by Adam Hartung | Sep 23, 2016 | Disruptions, In the Rapids, Innovation, Leadership, Television, Web/Tech

In early August Tesla announced it would be buying SolarCity. The New York Times discussed how this combination would help CEO Elon Musk move toward his aspirations for greater clean energy use. But the Los Angeles Times took the companies to task for merging in the face of tremendous capital needs at both, while Tesla was far short of hitting its goals for auto and battery production.

Since then the press has been almost wholly negative on the merger. Marketwatch’s Barry Randall wrote that the deal makes no sense. He argues the companies are in two very different businesses that are not synergistic – and he analogizes this deal to GM buying Chevron. He also makes the case that SolarCity will likely go bankrupt, so there is no good reason for Tesla shareholders to “bail out” the company. And he argues that the capital requirements of the combined entities are unlikely to be fundable, even for its visionary CEO.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

But short-sellers are clearly not long-term investors. And there is a lot more ability for this deal to succeed and produce tremendous investor returns than anyone could ever glean from studying historical financial statements of both companies.

GM buying Chevron is entirely the wrong analogy to compare with Tesla buying SolarCity. Instead, compare this deal to what happened in the creation of television after General Sarnoff, who ran RCA, bought what he renamed NBC.

The world already had radio (just as we already have combustion powered cars.) The conundrum was that nobody needed a TV, especially when there were no TV programs. But nobody would create TV programs if there were no consumers with TVs. General Sarnoff realized that both had to happen simultaneously – the creation of both demand, and supply. It would only be by the creation, and promotion, of both that television could be a success. And it was General Sarnoff who used this experience to launch the first color televisions at the same time as NBC launched the first color programming – which fairly quickly pushed the industry into color.

Skeptics think Mr. Musk and his companies are in over their heads, because there are manufacturing issues for the batteries and the cars, and the solar panel business has yet to be profitable. Yet, the older among us can recall all the troubles with launching TV.

Early sets were not only expensive, they were often problematic, with frequent component failures causing owners to take the TV to a repairman. Often reception was poor, as people relied on poor antennas and weak network signals. It was common to turn on a set and have “snow” as we called it – images that were far from clear. And there was often that still image on the screen with the words “Technical Difficulties,” meaning that viewers just waited to see when programming would return. And programming was far from 24×7 – and quality could be sketchy. But all these problems have been overcome by innovation across the industry.

Yes, the evolution of electric cars will involve a lot of ongoing innovation. So judging its likely success on the basis of recent history would be foolhardy. Today Tesla sells 100% of its cars, with no discounts. The market has said it really, really wants its vehicles. And everybody who is offered electric panels with (a) the opportunity to sell excess power back to the grid and (b) financing, takes the offer. People enjoy the low cost, sustainable electricity, and want it to grow. But lacking a good storage device, or the inability to sell excess power, their personal economics are more difficult.

Electricity production, electricity storage (batteries) and electricity consumption are tightly linked technologies. Nobody will build charging stations if there are no electric cars. Nobody will build electric cars if there are not good batteries. Nobody will make better batteries if there are no electric cars. Nobody will install solar panels if they can’t use all the electricity, or store what they don’t immediately need (or sell it.)

This is not a world of an established marketplace, where GM and Chevron can stand alone. To grow the business requires a vision, business strategy and technical capability to put it all together. To make this work someone has to make progress in all the core technologies simultaneously – which will continue to improve the storage capability, quality and safety of the electric consuming automobiles, and the electric generating solar panels, as well as the storage capabilities associated with those panels and the creation of a new grid for distribution.

This is why Mr. Musk says that combining Tesla and SolarCity is obvious. Yes, he will have to raise huge sums of money. So did such early pioneers as Vanderbilt (railways,) Rockefeller (oil,) Ford (autos,) and Watson (computers.) More recently, Steve Jobs of Apple became heroic for figuring out how to simultaneously create an iPhone, get a network to support the phone (his much maligned exclusive deal with AT&T,) getting developers to write enough apps for the phone to make it valuable, and creating the retail store to distribute those apps (iTunes.) Without all those pieces, the ubiquitous iPhone would have been as successful as the Microsoft Zune.

It is fair for investors to worry if Tesla can raise enough money to pull this off. But, we don’t know how creative Mr. Musk may become in organizing the resources and identifying investors. So far, Tesla has beaten all the skeptics who predicted failure based on price of the cars (Tesla has sold 100% of its production,) lack of range (now up to nearly 300 miles,) lack of charging network (Tesla built one itself) and charging time (now only 20 minutes.) It would be shortsighted to think that the creativity which has made Tesla a success so far will suddenly disappear. And thus remarkably thoughtless to base an analysis on the industry as it exists today, rather than how it might well look in 3, 5 and 10 years.

The combination of Tesla and SolarCity allows Tesla to have all the components to pursue greater future success. Investors with sufficient risk appetite are justified in supporting this merger because they will be positioned to receive the future rewards of this pioneering change in the auto and electric utility industries.

by Adam Hartung | Jul 15, 2016 | Defend & Extend, Entertainment, Games, Innovation, Lock-in, Mobile, Trends

Poke’Mon Go is a new sensation. Just launched on July 6, the app is already the #1 app in the world – and it isn’t even available in most countries. In less than 2 weeks, from a standing start, Nintendo’s new app is more popular than both Facebook and Snapchat. Based on this success, Nintendo’s equity valuation has jumped 90% in this same short time period.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

A bit of history

Nintendo launched the Wii in 2006 and it was a sensation. Gamers could do things not previously possible. Unit sales exceeded 20m units/year for 2006 through 2009. But Sony (PS4) and Microsoft (Xbox) both powered up their game consoles and started taking share from Nintendo. By 2011 Nintendo sale were down to 11.6m units, and in 2012 sales were off another 50%. The Wii console was losing relevance as competitors thrived.

Sony and Microsoft both invested heavily in their competition. Even though both were unprofitable at the business, neither was ready to concede the market. In fall, 2014 Microsoft raised the competitive ante, spending $2.5B to buy the maker of popular game Minecraft. Nintendo was becoming a market afterthought.

Meanwhile, back in 2009 Nintendo had 70% of the handheld gaming market with its 3DS product. But people started carrying the more versatile smartphones that could talk, text, email, execute endless apps and even had a lot of games – like Tetrus. The market for handheld games pretty much disappeared, dealing Nintendo another blow.

Competitor strategic errors

Fortunately, the bitter “fight to the death” war between Sony and Microsoft kept both focused on their historical game console business. Both kept investing in making the consoles more powerful, with more features, supporting more intense, lifelike games. Microsoft went so far as to implement in Windows 10 the capability for games to be played on Xbox and PCs, even though the PC gaming market had not grown in years. These massive investments were intended to defend their installed base of users, and extend the platform to attract new growth to the traditional, nearly 4 decade old market of game consoles that extends all the way back to Atari.

Both companies did little to address the growing market for mobile gaming. The limited power of mobile devices, and the small screens and poor sound systems made mobile seem like a poor platform for “serious gaming.” While game apps did come out, these were seen as extremely limited and poor quality, not at all competitive to the Sony or Microsoft products. Yes, theoretically Windows 10 would make gaming possible on a Microsoft phone. But the company was not putting investment there. Mobile gaming was simply not serious, and not of interest to the two Goliaths slugging it out for market share.

Building on trends makes all the difference

Back in 2014 I recognized that the console gladiator war was not good for either big company, and recommended Microsoft exit the market. Possibly seeing if Nintendo would take the business in order to remove the cash drain and distraction from Microsoft. Fortunately for Nintendo, that did not happen.

Nintendo observed the ongoing growth in mobile gaming. While Candy Crush may have been a game ignored by serious gamers, it nonetheless developed a big market of users who loved the product. Clearly this demonstrated there was an under-served market for mobile gaming. The mobile trend was real, and it’s gaming needs were unmet.

Simultaneously Nintendo recognized the trend to social. People wanted to play games with other people. And, if possible, the game could bring people together. Even people who don’t know each other. Rather than playing with unseen people located anywhere on the globe, in a pre-organized competition, as console games provided, why not combine the social media elements of connecting with those around you to play a game? Make it both mobile, and social. And the basics of Poke’Mon Go were born.

Then, build out the financial model. Don’t charge to play the game. But once people are in the game charge for in-game elements to help them be more successful. Just as Facebook did in its wildly successful social media game Farmville. The more people enjoyed meeting other people through the game, and the more they played, the more they would buy in-app, or in-game, elements. The social media aspect would keep them wanting to stay connected, and the game is the tool for remaining connected. So you use mobile to connect with vastly more people and draw them together, then social to keep them playing – and spending money.

