by Adam Hartung | Feb 27, 2018 | Growth Stall, Innovation, Investing, Software

This February, Warren Buffett admitted he had no faith in IBM. After accumulating a huge position, by 4th quarter of 2017 he sold out almost the entire Berkshire Hathaway position. He lost faith in the IBM CEO Virginia (Ginni) Rometty, who talked big about a turnaround, but it never happened.

Mr. Buffett would have been wise to stopped having “faith” long ago. All the way back in May, 2014 I wrote that IBM was not going to be a turnaround. CEO Rommetty was spending ALL its money on share buybacks, rather than growing its business. The Washington Post made IBM the “poster child” for stupid share buybacks, pointing out that spending over $8B on repurchases had maintained earnings-per-share, and propped up the stock price, but giving IBM the largest debt-to-equity ratio of comparable companies.

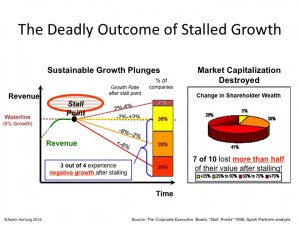

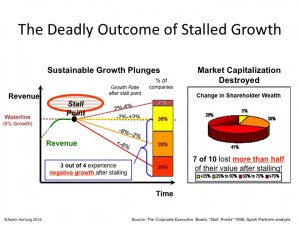

IBM was already in a Growth Stall, something about which I’ve written often. Once a company stalls, its odds  of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

By April, 2017 it was clear IBM was a disaster. By then we had 20 consecutive quarters of declining revenue. Amazing. How Rometty kept her job was completely unclear. Five years of shrinkage, while all investments were in buying the stock of its shrinking enterprise – intended to hide the shrink! CEO Rometty continued promising a turnaround, with vague references to the “wonderful” Watson program. But it was clear, Buffett (and everyone else) needed to get out in 2014. So Berkshire ate its losses, took the money and ran.

Have you learned your lesson? As an investor are you holding onto stocks long after leadership has shown they have no idea how to grow revenues? If so, why? Hope is not a strategy.

As a leader, are you still forecasting hockey stick turnarounds, while continuing to invest in outdated products and businesses? Are you hoping your past will somehow create your future, even though competitors and markets have moved on? Are you leading like Rometty, hoping you can hide your failures with financial machinations and Powerpoint presentations about how things will turn your way in the future – even though those assumptions are made out of hole cloth?

It’s time to get real about your investments, and your business. When revenues are challenged, something bad is happening. It’s time to do something. Fast. Before a bad quarter becomes 20, and everyone is giving up.

by Adam Hartung | Feb 6, 2018 | Innovation, Mobile, Software, Web/Tech

InvestorPlace.com declared Snap stock will be a big disappointment in 2018. Bad news for investors, because SNAP was an enormous disappointment in 2017. After going public at $27/share in early March, the stock dropped to $20 by mid-March, then just kept dropping until it bottomed at just under $12 in August. Since then the stock has largely gone sideways at $15.

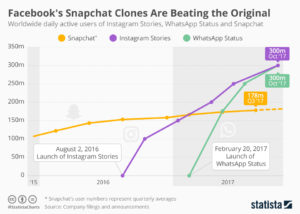

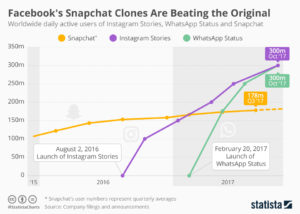

This was not unexpected. As I wrote in April, Snapchat was not without competition and was unlikely to be a long-term winner. Even though Snapchat and its Stories feature grew popular with teenagers 14 to 19, in August, 2016 Facebook launched Instagram Stories as a direct competitor. In just 7 months – just as SNAP went public – Instagram Stories had more users than Snapchat. It was clear then if you wanted to make money on the photo and video sharing trends, investors were better off to own Facebook stock and avoid the newly available SNAP shares (stock, not pix!)

Now the situation is far worse. Facebook launched WhatsApp Status as another competitive product in February, 2017 and it took less than 3 months for its user base to exceed Snapchat. As the chart below shows, by October, 2017 Stories and Status each had 300 million users, while Snapchat was mired at 180 million users. With only 30% the users of Facebook, Snapchat has little chance to succeed against the social media powerhouse.

Statista

Facebook is now a very large company. But, it has shown it is adaptable. Rather than sticking to its original market, Facebook went mobile and has launched new products as fast as competitors tried to carve out niches. The question is, are you constantly scanning the horizon for new products and adapting – fast – to keep your customers and grow? Or are you stuck trying to defending your old business while upstarts carve up your market?”

by Adam Hartung | Jun 9, 2016 | Innovation, Investing, Software, Teamwork

Last week Bloomberg broke a story about how Microsoft’s Chairman, John Thompson, was pushing company management for a faster transition to cloud products and services. He even recommended changes in spending might be in order.

Really? This is news?

Let’s see, how long has the move to mobile been around? It’s over a decade since Blackberry’s started the conversion to mobile. It was 10 years ago Amazon launched AWS. Heck, end of this month it will be 9 years since the iPhone was released – and CEO Steve Ballmer infamously laughed it would be a failure (due to lacking a keyboard.) It’s now been 2 years since Microsoft closed the Nokia acquisition, and just about a year since admitting failure on that one and writing off $7.5B And having failed to achieve even 3% market share with Windows phones, not a single analyst expects Microsoft to be a market player going forward.

