by Adam Hartung | Jan 6, 2017 | Advertising, Innovation, Marketing, Mobile, Trends, Web/Tech

It’s been over a decade since the Internet transformed print media.

Very quickly the web’s ability to rapidly disseminate news, and articles, made newspapers and magazines obsolete. Along with their demise went the ability for advertisers to reach customers via print. What was once an “easy buy” for the auto or home section of a paper, or for magazines targeting your audience, simply disappeared. Due to very clear measuring tools, unlike print, Internet ads were far cheaper and more appealing to advertisers – so that’s where at least some of the money went.

In 2012 Google surpassed all print media in generating ad revenue. Source Statista courtesy of NewspaperDeathWatch.com

While this trend was easy enough to predict, few expected the unanticipated consequences.

1. First was the trend to automated ad buying. Instead of targeting the message to groups, programmatic buying tools started targeting individuals based upon how they navigated the web. The result was a trolling of web users, and ad placements in all kinds of crazy locations.

Heaven help the poor soul who looks for a credenza without turning off cookies. The next week every site that person visits, whether it be a news site, a sports site, a hobby site – anywhere that is ad supported – will be ringed with ads for credenzas. That these ads in no way connect to the content is completely lost. Like a hawker who won’t stop chasing you down the street to buy his bad watches, the web surfer can’t avoid the onslaught of ads for a product he may well not even want.

2. Which led to the next unanticipated consequence, the rising trend of bad – and even fake – journalism.

Now anybody, without any credentials, could create their own web site and begin publishing anything they want. The need for accuracy is no longer as important as the willingness to do whatever is necessary to obtain eyeballs. Learning how to “go viral” with click-bait keywords and phrases became more critical than fact checking. Because ads are bought by programs, the advertiser is no longer linked to the content or the publisher, leaving the world awash in an ocean of statements – some accurate and some not. Thus, what were once ads that supported noteworthy journals like the New York Times now support activistpost.com.

3. The next big trend is the continuing rise of paid entertainment sites that are displacing broadcast and cable TV.

Netflix is now spending $6 billion per year on original content. According to SymphonyAM’s measurement of viewership, which includes streaming as well as time-shifted viewing, Netflix had the no. 1 most viewed show (Orange is the New Black) and three of the top four most viewed shows in 2016.

Increasingly, purchased streaming services (Netflix, Hulu, et.al.) are displacing broadcast and cable, making it harder for advertisers to reach their audience on TV. As Barry Diller, founder of Fox Broadcasting, said at the Consumer Electronics Show, people who can afford it will buy content – and most people will be able to afford it as prices keep dropping. Soon traditional advertisers will “be advertising to people who can’t afford your goods.”

4. And, lastly, there is the trend away from radio.

Radio historically had an audience of people who listened to their favorite programming at home or in their car. But according to BuzzAngle that too is changing quickly. Today the trend is to streaming audio programming, which jumped 82.6% in 2016, while downloading songs and albums dropped 15-24%. With Apple, Amazon and Google all entering the market, streaming audio is rapidly displacing real-time radio.

Declining free content will affect all consumers and advertisers.

Thus, the assault on advertisers which began with the demise of print continues. This will impact all consumers, as free content increasingly declines. Because of these trends, users will have a lot more options, but simultaneously they will have to be much more aware of the source of their content, and actively involved in selecting what they read, listen to and view. They can’t rely on the platforms (Facebook, etc.) to manage their content. It will require each person select their sources.

Meanwhile, consumer goods companies and anyone who depends on advertising will have to change their success formulas due to these trends. Built-in audiences – ready made targets – are no longer a given. Costs of traditional advertising will go up, while its effectiveness will go down. As the old platforms (print, TV, radio) die off these companies will be forced to lean much, much heavier on social media (Facebook, Snapchat, etc.) and sites like YouTube as the new platforms to push their product message to potential customers.

There will be big losers, and winners, due to these trends.

These market shifts will favor those who aggressively commit early to new communications approaches, and learn how to succeed. Those who dally too long in the old approach will lose awareness, and eventually market share. Lack of ad buying scale benefits, which once greatly favored the very large consumer goods companies (Kraft, P&G, Nestle, Coke, McDonalds) means it will be harder for large players to hold onto dominance. Meanwhile, the easy access and low cost of new platforms means more opportunities will exist for small market disrupters to emerge and quickly grow.

And these trends will impact the fortunes of media and tech companies for investors The decline in print, radio and TV will continue, hurting companies in all three media. When Gannet tried to buy Tronc the banks balked at the price, killing the deal, fearing that forecasted revenues would not materialize.

Just as print distributors have died off, cable’s role as a programming distributor will decline as customers opt for bandwidth without buying programming. Thus trends put the growth prospects of companies such as Comcast and DirecTV/AT&T at peril, as well as their valuations.

Privatized content will benefit Netflix, Amazon and other original content creators. While traditionalists question the wisdom of spending so much on original content, it is clearly the trend and attracts customers. And these trends will benefit streaming services that deliver paid content, like Apple, Amazon and Google. It will benefit social media networks (Facebook and Alphabet) who provide the new platforms for reaching audiences.

Media has changed dramatically from the business it was in 2000. And that change is accelerating. It will impact everyone, because we all are consumers, altering what we consume and how we consume it. And it will change the role, placement and form of advertising as the platforms shift dramatically. So the question becomes, is your business (and your portfolio) ready?

by Adam Hartung | Dec 30, 2016 | Economy, Innovation, Leadership, Manufacturing

2016 was an election year, and Americans were inundated with talk. Unfortunately, a lot of it was pure hubris.

President-elect Donald Trump inspired people to “make America great again.” In doing so, he developed the theme that the reason America wasn’t so great had to do with too much work being done offshore, rather than onshore. And that there were far too many immigrants, which harmed the economy and the country. This became rather popular with a significant voting block, led in particular by white males – and within that group those lacking higher education. These people expressed, with their votes and with their words at many rallies, that they were economically depressed by America’s policies allowing work to be completed by people not born in America.

Oh, if it was only so simple.

Any time something is manufactured offshore there is a cost to supply the raw materials, often the equipment, and frequently the working capital. These are added costs, not incurred by U.S. manufacturing. The reason manufacturing jobs went offshore had everything to do with (1) Americans unwilling to work at jobs for the pay offered, and (2) an unwillingness for Americans to invest in their skill sets so they could do the work.

Although they are easy targets. Instead, those Americans should blame themselves for not knuckling down and working harder to make themselves more competitive.

Since the 1980s America has lost some five million manufacturing jobs (from about 17.5 million to 12.5million). That sounds terrible, until you realize that the amount of goods manufactured in America is near an all-time. While it may sound backwards, the honest truth is that automation has greatly improved the output of plant and equipment with less labor. between 1985 and 2009. As the Great Recession has abated, output is again back to all-time highs. It just doesn’t take nearly as many people as it once did.

But it does take much smarter, better trained people.

Manufacturing today isn’t about sweat shops. Not in the USA, and not in Mexico, China or India. The plants in all these countries are equally high-tech, sophisticated and automated. Just look at the images of workers at the Chinese Foxconn plants, or the Mexican auto parts plants, and you’ll see something that could just as easily be in the USA. The reality is that those plants are in those countries because the workers in those countries train themselves to be very productive, and they make great products at very high quality.

And don’t blame regulations and unions for creating offshoring.

