by Adam Hartung | Jan 28, 2017 | Immigration, Leadership, Politics, Trends

(Photo: NICHOLAS KAMM/AFP/Getty Images)

“Get the assumptions wrong and nothing else matters” – Peter F. Drucker

President Donald Trump made it very clear last week that his administration intends to build a border wall between the U.S. and Mexico. And he intends to make Mexico pay for it. He is so adamant he is willing to risk U.S./Mexican relations, canceling a meeting with the Mexican president.

Unfortunately, this tempest is all because of a really bad idea. The wall is a bad idea because the assumptions behind this project are entirely false. Like far too many executives, President Trump is building a plan based on bad assumptions rather than obtaining the facts – even if they belie his assumptions – and developing a good solution. Making decisions, and investing, on bad assumptions is simply bad leadership.

The stated claim is Mexico is sending illegal immigrants across the border in droves. These illegal immigrants are Mexican ne’er do wells who are coming to America to live off government subsidies and/or commit criminal activity. The others are coming to steal higher paying jobs from American workers. America will create a h

Unfortunately, almost everything in that line of logic is untrue. And thus the purported conclusion will not happen.

1. Although it cannot be proven, analysts believe the majority (possibly vast majority) of illegal immigrants enter America by air. There are two kinds of illegal immigration. President Trump’s rhetoric focuses on “entries without inspection.” But most illegal immigrants actually arrive in America with a visa – and then simply don’t leave. These are called “overstays.” They come from Mexico, India, Canada, Europe, Asia, South America, Africa – all over the world. If you want to identify and reduce illegal immigration, you need to focus on identifying likely overstays and making sure they return. The wall does not address this.

3. More non-Mexicans than Mexicans were apprehended at the U.S. border – and the the number of Mexicans has been declining. From 1.6 million in 2000, by 2014 the number dwindled to 229,000 (a decline of 85%). If you want to stop illegal border immigrants into the U.S., the best (and least costly) policy would be to cooperate with Mexico to capture these immigrants as they flee Central America and find a solution for either housing them in Mexico or returning them to their country of origin. It is ridiculous to expect Mexico to pay for a wall when it is not Mexico’s citizens creating the purported illegal immigration problem on the border.

4. In 2015 over 43,000 Cubans illegally immigrated to the U.S. – about 20% as many as from Mexico. The cost of a wall is rather dramatically high given the weighted number of illegal immigrants from other countries.

5. The number of illegal immigrants living in the U.S. is actually declining. There are more Mexicans returning to live in Mexico than are illegally entering the U.S. Between 2009 and 2014 over 1 million illegal Mexican immigrants willingly returned to Mexico where working conditions had improved and they could be with family. In other words, there were more American jobs created by Mexicans returning to Mexico than “stolen” by new illegal immigrants entering the country. If the administration would like to stop illegal immigration the best way is to help Mexico create more high-paying jobs (say with a trade deal like NAFTA) so they don’t come to America, and those in America simply choose to go to Mexico.

6. Illegal immigrants are not “stealing” more jobs every year. Since 2006, the number of illegal immigrants working in the U.S. has stabilized at about 8 million. All the new job growth over the last decade has gone to legitimate American workers or legal immigrants working with proper papers. Illegal immigration is not the reason some Americans do not have jobs, and blaming illegal immigrants is a ruse for people who simply don’t want to work – or refuse to upgrade their skills to make themselves employable.

7. Illegal immigrants in the U.S. is not a rising group – in fact most illegal immigrants have been in the U.S. for over 10 years. In 2014, over 66% of all illegal immigrants had been in the U.S. for 10 years or more. Only 14% have been in the U.S. for 5 years or less. We don’t have a problem needing to stop new illegal immigrants (the ostensible reason for a wall). Rather, we have a need to reform immigration so all these long-term immigrants already in the workforce can be normalized and make sure they pay the necessary taxes.

8. The states where illegal immigration is growing are not on the Mexican border. The states with rising illegal immigration are Washington, Pennsylvania, New Jersey, Virginia, Massachusetts and Louisiana. Texas, New Mexico and Arizona have seen no significant, measurable increase in illegal immigrants. And California, Nevada, Illinois, Alabama, Georgia and South Carolina have seen their illegal immigrant population decline. A border wall does not address the growth of illegal immigrants, as to the extent illegal immigrants are working in the U.S. they are clearly not in the border states.

Good leaders get all the facts. They sift through the facts to determine problems, and develop solutions which address the problem.

Bad leaders jump to conclusions. They base their actions on outdated assumptions. They invest in the wrong places because they think they know everything, rather than making sure they know the situation as it really exists.

America’s “flood of illegal immigrants” problem is wildly overblown. Most illegal immigrants are people from advanced countries, often with an education, who overstay their visa limits. But few Americans seem to think they are a problem.

Most border crossing illegal immigrants today are minors from Central America simply trying to stay alive. They aren’t Mexican criminals, stealing jobs, or creating a crime spree. They are mostly starving.

President Trump has “whipped up” a lot of popular anxiety with his claims about illegal Mexican immigrants and the need to build a border wall. Interestingly, the state with the longest Mexican border is Texas – and of its 38 congressional members (36 in Congress, 2 in the Senate and 25 Republican) not one (not one) supports building the wall. The district with the longest border (800 miles) is represented by Republican Will Hurd, who said “building a wall is the most expensive and least effective way to secure the border.”

Good leaders do not make decisions on bad assumptions. Good leaders don’t rely on “alternative facts.” Good leaders carefully study, dig deeply to find facts, analyze those facts to determine if there is a problem – and then understand that problem deeply. Only after all that do they invest resources on plans that address problems most effectively for the greatest return.

by Adam Hartung | Jan 24, 2017 | Leadership, Politics

(Photo by Shawn Thew-Pool/Getty Images)

Professor John Kotter (Konosuke Matsushita Professor of Leadership HBS) penned Power and Influence (1985, Free Press) after teaching his course of the same name at the Harvard Business School. The one thing he found clear, as did his students (of which I was one), was that a person can be powerful and have influence, but that does not make them a leader. Leaders understand how to create and use both power and influence. But merely having access to either, or both, does not make a person a leader.

One of my mentors, Colonel Carl Bernard, famed leader of U.S. Special Forces in Laos and Vietnam during the 1960s, met an executive at DuPont in the mid-1980s who had been given a large organization but was struggling. Col. Bernard was asked to review this fellow and offer his leadership insights so this fellow’s peers could help him be a better corporate leader. After a few meetings with this exec, alone and in groups, Col. Bernard concluded, “DuPont can give him resources, and access to the CEO, but that man could not lead a Boy Scout troop. Best they close the business now before he causes too much trouble. There’s nothing I can do for him.” Two years later, and tremendous turmoil later, DuPont did close that business, fired him and wrote off everything the company had invested.

Last Friday, Donald Trump was sworn in as president of the United States. He now has the most powerful job in the free world and unparalleled influence. But, he’s not yet proven himself a leader. His accomplishments to date have all been executive orders – issued unilaterally. To achieve the title “leader,” he has to prove people will follow him.

President Trump did not win the popular vote, and he assumes his new job with the lowest approval rating of any first-term president ever elected. Numbers alone do not imply that the country is ready to call him its leader.

