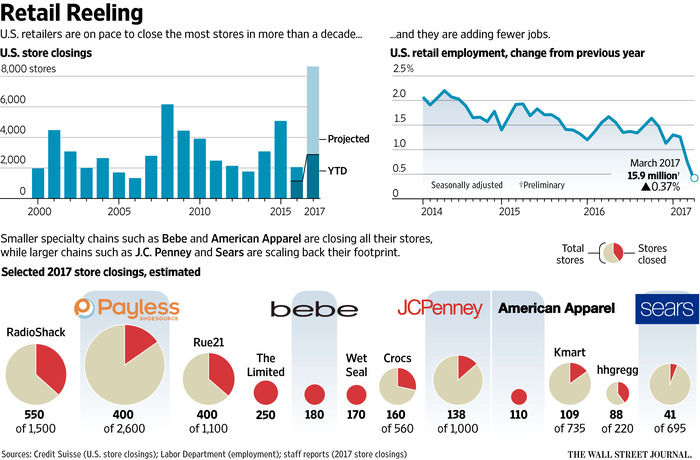

The Labor Department March jobs report came out last week, and it disappointed a lot of people. At 98,000 new jobs, the number was about half what economists predicted. Simultaneously, the report revised January and February down a combined 38,000 jobs. Retail workers lost 30,000 jobs in March, which combined with February means 56,000 retailers lost jobs in just two months. There was ample disappointment to go around.

But, if we take a longer-term view the trend is much more pronounced, and we can easily see that overall the jobs market is very, very healthy – forcing employers to raise wages.

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

As the chart above indicates, America has recreated almost all the jobs lost in the Great Recession (chart courtesy of Kriston McIntosh of The Hamilton Project – Brookings). Almost 10 million jobs were lost between 2008 and 2010 as the financial crisis wiped out banks, and lending. That was a staggering decline of about 420,000 jobs per month.

Because businesses were loath to re-invest following the economic meltdown, the rate of job creation has been considerably slower than the speed with which executives laid off employees. However, since the end of 2011 the U.S. has been adding jobs at the rate of over 200,000 per month – a dramatic growth in job creation over an extraordinarily long-term period. Literally, unprecedented.

And, if we average the job creation rate the first three months of 2017 it comes to 178,000 per month. At this lower pace the jobs market will have fully recovered within the next four months (by August, 2017). This jobs growth rate may be less than the last six years, but it is far more than is necessary to maintain employment rates – including population gains.

We see this very healthy improvement in the jobs situation in other statistics. Those in part-time positions seeking full-time positions fell to the lowest in several years at 8.9%. And, unemployment declined to 4.5% from 4.7% – a clear indication that there were more people finding work than losing work, pulling more people into the workforce for yet another month. At 4.5%, this is the lowest unemployment rate in a decade.

Net/net, America is rapidly approaching “

full employment” – a term that means everyone who wants a job either has one, or is intentionally looking for a job and reasonably expects to find one in three months. Or, in other words, if you know somebody complaining they can’t find a job it is either because they aren’t really trying, or they are picky about what they want to do, or they can find a job but won’t take it because they want higher pay.

And hourly pay continues to rise, increasing 2.7% versus March, 2016. This is less than in good times, when pay tends to rise at 3-4%/year – but the fact that pay is going up means the labor market is tightening. And as the economy reaches higher levels of employment, and lower levels of unemployment, companies will have to pay more to find new workers – and increase wages on current workers to keep them from leaving. Thus, it is a surety that pay will rise throughout 2017, and probably into the foreseeable future.

Whether you liked President Obama or not, the policies of the last six years allowed America to escape the Great Recession. Today 78.5% of all working age people are in the workforce – that is the highest labor participation rate of working age people since 2008 – indicating a complete recovery from the job collapse.

Thus, it is time for changes in economic policy. To keep calling for job creation is, classically, “fighting the last war.” Even as government is reducing employment, and some industries (like traditional retail) are collapsing employment, there are other parts of the economy growing jobs. Amazon.com, for example, has announced it will be adding 100,000 U.S. jobs by the middle of 2018.

For President Trump to claim there are 100 million people in the USA looking for work is an impossibility. There are only 325 million people in America, and 26.4% of those are between under the age of 17 and over 65 – so 86 million. That only leaves 239 million people of working age in the country. We know that of those at least 78.5% are employed – which is 188 million. Thus, at its maximum, there are only 51 million people who could be looking for work. But we know that many are not because of ill-health, or simply choice. According to the Labor Department, there are about 5 million people looking for work in the U.S. at this time, which is just about the same number of job openings.