For almost all U.S. companies, their offshore plants comply with the U.S. regulations. Most require the same level of safety and working conditions globally.

Union membership has been declining for 75 years. Fifty years ago one in three workers was in a union. Today, it’s less than one in 10. In 2015 the Bureau of Labor reported that only 6.7% of private sector workers were unionized – an all time modern era low. Unions are almost unimportant today. It hasn’t been union obstructionism that has driven jobs oversees – it’s largely been an inability to hire qualified workers.

Much was made the last few years of a lower labor participation rate. Many Trump followers said that the Obama administration was failing to create jobs, so people stayed home. But that simply was not true. While the economy was recovering, the unemployment rate fell to its lowest level since the super-heated economy of 2001. To find this low level of unemployment prior to that you have to go all the way back to 1970!

There are plenty of jobs. The issue is getting people trained to do the work.

And here is the real rub. You can’t sit home complaining and moping, you have to study hard and train. Before today’s level of computerization and automation, when work was a lot more manual, it didn’t matter how much education you had, nor how well you could read and do math and science. But today, work is not manual. It takes minimal manual skill to operate equipment. Today it takes computer programming skills, engineering skills and math skills.

The Organization for Economic Cooperation and Development (OECD) does an annual Program for International Student Assessment (PISA) study. This looks at test scores across the world to see where students fair best. Of course, economically displaced Americans are sure that Americans are at the top of these test results – because it is easy to assume so.

Americans are in the bottom half of the planet’s educational performance .

The 2015 results are here, and in reading, science and math America doesn’t even crack the top 10. In fact, the poorest 10% of Vietnamese students did better than the average American teen. In all three categories, the USA scored below the global average. American’s are not above average – they are now below average.

American’s have simply gotten lazy. For far too long, when somebody did poorly Americans have blamed the teacher, blamed the test, blamed the “system” — blamed everyone and everything except the person themselves. It has become unacceptable to tell someone they are doing a below-average job. It is unacceptable to tell someone their skills don’t match up to the needs of the job. Instead,

Instead of forcing people to work hard – really hard – and expecting that each and every person will work hard to compete in a global economy – just to keep up – the expectation has developed that hard work is not necessary, and everyone should do really well. Instead of thinking that hard mental effort, ongoing education and additional training are the minimal acceptable standards to maintaining a job, it is expected that high paying jobs should just be there for everyone – even if they lack the skills to perform. American no longer want to admit that someone is being outperformed.

In 1988 Nike set the company on a growth trajectory with their trademarked phrase “Just Do It.” Just get up off the couch and do it. Quit complaining about being out of shape – just do it.

And that’s my wish for America in 2017. Quit blaming foreigners for working harder at school than we do. Quit blaming immigrants for being better trained, and harder working, than Americans. Quit pretending like the problem with the labor participation rate is some kind of problem created by the government. Quit finger-pointing and blaming someone else for being better than us.

Instead, get up off the couch and do it. Go back to school and study hard – harder than the competition. Grades matter. Learn geometry, trigonometry and calculus so you can make things – or operate equipment that makes things. Gain some engineering skills so you can learn to program, in order to improve productivity with a mobile device – or even a personal computer. Become facile in more than one language so you can operate and compete in a global economy.

Hey Americans, instead of blaming everyone else for workers lacking a job, or a higher income, quit talking about the problems. If you want to “make America great again” quit complaining and just do it.

by Adam Hartung | Dec 23, 2016 | Advertising, Marketing, Trends, Web/Tech

‘Tis the season of holiday giving. We hunt for just the right gift, for just the right person, to make sure they know we care about them. This act of matching a gift to the person has tremendous importance, because it demonstrates care from the giver about the recipient.

Once advertising was like that. Marketers built brands with loving care. They worked very hard to know the target for their brand (and product) and they carefully crafted every nuance of the brand – imagery, typography, colors, images, sounds – even spokespeople (famous or created) to project that brand properly for the intended customers. We’ve seen great brand images over time, from Tony the Tiger promoting cereal to start your day to Ronald McDonald bringing a family together.

SAUL LOEB/AFP/Getty Images

Ad placement delivered the brand’s gift to the customer.

And, once upon a time, how that brand was placed in front of targeted customers was every bit as crafted as the brand itself. Marketers worked with ad agencies to make sure newspaper, magazine, billboard location, radio show or TV program matched the brand. The brand was considered linked not just to the medium, but to the message that medium projected. Want to sell a muscle car, you promoted it via media focused on sports, DIY projects, men’s health – a positive connection between the media’s message/content and the advertiser’s goal for the brand.

And marketers knew that if they put their brand with the right media content, in front of their targets, it would lead to brand identification, brand enhancement, and sales growth. The objective wasn’t how many people saw the ads, but putting the ad in front of the right people, associated with the right content, to build on the brand’s value, and make the products more appealing to target buyers. Placement led to sales.

Just like finding the right gift is important for the holidays, matching the gift to the recipient, finding the right ad placement was very important to the customer. It was an act of diligence on the part of the advertiser to demonstrate to target customers “hey, I know you. I get where you’re coming from. I connect with you.”

Then the internet changed everything.

In the old days marketers really didn’t know how many people connected with their ads post-placement. There were raw numbers on readers/listeners/viewers, but nothing specific. There was a lot of trust by the marketer that “owned” brand placed in working with the ad agencies to link the brand to the right media – the right content – so that brand would flourish and product sales would grow.

Yes, ads were measured for their appeal, how well they were remembered and audience coverage. But these metrics, and especially raw volume numbers, were each just one piece of how to craft the brand and deliver the message. It was reaching the right people that mattered, and that required people to make media decisions – and that required really knowing the content tied to the ad being placed.

Marketers clearly understood that customers knew the product paid for those ads to promote that content. Customers linked the brand and the content, and thus it was important to make sure they matched. The content had to be right for the ad to have its intended affect.

But in the internet age, all that caring about customers, branding and links to the right content began disappearing. Instead, ad decisions were dominated by metrics – “how many placements did my ad receive?” “how many people saw my ad?” “how many people clicked on my ad?” “how many page views does this web site generate?” “how many page views does this writer/blogger generate?” The brand was being lost – the customer was being lost – in identifying how many people saw the ad, and whether or not they clicked on it, and where they went after the ad was presented on the web page.

And, the worst of all, “Do we have the information to know who this internet surfer is, follow them, and deliver ads to them as they cross pages and web sites?” At this point, content no longer mattered. If some page viewer was known to be looking for a desk, ads for desks would be placed on page after page the reader (potential customer) visited — regardless the content!

Marketers allowed their brands to be disconnected from the content entirely – ouch.

In the era of programmatic ad buying, content no longer matters. Follow the target, hammer on them with ads, even if the brand is positioned first next to information on weather, and next on a site about buying inexpensive baby clothes, and next on a site about high end power tools.

The care and crafting of ad buying, which was crucial to brand building and demonstrating customers really mattered to those who created and crafted the products, and brand, was lost.

In 2016, we saw the ultimate in forgetting brand value while programmatically placing ads. “Fake news” emerged. And marketers started to see their ads next to those fake (often invented and totally false) stories, just like they would be placed next to legitimate information. The breakdown between content and brand was complete. In the unbridled pursuit of “eyeballs” brands were paying for the worst any media could offer – not journalism or legitimate content, but outright crap.

