by Adam Hartung | Aug 26, 2016 | In the Swamp, Investing, Retail, Trends

Photographer: Luke Sharrett/Bloomberg

Walmart is in more trouble than its leadership wants to acknowledge. Investors

need to realize that it is up to Jet.com to turn around the ailing giant. And

that is a big task for the under $1 billion company.

Relevancy Is Hard To Keep – Look At Sears

Nobody likes to think their business can disappear. What CEO wants to tell his investors or employees “we’re no longer relevant, and it looks like our customers are all going somewhere else for their solutions”? Unfortunately, most leadership teams become entrenched in the business model and deny serious threats to longevity, thus leading to inevitable failure as customers switch.

Gallery: “Walmart Goes Small”

In early September the Howard Johnson’s in Bangor, Maine will close. This will leave just one remaining HoJo in the USA. What was once an iconic brand with hundreds of outlets strung along the fast growing interstate highway system is now nearly dead. People still drive the interstate, but trends changed, fast food became a good substitute, and unable to update its business model this once great brand died.

AP Photo/Elise Amendola

Sears announced another $350 million quarterly loss this week. That makes $9 billion in accumulated losses the last several quarters. Since Chairman and CEO Ed Lampert took over, Sears and Kmart have seen same store sales decline every single quarter except one. Unable to keep its customers Mr. Lampert has been closing stores and selling assets to stem the cash drain. But to keep the company afloat his hedge fund, ESL, is loaning Sears Holdings SHLD -2.94% another $300 million. On top of the $500 million the company borrowed last quarter. That the once iconic company, and Dow Jones Industrial Average component, is going to fail is a foregone conclusion.

But most people still think this fate cannot befall the nearly $500 billion revenue behemoth Walmart. It’s simply too big to fail in most people’s eyes.

Walmart’s Crime Problem Is Another Telltale Sign Of Problems In The Business Model

Yet, the primary news about Walmart is not good. Bloomberg this week broke the news that one of the most crime-ridden places in America is the local Walmart store. One store in Tulsa, Oklahoma has had 5,000 police visits in the last five years, and four local stores have had 2,000 visits in the last year alone. Across the system, there is one violent crime in a Walmart every day. By constantly promoting its low cost strategy Walmart has attracted a class of customer that simply is more prone to committing crime. And policies implemented to hang onto customers, like letting them camp out overnight in the parking lots, serve to increase the likelihood of poverty-induced crime.

But this outcome is also directly related to Walmart’s business model and strategy. To promote low prices Walmart has automated more operations, and cut employees like greeters. Thus leadership brags about a 23% increase in sales/employee the last decade. But that has happened as the employment shrank by 400,000. Fewer employees in the stores encourages more crime.

In a real way Walmart has “outsourced” its security to local police departments. Experts say the cost to eliminate this security problem are about $3.2 billion – or about 20% of Walmart’s total profitability. Ouch! In a world where Walmart’s net margin of 3% is fully one-third lower than Target’s 4.6% the money just isn’t there any longer for Walmart to invest in keeping its stores safe.

With each passing month Walmart is becoming the “retailer of last resort” for people who cannot shop online. People who lack credit cards, or even bank accounts. People without the means, or capability, of shopping by computer, or paying electronically. People who have nowhere else to go to shop, due to poverty and societal conditions. Not exactly the ideal customer base for building a growing, profitable business.

Competitors Relentlessly Pick Away At Walmart’s Sales And Profits

To maintain revenues the last several years Walmart has invested heavily in transitioning to superstores which offer a large grocery section. But now Kroger KR -0.5%, Walmart’s no. 1 grocery competitor, is taking aim at the giant retailer, slashing prices on 1,000 items. Just like competition from the “dollar stores” has been attacking Walmart’s general merchandise aisles. Thus putting even more pressure on thinning margins, and leaving less money available to beef up security or entice new customers to the stores.

