by Adam Hartung | Aug 17, 2021 | Defend & Extend, Leadership, Politics, Strategy, Trends

Afghanistan’s Fall Was Foreseeable

After 20 years of American occupation, the Taliban retook Afghanistan in a matter of days. Pundits across the news channels are expressing extreme surprise. But they should not be surprised, this speed of change was entirely predictable. The chaos in Afghanistan may seem a world away, but this unfortunate situation can offer 2 significant lessons for business.

Lesson #1 – Failure (change) always happens faster than we expect.

It took 35 years to build the infrastructure for VHS tapes, then DVDs, to become a big market. We had to open a lot of stores, and put a lot of machines in homes. Then that all became pretty much worthless in 18 months when streaming came along. We used travel agents to book air flights and hotels for 40 years, but they practically all disappeared in a year when we could book on-line. We were ardent radio listeners until iTunes and streaming services pushed radio further toward obsolescence in 6 months when the pandemic magnified these trends. Radio consumption in cars came to an abrupt halt when commuting stopped.

Fringe competitors are constantly trying to become mainstream. They never give up. Innovators keep trying new ways to serve our customers. Then, when there’s a shift in technology, regulation or another major market component they leap forward in a huge step overtaking the marketplace. The Taliban never went away. They kept getting better and waited until the USA announced its planned withdrawal. That created the opportunity and in one big step they leapt forward. Business leaders continually believe that markets will shift gradually. Leaders underestimate how well fringe competitors are prepared to move forward, and leaders fail to anticipate how quickly customers will shift buying patterns (like Afghan troops dropping their guns and fleeing.)

It’s not gradual. Change happens fast. If you see a change on the horizon, don’t think it’ll come slowly. Think like the fellow pushed off a 20 story building. At the twelfth story it’s not “so far so good,” but rather “we better prepare for disaster.” When change is going to happen, pack your parachute. Figure out how you’ll keep pushing forward. Or you’ll find a swift, hard landing.

Lesson #2 – You are either growing, or you are dying. There is no “maintenance, status quo.”

Despite two decades fighting in Afghanistan, by no measure was America becoming more popular. America’s image, trade, world standing were not improving in Afghanistan. America was fighting merely to maintain. Watch “Charlie Wilson’s War” and it’s evident America had no plans to “heap any love” on Afghanistan. No schools, agricultural assistance, preservation of mosques or other religious sites, family assistance programs, immigration. America just kept working to preserve the situation after killing Osama bin Laden. The relationship wasn’t growing, improving, becoming something beneficial to both sides. Without growth in the relationship it was deteriorating. Afghans were increasingly weary of occupation, and in a great sense ready for change.

Too often, business leaders think they don’t need to focus on growth. According to recent Gartner research only 56% of chief executives see Growth as the top priority for their firms. They don’t think they need to think about how to launch new solutions, new services, new opportunities to please their customers. They drift into preserving the status quo business, perhaps working on doing things a little faster, a little better, a little cheaper. But as time passes needs change. New needs emerge. Markets don’t stay the same, new competitors challenge old norms – challenge the status quo. The customer relationship deteriorates as new unmet needs aren’t addressed. If we aren’t helping the customer to grow, and thus growing ourselves, the market becomes dull, and ready for a major shift. Poised to be overtaken by something new.

We used to think we could create a market, then erect entry barriers to keep out competitors. Things like scale advantages, control of distribution, control of technology, regulatory limitations became the “moats” that would protect the business. And we thought with those protections we had “competitive advantage” allowing revenues, and profits, to go on infinitely. But that simply isn’t true. Fringe competitors are constantly attacking the “moat.” Things happen in the world creating opportunities for new solutions. A “reinvention gap” emerges as the old business becomes stale and customers are looking for something new. And fringe competitors are waiting for the opportunity to take action – and market share.

The only way you can remain vital is to constantly grow. You have to keep up with economic growth (3%/yr) and overall inflation (3%/year) just to remain even – without any return to shareholders. Add on 3 more points of growth to keep investors and you need to grow 9-10%/year just to sustain. Leaders too often take for granted that customers are happy, their particular market is “low growth” and they focus on the bottom line. Wrong, and deadly. Instead focus on the top line. You have to constantly grow revenues. It’s the only way you can remain vital with your customers, and the only route to success.

This analogy is not to belittle the catastrophic circumstances in Afghanistan. Under the Taliban most people will be denied the things I personally hold dear. It is a human tragedy.

But the story is one told all too often. Focusing on the bottom line, forgetting the need to grow your organization and your relationship with customers. And then thinking that any transition will take some time, providing ample room to react. I see these errors regularly. Think of Sears, ToysRUs, Hostess Baking, Sun Microsystems, Wang, GM/Ford/Chrysler, Motorola….. it’s a very long list of companies that made these two mistakes. As the newscasters harp on how fast Afghanistan fell, remember that this was a failure many years in the making. Lots of defend and extend behavior (military might) by America, far too little innovation and not meeting unmet needs (food, shelter, clean water, education, protection from harm.)

Are you on “cruise control” running your business?

Ask yourself, Are you trying to defend and extend what you’ve always done? Or are you meeting unmet customer needs, helping customers to grow and in turn growing yourself? If you’re the former, get ready for a rude awakening.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | May 12, 2021 | Employment, Immigration, Scenario Planning, Strategy, Trends

Demographics is Destiny

Planning is all about the future. And the future is easiest to predict when we look at demographics. Population trends are easy to spot, and long-lived. So the recent U.S. census, which built on previous trends, gives us great insights for planning our investments. Let’s focus here on the two biggest demographic trends.

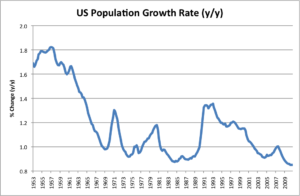

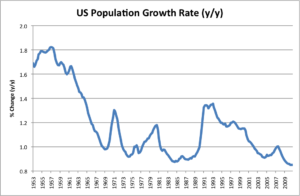

First, the U.S. population growth rate is terrible. Less than 1%/year. Its the 2nd worst decade  since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

In 2018, I wrote about the Japanese demographic “trend bomb.” Low birthrates and anti-immigration meant there were only 2 working people to support each retiree. And the situation was worsening. It’s time America starts considering what it will do if we don’t let immigrants return to spark growth. Growth can hide a multitude of sins, Source: Avondale Asset Management

because it creates demand for more goods and services – thus creating economic growth. People in China and

India aren’t starving any longer, because they’ve grown their economies out of poverty.