It’s time to get over the constant complaining about a job shortage. And here’s what this means for you:

1. After a long decade of stagnation, we can expect everyone to receive higher pay.

2. Job mobility will improve. If you don’t like your current job you can probably find another one.

3. Employers will have to stop burning out employees and do more to keep them as unemployment rates decline.

4. Immigration will be less of an issue, because America will need people to fill jobs (many employers are already complaining about changes to H1-B visa rules).

5. Employers will pay more for employee training and retraining.

6. People 30 and younger have struggled to build careers and start families during the recovery. Expect that situation to reverse.

7. More jobs, more money, a faster growing economy is better for tax receipts. This will relieve stress on government budgets.

8. Higher real estate prices. Some markets are already back to pre-recession levels, yet others have languished. Expect across the board increases.

9. Interest rates will go up (from record lows). Lock-in your mortgage now. Adjust your portfolio from bonds to stocks.

10. Expect the dollar to remain strong, so imports will be cheap and exporting will continue to be more difficult. It’s a good time to visit foreign destinations, and it will be a struggle to attract international tourists.

Look beyond short-term numbers. Month-to-month, even quarter-to-quarter, numbers often yield little analytical value. Look at the long-term trend. Then make sure you, and your business, are ready. Don’t keep fighting the last war, prepare to capture the next opportunity.

by Adam Hartung | Mar 22, 2017 | In the Whirlpool, Investing, Retail

(Photo by Scott Olson/Getty Images)

Traditional retailers just keep providing more bad news. Payless Shoes said it plans to file bankruptcy next week, closing 500 of its 4,000 stores. Most likely it will follow the path of Radio Shack, which hasn’t made a profit since 2011. Radio Shack filed bankruptcy and shut a gob of stores as part of its “turnaround plan.” Then in February Radio Shack filed its second bankruptcy — most likely killing the chain entirely this time.

Sears Holdings finally admitted it probably can’t survive as a going concern this week. Sears has lost over $10 billion since 2010 — when it last showed a profit — and owes over $4 billion to its creditors. Retail stocks cratered Monday as the list of retailers closing stores accelerated: Sears, KMart, Macy’s, Radio Shack, JCPenney, American Apparel, Abercrombie & Fitch, The Limited, CVS, GNC, Office Depot, HHGregg, The Children’s Place and Crocs are just some of the household names that are slowly (or not so slowly) dying.

None of this should be surprising. By the time CEO Ed Lampert merged KMart with Sears the trend to e-commerce was already pronounced. Anyone could build an excel spreadsheet that would demonstrate as online retail grew, brick-and-mortar retail would decline. In the low margin world of retail, profits would evaporate. It would be a blood bath. Any retailer with any weakness simply would not survive this market shift — and that clearly included outdated store concepts like Sears, KMart and Radio Shack which long ago were outflanked by on-line shopping and trendier storefronts.

Yet, not everyone is ready to give up on some retailers. Walmart, for example, still trades at $70 per share, which is higher than it traded in 2015 and about where it traded back in 2012. Some investors still think that there are brick-and-mortar outfits that are either immune to the trends, or will survive the shake-out and have higher profits in the future.

And that is why we have to be very careful about business myths. There are a lot of people that believe as markets shrink the ultimate consolidation will leave one, or a few, competitors who will be very profitable. Capacity will go away, and profits will return. In the end, they believe if you are the last buggy whip maker you will be profitable — so investors just need to pick who will be the survivor and wait it out. And, if you believe this, then you have justified owning Walmart.

Only, markets don’t work that way. As industries consolidate they end up with competitors who either lose money or just barely eke out a small profit. Think about the auto industry, airlines or land-line telecom companies.

Two factors exist which effectively forces all the profits out of these businesses and therefore make it impossible for investors to make money long-term.

First, competitive capacity always remains just a bit too much for the market need. Management, and often investors, simply don’t want to give up in the face of industry consolidation. They keep hoping to reach a rainbow that will save them. So capacity lingers and lingers — always pushing prices down even as costs increase. Even after someone fails, and that capacity theoretically goes away, someone jumps in with great hopes for the future and boosts capacity again. Therefore, excess capacity overhangs the marketplace forcing prices down to break-even, or below, and never really goes away.

Given the amount of retail real estate out there and the bargains being offered to anyone who wants to open, or expand, stores this problem will persist for decades in retail.

Second, demand in most markets keeps declining. Hopefuls project that demand will “stabilize,” thus balancing the capacity and allowing for price increases. Because demand changes aren’t linear, there are often plateaus that make it appear as if demand won’t go down more. But then something changes — an innovation, regulatory change, taste change — and demand takes another hit. And all the hope goes away as profits drop, again.