The underserved market is vastly larger than the over-served market

Nintendo recognized that the under-served mobile gaming market is vastly larger than the overserved console market. Those console gamers have ever more powerful machines, but they are in some ways over-served by all that power. Games do so much that many people simply don’t want to take the time to learn the games, or invest in playing them sitting in a home or office. For many people who never became serious gaming hobbyists, the learning and intensity of serious gaming simply left them with little interest.

But almost everyone has a mobile phone. And almost everyone does some form of social media. And almost everyone enjoys a good game. Give them the right game, built on trends, to catch their attention and the number of potential customers is – literally – in the billions. And all they have to do is download the app. No expensive up-front cost, not much learning, and lots of fun. And thus in two weeks you have millions of new users. Some are traditional gamers. But many are people who would never be a serious gamer – they don’t want a new console or new complicated game. People of all ages and backgrounds could become immediate customers.

David can beat Goliath if you use trends

In the Biblical story, smallish David beat the giant Goliath by using a sling. His new technology allowed him to compete from far enough away that Goliath couldn’t reach David. And David’s tool allowed for delivering a fatal blow without ever touching the giant. The trend toward using tools for hunting and fighting allowed the younger, smaller competitor to beat the incumbent giant.

In business trends are just as important. Any competitor can study trends, see what people want, and then expand their thinking to discover a new way to compete. Nintendo lost the console war, and there was little value in spending vast sums to compete with Sony and Microsoft toe-to-toe. Nintendo saw the mobile game market disintegrate as smartphones emerged. It could have become a footnote in history.

But, instead Nintendo’s leaders built on trends to deliver a product that filled an unmet need – a game that was mobile and social. By meeting that need Nintendo has avoided direct competition, and found a way to dramatically grow its revenues. This is a story about how any competitor can succeed, if they learn how to leverage trends to bring out new products for under-served customers, and avoid costly gladiator competition trying to defend and extend past products.

by Adam Hartung | Jun 14, 2016 | Defend & Extend, Investing, Leadership, Web/Tech

Microsoft is buying Linked-In, and we should expect this to be a disaster.

It is clear why Linked-in agreed to be purchased. As revenues have grown, gross margins have dropped precipitously, and the company is losing money. And LInked-in still receives 2/3 of its revenue from recruiting ads (the balance is almost wholly subscription fees,) unable to find a wider advertiser base to support growth. Although membership is rising, monthly active users (MAUs, the most important gauge of social media growth) is only 9% – like Twitter, far below the 40% plus rate of Facebook and upcoming networks. With only 106M MAUs, Linked in is 1/3 the size of Twitter, and 1/15th the size of Facebook. And its $1.5B Lynda acquisition is far, far, far from recovering its investment – or even demonstrating viability as a business.

Even though the price is below the all-time highs for LNKD investors, Microsoft’s offer is far above recent trading prices and a big windfall for them.

But for Microsoft investors, this is a repeat of the pattern that continues to whittle away at their equity value.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

But the world changed. Today PC sales continue their multi-year, accelerating decline, while some markets (such as education) are shifting to Chromebooks for low cost desktop/laptop computing, growing their sales and share. Meanwhile, mobile devices have been the growth market for years. Networks are largely public (rather than private) and storage is primarily in the cloud – and supplied by Amazon. Solutions are spread all around, from Google Drive to apps of every flavor and variety. People spend less computing cycles creating documents, spreadsheets and presentations, and a lot more cycles either searching the web or on Facebook, Instagram, WhatsApp, YouTube and Snapchat.

But Microsoft’s leadership still would like to capture that old world. They still hope to put the genie back in the bottle, and have everyone live and work entirely on Microsoft. And somehow they have deluded themselves into thinking that buying Linked-in will allow them to return to the “good old days.”

Microsoft has not done a good job of integrating its own solutions like Office 365, Skype, Sharepoint and Dynamics into a coherent, easy to use, and to some extent mobile, solution. Yet, somehow, investors are expected to believe that after buying Linked-in the two companies will integrate these solutions into the LInked-in social platform, enabling vastly greater adoption/use of Office 365 and Dynamics as they are tied to Linked-in Sales Navigator. Users will be thrilled to have their personal information analyzed by Microsoft big data tools, then sold to advertisers and recruiters. Meanwhile, corporations will come back to Microsoft in droves as they convert Linked-in into a comprehensive project management tool that uses Lynda to educate employees, and 365 to push materials to employees – and allow document collaboration – all across their mobile devices.

Do you really believe this? It might run on the Powerpoint operating system, but this vision will take an enormous amount of code integration. And with Linked-in operated as separate company within Microsoft, who is going to do this integration? This will involve a lot of technical capability, and based on previous performance it appears both companies lack the skills necessary to pull it off. How this mysterious, magical integration will happen is far, far from obvious, or explained in the announcement documents. Sounds a lot more like vaporware than a straightforward software project.

And who thinks that today’s users, from individuals to corporations, have a need for this vision? While it may sound good to Microsoft, have you heard Linked-in users saying they want to use 365 on Linked in? Or that they’ll continue to use Linked-in if forced to buy 365? Or that they want their personal information data mined for advertisers? Or that they desire integration with Dynamics to perform Linked-in based CRM? Or that they see a need for a social-network based project management tool that feeds up training documents or collaborative documents? Are people asking for an integrated, holistic solution from one vendor to replace their current mobile devices and mobile solutions that are upgraded by multiple vendors almost weekly?

And, who really thinks Microsoft is good at acquisition integration? Remember aQuantive? In 2007 Microsoft spent $6B (an 85% premium to market price) to purchase this digital ad agency in order to build its business in the fast growing digital ad space. Don’t feel bad if you don’t remember, because in 2012 Microsoft wrote it off. Of course, there was the buy-it-and-write-it-off pattern repeated with Nokia. Microsoft’s success at taking “bold moves” to expand beyond its core business has been nothing less than horrible. Even the $1.2B acquisition of Yammer in 2012 to make Sharepoint more collaborative and usable has been unsuccessful, even though rolled out for free to 365 users. Yammer is adding nothing to Microsoft’s sales or value as competitor Slack has reaped the growth in corporate messaging.

The only good news story about Microsoft acquisitions is that they missed spending $44B to buy Yahoo – which is now on the market for $5B. Whew, thank goodness that one got away!

Microsoft’s leadership primed the pump for this week’s announcement by having the Chairman talk about investing outside of the company’s core a couple of weeks ago. But the vast majority of analysts are now questioning this giant bet, at a price so high it will lower Microsoft’s earnings for 2 years. Analysts are projecting about a $2B revenue drop for $90B Microsoft next year, and this $26B acquisition will deliver only a $3B bump. Very, very expensive revenue replacement.

Despite all the lingo, Microsoft simply cannot seem to escape its past. Its acquisitions have all been designed to defend and extend its once great history – but now outdated. Customers don’t want the past, they are looking to the future. And no matter how hard they try, Microsoft’s leaders simply appear unable to define a future that is not tightly linked to the company’s past. So investors should expect Linked-In’s future to look a lot like aQuantive. Only this one is going to be the most painful yet in the long list of value transfer from Microsoft investors to the investors of acquired companies.

by Adam Hartung | May 10, 2016 | Defend & Extend, In the Swamp, Leadership, Lifecycle, Web/Tech