The election served to demonstrate this in an entirely new way. People went to websites, formerly considered “fringe,” such as Breitbart, to find out information on candidates and their supporters. And there would be ads. The ad was following the eyeballs, no longer the content. Family product ads, such as for cereal, were suddenly appearing next to content that was in no way associated with the marketer’s goal for that brand image.

And by being content independent, these programmatic ads were not just harming the brands – they supported bad journalism, and bad content.

“Click bait” became ever more important. With no people involved in ad buying, ads were no longer were tied to content so there was no “editorial” management of how the ad was placed. What those smart ad buyers once did, helping to build the brand, was lost. Now, any writer who could figure out how to use the right key words – and often outrageous content (of any kind) – was able to pull eyeballs. If s/he could pull eyeballs – regardless of the content – they pulled ads. And that pulled dollars.

Media brand value was dramatically lost – and journalism suffered.

In other words, you no longer needed the credibility of a brand like NBC, Wall Street Journal, ESPN, Forbes, etc. to obtain ads. Those old media brands worked hard to make edited content, reliable content, available to readers – and something a brand marketer could understand and use to build her customer base. But now all a publisher/producer needed was something that brought in eyeballs – and often the more outrageous, more salacious, more demeaning, more hostile, more ridiculous the content the more eyeballs were attracted (like watching a train wreck).

And the more this pulled ad money to non-journalistic, bad content, and away from legitimate content providers that focused on building their brand, the more it hurt journalism and marketing. What a decade ago seemed like a possible fear came true in 2016. Unharnessed media access by everyone was proven to lead to the growth of bad journalism as funds for good research, writing, editing and masthead curating was lost to those who demonstrated merely the ability to pull eyeballs.

Those who have benefited from this shift think programmatic ad buying is great. To them if people want to read from their site, look at their photos, cartoons and other images, or watch videos then these site owners claim there is no reason that advertisers should complain. “If people want this content, then why shouldn’t we be paid to create it. This is a monetized democracy of the media putting the customer in control.”

But that is simply not true. Customers link the brand message to the content on the screen. And there should be care taken to make sure that content and the brand message link. And that’s where programmatic ad buying is failing everyone.

Net/net, we need people involved in ad placement. Just as we care about the gifts we give at holidays, it takes a personal touch to make that selection work. It takes people to craft the delivery of ads.

Hopefully in 2017, the lessons of 2016 will become very clear, causing marketers and advertisers to rely far less on programmatic, and get people involved in ad placement once again. For the good of brands and for decent content.

Happy Holidays!

by Adam Hartung | Dec 17, 2016 | Defend & Extend, Investing, Retail, Trends

Sears recently announced it is closing another big batch of stores. Yawn. Who cares? Sears losses since 2010 are nearly $10 billion, with a $.75 billion loss in just the third quarter. As revenue fell another 13% overall and comparable store sales declined 7.4% investors have fled the stock for years.

Five years ago Sears had 3,510 stores. Now it has 1,687. It has 750 with leases expiring in the next five years and CFO Jason Hollar has said 550 of those are short-term enough they will let those close.

What’s striking about this statement is that Sears is a perfect candidate to file bankruptcy, renegotiate those leases, and start with a new plan for the future. Unless it has no plan. Lacking a plan to make its business successful and return those stores to profitability, the CFO is admitting the company has no choice but to keep shrinking assets as Sears simply disappears. Investors should view Sears as a microcosm of trends in traditional brick-and-mortar retailing across the industry. The business is shrinking. Fast

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

Just look at retail employment. Amidst another strong jobs report for November, retail employment actually shrank. This previously only happened in recessions – and 2016 is definitely not a recession year. And all the losses were in traditional store retailing. Kohl’s said it is hiring almost 13% fewer seasonal workers, and Macy’s says it is hiring 2.4% fewer.

Of course, Amazon seasonal hiring is up 20%.

In January, 2015 I wrote how the trend to e-commerce had taken hold, and traditional retailing would never again be the same. For the 2014 holiday season online retail grew 17%, but brick-and-mortar sales actually declined. This was a pivotal event. It clearly indicated a sea change in the marketplace, and it was clear valuations would be shifting accordingly. Surprising many, but not those who really understood the trends and market shifts, six months later (July, 2015) Amazon’s market cap exceeded that of much larger Wal-Mart.

ALL trends (including mobile use) reinforce on-line growth, brick and mortar decline.

The 2016 holiday season is further reinforcing this trend. The National Retail Federation reported that on black Friday 99 million people went to stores. 108.5million shopped online. Black Friday online sales jumped 21.6%.

And this . E-commerce apps are making the on-line experience constantly better. On Thanksgiving day 70% of all on-line retail traffic was mobile, and for the first time ever 53% of on-line orders were from mobile devices – exceeding the orders placed on PCs. With this kind of access, and easy shopping, the need to travel to physical stores accelerates their decline.

Sears is beyond rescue. Unfortunately, there are a number of retailers already so challenged by the on-line competition that they are “the walking dead.” They will falter, and fail, just like the former Dow Jones Industrial retailing giant. They will not make the shift to on-line effectively. They are unwilling to dramatically change their business model, unwilling to cannibalize store sales to create an aggressively competitive on-line business. Expect bad things at JCPenney, Kohl’s, Pier 1 – and weakness at giants Wal-Mart and even Target.

Christmas used to be the time when investors in traditional retail cheered. Results for the quarter could create great gains in stock values. But that time is long gone – passed during the 2014 inflection when traditional started declining while e-commerce continued double digit growth. One can understand the Scrooge-like mentality of those investors, who dread seeing the shift in customers, and valuation, away from their companies and toward the Amazon’s who embrace trends and market shifts.

by Adam Hartung | Dec 6, 2016 | Disruptions, Innovation, Investing, Leadership, Retail

(Photo by Spencer Platt/Getty Images)

But, is it right to hand-wring over Schultz’s departure as CEO? After all, things have not been pretty for investors since Mr. Jobs turned over Apple to his hand-picked successor Tim Cook. However, could this change mean something better is in store for shareholders?

First, let’s address the very – and Starbucks was saved only by Mr. Schultz returning with his tremendous creativity and servant leadership. While it is great propaganda for making the Schultz as hero story more appealing, it isn’t exactly accurate.

Starting in 1982, Howard Schultz built Starbucks from four stores to over 2,800 (and over $2 billion revenue) in 16 years. That was a tremendous success. And he is to be lauded. But when he left,

Starbucks had only 35o stores outside the USA. It was an American phenomenon, a place to buy and drink coffee, with every store company owned, every employee company trained, and not an ounce of variability in the business model. Not exactly diversified. At the time, the stock traded for roughly (split adjusted) $4 per share.

His successor, Orin Smith, far outperformed Mr. Schultz, more than tripling the chain to over 9,000 stores and expanding revenue to over $5 billion in just four years! He expanded the original model internationally, began adding many new varieties of coffee and other drinks, and even added food. These enhancements were tremendously successful at bringing in additional revenue, even if the average store revenue fell as smaller stores were added in places like airports, hotels and entertainment venues.

In 2005, Jim Donald replaced Mr. Smith. By 2007 (in just teo years) he added a staggering additional 4,000 stores. He expanded the menu. And he even branched out to selling branded Starbucks coffee on airplanes, in hotels and even retailed in grocery stores. Further, he launched a successful international coffee liqueur under the Starbucks brand. And he moved the company into entertainment, creating an artist representation company and even producing movies (Akeelah and the Bee) which won multiple awards.