It is not a successful strategy to try being the “last man standing” in any declining market. No competitor is immune to these forces when markets shift. No matter how big, when trends shift and new forms of competition start growing every old-line company will be negatively affected. Whether fast, or slow, the value of these companies will continue declining until they eventually become worthless.

Nor is it successful long-term to try and segment the business into small groupings which management thinks can be protected. When Xerox brought to market photocopying, small offset press manufacturers (ABDick and Multigraphics ) said not to worry. Xeroxing might be OK in some office installations, but there were customer segments that would forever use lithography. Even as demand shrunk, well into the 1990s, they said that big corporations, industrial users, government entities, schools and other segments would forever need the benefits of lithography, so investors were safe. Today the small offset press market is a tiny fraction of its size in the 1960s. ABDick and Multigraphics both went through rounds of bankruptcies before disappearing. Xerography, its child desktop publishing, and its grandchild electronic screens, killed offset for almost all applications.

So don’t be lured into false hopes by retailers who claim their segment is “protected.” Short-term things might not look bad. But the market has already shifted to e-commerce and this is just round one of change. More and more innovations are coming that will make the need for traditional stores increasingly unnecessary.

Many readers have expressed their disappointment in my chronic warnings about Walmart. But those warnings are no different than my warnings about Sears Holdings. It’s just that the timing may be different. Both companies have been over-investing in assets (brick-and-mortar stores) that are declining in value as they have attempted to defend and extend their old business model. Both radically under-invested in new markets which were cannibalizing their old business. And, in the end, both will end up with the same results.

And this is true for all retailers that depend on traditional brick-and-mortar sales for their revenues and profits — it’s only a matter of when things will go badly, not if. So traditional retail is nowhere that any investor wants to be.

by Adam Hartung | Mar 10, 2017 | Books, Defend & Extend, Employment, Leadership

Harvard Business Review Press just published an insightful new book by two senior partners at Bain & Company, one of the world’s three leading strategy consulting firms, entitled Time Talent Energy. The book’s great insight is that companies utilize a plethora of tools to manage money and financials to the nth degree, but that approach is less successful than putting a greater focus on managing employee time, talent and energy.

Harvard Business Review Press

Harvard Business Review Press

Time Talent Energy jacket cover

While managing financials is required in the modern organization, it is insufficient for success. Mankins and Garton discovered that organizations which focus more heavily on managing how employees spend their time and how they thoughtfully place people in their roles, create companies where employees are inspired and 40% more productive than their competition. And this pays off, with profit margins which are 30-50% higher than their industry average. The improvement is so great from focusing on employees that in today’s low cost and easily accessible capital world it is better to waste some cash in the process of better managing time and talent.

In most companies 25% of all productive time is wasted and can reach as high as 40% in complex organizations. Think of all the emails, texts, voice mails and meetings that absorb vast amounts of time. Yet, as the authors are fond of pointing out, nobody can create a 25 hour day. So if you can recapture that time, productivity will soar. The results are far greater than squeezing another 1% (or even 10%) out of your cost structure. If instead of spending so much time managing costs we spent more time eliminating complexity and unneeded tasks, competitiveness will soar.

Some people think that the best companies hire better people. Surprisingly, this is not true. About 15-16% of employees in every company are “A” players. But most companies squander this talent by spreading it around the organization. To achieve higher productivity and greater success, leading companies cluster their “A” players into teams focused on the most critical, important parts of the business. Thus, the best talent is working side-by-side on the most important challenges which can lead to the greatest gains. This talent clustering energizes the best workers, increasing productivity by 44%. But more than that, as the culture is inspired from building on its own gains productivity soars as much as 125%.

But in most organizations the focus still remains on finance. The CFO is frequently the second most powerful individual, behind only the CEO. The head of Human Resources (Chief Human Resources Officer — CHRO) rarely has the clout of a CFO. And the CFO job is seen as the route to CEO — far more CFOs than CHROs become CEOs. Simultaneously, organizations spend exorbitantly on financial control tools, such as ERP (Enterprise Resource Planning) from companies like Oracle and SAP — while very few have any kind of tool set for effectively managing employee time or talent deployment. The authors conclude it is apparent business leaders have significantly overshot on managing financial resources, while allowing their organization to be woefully incapable of managing its human resources.

I had the opportunity to interview Michael Mankins to obtain some additional insight about managing time, talent and energy:

Adam Hartung: Do businesses need to lessen the CFO role, and heighten the CHRO role?

Michael Mankins: The reality is that most human resource decisions, those that determine how people spend their time, and how talent is deployed, are made by line managers. Made within the bowels of the organization, with little more than senior leadership guidelines. There needs to be significantly more involvement by senior leadership in collecting and reviewing data on critical skills for the organization, “A” player performance and leadership development. If as much time was spent by senior leadership teams discussing human resources as spent on budgets there would be a tremendous improvement in productivity.

