Newsletters

NEWSLETTER ARCHIVE

Get the latest newsletter here or subscribe and receive in your email.

Get the latest newsletter here or subscribe and receive in your email.

Kids going back to school, football season starting, the weather turning cooler – indicators that things are changing, and we have to prepare. This newsletter is all about predicting change, and preparing to pivot to meet those changes. Growing firms know that adapting – pivoting – is essential, and it always requires reading the trends and preparing to change.

In business we often focus on “Doing things right.” It’s frequently about execution. But success requires moving beyond that focus to “Do the right things.” Implementation strength is no good if you aren’t doing the right things. Knowing how to prepare for a beach outing, or dress for a camp out, or handicap baseball statistics isn’t valuable when fall comes and you need to prepare for school, cold weather and a new fantasy football season.

“Doing the right things” is the heart of strategy and governance. Much more than executional focus. And to know what the right thing is to do you have to read market changes – recognize the shifting seasons – and that means having a keen eye for Trends.

Bill Gates called today’s climate “Business at the Speed of Thought.” With technologies, regulations, social norms, and global forces changing so fast, “strategic thinking” requires insight as to what is going to happen next and organizational nimbleness. Success requires a willingness to realize the future probably won’t look like the past, and that means looking past piles of historical information (all gleaned from the rear view mirror,) and figuring out how to read the trends, predict implications and create adaptability.

Bill Gates called today’s climate “Business at the Speed of Thought.” With technologies, regulations, social norms, and global forces changing so fast, “strategic thinking” requires insight as to what is going to happen next and organizational nimbleness. Success requires a willingness to realize the future probably won’t look like the past, and that means looking past piles of historical information (all gleaned from the rear view mirror,) and figuring out how to read the trends, predict implications and create adaptability.

The Divine Creator gave us infinite information about the past. So we love to study everything that happened yesterday. But today this rarely predicts the future. Lacking facts about the future, we like to pretend it will be like the past. But we can break out of this backward fixation – by focusing on Trends. Trends are our guidemarkers to the future status.

To take advantage of future opportunities created by intersecting trends (insert Venn diagram here!), successful firms create strategies adaptable enough to overcome myopia, allowing them to shift the business in a new direction within the strategy. We used to call this “transformation” or “makeover,” but today it’s more appropriately known as a “strategic pivot”. Eric Ries coined the term in 2009 and it has become ubiquitous, especially in Silicon Valley, because it so accurately represents the action of quickly changing direction in order to keep your business aligned with trends, and growing.

How does an NFL running back “pivot” to quickly capture additional yardage in a crowded field of giant, elite athletes? He practices. He learns to read the cues, and predict the direction other players will take. But, unlike the running back, most firms don’t pivot often, if at all. They never develop the skills to read the field in front of them, or predict competitive action. They focus on running forward, and hope nobody knocks them down. Vince Lombardi, Head Coach of the Green Bay Packers and winner of Superbowls I & II had a simple principle for his running backs.

“Run to daylight.”

Vince Lombardi

Don’t hesitate to ask for help in making your organization more adaptable, and your strategy embedded with options to pivot based on market shifts. You could start with an underperforming product or brand. Practice the “pivot” and learn how to implement change. And ask for coaching.

Watch my new video discussing Netflix’ adaptable strategy and skill at pivoting

We are here to help as your coach on trends and pivots. We bring years of experience studying trends, organizations, and recognizing the signs that pivots are necessary, as well as how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Go the website. Send me a reply to this email, or call me today, and let’s start talking about what trends will impact your organization and what you’ll need to do to pivot toward greater success. Let’s start now, so 2017 is your best year ever!

August is beach season- you are probably on, near or thinking about relaxing on a beach! Well, to an innovation/disruption expert like me, beaches remind me of…white space! That’s the market which is beyond the “box” of the current success formula.

A colleague recently competed in the Chicago to Mackinac sailboat race. This year, after 12 hours of lightning, wind, rain and waves, the sun came out and they were greeted by the sight of the gleaming Sleeping Bear sand dunes on the Michigan shore. To the sailors, the dunes are a milestone of the race course. For innovators, they are a good analogy of the path to white space.