Historically, a president has had to screw up in office to have such low popularity. But on Saturday millions of demonstrators took to the streets of Washington, Los Angeles, Chicago, Minneapolis and other cities to protest a president who had yet to do anything in his new role. Far more demonstrated than attended the inauguration, which had about half the attendees as Barack Obama’s first inauguration. It took Lyndon Johnson years to create the animosity which lead to demonstrators chanting, “Hey, hey LBJ, how many kids did you kill today?” (referencing his escalation of the Vietnam War).

Business school thought leaders, and business executives, have been studying leadership for at least six decades, and they have discovered there are consistencies in how to encourage followership. Roger Ferguson, CEO of TIAA-CREF,

said leadership is about inspiring people. He teaches that this is done by

• demonstrating expertise – which Trump has yet to do as a politician,

• making yourself appealing – which Trump has missed by deriding those who speak out against him,

• showing empathy for others – a trait so far missing in Trump’s tweets, or comments about detractors

• and showing the fortitude of being the calm in the storm – the opposite of Trump, who’s fiery rhetoric creates more storms than it calms.

In 2013, fellow Forbes contributor Mike Myatt offered his insights into how one should lead those who don’t want to follow, tips that should be very interesting to the unpopular President Trump:

• Be consistent. This seems the antithesis of Trump, who favors inconsistency and campaigned that as President he intended to be inconsistent.

• Focus on what’s important. Reading Trump’s tweets, it is clear he struggles to separate the important from the meaningless

• Make respect a priority. Should we talk about Trump’s references to women? Or his comments about war heroes like John McCain?

• Know what’s in it for the other guy. Trump likes to brag about taking advantage of others in his business dealings, and showing blatant disregard for the concerns of others. Recommending African-Americans vote for him because “what have you got to lose” does not demonstrate knowledge of that constituency’s needs.

• Demonstrate clarity of purpose. Firstly, what does it mean to “make America great again?” It would be nice to know what that slogan even means. Second, if Trump is the President for “those of you left behind,” as he referenced in his inauguration speech, can he tell us who is in that group? Am I included? Are you? How do you know who’s in this group he now represents? And who’s not?

Americans frequently confuse position with leadership. Many CEOs are treated laudably, even after they have destroyed shareholder value, destroyed thousands of jobs, stripped suppliers of money and resources, doomed local economies with shuttered facilities and left their positions with millions of dollars despite a terrible performance. These CEOs demonstrated they had power and influence. But many are despised by their former employees, investors, bankers, suppliers and community connections. They did not demonstrate they were leaders.

Despite his great wealth, which has bought him substantial power and influence, Americans have yet to see if President Trump can lead. He has never been a commissioned or non-commissioned officer in a military organization. He has never led a substantial corporation with large employment. He has never led a substantial non-profit or religious organization. Contrarily, he has largely been the head of hundreds of small businesses (by employee standards) many of which he has closed or bankrupted, often leaving people unemployed, his investors losing money and communities (such as Atlantic City) worse off from his real estate dealings.

I prefer to write about corporate leaders and market leaders. But for a while now, almost all the news has been about Mr. Trump. Now President Trump, who has not previously led even a Boy Scout troop. One wonders of Col. Bernard would think he could.

“The greatest leader is not necessarily the one who does the greatest things. He is the one that gets the people to do the greatest things” – Ronald Reagan

by Adam Hartung | Dec 30, 2016 | Economy, Innovation, Leadership, Manufacturing

2016 was an election year, and Americans were inundated with talk. Unfortunately, a lot of it was pure hubris.

President-elect Donald Trump inspired people to “make America great again.” In doing so, he developed the theme that the reason America wasn’t so great had to do with too much work being done offshore, rather than onshore. And that there were far too many immigrants, which harmed the economy and the country. This became rather popular with a significant voting block, led in particular by white males – and within that group those lacking higher education. These people expressed, with their votes and with their words at many rallies, that they were economically depressed by America’s policies allowing work to be completed by people not born in America.

Oh, if it was only so simple.

Any time something is manufactured offshore there is a cost to supply the raw materials, often the equipment, and frequently the working capital. These are added costs, not incurred by U.S. manufacturing. The reason manufacturing jobs went offshore had everything to do with (1) Americans unwilling to work at jobs for the pay offered, and (2) an unwillingness for Americans to invest in their skill sets so they could do the work.

Although they are easy targets. Instead, those Americans should blame themselves for not knuckling down and working harder to make themselves more competitive.

Since the 1980s America has lost some five million manufacturing jobs (from about 17.5 million to 12.5million). That sounds terrible, until you realize that the amount of goods manufactured in America is near an all-time. While it may sound backwards, the honest truth is that automation has greatly improved the output of plant and equipment with less labor. between 1985 and 2009. As the Great Recession has abated, output is again back to all-time highs. It just doesn’t take nearly as many people as it once did.

But it does take much smarter, better trained people.

Manufacturing today isn’t about sweat shops. Not in the USA, and not in Mexico, China or India. The plants in all these countries are equally high-tech, sophisticated and automated. Just look at the images of workers at the Chinese Foxconn plants, or the Mexican auto parts plants, and you’ll see something that could just as easily be in the USA. The reality is that those plants are in those countries because the workers in those countries train themselves to be very productive, and they make great products at very high quality.

And don’t blame regulations and unions for creating offshoring.

For almost all U.S. companies, their offshore plants comply with the U.S. regulations. Most require the same level of safety and working conditions globally.

Union membership has been declining for 75 years. Fifty years ago one in three workers was in a union. Today, it’s less than one in 10. In 2015 the Bureau of Labor reported that only 6.7% of private sector workers were unionized – an all time modern era low. Unions are almost unimportant today. It hasn’t been union obstructionism that has driven jobs oversees – it’s largely been an inability to hire qualified workers.

Much was made the last few years of a lower labor participation rate. Many Trump followers said that the Obama administration was failing to create jobs, so people stayed home. But that simply was not true. While the economy was recovering, the unemployment rate fell to its lowest level since the super-heated economy of 2001. To find this low level of unemployment prior to that you have to go all the way back to 1970!

There are plenty of jobs. The issue is getting people trained to do the work.

And here is the real rub. You can’t sit home complaining and moping, you have to study hard and train. Before today’s level of computerization and automation, when work was a lot more manual, it didn’t matter how much education you had, nor how well you could read and do math and science. But today, work is not manual. It takes minimal manual skill to operate equipment. Today it takes computer programming skills, engineering skills and math skills.

The Organization for Economic Cooperation and Development (OECD) does an annual Program for International Student Assessment (PISA) study. This looks at test scores across the world to see where students fair best. Of course, economically displaced Americans are sure that Americans are at the top of these test results – because it is easy to assume so.

Americans are in the bottom half of the planet’s educational performance .

The 2015 results are here, and in reading, science and math America doesn’t even crack the top 10. In fact, the poorest 10% of Vietnamese students did better than the average American teen. In all three categories, the USA scored below the global average. American’s are not above average – they are now below average.

American’s have simply gotten lazy. For far too long, when somebody did poorly Americans have blamed the teacher, blamed the test, blamed the “system” — blamed everyone and everything except the person themselves. It has become unacceptable to tell someone they are doing a below-average job. It is unacceptable to tell someone their skills don’t match up to the needs of the job. Instead,

Instead of forcing people to work hard – really hard – and expecting that each and every person will work hard to compete in a global economy – just to keep up – the expectation has developed that hard work is not necessary, and everyone should do really well. Instead of thinking that hard mental effort, ongoing education and additional training are the minimal acceptable standards to maintaining a job, it is expected that high paying jobs should just be there for everyone – even if they lack the skills to perform. American no longer want to admit that someone is being outperformed.

