by Adam Hartung | Jun 9, 2016 | Innovation, Investing, Software, Teamwork

Last week Bloomberg broke a story about how Microsoft’s Chairman, John Thompson, was pushing company management for a faster transition to cloud products and services. He even recommended changes in spending might be in order.

Really? This is news?

Let’s see, how long has the move to mobile been around? It’s over a decade since Blackberry’s started the conversion to mobile. It was 10 years ago Amazon launched AWS. Heck, end of this month it will be 9 years since the iPhone was released – and CEO Steve Ballmer infamously laughed it would be a failure (due to lacking a keyboard.) It’s now been 2 years since Microsoft closed the Nokia acquisition, and just about a year since admitting failure on that one and writing off $7.5B And having failed to achieve even 3% market share with Windows phones, not a single analyst expects Microsoft to be a market player going forward.

So just now, after all this time, the Board is waking up to the need to change the resource allocation? That does seem a bit like looking into barn lock acquisition long after the horses are gone, doesn’t it?

The problem is that historically Boards receive almost all their information from management. Meetings are tightly scheduled affairs, and there isn’t a lot of time set aside for brainstorming new ideas. Or even for arguing with management assumptions. The work of governance has a lot of procedures related to compliance reporting, compensation, financial filings, senior executive hiring and firing – there’s a lot of rote stuff. And in many cases, surprisingly to many non-Directors, the company’s strategy may only be a topic once a year. And that is usually the result of a year long management controlled planning process, where results are reviewed and few challenges are expected. Board reviews of resource allocation are at the very, very tail end of management’s process, and commitments have often already been made – making it very, very hard for the Board to change anything.

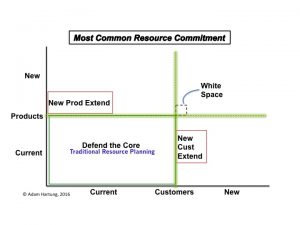

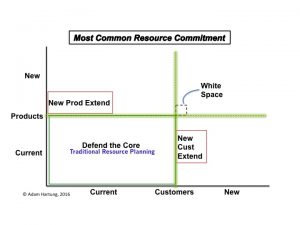

And these planning processes are backward-oriented tools, designed to defend and extend existing products and services, not predict changes in markets. These processes originated out of financial planning, which used almost exclusively historical accounting information. In later years these programs were expanded via ERP (Enterprise Resource Planning) systems (such as SAP and Oracle) to include other information from sales, logistics, manufacturing and procurement. But, again, these numbers are almost wholly historical data. Because all the data is historical, the process is fixated on projecting, and thus defending, the old core of historical products sold to historical customers.

Copyright Adam Hartung

Efforts to enhance the process by including extensions to new products or new customers are very, very difficult to implement. The “owners” of the planning processes are inherent skeptics, inclined to base all forecasts on past performance. They have little interest in unproven ideas. Trying to plan for products not yet sold, or for sales to customers not yet in the fold, is considered far dicier – and therefore not worthy of planning. Those extensions are considered speculation – unable to be forecasted with any precision – and therefore completely ignored or deeply discounted.

And the more they are discounted, the less likely they receive any resource funding. If you can’t plan on it, you can’t forecast it, and therefore, you can’t really fund it. And heaven help some employee has a really novel idea for a new product sold to entirely new customers. This is so “white space” oriented that it is completely outside the system, and impossible to build into any future model for revenue, cost or – therefore – investing.

Take for example Microsoft’s recent deal to sell a bunch of patent rights to Xiaomi in order to have Xiaomi load Office and Skype on all their phones. It is a classic example of taking known products, and extending them to very nearby customers. Basically, a deal to sell current software to customers in new markets via a 3rd party. Rather than develop these markets on their own, Microsoft is retrenching out of phones and limiting its investments in China in order to have Xiaomi build the markets – and keeping Microsoft in its safe zone of existing products to known customers.

The result is companies consistently over-investment in their “core” business of current products to current customers. There is a wealth of information on those two groups, and the historical info is unassailable. So it is considered good practice, and prudent business, to invest in defending that core. A few small bets on extensions might be OK – but not many. And as a result the company investment portfolio becomes entirely skewed toward defending the old business rather than reaching out for future growth opportunities.

This can be disastrous if the market shifts, collapsing the old core business as customers move to different solutions. Such as, say, customers buying fewer PCs as they shift to mobile devices, and fewer servers as they shift to cloud services. These planning systems have no way to integrate trend analysis, and therefore no way to forecast major market changes – especially negative ones. And they lack any mechanism for planning on big changes to the product or customer portfolio. All future scenarios are based on business as it has been – a continuation of the status quo primarily – rather than honest scenarios based on trends.

How can you avoid falling into this dilemma, and avoiding the Microsoft trap? To break this cycle, reverse the inputs. Rather than basing resource allocation on financial planning and historical performance, resource allocation should be based on trend analysis, scenario planning and forecasts built from the future backward. If more time were spent on these plans, and engaging external experts like Board Directors in discussions about the future, then companies would be less likely to become so overly-invested in outdated products and tired customers. Less likely to “stay at the party too long” before finding another market to develop.

If your planning is future-oriented, rather than historically driven, you are far more likely to identify risks to your base business, and reduce investments earlier. Simultaneously you will identify new opportunities worthy of more resources, thus dramatically improving the balance in your investment portfolio. And you will be far less likely to end up like the Chairman of a huge, formerly market leading company who sounds like he slept through the last decade before recognizing that his company’s resource allocation just might need some change.

by Adam Hartung | May 27, 2016 | Investing, Mobile, Trends, Web/Tech

Snapchat filed its latest fundraising with the SEC this week. According to TechCrunch, $1.8 billion cash was added to the company, based on a current valuation in the range of $18 billion to $20 billion. Not bad for a company with 2015 revenues of about $59 million. And quite a high valuation for a one-product company that probably nobody who reads this column has ever used – or even knows anything about.

Why is Snapchat so highly valued? Because revenue estimates are for $250 million to $350 million in 2016, and up to $1 billion for 2017. From 50 million daily active users in March, 2014 Snapchat has grown to 110 million users by December, 2015 – so a growth rate of about 50% per year. And this growth has not been all USA, over half the Snapchat users are from Europe and the rest of the world – and the non-USA markets are growing the fastest. Clearly, at 20 times 2017 revenue estimates, investors are expecting dramatic growth in users, and revenue to continue. They anticipate numbers of the magnitude that drove the valuation of Google (over $500 billion) and Facebook ($340 billion).

What is Snapchat? It is the complete opposite of this column. Snapchat is like Twitter only without the text. Of course, most of my readers don’t tweet either, so that may not help. It is a picture or 10 second video messaging app. But, most of my readers don’t use messaging apps either, so that may not be helpful.

Think of texting, only you don’t actually text. Instead you send a picture or short video. That’s it. Pretty simple. Just a way to send your friends pics and videos with your phone – although you can be creative with the pictures and make changes.

People who use Snapchat find it addictive. They may send dozens, or hundreds, of pictures daily. To single friends, groups, or even all their friends – since users can pick who gets the pic.

For many of my readers, this must seem ridiculous. Who would want to send, or receive, several pictures every day from some, or many, of your colleagues and friends?

In 1927 Fred Bernard [trivia] popularized the phrase we use today “

A picture is worth a thousand words.” And today, that is more true than ever. Pictures are replacing words for a vast and growing segment of the population. This is now a very fast growing trend, and it is projected to continue.

“Why is this a trend, and not a fad?” you may ask. The answer goes to the heart of how we use language and images. For thousands of years very few people knew how to read or write. To promulgate information, religious and government leaders would have artists paint images that told the story they wanted spread. These images were then taken from town to town, and people were taught the stories by having someone explain the picture. Then the image could be recalled by the population. It was only after the advent of mass education that using written words became the primary medium for providing information.

Simultaneously, paintings were really expensive. And early photography was expensive. Both mediums were used primarily to memorialize a story, or event. Thus there were relatively few of these images, and they were often treasured, hung on walls or kept in albums for later review. Most of my readers are still stuck in the historical context of thinking of pictures as memorials.

But today images are extremely cheap and easy. Almost everyone has a phone with a camera. So it is easy to take a picture, and it is easy to view a picture. Pictures have become free. And if you can replace a thousand words with one photo, it is far more efficient – and thus from a resource perspective photos are far cheaper (think of how long it takes to write an email as opposed to taking a picture). Given that this flip in resources required has happened, and that the use of mobile technology is growing worldwide and will never revert, we know that this is not s short-term fad, but rather a trend.

Once we communicated by telephone calls. That has dropped dramatically because real-time communication takes a lot more effort to coordinate and implement than asynchronous communication. I can email or text any time I want, and my friend can receive that message when it is convenient for her. And she can choose to respond at her convenience, or not respond at all. Thus email and texting exploded due to the technical capability and their improved economy. Today we have the ability to communicate in pictures or short videos which is even more information dense, and even more economical.

I’m sure many of my readers are saying “well, that may be good for someone else, but not for me.” And that’s good, because you read these columns. But factually, the number of readers is destined to decrease as the number of viewers go up.

There’s a reason every time you open an on-line magazine column you are bombarded by short videos ads. They are more communication dense and they are more successful at capturing attention – even if they do irritate you.