In 2007 Starbucks fourth quarter saw 22% revenue increase, and for the year 21% growth. Comparable store sales grew 5%. International margins expanded, and net earnings grew over 19% from $564 million to $673 million.

Starbucks’ stock, from 2000 when Mr. Schultz departed into 2006 rose 375%, from $4 to just under $19 per share. Not the ruination that some seem to think was happening.

But Mr. Schultz did not like the diversification, even if it produced more revenue and profit. He joined the chorus of analysts that beat down the P/E ratio, and the stock price, as the company expanded beyond its “core” coffee store business.

When the Great Recession hit, and people realized they could live without $4 per cup of coffee and a $50 per day habit, revenues plummeted, as they did for many restaurants and retailers. Mr. Schultz seized the opportunity to return to his old job as CEO. That the downturn in Starbucks had far more to do with the greatest economic debacle since the 1930s was overlooked as Mr. Schultz blamed everything on the previous CEO and his leadership team – firing them all.

Since 2012 Starbucks has returned to doing what it did prior to 2000 – opening more stores. Growing from 17,000 to 25,000 stores. Refocused on its very easy to understand, if dated, business model analysts loved the simpler company and bid up the P/E to over 30 – creating a trough (2008) to peak (2016) increase in adjusted stock price from $4 to $60 – an incredible 15 times!

But, more realistically one should compare the price today to that of 2006, before the entire market crashed and analysts turned negative on the profitable Starbucks diversification and business model expansion. That gain is a more modest 300% – basically a tripling over a decade – far less a gain for investors than happened under the 2000-2006 era of Mr. Schultz’s successors.

Mr. Schultz succeeded in returning Starbucks to its “core.” But now he’s leaving a much more vulnerable company. As my fellow Forbes contributor Richard Kestenbaum has noted, retail success requires innovation. Starbucks is now almost everywhere, leaving little room for new store expansion. Yet it has abandoned other revenue opportunities pioneered under Messrs. Smith and Donald. And competition has expanded dramatically – both via direct coffee store competitors and the emergence of new gathering spots like smoothie stores, tech stores and fast casual restaurants that are attracting people away from a coffee addiction.

At some point Starbucks and its competition will saturate the market. And tastes will change. And when that happens, growth will be a lot harder to find. As McDonald’s and WalMart have learned, . Exciting new competitors emerge, like Starbucks once was, and Amazon.com is increasingly today.

Mr. Schultz has said he is vastly more confident in this change of leadership than he was the last time he left – largely because he feels this hand-picked team (as if he didn’t pick the last team, by the way) will continue to remain tightly focused on defending and extending Starbucks “core” business. This approach sounds all too familiar – like Jobs selection of Cook – and the risks for investors are great.

A focus on the core has real limits. Diminishing returns do apply. And P/E compression (from the very high 30+ today) could cause Starbucks to lose any investor upside, possibly even cause the stock to decline. If Mr. Schultz’s departure was opening the door for more innovation, new business expansion and a change to new trends that sparked growth one could possibly be excited. But there is real reason for concern – just as happened at Apple.

by Adam Hartung | Nov 11, 2016 | Economy, Election, Investing

Traders work on the floor of the NYSE the morning after Donald Trump

won a major upset in the presidential election. (Photo by Spencer Platt/Getty Images)

Since election day there has been an enormous shift in the U.S. stock market. The Dow (Dow Jones Industrial Average – DJIA) has hit new highs. But simultaneously the NASDAQ 100 is falling. In short, most tech stocks have been creamed, while out-of-favor laggards have been bid up.

I 100% favor long-term investing. Anyone who tries to be a trader, or otherwise time the markets, is most likely going to get burned. If you want to share in the growth of America’s economy the best way is to buy stocks in good, growing companies and hold them a long time. As Warren Buffett said after the election, the American economy will be bigger, and stocks will be worth more, in 10, 20, 30 years regardless who is president.

Traders make decisions on the smallest bit of information. Often information that is nothing more than an unproven thought. Looking into the future they try to have a crystal ball, but they rarely use trend information and often use guesses.

So, after the election,

the trader theory goes that tech companies will be burned. Trump apparently

doesn’t use a computer, so he doesn’t use the Internet. And he doesn’t actually tweet, or use social media, he just blurts things out and someone else enters the blurts. So his lack of interest in technology is bad for tech companies. Further, his trade policies will create havoc with tech company supply chains that rely on manufacturing across Asia, and much on China, dramatically raising costs. Additionally these policies will cause foreign markets to purchase less tech products, damaging tech sales.

As a result, rapidly, big, successful tech stocks have been massacred:

Apple from $118 to $107, a drop of 9%

Facebook from $133 to $116, a drop of 13%

Netflix from $128 to $115, a drop of 10%

Google from $815 to $755, a drop of 7%

Amazon from $840 to $730, a drop of 13%

Yet, nothing has happened. These companies are still doing exactly the same thing they did a month ago. Apple is still the no. 1 maker and seller of mobile devices. Facebook still dominates social media, has a huge lead in social media advertising, and continues to launch additional functionality to make its site sticky for users. Netflix is still the leader in streaming and developing new original content outside of networks. Google is still the king of search and no. 1 in search advertising. And Amazon still leads all competitors in online commerce, and will have another great holiday season the next six weeks.

None of these businesses have been destroyed by the election. And the trends that drove their long-term growth remain in place. People will continue to use mobile devices for more applications, turn to social media for communicating with friends and finding information, download movies and other shows via the web, search for answers to most of their questions via search engines and buy more and more stuff online. These trends will not change, as there is pretty much no way Donald Trump or Congress can stop them.

Meanwhile, valuations of long-time laggard companies are suddenly hitting new highs. Somehow the trend to globalization will be ended, budget problems will be immediately resolved leading to greater spending capability by Congress and concerns about long-term debt build-up will disappear encouraging massive new investments in traditional infrastructure like roads and bridges. New trends will suddenly emerge that will return the basics of the U.S. economy, the sector balances, to something akin to 1984.

Thus, traders have bid up prices of old-line manufacturers. Despite exiting financial services as well as its oil and gas business, making GE much smaller than it was a decade ago, GE has jumped from $28.25 to $30.50, a gain of 8%. Caterpillar Tractor has had five straight years of revenue declines, yet it also rose from $28.25 to $30.50 for a similar 8% gain.

Remarkably GE’s P/E (price/earnings multiple) is now 24! Cat’s is an even more remarkable 53! Companies that rely on manufacturing are being priced like tech stocks – or even greater! Apple’s P/E has fallento 13, Google’s is 27 (about the same as GE) and Facebook’s P/E of 46 is lower than Caterpillar’s.

Really? In one day major, global trends have reversed course, steering the economy back to the days when Jack Welch ran GE, and Caterpillar was selling gear to a booming U.S. forestry business as well as massive volumes to China and India for building their fledgling infrastructures? People will stop buying smartphones and give up their reliance on the internet for a vast array of daily tasks? And droves of young workers trained for tech jobs are going to staff up a massive rebuilding of U.S. manufacturing plants? Displaced workers, trained on equipment now wildly antiquated and uneconomic, will be retrained overnight to operate plants with far fewer employees and lots more high-tech equipment? And boomers will quit retiring and undertake retraining – not for tech jobs but for manufacturing or equipment operator jobs?

Don’t diminish the power of a president. And don’t diminish how structural changes in tax codes, military spending and international relations can alter course. But, simultaneously, don’t diminish the power of trends.