And the pressure from e-commerce is relentless. As detailed in the Wall Street Journal, Walmart has been selling online for about 15 years, and has a $14 billion online sales presence. But this is only 3% of total sales. And growth has been decelerating for several quarters. Last quarter Walmart’s e-commerce sales grew 7%, while the overall market grew 15% and Amazon ($100 billion revenues) grew 31%. It is clear that Walmart.com simply is not attracting enough customers to grow a healthy replacement business for the struggling stores.

Thus the acquisition of Jet.com.

The hope is that this extremely unprofitable $1 billion online retailer will turn around Walmart’s fortunes. Imbue it with much higher growth, and enhanced profitability. But will Walmart make this transition. Is leadership ready to cannibalize the stores for higher electronic sales? Are they willing to make stores smaller, and close many more, to shift revenues online? Are they willing to suffer Amazon-like profits (or losses) to grow? Are they willing to change the Walmart brand to something different, while letting Jet.com replace Walmart as the dominant brand? Are they willing to give up on the past, and let new leadership guide the company forward?

If they do then Walmart could become something very different in the future. If they really realize that the market is shifting, and that an extreme change is necessary in strategy and tactics then Walmart could become something very different, and remain competitive in the highly segmented and largely online retail future. But if they don’t, Walmart will follow Sears into the whirlpool, and end up much like Howard Johnson’s.

by Adam Hartung | Aug 12, 2016 | Diversity, Innovation, Teamwork, Television

Most of the time “diversity” is a code word for adding women or minorities to an organization. But that is only one way to think about diversity, and it really isn’t the most important. To excel you need diversity in thinking. And far too often, we try to do just the opposite.

“Mythbusters” was a television series that ran 14 seasons across 12 years. The thesis was to test all kinds of things people felt were facts, from historical claims to urban legends, with sound engineering approaches to see if the beliefs were factually accurate – or if they were myths. The show’s ability to bust, or prove, these myths made it a great success.

The show was led by 2 engineers who worked together on the tests and props. Interestingly, these two fellows really didn’t like each other. Despite knowing each other for 20 years, and working side-by-side for 12, they never once ate a meal together alone, or joined in a social outing. And very often they disagreed on many aspects of the show. They often stepped on each others toes, and they butted heads on multiple issues. Here’s their own words:

The show was led by 2 engineers who worked together on the tests and props. Interestingly, these two fellows really didn’t like each other. Despite knowing each other for 20 years, and working side-by-side for 12, they never once ate a meal together alone, or joined in a social outing. And very often they disagreed on many aspects of the show. They often stepped on each others toes, and they butted heads on multiple issues. Here’s their own words:

“We get on each other’s nerves and everything all the time, but whenever that happens, we say so and we deal with it and move on,” he explained. “There are times that we really dislike dealing with each other, but we make it work.”

The pair honestly believed it is their differences which made the show great. They challenged each other continuously to determine how to ask the right questions, and perform the right tests, and interpret the results. It was because they were so different that they were so successful. Individually each was good. But together they were great. It was because they were of different minds that they pushed each other to the highest standards, never had an integrity problem, and achieved remarkable success.

Yet, think about how often we select people for exactly the opposite reason. Think about “knock-out” comments and questions you’ve heard that were used to keep from increasing the diversity:

- I wouldn’t want to eat lunch with that person, so why would I want to work with them?

- We find that people with engineering (or chemical, or fine arts, etc.) backgrounds do well here. Others don’t.

- We like to hire people from state (or Ivy League, etc) colleges because they fit in best

- We always hire for industry knowledge. We don’t want to be a training ground for the basics in how our industry works

- Results are not as important as how they were obtained – we have to be sure this person fits our culture

- Directors on our Board need to be able to get along or the Board cannot be effective

- If you weren’t trained in our industry, how could you be helpful?

- We often find that the best/top graduates are unable to fit into our culture

- We don’t need lots of ideas, or challenges. We need people that can execute our direction

- He gets things done, but he’s too rough around the edges to hire (or promote.) If he leaves he’ll be someone else’s problem.

