by Adam Hartung | Sep 29, 2017 | Entertainment, Politics, Sports, Trends

LANDOVER, MD – SEPTEMBER 24: Washington Redskins players link arms during the national anthem before their game against the Oakland Raiders at FedExField on September 24, 2017 in Landover, Maryland. (Photo by Patrick Smith/Getty Images)

A recent top news story has been NFL players kneeling during the national anthem. The controversy was amplified when President Trump weighed in with objections to this behavior, and his recommendation that the NFL pass a rule disallowing it. This kind of controversy doesn’t make life easier for NFL leaders, but it really isn’t their biggest problem. Ratings didn’t start dropping recently, viewership has been declining since 2015.

NFL ratings stalled in 2015

NFL viewership had a pretty steady climb through 2014. But in 2015 ratings leveled. Then in 2016 viewership fell a whopping 9%. During the first 6 weeks of the 2016 regular season (into early October)viewership was down 11%. Through the first 9 weeks of 2016 ratings were down 14% before things finally leveled off. Although nobody had a clear explanation why viewership declined so markedly, there was widespread agreement that 2016 was a ratings crash for the league. Fox had its worst NFL viewership since 2008, and ESPN had its worst since 2005.

Interestingly, later analysis showed that overall people were watching 5% more games. But they were watching less of each game. In other words, fans had become more casual about their viewership. People were watching less TV, watching less cable, and that included live sports. And those who stream games almost never streamed the entire game.

And this behavior change wasn’t limited to the NFL. As reported at Politifact.com, Paulsen, editor in chief of Sports Media Watch said, “it’s really important to note the NFL is not declining while other leagues are increasing. NASCAR ratings are in the cellar right now. The NBA had some of its lowest rated games ever on network television last year… It’s an industry-wide phenomenon and the NFL isn’t immune to it anymore.” So the declining viewership problem is widespread, and much older than the recent national anthem controversy.

Live sports is not attracting new, younger viewers

Magna Global recently released its 2017 U.S. Sports Report. According to Radio + Television Business Report (RBR.com) the age of live sports viewers is scewing older. Much older. Today the average NFL viewer is at least 50. Similar to tennis, and college basketball and football. That’s second only to baseball at 57 – which was 50 as recently as 2000. But no sport is immune. NHL viewers are now typically 49. They were 33 in 2000. As simple arithmetic shows, the same folks are watching hockey but few new viewers are being attracted. Based on recent trends, Magna projects viewership for the Sochi Olympics and 2018 World Cup will both decline.

I’ve written before about the importance of studying demographic trends when planning. These trends are highly reliable, even if boring. And they provide a lot of insight. In the case of live sports watching, younger people simply don’t sit down and watch a complete game. Younger people have different behaviors. They watch an entire season of shows in one day. They multi-task, doing many things at once. And they prefer information in short bursts – like weekly blogs rather than a book. And they are more interested in outcomes, the final result, than watching how it happened. Where older people watch a game play-by-play, younger people simply want to know the major events and the final score.

To understand what’s happening with NFL ratings we really don’t have to look much further than simple demographics — the aging of the U.S. population — and the change in viewing behavior from older groups to younger groups.

Unfortunately, according to a recent CNN poll, while 56% of people under age 45 think the recent demonstrations are the right thing to do, 59% of those over 45 say the demonstrations are wrong. In its “core” NFL viewership folks don’t like the kneeling, so it would appear the NFL should heed the President’s advice. But, looking down the road, the NFL won’t succeed unless it finds a way to attract a younger audience. With younger people approving the demonstrations NFL leadership risks throwing the baby out with the bathwater if they knee-jerk control player behavior.

Understanding customer demographic trends, and adapting, is crucial to success

The demonstrations are interesting as an expression of American ideals. And they are gathering a lot of discussion. But they are not what’s plaguing NFL viewership. Today the NFL has a much bigger task of making changes to attract young people as viewers. Should leaders shorten the game’s length? Should they change rules to increase scoring and create more excitement during the game? Should they invest in more apps to engage viewers in play-by-play activity? Should they seek out ways to allow more gambling during the game? Whatever leadership does, the traditions of the NFL need to be tested and altered in order to attract new people to watching the game if they want to preserve the advertising dollars that make it a success.

