by Adam Hartung | Aug 17, 2021 | Defend & Extend, Leadership, Politics, Strategy, Trends

Afghanistan’s Fall Was Foreseeable

After 20 years of American occupation, the Taliban retook Afghanistan in a matter of days. Pundits across the news channels are expressing extreme surprise. But they should not be surprised, this speed of change was entirely predictable. The chaos in Afghanistan may seem a world away, but this unfortunate situation can offer 2 significant lessons for business.

Lesson #1 – Failure (change) always happens faster than we expect.

It took 35 years to build the infrastructure for VHS tapes, then DVDs, to become a big market. We had to open a lot of stores, and put a lot of machines in homes. Then that all became pretty much worthless in 18 months when streaming came along. We used travel agents to book air flights and hotels for 40 years, but they practically all disappeared in a year when we could book on-line. We were ardent radio listeners until iTunes and streaming services pushed radio further toward obsolescence in 6 months when the pandemic magnified these trends. Radio consumption in cars came to an abrupt halt when commuting stopped.

Fringe competitors are constantly trying to become mainstream. They never give up. Innovators keep trying new ways to serve our customers. Then, when there’s a shift in technology, regulation or another major market component they leap forward in a huge step overtaking the marketplace. The Taliban never went away. They kept getting better and waited until the USA announced its planned withdrawal. That created the opportunity and in one big step they leapt forward. Business leaders continually believe that markets will shift gradually. Leaders underestimate how well fringe competitors are prepared to move forward, and leaders fail to anticipate how quickly customers will shift buying patterns (like Afghan troops dropping their guns and fleeing.)

It’s not gradual. Change happens fast. If you see a change on the horizon, don’t think it’ll come slowly. Think like the fellow pushed off a 20 story building. At the twelfth story it’s not “so far so good,” but rather “we better prepare for disaster.” When change is going to happen, pack your parachute. Figure out how you’ll keep pushing forward. Or you’ll find a swift, hard landing.

Lesson #2 – You are either growing, or you are dying. There is no “maintenance, status quo.”

Despite two decades fighting in Afghanistan, by no measure was America becoming more popular. America’s image, trade, world standing were not improving in Afghanistan. America was fighting merely to maintain. Watch “Charlie Wilson’s War” and it’s evident America had no plans to “heap any love” on Afghanistan. No schools, agricultural assistance, preservation of mosques or other religious sites, family assistance programs, immigration. America just kept working to preserve the situation after killing Osama bin Laden. The relationship wasn’t growing, improving, becoming something beneficial to both sides. Without growth in the relationship it was deteriorating. Afghans were increasingly weary of occupation, and in a great sense ready for change.

Too often, business leaders think they don’t need to focus on growth. According to recent Gartner research only 56% of chief executives see Growth as the top priority for their firms. They don’t think they need to think about how to launch new solutions, new services, new opportunities to please their customers. They drift into preserving the status quo business, perhaps working on doing things a little faster, a little better, a little cheaper. But as time passes needs change. New needs emerge. Markets don’t stay the same, new competitors challenge old norms – challenge the status quo. The customer relationship deteriorates as new unmet needs aren’t addressed. If we aren’t helping the customer to grow, and thus growing ourselves, the market becomes dull, and ready for a major shift. Poised to be overtaken by something new.

We used to think we could create a market, then erect entry barriers to keep out competitors. Things like scale advantages, control of distribution, control of technology, regulatory limitations became the “moats” that would protect the business. And we thought with those protections we had “competitive advantage” allowing revenues, and profits, to go on infinitely. But that simply isn’t true. Fringe competitors are constantly attacking the “moat.” Things happen in the world creating opportunities for new solutions. A “reinvention gap” emerges as the old business becomes stale and customers are looking for something new. And fringe competitors are waiting for the opportunity to take action – and market share.

The only way you can remain vital is to constantly grow. You have to keep up with economic growth (3%/yr) and overall inflation (3%/year) just to remain even – without any return to shareholders. Add on 3 more points of growth to keep investors and you need to grow 9-10%/year just to sustain. Leaders too often take for granted that customers are happy, their particular market is “low growth” and they focus on the bottom line. Wrong, and deadly. Instead focus on the top line. You have to constantly grow revenues. It’s the only way you can remain vital with your customers, and the only route to success.

This analogy is not to belittle the catastrophic circumstances in Afghanistan. Under the Taliban most people will be denied the things I personally hold dear. It is a human tragedy.

But the story is one told all too often. Focusing on the bottom line, forgetting the need to grow your organization and your relationship with customers. And then thinking that any transition will take some time, providing ample room to react. I see these errors regularly. Think of Sears, ToysRUs, Hostess Baking, Sun Microsystems, Wang, GM/Ford/Chrysler, Motorola….. it’s a very long list of companies that made these two mistakes. As the newscasters harp on how fast Afghanistan fell, remember that this was a failure many years in the making. Lots of defend and extend behavior (military might) by America, far too little innovation and not meeting unmet needs (food, shelter, clean water, education, protection from harm.)

Are you on “cruise control” running your business?

Ask yourself, Are you trying to defend and extend what you’ve always done? Or are you meeting unmet customer needs, helping customers to grow and in turn growing yourself? If you’re the former, get ready for a rude awakening.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jun 2, 2021 | Economy, Innovation, Scenario Planning, Strategy, Trends

Nomadland art … IS Life

The Academy Award winning movie “Nomadland” portrays a woman whose town is decimated when its largest employer leaves. No jobs means homes go valueless, and people are forced to leave. Not only the economy, but lives are wrecked without money, healthcare and any sense of economic future. What follows is a pretty bleak overview of living in one’s vehicle, hustling for jobs of any kind and building networks of other nomads who give encouragement to each other – but not a lot of help. During the movie, the lead character is offered at least two very solid opportunities to move into a more stable situation (one with her family, and one with the family of another nomad.) Yet, she turns down both. Despite living what the filmmakers portray as a very difficult, lonely and economically bleak situation she chooses to continue the nomad lifestyle.Today’s Gig Workers, or Digital Nomads, are often thought of as bleak, lonely people. No permanent job, no permanent employer, no “corporate” home. The view is often of people who are on the stark edges of the economy, struggling to survive in an uncertain future. And that view would largely be wrong.

