by Adam Hartung | May 30, 2017 | Innovation, Lifecycle

Last week Microsoft announced its new Surface Pro 5 tablet would be available June 15. Did you miss it? Do you care?

Do you remember when it was a big deal that a major tech company released a new, or upgraded, device? Does it seem like increasingly nobody cares?

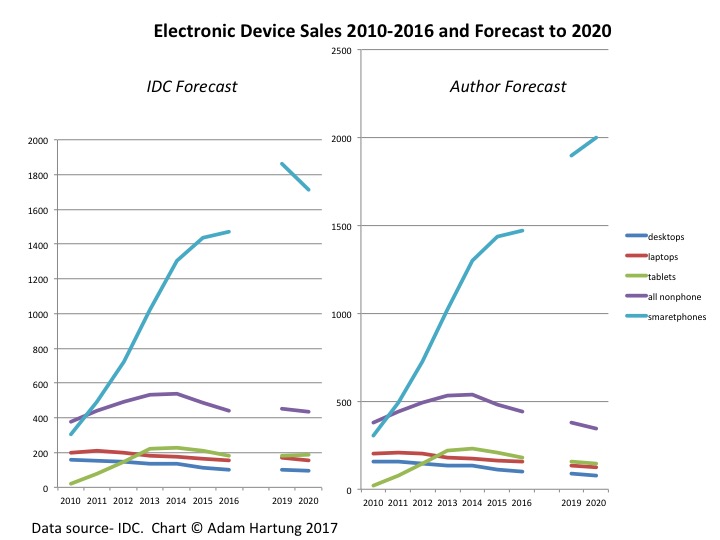

Non-phone device sales are declining, while smartphone sales accelerate

This chart compares IDC sales data, and forecasts, with adjustments to the forecast made by the author. The adjustments offer a fix to IDC’s historical underestimates of PC and tablet sales declines, while simultaneously underestimating sales growth in smartphones.

Since 2010 people are buying fewer desktops and laptops. And after tablet sales ramped up through 2013, tablet purchases have declined precipitously as well. Meanwhile, since 2014 sales of smartphones have doubled, or more, sales of all non-phone devices. And it’s also pretty clear that these trends show no signs of changing.

Why such a stark market shift? After all desktop and laptop sales grew consistently for some 3 decades. Why are they in such decline? And why did the tablet market make such a rapid up, then down movement? It seems pretty clear that people have determined they no longer need large internal hard drives to work locally, nor big keyboards and big screens of non-phone devices. Instead, they can do so much with a phone that this device is becoming the only one they need.

Today a new desktop starts at $350-$400. Laptops start as low as $180, and pretty powerful ones can be had for $500-$700. Tablets also start at about$180, and the newest Microsoft Surface 5 costs $800. Smartphones too start at about $150, and top of the line are $600-$800. So the purchase decision today is not based on price. All devices are more-or-less affordable, and with a range of capabilities that makes price not the determining factor.

Smartphones let most people do most of what they need to do

Every month the Internet-of-Things (IoT) is putting more data in the cloud. And developers are figuring out how to access that data from a smartphone. And smartphone apps are making it increasingly easy to find data, and interact with it, without doing a lot of typing. And without doing a lot of local processing like was commonplace on PCs. Instead, people access the data – whether it is financial information, customer sales and order data, inventory, delivery schedules, plant performance, equipment performance, maintenance specs, throughput, other operating data, web-based news, weather, etc. — via their phone. And they are able to analyze the data with apps they either buy, or that their companies have built or purchased, that don’t rely on an office suite.

Additionally, people are eschewing the old forms of connecting — like email, which benefits from a keyboard — for a combination of texting and social media sites. Why type a lot of words when a picture and a couple of emojis can do the trick?

And nobody listens to CD-based, or watches DVD-based, entertainment any longer. They either stream it live from an app like Pandora, Spotify, StreamUp, Ustream, GoGo or Facebook Live, or they download it from the cloud onto their phone.

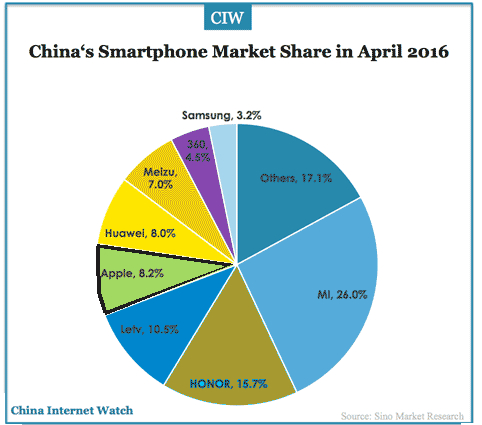

To obtain additional insight into just how prevalent this shift to smartphones has become look beyond the USA. According to IDC there are about 1.8 billion smartphone users globally. China has nearly 600M users, and India has over 300 million users — so they account for at least half the market today. And those markets are growing by far the fastest, increasing purchases every quarter in the range of 15-25% more than previous years.

Chinese manufacturers are rapidly catching up to Apple and Samsung – there will be losers

Clayton Christensen often discusses how technology developers “overshoot” user needs. Early market leaders keep developing enhancements long after their products do all people want, producing upgrades that offer little user benefit. And that has happened with PCs and most tablets. They simply do more than people need today, due to the capabilities of the cloud, IoT and apps. Thus, in markets like China and India we see the rapid uptake of smartphones, while demand for PCs, laptops and tablets languish. People just don’t need those capabilities when the smartphone does what they want — and provides greater levels of portability and 24×7 access, which are benefits greatly treasured.

And that is why companies like Microsoft, Dell and HP really have to worry. Their “core” products such as Windows, Office, PCs, laptops and tablets are getting smaller. And these companies are barely marginal competitors in the high growth sales of smartphones and apps. As the market shifts, where will their revenues originate? Cloud services, versus Amazon AWS? Game consoles?

Even Apple and Samsung have reasons to worry. In China Apple has 8.4% market share, while Samsung has 6%. But the Chinese suppliers Oppo, Vivo, Huawei and Xiaomi have 58.4%. And as 2016 ended Chinese manufacturers, including Lenovo, OnePlus and Gionee, were grabbing over 50% of the Indian market, while Samsung has about 20% and Apple is yet to participate. How long will Apple and Samsung dominate the global market as these Chinese manufacturers grow, and increase product development?

When looking at trends it’s easy to lose track of the forest while focusing on individual trees. Don’t become mired in the differences, and specs, comparing laptops, hybrids, tablets and smartphones. Recognize the big shift is away from all devices other than smartphones, which are constantly increasing their capabilities as cloud services and IoT grows. So buy what suits your, and your company’s, needs — without “overbuying” because capabilities just keep improving. And keep your eyes on new, emerging competitors because they have Apple and Samsung in their sites.

by Adam Hartung | May 26, 2017 | Disruptions, Marketing, Web/Tech

The words “search” and “Google” are practically synonymous. We’ve even turned the name of the ubiquitous web application into a verb by telling people to “Google it.” And that’s good, because Alphabet’s revenue (that’s Google’s parent company) soared more than 25% in the last quarter, and over 90% of Alphabet’s revenue comes from Google AdWords. The more people search using Google, the more money Alphabet makes.