There’s a reason that fewer and fewer people read books, and rely instead on columns like this one to gain insights. And there’s a reason more and more people connect on Facebook rather than sending emails – and rather than sending snail mail (when was the last time you actually mailed someone a birthday card?). Haven’t you ever watched a YouTube video rather than read an instruction manual? While you may not imagine using pictures to replace language, the fact is it is happening with increasing frequency, and lots of people are making the switch. Thus it is a trend that will affect how we do many things for many years into the future.

Snapchat has capitalized on this new trend by making an app which allows you and your friends to communicate far more information a whole lot faster. Rather than interrupting your friends with a phone call (they may be busy right now,) or writing them an email or text message, you can just send them a photo. Have you ever used your phone to photo a label and sent it to someone who’s shopping for you? Or taken a photo of an item so you can find an exact replacement? That same action now can become your way of communicating – of telling your current story. Don’t tell your friends what you had for lunch, just send a photo. Don’t tell your friends you are shopping on Madison Avenue, just take a picture. Pictures are not archives, but rather just a fast, more compact and information filled form of communication.

Snapchat did not discover a new bio-pharmaceutical. It did not create a breakthrough new technology, such as extended battery life. It did not identify a sales opportunity in a far flung country. Nor did it have a breakthrough manufacturing process. Rather, merely by being the leader at implementing an emerging trend Snapchat’s founders have created $20 billion of current value.

Now that you know this trend, what are you going to do so you can capture additional value for your business?

by Adam Hartung | May 20, 2016 | E-Commerce, Investing, Retail, Trends

WalMart announced 1st quarter results on Thursday, and the stock jumped almost 10% on news sales were up versus last year. It was only $1.1B on $115B, about 1%, but it was UP! Same store sales were also up 1%, but analysts pointed out that was largely due to lower prices to hold competitors at bay.

While investors cheered the news, at the higher valuation WalMart is still only worth what it was in June, 2012 (just under $70/share.) From then through August, 2015 WalMart traded at a higher valuation – peaking at $90 in January, 2015. Subsequent fears of slower sales had driven the stock down to $56.50 by November, 2015. So this is a recovery for crestfallen investors the last year, but far from new valuation highs.

Unfortunately, this is likely to be just a blip up in a longer-term ongoing valuation decline for WalMart. And that value will be captured by those who understand the most important, undeniable trend in retail.

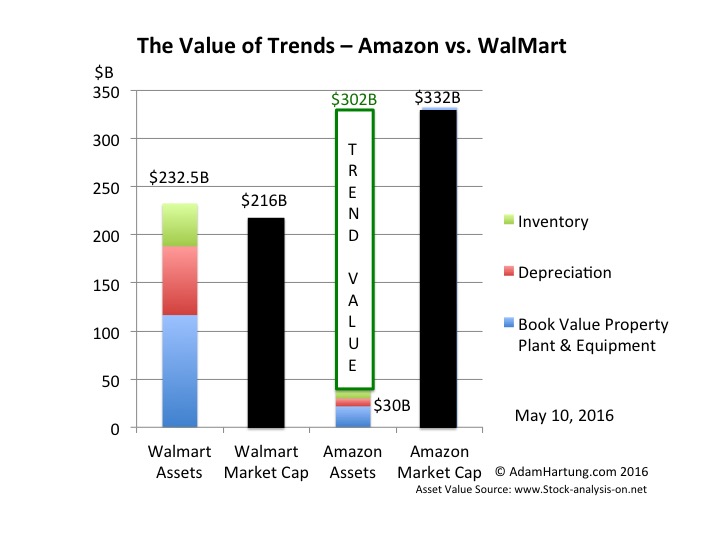

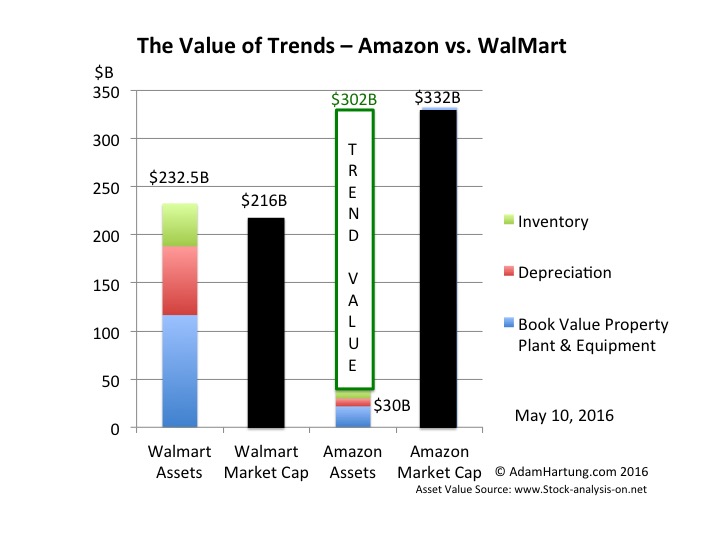

(c) AdamHartung.com Data Sources: Yahoo Finance and www.trend-stock-analysis-on.net

Although the numbers for WalMart’s valuation are a bit better than when the associated chart was completed last week, as you can see WalMart’s assets are greater than the company’s total valuation. This is because the return on its assets, today and projected, are so low that WalMart must borrow money in order to make them overall worthwhile. And the fact that on the balance sheet, at book value, the assets appear to be some $50B lower due to depreciation, and the difference be cost and market value.

This is because WalMart competes almost entirely in the intensely competitive and asset-dense market of traditional brick-and-mortar retail. This requires a lot of land, buildings, shelves and inventory. And that market is barely growing. Maybe 1-2%/year.

Compare t his with Amazon. Amazon has about $30B of assets. Yet its valuation is over $330B. So Amazon captures an extra value of $300B by competing in the asset sparse market of on-line retailing where it needs little land, few buildings, far less shelving and a lot less inventory. And it is competing in a market the Commerce Department says is growing at 15%/year.

The trend to on-line sales is extremely important, as it has entirely different customer acquisition and retention requirements, and very different ways of competing. Amazon understands those trends, and continues to lead its rivals. Today on-line retail is 10.5% of all non-restaurant, non-bar retail. And that 15% growth rate accounts for 60% of ALL the growth in this retail segment. Amazon keeps advancing, growing as fast (or faster) than the industry average, especially in key categories. Meanwhile, despite its vast resources and best efforts WalMart admitted its on-line sales growth is only 7% – half the segment growth rate – and its growth is decelerating.

By understanding this one trend – a very big, important, powerful trend – Amazon captures more value than the current value of ALL the Walmart stores, distribution centers and their contents. With all those assets WalMart can only convince investors it is worth about $200B. With about 13% of the assets used by WalMart, Amazon convinces investors it is worth 33% more than WalMart – over $330B. That’s $300B of value created just by knowing where the market is headed, and how to deliver for customers in that future market.

Yes, Amazon has other businesses, such as AWS cloud services and tech products in tablets, smartphones and smart speakers. But these too (some not nearly as successful as others, mind you) are very much on trends. WalMart once dominated retail technology with its massive computer systems and enormous databases. But WalMart limited itself to using its technology to defend & extend its core traditional retail business via store forecasts, optimized distribution and extensive pricing schemes. Amazon is monetizing its technology prowess by, again, leveraging trends and making its services and products available to others.

How does this apply to you? When someone asks “If you could have anything you want, what would you ask for?” most of us would start with health, happiness, peace and similar intangibles for us, our families and mankind. But if forced to make a tangible selection, we would ask for an asset. Buildings, equipment, cash. Yet, as WalMart and Amazon show us, those assets are only as valuable as what you do with them. And thus, it is more valuable to understand the trends, and how to use assets wisely for greatest value, than it is to own a pile of assets.

So the really important question is “Do you know what trends are going to be important to your business, and are you implementing a strategy to leverage those key trends?” If you are trying to protect your assets, you will likely be overwhelmed by the trend leader. But if you really understand the trends and are ready to act on them, you could be the one to capture the most value in your marketplace, and likely without adding a lot more costly assets.