In 1988 Nike set the company on a growth trajectory with their trademarked phrase “Just Do It.” Just get up off the couch and do it. Quit complaining about being out of shape – just do it.

And that’s my wish for America in 2017. Quit blaming foreigners for working harder at school than we do. Quit blaming immigrants for being better trained, and harder working, than Americans. Quit pretending like the problem with the labor participation rate is some kind of problem created by the government. Quit finger-pointing and blaming someone else for being better than us.

Instead, get up off the couch and do it. Go back to school and study hard – harder than the competition. Grades matter. Learn geometry, trigonometry and calculus so you can make things – or operate equipment that makes things. Gain some engineering skills so you can learn to program, in order to improve productivity with a mobile device – or even a personal computer. Become facile in more than one language so you can operate and compete in a global economy.

Hey Americans, instead of blaming everyone else for workers lacking a job, or a higher income, quit talking about the problems. If you want to “make America great again” quit complaining and just do it.

by Adam Hartung | Dec 6, 2016 | Disruptions, Innovation, Investing, Leadership, Retail

(Photo by Spencer Platt/Getty Images)

But, is it right to hand-wring over Schultz’s departure as CEO? After all, things have not been pretty for investors since Mr. Jobs turned over Apple to his hand-picked successor Tim Cook. However, could this change mean something better is in store for shareholders?

First, let’s address the very – and Starbucks was saved only by Mr. Schultz returning with his tremendous creativity and servant leadership. While it is great propaganda for making the Schultz as hero story more appealing, it isn’t exactly accurate.

Starting in 1982, Howard Schultz built Starbucks from four stores to over 2,800 (and over $2 billion revenue) in 16 years. That was a tremendous success. And he is to be lauded. But when he left,

Starbucks had only 35o stores outside the USA. It was an American phenomenon, a place to buy and drink coffee, with every store company owned, every employee company trained, and not an ounce of variability in the business model. Not exactly diversified. At the time, the stock traded for roughly (split adjusted) $4 per share.

His successor, Orin Smith, far outperformed Mr. Schultz, more than tripling the chain to over 9,000 stores and expanding revenue to over $5 billion in just four years! He expanded the original model internationally, began adding many new varieties of coffee and other drinks, and even added food. These enhancements were tremendously successful at bringing in additional revenue, even if the average store revenue fell as smaller stores were added in places like airports, hotels and entertainment venues.

In 2005, Jim Donald replaced Mr. Smith. By 2007 (in just teo years) he added a staggering additional 4,000 stores. He expanded the menu. And he even branched out to selling branded Starbucks coffee on airplanes, in hotels and even retailed in grocery stores. Further, he launched a successful international coffee liqueur under the Starbucks brand. And he moved the company into entertainment, creating an artist representation company and even producing movies (Akeelah and the Bee) which won multiple awards.

In 2007 Starbucks fourth quarter saw 22% revenue increase, and for the year 21% growth. Comparable store sales grew 5%. International margins expanded, and net earnings grew over 19% from $564 million to $673 million.

Starbucks’ stock, from 2000 when Mr. Schultz departed into 2006 rose 375%, from $4 to just under $19 per share. Not the ruination that some seem to think was happening.

But Mr. Schultz did not like the diversification, even if it produced more revenue and profit. He joined the chorus of analysts that beat down the P/E ratio, and the stock price, as the company expanded beyond its “core” coffee store business.

When the Great Recession hit, and people realized they could live without $4 per cup of coffee and a $50 per day habit, revenues plummeted, as they did for many restaurants and retailers. Mr. Schultz seized the opportunity to return to his old job as CEO. That the downturn in Starbucks had far more to do with the greatest economic debacle since the 1930s was overlooked as Mr. Schultz blamed everything on the previous CEO and his leadership team – firing them all.

Since 2012 Starbucks has returned to doing what it did prior to 2000 – opening more stores. Growing from 17,000 to 25,000 stores. Refocused on its very easy to understand, if dated, business model analysts loved the simpler company and bid up the P/E to over 30 – creating a trough (2008) to peak (2016) increase in adjusted stock price from $4 to $60 – an incredible 15 times!

But, more realistically one should compare the price today to that of 2006, before the entire market crashed and analysts turned negative on the profitable Starbucks diversification and business model expansion. That gain is a more modest 300% – basically a tripling over a decade – far less a gain for investors than happened under the 2000-2006 era of Mr. Schultz’s successors.

Mr. Schultz succeeded in returning Starbucks to its “core.” But now he’s leaving a much more vulnerable company. As my fellow Forbes contributor Richard Kestenbaum has noted, retail success requires innovation. Starbucks is now almost everywhere, leaving little room for new store expansion. Yet it has abandoned other revenue opportunities pioneered under Messrs. Smith and Donald. And competition has expanded dramatically – both via direct coffee store competitors and the emergence of new gathering spots like smoothie stores, tech stores and fast casual restaurants that are attracting people away from a coffee addiction.

At some point Starbucks and its competition will saturate the market. And tastes will change. And when that happens, growth will be a lot harder to find. As McDonald’s and WalMart have learned, . Exciting new competitors emerge, like Starbucks once was, and Amazon.com is increasingly today.

Mr. Schultz has said he is vastly more confident in this change of leadership than he was the last time he left – largely because he feels this hand-picked team (as if he didn’t pick the last team, by the way) will continue to remain tightly focused on defending and extending Starbucks “core” business. This approach sounds all too familiar – like Jobs selection of Cook – and the risks for investors are great.

A focus on the core has real limits. Diminishing returns do apply. And P/E compression (from the very high 30+ today) could cause Starbucks to lose any investor upside, possibly even cause the stock to decline. If Mr. Schultz’s departure was opening the door for more innovation, new business expansion and a change to new trends that sparked growth one could possibly be excited. But there is real reason for concern – just as happened at Apple.

by Adam Hartung | Oct 26, 2016 | Growth Stall, Innovation, Investing, Leadership, Web/Tech

Apple AAPL -0.72% announced sales and earnings yesterday. For the first time in 15 years, ever since it rebuilt on a strategy to be the leader in mobile products, full year sales declined. After three consecutive down quarters, it was not unanticipated. And Apple’s guidance for next quarter was for investors to expect a 1% or 2% improvement in sales or earnings. That’s comparing to the disastrous quarter reported last January, which started this terrible year for Apple investors.

Yet, most analysts remain bullish on Apple stock. At a price/earnings (P/E) of 13.5, it is by far the cheapest tech stock. iPad sales are stagnant, iPhone sales are declining, Apple Watch sales dropped some 70% and Chromebook breakout sales caused a 20% drop in Mac Sales. Yet most analysts believe that something will improve and Apple will get its mojo back.

Only, the odds are against Apple. As I pointed out last January, Apple’s value took a huge hit because stagnating sales caused the company to completely lose its growth story. And, the message that Apple doesn’t know how to grow just keeps rolling along. By last quarter – July – I wrote Apple had fallen into a Growth Stall. And that should worry investors a lot.