Trends propel forward, and take people to greater productivity and a higher quality of life. All those people who voted for Donald Trump are not tech avoiders. They are mobile, socially active people who are as linked to the trends as everyone who voted for Hillary Clinton. They don’t want to return to a pre-information economy lacking in technology that has made their lives better. They still want technology in their lives, and they want that technology to become better, faster and cheaper.

And no manufacturer is going to go back to labor-intensive manufacturing. Whether they make things in the U.S. or offshore, state-of-the-art equipment means manufacturing simply uses fewer people. And the growth of e-commerce will not stop, thus continuing the trend of declining demand for retail workers. These trends may alter slightly due to tax and trade policies, but they won’t reverse.

Smart investors don’t lose sight of long-term trends. They invest in companies where the opportunity exists to grow revenues and profits because demand for those company’s products and innovations are growing. With shares of the technology leaders beaten down, one should really consider if this is a time to sell, or buy. And with shares of companies that have terrible growth records, and stagnated earnings, bid up to extraordinarily high P/E multiples one should consider if this is the time to buy or sell.

by Adam Hartung | Nov 7, 2016 | Advertising, Election, Marketing

Republican presidential nominee Donald Trump debates Democratic presidential nominee Hillary Clinton during the third presidential debate. (Mark Ralston/Pool via AP)

Whoever wins tomorrow’s election, their success will have a lot to do with how they marketed their campaign. And in many ways, selling a candidate is not different from selling anything else.

Do you remember the “four Ps of marketing” from Marketing 101? They are product, price, place and promotion. Every newbie is taught not to overly rely on any one, and greatest success comes from a well planned use of all four.

Product: The candidates are about the same age and health. And while they represent very different parties, both have spent less time talking about what a great president they would be, and a lot more on what a terrible product the other candidate is. Message after message has denigrated the other, to the point where we hear most of the electorate is now less than happy with both.

Most marketers know that negative marketing is risky, because it tends to tar all products with similar negatives. Greatest sales happen when you convince people your product is superior in its own right – not just compared to alternatives. Barack Obama figured this out in both previous elections, and he was able to convince the majority of people he would be a good president. Unfortunately, in this election the competitive attacks have cancelled each other out, and neither candidate has a majority of people liking them. An opportunity lost by both candidates to make their product more appealing, and thus bringing out more people to vote for them based on policies and the core of how their presidency would make voters happy.

Price: One could say that the tax policies of Hillary Clinton make her a more expensive candidate than Donald Trump. However, the long-term cost of the debt increase from Trump means that the price of his presidency will be costlier than Clinton. Let’s just be practical and say that neither candidate has positioned themselves as the candidate better for everyone’s pocketbook.

Again, an opportunity lost. Ronald Reagan did a superb job of positioning himself as being good for people’s pocketbooks, and it helped him unseat Jimmy Carter. Barack Obama made hay out of the economic crisis as Republican George Bush left office, helping him convince voters that he would be far better for their pocketbooks – via job creation – than his opponent.

Place: This is all about “get out the vote.” Here the advantage clearly goes to Clinton. Candidate Clinton has done a superb job of building a “machine” that has turned out a record number of Democrats to early vote. And she has worked diligently with her party to make sure local support exists across the country to help take people to the polls, and encourage voting on election day. By making sure her constituents make it to vote, she will likely do far better at collecting votes than her opponent.

Additionally, candidate Clinton is not only campaigning, but she has a two former presidents campaigning for her, a sitting first lady, a sitting vice president and her key opponent from the primaries. This breadth of support, canvasing across multiple states, further puts her message into voters ears right before the election, and encourages people to go vote for her tomorrow. Her large fundraising, and ability to offer funds to down-ticket candidates, has helped make sure her message was clear at the local level.

On the other hand, candidate Trump is walking a nearly singular path, with precious little party support. While he swept the primaries, he has not built a strong machine to make sure that those beyond the party faithful – those who are undecided or independent – are going to make it to the voting booth to help him be elected. It is one thing to excite people about your product, it is another to make sure people actually invest the resources to obtain it.

In Trump’s case the advertising has been relentless, but the local machine support to turn out registered party voters, and everyone else who might enjoy his candidacy, is quite weak. One reason candidate Trump keeps saying the election is “rigged” is because he’s now realizing he failed to put in place the distribution system to get his voters to the ballot box.

Further, those who are helping candidate Trump secure his message are few and far between. Outside of family members there are few making the case to get out the vote. Despite two living former Republican presidents and one vice president available, none is helping him be elected. Likewise, despite a large number of primary opponents, most of which pledged their support for whoever won the primary, there is only one (Chris Christie) that has been a notable advocate for candidate Trump.

And the party itself has not been mobilized to get out the vote for candidate Trump. His personal wealth has allowed Trump to implement a credible campaign. But his inability, or unwillingness, to raise lots of money to invest in down-ticket races has meant he has not garnered support from other candidates running for Congress, Senate, governorships, etc. to promote his message at a more local level.

For months we have been inundated with polls. But on election day it is not someone calling your house to hear for whom you might vote. Rather, people have to leave their houses, make time in their busy days and go to the election booth – then stand in line and vote. Mr. Trump has not done the sort of job one would expect for building the support necessary to make sure voters turn out for him.

Promotion: This might be where the two marketing programs most differ.

Candidate Trump has relied on advertising. Years ago marketing programs often relied on huge ad budgets to build a brand. Companies quickly learned that if you spent a lot on advertising you could drown out a competitive message, and bring your brand to the forefront. Simply on the basis of a big ad spend, heavily reliant on television, success was once possible. And the Trump campaign has used advertising like a soap company launching a new brand. Lots and lots and lots of advertising.

Notably, there has been little use of digital, internet and mobile advertising. Little use of social media to build trends and increase brand effectiveness. The candidate himself has gone almost entirely against modern thinking about social, mobile and internet marketing by unleashing tweets which have been simultaneously shocking, and often opposed to the brand message the advertising set out to create. While entertaining, this has not met even the minimum standards of modern marketing.

Candidate Clinton has matched candidate Trump in television and other traditional media advertising. Thus, her candidacy has not been overwhelmed by competitive spending While most people are likely tired of the ads from both candidates, it is clear that when it comes to traditional ad programs Clinton’s marketing has met the competitive level necessary to neutralize any possible Trump advantage.

But internet, mobile and social marketing has been much more successful for Clinton. Barack Obama did a splendid job of using these tools to mobilize young and minority voters in previous elections. This sort of marketing often touches people much closer, and has a greater “one-on-one” appeal, even if it is a modified “one-to-many.” And the Clinton campaign has lifted those guidelines, perhaps not as effectively as the Obama campaigns, to convert Sanders constituents to her as well as independents and undecideds.

The Trump campaign relied almost wholly on advertising, and an effort at achieving greater public relations via outrageous messaging. This has kept the candidate squarely in the public eye. But every marketer will tell you that it is not possible to build high commitment for your product with advertising alone. It takes an ability to touch people on a more personal, closer to home basis. It is critical now, more than for many years, to create identification with local issues within the home and workplace, and often reinforce social relationships.

At this, the Trump campaign has been out of step with modern marketing, and overly reliant on tools that were more effective in the ’80s and ’90s. Thus his appeal outside of European heritage, Christian, white and mostly male voter groups has struggled.