So just now, after all this time, the Board is waking up to the need to change the resource allocation? That does seem a bit like looking into barn lock acquisition long after the horses are gone, doesn’t it?

The problem is that historically Boards receive almost all their information from management. Meetings are tightly scheduled affairs, and there isn’t a lot of time set aside for brainstorming new ideas. Or even for arguing with management assumptions. The work of governance has a lot of procedures related to compliance reporting, compensation, financial filings, senior executive hiring and firing – there’s a lot of rote stuff. And in many cases, surprisingly to many non-Directors, the company’s strategy may only be a topic once a year. And that is usually the result of a year long management controlled planning process, where results are reviewed and few challenges are expected. Board reviews of resource allocation are at the very, very tail end of management’s process, and commitments have often already been made – making it very, very hard for the Board to change anything.

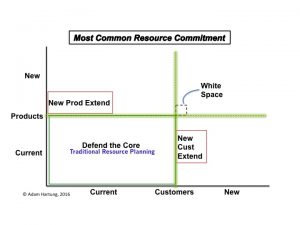

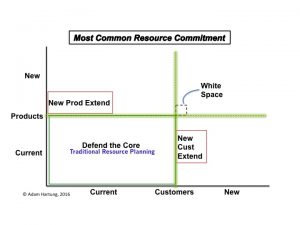

And these planning processes are backward-oriented tools, designed to defend and extend existing products and services, not predict changes in markets. These processes originated out of financial planning, which used almost exclusively historical accounting information. In later years these programs were expanded via ERP (Enterprise Resource Planning) systems (such as SAP and Oracle) to include other information from sales, logistics, manufacturing and procurement. But, again, these numbers are almost wholly historical data. Because all the data is historical, the process is fixated on projecting, and thus defending, the old core of historical products sold to historical customers.

Copyright Adam Hartung

Efforts to enhance the process by including extensions to new products or new customers are very, very difficult to implement. The “owners” of the planning processes are inherent skeptics, inclined to base all forecasts on past performance. They have little interest in unproven ideas. Trying to plan for products not yet sold, or for sales to customers not yet in the fold, is considered far dicier – and therefore not worthy of planning. Those extensions are considered speculation – unable to be forecasted with any precision – and therefore completely ignored or deeply discounted.

And the more they are discounted, the less likely they receive any resource funding. If you can’t plan on it, you can’t forecast it, and therefore, you can’t really fund it. And heaven help some employee has a really novel idea for a new product sold to entirely new customers. This is so “white space” oriented that it is completely outside the system, and impossible to build into any future model for revenue, cost or – therefore – investing.

Take for example Microsoft’s recent deal to sell a bunch of patent rights to Xiaomi in order to have Xiaomi load Office and Skype on all their phones. It is a classic example of taking known products, and extending them to very nearby customers. Basically, a deal to sell current software to customers in new markets via a 3rd party. Rather than develop these markets on their own, Microsoft is retrenching out of phones and limiting its investments in China in order to have Xiaomi build the markets – and keeping Microsoft in its safe zone of existing products to known customers.

The result is companies consistently over-investment in their “core” business of current products to current customers. There is a wealth of information on those two groups, and the historical info is unassailable. So it is considered good practice, and prudent business, to invest in defending that core. A few small bets on extensions might be OK – but not many. And as a result the company investment portfolio becomes entirely skewed toward defending the old business rather than reaching out for future growth opportunities.

This can be disastrous if the market shifts, collapsing the old core business as customers move to different solutions. Such as, say, customers buying fewer PCs as they shift to mobile devices, and fewer servers as they shift to cloud services. These planning systems have no way to integrate trend analysis, and therefore no way to forecast major market changes – especially negative ones. And they lack any mechanism for planning on big changes to the product or customer portfolio. All future scenarios are based on business as it has been – a continuation of the status quo primarily – rather than honest scenarios based on trends.

How can you avoid falling into this dilemma, and avoiding the Microsoft trap? To break this cycle, reverse the inputs. Rather than basing resource allocation on financial planning and historical performance, resource allocation should be based on trend analysis, scenario planning and forecasts built from the future backward. If more time were spent on these plans, and engaging external experts like Board Directors in discussions about the future, then companies would be less likely to become so overly-invested in outdated products and tired customers. Less likely to “stay at the party too long” before finding another market to develop.

If your planning is future-oriented, rather than historically driven, you are far more likely to identify risks to your base business, and reduce investments earlier. Simultaneously you will identify new opportunities worthy of more resources, thus dramatically improving the balance in your investment portfolio. And you will be far less likely to end up like the Chairman of a huge, formerly market leading company who sounds like he slept through the last decade before recognizing that his company’s resource allocation just might need some change.

by Adam Hartung | Apr 27, 2016 | Food and Drink, In the Rapids, In the Swamp, Retail, Software, Web/Tech

Growth fixes a multitude of sins. If you grow revenues enough (you don’t even need profits, as Amazon has proven) investors will look past a lot of things. With revenue growth high enough, companies can offer employees free meals and massages. Executives and senior managers can fly around in private jets. Companies can build colossal buildings as testaments to their brand, or pay to have thier names on public buildings. R&D budgets can soar, and product launches can fail. Acquisitions are made with no concerns for price. Bonuses can be huge. All is accepted if revenues grow enough.