When your business falters, do you look at long-term trends, or react to a short-term event? It’s easy for politicians and newscasters to focus on the short-term, creating headlines and controversy. But business leaders have an obligation to look much deeper, and longer term. It is critical we move beyond “that’s the way the game is played” to looking at how the game may need to change in order to remain relevant and engage new customers.

Note how boxing recently brought in a mixed martial arts fighter to take on the world champion. The outcome was nearly a foregone conclusion, but nobody cared because it brought in people to a boxing match that otherwise would not have been there. If you don’t recognize demographic shifts, and take actions to meet emerging trends you risk becoming as left behind as cricket, badminton, horseshoes, bocce ball and darts.

by Adam Hartung | Aug 29, 2017 | Innovation, Leadership, Marketing, Mobile, Web/Tech

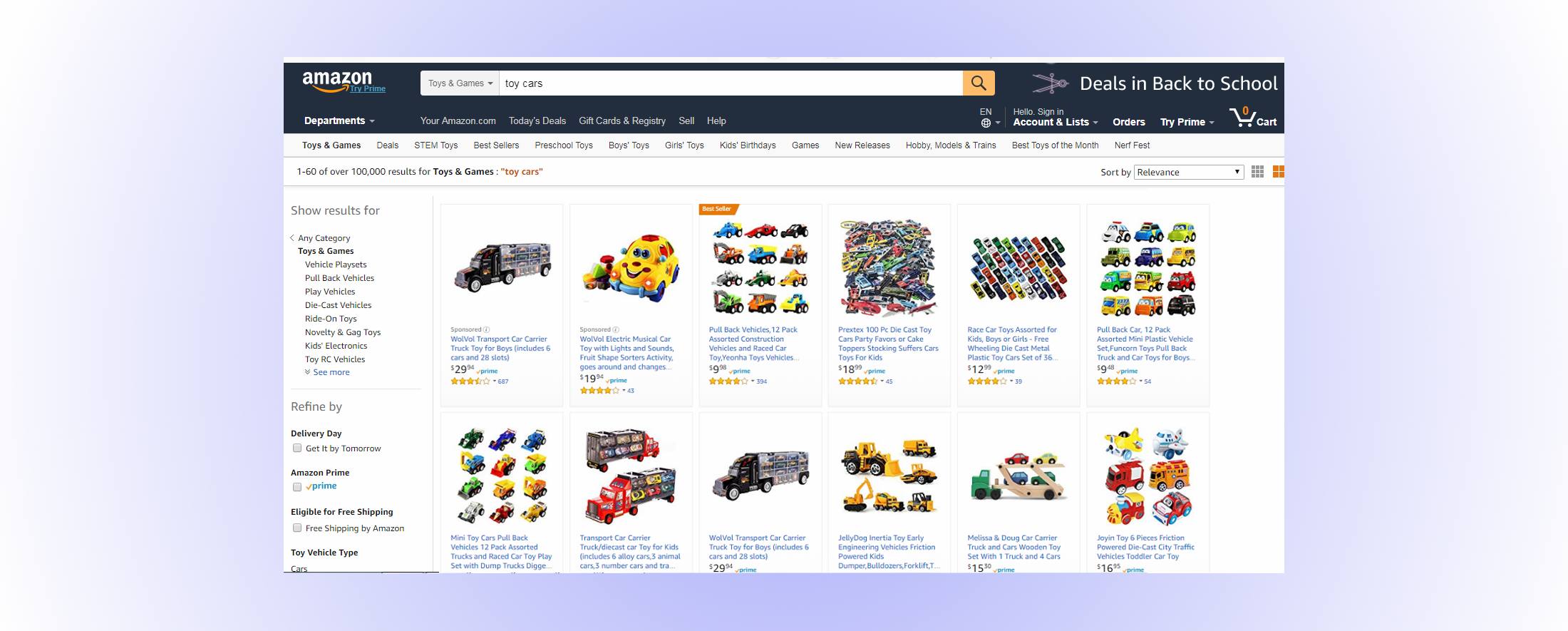

For most consumers an Android-based phone from one of the various manufacturers, most likely bought through a wireless provider if in the USA, does pretty much everything the consumer wants. Developers of most consumer apps, such as games, navigation, shopping, etc. make sure their products work on all phones. For that reason, the bulk of consumers are happy to buy their phone for $200 or less, and most don’t even care what version of Android it runs. As a stand-alone tool an Android phone does pretty much everything they want, and they can afford to replace it every year or two.

But the business community has different requirements.

And because iOS has superior features, Apple continues to dominate the enterprise environment:

- All iPhones are encrypted, giving a security advantage to iOS. Due to platform fragmentation (a fancy way of saying Android is not the same on all platforms, and some Android phones run pretty old versions) most Android phones are not encrypted. That leads to more malware on Android phones. And, Android updates are pushed out by the carrier, compared to Apple controlling all iOS updates regardless of carrier. When you’re building an enterprise app, these security issues are very important.

- iOS is seamless with Macs, and can be pretty well linked to Windows if necessary for an apps’ purpose. Android plays well with Chromebooks, but is far less easy to connect with established PC platforms. So if you want the app to integrate across platforms, such as in a corporation, it’s easier with iOS.

- iPhones come exactly the same, regardless of the carrier. Not true for Android phones. Almost all Androids come with various “junkware.” These apps can conflict with an enterprise app. For enterprise app developers to make things work on an Android phone they really need to “wipe” the phone of all apps, make sure each phone has the same version of Android and then make sure users don’t add anything which can cause a user conflict with the enterprise app. Much easier to just ask people to use an iPhone.