The Clinton campaign’s use of these tools has spread her base considerably wider. She has been able to connect with minorities, women, people of color, people of different religions and other groups much more effectively. In tune with demographic trends in America, this greatly enhances her opportunity to obtain the largest share of market. Tied to a superior placement campaign (to get out the vote,) this use of modern tools gives her a significant advantage.

These two campaigns have lessons for all business leaders. Too often we rely on product alone to think we will succeed. But product is only part of successfully luring buyers. You also have to make sure your product is in the right place, accessible to the most people, at time of purchase.

And today budget is only a part of good promotion, because effective use of social, mobile and internet marketing tools can help you connect with your targets more closely, and more personally. New promotion tools can expand your base, identify new target markets, develop strengths in niche groups and achieve greater loyalty at lower cost.

In history, there are almost no great campaigns that were won just because a product was superior. Nor because a product was cheaper. And despite some great ad lines (“Where’s the beef?” or “Plop, plop, fizz, fizz oh what a relief it is”) advertising has limited ability to actually make a product successful. Those that win build a marketing program using all four Ps most effectively to build on trends and excite customers.

by Adam Hartung | Oct 21, 2016 | Boards of Directors, Finance, Investing

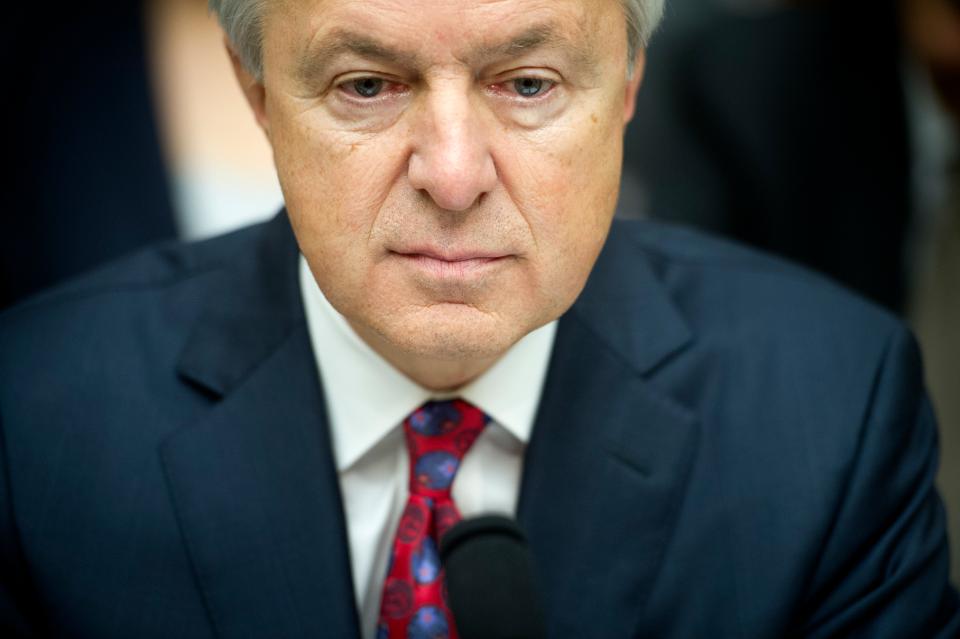

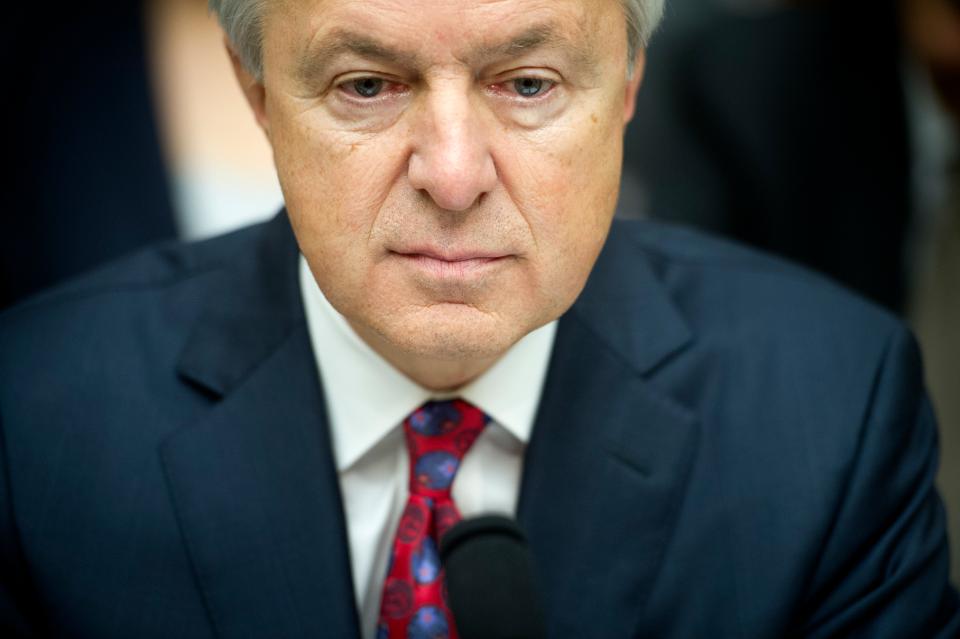

(AP Photo/Cliff Owen, File)

Wells Fargo’s CEO John Stumpf resigned last week. This week he also resigned from the boards of directors at Chevron and Target. For those two roles he was being paid something like $650,000 per year. The interesting question is, why was he on those boards at all? Wasn’t being the CEO and on the board at one of America’s biggest banks a full-time job? After all, he was paid $19.3 million in both 2015 and 2014. You would not have thought he needed a side job to make ends meet.

Which leads to the question, are America’s boards of directors actually staffed with the right people? Ostensibly the board is responsible for governing the corporation. Directors are responsible to insure management makes the right decisions for the long-term best interests of shareholders. And legislators’ have passed multiple laws, such as Sarbanes-Oxley and Dodd-Frank, to allow the regulators, primarily at the SEC (Securities and Exchange Commission), to put real teeth (and enforcement) into directors’ responsibilities.

According to the National Association of Corporate Directors (NACD) a sitting director should do a minimum of 200 hours of work on a board every year. For larger companies committee requirements on top of general board work could easily push this to nearly 300 hours. Thus, Mr. Stumpf should have been doing at least 500 hours of work for Chevron and Target – about 12.5 weeks, or three months. Do you think he actually spent this much time on these roles, given his full time job at Wells Fargo?

This also means that Mr. Stumpf only had nine months to actually work as CEO of Wells Fargo. Maybe that was why he was so unaware of the unethical behavior at the company he led? Why would a board think it is acceptable for a CEO to work only three-fourths of the year? Not many employees have the opportunity to draw full compensation yet take off so much time.

Either Mr. Stumpf wasn’t paying enough attention to Wells Fargo, or he wasn’t paying enough attention to Chevron and Target. Yet, he was being paid very, very handsomely for all those roles. How is that good governance for any one of the three companies?

CEOs serving on additional boards is a bit like electing a governor, who is paid to run the state, and then hearing that the governor is simultaneously going to do part time work for a company or perhaps an agency of a different state. Would any state accept that their governor, state CEO, be allowed to spend three months of every year working side jobs that have nothing to do with being governor? Yet, corporate CEOs regularly take on director roles for other corporations – which in no way benefits their company’s employees, or shareholders. Why?