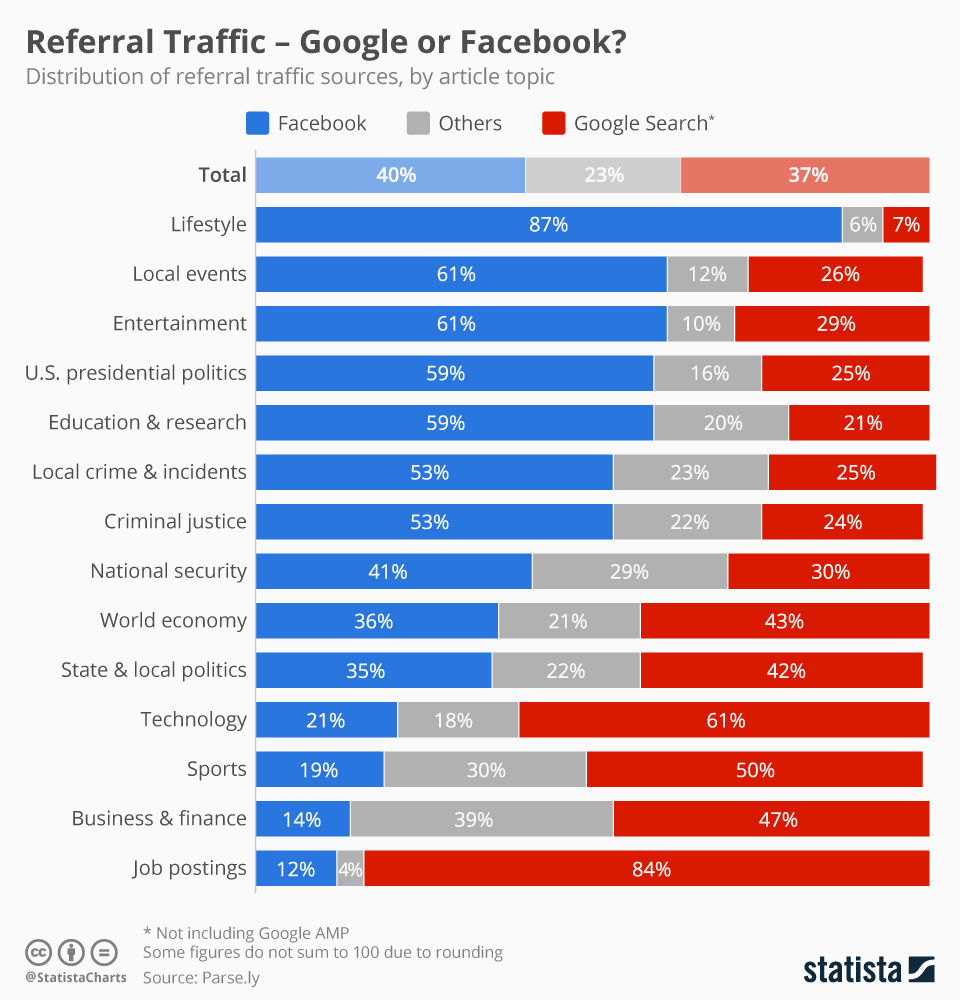

Chart courtesy of Martin Armstrong at Statista.com

But ever since Facebook came along, a new trend has started emerging. People often want answers to their questions within the context of their community. So “searches” are changing. People are going back to what they did before Google existed – they are asking for information from their friends. But online. And primarily using Facebook.

There is no doubt Google dominates keyword searching. But that type of searching has its shortcomings. How often have you found yourself doing multiple searches — adding words, adding phrases, dropping words, etc. trying to find what you were seeking? It’s a common problem, and we all know people who are better “Googlers” than others because of their skill at putting together key words to actually find what we want. And how often do we find ourselves lost in the initial batch of ads, but not finding the link we want? Or going through several pages of links in search of what we seek?

Context often matters. Take the classic problem of finding a place to eat. Googling an answer requires we enter the location, type of food, price point, and other info — which often doesn’t lead us to the desired information, but instead puts us into some kind of web site, or article, with restaurant review. What seems an easy question can be hard to answer when relying on key words.

But, we know how incredibly easy it is for a friend to answer this question. So when seeking a place to eat we use Facebook to ask our friends “hey, any ideas on where I should eat dinner?” Because they know us, and where we are, they fire back specific answers like “the Mexican place two blocks north is just for you,” or “spend the money to eat at that place across the street – pricey but worth it.” Your friends are loaded with context about you, your habits, your favorites and they can give great answers much faster than Google.

Think of these kind of referrals – for food, entertainment, directions, quick facts, local info — as “context based searches” rather than referrals. Instead of making a query with a string of key words, we use context to derive the answer — and our friends. Most people undertake far more of these kind of “searches” than keywords every day.

Even though Google is still growing incredibly fast, context searching — or referrals — pose a threat. People will use their network to answer questions. The web birthed on-line data, and we all quickly wanted engines to help us find that data. We were excited to use Excite, Lycos, InfoSeek, AltaVista and Ask Jeeves to name just a few of the early search engines. We gravitated toward Google because it was simply better. But with the growth of Facebook today we can ask our friends a question faster, and easier, than Google — and often we obtain better results.

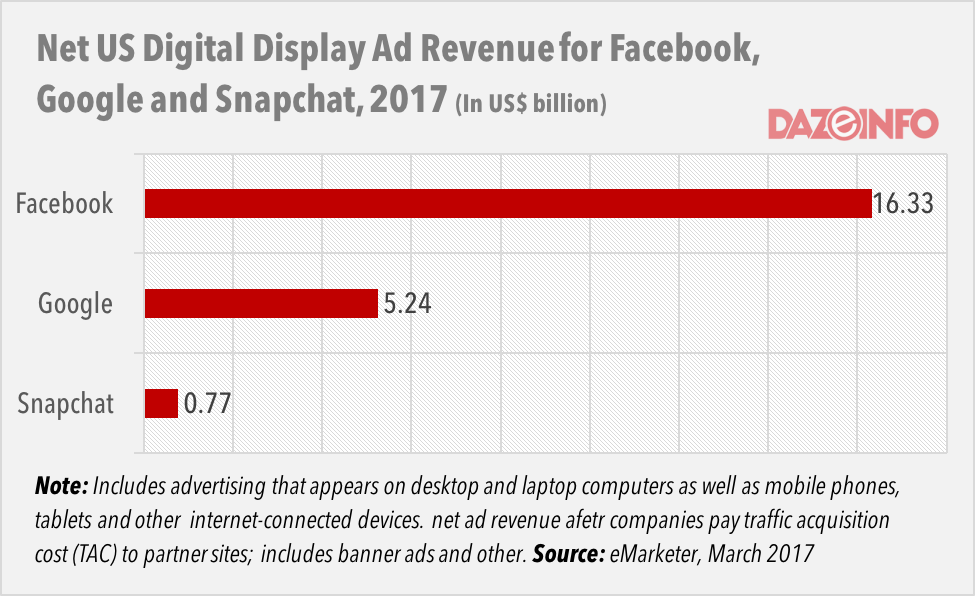

Both Google and Facebook rely on ads for most of their revenue. But if consumer goods companies, event promoters, apparel manufacturers and other “core advertisers” realize that people are using Facebook to ask for information, rather than searching Google, where do you think they will spend their on-line ad dollars? Isn’t it better to have an ad for diapers on the screen when someone asks “what diapers do you like best?” than relying on someone to search for diaper reviews?

This is why Google+ with its Groups and Google Hangouts was such a big deal. Google+ allows users to come together in discussions much like Facebook. But Plus, Groups and Hangouts never really caught on, and Plus isn’t nearly as popular as Facebook discussions, or Instagram picture sharing or WhatsApp messaging. Today, when it comes to referral traffic Facebook has eclipsed Google. Five years ago most people would have guessed this would never happen.