Just look at Facebook. Today Facebook announced today that for the quarter ended March, 2016 revenues jumped to $5.4B from $3.5B a year ago. Net income tripled to $1.5B from $500M. And the company is basically making all its revenue – 82% – from 1 product, mobile ads. In the last few years Facebook paid enormous premiums to buy WhatsApp and Instagram – but who cares when revenues grow this fast.

Anticipating good news, Facebook’s stock was up a touch today. But once the news came out, after-hours traders pumped the stock to over $118//share, a new all time high. That’s a price/earnings (p/e) multiple of something like 84. With growth like that Facebook’s leadership can do anything it wants.

But, when revenues slide it can become a veritable poop puddle. As Apple found out.

Rumors had swirled that Apple was going to say sales were down. And the stock had struggled to make gains from lows earlier in 2016. When the company’s CEO announced Tuesday that sales were down 13% versus a year ago the stock cratered after-hours, and opened this morning down 10%. Breaking a streak of 51 straight quarters of revenue growth (since 2003) really sent investors fleeing. From trading around $105/share the last 4 days, Apple closed today at ~$97. $40B of equity value was wiped out in 1 day, and the stock trades at a p/e multiple of 10.

The new iPhone 6se outsold projections, iPads beat expectations. First year Apple Watch sales exceeded first year iPhone sales. Mac sales remain much stronger than any other PC manufacturer. Apple iBeacons and Apple Pay continue their march as major technologies in the IoT (Internet of Things) market. And Apple TV keeps growing. There are about 13M users of Apple’s iMusic. There are 1.5M apps on the iTunes store. And the installed base keeps the iTunes store growing. Share buybacks will grow, and the dividend was increased yet again. But, none of that mattered when people heard sales growth had stopped. Now many investors don’t think Apple’s leadership can do anything right.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Which leads us to Chipotle. Chipotle announced that same store sales fell almost 30% in Q1, 2016. That was after a 15% decline in Q4, 2015. And profits turned to losses for the quarter. That is a growth stall. Chipotle shares were $750/share back in early October. Now they are $417 – a drop of over 44%.

Customer illnesses have pointed to a company that grew fast, but apparently didn’t have its act together for safe sourcing of local ingredients, and safe food handling by employees. What seemed like a tactical problem has plagued the company, as more customers became ill in March.

Whether that is all that’s wrong at Chipotle is less clear, however. There is a lot more competition in the fast casual segment than 2 years ago when Chipotle seemed unable to do anything wrong. And although the company stresses healthy food, the calorie count on most portions would add pounds to anyone other than an athlete or construction worker – not exactly in line with current trends toward dieting. What frequently looks like a single problem when a company’s sales dip often turns out to have multiple origins, and regaining growth is nearly always a lot more difficult than leadership expects.

Growth is magical. It allows companies to invest in new products and services, and buoy’s a stock’s value enhancing acquisition ability. It allows for experimentation into new markets, and discovering other growth avenues. But lack of growth is a vital predictor of future performance. Companies without growth find themselves cost cutting and taking actions which often cause valuations to decline.

Right now Facebook is in a wonderful position. Apple has investors rightly concerned. Will next quarter signal a return to growth, or a Growth Stall? And Chipotle has investors heading for the exits, as there is now ample reason to question whether the company will recover its luster of yore.