by Adam Hartung | May 15, 2016 | In the Swamp, Investing, real estate, Retail

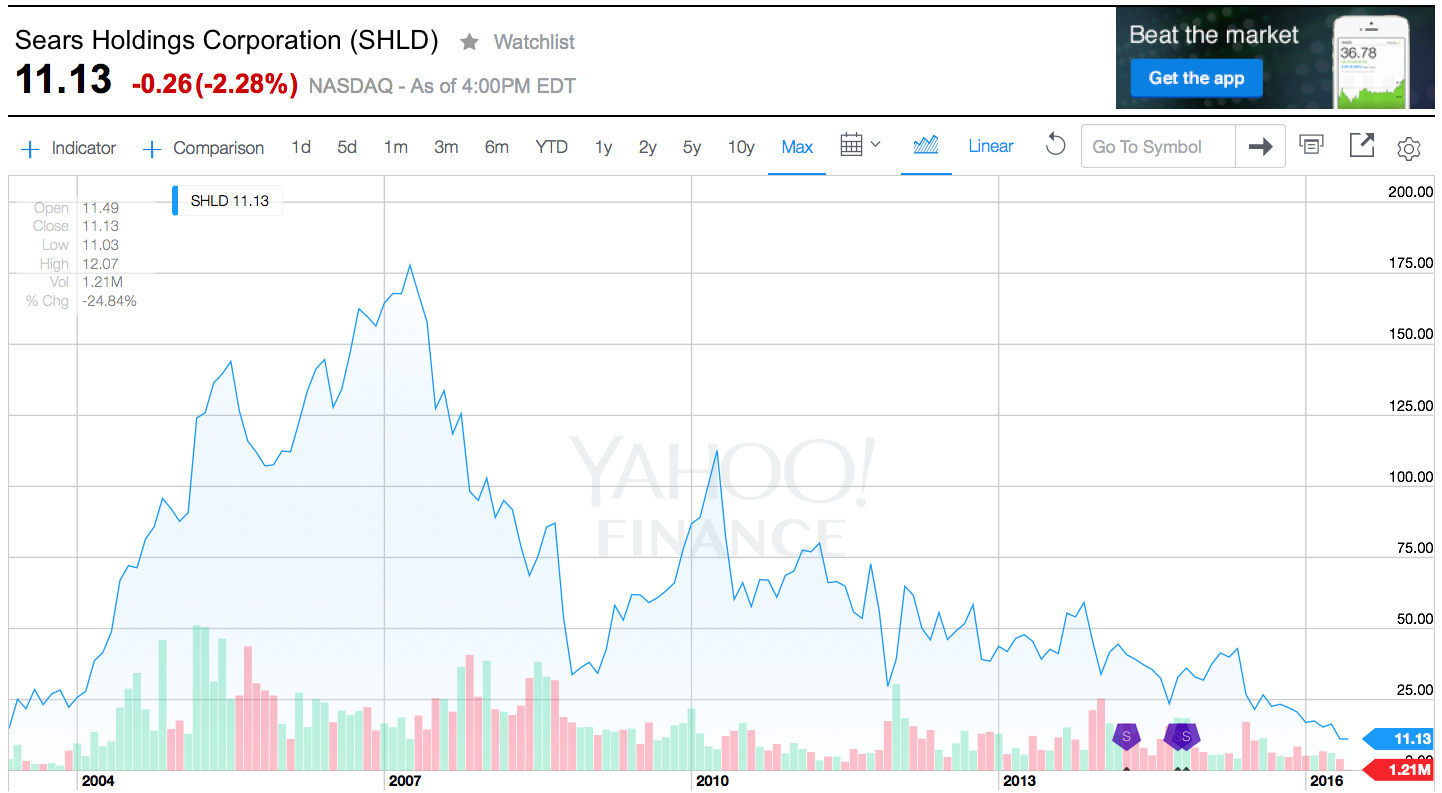

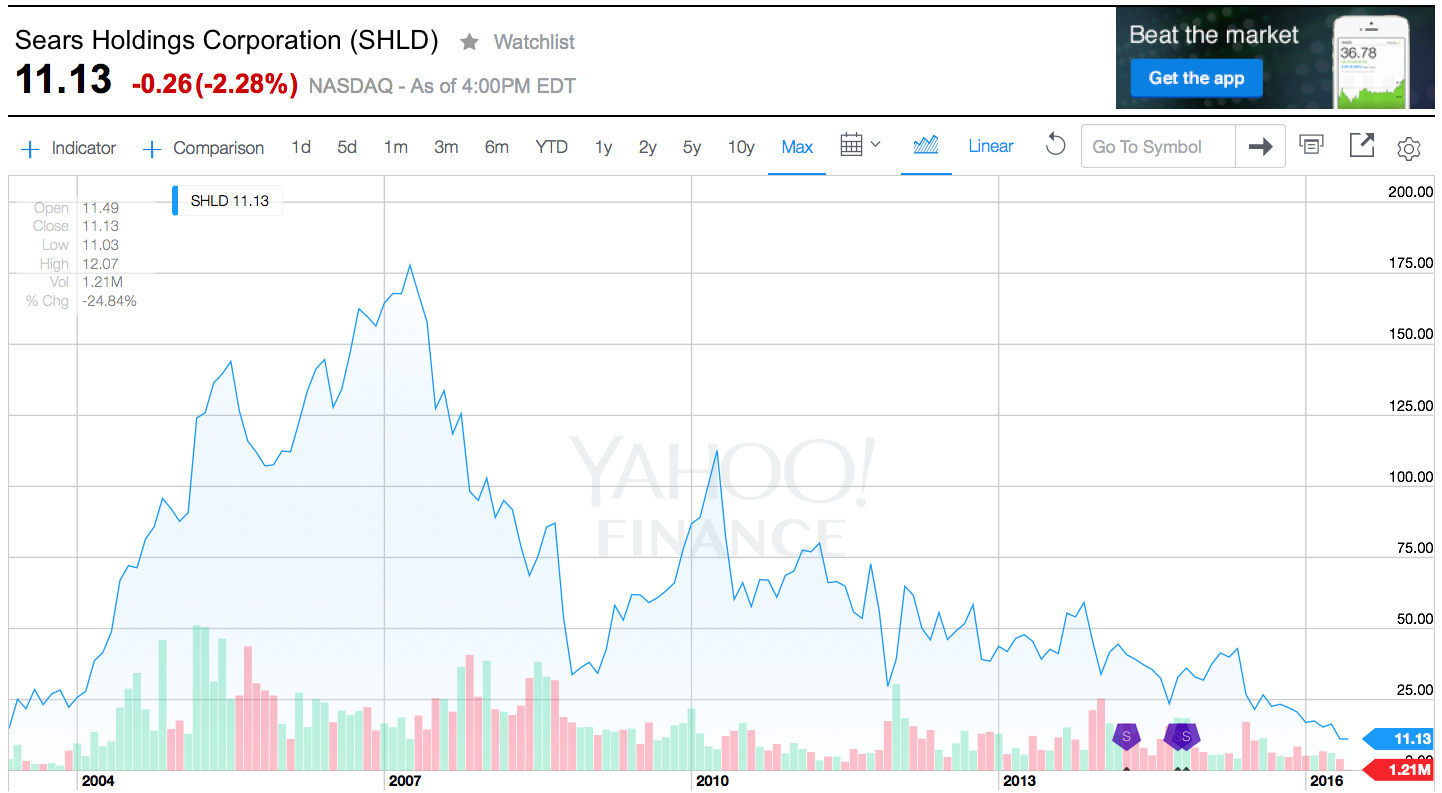

Last week Sears announced sales and earnings. And once again, the news was all bad. The stock closed at a record, all time low. One chart pretty much sums up the story, as investors are now realizing bankruptcy is the most likely outcome.

Chart Source: Yahoo Finance 5/13/16

Quick Rundown: In January, 2002 Kmart is headed for bankruptcy. Ed Lampert, CEO of hedge fund ESL, starts buying the bonds. He takes control of the company, makes himself Chairman, and rapidly moves through proceedings. On May 1, 2003, KMart begins trading again. The shares trade for just under $15 (for this column all prices are adjusted for any equity transactions, as reflected in the chart.)

Lampert quickly starts hacking away costs and closing stores. Revenues tumble, but so do costs, and earnings rise. By November, 2004 the stock has risen to $90. Lampert owns 53% of Kmart, and 15% of Sears. Lampert hires a new CEO for Kmart, and quickly announces his intention to buy all of slow growing, financially troubled Sears.

In March, 2005 Sears shareholders approve the deal. The stock trades for $126. Analysts praise the deal, saying Lampert has “the Midas touch” for cutting costs. Pumped by most analysts, and none moreso than Jim Cramer of “Mad Money” fame (Lampert’s former roommate,) in 2 years the stock soars to $178 by April, 2007. So far Lampert has done nothing to create value but relentlessly cut costs via massive layoffs, big inventory reductions, delayed payments to suppliers and store closures.

Homebuilding falls off a cliff as real estate values tumble, and the Great Recession begins. Retailers are creamed by investors, and appliance sales dependent Sears crashes to $33.76 in 18 months. On hopes that a recovering economy will raise all boats, the stock recovers over the next 18 months to $113 by April, 2010. But sales per store keep declining, even as the number of stores shrinks. Revenues fall faster than costs, and the stock falls to $43.73 by January, 2013 when Lampert appoints himself CEO. In just under 2.5 years with Lampert as CEO and Chairman the company’s sales keep falling, more stores are closed or sold, and the stock finds an all-time low of $11.13 – 25% lower than when Lampert took KMart public almost exactly 13 years ago – and 94% off its highs.

What happened?

Sears became a retailing juggernaut via innovation. When general stores were small and often far between, and stocking inventory was precious, Sears invented mail order catalogues. Over time almost every home in America was receiving 1, or several, catalogues every year. They were a major source of purchases, especially by people living in non-urban communities. Then Sears realized it could open massive stores to sell all those things in its catalogue, and the company pioneered very large, well stocked stores where customers could buy everything from clothes to tools to appliances to guns. As malls came along, Sears was again a pioneer “anchoring” many malls and obtaining lower cost space due to the company’s ability to draw in customers for other retailers.