- iOS backs up to iCloud or via iTunes. Straightforward and simple. And if you need to restore, or change devices, it is a simple process. But in the Android world companies like Verizon and Samsung integrate their own back-up tools, which are inconsistent and can be quite hard for a developer to integrate into the app. Enterprise apps need back-ups, and making that difficult can be a huge problem for enterprise developers who have to support thousands of end users. And the fact that Android restores are not consistent, or reliable, makes this a tough issue.

- Search is built-in with iOS. Simple. But Android does not have a clean and simple search feature. And the old cross-platform inconsistencies plague the various search functions offered in the Android world. When using an enterprise app, which may well have considerable complexity, accessing an easy search function is a great benefit.

Most of these issues are no big deal for the typical smartphone consumer who just uses their phone independently of their work. But when someone wants to create an enterprise app, these become really important issues. To make sure the app works well, meeting corporate and end user needs, it is much easier, and better, to build it on iOS.

This allows Apple to price well above the market average

Today Apple charges around $800 for an iPhone 7, and expectations are for the iPhone 8 to be priced around $1,000. Because Apple’s pricing is some 4-5x higher, it allows Apple’s iOS revenue to actually exceed the revenue of all the Android phones sold! And because Android phone manufacturers compete on price, rather than features and capabilities, Apple makes almost ALL the profit in the smartphone hardware business. Even as iPhone unit volume has struggled of late, and some analysts have challenged Apple’s leadership given its under 20% market share, profits keep rolling in, and up, for the iPhone.

By taking the lead with enterprise app developers Apple assures itself of an ongoing market. Three years ago I pointed out the importance of winning the developer war when IBM made its huge commitment to build enterprise apps on iOS. This decision spelled doom for Windows phone and Blackberry — which today have inconsequential market shares of .1% and .0% (yes, Blackberry’s share is truly a rounding error in the marketplace.) Blackberry has become irrelevant. And having missed the mobile market Microsoft is now trying to slow the decline of PC sales by promoting hybrid devices like the Surface tablet as a PC replacement. But, lacking developers for enterprise mobile apps on Microsoft O/S it will be very tough for Microsoft to keep the mobile trend from eventually devastating Windows-based device sales.