by Adam Hartung | Mar 27, 2015 | Investing, Mobile, Software, Trends, Web/Tech

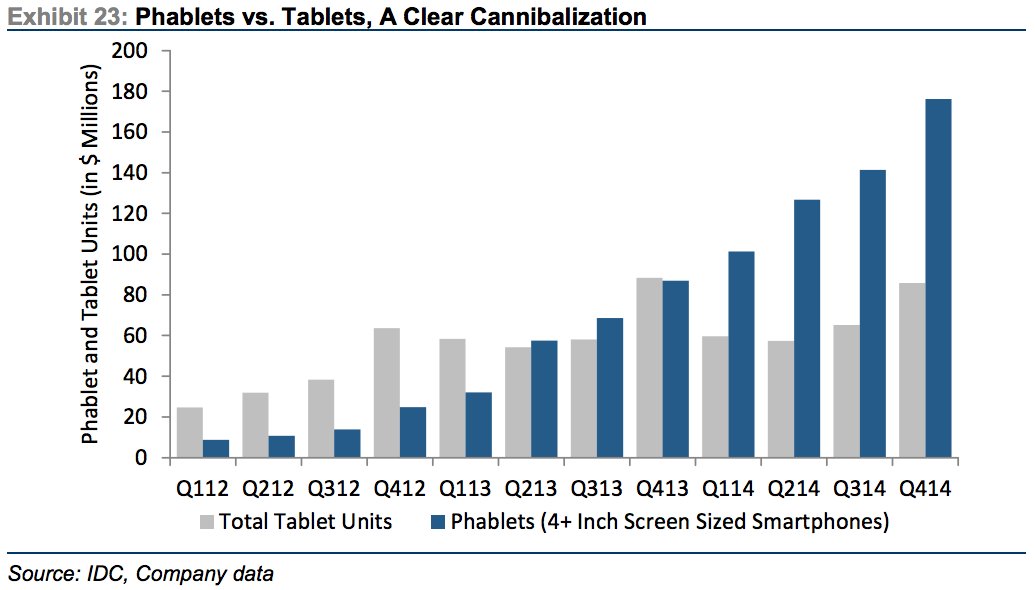

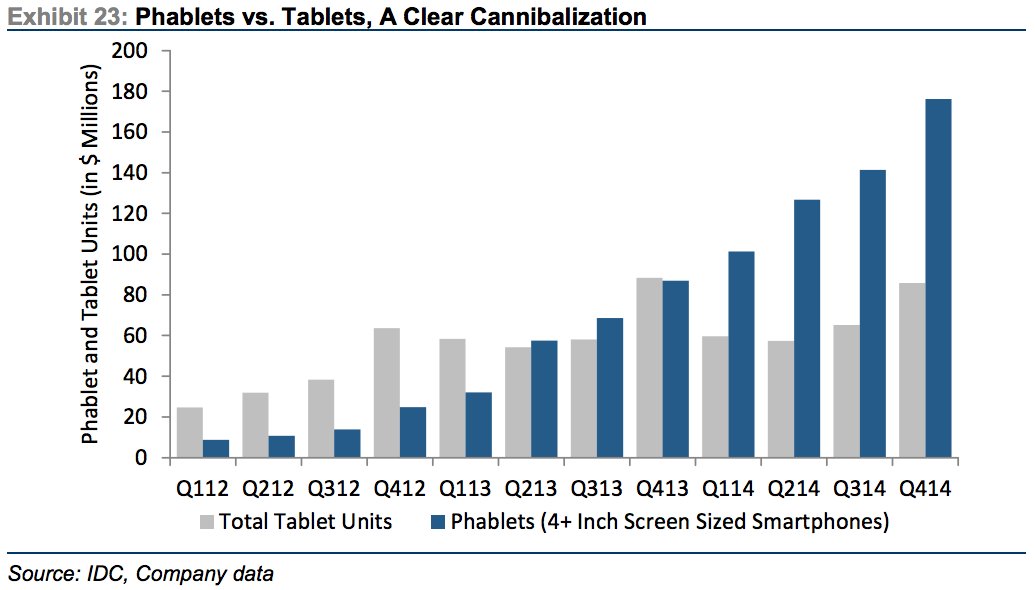

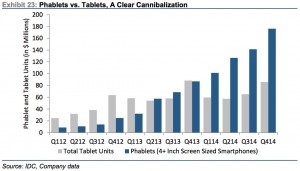

Phablets are a very hot, growing market. Phablets are those huge phones (greater than 4″ screen size) that some people carry around. From almost nothing in 2012, over the last 3 years the market has exploded:

Source: Jay Yarrow, Business Insider http://www.businessinsider.com/in-one-chart-heres-why-the-ipad-business-is-cratering-2015-3?utm_content=&utm_medium=email&utm_source=alerts&nr_email_referer=1

The original creator of this market data, Kulbinder Garcha of Credit Suisse, thinks this demonstrates cannibalization of tablet sales by phablets. And this is supposedly a bad thing for Apple.

But there is another way to look at this. By introducing and promoting a phablet (iPhone 6+ and Galaxy S6,) Apple and Samsung are growing users of mobile media and mobile apps. As the chart shows, growth in tablet sales was nothing compared to what happened when phablets came along. So people who didn’t buy a tablet, and maybe (likely?) wouldn’t, are buying phablets. The market is growing faster with phablets than had they not been introduced, and even if tablet sales shrink Apple and Samsung see revenues continue growing.

Who wins as phablet sales grow? Those who have phablet products in the market, and newer versions in the works.

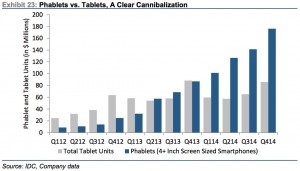

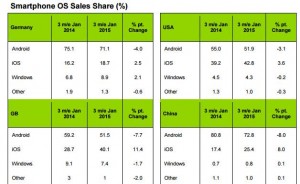

Source: Kantar WorldPanel and Seeking Alpha http://seekingalpha.com/article/3032926-microsoft-the-china-mobile-backed-lenovo-windows-10-smartphone-could-be-a-future-tailwind?ifp=0

As this chart shows, the companies who dominate smartphone sales are those who make Android-based products (#1 is Samsung) and Apple. Microsoft missed the mobile/smartphone trend, and even though it purchased Nokia it has never obtained anything close to double digit share in any market.

Unfortunately for Microsoft enthusiasts, and investors, Microsoft’s Windows10 product is focused first on laptop (PC) users, second on hybrid (products used as both a laptop and tablet), third tablets (primarily the slow-selling Microsoft Surface) and in a far, far trailing position smartphones.