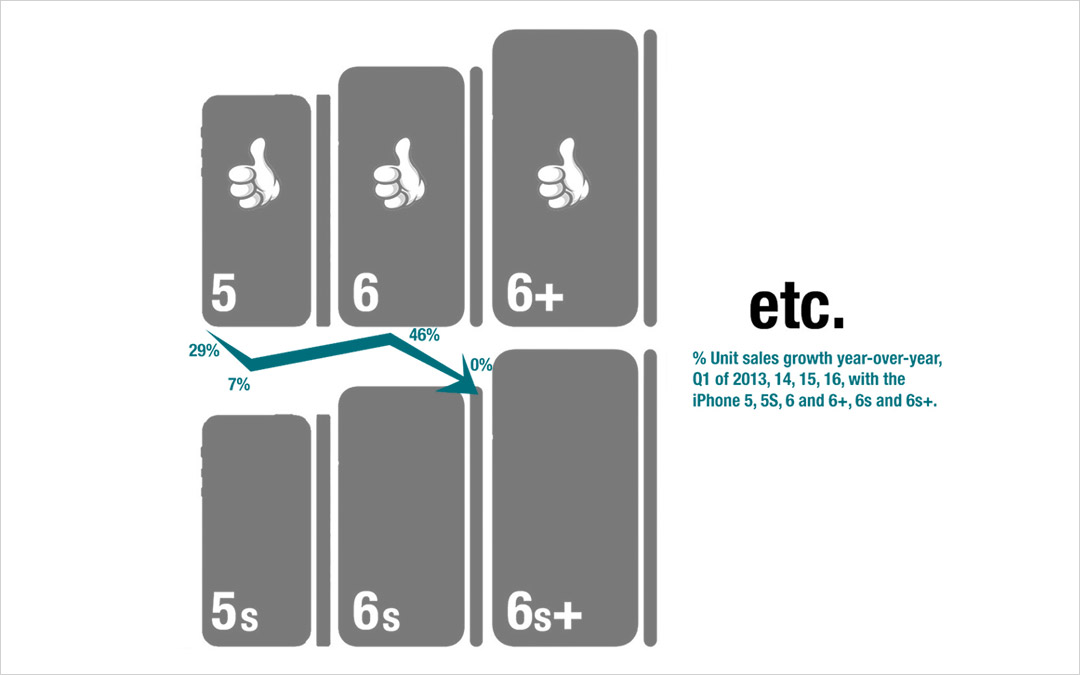

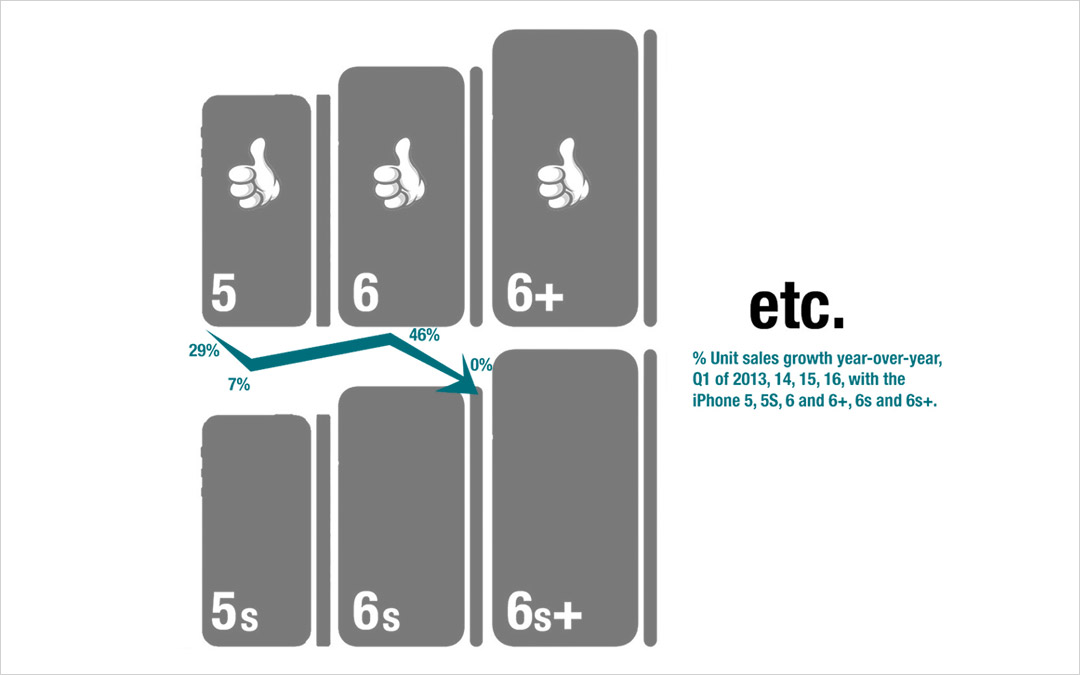

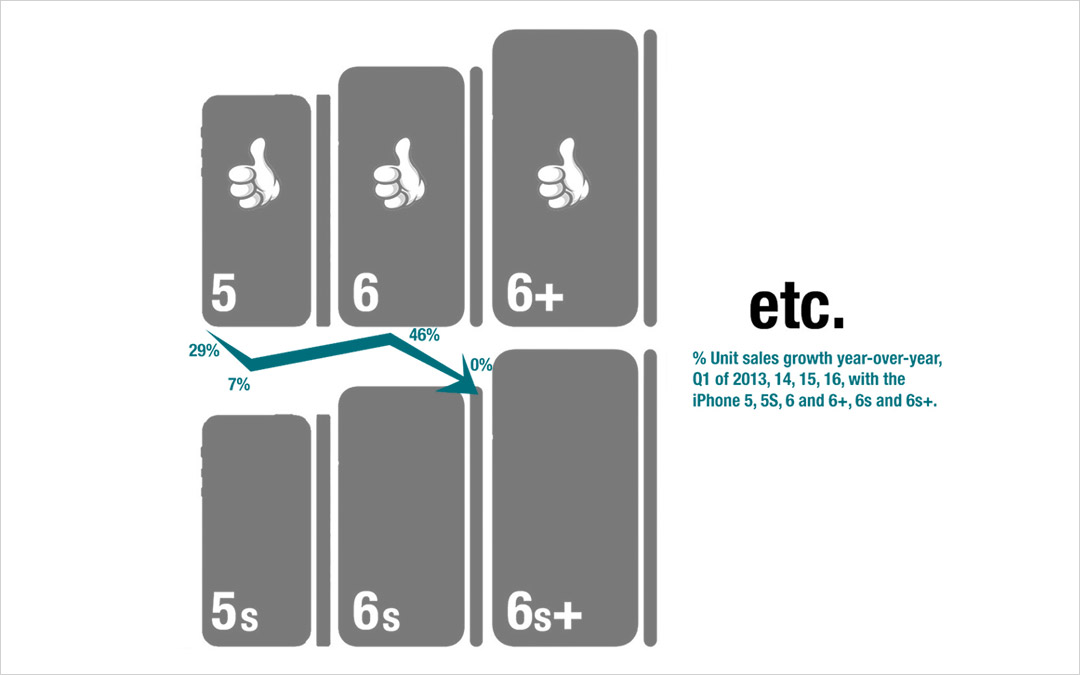

My last column focused on growth, and the risks inherent in a Growth stall. As I mentioned then, Apple will enter a Growth Stall if its revenue declines year-over-year in the current quarter. This forecasts Apple has only a 7% probability of consistently growing just 2%/year in the future.

This usually happens when a company falls into Defend & Extend (D&E) management. D&E management is when the bulk of management attention, and resources, flow into protecting the “core” business by seeking ways to use sustaining innovations (rather than disruptive innovations) to defend current customers and extend into new markets. Unfortunately, this rarely leads to high growth rates, and more often leads to compressed margins as growth stalls. Instead of working on breakout performance products, efforts are focused on ways to make new versions of old products that are marginally better, faster or cheaper.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

For example, Apple’s CEO has trumpeted the company’s installed base of 1B iPhones, and stated they will be a future money maker. He bragged about the 20% growth in “services,” which are iPhone users taking advantage of Apple Music, iCloud storage, Apps and iTunes. This shows management’s desire to extend sales to its “installed base” with sustaining software innovations. Unfortunately, this 20% growth was a whopping $1.2B last quarter, which was 2.4% of revenues. Not nearly enough to make up for the decline in “core” iPhone, iPad or Mac sales of approximately $9.5B.

Apple has also been talking a lot about selling in China and India. Unfortunately, plans for selling in India were at least delayed, if not thwarted, by a decision on the part of India’s regulators to not allow Apple to sell low cost refurbished iPhones in the country. Fearing this was a cheap way to dispose of e-waste they are pushing Apple to develop a low-cost new iPhone for their market. Either tactic, selling the refurbished products or creating a cheaper version, are efforts at extending the “core” product sales at lower margins, in an effort to defend the historical iPhone business. Neither creates a superior product with new features, functions or benefits – but rather sustains traditional product sales.

Of even greater note was last week’s announcement that Apple inked a partnership with SAP to develop uses for iPhones and iPads built on the SAP ERP (Enterprise Resource Planning) platform. This announcement revealed that SAP would ask developers on its platform to program in Swift in order to support iOS devices, rather than having a PC-first mentality.

This announcement builds on last year’s similar announcement with IBM. Now 2 very large enterprise players are building applications on iOS devices. This extends the iPhone, a product long thought of as great for consumers, deeply into enterprise sales. A market long dominated by Microsoft. With these partnerships Apple is growing its developer community, while circumventing Microsoft’s long-held domain, promoting sales to companies as well as individuals.