The CFO and CHRO should definitely be peers. To do that requires a cultural change from being an organization focused on preserving the status quo, reducing mistakes and keeping leadership out of jail to one that is far more future oriented. This can be done and in the book we highlight companies such as ABInBev, Ford, Nordstrom, Starbucks, IKEA, Netflix and others who have accomplished this.

Hartung: Companies spent enormous sums installing ERP systems and they spend a lot to maintain them. Yet, from reading your book it seems like this may have been misguided.

Mankins: All companies need to be able to change their business model as markets shift. ERP frequently creates a wiring that makes it hard to change with the competitive landscape, or as changes in capability are required. ERP locks in the business model at a point in time — but great performers develop ways to adapt.

All companies need a great general ledger. ERP goes far beyond the general ledger and in doing so can make a company too inflexible for today’s rate of change. There needs to be a flexible ERP system —which just doesn’t seem to exist right now. The ERP market seems ripe for a marketplace disrupter!

Simultaneously there aren’t any great tools out there for collecting data that can help a company reduce complexity and eliminate time wasters. Nor are there great tools for managing the performance of “A” players. The top performing companies do create a discipline around these tasks, collecting and analyzing data. Many companies would be helped by a tool that would do for time and talent management what we’ve done for financial management.

Hartung: You demonstrate that clustering “A” players creates dramatic improvement in productivity and company performance. Do great companies focus these clusters on improving the company as it is, or looking for the next “big thing?”

Mankins: We discovered that by and large the greatest gains come from focusing on the latter. Almost all MBA programs are maniacal about training managers to improve the existing business. For many years corporate planning systems have focused almost entirely on improving the operating model. The result is that in many, many industries leadership has almost no hope of improving operating margins by even 1%. There simply is nothing left to improve which can achieve significant results.

Simultaneously, 1% growth has a far, far greater return on investment than 1% operating margin improvement. So if companies focus their best talent on breakthroughs, in whole new ways of running the business, or creating new markets, the results are significantly greater.

Hartung: Many companies have clustered their top performers into “all star teams.” But this has been met by demotivation of employees not on these teams – feeling like “also rans” or “bench warmers.” And often there is a compensation difference between the all-star team members and others that is demotivating. How do leaders manage this conundrum?

Mankins: If this demotivation is driven by internal competitiveness — by ambition to move up the organization — there is a culture problem. Everyone is not on the same page about company needs and the talent to address those needs. Internal competitiveness should be addressed so everyone wants the company to succeed, so everyone individually can succeed. Rewards, compensation and non-compensation, need to be geared for groups to be motivated, not just individuals.

In the organization, leadership should work hard to make sure everyone knows they are important. There should be an effort to reward the “supporting cast” and not just the main characters. It is true that in today’s world many people have an exaggerated view of their own performance. We address this in the book with recommendations for how to give people feedback so they know the reality of their role and their performance in order to grow and do better. Today most companies have a very poorly performing review and training process, because they tie it to the compensation cycle thus limiting feedback to once per year and, unfortunately, doing feedback at the same time (often the same meeting) as compensation and bonus decisions. Addressing the performance feedback process can go a long way to avoid the demotivation problem.

Hartung: How do companies find “A” players?

Mankins: Search firms are the antithesis of finding “A” players. Their approach, their process, is not designed to deliver “A” candidates. To build a good group of “A” players requires the CEO, CHRO and senior leadership team understand what constitutes an “A” player in their organization. Then they can use the entire organization to seek out people with this behavioral signature in order to recruit them.

It is unfortunate that most company HR processes would not recognize an “A” player if one submitted a resume and would not hire one if they arrived for an interview. Most current processes focus too much on relationships (who candidates know,) narrow skills and prior specific experiences and not enough on what is needed for future success. And hiring decisions are often made by the wrong people; people too low in the organization and people who don’t know the desired behavioral signature. Google is one role model for knowing how to find and develop “A” players.

Unfortunately there is enormous ageism in hiring today. Especially in technology. Employers lack awareness of the value of generalizable experience they can bring into their company. The search for very specific experiences often leads to a very limited list of candidates with narrow experience and too often they do not perform at the “A” level when placed in the context of the new company and new competitive market requirements. Looking more broadly at candidates with great experience, even if not seemingly directly applicable (including candidates in their 50s and 60s) could lead to far greater success.

by Adam Hartung | Feb 28, 2017 | E-Commerce, Employment, real estate, Retail

(Photo: JOHN MACDOUGALL/AFP/Getty Images)

Amazon.com has become an important part of the American economy, and the lives of people globally. But, far too few people still understand the repercussions of Amazon’s success on retailers, consumer goods manufacturers, real estate – and ultimately everyone’s lives. The implications are enormous. Smart leaders, and investors, will plan for these implications and take advantage of the market shift.