As wrote in 2017, it was America’s population growth – driven by immigration – that made 1800s and 1900s America the jewel of the world. Despite horrors at Ellis Island, those boatloads of immigrants created the agricultural and industrial America with its flourishing economy. Like I observed in 2016, unless we re–invigorate growth through immigration, the woes Trumpers complain about will get much, much worse. Soon Pakistan and Indonesia will have more people than the USA! China and India, with their growing populations, growing economies and growing diaspora are making an ever–bigger imprint on the global economy. Meanwhile, America is on its way to stagnant performance like most European countries.

U.S. Population is Mobile, Despite the Pandemic

Second, the trend south and west continues unabated. In 1970, the South and West accounted for less than half the population. Now they account for 62%. The Northeast is losing people rapidly, with 48 of 62 New York counties losing people. And Illinois has seen the problem in spades. Chicago and Illinois are already in a world of hurt due to declining population causing a declining economy causing real estate prices to fall and taxes to rise. (Though the pent-up pandemic housing demand is temporarily increasing housing prices, masking the long term trend.) When population trends down, it becomes a whirlpool of problems – just look at what’s happened in Detroit! You must have the people to build a strong economy.

Looking at both these trends, do you see the unabashed irony? We see no problem with cities and states competing for migrants from other cities and states. Local and state governments lure in companies and people with tax breaks, subsidies and other allowances. We think immigration within our country is good – and recognize losing people from our local area is bad. But at a national level, we still have people who object to immigration. They want the borders closed, and no new entries. We have politicians who want to freeze the economy in place. Yet we know from our past that the only solution to getting our economy to grow REQUIRES immigration. It is the #1 reason the economy was so sluggish coming out of the Great Recession – we cut immigration to unprecedented levels under Obama and continued the decline under Trump. We are unlikely to birth our way to growth, given trends in lifestyles and gender equality. But, we can bring in immigrants who can help the economy grow. We need to get over this hypocrisy and move toward greater immigration as a pro-America policy!

What does this mean for your business?

First – are you sure you want to do business only in the USA? The growth markets are elsewhere. Have you considered selling in China, India, Indonesia, Micronesia, Thailand, South America and Africa? These are growing markets where Chinese businesses (in particular) are making big investments. By going where the population is growing they are able to grow their revenues, and their influence. America isn’t the dominant international player it once was, and there’s never been a better time to look outside America for your next growth market.

Second – Take your business where you see the growth in America. Lots of businesses are going to Texas (and Nevada, Utah, Idaho and Arizona) because lots of people are going there! If you open a restaurant in a town losing people, to succeed you have to entice people to drive to your town and restaurant. You better be really good, and you’ll probably have to make price allowances to have repeat business. But if you have a restaurant in a locality where people are immigrating in large numbers you can do well even if your food is mediocre. Growth hides a multitude of sins!! Your food need not be fantastic, and you can price higher, and you can even have shorter hours because you’re where the people are! It’s simply a lot easier to succeed when you are in a growing marketplace. Are you planning to be someplace because that’s where you started, have family, or went to college? Or are you planning to be someplace where the people, and money, are?

Have you taken into account changes in demographics when making your plans? It is undoubtedly the #1 trend you should use for planning (Fleeing Illinois) . It is highly predictable, and has a lot to do with success. Simply going where the people are will help you succeed. There’s nothing more important to your scenario planning than obtaining a copy of the latest census and studying it really, really hard. It’ll jump start you on the road to greater sales and more success!

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465

by Adam Hartung | Jan 22, 2021 | eBooks, Politics, Strategy, Trends

Click for ebook

Thrive to the Future – 4 top trends for 2021 and beyond.

Businesses need to plan for the future. And part of planning are the assumptions you make. As Biden takes office, there is a lot of talk about whether the “movement” that Trump led is at its end, or just beginning. The good news is we have the tools to be predictive when answering that question, and those tools tell us that for the most part Trumpism is over.

As I wrote in August when California put to vote its “Gig Economy Law,” not even a state legislature can stop a trend. The Gig Economy is one of the biggest mega-trends out there, so trying to legislate away the trend and return to old methods of employment was simply not going to work. California needed to make changes that aligned with needs of gig workers, not try to outlaw the practice. And the measure failed.

It’s this same logic that makes me confident the policies that applied the last 4 years will go away, and any “movement” to try and return to that course will not succeed. Like California’s effort, the policies of Trumpism were anti-trend. While these policies could be enforced for a short time, they simply could not withstand the power of the long-term trends, and thus were doomed from the outset. Let’s take a look at some of those policies and trends, and review why they were (at best) short-term actions. {Note, this is not predicting an end to the Republican Party, nor Conservative politics. This discussion is focused on the American policies of the last 4 years during the Trump administration.}

-

- Anti-globalization is doomed to fail. We have the internet now. Everybody can see what’s happening in the world, and everybody can talk to everybody else. Borders have meaning, but trade across borders cannot be stopped. We all buy and sell products internationally daily. Even the Trump website sold apparel made in China. To try and stop trade is impossible, and tools like tariffs are simply woefully out of date. Those who try to interfere with globalization will have economic suffering, while allowing stronger international traders to grow. { Side note read column on why Brexit is Economic Destruction vs. Creative Destruction }

- Anti-immigration is doomed to fail. America, like almost all mature economies, is an aging demography. If you don’t add new people economic activity will suffocate under the weight of caring for the aged. You need demographic growth, and it needs to be younger people who are working. Simultaneously, companies that need skills need access to international markets to recruit people to work under visas. Immigration is good for economic growth, and an inherent part of globalization. Simply put, America needs immigration to keep growing. { Side note read column on why Japan’s aging demographics is an economic “time bomb”. }

- Chronic tax cuts without equal (or greater) investment is doomed to fail. The argument for low taxes is to provide more money for investing in business to grow – thus creating jobs that see higher pay due to increased demand for workers. However, recent tax cuts did not have associated policies for re-investment, and thus much of the money was used to repurchase shares of stock, make acquisitions of existing businesses and simply build a cash hoard. Simultaneously, tax cuts led to a reduction in government spending on infrastructure and other jobs creating projects, which further worsened the economic growth opportunity. This led to enormous income inequality – which has quite literally led to people “taking to the streets.” At some point policies have to shift toward investment to generate economic growth. { Side note read column on why share buybacks are not good for the economy nor good for shareholders. }

