by Adam Hartung | Sep 30, 2016 | Immigration, Leadership, Lifecycle, Trends

I write about trends. Technology trends are exciting, because they can come and go fast – making big winners of some companies (Apple, Facebook, Tesla, Amazon) and big losers out of others (Blackberry, Motorola, Saab, Sears.) Leaders that predict technology trends can make lots of money, in a hurry, while those who miss these trends can fail faster than anyone expected.

But unlike technology, one of the most important trends is also the most predictable trend. That is demographics. Quite simply, it is easy to predict the population of most countries, and most states. And predict the demographic composition of countries by age, gender, ancestry, even religion. And while demographic trends are remarkably easy to predict very accurately, it is amazing how few people actually plan for them. Yet, increasingly, ignoring demographic trends is a bad idea.

Take for example the aging world population. Quite simply, in most of the world there have not been enough births to keep up with those who ar\e getting older. Fewer babies, across decades, and you end up with a population that is skewed to older age. And, eventually, a population decline. And that has a lot of implications, almost all of which are bad.

Look at Japan. Every September 19 the Japanese honor Respect for the Aged Day by awarding silver sake dishes to those who are 100 or older. In 1966, they gave out a few hundred. But after 46 straight years of adding centenarians to the population, including adding 32,000 in just the last year, there are over 65,000 people in Japan over 100 years old. While this is a small percentage, it is a marker for serious economic problems.

Over 25% of all Japanese are over 65. For decades Japan has had only 1.4 births per woman, a full third less than the necessary 2.1 to keep a population from shrinking. That means today there are only 3 people in Japan for every “retiree.” So a very large percentage of the population are no longer economically productive. They no longer are creating income, spending and growing the economy. With only 3 people to maintain every retiree, the national cost to maintain the ageds’ health and well being soon starts becoming an enormous tax, and economic strain.

What’s worse, by 2060 demographers expect that 40% of Japanese will be 65+. Think about that – there will be almost as many over 65 as under 65. Who will cover the costs of maintaining this population? The country’s infrastructure? Japan’s defense from potentially being overtaken by neighbors, such as China? How does an economy grow when every citizen is supporting a retiree in addition to themselves?

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

This means that China’s aging population problem will not recover for several more decades. Today there are 5 workers for every retiree in China. But there are already more people exiting China’s workforce than entering it each year. We can easily predict there will be both an aging, and a declining, population in China for another 40 years. Thus, by 2040 (just 24 years away) there will be only 1.6 workers for each retiree. The median age will shift from 30 to 46, making China one of the planet’s oldest populations. There will be more people over age 65 in China than the entire populations of Germany, Japan, France and Britain combined!

While it is popular to discuss an emerging Chinese middle class, that phenomenon will be short-lived as the country faces questions like – who will take care of these aging people? Who will be available to work, and grow the economy? To cover health care costs? Continued infrastructure investment? Lacking immigration, how will China maintain its own population?

“OK,” American readers are asking, “that’s them, but what about us?” In 1970 there were about 20M age 65+ in the USA. Today, 50M. By 2050, 90M. In 1980 this was 11% of the population. But 2040 it will be over 20% (stats from Population Reference Bureau.)

While this is a worrisome trend, one could ask why the U.S. problem isn’t as bad as other countries? The answer is simply immigration. While Japan and China have almost no immigration, the U.S. immigrant population is adding younger people who maintain the workforce, and add new babies. If it were not for immigration, the U.S. statistics would look far more like Asian countries.

Think about that the next time it seems appealing to reduce the number of existing immigrants, or slow the number of entering immigrants. Without immigrants the U.S. would be unable to care for its own aging population, and simultaneously unable to maintain sufficient economic growth to maintain a competitive lead globally. While the impact is a big shift in the population from European ancestry toward Latino, Indian and Asian, without a flood of immigrants America would crush (like Japan and China) under the weight of its own aging demographics.

Like many issues, what looks obvious in the short-term can be completely at odds with a long-term solution. In this case, the desire to remove and restrict immigration sounds like a good idea to improve employment and wages for American citizens. And shutting down trade with China sounds like a positive step toward the same goals. But if we look at trends, it is clear that demographic shifts indicate that the countries that maximize their immigration will actually do better for their indigenous population, while improving international competitiveness.

Demographic trends are incredibly accurately predictable. And they have enormous implications for not only countries (and their policies,) but companies. Do your forward looking plans use demographic trends to plan for:

- maintaining a trained workforce?

- sourcing products from a stable, competitive country?

- having a workplace conducive to employees who speak English as a second language?

- a workplace conducive to religions beyond Christianity?

- investing in more capital to produce more with fewer workers?

- products that appeal to people not born in the USA?

- selling products in countries with growing populations, and economies?

- paying higher costs for more retirees who live longer?

Most planning systems, unfortunately, are backward-looking. They bring forward lots of data about what happened yesterday, but precious few projections about trends. Yet, we live in an ever changing world where trends create important, large shifts – often faster than anticipated. And these trends can have significant implications. To prepare everyone should use trends in their planning, and you can start with the basics. No trend is more basic than understanding demographics.

by Adam Hartung | Sep 14, 2016 | Immigration, In the Rapids, Innovation, Telecom, Trends

I’m amazed about Americans’ debate regarding immigration. And all the rhetoric from candidate Trump about the need to close America’s borders.

I was raised in Oklahoma, which prior to statehood was called The Indian Territory. I was raised around the only real Native Americans. All the rest of us are immigrants. Some voluntarily, some as slaves. But the fact that people want to debate whether we allow people to become Americans seems to me somewhat ridiculous, since 98% of Americans are immigrants. The majority within two generations.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

And almost since the beginning, immigrants have been not only abused but scammed. Those who have resources frequently took advantage of the newcomers that did not. And this persists. Immigrants that lack a social security card are unable to obtain a driver’s license, unable to open bank accounts, unable to apply for credit cards, unable to even sign up for phone service. Thus they remain at the will of others to help them, which creates the opportunity for scamming.

Take for example an immigrant trying to make a phone call to his relatives back home. For most immigrants this means using a calling card. Only these cards are often a maze of fees, charges and complex rules that result in much of the card’s value being lost. A 10-minute call to Ghana can range from $2.86 to $8.19 depending on which card you use. This problem is so bad that the FCC has fined six of the largest card companies for misleading consumers about calling cards. They continue to advise consumers about fraud. And even Congress has held hearings on the problem.

One outcome of immigrants’ difficulties has been the ingenuity and innovativeness of Americans. To this day around the world people marvel at how clever Americans are, and how often America leads the world in developing new things. As a young country, and due to the combination of resources and immigrants’ tough situation, America frequently is first at developing new solutions to solve problems – many of which are problems that clearly affect the immigrant population.

So, back to that phone call. Some immigrants can use Microsoft Skype to talk with their relatives, using the Internet rather than a phone. But this requires the people back home have a PC and an internet connection. Both of which could be dicey. Another option would be to use something like Facebook’s WhatsApp, but this requires the person back home have either a PC or mobile device, and either a wireless connection or mobile coverage. And, again, this is problematic.

But once again, ingenuity prevails. A Romanian immigrant named Daniel Popa saw this problem, and set out to make communications better for immigrants and their families back home. In 2014 he founded QuickCall.com to allow users to make a call over wireless technology, but which can then interface with the old-fashioned wired (or wireless) telecom systems around the world. No easy task, since telephone systems are a complex environment of different international, national and state players that use a raft of different technologies and have an even greater set of complicated charging systems.

