by Adam Hartung | May 30, 2017 | Innovation, Lifecycle

Last week Microsoft announced its new Surface Pro 5 tablet would be available June 15. Did you miss it? Do you care?

Do you remember when it was a big deal that a major tech company released a new, or upgraded, device? Does it seem like increasingly nobody cares?

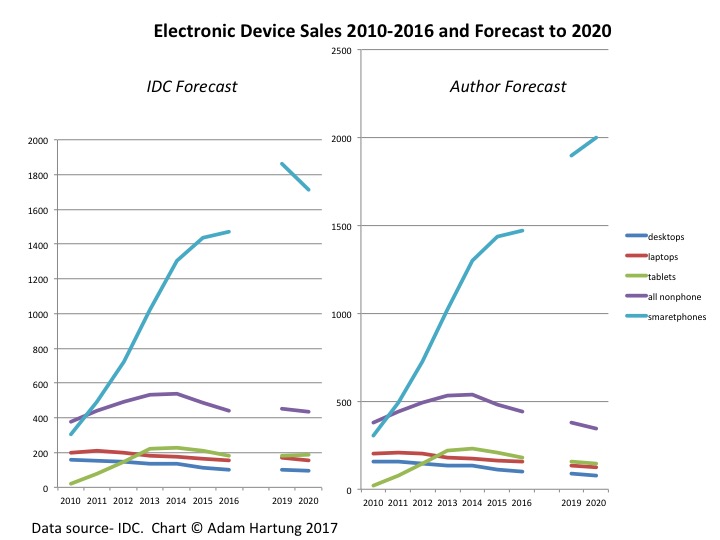

Non-phone device sales are declining, while smartphone sales accelerate

This chart compares IDC sales data, and forecasts, with adjustments to the forecast made by the author. The adjustments offer a fix to IDC’s historical underestimates of PC and tablet sales declines, while simultaneously underestimating sales growth in smartphones.

Since 2010 people are buying fewer desktops and laptops. And after tablet sales ramped up through 2013, tablet purchases have declined precipitously as well. Meanwhile, since 2014 sales of smartphones have doubled, or more, sales of all non-phone devices. And it’s also pretty clear that these trends show no signs of changing.

Why such a stark market shift? After all desktop and laptop sales grew consistently for some 3 decades. Why are they in such decline? And why did the tablet market make such a rapid up, then down movement? It seems pretty clear that people have determined they no longer need large internal hard drives to work locally, nor big keyboards and big screens of non-phone devices. Instead, they can do so much with a phone that this device is becoming the only one they need.

Today a new desktop starts at $350-$400. Laptops start as low as $180, and pretty powerful ones can be had for $500-$700. Tablets also start at about$180, and the newest Microsoft Surface 5 costs $800. Smartphones too start at about $150, and top of the line are $600-$800. So the purchase decision today is not based on price. All devices are more-or-less affordable, and with a range of capabilities that makes price not the determining factor.

Smartphones let most people do most of what they need to do

Every month the Internet-of-Things (IoT) is putting more data in the cloud. And developers are figuring out how to access that data from a smartphone. And smartphone apps are making it increasingly easy to find data, and interact with it, without doing a lot of typing. And without doing a lot of local processing like was commonplace on PCs. Instead, people access the data – whether it is financial information, customer sales and order data, inventory, delivery schedules, plant performance, equipment performance, maintenance specs, throughput, other operating data, web-based news, weather, etc. — via their phone. And they are able to analyze the data with apps they either buy, or that their companies have built or purchased, that don’t rely on an office suite.

Additionally, people are eschewing the old forms of connecting — like email, which benefits from a keyboard — for a combination of texting and social media sites. Why type a lot of words when a picture and a couple of emojis can do the trick?

And nobody listens to CD-based, or watches DVD-based, entertainment any longer. They either stream it live from an app like Pandora, Spotify, StreamUp, Ustream, GoGo or Facebook Live, or they download it from the cloud onto their phone.

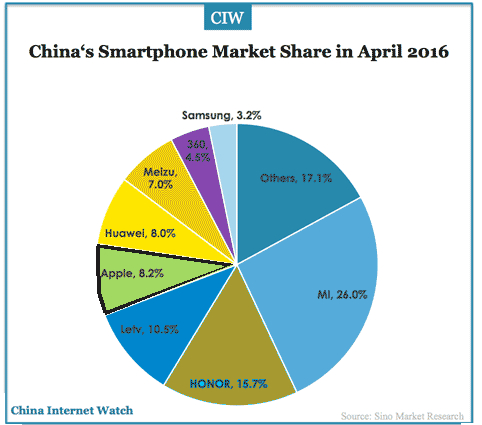

To obtain additional insight into just how prevalent this shift to smartphones has become look beyond the USA. According to IDC there are about 1.8 billion smartphone users globally. China has nearly 600M users, and India has over 300 million users — so they account for at least half the market today. And those markets are growing by far the fastest, increasing purchases every quarter in the range of 15-25% more than previous years.

Chinese manufacturers are rapidly catching up to Apple and Samsung – there will be losers

Clayton Christensen often discusses how technology developers “overshoot” user needs. Early market leaders keep developing enhancements long after their products do all people want, producing upgrades that offer little user benefit. And that has happened with PCs and most tablets. They simply do more than people need today, due to the capabilities of the cloud, IoT and apps. Thus, in markets like China and India we see the rapid uptake of smartphones, while demand for PCs, laptops and tablets languish. People just don’t need those capabilities when the smartphone does what they want — and provides greater levels of portability and 24×7 access, which are benefits greatly treasured.

And that is why companies like Microsoft, Dell and HP really have to worry. Their “core” products such as Windows, Office, PCs, laptops and tablets are getting smaller. And these companies are barely marginal competitors in the high growth sales of smartphones and apps. As the market shifts, where will their revenues originate? Cloud services, versus Amazon AWS? Game consoles?

Even Apple and Samsung have reasons to worry. In China Apple has 8.4% market share, while Samsung has 6%. But the Chinese suppliers Oppo, Vivo, Huawei and Xiaomi have 58.4%. And as 2016 ended Chinese manufacturers, including Lenovo, OnePlus and Gionee, were grabbing over 50% of the Indian market, while Samsung has about 20% and Apple is yet to participate. How long will Apple and Samsung dominate the global market as these Chinese manufacturers grow, and increase product development?