The Gig Economy, and its self-employed Digital Nomads, represented HALF the U.S. Workforce before the pandemic hit. The World Economic Forum, Ernst & Young and the U.S. Federal Reserve all said that the emergence of the self-employed Gig Economy Digital Nomad represented the largest single economic shift in several generations. All have said this trend for business is as big as the emergence of mobile and internet technologies. It is characterized as a fundamental change in how people work, and a dramatic change in the outdated Industrial Era “contract” between companies and employees.

Digital Nomads are NOT merely a pandemic artifact.

They are members of an enormous mega-Trend: (1)

- The gig economy is growing so fast its job creation alone can account for all the jobs created in the USA from 2005 through 2016 (corporate hirings/firings were a net no gain)

- In the last 40 years the employer/employee compact has disintegrated, leading fewer people to trust their employers, so they seek alternative cash flow sources

- It is estimated half of gig workers maintained full time jobs – but are actively seeking entrepreneurship. Thus the resulting unwillingness to return to low-pay jobs as the pandemic ends.

- The Gig workforce of Digital Nomads is growing 5x faster than growth in traditional jobs

- 63% of Gig workers say they started not due to economic requirements, but as a choice

- In 2017, 53 million Americans participated in gig work (36% of all employees)

- By 2027, trends project over half of all Americans will be involved in gig work. This pre-pandemic statistic is likely to understate the likely results due to pandemic changes.

- Prior to the pandemic at least 40% of the American work force made at least 40% of their income from Gig Economy work

- Digital Nomads cross all age groups? 44% of Boomers, 59% of GenX, 63% of Millennials

Digital Nomads mostly CHOOSE this work approach. In a fast-paced, quickly shifting world the idea that an employer can “protect” its employees is a façade. With the average corporation lifespans now a mere 8 years, no job and no employee can be protected. Neither pay nor benefits are ever a given in markets where companies acquire, merge, are acquired or fail with such regularity.

Employees Empower Themselves In Gig Work

Employees Empower Themselves In Gig Work

Being a Gig Worker actually fulfills the corporate goal, sought for 35 years, of “empowering employees.” Despite what managers said, organizations operate today in the militaristic style of the last 100 years. Unless you’re the CEO (dictating your own pay and terms) someone is your boss. And your #1 job is to please the boss. Success is less about results, and a lot more about politics, corporate behavior and luck. But as a Digital Nomad you are your own boss. You contract to do something, at a rate, on a timeline and then you deliver. You are empowered to do the work you want, when you want it. To lead the lifestyle you choose, making as much as you desire. Doing your own training, building your own skills, selling your services and reaping the rewards.