But this new virtual phone network, which links the internet to the traditional telecom system, is a blessing for any immigrant who needs to contact someone in a rural, or poor, location that still depends on phone service. If the person on the other end can access a WiFi system, then the calls are free. If the connection is to a phone system then the WiFi interface on the American end makes the call much cheaper – and performs far, far better than any other technology. QuickCall has built the carrier relationships around the world to make the connections far more seamless, and the quality far higher.

But like all disruptive innovations, the initial market (immigrants) is just the early adopter with a huge need. Being able to lace together an internet call to a phone system is pretty powerful for a lot of other users. Travelers heading to a remote location, like Micronesia, Africa or much of South America — and even Eastern Europe – can lower the cost of planning their trip and connect with locals by using QuickCall.com. And for most Americans traveling in non-European locations their cell phone service from Sprint, Verizon, AT&T or another carrier simply does not work well (if at all) and is very expensive when they arrive. QuickCall.com solves that problem for these travelers.

Small businesspeople who have suppliers, or customers, in these locations can use QuickCall.com to connect with their business partners at far lower cost. Businesses can even have their local partners obtain a local phone number via QuickCall.com and they can drive the cost down further (potentially to zero). This makes it affordable to expand the offshore business, possibly even establishing small scale customer support centers at the local supplier, or distributor, location.

In The Innovator’s Dilemma Clayton Christensen makes the case that disruptive innovations develop by targeting a customer with an unmet need. Usually the innovation isn’t as good as the current “standard,” and is also more costly. Today, making an international call through the phone system is the standard, and it is fairly cheap. But this solution is often unavailable to immigrants, and thus QuickCall.com fills their unmet need, and at a cost substantially lower than the infamous calling cards, and with higher quality than a pure WiFi option.

But now that it is established, and expanding to more countries – including developed markets like the U.K. – the technology behind QuickCall.com is becoming more mainstream. And its uses are expanding. And it is reducing the need for people to have international calling service on their wired or wireless phone because the available market is expanding, the quality is going up, and the cost is going down. Exactly the way all disruptive innovations grow, and thus threaten the entrenched competition.

The end-game may be some form of Facebook in-app solution. But that depends on Facebook or one of its competitors seizing this opportunity quickly, and learning all QuickCall.com already knows about the technology and customers, and building out that network of carrier relationships. Notice that Skype was founded in 2003, and acquired by Microsoft in 2011, and it still doesn’t have a major presence as a telecom replacement. Will a social media company choose to make the investment and undertake developing this new solution?

As small as QuickCall.com is – and even though you may have never heard of it – it is an example of a disruptive innovation that has been successfully launched, and is successfully expanding. It may seem like an impossibility that this company, founded by an immigrant to solve an unmet need of immigrants, could actually change the way everyone makes international calls. But, then again, few of us thought the iPhone and its apps would cause us to give up Blackberries and quit carrying our PCs around.

America is known for its ingenuity and innovations. We can thank our heritage as immigrants for this, as well as the immigrant marketplace that spurs new innovation. America’s immigrants have the need to succeed, and the unmet needs that create new markets for launching new solutions. For all those conservatives who fear “European socialism,” they would be wise to realize the tremendous benefits we receive from our immigrant population. Perhaps these naysayers should use QuickCall.com to connect with a few more immigrants and understand the benefits they bring to America.

by Adam Hartung | Aug 26, 2016 | In the Swamp, Investing, Retail, Trends

Photographer: Luke Sharrett/Bloomberg

Walmart is in more trouble than its leadership wants to acknowledge. Investors

need to realize that it is up to Jet.com to turn around the ailing giant. And

that is a big task for the under $1 billion company.

Relevancy Is Hard To Keep – Look At Sears

Nobody likes to think their business can disappear. What CEO wants to tell his investors or employees “we’re no longer relevant, and it looks like our customers are all going somewhere else for their solutions”? Unfortunately, most leadership teams become entrenched in the business model and deny serious threats to longevity, thus leading to inevitable failure as customers switch.

Gallery: “Walmart Goes Small”

In early September the Howard Johnson’s in Bangor, Maine will close. This will leave just one remaining HoJo in the USA. What was once an iconic brand with hundreds of outlets strung along the fast growing interstate highway system is now nearly dead. People still drive the interstate, but trends changed, fast food became a good substitute, and unable to update its business model this once great brand died.

AP Photo/Elise Amendola

Sears announced another $350 million quarterly loss this week. That makes $9 billion in accumulated losses the last several quarters. Since Chairman and CEO Ed Lampert took over, Sears and Kmart have seen same store sales decline every single quarter except one. Unable to keep its customers Mr. Lampert has been closing stores and selling assets to stem the cash drain. But to keep the company afloat his hedge fund, ESL, is loaning Sears Holdings SHLD -2.94% another $300 million. On top of the $500 million the company borrowed last quarter. That the once iconic company, and Dow Jones Industrial Average component, is going to fail is a foregone conclusion.

But most people still think this fate cannot befall the nearly $500 billion revenue behemoth Walmart. It’s simply too big to fail in most people’s eyes.

Walmart’s Crime Problem Is Another Telltale Sign Of Problems In The Business Model

Yet, the primary news about Walmart is not good. Bloomberg this week broke the news that one of the most crime-ridden places in America is the local Walmart store. One store in Tulsa, Oklahoma has had 5,000 police visits in the last five years, and four local stores have had 2,000 visits in the last year alone. Across the system, there is one violent crime in a Walmart every day. By constantly promoting its low cost strategy Walmart has attracted a class of customer that simply is more prone to committing crime. And policies implemented to hang onto customers, like letting them camp out overnight in the parking lots, serve to increase the likelihood of poverty-induced crime.

But this outcome is also directly related to Walmart’s business model and strategy. To promote low prices Walmart has automated more operations, and cut employees like greeters. Thus leadership brags about a 23% increase in sales/employee the last decade. But that has happened as the employment shrank by 400,000. Fewer employees in the stores encourages more crime.

In a real way Walmart has “outsourced” its security to local police departments. Experts say the cost to eliminate this security problem are about $3.2 billion – or about 20% of Walmart’s total profitability. Ouch! In a world where Walmart’s net margin of 3% is fully one-third lower than Target’s 4.6% the money just isn’t there any longer for Walmart to invest in keeping its stores safe.

With each passing month Walmart is becoming the “retailer of last resort” for people who cannot shop online. People who lack credit cards, or even bank accounts. People without the means, or capability, of shopping by computer, or paying electronically. People who have nowhere else to go to shop, due to poverty and societal conditions. Not exactly the ideal customer base for building a growing, profitable business.

Competitors Relentlessly Pick Away At Walmart’s Sales And Profits

To maintain revenues the last several years Walmart has invested heavily in transitioning to superstores which offer a large grocery section. But now Kroger KR -0.5%, Walmart’s no. 1 grocery competitor, is taking aim at the giant retailer, slashing prices on 1,000 items. Just like competition from the “dollar stores” has been attacking Walmart’s general merchandise aisles. Thus putting even more pressure on thinning margins, and leaving less money available to beef up security or entice new customers to the stores.