When looking at trends it’s easy to lose track of the forest while focusing on individual trees. Don’t become mired in the differences, and specs, comparing laptops, hybrids, tablets and smartphones. Recognize the big shift is away from all devices other than smartphones, which are constantly increasing their capabilities as cloud services and IoT grows. So buy what suits your, and your company’s, needs — without “overbuying” because capabilities just keep improving. And keep your eyes on new, emerging competitors because they have Apple and Samsung in their sites.

by Adam Hartung | May 20, 2017 | In the Rapids, Innovation, Investing, Trends

Writing on trends, I frequently profile tech companies that use trends to outperform competitors. But using trends is not restricted to tech companies.

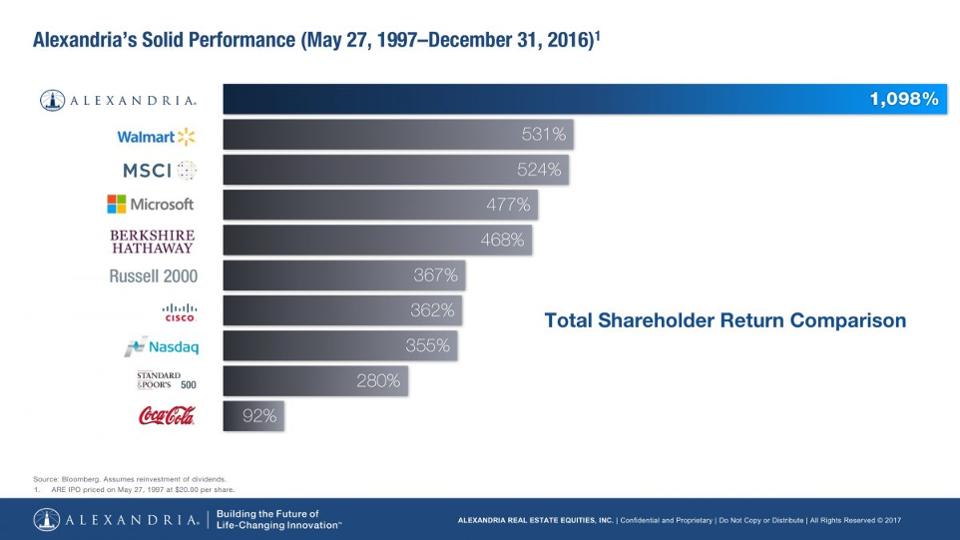

By following trends, since 1998 Alexandria Real Estate Equities has tripled the performance of the NASDAQ, quadrupled returns of the S&P 500, and quintupled the Russell 2000. Alexandria has even outperformed technology stalwart Microsoft, and investment guru Berkshire Hathaway by 230%.

Although you probably never heard of it, Alexandria has trounced its real estate peers. Over the last three years Alexandria has returned double the FTSE NAREIT Equity Office Index, and double the SNL US REIT Office Index. Alexandria’s value has almost doubled during this time, and produced returns 2.3 times better than such well known competitors as Vornado Realty Trust and Boston Properties.

In 1983, Joel Marcus was a lawyer in the IPO market when he noticed the high value launch of biotech firms like Amgen and Genentech. He began tracking the growth of biotechs to see what kind of opportunity might appear to serve these high growth companies.

By 1994 Marcus realized that these companies were struggling to find appropriate real estate to serve their unique needs for laboratory space, and the infrastructure these labs require. It was a classic under-served market, and it was growing fast.

Jacobs Engineering (NYSE:JEC) was serving some of these companies’ needs, including erecting structures for them. But Jacobs did not own any buildings or consider itself a real estate developer. So Marcus approached Jacobs about starting a company to meet the real estate needs of this high growth biotech industry. Marcus put up some money, Jacobs put up some money, and other friends/associates combined to raise $19 million. There was no professionally managed money involved – and no real estate developers.

Focusing on the rapidly expanding biotech scene in San Diego, the newly created Alexandria bought 4 buildings. They refocused the buildings on the unserved needs of local biotech companies and did a quick flip, breaking even on the transaction. With just a bit of money Alexandria had proven that the market existed, the trend was real and users were under-served.

But, like any idea based on an emerging trend, growing was not easy. Using their first transaction as “proof of concept” CEO Marcus and his team set out to raise $100 million. Quickly Paine Webber (now UBS) secured $75 million in debt financing. But moving forward required raising $25 million in equity.

Over the next few weeks Alexandria pitched a slew of nay-sayers. From GE Capital to CALPERS investors felt that their first deal was a “1-trick pony,” and this “niche market” was not a sustainable business. Finally, after 29 failed pitches, the AEW pension fund, an early stage real estate investor, saw the trend and invested.

The Alexandria team realized that fast client growth meant there was no time to develop from ground up. They focused on high growth geographies for biotech, places where the trend was more pronounced, and bought 11 existing properties:

- In Seattle they found a cancer center they could buy, improve and do a sale-leaseback

- In San Francisco they identified a portfolio of properties in Alameda they could improve, lease to biotech companies and even suit the needs of the FDA as a tenant

- In Maryland they identified opportunities to support the lab needs of the Army Corps of Engineers forensic research lab, and ATF testing lab for imported vodka, and a medical testing lab near Dulles – which is now leased to Quest Diagnostics

Realizing that companies needing labs tended to cluster, leadership focused on finding locations where clusters were likely to emerge. They bought land in San Francisco, San Diego, New York and Worcester, MA. What looked like risky locations to others looked like profitable opportunities to Alexandria due to their superior trend research.

Historically pharma companies built their headquarters, and labs, in suburban locations where development was easy, and labs were welcome. Alexandria realized the new trend for emerging companies was to be near universities in urban environments, and although land was costly — and development more difficult — this was the right place to leverage the trend.

Today Alexandria is the bona fide market leader in labs and tech facilities in the USA. By seeing the trend early they bought land which is now so expensive it is practically untouchable – even for $1 billion. Their development pipeline includes Mission Bay, Kendall Square, the Manhattan borough of New York City and RTP (Research Triangle Park.) Today companies want to be where the lab is — and frequently the lab space is now owned, or being developed, by Alexandria.

This didn’t happen by accident. Not at the beginning nor as Alexandria plans its future growth. The company maintains a team of 13 researchers studying market trends in technology, and under-served real estate needs. They constantly track employers of tech/research people, competitors, historical and emerging customers — and identify prospective tech tenants who will need specialized real estate. A few of the leading trends Alexandria follows include:

- Urbanization — The siloed campuses set in bucolic suburbs is the past

- Innovation externalization — Over 50% of innovation in big pharma is now outsourced. And universities are spinning out innovations faster than ever into development centers for testing and commercialization

- Nutrition and disease management — These are emerging markets ripe with new products making their way to commercialization, and needing space to grow

Alexandria’s historical and ongoing successes relied first and foremost on using trends to understand underserved markets where needs will soon be the greatest. This is an important lesson for all businesses. No matter what you do, what you sell, or your industry you can generate higher returns, outperform your peers, and outperform the market rewarding investors by identifying trends and investing in them.