Further, boards are dominated by sitting or former CEOs. Why? The world moves fast toda, and there are a wealth of skills boards need to effectively govern – far beyond having a room full of CEOs. IT skills, cyber security skills, social media skills, marketing and advertising skills, branding skills, global market skills, intellectual property skills – there is a long list of skills which would greatly improve board diversity, and thereby a board’s ability to govern effectively. So why is hiring so biased toward CEOs? NACD has been asking the same question as it promotes diversity in the boardroom.

Yet, there is one group that is making hay with all that board pay. Former regulators and members of Congress. These people are required to register if they become lobbyists, and they are forced to wait a year, or more, before they can do work for government contractors. But there is nothing which stops them from joining a board of directors.

There is nothing about being a Congressman or Senator which prepares these people for corporate governance, yet this is common practice as corporations seek ways to find influence without breaking the law. But is it worthwhile to investors to have directors that were prominent in government, but perhaps lacking competency for today’s fast-paced business world? Should a directorship and the compensation be a reward for previous government work – or should it be a position of great importance looking out for the interest of the corporation?

There are currently 64 former members of Congress serving on corporate boards. According to a Harvard and Boston University study, 44% of Senators, and 11% of Congress members have landed corporate board directorships since 1992. Their average compensation, per board, is $350,000. Much better than being in Congress. Especially for a part-time job.

Former Speaker John Boehner and famous cigarette smoker, just joined the tobacco company Reynolds America board – although that may be short-lived as British American Tobacco has offered to acquire Reynolds. Former Majority leader Eric Cantor, who was up for the Speaker job when losing his last election, is now on the board of a Wall Street firm, where he earned $2 million in 2015 for bringing in new business – making him the highest paid director in this group. Former Majority Leader Dick Gephardt has accumulated $10.8 million in director compensation since retiring from Congress in 2005.

Tom Ridge, who was a governor, house member and secretary of Homeland Security – but never a businessperson – raked in $1.4 million in director compensation last year. Even former Congressman and subsequently Secretary of Defense and director of the CIA Leon Panetta made almost $600,000 in director comp last year. These fellows are obviously well connected to government leaders, but do they have a clue about how to effectively implement regulations for corporate audit, compensation or nominating and governance committee roles? Are they hired to apply good governance for investors, or to be rainmakers for the company? Or just to give them a good retirement plan?

Boards exist to protect the rights of shareholders. But do they? The issues at Wells Fargo are an example of how ineffective a board can be at oversight, given that serious problems lasted there for at least five years, and whistle-blowers were terminated for specious reasons. And the Wells board paid the CEO almost $20 million per year, while letting him work a quarter or more of each year as a director for other companies. Hard to see how those directors were doing their job.

When companies do poorly employees, investors and analysts will ask “where was the board?” Increasingly it is clear that more should be asking “who is on the board?” Boards should not be stacked with folks that have lofty titles from previous positions, but which are irrelevant to the needs of that corporation and frequently lacking the qualifications to govern effectively. Target’s investors, for example, probably would have benefited far more by a director that understood networks and cyber crime than paying Mr. Stumpf for his part-time assistance away from Wells Fargo. And with oil prices at generational lows, how did Mr. Stumpf help Chevron prepare for a new world of lower oil demand and greater supplier anxiety in the Middle East?

Sarbanes-Oxley was passed after the outrage that occurred at Enron, where the company completely failed and yet the board said it had no idea of the company’s problems. When America’s financial services industry nearly melted down Dodd-Frank was passed to put more onus on directors to understand the financials and compensation practices of their companies. But, it will most likely take yet more legislation, and more regulation, if investors are to be protected by truly independent directors that are the right people, in the right job, and feel accountable for management oversight and company outcomes.

by Adam Hartung | Oct 13, 2016 | Boards of Directors, Ethics, Finance, Investing, Leadership

SAUL LOEB/AFP/Getty Images

Everyone knows what happened at Wells Fargo. For many years, possibly as far back as 2005, Wells Fargo leaders pushed employees to “cross-sell” products, like high profit credit cards, to customers. Eventually the company bragged it had an industry leading 6.7 products sold to every customer household. However, we now know that some two million of these accounts were fakes – created by employees to meet aggressive sales goals. And, unfortunately, costing unsuspecting customers quite a lot of fees.

We also know that Wells Fargo leadership knew about this practice for at least five years – and agreed to a $190 million fine. And the company apparently fired 5,300

Which begs the obvious question – if management knew this was happening, why did it continue for at least five years?

Let’s face it, if you owned a restaurant and you knew waiters were adding extras onto the bill, or tip, you would not only fire those waiters, but put in place procedures to stop the practice. But in this case we know that management at Wells Fargo was receiving big bonuses based upon this employee behavior. So they allowed it to continue, perhaps with a gloss of disdain, in order for the execs to make more money.

This is the modern, high-tech financial services industry version of putting employees in known dangerous jobs, like picking coal, in order to make more profit. A lot less bloody, for sure, but no less condemnable. Management was pushing employees to skirt the law, while wearing a fig-leaf of protection.

Ignorance is not excuse – especially for a well-paid CEO.

CEO Stumpf’s testified to Congress that he didn’t know the details of what was happening at the lower levels of his bank. He didn’t know bankers were expected to make 100 sales calls per day. When asked about how sales goals were implemented, he responded to Representative Keith Ellison “Congressman, I don’t know that level of detail.”

Really? Sounds amazingly like Bernie Ebbers at Worldcom. Or Jeff Skilling and Ken Lay at Enron. Men making millions of dollars from illegal activities, but claiming they were ignorant of what their own companies were doing. And if they didn’t know, there was no way the board of directors could know, so don’t blame them either.

Does anyone remember how Congress reacted to those please of ignorance? “No more.” Quickly the Sarbanes-Oxley act was passed, making not only top executives but Boards, and in particular audit chairs, responsible for knowing what happened in their companies. And later Dodd-Frank was passed strengthening these laws – particularly for financial services companies. Ignorance would no longer be an excuse.

Where was Wells Fargo’s compliance department?

Based on these laws every Board of Directors is required to establish a compliance officer to make sure procedures are in place to insure proper behavior by management. This compliance officer is required to report to the board that procedures exist, and that there are metrics in place to make sure laws, and ethics policies, are followed.

Additionally, every company is required to implement a whistle-blower hotline so that employees can report violations of laws, regulations, or company policies. These reports are to go either to the audit chair, or the company external legal counsel. If it is a small company, possibly the company general counsel who is bound by law to keep reports confidential, and report to the board. This was implemented, as law, to make sure employees who observed illegal and unethical management behavior, as happened at Worldcom, Enron and Tyco, could report on management and inform the board so Directors could take corrective action.

Which begs the first question “where the heck was Wells Fargo’s compliance office the last five years?” These were not one-off events. They were standard practice at Wells Fargo. Any competent Chief Compliance Officer had to know, after five-plus years of firings, that the practices violated multiple banking practice laws. He must have informed the CEO. He was, by law, supposed to inform the board. Who was the Chief Compliance Officer? What did he report? To whom? When? Why wasn’t action taken, by the board and CEO, to stop these banking practices?

Should regulators allow executives to fire whistle-blowers?

And about that whistle-blower hotline – apparently employees took advantage of it. In 2010, 2011, 2013 and more recently employees called the hotline, even wrote the Human Resources Department and the office of CEO John Stumpf to report unethical practices. Were their warnings held in anonymity? Were they rewarded for coming forward?