And the pressure from e-commerce is relentless. As detailed in the Wall Street Journal, Walmart has been selling online for about 15 years, and has a $14 billion online sales presence. But this is only 3% of total sales. And growth has been decelerating for several quarters. Last quarter Walmart’s e-commerce sales grew 7%, while the overall market grew 15% and Amazon ($100 billion revenues) grew 31%. It is clear that Walmart.com simply is not attracting enough customers to grow a healthy replacement business for the struggling stores.

Thus the acquisition of Jet.com.

The hope is that this extremely unprofitable $1 billion online retailer will turn around Walmart’s fortunes. Imbue it with much higher growth, and enhanced profitability. But will Walmart make this transition. Is leadership ready to cannibalize the stores for higher electronic sales? Are they willing to make stores smaller, and close many more, to shift revenues online? Are they willing to suffer Amazon-like profits (or losses) to grow? Are they willing to change the Walmart brand to something different, while letting Jet.com replace Walmart as the dominant brand? Are they willing to give up on the past, and let new leadership guide the company forward?

If they do then Walmart could become something very different in the future. If they really realize that the market is shifting, and that an extreme change is necessary in strategy and tactics then Walmart could become something very different, and remain competitive in the highly segmented and largely online retail future. But if they don’t, Walmart will follow Sears into the whirlpool, and end up much like Howard Johnson’s.

by Adam Hartung | Jul 15, 2016 | Defend & Extend, Entertainment, Games, Innovation, Lock-in, Mobile, Trends

Poke’Mon Go is a new sensation. Just launched on July 6, the app is already the #1 app in the world – and it isn’t even available in most countries. In less than 2 weeks, from a standing start, Nintendo’s new app is more popular than both Facebook and Snapchat. Based on this success, Nintendo’s equity valuation has jumped 90% in this same short time period.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

A bit of history

Nintendo launched the Wii in 2006 and it was a sensation. Gamers could do things not previously possible. Unit sales exceeded 20m units/year for 2006 through 2009. But Sony (PS4) and Microsoft (Xbox) both powered up their game consoles and started taking share from Nintendo. By 2011 Nintendo sale were down to 11.6m units, and in 2012 sales were off another 50%. The Wii console was losing relevance as competitors thrived.

Sony and Microsoft both invested heavily in their competition. Even though both were unprofitable at the business, neither was ready to concede the market. In fall, 2014 Microsoft raised the competitive ante, spending $2.5B to buy the maker of popular game Minecraft. Nintendo was becoming a market afterthought.

Meanwhile, back in 2009 Nintendo had 70% of the handheld gaming market with its 3DS product. But people started carrying the more versatile smartphones that could talk, text, email, execute endless apps and even had a lot of games – like Tetrus. The market for handheld games pretty much disappeared, dealing Nintendo another blow.

Competitor strategic errors

Fortunately, the bitter “fight to the death” war between Sony and Microsoft kept both focused on their historical game console business. Both kept investing in making the consoles more powerful, with more features, supporting more intense, lifelike games. Microsoft went so far as to implement in Windows 10 the capability for games to be played on Xbox and PCs, even though the PC gaming market had not grown in years. These massive investments were intended to defend their installed base of users, and extend the platform to attract new growth to the traditional, nearly 4 decade old market of game consoles that extends all the way back to Atari.

Both companies did little to address the growing market for mobile gaming. The limited power of mobile devices, and the small screens and poor sound systems made mobile seem like a poor platform for “serious gaming.” While game apps did come out, these were seen as extremely limited and poor quality, not at all competitive to the Sony or Microsoft products. Yes, theoretically Windows 10 would make gaming possible on a Microsoft phone. But the company was not putting investment there. Mobile gaming was simply not serious, and not of interest to the two Goliaths slugging it out for market share.

Building on trends makes all the difference

Back in 2014 I recognized that the console gladiator war was not good for either big company, and recommended Microsoft exit the market. Possibly seeing if Nintendo would take the business in order to remove the cash drain and distraction from Microsoft. Fortunately for Nintendo, that did not happen.

Nintendo observed the ongoing growth in mobile gaming. While Candy Crush may have been a game ignored by serious gamers, it nonetheless developed a big market of users who loved the product. Clearly this demonstrated there was an under-served market for mobile gaming. The mobile trend was real, and it’s gaming needs were unmet.

Simultaneously Nintendo recognized the trend to social. People wanted to play games with other people. And, if possible, the game could bring people together. Even people who don’t know each other. Rather than playing with unseen people located anywhere on the globe, in a pre-organized competition, as console games provided, why not combine the social media elements of connecting with those around you to play a game? Make it both mobile, and social. And the basics of Poke’Mon Go were born.

Then, build out the financial model. Don’t charge to play the game. But once people are in the game charge for in-game elements to help them be more successful. Just as Facebook did in its wildly successful social media game Farmville. The more people enjoyed meeting other people through the game, and the more they played, the more they would buy in-app, or in-game, elements. The social media aspect would keep them wanting to stay connected, and the game is the tool for remaining connected. So you use mobile to connect with vastly more people and draw them together, then social to keep them playing – and spending money.

The underserved market is vastly larger than the over-served market

Nintendo recognized that the under-served mobile gaming market is vastly larger than the overserved console market. Those console gamers have ever more powerful machines, but they are in some ways over-served by all that power. Games do so much that many people simply don’t want to take the time to learn the games, or invest in playing them sitting in a home or office. For many people who never became serious gaming hobbyists, the learning and intensity of serious gaming simply left them with little interest.

But almost everyone has a mobile phone. And almost everyone does some form of social media. And almost everyone enjoys a good game. Give them the right game, built on trends, to catch their attention and the number of potential customers is – literally – in the billions. And all they have to do is download the app. No expensive up-front cost, not much learning, and lots of fun. And thus in two weeks you have millions of new users. Some are traditional gamers. But many are people who would never be a serious gamer – they don’t want a new console or new complicated game. People of all ages and backgrounds could become immediate customers.

David can beat Goliath if you use trends

In the Biblical story, smallish David beat the giant Goliath by using a sling. His new technology allowed him to compete from far enough away that Goliath couldn’t reach David. And David’s tool allowed for delivering a fatal blow without ever touching the giant. The trend toward using tools for hunting and fighting allowed the younger, smaller competitor to beat the incumbent giant.

In business trends are just as important. Any competitor can study trends, see what people want, and then expand their thinking to discover a new way to compete. Nintendo lost the console war, and there was little value in spending vast sums to compete with Sony and Microsoft toe-to-toe. Nintendo saw the mobile game market disintegrate as smartphones emerged. It could have become a footnote in history.

But, instead Nintendo’s leaders built on trends to deliver a product that filled an unmet need – a game that was mobile and social. By meeting that need Nintendo has avoided direct competition, and found a way to dramatically grow its revenues. This is a story about how any competitor can succeed, if they learn how to leverage trends to bring out new products for under-served customers, and avoid costly gladiator competition trying to defend and extend past products.

by Adam Hartung | Jul 13, 2016 | Employment, Leadership, Regulations, Trends

This week Starbucks and JPMorganChase announced they were raising the minimum pay of many hourly employees. For about 168,000 lowly paid employees, this is really good news. And both companies played up the planned pay increases as benefitting not only the employees, but society at large. The JPMC CEO, Jamie Dimon, went so far as to say this was a response to a national tragedy of low pay and insufficient skills training now being addressed by the enormous bank.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

Since 2014 there has been an undeniable trend toward raising the minimum wage, now set nationally at $7.25. Fourteen states actually raised their minimum wage starting in 2016 (Massachusetts, California, New York, Nebraska, Connecticut, Michigan, Hawaii, Colorado, Nebraska, Vermont, West Virginia, South Dakota, Rhode Island and Alaska.) Two other states have ongoing increases making them among the states with fastest growing minimum wages (Maryland and Minnesota.) And there are 4 additional states that promoters of a $15 minimum wage think will likely pass within months (Illinois, New Jersey, Oregon and Washington.) That makes 20 states raising the minimum wage, with 46.4% of the U.S. population. And they include 5 of the largest cities in the USA that have already mandated a $15 minimum wage (New York, Washington D.C., Seattle, San Francisco and Los Angeles.)