Thanks to Joel Marcus for providing an interview to explain the history and current practices at Alexandria.

by Adam Hartung | Mar 28, 2017 | In the Rapids, Innovation, Investing, Leadership

(Photo: General Electric CEO Jeffrey Immelt, ERIC PIERMONT/AFP/Getty Images)

General Electric stock had a small pop recently when investors thought CEO Jeffrey Immelt might be pushed out. Obviously more investors hope the CEO leaves than stays. And it appears clear that activist investor Nelson Peltz of Trian Partners thinks it is time for a change in CEO atop the longest running member of the Dow Jones Industrial Average (DJIA.)

You can’t blame investors, however. Since he took over the top job at General Electric in 2001 (16 years ago) GE’s stock value has dropped 38%. Meanwhile, the DJIA has almost doubled. Over that time, GE has been the greatest drag on the DJIA, otherwise the index would be valued even higher! That is terrible performance — especially as CEO of one of America’s largest companies.

But, after 16 years of Immelt’s leadership, there’s a lot more wrong than just the CEO at General Electric these days. As the JPMorgan Chase analyst Stephen Tusa revealed in his analysis, these days GE is actually overvalued, “cash is weak, margins/share of customer wallet are already at entitlement, the sum of the parts valuation points to a low 20s stock price.” He goes on to share his pessimism in GE’s ability to sell additional businesses, or create cost lowering synergies or tax strategies.

Former Chairman and CEO of General Electric Jack Welch. (AP Photo/Richard Drew)

What went so wrong under Immelt? Go back to 1981. GE installed Jack Welch as its new CEO. Over the next 20 years there wasn’t a business Neutron Jack wouldn’t buy, sell or trade. CEO Welch understood the importance of growth. He bought business after business, in markets far removed from traditional manufacturing, building large positions in media and financial services. He expanded globally, into all developing markets. After businesses were acquired the pressure was relentless to keep growing. All had to be no. 1 or no. 2 in their markets or risk being sold off. It was growth, growth and more growth.

Welch’s focus on growth led to a bigger, more successful GE. Adjusted for splits, GE stock rose from $1.30 per share to $46.75 per share during the 20 year Welch leadership. That is an improvement of 35 times – or 3,500%. And it wasn’t just due to a great overall stock market. Yes, the DJIA grew from 973 to 10,887 — or about 10.1 times. But GE outperformed the DJIA by 3.5 times (350%). Not everything went right in the Welch era, but growth hid all sins — and investors did very, very, very well.

Under Welch, GE was in the rapids of growth. Welch understood that good operating performance was not enough. GE had to grow. Investors needed to see a path to higher revenues in order to believe in long term value creation. Immediate profits were necessary but insufficient to create value, because they could be dissipated quickly by new competitors. So Welch kept the headquarters team busy evaluating opportunities, including making some 600 acquisitions. They invested in things that would grow, whether part of historical GE, or not.

Jeff Immelt as CEO took a decidedly different approach to leadership. During his 16 year leadership GE has become a significantly smaller company. He sold off the plastics, appliances and media businesses — once good growth providers — in the name of “refocusing the company.” Plans currently exist to sell off the electrical distribution/grid business (Industrial Solutions) and water businesses, eliminating another $5 billion in annual revenue. He has dismantled the entire financial services and real estate businesses that created tremendous GE value, because he could not figure out how to operate in a more regulated environment. And cost cutting continues. In the GE Transportation business, which is supposed to remain, plans have been announced to double down on cost cutting, eliminating another 2,900 jobs.

Under Immelt GE has focused on profits. Strategy turned from looking outside, for new growth markets and opportunities, to looking inside for ways to optimize the company via business sales, asset sales, layoffs and other cost cutting. Optimizing the business against some sense of an historical “core” caused nearsighted — and shortsighted — quarterly actions, financial gyrations and transactions rather than building a sustainable, growing revenue stream. Under Immelt sales did not just stagnate, sales actually declined while leadership pursued higher margins.

By focusing on the “core” GE business (as defined by Immelt) and pursuing short term profit maximization, leadership significantly damaged GE. Nobody would have ever imagined an activist investor taking a position in Welch’s GE in an effort to restructure the company. Its sales growth was so good, its prospects so bright, that its P/E (price to earnings) multiple kept it out of activist range.

But now the vultures see the opportunity to do an even bigger, better job of whacking up GE — of tearing it into small bits while killing off all R&D and innovation — like they did at DuPont. Over 16 years Immelt has weakened GE’s business — what was the most omnipresent industrial company in America, if not the world – to the point that it can be attacked by outsiders ready to chop it up and sell it off in pieces to make a quick buck.

Thomas Edison, one of the world’s great inventors, innovators and founder of GE, would be appalled. That GE needs now, more than ever, is a leader who understands you cannot save your way to prosperity, you have to invest in growth to create future value and increase your equity valuation.

In May, 2012 (five years ago) I warned investors that Immelt was the wrong CEO. I listed him as the fourth worst CEO of a publicly traded company in America. While he steered GE out of trouble during the financial crisis, he also simply steered the company in circles as it used up its resources. Then was the time to change CEOs, and put in place someone with the fortitude to develop a growth strategy that would leverage the resources, and brand, of GE. But, instead, Immelt remained in place, and GE became a lot smaller, and weaker.

At this point, it is probably too late to save GE. By losing sight of the need to grow, and instead focusing on optimizing the old business while selling assets to raise cash for reorganizations, Immelt has destroyed what was once a great innovation engine. Now that the activists have GE in their sites it is unlikely they will let it ever return to the company it once was – creating whole new markets by developing new technologies that people never before imagined. The future looks a lot more like figuring out how to maximize the value of each piece of meat as it’s carved off the GE carcass.

by Adam Hartung | Mar 22, 2017 | In the Whirlpool, Investing, Retail

(Photo by Scott Olson/Getty Images)

Traditional retailers just keep providing more bad news. Payless Shoes said it plans to file bankruptcy next week, closing 500 of its 4,000 stores. Most likely it will follow the path of Radio Shack, which hasn’t made a profit since 2011. Radio Shack filed bankruptcy and shut a gob of stores as part of its “turnaround plan.” Then in February Radio Shack filed its second bankruptcy — most likely killing the chain entirely this time.

Sears Holdings finally admitted it probably can’t survive as a going concern this week. Sears has lost over $10 billion since 2010 — when it last showed a profit — and owes over $4 billion to its creditors. Retail stocks cratered Monday as the list of retailers closing stores accelerated: Sears, KMart, Macy’s, Radio Shack, JCPenney, American Apparel, Abercrombie & Fitch, The Limited, CVS, GNC, Office Depot, HHGregg, The Children’s Place and Crocs are just some of the household names that are slowly (or not so slowly) dying.