And Apple has shown a willingness to help grow this market by introducing the iPhone 6se which is smaller and cheaper in order to obtain more traction with corporate buyers and corporate employees who have been iPhone resistant. This is a classic market extension intended to sustain sales with more applications while making no significant improvements in the “core” product itself.

And Apple’s CEO has said he intends to make more acquisitions – which will surely be done to shore up weaknesses in existing products and extend into new markets. Although Apple has over $200M of cash it can use for acquisitions, unfortunately this tactic can be a very difficult way to actually find new growth. Each would be targeted at some sort of market extension, but like Beats the impact can be hard to find.

Remember, after all revenue gains and losses were summed, Apple’s revenue fell $7.6B last quarter. Let’s look at some favorite analyst acquisition targets to explain:

- Box could be a great acquisition to help bring more enterprise developers to Apple. Box is widely used by enterprises today, and would help grow where iCloud is weak. IBM has already partnered with Box, and is working on applications in areas like financial services. Box is valued at $1.45B, so easily affordable. But it also has only $300M of annual revenue. Clearly Apple would have to unleash an enormous development program to have Box make any meaningful impact in a company with over $500B of revenue. Something akin of Instagram’s growth for Facebook would be required. But where Instagram made Facebook a pic (versus words) site, it is unclear what major change Box would bring to Apple’s product lines.

- Fitbit is considered a good buy in order to put some glamour and growth onto iWatch. Of course, iWatch already had first year sales that exceeded iPhone sales in its first year. But Apple is now so big that all numbers have to be much bigger in order to make any difference. With a valuation of $3.7B Apple could easily afford FitBit. But FitBit has only $1.9B revenue. Given that they are different technologies, it is unclear how FitBit drives iWatch growth in any meaningful way – even if Apple converted 100% of Fitbit users to the iWatch. There would need to be a “killer app” in development at FitBit that would drive $10B-$20B additional annual revenue very quickly for it to have any meaningful impact on Apple.

- GoPro is seen as a way to kick up Apple’s photography capabilities in order to make the iPhone more valuable – or perhaps developing product extensions to drive greater revenue. At a $1.45B valuation, again easily affordable. But with only $1.6B revenue there’s just not much oomph to the Apple top line. Even maximum Apple Store distribution would probably not make an enormous impact. It would take finding some new markets in industry (enterprise) to build on things like IoT to make this a growth engine – but nobody has said GoPro or Apple have any innovations in that direction. And when Amazon tried to build on fancy photography capability with its FirePhone the product was a flop.

- Tesla is seen as the savior for the Apple Car – even though nobody really knows what the latter is supposed to be. Never mind the actual business proposition, some just think Elon Musk is the perfect replacement for the late Steve Jobs. After all the excitement for its products, Tesla is valued at only $28.4B, so again easily affordable by Apple. And the thinking is that Apple would have plenty of cash to invest in much faster growth — although Apple doesn’t invest in manufacturing and has been the king of outsourcing when it comes to actually making its products. But unfortunately, Tesla has only $4B revenue – so even a rapid doubling of Tesla shipments would yield a mere 1.6% increase in Apple’s revenues.

- In a spree, Apple could buy all 4 companies! Current market value is $35B, so even including a market premium $55B-$60B should bring in the lot. There would still be plenty of cash in the bank for growth. But, realize this would add only $8B of annual revenue to the current run rate – barely 25% of what was needed to cover the gap last quarter – and less than 2% incremental growth to the new lower run rate (that magic growth percentage to pull out of a Growth Stall mentioned earlier in this column.)

Such acquisitions would also be problematic because all have P/E (price/earnings) ratios far higher than Apple’s 10.4. FitBit is 24, GoPro is 43, and both Box and Tesla are infinite because they lose money. So all would have a negative impact on earnings per share, which theoretically should lower Apple’s P/E even more.

Acquisitions get the blood pumping for investment bankers and media folks alike – but, truthfully, it is very hard to see an acquisition path that solves Apple’s revenue problem.

All of Apple’s efforts big efforts today are around sustaining innovations to defend & extend current products. No longer do we hear about gee whiz innovations, nor do we hear about growth in market changing products like iBeacons or ApplePay. Today’s discussions are how to rejuvenate sales of products that are several versions old. This may work. Sales may recover via growth in India, or a big pick-up in enterprise as people leave their PCs behind. It could happen, and Apple could avoid its Growth Stall.

But investors have the right to be concerned. Apple can grow by defending and extending the iPhone market only so long. This strategy will certainly affect future margins as prices, on average, decline. In short, investors need to know what will be Apple’s next “big thing,” and when it is likely to emerge. It will take something quite significant for Apple to maintain it’s revenue, and profit, growth.

The good news is that Apple does sell for a lowly P/E of 10 today. That is incredibly low for a company as profitable as Apple, with such a large installed base and so many market extensions – even if its growth has stalled. Even if Apple is caught in the Innovator’s Dilemma (i.e. Clayton Christensen) and shifting its strategy to defending and extending, it is very lowly valued. So the stock could continue to perform well. It just may never reach the P/E of 15 or 20 that is common for its industry peers, and investors envisioned 2 or 3 years ago. Unless there is some new, disruptive innovation in the pipeline not yet revealed to investors.

by Adam Hartung | Apr 15, 2016 | Defend & Extend, In the Whirlpool, Lifecycle, Web/Tech

Leading tech tracking companies IDC and Gartner both announced Q1, 2016 PC sales results, and they were horrible. Sales were down 9.5%-11.5% depending on which tracker you asked. And that’s after a horrible Q4, 2015 when sales were off more than 10%. PC sales have now declined for 6 straight quarters, and sales are roughly where they were in 2007, 9 years ago.

Oh yeah, that was when the iPhone launched – June, 2007. And just a couple of years before the iPad launched. Correlation, or causation?

Amazingly, when Q4 ended the forecasters were still optimistic of a stabilization and turnaround in PC sales. Typical analyst verbage was like this from IDC, “Commercial adoption of Windows 10 is expected to accelerate, and consumer buying should also stabilize by the second half of the year. Most PC users have delayed an upgrade, but can only maintain this for so long before facing security and performance issues.” And just to prove that hope springs eternal from the analyst breast, here is IDC’s forecast for 2016 after the horrible Q1, “In the short term, the PC market must still grapple with limited consumer interest and competition from other infrastructure upgrades in the commercial market. Nevertheless….things should start picking up in terms of Windows 10 pilots turning into actual PC purchases.”

Fascinating. Once again, the upturn is just around the corner. People have always looked forward to upgrading their PCs, there has always been a “PC upgrade cycle” and one will again emerge. Someday. At least, the analysts hope so. Maybe?

Microsoft investors must hope so. The company is selling at a price/earnings multiple of 40 on hopes that Windows 10 sales will soon boom, and re-energize PC growth. Surely. Hopefully. Maybe?

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was so little interest that its launch barely made any news at all. This market, these products, are really no longer relevant to the growth of personal technology.

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was so little interest that its launch barely made any news at all. This market, these products, are really no longer relevant to the growth of personal technology.

Back when I predicted that Windows 8 would be a flop I was inundated with hate mail. It was clear that Ballmer was a terrible CEO, and would soon be replaced by the board. Same when I predicted that Surface tablets would not sell well, and that all Windows devices would not achieve significant share. People called me “an Apple Fanboy” or a “Microsoft hater.” Actually, neither was true. It was just clear that a major market shift was happening in computing. The world was rapidly going mobile, and cloud-based, and the PC just wasn’t going to be relevant. As the PC lost relevancy, so too would Microsoft because it completely missed the market, and its entries were far too tied to old ways of thinking about personal and corporate computing – not to mention the big lead competitors had in devices, apps and cloud services.

I’ve never said that modern PCs are bad products. I have a son half way through a PhD in Neurobiological Engineering. He builds all kinds of brain models and 3 dimensional brain images and cell structure plots — and he does all kinds of very exotic math. His world is built on incredibly powerful, fast PCs. He loves Windows 10, and he loves PCs — and he really “doesn’t get” tablets. And I truly understand why. His work requires local computational power and storage, and he loves Windows 10 over all other platforms.

But he is not a trend. His deep understanding of the benefits of Windows 10, and some of the PC manufacturers as well as those who sell upgrade componentry, is very much a niche. While he depends heavily on Microsoft and Wintel manufacturers to do his work, he is a niche user. (BTW he uses a Nexus phone and absolutely loves it, as well. And he can wax eloquently about the advantages he achieves by using an Android device.)

Today, I doubt I will receive hardly any comments to this column. Because to most people, the PC is nearly irrelevant. People don’t actually care about PC sales results, or forecasts. Not nearly as much as, say, care about whether or not the iPhone 6se advances the mobile phone market in a meaningful way.