In 2011 I wrote in Forbes “Why Steve Jobs Couldn’t Find a Job Today.” The column pointed out that hiring practices are designed for the lowest common denominator, not the best person to do a job. Personalities like Steve Jobs would be washed out of almost any hiring evaluation because he was too opinionated, and there would be concerns he would cause too much tension between workers, and be too challenging for his superiors.

Simply put, we are biased to hire people that think like us. It makes us comfortable. Yet, it is a myth that homogeneous groups, or cultures, are the best performing. It is the melding of diverse ways of thinking, and doing, that leads to the best solutions. It is the disagreement, the arguing, the contention, the challenging and the uncomfortableness that leads to better performance. It leads to working better, and smarter, to see if your assumptions, ideas and actions can perform better than your challengers. And it leads to breakthroughs as challenges force us to think differently when solving problems, and thus developing new combinations and approaches that yield superior returns.

What should we do to hire better, and develop better talent that produces superior results?

- Put results and accomplishments ahead of culture or fit. Those who succeed usually keep succeeding, and we need to build on those skills for everyone to learn how to perform better

- Don’t let ego into decisions or discussions. Too many bad decisions are made because someone finds their assumptions or beliefs challenged, and thus they let “hurt feelings” keep them from listening and considering alternatives.

- Set goals, not process. Tell someone what they need to accomplish, and not how they should do it. If how someone accomplishes their goals offends you, think about your own assumptions rather than attacking the other person. There can be no creativity if the process is controlled.

- Set big goals, and avoid the desire to set a lot of small goals. When you break down the big goal into sub-goals you effectively kill alternative approaches – approaches that might not apply to these sub-goals. In other words, make sure the big objective is front and center, then “don’t sweat the small stuff.”

- Reward people for thinking differently – and be very careful to not punish them. It is easy to scoff at an idea that sounds foreign, and in doing so kill new ideas. Often it’s not what they don’t know that is material, but rather what you don’t know that is most important.

- Be blind to gender, skin color, historical ancestry, religion and all other elements of background. Don’t favor any background, nor disfavor another. This doesn’t mean white men are the only ones who need to be aware. It is extremely easy for what we may call any minority to favor that minority. Assumptions linked to physical attributes and history run deep, and are hard to remove from our bias. But it is not these historical physical and educational elements that matter, it is how people think that matters – and the results they achieve.

by Adam Hartung | Aug 4, 2016 | Election, Leadership, Politics

Donald Trump has had a lot of trouble gaining good press lately. Instead, he’s been troubled by people from all corners reacting negatively to his comments regarding the Democrat’s convention, some speakers at the convention, and his unwillingness to endorse re-election for the Republican speaker of the house. For a guy who has been in the limelight a really long time, it seems a bit odd he would be having such a hard time – especially after all the practice he had during the primaries.

The trouble is that Donald Trump still thinks like a CEO. And being a CEO is a lot easier than being the chief executive of a governing body.

CEOs are much more like kings than mayors, governors or presidents:

- They aren’t elected, they are appointed. Usually after a long, bloody in-the-trenches career of fighting with opponents – inside and outside the company.

- They have the final say on pretty much everything. They can choose to listen to their staff, and advisors, or ignore them. Not employees, customers or suppliers can appeal their decisions.

- If they don’t like the input from an employee or advisor, they can simply fire them.

- If they don’t like a supplier, they can replace them with someone else.

- If they don’t like a customer, they can ignore them.

- Their decisions about resources, hiring/firing, policy, strategy, fund raising/pricing, spending – pretty much everything – is not subject to external regulation or legal review or potential lawsuits.

- Most decisions are made by understanding finance. Few require a deep knowledge of law.

- There is really only 1 goal – make money for shareholders. Determining success is not overly complicated, and does not involve multiple, equally powerful constituencies.

- They can make a ton of mistakes, and pretty much nobody can fire them. They don’t stand for re-election, or re-affirmation. There are no “term limits.” There is little to tie them personally to their decisions.