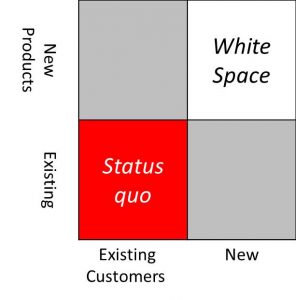

Innovation is often represented by a 2 x 2 matrix of new and existing products and customers. But this model does not capture a key obstacle to innovation adoption- behavior.

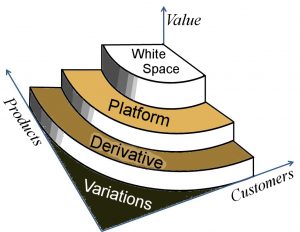

Another way to view innovations is to consider the four ways that innovation changes behaviors of the supplier and customer as innovative thinking moves upslope to white space.

Another way to view innovations is to consider the four ways that innovation changes behaviors of the supplier and customer as innovative thinking moves upslope to white space.

Most companies devote the largest share of investment to Variations, at the bottom of the sand dune where the risk is minimal and the sand is flat. Then, they typically fund a few projects in Derivative and Platform innovations which are higher up the slope, but not far from the success formula on the beach. Very little investment is allocated to Fundamental projects because climbing that sand dune is difficult and risky.

The height of the sand dune can represent long term value to the company. After the tough climb through the sand, you are rewarded with breathtaking views and cool breezes. There usually are no “competitors” at the top- you have the market and profits to yourself to create a new success formula. The payoff goes up as you climb, with the highest rewards at the top.

To complete the analogy, the sands are like trends- soft, sliding, uncertain. Once you master the trends, the path to the top and white space is clear.

The Sleeping Bear Dunes in Michigan were named “The most beautiful place in America” by the Good Morning America show. Think about climbing to the top of your local beach to reach the whitespace at the top- you’ll enjoy the view.

Have a great end of your summer!

Let us help you use trends to drive your innovation, positioning, organizational design, staffing, and culture to gain more revenues, higher profits and increased valuation. By adding our trend expertise to your organizational knowledge, you can build a company that is future focused for greater success.

“One sits down on a desert sand dune, sees nothing, hears nothing.

Yet through the silence something…gleams.”Antoine de Saint-Exupéry

Don’t let the rest of summer slip by. Start your 2017 new product planning by having us help you identify key trends and how they can impact your growth. Call us in August, mention this newsletter and receive a 15% discount on all services. Our summer guarantee – We’ll give you the key trends and impacts – or there is no charge!!

Send an email now, or pick up the phone and call us at 847-331-6384 or 847-331-6446.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Upcoming Conference Workshops on Status Quo Risk Management

Recent Forbes Columns:

Did you sample the televised fireworks broadcasts on July 4th? Ratings confirmed that over 17 million people tuned in to the national broadcasts, and millions more watched locally broadcast displays as well. Advertisers have capitalized on this growing audience.

Why are more people watching these shows? What happened to the picnic blanket and the concussion of loud shells? In a word: Trends.

The rise of reality shows where we are the spectator, rather than participant, is one important trend. The addition of popular live entertainers to the broadcast makes watching events televised can offer more than being there in person. And the new use of technologies such as stop frame cameras, slow motion, instant replays, and commentator overlays heightens the offering – the experience – beyond being there live.

Viewers don’t need fireworks displays, but they do want patriotic entertainment on Independence Day. The sights, sounds and smells of a live display are great, but just one way to fulfill this want. And once experienced live, people realize there is little new on the second, or third viewing. Further, viewers don’t want crowds, bugs, travel time, cost, etc. The trick for marketers is to look beyond what we think our customers need (the display) and offer customers what they want. Connecting the entertainment industry, automated remote technology and video technology has created a new experience that in many ways exceeds the original product. It moves beyond the need and gives customers what they want.

Customer Wants + Trends = Fulfilling Wishes

Satisfying customer needs is the minimum requirement – the ante to get in on the sale. But the competitor that satisfies customer wants is differentiated – and can win more often.

Just look at some notable competitors that met customer needs, but lost out to those who focused on wants:

Sears– missed online sales despite being the original “at home” marketer with its historic catalogues

Microsoft– missed the social media market even though Internet Explorer opened the door for explosive internet use and eventually social media’s rise

Sports Authority- invented the sports focused retail store, but missed the shift to e-commerce and portals as direct marketing tools for vendors

Borders– Won the bookseller wars against B. Dalton and others, but then actually created its ultimate competitor by hiring Amazon to manage its ecommerce business

Rand McNally – Dominated the retail mapping business, but failed to see that maps were merely a means to an end, as customers really wished for directions

The marketer’s job is to anticipate customer wants, and tie to trends in order to deliver those wants. By linking wants and trends you can deliver the Next Big Thing. These companies didn’t look at how trends made it possible to move beyond what they perceived customers needed, to give them what they truly wished for. They failed to ask “What if?” and then to use trends to deliver Customer Wishes.