Most people do their work, almost if not all their work, on a mobile device. They depend on cloud and SaaS (software-as-a-service) providers and get a lot done on apps. What they can’t do on a phone, they do on a tablet, by and large. They may, or may not, use a PC of some kind (Mac included in that reference) but it is not terribly important to them. PCs are now truly generic, like a refrigerator, and if they need one they don’t much care who made it or anything else – they just want it to do whatever task they have yet to migrate to their mobile world.

The amazing thing is not that PC sales have fallen for 6 quarters. That was easy to predict back in 2013. The amazing thing is that some people still don’t want to accept that this trend will never reverse. And many people, even though they haven’t carried around a laptop for months (years?) and don’t use a Windows mobile device, still think Microsoft is a market leader, and has a great future. PCs, and for the most part Microsoft, are simply no more relevant than Sears, Blackberry, or the Encyclopedia Britannica. Yet it is somewhat startling that some people have failed to think about the impact this has on their company, companies that make PC software and hardware – and the impact this will have on their lives – and likely their portfolios.

by Adam Hartung | Apr 5, 2016 | Disruptions, In the Rapids, Leadership, Web/Tech

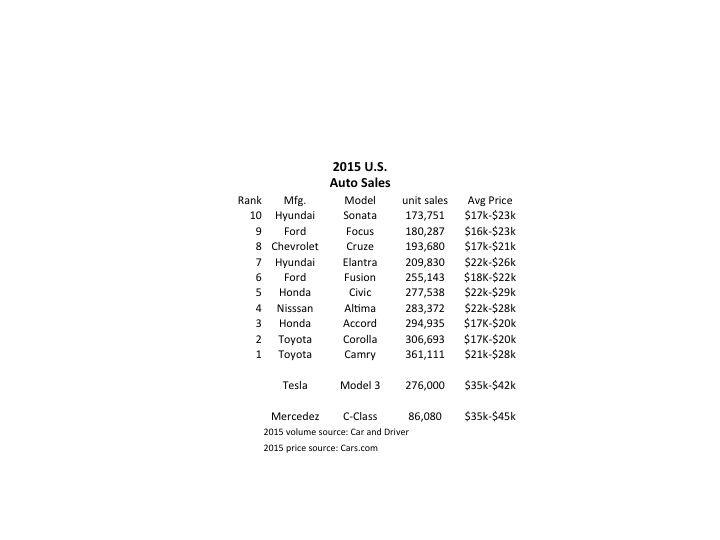

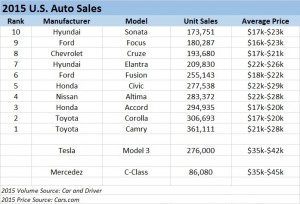

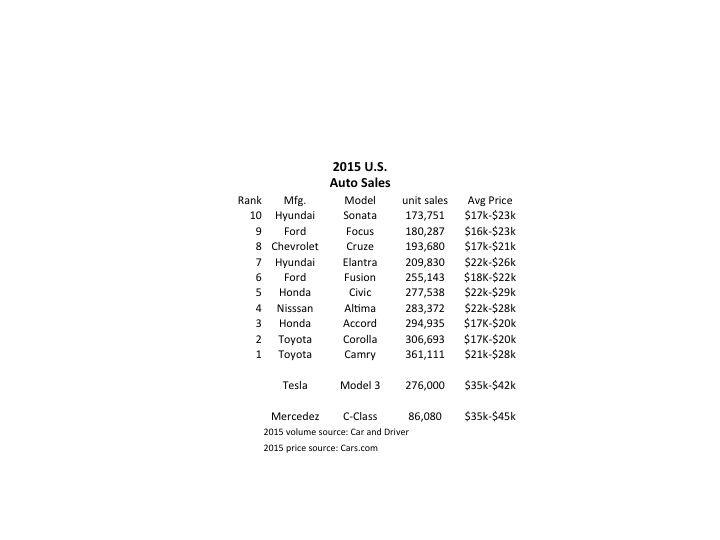

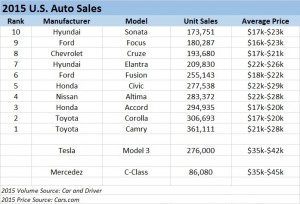

Tesla started taking orders for the Model 3 last week, and the results were remarkable. In 24 hours the company took $1,000 deposits for 198,000 vehicles. By end of Saturday the $1,000 deposits topped 276,000 units. And for a car not expected to be available in any sort of volume until 2017. Compare that with the top selling autos in the U.S. in 2015:

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Even more astonishing is the average selling price. Note that top 10 cars are not highly priced, mostly in the $17,000 to $25,000 price range. But the Tesla is base priced at $35,000, and expected with options to sell closer to $42,000. That is almost twice as expensive as the typical top 10 selling auto in the U.S.

Tesla has historically been selling much more expensive cars, the Model S being its big seller in 2015. So if we classify Tesla as a “luxury” brand and compare it to like-priced Mercedes Benz C-Class autos we see the volumes are, again, remarkable. In under 1 week the Model 3 took orders for 3 times the volume of all C-Class vehicles sold in the U.S. in 2015.

[Car and Driver top 10 cars; Mercedes Benz 2015 unit sales; Tesla 2015 unit sales; Model 3 pricing]

Although this has surprised a large number of people, the signs were all pointing to something extraordinary happening. The Tesla Model S sold 50,000 vehicles in 2015 at an average price of $70,000 to $80,000. That is the same number of the Mercedes E-Class autos, which are priced much lower in the $50,000 range. And if you compare to the top line Mercedes S-Class, which is only slightly more expensive at an average $90,0000, the Model S sold over 2 times the 22,000 units Mercedes sold. And while other manufacturers are happy with single digit percentage volume growth, in Q4 Tesla shipments were 75% greater in 2015 than 2014.

In other words, people like this brand, like these cars and are buying them in unprecedented numbers. They are willing to plunk down deposits months, possibly years, in advance of delivery. And they are paying the highest prices ever for cars sold in these volumes. And demand clearly outstrips supply.

Yet, Tesla is not without detractors. From the beginning some analysts have said that high prices would relegate the brand to a small niche of customers. But by outselling all other manufacturers in its price point, Tesla has demonstrated its cars are clearly not a niche market. Likewise many analysts argued that electric cars were dependent on high gasoline prices so that “economic buyers” could justify higher prices. Yet, as gasoline prices have declined to prices not seen for nearly a decade Tesla sales keep going up. Clearly Tesla demand is based on more than just economic analysis of petroleum prices.

People really like, and want, Tesla cars. Even if the prices are higher, and if gasoline prices are low.

Emerging is a new group of detractors. They point to the volume of cars produced in 2015, and first quarter output of just under 15,000 vehicles, then note that Tesla has not “scaled up” manufacturing at anywhere near the necessary rate to keep customers happy. Meanwhile, constructing the “gigafactory” in Nevada to build batteries has slowed and won’t meet earlier expectations for 2016 construction and jobs. Even at 20,000 cars/quarter, current demand for Model S and Model 3 They project lots of order cancellations would take 4.5 years to fulfill.

Which leads us to the beauty of sales growth. When products tap an under- or unfilled need they frequently far outsell projections. Think about the iPod, iPhone and iPad. There is naturally concern about scaling up production. Will the money be there? Can the capacity come online fast enough?

Of course, of all the problems in business this is one every leader should want. It is certainly a lot more fun to worry about selling too much rather than selling too little. Especially when you are commanding a significant price premium for your product, and thus can be sure that demand is not an artificial, price-induced variance.

With rare exceptions, investors understand the value of high sales at high prices. When gross margins are good, and capacity is low, then it is time to expand capacity because good returns are in the future. The Model 3 release projects a backlog of almost $12B. Booked orders at that level are extremely rare. Further, short-term those orders have produced nearly $300million of short-term cash. Thus, it is a great time for an additional equity offering, possibly augmented with bond sales, to invest rapidly in expansion. Problematic, yes. Insolvable, highly unlikely.

On the face of it Tesla appears to be another car company. But something much more significant is afoot. This sales level, at these prices, when the underlying economics of use seem to be moving in the opposite direction indicates that Tesla has tapped into an unmet need. It’s products are impressing a large number of people, and they are buying at premium prices. Based on recent orders Tesla is vastly outselling competitive electric automobiles made by competitors, all of whom are much bigger and better resourced. And those are all the signs of a real Game Changer.

by Adam Hartung | Mar 6, 2016 | Defend & Extend, Leadership

We all like to think the world is a meritocracy, where hard work is important and results matter.