I’m not saying that Google searches will decline, nor am I saying Google will stop growing, nor am I saying that Google’s other revenue generators, like YouTube, won’t grow. I am saying that Facebook as a platform is growing incredibly fast, and becoming an ever more powerful tool for users and advertisers. Possibly a lot more powerful than Google as people use it for more and more information gathering — and referrals. The more people make referrals on Facebook, the more it will attract advertisers, and potentially take searches away from Google.

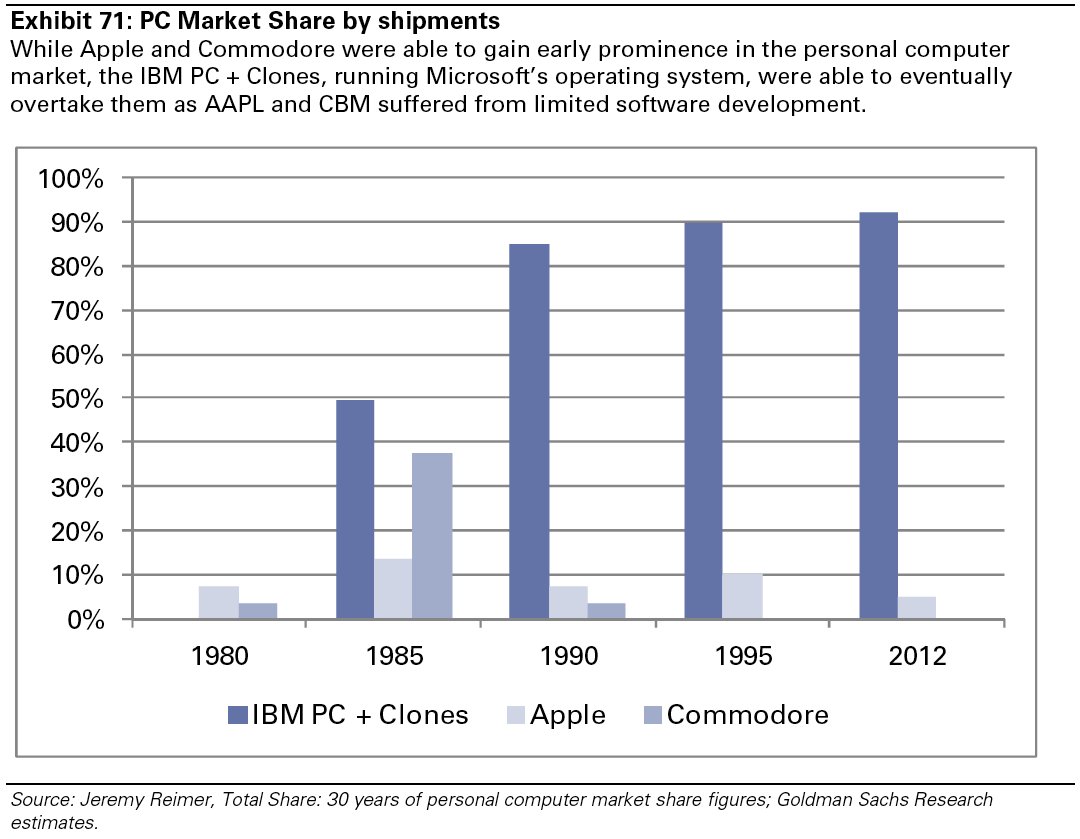

By comparison, this moment may be like the late 1980s when PC sales finally edged ahead of Apple Mac sales. At the time it didn’t look deadly for Apple. But it didn’t take long for the Wintel platform to dominate the market, and the Mac began its slide toward being a submarket favorite.

by Adam Hartung | May 20, 2017 | In the Rapids, Innovation, Investing, Trends

Writing on trends, I frequently profile tech companies that use trends to outperform competitors. But using trends is not restricted to tech companies.

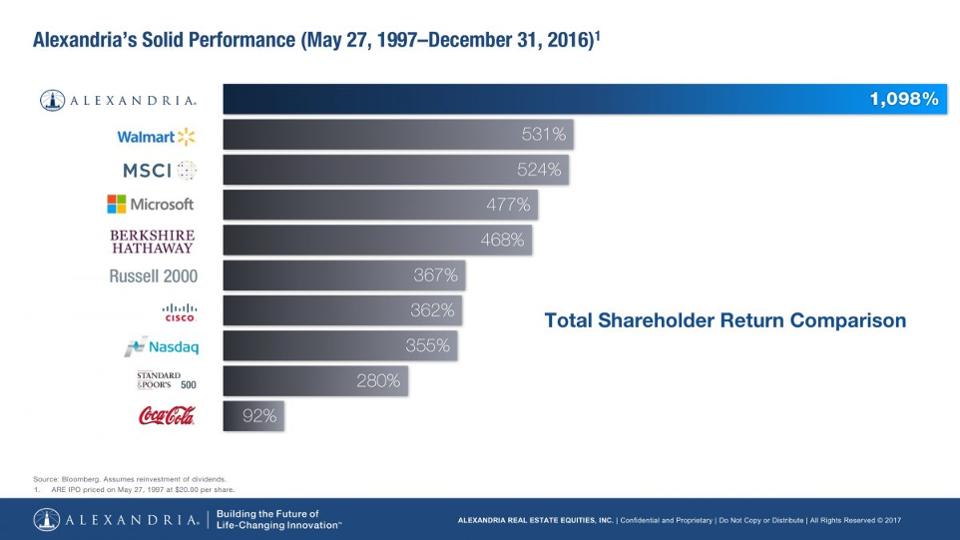

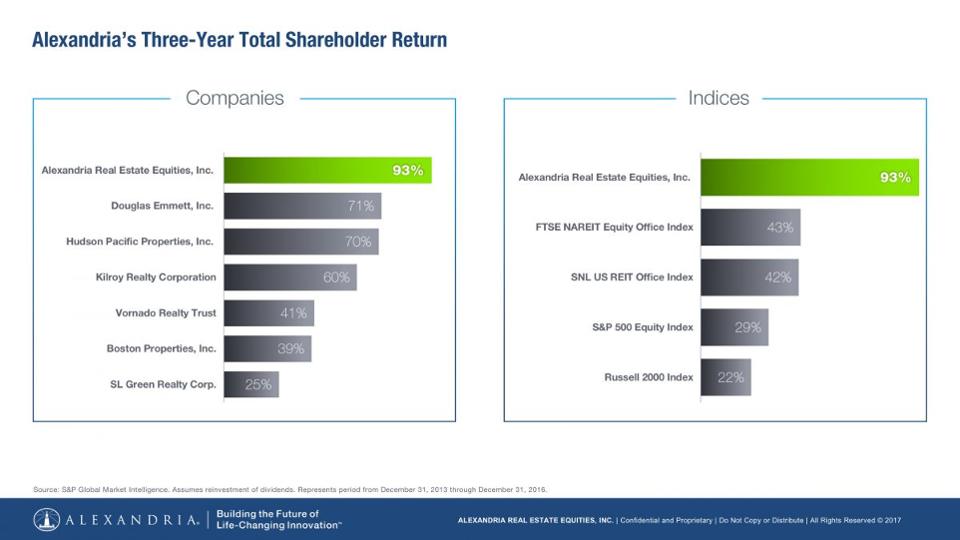

By following trends, since 1998 Alexandria Real Estate Equities has tripled the performance of the NASDAQ, quadrupled returns of the S&P 500, and quintupled the Russell 2000. Alexandria has even outperformed technology stalwart Microsoft, and investment guru Berkshire Hathaway by 230%.