Invest in ecommerce, divest traditional retailers.

The first implication is just thinking about investing in Amazon and/or its competitors in retail. In May, 2016 I compared the market value of Wal-Mart, the world’s largest retailer, with Amazon. At the time Wal-Mart was worth $216 billion, and Amazon was worth $332 billion. The difference could be explained by realizing that Wal-Mart was the leader at brick-and-mortar sales, which were shrinking, while Amazon was the leader in e-commerce, which is growing. Since then Wal-Mart’s value has increased to $222 billion – up $6 billion, 2.8%. Meanwhile Amazon’s value has increased to $403 billion- up $71 billion, 21.4%. Over three years (starting 3/3/14) Wal-Mart’s per share value has declined from $74 to $71 (down 4%,) while Amazon’s has risen from $370 to $845 (up 128%.)

To put it mildly, investing in Amazon, which is the leader in e-commerce, has created a great return. Contrastingly that value increase has been fueled by declines in traditional retailers. The Amazon Effect has caused shares in companies like Sears Holdings, JCPenney, Kohl’s, Macy’s and many other stalwarts of the bygone era to be crushed. Over the last year investors in XRT (the retail industry spider) have increased 1.6%, while the S&P 500 spider has jumped 22%. The number of retailers with debt rated at Moody’s most distressed level has tripled since 2009 – and Moody’s predicts this list will worsen over the next five years.

There is vastly too much retail space, and nobody knows what to do with it.

And this has an impact on real estate. As online sales come to over 11% of all holiday sales in 2016, and Amazon accounts for 40% of all those sales, it is clear people just don’t go to stores any more anywhere near the way they once did. Historically prime retail real estate was considered valuable – and in 2007 many people thought Sears real estate was worth more than Sears as a retailer. But no longer. According to Morningstar, Sears store closings alone could cause 200 malls to close.

It is apparent the Amazon Effect has left America with far more storefronts than needed. Stand-alone stores are being shuttered, with no alternative use for most buildings. Malls and shopping centers go begging as traffic drops, tenants leave, lease rates collapse and the facilities end up wholly or nearly empty. This means you don’t want to invest in retail real estate REITs. But it also means that neighborhoods, and sometimes entire towns, will be impacted as these empty buildings reduce interest in housing and push down residential prices.

Tax receipts will fall, and nobody knows how to replace them.

For a long time governments gave handouts to retailers in the form of tax breaks to build stores or locate their headquarters. But as stores close the property tax receipts decline, putting a greater burden on homeowners to pay for schools and infrastructure. Same with sales taxes which disappear from the local government coffers. And tax breaks once given to hold onto jobs – like the ones the village of Hoffman Estates and state of Illinois, gave Sears in 2011 to not move its headquarters, look far less justified. In short, the Amazon Effect has an enormous impact on the local tax base – and those missing dollars will inevitably have to come from residents – or a significant curtailing of services.

The impact on job eliminations will be staggering.

The Amazon Effect also has an impact on jobs. Amazon’s growth keeps escalating, from 19% in 2014 to 20% in 2015 to 28% in 2016, which takes the jobs away from traditional retailers. Macy’s plans to shed 10,000 workers as it shrinks and streamlines. JCPenney will eliminate 6,000 employees via early retirement completely separate from its store closings, and HHGregg is shedding 1,500 jobs as stores close. And thousands more are being lost across traditional retail in stores, supply chain positions and headquarters facilities.

Traditional retail employs about 16.5 million Americans – nearly 10% of the entire workforce. 6.2 million are in the prime product lines targeted by e-commerce (GAFO – General, Apparel, Furniture and Other.) The Amazon Effect will continue to eliminate these positions. Over the next five years it is not unlikely that the decline of brick-and-mortar will cause 16% of GAFO jobs to disappear, which is almost 1 million jobs. Simultaneously this could easily cause 10% of the non-GAFO jobs (10.3 million) to disappear – which is another 1 million. This likely scenario would cause the loss of 2 million jobs in just five years, which is the entirety of all lost manufacturing jobs to China. The Trump administration has more employment concerns to face than just the return of manufacturing.

The Amazon Effect is changing grocery shopping, without even being a major competitor in that sector. Because Wal-Mart has lost so much general merchandise sales to e-commerce, the company has amped up grocery sales – which are now 56% of total revenue. To continue growing groceries Wal-Mart is undertaking a massive price war pitting itself against the long-running low cost grocer Aldi. This is creating even more intense profit pressure on Wal-Mart, which last year saw gross margins drop by eight points, as net income fell 18%. Such intense price competition is creating the need for even more cost cutting among all grocers – which means investors beware – and we can expect even more job cutting as the spiral downward continues.