- Isolating China only makes them stronger. We have a balance of trade deficit with China, but tariffs and attempts to stop trade only made the balance of trade WORSE. The net is we want Chinese labor, and products, a lot more than they need American products. Retaliation is very real, and the USA is woefully unprepared for economic retaliation. The biggest market hurt by Chinese retaliation is agriculture, as witnessed by the incredible number of farm failures last 4 years. Them not buying from us doesn’t affect them nearly as much as it affects us. Meanwhile, China keep investing in global projects, their economy keeps growing, and now China’s economy is larger than the USA’s. We desperately need to focus on how to compete with China in global markets, not blindly think we can simply walk away. { Side note column on changing economic positions and how China’s growth is impacting global positions including currency valuations. }

- Sanctions and other policies to try controlling middle-east behavior are doomed. US policy was historically built on petroleum demand. But now these countries must move beyond oil sales to grow, and they desperately know this. The only successful long-term policy is to help these nations grow diversified economies so they can create jobs and keep their citizens happy. {Side note column on how falling petroleum demand is affecting global markets and changing the winners. }

- These are just some of the long-term trends that Trumpism ignored. Short-term shear force of will, lying about the data and ignoring the obvious could allow naysayers to hope they would change the trajectory of history. But long-term, trends always win. Evolution always moves forward, never backward. While Trumpism was a very interesting effort to fight trends, it was doomed to fail. And now that we can see the almost wholly negative economic implications of these policies it is extremely unlikely any such “movement” can re-establish itself. People do not act against their own self interest very long.

-

Winners don’t fear trends and the change they create. Rather they accept the trends on build on them to grow. Looking forward business should not plan for Trumpism to return in any meaningful way. As a set of policies they are as likely to succeed as storming the capital was likely to change the course of an election. Short term a lot of noise, long-term meaningless. So we can move forward building our plans based on trends, and a shift to economic policies much more aligned with long-term trends.

Key lessons?

First, the world is growing and leading businesses will grow. If you’re not growing, you’re dying. Second, never plan from past success, but instead plan for the future. You don’t grow value by being operationally excellent, because the world is forever changing and it will make your past business less valuable even if you do run it well. Third, make sure your plans are all built on trends. Let trends be the wind in your sales, or the current under your boat, or whatever analogy you like – just be sure you’re using TRENDS to drive you business planning, product development and solutions generation. Customers buy trends and help for them to achieve the future.

- Here at Spark Partners, we are experts at trend analysis, trend planning and effective resource allocation. Don’t let a comfort level on doing more of the same get in the way of your future growth. Embrace trends in the market and let us help you identify critical trends and invest smarter to build on trends and grow.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jan 14, 2021 | eBooks, Investing, Politics, Strategy, Trends

Chicago, and Illinois, are in big economic trouble.

- 7th straight year of population decline. Losing 235,000 people in 10 years, 3x the amount of any other state. Last year saw a decline of 79,500 people – second only to much larger New York – and the rate of people leaving is accelerating.

- Illinois has, on average, property taxes 2x the national average. If you owned the “Home Alone” house in suburban Chicago, since the movie was made in 1990 you would have paid $890,000 in property taxes.

- Chicago is the worst residential real estate market of any large city in America. While values have been rising elsewhere since the Great Recession, in the last decade, property values in Chicago have declined 20%.

- Sales tax is 9%, and on some products 10%+, one of the highest rates in the USA. On-line purchases are taxed at 10.25%, for example. Illinois is one of only 7 states to charge sales tax on gasoline. And Illinois has the highest cell phone tax in the country.

- Illinois roadway toll fees are widespread, and among the highest in the USA, with the majority of those funds going NOT to road improvement but rather into the general budget to cover state expenses.

- Illinois is 46th in private sector job growth – and would be 50th except the #1 source of job growth is government jobs. And 40% of the government workforce makes $100k+/year. The total number of jobs in Illinois December, 2019 was 6.2M – unchanged since 2015 – and up only slightly from 5.9M in 2010 – yielding a pathetically low growth rate for jobs of 1/2 of 1% (.5%) per year

- 1/3 of the state budget is pension payments, and pension debt is 26% of state GDP – highest in the country. Lots of retirees, very few new jobs to pay their pensions.

Thrive to the Future – 4 top trends for 2021 and beyond.

Gibbon wrote “The Decline and Fall of the Roman Empire” as a treatise to uncover how such a powerful empire could lose its greatness. There is no doubt, Chicago and Illinois were once great. The area was known for great jobs, great infrastructure, great transportation system, great homeownership – and for many decades considered one of the best places to live in America. Back when agriculture and manufacturing dominated the economy. But quite obviously, as the world changed, and the sources of economic value (including jobs) changed, the late, great state of Illinois kept pushing on with “business as usual” instead of changing policies and investments to re-orient for the Information Era.

Things were not destined to become this bleak. Chicago could be Austin today – but obviously it isn’t. Where Austin, and Texas, looked at trends and made investments beyond the old “core” of oil and gas, Chicago and Illinois completely failed to look at trends that indicated a clear need to change. Problems, and the path to solve them, have been obvious for years. It was easy to predict this would happen. But a chronic focus on the short-term, rather than the long-term, combined with a complete unwillingness to change how investments were made caused state and city leaders to consistently ignore warning signs and make one bad decision after another.