Let us help you use trends to drive your innovation, positioning, organizational design, staffing, and culture to gain more revenues, higher profits and increased valuation. By adding our trend expertise to your organizational knowledge, you can build a company that is future focused for greater success.

Don’t let the summer months slip by. Get a jump on your 2017 planning by having us help you identify key trends and how they will impact your future growth. Give us a call in July, mention this newsletter and receive a 20% discount on all services. Our summer guarantee – We’ll give you the key trends and impacts – or there is no charge!!

Send an email now, or pick up the phone and call us at 847-331-6384 or 847-331-6446.

It’s more economical than you think, and the payoff can be extraordinary. Act like Amazon, and build a mountain of future value while others wait to be shown the way.

“The iPhone is a niche product.”

Olli-Pekka Kollasvuo

CEO, Nokia 2008

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team.

See my Status Quo Risk Management Playbook.

Where Trends Meet Lie Great Opportunities

Upcoming Conference Workshops on Status Quo Risk Management

NACD Director Professionalism Course August California

Recent Forbes Columns:

The Market Values Trends, Shouldn’t You?

Summer is here in the Northern Hemisphere, and it is time to get outside. And it is also time to take a new look at what’s going on outside your business.

Why do most companies spend all their resources on projects that support the current, internal company status quo? Why is 85% of corporate public information focused on the past? Why is past data scrutinized ad nauseum? Why does the planning process rely almost exclusively on past results? After all, isn’t it most important to project what will happen…in the future?

Past data is understood, certain and quantitative. Future trends are messy, uncertain, and often qualitative, but… these are what truly determine growth – or lack thereof.

Why do financial analysts research trends? Because they are always on the lookout for an opportunity – an information advantage – to better forecast future value. They are looking for explanations regarding future results, before they even happen, and thus provide better forecasts. They realize the future could well look entirely different than the past, and how a company competes in the future is what determines its future value. Not what it did in the past.

So what’s the impact on the valuation of a company that sees and takes advantage of trends?

Amazon vs. Walmart

Walmart’s overall revenues for 1Q16 quarter fell 1.4% while net sales for Amazon grew 22%

Online sales increased 12% for Walmart but increased 20% for Amazon.

Walmart was slow to implement online sales, fearful of cannibalization and certain that customers wanted a brick and mortar experience.

Meanwhile Amazon avoided looking at past “best practices” in retail and successfully disrupted the industry with online sales. And then took advantage of its investment in understanding future retail trends by selling its online experience to other companies.

Now Amazon is worth a whole lot more than Walmart – almost 50% more, in fact. And that value didn’t come from big asset piles. Instead it came from understanding one big trend, and building a business to deliver on it. Amazon’s trend value is greater than the entire value of Walmart – the world’s largest traditional retailer

What makes trends so difficult to use and easy to overlook is that they are outside the walls of our business. They are uncontrollable. They defy management mandates. They rely on interactions with suppliers, customers, technology, regulations and many other touch points. Because they don’t come with built-in data sets – like the company accounting system – they can be elusive to identify, and interpret. They take hard work to understand, but offer unbelievable value to those who seek them out and add them to their business.

Understanding trends is always a competitive advantage.

Future planning should be all about trends, and how to leverage them. They require obtaining information, data, insights and often understanding from people who are outside the organization. They demand using external experts, and external data.

And when added to implementation skill, they create huge value.

Let us help you use trends to drive your innovation, positioning, organizational design, staffing, and culture to gain more revenues, higher profits and increased valuation. By adding our trend expertise to your organizational knowledge, you can build a company that is future focused for greater success.

Respond to this email right now, or call (847) 726-8465, and let’s talk about how a presentation at your management meeting, or a workshop with your team, can help you have a much more powerful plan for success in 2017 and beyond. Let us do for you what we’ve done for dozens of other companies, and industry conferences, and help you use trends to see avenues for new growth.

It’s a lot cheaper than you think, and the payoff can be extraordinary. Act like Amazon, and build a mountain of future value while others wait to be shown the way.

“Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him.”

Dwight D. Eisenhower

Listen to my Sirius XM interview on how Sears and Kmart lost to Status Quo Risk

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Upcoming Conference Workshops on Status Quo Risk Management

Where Trends Meet Lie Great Opportunities

NACD Director Professionalism Course June Chicago

NACD Director Professionalism Course August California

Recent Forbes Columns:

Cosmic cataclysm, Jurassic Park, rain drops, Tesla

Jurassic Extreme www.houstondinosaurs.com

No, this isn’t an SAT question, but what do they have in common? (You may not have thought of dinosaurs and electric cars in the same sentence!)

Ripples

Ripples as in wavelets. Stock market theory for years has taught about ripples, waves and tides as an analogy for patterns in financial markets. The same idea can be extended to using trends as a way to anticipate business opportunities.

In February of this year, astrophysicists discovered evidence of gravitational waves through nearly imperceptible disturbances, smaller than an atom. Billions of years later, we learned of a stellar event whose magnitude staggers the imagination. Something very small happens, and it leads to something very, very big.

Like when Steven Spielberg clues in the viewer that something very big is about to happen by the actor seeing a trembling cup. At first, it’s an odd tremor. Next, a giant dinosaur is out to eat you. Recognizing activities early has enormous importance.

My last newsletter, and the Status Quo Risk Management Playbook, talked about watching for trends. Trends are the ripples in the market from innovations that individually look very small. But these trends can build, just as ripples interact, and can grow in size very quickly to become waves. (Thomas Young, 1803)

Trends build on Trends

Like ripples on a pond’s surface from raindrops, trends spread across the market colliding with other trends. By observing where trends intersect we can identify opportunities and threats. Tesla, Netflix and wind turbine market leaders Siemens and GE are successfully riding the combined trends of technology, changing consumer demand and government involvement.

Understanding the potential peaks and troughs of market trends allows businesses to “pressure test” growth plans against scenarios – up or down. Your business can react faster because you know where to look, you will be better prepared for the most likely “what if” scenarios, and you can avoid the trap of Status Quo complacency.

Send us an email to set up a call, or call us now, to discuss how we can apply to you what we’ve done for dozens of clients that overcame Status Quo Risk and grow.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Where trends intersect can be great opportunity or great risk

Upcoming Conference Workshops on Status Quo Risk Management

NACD Director Professionalism Course June Chicago

NACD Director Professionalism Course August California

Recent Forbes Columns:

Tesla Model 3 – What a Game Changer Looks Like

Can Netflix Double-Pivot To Be A Media Game Changer?

Explaining the value jump at Facebook, and value rout at Apple and Chipotle, via growth analysis

How does your company manage risk?

Companies prepare for the most visible risks, such as in-kind competition, supplier failures or regulatory change. They build “moats” around the core business up and down the value chain. They buy suppliers, buy distributors, use industry standards to increase cost of entry, add new features and bundled pricing plans, influence favorable legislation – countless other techniques.

Risk management has been focused on defending the status quo – not anticipating change. But moats and walls were defeated by innovative competitors that created new attacks such as the trebuchet and Greek fire that made the risk management defenses obsolete.

By planning only on traditional threats, companies spend far too much time, and money, improving their “moats” or “walls.” Meanwhile competitors, and customers, are finding a way around, over or under traditional business protection defenses. The company keeps improving status quo defenses — instead of anticipating trends that can nullify old business protections.

Western Union turned down an offer to buy the patent for Alexander Graham Bell’s new telephone, preferring instead to invest in the telegraph. Western Union even ran wires for Bell’s new innovation, not accepting that the telephone (which was vastly more expensive) could obsolete their “core product.”

Kodak invented the digital camera, but dismissed it as an expensive, low resolution novelty while developing more amateur film products and more efficient film manufacturing.

Too often companies adopt innovative technology, but as a way to become more efficient at what they always did rather than seeing the risk innovations create in their core markets.

Encyclopedia Britannica embraced desktop publishing technology to lower costs in their core business: printing. Leaders dismissed CDs and on-line sites as a book replacement.

Rand McNally adopted online mapping, but focused entirely on digitizing paper maps. They totally missed the market for two simpler, but higher volume end user needs – …directions… while traveling in your car.

Can you think of situations like this in your industry, or company? Have folks seen the new technologies, but refused to accept they could completely change competition?