In other words, the minimum wage is going up. And decisively so in heavily populated states with big cities where Starbucks and JPMC have lots of employees. And the jigsaw puzzle of different state requirements is actually a threat to any sort of corporate compensation plan that would attempt to treat employees equally for common work. Simultaneously the unemployment rate keeps dropping – now below 5% – causing it to take longer to fill open positions than at any time in the last 15+ years. Simply put, to meet local laws, find and retain decent employees, and have any sort of equitable compensation across regions both companies had no choice but to take action to raise the pay for these bottom-level jobs.

Starbucks pointed out that this will increase pay by 5-15% for its 150,000 employees. But at least 8.5% of those employees had already signed a petition demanding higher pay. Time will tell if this raise is enough to keep the stores open and the coffee hot. However, the price increases announced the very next day will probably be more meaningful for the long term revenues and profits at Starbucks than this pay raise.

At JPMC the average pay increase is about $4.10/hour – from $10.15 to $12-$16.50/hour. Across all 18,000 affected employees, this comes to about $153.5million of incremental cost. Heck, the total payroll of these 18,000 employees is only $533.5M (after raises.) Let’s compare that to a few other costs at JPMC:

Wow, compared to these one-off instances, the recent pay raises seem almost immaterial. While there is probably great sincerity on the part of these CEOs for improving the well being of their employees, and society, the money here really isn’t going to make any difference to larger issues. For example, the JPMC CEO’s 2015 pay of $27M is about the same as 900 of these lowly paid employees. Thus the impact on the bank’s financials, and the impact on income inequality, is — well — let’s say we have at least added one drop to the bucket.

The good news is that both companies realize they cannot fight trends. So they are taking actions to help shore up employment. That will serve them well competitively. And some folks are getting a long-desired pay raise. But neither action is going to address the real problems of income inequality.

by Adam Hartung | Jun 27, 2016 | Finance, Trends

I’m a believer in Disruptive Innovation. For almost 100 years economists have been writing about “Creative Destruction,” in which new technologies come along making old technologies — and the companies built on them — obsolete. In the last 20 years, largely thanks to the initial insights of the faculty at Harvard Business School, we’ve seen a dramatic increase in understanding how new companies use new technologies to disrupt markets and wipe out the profitability of companies that were once clearly successful. In a large way, we’ve come to accept that Disruptive Innovation is good, and the concomitant creative destruction of the old players leads to more rapid growth for the economy, increasing jobs and the wherewithal of everyone.

But, not really everyone. The trickle to lots of people can be a long time coming. When market shifts happen, and people lose jobs to new competitors — domestic or offshore — they only know that their life, at least short term, is a lot worse. As they struggle to pay a mortgage, and find a new job, they often learn their skills are outdated. There are jobs, but these folks are not qualified. As they take lesser jobs, their incomes dwindle, and they may well lose their homes. And their healthcare.

Economists call this workplace transition “temporary economic dislocation.” Fancy term. They claim that eventually folks do enter the workplace who are properly trained, and those folks make more money than the workers associated with the previous, now inferior, technology.

That’s great for economists. But terrible for the folks who lost their jobs. As someone once said “a recession is when your neighbor loses his job. A depression is when you lose your job.” And for a lot of people, the market shift from an industrial economy to an information economy has created severe economic depression in their lives.

A person learns to be a printer, or a printing plate maker, in the 1970s when they are 20-something. Good job, makes a great wage. Secure, as printing demand just keeps rising. But then along comes the internet with PDF and JPEG documents that people read on a screen, and folks simply quit needing, or wanting, printed documents. In 2016, now age 50-something, this printer or plate-maker no longer has a job. Demand is down, and its really easy to send the printing to some offshore market like Thailand, Brazil or India where printing is cheaper.

What’s he or she to do now? Go back to school you may say. But to learn how to do what? Say it’s on-line (or digital) document production. OK, but since everyone in the 20s has been practicing this for over a decade it takes years to actually be competitive. And then, what’s the pay for a starting digital graphic artist? A lot less than what they made as a printer. And who’s going to hire the 58-62 year old digital graphic artist, when there are millions of well trained 20 somethings who seem to be quicker, and more attuned to what the publishers want (especially when the boss ordering the work is 35-42, and really uncomfortable giving orders and feedback to someone her parents’ age.) Oh, and when you look around there are millions of immigrants who are able to do the work, and willing to do it for a whole lot less than anyone native born to your country.

Source: Master Investor UK

In England last week these disaffected people made it a point to show their country’s leadership that their livelihoods were being “creatively destroyed.” How were they to keep up their standard of living with the flood of immigrants? And with the wealth of the country constantly shifting from the middle class to the wealthy business leaders and bankers? While folks who have done well the last 25 years voted overwhelmingly to remain in the EU (such as those who live in what’s called “The City”), those in the suburbs and outlying regions voted overwhelmingly to leave. Sort of like their income gains, and jobs, left.

To paraphrase the famous line from the movie Network, “they were mad as Hell and they weren’t going to take it any longer.” Simply put, if they couldn’t participate in the wonderful economic growth of EU participation, they would take it away from those who did. The point wasn’t whether or not the currency might fall 10% or more, or whether stocks on the UK exchange would be routed. After all, these folks largely don’t go to Europe or America, so they don’t care that much what the Euro or dollar costs. And they don’t own stocks, because they aren’t rich enough to do so, so what does it hurt them if equities fall? If this all puts a lot of pain on the wealthy – well just maybe that is what they really wanted.

America is seeing this in droves. It’s called the Donald Trump for President campaign. While unemployment is a remarkably low 5%, there are a lot of folks who are working for less money, or simply out of work entirely, because they don’t know how to get a job. They may laugh at Robert DiNero as a retired businessman now working for free in “The Intern.” But they really don’t think it’s funny. They can’t afford to work for free. They need more income to pay higher property taxes, sales taxes, health care and the costs of just about everything else. And mostly they know they are rapidly being priced out of their lifestyle, and their homes, and figuring they’ll be working well into their 70s just to keep from falling into poverty.

These people hate President Obama. They don’t care if the stock market has soared during his Presidency – they don’t own stocks (and if they do in a 401K or similar program they don’t care because it does them no good today.) They don’t care that he’s created more jobs than anyone since Reagan or Roosevelt, because they see their jobs gone, and they blame him if their recent college graduate doesn’t have a well-paying job. They don’t care if we are closing in on universal health care, because all they see is that health care is becoming ever more expensive – and often beyond their ability to pay. For them, their personal America is not as good as they expected it to be – and they are very, very angry. And the President is a very identifiable symbol they can blame.