Indicators of Decline

I’m an expert on trend-based planning, so let’s take a look at the telltales this was coming and how those telltale indicators were ignored:

- In February, 2006 (yes 15 years ago) I wrote that Illinois was the #1 net job loss market in the country. This factoid highlighted an emerging problem in the underlying economy. The state was still considerably dependent on old-line agriculture/food giants, those businesses were crumbling and unlikely to recover as the economy shifted. Notably Kraft was in its 5th year of what was to be a turnaround (that never happened) and Sara Lee was under incompetent leadership that kept selling businesses to shore up declining revenues and earnings. The state, and city, had failed to develop an infrastructure for investment in start-up companies. There was a total lack of investment money for entrepreneurs from paternalistic large companies such as Motorola and Ameritech. And a lack of money for innovation from banks, venture capital and private equity firms. Existing businesses were aging, cutting jobs and none were focused on investing in new companies to keep the local economy tied to the emerging Information Economy [ link ]

- In February, 2009 Forbes selected Chicago as the 3rd most miserable city in the USA, citing high taxes, no job growth, infrastructure decay, congestion and bad weather. An uproar ensued – but no change. I then noted my 2006 column, and recommended a very serious Disruption in how Chicago was managing its resources. Clearly the “more of the same” strategy trying to defend its past was not working. Unless there was a disruption, Chicago would get worse – not remain the same, and certainly not get better. The signs were clear that from ’06 to ’09 nobody was thinking about the big changes needed [ link ]

- In June, 2010 it was reported that Illinois lost 260,000 jobs between 2000 and 2010 – and that was an indicator of why Chicago and the state were having so many economic problems. I recommended the city and state make significant changes in resource allocation to keep more start-ups local. The University of Illinois was the #4 engineering school in the US, but the vast majority of graduates left to one or the other coasts. Local businesses were not developing new businesses, thus not hiring these top students. Start-ups at the universities, and by recent grads, could not obtain funding, so they fled to where the money was. Economic reliance on stalled companies like Kraft, Sara Lee, Motorola, Lucent, Sears and United had created a Growth Stall that was sure to lead to additional job losses – when the best talent was right there in the state! [link ]

- I followed up a week later that same June with a column on how Mayor Daley was very popular with voters and local businesses, but he was setting up the city (and state) for failure. There was a focus on keeping the “old guard” happy, and doing so by completely ignoring opportunities for future growth. Offering tax breaks and subsidies to recruit corporate headquarters (like Boeing) created very few jobs, and was a poor use of resources that should be diverted to funding start-up tech and bio-tech companies. And financial machinations, like selling the city’s parking rights, gave a short-term lift to the budget, hiding significant weaknesses, while creating massive long-term problems. Chicago and Illinois politicians were focused on short-term actions to get votes, and ignoring the very real jobs problem that was tanking the economy. [ link ]

- By April, 2014 I was able to clearly demonstrate that my predicted economic stagnation spiral had taken hold in Illinois. Defend & Extend investments to shore up declining companies – like Sears – robbed local governments of funds for job creating programs. And a decade + of no job creation was forcing taxes up – at a remarkable rate – which kept businesses from moving to Illinois; kept them from opening software labs, coding facilities, research centers, pharma and bio-pharma production plants, etc. With no growth, but rising costs, the death spiral had begun and needed immediate attention [ link ]

- In September, 2016 the outward migration from Chicago and Illinois had become a powerful trend. Looking at demographics, the market was aging. Rising costs and no growth had pinched budgets to the limit, while pension costs had become an unsustainable burden on the state’s citizens. Just like Japan was in an aging crisis, Illinois was in an aging crisis. And this was destined to create even more problems for the economic death spiral that began before 2006. [ link ]

- So by January, 2017 the demographic tailspin was clearly creating a vacuum pulling people out of Chicago and Illinois. Fully 4 years ago it was obvious that the predicted trends had taken hold, and nothing short of an incredible disruption would save Chicago from becoming the next Detroit. Using the simplest trend planning tools made it clear that unless there was radical change in investments the Chicago empire was at its end. [ link ]

Lessons for business?

Far too many businesses act like Chicago. “Business as usual” dominates. Resources are automatically routed to defending old business lines, rather than investing in new products and solutions. Focusing plans on historical customers, products and markets create blindness to market shifts, and a reluctance to move forward to new technologies and markets. Very little energy is put into trend analysis, and plans are not built based on trends and likely future outcomes (planning from the past dominates over planning for the future.) People who point out likely future bad outcomes unless serious change is undertaken are ignored, or shouted down, or removed entirely. Short-term financial machinations (selling assets, or a business, or offering deep discounts to keep customers) create an illusion of security while long-term trends are undermining the business’ foundation.

We are experts at trend analysis, trend planning and effective resource allocation. It was clear 15 years ago that major resource reallocation was necessary for Chicago to continue growing its economy. Don’t let a fixation on doing more of the same get in the way of your future growth, like Chicago. Let us help you identify critical trends and invest smarter to build on trends and grow.

Key lessons?

First, the world is growing and leading businesses will grow. If you’re not growing, you’re dying. Just like GE and Exxon. Second, never plan from past success, but instead plan for the future. You don’t grow value by being operationally excellent, because the world is forever changing and it will make your past business less valuable even if you do run it well. Third, make sure your plans are all built on trends. Let trends be the wind in your sales, or the current under your boat, or whatever analogy you like – just be sure you’re using TRENDS to drive you business planning, product development and solutions generation. Customers buy trends and help for them to achieve the future.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Aug 25, 2020 | Economy, Innovation, Leadership, Regulations, Strategy, Trends

In 2019, the California legislature passed Assembly Bill, AB5 “The Gig Economy Law.” It redefined “employee” in an effort to try and dramatically reduce “contract workers.” This law is intended to force people who work to become ”employees” (of someone), and thereby receive more rights. Simultaneously it forces those who pay for work to become “employers” covering additional costs forced onto them by the legal definition of an “employee”. In other words, AB5 attempts to set back the advancement of the Gig Economy 30+ years. Last week, that law was put on hold by a California court, and California citizens will vote in November on whether requirements of AB5 should remain, or be repealed.

Go back to 1900 and there were very few “employees.” Most people just worked. But the industrial economy boomed, and with it the need to put people into factories. Showing up on time, doing a job, was crucial to the industrial economy – whether you were making car parts or pushing invoices around. We’ve all seen pictures of assembly lines in factories making shirts or lawn mowers, and assembly lines of gray steel desks where people manually processed documentation. Being an “employee” meant showing up and was central to developing the industrial economy, where lots of cogs were needed for the machine to work.

There is one thing stronger than all the armies in the world, and that is an Idea whose time has come.

Victor Hugo

But we’re not in an industrial economy any more. Since 1990 we’ve been transforming into the information economy (or the knowledge economy, pick your preferred term.) Automation has replaced labor, with robots making trucks while computers process documents. People don’t stand in assembly lines – machines do. Work doesn’t happen with our hands, it happens with our brains – and machines do the manual labor. Managers don’t manage people, they manage processes. As a result, companies have been realizing they need a lot fewer people.