You can avoid missing the disruptive innovation problems, and achieve the next plateau.

Does your outward-looking team want to drive change?

Gathering and interpreting trend information from end-users, competitors and the environment would have identified the risks to the status quo of companies like Rand McNally. They needed a risk monitoring approach outside the status quo organization which would have created a view of potentially business altering, even business obsoleting, changes.

Is your company reluctant to consider marketplace innovations as real threats?

Status quo risk is the most difficult risk to assess, and to overcome. It is created by biases built into the existing business and the existing value delivery system. Status quo risk is the risk created by not knowing what you don’t know – and thus are unable to perceive or prepare for.

Only by analyzing assumptions and biases can we discover how new technologies and business practices threaten sales and profits as adoption changes the marketplace.

Perhaps we can help your business by:

Send us an email to set up a call, or call us now, to discuss what we’ve done for dozens of clients that overcame Status Quo Risk and can apply to your situation.

Listen to my recent Sirius XM interview on how Sears and Kmart lost to Status Quo Risk

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Upcoming Conference Workshops on Status Quo Risk Management

NACD Director Professionalism Course June Chicago

NACD Director Professionalism Course August California

Recent Forbes Columns:

Tesla Model 3 – What a Game Changer Looks Like

Apple – Better, Faster, Cheaper Is Not Disruptive Innovation. But Is That OK?

Why Activists Succeed – and Will Change Yahoo

In the last newsletter, I talked about the importance of incorporating trends into business plans, organizations and innovation programs. An analysis of the subtle features behind a surface trend, or event, often shows they are born from changes in underlying conditions.

Most of an iceberg is below the surface. Here are two examples of surface events and understanding how they can be analyzed to expose underlying trends:

A Walmart truck critically injured comedian Tracy Morgan and killed the driver, making headlines and creating a public relations crisis for Walmart. But looking deeper suggests longer term business problems at Wal-Mart.

A thorough assessment considers not only the business issues but also the human issues as well.

In 2013 Yahoo announced that workers could no longer work remotely. Leadership cited the cost savings and collaborative benefits. That’s on the surface. Dive a little deeper and ask,

Focusing on cost is a classic Status Quo Lock-in and indicates problems with the company Success Formula. Both show efforts to Defend & Extend a situation that is under stress, and leadership trying to squeeze out higher profits. They are telltale signs of worse problems likely to emerge as competition keeps putting pressure on the company.

In our consulting practice, we call such event analysis to identify underlying trends “The Whys”. Creating actionable change in a business requires looking hard at events to understand the drivers. We ask over and over, “Why?”

Once the underlying drivers to surface events trends are identified, the next step in the Status Quo Playbook is Pressure Testing your own Success Formula and Planning for Risk Impact.

Recent Work

The Valore National Conference on Social Change, Salvadore, Brazil

In a keynote address to Brazil’s business and government leaders I discussed the impact of disruptive innovations. Anticipating disruptive innovation helps companies and governments incorporate them to improve products and services. In the case of many South American countries the technology flow is relentless, but resources to take advantage of these technologies are limited. The task is to understand the most important trends and prioritize how to incorporate these into future plans.

NACD Battlefield to the Boardroom conference, Washington, DC

Retiring military generals and flag officers are often invited to serve on company boards to provide benefits based on their deep management experience. But these accomplished officers can have a deeper impact on governance. My keynote described how military experience is well suited to identifying and preparing for possible disruptive business impacts. Skills such as continually sensing the enemy/competition, adapting plans and using the environment to their advantage, innovating in real-time are very valuable in business today. The military is often believed to function with a top-down control model, but in reality, tactical responsibility is delegated to the commanders closest to the action and units are given latitude to adapt to changing conditions – something many companies fail to accomplish. It’s not intuitive to many civilians, but military expertise can dramatically improve corporate innovation and preparedness.

Listen to my recent interview on Business Radio Sirius XM, powered by Wharton:

“Sears Closing Stores-The beginning of the end?”

Here’s hoping you had a restful and pleasant holiday season, and you are recharged for completing the flurry of activity that typically begins every new year.

What we once considered the safest of investments – real estate – did a 180 in the first decade of the 2000’s. Bonds lost all value as interest rates fell to zero. And although the stock market climbed a world of worry from 2008 to 2014, 2015 ended negatively and 2016 started with the worst 4 day record in history! Given stock market events in December and January, many readers are confused about where they should invest – or if they should invest at all!