Ten Deadly Sins Of Networking

Companies that hit growth stalls almost always do a lot worse before things improve – if they ever improve. Seventy-five percent of companies that hit a growth stall have negative growth for several quarters after a stall. Only 7% of companies grow a mere 6%. To understand the pattern, think about companies like Sears, Sony, RIM/Blackberry, Caterpillar Tractor. When they slip off the growth curve, there is almost always an ongoing decline.

And because so few regain a growth story, 70% of the companies that hit a growth stall lose over half their market capitalization. Only 5% lose less than 25% of their market cap.

Why? Because results reflect history, and by the time sales and profits are falling the company has already missed a market shift. The company begins defending and extending its old products, services and business practices in an effort to “shore up” sales. But the market shifted, either to a competitor or often a new solution, and new rev levels do not excite customers enough to create renewed growth. But since the company missed the shift, and hunkered down to fight it, things get worse (usually a lot worse) before they get better.

Think about how Microsoft MSFT -0.42% missed the move to mobile. Too late, and its Windows 10 phones and tablet never captured more than 3% market share. A big miss as the traditional PC market eroded.

Right now there is nothing which indicates Apple is not going to follow the trend created by almost all growth stalls. Yes, it has a mountain of cash. But debt is growing faster than cash now, and companies have shown a long history of burning through cash hoards rather than returning the money to shareholders.

Apple has no new products generating market shifts, like the “i” line did. And several products are selling less than in previous quarters. And the CEO, Tim Cook, for all his operational skills, offers no vision. He actually grew testy when asked, and his answer about a “strong pipeline” should be far from reassuring to investors looking for the next iPhone.

Will Apple shares rise or fall over the next quarter or year? I don’t know. The stock’s P/E is cheap, and it has plenty of cash to repurchase shares in order to manipulate the price. And investors are often far from rational when assessing future prospects. But everyone would be wise to pay attention to patterns, and Apple’s Growth Stall indicates the road ahead is likely to be rocky.

by Adam Hartung | Oct 13, 2016 | Boards of Directors, Ethics, Finance, Investing, Leadership

SAUL LOEB/AFP/Getty Images

Everyone knows what happened at Wells Fargo. For many years, possibly as far back as 2005, Wells Fargo leaders pushed employees to “cross-sell” products, like high profit credit cards, to customers. Eventually the company bragged it had an industry leading 6.7 products sold to every customer household. However, we now know that some two million of these accounts were fakes – created by employees to meet aggressive sales goals. And, unfortunately, costing unsuspecting customers quite a lot of fees.

We also know that Wells Fargo leadership knew about this practice for at least five years – and agreed to a $190 million fine. And the company apparently fired 5,300

Which begs the obvious question – if management knew this was happening, why did it continue for at least five years?

Let’s face it, if you owned a restaurant and you knew waiters were adding extras onto the bill, or tip, you would not only fire those waiters, but put in place procedures to stop the practice. But in this case we know that management at Wells Fargo was receiving big bonuses based upon this employee behavior. So they allowed it to continue, perhaps with a gloss of disdain, in order for the execs to make more money.

This is the modern, high-tech financial services industry version of putting employees in known dangerous jobs, like picking coal, in order to make more profit. A lot less bloody, for sure, but no less condemnable. Management was pushing employees to skirt the law, while wearing a fig-leaf of protection.

Ignorance is not excuse – especially for a well-paid CEO.

CEO Stumpf’s testified to Congress that he didn’t know the details of what was happening at the lower levels of his bank. He didn’t know bankers were expected to make 100 sales calls per day. When asked about how sales goals were implemented, he responded to Representative Keith Ellison “Congressman, I don’t know that level of detail.”

Really? Sounds amazingly like Bernie Ebbers at Worldcom. Or Jeff Skilling and Ken Lay at Enron. Men making millions of dollars from illegal activities, but claiming they were ignorant of what their own companies were doing. And if they didn’t know, there was no way the board of directors could know, so don’t blame them either.

Does anyone remember how Congress reacted to those please of ignorance? “No more.” Quickly the Sarbanes-Oxley act was passed, making not only top executives but Boards, and in particular audit chairs, responsible for knowing what happened in their companies. And later Dodd-Frank was passed strengthening these laws – particularly for financial services companies. Ignorance would no longer be an excuse.

Where was Wells Fargo’s compliance department?

Based on these laws every Board of Directors is required to establish a compliance officer to make sure procedures are in place to insure proper behavior by management. This compliance officer is required to report to the board that procedures exist, and that there are metrics in place to make sure laws, and ethics policies, are followed.

Additionally, every company is required to implement a whistle-blower hotline so that employees can report violations of laws, regulations, or company policies. These reports are to go either to the audit chair, or the company external legal counsel. If it is a small company, possibly the company general counsel who is bound by law to keep reports confidential, and report to the board. This was implemented, as law, to make sure employees who observed illegal and unethical management behavior, as happened at Worldcom, Enron and Tyco, could report on management and inform the board so Directors could take corrective action.

Which begs the first question “where the heck was Wells Fargo’s compliance office the last five years?” These were not one-off events. They were standard practice at Wells Fargo. Any competent Chief Compliance Officer had to know, after five-plus years of firings, that the practices violated multiple banking practice laws. He must have informed the CEO. He was, by law, supposed to inform the board. Who was the Chief Compliance Officer? What did he report? To whom? When? Why wasn’t action taken, by the board and CEO, to stop these banking practices?

Should regulators allow executives to fire whistle-blowers?

And about that whistle-blower hotline – apparently employees took advantage of it. In 2010, 2011, 2013 and more recently employees called the hotline, even wrote the Human Resources Department and the office of CEO John Stumpf to report unethical practices. Were their warnings held in anonymity? Were they rewarded for coming forward?

Quite to the contrary, one employee, eight days after logging a hotline call, was fired for tardiness. Another was fired days after sending an email to CEO Stumpf alerting him of aberrant, unethical practices. A Wells Fargo HR employee confirmed that it was common practice to find fault with employees who complained, and fire them. Employees who learned from Enron, and tried to do the right thing, were harassed and fired. Exactly 180 degrees contrary to what Congress ordered when passing recent laws.

None of this was a mystery to Wells Fargo leadership, or CEO Stumpf. CNNMoney reported the names of employees, actions they took and the decisively negative reactions taken by Wells Fargo on September 21. There is no way the Wells Fargo folks who prepared CEO Stumpf for his September 29 testimony were unaware. Yet, he replied to questions from Congress that he didn’t know, or didn’t remember, these events – or these people. In eight days these staffers could have unearthed any information – if it had been exculpatory. That Stumpf’s answer was another plea of ignorance only points to leadership’s plan of hiding behind fig leafs.

CEO Stumpf obviously knew the practices at Wells Fargo. So did all his direct reports. And likely two or three levels downs, at a minimum. Clearly, all the way to branch managers. Additionally, the compliance function was surely fully aware, as was HR, of these practices and chose not to solve the issues – but rather hide them and fire employees in an effort to eliminate credible witnesses from reporting wrongdoing by top leadership.

Where was the board of directors? Why didn’t the audit chair intervene?