Although you probably never heard of it, Alexandria has trounced its real estate peers. Over the last three years Alexandria has returned double the FTSE NAREIT Equity Office Index, and double the SNL US REIT Office Index. Alexandria’s value has almost doubled during this time, and produced returns 2.3 times better than such well known competitors as Vornado Realty Trust and Boston Properties.

In 1983, Joel Marcus was a lawyer in the IPO market when he noticed the high value launch of biotech firms like Amgen and Genentech. He began tracking the growth of biotechs to see what kind of opportunity might appear to serve these high growth companies.

By 1994 Marcus realized that these companies were struggling to find appropriate real estate to serve their unique needs for laboratory space, and the infrastructure these labs require. It was a classic under-served market, and it was growing fast.

Jacobs Engineering (NYSE:JEC) was serving some of these companies’ needs, including erecting structures for them. But Jacobs did not own any buildings or consider itself a real estate developer. So Marcus approached Jacobs about starting a company to meet the real estate needs of this high growth biotech industry. Marcus put up some money, Jacobs put up some money, and other friends/associates combined to raise $19 million. There was no professionally managed money involved – and no real estate developers.

Focusing on the rapidly expanding biotech scene in San Diego, the newly created Alexandria bought 4 buildings. They refocused the buildings on the unserved needs of local biotech companies and did a quick flip, breaking even on the transaction. With just a bit of money Alexandria had proven that the market existed, the trend was real and users were under-served.

But, like any idea based on an emerging trend, growing was not easy. Using their first transaction as “proof of concept” CEO Marcus and his team set out to raise $100 million. Quickly Paine Webber (now UBS) secured $75 million in debt financing. But moving forward required raising $25 million in equity.

Over the next few weeks Alexandria pitched a slew of nay-sayers. From GE Capital to CALPERS investors felt that their first deal was a “1-trick pony,” and this “niche market” was not a sustainable business. Finally, after 29 failed pitches, the AEW pension fund, an early stage real estate investor, saw the trend and invested.

The Alexandria team realized that fast client growth meant there was no time to develop from ground up. They focused on high growth geographies for biotech, places where the trend was more pronounced, and bought 11 existing properties:

- In Seattle they found a cancer center they could buy, improve and do a sale-leaseback

- In San Francisco they identified a portfolio of properties in Alameda they could improve, lease to biotech companies and even suit the needs of the FDA as a tenant

- In Maryland they identified opportunities to support the lab needs of the Army Corps of Engineers forensic research lab, and ATF testing lab for imported vodka, and a medical testing lab near Dulles – which is now leased to Quest Diagnostics

Realizing that companies needing labs tended to cluster, leadership focused on finding locations where clusters were likely to emerge. They bought land in San Francisco, San Diego, New York and Worcester, MA. What looked like risky locations to others looked like profitable opportunities to Alexandria due to their superior trend research.

Historically pharma companies built their headquarters, and labs, in suburban locations where development was easy, and labs were welcome. Alexandria realized the new trend for emerging companies was to be near universities in urban environments, and although land was costly — and development more difficult — this was the right place to leverage the trend.

Today Alexandria is the bona fide market leader in labs and tech facilities in the USA. By seeing the trend early they bought land which is now so expensive it is practically untouchable – even for $1 billion. Their development pipeline includes Mission Bay, Kendall Square, the Manhattan borough of New York City and RTP (Research Triangle Park.) Today companies want to be where the lab is — and frequently the lab space is now owned, or being developed, by Alexandria.

This didn’t happen by accident. Not at the beginning nor as Alexandria plans its future growth. The company maintains a team of 13 researchers studying market trends in technology, and under-served real estate needs. They constantly track employers of tech/research people, competitors, historical and emerging customers — and identify prospective tech tenants who will need specialized real estate. A few of the leading trends Alexandria follows include:

- Urbanization — The siloed campuses set in bucolic suburbs is the past

- Innovation externalization — Over 50% of innovation in big pharma is now outsourced. And universities are spinning out innovations faster than ever into development centers for testing and commercialization

- Nutrition and disease management — These are emerging markets ripe with new products making their way to commercialization, and needing space to grow

Alexandria’s historical and ongoing successes relied first and foremost on using trends to understand underserved markets where needs will soon be the greatest. This is an important lesson for all businesses. No matter what you do, what you sell, or your industry you can generate higher returns, outperform your peers, and outperform the market rewarding investors by identifying trends and investing in them.

Thanks to Joel Marcus for providing an interview to explain the history and current practices at Alexandria.

by Adam Hartung | Apr 27, 2017 | Investing, Mobile, Web/Tech

People love to watch tech stocks, because there is so much volatility. Just today (April 27, 2017) Alphabet beat expectations and its shares rose $34 (about 4%) after hours. GOOG is up 15.5% in 2017, and 31% for the year. But not all tech stocks do this well. Twitter, for example, had a nice increase of late — but TWTR is down 33% since peaking in early October, and it is down 69% from 10/2014 highs.

So how is an investor to know which tech stocks to own, and which to eschew?

They key, of course, is to watch trends. And to recognize who absolutely dominates those trends. When it comes to the rapidly growing world of social media, it is increasingly clear there is only one Goliath — and that is Facebook.

Felix Richter, Statista

Felix Richter, Statista

Snapchat created a lot of interest when it hit the scene. A darling of the most youthful set, it was growing very fast and had exceeded 100 million users by January 2016. By January 2017 Snapchat added another 60 million users — growing 60%. But since going public the stock has dropped about 10%. And according to Marketwatch only 12 analysts rank it a “buy” while 23 rank it a “hold,” “underweight” or “sell.”

Should you buy Snapchat? After all, Facebook dropped after its IPO

As the chart from Statista shows, in just eight months Instagram Stories has blown way past the user base of Snapchat. In April 2012 Facebook paid $1 billion for Instagram, then a popular photo-sharing app, which had no revenues. The idea was to leverage Facebook’s installed base to grow the app. Since September, 2013 Instagram has been adding 50 million users per quarter. Instagram now has 600 million active users and became one of the five most popular mobile apps in the world.

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

The Facebook App Ecosystem Totally Dominates Mobile. Chart reproduced courtesy of Felix Richter at Statista

Looking at Facebook, one has to marvel at how the company has kept users in its ecosystem. As the Statista chart shows, since 2016 Facebook has had four of the top five mobile app downloads. Now that Instagram Stories has blown past Snapchat, Facebook holds all four top positions.

Does anyone remember when Facebook purchased Beluga in 2011 for about $20 million? That is now Messenger, and it opened the door for sending pictures and video. Do you remember the $19 billion acquisition of WhatsApp — which had only $10 million in revenues? Both have added multiple capabilities, and now Messenger has 1 billion active users, and WhatsApp has 1.2 billion users.

In fiscal 2012 Facebook hit $1 billion in quarterly revenue, and ended the year with just over $4 billion in annual revenues. Q4 2016 exceeded $8.8 billion, and for the year $27.6 billion.

It is for good reason that almost twice as many analysts are skeptical of Snapchat’s future value as those who think it will go up.