None of this should be surprising. By the time CEO Ed Lampert merged KMart with Sears the trend to e-commerce was already pronounced. Anyone could build an excel spreadsheet that would demonstrate as online retail grew, brick-and-mortar retail would decline. In the low margin world of retail, profits would evaporate. It would be a blood bath. Any retailer with any weakness simply would not survive this market shift — and that clearly included outdated store concepts like Sears, KMart and Radio Shack which long ago were outflanked by on-line shopping and trendier storefronts.

Yet, not everyone is ready to give up on some retailers. Walmart, for example, still trades at $70 per share, which is higher than it traded in 2015 and about where it traded back in 2012. Some investors still think that there are brick-and-mortar outfits that are either immune to the trends, or will survive the shake-out and have higher profits in the future.

And that is why we have to be very careful about business myths. There are a lot of people that believe as markets shrink the ultimate consolidation will leave one, or a few, competitors who will be very profitable. Capacity will go away, and profits will return. In the end, they believe if you are the last buggy whip maker you will be profitable — so investors just need to pick who will be the survivor and wait it out. And, if you believe this, then you have justified owning Walmart.

Only, markets don’t work that way. As industries consolidate they end up with competitors who either lose money or just barely eke out a small profit. Think about the auto industry, airlines or land-line telecom companies.

Two factors exist which effectively forces all the profits out of these businesses and therefore make it impossible for investors to make money long-term.

First, competitive capacity always remains just a bit too much for the market need. Management, and often investors, simply don’t want to give up in the face of industry consolidation. They keep hoping to reach a rainbow that will save them. So capacity lingers and lingers — always pushing prices down even as costs increase. Even after someone fails, and that capacity theoretically goes away, someone jumps in with great hopes for the future and boosts capacity again. Therefore, excess capacity overhangs the marketplace forcing prices down to break-even, or below, and never really goes away.

Given the amount of retail real estate out there and the bargains being offered to anyone who wants to open, or expand, stores this problem will persist for decades in retail.

Second, demand in most markets keeps declining. Hopefuls project that demand will “stabilize,” thus balancing the capacity and allowing for price increases. Because demand changes aren’t linear, there are often plateaus that make it appear as if demand won’t go down more. But then something changes — an innovation, regulatory change, taste change — and demand takes another hit. And all the hope goes away as profits drop, again.

It is not a successful strategy to try being the “last man standing” in any declining market. No competitor is immune to these forces when markets shift. No matter how big, when trends shift and new forms of competition start growing every old-line company will be negatively affected. Whether fast, or slow, the value of these companies will continue declining until they eventually become worthless.

Nor is it successful long-term to try and segment the business into small groupings which management thinks can be protected. When Xerox brought to market photocopying, small offset press manufacturers (ABDick and Multigraphics ) said not to worry. Xeroxing might be OK in some office installations, but there were customer segments that would forever use lithography. Even as demand shrunk, well into the 1990s, they said that big corporations, industrial users, government entities, schools and other segments would forever need the benefits of lithography, so investors were safe. Today the small offset press market is a tiny fraction of its size in the 1960s. ABDick and Multigraphics both went through rounds of bankruptcies before disappearing. Xerography, its child desktop publishing, and its grandchild electronic screens, killed offset for almost all applications.

So don’t be lured into false hopes by retailers who claim their segment is “protected.” Short-term things might not look bad. But the market has already shifted to e-commerce and this is just round one of change. More and more innovations are coming that will make the need for traditional stores increasingly unnecessary.

Many readers have expressed their disappointment in my chronic warnings about Walmart. But those warnings are no different than my warnings about Sears Holdings. It’s just that the timing may be different. Both companies have been over-investing in assets (brick-and-mortar stores) that are declining in value as they have attempted to defend and extend their old business model. Both radically under-invested in new markets which were cannibalizing their old business. And, in the end, both will end up with the same results.

And this is true for all retailers that depend on traditional brick-and-mortar sales for their revenues and profits — it’s only a matter of when things will go badly, not if. So traditional retail is nowhere that any investor wants to be.

by Adam Hartung | Nov 17, 2016 | Food and Drink, In the Swamp, Innovation, Marketing, Trends

(PAUL J. RICHARDS/AFP/Getty Images)

McDonald’s has been trying for years to re-ignite growth. But, unfortunately for customers and investors alike, leadership keeps going about it the wrong way. Rather than building on new trends to create a new McDonald’s, they keep trying to defend extend the worn out old strategy with new tactics.

Recently McDonald’s leadership tested a new version of the Big Mac,first launched in 1967. They replaced the “special sauce” with Sriracha sauce in order to make the sandwich a bit spicier. They are now rolling it out to a full test market in central Ohio with 128 stores. If this goes well – a term not yet defined – the sandwich could roll out nationally.

This is a classic sustaining innovation. Take something that exists, make a minor change, and offer it as a new version. The hope is that current customers keep buying the original version, and the new version attracts new customers. Great idea, if it works. But most of the time it doesn’t.

Unfortunately, most people who buy a product like it the way it is. Slower Big Mac sales aren’t due to making bad sandwiches. They’re due to people changing their buying habits to new trends. Fifty years ago a Big Mac from McDonald’s was something people really wanted. Famously, in the 1970s a character on the TV series Good Times used to become very excited about going to eat his weekly Big Mac.

People who are still eating Big Macs know exactly what they want. And it’s the old Big Mac, not a new one. Thus the initial test results were “mixed” – with many customers registering disgust at the new product. Just like the failure of New Coke, a New Big Mac isn’t what customers are seeking.

After 50 years, times and trends have changed. Fewer people are going to McDonald’s, and fewer are eating Big Macs. Many new competitors have emerged, and people are eating at Panera, Panda Express, Zaxby’s, Five Guys and even beleaguered Chipotle. Customers are looking for a very different dining experience, and different food. While a version two of the Big Mac might have driven incremental sales in 1977, in 2017 the product has grown tired and out of step with too many people and there are too many alternative choices.

Similarly, McDonald’s CEO’s effort to revitalize the brand by adding ordering kiosks and table service in stores, in a new format labeled the “Experience of the Future,” will not make much difference. Due to the dramatic reconfiguration, only about 500 stores will be changed – roughly 3.5% of the 14,500 McDonald’s. It is an incremental effort to make a small change when competitors are offering substantially different products and experiences.