- They have 100% control of all the resources/assets, and can direct those resources wherever they want, whenever they want, without asking permission or dealing with oversight.

- They can say anything they want, and they are unlikely to be admonished or challenged by anyone due to their control of resource allocation and firing.

- 99% of what they say is never reported. They talk to a few people on their staff, and those people can rephrase, adjust, improve, modify the message to make it palatable to employees, customers, suppliers and local communities. There is media attention on them only when they allow it.

- They have the “power of right” on their side. They can make everyone unhappy, but if their decision improves shareholder value (if they are right) then it really doesn’t matter what anyone else thinks

One might challenge this by saying that CEOs report to the Board of Directors. Technically, this is true. But, Boards don’t manage companies. They make few decisions. They are focused on long-term interests like compliance, market entry, sales development, strategy, investor risk minimization, dividend and share buyback policy. About all they can do to a CEO if one of the above items troubles them is fire the CEO, or indicate a lack of support by adjusting compensation. And both of those actions are far from easy. Just look at how hard it is for unhappy shareholders to develop a coalition around an activist investor in order to change the Board — and then actually take action. And, if the activist is successful at taking control of the board, the one action they take is firing the CEO, only to replace that person with someone knew that has all the power of the old CEO.

It is very alluring to think of a CEO and their skills at corporate leadership being applicable to governing. And some have been quite good. Mayor Bloomberg of New York appears to have pleased most of the citizens and agencies in the city, and his background was an entrepreneur and successful CEO.

But, these are not that common. More common are instances like the current Governor of Illinois, Bruce Rauner. A billionaire hedge fund operator, and first-time elected politician, he won office on a pledge of “shaking things up” in state government. His first actions were to begin firing employees, cutting budgets, terminating pension benefits, trying to remove union representation of employees, seeking to bankrupt the Chicago school district, and similar actions. All things a “good CEO” would see as the obvious actions necessary to “fix” a state in a deep financial mess. He looked first at the financials, the P&L and balance sheet, and set about to improve revenues, cut costs and alter asset values. His mantra was to “be more like Indiana, and Texas, which are more business friendly.”

Only, governors have nowhere near the power of CEOs. He has been unable to get the legislature to agree with his ideas, most have not passed, and the state has languished without a budget going on 2 years. The Illinois Supreme Court said the pension was untouchable – something no CEO has to worry about. And it’s nowhere near as easy to bankrupt a school district as a company you own that needs debt/asset restructuring because of all those nasty laws and judges that get in the way. Additionally, government employee unions are not the same as private unions, and nowhere near as easy to “bust” due to pesky laws passed by previous governors and legislators that you can’t just wipe away with a simple decision.

With the state running a deficit, as a CEO he sees the need to undertake the pain of cutting services. Just like he’d cut “wasteful spending” on things he deemed non-essential at one of the companies he ran. So refusing funding during budget negotiations for health care worker overtime, child care, and dozens of other services that primarily are directed at small groups seems like a “hard decision, well needed.” And if the lack of funding means the college student loan program dries up, well those students will just have to wait to go to college, or find funding elsewhere. And if that becomes so acute that a few state colleges have to close, well that’s just the impact of trying to align spending with the reality of revenues, and the customers will have to find those services elsewhere.

And when every decision is subjected to media reporting, suddenly every single decision is questioned. There is no anonymity behind a decision. People don’t just see a college close and wonder “how did that happen” because there are ample journalists around to report exactly why it happened, and that it all goes back to the Governor. Just like the idea of matching employee rights, pay requirements, contract provisioning and regulations to other states – when your every argument is reported by the media it can come off sounding a lot like as state CEO you don’t much like the state you govern, and would prefer to live somewhere else. Perhaps your next action will be to take the headquarters (now the statehouse) to a neighboring state where you can get a tax abatement?