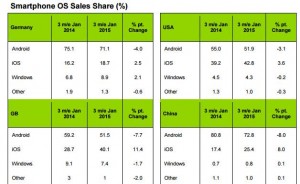

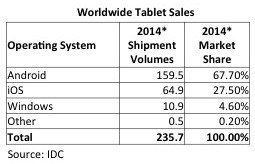

Source: IDC

As data from IDC shows, Surface sales are inconsequential. So the big loser from phablet cannibalization of tablets will be Microsoft. Given its very small user base, and the heavy losses Microsoft has taken on Surface, there is little revenue or cash flow to support an intense competitive effort in a shrinking market. Apple and Samsung will market hard to grow as many sales as possible, and likely will make the tablet products more affordable. Thus one should anticipate Microsoft’s very small tablet share would decline as tablet sales shrink.

This is the problem created when any business misses a major trend.

Microsoft missed the trend to mobile. They didn’t prepare for it in any of their major products, and they let new products, like music player Zune and Lumia phones, languish – and mostly die. By the time Microsoft reacted Apple and Samsung had enormous leads. Microsoft is still trying to play catch-up with its “core” Windows product.

But worse, because it is so far behind, Microsoft’s leaders are unable to forecast where the market will be in 3 years. Consequently they develop products for today’s market, like tablets (and their hybrid products,) which we now see will be obsolete as the market shifts to new products (like phablets.) Because Apple and Samsung already have the new products (phablets) they are prepared to cannibalize the old product sales (tablets) in order to overall grow the marketplace. But Microsoft has no phablet product, really no smartphone product, and will find itself most likely writing off more future Surface products as its tiny market share erodes to nothing.

So this trend to phablets continues to make a Microsoft comeback as a major personal technology competitor problematic. Windows 10 may be coming, but its relevance looks increasingly like that of new Blackberry models. There is little reason to care, because the products are years late and poorly positioned for leading edge customers. Further, developers will already be onto new competitive platforms long before the outdated Microsoft products make it to market. Without share you don’t capture developers, without developers you don’t have a robust app market, without apps you don’t capture customers, without customers you can’t build share — and that’s a terrible whirlpool Microsoft is captured within.

Be sure your business keeps its eyes on trends, and does not wait to react. Waiting can turn out to be deadly.

by Adam Hartung | Jan 22, 2015 | Current Affairs, Defend & Extend, Games, In the Swamp, Innovation, Leadership, Software, Web/Tech

Yesterday Microsoft conducted a pre-launch of Windows 10, demonstrating its features in an effort to excite developers and create some buzz before consumer launch later in 2015.

By and large, nobody cared. Were you aware of the event? Did you try to watch the live stream, offered via the Microsoft web site? Were you eager to read what people thought of the product? Did you look for reviews in the Wall Street Journal, USA Today and other general news outlets?

Microsoft really blew it with Windows 8 – which is the second most maligned Windows product ever, exceeded only by

Vista. But that wasn’t hard to predict, in June, 2012. Even then it was clear that Windows 8, and Surface tablets, were designed to defend and extend the installed Windows base, and as such the design precluded the opportunity to change the market and pull mobile users to Microsoft.

And, unfortunately, that is how Windows 10 has been developed. At the event’s start Microsoft played a tape driving home how it interviewed dozens and dozens of loyal Windows customers, asking them what they didn’t like about 8, and what they wanted in a Windows upgrade. That set the tone for the new product.

Microsoft didn’t seek out what would convert all those mobile users already on iOS or Android to throw away their devices and buy a Microsoft product. Microsoft didn’t ask its defected customers what it would take to bring them back, nor did it ask the over 50% of the market using Windows 7 or older products what it would take to get them to go to Windows mobile rather than an iPad or Galaxy tablet. Nope. Microsoft went to its installed base and asked them what they would like.

Imagine it’s 1975 and for two decades you have successfully made and sold small offset printing presses. Every single company of any size has one in their basement. But customers have started buying really simple, easy to use Xerox machines. Fewer admins are sending even fewer jobs to the print shop in the basement, as they choose to simply run off a bunch of copies on the Xerox machine. Of course these copies are more expensive than the print shop, and the quality isn’t as good, but the users find the new Xerox machines good enough, and they are simple and convenient.

What are you to do if you make printing presses? You probably need to find out how you can get into a new product that actually appeals to the users who no longer use the print shop. But, instead, those companies went to the print shop operators and asked them what they wanted in a new, small print machine. And then the companies upgraded their presses and other traditional printing products based upon what that installed base recommended. And it wasn’t long before their share of printing eroded to a niche of high-volume, and often color, jobs. And the commercial print market went to Xerox.

That’s what Microsoft did with Windows 10. It asked its installed base what it wanted in an operating system. When the problem isn’t the installed base, its the substitute product that is killing the company. Microsoft didn’t need input from its installed base of loyal users, it needed input from people who have quit using HP laptops in favor of iPads.

There are a lot of great new features in Windows 10. But it really doesn’t matter.

The well spoken presenters from Microsoft laid out how Windows 10 would be great for anyone who wants to go to an entirely committed Windows environment. To achieve Microsoft’s vision of the future every one of us will throw away our iOS and Android products and go to Windows on every single device. Really. There wasn’t one demonstration of how Windows would integrate with anything other than Windows. And there appeared on intention of making the future an interoperable environment. Microsoft’s view was we would use Windows on EVERYTHING.