As we watched Mitt Romney, and others, frontally assault Donald Trump this week it was clear they were saying Mr. Trump is not the right person to be President. They are pointing out his use of bankruptcies to protect his personal wealth, while leaving investors holding the empty bag. And his flip-flopping on various issues, including how he would deploy military forces. And his use of misogynistic language against women, while simultaneously referring to most Mexicans and lawbreakers and all Muslims as terrorists, are gross generalities they say are not supported by facts.

Yet, while many sober-minded leaders are denouncing Mr. Trump, it is not clear that it matters. His followers seem to remain passionately loyal, and completely unmoved by any factual representation of their candidate as anything other than a savior for America. The “Super Saturday” delegate selection resulted in Mr. Trump winning 2 more contests (Louisiana and Kentucky) while coming in second in 2 others (Kansas and Maine.) And it demonstrated the ongoing pattern of Mr. Trump winning the popular vote in primaries.

Everyone remembers a situation where a very hard working, smart, industrious person did things well for years. But they weren’t promoted, or even given large pay increases. Or, worse, they made one mistake and lost their position, or job.

Simultaneously, we all also can think of at least one, or more, person who simply wasn’t that good, and often didn’t work that hard, but was promoted (often beyond their competency) and given large pay increases. And every time this person made a mistake it was explained away as a “learning experience” that would make them a better future performer. They were blessed with continuous upward mobility, and could seemingly do no wrong.

For each of us these experiences seemed unique, and we often tied them to the specific individuals involved – including not only the person at the center of these experiences but their superiors, subordinates and peers. And many people are saying the political rise of Donald Trump is unique to him and the current state of his political party.

But rather than each being unique, these experiences all have something in common. The actual frequency of these experiences belies the notion that they are all unique. Rather, what all of these demonstrate is the implementation of selective bias. They demonstrate that very often we prefer people because they reinforce our bias, and their past results do not matter.

Bosses who promote incompetency don’t really care about the competency as much as they care that the individual reinforces their inherent Beliefs, Interpretations, Assumptions and Strategies about the world. There is often a familial, geographic, academic, business relationship, religious or gender trait (or often multiple traits) which reinforces in these bosses that their view of the world is right, and should be promoted.

This may be due to the person being very much similar to the boss. But, not always. It just requires that the target be a visible, walking, talking implementation of how they think the world works. Whether or not the person is successful really does not matter. If they are different from the boss’s viewpoint, no success will be great enough to have the boss support them. If they fulfill the boss’s bias then they often can do no wrong.

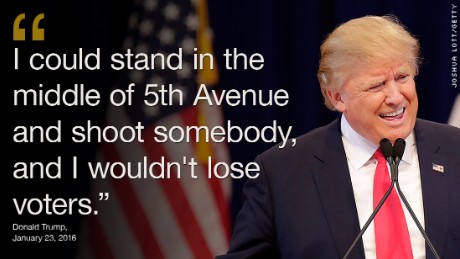

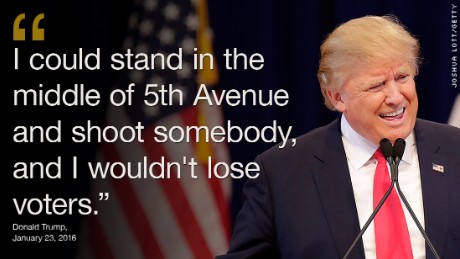

Donald Trump has been leading his candidate competitors not because he was wildly successful. Rather, he is attracting a larger group of people who identify with him; who share his basic Beliefs, Interpretations of the world, Assumptions about how people behave, and Strategies for how to succeed. They share his bias, and thus they select him. As Mr. Trump said himself “I could stand in the middle of 5th Avenue and shoot somebody and I wouldn’t lose voters.”

Donald Trump has been leading his candidate competitors not because he was wildly successful. Rather, he is attracting a larger group of people who identify with him; who share his basic Beliefs, Interpretations of the world, Assumptions about how people behave, and Strategies for how to succeed. They share his bias, and thus they select him. As Mr. Trump said himself “I could stand in the middle of 5th Avenue and shoot somebody and I wouldn’t lose voters.”

Regardless of the robustness of the American economy and the ongoing growth in jobs creation, they Believe America is in terrible shape, and that almost all media participants are liars. No matter what the truth is about the value of immigrants on the economy, they Interpret all immigrants as job-stealing bad people that have made their lives worse. No matter the truth about the spirit of Islam and the goodness of Muslims, they Assume all of them terrorists out to blow up the world. And they agree with Strategies like stopping immigrants with walls, killing civilian Muslims as collateral damage in a religious war, torturing prisoners of war (possibly to death,) eliminating international trade, and depriving poor people of health care and other services.

Thus, selective bias ties these voters to Mr. Trump with a bind that is not breakable by discussing his performance, or pointing out his failings. Facts are not relevant. Their judgement is not based on historical facts, but rather a clear alignment with their bias. No matter who says Mr. Trump may have lied, or exaggerated, or misinterpreted history that messenger will not be believed. Because the real results don’t matter. What matters is reinforcing their bias.

Unfortunately we see this selective bias all too often in business. Leaders that favor some over others simply because of bias, rather than results. It has long been a problem which has restricted diversity in the workforce, and inhibited equal pay. It has long created a caste system for admission to top schools and places of employment. And because selective bias is so rampant in American business, it is second nature to Mr. Trump. It is easy for him to say what is on his mind, and expect that lots of people will agree with him. It’s how he sees the world, it is his bias, and he’s used to having it reinforced by those who wish to work with him.

Whatever happens in this Presidential campaign, as business leaders we can learn from this situation that if we allow selective bias to sway us then we are no longer really paying attention to results. As leaders which of the following should be important – promoting those who reinforce our beliefs, interpretations, assumptions and strategies, or finding the best people to do the job and rewarding those who really have worked hard for good results?

by Adam Hartung | Feb 24, 2016 | Defend & Extend, In the Swamp, Leadership

Walmart announced quarterly financial results last week, and they were not good. Sales were down $500million vs the previous year, and management lowered forecasts for 2016. And profits were down almost 8% vs. the previous year. The stock dropped, and pundits went negative on the company.

But if we take an historical look, despite how well WalMart’s value has done between 2011 and 2014, there are ample reasons to forecast a very difficult future. Sailors use small bits of cloth tied to their sails in order to get early readings on the wind. These small bits, called telltales, give early signs that good sailors use to plan their navigation forward. If we look closely at events at WalMart we can see telltales of problems destined to emerge for the retailing giant:

1 – In March, 2008 WalMart sued a brain damaged employee. The employee was brain damaged by a truck accident. WalMart’s insurance paid out $470,000 in health care cost. The employee’s family sued the trucking company, at their own expense, and won a $417,000 verdict for lost future wages, pain and suffering and future care needs. Then, WalMart decided it would sue the employee to recover the health care costs it had previously paid. As remarkable as this seems, it is a great telltale. It demonstrates a company so focused on finding ways to cut costs, and so insensitive to its employees and the plight of its customers that it loses all common sense. Not to mention the questionable ethics of this action, it at the very least demonstrates blatant disregard for the PR impact of its actions. It shows a company where management feels it is unquestionable, and a believe its brand is untouchable.

1 – In March, 2008 WalMart sued a brain damaged employee. The employee was brain damaged by a truck accident. WalMart’s insurance paid out $470,000 in health care cost. The employee’s family sued the trucking company, at their own expense, and won a $417,000 verdict for lost future wages, pain and suffering and future care needs. Then, WalMart decided it would sue the employee to recover the health care costs it had previously paid. As remarkable as this seems, it is a great telltale. It demonstrates a company so focused on finding ways to cut costs, and so insensitive to its employees and the plight of its customers that it loses all common sense. Not to mention the questionable ethics of this action, it at the very least demonstrates blatant disregard for the PR impact of its actions. It shows a company where management feels it is unquestionable, and a believe its brand is untouchable.

2 – In March, 2010 AdAge ran a column about WalMart being “stuck in the middle” and effectively becoming the competitive “bulls-eye” of retailing. After years of focusing on its success formula, “dollar store” competition was starting to undermine it on cost and price at the low end, while better merchandise and store experience boxed WalMart from higher end competitors – that often weren’t any more expensive. This was the telltale sign of a retailer that had focused on beating up its suppliers for years, cutting them out of almost all margin, without thinking about how it might need to change its business model to grow as competitors chopped up its traditional marketplace.