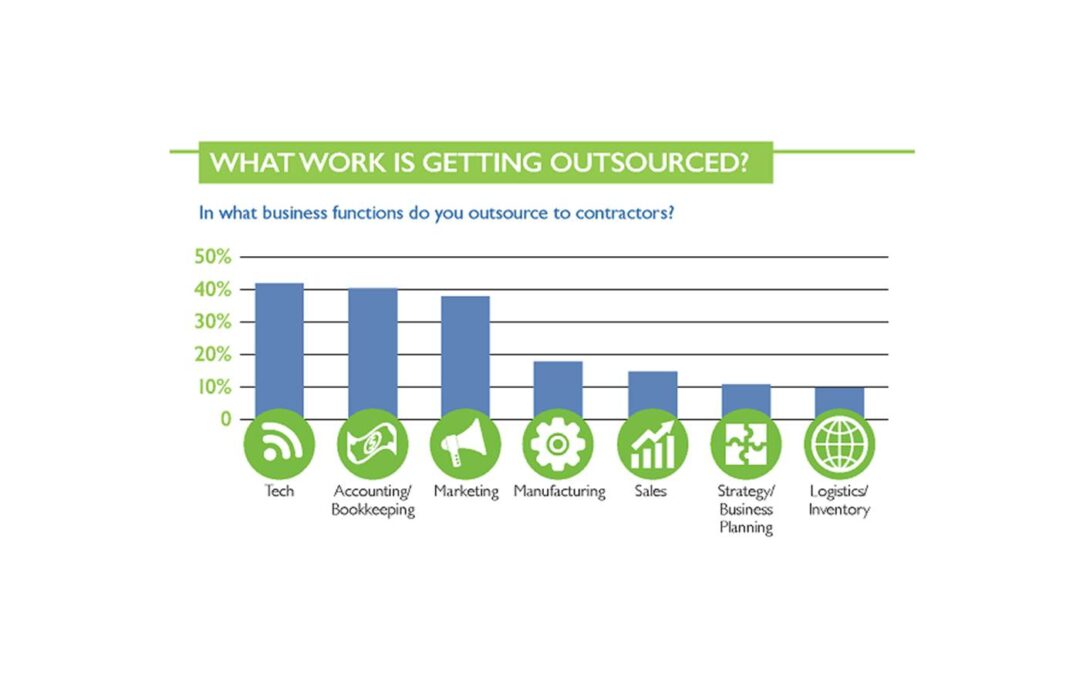

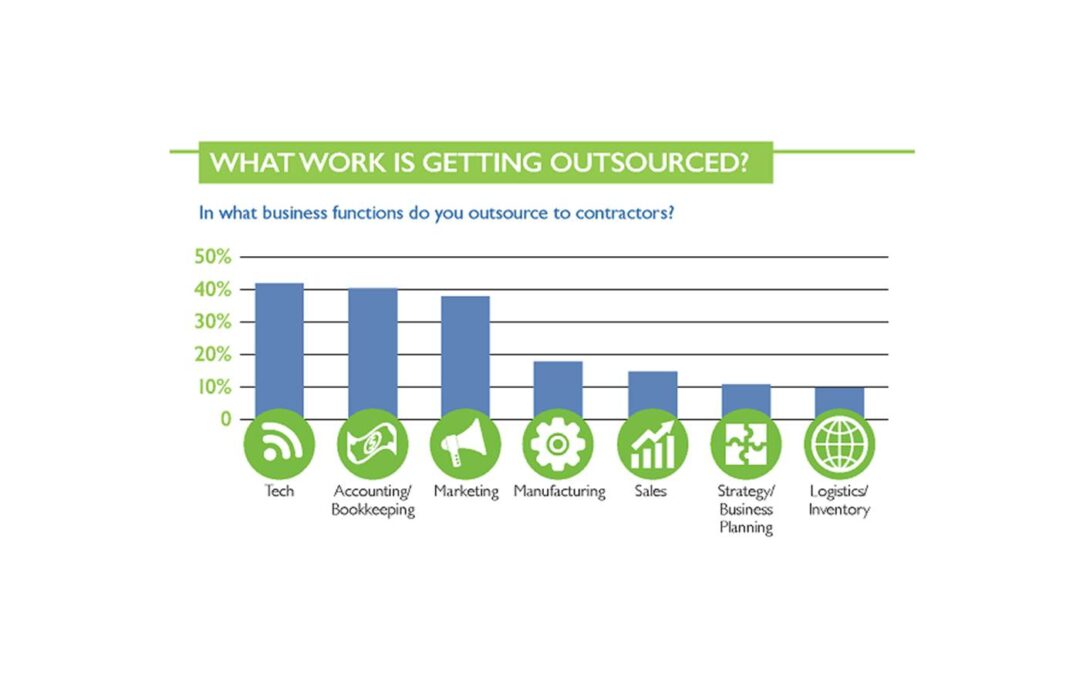

Corporate Nomadland is much, much bigger than the Nomadland of the movie. And it is largely comprised of people who want to work like Digital Nomads. It’s not bleak. Rather, in many ways it is the future of work. Especially for people who provide services — from accounting to marketing to sales to planning, to education, workshops, security, etc. It is a world built on networking, connectivity, individual accountability, and entrepreneurial behavior as it existed prior to the Industrial Era.

For Full image: JDP Employee Screening

Unfortunately, a lot of old-school employers and government officials still don’t understand this mega-Trend. They keep trying to force Digital Nomads into becoming employees, by altering work rules and regulations and promoting old-school style unions. Efforts attempting to force employers to do what they can’t – operate their business like it’s 1966. Business people today must be adaptable to market shifts, changing competition and fast moving customer needs. They can’t afford full-time employees and incumbent overhead costs on roles that simply are not economically suited to their needs. Trying to force this behavior hurts the Digital Nomads even worse than the employers, because they don’t want these changes. That’s why the effort to change laws making Gig Workers employees failed in California. That’s why employees failed to unionize an Amazon facility in Alabama. Even President Biden favors unions, “The policy of our government is to encourage union organizing.” (POTUS tweet 4 Feb 21) Those are not the right answers to today’s problems.

We are living a mega-Trend, accelerated by the pandemic

We now know we can work asynchronously and mobile. We know the results of our work are more important than physically attending meetings, or office politics. We know that we can be more efficient, and capable, when empowered to focus on results and not outdated policies, procedures and processes. And this trend will continue to grow. Despite the CEOs and other leaders that want to force everyone back in offices, in large droves people are choosing not to go.

That’s not to say the government couldn’t be a lot more effective if it accepted this mega-Trend and attempted to assist its citizenry with new approaches. There need to be entirely new approaches for implementing and regulating safety nets – like unemployment, health care and retirement programs. There need to be new regulations for contract negotiations and dispute resolutions between large corporate entities and Gig workers. New approaches for Digital Nomads to network in ways to set output standards, work standards, pricing standards for effectively working with their much bigger customers. There need to be new approaches for bringing on and eliminating transition teams for large projects. Basically, new approaches which support the adaptability and flexibility needed by both employees and Gig Digital Nomads. Digital Nomads are here to stay. Speaking of mega-Trends, have you seen the new AI-controlled, EV camper?

(1) Section reference

(2) Additional references

-MegaTrends by HP “The Future of Work – The Gig Economy”

-World Economic Forum – “The MegaTrend that Will Shape Our Working Future” the Gig Economy

-EY MegaTrends – “The Future of Work” the Gig Economy

-Supermoney – “The Growing Importance of the Gig Economy”

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | May 12, 2021 | Employment, Immigration, Scenario Planning, Strategy, Trends

Demographics is Destiny

Planning is all about the future. And the future is easiest to predict when we look at demographics. Population trends are easy to spot, and long-lived. So the recent U.S. census, which built on previous trends, gives us great insights for planning our investments. Let’s focus here on the two biggest demographic trends.