Snapchat is competing with Facebook, a company that has shown time and again it can watch the trends and put in place products that initially meet, but then eventually exceed customer expectations. One might like to think Snapchat is a good David, putting up a good fight. But this time, investors are likely to be much better off betting on Goliath. Facebook still has a lot of opportunity to grow.

by Adam Hartung | Apr 24, 2017 | Newsletter Post

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Stop Throwing Your Company’s Resources Away

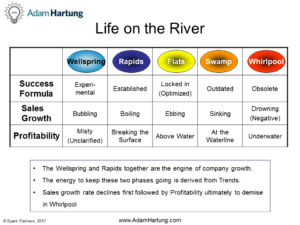

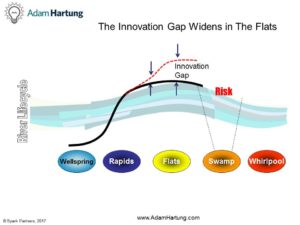

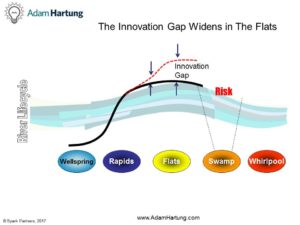

Is your organization stuck in the Flats of the River Lifecycle  while the Innovation Gap grows? Are you pouring your resources into doing more of what you’ve done, even though you aren’t achieving the results you want – and need? Are competitors outflanking you with innovations? Are your customers telling you everything is fine, then buying from competitors? OUCH!!!

while the Innovation Gap grows? Are you pouring your resources into doing more of what you’ve done, even though you aren’t achieving the results you want – and need? Are competitors outflanking you with innovations? Are your customers telling you everything is fine, then buying from competitors? OUCH!!!

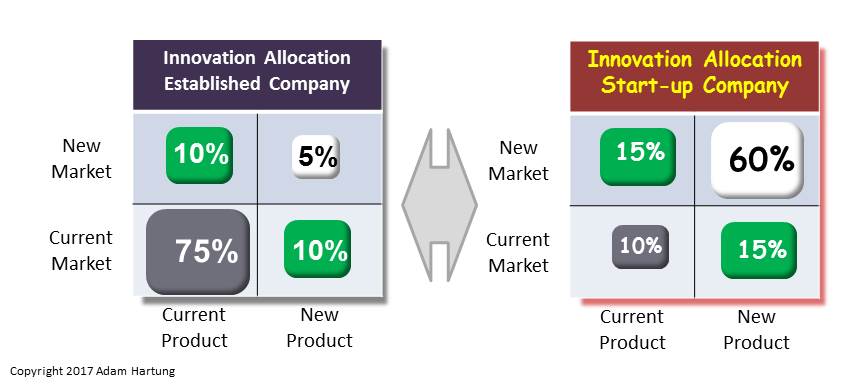

You need to change how you use your resources. You need to figure out how to put more resources into new products and customers, and less into trying to defend & extend sales of current products to current customers.

You need to change how you use your resources. You need to figure out how to put more resources into new products and customers, and less into trying to defend &extend sales of current products to current customers.

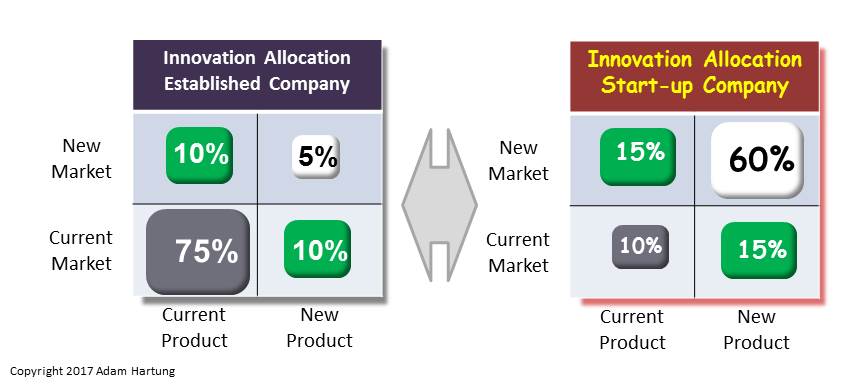

For established companies, the investment mix often looks like this.

But for start-ups would you be surprised to know their resources are allocated more like this?

Our experience taught us that when the Current/Current investment exceeds 40% the company is “Stuck in the Flats;” over-resourcing slow growth business while under-resourcing new opportunities. After the frenzied growth in the Rapids, it feels like a relief to reach the Flats – where leadership would love to cruise along on auto-pilot, fine-tuning a few things and watching costs. But, the drift into decline begins at that moment- because the focus shifts to internal process optimization at the expense of monitoring external market trends. (Click here for last month’s newsletter on the River.)

Remember, the Ansoff matrix doesn’t just apply to where you put the money. As the Bain alums wrote in “Time,Talent, Energy” (see my review here,) you can use the Ansoff matrix to manage your talented people. In the Flats, leadership puts the best people in the Existing/Existing corner – optimizing the OLD business. The unintended effect is to dry up the Wellspring of new ideas, and leave precious little talent available for focusing on new growth.

To remain on the growth curve, companies need to put their best people onto new efforts, including projects in the New/New corner! By moving more investment capital, and talent clusters, into other cells any company can keep the Wellspring flowing with ideas and find The Next Big thing.

“Knowing your purpose helps you in using all available resources in achieving your goals.”

Sunday Adelaja

Pastor and Author

Examine or audit your investment in innovation. Try to assess the investment in each cell of the Ansoff matrix. Be rigorous about your classification because your competitors may be innovating or “pivoting” just to survive. Look for an outside source to provide some objective feedback on investment of people, funds and assets. Don’t hesitate to ask for help in making your organization more adaptable, and your strategy embedded with options to pivot based on market shifts. You could start with an underperforming product or brand.

We are your experts at identifying trends, creating scenarios and building monitoring systems. We’ve done this kind of work for over 20 years, and bring a wealth of experience, and tools, to the task. You don’t have to go into scenario planning alone; we can be your coach and mentor to speed learning, and success.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Give us a call today, or send an email, so we can talk about how you can be a leader, rather than follower. Or check out the rest of the website to read up on what we do so we can create the right level of engagement for you.

Forbes Posts- Hartung on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Apr 21, 2017 | Boards of Directors, Investing, Leadership

When I was young, IBM dominated computing. In the tech world, when comparing platforms, everyone said, “Nobody ever got fired for buying IBM.” IBM was a standout role model for sales success, product leadership and investor returns.

Now, not so much. IBM’s stock fell almost 5% on Wednesday after the company reported “lackluster” results. For the week IBM lost about $20 per share – almost 12%. Quarterly revenue last quarter fell 3%, making 20 consecutive quarters of declining revenue for the once-dominant behemoth and Dow Jones Industrial Average (DJIA) component.

CEO of IBM Ginni Rometty (Photo by Neilson Barnard/Getty Images for New York Times)

The stock is still up from January 2016 lows of $125, and you might think this pullback is a buying opportunity. But you would be wrong. For long-term investors the stock has fallen from about $194 when CEO Ginni Rometty took control to the recent $160 — a 17.5% decline over five years. And that is after spending $9 billion on payouts (mostly share buybacks) to prop up the stock!

But because of its long-term “growth stall” the odds are almost a certainty things will continue to worsen for IBM.

(c) Adam Hartung and Spark Partners

(c) Adam Hartung and Spark Partners

Growth Stalls are Deadly Accurate Predictors of Future Value Declines

When a company has two consecutive declining quarters of revenue or earnings, or two consecutive quarters of revenue or earnings lower than the previous year, that company is in a “growth stall.” After stalling, 93% of companies will struggle to consistently grow a mere 2%. Seventy percent will lose more than half their market cap.

I made this same

call, to not own IBM, in May 2014. Then IBM had registered a stall on both the quarter-to-quarter metric, and on the year-over-year quarterly metric. IBM was clearly in a “growth stall” and showed no signs of turning around its fortunes. Now IBM has failed to grow quarterly revenue for

five years!Supported by the company PR and investor relations departments, optimists will claim there is reason to think things will improve. For example, in September 2015 IBM executive John Kelly predicted that Watson would be the next “huge engine” for growth. Today the Cognitive Computing segment that is Watson is about the same size it was then. In fact none of the five IBM segments are showing strong growth.