Creative Destruction, and disruptive innovations, are great for the winners. But they can be wildly painful to the losers. And when the disruptions are as big, and frequent, as what’s happened the last 30 years – globalized economy, nationwide and international super banks, outsourcing, offshoring and the entirety of the Internet of Things – it has left a lot of people really concerned about their future. As they see the top 1% live opulent lifestyles, they struggle to keep a 12 year old car running and pay the higher license plate fees. They really don’t care if the economy is growing, or the dollar is strong, or if unemployment is at near-record lows. They know they are on the losing end of the stick. For them, well, America really isn’t all that great anymore.

So, hungry for revenge, they are happy to kill the goose for dinner that laid the golden eggs. They will take what they can, right now, and they don’t care if the costs are astronomical.

Despite their hard times, does this not sound at the least petty, and short-sighted? Doesn’t it seem rather selfish to damn everyone just because your situation isn’t so good?

Some folks will think that government policy really doesn’t matter that much. That actions like Brexit won’t stop they improvements coming from innovation. They think all will work out OK. They so long for a return to a previous time, when they perceived things were much better, that they are ready to stop the merry-go-round for everyone.

And they can do this. Brexit will create a Depression for the UK. The economy not only won’t grow, it will shrink. Probably for another decade. There will be fewer jobs, meaning less wealth for everyone. Those with assets will ride it out. Those who already struggled will struggle more. Lacking investment funds, private and public, there will be less investment in infratructure and the means of production, making life harder for everyone. There will be less, if any, money to invest in innovation, so there will be fewer new products to enjoy, and fewer improvements in lifestyle and productivity. The currency will be lower, so there will be fewer imports, making the cost of everything go up. In short, it will be very, painful, and costly, for everyone now that those who felt left out of the economic expansion have had their day at the polls.

Growth is a great thing. Growth creates jobs, a better lifestyle, higher productivity, more income and more wealth for everyone. But growth is NOT a given. Policies, and government actions, can stop growth dead in its tracks. The innovations we’ve all been fascinated by, and made part of our everyday lives, from smartphones to autos that last hundreds of thousands of miles and tens of years, to low cost air conditioning, to electricity nearly everywhere, to miracle drugs and gene-based bio-pharmaceuticals that have extended our lives by 30%+ in just one generation — all of these things can come to a screeching, terrible halt.

All it takes to stop the gains of innovation are policies that try to return us to a previous time. In the process of making our countries great again, we can absolutely destroy them. It is impossible to go back in time. It is not impossible to kill the means of economic growth. All we have to do is focus on constructing walls instead of creating jobs, protecting industries instead of free trade, and wrapping ourselves in the flag of sovereignty instead of collaborating globally to maximize growth. By focusing on ourselves we can absolutely hurt a lot of other people.

The politicians getting attention now are those espousing a return to some bygone era. Those who denounce the gains of innovation, and offer pity to those who’ve struggled with market disruptions. But these are not the leaders who will help people improve their lives. Those who focus on promoting innovation, attacking the concentration of wealth at the top, providing more incentives to infrastructure development, and mobilizing resources for training and new job creation can make life better for everyone.

Let’s hope everyone watches what happens in the UK last week, this week and going forward learn the long-term lesson of short-term thinking. Let’s hope that we can return to favoring growth, even a the cost of disruption and creative destruction.

by Adam Hartung | May 27, 2016 | Investing, Mobile, Trends, Web/Tech

Snapchat filed its latest fundraising with the SEC this week. According to TechCrunch, $1.8 billion cash was added to the company, based on a current valuation in the range of $18 billion to $20 billion. Not bad for a company with 2015 revenues of about $59 million. And quite a high valuation for a one-product company that probably nobody who reads this column has ever used – or even knows anything about.

Why is Snapchat so highly valued? Because revenue estimates are for $250 million to $350 million in 2016, and up to $1 billion for 2017. From 50 million daily active users in March, 2014 Snapchat has grown to 110 million users by December, 2015 – so a growth rate of about 50% per year. And this growth has not been all USA, over half the Snapchat users are from Europe and the rest of the world – and the non-USA markets are growing the fastest. Clearly, at 20 times 2017 revenue estimates, investors are expecting dramatic growth in users, and revenue to continue. They anticipate numbers of the magnitude that drove the valuation of Google (over $500 billion) and Facebook ($340 billion).

What is Snapchat? It is the complete opposite of this column. Snapchat is like Twitter only without the text. Of course, most of my readers don’t tweet either, so that may not help. It is a picture or 10 second video messaging app. But, most of my readers don’t use messaging apps either, so that may not be helpful.

Think of texting, only you don’t actually text. Instead you send a picture or short video. That’s it. Pretty simple. Just a way to send your friends pics and videos with your phone – although you can be creative with the pictures and make changes.

People who use Snapchat find it addictive. They may send dozens, or hundreds, of pictures daily. To single friends, groups, or even all their friends – since users can pick who gets the pic.

For many of my readers, this must seem ridiculous. Who would want to send, or receive, several pictures every day from some, or many, of your colleagues and friends?

In 1927 Fred Bernard [trivia] popularized the phrase we use today “

A picture is worth a thousand words.” And today, that is more true than ever. Pictures are replacing words for a vast and growing segment of the population. This is now a very fast growing trend, and it is projected to continue.

“Why is this a trend, and not a fad?” you may ask. The answer goes to the heart of how we use language and images. For thousands of years very few people knew how to read or write. To promulgate information, religious and government leaders would have artists paint images that told the story they wanted spread. These images were then taken from town to town, and people were taught the stories by having someone explain the picture. Then the image could be recalled by the population. It was only after the advent of mass education that using written words became the primary medium for providing information.

Simultaneously, paintings were really expensive. And early photography was expensive. Both mediums were used primarily to memorialize a story, or event. Thus there were relatively few of these images, and they were often treasured, hung on walls or kept in albums for later review. Most of my readers are still stuck in the historical context of thinking of pictures as memorials.

But today images are extremely cheap and easy. Almost everyone has a phone with a camera. So it is easy to take a picture, and it is easy to view a picture. Pictures have become free. And if you can replace a thousand words with one photo, it is far more efficient – and thus from a resource perspective photos are far cheaper (think of how long it takes to write an email as opposed to taking a picture). Given that this flip in resources required has happened, and that the use of mobile technology is growing worldwide and will never revert, we know that this is not s short-term fad, but rather a trend.

Once we communicated by telephone calls. That has dropped dramatically because real-time communication takes a lot more effort to coordinate and implement than asynchronous communication. I can email or text any time I want, and my friend can receive that message when it is convenient for her. And she can choose to respond at her convenience, or not respond at all. Thus email and texting exploded due to the technical capability and their improved economy. Today we have the ability to communicate in pictures or short videos which is even more information dense, and even more economical.

I’m sure many of my readers are saying “well, that may be good for someone else, but not for me.” And that’s good, because you read these columns. But factually, the number of readers is destined to decrease as the number of viewers go up.

There’s a reason every time you open an on-line magazine column you are bombarded by short videos ads. They are more communication dense and they are more successful at capturing attention – even if they do irritate you.

There’s a reason that fewer and fewer people read books, and rely instead on columns like this one to gain insights. And there’s a reason more and more people connect on Facebook rather than sending emails – and rather than sending snail mail (when was the last time you actually mailed someone a birthday card?). Haven’t you ever watched a YouTube video rather than read an instruction manual? While you may not imagine using pictures to replace language, the fact is it is happening with increasing frequency, and lots of people are making the switch. Thus it is a trend that will affect how we do many things for many years into the future.