Donald Trump the CEO has loved the headlines, and the media. He was the businessman-turned-reality-TV-star who made the phrase “you’re fired” famous. Because on that show, he was the CEO. He could make any decision he wanted; unchallenged. And viewers could turn on his show, or not, it really didn’t matter. And he only needed to get a small fraction of the population to watch his show for it to make money, not a majority. And he appears to be very genuinely a CEO. As a CEO, as a TV celebrity — and now as a candidate for President.

Obviously, governing body chief executives have to be able to create coalitions in order to get things done. It doesn’t matter the party, it requires obtaining the backing of your own party (just as John Boehner about what happens when that falters) as well as the backing of those who don’t agree with you. ou don’t have the luxury of being the “tough guy” because if you twist the arm to hard today, these lawmakers, regulators and judges (who have long memories) will deny you something you really, really want tomorrow. And you have to be ready to work with journalists to tell your story in a way that helps build coalitions, because they decide what to tell people you said, and they decide how often to repeat it. And you can’t rely on your own money to take care of you. You have to raise money, a lot of money, not just for your campaign, but to make it available to give away through various PACs (Political Action Committees) to the people who need it for their re-elections in order to keep them backing you, and your ideas. Because if you can’t get enough people to agree on your platforms, then everything just comes to a stop — like the government of Illinois. Or the times the U.S. Government closed for a few days due to a budget impasse.

And, in the end, the voters who elected you can decide not to re-elect you. Just ask Jimmy Carter and George H.W. Bush about that.

On the whole, it’s a whole lot easier to be a CEO than to be a mayor, or governor, or President. And CEOs are paid a whole lot better. Like the moviemaker Mel Brooks (another person born in New York by the way) said in History of the World, Part 1 “it’s good to be king.“

by Adam Hartung | Jul 27, 2016 | Food and Drink, Growth Stall, In the Swamp, Leadership, Web/Tech

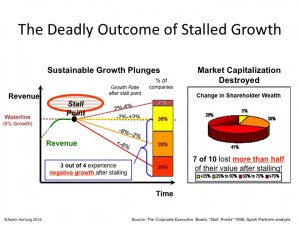

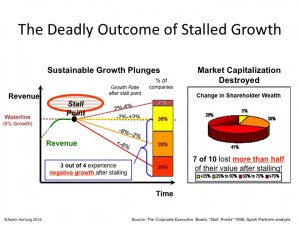

Growth Stalls are deadly for valuation, and both Mcdonald’s and Apple are in one.

August, 2014 I wrote about McDonald’s Growth Stall. The company had 7 straight months of revenue declines, and leadership was predicting the trend would continue. Using data from several thousand companies across more than 3 decades, companies in a Growth Stall are unable to maintain a mere 2% growth rate 93% of the time. 55% fall into a consistent revenue decline of more than 2%. 20% drop into a negative 6%/year revenue slide. 69% of Growth Stalled companies will lose at least half their market capitalization in just a few years. 95% will lose more than 25% of their market value. So it is a long-term concern when any company hits a Growth Stall.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

McDonald’s stock languished around $94/share from 8/2014 through 8/2015 – but then broke out to $112 in 2 months on investor hopes for a turnaround. At the time I warned investors not to follow the herd, because there was nothing to indicate that trends had changed – and McDonald’s still had not altered its business in any meaningful way to address the new market realities.

Yet, hopes remained high and the stock peaked at $130 in May, 2016. But since then, the lack of incremental revenue growth has become obvious again. Customers are switching from lunch food to breakfast food, and often switching to lower priced items – but these are almost wholly existing customers. Not new, incremental customers. Thus, the company trumpets small gains in revenue per store (recall, the number of stores were cut) but the growth is less than the predicted 2%. The only incremental growth is in China and Russia, 2 markets known for unpredictable leadership. The stock has now fallen back to $120.