The reason a “growth stall” is such an accurate predictor of future bad results is its ability, in a very simple way, to describe when a company falls out of step with its customers/marketplace. The market went one way — in this case to mobile apps, mobile devices and cloud computing — while the company remained in outdated businesses and launched competitive offerings too late to catch the early market makers. At IBM, Cognitive has not become a big new market, while the historical Business Services and Systems segments keep shrinking, and Cloud Services is simply out-gunned by competitors like Amazon.

Rometty should be replaced by someone from outside IBM.

Meanwhile, the CEO keeps her job and even achieves pay raises! In 2016 IBM’s stock had dropped 36% since Rometty took the CEO position, yet the board of directors payed out the max bonus, leading the LA Times to headline “IBM’s CEO Writes a New Chapter on How To Turn Failure Into Wealth.” Last year the company share price bounced of its lows, but still far below what it was when she took the job, and in 2017 the Board increased her bonus from 2016! And the CEO will be granted a long-term pay incentive of $13.3 million in June (to be paid in 2020).

Like Immelt at GE, Rometty should be fired. If there were an updated list of the “5 Worst CEO’s Who Should Have Already Been Fired,” CEO Rometty surely deserves to be on it. And a new leader needs to implement an entirely new strategy if IBM is ever to regain its lost glory.

IBM’s stock may bounce around quite a bit. It’s shareholder base is very large. And really big investors, like pension funds and mutual funds, are very slow to dump their positions. But, eventually, everyone realizes that a shrinking company is not a value creation company, and they keep selling shares into any sign of strength. Big investors eventually recognize when a Board is unwilling to actually help lead a company, and unwilling to face down a bad CEO and replace her with someone more competently able to turn around a perennial terrible performer. So they start selling before the bottom falls out — like Sears and AT&T after they were removed from the DJIA.

There’s a lot more downside potential for IBM’s valuation.

In IBM’s case, the shares are at about $195 when the first data indicating a growth stall were evident (Q3 2012). They then peaked at $213 in March 2013. And it has been an ugly ride since. he “bounce” in 2016 from $125 to $180 was actually the best selling opportunity since September 2014 (just after I made the call to get out). At $160, IBM is down about 18% since the growth stall started (largely due to share buybacks) and revenues have kept dropping. According to “growth stall” analysis there is a 69% probability IBM’s shares will fall to $85 per share — or less — before the company fails, or starts a true, long-term recovery under new leadership.

by Adam Hartung | Apr 10, 2017 | Leadership, Transportation

Most readers of this column will already know that on Sunday, April 9, 2017 United Airlines forcibly removed a 69-year-old passenger from a flight, over his objections. United employees had Chicago Aviation Police board the plane, grab the passenger (who had a valid boarding pass) and drag him off the plane as if he were a hijacker. In the process the police banged his head on an armrest, leaving him battered and bloodied. When the passenger returned to the plane the police again forcibly manhandled him, restrained him and took him off the plane strapped onto a stretcher.

All so the airline could board a flight attendant that needed to reach the plane’s destination in order to make her next working flight. In other words, United’s front line management chose to not only inconvenience a paying customer, but physically abuse that customer so the airline would maintain its operating crew schedule.

After, the company CEO Oscar Munoz apologized for “re-accomodating” customers. Since about 40,000 people are “re-accomodated” — or bumped from oversold flights — annually, the CEO’s apology covers the 3,675 United customers bumped in 2016. But, he did not apologize for United employees taking action that directly led to the physical abuse of a customer.

Most of us would not believe this story if it were part of a fictional movie. How could it be possible for a front-line employee to think it is acceptable to forcibly eject a paying customer already on the plane?How could it be possible that a CEO would be so uncaring as to not apologize for a clear, horrific lapse in judgement by someone on his management team? Whatever the situation, every action taken by United merely served to make the situation worse. How could a company so large be so mismanaged — from the bottom to the top?

Blame “Operational Excellence”

That is the problem with CEOs, and leadership teams, that focus on “operational excellence” as a strategy. They become so focused on efficiency, cost cutting and business operations that they forget about customers — or anything else. All that matters is keeping the business operating, while trying to keep costs as low as absolutely possible. Management, from bottom to top, is rewarded for operational performance, while all other metrics are ignored. Including customer satisfaction.

In “operationally excellent” companies the focus on low costs is driven by a desire to keep prices low. The perception among management is that customers care only about price, so there is no reason to track anything other than costs. If they keep costs (and prices) low customers will be happy, regardless of anything else in the customer’s experience.

United Has Abused Customers For Years

This is not the first time United has had this kind of problem. In 2009 Canadian musician Dave Carroll became a sensation after producing a series of YouTube videos that chronicled his experience after United baggage handlers destroyed his guitar. The baggage handlers clearly did not care about his guitar. Nor did the gate agents, the baggage department or the customer service department. After many, many calls United personnel simply decided Mr. Caroll’s broken guitar would not be compensated — even though they broke it — and he should just “get over it.”

In 2013, United came in dead last in the Airline Quality Rating. United’s response (as I detailed in a 2013 Forbes column) was simply that “they did not care.” Quite literally, lowering cost was more important that being dead last in customer satisfaction.

In 2016, United fired its CEO after discovering he was bribing government officials to obtain favorable treatment at New Jersey and New York airports. The pressure to lower cost in the “operationally excellent” strategy was so paramount that judgement falters not only at low levels, but all the way up to the CEO.

Operational Excellence Hurt WalMart As Well As United

United isn’t alone in its failures due to operational excellence focus. WalMart has been the victim of bad management judgment for the same reason. Remember in July, 2014 when a WalMart truck driver who had been awake for 24 hours hit a car in New Jersey killing comedian James McNair and seriously injuring comedian Tracy Morgan? That driver had been on the road longer than he should, with insufficient sleep, in his effort to meet operational deadlines – and was charged with aggravated manslaughter, second-degree vehicular homicide and 8 counts of third-degree aggravated assault charges.

This happened just two years after investors learned WalMart was accused of bribing Mexican government officials to keep costs low there — bribery that caused the departure of the WalMart Mexico president, and eventually Walmart’s CEO. In both cases, at the top and at the front line, judgment was impaired by leadership’s focus on operational efficiency.

Unfortunately, too many business leaders put too much energy into operational excellence. They focus on cutting costs, improving operations, and trying to offer low price as the primary reason customers should do business with them. They quickly lose sight of customer needs, wants and wishes as they overly simplify their business’ offering into price. And this leads to bad decision-making all the way from the CEO to the front line manager — who will drive customers away in his effort to meet operational metrics and goals.

Once Locked In Operational Excellence Is A Hard Strategy, And Culture, To Change

United clearly needs a cultural change. But will it make one? Given the CEO’s reaction to this incident, it appears highly unlikely. Locked in to viewing his company operationally, Munoz appears to have lost common sense when it comes to customers – and running the business in a way that can lead to long-term profitability. Herb Kelleher, founder of Southwest Airlines, and Richard Branson, founder of Virgin Airlines, knew there was more to a successful airline than flight schedules and cheap fuel purchases. So far United’s leadership has failed to see the obvious.

by Adam Hartung | Apr 8, 2017 | Economy, Employment

The Labor Department March jobs report came out last week, and it disappointed a lot of people. At 98,000 new jobs, the number was about half what economists predicted. Simultaneously, the report revised January and February down a combined 38,000 jobs. Retail workers lost 30,000 jobs in March, which combined with February means 56,000 retailers lost jobs in just two months. There was ample disappointment to go around.