As the world goes mobile, devices become smaller and more capable. The need for two devices, such as a phone and a PC, is becoming smaller with each day. Those who predicted “nobody can do real work on a smartphone” are finding out that an incredible amount of work can be done on a wirelessly connected smartphone. As the number of enterprise apps grows, and Apple remains the preferred developer platform, it bodes well for future sales of devices and software for Apple — and creates a dark cloud over those with minimal share like Blackberry and Microsoft.

by Adam Hartung | Aug 15, 2017 | Disruptions, Web/Tech

Even though most people don’t even know what they are, Bitcoins increased in value from about $570 to more than $4,300 — an astounding 750% — in just the last year. Because of this huge return, more people, hoping to make a fast fortune, are becoming interested in possibly owning some Bitcoins. That would be very risky.

Bitcoins are a crypto-currency. That means they can be used like a currency, but don’t physically exist like dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

Being virtual is not inherently a bad thing. The dollars on our financial institution statement, viewed online, are considered real money, even though those are just digital dollars. The fact that Bitcoins aren’t available in physical form is not really a downside, any more than the numbers on your financial statement are not available as physical currency either. Just like we use credit cards or debit cards to transfer value, Bitcoins can be spent in many locations, just like dollars.

What makes Bitcoins unique, versus other currencies, is that there is no financial system, like the U.S. Federal Reserve, managing their existence and value. Instead Bitcoins are managed by a bunch of users who track them via blockchain technology. And blockchain technology itself is not inherently a problem; there are folks figuring out all kinds of uses, like accounting, using blockchain. It is the fact that no central bank controls Bitcoin production that makes them a unique currency. Independent people watch who buys and sells, and owns, Bitcoins, and in some general fashion make a market in Bitcoins. This makes Bitcoins very different from dollars, euros or rupees. There is no “good faith and credit” of the government standing behind the currency.

Why are currencies different from everything else?

Currencies are sort of magical things. If we didn’t have them we would have to do all transactions by barter. Want some gasoline? Without currency you would have to give the seller a chicken or something else the seller wants. That is less than convenient. So currencies were created to represent the value of things. Instead of saying a gallon of gas is worth one chicken, we can say it is worth $2.50. And the chicken can be worth $2.50. So currency represents the value of everything. The dollar, itself, is a small piece of paper that is worth nothing. But it represents buying power. Thus, it is stored value. We hold dollars so we can use the value they represent to obtain the things we want.

Currencies are not the only form of stored value. People buy gold and lock it in a safe because they believe the demand for gold will rise, increasing its value, and thus the gold is stored value. People buy collectible art or rare coins because they believe that as time passes the demand for such artifacts will increase, and thus their value will increase. The art becomes a stored value. Some people buy real estate not just to live on, but because they think the demand for that real estate will grow, and thus the real estate is stored value.

But these forms of stored value are risky, because the stored value can disappear. If new mines suddenly produce vast new quantities of gold, its value will decline. If the art is a fake, its value will be lost. If demand for an artist or for ancient coins cools, its value can fall. The stored value is dependent on someone else, beyond the current owner, determining what that person will pay for the item.

Assets held as stored value can crash

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

But there were no controls on tulip bulb production. Eventually it became clear that more tulip bulbs were being created, and the value was much, much greater than one could ever get for the tulips once planted and flowered. Even though it took many months for the value of tulip bulbs to become so high, their value crashed in a matter of two months. When tulip bulb holders realized there was nobody guaranteeing the value of their tulip bulbs, everyone wanted to sell them as fast as possible, causing a complete loss of all value. What people thought was stored value evaporated, leaving the tulip bulb holders with worthless bulbs.