Microsoft’s insular view is that all of us have been craving a way to put Windows on all our devices. We’ve been sitting around using our laptops (or desktops) and saying “I can’t wait for Microsoft to come out with a solution so I can throw away my iPhone and iPad. I can’t wait to tell everyone in my organization that now, finally, we have an operating system that IT likes so much that we want everyone in the company to get rid of all other technologies and use Windows on their tablets and phones – because then they can integrate with the laptops (that most of us don’t use hardly at all any longer.)”

Microsoft even went out of its way to demonstrate how well Win10 works on 2-in-1 devices, which are supposed to be both a tablet and a laptop. But, these “hybrid” devices really don’t make any sense. Why would you want something that is both a laptop and a tablet? Who wants a hybrid car when you can have a Tesla? Who wants a vehicle that is both a pick-up and a car (once called the El Camino?) Microsoft thinks these are good devices, because Microsoft can’t accept that most of us already quit using our laptop and are happy enough with a tablet (or smartphone) alone!

Microsoft presenters repeatedly reminded us that Windows is evolving. Which completely ignores the fact that the market has been disrupted. It has moved from laptops to mobile devices. Yes, Windows has a huge installed base on machines that we use less and less. But Windows 10 pretends that there does not exist today an equally huge, and far more relevant, installed base of mobile devices that already has millions of apps people use every single day over and over. Microsoft pretended as if there is no world other than Windows, and that a more robuts Windows is something people can’t wait to use! We all can’t wait to go back to a exclusive Microsoft world, using Windows, Office, the new Spartan browser – and creating documents, spreadsheets and even presentations using Office, with those hundreds of complex features (anyone know how to make a pivot table?) on our phones!

Just like those printing press manufacturers were sure people really wanted documents printed on presses, and couldn’t wait to unplug those Xerox machines and return to the old way of doing things. They just needed presses to have more features, more capabilities, more speed!

The best thing in Windows 10 is Cortana, which is a really cool, intelligent digital assistant. But, rather than making Cortana a tool developers can buy to integrate into their iOS or Android app the only way a developer can use Cortana is if they go into this exclusive Windows-only world. That’s a significant request.

Microsoft made this mistake before. Kinect was a great tool. But the only way to use it, initially, was on an xBox – and still is limited to Windows. Despite its many superb features, Kinect didn’t develop anywhere near its potential. Cortana now suffers from the same problem. Rather than offering the tool so it can find its best use and markets, Microsoft requires developers and consumers buy into the Windows-exclusive world if you want to use Cortana.

Microsoft hasn’t yet figured out that it lost relevance years ago when it missed the move to mobile, and then launched Windows 8 and Surface to markets that didn’t really want those products. Now the market has gone mobile, and the leader isn’t Microsoft. Microsoft has to find a way to be relevant to the millions of people using alternative products, and the Windows 10 vision, which excludes all those competing devices, simply isn’t it.

There was lots of neat geeky stuff shown. Surface tablets using Windows 10 with an xBox app can now do real gaming, which looks pretty cool and helps move Microsoft forward in mobile gaming. That may be a product that sets Sony’s Playstation and Nintendo’s Wii on their heels. But that’s gaming, and historically not where Microsoft makes any money (nor for that matter does Sony or Nintendo.)

There is a new interactive whiteboard that integrates Skype and Windows tablets for digital enhancement of brainstorming meetings. But it is unclear how a company uses it when most employees already have iPhones or Samsung S5s or Notes. And for the totally geeky there was a demo of a holographic headset. But when it comes to disruptive products like this success requires finding really interesting applications that otherwise cannot be completed, and then the initial customers who have a really desperate need for that application who will become devoted users.

Launching such disruptive products has long been the bane of Microsoft’s existence. Microsoft thinks in mass market terms, and selling to its base. Not developing breakthrough applications and finding niche markets to launch new uses. Nor has Microsoft created a developer community aligned with that kind of work. They have long been taught to simply continue to do things that defend and extend the traditional base of product uses and customers.

The really big miss for this meeting was understanding developer needs. Today developers have an enormous base of iOS and Android users to whom they can sell their products. Windows has less than 3% share in mobile devices. What developer would commit their resources to developing products for Windows 10, which has an installed base only in laptops and desktops? In other words, yesterday’s technology base? Especially when to obtain the biggest benefits of Windows 10 that developer has to find end use customers (companies or consumers) willing to commit 100% to Windows everywhere – even including their televisions, thermostats and other devices in our ever smarter buildings?

Windows 10 has a lot of cool features. But Microsoft made a big miss by listening to the wrong people. By assuming its installed base couldn’t wait for a Microsoft-exclusive solution, and by behaving as if the installed base of mobile devices either didn’t exist or didn’t matter, the company showed its hubris (once again.) If all it took to succeed were great products, the market would never have shifted from Macintosh computers to Windows machines in the 1990s. Microsoft simply doesn’t realize that it lacks the relevance to pull of its grand vision, and as such Windows 10 has almost no chance of stopping the Apple/Google/Samsung juggernaut.

by Adam Hartung | Aug 23, 2013 | In the Swamp, Leadership, Software, Web/Tech

Steve Ballmer announced he would be retiring as CEO of Microsoft within the next 12 months. This extended timing, rather than immediately, shows clear the Board is ready for him to go but there is nobody ready to replace him.