Snapchat has capitalized on this new trend by making an app which allows you and your friends to communicate far more information a whole lot faster. Rather than interrupting your friends with a phone call (they may be busy right now,) or writing them an email or text message, you can just send them a photo. Have you ever used your phone to photo a label and sent it to someone who’s shopping for you? Or taken a photo of an item so you can find an exact replacement? That same action now can become your way of communicating – of telling your current story. Don’t tell your friends what you had for lunch, just send a photo. Don’t tell your friends you are shopping on Madison Avenue, just take a picture. Pictures are not archives, but rather just a fast, more compact and information filled form of communication.

Snapchat did not discover a new bio-pharmaceutical. It did not create a breakthrough new technology, such as extended battery life. It did not identify a sales opportunity in a far flung country. Nor did it have a breakthrough manufacturing process. Rather, merely by being the leader at implementing an emerging trend Snapchat’s founders have created $20 billion of current value.

Now that you know this trend, what are you going to do so you can capture additional value for your business?

by Adam Hartung | May 20, 2016 | E-Commerce, Investing, Retail, Trends

WalMart announced 1st quarter results on Thursday, and the stock jumped almost 10% on news sales were up versus last year. It was only $1.1B on $115B, about 1%, but it was UP! Same store sales were also up 1%, but analysts pointed out that was largely due to lower prices to hold competitors at bay.

While investors cheered the news, at the higher valuation WalMart is still only worth what it was in June, 2012 (just under $70/share.) From then through August, 2015 WalMart traded at a higher valuation – peaking at $90 in January, 2015. Subsequent fears of slower sales had driven the stock down to $56.50 by November, 2015. So this is a recovery for crestfallen investors the last year, but far from new valuation highs.

Unfortunately, this is likely to be just a blip up in a longer-term ongoing valuation decline for WalMart. And that value will be captured by those who understand the most important, undeniable trend in retail.

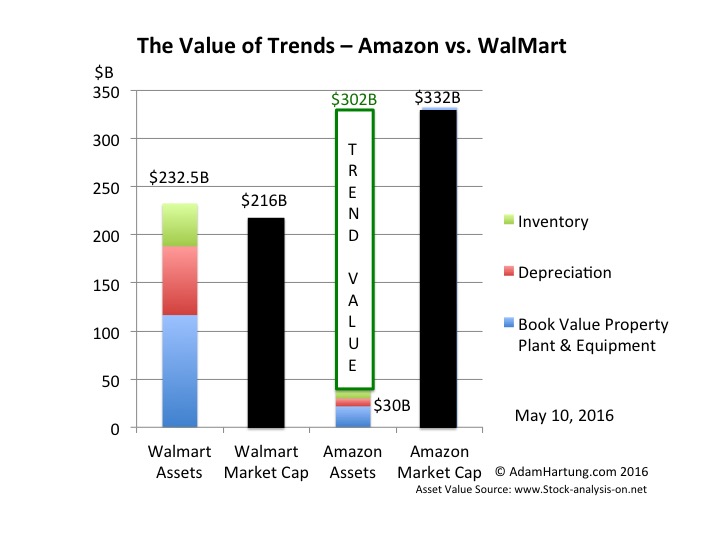

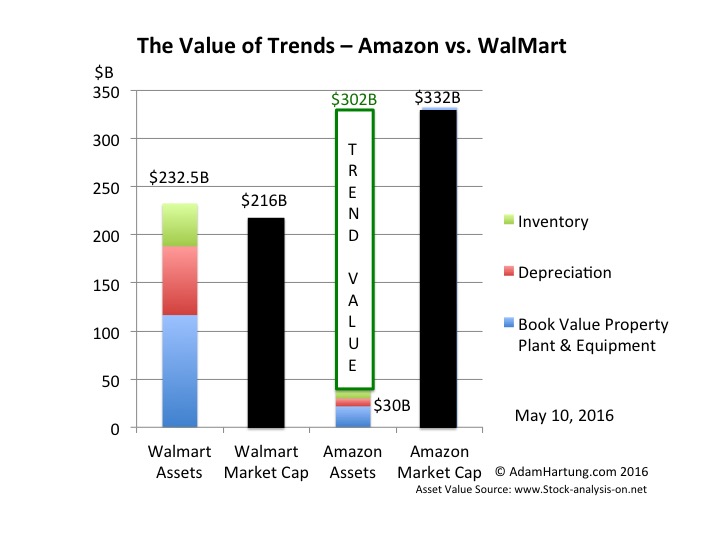

(c) AdamHartung.com Data Sources: Yahoo Finance and www.trend-stock-analysis-on.net

Although the numbers for WalMart’s valuation are a bit better than when the associated chart was completed last week, as you can see WalMart’s assets are greater than the company’s total valuation. This is because the return on its assets, today and projected, are so low that WalMart must borrow money in order to make them overall worthwhile. And the fact that on the balance sheet, at book value, the assets appear to be some $50B lower due to depreciation, and the difference be cost and market value.

This is because WalMart competes almost entirely in the intensely competitive and asset-dense market of traditional brick-and-mortar retail. This requires a lot of land, buildings, shelves and inventory. And that market is barely growing. Maybe 1-2%/year.

Compare t his with Amazon. Amazon has about $30B of assets. Yet its valuation is over $330B. So Amazon captures an extra value of $300B by competing in the asset sparse market of on-line retailing where it needs little land, few buildings, far less shelving and a lot less inventory. And it is competing in a market the Commerce Department says is growing at 15%/year.

The trend to on-line sales is extremely important, as it has entirely different customer acquisition and retention requirements, and very different ways of competing. Amazon understands those trends, and continues to lead its rivals. Today on-line retail is 10.5% of all non-restaurant, non-bar retail. And that 15% growth rate accounts for 60% of ALL the growth in this retail segment. Amazon keeps advancing, growing as fast (or faster) than the industry average, especially in key categories. Meanwhile, despite its vast resources and best efforts WalMart admitted its on-line sales growth is only 7% – half the segment growth rate – and its growth is decelerating.

By understanding this one trend – a very big, important, powerful trend – Amazon captures more value than the current value of ALL the Walmart stores, distribution centers and their contents. With all those assets WalMart can only convince investors it is worth about $200B. With about 13% of the assets used by WalMart, Amazon convinces investors it is worth 33% more than WalMart – over $330B. That’s $300B of value created just by knowing where the market is headed, and how to deliver for customers in that future market.

Yes, Amazon has other businesses, such as AWS cloud services and tech products in tablets, smartphones and smart speakers. But these too (some not nearly as successful as others, mind you) are very much on trends. WalMart once dominated retail technology with its massive computer systems and enormous databases. But WalMart limited itself to using its technology to defend & extend its core traditional retail business via store forecasts, optimized distribution and extensive pricing schemes. Amazon is monetizing its technology prowess by, again, leveraging trends and making its services and products available to others.

How does this apply to you? When someone asks “If you could have anything you want, what would you ask for?” most of us would start with health, happiness, peace and similar intangibles for us, our families and mankind. But if forced to make a tangible selection, we would ask for an asset. Buildings, equipment, cash. Yet, as WalMart and Amazon show us, those assets are only as valuable as what you do with them. And thus, it is more valuable to understand the trends, and how to use assets wisely for greatest value, than it is to own a pile of assets.