While a complete collapse is unlikely, people should approach owning Bitcoins with great caution. There are other risks. Someone could hack the exchange you are using to trade or store Bitcoins. Also, cryptocurrencies are subject to wild swings of volatility, so large purchases or sales of Bitcoin can move prices 30% or more in a single day.

Be an investor, not a speculator, and avoid Bitcoins

There are speculators and traders who make markets in things like Bitcoins. They don’t care about the underlying value of anything. All they care about is the value right now, and the momentum of the pricing. If something looks like it is going up they buy it, simply on the hope they can sell it for more than they paid and take a profit on the trade. They don’t see the things they trade as having stored value because they intend to spin the transaction very quickly in order to make a fast buck. Even if value falls they sell, taking a loss. That’s why they are speculators.

Most of us work hard to put a few dollars, euros, pounds, rupees or other currencies into our bank accounts. Most of those dollars we spend on consumption, buying food, utilities, entertainment and everything else we enjoy. If we have extra money and want the value to grow we invest that money in assets that have an underlying value, like real estate or machinery or companies that put assets to work making things people want. We expect our investment to grow because the assets yield a return. We invest our money for the long-term, hoping to create a nest egg for future consumption.

Unless you are a professional trader, or you simply want to gamble, stay away from Bitcoins. They have no inherent value, because they are a currency which represents value rather than having value themselves. The Bitcoin currency is not managed by any government agency, nor is it backed by any government. Bitcoin values are purely dependent upon holders having faith they will continue to have value. Right now the market looks a lot more like tulip mania than careful investing.

by Adam Hartung | Aug 10, 2017 | Entrepreneurship, Leadership, Web/Tech

Recently, I wrote a column about 10 young entrepreneurs. Originally I titled it “10 under 20” but the Forbes editors thought that was too close to their “30 under 30” column so they changed it to “10 Great Lessons From Millennial Entrepreneurs.” I didn’t like that title, because it implied these were “great” entrepreneurs, and I really didn’t think they were all that great. Now that some time has gone by, I really regret having written the column.

I’ve written this column at Forbes for almost 7 years. So I am pitched for unsolicited columns every day by PR firms. On average, about 10 pitches every day. But nothing compared with the onslaught of emails I received after the millenial column. Firm after firm, and even individuals, contacted me by email, on Facebook, Linked-in, and Twitter to tell me about some incredible young person who just absolutely needed to be written about. You would think that every high school, and small university, in America had at least one, if not multiple, young prodigies all of which were destined to change the world. It was an avalanche of pitches, from which I could not even begin to fully read, much less respond.

But, almost universally these businesses were not that fantastic. Most were the modern day equivalent of someone opening a lawn service in 1960. Simple businesses that had little to distinguish them. Many had no revenues, and many were little more than somebody’s idea of a business they would like to build. Those that had revenues were so small as to be meaningless, and almost none made any impact on their industry or competition.

The pitches were, without a doubt, the most hyped pitches I have ever received. Over and over I kept asking “why would anyone think this is in the slightest interesting?

The only reason this is being pitched is because it involves someone under the age of 25. And usually that someone lacks any credentials and offers no new insight to the industry or product.”

2 -Not a sustainable business

Writing an app is not a business. Even if it sold a few thousand copies. Nor is trading baseball cards, or selling someone else’s stuff on eBay. Nor is buying bitcoins. By and large, 99% of the pitches were for one-product opportunities that clearly lacked any sense of being a sustainable business which could produce recurring revenue over multiple years. Almost none had any employees, and those that did had a mere handful with no plans to scale any larger.

At best most were simply a single shot situation which generated some revenue for the millennial founder. And most could only pay the founder because the business had no overhead and a highly subsidized cost structure due to support from parents. Many had no, or little, profits and there was nowhere near enough cash to repay traditional investors. Because there was no cost for financing, overhead or even variable activities like payroll, these businesses could not be considered a success in any traditional sense.