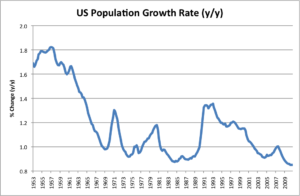

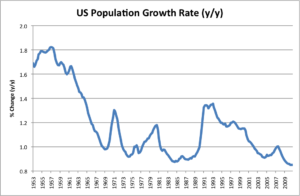

First, the U.S. population growth rate is terrible. Less than 1%/year. Its the 2nd worst decade  since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

In 2018, I wrote about the Japanese demographic “trend bomb.” Low birthrates and anti-immigration meant there were only 2 working people to support each retiree. And the situation was worsening. It’s time America starts considering what it will do if we don’t let immigrants return to spark growth. Growth can hide a multitude of sins, Source: Avondale Asset Management

because it creates demand for more goods and services – thus creating economic growth. People in China and

India aren’t starving any longer, because they’ve grown their economies out of poverty.

As wrote in 2017, it was America’s population growth – driven by immigration – that made 1800s and 1900s America the jewel of the world. Despite horrors at Ellis Island, those boatloads of immigrants created the agricultural and industrial America with its flourishing economy. Like I observed in 2016, unless we re–invigorate growth through immigration, the woes Trumpers complain about will get much, much worse. Soon Pakistan and Indonesia will have more people than the USA! China and India, with their growing populations, growing economies and growing diaspora are making an ever–bigger imprint on the global economy. Meanwhile, America is on its way to stagnant performance like most European countries.

U.S. Population is Mobile, Despite the Pandemic

Second, the trend south and west continues unabated. In 1970, the South and West accounted for less than half the population. Now they account for 62%. The Northeast is losing people rapidly, with 48 of 62 New York counties losing people. And Illinois has seen the problem in spades. Chicago and Illinois are already in a world of hurt due to declining population causing a declining economy causing real estate prices to fall and taxes to rise. (Though the pent-up pandemic housing demand is temporarily increasing housing prices, masking the long term trend.) When population trends down, it becomes a whirlpool of problems – just look at what’s happened in Detroit! You must have the people to build a strong economy.

Looking at both these trends, do you see the unabashed irony? We see no problem with cities and states competing for migrants from other cities and states. Local and state governments lure in companies and people with tax breaks, subsidies and other allowances. We think immigration within our country is good – and recognize losing people from our local area is bad. But at a national level, we still have people who object to immigration. They want the borders closed, and no new entries. We have politicians who want to freeze the economy in place. Yet we know from our past that the only solution to getting our economy to grow REQUIRES immigration. It is the #1 reason the economy was so sluggish coming out of the Great Recession – we cut immigration to unprecedented levels under Obama and continued the decline under Trump. We are unlikely to birth our way to growth, given trends in lifestyles and gender equality. But, we can bring in immigrants who can help the economy grow. We need to get over this hypocrisy and move toward greater immigration as a pro-America policy!

What does this mean for your business?

First – are you sure you want to do business only in the USA? The growth markets are elsewhere. Have you considered selling in China, India, Indonesia, Micronesia, Thailand, South America and Africa? These are growing markets where Chinese businesses (in particular) are making big investments. By going where the population is growing they are able to grow their revenues, and their influence. America isn’t the dominant international player it once was, and there’s never been a better time to look outside America for your next growth market.

Second – Take your business where you see the growth in America. Lots of businesses are going to Texas (and Nevada, Utah, Idaho and Arizona) because lots of people are going there! If you open a restaurant in a town losing people, to succeed you have to entice people to drive to your town and restaurant. You better be really good, and you’ll probably have to make price allowances to have repeat business. But if you have a restaurant in a locality where people are immigrating in large numbers you can do well even if your food is mediocre. Growth hides a multitude of sins!! Your food need not be fantastic, and you can price higher, and you can even have shorter hours because you’re where the people are! It’s simply a lot easier to succeed when you are in a growing marketplace. Are you planning to be someplace because that’s where you started, have family, or went to college? Or are you planning to be someplace where the people, and money, are?

Have you taken into account changes in demographics when making your plans? It is undoubtedly the #1 trend you should use for planning (Fleeing Illinois) . It is highly predictable, and has a lot to do with success. Simply going where the people are will help you succeed. There’s nothing more important to your scenario planning than obtaining a copy of the latest census and studying it really, really hard. It’ll jump start you on the road to greater sales and more success!

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465

by Adam Hartung | Jul 22, 2020 | Disruptions, Innovation, Leadership, Marketing, Trends

As the pandemic dropped on the USA with full force mid-April the price of oil dropped to less than $0. OK, it was something of a fluke. Demand dropped so fast that supply couldn’t fall fast enough, so oil was flowing into refineries and tanks and pipelines so fast that nobody knew where to put it – and that resulted in suppliers having to pay someone to take their oil.

But… the point was very real. Oil prices depend on demand – every bit as much as supply. Even though for a generation we’ve taken growing oil demand for granted, and focused on how to create additional supply, it is a fact that NOW declining demand will limit the value of oil and gas (which is, after all, a commodity.) The TREND has changed course, with demand in the USA barely, or not, growing – and globally demand growth primarily all in Asia (mostly China.) Overall, supply growth has beaten demand growth by a wide margin, and prices are not only low now – they will likely go lower. Even oil company CEOs are predicting US production will decline – but to lower demand

In 2015, I predicted that Tesla could put a big hurt on Exxon. Most people thought that was a joke. Tesla was a fraction the size of GM, and “small potatoes” in the car industry. Meanwhile Exxon was one of the world’s largest oil producers and refiners. That really would be a very small David smacking a very big Goliath – and with a very small rock. But what I pointed out in 2015 was that traditional analysts predicted a very gradual growth in electric cars, and a continued growth in petroleum powered cars, and pretty much constant growth in oil & gas consumption with economic growth. In other words,analysts were using old assumptions all around and expecting only a tiny impact from a few weirdos buying electric cars.

