by Adam Hartung | Mar 13, 2016 | In the Swamp, Leadership, Travel

United Continental Holdings is the most recent public company to come under attack by hedge funds. Last week Altimeter Capital and PAR Capital announced they were using their combined 7.1% ownership of United to propose a slate of 6 new directors to the company’s board. As is common in such hedge fund moves, they expressed strongly their lack of confidence in United’s board, and pointed out multiple years of underperformance.

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

But is changing the directors going to change the company? Or is it just changing the guest list for an haute couture affair? Should customers, employees, suppliers and investors expect things to really improve, or is this a selection between the devil and the deep blue sea?

Much was made of the fact that one of the proposed new directors is the former CEO of Continental, Gordon Bethune, who was very willing to speak out loudly and negatively regarding United’s current board. But Mr. Bethune is 74 years old. Today most companies have mandatory director retirement somewhere between age 68 and 72. Retired since 2004, is Mr. Bethune really in step with the needs of airline customers today? Does he really have a current understanding of how the best performing airlines keep customers happy while making money?

And, don’t forget, Mr. Bethune hand picked Mr. Jeff Smisek to replace him at Continental. Mr. Smisek was the fellow who took over Mr. Bethune’s board seat in 2004 after being appointed President and COO when Mr. Bethune retired. Smisek became CEO in 2010, and CEO of United Continental after the merger, and led the ongoing deterioration in United’s performance as well as declining employee moral. And then there’s that pesky problem of Mr. Smisek bribing government officials to improve United’s gate situation in Newark, NJ which caused him to be fired by the current board. Is it coincidental that this attack on the Board did not happen for years, but happens now that there is a new CEO – who happens to be recently recovering from a heart replacement?

Although Mr. Bethune has commented that the new board would be one that understands the airline industry, the slate does not reflect this. Mr. Gerstner is head of Altimiter and by all accounts appears to be a finance expert. That was the background Ed Lampert brought to Sears, another big Chicago company, when he took over that board. And that has not worked out too well at all for any constituents – including investors.

One can give great kudos to the hedge funds for proposing a very diverse slate. Half the proposed directors are either female or of color. And, other than Mr. Bethune, the slate is pretty young – with 2 proposed directors under age 50. Congratulations on achieving diversification! But a deeper look can cause us to wonder exactly what these directors bring to the challenges, and what they are likely to want to change at United.

Rodney O’Neal was the former CEO of Delphi Automotive. A lifelong automotive manager and executive, he graduated from the General Motors Institute and spent his career at GM before going to the parts unit GM had created in 1997 as a Vice President. Many may have forgotten that Delphi famously filed for bankruptcy in 2005, and proceeded to close over half its U.S. plants, then close or sell almost all of the other half in 2006. Mr. O’Neal became CEO in 2007, after which the company closed its plants in Spain despite having signed a commitment letter not to do so. He was CEO in 2008 when the company sued its shareholders. And in 2009 when the company sold its core assets to private investors, then dumped assets into the bankrupt GM, cancelled the stock and renamed the old Delphi DPH Holdings. Cutting, selling and reorganizing seem to be his dominant executive experience.

Barney Harford is a young, talented tech executive. He headed Orbitz, where Mr. Gerstner was on the board. Orbitz was originally created as the Travelocity and Expedia killer by the major airlines. Unfortunately, it never did too well and Mr. Harford actually changed the company direction from primarily selling airline tickets to selling hotel rooms.

It is always good to see more women proposed for board positions. However, Ms. Brenda Yester Baty is an executive with Lennar, a very large Florida-based home builder. And Ms. Tina Stark leads Sherpa Foundry which has a 1 page web site saying “Sherpa Foundry builds

bridges between the world’s leading Corporations and the Innovation Economy.” What that means leaves a lot of room for one’s imagination, and precious little specifics. What either of these people have to do with creating a major turnaround in the operations of United is unclear.

There is no doubt that United is ripe for change. Replacing the CEO was clearly a step in the right direction – if a bit late. But one has to wonder if the new directors are there to make some specific change? If so, what kind of change? Despite the rough rhetoric, there has been no proclamation of what the new director slate would actually do differently. No discussion of a change in strategy – or any changes in any operating characteristics. Just vague statements about better governance.

Historically most activists take firm aim at cutting costs. And this is probably why the 2 largest unions have already denounced the new slate, and put their full support behind the existing board of directors. After so many years of ill-will between management and labor at United, one would wonder why these unions would not welcome change. Unless they fear the new board will be mostly focused on cost-cutting, and further attempts at downsizing and pay/benefits reductions.

Investors will most likely get to vote on this decision. Keep existing board members, or throw them out in favor of a new slate? One would like to see United’s reputation, and operations, improve dramatically. But is changing out 6 directors the answer? Or are investors facing a vote that has them selecting between 2 less than optimal options? It would be good if there was less rhetoric, and more focus on actual proposals for change.

by Adam Hartung | Mar 6, 2016 | Defend & Extend, Leadership

We all like to think the world is a meritocracy, where hard work is important and results matter.

As we watched Mitt Romney, and others, frontally assault Donald Trump this week it was clear they were saying Mr. Trump is not the right person to be President. They are pointing out his use of bankruptcies to protect his personal wealth, while leaving investors holding the empty bag. And his flip-flopping on various issues, including how he would deploy military forces. And his use of misogynistic language against women, while simultaneously referring to most Mexicans and lawbreakers and all Muslims as terrorists, are gross generalities they say are not supported by facts.

Yet, while many sober-minded leaders are denouncing Mr. Trump, it is not clear that it matters. His followers seem to remain passionately loyal, and completely unmoved by any factual representation of their candidate as anything other than a savior for America. The “Super Saturday” delegate selection resulted in Mr. Trump winning 2 more contests (Louisiana and Kentucky) while coming in second in 2 others (Kansas and Maine.) And it demonstrated the ongoing pattern of Mr. Trump winning the popular vote in primaries.

Everyone remembers a situation where a very hard working, smart, industrious person did things well for years. But they weren’t promoted, or even given large pay increases. Or, worse, they made one mistake and lost their position, or job.

Simultaneously, we all also can think of at least one, or more, person who simply wasn’t that good, and often didn’t work that hard, but was promoted (often beyond their competency) and given large pay increases. And every time this person made a mistake it was explained away as a “learning experience” that would make them a better future performer. They were blessed with continuous upward mobility, and could seemingly do no wrong.

For each of us these experiences seemed unique, and we often tied them to the specific individuals involved – including not only the person at the center of these experiences but their superiors, subordinates and peers. And many people are saying the political rise of Donald Trump is unique to him and the current state of his political party.

But rather than each being unique, these experiences all have something in common. The actual frequency of these experiences belies the notion that they are all unique. Rather, what all of these demonstrate is the implementation of selective bias. They demonstrate that very often we prefer people because they reinforce our bias, and their past results do not matter.

Bosses who promote incompetency don’t really care about the competency as much as they care that the individual reinforces their inherent Beliefs, Interpretations, Assumptions and Strategies about the world. There is often a familial, geographic, academic, business relationship, religious or gender trait (or often multiple traits) which reinforces in these bosses that their view of the world is right, and should be promoted.

This may be due to the person being very much similar to the boss. But, not always. It just requires that the target be a visible, walking, talking implementation of how they think the world works. Whether or not the person is successful really does not matter. If they are different from the boss’s viewpoint, no success will be great enough to have the boss support them. If they fulfill the boss’s bias then they often can do no wrong.