But, if we take a longer-term view the trend is much more pronounced, and we can easily see that overall the jobs market is very, very healthy – forcing employers to raise wages.

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

As the chart above indicates, America has recreated almost all the jobs lost in the Great Recession (chart courtesy of Kriston McIntosh of The Hamilton Project – Brookings). Almost 10 million jobs were lost between 2008 and 2010 as the financial crisis wiped out banks, and lending. That was a staggering decline of about 420,000 jobs per month.

Because businesses were loath to re-invest following the economic meltdown, the rate of job creation has been considerably slower than the speed with which executives laid off employees. However, since the end of 2011 the U.S. has been adding jobs at the rate of over 200,000 per month – a dramatic growth in job creation over an extraordinarily long-term period. Literally, unprecedented.

And, if we average the job creation rate the first three months of 2017 it comes to 178,000 per month. At this lower pace the jobs market will have fully recovered within the next four months (by August, 2017). This jobs growth rate may be less than the last six years, but it is far more than is necessary to maintain employment rates – including population gains.

We see this very healthy improvement in the jobs situation in other statistics. Those in part-time positions seeking full-time positions fell to the lowest in several years at 8.9%. And, unemployment declined to 4.5% from 4.7% – a clear indication that there were more people finding work than losing work, pulling more people into the workforce for yet another month. At 4.5%, this is the lowest unemployment rate in a decade.

Net/net, America is rapidly approaching “

full employment” – a term that means everyone who wants a job either has one, or is intentionally looking for a job and reasonably expects to find one in three months. Or, in other words, if you know somebody complaining they can’t find a job it is either because they aren’t really trying, or they are picky about what they want to do, or they can find a job but won’t take it because they want higher pay.

And hourly pay continues to rise, increasing 2.7% versus March, 2016. This is less than in good times, when pay tends to rise at 3-4%/year – but the fact that pay is going up means the labor market is tightening. And as the economy reaches higher levels of employment, and lower levels of unemployment, companies will have to pay more to find new workers – and increase wages on current workers to keep them from leaving. Thus, it is a surety that pay will rise throughout 2017, and probably into the foreseeable future.

Whether you liked President Obama or not, the policies of the last six years allowed America to escape the Great Recession. Today 78.5% of all working age people are in the workforce – that is the highest labor participation rate of working age people since 2008 – indicating a complete recovery from the job collapse.

Thus, it is time for changes in economic policy. To keep calling for job creation is, classically, “fighting the last war.” Even as government is reducing employment, and some industries (like traditional retail) are collapsing employment, there are other parts of the economy growing jobs. Amazon.com, for example, has announced it will be adding 100,000 U.S. jobs by the middle of 2018.

For President Trump to claim there are 100 million people in the USA looking for work is an impossibility. There are only 325 million people in America, and 26.4% of those are between under the age of 17 and over 65 – so 86 million. That only leaves 239 million people of working age in the country. We know that of those at least 78.5% are employed – which is 188 million. Thus, at its maximum, there are only 51 million people who could be looking for work. But we know that many are not because of ill-health, or simply choice. According to the Labor Department, there are about 5 million people looking for work in the U.S. at this time, which is just about the same number of job openings.

It’s time to get over the constant complaining about a job shortage. And here’s what this means for you:

1. After a long decade of stagnation, we can expect everyone to receive higher pay.

2. Job mobility will improve. If you don’t like your current job you can probably find another one.

3. Employers will have to stop burning out employees and do more to keep them as unemployment rates decline.

4. Immigration will be less of an issue, because America will need people to fill jobs (many employers are already complaining about changes to H1-B visa rules).

5. Employers will pay more for employee training and retraining.

6. People 30 and younger have struggled to build careers and start families during the recovery. Expect that situation to reverse.

7. More jobs, more money, a faster growing economy is better for tax receipts. This will relieve stress on government budgets.

8. Higher real estate prices. Some markets are already back to pre-recession levels, yet others have languished. Expect across the board increases.

9. Interest rates will go up (from record lows). Lock-in your mortgage now. Adjust your portfolio from bonds to stocks.

10. Expect the dollar to remain strong, so imports will be cheap and exporting will continue to be more difficult. It’s a good time to visit foreign destinations, and it will be a struggle to attract international tourists.

Look beyond short-term numbers. Month-to-month, even quarter-to-quarter, numbers often yield little analytical value. Look at the long-term trend. Then make sure you, and your business, are ready. Don’t keep fighting the last war, prepare to capture the next opportunity.

by Adam Hartung | Mar 30, 2017 | Boards of Directors, Disruptions, Investing, Leadership

(Photo: CEO of Amazon.com, Inc. Jeff Bezos, TOMMASO BODDI/AFP/Getty Images)

Amazon.com is now worth about the same as Berkshire Hathaway. Amazon has had an amazing run-up in value. The stock is up 17% year to date, and 46% over the last 12 months. By comparison, Berkshire has risen 3.1% this year and Microsoft has risen 5.6% —while the S&P 500 is up 5.8%. Due to this greater value increase, Jeff Bezos has become the second richest man in the world, jumping past Warren Buffett while Bill Gates remains No. 1.

Obviously, it wouldn’t take much of a slip in Amazon, or a jump in Berkshire, to reverse the positions of the companies and their CEOs. But it is important to recognize what is happening when a barely profitable company that sells general merchandise, technology products (Kindles, Fires and Echos) and technology services (AWS) eclipses one of the most revered financial minds and successful investment managers of all time.

Warren Buffett (Photo by Paul Morigi/Getty Images for Fortune/Time Inc)

Berkshire Hathaway was a financial pioneer for the Industrial Era. Warren Buffett bought a down-and-out textile company and created enormous value by turning it into a financial powerhouse. At the time America, and the world, was still in the Industrial Revolution. Making things – manufacturing – was the biggest industry of all. Buffett and his colleagues recognized that capital for these companies was deployed very inefficiently. Often too much capital was invested in poor ways, while insufficient capital was invested in good opportunities. If Berkshire could build a capital base it could deploy that capital into high-return opportunities, and make above-average rates of return.

When Buffett started his magical machine he realized that capital was often in short supply. Companies had to ration capital, unable to build the means of production they desired. Banks were unwilling to lend when they perceived any risk, even when the risk was not that great. Simultaneously investment banks were highly inefficient. The industry was unwilling to support companies prior to going public, often uninterested in taking companies public, and poor at allocating additional capital to the highest return opportunities. By the time you were big enough to use an investment bank you really didn’t need them to raise capital – they just organized the transactions.

This inefficiency in capital allocation meant that an investor with capital could create tremendous gains by deploying it in high return opportunities that often had minimal risk – or at least risk that could be offset with other investments.

Berkshire Hathaway was a big winner at mastering finance during the industrial era. By putting money in the right place, at the right time, tremendous gains could be made. Berkshire didn’t have to be a manufacturer, it could make a higher rate of return by understanding how to deploy capital to industrial companies in a marketplace where capital was rationed. In other words, give people money when they need it and Berkshire could generate outsized returns.

It was a great strategy for supporting companies in the Industrial Age. And a great way to make money when capital was hard to come by.

But the world has changed. Two important things happened First, capital became a lot easier to acquire. Deregulation and a vast expansion of financial services led to a greater willingness to lend by banks, larger secondary markets for bank-originated products that carried risk, the creation of venture capital and private equity firms willing to invest in riskier opportunities, and a dramatic growth in investment banking globally making it far easier to go public and raise equity. Capital became vastly more available, and the cost of capital dropped dramatically.