Consumer Goods manufacturers, and their suppliers, will be stressed.

Of course this pushes the Amazon Effect onto consumer goods companies that supply grocery retailers. Wal-Mart has held meetings with P&G, Unilever, Conagra, Coca-Cola and other big name companies demanding across-the-board 15% price reductions at wholesale. And Wal-Mart expects these suppliers to help Wal-Mart beat its head-to-head competitors on price 8o% of the time. This will cause consumer goods manufacturers to cut their own costs, including jobs, as well as pressure their raw material suppliers to further reduce their costs – leading to an ongoing spiral of cost cutting, job eliminations and additional pressures for change.

The internet gave us e-commerce, and that birthed Amazon.com. Few predicted the enormous implications this would have on retail, and society. Every single American is affected by the Amazon Effect, which is now inescapable. The only remaining question is whether your business, your government leaders and you are planning for this and preparing for the inevitable changes which will continue coming?

by Adam Hartung | Feb 15, 2017 | Marketing, Mobile, Retail, Web/Tech

(Photo by Andrew Burton/Getty Images)

Apple’s stock is on a tear. After languishing for well over a year, it is back to record high levels. Once again Apple is the most valuable publicly traded company in America, with a market capitalization exceeding $700 billion. And pretty overwhelmingly, analysts are calling for Apple’s value to continue rising.

But today’s Apple, and the Apple emerging for the future, is absolutely not the Apple which brought investors to this dance. That Apple was all about innovation. That Apple identified big trends – specifically mobile – then created products that turned the trend into enormous markets. The old Apple knew that to create those new markets required an intense devotion to product development, bringing new capabilities to products that opened entirely new markets where needs were previously unmet, and making customers into devotees with really good quality and customer service.

That Apple was built by Steve Jobs. Today’s Apple has been remade by Tim Cook, and it is an entirely different company.

Today’s Apple – the one today’s analysts love – is all about making and selling more iPhones. And treating those iPhone users as a “loyal base” to which they can sell all kinds of apps/services. Today’s Apple is about using the company’s storied position, and brand leadership, to milk more money out of customers that own their devices, and expanding into adjacent markets where the installed base can continue growing.

UBS likes Apple because they think the services business is undervalued. After noting that it today would stand alone as a Fortune 100 company, they expect those services to double in four years. Bernstein notes services today represents 11% of revenue, and should grow at 22% per year. Meanwhile they expect the installed base of iPhones to expand by 27% – largely due to offshore sales – adding further to services growth.

Analysts further like Apple’s likely expansion into India – a previously almost untapped market. CEO Cook has led negotiations to have Foxxcon and Wistron, the current Chinese-based manufacturers, open plants in India for domestic production of iPhones. This expansion into a new geographic market is anticipated to produce tremendous iPhone sales growth. Do you remember when, just before filing for bankruptcy, Krispy Kreme was going to keep up its valuation by expanding into China?

Of course, with so many millions of devices, it is expected that the apps and services to be deployed on those devices will continue growing. Likely exponentially. The iOS developer community has long been one of Apple’s great strengths. Developers like how quickly they can deploy new apps and services to the market via Apple’s sales infrastructure. And with companies the size of IBM dedicated to building enterprise apps for iOS the story heard over and again is about expanding the installed base, then selling the add-ons.

Gee, sounds a lot like the old “razors lead to razor blade sales” strategy – business innovation circa 1966.

Overall, doesn’t this sound a lot like Microsoft? Bill Gates founded a company that revolutionized computing with low-cost software on low-cast hardware that did just about anything you would want. Windows made life easy. Microsoft gave users office automation, databases and all the basic work tools. And when the internet came along Microsoft connected everyone with Internet Explorer – for free! Microsoft created a platform with Windows upon which hordes of developers could build special applications for dedicated markets.

Once this market was created, and pretty much monopolized by Microsoft CEO Gates turned the reigns over to CEO Steve Ballmer. And Mr. Ballmer maximized these advantages. He invested constantly in developing updates to Windows and Office which would continue to insure Microsoft’s market share against emerging competitors like Unix and Linux. The money was so good that over a decade money was poured into gaming, even though that business lost more money than it made in revenue – but who cared? There were occasional investments in products like tablets, hand-helds and phones, but these were merely attractions around the main show. These products came and went and, again, nobody really cared.