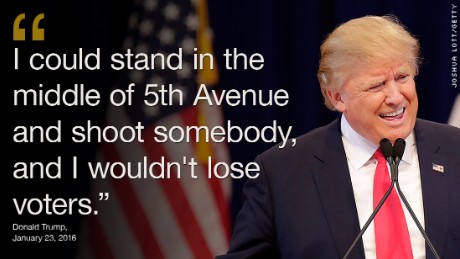

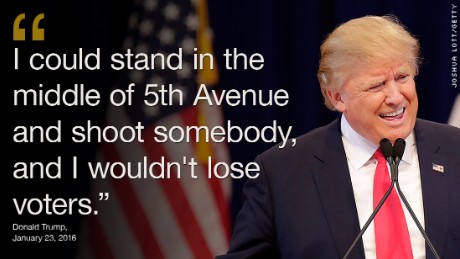

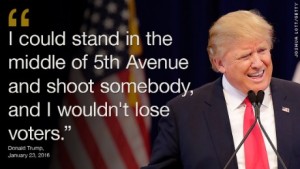

Donald Trump has been leading his candidate competitors not because he was wildly successful. Rather, he is attracting a larger group of people who identify with him; who share his basic Beliefs, Interpretations of the world, Assumptions about how people behave, and Strategies for how to succeed. They share his bias, and thus they select him. As Mr. Trump said himself “I could stand in the middle of 5th Avenue and shoot somebody and I wouldn’t lose voters.”

Donald Trump has been leading his candidate competitors not because he was wildly successful. Rather, he is attracting a larger group of people who identify with him; who share his basic Beliefs, Interpretations of the world, Assumptions about how people behave, and Strategies for how to succeed. They share his bias, and thus they select him. As Mr. Trump said himself “I could stand in the middle of 5th Avenue and shoot somebody and I wouldn’t lose voters.”

Regardless of the robustness of the American economy and the ongoing growth in jobs creation, they Believe America is in terrible shape, and that almost all media participants are liars. No matter what the truth is about the value of immigrants on the economy, they Interpret all immigrants as job-stealing bad people that have made their lives worse. No matter the truth about the spirit of Islam and the goodness of Muslims, they Assume all of them terrorists out to blow up the world. And they agree with Strategies like stopping immigrants with walls, killing civilian Muslims as collateral damage in a religious war, torturing prisoners of war (possibly to death,) eliminating international trade, and depriving poor people of health care and other services.

Thus, selective bias ties these voters to Mr. Trump with a bind that is not breakable by discussing his performance, or pointing out his failings. Facts are not relevant. Their judgement is not based on historical facts, but rather a clear alignment with their bias. No matter who says Mr. Trump may have lied, or exaggerated, or misinterpreted history that messenger will not be believed. Because the real results don’t matter. What matters is reinforcing their bias.

Unfortunately we see this selective bias all too often in business. Leaders that favor some over others simply because of bias, rather than results. It has long been a problem which has restricted diversity in the workforce, and inhibited equal pay. It has long created a caste system for admission to top schools and places of employment. And because selective bias is so rampant in American business, it is second nature to Mr. Trump. It is easy for him to say what is on his mind, and expect that lots of people will agree with him. It’s how he sees the world, it is his bias, and he’s used to having it reinforced by those who wish to work with him.

Whatever happens in this Presidential campaign, as business leaders we can learn from this situation that if we allow selective bias to sway us then we are no longer really paying attention to results. As leaders which of the following should be important – promoting those who reinforce our beliefs, interpretations, assumptions and strategies, or finding the best people to do the job and rewarding those who really have worked hard for good results?

by Adam Hartung | Feb 24, 2016 | Defend & Extend, In the Swamp, Leadership

Walmart announced quarterly financial results last week, and they were not good. Sales were down $500million vs the previous year, and management lowered forecasts for 2016. And profits were down almost 8% vs. the previous year. The stock dropped, and pundits went negative on the company.

But if we take an historical look, despite how well WalMart’s value has done between 2011 and 2014, there are ample reasons to forecast a very difficult future. Sailors use small bits of cloth tied to their sails in order to get early readings on the wind. These small bits, called telltales, give early signs that good sailors use to plan their navigation forward. If we look closely at events at WalMart we can see telltales of problems destined to emerge for the retailing giant:

1 – In March, 2008 WalMart sued a brain damaged employee. The employee was brain damaged by a truck accident. WalMart’s insurance paid out $470,000 in health care cost. The employee’s family sued the trucking company, at their own expense, and won a $417,000 verdict for lost future wages, pain and suffering and future care needs. Then, WalMart decided it would sue the employee to recover the health care costs it had previously paid. As remarkable as this seems, it is a great telltale. It demonstrates a company so focused on finding ways to cut costs, and so insensitive to its employees and the plight of its customers that it loses all common sense. Not to mention the questionable ethics of this action, it at the very least demonstrates blatant disregard for the PR impact of its actions. It shows a company where management feels it is unquestionable, and a believe its brand is untouchable.

1 – In March, 2008 WalMart sued a brain damaged employee. The employee was brain damaged by a truck accident. WalMart’s insurance paid out $470,000 in health care cost. The employee’s family sued the trucking company, at their own expense, and won a $417,000 verdict for lost future wages, pain and suffering and future care needs. Then, WalMart decided it would sue the employee to recover the health care costs it had previously paid. As remarkable as this seems, it is a great telltale. It demonstrates a company so focused on finding ways to cut costs, and so insensitive to its employees and the plight of its customers that it loses all common sense. Not to mention the questionable ethics of this action, it at the very least demonstrates blatant disregard for the PR impact of its actions. It shows a company where management feels it is unquestionable, and a believe its brand is untouchable.

2 – In March, 2010 AdAge ran a column about WalMart being “stuck in the middle” and effectively becoming the competitive “bulls-eye” of retailing. After years of focusing on its success formula, “dollar store” competition was starting to undermine it on cost and price at the low end, while better merchandise and store experience boxed WalMart from higher end competitors – that often weren’t any more expensive. This was the telltale sign of a retailer that had focused on beating up its suppliers for years, cutting them out of almost all margin, without thinking about how it might need to change its business model to grow as competitors chopped up its traditional marketplace.

3 – In October, 2010 Fortune ran an article profiling then-CEO Mike Duke. It described an executive absolutely obsessive about operational minutia. Banana pricing, underwear inventory, cereal displays – there was no detail too small for the CEO. Another telltale of a company single-mindedly focused on execution, to the point of ignoring market shifts created by changing consumer tastes, improvements at competitors and the rapid growth of on-line retailing. There was no strategic thinking happening at WalMart, as executives believed there would never be a need to change the strategy.

4 – In April, 2012 WalMart found itself mired in a scandal regarding bribing Mexican government officials in its effort to grow sales. WalMart had never been able to convert its success formula into a growing business in any international market, but Mexico was supposedly its breakout. However, we learned the company had been paying bribes to obtain store sites and hold back local competitors. A telltale of a company where pressure to keep defending and extending the old business was so great that very highly placed executives do the unethical, and quite likely the illegal, to make the company look like it is performing better.

5 – In July, 2014 a WalMart truck driver hits a car seriously injuring comedian Tracy Morgan and killing his friend. While it could be taken as a single incident, the truth was that the driver had been driving excessive hours and excessive miles, not complying with government mandated rest periods, in order to meet WalMart distribution needs. This telltale showed how the company was stressed all the way down into the heralded distribution environment to push, push, push a bit harder to do more with less in order to find extra margin opportunities. What once was successful was showing stress at the seams, and in this case it led to a fatal accident by an employee.

6 – In January, 2015 we discovered traditional brick-and-mortar retail sales fell 1% from the previous year. The move to on-line shopping was clearly a force. People were buying more on-line, and less in stores. This telltale bode very poorly for all traditional retailers, and it would be clear that as the biggest WalMart was sure to face serious problems.

7 – In July, 2015 Amazon’s market value exceeds WalMart’s. Despite being quite a bit smaller, Amazon’s position as the on-line retail leader has investors forecasting tremendous growth. Even though WalMart’s value was not declining, its key competition was clearly being forecast to grow impressively. The telltale implies that at least some, if not a lot, of that growth was going to eventually come directly from the world’s largest traditional retailer.