No longer can employers consider employees for life. Rather, companies need flexibility to adjust to the fast paced marketplace. Owning resources, including labor, can feel like dragging an anchor along with your business. Yes, people are needed people to do things. But every business leader knows that the brainpower needed today is probably not what was needed yesterday and not what will be needed tomorrow. Businesses need to access the knowledge workers they need quickly and shift their resources fast in order to meet changing market conditions- agility not stability. Relationships are transactional, not societal.

This is actually good for everyone. A hundred years ago studios controlled everything about movie making, including actor salaries. Many actors (i.e. Judy Garland & Mickey Rooney) made dozens of movies, yet had very little money. But that lock was broken, and it allowed actors to sell their services to the highest bidder – leading to today’s “star economy” where actors make what they can get producers to pay. There is a set scale to employment, but every actor is a free agent able to negotiate their terms of “employment” for each project.

This is actually good for everyone. A hundred years ago studios controlled everything about movie making, including actor salaries. Many actors (i.e. Judy Garland & Mickey Rooney) made dozens of movies, yet had very little money. But that lock was broken, and it allowed actors to sell their services to the highest bidder – leading to today’s “star economy” where actors make what they can get producers to pay. There is a set scale to employment, but every actor is a free agent able to negotiate their terms of “employment” for each project.

Major league sports is the same. Where once club owners dictated pay, today players negotiate across teams for the best contracts. It allows for negotiating the best price for the best service in an open, flexible economy. If you’re good at playing, or coaching, you negotiate with the teams to get your best price for your services.

Uber and Lyft aren’t much different from studios and sports franchisees. Once, taxi companies controlled the market. All of us spent time standing in lines, waiting on cabs, that too often were dirty and broken. Market access was controlled by taxi tokens, and so was pricing. So service deteriorated to as low as possible, while customers stood in line on Friday night hoping to get a cab home from the theatre. But Uber unleashed the market. Resources could be added, or removed, by market participants. Pricing was determined by the buyers and sellers. And pricing variability allowed for quality variations as drivers tried to acquire repeat business. Surge pricing meant you could get a ride on New Year’s eve, meeting the customer needs and with pricing to meet the supplier’s need for expanding short-term capacity.

Uber and Lyft aren’t much different from studios and sports franchisees. Once, taxi companies controlled the market. All of us spent time standing in lines, waiting on cabs, that too often were dirty and broken. Market access was controlled by taxi tokens, and so was pricing. So service deteriorated to as low as possible, while customers stood in line on Friday night hoping to get a cab home from the theatre. But Uber unleashed the market. Resources could be added, or removed, by market participants. Pricing was determined by the buyers and sellers. And pricing variability allowed for quality variations as drivers tried to acquire repeat business. Surge pricing meant you could get a ride on New Year’s eve, meeting the customer needs and with pricing to meet the supplier’s need for expanding short-term capacity.

You might not think of Kim Kardashian, Tom Brady and an Uber driver as gig workers. But they are. And this hasn’t been lost on most of us. As publishers have disappeared, writers now must sell their research and writing independently, no longer expecting a set salary and benefits from newspaper owners. Virtual office assistants abound. For almost 30 years we’ve been building a flourishing economy of “gig workers” who are looking to match their skills with market needs. Uber and Lyft are just platforms created to help match the sellers and buyers (as is FiveRR for graphics and other office services.) Their success has been due to meeting a very real market need.

Uber and Lyft have helped the trend toward individual economic independence grow, not created the trend. When you see managers, who work for a set wage, working 24x7x365 on their iPhone or other mobile device, what’s the difference between them and a “gig worker?” When it comes to getting the work done, nothing. Just how they are paid – and some serious illusions about the employee/employer compact that are wholly out of date. Increasingly, we are recognizing we are better off to maximize the value of our services working independently, and seeking out projects that can use our services as contractors, rather than going through the burden of “hiring” and “firing” across “employers” in a fast changing world. Uber didn’t put people out of work, the knowledge economy redefined work. Uber doesn’t create low pay, it just offers a market that allows for flexible capacity and variable pricing. Uber offers a platform matching buyers and sellers. And that’s something we need MORE as adaptability demands keep rising.

California legislators can see that work has changed. But their approach was backward. They are trying to push everyone – both workers and business people – into an outdated model. An industrial model of employment. That will never work. It won’t work because the economy has changed, the world has changed, needs have changed, and these trends will not reverse. Trying to rewind the clock will only cause employers to abandon markets, as Uber and Lyft did when they said they would leave California. Solutions must address trends for independence and accessibility, not try to apply 100 year old definitions to a modern problem.

Contract work is here to stay. It’s been growing for 30 years. What’s needed are better Gig Marketplace tools to help business people find the resources they need, for workers to find projects that fit their skills and that meet their societal needs.

The old model created the term “benefits” for societal needs comprised of unemployment pay, retirement pay, hazard compensation, health care, etc. and forced those costs onto the “employer.” In much of the world today these costs are born by the government, but in the USA they are still borne by “employers”. In a contractor relationship, no one is required to cover the costs of those benefits. In most businesses now, “employer” is a term with a lot less meaning since businesses need much more agility than they did in an industrial economy. During this transition from industrial to gig economy, those societal needs are not being met effectively, leading to individual suffering and much, much higher costs to society.

New solutions are required to meet these needs – instead of forcing the old model onto a new economy. Legislators and regulators need to recognize that old approaches need to be revamped. All of these problems need new solutions – not some effort to force the industrial model onto platform providers that do little more than match needs with skills.

And this requirement for change applies to labor representation as well. The Department of Labor is an industrial era dinosaur that has little to no value in a world of work-from-home employees, outsourced manufacturing plants and easily available offshore production. Industrial era labor unions make no sense when we don’t work on assembly lines. Yet, unions are a very important part of entertainment and professional sports. Because in the latter markets leaders have adapted the union’s services to meet modern needs. Whether they realize it or not, gig workers need help with representation. But that representation must be a lot more sophisticated at helping workers than the throngs of attorneys at the AFL-CIO.

Californians would be suffer negative impacts if Uber and Lyft leave the market. And they realize that. But the solution is not the blunt axe of AB5. Thus, the law will almost surely be reversed in the next election. Then, hopefully, California will step up to the challenge of leading the country with new approaches that meet gig worker needs – expanding their markets and opportunities while building social solutions to every day needs.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam@Sparkpartners.com

by Adam Hartung | Jun 30, 2020 | Culture, Leadership, Marketing, Politics, Web/Tech

In my recent “Rebooting Business” on-line conference I was asked if Black Lives Mattered and other protests should affect strategy. I said “of course!!” These demonstrations clearly show a segment of the marketplace with unserved and under-served needs. Needs so badly served people have taken to the streets!