It is the explicit job of the audit chair to know that the company is in compliance with all applicable laws. It is the audit chairs’ job to implement the Sarbanes-Oxley and Dodd-Frank regulations, and report any variations from regulations to the company auditors, general counsel, lead outside director and chairperson. Where was proper governance of Wells Fargo? Were the Directors doing their jobs, as required by law, in the post Enron, WorldCom, Tyco, Lehman, AIG world?

Should CEO Stumpf be gone? Without a doubt. He should have been gone years ago, for failing to properly implement and enforce compliance. But he is not alone. The officers who condoned these behaviors should also be gone, as should all HR and other managers who failed to implement the regulations as Congress intended.

Additionally, the board of Wells Fargo has plenty of responsibility to shoulder. The board was not effective, and did not do its job. The directors, who were well paid, did not do enough to recognize improper behavior, implement and monitor compliance or take action.

There is a lot more blame here, and if Wells Fargo is to regain the public trust there need to be many more changes in leadership, and Board composition. It is time for the SEC to dig much deeper into the situation at Wells Fargo, and the leaders complicit in failing to follow the intent of Congress.

by Adam Hartung | Sep 30, 2016 | Immigration, Leadership, Lifecycle, Trends

I write about trends. Technology trends are exciting, because they can come and go fast – making big winners of some companies (Apple, Facebook, Tesla, Amazon) and big losers out of others (Blackberry, Motorola, Saab, Sears.) Leaders that predict technology trends can make lots of money, in a hurry, while those who miss these trends can fail faster than anyone expected.

But unlike technology, one of the most important trends is also the most predictable trend. That is demographics. Quite simply, it is easy to predict the population of most countries, and most states. And predict the demographic composition of countries by age, gender, ancestry, even religion. And while demographic trends are remarkably easy to predict very accurately, it is amazing how few people actually plan for them. Yet, increasingly, ignoring demographic trends is a bad idea.

Take for example the aging world population. Quite simply, in most of the world there have not been enough births to keep up with those who ar\e getting older. Fewer babies, across decades, and you end up with a population that is skewed to older age. And, eventually, a population decline. And that has a lot of implications, almost all of which are bad.

Look at Japan. Every September 19 the Japanese honor Respect for the Aged Day by awarding silver sake dishes to those who are 100 or older. In 1966, they gave out a few hundred. But after 46 straight years of adding centenarians to the population, including adding 32,000 in just the last year, there are over 65,000 people in Japan over 100 years old. While this is a small percentage, it is a marker for serious economic problems.

Over 25% of all Japanese are over 65. For decades Japan has had only 1.4 births per woman, a full third less than the necessary 2.1 to keep a population from shrinking. That means today there are only 3 people in Japan for every “retiree.” So a very large percentage of the population are no longer economically productive. They no longer are creating income, spending and growing the economy. With only 3 people to maintain every retiree, the national cost to maintain the ageds’ health and well being soon starts becoming an enormous tax, and economic strain.

What’s worse, by 2060 demographers expect that 40% of Japanese will be 65+. Think about that – there will be almost as many over 65 as under 65. Who will cover the costs of maintaining this population? The country’s infrastructure? Japan’s defense from potentially being overtaken by neighbors, such as China? How does an economy grow when every citizen is supporting a retiree in addition to themselves?

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

This means that China’s aging population problem will not recover for several more decades. Today there are 5 workers for every retiree in China. But there are already more people exiting China’s workforce than entering it each year. We can easily predict there will be both an aging, and a declining, population in China for another 40 years. Thus, by 2040 (just 24 years away) there will be only 1.6 workers for each retiree. The median age will shift from 30 to 46, making China one of the planet’s oldest populations. There will be more people over age 65 in China than the entire populations of Germany, Japan, France and Britain combined!

While it is popular to discuss an emerging Chinese middle class, that phenomenon will be short-lived as the country faces questions like – who will take care of these aging people? Who will be available to work, and grow the economy? To cover health care costs? Continued infrastructure investment? Lacking immigration, how will China maintain its own population?

“OK,” American readers are asking, “that’s them, but what about us?” In 1970 there were about 20M age 65+ in the USA. Today, 50M. By 2050, 90M. In 1980 this was 11% of the population. But 2040 it will be over 20% (stats from Population Reference Bureau.)

While this is a worrisome trend, one could ask why the U.S. problem isn’t as bad as other countries? The answer is simply immigration. While Japan and China have almost no immigration, the U.S. immigrant population is adding younger people who maintain the workforce, and add new babies. If it were not for immigration, the U.S. statistics would look far more like Asian countries.

Think about that the next time it seems appealing to reduce the number of existing immigrants, or slow the number of entering immigrants. Without immigrants the U.S. would be unable to care for its own aging population, and simultaneously unable to maintain sufficient economic growth to maintain a competitive lead globally. While the impact is a big shift in the population from European ancestry toward Latino, Indian and Asian, without a flood of immigrants America would crush (like Japan and China) under the weight of its own aging demographics.

Like many issues, what looks obvious in the short-term can be completely at odds with a long-term solution. In this case, the desire to remove and restrict immigration sounds like a good idea to improve employment and wages for American citizens. And shutting down trade with China sounds like a positive step toward the same goals. But if we look at trends, it is clear that demographic shifts indicate that the countries that maximize their immigration will actually do better for their indigenous population, while improving international competitiveness.

Demographic trends are incredibly accurately predictable. And they have enormous implications for not only countries (and their policies,) but companies. Do your forward looking plans use demographic trends to plan for:

- maintaining a trained workforce?

- sourcing products from a stable, competitive country?

- having a workplace conducive to employees who speak English as a second language?

- a workplace conducive to religions beyond Christianity?

- investing in more capital to produce more with fewer workers?

- products that appeal to people not born in the USA?

- selling products in countries with growing populations, and economies?

- paying higher costs for more retirees who live longer?

Most planning systems, unfortunately, are backward-looking. They bring forward lots of data about what happened yesterday, but precious few projections about trends. Yet, we live in an ever changing world where trends create important, large shifts – often faster than anticipated. And these trends can have significant implications. To prepare everyone should use trends in their planning, and you can start with the basics. No trend is more basic than understanding demographics.

by Adam Hartung | Sep 23, 2016 | Disruptions, In the Rapids, Innovation, Leadership, Television, Web/Tech

In early August Tesla announced it would be buying SolarCity. The New York Times discussed how this combination would help CEO Elon Musk move toward his aspirations for greater clean energy use. But the Los Angeles Times took the companies to task for merging in the face of tremendous capital needs at both, while Tesla was far short of hitting its goals for auto and battery production.

Since then the press has been almost wholly negative on the merger. Marketwatch’s Barry Randall wrote that the deal makes no sense. He argues the companies are in two very different businesses that are not synergistic – and he analogizes this deal to GM buying Chevron. He also makes the case that SolarCity will likely go bankrupt, so there is no good reason for Tesla shareholders to “bail out” the company. And he argues that the capital requirements of the combined entities are unlikely to be fundable, even for its visionary CEO.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

But short-sellers are clearly not long-term investors. And there is a lot more ability for this deal to succeed and produce tremendous investor returns than anyone could ever glean from studying historical financial statements of both companies.

GM buying Chevron is entirely the wrong analogy to compare with Tesla buying SolarCity. Instead, compare this deal to what happened in the creation of television after General Sarnoff, who ran RCA, bought what he renamed NBC.