To help customers buy more Sears created customer installment loans. If a young couple couldn’t afford a stove for their new home they could buy it on terms, paying $10 or $15 a month, long before credit cards existed. The more people bought on their revolving credit line, and the more they paid Sears, the more Sears increased their credit limit. Sears was the “go to” place for cash strapped consumers. (Eventually, this became what we now call the Discover card.)

In 1930 Sears expanded the Allstate tire line to include selling auto insurance – and consumers could not only maintain their car at Sears they could insure it as well. As its customers grew older and more wealthy, many needed help with financia advice so in 1981 Sears bought Dean Witter and made it possible for customers to figure out a retirement plan while waiting for their tires to be replaced and their car insurance to update.

To put it mildly, Sears was the most innovative retailer of all time. Until the internet came along. Focused on its big stores, and its breadth of products and services, Sears kept trying to sell more stuff through those stores, and to those same customers. Internet retailing seemed insignificantly small, and unappealing. Heck, leadership had discontinued the famous catalogues in 1993 to stop store cannibalization and push people into locations where the company could promote more products and services. Focusing on its core customers shopping in its core retail locations, Sears leadership simply ignored upstarts like Amazon.com and figured its old success formula would last forever.

But they were wrong. The traditional Sears market was niched up across big box retailers like Best Buy, clothiers like Kohls, tool stores like Home Depot, parts retailers like AutoZone, and soft goods stores like Bed, Bath & Beyond. The original need for “one stop shopping” had been overtaken by specialty retailers with wider selection, and often better pricing. And customers now had credit cards that worked in all stores. Meanwhile, for those who wanted to shop for many things from home the internet had taken over where the catalogue once began. Leaving Sears’ market “hollowed out.” While KMart was simply overwhelmed by the vast expansion of WalMart.

What should Lampert have done?

There was no way a cost cutting strategy would save KMart or Sears. All the trends were going against the company. Sears was destined to keep losing customers, and sales, unless it moved onto trends. Lampert needed to innovate. He needed to rapidly adopt the trends. Instead, he kept cutting costs. But revenues fell even faster, and the result was huge paper losses and an outpouring of cash.

To gain more insight, take a look at Jeff Bezos. But rather than harp on Amazon.com’s growth, look instead at the leadership he has provided to The Washington Post since acquiring it just over 2 years ago. Mr. Bezos did not try to be a better newspaper operator. He didn’t involve himself in editorial decisions. Nor did he focus on how to drive more subscriptions, or sell more advertising to traditional customers. None of those initiatives had helped any newspaper the last decade, and they wouldn’t help The Washington Post to become a more relevant, viable and profitable company. Newspapers are a dying business, and Bezos could not change that fact.

Mr. Bezos focused on trends, and what was needed to make The Washington Post grow. Media is under change, and that change is being created by technology. Streaming content, live content, user generated content, 24×7 content posting (vs. deadlines,) user response tracking, readers interactivity, social media connectivity, mobile access and mobile content — these are the trends impacting media today. So that was where he had leadership focus. The Washington Post had to transition from a “newspaper” company to a “media and technology company.”

So Mr. Bezos pushed for hiring more engineers – a lot more engineers – to build apps and tools for readers to interact with the company. And the use of modern media tools like headline testing. As a result, in October, 2015 The Washington Post had more unique web visitors than the vaunted New York Times. And its lead is growing. And while other newspapers are cutting staff, or going out of business, the Post is adding writers, editors and engineers. In a declining newspaper market The Washington Post is growing because it is using trends to transform itself into a company readers (and advertisers) value.

CEO Lampert could have chosen to transform Sears Holdings. But he did not. He became a very, very active “hands on” manager. He micro-managed costs, with no sense of important trends in retail. He kept trying to take cash out, when he needed to invest in transformation. He should have sold the real estate very early, sensing that retail was moving on-line. He should have sold outdated brands under intense competitive pressure, such as Kenmore, to a segment supplier like Best Buy. He then should have invested that money in technology. Sears should have been a leader in shopping apps, supplier storefronts, and direct-to-customer distribution. Focused entirely on defending Sears’ core, Lampert missed the market shift and destroyed all the value which initially existed in the great retail merger he created.

Impact?

Every company must understand critical trends, and how they will apply to their business. Nobody can hope to succeed by just protecting the core business, as it can be made obsolete very, very quickly. And nobody can hope to change a trend. It is more important than ever that organizations spend far less time focused on what they did, and spend a lot more time thinking about what they need to do next. Planning needs to shift from deep numerical analysis of the past, and a lot more in-depth discussion about technology trends and how they will impact their business in the next 1, 3 and 5 years.

Sears Holdings was a 13 year ride. Investor hope that Lampert could cut costs enough to make Sears and KMart profitable again drove the stock very high. But the reality that this strategy was impossible finally drove the value lower than when the journey started. The debacle has ruined 2 companies, thousands of employees’ careers, many shopping mall operators, many suppliers, many communities, and since 2007 thousands of investor’s gains. Four years up, then 9 years down. It happened a lot faster than anyone would have imagined in 2003 or 2004. But it did.

And it could happen to you. Invert your strategic planning time. Spend 80% on trends and scenario planning, and 20% on historical analysis. It might save your business.

by Adam Hartung | May 10, 2016 | Defend & Extend, In the Swamp, Leadership, Lifecycle, Web/Tech