Every organization needs to assess its strategy to determine if it is on this trend toward inclusion. Are you sensitive to the needs of these under-served segments? Or are you sloppily still out there with old stereo-tropes like the Aunt Jemima syrup – which Quaker Oats finally pulled. Do you know if your organization, products, suppliers, customers and communities are meeting market needs for inclusion? Or are you just assuming you’ll be OK?

Amazingly one of the biggest trend creating companies has demonstrated the cost of missing trends. Facebook is a remarkable company. Where MySpace failed, and countless others never created a marketplace, Facebook used its initial platform, then added Instagram, then Messenger, then WhatsApp to take an enormous lead in social media. Facebook built on trends in our desire to be mobile, and to communicate asynchronously, to attract billions of people to its platform – and as a result advertisers.

But…. Inexplicably…. the CEO Mark Zuckerberg and his leadership team have been tone-deaf to the events since George Floyd was killed. And they were remarkably blindsided, showing they truly weren’t prepared. Zuckerberg has long refused to even look for false information on Facebook – and never really considered removing it. Lies, falsehoods, misstatements – Facebook let people of all stripes (good, and very often bad) say anything they wanted on the platform. This wasn’t inclusion, it was allowing loud voices to present harmful content – and it was clearly disturbing a whole lot of people.

Now is the comeuppance. Advertisers have decided not to advertise on Facebook. They realize that their ads, presented next to false, and sometimes truly hateful, content gives the impression that they support this content. So, in droves, they have said their ad dollars will go somewhere else. Giant consumer goods companies Honda, Unilever, Proctor & Gamble, Coca-Cola, Diageo and Hershey as well as one of the world’s largest mobile providers Verizon, and mercantile suppliers North Face and Patagonia have joined retailers like Starbucks and REI as just some of the larger boycotters – out of over 100 on the growing list. So serious is this problem that some advertisers are “pausing” social media ads all together, suggesting another possible trend

Nobody can fight trends and hope to win. Nobody. No matter how big. And this is a sharp rebuke for one of the trendiest companies on the planet. That the leadership team didn’t see this coming is astonishing. In a late reversal, Facebook has made new efforts to identify hate content (including harmful posts by politicians), but that they didn’t react much quicker is just absurd. That they appeared to think they could platform political ads, and political content, and not have viewers associate Facebook with politics is downright bizarre. This has been the dumbest self-inflicted move by a big company in a very long time. And all they had to do to avoid this nightmare was admit that inclusion was a very big global trend that they had to build into their offering.

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business https://adamhartung.com/assessments/

by Adam Hartung | Jun 24, 2020 | Finance, Manufacturing, Politics, Web/Tech

Americans take it for granted that all currencies are measured against the US Dollar. It’s been that way since WWII, so they just expect it will always be that way. But, things have a way of changing.

In this pandemic the US Federal Reserve is printing money as fast as possible to help prop up the economy. That’s better than the alternative, which would be another Great Depression. But, eventually we have to create value via goods and services to put value in those dollars, or they will be worth a whole lot less. In other words, if we don’t change our fiscal policy to improve production of goods and services, the US Dollar will fall in value – maybe a lot – and it could even lose its status as the world’s “reserve currency.”

Back in 2008, I wrote that there was no inherent reason the US Dollar would be the benchmark for all currencies. It gained that position as the dominant economy after WWII. American’s like to assume superiority, and therefore the US Dollar will always reign supreme. But as I also said in 2008, that’s an assumption that can easily be changed – especially regarding currencies. Lots of factors could cause the US Dollar to suddenly lose a whole lot of value – creating inflation rates that make the 1980s (>18%/year) seem tame.

Since WWII, a lot has happened. Economies in Europe grouped into the Economic Union (EU) making the Euro more powerful. And the economy of China has grown enormously. (China’s economy will be bigger than the USA economy sometime in 2020 or 2021.) Simultaneously, isolationism has hurt growth in America, and caused the EU to lose the UK. What’s rapidly happening is a shift in economic power away from the US and Europe to China.

Additionally, the largest holder of US debt is China. As I pointed out in 2009, this policy of supporting US debt has aided China’s desire to grow. But, as China becomes larger it will no longer need to prop up the US Dollar by purchasing Treasuries. Once bigger than the USA, China could demand that its trade be in Yuan and the value of the dollar could fall very far, very fast.

China has developed enormous inroads into the global economy, across dozens of countries, with its “Belt and Road Initiative” created in 2013. China has quietly become more important to the economy of 70 countries than the USA. Instead of supplying countries guns, China gave them infrastructure and facilities – and jobs – and economic growth. In most of these countries, the USA is more feared than adored, while the Chinese are seen as a very good friend. Meanwhile, the USA “put America first” policies, including trade wars and social justice, have isolated the USA from not only rivals but its global friends – including Europe (threats to kill NATO, for example.)

Now, we are in a pandemic. The Chinese are very determined to control its impact. Meanwhile the USA, UK and many other democracies are being far less careful. If this plays out with a full pandemic recession in the USA, China could stop buying American bonds and the value of the dollar could disintegrate in weeks. Disintegrate as in $1 could be worth 1 penny. It would take bushels of dollars to buy imported goods in stores.

In this election year, the biggest concern is, do those leading the USA realize the peril? Do business leaders? Do you?

by Adam Hartung | Sep 29, 2017 | Entertainment, Politics, Sports, Trends

LANDOVER, MD – SEPTEMBER 24: Washington Redskins players link arms during the national anthem before their game against the Oakland Raiders at FedExField on September 24, 2017 in Landover, Maryland. (Photo by Patrick Smith/Getty Images)

A recent top news story has been NFL players kneeling during the national anthem. The controversy was amplified when President Trump weighed in with objections to this behavior, and his recommendation that the NFL pass a rule disallowing it. This kind of controversy doesn’t make life easier for NFL leaders, but it really isn’t their biggest problem. Ratings didn’t start dropping recently, viewership has been declining since 2015.