The world already had radio (just as we already have combustion powered cars.) The conundrum was that nobody needed a TV, especially when there were no TV programs. But nobody would create TV programs if there were no consumers with TVs. General Sarnoff realized that both had to happen simultaneously – the creation of both demand, and supply. It would only be by the creation, and promotion, of both that television could be a success. And it was General Sarnoff who used this experience to launch the first color televisions at the same time as NBC launched the first color programming – which fairly quickly pushed the industry into color.

Skeptics think Mr. Musk and his companies are in over their heads, because there are manufacturing issues for the batteries and the cars, and the solar panel business has yet to be profitable. Yet, the older among us can recall all the troubles with launching TV.

Early sets were not only expensive, they were often problematic, with frequent component failures causing owners to take the TV to a repairman. Often reception was poor, as people relied on poor antennas and weak network signals. It was common to turn on a set and have “snow” as we called it – images that were far from clear. And there was often that still image on the screen with the words “Technical Difficulties,” meaning that viewers just waited to see when programming would return. And programming was far from 24×7 – and quality could be sketchy. But all these problems have been overcome by innovation across the industry.

Yes, the evolution of electric cars will involve a lot of ongoing innovation. So judging its likely success on the basis of recent history would be foolhardy. Today Tesla sells 100% of its cars, with no discounts. The market has said it really, really wants its vehicles. And everybody who is offered electric panels with (a) the opportunity to sell excess power back to the grid and (b) financing, takes the offer. People enjoy the low cost, sustainable electricity, and want it to grow. But lacking a good storage device, or the inability to sell excess power, their personal economics are more difficult.

Electricity production, electricity storage (batteries) and electricity consumption are tightly linked technologies. Nobody will build charging stations if there are no electric cars. Nobody will build electric cars if there are not good batteries. Nobody will make better batteries if there are no electric cars. Nobody will install solar panels if they can’t use all the electricity, or store what they don’t immediately need (or sell it.)

This is not a world of an established marketplace, where GM and Chevron can stand alone. To grow the business requires a vision, business strategy and technical capability to put it all together. To make this work someone has to make progress in all the core technologies simultaneously – which will continue to improve the storage capability, quality and safety of the electric consuming automobiles, and the electric generating solar panels, as well as the storage capabilities associated with those panels and the creation of a new grid for distribution.

This is why Mr. Musk says that combining Tesla and SolarCity is obvious. Yes, he will have to raise huge sums of money. So did such early pioneers as Vanderbilt (railways,) Rockefeller (oil,) Ford (autos,) and Watson (computers.) More recently, Steve Jobs of Apple became heroic for figuring out how to simultaneously create an iPhone, get a network to support the phone (his much maligned exclusive deal with AT&T,) getting developers to write enough apps for the phone to make it valuable, and creating the retail store to distribute those apps (iTunes.) Without all those pieces, the ubiquitous iPhone would have been as successful as the Microsoft Zune.

It is fair for investors to worry if Tesla can raise enough money to pull this off. But, we don’t know how creative Mr. Musk may become in organizing the resources and identifying investors. So far, Tesla has beaten all the skeptics who predicted failure based on price of the cars (Tesla has sold 100% of its production,) lack of range (now up to nearly 300 miles,) lack of charging network (Tesla built one itself) and charging time (now only 20 minutes.) It would be shortsighted to think that the creativity which has made Tesla a success so far will suddenly disappear. And thus remarkably thoughtless to base an analysis on the industry as it exists today, rather than how it might well look in 3, 5 and 10 years.

The combination of Tesla and SolarCity allows Tesla to have all the components to pursue greater future success. Investors with sufficient risk appetite are justified in supporting this merger because they will be positioned to receive the future rewards of this pioneering change in the auto and electric utility industries.

by Adam Hartung | Sep 16, 2016 | Leadership

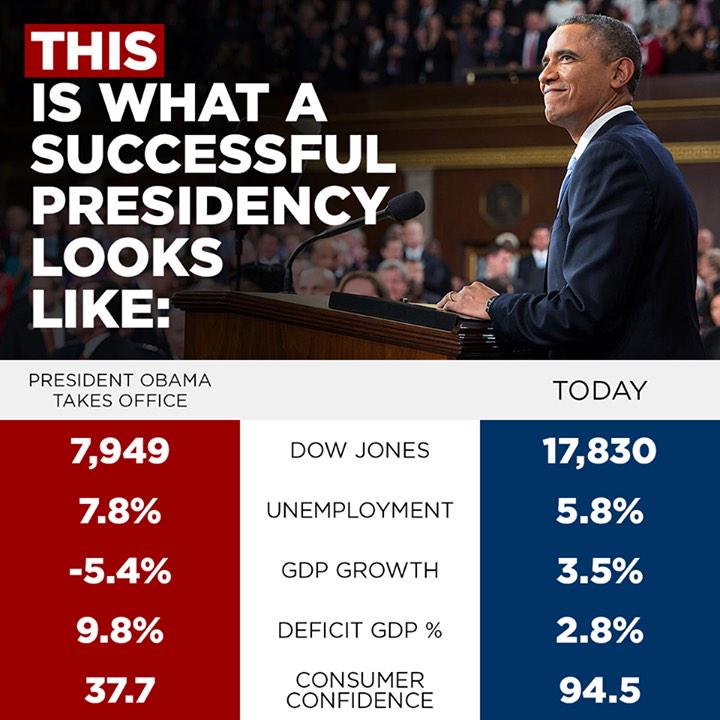

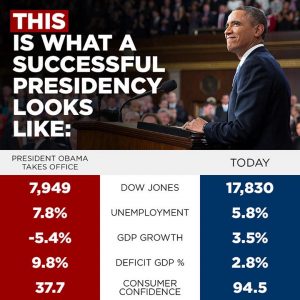

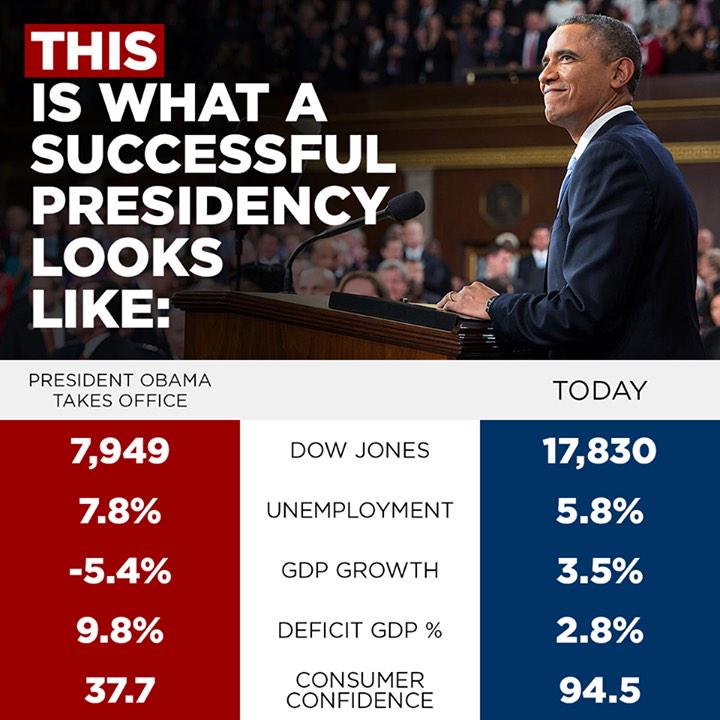

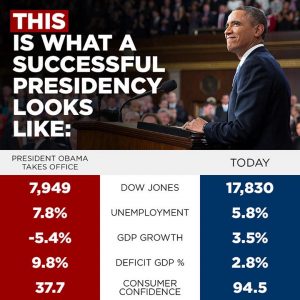

Donald Trump has been campaigning on how poorly America’s economy is doing. Yet, the headlines don’t seem to align with that position. Today we learned that U.S. household net worth climbed by over $1trillion in the second quarter. Rising stock values and rising real estate values made up most of the gain. And owners’ equity in their homes grew to 57.1%, highest in over a decade. Simultaneously this week we learned that middle-class earnings rose for the first time since the Great Recession, and the poverty rate fell by 1.2 percentage points.