The big question is, who would want Ballmer's job? It will be very tough to make Microsoft an industry leader again. What would his replacement propose to do? The fuse for a turnaround is short, and the options faint.

Microsoft has been on a downhill trajectory for at least 4 years. Although the company has introduced innovations in gaming (xBox and Kinect) as well as on-line (games and Bing), those divisions perpetually lose money. Stiff competitors Sony, Nintendo and Google have made these forays intellectually interesting, but of no value for investors or customers. The end-game for Microsoft has remained Windows – and as PC sales decline that's very bad news.

Microsoft viability has been firmly tied to Windows and Office sales. Historically these have been unassailable products, creating over 100% of the profits at Microsoft (covering losses in other divisions.) But, these products have lost growth, and relevancy. Windows 8 and Office 365 are product nobody really cares about, while they keep looking for updates from Apple, Google, Amazon and Samsung.

The market started going mobile 10 years ago. As Apple and Google promoted increased mobility, Microsoft tried to defend & extend its PC stronghold. It was a classic business inflection point in the making. Everyone knew at some point mobile devices would be more important than PCs. But most industry insiders (including Microsoft) kept thinking it would be later rather than sooner.

They were wrong. The shift came a lot faster than expected. Like in sailboat racing, suddenly the wind was taken out of Microsoft's sails as competitors shot to the lead in customer interest. While people were excited for new smartphones and tablets, Microsoft tried to re-engineer its historical product as an extension into the new market.

Windows 8 tablets and Surface tablets were ill-fated from the beginning. They did not appeal to the huge installed base of Windows customers, because changes like touch screens and tiles simply were too expensive and too behaviorally different. And they offered no advantage for people to switch that had already started buying iOS and Android products. Not to mention an app availability about 10% of the market leaders. Simply put, investing in Windows 8 and its own tablet was like adding bricks to a downhill runaway truck (end-of-life for PCs) – it sped up the time to an inevitable crash.

And spending money on poorly thought out investments like the Barnes & Noble Nook merely demonstrated Microsoft had money to burn, rather than a strategy for competing. Skype cost some $8B, but how has that helped Microsoft become more competive? It's not just an overspending on internal projects that failed to achieve any market success, but a series of wasted investments in bad acquisitions that showed Microsoft had no idea how it was going to regain industry leadership in a changing marketplace going more mobile and into the cloud every month.

Now the situation is pretty dire, and now is the time for Microsoft to give up on its defend and extend strategy for Windows/Office. Customers are openly uninterested in new laptops running Windows 8. And Win 8.1 will not change this lackadaisical attitude. Nobody is interested in Windows 8 phones, or tablets. This has left companies in the Microsoft ecosystem like HP, Dell and Nokia gasping for air as sales tumble, profits evaporate and customers flock to new solutions from Apple and Samsung. Instead of seeking out an update to Office for a new PC, people are using much lighter (and cheaper) cloud services from Amazon and office solutions like Google docs. And most of those old add-on product sales, like printers and servers, are disappearing into the cloud and mobile displays.

So now, after being forced to write off Surface and report a horrible quarter, the Board has pushed Ballmer out the door. Pretty remarkable. But, incredibly late. Just like the leaders at RIM stayed too long, leaving the company with no future options as Blackberry sales plummeted, Ballmer is taking leave as sales, profits and cash flow are taking a turn for the worst. And only months after a reorganization that simply made the whole situation a lot more confusing for not only investors, but internal managers and employees.

Microsoft has a big cash hoard, but how long will that last? As its distribution system falters, and sales drop, the costs will rapidly catch up with cash flow. Big layoffs are a certainty; think half the workforce in 2 years. Equally certain are sales of divisions (who can buy xBox market share and turn it competitively profitable?) or shut-downs (how long will Bing stay alive when it is utterly unnecessary and expensive to maintain?)

But, there is a better option. Without the cash from

Windows/Office, you can't keep much of the rest of Microsoft walking. So

now is the time to cut investments in Windows/Office and put money into the

best things Microsoft has going – primarily Kinect and cloud services. A radical restructuring of its spending and investments.

Kinect is an incredible product. It has found multiple applications Microsoft fails to capitalize upon. Kinect has the possibility of becoming the centerpiece for managing how we connect to data, how we store data, how we find data. It can bring together our smartphone, tablet and historical laptop worlds – and possibly even connect this to traditional TV and radio. It can be the centerpiece for two-way communications (think telephone or skype via all your devices.) Coupled with the right hardware, it can leapfrog iTV (which we still are waiting to see) and Cisco simultaneously.

In cloud services it will take a lot to compete with leaders Amazon, IBM, Apple and Google. They have made big investments, and are far in front. But, this is the bread-and-butter market for Microsoft. Millions of small businesses that want easy to use BYOD (bring your own device) environment, and easy access to data, documents and functionality for IT, like guaranteed data back-up and uptime, and user functionality like all those apps. These customers have relied on Microsoft for these kind of services for years, and would enjoy a services provider with an off-the-shelf product they can implement easily and cheaply that supports all their needs. Expensive to develop, but a growing market where Microsoft has a chance to leapfrog competitors.