Ballmer optimized the gains from Microsoft’s installed base. And a lot – a lot – of money was made doing this. nvestors appreciated the years of ongoing profits, dividends – and even occasional special dividends – as the money poured in. Microsoft was unstoppable in personal computing. The only thing that slowed Microsoft down was the market shift to mobile, which caused the PC market to collapse as unit sales have declined for six straight years (PC sales in 2016 barely managed levels of 2006). But, for a goodly while, it was a great ride!

Today all one hears about at Apple is growing the installed base. Maximizing sales of iPhones. And then selling everyone services. Oh yeah, the Apple Watch came out. Sort of flopped. Nobody really seemed to care much. Not nearly as much as they cared about 2 quarters of sales declines in iPhones. And whatever happened to AppleTV? ApplePay? iBeacons? Beats? Weren’t those supposed to be breakthrough innovations to create new markets? Oh well, nobody seems to much care about those things any longer. Attractions around the main event – iPhones!

So now analysts today aren’t put in the mode of evaluating breakthrough innovations and trying to guess the size of brand new, never before measured markets. That was hard. Now they can be far more predictable forecasting smartphone sales and services revenue, with simulations up and down. And that means they can focus on cash flow. After all, Apple makes more cash than it makes profit! Apple has a $246 billion cash hoard. Most people think Berkshire Hathaway, led by famed investor Warren Buffett, spent $6.6 billion on Apple stock in 2016 because Berkshire sees Apple as a cash generation machine – sort of like a railroad! And if those meetings between CEO Cook and President Trump can yield a tax change allowing repatriation at a low rate then all that cash could lead to a big one time dividend!

And, most likely, the stock will go up. Most likely, a lot. Because for at least a while Apple’s iPhone business is going to be pretty good. And the services business is going to grow. It will be a lot like Microsoft – at least until mobile changed the business. Or, maybe like Xerox giving away copiers to obtain toner sales – until desktop publishing and email cratered the need for copiers and large printers. Or, going all the way back into the 1950s and 60s, when Multigraphics and AB Dick practically gave away small printers to get the ink and plate sales – until xerography crushed that business. Of course you couldn’t go wrong investing in Sears for years, because they had the store locations, they had the brands (Kenmore, Craftsman, et.al.,) they had the credit card services – until Wal-Mart and Amazon changed that game.

You see, that’s the problem with all of these sort of “milk the base” businesses. As the focus shifts to grow the base and add-on sales the company loses sight of customer needs. Innovation declines, then evaporates as everything is poured into maximizing returns from the “core” business. Optimization leads to a focus on costs, and price reductions. Arrogance, based on market leadership, emerges and customer service starts to wane. Quality falters, but is not considered as important because sales are so large.

These changes take time, and the business looks really good as profits and cash flow continue, so it is easy to overlook these cultural and organizational changes, and their potential negative impact. Many applaud cost reductions – remember the glee with which analysts bragged about the cost savings when Dell moved its customer service to India some 20 years ago?

Today we’re hearing more stories about long-term Apple customers who aren’t as happy as they once were.

Genius bar experiences aren’t always great. In a telling AdAge column one long-time Apple user discusses how he had two iPhones fail, and Apple could not replace them leaving the customer with no phone for two weeks – demonstrating a lack of planning for product failures and a lack of concern for customer service. And the same issues were apparent when his corporate Macbook Pro failed. This same corporate customer bemoans design changes that have led to incompatible dongles and jacks, making interoperability problematic even within the Apple line.

Meanwhile, over the last four years Apple has spent lavishly on a new corporate headquarters befitting the country’s most valuable publicly traded company. And Apple leaders have been obsessive about making sure this building is built right! Which sounds well and good, except this was a company that once put customers – and unearthing their hidden needs, wants and wishes – first. Now, a lot of attention is looking inward. Looking at how they are spending all that money from milking the installed base. Putting some of the best managers on building the building – rather than creating new markets.

Who was that retailer that was so successful that it built what was, at the time, the world’s tallest building? Oh yeah, that was Sears.

Markets always shift. Change happens. Today it happens faster than ever in history. And nowhere does change happen faster than in technology and consumer electronics. CEO Cook is leading like CEO Ballmer. He is maximizing the value, and profitability, of the Apple’s core product – the iPhone. And analysts love it. It would be wise to disavow yourself of any thoughts that Apple will be the innovative market creating Jobs/Ives organization it once was.

How long will this be a winning strategy? Your answer to that should determine how long you would like to be an Apple investor. Because some day something new will come along.

by Adam Hartung | Jan 16, 2017 | Economy, Politics, Trends

Trend analysis is the most critical part of planning.

Some trends are hard to spot, because people think they are just a fad. Many folks think electric cars fit that category.