Gallup reminded us this month that the percentage of Americans who perceive they are “thriving” has increased consistently the last 8 years, from 48.9% to 55.4%. And Pew informed us that across the globe, respect for Americans has risen the last 8 years, doubling in many countries such as Britain, Germany and France – and reaching as high as 84% favorability in Isreal.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

I thought it would be a good idea to revisit the author of “Bulls, Bears and the Ballot Box,” Bob Deitrick. Bob contributed to my 2012 article on Democrats actually being better for the economy than Republicans, despite popular wisdom to the contrary.

AH – Bob, there are a lot of people saying that the Obama Presidency was bad for the economy. Is that true?

Deitrick – To the contrary Adam, the Obama Presidency has economically been one of the best in modern history. Let’s start by comparing stock market performance, an indicator of investor sentiment about the economy using average annual compounded growth rates:

DJIA S&P 500 NASDAQ

Obama 11.1% 13.2% 17.7%

Bush -3.1% -5.6% -7.1%

Clinton 16.0% 15.1% 18.8%

Bush 4.8% 5.3% 7.5%

Reagan 11.0% 10.0% 8.8%

As you can see, Democrats have significantly outperformed Republicans. If you had $10,000 in an IRA, during the 16 years of Democratic administrations it would have grown to $72,539. During the 16 years of Republican administrations it would have grown to only $14,986. That is almost a 5x better performance by Democrats.

Obama’s administration has recovered all losses from the Bush crash, and gained more. Looking back further, we can see this is a common pattern. All 6 of the major market crashes happened under Republicans – Hoover (1), Nixon (2), Reagan (1) and Bush (2). The worst crash ever was the 58% decline which happened in 17 months of 2007-2009, during the Bush administration. But we’ve had one of the longest bull market runs in Presidential history under Obama. Consistency, stability and predictability have been recent Democratic administration hallmarks, keeping investors enthusiastic.

AH – But what about corporate profits?

Deitrick – During the 8 years of Reagan’s administration, the best for a Republican, corporate profits grew 26.82%. During the last 8 years corporate profits grew 55.79%. It’s hard to see how Mr. Trump identifies poor business conditions in America during Obama’s administration.

AH – What about jobs?

Deitrick – Since the recession ended in September, 2010 America has created 14,226,00 new jobs. All in, including the last 2 years of the Great Recession, Obama had a net increase in jobs of 10,545,000. Compare this to the 8 years of George W. Bush, who created 1,348,000 jobs and you can see which set of policies performed best.

AH – What about the wonkish stuff, like debt creation? Many people are very upset at the large amount of debt added the last 8 years.

Deitrick – All debt has to be compared to the size of the base. Take for example a mortgage. Is a $1million mortgage big? To many it seems huge. But if that mortgage is on a $5million house, it is only 20% of the asset, so not that large. Likewise, if the homeowner makes $500,000 a year it is far less of an issue (2x income) than if the homeowner made $50,000/year (20x income.)

The Reagan administration really started the big debt run-up. During his administration national debt tripled – increased 300%. This was an astounding increase in debt. And the economy was much smaller then than today, so the debt as a percent of GDP doubled – from 31.1% to 62.2%%. This was the greatest peacetime debt increase in American history.

During the Obama administration total debt outstanding increased by 63.5% – which is just 20% of the debt growth created during the Reagan administration. As a percent of GDP the debt has grown by 28% – just about a quarter of the 100% increase during Reagan’s era. Today we have an $18.5trillion economy, 4 to 6 times larger than the $3-$5trillion economy of the 1980s. Thus, the debt number may appear large, but it is nothing at all as important, or an economic drag, as the debt added by Republican Reagan.

Digging into the details of the Obama debt increase (for the wonks,) out of a total of $8.5trillion added 70% was created by 2 policies implemented by Republican Bush. Ongoing costs of the Afghanistan war has accumulated to $3.6trillion, and $2.9trillion came from the Bush tax cuts which continued into 2003. Had these 2 Republican originated policies not added drastically to the country’s operating costs, debt increases would have been paltry compared to the size of the GDP. So it hasn’t been Democratic policies, like ACA (Affordable Care Act), or even the American Reinvestment and Recovery Act which has led to home values returning to pre-crisis levels, that created recent debt, but leftover activities tied to Republican Bush’s foray into Afghanistan and Republican policies of cutting taxes (mostly for the wealthy.)

Since Reagan left office the U.S. economy has grown by $13.5trillion. 2/3 of that (67%) happened during Clinton and Obama (Democrats) with only 1/3 happening during Bush and Bush (Republicans.)

AH – What about public sentiment? Listening to candidate Trump one would think Americans are extremely unhappy with President Obama.

Deitrick – The U.S. Conference Board’s Consumer Confidence Index was at a record high 118.9 when Democrat Clinton left office. Eight years later, ending Republican Bush’s administration, that index was at a record low 26.8. Today that index is at 101.1. Perhaps candidate Trump should be reminded of Senator Daniel Patrick Moynihan’s famous quote “everyone is entitled to his own opinion, but not to his own facts.”

Candidate Trump’s rhetoric makes it sound like Americans live in a crime-filled world – all due to Democrats. But FBI data shows that violent crime has decreased steadily since 1990 – from 750 incidents per 100,000 people to about 390 today. Despite the rhetoric, Americans are much safer today than in the past. Interestingly, however, violent crime declined 10.2% in the second Bush’s 8 year term. But during the Clinton years violent crime dropped 34%, and during the Obama administration violent crime has dropped 17.8%. Democratic policies of adding federal money to states and local communities has definitely made a difference in crime.

Despite the blistering negativity toward ACA, 20million Americans are insured today that weren’t insured previously. That’s almost 6.25% of the population now with health care coverage – a cost that was previously born by taxpayers at hospital emergency rooms.

AH – Final thoughts?

Deitrick – We predicted that the Obama administration would be a great boon for Americans, and it has. Unfortunately there are a lot of people who obtain media coverage due to antics, loud voices, and access obtained via wealth that have spewed false information. When one looks at the facts, and not just opinions, it is clear that like all administrations the last 90 years Democrats have continued to be far better economic stewards than Republicans.

It is important people know the facts. For example, it would have kept an investor in this great bull market – rather than selling early on misplaced fear. It would have helped people to understand that real estate would regain its lost value. And understand that the added debt is not a great economic burden, especially at the lowest interest rates in American history.