3 – These were not really entrepreneurs

French economist Jean-Baptiste Say coined the term entrepreneur. He used it to describe people who seek out inefficient uses of resources and capital then redeployed them into more productive, higher-profit uses. None of the pitched businesses actually redeployed any resources. And none really developed a new industry that created greater productivity. These were just ideas that manifested into a product that fit an immediate need. Most used an existing infrastructure, such as an app store, to do one thing – like sell an app. Maybe someday they’ll write another – but there was no indication any research was happening, customer analysis or market testing to create a long-term business.

Additionally, for entrepreneurs there is some element of risk-taking. For taking risk, by investing in something where others won’t invest, there is the opportunity for outsized returns. But these folks didn’t take any risk at all. It wasn’t their money they invested, but rather their family’s. Most either lived at home, or lived in housing paid for by family (such as a college dorm room.) Most had nothing invested in their “business” other than personal time, and if this failed there was almost nothing lost. And most had minimal gains relative to the size of the risk they undertook with other people’s resources.

And they all lacked any sense of a business plan. Now I’m all for innovation and trying new things, but business success requires the ability to generate ongoing revenue for a prolonged period that covers all costs and creates returns for investors. These folks simply promoted ideas with no description of how this was to be a long-term profitable venture that succeeded for customers, suppliers and financial backers. I found that I would not have been an investor in hardly any of these “businesses” and surely would not recommend readers to back them.

4 – These folks were big self-promoters, not business promoters

Almost to a pitch every story was about some individual – not a business success. I was told over and over and over about how some 17, 18, 19 or 20 year old was absolutely a genius; a modern miracle of incredible business insight. Yet, there was little to back-up these claims. In the end, these were just young folks who had some sense of ambition and fortitude that were doing a few experiments and had (in some instances, not all) sold a few things. But their stories really weren’t that interesting.

One young fellow washed vehicles. He got a contract to wash trucks. And he had expanded his truck washing capability to multiple trucking companies. OK, ambitious and hard working. But nothing fantastic. No technology breakthrough. Just a basic service that he sold cheaply enough to win some contracts. But, he was unwilling to discuss his margins, how much he paid himself or others and how he financed the company or paid a return to his backers. Yet, he was certain that he could franchise his truck washing business and soon enough he would be the next Ray Kroc. He, and his PR person (and it was unclear who paid her) failed to realize that his story might be interesting in 20 years after he proved he could build the next McDonald’s making himself, his investors and his franchisees rich.

Add onto this the fact that almost all of these people had nothing good to say about anyone older. For some reason I was informed over and again that nobody over 40 could really understand how brilliant this person is, and how guaranteed was future success. These people universally had no value for advice from people older than them,  no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

I kept saying to myself “get over yourself kid. You are working hard, but so are a lot of other people. You really haven’t accomplished anything of merit yet. And there’s not really anything here that indicates you will achieve great things. You may win awards for just showing up at school, or at the soccer match, but in business you have a LOT more to prove than you can show up and possibly accomplish some of the basics. Once..”

5 – No sense of how to build something, or even engage in quid pro quo

Bill Gates built a company that produced software millions of people wanted. Steve Jobs built a company that made devices (computers initially) that millions wanted. Henry Ford made cheap cars that millions of people wanted. Mark Zuckerberg created an interaction engine that millions of people wanted (and advertisers would pay to reach.) These founders understood that building a successful business meant combining multiple resources into an organization that functions capably to build products and markets.

If you asked them “why should I write about you?” they would answer, “to tell folks about the improvement in their life from my company’s products.”

When I asked these millennial entrepreneurs why I should write about them, the answer was “because I’m young and great and going places.”

Worse, when I pointed out that in today’s world columnists rely on readers, and therefore columnists want to know the topic will generate reads, they were without even a good idea of how a column on them would generate reads. When I asked “will you promote this through a large social media conduit to drive readers to the column?” they responded with “but isn’t that what Forbes does, bring in readers? I think you should write about me so Forbes readers can become enlightened. Why should I be asked to promote your column, isn’t that what you and Forbes do?”