3 – In October, 2010 Fortune ran an article profiling then-CEO Mike Duke. It described an executive absolutely obsessive about operational minutia. Banana pricing, underwear inventory, cereal displays – there was no detail too small for the CEO. Another telltale of a company single-mindedly focused on execution, to the point of ignoring market shifts created by changing consumer tastes, improvements at competitors and the rapid growth of on-line retailing. There was no strategic thinking happening at WalMart, as executives believed there would never be a need to change the strategy.

4 – In April, 2012 WalMart found itself mired in a scandal regarding bribing Mexican government officials in its effort to grow sales. WalMart had never been able to convert its success formula into a growing business in any international market, but Mexico was supposedly its breakout. However, we learned the company had been paying bribes to obtain store sites and hold back local competitors. A telltale of a company where pressure to keep defending and extending the old business was so great that very highly placed executives do the unethical, and quite likely the illegal, to make the company look like it is performing better.

5 – In July, 2014 a WalMart truck driver hits a car seriously injuring comedian Tracy Morgan and killing his friend. While it could be taken as a single incident, the truth was that the driver had been driving excessive hours and excessive miles, not complying with government mandated rest periods, in order to meet WalMart distribution needs. This telltale showed how the company was stressed all the way down into the heralded distribution environment to push, push, push a bit harder to do more with less in order to find extra margin opportunities. What once was successful was showing stress at the seams, and in this case it led to a fatal accident by an employee.

6 – In January, 2015 we discovered traditional brick-and-mortar retail sales fell 1% from the previous year. The move to on-line shopping was clearly a force. People were buying more on-line, and less in stores. This telltale bode very poorly for all traditional retailers, and it would be clear that as the biggest WalMart was sure to face serious problems.

7 – In July, 2015 Amazon’s market value exceeds WalMart’s. Despite being quite a bit smaller, Amazon’s position as the on-line retail leader has investors forecasting tremendous growth. Even though WalMart’s value was not declining, its key competition was clearly being forecast to grow impressively. The telltale implies that at least some, if not a lot, of that growth was going to eventually come directly from the world’s largest traditional retailer.

8 – In January, 2016 we learn that traditional retail store sales declined in the 2015 holiday season from 2014. This was the second consecutive year, and confirmed the previous year’s numbers were the start of a trend. Even more damning was the revelation that Black Friday sales had declined in 2013, 2014 and 2015 strongly confirming the trend away from Black Friday store shopping toward Cyber Monday e-commerce. A wicked telltale for the world’s largest store system.

9 – In January, 2016 we learned that WalMart is reacting to lower sales by closing 269 stores. No matter what lipstick one would hope to place on this pig, this telltale is an admission that the retail marketplace is shifting on-line and taking a toll on same-store sales.

10 – We now know WalMart is in a Growth Stall. A Growth Stall occurs any time a company has two consecutive quarters of lower sales versus the previous year (or two consecutive declining back-to-back quarters.) In the 3rd quarter of 2015 Walmart sales were $117.41B vs. same quarter in 2014 $119.00B – a decline of $1.6B. Last quarter WalMart sales were $129.67B vs. year ago same quarter sales of $131.56B – a decline of $1.9B. While these differences may seem small, and there are plenty of explanations using currency valuations, store changes, etc., the fact remains that this is a telltale of a company that is already in a declining sales trend. And according to The Conference Board companies that hit a Growth Stall only maintain a mere 2% growth rate 7% of the time – the likelihood of having a lower growth rate is 93%. And 95% of stalled companies lose 25% of their market value, while 69% of companies lose over half their value.

WalMart is huge. And its valuation has actually gone up since the Great Recession began. It’s valuation also rose from 2011- 2014 as Amazon exploded in size. But the telltale signs are of a company very likely on the way downhill.

by Adam Hartung | Feb 11, 2016 | Current Affairs, In the Whirlpool, Leadership, Lock-in

USAToday alerted investors that when Sears Holdings reports results 2/25/16 they will be horrible. Revenues down another 8.7% vs. last year. Same store sales down 7.1%. To deal with ongoing losses the company plans to close another 50 stores, and sell another $300million of assets. For most investors, employees and suppliers this report could easily be confused with many others the last few years, as the story is always the same. Back in January, 2014 CNBC headlined “Tracking the Slow Death of an Icon” as it listed all the things that went wrong for Sears in 2013 – and they have not changed two years later. The brand is now so tarnished that Sears Holdings is writing down the value of the Sears name by another $200million – reducing intangible value from the $4B at origination in 2004 to under $2B.

This has been quite the fall for Sears. When Chairman Ed Lampert fashioned the deal that had formerly bankrupt Kmart buying Sears in November, 2004 the company was valued at $11billion and 3,500 stores. Today the company is valued at $1.6billion (a decline of over 85%) and according to Reuters has just under 1,700 stores (a decline of 51%.) According to Bloomberg almost no analysts cover SHLD these days, but one who does (Greg Melich at Evercore ISI) says the company is no longer a viable business, and expects bankruptcy. Long-term Sears investors have suffered a horrible loss.

When I started business school in 1980 finance Professor Bill Fruhan introduced me to a concept that had never before occurred to me. Value Destruction. Through case analysis the good professor taught us that leadership could make decisions that increased company valuation. Or, they could make decisions that destroyed shareholder value. As obvious as this seems, at the time I could not imagine CEOs and their teams destroying shareholder value. It seemed anathema to the entire concept of business education. Yet, he quickly made it clear how easily misguided leaders could create really bad outcomes that seriously damaged investors.

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

1 – Micro-management in lieu of strategy. Mr. Lampert has been merciless in his tenacity to manage every detail at Sears. Daily morning phone calls with staff, and ridiculously tight controls that eliminate decision making by anyone other than the top officers. Additionally, every decision by the officers was questioned again and again. Explanations took precedent over action as micro-management ate up management’s time, rather than trying to run a successful company. While store employees and low- to mid-level managers could see competition – both traditional and on-line – eating away at Sears customers and core sales, they were helpless to do anything about it. Instead they were forced to follow orders given by people completely out of touch with retail trends and customer needs. Whatever chance Sears and Kmart had to grow the chain against intense competition it was lost by the Chairman’s need to micro-manage.

2 – Manage-by-the-numbers rather than trends. Mr. Lampert was a finance expert and former analyst turned hedge fund manager and investor. He truly believed that if he had enough numbers, and he studied them long enough, company success would ensue. Unfortunately, trends often are not reflected in “the numbers” until it is far, far too late to react. The trend to stores that were cleaner, and more hip with classier goods goes back before Lampert’s era, but he completely missed the trend that drove up sales at Target, H&M and even Kohl’s because he could not see that trend reflected in category sales or cost ratios. Merchandising – from buying to store layout and shelf positioning – are skills that go beyond numerical analysis but are critical to retail success. Additionally, the trend to on-line shopping goes back 20 years, but the direct impact on store sales was not obvious until customers had long ago converted. By focusing on numbers, rather than trends, Sears was constantly reacting rather than being proactive, and thus constantly retreating, cutting stores and cutting product lines.

3 – Seeking confirmation rather than disagreement. Mr. Lampert had no time for staff who did not see things his way. Mr. Lampert wanted his management team to agree with him – to confirm his Beliefs, Interpretations, Assumptions and Strategies — to believe his BIAS. By seeking managers who would confirm his views, and execute, rather than disagree Mr. Lampert had no one offering alternative data, interpretations, strategies or tactics. And, as Mr. Lampert’s plans kept faltering it led to a revolving door of managers. Leaders came and went in a year or two, blamed for failures that originated at the Chairman’s doorstep. By forcing agreement, rather than disagreement and dialogue, Sears lacked options or alternatives, and the company had no chance of turning around.

4 – Holding assets too long. In 2004 Sears had a LOT of assets. Many that could likely be redeployed at a gain for shareholders. Sears had many owned and leased store locations that were highly valuable with real estate prices climbing from then through 2008. But Mr. Lampert did not spin out that real estate in a REIT, capturing the value for SHLD shareholders while the timing was good. Instead he held those assets as real estate in general plummeted, and as retail real estate fell even further as more revenue shifted to e-commerce. By the time he was ready to sell his REIT much of the value was depleted.

Additionally, Sears had great brands in 2004. DieHard batteries, Craftsman tools, Kenmore appliances and Lands End apparel were just 4 household brands that still had high customer appeal and tremendous value. Mr. Lampert could have sold those brands to another retailer (such as selling DieHard to WalMart, for example) as their house brands, capturing that value. Or he could have mass marketd the brand beyond the Sears store to increase sales and value. Or he could have taken one or more brands on-line as a product leader and “category killer” for ecommerce customers. But he did not act on those options, and as Sears and Kmart stores faded, so did these brands – which largely no longer have any value. Had he sold when value was high there were profits to be made for investors.