When a business, brand or product line is growing it is on a trend. Like McDonald’s was in the 1960s and 1970s, offering quality food, fast and at a consistent price nationwide at a time when customers could not count on those factors across independent cafes. At that time, offering new products – like a Big Mac – that are variations on the theme that is riding the trend is a good way to expand sales.

But over time trends change, and adding new features has less and less impact. These sustaining innovations, as Clayton Christensen of Harvard calls them, have “diminishing marginal returns.” That’s an academic’s fancy way of saying that you have to spend ever greater amounts to create the variations, but their benefits keep having less and less impact on growing, or even maintaining, sales. Yet, most leaders keep right on trying to defend & extend the old business by investing in these sustaining measures, even as returns keep falling.

Over time a re-invention gap is created between the customer and the company. Customers want something new and different, which would require the business re-invent itself. But the business keeps trying to tweak the old model. And thus the gap. The longer this goes on, the bigger the re-invention gap. Eventually customers give up, and the product, or company, disappears.

Think about portable hand held AM radios. If someone gave you the best one in the world you wouldn’t care. Same for a really good portable cassette tape player. Now you listen to your portable music on a phone. Companies like Zenith were destroyed, and Sony made far less profitable, as the market shifted from radios and cathode-ray televisions to more portable, smarter, better products.

Motorola, one of the radio pioneers, survived this decline by undertaking a “strategic pivot.” Motorola invested in cell phone technology and transformed itself into something entirely new and different – from a radio maker into a pioneer in mobile phones. (Of course leadership missed the transition to apps and smart phones, and now Motorola Solutions is a ghost of the former company.)

McDonald’s could have re-invented itself a decade ago when it owned Chipotle’s. Leadership could have stopped investing in McDonald’s and poured money into Chipotle’s, aiding the cannibalization of the old while simultaneously capturing a strong position on the new trend. But instead of pivoting, leadership sold Chipotle’s and used the money to defend & extend the already tiring McDonald’s brand.

Strategic pivots are hard. Just look at Netflix, which pivoted from sending videos in the mail to streaming, and is pivoting again into original content. But, they are a necessity if you want to keep growing. Because eventually all strategies become out of step with changing trends, and sustaining innovations fail to keep customers.

McDonald’s needs a very different strategy. It has hit a growth stall, and has a very low probability of ever growing consistently at even 2%. The company needs a lot more than sriracha sauce on a Big Mac if it is to spice up revenue and profit growth.

by Adam Hartung | Oct 26, 2016 | Growth Stall, Innovation, Investing, Leadership, Web/Tech

Apple AAPL -0.72% announced sales and earnings yesterday. For the first time in 15 years, ever since it rebuilt on a strategy to be the leader in mobile products, full year sales declined. After three consecutive down quarters, it was not unanticipated. And Apple’s guidance for next quarter was for investors to expect a 1% or 2% improvement in sales or earnings. That’s comparing to the disastrous quarter reported last January, which started this terrible year for Apple investors.

Yet, most analysts remain bullish on Apple stock. At a price/earnings (P/E) of 13.5, it is by far the cheapest tech stock. iPad sales are stagnant, iPhone sales are declining, Apple Watch sales dropped some 70% and Chromebook breakout sales caused a 20% drop in Mac Sales. Yet most analysts believe that something will improve and Apple will get its mojo back.

Only, the odds are against Apple. As I pointed out last January, Apple’s value took a huge hit because stagnating sales caused the company to completely lose its growth story. And, the message that Apple doesn’t know how to grow just keeps rolling along. By last quarter – July – I wrote Apple had fallen into a Growth Stall. And that should worry investors a lot.

Ten Deadly Sins Of Networking

Companies that hit growth stalls almost always do a lot worse before things improve – if they ever improve. Seventy-five percent of companies that hit a growth stall have negative growth for several quarters after a stall. Only 7% of companies grow a mere 6%. To understand the pattern, think about companies like Sears, Sony, RIM/Blackberry, Caterpillar Tractor. When they slip off the growth curve, there is almost always an ongoing decline.

And because so few regain a growth story, 70% of the companies that hit a growth stall lose over half their market capitalization. Only 5% lose less than 25% of their market cap.

Why? Because results reflect history, and by the time sales and profits are falling the company has already missed a market shift. The company begins defending and extending its old products, services and business practices in an effort to “shore up” sales. But the market shifted, either to a competitor or often a new solution, and new rev levels do not excite customers enough to create renewed growth. But since the company missed the shift, and hunkered down to fight it, things get worse (usually a lot worse) before they get better.

Think about how Microsoft MSFT -0.42% missed the move to mobile. Too late, and its Windows 10 phones and tablet never captured more than 3% market share. A big miss as the traditional PC market eroded.

Right now there is nothing which indicates Apple is not going to follow the trend created by almost all growth stalls. Yes, it has a mountain of cash. But debt is growing faster than cash now, and companies have shown a long history of burning through cash hoards rather than returning the money to shareholders.

Apple has no new products generating market shifts, like the “i” line did. And several products are selling less than in previous quarters. And the CEO, Tim Cook, for all his operational skills, offers no vision. He actually grew testy when asked, and his answer about a “strong pipeline” should be far from reassuring to investors looking for the next iPhone.

Will Apple shares rise or fall over the next quarter or year? I don’t know. The stock’s P/E is cheap, and it has plenty of cash to repurchase shares in order to manipulate the price. And investors are often far from rational when assessing future prospects. But everyone would be wise to pay attention to patterns, and Apple’s Growth Stall indicates the road ahead is likely to be rocky.

by Adam Hartung | Sep 30, 2016 | Immigration, Leadership, Lifecycle, Trends

I write about trends. Technology trends are exciting, because they can come and go fast – making big winners of some companies (Apple, Facebook, Tesla, Amazon) and big losers out of others (Blackberry, Motorola, Saab, Sears.) Leaders that predict technology trends can make lots of money, in a hurry, while those who miss these trends can fail faster than anyone expected.

But unlike technology, one of the most important trends is also the most predictable trend. That is demographics. Quite simply, it is easy to predict the population of most countries, and most states. And predict the demographic composition of countries by age, gender, ancestry, even religion. And while demographic trends are remarkably easy to predict very accurately, it is amazing how few people actually plan for them. Yet, increasingly, ignoring demographic trends is a bad idea.

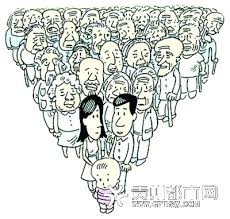

Take for example the aging world population. Quite simply, in most of the world there have not been enough births to keep up with those who ar\e getting older. Fewer babies, across decades, and you end up with a population that is skewed to older age. And, eventually, a population decline. And that has a lot of implications, almost all of which are bad.