This made finding opportunities for outsized returns just based on investing considerably more difficult. And thus every year it has become harder for Berkshire Hathaway to find investment opportunities that exceed market rates of return. Berkshire isn’t doing poorly, but it now competes in a world of many competitors who have driven down returns for everyone. Thus, Berkshire’s returns increasingly move toward the market norm.

The Industrial Era is dead — usher in the Information Era. Second, we are no longer in the Industrial Age. Sometime in the 1990s (economic historians will pin it to a specific date eventually) the world transitioned into the Information Age. In the Information Age assets are no longer worth as much as they previously were. Instead, information has become much more valuable. What a business knows about customers, markets and supply chains is worth more than the buildings, machines and trucks that actually make up the physical economy. The value from having information has become much higher than the value of things — or of providing capital to purchase things.

In the Information Era, few companies have mastered the art of information management better than Amazon.com. Amazon doesn’t succeed because it has great retail stores, or great product inventory or even great computers. Amazon’s success is based on knowing things about markets and its customers. Amazon has piles and piles of data, and Amazon monetizes that information into sales.

By studying customer habits, every time they buy something, Amazon has been able to make the company more valuable to customers. Often Amazon is able to tell a customer what they need before they realize they need it. And Amazon is able to predict the flow of new product introductions, and predict sales for manufacturers with great accuracy. Amazon is able to understand what media customers want, and when they’ll want it. Amazon is able to predict a business’ “cloud needs” before that business knows – and predict the customer’s likely future services needs long before the customer knows.

In the Information Age, Amazon is one of the very, very best information companies out there. It knows how to obtain information, analyze those mounds of “big data” to determine and predict needs, then connect customers with things they want to buy. Being great at information means that Amazon, even with its relatively poor current profits, is positioned to capitalize on its intellectual property for years to come. Not without competition. But with a tremendous competitive lead.

So, how is your portfolio allocated? Are you invested in assets, or information? Accumulating assets is a very hard way to make high rates of return. But creating sales, and profits, out of information is far easier today. The relative change in the value of Amazon and Berkshire is telling investors that it is now smarter to be long information rich companies than asset rich companies.

If you’re long GE, GM, 3M and Walmart how well will you do in an economy where information is more valuable than assets? If you don’t own data rich, analytically intensive companies like Amazon, Facebook, Alphabet/Google and Netflix how would you expect to make above-average rates of return?

And where is your business investing? Are you still putting most of your attention on how you allocate capital, in a world where capital is abundant and cheap? Are you focusing your attention on getting the most out of what you know about markets, customers and suppliers, or just making and selling more stuff? Do you invest in projects to give you insights competitors don’t have, or in making more of the products you have — or launching product version X?

And are you being smart about how you manage your most important information tool — your talented employees? Information is worthless without insight. It is critical companies today do all they can to help employees develop insights, and then rapidly deploy those insights to grow sales. If you spend a few hours pouring over expenses to find dimes, consider letting that activity go in order to spend hours brainstorming how to find new markets and new product opportunities that can generate a lot more revenue dollars.

by Adam Hartung | Mar 30, 2017 | Newsletter Post

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

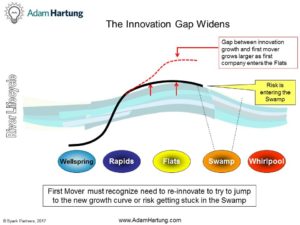

Are You Lost in the Innovation Gap?

Copyright Adam Hartung, 2017

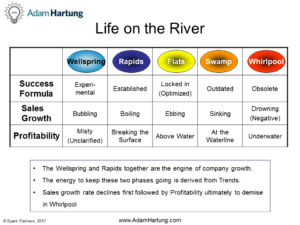

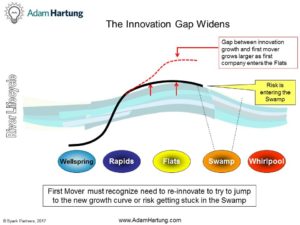

In the Wellspring of the product lifecycle river, organizations are creating innovations (see last month’s newsletter on the Lifecycle River here.) In the Rapids it’s all about finding customers for those innovations.

As volume grows organizations start focusing on optimizing operations, thereby “locking in” the Success Formula. Unfortunately, this decision – which seems obvious – almost always leads to decline!

Optimization causes an organizational shift away from focusing on the marketplace, toward focusing internally. More controls are implemented to insure standardization – and “process management” affects all parts of the company. The byword is “focus” as parts of the business are jettisoned, product lines dropped, assets sold and headcount lowered. These actions move the company from the Rapids of growth to the Flats of business model optimization – which produces short-term profit improvements, but cuts ties to market inputs necessary for long-term growth.

As CEO from 1981 to 2001 Neutron Jack expanded GE into multiple businesses from media (NBC/Universal) to financial services (GE Capital.) In the growth Rapids GE’s value (adjusted for splits, etc.) rose from $1.30/share to $46.75 – 35x or 3,500%. As CEO Jeff Immelt has“refocused” GE on its “core,” selling multiple businesses as he moved to grow profitability. Since 2001 GE’s value has fallen to $29.05/share – a decline of 38% (meanwhile the DJIA has almost doubled in value.)

In the Flats investments for low risk projects improving the existing business are approved rather than grander investments in new innovations. Although profits improve,the further the company (or product line) travels from the Rapids of customer focus into the optimization Flats, the greater the chance it will miss the next cycle of innovation and slip into the Swamp of decline.

As other companies continue innovating, market growth continues (often with substitutes) but the former leader does not participate. “First Mover” advantage disappears because innovators leapfrog the creator. This gap between market growth and company growth is called the Innovation Gap. The longer the company focuses on optimization, and profit maximization, the larger the Innovation Gap becomes.

As other companies continue innovating, market growth continues (often with substitutes) but the former leader does not participate. “First Mover” advantage disappears because innovators leapfrog the creator. This gap between market growth and company growth is called the Innovation Gap. The longer the company focuses on optimization, and profit maximization, the larger the Innovation Gap becomes.

To avoid becoming stuck in the Flats it is crucial to maintain a growth focus and avoid a profit focus. Like Amazon.com, you must track trends and competition and never hesitate to keep innovating. Investments in Wellspring projects must be maintained, and the lure of constantly investing to improve the old must be held at bay.

Next month we’ll discuss how you can track your resources in order to keep investing in the Rapids.

“You’ve got to keep reinventing. You’ll have new competitors. You’ll have new customers all around you.”

Ginni Rometty

Chairman, President and CEO of IBM

Don’t hesitate to ask for help in making your organization more adaptable, and your strategy embedded with options based on market shifts. You could start with an underperforming product or brand. Audit your company’s market sensing process at least twice a year. Does the process look outside the customer base and known competitors? What technologies might put the product line at risk?

Our two decades of helping organizations identify and implement innovations gives us keen insight into how sustaining, expanding and disruptive innovations can be identified, evaluated for risk and cost, and managed for successful market growth. Our experience and processes will help you grow via innovation with more confidence, less time investment, lower cost and faster, greater returns.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Give us a call today, or send an email, so we can talk about how you can be a leader, rather than follower, in 2017 and beyond. Or check out the rest of the website to read up on what we do so we can create the right level of engagement for you.

Forbes Posts- Hartung on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

Felix Richter, Statista

Felix Richter, Statista

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

(c) Adam Hartung and Spark Partners

(c) Adam Hartung and Spark Partners

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director