8 – In January, 2016 we learn that traditional retail store sales declined in the 2015 holiday season from 2014. This was the second consecutive year, and confirmed the previous year’s numbers were the start of a trend. Even more damning was the revelation that Black Friday sales had declined in 2013, 2014 and 2015 strongly confirming the trend away from Black Friday store shopping toward Cyber Monday e-commerce. A wicked telltale for the world’s largest store system.

9 – In January, 2016 we learned that WalMart is reacting to lower sales by closing 269 stores. No matter what lipstick one would hope to place on this pig, this telltale is an admission that the retail marketplace is shifting on-line and taking a toll on same-store sales.

10 – We now know WalMart is in a Growth Stall. A Growth Stall occurs any time a company has two consecutive quarters of lower sales versus the previous year (or two consecutive declining back-to-back quarters.) In the 3rd quarter of 2015 Walmart sales were $117.41B vs. same quarter in 2014 $119.00B – a decline of $1.6B. Last quarter WalMart sales were $129.67B vs. year ago same quarter sales of $131.56B – a decline of $1.9B. While these differences may seem small, and there are plenty of explanations using currency valuations, store changes, etc., the fact remains that this is a telltale of a company that is already in a declining sales trend. And according to The Conference Board companies that hit a Growth Stall only maintain a mere 2% growth rate 7% of the time – the likelihood of having a lower growth rate is 93%. And 95% of stalled companies lose 25% of their market value, while 69% of companies lose over half their value.

WalMart is huge. And its valuation has actually gone up since the Great Recession began. It’s valuation also rose from 2011- 2014 as Amazon exploded in size. But the telltale signs are of a company very likely on the way downhill.

by Adam Hartung | Feb 11, 2016 | Current Affairs, In the Whirlpool, Leadership, Lock-in

USAToday alerted investors that when Sears Holdings reports results 2/25/16 they will be horrible. Revenues down another 8.7% vs. last year. Same store sales down 7.1%. To deal with ongoing losses the company plans to close another 50 stores, and sell another $300million of assets. For most investors, employees and suppliers this report could easily be confused with many others the last few years, as the story is always the same. Back in January, 2014 CNBC headlined “Tracking the Slow Death of an Icon” as it listed all the things that went wrong for Sears in 2013 – and they have not changed two years later. The brand is now so tarnished that Sears Holdings is writing down the value of the Sears name by another $200million – reducing intangible value from the $4B at origination in 2004 to under $2B.

This has been quite the fall for Sears. When Chairman Ed Lampert fashioned the deal that had formerly bankrupt Kmart buying Sears in November, 2004 the company was valued at $11billion and 3,500 stores. Today the company is valued at $1.6billion (a decline of over 85%) and according to Reuters has just under 1,700 stores (a decline of 51%.) According to Bloomberg almost no analysts cover SHLD these days, but one who does (Greg Melich at Evercore ISI) says the company is no longer a viable business, and expects bankruptcy. Long-term Sears investors have suffered a horrible loss.

When I started business school in 1980 finance Professor Bill Fruhan introduced me to a concept that had never before occurred to me. Value Destruction. Through case analysis the good professor taught us that leadership could make decisions that increased company valuation. Or, they could make decisions that destroyed shareholder value. As obvious as this seems, at the time I could not imagine CEOs and their teams destroying shareholder value. It seemed anathema to the entire concept of business education. Yet, he quickly made it clear how easily misguided leaders could create really bad outcomes that seriously damaged investors.

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

1 – Micro-management in lieu of strategy. Mr. Lampert has been merciless in his tenacity to manage every detail at Sears. Daily morning phone calls with staff, and ridiculously tight controls that eliminate decision making by anyone other than the top officers. Additionally, every decision by the officers was questioned again and again. Explanations took precedent over action as micro-management ate up management’s time, rather than trying to run a successful company. While store employees and low- to mid-level managers could see competition – both traditional and on-line – eating away at Sears customers and core sales, they were helpless to do anything about it. Instead they were forced to follow orders given by people completely out of touch with retail trends and customer needs. Whatever chance Sears and Kmart had to grow the chain against intense competition it was lost by the Chairman’s need to micro-manage.

2 – Manage-by-the-numbers rather than trends. Mr. Lampert was a finance expert and former analyst turned hedge fund manager and investor. He truly believed that if he had enough numbers, and he studied them long enough, company success would ensue. Unfortunately, trends often are not reflected in “the numbers” until it is far, far too late to react. The trend to stores that were cleaner, and more hip with classier goods goes back before Lampert’s era, but he completely missed the trend that drove up sales at Target, H&M and even Kohl’s because he could not see that trend reflected in category sales or cost ratios. Merchandising – from buying to store layout and shelf positioning – are skills that go beyond numerical analysis but are critical to retail success. Additionally, the trend to on-line shopping goes back 20 years, but the direct impact on store sales was not obvious until customers had long ago converted. By focusing on numbers, rather than trends, Sears was constantly reacting rather than being proactive, and thus constantly retreating, cutting stores and cutting product lines.

3 – Seeking confirmation rather than disagreement. Mr. Lampert had no time for staff who did not see things his way. Mr. Lampert wanted his management team to agree with him – to confirm his Beliefs, Interpretations, Assumptions and Strategies — to believe his BIAS. By seeking managers who would confirm his views, and execute, rather than disagree Mr. Lampert had no one offering alternative data, interpretations, strategies or tactics. And, as Mr. Lampert’s plans kept faltering it led to a revolving door of managers. Leaders came and went in a year or two, blamed for failures that originated at the Chairman’s doorstep. By forcing agreement, rather than disagreement and dialogue, Sears lacked options or alternatives, and the company had no chance of turning around.

4 – Holding assets too long. In 2004 Sears had a LOT of assets. Many that could likely be redeployed at a gain for shareholders. Sears had many owned and leased store locations that were highly valuable with real estate prices climbing from then through 2008. But Mr. Lampert did not spin out that real estate in a REIT, capturing the value for SHLD shareholders while the timing was good. Instead he held those assets as real estate in general plummeted, and as retail real estate fell even further as more revenue shifted to e-commerce. By the time he was ready to sell his REIT much of the value was depleted.

Additionally, Sears had great brands in 2004. DieHard batteries, Craftsman tools, Kenmore appliances and Lands End apparel were just 4 household brands that still had high customer appeal and tremendous value. Mr. Lampert could have sold those brands to another retailer (such as selling DieHard to WalMart, for example) as their house brands, capturing that value. Or he could have mass marketd the brand beyond the Sears store to increase sales and value. Or he could have taken one or more brands on-line as a product leader and “category killer” for ecommerce customers. But he did not act on those options, and as Sears and Kmart stores faded, so did these brands – which largely no longer have any value. Had he sold when value was high there were profits to be made for investors.

5 – Hubris – unfailingly believing in oneself regardless the outcomes. In May, 2012 I wrote that Mr. Lampert was the 2nd worst CEO in America and should fire himself. This was not a comment made in jest. His initial plans had all panned out very badly, and he had no strategy for a turnaround. All results, from all programs implemented during his reign as Chairman had ended badly. Yet, despite these terrible numbers Mr. Lampert refused to recognize he was the wrong person in the wrong job. While it wasn’t clear if anyone could turn around the problems at Sears at such a late date, it was clear Mr. Lampert was not the person to do it. If Mr. Lampert had been as self-analytical as he was critical of others he would have long before replaced himself as the leader at Sears. But hubris would not allow him to do this, he remained blind to his own failings and the terrible outcome of a failed company was pretty much sealed.