Look at Japan. Every September 19 the Japanese honor Respect for the Aged Day by awarding silver sake dishes to those who are 100 or older. In 1966, they gave out a few hundred. But after 46 straight years of adding centenarians to the population, including adding 32,000 in just the last year, there are over 65,000 people in Japan over 100 years old. While this is a small percentage, it is a marker for serious economic problems.

Over 25% of all Japanese are over 65. For decades Japan has had only 1.4 births per woman, a full third less than the necessary 2.1 to keep a population from shrinking. That means today there are only 3 people in Japan for every “retiree.” So a very large percentage of the population are no longer economically productive. They no longer are creating income, spending and growing the economy. With only 3 people to maintain every retiree, the national cost to maintain the ageds’ health and well being soon starts becoming an enormous tax, and economic strain.

What’s worse, by 2060 demographers expect that 40% of Japanese will be 65+. Think about that – there will be almost as many over 65 as under 65. Who will cover the costs of maintaining this population? The country’s infrastructure? Japan’s defense from potentially being overtaken by neighbors, such as China? How does an economy grow when every citizen is supporting a retiree in addition to themselves?

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

This means that China’s aging population problem will not recover for several more decades. Today there are 5 workers for every retiree in China. But there are already more people exiting China’s workforce than entering it each year. We can easily predict there will be both an aging, and a declining, population in China for another 40 years. Thus, by 2040 (just 24 years away) there will be only 1.6 workers for each retiree. The median age will shift from 30 to 46, making China one of the planet’s oldest populations. There will be more people over age 65 in China than the entire populations of Germany, Japan, France and Britain combined!

While it is popular to discuss an emerging Chinese middle class, that phenomenon will be short-lived as the country faces questions like – who will take care of these aging people? Who will be available to work, and grow the economy? To cover health care costs? Continued infrastructure investment? Lacking immigration, how will China maintain its own population?

“OK,” American readers are asking, “that’s them, but what about us?” In 1970 there were about 20M age 65+ in the USA. Today, 50M. By 2050, 90M. In 1980 this was 11% of the population. But 2040 it will be over 20% (stats from Population Reference Bureau.)

While this is a worrisome trend, one could ask why the U.S. problem isn’t as bad as other countries? The answer is simply immigration. While Japan and China have almost no immigration, the U.S. immigrant population is adding younger people who maintain the workforce, and add new babies. If it were not for immigration, the U.S. statistics would look far more like Asian countries.

Think about that the next time it seems appealing to reduce the number of existing immigrants, or slow the number of entering immigrants. Without immigrants the U.S. would be unable to care for its own aging population, and simultaneously unable to maintain sufficient economic growth to maintain a competitive lead globally. While the impact is a big shift in the population from European ancestry toward Latino, Indian and Asian, without a flood of immigrants America would crush (like Japan and China) under the weight of its own aging demographics.

Like many issues, what looks obvious in the short-term can be completely at odds with a long-term solution. In this case, the desire to remove and restrict immigration sounds like a good idea to improve employment and wages for American citizens. And shutting down trade with China sounds like a positive step toward the same goals. But if we look at trends, it is clear that demographic shifts indicate that the countries that maximize their immigration will actually do better for their indigenous population, while improving international competitiveness.

Demographic trends are incredibly accurately predictable. And they have enormous implications for not only countries (and their policies,) but companies. Do your forward looking plans use demographic trends to plan for:

- maintaining a trained workforce?

- sourcing products from a stable, competitive country?

- having a workplace conducive to employees who speak English as a second language?

- a workplace conducive to religions beyond Christianity?

- investing in more capital to produce more with fewer workers?

- products that appeal to people not born in the USA?

- selling products in countries with growing populations, and economies?

- paying higher costs for more retirees who live longer?

Most planning systems, unfortunately, are backward-looking. They bring forward lots of data about what happened yesterday, but precious few projections about trends. Yet, we live in an ever changing world where trends create important, large shifts – often faster than anticipated. And these trends can have significant implications. To prepare everyone should use trends in their planning, and you can start with the basics. No trend is more basic than understanding demographics.

by Adam Hartung | Sep 23, 2016 | Disruptions, In the Rapids, Innovation, Leadership, Television, Web/Tech

In early August Tesla announced it would be buying SolarCity. The New York Times discussed how this combination would help CEO Elon Musk move toward his aspirations for greater clean energy use. But the Los Angeles Times took the companies to task for merging in the face of tremendous capital needs at both, while Tesla was far short of hitting its goals for auto and battery production.

Since then the press has been almost wholly negative on the merger. Marketwatch’s Barry Randall wrote that the deal makes no sense. He argues the companies are in two very different businesses that are not synergistic – and he analogizes this deal to GM buying Chevron. He also makes the case that SolarCity will likely go bankrupt, so there is no good reason for Tesla shareholders to “bail out” the company. And he argues that the capital requirements of the combined entities are unlikely to be fundable, even for its visionary CEO.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

But short-sellers are clearly not long-term investors. And there is a lot more ability for this deal to succeed and produce tremendous investor returns than anyone could ever glean from studying historical financial statements of both companies.

GM buying Chevron is entirely the wrong analogy to compare with Tesla buying SolarCity. Instead, compare this deal to what happened in the creation of television after General Sarnoff, who ran RCA, bought what he renamed NBC.

The world already had radio (just as we already have combustion powered cars.) The conundrum was that nobody needed a TV, especially when there were no TV programs. But nobody would create TV programs if there were no consumers with TVs. General Sarnoff realized that both had to happen simultaneously – the creation of both demand, and supply. It would only be by the creation, and promotion, of both that television could be a success. And it was General Sarnoff who used this experience to launch the first color televisions at the same time as NBC launched the first color programming – which fairly quickly pushed the industry into color.

Skeptics think Mr. Musk and his companies are in over their heads, because there are manufacturing issues for the batteries and the cars, and the solar panel business has yet to be profitable. Yet, the older among us can recall all the troubles with launching TV.

Early sets were not only expensive, they were often problematic, with frequent component failures causing owners to take the TV to a repairman. Often reception was poor, as people relied on poor antennas and weak network signals. It was common to turn on a set and have “snow” as we called it – images that were far from clear. And there was often that still image on the screen with the words “Technical Difficulties,” meaning that viewers just waited to see when programming would return. And programming was far from 24×7 – and quality could be sketchy. But all these problems have been overcome by innovation across the industry.