But I asked, what if those assumptions were wrong? In 2015, the world was awash in oil, inventories were then at record levels, and electric car sales were taking off. And the truth was, a lot was happening to reduce demand for oil. Renewable energy programs, conservation, and a change in economic activity from basic manufacturing and commodity processing to a knowledge economy. These trends were all putting big dampers on oil demand. And electric auto sales were poised for a big boom. I predicted demand for oil would drop substantially, inventories would skyrocket and industry problems would worsen as prices cratered.

Uh-hum – what was the price of oil in April?

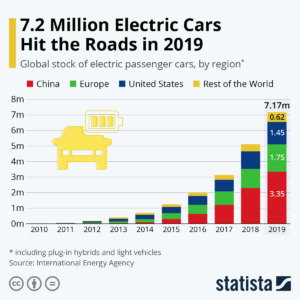

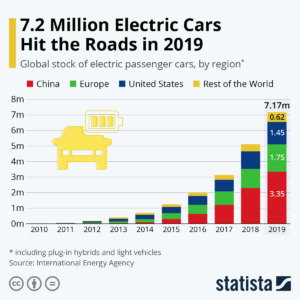

In 2009, I made the case that electric cars were a small base, but that geometric demand growth would make them an important economic impact . Today, most Americans still think that’s the case. In 2009 less than 100,000 new cars were electric. But by 2015, over 1 million electric cars had been sold. Then, with the help of game changers like the Tesla Model 3 in 2019 sales exceeded 7 million! A 7-fold increase in 5 years, or nearly 50%/year market growth!!

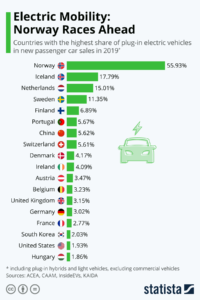

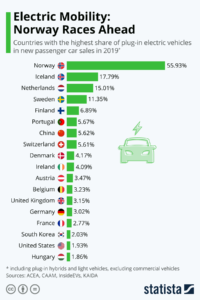

Americans aren’t aware of this phenomenon largely because the big growth centers are outside the USA. Where electrics are ~2% of US car sales, in some European countries they are well over 10% of the market. Even in China they represent over 5% of sales!

Remember what I said above about demand growth depending on China? Look again at who’s buying the most electric cars.

Lessons:

1 – Never think your product is beyond attack by market forces. Be paranoid.

2 – Very small, fringe competition can sneak up and steal your market faster than you think.

3 – Fringe changers don’t have to take a huge market share to make a BIG impact on your market and pricing.

4 – Disruptive events favor the upstarts, who are on trend, and hurt big incumbents, who depend on “business as usual.”

5 – Don’t expect markets to “return to normal.” Markets always move forward, with trends.

6 – Don’t plan from the past, plan for the future – and pay attention to disruptions, they can break you.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jul 14, 2020 | Disruptions, Innovation, Leadership, Marketing, real estate, Retail, Trends

TRENDS: Covid-19 has accelerated a lot of trends. Few more than retail. Oddly some people have taken the view that Covid-19 changed retail. Actually, it didn’t. The pandemic has merely accelerated trends that have been driving industry change for almost two decades.

Back in 2004, Eddie Lampert bought all the bonds of defunct Kmart and used those assets to do a merger with Sears – creating Sears Holdings that encompassed both brands. The day of announcement Chicago Tribune asked for my opinion, and famously I predicted the merger would be a disaster. Clearly both Kmart and Sears were far, far off trends in retail, both were already struggling – and neither had a clue about emerging e-commerce.

Why in 2004 would I predict Sears would fail? The #1 trend in retail was e-commerce, which was all about individualized customer experience, problem solving for customer needs — and only, finally fulfillment. By increasing “scale” – primarily owning a lot more real estate – this new organization would NOT be more competitive. Walmart was already falling behind the growth curve, and everyone in retail was ignoring the elephant in the room – Amazon.com. Loading up on a lot more real estate, more inventory, more employees, more supplier relationships and more community commitments – old ideas about how to succeed related to fulfillment – would hurt more than help. Retail was an industry in transition. All of these factors were boat anchors on future success, which relied on aggressively moving to greater internet use.

Unfortunately, Eddie Lampert as CEO was like most CEOs. He thought success would come from doing more of what worked in the past. Be better, faster, cheaper at what you used to do. In 2011 Sears asked its HQ town (Hoffman Estates) and the state (Illinois) for tax subsidies to keep the HQ there. Sears had built what was once the world’s once tallest building, named the Sears Tower. But many years earlier Sears left, the building was renamed, and Sears was becoming a ghost of itself. I pleaded with government officials to “let Sears go” since the money would be wasted. And it was clear by 2016, that Lampert and his team’s bias toward old retail approaches had only served to hurt Sears more and guarantee its failure. Now – in 2020 – Hoffman Estates has taken the embarrassing act of removing the Sears name from the town’s arena, admitting Sears is washed up.

****

It was with a multi-year observation of trends that I told people in 2/2017 that retail real estate values would crumble . Now mall vacancies are at an 8 year high and 50% of mall department stores will permanently close within a year. We are “over-stored” and nothing will change the fast decline in retail real estate values. Who knows what will happen to all this empty space?