[Author’s note: Bob Deitrick is CEO of Polaris Financial Partners, a private investment firm in suburban Columbus, Ohio. His firm uses economic and political tracking as part of its analysis to determine the best investments for his customers – and is proud to say they have remained long in the stock market throughout the Obama administration gains. For more on their analysis and forecasts contact PolarsFinancial.net]

by Adam Hartung | Aug 4, 2016 | Election, Leadership, Politics

Donald Trump has had a lot of trouble gaining good press lately. Instead, he’s been troubled by people from all corners reacting negatively to his comments regarding the Democrat’s convention, some speakers at the convention, and his unwillingness to endorse re-election for the Republican speaker of the house. For a guy who has been in the limelight a really long time, it seems a bit odd he would be having such a hard time – especially after all the practice he had during the primaries.

The trouble is that Donald Trump still thinks like a CEO. And being a CEO is a lot easier than being the chief executive of a governing body.

CEOs are much more like kings than mayors, governors or presidents:

- They aren’t elected, they are appointed. Usually after a long, bloody in-the-trenches career of fighting with opponents – inside and outside the company.

- They have the final say on pretty much everything. They can choose to listen to their staff, and advisors, or ignore them. Not employees, customers or suppliers can appeal their decisions.

- If they don’t like the input from an employee or advisor, they can simply fire them.

- If they don’t like a supplier, they can replace them with someone else.

- If they don’t like a customer, they can ignore them.

- Their decisions about resources, hiring/firing, policy, strategy, fund raising/pricing, spending – pretty much everything – is not subject to external regulation or legal review or potential lawsuits.

- Most decisions are made by understanding finance. Few require a deep knowledge of law.

- There is really only 1 goal – make money for shareholders. Determining success is not overly complicated, and does not involve multiple, equally powerful constituencies.

- They can make a ton of mistakes, and pretty much nobody can fire them. They don’t stand for re-election, or re-affirmation. There are no “term limits.” There is little to tie them personally to their decisions.

- They have 100% control of all the resources/assets, and can direct those resources wherever they want, whenever they want, without asking permission or dealing with oversight.

- They can say anything they want, and they are unlikely to be admonished or challenged by anyone due to their control of resource allocation and firing.

- 99% of what they say is never reported. They talk to a few people on their staff, and those people can rephrase, adjust, improve, modify the message to make it palatable to employees, customers, suppliers and local communities. There is media attention on them only when they allow it.

- They have the “power of right” on their side. They can make everyone unhappy, but if their decision improves shareholder value (if they are right) then it really doesn’t matter what anyone else thinks

One might challenge this by saying that CEOs report to the Board of Directors. Technically, this is true. But, Boards don’t manage companies. They make few decisions. They are focused on long-term interests like compliance, market entry, sales development, strategy, investor risk minimization, dividend and share buyback policy. About all they can do to a CEO if one of the above items troubles them is fire the CEO, or indicate a lack of support by adjusting compensation. And both of those actions are far from easy. Just look at how hard it is for unhappy shareholders to develop a coalition around an activist investor in order to change the Board — and then actually take action. And, if the activist is successful at taking control of the board, the one action they take is firing the CEO, only to replace that person with someone knew that has all the power of the old CEO.

It is very alluring to think of a CEO and their skills at corporate leadership being applicable to governing. And some have been quite good. Mayor Bloomberg of New York appears to have pleased most of the citizens and agencies in the city, and his background was an entrepreneur and successful CEO.

But, these are not that common. More common are instances like the current Governor of Illinois, Bruce Rauner. A billionaire hedge fund operator, and first-time elected politician, he won office on a pledge of “shaking things up” in state government. His first actions were to begin firing employees, cutting budgets, terminating pension benefits, trying to remove union representation of employees, seeking to bankrupt the Chicago school district, and similar actions. All things a “good CEO” would see as the obvious actions necessary to “fix” a state in a deep financial mess. He looked first at the financials, the P&L and balance sheet, and set about to improve revenues, cut costs and alter asset values. His mantra was to “be more like Indiana, and Texas, which are more business friendly.”

Only, governors have nowhere near the power of CEOs. He has been unable to get the legislature to agree with his ideas, most have not passed, and the state has languished without a budget going on 2 years. The Illinois Supreme Court said the pension was untouchable – something no CEO has to worry about. And it’s nowhere near as easy to bankrupt a school district as a company you own that needs debt/asset restructuring because of all those nasty laws and judges that get in the way. Additionally, government employee unions are not the same as private unions, and nowhere near as easy to “bust” due to pesky laws passed by previous governors and legislators that you can’t just wipe away with a simple decision.

With the state running a deficit, as a CEO he sees the need to undertake the pain of cutting services. Just like he’d cut “wasteful spending” on things he deemed non-essential at one of the companies he ran. So refusing funding during budget negotiations for health care worker overtime, child care, and dozens of other services that primarily are directed at small groups seems like a “hard decision, well needed.” And if the lack of funding means the college student loan program dries up, well those students will just have to wait to go to college, or find funding elsewhere. And if that becomes so acute that a few state colleges have to close, well that’s just the impact of trying to align spending with the reality of revenues, and the customers will have to find those services elsewhere.

And when every decision is subjected to media reporting, suddenly every single decision is questioned. There is no anonymity behind a decision. People don’t just see a college close and wonder “how did that happen” because there are ample journalists around to report exactly why it happened, and that it all goes back to the Governor. Just like the idea of matching employee rights, pay requirements, contract provisioning and regulations to other states – when your every argument is reported by the media it can come off sounding a lot like as state CEO you don’t much like the state you govern, and would prefer to live somewhere else. Perhaps your next action will be to take the headquarters (now the statehouse) to a neighboring state where you can get a tax abatement?

Donald Trump the CEO has loved the headlines, and the media. He was the businessman-turned-reality-TV-star who made the phrase “you’re fired” famous. Because on that show, he was the CEO. He could make any decision he wanted; unchallenged. And viewers could turn on his show, or not, it really didn’t matter. And he only needed to get a small fraction of the population to watch his show for it to make money, not a majority. And he appears to be very genuinely a CEO. As a CEO, as a TV celebrity — and now as a candidate for President.

Obviously, governing body chief executives have to be able to create coalitions in order to get things done. It doesn’t matter the party, it requires obtaining the backing of your own party (just as John Boehner about what happens when that falters) as well as the backing of those who don’t agree with you. ou don’t have the luxury of being the “tough guy” because if you twist the arm to hard today, these lawmakers, regulators and judges (who have long memories) will deny you something you really, really want tomorrow. And you have to be ready to work with journalists to tell your story in a way that helps build coalitions, because they decide what to tell people you said, and they decide how often to repeat it. And you can’t rely on your own money to take care of you. You have to raise money, a lot of money, not just for your campaign, but to make it available to give away through various PACs (Political Action Committees) to the people who need it for their re-elections in order to keep them backing you, and your ideas. Because if you can’t get enough people to agree on your platforms, then everything just comes to a stop — like the government of Illinois. Or the times the U.S. Government closed for a few days due to a budget impasse.

And, in the end, the voters who elected you can decide not to re-elect you. Just ask Jimmy Carter and George H.W. Bush about that.

On the whole, it’s a whole lot easier to be a CEO than to be a mayor, or governor, or President. And CEOs are paid a whole lot better. Like the moviemaker Mel Brooks (another person born in New York by the way) said in History of the World, Part 1 “it’s good to be king.“

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.