From $11B valuation and a $92/share stock price at time of merging KMart and Sears, to a $1.6B valuation and a $15/share stock price. A loss of $9.4B (that’s BILLION DOLLARS). That is amazing value destruction. In a world where employees are fired every day for making mistakes that cost $1,000, $100 or even $10 it is a staggering loss created by Mr. Lampert. At the very least we should learn from his mistakes in order to educate better, value creating leaders.

by Adam Hartung | Feb 9, 2016 | Current Affairs, In the Swamp, Leadership, Web/Tech

Verizon tipped its hand that it would be interested to buy Yahoo back in December. In the last few days this possibility drew more attention as Verizon’s CFO confirmed interest on CNBC, and Bloomberg reported that AOL’s CEO Tim Armstrong is investigating a potential acquisition. There are some very good reasons this deal makes sense:

First, this acquisition has the opportunity to make Verizon distinctive. Think about all those ads you see for mobile phone service. Pretty much alike. All of them trying to say that their service is better than competitors, in a world where customers don’t see any real difference. 3G, 4G – pretty soon it feels like they’ll be talking about 10G – but users mostly don’t care. The service is usually good enough, and all competitors seem the same.

First, this acquisition has the opportunity to make Verizon distinctive. Think about all those ads you see for mobile phone service. Pretty much alike. All of them trying to say that their service is better than competitors, in a world where customers don’t see any real difference. 3G, 4G – pretty soon it feels like they’ll be talking about 10G – but users mostly don’t care. The service is usually good enough, and all competitors seem the same.

So, that leads to the second element they advertise – price. How many different price programs can anyone invent? And how many phone or tablet give-aways. What is clear is that the competition is about price. And that means the product has become generic. And when products are generic, and price is the #1 discussion, it leads to low margins and lousy investor returns.

But a Yahoo acquisition would make Verizon differentiated. Verizon could offer its own unique programming, at a meaningful level, and make it available only on their network. And this could offer price advantages. Like with Go90 streaming, Verizon customers could have free downloads of Verizon content, while having to pay data fees for downloads from other sites like YouTube, Facebook, Vine, Instagram, Amazon Prime, etc. The Verizon customer could have a unique experience, and this could allow Verizon to move away from generic selling and potentially capture higher margins as a differentiated competitor.

Second, Yahoo will never be a lead competitor and has more value as a supporting player. Yahoo has lost its lead in every major competitive market, and it will never catch up. Google is #1 in search, and always will be. Google is #1 in video, with Facebook #2, and Yahoo will never catch either. Ad sales are now dominated by adwords and social media ads – and Yahoo is increasingly an afterthought. Yahoo’s relevance in digital advertising is at risk, and as a weak competitor it could easily disappear.

But, Verizon doesn’t need the #1 player to put together a bundled solution where the #2 is a big improvement from nothing. By integrating Yahoo services and capabilities into its unique platform Verizon could take something that will never be #1 and make it important as part of a new bundle to users and advertisers. As supporting technology and products Yahoo is worth quite a bit more to Verizon than it will ever be as an independent competitor to investors – who likely cannot keep up the investment rates necessary to keep Yahoo alive.

Third, Yahoo is incredibly cheap. For about a year Yahoo investors have put no value on the independent Yahoo. The company’s value has been only its stake in Alibaba. So investors inherently have said they would take nothing for the traditional “core” Yahoo assets.

Additionally, Yahoo investors are stuck trying to capture the Alibaba value currently locked-up in Yahoo. If they try to spin out or sell the stake then a $10-12Billion tax bill likely kicks in. By getting rid of Yahoo’s outdated business what’s left is “YaBaba” as a tracking stock on the NASDAQ for the Chinese Alibaba shares. Or, possibly Alibaba buys the remaining “YaBaba” shares, putting cash into the shareholder pockets — or giving them Alibaba shares which they may prefer. Etiher way, the tax bill is avoided and the Alibaba value is unlocked. And that is worth considerably more than Yahoo’s “core” business.

So it is highly unlikely a deal is made for free. But lacking another likely buyer Verizon is in a good position to buy these assets for a pretty low value. And that gives them the opportunity to turn those assets into something worth quite a lot more without the overhang of huge goodwill charges left over from buying an overpriced asset – as usually happens in tech.

Fourth, Yahoo finally gets rid of an ineffectual Board and leadership team. The company’s Board has been trying to find a successful leader since the day it hired Carol Bartz. A string of CEOs have been unable to define a competitive positioning that works for Yahoo, leading to the current lack of investor enthusiasm.

The current CEO Mayer and her team, after months of accomplishing nothing to improve Yahoo’s competitiveness and growth prospects, is now out of ideas. Management consulting firm McKinsey & Company has been brought in to engineer yet another turnaround effort. Last week we learned there will be more layoffs and business closings as Yahoo again cannot find any growth prospects. This was the turnaround that didn’t, and now additional value destruction is brought on by weak leadership.

Most of the time when leaders fail the company fails. Yahoo is interesting because there is a way to capture value from what is currently a failing situation. Due to dramatic value declines over the last few years, most long-term investors have thrown in the towel. Now the remaining owners are very short-term, oriented on capturing the most they can from the Alibaba holdings. They are happy to be rid of what the company once was. Additionally, there is a possible buyer who is uniquely positioned to actually take those second-tier assets and create value out of them, and has the resources to acquire the assets and make something of them. A real “win/win” is now possible.

by Adam Hartung | Feb 3, 2016 | Current Affairs, Leadership, Lifecycle, Web/Tech

The three highest valued publicly traded companies today (2/3/16) are Google/Alphabet, Apple and Microsoft. All 3 are tech companies, and they compete – although with different business models – in multiple markets. However, investor views as to their futures are wildly different. And that has everything to do with how the leadership teams of these 3 companies have explained their recent results, and described their futures.

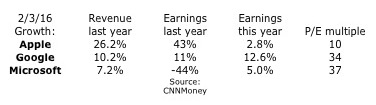

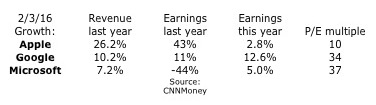

Looking at the financial performance of these companies, it is impossible to understand the price/earnings multiple assigned to each. Apple clearly had better revenue and earnings performance in all but the most recent year. Yet, both Alphabet and Microsoft have price to earnings (P/E) multiples that are 3-4 times that of Apple.

Much was made this week about Alphabet’s valuation exceeding that of Apple’s. But the really big story is the difference in multiples. If Apple had a multiple even half that of Alphabet or Microsoft it’s value would be much, much higher.

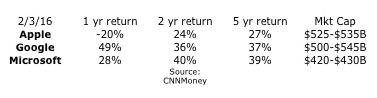

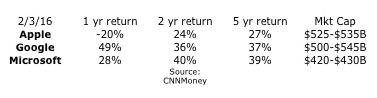

But, as we can see, investors did the best over both 2 years and 5 years by investing in Microsoft. And Apple investors have fared the poorest of all 3 companies regardless of time frame. Looking at investment performance, one would think that the revenue and earnings performance of these companies would be the reverse of what’s seen in the first chart.

The missing piece, of course, is future expectations. In this column a few days ago, I pointed out that Apple has done a terrible job explaining its future. In that column I pointed out how Facebook and Amazon both had stratospheric P/E multiples because they were able to keep investors focused on their future growth story, even more than their historical financial performance.

Alphabet stole the show, and at least briefly the #1 valuation spot, from Apple by convincing investors they will see significant, profitable growth. Starting even before earnings announcements the company was making sure investors knew that revenues and profits would be up. But even more they touted the notion that Alphabet has a lot of growth in non-monetized assets. For example, vastly greater ad sales should be expected from YouTube and Google Maps, as well as app sales for Android phones through Google Play. And someday on the short horizon profits will emerge from Fiber transmission revenues, smart home revenues via Nest, and even auto market sales now that the company has logged over 1million driverless miles.

This messaging clearly worked, as Alphabet’s value shot up. Even though 99% of the company’s growth was in “core” products that have been around for a decade! Yes, ad revenue was up 15%, but most of that was actually on the company’s own web sites. And most was driven by further price erosion. The number of paid clicks were up 30%, but price/click was actually down yet another 15% – a negative price trend that has been happening for years. Eventually prices will erode enough that volume will not make up the difference – and what will investors do then? Rely on the “moonshot” projects which still have almost no revenue, and no proven market performance!