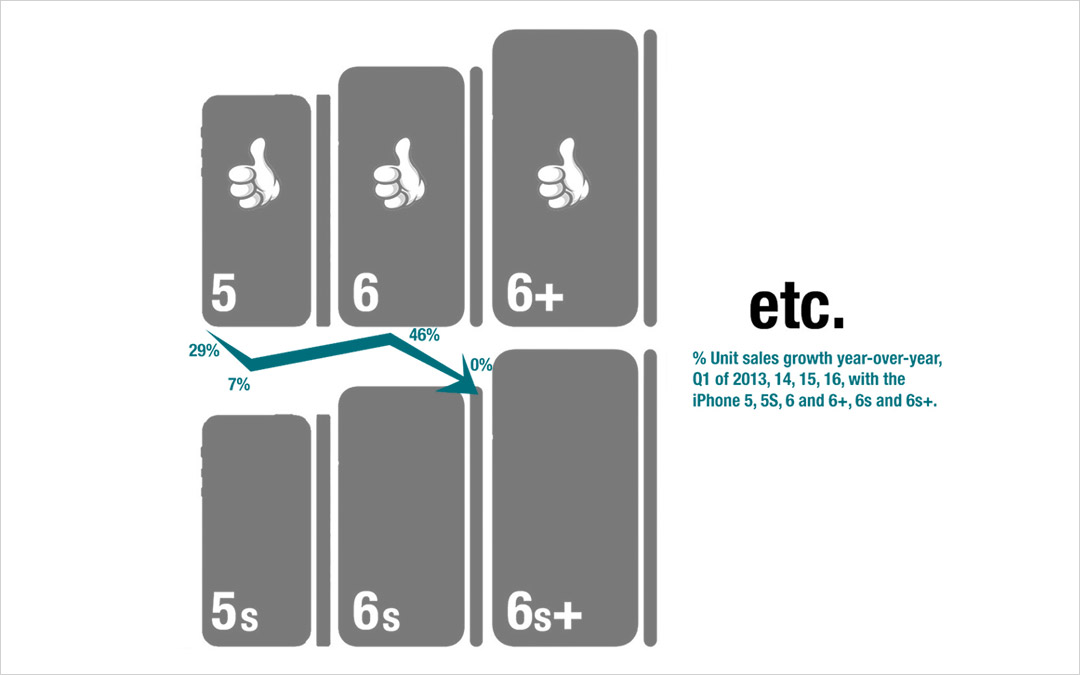

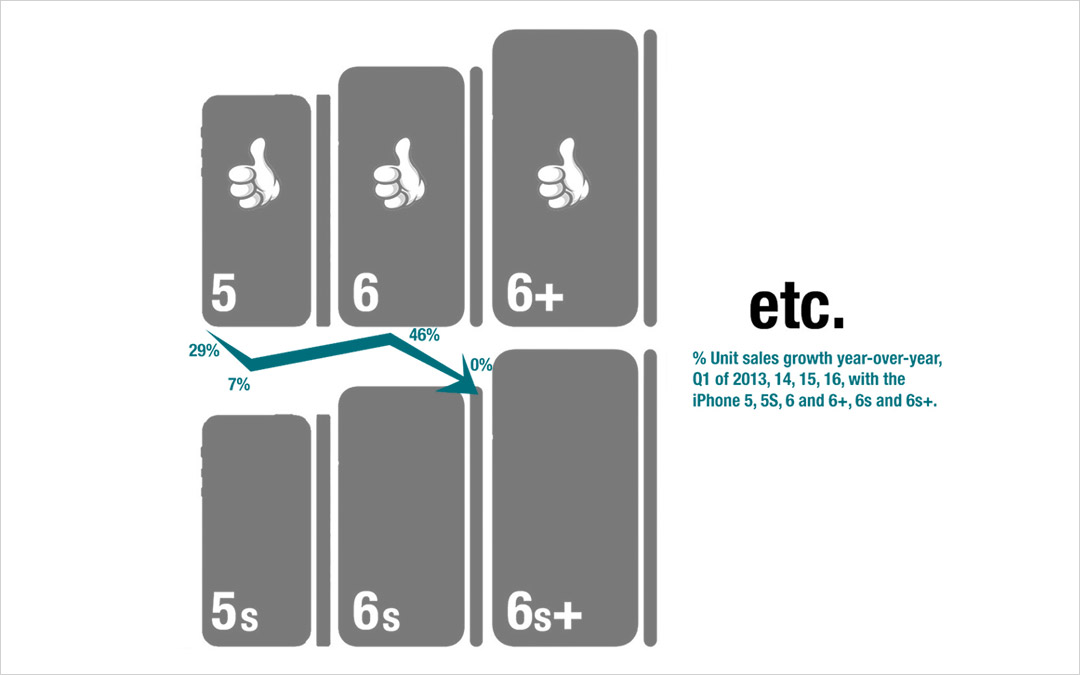

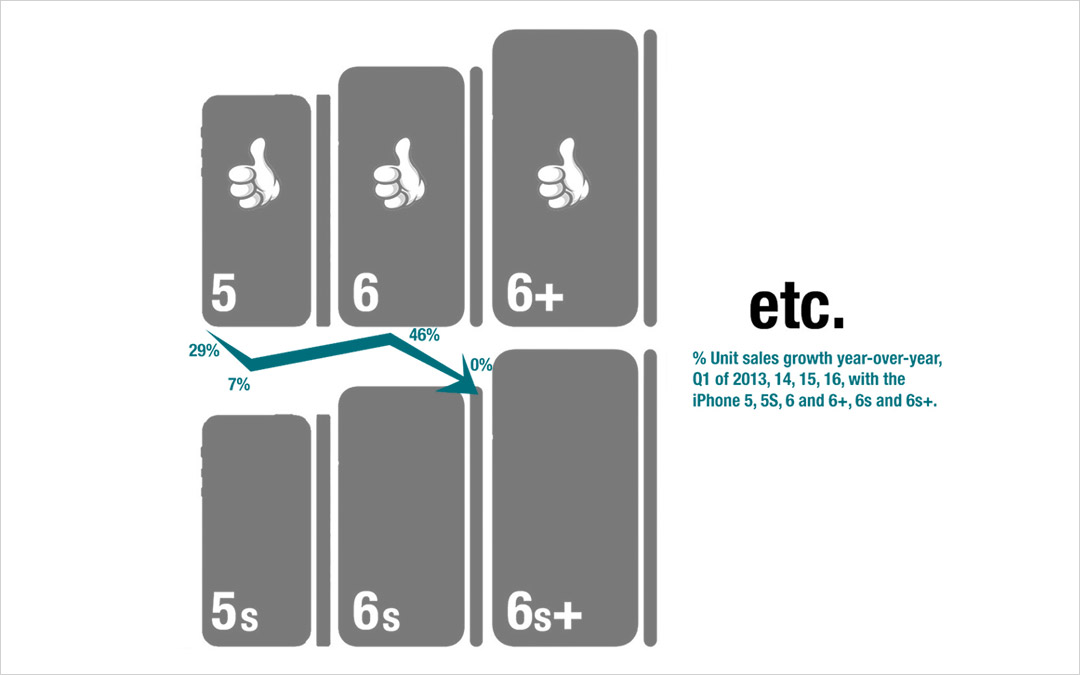

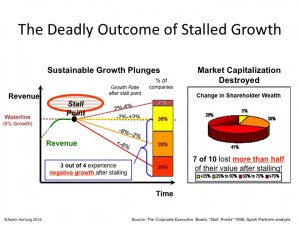

My last column focused on growth, and the risks inherent in a Growth stall. As I mentioned then, Apple will enter a Growth Stall if its revenue declines year-over-year in the current quarter. This forecasts Apple has only a 7% probability of consistently growing just 2%/year in the future.

This usually happens when a company falls into Defend & Extend (D&E) management. D&E management is when the bulk of management attention, and resources, flow into protecting the “core” business by seeking ways to use sustaining innovations (rather than disruptive innovations) to defend current customers and extend into new markets. Unfortunately, this rarely leads to high growth rates, and more often leads to compressed margins as growth stalls. Instead of working on breakout performance products, efforts are focused on ways to make new versions of old products that are marginally better, faster or cheaper.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

For example, Apple’s CEO has trumpeted the company’s installed base of 1B iPhones, and stated they will be a future money maker. He bragged about the 20% growth in “services,” which are iPhone users taking advantage of Apple Music, iCloud storage, Apps and iTunes. This shows management’s desire to extend sales to its “installed base” with sustaining software innovations. Unfortunately, this 20% growth was a whopping $1.2B last quarter, which was 2.4% of revenues. Not nearly enough to make up for the decline in “core” iPhone, iPad or Mac sales of approximately $9.5B.

Apple has also been talking a lot about selling in China and India. Unfortunately, plans for selling in India were at least delayed, if not thwarted, by a decision on the part of India’s regulators to not allow Apple to sell low cost refurbished iPhones in the country. Fearing this was a cheap way to dispose of e-waste they are pushing Apple to develop a low-cost new iPhone for their market. Either tactic, selling the refurbished products or creating a cheaper version, are efforts at extending the “core” product sales at lower margins, in an effort to defend the historical iPhone business. Neither creates a superior product with new features, functions or benefits – but rather sustains traditional product sales.

Of even greater note was last week’s announcement that Apple inked a partnership with SAP to develop uses for iPhones and iPads built on the SAP ERP (Enterprise Resource Planning) platform. This announcement revealed that SAP would ask developers on its platform to program in Swift in order to support iOS devices, rather than having a PC-first mentality.

This announcement builds on last year’s similar announcement with IBM. Now 2 very large enterprise players are building applications on iOS devices. This extends the iPhone, a product long thought of as great for consumers, deeply into enterprise sales. A market long dominated by Microsoft. With these partnerships Apple is growing its developer community, while circumventing Microsoft’s long-held domain, promoting sales to companies as well as individuals.

And Apple has shown a willingness to help grow this market by introducing the iPhone 6se which is smaller and cheaper in order to obtain more traction with corporate buyers and corporate employees who have been iPhone resistant. This is a classic market extension intended to sustain sales with more applications while making no significant improvements in the “core” product itself.

And Apple’s CEO has said he intends to make more acquisitions – which will surely be done to shore up weaknesses in existing products and extend into new markets. Although Apple has over $200M of cash it can use for acquisitions, unfortunately this tactic can be a very difficult way to actually find new growth. Each would be targeted at some sort of market extension, but like Beats the impact can be hard to find.

Remember, after all revenue gains and losses were summed, Apple’s revenue fell $7.6B last quarter. Let’s look at some favorite analyst acquisition targets to explain:

- Box could be a great acquisition to help bring more enterprise developers to Apple. Box is widely used by enterprises today, and would help grow where iCloud is weak. IBM has already partnered with Box, and is working on applications in areas like financial services. Box is valued at $1.45B, so easily affordable. But it also has only $300M of annual revenue. Clearly Apple would have to unleash an enormous development program to have Box make any meaningful impact in a company with over $500B of revenue. Something akin of Instagram’s growth for Facebook would be required. But where Instagram made Facebook a pic (versus words) site, it is unclear what major change Box would bring to Apple’s product lines.

- Fitbit is considered a good buy in order to put some glamour and growth onto iWatch. Of course, iWatch already had first year sales that exceeded iPhone sales in its first year. But Apple is now so big that all numbers have to be much bigger in order to make any difference. With a valuation of $3.7B Apple could easily afford FitBit. But FitBit has only $1.9B revenue. Given that they are different technologies, it is unclear how FitBit drives iWatch growth in any meaningful way – even if Apple converted 100% of Fitbit users to the iWatch. There would need to be a “killer app” in development at FitBit that would drive $10B-$20B additional annual revenue very quickly for it to have any meaningful impact on Apple.

- GoPro is seen as a way to kick up Apple’s photography capabilities in order to make the iPhone more valuable – or perhaps developing product extensions to drive greater revenue. At a $1.45B valuation, again easily affordable. But with only $1.6B revenue there’s just not much oomph to the Apple top line. Even maximum Apple Store distribution would probably not make an enormous impact. It would take finding some new markets in industry (enterprise) to build on things like IoT to make this a growth engine – but nobody has said GoPro or Apple have any innovations in that direction. And when Amazon tried to build on fancy photography capability with its FirePhone the product was a flop.

- Tesla is seen as the savior for the Apple Car – even though nobody really knows what the latter is supposed to be. Never mind the actual business proposition, some just think Elon Musk is the perfect replacement for the late Steve Jobs. After all the excitement for its products, Tesla is valued at only $28.4B, so again easily affordable by Apple. And the thinking is that Apple would have plenty of cash to invest in much faster growth — although Apple doesn’t invest in manufacturing and has been the king of outsourcing when it comes to actually making its products. But unfortunately, Tesla has only $4B revenue – so even a rapid doubling of Tesla shipments would yield a mere 1.6% increase in Apple’s revenues.

- In a spree, Apple could buy all 4 companies! Current market value is $35B, so even including a market premium $55B-$60B should bring in the lot. There would still be plenty of cash in the bank for growth. But, realize this would add only $8B of annual revenue to the current run rate – barely 25% of what was needed to cover the gap last quarter – and less than 2% incremental growth to the new lower run rate (that magic growth percentage to pull out of a Growth Stall mentioned earlier in this column.)