Other trends are hard to accept because they imply a big shift in how we live or work – or how we run our business. Scores of IT people who have written me over the years saying mobile devices on common networks (telecom to AWS) will never replace PCs connected to server farms. The implications of this trend are severely negative related to demand for their skills, so they ignore it.

But every plan should be built on trends, because these forecasts are critical for decision-making. It’s the future that matters, not the past. Too often plans are built on history, when trends clearly indicate that things are going to change, and old assumptions are outdated.

Demographic trends are easy to forecast, and important.

While some trends are hard to forecast, some trends are really easy to spot and forecast. And the easiest trend to understand is demographics. If you don’t use any other trends in your planning, you should have demographic trends at the core of your assumptions.

Take for example the movement of people across the United States. Ever since the wagon train people have been moving west. And, like my friend Buckley Brinkman (executive director and CEO of the Wisconsin Center for Manufacturing and Productivity) likes to say, “ever since the invention of air conditioning people have been moving south.” Yet, I’m startled how few organizations plan for this shift and adjust their strategies and tactics to be more successful.

From July 1, 2015 to July 1, 2016 the seven fastest growing states were western. And of 50 states, only eight lost population.

Growth is sublime, decline is disastrous.

Bruce Henderson, founder of the Boston Consulting Group, used to say that if you want to hunt or farm you’re far better off in the Amazon than you are in the Arctic. Basically, where there are resources, and lots of growth, it’s a lot easier to succeed.

For business, this means that if you want to grow your business – whether you’re installing HVAC systems or building a state-of-the-art battery manufacturing plant – you’ll find it relatively easier in faster growing states. It doesn’t mean there is no competition, but it does mean that growth makes it easier for competitors to succeed.

Contrastingly, there were eight states that lost population in this same 12 months.

This means that competition is intensifying in these states. As people move out there are fewer customers to buy what each business sells, so these companies have to fight harder, and price lower, to grow – or even maintain. As the population declines taxes have to go up because there are fewer taxpayers to cover government costs. These states become less desirable places for business.

The businesses in Illinois, for example, are in the middle of a bare-knuckle brawl over the state budget that has gone on for two years. The Governor and the legislature cannot agree on how to manage costs, or revenues. Bond ratings have been slashed as costs to borrow have gone up. Several services have been shut down, and student costs at universities have gone up while programs have been gutted or discontinued.

Governor Rauner (R – IL) has repeatedly said he wants Illinois to be more like Indiana, its neighbor to the east. Perversely people apparently are listening, because Illinois is shrinking, while Indiana grew a healthy 0.31%. For residents remaining in Illinois this worsens a host of maladies:

• the state’s jobs situation struggles as the number of paying jobs declines, making it harder to recruit new talent, or even keep its own university graduates;

• Illinois’ pension problems worsen, as there are fewer people paying into the pension funds while those drawing out funds keep increasing;

• Illinois is unable to fund schools properly, especially Chicago, due to less income – forcing up property taxes;

• taxes keep rising due to fewer people and businesses (when adding property taxes, sales taxes and income taxes Illinois is now the highest tax state in the country);

• new highways are being built with federal funds, but other infrastructure is in trouble, as city, county and state roads are pothole ridden. Trains and subways become outdated and fall into disrepair. And one-time budget Hail Mary’s, like Chicago selling its parking structures and meters in order to balance the budget for one year, strip citizens of future revenues while they watch parking (and other) service costs skyrocket;

• and Chicago has suffered the lowest real estate recovery rate of the top 30 major U.S. cities –not even returning to prices in 2008.

Growth solves a multitude of sins.

Just like a rising tide raises all boats, growth creates more growth. More people increases demand for everything, which increases business sales, which increases jobs and wages, which increases the value of real estate and household wealth, which increases tax revenue, which allows offering more services to make a state even more appealing.

On the other hand, shrinking can become like the whirlpool over a drain. As the problems increase more people decide to leave, making the problems worsen. As more people go, there are fewer people left behind to make things better. Jobs go away, wages fall, demand drops, real estate prices drop, infrastructure projects stop, services stop and yet taxes have to be raised on the fewer remaining residents.

Few trends are more important for planning than understanding demographics. Demographics affect demand for everything, and planning for changes offers businesses the opportunity to be in the right place, at the right time, to be more successful. And, demographic trends are some of the easiest to predict:

• population size

• average age, and sizes of age groups

• average income, and sizes of income groups

• ethnicity

• religion

Plans should be based on trends, not history. Understanding trends, and their trajectory, can help you be in the right market, at the right time, with the right product in order to succeed. There are lots of trends, but one that is fairly obvious, and incredibly important, is simply understanding demographics. Is this built into your planning system?

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Harvard Business Review Press

Harvard Business Review Press