So the really important question is “Do you know what trends are going to be important to your business, and are you implementing a strategy to leverage those key trends?” If you are trying to protect your assets, you will likely be overwhelmed by the trend leader. But if you really understand the trends and are ready to act on them, you could be the one to capture the most value in your marketplace, and likely without adding a lot more costly assets.

by Adam Hartung | Mar 27, 2015 | Investing, Mobile, Software, Trends, Web/Tech

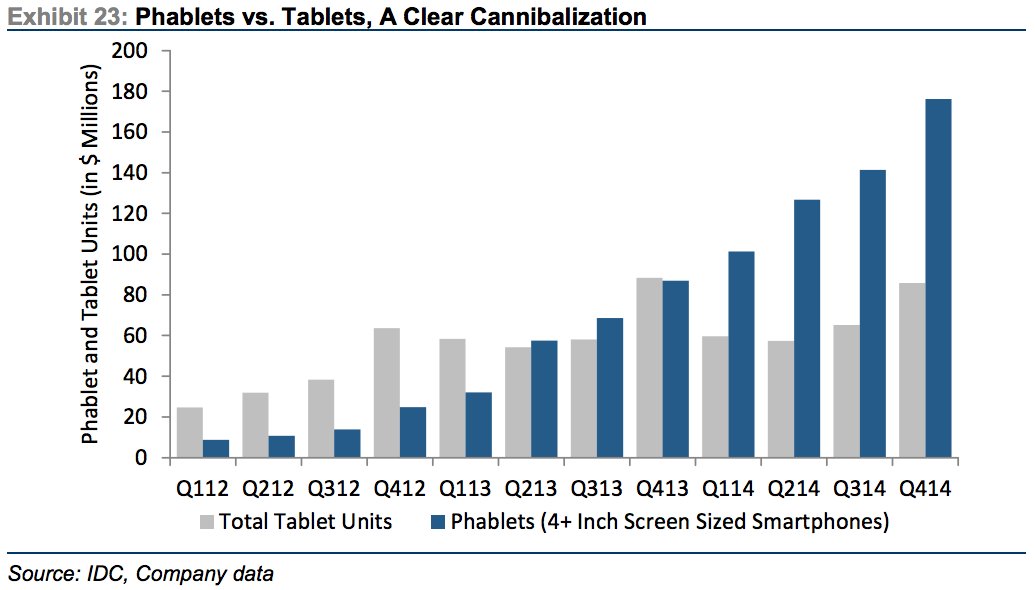

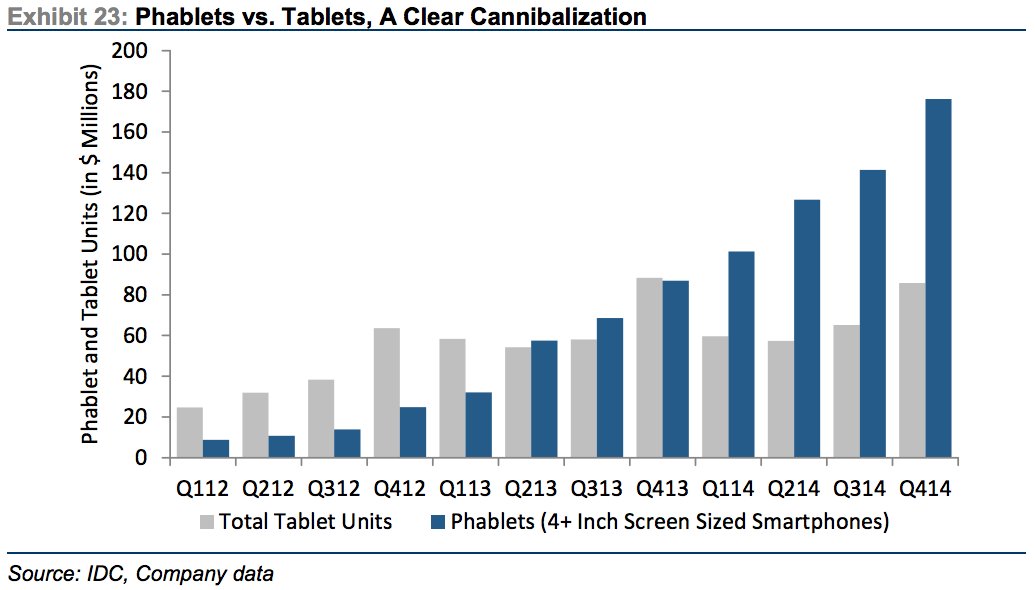

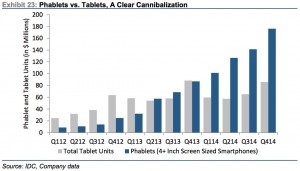

Phablets are a very hot, growing market. Phablets are those huge phones (greater than 4″ screen size) that some people carry around. From almost nothing in 2012, over the last 3 years the market has exploded:

Source: Jay Yarrow, Business Insider http://www.businessinsider.com/in-one-chart-heres-why-the-ipad-business-is-cratering-2015-3?utm_content=&utm_medium=email&utm_source=alerts&nr_email_referer=1

The original creator of this market data, Kulbinder Garcha of Credit Suisse, thinks this demonstrates cannibalization of tablet sales by phablets. And this is supposedly a bad thing for Apple.

But there is another way to look at this. By introducing and promoting a phablet (iPhone 6+ and Galaxy S6,) Apple and Samsung are growing users of mobile media and mobile apps. As the chart shows, growth in tablet sales was nothing compared to what happened when phablets came along. So people who didn’t buy a tablet, and maybe (likely?) wouldn’t, are buying phablets. The market is growing faster with phablets than had they not been introduced, and even if tablet sales shrink Apple and Samsung see revenues continue growing.

Who wins as phablet sales grow? Those who have phablet products in the market, and newer versions in the works.

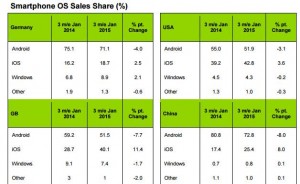

Source: Kantar WorldPanel and Seeking Alpha http://seekingalpha.com/article/3032926-microsoft-the-china-mobile-backed-lenovo-windows-10-smartphone-could-be-a-future-tailwind?ifp=0

As this chart shows, the companies who dominate smartphone sales are those who make Android-based products (#1 is Samsung) and Apple. Microsoft missed the mobile/smartphone trend, and even though it purchased Nokia it has never obtained anything close to double digit share in any market.

Unfortunately for Microsoft enthusiasts, and investors, Microsoft’s Windows10 product is focused first on laptop (PC) users, second on hybrid (products used as both a laptop and tablet), third tablets (primarily the slow-selling Microsoft Surface) and in a far, far trailing position smartphones.

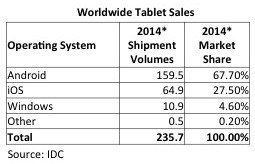

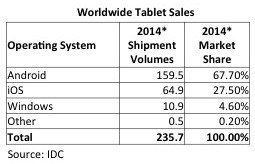

Source: IDC

As data from IDC shows, Surface sales are inconsequential. So the big loser from phablet cannibalization of tablets will be Microsoft. Given its very small user base, and the heavy losses Microsoft has taken on Surface, there is little revenue or cash flow to support an intense competitive effort in a shrinking market. Apple and Samsung will market hard to grow as many sales as possible, and likely will make the tablet products more affordable. Thus one should anticipate Microsoft’s very small tablet share would decline as tablet sales shrink.