Such acquisitions would also be problematic because all have P/E (price/earnings) ratios far higher than Apple’s 10.4. FitBit is 24, GoPro is 43, and both Box and Tesla are infinite because they lose money. So all would have a negative impact on earnings per share, which theoretically should lower Apple’s P/E even more.

Acquisitions get the blood pumping for investment bankers and media folks alike – but, truthfully, it is very hard to see an acquisition path that solves Apple’s revenue problem.

All of Apple’s efforts big efforts today are around sustaining innovations to defend & extend current products. No longer do we hear about gee whiz innovations, nor do we hear about growth in market changing products like iBeacons or ApplePay. Today’s discussions are how to rejuvenate sales of products that are several versions old. This may work. Sales may recover via growth in India, or a big pick-up in enterprise as people leave their PCs behind. It could happen, and Apple could avoid its Growth Stall.

But investors have the right to be concerned. Apple can grow by defending and extending the iPhone market only so long. This strategy will certainly affect future margins as prices, on average, decline. In short, investors need to know what will be Apple’s next “big thing,” and when it is likely to emerge. It will take something quite significant for Apple to maintain it’s revenue, and profit, growth.

The good news is that Apple does sell for a lowly P/E of 10 today. That is incredibly low for a company as profitable as Apple, with such a large installed base and so many market extensions – even if its growth has stalled. Even if Apple is caught in the Innovator’s Dilemma (i.e. Clayton Christensen) and shifting its strategy to defending and extending, it is very lowly valued. So the stock could continue to perform well. It just may never reach the P/E of 15 or 20 that is common for its industry peers, and investors envisioned 2 or 3 years ago. Unless there is some new, disruptive innovation in the pipeline not yet revealed to investors.

by Adam Hartung | Apr 27, 2016 | Food and Drink, In the Rapids, In the Swamp, Retail, Software, Web/Tech

Growth fixes a multitude of sins. If you grow revenues enough (you don’t even need profits, as Amazon has proven) investors will look past a lot of things. With revenue growth high enough, companies can offer employees free meals and massages. Executives and senior managers can fly around in private jets. Companies can build colossal buildings as testaments to their brand, or pay to have thier names on public buildings. R&D budgets can soar, and product launches can fail. Acquisitions are made with no concerns for price. Bonuses can be huge. All is accepted if revenues grow enough.

Just look at Facebook. Today Facebook announced today that for the quarter ended March, 2016 revenues jumped to $5.4B from $3.5B a year ago. Net income tripled to $1.5B from $500M. And the company is basically making all its revenue – 82% – from 1 product, mobile ads. In the last few years Facebook paid enormous premiums to buy WhatsApp and Instagram – but who cares when revenues grow this fast.

Anticipating good news, Facebook’s stock was up a touch today. But once the news came out, after-hours traders pumped the stock to over $118//share, a new all time high. That’s a price/earnings (p/e) multiple of something like 84. With growth like that Facebook’s leadership can do anything it wants.

But, when revenues slide it can become a veritable poop puddle. As Apple found out.

Rumors had swirled that Apple was going to say sales were down. And the stock had struggled to make gains from lows earlier in 2016. When the company’s CEO announced Tuesday that sales were down 13% versus a year ago the stock cratered after-hours, and opened this morning down 10%. Breaking a streak of 51 straight quarters of revenue growth (since 2003) really sent investors fleeing. From trading around $105/share the last 4 days, Apple closed today at ~$97. $40B of equity value was wiped out in 1 day, and the stock trades at a p/e multiple of 10.

The new iPhone 6se outsold projections, iPads beat expectations. First year Apple Watch sales exceeded first year iPhone sales. Mac sales remain much stronger than any other PC manufacturer. Apple iBeacons and Apple Pay continue their march as major technologies in the IoT (Internet of Things) market. And Apple TV keeps growing. There are about 13M users of Apple’s iMusic. There are 1.5M apps on the iTunes store. And the installed base keeps the iTunes store growing. Share buybacks will grow, and the dividend was increased yet again. But, none of that mattered when people heard sales growth had stopped. Now many investors don’t think Apple’s leadership can do anything right.

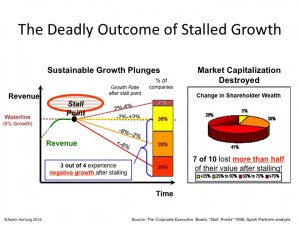

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Which leads us to Chipotle. Chipotle announced that same store sales fell almost 30% in Q1, 2016. That was after a 15% decline in Q4, 2015. And profits turned to losses for the quarter. That is a growth stall. Chipotle shares were $750/share back in early October. Now they are $417 – a drop of over 44%.

Customer illnesses have pointed to a company that grew fast, but apparently didn’t have its act together for safe sourcing of local ingredients, and safe food handling by employees. What seemed like a tactical problem has plagued the company, as more customers became ill in March.

Whether that is all that’s wrong at Chipotle is less clear, however. There is a lot more competition in the fast casual segment than 2 years ago when Chipotle seemed unable to do anything wrong. And although the company stresses healthy food, the calorie count on most portions would add pounds to anyone other than an athlete or construction worker – not exactly in line with current trends toward dieting. What frequently looks like a single problem when a company’s sales dip often turns out to have multiple origins, and regaining growth is nearly always a lot more difficult than leadership expects.

Growth is magical. It allows companies to invest in new products and services, and buoy’s a stock’s value enhancing acquisition ability. It allows for experimentation into new markets, and discovering other growth avenues. But lack of growth is a vital predictor of future performance. Companies without growth find themselves cost cutting and taking actions which often cause valuations to decline.

Right now Facebook is in a wonderful position. Apple has investors rightly concerned. Will next quarter signal a return to growth, or a Growth Stall? And Chipotle has investors heading for the exits, as there is now ample reason to question whether the company will recover its luster of yore.

by Adam Hartung | Apr 21, 2016 | In the Rapids, Leadership, Lifecycle, Television, Web/Tech

Netflix has been a remarkable company. Because it has accomplished something almost no company has ever done. It changed its business model, leading to new growth and higher profits.

Almost nobody pulls that off, because they remain stuck defending and extending their old model until they become irrelevant, or fail. Think about Blackberry, that gave us the smartphone business then lost it to Apple and its creation of the app market. Consider Circuit City, that lost enough customers to Amazon it could no longer survive. Sun Microsystems disappeared after PC servers caught up to Unix servers in capability. Remember the Bell companies and their land-line and long distance services, made obsolete by mobile phones and cable operators? These were some really big companies that saw their market shifts, but failed to “pivot” their strategy to remain competitive.

Netflix built a tremendous business delivering physical videos on tape and CD to homes, wiping out the brick-and-mortar stores like Blockbuster and Hollywood Video. By 2008 Netflix reached $1B revenues, reducing Blockbuster by a like amount. By 2010 Blockbuster was bankrupt. Netflix’ share price soared from $50/share to almost $300/share during 2011. By the end of 2012 CD shipments were dropping precipitously as streaming viewership was exploding. People thought Netflix was missing the wave, and the stock plummeted 75%. Most folks thought Netflix couldn’t pivot fast enough, or profitably, either.

But in 2013 Netflix proved the analysts wrong, and the company built a very successful – in fact market leading – streaming business. The shares soared, recovering all that lost value. By 2015 the company had more than doubled its previous high valuation.

But Netflix may be breaking entirely new ground in 2016. It is becoming a market leader in original programming. Something we long attributed to broadcasters and/or cable distributors like HBO and Showtime.

Today’s broadcast companies, like NBC, CBS and ABC, are offering less and less original programming. Overall there are 3 hours/night of prime time television which broadcasters used to “own” as original programming hours. Over the course of a year, allowing for holidays and one open night per week, that meant about 900 hours of programming for each network (including reruns as original programming.) But that was long ago.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

Against that backdrop, Netflix has announced it will program 600 hours of original programming this year. That will approximately double any single large broadcast network. In a very real way, if you don’t want to watch sports or reality TV any more you probably will be watching some kind of “on demand” program. Either streamed from a cable service, or from a provider such as Netflix, Hulu or Amazon.

When it comes to original programming, the old broadcast networks are losing their relevancy to streaming technology, personal video devices and the customer’s ability to find what they want, when they want it – and increasingly at a quality they prefer – from streaming as opposed to broadcast media.

To complete this latest “pivot,” from a video streaming company to a true media company with its own content, Morgan Stanley has published that Netflix is now considered by customers as the #1 quality programming across streaming services. 29% of viewers said Netflix was #1, followed by long-time winner HBO now #2 with 21% of customers saying their programming is best. Amazon, Showtime and Hulu were seen as the best quality by 4%-5% of viewers.

So a decade ago Netflix was a CD distribution company. The largest customer of the U.S. Postal Service. Signing up folks to watch physical videos in their homes. Now they are the largest data streaming company on the planet, and one of the largest original programming producers and programmers in the USA – and possibly the world. And in this same decade we’ve watched the network broadcast companies become outlets for sports and reality TV, while cutting far back on their original shows. Sounds a lot like a market shift, and possibly Netflix could be the game changer, as it performs the first strategy double pivot in business history.

by Adam Hartung | Apr 15, 2016 | Defend & Extend, In the Whirlpool, Lifecycle, Web/Tech

Leading tech tracking companies IDC and Gartner both announced Q1, 2016 PC sales results, and they were horrible. Sales were down 9.5%-11.5% depending on which tracker you asked. And that’s after a horrible Q4, 2015 when sales were off more than 10%. PC sales have now declined for 6 straight quarters, and sales are roughly where they were in 2007, 9 years ago.