Trends led me in March 2017 to advise investors they should own NO traditional retail equities. Shortly after Sears filed bankruptcy Radio Shack and storied ToysRUs followed. And with the pandemic acting as gasoline fueling change, we’ve now seen the bankruptcies of Neiman Marcus, JCPenney, J Crew, Forever 21, GNC and Chuck e Cheese (but, really, weren’t you a bit surprised the last one was still even in business?) After 3 years of pre-Covid store closings, Industry pundits are finally predicting “record numbers of store closings”. And, after 15 years of predictions, I’m being asked by radio hosts to explain the impact of widespread failures of both local and national retailers ( ). Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

As we move forward, what will happen to your business? Will you build on trends to create a new future where growth abounds? Will you align your strategy with the future so you “skate to where the puck will be?” Or will you – like Sears and so many others – find an ignominious end to your organization? Will the signs change, or will the signs come down? The trends have never been stronger, the markets have never moved faster and the rewards have never been greater. It’s time to plan for the future, and build your strategy on trends (not what worked in the past.)

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jan 16, 2020 | Boards of Directors, Defend & Extend, Leadership, Software, Web/Tech

People who follow my speaking and writing – including my over 400 Forbes columns – know that I preach the importance of growth. Successful organizations are agile – and agility is the sum of learning + adaptability. Smart organizations are constantly looking externally, gathering data, learning about markets and shifts – then structured to adopt those learnings into their business model and adapt the organization to new market needs.

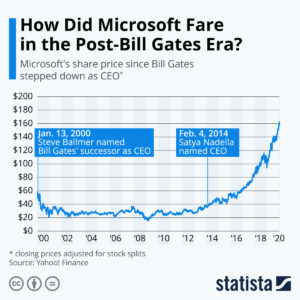

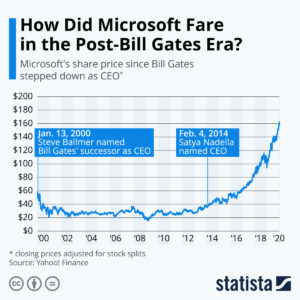

Steve Ballmer was the antithesis of agility. For his entire career he knew only that  Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

So as the market went mobile, Ballmer kept over-investing. He spent billions launching Windows 8, which I predicted was obviously going to fail at growing the Windows market as early as 2012. And it was easy to predict that Win8 tablets were going to be a bust when launched in 2012 as well. But Ballmer was “all-in” on Windows and Office. He was completely locked-in, and unwilling to even consider any data indicating that the PC market was dying – effectively driving Microsoft over a cliff.

It was not hard to identify Steve Ballmer as the worst CEO in America in 2012. When Ballmer took over Microsoft it was worth $60/share. He drove that value down to $20. And the company valuation was almost unchanged his entire 14 years as CEO. He remained locked-in to trying to Defend & Extend PC sales, and it did Microsoft no good. But when the Board replaced Ballmer with Nadella the company moved quickly into growth in gaming, and especially cloud services. In just 6 years Nadella has improved the company’s value by 400%!!!

Success is NOT about defending the past. Success IS about growth. Don’t be locked in to what worked before. Focus on what markets want and need – learn how to understand these needs – and then adapt to giving customers new solutions. Don’t make the mistakes of Ballmer – be a Nadella to lead your organization into growth opportunities!

by Adam Hartung | Dec 27, 2019 | Advertising, Disruptions, Innovation, Television, Trends

In 2020, internet ads will represent over 50% of all advertising money spent. Think about that factoid. An ad medium that wasn’t even important to the ad industry a decade ago now accounts for half of the industry. It took three years after the Dot Com bubble burst for internet advertising to hit bottom, but then it took off and hasn’t stopped growing.

An example of rapid, disruptive change. A market shift of tremendous proportions that has forever changed the media industry, and how we all consume both entertainment and news. Did you prepare for this shift? And is it helping you sell more stuff and make more money?

This was easy to predict. Seven years ago (12/10/12), I wrote “The Day TV Died.” The trend was unmistakable – eyeballs were going to the internet. And as eyeballs went digital, so did ads. These new, low cost ads were “democratizing” brand creation and allowing smaller companies to go direct to consumers with products and solutions like never before in history. It was ushering in a “golden age” for small businesses that took advantage.

However, small businesses – and large businesses – largely failed to adjust to these trends effectively. By 3/21/13 I pointed out in “Small Business Leaders Missing Digital/Mobile Revolution” that small businesses were continuing to rely on the least economical forms of media outreach – direct mail and print! They were biased toward what they knew how to do, and old metrics for media, instead of seizing the opportunity. Likewise, by 12/11/14 in “TV is Dying Yet Marketers Overspend on TV” I was able to demonstrate that the only thing keeping TV alive were ad price increases so big they made up for declining audiences. The leaders of big companies were biased toward the TV they knew, instead of the better performing and lower cost new internet media capabilities.

Three years ago (1/6/17), I pointed out in “Four Trends That Will Forever Change Media… and You” it was obvious that digital social media advertising was making a huge impact on everyone. Fast shifting eyeballs were being tracked by new technology, so ads were being purchased by robots to catch those eyeballs – and this meant fake news would be rampant as media sites sought eyeballs by any means. And Netflix was well on its way to becoming the Amazon of media with its own programs and competitive lead.

So the point? It was predictable all the way back in 2012 that digital media would soon dominate. This would change advertising, distribution and content. Now digital advertising is bigger than all other advertising COMBINED. Those who acted early would get a huge benefit (think Facebook/Instagram Path to Media Domination) while those who didn’t react would feel a huge hurt (newspapers, radio, broadcast TV, brick and mortar retail, large consumer goods companies that rely on high priced TV.) But did you take action? Did you take advantage of these trends to make your business bigger, stronger, more profitable, more relevant? Or are you still reacting to the market, struggling to understand changes and how they will impact your business?