Yes, the evolution of electric cars will involve a lot of ongoing innovation. So judging its likely success on the basis of recent history would be foolhardy. Today Tesla sells 100% of its cars, with no discounts. The market has said it really, really wants its vehicles. And everybody who is offered electric panels with (a) the opportunity to sell excess power back to the grid and (b) financing, takes the offer. People enjoy the low cost, sustainable electricity, and want it to grow. But lacking a good storage device, or the inability to sell excess power, their personal economics are more difficult.

Electricity production, electricity storage (batteries) and electricity consumption are tightly linked technologies. Nobody will build charging stations if there are no electric cars. Nobody will build electric cars if there are not good batteries. Nobody will make better batteries if there are no electric cars. Nobody will install solar panels if they can’t use all the electricity, or store what they don’t immediately need (or sell it.)

This is not a world of an established marketplace, where GM and Chevron can stand alone. To grow the business requires a vision, business strategy and technical capability to put it all together. To make this work someone has to make progress in all the core technologies simultaneously – which will continue to improve the storage capability, quality and safety of the electric consuming automobiles, and the electric generating solar panels, as well as the storage capabilities associated with those panels and the creation of a new grid for distribution.

This is why Mr. Musk says that combining Tesla and SolarCity is obvious. Yes, he will have to raise huge sums of money. So did such early pioneers as Vanderbilt (railways,) Rockefeller (oil,) Ford (autos,) and Watson (computers.) More recently, Steve Jobs of Apple became heroic for figuring out how to simultaneously create an iPhone, get a network to support the phone (his much maligned exclusive deal with AT&T,) getting developers to write enough apps for the phone to make it valuable, and creating the retail store to distribute those apps (iTunes.) Without all those pieces, the ubiquitous iPhone would have been as successful as the Microsoft Zune.

It is fair for investors to worry if Tesla can raise enough money to pull this off. But, we don’t know how creative Mr. Musk may become in organizing the resources and identifying investors. So far, Tesla has beaten all the skeptics who predicted failure based on price of the cars (Tesla has sold 100% of its production,) lack of range (now up to nearly 300 miles,) lack of charging network (Tesla built one itself) and charging time (now only 20 minutes.) It would be shortsighted to think that the creativity which has made Tesla a success so far will suddenly disappear. And thus remarkably thoughtless to base an analysis on the industry as it exists today, rather than how it might well look in 3, 5 and 10 years.

The combination of Tesla and SolarCity allows Tesla to have all the components to pursue greater future success. Investors with sufficient risk appetite are justified in supporting this merger because they will be positioned to receive the future rewards of this pioneering change in the auto and electric utility industries.

by Adam Hartung | Sep 14, 2016 | Immigration, In the Rapids, Innovation, Telecom, Trends

I’m amazed about Americans’ debate regarding immigration. And all the rhetoric from candidate Trump about the need to close America’s borders.

I was raised in Oklahoma, which prior to statehood was called The Indian Territory. I was raised around the only real Native Americans. All the rest of us are immigrants. Some voluntarily, some as slaves. But the fact that people want to debate whether we allow people to become Americans seems to me somewhat ridiculous, since 98% of Americans are immigrants. The majority within two generations.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

And almost since the beginning, immigrants have been not only abused but scammed. Those who have resources frequently took advantage of the newcomers that did not. And this persists. Immigrants that lack a social security card are unable to obtain a driver’s license, unable to open bank accounts, unable to apply for credit cards, unable to even sign up for phone service. Thus they remain at the will of others to help them, which creates the opportunity for scamming.

Take for example an immigrant trying to make a phone call to his relatives back home. For most immigrants this means using a calling card. Only these cards are often a maze of fees, charges and complex rules that result in much of the card’s value being lost. A 10-minute call to Ghana can range from $2.86 to $8.19 depending on which card you use. This problem is so bad that the FCC has fined six of the largest card companies for misleading consumers about calling cards. They continue to advise consumers about fraud. And even Congress has held hearings on the problem.

One outcome of immigrants’ difficulties has been the ingenuity and innovativeness of Americans. To this day around the world people marvel at how clever Americans are, and how often America leads the world in developing new things. As a young country, and due to the combination of resources and immigrants’ tough situation, America frequently is first at developing new solutions to solve problems – many of which are problems that clearly affect the immigrant population.

So, back to that phone call. Some immigrants can use Microsoft Skype to talk with their relatives, using the Internet rather than a phone. But this requires the people back home have a PC and an internet connection. Both of which could be dicey. Another option would be to use something like Facebook’s WhatsApp, but this requires the person back home have either a PC or mobile device, and either a wireless connection or mobile coverage. And, again, this is problematic.

But once again, ingenuity prevails. A Romanian immigrant named Daniel Popa saw this problem, and set out to make communications better for immigrants and their families back home. In 2014 he founded QuickCall.com to allow users to make a call over wireless technology, but which can then interface with the old-fashioned wired (or wireless) telecom systems around the world. No easy task, since telephone systems are a complex environment of different international, national and state players that use a raft of different technologies and have an even greater set of complicated charging systems.

But this new virtual phone network, which links the internet to the traditional telecom system, is a blessing for any immigrant who needs to contact someone in a rural, or poor, location that still depends on phone service. If the person on the other end can access a WiFi system, then the calls are free. If the connection is to a phone system then the WiFi interface on the American end makes the call much cheaper – and performs far, far better than any other technology. QuickCall has built the carrier relationships around the world to make the connections far more seamless, and the quality far higher.

But like all disruptive innovations, the initial market (immigrants) is just the early adopter with a huge need. Being able to lace together an internet call to a phone system is pretty powerful for a lot of other users. Travelers heading to a remote location, like Micronesia, Africa or much of South America — and even Eastern Europe – can lower the cost of planning their trip and connect with locals by using QuickCall.com. And for most Americans traveling in non-European locations their cell phone service from Sprint, Verizon, AT&T or another carrier simply does not work well (if at all) and is very expensive when they arrive. QuickCall.com solves that problem for these travelers.

Small businesspeople who have suppliers, or customers, in these locations can use QuickCall.com to connect with their business partners at far lower cost. Businesses can even have their local partners obtain a local phone number via QuickCall.com and they can drive the cost down further (potentially to zero). This makes it affordable to expand the offshore business, possibly even establishing small scale customer support centers at the local supplier, or distributor, location.

In The Innovator’s Dilemma Clayton Christensen makes the case that disruptive innovations develop by targeting a customer with an unmet need. Usually the innovation isn’t as good as the current “standard,” and is also more costly. Today, making an international call through the phone system is the standard, and it is fairly cheap. But this solution is often unavailable to immigrants, and thus QuickCall.com fills their unmet need, and at a cost substantially lower than the infamous calling cards, and with higher quality than a pure WiFi option.