Oh yeah, that was when the iPhone launched – June, 2007. And just a couple of years before the iPad launched. Correlation, or causation?

Amazingly, when Q4 ended the forecasters were still optimistic of a stabilization and turnaround in PC sales. Typical analyst verbage was like this from IDC, “Commercial adoption of Windows 10 is expected to accelerate, and consumer buying should also stabilize by the second half of the year. Most PC users have delayed an upgrade, but can only maintain this for so long before facing security and performance issues.” And just to prove that hope springs eternal from the analyst breast, here is IDC’s forecast for 2016 after the horrible Q1, “In the short term, the PC market must still grapple with limited consumer interest and competition from other infrastructure upgrades in the commercial market. Nevertheless….things should start picking up in terms of Windows 10 pilots turning into actual PC purchases.”

Fascinating. Once again, the upturn is just around the corner. People have always looked forward to upgrading their PCs, there has always been a “PC upgrade cycle” and one will again emerge. Someday. At least, the analysts hope so. Maybe?

Microsoft investors must hope so. The company is selling at a price/earnings multiple of 40 on hopes that Windows 10 sales will soon boom, and re-energize PC growth. Surely. Hopefully. Maybe?

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was so little interest that its launch barely made any news at all. This market, these products, are really no longer relevant to the growth of personal technology.

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was so little interest that its launch barely made any news at all. This market, these products, are really no longer relevant to the growth of personal technology.

Back when I predicted that Windows 8 would be a flop I was inundated with hate mail. It was clear that Ballmer was a terrible CEO, and would soon be replaced by the board. Same when I predicted that Surface tablets would not sell well, and that all Windows devices would not achieve significant share. People called me “an Apple Fanboy” or a “Microsoft hater.” Actually, neither was true. It was just clear that a major market shift was happening in computing. The world was rapidly going mobile, and cloud-based, and the PC just wasn’t going to be relevant. As the PC lost relevancy, so too would Microsoft because it completely missed the market, and its entries were far too tied to old ways of thinking about personal and corporate computing – not to mention the big lead competitors had in devices, apps and cloud services.

I’ve never said that modern PCs are bad products. I have a son half way through a PhD in Neurobiological Engineering. He builds all kinds of brain models and 3 dimensional brain images and cell structure plots — and he does all kinds of very exotic math. His world is built on incredibly powerful, fast PCs. He loves Windows 10, and he loves PCs — and he really “doesn’t get” tablets. And I truly understand why. His work requires local computational power and storage, and he loves Windows 10 over all other platforms.

But he is not a trend. His deep understanding of the benefits of Windows 10, and some of the PC manufacturers as well as those who sell upgrade componentry, is very much a niche. While he depends heavily on Microsoft and Wintel manufacturers to do his work, he is a niche user. (BTW he uses a Nexus phone and absolutely loves it, as well. And he can wax eloquently about the advantages he achieves by using an Android device.)

Today, I doubt I will receive hardly any comments to this column. Because to most people, the PC is nearly irrelevant. People don’t actually care about PC sales results, or forecasts. Not nearly as much as, say, care about whether or not the iPhone 6se advances the mobile phone market in a meaningful way.

Most people do their work, almost if not all their work, on a mobile device. They depend on cloud and SaaS (software-as-a-service) providers and get a lot done on apps. What they can’t do on a phone, they do on a tablet, by and large. They may, or may not, use a PC of some kind (Mac included in that reference) but it is not terribly important to them. PCs are now truly generic, like a refrigerator, and if they need one they don’t much care who made it or anything else – they just want it to do whatever task they have yet to migrate to their mobile world.

The amazing thing is not that PC sales have fallen for 6 quarters. That was easy to predict back in 2013. The amazing thing is that some people still don’t want to accept that this trend will never reverse. And many people, even though they haven’t carried around a laptop for months (years?) and don’t use a Windows mobile device, still think Microsoft is a market leader, and has a great future. PCs, and for the most part Microsoft, are simply no more relevant than Sears, Blackberry, or the Encyclopedia Britannica. Yet it is somewhat startling that some people have failed to think about the impact this has on their company, companies that make PC software and hardware – and the impact this will have on their lives – and likely their portfolios.

by Adam Hartung | Apr 5, 2016 | Disruptions, In the Rapids, Leadership, Web/Tech

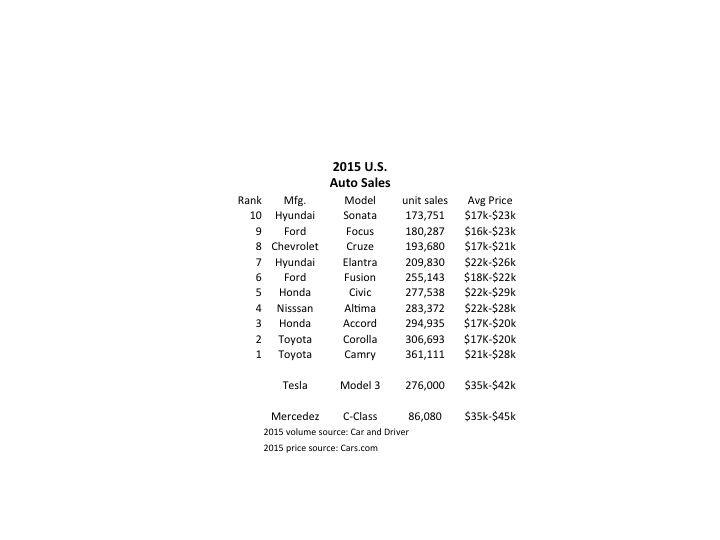

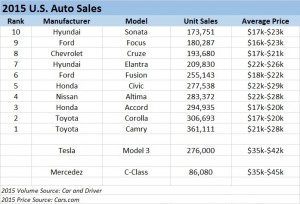

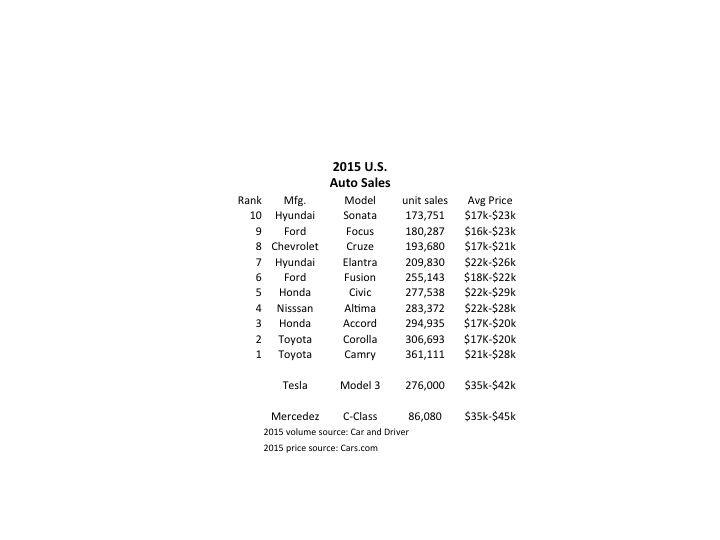

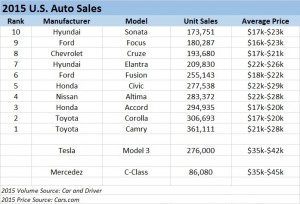

Tesla started taking orders for the Model 3 last week, and the results were remarkable. In 24 hours the company took $1,000 deposits for 198,000 vehicles. By end of Saturday the $1,000 deposits topped 276,000 units. And for a car not expected to be available in any sort of volume until 2017. Compare that with the top selling autos in the U.S. in 2015:

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Even more astonishing is the average selling price. Note that top 10 cars are not highly priced, mostly in the $17,000 to $25,000 price range. But the Tesla is base priced at $35,000, and expected with options to sell closer to $42,000. That is almost twice as expensive as the typical top 10 selling auto in the U.S.

Tesla has historically been selling much more expensive cars, the Model S being its big seller in 2015. So if we classify Tesla as a “luxury” brand and compare it to like-priced Mercedes Benz C-Class autos we see the volumes are, again, remarkable. In under 1 week the Model 3 took orders for 3 times the volume of all C-Class vehicles sold in the U.S. in 2015.

[Car and Driver top 10 cars; Mercedes Benz 2015 unit sales; Tesla 2015 unit sales; Model 3 pricing]

Although this has surprised a large number of people, the signs were all pointing to something extraordinary happening. The Tesla Model S sold 50,000 vehicles in 2015 at an average price of $70,000 to $80,000. That is the same number of the Mercedes E-Class autos, which are priced much lower in the $50,000 range. And if you compare to the top line Mercedes S-Class, which is only slightly more expensive at an average $90,0000, the Model S sold over 2 times the 22,000 units Mercedes sold. And while other manufacturers are happy with single digit percentage volume growth, in Q4 Tesla shipments were 75% greater in 2015 than 2014.