The world continues to be a fast changing place. Mobile phones and social media will not go away – no matter what Congress, the UN or the EU regulators do. Global competition will grow, regardless what politicians say. Those who understand how these big trends create opportunities will find themselves more successful. Those who focus on the past, try to execute better with their old “core,” and rely on historical biases will find themselves slowly made irrelevant by those who use new technologies and solutions to offer customers greater need satisfaction. Which will you be? A laggard? Or a leader? Will you build on trends to grow – or slump off into obsolescence? The choice is yours.

by Adam Hartung | Nov 2, 2019 | Disruptions, Food and Drink, Innovation, Marketing, Strategy, Trends

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Mighty Oaks from Tiny Acorns Grow – Beyond Meat

TREND: Beyond Meat (BYND, NASDAQ)

A big, new trend is emerging. Sales of plant based protein products may be small, but growth is remarkable. Could Beyond Meat be the next Netflix?

In Q3 2019, Beyond Meat’s revenue is up 2.5x (250%) vs Q3 2018 — which was up 2.5x (250%) over Q3 2017. Yes, you can say this growth is on a small base, given that last quarter was $100M revenue.

Imagine what it’s like growing that fast. Imagine the exhilaration of solving problems – like funding your accounts receivable that’s growing with accelerating orders. Or amping up production faster than ever imagined. Or meeting needs of your customers, retailers and restaurants. Or paying out big bonuses due to beating all your planned metrics.

It’s not that much fun to work at Cargill. Or Tyson Foods. Or Smithfield. Or any other traditional company producing beef, or pork, or chicken. Those are huge companies, with lots of people. But they aren’t maxing out sales and profits – and bonuses – like Beyond Meat.

It’s easy to ignore a start up. But one has to look at the relative growth of a company to judge its future. There were cracks in the growth rate at Blockbuster 6 years before it failed. And during that time, Blockbuster kept saying Netflix was a nit that didn’t matter. But Netflix was growing like the proverbial weed. Netflix wasn’t even half the size of Blockbuster when Blockbuster filed for bankruptcy.

With growth like Beyond Meat it didn’t take long to upset an entire industry biz model. Amazon still doesn’t sell as much as WalMart, but it wiped out a significant number of retailers by changing volumes enough to erase their profits. Think about the changes wrought on the advertising industry by Google, which has pretty much killed print ads. Look at what’s happened to other media ad models, like TV and radio, by Facebook’s growth. And entertainment has been entirely changed – where today the onetime distributor is one of the biggest content producers – Netflix.

In traditional marketing theory, Beyond Meat, like Netflix, is selling new products to existing markets.

Most disruptors enter the markets in the new product/new market quadrant of the Ansoff matrix. They create the new market just by entering. If they even see them as competitors, established businesses dismiss these potential disruptors because of established focus on current markets/current products with sustaining innovations. Selling new products to existing customers is the first step companies take as they start to innovate.

Kraft was on this path when they acquired a new productc with its purchase of Boca Burger in 2000. Kellogg’s and General Foods jumped into the alternative meat products at about the same time. Vegetarian burger substitutes threatened the success formula of meat products and were relegated to niche products. In 2018, Kraft’s incubator tried to relaunch Boca, but the smaller, more nimble start-ups had already captured consumers’ attention and reframed the market.

Beyond Meat had morphed quickly into a direct competitor to the meat industry by selling this new product to existing meat customers!

Riding the trends of climate change, sustainability and organic foods, Beyond Meat is starting to look like a true game changer. It may be small, but those other companies were too (along with Tesla, don’t forget, considered immaterial by GM, et.al.) Those who are in the traditional protein market (beef especially) had better pay attention – their profit model is already under attack!!

“The creation of a thousand forests is in one acorn.”

What’s on your company’s radar today?

Spark Partners is here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Let us do an opportunity assessment for your organization. For less than your annual gym cost, or auto insurance premium, we could likely identify some good opportunities your blinders are hiding. Read my Assessment Page to learn more.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my

Status Quo Risk Management Playbook.

Give us a

call today, or send an email, so we can talk about how you can be a leader, rather than follower. Or check out the rest of the

website to read up on what we do so we can create the right level of engagement for you.

Hartung Recent Blog Posts on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | May 1, 2019 | Disruptions, Innovation, Marketing, Strategy

Find Opportunities Out of the Box

If your company is like most businesses, your list of new product or service ideas looks like a sales wish list- new features at a lower cost. Marketing or product management may go a step further and group the ideas into product line extensions or possibly entries into new market segments. Unfortunately, while generating revenue in the short run, this process leaves the company vulnerable to competition and missing opportunities in the long run.

Well, you are not alone. Since about 2012, the pace of innovation has slowed even in the popular market of social media. According to KeyMedia, “What was once a world of diversity and originality has slowly started to look like a bad case of déjà vu… (as platforms are) becoming more similar to each other…”

Most companies devote resources to a quadrant on the innovation matrix known as “sustaining innovation.” They improve existing products sold to existing customers. It’s low risk, true, but it’s also low return. Why do companies follow this death spiral? It’s because “innovation” has gotten a bad reputation.

According to Inc. magazine, “…many (business) people have come to equate the idea of innovation with disruptive innovation. But the fact is that for most businesses, placing big bets on high-risk ideas is not only unfeasible, it’s unwise.”

The Ansoff matrix of new and existing markets and products is usually interpreted as 4 quadrants. It is much more than that: it is a continuum between sustaining and disruptive innovation. .

Adam Hartung often tells clients, “Get out of the box, then think!” This applies directly to the Ansoff model. Once a company sees the matrix, not as fixed “boxes” but as a spectrum of opportunities, markets are viewed not as filled with risk, but filled with opportunities!

Consider Ricoh’s new “clickable paper” that combines the print channel, with an app and that integrates to social media or a website. Not disruptive in the classical sense, but an adjacent product and adjacent market segment that makes print relevant to tech savvy consumers. Or Dr. Dre’s Beats headphones that combine pre-equalized sound with noise cancellation and style- a clever and highly successful blend of existing technologies, vigorously marketed.