Quite to the contrary, one employee, eight days after logging a hotline call, was fired for tardiness. Another was fired days after sending an email to CEO Stumpf alerting him of aberrant, unethical practices. A Wells Fargo HR employee confirmed that it was common practice to find fault with employees who complained, and fire them. Employees who learned from Enron, and tried to do the right thing, were harassed and fired. Exactly 180 degrees contrary to what Congress ordered when passing recent laws.

None of this was a mystery to Wells Fargo leadership, or CEO Stumpf. CNNMoney reported the names of employees, actions they took and the decisively negative reactions taken by Wells Fargo on September 21. There is no way the Wells Fargo folks who prepared CEO Stumpf for his September 29 testimony were unaware. Yet, he replied to questions from Congress that he didn’t know, or didn’t remember, these events – or these people. In eight days these staffers could have unearthed any information – if it had been exculpatory. That Stumpf’s answer was another plea of ignorance only points to leadership’s plan of hiding behind fig leafs.

CEO Stumpf obviously knew the practices at Wells Fargo. So did all his direct reports. And likely two or three levels downs, at a minimum. Clearly, all the way to branch managers. Additionally, the compliance function was surely fully aware, as was HR, of these practices and chose not to solve the issues – but rather hide them and fire employees in an effort to eliminate credible witnesses from reporting wrongdoing by top leadership.

Where was the board of directors? Why didn’t the audit chair intervene?

It is the explicit job of the audit chair to know that the company is in compliance with all applicable laws. It is the audit chairs’ job to implement the Sarbanes-Oxley and Dodd-Frank regulations, and report any variations from regulations to the company auditors, general counsel, lead outside director and chairperson. Where was proper governance of Wells Fargo? Were the Directors doing their jobs, as required by law, in the post Enron, WorldCom, Tyco, Lehman, AIG world?

Should CEO Stumpf be gone? Without a doubt. He should have been gone years ago, for failing to properly implement and enforce compliance. But he is not alone. The officers who condoned these behaviors should also be gone, as should all HR and other managers who failed to implement the regulations as Congress intended.

Additionally, the board of Wells Fargo has plenty of responsibility to shoulder. The board was not effective, and did not do its job. The directors, who were well paid, did not do enough to recognize improper behavior, implement and monitor compliance or take action.

There is a lot more blame here, and if Wells Fargo is to regain the public trust there need to be many more changes in leadership, and Board composition. It is time for the SEC to dig much deeper into the situation at Wells Fargo, and the leaders complicit in failing to follow the intent of Congress.

by Adam Hartung | Sep 23, 2016 | Disruptions, In the Rapids, Innovation, Leadership, Television, Web/Tech

In early August Tesla announced it would be buying SolarCity. The New York Times discussed how this combination would help CEO Elon Musk move toward his aspirations for greater clean energy use. But the Los Angeles Times took the companies to task for merging in the face of tremendous capital needs at both, while Tesla was far short of hitting its goals for auto and battery production.

Since then the press has been almost wholly negative on the merger. Marketwatch’s Barry Randall wrote that the deal makes no sense. He argues the companies are in two very different businesses that are not synergistic – and he analogizes this deal to GM buying Chevron. He also makes the case that SolarCity will likely go bankrupt, so there is no good reason for Tesla shareholders to “bail out” the company. And he argues that the capital requirements of the combined entities are unlikely to be fundable, even for its visionary CEO.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

But short-sellers are clearly not long-term investors. And there is a lot more ability for this deal to succeed and produce tremendous investor returns than anyone could ever glean from studying historical financial statements of both companies.

GM buying Chevron is entirely the wrong analogy to compare with Tesla buying SolarCity. Instead, compare this deal to what happened in the creation of television after General Sarnoff, who ran RCA, bought what he renamed NBC.

The world already had radio (just as we already have combustion powered cars.) The conundrum was that nobody needed a TV, especially when there were no TV programs. But nobody would create TV programs if there were no consumers with TVs. General Sarnoff realized that both had to happen simultaneously – the creation of both demand, and supply. It would only be by the creation, and promotion, of both that television could be a success. And it was General Sarnoff who used this experience to launch the first color televisions at the same time as NBC launched the first color programming – which fairly quickly pushed the industry into color.

Skeptics think Mr. Musk and his companies are in over their heads, because there are manufacturing issues for the batteries and the cars, and the solar panel business has yet to be profitable. Yet, the older among us can recall all the troubles with launching TV.

Early sets were not only expensive, they were often problematic, with frequent component failures causing owners to take the TV to a repairman. Often reception was poor, as people relied on poor antennas and weak network signals. It was common to turn on a set and have “snow” as we called it – images that were far from clear. And there was often that still image on the screen with the words “Technical Difficulties,” meaning that viewers just waited to see when programming would return. And programming was far from 24×7 – and quality could be sketchy. But all these problems have been overcome by innovation across the industry.

Yes, the evolution of electric cars will involve a lot of ongoing innovation. So judging its likely success on the basis of recent history would be foolhardy. Today Tesla sells 100% of its cars, with no discounts. The market has said it really, really wants its vehicles. And everybody who is offered electric panels with (a) the opportunity to sell excess power back to the grid and (b) financing, takes the offer. People enjoy the low cost, sustainable electricity, and want it to grow. But lacking a good storage device, or the inability to sell excess power, their personal economics are more difficult.

Electricity production, electricity storage (batteries) and electricity consumption are tightly linked technologies. Nobody will build charging stations if there are no electric cars. Nobody will build electric cars if there are not good batteries. Nobody will make better batteries if there are no electric cars. Nobody will install solar panels if they can’t use all the electricity, or store what they don’t immediately need (or sell it.)

This is not a world of an established marketplace, where GM and Chevron can stand alone. To grow the business requires a vision, business strategy and technical capability to put it all together. To make this work someone has to make progress in all the core technologies simultaneously – which will continue to improve the storage capability, quality and safety of the electric consuming automobiles, and the electric generating solar panels, as well as the storage capabilities associated with those panels and the creation of a new grid for distribution.

This is why Mr. Musk says that combining Tesla and SolarCity is obvious. Yes, he will have to raise huge sums of money. So did such early pioneers as Vanderbilt (railways,) Rockefeller (oil,) Ford (autos,) and Watson (computers.) More recently, Steve Jobs of Apple became heroic for figuring out how to simultaneously create an iPhone, get a network to support the phone (his much maligned exclusive deal with AT&T,) getting developers to write enough apps for the phone to make it valuable, and creating the retail store to distribute those apps (iTunes.) Without all those pieces, the ubiquitous iPhone would have been as successful as the Microsoft Zune.

It is fair for investors to worry if Tesla can raise enough money to pull this off. But, we don’t know how creative Mr. Musk may become in organizing the resources and identifying investors. So far, Tesla has beaten all the skeptics who predicted failure based on price of the cars (Tesla has sold 100% of its production,) lack of range (now up to nearly 300 miles,) lack of charging network (Tesla built one itself) and charging time (now only 20 minutes.) It would be shortsighted to think that the creativity which has made Tesla a success so far will suddenly disappear. And thus remarkably thoughtless to base an analysis on the industry as it exists today, rather than how it might well look in 3, 5 and 10 years.

The combination of Tesla and SolarCity allows Tesla to have all the components to pursue greater future success. Investors with sufficient risk appetite are justified in supporting this merger because they will be positioned to receive the future rewards of this pioneering change in the auto and electric utility industries.

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.