NFL ratings stalled in 2015

NFL viewership had a pretty steady climb through 2014. But in 2015 ratings leveled. Then in 2016 viewership fell a whopping 9%. During the first 6 weeks of the 2016 regular season (into early October)viewership was down 11%. Through the first 9 weeks of 2016 ratings were down 14% before things finally leveled off. Although nobody had a clear explanation why viewership declined so markedly, there was widespread agreement that 2016 was a ratings crash for the league. Fox had its worst NFL viewership since 2008, and ESPN had its worst since 2005.

Interestingly, later analysis showed that overall people were watching 5% more games. But they were watching less of each game. In other words, fans had become more casual about their viewership. People were watching less TV, watching less cable, and that included live sports. And those who stream games almost never streamed the entire game.

And this behavior change wasn’t limited to the NFL. As reported at Politifact.com, Paulsen, editor in chief of Sports Media Watch said, “it’s really important to note the NFL is not declining while other leagues are increasing. NASCAR ratings are in the cellar right now. The NBA had some of its lowest rated games ever on network television last year… It’s an industry-wide phenomenon and the NFL isn’t immune to it anymore.” So the declining viewership problem is widespread, and much older than the recent national anthem controversy.

Live sports is not attracting new, younger viewers

Magna Global recently released its 2017 U.S. Sports Report. According to Radio + Television Business Report (RBR.com) the age of live sports viewers is scewing older. Much older. Today the average NFL viewer is at least 50. Similar to tennis, and college basketball and football. That’s second only to baseball at 57 – which was 50 as recently as 2000. But no sport is immune. NHL viewers are now typically 49. They were 33 in 2000. As simple arithmetic shows, the same folks are watching hockey but few new viewers are being attracted. Based on recent trends, Magna projects viewership for the Sochi Olympics and 2018 World Cup will both decline.

I’ve written before about the importance of studying demographic trends when planning. These trends are highly reliable, even if boring. And they provide a lot of insight. In the case of live sports watching, younger people simply don’t sit down and watch a complete game. Younger people have different behaviors. They watch an entire season of shows in one day. They multi-task, doing many things at once. And they prefer information in short bursts – like weekly blogs rather than a book. And they are more interested in outcomes, the final result, than watching how it happened. Where older people watch a game play-by-play, younger people simply want to know the major events and the final score.

To understand what’s happening with NFL ratings we really don’t have to look much further than simple demographics — the aging of the U.S. population — and the change in viewing behavior from older groups to younger groups.

Unfortunately, according to a recent CNN poll, while 56% of people under age 45 think the recent demonstrations are the right thing to do, 59% of those over 45 say the demonstrations are wrong. In its “core” NFL viewership folks don’t like the kneeling, so it would appear the NFL should heed the President’s advice. But, looking down the road, the NFL won’t succeed unless it finds a way to attract a younger audience. With younger people approving the demonstrations NFL leadership risks throwing the baby out with the bathwater if they knee-jerk control player behavior.

Understanding customer demographic trends, and adapting, is crucial to success

The demonstrations are interesting as an expression of American ideals. And they are gathering a lot of discussion. But they are not what’s plaguing NFL viewership. Today the NFL has a much bigger task of making changes to attract young people as viewers. Should leaders shorten the game’s length? Should they change rules to increase scoring and create more excitement during the game? Should they invest in more apps to engage viewers in play-by-play activity? Should they seek out ways to allow more gambling during the game? Whatever leadership does, the traditions of the NFL need to be tested and altered in order to attract new people to watching the game if they want to preserve the advertising dollars that make it a success.

When your business falters, do you look at long-term trends, or react to a short-term event? It’s easy for politicians and newscasters to focus on the short-term, creating headlines and controversy. But business leaders have an obligation to look much deeper, and longer term. It is critical we move beyond “that’s the way the game is played” to looking at how the game may need to change in order to remain relevant and engage new customers.

Note how boxing recently brought in a mixed martial arts fighter to take on the world champion. The outcome was nearly a foregone conclusion, but nobody cared because it brought in people to a boxing match that otherwise would not have been there. If you don’t recognize demographic shifts, and take actions to meet emerging trends you risk becoming as left behind as cricket, badminton, horseshoes, bocce ball and darts.

by Adam Hartung | Sep 28, 2017 | Entertainment, Leadership, Politics, Trends

Photo: NEW YORK, NY – FEBRUARY 19: Writers and crew of ‘The Late Show with Stephen Colbert’ attend 69th Writers Guild Awards New York Ceremony at Edison Ballroom on February 19, 2017 in New York City. (Photo by Nicholas Hunt/Getty Images)

The Late Show hosted by Stephen Colbert is now the #1 program in late night television. This come-from-far-behind change in market leadership, overtaking The Tonight Show hosted by Jimmy Fallon, is not about politics. It is about understanding trends and using them to create value.

Back in February, 2014 there was real concern about the future of late night television. Audiences had peaked decades before, when Nightline was huge and competed with The Tonight Show hosted by legend Johnny Carson. By 2014 many wondered if American programming after the late news was all shifting to cable TV as audiences continued shrinking. Producers replaced Jay Leno with Jimmy Fallon in order to revitalize viewers. Jimmy Kimmel was moved up in time as ABC killed Nightline, hoping he could carve out a growing niche. And David Letterman, late night’s senior statesman, was about to be replaced by cable satirist Stephen Colbert. But these changes gathered little industry interest, because the time slots simply were not doing well for broadcasters – or advertisers.

Fallon maintained a dominant lead in the time slot as Colbert’s first year was a yawner.

As

TheWrap.com reported in September, 2016, despite the fanfare of Colbert taking over hosting, he “posed no threat whatsoever to Jimmy Fallon.” Fallon’s show maintained a huge lead. With 3.65 million viewers it bested

The Late Show by over 800,000. Colbert, with 2.82 million viewers seemed mostly trying to keep a lead over Kimmel’s 2.3 million viewers.

ANDREW LIPOVSKY/NBC/NBCU PHOTO BANK VIA GETTY IMAGES

Meanwhile the producers at The Late Show kept their eyes on the mood of the electorate.

They had largely let Colbert promote Democrat Clinton, and even though she lost the election noted she had won the popular vote. As Colbert continued to criticize the President, his audience grew. Soon, Colbert was beating Fallon in total audience – something nobody predicted just a few months earlier. It was quite a surprise when the 2016-2017 September to May season drew to a close and it was discovered that Colbert actually won the time slot, producing a larger total audience than Fallon. It was only about 20,000 – but it was a win few saw coming.