But now that it is established, and expanding to more countries – including developed markets like the U.K. – the technology behind QuickCall.com is becoming more mainstream. And its uses are expanding. And it is reducing the need for people to have international calling service on their wired or wireless phone because the available market is expanding, the quality is going up, and the cost is going down. Exactly the way all disruptive innovations grow, and thus threaten the entrenched competition.

The end-game may be some form of Facebook in-app solution. But that depends on Facebook or one of its competitors seizing this opportunity quickly, and learning all QuickCall.com already knows about the technology and customers, and building out that network of carrier relationships. Notice that Skype was founded in 2003, and acquired by Microsoft in 2011, and it still doesn’t have a major presence as a telecom replacement. Will a social media company choose to make the investment and undertake developing this new solution?

As small as QuickCall.com is – and even though you may have never heard of it – it is an example of a disruptive innovation that has been successfully launched, and is successfully expanding. It may seem like an impossibility that this company, founded by an immigrant to solve an unmet need of immigrants, could actually change the way everyone makes international calls. But, then again, few of us thought the iPhone and its apps would cause us to give up Blackberries and quit carrying our PCs around.

America is known for its ingenuity and innovations. We can thank our heritage as immigrants for this, as well as the immigrant marketplace that spurs new innovation. America’s immigrants have the need to succeed, and the unmet needs that create new markets for launching new solutions. For all those conservatives who fear “European socialism,” they would be wise to realize the tremendous benefits we receive from our immigrant population. Perhaps these naysayers should use QuickCall.com to connect with a few more immigrants and understand the benefits they bring to America.

by Adam Hartung | Aug 26, 2016 | In the Swamp, Investing, Retail, Trends

Photographer: Luke Sharrett/Bloomberg

Walmart is in more trouble than its leadership wants to acknowledge. Investors

need to realize that it is up to Jet.com to turn around the ailing giant. And

that is a big task for the under $1 billion company.

Relevancy Is Hard To Keep – Look At Sears

Nobody likes to think their business can disappear. What CEO wants to tell his investors or employees “we’re no longer relevant, and it looks like our customers are all going somewhere else for their solutions”? Unfortunately, most leadership teams become entrenched in the business model and deny serious threats to longevity, thus leading to inevitable failure as customers switch.

Gallery: “Walmart Goes Small”

In early September the Howard Johnson’s in Bangor, Maine will close. This will leave just one remaining HoJo in the USA. What was once an iconic brand with hundreds of outlets strung along the fast growing interstate highway system is now nearly dead. People still drive the interstate, but trends changed, fast food became a good substitute, and unable to update its business model this once great brand died.

AP Photo/Elise Amendola

Sears announced another $350 million quarterly loss this week. That makes $9 billion in accumulated losses the last several quarters. Since Chairman and CEO Ed Lampert took over, Sears and Kmart have seen same store sales decline every single quarter except one. Unable to keep its customers Mr. Lampert has been closing stores and selling assets to stem the cash drain. But to keep the company afloat his hedge fund, ESL, is loaning Sears Holdings SHLD -2.94% another $300 million. On top of the $500 million the company borrowed last quarter. That the once iconic company, and Dow Jones Industrial Average component, is going to fail is a foregone conclusion.

But most people still think this fate cannot befall the nearly $500 billion revenue behemoth Walmart. It’s simply too big to fail in most people’s eyes.

Walmart’s Crime Problem Is Another Telltale Sign Of Problems In The Business Model

Yet, the primary news about Walmart is not good. Bloomberg this week broke the news that one of the most crime-ridden places in America is the local Walmart store. One store in Tulsa, Oklahoma has had 5,000 police visits in the last five years, and four local stores have had 2,000 visits in the last year alone. Across the system, there is one violent crime in a Walmart every day. By constantly promoting its low cost strategy Walmart has attracted a class of customer that simply is more prone to committing crime. And policies implemented to hang onto customers, like letting them camp out overnight in the parking lots, serve to increase the likelihood of poverty-induced crime.

But this outcome is also directly related to Walmart’s business model and strategy. To promote low prices Walmart has automated more operations, and cut employees like greeters. Thus leadership brags about a 23% increase in sales/employee the last decade. But that has happened as the employment shrank by 400,000. Fewer employees in the stores encourages more crime.

In a real way Walmart has “outsourced” its security to local police departments. Experts say the cost to eliminate this security problem are about $3.2 billion – or about 20% of Walmart’s total profitability. Ouch! In a world where Walmart’s net margin of 3% is fully one-third lower than Target’s 4.6% the money just isn’t there any longer for Walmart to invest in keeping its stores safe.

With each passing month Walmart is becoming the “retailer of last resort” for people who cannot shop online. People who lack credit cards, or even bank accounts. People without the means, or capability, of shopping by computer, or paying electronically. People who have nowhere else to go to shop, due to poverty and societal conditions. Not exactly the ideal customer base for building a growing, profitable business.

Competitors Relentlessly Pick Away At Walmart’s Sales And Profits

To maintain revenues the last several years Walmart has invested heavily in transitioning to superstores which offer a large grocery section. But now Kroger KR -0.5%, Walmart’s no. 1 grocery competitor, is taking aim at the giant retailer, slashing prices on 1,000 items. Just like competition from the “dollar stores” has been attacking Walmart’s general merchandise aisles. Thus putting even more pressure on thinning margins, and leaving less money available to beef up security or entice new customers to the stores.

And the pressure from e-commerce is relentless. As detailed in the Wall Street Journal, Walmart has been selling online for about 15 years, and has a $14 billion online sales presence. But this is only 3% of total sales. And growth has been decelerating for several quarters. Last quarter Walmart’s e-commerce sales grew 7%, while the overall market grew 15% and Amazon ($100 billion revenues) grew 31%. It is clear that Walmart.com simply is not attracting enough customers to grow a healthy replacement business for the struggling stores.

Thus the acquisition of Jet.com.

The hope is that this extremely unprofitable $1 billion online retailer will turn around Walmart’s fortunes. Imbue it with much higher growth, and enhanced profitability. But will Walmart make this transition. Is leadership ready to cannibalize the stores for higher electronic sales? Are they willing to make stores smaller, and close many more, to shift revenues online? Are they willing to suffer Amazon-like profits (or losses) to grow? Are they willing to change the Walmart brand to something different, while letting Jet.com replace Walmart as the dominant brand? Are they willing to give up on the past, and let new leadership guide the company forward?

If they do then Walmart could become something very different in the future. If they really realize that the market is shifting, and that an extreme change is necessary in strategy and tactics then Walmart could become something very different, and remain competitive in the highly segmented and largely online retail future. But if they don’t, Walmart will follow Sears into the whirlpool, and end up much like Howard Johnson’s.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.