But, the best performer has been Microsoft. Investors know that PC sales have been eroding for years, that PC sales will continue eroding as users go mobile, and that PC’s are the core of Microsoft’s revenue. Investors also knows that Microsoft missed the move to mobile, and has practically no market share in the war between Apple’s iOS and Google’s Android. Further, investors have known forever that gaming (xBox,) search and entertainment products have always been a money-loser for Microsoft. Yet, Microsoft investors have done far better than Apple investors, and long-term better than Google investors!

Microsoft has done an absolutely terrific job of constantly trumpeting itself as a company with a huge installed base of users that it can leverage into the future. Even when investors don’t know how that eroding base will be leveraged, Microsoft continually makes the case that the base is there, that Microsoft is the “enterprise” brand and that those users will stay loyal to Microsoft products.

Forget that Windows 8 was a failure, that despite the billions spent on development Win8 never reached even 10% of the installed base and the company is even dropping support for the product. Forget that Windows 10 is a free upgrade (meaning no revenue.) Just believe in that installed base.

Microsoft trumpeted that its Surface tablet sales rose 22% in the last quarter! Yay! Of course there was no mention that in just the last 6 weeks of the quarter Apple’s newly released iPad Pro actually sold more units than all Surface tablets did for the entire quarter! Or that Microsoft’s tablet market share is barely registerable, not even close to a top 5 player, while Apple still maintains 25% share. And investors are so used to the Microsoft failure in mobile phones that the 49% further decline in sales was considered acceptable.

Instead Microsoft kept investors focused on improvements to Windows 10 (that’s the one you can upgrade to for free.) And they made sure investors knew that Office 365 revenue was up 70%, as 20million consumers now use the product. Of course, that is a cumulative 20million – compared to the 75million iPhones Apple sold in just one quarter. And Azure revenue was up 140% – to something that is almost a drop in the bucket that is AWS which is over 10 times the size of all its competitors combined.

To many, this author included, the “growth story” at Microsoft is more than a little implausible. Sales of its core products are declining, and the company has missed the wave to mobile. Developers are writing for iOS first and foremost, because it has the really important installed base for today and tomorrow. And they are working secondarily on Android, because it is in some flavor the rest of the market. Windows 10 is a very, very distant third and largely overlooked. xBox still loses money, and the new businesses are all relatively quite small. Yet, investors in Microsoft have been richly rewarded the last 5 years.

Meanwhile, investors remain fearful of Apple. Too many recall the 1980s when Apple Macs were in a share war with Wintel (Microsoft Windows on Intel processors) PCs. Apple lost that war as business customers traded off the Macs ease of use for the lower purchase cost of Windows-based machines. Will Apple make the same mistake? Will iPad sales keep declining, as they have for 2 years now? Will the market shift to mobile favor lower-priced Android-based products? Will app purchases swing from iTunes to Google Play as people buy lower cost Android-based tablets? Have iPhone sales really peaked, and are they preparing to fall? What’s going to happen with Apple now? Will the huge Apple mobile share be eroded to nothing, causing Apple’s revenues, profits and share price to collapse?

This would be an interesting academic discussion were the stakes not so incredibly high. As I said in the opening paragraph, these are the 3 highest valued public companies in America. Small share price changes have huge impacts on the wealth of individual and institutional investors. It is rather quite important that companies tell their stories as good as possible (which Apple clearly has not, and Microsoft has done extremely well.) And likewise it is crucial that investors do their homework, to understand not only what companies say, but what they don’t say.

by Adam Hartung | Jan 30, 2016 | Current Affairs, In the Rapids, Leadership, Web/Tech

Apple announced earnings for the 4th quarter this week, and the company was creamed. Almost universally industry analysts and stock analysts had nothing good to say about the company’s reports, and forecast. The stock ended the week down about 5%, and down a whopping 27.8% from its 52 week high.

Wow, how could the world’s #1 mobile device company be so hammered? After all, sales and earnings were both up – again! Apple’s brand is still one of the top worldwide brands, and Apple stores are full of customers. It’s PC sales are doing better than the overall market, as are its tablet sales. And it is the big leader in wearable devices with Apple Watch.

Yet, let’s compare the stock price to earnings (P/E) multiple of some well known companies (according to CNN Money 1/29/16 end of day):

- Apple – 10.3

- Used car dealer AutoNation – 10.7

- Food company Archer Daniel Midland (ADM) – 12.2

- Industrial equipment maker Caterpillar Tractor – 12.9

- Farm equipment maker John Deere – 13.3

- Defense equipment maker General Dynamics – 15.1

- Utility American Electric Power – 16.9

- Industrial product company Illinois Tool Works (ITW) – 17.7

- Industrial product company 3M – 19.5

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

And Apple’s presentation created growth stall fears. While iPhone sales are enormous (75million units/quarter,) there was little percentage growth in Q4. And CEO Tim Cook actually predicted a sales decline next quarter! iPod sales took off like a rocket years ago, but they have now declined for 6 straight quarters and there was no prediction of a return to higher sales volumes. And as for future products, the company seems only capable of talking about Apple Watch, and so far few people have seen any reason to buy one. Amidst this gloom, Apple presented an unclear story about a future based on services – a market that is at the very least vague, where Apple has no market presence, little experience and no brand position. And wasn’t that IBM’s story some 2.5 decades ago?

In other words, Apple fed investor’s worst fears. That growth had stopped. And usually, like in the examples above, when growth stops – especially in tech companies – it presages a dramatic reversal in sales and profits. Sales have been known to fall far, far faster than management predicts. Although Apple has not yet entered a Growth Stall (which is 2 consecutive quarters of declining sales and/or profits, or 2 consecutive quarters than the previous year’s sales or profits) investors are now worried that one is just around the corner.

Contrast this with Facebook. P/E – 113.3. Facebook said ad revenues rose 57%, and net income was up 2.2x the previous year’s quarter. But what was really important was Facebook’s story about its future:

- Facebook is now a “must buy” for advertisers

- Mobile is the #1 ad trend, and 80% of revenues are from mobile

- Revenue/user is up 33%, and growing

- There are multiple unmonetized new markets that Facebook is just developing – Instagram, WhatsApp, FB Messenger and Oculus

In other words, the past was great – but the future will be even better. The short-term result? FB stock rose 7.4% for the week, and intraday hit a new 52 week high. Facebook might have seemed like a fad 3 years ago, especially to older folks. But now the company’s story is all about market trends, and how Facebook is offering products on those trends that will drive future revenue and profit growth.

Amazon may be an even better example of smart communications. As everyone knows, Amazon makes no profit. So it sells for an astonishing P/E of 846.9. Amazon sales increased 22% in Q4, and Amazon continued gaining share of the fast growing, #1 trend in retail — ecommerce. While WalMart and Macy’s are closing stores, Amazon is expanding and even creating its own logistics system.

Profits were up, but only 2/3 of expectations – ouch! Anticipating higher sales and earnings announcements the stock had run up $40/share. But the earnings miss took all that away and more as the stock crashed about $70/share! A wild 12.5% peak-to-trough swing was capped at end of week down a mere 2.5%.

But, Amazon did a great job, once again, of selling its future. In addition to the good news on retail sales, there was ongoing spectacular growth in cloud services – meaning Amazon Web Services (AWS.) JPMorganChase, Wells Fargo, Raymond James and Benchmark all raised their future price forecasts after the announcement, based on future performance expectations. Even analysts who cut their price targets still kept price targets higher than where Amazon actually ended the week. And almost all analysts expect Amazon one year from now to be worth more than its historical 52 week high, which is 19% higher than current pricing.

So, despite bad earnings news, Amazon continued to sell its growth story. Growth can heal all wounds, if investors continue to believe. We’ll see how it plays out, but for now things appear at least stable.