In other words, people like this brand, like these cars and are buying them in unprecedented numbers. They are willing to plunk down deposits months, possibly years, in advance of delivery. And they are paying the highest prices ever for cars sold in these volumes. And demand clearly outstrips supply.

Yet, Tesla is not without detractors. From the beginning some analysts have said that high prices would relegate the brand to a small niche of customers. But by outselling all other manufacturers in its price point, Tesla has demonstrated its cars are clearly not a niche market. Likewise many analysts argued that electric cars were dependent on high gasoline prices so that “economic buyers” could justify higher prices. Yet, as gasoline prices have declined to prices not seen for nearly a decade Tesla sales keep going up. Clearly Tesla demand is based on more than just economic analysis of petroleum prices.

People really like, and want, Tesla cars. Even if the prices are higher, and if gasoline prices are low.

Emerging is a new group of detractors. They point to the volume of cars produced in 2015, and first quarter output of just under 15,000 vehicles, then note that Tesla has not “scaled up” manufacturing at anywhere near the necessary rate to keep customers happy. Meanwhile, constructing the “gigafactory” in Nevada to build batteries has slowed and won’t meet earlier expectations for 2016 construction and jobs. Even at 20,000 cars/quarter, current demand for Model S and Model 3 They project lots of order cancellations would take 4.5 years to fulfill.

Which leads us to the beauty of sales growth. When products tap an under- or unfilled need they frequently far outsell projections. Think about the iPod, iPhone and iPad. There is naturally concern about scaling up production. Will the money be there? Can the capacity come online fast enough?

Of course, of all the problems in business this is one every leader should want. It is certainly a lot more fun to worry about selling too much rather than selling too little. Especially when you are commanding a significant price premium for your product, and thus can be sure that demand is not an artificial, price-induced variance.

With rare exceptions, investors understand the value of high sales at high prices. When gross margins are good, and capacity is low, then it is time to expand capacity because good returns are in the future. The Model 3 release projects a backlog of almost $12B. Booked orders at that level are extremely rare. Further, short-term those orders have produced nearly $300million of short-term cash. Thus, it is a great time for an additional equity offering, possibly augmented with bond sales, to invest rapidly in expansion. Problematic, yes. Insolvable, highly unlikely.

On the face of it Tesla appears to be another car company. But something much more significant is afoot. This sales level, at these prices, when the underlying economics of use seem to be moving in the opposite direction indicates that Tesla has tapped into an unmet need. It’s products are impressing a large number of people, and they are buying at premium prices. Based on recent orders Tesla is vastly outselling competitive electric automobiles made by competitors, all of whom are much bigger and better resourced. And those are all the signs of a real Game Changer.

by Adam Hartung | Mar 30, 2016 | In the Whirlpool, Leadership, Lifecycle, Web/Tech

Starboard Value last week sent a letter to Yahoo’s Board of Directors announcing its intention to ask shareholders to replace the entire Board. That is why Starboard is called an “activist” fund. It is not shy about seeking action at the Board level to change the direction of a company – by changing the CEO, seeking downsizings and reogranizations, changing dividend policy, seeking share buybacks, recommending asset sales, or changing other resource allocations. They are different than other large investors, such as pension funds or mutual funds, who purchase lots of a company’s equity but don’t seek to overtly change the direction, and management, of a company.

Activists have been around a long time. And for years, they were despised. Carl Icahn made himself famous by buying company shares, then pressuring management into decisions which damaged the company long-term while he made money fast. For example, he bought TWA shares then pushed the company to add huge additional debt and repurchase equity (including buying his position via something called “green mail”) in order to short-term push up the earnings per share. This made Icahn billions, but ended up killing the company.

Similarly, Mr. Icahn bought a big position in Motorola right after it successfully launched the RAZR phone. He pushed the board to shut down expensive R&D and product development to improve short-term earnings. Then borrow a lot of money to repurchase shares, improving earnings per share but making the company over-leveraged. He then sold out and split with his cash. But Motorola never launched another successful phone, the technology changed, and Motorola had to sell its cell phone business (that pioneered the industry) in order to pay off debt and avoid bankruptcy. Motorola is now a fragment of its former self, and no longer relevant in the tech marketplace.

So now you understand why many people hate activists. They are famous for

- cutting long-term investments on new products leaving future sales pipelines weakened,

- selling assets to increase cash while driving down margins as vendors take more,

- selling whole businesses to raise cash but leave the company smaller and less competitive,

- cutting headcount to improve short-term earnings but leaving management and employees decimated and overworked,

- increasing debt massively to repurchase shares, but leaving the company financially vulnerable to the slightest problem,

- doing pretty much anything to make the short-term look better with no concern for long-term viability.

Yet, they keep buying shares, and they have defenders among shareholders. Many big investors say that activists are the only way shareholders can do anything about lousy management teams that fail to deliver, and Boards of Directors that let management be lazy and ineffective.

Which takes us to Yahoo. Yahoo was an internet advertising pioneer. Yet, for several years Yahoo has been eclipsed by competitors from Google to Facebook and even Microsoft that have grown their user base and revenues as Yahoo has shrunk. In the 4 years since becoming CEO Marissa Mayer has watched Yahoo’s revenues stagnate or decline in all core sectors, while its costs have increased – thus deteriorating margins. And to prop up the stock price she sold Alibaba shares, the only asset at Yahoo increasing in value, and used the proceeds to purchase Yahoo shares. There are very, very few defenders of Ms. Mayer in the investment community, or in the company, and increasingly even the Board of Directors is at odds with her leadership.

Which takes us to Yahoo. Yahoo was an internet advertising pioneer. Yet, for several years Yahoo has been eclipsed by competitors from Google to Facebook and even Microsoft that have grown their user base and revenues as Yahoo has shrunk. In the 4 years since becoming CEO Marissa Mayer has watched Yahoo’s revenues stagnate or decline in all core sectors, while its costs have increased – thus deteriorating margins. And to prop up the stock price she sold Alibaba shares, the only asset at Yahoo increasing in value, and used the proceeds to purchase Yahoo shares. There are very, very few defenders of Ms. Mayer in the investment community, or in the company, and increasingly even the Board of Directors is at odds with her leadership.

The biggest event in digital marketing is the Digital Content NewFronts in New York City this time every year. Big digital platforms spend heavily to promote themselves and their content to big advertisers. But in the last year Yahoo closed several verticals, and discontinued original programming efforts taking a $42M charge. It also shut is online video hub, Screen. Smaller, and less competitive than ever, Yahoo this year has cut its spending and customer acquisition efforts at NewFronts, a decision sure to make it even harder to reverse its declining fortunes. Not pleasant news to investors.

And Yahoo keeps going down in value. Looking at the market the value of Yahoo and Alibaba, and the Alibaba shares held in Yahoo, the theoretical value of Yahoo’s core business is now zero. But that is an oversimplification. Potential buyers have valued the business at $6B, while management has said it is worth $10B. Only in 2008 Ballmer-led Microsoft made an offer to buy it for $45B! That’s value destruction to the amount of $35B-$39B!

Yet management and the Board remains removed from the impact of that value destruction. And the risk remains that Yahoo leadership will continue selling off Alibaba value to keep the other businesses alive, thus bleeding additional investor value out of the company. There are reports that CEO Mayer never took seriously the threat of an activist involving himself in changing the company, and removing her as CEO. Ensconced in the CEO’s office there was apparently little concern about shareholder value while she remained fixated on Quixotic efforts to compete with much better positioned, growing and more profitable competitors Google and Facebook. Losing customers, losing sales, and losing margin as her efforts proved reasonable fruitless amidst product line shutdowns, bad acquisitions, layoffs and questionable micro-management decisions like eliminating work from home policies.

There appear to be real buyers interested in Yahoo. There are those who think they can create value out of what is left. And they will give the Yahoo shareholders something for the opportunity to take over those business lines. Some want it as part of a bigger business, such as Verizon, and others see independent routes. Even Microsoft is reportedly interested in funding a purchase of Yahoo’s core. But there is no sign that management, or the Board, are moving quickly to redirect the company.

And that is why Starboard Value wants to change the Board of Directors. If they won’t make changes, then Starboard will make changes. And investors, long weary of existing leadership and its inability to take positive action, see Starboard’s activism as the best way to unlock what value remains in Yahoo for them. After years of mismanagement and underperformance what else should investors do?

Activists are easy to pick at, but they play a vital role in forcing management teams and Boards of Directors to face up to market challenges and internal weaknesses. In cases like Yahoo the activist investor is the last remaining player to try and save the company from weak leadership.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Which takes us to Yahoo. Yahoo was an internet advertising pioneer. Yet, for several years Yahoo has been eclipsed by competitors from Google to Facebook and even Microsoft that have grown their user base and revenues as Yahoo has shrunk. In the 4 years since becoming CEO Marissa Mayer has watched

Which takes us to Yahoo. Yahoo was an internet advertising pioneer. Yet, for several years Yahoo has been eclipsed by competitors from Google to Facebook and even Microsoft that have grown their user base and revenues as Yahoo has shrunk. In the 4 years since becoming CEO Marissa Mayer has watched