Uncovering these market opportunities that can deliver improved returns at a manageable risk for the firm. New products will also generate an increasing percentage of revenue leading to continued growth. Companies that master this process have a long range radar to identify potential opportunities in a process called, “continuous innovation”.

What’s on your company’s radar today?

We are here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Go the website and view the Assessment Page. Send me a reply to this email, or call me today, and let’s start talking about what trends will impact your organization and what you’ll need to do to pivot toward greater success.

by Adam Hartung | Mar 20, 2018 | Investing, Leadership, Lock-in, Marketing, Strategy, Transportation

Do you remember the songs, and videos, from 2008 “United Breaks Guitars?” After United Airlines destroyed musician Dave Carroll’s guitar he chronicled the months-long journey he took trying to replace it. In the end, United told him “F**k you” as customer service blew him off completely. He went on to make a few million dollars with his songs and parody about the horrible experience. Because so many people felt they were abused like Mr. Carroll.

“United Breaks Guitars” was a hit because so many people related to the terrible customer experience on United.  “The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction.

“The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction.

Things certainly haven’t changed. In 2017, United ejected a 69 year old physician from a plane, breaking his nose, knocking out his teeth and giving him a concussion. That created an uproar. Yet within a week United killed the world’s largest bunny rabbit in an airplane holding bin. But, even worse, last week United actually killed a puppy by forcing it be placed in an overhead bin. At least the dog United sent on a 1,000 mile unexpected flight to Japan survived, and the interviewed owner said he felt lucky the airline hadn’t killed his pet. Of course United refunded their money – which as you can imagine was a slap in the face to all these people who were so abused.

Unfortunately, United is just the worst of a bunch of bad airlines. Customer service really isn’t any better on Delta, American, JetBlue or Southwest. Saying these other airlines are better is just picking out a less heinous member of the Khmer Rouge Army.

STRATEGY MATTERS

This all goes back to deregulation. When President Carter allowed the airlines to charge as they like the industry really had no idea what it was going to do. There was chaos for years. But eventually consolidation kicked-in, and cutting cost was the only thing all 3 majors agreed upon. Buy more market share, as opposed to winning it with customer service, then slash the costs. This did the wonderfulness of leading all of them to file bankruptcy! Some twice! What a grand industry strategy!

Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he ordered olives removed from the first class meals. He was cheered for saving $100K. But what folks missed was that he, and his peers leading the airlines, were systematically trying to figure out “how do we offer the least possible service.” By focusing on a strategy of lowering cost, and being doggedly determined in that strategy, soon nothing else mattered.

Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he ordered olives removed from the first class meals. He was cheered for saving $100K. But what folks missed was that he, and his peers leading the airlines, were systematically trying to figure out “how do we offer the least possible service.” By focusing on a strategy of lowering cost, and being doggedly determined in that strategy, soon nothing else mattered.

Today, there are no free meals in coach, and terrible meals in first class. Management angered employees into strikes and multi-year negotiations, beating down compensation and eliminating benefits leading to unhappiness so bad that in 2010 a Jet Blue flight attendant pulled the emergency exit and jumped out of the plane as he quit.

So, all the airlines in America stink. And, many domestic airlines in Europe, such as Ryan Air, have followed suit. The execs keep saying “all customers care about is price.” They use that excuse to create a culture so hostile to employees, and customers, that pretty soon employees are beating up customers and killing family pets (after charging extra to take the pet on the plane) and actually not caring.

Employees have become gestapos for the leadership – which has created a culture in which nobody wins. So flight attendants do as little as possible, because they don’t care about customers any more than leadership does. In 2017, a JetBlue attendant threw a family off flight because their toddler kicked the seat. When a woman complains about a child in seat next to her a Delta attendant throws her off the plane. And just last week when a 2 year old cries during boarding a Southwest attendant throws the child and her father off the plane.

Deregulation led to an oligopoly. Now, customers have no choice. Some of us fly almost every week on business, and it is pure hell. Nobody we deal with, from TSA to airport vendors to airline staff like customers. The culture has become “I’m abused, so you will be abused.” To fly is to succumb to being obsequious to ALL employees in your effort to not anger anyone, for fear they will deny you service. Or, worse, beat you up or kill your pet. But, honestly, there is nothing customers can do about it.

STRATEGY MATTERS

The leadership of the airlines, lacking regulation, implemented a strategy of “be low cost.” The result was creating a culture where employees routinely abuse customers in the process of trying to save a few dimes. If the next Mark Zuckerberg, Elon Musk or Reed Hastings showed up, do you think HR would hire them? Would the Board of Directors, so focused on the wrong strategy, consider any of them as CEO? The wrong strategy has led to the ruination of an entire industry, miserable employees, unhappy customers and marginal returns. It is a terrible culture.

So what is your strategy? Is your strategy creating the culture you want? Are you headed toward happy customers who want more of your product or service, and create growth? Or are you letting your lack of a forward-thinking strategy default you into operational cost cutting, and the movement toward a culture of misery that drives away employees, vendors and eventually customers?

“The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction.

“The Unfriendly Skies” was the motto of customers, mocking the airlines “Friendly Skies” ads. It was clear that by 2008 United did not care about customers. Moving headlong to constantly lower operating costs, United built a culture that focused solely on efficiency, leading to terrible customer service, unhappy customers and employees that were a lot more worried about being yelled at by their bosses for not cutting costs than creating any customer satisfaction. Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he

Then Chairman of American Airlines received Wall Street Journal front-page coverage for realizing people weren’t eating their olives in first class, so he