Steve Jobs was, by most accounts, an excellent showman. But what he did particularly well was tell a great growth story. No matter Apple’s past results, or concerns about the company, when Steve Jobs took the stage his team had crafted a story about Apple’s future growth. It wasn’t about cash flow, cash in the bank, assets in place, market share or historical success – boring, boring. There was an Apple growth story. There was always a reason for investor’s to believe that competitors will falter, markets will turn to Apple, and growth will increase!

Should investors think Apple is without future growth? Unfortunately, the communications team at Apple last week let investors think so. It is impossible to believe this is true, but the communicators this week simply blew it. Because what they said led to nothing but headlines questioning the company’s future.

What should Apple have said?

- Give investors a great news story about wearables. Show applications in health care, retail, etc. that really makes investors think all those people with a Timex or Rolex will wear an AppleWatch in the future. Apple sold investors the future of iPhone apps long before most of people used anything other than maps and weather – and the story led investors to believe if people didn’t have an iPhone they would miss out on something important, so they were bound to go buy one. Where’s that story when it comes to wearables?

- ApplePay is going to change the world. While ApplePay is #1, investors are wondering if mobile payments is ever going to be big. What will make it big, when, and what is Apple doing to make this a multi-billion dollar business? ApplePay launched to a lot of hype, but very little has been said since. Is this going to be the Apple version of Microsoft’s Zune? Make investors believers in ApplePay. Convince them this is worth a lot of future value.

- iBeacons are one of the most important technology products in retail and inventory control. iBeacons were launched as a great tool for local businesses, but since then Apple has said almost nothing. B2B may not be as sexy as consumer markets, but Microsoft made investors believers in the value of enterprise products. Demonstrate that Apple’s technology is the best, and give investors some stories about how companies are winning. Most investors have forgotten about beacons and thus they no longer plan for substantial revenues.

- Apple has the #1 mobile developer community, and the best products are yet to come – so sales are far from stalling. Honestly, the developer war is critical. The platform with the most developers wins the most customers. Microsoft taught investors that. But Apple never talks about its developer community. IBM has made a huge commitment to develop iOS enterprise apps that should drive substantial future sales, but Apple isn’t exciting investors about that opportunity. Tell investors more stories about how Apple is king of the developer world, and will remain in the top spot – better than Android or anyone – for years. Tell investors this will turn users toward tablets from PCs faster, and iPod sales will start growing again as smartphone and wearable sales join suit.

- Apple will win big revenues in auto markets. There was lots of rumors about hiring people to design a car, and now firing the lead guy. What is going on? Google has been pretty clear about its plans, but Apple offers investors no encouragement to think the company will succeed at even winning the war to be in other manufacturer’s cars, much less build its own. Given that the story sounds limited for Apple’s “core” products, investors need some stories about Apple’s own “moonshot” projects.

- Apple is not a 1-pony, iPhone story. Make investors believe it.

Tim Cook and the rest of Apple leadership are obviously competent. But when it comes to storytelling, this week their messaging looked like it was created as a high school communications project. Growth is what matters, and Apple completely missed the target. And investors are moving on to better stories – fast.

by Adam Hartung | Jan 23, 2016 | Current Affairs, Ethics, Food and Drink, Web/Tech

Cheating in sports is now officially prevalent. The World Anti-Doping Agency (WADA) last week issued its report, and confirmed that across the International Association of Athletics Federation (IAAF) athletes were cheating. And very frequently doing so under the supervision of those leading major sports operations at a national, and international level.

Quite simply, those responsible for the future of various sports were responsible for organizing and enabling the illegal doping of athletes. This behavior is now so commonplace that corruption is embedded in the IAAF, making cheating by far the norm rather than the exception.

Wow, we all thought that after Lance Armstrong was found guilty of doping this had all passed. Sounds like, to the contrary, Lance was just the poor guy who got caught. Perhaps he was pilloried because he was an early doping innovator, at a time when few others lacked access. As a result of his very visible take-down for doping, today’s competitors, their coaches and sponsors have become a lot more sophisticated about implementation and cover-ups.

Accusations of steroid use for superior performance have been around a long time. Major league baseball held hearings, and accused several players of doping. The long list of MLB players accused of cheating includes several thought destined for the Hall of Fame including Barry Bonds, Jose Conseco, Roger Clemens, Mark McGwire, Manny Ramirez, Alex Rodriguez, and Sammy Sosa. Even golf has had its doping accusations, with at least one top player, Vijay Sing, locked in a multi-year legal battle due to admitting using deer antler spray to improve his performance.

The reason is, of course, obvious. The stakes are, absolutely, so incredibly high. If you are at the top the rewards are in the hundreds of millions of dollars (or euros.) Due to not only enormously high salaries, but also the incredible sums paid by manufacturers for product endorsements, being at the top of all sports is worth 10 to 100 times as much as being second.

For example – name any other modern golfer besides Tiger Woods. Bet you even know his primary sponsor – Nike. Yet, he didn’t even play much in 2015. Name any other Tour de France rider other than Lance Armstrong. And he made the U.S. Postal Service recognizable as a brand. I travel the world and people ask me, often in their native language or broken English, where I live. When I say “Chicago” the #1 response – by a HUGE margin is “Michael Jordan.” And everyone knows Air Nike.

We know today that some competitors are blessed with enormous genetic gifts. Regardless of what you may have heard about practicing, in reality it is chromosomes that separate the natural athletes from those who are merely extremely good. Practicing does not hurt, but as the good doctor described to Lance Armstrong, if he wanted to be great he had to overcome mother nature. And that’s where drugs come in. Regardless of the sport in which an athlete competes, greatness simply requires very good genes.

If the payoff is so huge why wouldn’t you cheat? If mother nature didn’t give you the perfect genes, why not alter them? It is not hard to imagine anyone realizing that they are very, very, very good – after years of competing from childhood through their early 20s – but not quite as good as the other guy. The lifetime payoff between the other guy and you could be $1Billion. A billion dollars! If someone told you that they could help, and it might take a few years off your life some time in the distant future, would you really hesitate? Would the daily pain of drugs be worse than the pain of constant training?

The real question is, should we call it cheating? If lots and lots of people are doing it, as the WADA report and multiple investigations tell us, is it really cheating?

The real question is, should we call it cheating? If lots and lots of people are doing it, as the WADA report and multiple investigations tell us, is it really cheating?

After all, isn’t this a personal decision? Where should regulators draw the line?

We allow athletes to drink sports drinks. Once there was only Gatorade, and it was only available to Florida athletes. Because they didn’t dehydrate as quickly as other teams these athletes performed better. But obviously sports drinks were considered OK. How many cups of coffee should be allowed? How about taking vitamins?

Exactly who should make these decisions? And why? Why “outlaw” some products, and not others? How do you draw the line?

After watching “The Program” about Lance Armstrong’s doping routine it was clear to me I would never do it, and I would hope those I love would never do it. But I also hope they don’t smoke cigarettes, drink too much liquor or make a porno movie. Yet, those are all personal decisions we allow. And the first two can certainly lead to an early grave. As painful as doping was to biker Armstrong and his team, it was their decision to do it. As bad as it was, why isn’t it their decision? Why is someone put in a position to say it is cheating?

After all, we love winners. When Lance was winning the Tour de France he was very, very popular. Even as allegations swirled around him fans, and sponsors, pretty much ignored them. Even the reporter who chased the story was shunned by his colleagues, and degraded by his publisher, as he systematically built the undeniable case that Armstrong was cheating. Nobody wanted to hear that Lance was cheating – even if he was.

Fans and sponsors really don’t care how athletes win, just that they win. If athletes do something wrong fans pretty much just hope they don’t get caught. Just look at how fans overwhelming supported Armstrong for years. Or how football fans have overwhelming supported Patriots quarterback Tom Brady, and ridiculed the NFL’s commissioner Roger Goodall, over the Deflategate cheating charges and investigation. Fans support a winner, regardless how they win.

So, now we know performance enhancing drugs are endemic in professional sports. Why do we still make them against the rules? If they are common, should we be trying to change behavior, or change the rules?