This is the problem created when any business misses a major trend.

Microsoft missed the trend to mobile. They didn’t prepare for it in any of their major products, and they let new products, like music player Zune and Lumia phones, languish – and mostly die. By the time Microsoft reacted Apple and Samsung had enormous leads. Microsoft is still trying to play catch-up with its “core” Windows product.

But worse, because it is so far behind, Microsoft’s leaders are unable to forecast where the market will be in 3 years. Consequently they develop products for today’s market, like tablets (and their hybrid products,) which we now see will be obsolete as the market shifts to new products (like phablets.) Because Apple and Samsung already have the new products (phablets) they are prepared to cannibalize the old product sales (tablets) in order to overall grow the marketplace. But Microsoft has no phablet product, really no smartphone product, and will find itself most likely writing off more future Surface products as its tiny market share erodes to nothing.

So this trend to phablets continues to make a Microsoft comeback as a major personal technology competitor problematic. Windows 10 may be coming, but its relevance looks increasingly like that of new Blackberry models. There is little reason to care, because the products are years late and poorly positioned for leading edge customers. Further, developers will already be onto new competitive platforms long before the outdated Microsoft products make it to market. Without share you don’t capture developers, without developers you don’t have a robust app market, without apps you don’t capture customers, without customers you can’t build share — and that’s a terrible whirlpool Microsoft is captured within.

Be sure your business keeps its eyes on trends, and does not wait to react. Waiting can turn out to be deadly.

by Adam Hartung | Jan 14, 2015 | Investing, Retail, Trends

Retail sales fell .9% in December. Even excluding autos and gasoline, retail sales fell .3%. Further, November retail sales estimates were revised downward from an initial .7% gain to a meager .4%, and October sales advances were revised downward from a .5% gain to a mere .3%. Sales were down at electronic stores, clothing stores and department stores – all places we anticipated gains due to an improving economy, more jobs and more cash in consumer pockets.

Whoa, what’s happening? Wasn’t lower gasoline pricing going to free up cash for people to go crazy buying holiday gifts? Weren’t we all supposed to feel optimistic about our jobs, higher future wages and more money to spend after that horrible Great Recession thus leading us to splurge this holiday?

There were early signals that conventional wisdom was going to be wrong. Back on Black Friday (so named because it is supposedly the day when retailers turn a profit for the year) we learned sales came in a disappointing 11% lower than 2013. Barron’s analyzed press releases from Wal-Mart, and discerned that 2014 was a weaker Black Friday than 2013 and probably 2012. Simply put, fewer people went shopping on Black Friday than before, despite longer store hours, and they bought less.

So was this really a horrible holiday?

Retail store sales are only part of the picture. Increasingly, people are shopping on-line – and we all know it. According to ComScore, on-line sales made to users of PCs (this excludes mobile devices) were up 17% on Cyber Monday, in stark contrast to traditional brick-and-mortar. Exceeding $2B, it was the largest on-line retail day in history. The Day after Cyber Monday sales were up 27%, and the Green Monday (one week after Cyber Monday) sales were up 15% (all compared to year ago.) Overall, the week after Thanksgiving on-line sales rose 14%, and on Thanksgiving Day itself sales were up a whopping 32%. The week before Christmas (16th-21st) on-line sales surged 18%. According to IBM Digital Analytics the on-line November-December sales were up 13.9% vs. 2013.

The trend has never been more pronounced. Regardless of how much people are going to spend, they are spending less of it in traditional brick-and-mortar retail, and more of it on-line.

So, what about Wal-Mart? The chain remains mired in its traditional way of doing business. Even though same-store sales have been flat-to-down most of the last 2 years, and the number of full-line stores has declined in the USA, the chain remains committed quarter after quarter to defending its outdated success formula. Even in China, where Alibaba has demonstrated it can grow on-line ecommerce revenues more than 50%/year, Wal-Mart continues to try growing with a physical presence – even though it has been a tough, unsuccessful slog.

Yet, despite its bribery scandal in Mexico undertaken to prop up revenues, lawsuits due to over-worked, stressed truck drivers having accidents on double shifts killing and injuring people, and an inability to grow, Wal-Mart’s stock trades at near all-time highs. The stock has nearly doubled since 2011, even though the company is at odds with the primary retail, and demographic, trends.

On the other end of the spectrum is Amazon.com. Amazon is still growing revenues at over 20%/year. And introducing successful new publishing and internet service businesses, expanding same day delivery (and even one hour delivery) in urban markets like New York City, as well as expansion of its Prime service to include more original programming with famed director Woody Allen after winning the Golden Globe award for its original series Transparent.

However, several analysts were trash talking Amazon in 2014. 20% growth has them worried, given that the company once grew at 40%. Even though Amazon’s growth is a serious reason companies like Wal-Mart cannot grow. And there is the perennial lack of profitability – including a larger than expected loss in the second quarter ; a loss which included a $170M write-off on FirePhones which never really found a customer base. The latter item led to a Fast Company brutal lambasting of CEO Jeff Bezos as a micro-manager out-of-touch with customers.

This lack of analyst support has seriously hurt Amazon.com share performance. From 2010 to early 2014 the stock quadrupled in value from $100 to $400. But over the past year the stock has fallen back 25%. After dropping to $300/share in April, the stock has rallied but then retrenched no less than 3 times, and is now trading very close to its 52 week low. And, it shows no momentum, trading below its moving average.

Which is why investors in Wal-Mart should sell, and reinvest in Amazon.com.

All the trends point to Wal-Mart being overvalued. Its revenues show no signs of achieving any substantial growth. And, despite its sheer size, all retail trends are working against the behemoth. It has been trying to find a growth engine for 10 years, but nothing has come to fruition – including big investments in offshore markets. The company keeps trying to defend & extend its old success formula, thus creating a bigger and bigger gap between itself and future market success.

Simultaneously, Amazon.com continues to invest in major developing trends. From publishing to television programming to cloud/web services and even general retail, everything into which Amazon invests is growing. And even though this is a company with $100B in revenues, it is still growing at a remarkable 20%. While some analysts may wish the investment rate would slow, and that Amazon would never make mistakes (like Firephone,) the truth is that Amazon is putting money into projects which have pretty good odds of making sizable money as it helps change the game in multiple markets.

Think of investing like paddling a canoe. When you are investing against trends, it’s like paddling up the river. You can make progress, but it is hard. And, one little mistake and you easily slip backward. Lose any momentum at all and you could completely turn around and disappear (like happened to Circuit City, and now both Sears and JCPenney.) When you invest with the trends it is like paddling down the river. The trend, like a current, keeps you moving in the right direction. You can still make mistakes, but the odds are quite a lot higher you will make your destination easily, and with resources to spare. That’s why the sales results for December are important. The show traditional retailers are paddling up river, while on-line retailers are paddling down-river.

I don’t know if Wal-Mart’s stock value has peaked, but it is hard to understand why anybody would expect it to go higher. It could continue to rise, but there are ample reasons to expect investors will figure out how tough future profits will be for Wal-Mart and dispose of their positions. On the other hand, even though Amazon.com could continue to slide down further there are even more reasons to expect it will have great future quarters with revenue gains and – eventually – those long-sought-after profits that some analysts seek. Meanwhile, Amazon is investing in projects with internal rates of return far higher than most other companies because they are following major trends. Odds are pretty good that in a few years the trends will make investors happy they own Amazon, and dropped out of Wal-Mart.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.