In 2014, on the David Feldman radio program, he asked me to describe if, and why, small investors should even consider owning equities. He championed the idea, often expressed by non-investors, that equity markets are rigged against the small investor — and, to some extent, against all but institutional investors.

I helped explain the difference between indexes and “the market” and then suggested a way even the smallest investors could take advantage of indexes (like Exchange Traded Funds [ETFs]) to help minimize risk and maximize returns. Investing is not trading, and even small investors can do quite well if they insist on long-term horizons and smartly use the right index funds. Nobody can predict the stock market for 2016, but I remain a believer in long-term investing, and you might enjoy hearing my recommendations via this link to those two interviews.

As for your business plans in 2016, trends are the bedrock of good plans. Ignoring trends leads to blind spots and failures addressing emerging competitors, alternative solutions and disruptive technologies. I always recommend “setting the stage” for all planning with a discussion of important trends to put perspective on new, and even historical, ideas. Trend analysis is the best way to forecast target markets so your organization can head “…to where the puck will be…” (hat tip to Wayne Gretzky – after all, it is hockey season! Go Hawks!)

When traveling this holiday we ventured to several new destinations. In order to gain perspective and recognize both the history and opportunities, we used local guides that helped us make sense of what seemed unusual – and sometimes mindboggling – to us. Many of you may benefit from a consultant “guide” who can help you recognize trends, describe their history and forecast their future. This is some of the most interesting, and beneficial, work I do with clients every year. Because I live “outside the box” I am able to bring insights to the forefront that enlighten the planning process and avoid planning on a status quo future when the world is actually far more dynamic. For more on how this works I’ve created a “how to” that you can adapt for your team in my Status Quo Risk Management Playbook.

In 2016, it is more important than ever that everyone identify how they have locked-in on outdated assumptions about their firm and competition, then incorporate fast moving trends into future plans. If you’d like some help making your future plans more dynamic, and leading to better results, let’s discuss how I and my colleagues can help you prepare for business in 2020, rather than plan based on a return to 2010. Remember…..

“Plan for what you don’t know, rather than what you do.”

Create Marketplace Disruption: How to Stay Ahead of the Competition

Three Leadership Lessons From Tree Climbing Goats

A Christmas Carol 2015 – The Ebenezer 1% and Cratchit Middle Class

5 Leadership Lessons from 2015’s Business Headlines

Stay tuned, next month I’ll review how we incorporate “risk avoidance” into the Playbook, and discuss some of my recent international presentations.

![]()

Over the last few months I have had a number of international meetings in Hong Kong, Bali, Rome, Madrid and Marrakesh. Companies and associations in many countries have increased their focus on innovation in products, marketing and sales as a defense against marketplace disruptions. Senior execs recognize the need to identify and sidestep the status quo lock-ins in their companies as a first step to generate more internal ideas and absorb trends from the marketplace.

Innovation is uncomfortable for most companies because it runs counter to the lock-ins, but it is key to growth. Lock-ins are the practices, biases or beliefs the firm has developed to maintain business model. They function well to ensure efficiency for existing business lines, but can strangle innovation. Top on the holiday wish list for executives is to recognize their key lock-ins so they can take action in 2016. (My “Status Quo Playbook” can help.)

In my January newsletter, I’ll discuss a process to identify and incorporate market and competitive trends to help address the lock-ins and identify potential marketplace disruptions.

Here’s wishing you, your team and your family a happy and restful holiday and Christmas season!

| Hartung in Forbes | Authors in Other Publications |

|---|---|

| Mar 2013 “Why Yahoo Investors Should Worry about Marissa Mayer” | Dec 2013 Vanity Fair “Mayer…savior or its next big problem” Dec 2014 NYT “What happened when Marissa Mayer tried to be Steve Jobs” |

| Jan 2015 “Yahoo – Another Disappearing Giant Has Nowhere To Hide” | Oct 2015 The Economist, “Yahoo: A portal to nowhere”, Mayer has failed to revive the internet sloth |

| Dec 6, 2015 “Is Yahoo Doomed? Probably” | Dec 14, 2015 Business Insider “Why Yahoo needs to fire Marissa Mayer” |

“Ten Must Read Books for Modern Marketers 2015” features Adam’s book, “Create Marketplace Disruption, How to Stay Ahead of the Competition”