Go back 150 years in sports and frequently the best were those born to upper middle class families. They had the luck to receive good, healthy food. They had time to actually practice. So when these athletes were able to be paid for their play, we called them professionals. As professionals we would not allow them to compete with the local amateurs. Nor could they compete in international competitions, such as the Olympics.

Jim Thorpe won 2 Olympic gold medals in 1912, received a ticker-tape Broadway parade for his performance and was considered “the greatest athlete of all time.” He was also stripped years later of his medals because it was determined he had been paid to play in a couple of professional baseball games. He was considered a cheater because he had the luxury of practicing, as a professional, while other Olympic athletes did not. Today we consider this preposterous, as professional athletes compete freely in the Olympics. But what really changed? Primarily the rules.

It is impossible to think that we will ever roll back the great rewards given to modern athletes. Too many people love their top athletes, and relish in seeing them earn superstar incomes. Too many people love to buy products these athletes endorse, and too many companies obtain brand advantage with those highly paid endorsements. In other words, the huge prize will never go away.

What is next? Genetic engineering, of course. The good geneticists will continue to figure out how to build stronger bodies, and their results will be out there for athletes to use. Splice a gorilla gene into a wrestler, or a gazelle gene into a long-distance runner. It’s not pure fantasy. This will likely be illegal. But, over time, won’t those gene-altering programs become as common to professional athletes as steroids and human growth hormone are today? Exactly when does anyone think performance enhancement will stop?

And if the drugs keep becoming better, and athletes have such a huge incentive to use them, how are we ever to think a line can be drawn — or ever enforced?

Thus, the effort to stop doping would appear, at best, Quixotic.

Instead, why not simply say that at the professional level, anything goes? No more testing. If you are a pro, you can do whatever you want to win. “It’s your life brother and sister,” the decision is up to you.

If you are an amateur then you will be subjected to intense testing, and you will be caught. Testing will go up dramatically, and you will be caught if you cross any line we draw. And banned from competition for life. If you want to go that extra mile, just go pro.

Of course, one could imagine that there could be 2 pro circuits. One that allows all performance enhancing drugs, and one that does not. But we all know that will fail. Like minor league competition, nobody really cares about the second stringers. Fans want to see real amateurs, often competing locally and reinforcing pride. And they like to see pros — the very best of the very best. And in this latter category, the fans consistently tell us via their support and dollars, they don’t really care how those folks made it to the top.

So a difficult ethical dilemma now confronts sports fans – and those who monitor athletics:

1 – Do we pretend doping doesn’t exist and keep lying about it, but realize what we’re doing is a sham and waste of time?

2 – Do we spend millions of dollars in an upgraded “war on drugs” that is surely going to fail (and who will pay for this increased vigilance, by the way?)

3 – Do we realize that with the incentives that exist today, we need to change the rules on doping? Allow it, educate about its use, but give up trying to stop it. Just like pros now compete in the Olympics, enhancement drugs would no longer be banned.

This one’s above my pay grade. What do you readers think?

by Adam Hartung | Jan 17, 2016 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Stocks are starting 2016 horribly. To put it mildly. From a Dow (DJIA or Dow Jones Industrial Average) at 18,000 in early November values of leading companies have fallen to under 16,000 – a decline of over 11%. Worse, in many regards, has been the free-fall of 2016, with the Dow falling from end-of-year close 17,425 to Friday’s 15,988 – almost 8.5% – in just 10 trading days!

With the bottom apparently disappearing, it is easy to be fearful and not buy stocks. After all, we’re clearly seeing that one can easily lose value in a short time owning equities.

But if you are a long-term investor, then none of this should really make any difference. Because if you are a long-term investor you do not need to turn those equities into cash today – and thus their value today really isn’t important. Instead, what care about is the value in the future when you do plan to sell those equities.

Investors, as opposed to traders, buy only equities of companies they think will go up in value, and thus don’t need to worry about short-term volatility created by headline news, short-term politics or rumors. For investors the most important issue is the major trends which drive the revenues of those companies in which they invest. If those trends have not changed, then there is no reason to sell, and every reason to keep buying.

(1) Buy Amazon

Take for example Amazon. Amazon has fallen from its high of about $700/share to Friday’s close of $570/share in just a few weeks – an astonishing drop of over 18.5%. Yet, there is really no change in the fundamental market situation facing Amazon. Either (a) something dramatic has changed in the world of retail, or (b) investors are over-reacting to some largely irrelevant news and dumping Amazon shares.

Everyone knows that the #1 retail trend is sales moving from brick-and-mortar stores to on-line. And that trend is still clearly in place. Black Friday sales in traditional retail stores declined in 2013, 2014 and 2015 – down 10.4% over the Thanksgiving Holiday weekend. For all December, 2015 retail sales actually declined from 2014. Due to this trend, mega-retailer Wal-Mart announced last week it is closing 269 stores. Beleaguered KMart also announced more store closings as it, and parent Sears, continues the march to non-existence. Nothing in traditional retail is on a growth trend.

However, on-line sales are on a serious growth trend. In what might well be the retail inflection point, the National Retail Federation reported that more people shopped on line Black Friday weekend than those who went to physical stores (and that counts shoppers in categories like autos and groceries which are almost entirely physical store based.) In direct opposition to physical stores, on-line sales jumped 10.4% Black Friday.

And Amazon thoroughly dominated on-line retail sales this holiday season. On Black Friday Amazon sales tripled versus 2014. Amazon scored an amazing 35% market share in e-commerce, wildly outperforming number 2 Best Buy (8%) and ten-fold numbers 3 and 4 Macy’s and WalMart that accomplished just over 3% market share each.

Clearly the market trend toward on-line sales is intact. Perhaps accelerating. And Amazon is the huge leader. Despite the recent route in value, had you bought Amazon one year ago you would still be up 97% (almost double your money.) Reflecting market trends, Wal-Mart has declined 28.5% over the last year, while the Dow dropped 8.7%.

Amazon may not have bottomed in this recent swoon. But, if you are a long-term investor, this drop is not important. And, as a long-term investor you should be gratified that these prices offer an opportunity to buy Amazon at a valuation not available since October – before all that holiday good news happened. If you have money to invest, the case is still quite clear to keep buying Amazon.

(2) Buy Facebook

(2) Buy Facebook

The trend toward using social media has not abated, and Facebook continues to be the gorilla in the room. Nobody comes close to matching the user base size, or marketing/advertising opportunities Facebook offers. Facebook is down 13.5% from November highs, but is up 24.5% from where it was one year ago. With the trend toward internet usage, and social media usage, growing at a phenomenal clip, the case to hold what you have – and add to your position – remains strong. There is ample opportunity for Facebook to go up dramatically over the next few years for patient investors.

(3) Buy Netflix

When was the last time you bought a DVD? Rented a DVD? Streamed a movie? How many movies or TV programs did you stream in 2015? In 2013? Do you see any signs that the trend to streaming will revert? Or even decelerate as more people in more countries have access to devices and high bandwidth?

Last week Netflix announced it is adding 130 new countries to its network in 2016, taking the total to 190 overall. By 2017, about the only place in the world you won’t be able to access Netflix is China. Go anywhere else, and you’ve got it. Additionally, in 2016 Netflix will double the number of its original programs, to 31 from 16. Simultaneously keeping current customers in its network, while luring ever more demographics to the Netflix platform.

Netflix stock is known for its wild volatility, and that remains in force with the value down a whopping 21.8% from its November high. Yet, had you bought 1 year ago even Friday’s close provided you a 109% gain, more than doubling your investment. With all the trends continuing to go its way, and as Netflix holds onto its dominant position, investors should sleep well, and add to their position if funds are available.

(4) Buy Google

Ever since Google/Alphabet overwhelmed Yahoo, taking the lead in search and on-line advertising the company has never looked back. Despite all attempts by competitors to catch up, Google continues to keep 2/3 of the search market. Until the market for search starts declining, trends continue to support owning Google – which has amassed an enormous cash hoard it can use for dividends, share buybacks or growing new markets such as smart home electronics, expanded fiber-optic internet availability, sensing devices and analytics for public health, or autonomous cars (to name just a few.)