It was completely unclear to me who was paying for these PR firms. But to them, and to the hundreds of millennials who sent me Facebook, Linked-in and Twitter messages:

- Quit focusing on yourself and actually accomplish something. Don’t be proud you’re a drop-out, go finish school.

- Listen more and talk less. You really don’t have much that’s interesting to say. Pay attention to those who are older, wiser and could help you reach your goals. You need them, and most of them don’t need you. You’re really not as interesting as you think you are.

- Get some education. Bill Gates and Steve Jobs are my age – not yours. Every generation needs more skills than the one before it. Mark Zuckerberg is THE exception, not the rule. Dropping out of Harvard did not make him great. Before you decide you have all the answers, go learn what the questions are. Learn how to think, how to reason, before you decide you know all that’s needed to take action.

- Quit living on subsidies. If your parents or grandparents or aunts and uncles are paying for your rent, or car, or supplies then you still don’t understand basic economics. Become self-sufficient. Make enough money to buy your own new car, buy your own house, and pay 100% of your bills – and even enough that you could afford to raise children. Until you are self-reliant it is very hard to take you seriously as a business leader.

- Life is NOT a one-round event. You are very likely to live 100 years. Do you have the skills to maintain your lifestyle for that full 100 years? Quit crowing about the 1 success (by your definition) you’ve had so far and instead figure out how you’ll lead a productive 100 year existence. You’re only 20% of the way there.

I hear folks say we need to advance millennials onto boards of directors for public companies. Or fund their new ventures without business plans or traditional benchmarks. Or put them into highly placed positions of major corporations. I can’t agree with that. From what I observed, millennials are similar to all other young people. They don’t know what they don’t know. And only time, failures, successes, education (formal and informal) and hard work will prepare them to be tomorrow’s leaders.

I started my entrepreneurial life while a college junior. I was lucky enough to hook up with several people at least a decade older, and they found investors that were a generation older. The company made computer hardware, and largely due to good luck as well as hard work the company was successfull, and was sold for a great return to the investors and some money for the founders. Simultaneously I completed my undergraduate degree in 4 years, summa cum laude. What made me most excited about that experience was not trying to be featured in any journal, but rather that the folks at the Harvard Business School felt this experience was good enough to admit me to their institution to complete an MBA. And there is no doubt in my mind that what I learned in college, and grad school, was incredibly important to generating a lifetime of ongoing business accomplishments – long after that first company disappeared into the dustbin of obsolete technology.

by Adam Hartung | Jul 31, 2017 | In the Flats, Innovation, Investing, Leadership, Marketing

Amid all the political news last week it was easy to miss announcements in the business world. Especially one that was relatively small, like Starbucks announcement on Thursday July 27, 2017 that it was closing all 379 of its Teavana stores. While these will be missed by some product fanatics, the decision is almost immaterial given that these units represent only about 3% of Starbucks US stores, and about 1.5% of the 25,000 Starbucks globally.

Yet, closing Teavana is a telltale sign of concern for Starbucks investors.

Starbucks founding CEO Howard Schultz returned to the top job in January, 2008, promising to get out of distractions such as music production, movie production, internet sales, grocery products, liquor products and even in-store food sales in order to return the company to its “core” coffee business. Since then Starbucks valuation has risen some 5.5-6 fold, from $9.45/share to the recent range of $54 to $60 per share. A much better return than the roughly doubling of the Dow Jones Industrial Average over the same timeframe.