5 – Hubris – unfailingly believing in oneself regardless the outcomes. In May, 2012 I wrote that Mr. Lampert was the 2nd worst CEO in America and should fire himself. This was not a comment made in jest. His initial plans had all panned out very badly, and he had no strategy for a turnaround. All results, from all programs implemented during his reign as Chairman had ended badly. Yet, despite these terrible numbers Mr. Lampert refused to recognize he was the wrong person in the wrong job. While it wasn’t clear if anyone could turn around the problems at Sears at such a late date, it was clear Mr. Lampert was not the person to do it. If Mr. Lampert had been as self-analytical as he was critical of others he would have long before replaced himself as the leader at Sears. But hubris would not allow him to do this, he remained blind to his own failings and the terrible outcome of a failed company was pretty much sealed.

From $11B valuation and a $92/share stock price at time of merging KMart and Sears, to a $1.6B valuation and a $15/share stock price. A loss of $9.4B (that’s BILLION DOLLARS). That is amazing value destruction. In a world where employees are fired every day for making mistakes that cost $1,000, $100 or even $10 it is a staggering loss created by Mr. Lampert. At the very least we should learn from his mistakes in order to educate better, value creating leaders.

by Adam Hartung | Dec 30, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership

2015 was not short on bad decisions, nor bad outcomes. But there are 5 major leadership themes from 2015 that can help companies be better in 2016:

1 – Cost cutting, restructurings and stock buybacks do not increase company value – Dow/DuPont

1 – Cost cutting, restructurings and stock buybacks do not increase company value – Dow/DuPont

There was no shortage of financial engineering experiments in 2015 intended to increase short-term shareholder returns at the expense of long-term value creation. Companies continued borrowing money to buy back their own stock – spending more on repurchases than they made in profits.

Unfortunately, too many companies continue to increase earnings per share (EPS) via financial machinations rather than creating and introducing new products, or creating new markets.

In a grand show of value reducing financial re-engineering, 2015 is ending with the massive merger between Dow and DuPont. There is no intent of introducing new products or entering new markets via this merger. Rather, to the contrary, the plan is to merge these beasts, lay off tens of thousands of employees, cut the R&D staff, cut new product introductions and “rationalize” the company into 3 new businesses intended to be relaunched as new companies, with fewer products, less business development and less competition.

Massive cost cutting will weaken both companies, put thousands out of work and leave the marketplace with fewer new products. All just to create 3 new, different profit and loss statements in the hopes of improving the EPS and price to earnings (P/E) multiple. This story has become all too familiar the last few years, and the only winners are the bankers, who will make massive fees, and hedge fund managers that rapidly dump the stock in the terrible companies they leave behind.

2 – Doing more of the same is not innovative and does not create value – McDonald’s

McDonald’s has been losing market share to fast casual restaurants for over a decade. Yet, leadership insists on constantly maintaining its undying focus on the fast food success formula upon which the company was launched some 60 years ago.

As the number of customers continued declining, McDonalds kept closing more stores. Yet, sales per store remained weak even as the denominator grew smaller. Unwilling to actually update McDonald’s to make it fit modern trends, in 2015 leadership decided the path to growth was serving breakfast all-day. Really. It is still hard to believe. No new products, just the same McMuffins and sausage biscuits, but now offered for more hours.

Because of McDonald’s size and legacy the media covered this story heavily in 2015. Yet, as 2016 starts we all can look back and see that this was no story at all. Doing more of the same is not in any way innovative or revolutionary. Defending and extending an outdated success formula does not fix a company strategy that is out of date and rapidly losing relevancy.

3 – Hiring the wrong CEO is a BIG problem – Yahoo

We would like to think that Boards are really good at hiring CEOs. Unfortunately, we are regularly reminded they are not. The Board at Yahoo has spent a decade making bad CEO selections, and now the company’s core business is valueless.

In 2015 we saw that the decision by Yahoo’s board to hire a CEO based on political correctness (gender advantages), and limited experience with a well known company (a short Google career) rather than leadership capability could be deadly. Although Marissa Mayer was hired in 2012 amid much fanfare, we learned in 2015 that Yahoo is worth only the value of its Alibaba shareholdings, and no more. Yahoo as it was founded is now worth – nothing.

After 3 years of Mayer leadership it became clear that “there was no there, there” at Yahoo (to quote Gertrude Stein.) The value of the company’s “core” search and content accumulation businesses dropped to zero. Although 3 years have passed, practically no progress has been made toward developing a new business able to compete in the market shifted to social media and instant communications. Investors now realize Ms. Mayer has failed to grow future revenue and profits for the historical internet leader. Following a decade of incompetent CEOs, Yahoo has been left almost wholly irrelevant.

What was once Yahoo will soon be Alibaba USA, as the company gets rid of its old businesses – in some fashion, although who would want them is unclear – in order to allow shareholders to preserve their value in Alibaba stock purchased by Jerry Yang in 2005.

Yahoo has become irrelevant, replaced by its minority stake in Alibaba, largely due to a Board unable to identify and hire a competent CEO – ending with the wholly unqualified selection of Ms. Mayer, who will achieve at least a footnote in history for the outsized compensation package she received and the huge severance that will come her way, wildly out of proportion to her poor performance, when leaving Yahoo.

4 – Even 1 dumb leadership decision can devastate a company — Turing Pharmaceuticals and CEO Shkreli

In 2015 former hedge fund manager Martin Shkreli raised a lot of money, and obtained control of an anit-parasitic pharmaceutical product. Recognizing that his customers either paid up or died, and being young, naïve, enormously greedy and without much oversight he decided to raise product pricing 70-fold. This would leave his customers either dead, bankrupt or bankrupting the insurance companies paying for his product – but he infamously said he did not care.

Thumbing your nose at customers, and regulators, is never a good idea. And even if they could not roll back the price quickly, they could target the CEO and his company for further investigation. It didn’t take long until Mr. Shrkeli was indicted for stock manipulation, leaving Turing Pharmaceuticals in disrepair as it rapidly cut staff and tried to determine what it will do next. Now KaloBios Pharma, controlled by Turing, is forced to file bankruptcy.

Never forget that Al Capone did not go to prison for stealing, bribing police, bootlegging, number running, murder or other gangster behavior. He went to prison for tax evasion. The simple lesson is, when you think you are smarter than everyone else, can do whatever you want and thumb your nose at those with government powers you’ll soon find yourself under the microscope of investigation, and most likely in really big trouble. And in the desire to take down the unwise CEO corporations become mere fodder.

The pharma industry is a regular target of consumers and politicians. Now not only are the investors in Turing damaged by this foolishly incompetent CEO, but the entire industry will once again be under close scrutiny for its pricing practices. Arrogantly making brash decisions, based on ill-formed thinking and juvenile egotism, without careful, thoughtful consideration can create enormous damage.

5 – Putting short-term results above good business practice will hurt you very badly long-term – Volkswagen and Takata

VW cheated on its emissions tests. Takata sold deadly, exploding airbags. Both companies are large organizations with layers of management. How could judgemenetal errors so big, so costly and so deadly happen?

These outcomes did not happen because of just “one bad apple.” Cultural acceptance of lying takes years of leadership focused on short-term results, even when it means operating unethically or illegally, to be inculcated. It took years for layers of management to learn how to turn away from problems, falsify test results, fake outcomes, lie to customers and even lie to regulators. It took years to create a culture of tolerated deception and willful misrepresentation.

Unfortunately, the auto industry is a tough place to make money. There is a lot of regulation, and a lot of competition. When it becomes too hard to make money honestly, cheating can become far too easily accepted. Rather than trying to revolutionize the auto making process, or the product itself, it can be a lot easier to push managers all the way down to the front-line of procurement, manufacturing or sales to simply cheat.

“Make your numbers” becomes a mantra. If you want to keep your job, or even more importantly if you want to move up, do whatever it takes to tell those above you what they want to hear. And those above don’t ask too many questions, don’t try to figure out how results happen – just keep applying pressure to those below to do what’s necessary to make the numbers.

As VW and Takata showed us, eventually the company will be caught. And the consequences are severe. Now those companies, their customers, their employees and their shareholders are suffering. And industry regulations will tighten further to make it harder to cheat. Everyone loses when short-term results are the top goal, rather than building a sustainable long-term business.

Let’s hope for better leadership in 2016.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its  Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was