The Dow decline of 8.7% would be meaningless to a shareholder who bought one year ago, as GOOG is up 37% year-over year. Given its knowledge of trends and its investment in new products, that Google is down 12% from its recent highs only presents the opportunity to buy more cheaply than one could 2 months ago. There is no trend information that would warrant selling Google now.

(5) Buy Apple

Despite spending most of the last year outperforming the Dow, a one-year investor would today be down 10.7% in Apple vs. 8.7% for the Dow. Apple is off 27.6% from its 52 week high. With a P/E (price divided by earnings) ratio of 10.6 on historical earnings, and 9.3 based on forecasted earnings, Apple is selling at a lower valuation than WalMart (P/E – 13). That is simply astounding given the discussion above about Wal-mart’s operations related to trends, and a difference in business model that has Apple producing revenues of over $2.1M/employee/year while Walmart only achieve $220K/employee/year. Apple has a dividend yield of 2.3%, higher than Dow companies Home Depot, Goldman Sachs, American Express and Disney!

Apple has over $200B cash. That is $34.50/share. Meaning the whole of Apple as an operating company is valued at only $62.50/share – for a remarkable 6 times earnings. These are the kind of multiples historically reserved for “value companies” not expected to grow – like autos! Even though Apple grew revenues by 26% in fyscal 2015, and at the compounded rate of 22%/year from 2011- 2015.

Apple has a very strong base market, as the world leader today in smartphones, tablets and wearables. Additionally, while the PC market declined by over 10% in 2015, Apple’s Mac sales rose 3% – making Apple the only company to grow PC sales. And Apple continues to move forward with new enterprise products for retail such as iBeacon and ApplePay. Meanwhile, in 2016 there will be ongoing demand growth via new development partnerships with large companies such as IBM.

Unfortunately, Apple is now valued as if all bad news imaginable could occur, causing the company to dramatically lose revenues, sustain an enormous downfall in earnings and have its cash dissipated. Yet, Apple rose to become America’s most valuable publicly traded company by not only understanding trends, but creating them, along with entirely new markets. Apple’s ability to understand trends and generate profitable revenues from that ability seems to be completely discounted, making it a good long-term investment.

In August, 2015 I recommended FANG investing. This remains the best opportunity for investors in 2016 – with the addition of Apple. These companies are well positioned on long-term trends to grow revenues and create value for several additional years, thereby creating above-market returns for investors that overlook short-term market turbulence and invest for long-term gains.

by Adam Hartung | Jan 8, 2016 | Current Affairs, General, Leadership

“Those who cannot remember the past are doomed to repeat it”

– George Santayana, “The Life of Reason,” 1905

There seems to be nothing Donald Trump will not say. Or at least imply.

Take for example his recent comment that evangelicals should not trust Ted Cruz because his father is from Cuba, and Cubans are mostly Catholic. He didn’t say Mr. Cruz wasn’t an evangelical, he just inferred that Mr. Cruz must not be, due to his origins. That Mr. Cruz’s father is a “born again Christian” and Bible-belt evangelical minister is simply ignored, regardless of its relevance.

Or, take for example the notion that Mr. Cruz is not eligible to be President because he was born in Canada, even though his mother is an American citizen. Mr. Trump doesn’t say Mr. Cruz isn’t a natural born citizen, he just implies that possibly he is not and therefore he may not be a legitimate candidate. Maybe Mr. Cruz really isn’t the American he claims to be?

Or, implying all Muslims are bad, because some followers of Islam have implemented bad acts. Mr. Trump has denounced all Muslims, and would deny all Muslims entry into the USA, because of the actions of a few. After all, why not? If you can’t tell the good from the bad, why not condemn them all? If he were doing the same to Jewish believers we would call Mr. Trump’s language antisemitic. Could you imagine denying all Jews entry into the USA – for any reason?

These are just a few of the outrageous things Mr. Trump has said, and yet he has people who think he is an admirable business leader suitable to be a political leader. Recently a good friend of mine was quite eloquent in her praise for how well Mr. Trump “plays the media like a church organ.” Even if she didn’t like some of his messages, she thought it admirable how he obtains media attention, and keeps it focused on himself, and lures people into listening to him.

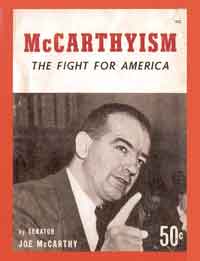

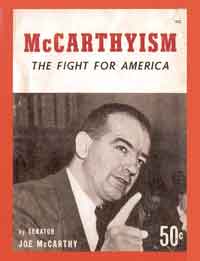

Which takes me to my opening quote. Mr. Trump is great at practicing McCarthyism – and yet nobody seems to care. And if we don’t do something, we may repeat a part of history that was a very black eye.

Senator Joe McCarthy was a conservative Senator from Wisconsin in the early 1950s. To achieve fame and glory, he famously developed a great skill for feeding the news media bits of information that would bring attention to himself. Senator McCarthy excelled at building on the public’s FUD – Fears, Uncertainties and Doubts.

Senator Joe McCarthy was a conservative Senator from Wisconsin in the early 1950s. To achieve fame and glory, he famously developed a great skill for feeding the news media bits of information that would bring attention to himself. Senator McCarthy excelled at building on the public’s FUD – Fears, Uncertainties and Doubts.

At the time, Americans were terribly afraid of communists, fearful they would ruin the U.S. social order and make the country into the next Soviet Union. So Senator McCarthy conveniently blamed all social ills on communist infiltrators – people working in government jobs who were set on destroying the country. He then would accuse those he didn’t like of being communists. Or, if that accusation was proven baseless, he would accuse those he saw as political opponents of sympathizing with communists – claims that amounted to “you are guilty unless you can prove yourself innocent.” He didn’t have to prove someone was bad, just that they might look bad, sound bad or know someone who was possibly bad.

Mr. McCarthy was fantastic at feeding great lines to the media – newspapers, radio and TV. He would seek out reporters and say outrageous comments, which were so outrageous that the media felt compelled to report them. And the more outrageous Senator McCarthy was, the more media attention he acquired. And the more attention he had, the more he used false attacks, innuendos and statements that pandered to the FUD of many Americans.

Eventually, Senator McCarthy was exposed as the blowhard that he truly was. Full of innuendo and attack, but lacking in any real policy skills or ability to govern. The word “McCarthyism” was born to “describe reckless, unsubstantiated accusations, as well as demagogic attacks on the character or patriotism of political adversaries.” (Wikipedia) Famous broadcaster Edward R. Murrow eventually exposed the baselessness of Senator McCarthy, leading to his Senatorial censure and media decline.

Few have ever demonstrated the skills of McCarthyism better than Mr. Trump. Feeding the public FUD, Mr. Trump doesn’t say President Obama is a Muslim – but he accepts the notion from an audience member’s shout out at a public rally. Just like McCarthy called members of the State Department “sympathizers” as he tried to ruin their careers, Mr. Trump says that the investigation of Benghazi implies that former Secretary of State Clinton did something wrong – even though the investigation results were that there was no wrong-doing by the Secretary or her staff. The “investigation” is held out as evidence, when it is nothing more than an inference. And attacks on whole groups of people, like Muslims, is the definition of demagoguery.

Mr. Trump may be good at media management, but that is not to be admired. Being good at a skill is admirable only if that skill is used for good. We admire magicians for slight-of-hand, but not pickpockets. We admire forest rangers for skillful use of burns, but not arsonists. We admire locksmiths for knowing how locks work, but not thieves. We admire artists for great brushwork, but not forgers. We admire hard working business people for their skills, but not skillful lawbreakers like Skillling of Enron, Ebbers of Worldcom or investment advisor Bernie Madoff.