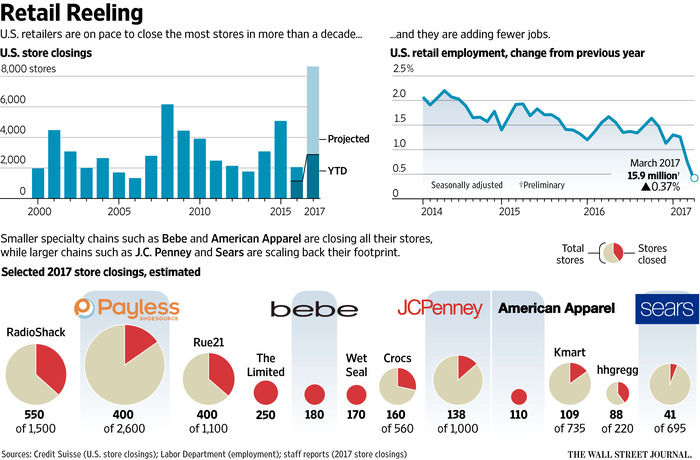

Yet, one should take time to evaluate what this closing means for the long-term future of Starbucks. This is the second time Starbucks made an acquisition only to shut it down. In 2015 Starbucks closed all 23 La Boulange bakery cafes, with little fanfare. Now, after paying $620M to buy Teavana in 2012, they are closing all those stores. While leadership blamed its decision on declining mall visits (undoubtedly a fact) for the closures, Teavana is not missing goals due to the Amazon Effect. There are multiple options for how to market Teavana’s fresh and packaged products far beyond mall store locations. Choosing to close all stores indicates leadership has minimal interest in the brand.

Starbucks’ focus leaves little opportunity for new growth

It increasingly appears that today’s Starbucks literally isn’t interested, or able, to do anything other than build, and operate, more Starbucks stores. And Starbucks is clearly doubling down on its plans to be Starbucks store-centric. The company opened 575 new units in the last year, and announced plans to open more stores creating 68,000 additional US jobs in the next 5 years. Further, Starbucks is paying $1.3B to buy the half of its China business previously owned by a partner. Clearly, leadership continues to tighten company focus on the “core” coffee store business for the future.

This sounds great short-term, given how well things have gone the last 8 years. But there are concerns. Sales are up 4% last quarter, but that is wholly based upon higher prices. Customer counts are flat, indicating that stores are not attracting new customers from competitors. Sales gains are due to average ticket prices increasing 5%, which is marginal and likely refers to higher priced products. Starbucks is now relying completely on new stores to create incremental growth, since bringing in new customers to existing stores is not happening.

Frequently this stagnant store sales metric indicates store saturation. A bad sign. Does the US, or international markets, really need more, new Starbucks stores? It was 2010 when comedian Lewis Black had a successful viral rant (PG version) claiming that when he observed a Starbucks across the street from another Starbucks he knew it was the end of civilization.

What happens when the market doesn’t need new Starbucks stores?

One does have to wonder when the maximum number of Starbucks will be reached. Especially given the ever growing number of competitors in all markets. Direct competitors such as Caribou Coffee, The Coffee Bean, Seattle’s Best, Gloria Jean’s, Costa, Lavazza, Tully’s, Peet’s and literally dozens of chain and independent coffee shops are competing for Starbucks’ customers. Simultaneously competition from low priced alternatives is emerging from brands like Dunkin Donuts and McDonald’s, now catering more to coffee lovers. And non-coffee fast casual shops are seeking to attract more people for congregating, such as Panera, Fuddruckers, Pei Wei, TGI Friday’s and others. All of these are competitors, either directly or indirectly, for the customer dollars sought by Starbucks. Are more Starbucks stores going to succeed?

As McDonald’s, Pizza Hut and other fast food chains learned the hard way, there comes a time when a brand has built all the market needs. Then leadership has to figure out how to do something else. McDonald’s invested heavily in Boston Market and Chipotle’s, but let those high growth operations go when it decided to refocus on its “core” hamburger business – leading to heavy valuation declines. Starbucks is closing Teavana, but should it? When will Starbucks saturate? And what will Starbucks do to grow when that happens?

Starbucks has had a great run. And that run appears not fully over. But long-term investors have reason to worry.

Is it smart to make such a huge bet on China?

Will store growth successfully continue, with all the stores that already exist?

Will direct and indirect competitors eat away at market share?

What will Starbucks do when it has reached it market maximum, and it doesn’t seem to have any emerging new store concepts to build upon?

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web. In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.