As for Bing, give it to Yahoo – if Marissa Mayer will take it. Stop the bloodletting and get out of a market where Microsoft has never succeeded. Bing is core to Yahoo's business. If you can trade for some Yahoo stock, go for it. Let Yahoo figure out how to sell content and ads, while Microsoft refocuses on the new platform for 2017; from the user to the infrastructure services.

Strong leaders have their benefits. But, when they don't understand market shifts, and spend far too long trying to defend & extend past markets, they can put their organizations in terrible jeopardy of total failure. Ballmer leaves no with clear replacement, nor with any vision in place for leapfrogging competitors and revitalizing Microsoft.

So it is imperative the new leader provide this kind of new thinking. There are trends developing that create future scenarios where Microsoft can once again be a market leader. And it will be the role of the new CEO to identify that vision and point Microsoft's investments in the right direction to regain viability by changing the game on the current winners.

by Adam Hartung | Aug 4, 2009 | Innovation, Investing, Leadership, Software

A typical headline from last week read "Microsoft, Yahoo to Begin Joint Assault on Google". After a year of negotiating, the behemoth Microsoft finally came up with an accord to get some Yahoo technology in order to be more effective with its search engine product. "Microsoft to Tap 400 Yahoo Workers in Partnership" is the Marketwatch headline today trumpeting the plan to bring Yahoo engineers to Microsoft.

Will it make a difference? If we look at the trend, it looks doubtful (slide courtesy Silicon Alley Insider):

Of course, lots of folks think this isn't a very good idea. (Cartoon Courtesy DenverPost.com):

As John Dvorak pointed out in his column: "Microsoft and Yahoo Bring Google Good News." After all, the Google's competitors just went from 2 to 1 – a 50% reduction. What's more, the remaining player is not known for expertise in internet technology – merely its money hoard. Moreover, when it used its money hoard in the past it has rarely (never?) resulted in a success. No wonder BusinessWeek headlined "Microsoft and Yahoo: Too Little, Too Late, Too Hyped."

What's more intriguing to me is what this deal says about Microsoft. The company has already missed the market shift in search and ad placement. Search is "yesterday's news". Microsoft is still trying to fight the last war, not the next one. As it has done far too often, Microsoft remained Locked-in to its old Success Formula — all about the desktop and personal computing. It has not been part of the market shift to new applications and new ways of personal automation. That has been going to RIM, Apple, Oracle and other players. Microsoft has sat on its market share in the old market, piled up cash, but not taken the actions to be a winner in the next market – the next battle for growth. Now it's joint venture with Yahoo will strip out engineers, attempt to convert them to Microsoft ways of thinking, and put them into battle with not only the largest player in search and on-line ad placement – but the only one making money. And the one introducing new technologies and products on a regular basis.

Someone asked me last week "Who's the next GM?" I think they meant "who's the next big bankruptcy." But the better question here is "Who's the giant company that everyone thinks is competitively insurmountable, but at great risk of falling from market leadership into the Whirlpool – and eventual bankruptcy?" To that I say keep your eyes on Microsoft.

The comparisons between Microsoft and GM are striking:

- Early market leaders

- Developed near monopolies

- Challenged by the trust busters

- Created very high growth rates and huge cash hoards

- Considered a great place to work, with great longevity

- Bought up competitors

- Bought up technologies, and often never took them to market

- Became arrogant to customers

- Implemented a strong Success Formula that everyone was expected to follow

- Strong leaders that kept the companies "focused"

- Dominated their local geography as employers

- Tended to talk a lot about their past, and how what they've previously accomplished

- Tended to ignore competitors

- Avoided Disruptions – late to market with every product. Tried using marketing and money to succeed rather than being first with great products and solutions

- Never allowed White Space to develop anything new

This joint venture is not White Space. Microsoft may want to be in Search and ad sales, but the company is still relying on its old business to "carry it through." They have ignored Google and other competitors, and are trying to use the old Success Formula to compete with a much nimbler and more market-attuned competitor. They have ignored Disruptive innovations, and not developed any new solutions themselves. They have refused to allow White Space to develop new solutions for shifting market needs – instead trying to push the market to buy their solutions based on old ways of doing business. Don't forget that MSN and it's search engine have been in the market since the beginning – it's not like they just woke up to discover the market existed. Rather, they just started hinting that maybe, after 15 years of failing, they aren't doing the right things.

If you still own Microsoft stock, I predict a really bumpy ride. They won't go bankrupt soon. But GM spent 30 years going sideways for investors before finally going bankrupt. That looks like the future at Microsoft. If you're a vendor, expect poor returns to create a procurement environment intending to suck all profits out of your business. If you're a customer, expect "me too" products that are late, expensive and at best "lowest common denominator" in appearance and performance. If you're an employee, expect increased turnover, lot of infighting, increased internal politics, promotions based on reinforcing the status quo rather than results, and few opportunities for personal growth.

Employees, vendors and investors of Microsoft should read the free ebook "The Fall of GM: What Went Wrong and How To Avoid Its Mistakes." Everyone who has to deal with shifting markets needs to.

of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.