The Late Show writers and producers noted the historic and growing unpopularity of President Trump, and the public interest in ongoing investigations, and built the headlines into the show. Variety headlined on 7/25/17 “Stephen Colbert’s Russia Week Lofts Late Show to Biggest Weekly Win Ever.” Using audience trends The Late Showdevoted a week to a comical look at Russia, which saw it generate a 2.87million total audience in comparison to The Tonight Show‘s 2.42million – a beat of a whopping 450,000 viewers.

All of this is very good news for CBS.

NBC (NBC/Universal is a division of Comcast) is not losing money on The Tonight Show. And in the desirable segment of those age 18-49 Fallon still has the largest audience. But, it is a good thing for CBS to have so many new viewers. It brings in more advertisers, and higher revenues for each ad. This leads to more profits.

One might say that this is all about the hosts, and their political leanings. Maybe the content is driven by host opinions. But CBS is winning viewers because it is following trends, and matching its programming to trends. This is growing its late night audience, while NBC’s is shrinking.

Steve Burke, chief executive of NBC Universal was quoted in the New York Times saying “I think the answer is for Jimmy to be Jimmy.” Sounds like what a father might say about his son when the boy finds himself in a rough patch. But I’m not so sure its the position a company CEO should take regarding a very expensive employee in the lead of a major project.

Maybe NBC’s producers should spend more time looking at trends, and figuring out how to program content that will improve The Tonight Show‘s competitiveness. The show was upended in just one year. What will total audience look like next May when the 2017-2018 season ends? Will revenues and profits be unaffected if NBC’s audience keeps falling while CBS’s keeps growing?

For the rest of us, the lesson should be clear. Nobody is relegated to always being #2. Regardless the leader’s size, if you study trends and figure out how to leverage them you can grow, and you can become #1.

Understanding trends and applying them to your business is the best way to invigorate growth and improve your competitiveness.

by Adam Hartung | Jul 26, 2017 | Regulations, Scenario Planning, Trends

Leaders like to be deciders. Most leaders think of themselves as decision makers. In 2006 President George Bush, defending Donald Rumsfeld as his Defense Secretary said “I am the Decider. I decide what’s best.” It earned him the nickname “Decider-in-Chief.” Most CEOs echo this sentiment. Most leaders like to define themselves by their decisions.

But whether a decision is good or not is open to interpretation. Often immediately after a decision things may look great. It might appear as if that decision was obvious. And often decisions quickly make a lot of people happy.

As we enter the most intense part of the U.S. presidential election, both candidates are eager to tell potential voters what decisions they have made – and what decisions they will make if elected. And most people will look no further than the immediate expected impact of those decisions.

AP Photo/Chuck Burton, File

It takes time to determine the quality of any decision.

However, the quality of most decisions is not based on the immediate, or obvious, first implications. Rather, the quality of a decision is discovered over time, as the consequences are revealed – intended and unintended. Because quite often, what looked good at first can turn out to be very, very bad.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All-Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100 million.

That action by the NBA is what’s called

unintended consequences. Lawmakers didn’t really consider that the NBA might decide to take its

business elsewhere due to this state legislation. It’s what some people call, “Oops. I didn’t think about

that when I made my decision.”

Often unintended consequences are more important than first reactions to decisions.

Robert Reich, Secretary of Labor for President Clinton, was a staunch supporter of unions. In his book Locked in the Cabinet, he tells the story of visiting an auto plant in Oklahoma supporting the local union. He thought his support would incent the company’s leaders to negotiate more favorably. Instead, the company closed the plant. Laid-off everyone. Oops. The unintended consequences of what he thought was obvious support led to the worst possible worker outcome.

President Obama worked Congress hard to create the Affordable Care Act, or Obamacare, for everyone in America. One intention was to make sure employers covered all their workers, so the law required that if an employer had health care for any workers he had to offer that health care to all employees who worked over 30 hours per week. So almost all employers of part time workers suddenly said that none could work more than 30 hours. Those that worked 32 (four days per week) or 36 suddenly had their hours cut. Now those lower-income people not only had no health care, but less money in their pay envelopes. Oops. Unintended consequence.

President Reagan and his First Lady launched the “War on Drugs.” How could that be a bad thing? Illegal drugs are dangerous, as is the supply chain. But now, some 30 years later, the Federal Bureau of Prisons reports that almost half (46.3% or over 85,000) of inmates are there on drug charges. The U.S. now spends $51 billion annually on this drug war, which is about 20% more than is spent on the real war being waged with Afghanistan, Iraq and ISIS. There are now over 1.5 million arrests each year, with 83% of those merely for possession. Oops. Unintended consequences. It seemed like such a good idea at the time.

This is why it is so important leaders take their time to make thoughtful decisions, often with the input of many other people. Because the quality of a decision is not measured by how one views it immediately. Rather, the value is decided over time as the opportunity arises to observe the unintended consequences, and their impact. The best decisions are those in which the future consequences are identified, discussed and made part of the planning – so they aren’t unintended and the “decider” isn’t running around saying “oops.”

Think hard about the long-term complications of any decision.

As you listen to the politicians this cycle, keep in mind what could be the unintended consequences of implementing what they say:

- What would be the social impact, and transfer of wealth, from suddenly forgiving all student loans?

- What would be the consequences on trade, and jobs, of not supporting historical government trade agreements?

- What would be the consequences on national security of not supporting historically allied governments?

- What would be the long-term consequence of not allowing visitors based on race, religion or sexual orientation?

- What would be the consequence of not repaying the government’s bonds?

- What would be the long-term impact on economic growth of higher regulations on banks – that already have seen dramatic increases in regulation slowing the recovery?

- What would be the long-term consequences on food production, housing and lifestyles of failing to address global warming?

Business leaders should be very aware of the long-term consequences of their decisions. Every time a decision is necessary, is the best effort made to obtain all the information available on the topic? Are inputs and expectations obtained from detractors, as well as admirers? Is there a balance between not only what is popular, but what will happen months into the future? Did you consider the potential reaction by customers? Employees? Suppliers? Competitors?

There are very few “perfect decisions.” All decisions have consequences. Often, there is a trade-off between the good outcomes, and the bad outcomes. But the key is to know them all, and balance the interests and outcomes. Consider the consequences, good and bad, and plan for them. Only by doing that can you avoid later saying “oops.”