Given that the realization is growing as to the McDonald’s inability to fundamentally change its business competitively, the prognosis is not good that a turnaround will really happen. Instead, the common pattern emerges of investors hoping that the Growth Stall was a “blip,” and will be easily reversed. They think the business is fundamentally sound, and a little management “tweaking” will fix everything. Small changes will lead to the classic hockey-stick forecast of higher future growth. So the stock pops up on short-term news, only to fall back when reality sets in that the long-term doesn’t look so good.

Unfortunately, Apple’s Q3 2016 results (reported yesterday) clearly show the company is now in its own Growth Stall. Revenues were down 11% vs. last year (YOY or year-over-year,) and EPS (earnings per share) were down 23% YOY. 2 consecutive quarters of either defines a Growth Stall, and Apple hit both. Further evidence of a Growth Stall exists in iPhone unit sales declining 15% YOY, iPad unit sales off 9% YOY, Mac unit sales down 11% YOY and “other products” revenue down 16% YOY.

This was not unanticipated. Apple started communicating growth concerns in January, causing its stock to tank. And in April, revealing Q2 results, the company not only verified its first down quarter, but predicted Q3 would be soft. From its peak in May, 2015 of $132 to its low in May, 2016 of $90, Apple’s valuation fell a whopping 32%! One could say it met the valuation prediction of a Growth Stall already – and incredibly quickly!

But now analysts are ready to say “the worst is behind it” for Apple investors. They are cheering results that beat expectations, even though they are clearly very poor compared to last year. Analysts are hoping that a new, lower baseline is being set for investors that only look backward 52 weeks, and the stock price will move up on additional company share repurchases, a successful iPhone 7 launch, higher sales in emerging countries like India, and more app revenue as the installed base grows – all leading to a higher P/E (price/earnings) multiple. The stock improved 7% on the latest news.

So far, Apple still has not addressed its big problem. What will be the next product or solution that will replace “core” iPhone and iPad revenues? Increasingly competitors are making smartphones far cheaper that are “good enough,” especially in markets like China. And iPhone/iPad product improvements are no longer as powerful as before, causing new product releases to be less exciting. And products like Apple Watch, Apple Pay, Apple TV and IBeacon are not “moving the needle” on revenues nearly enough. And while experienced companies like HBO, Netflix and Amazon grow their expanding content creation, Apple has said it is growing its original content offerings by buying the exclusive rights to “Carpool Karaoke“ – yet this is very small compared to the revenue growth needs created by slowing “core” products.

Like McDonald’s stock, Apple’s stock is likely to move upward short-term. Investor hopes are hard to kill. Long-term investors will hold their stock, waiting to see if something good emerges. Traders will buy, based upon beating analyst expectations or technical analysis of price movements. Or just belief that the P/E will expand closer to tech industry norms. But long-term, unless the fundamental need for new products that fulfill customer trends – as the iPad, iPhone and iPod did for mobile – it is unclear how Apple’s valuation grows.

by Adam Hartung | Jul 26, 2016 | Leadership, Marketing, Sports

Most leaders think of themselves as decision makers. Many people remember in 2006 when President George Bush, defending Donald Rumsfeld as his Defense Secretary said “I am the Decider. I decide what’s best.” It earned him the nickname “Decider-in-Chief.” Most CEOs echo this sentiment, Most leaders like to define themselves by the decisions they make.

But whether a decision is good, or not, has a lot of interpretations. Often the immediate aftermath of a decision may look great. It might appear as if that decision was obvious. And often decisions make a lot of people happy. As we are entering the most intense part of the U.S. Presidential election, both candidates are eager to tell you what decisions they have made – and what decisions they will make if elected. And most people will look no further than the immediate expected impact of those decisions.

However, the quality of most decisions is not based on the immediate, or obvious, first implications. Rather, the quality of decisions is discovered over time, as we see the consequences – intended an unintended. Because quite often, what looked good at first can turn out to be very, very bad.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100M.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100M.

That action by the NBA is what’s called unintended consequences. Lawmakers didn’t really consider that the NBA might decide to take its business elsewhere due to this state legislation. It’s what some people call “oops. I didn’t think about that when I made my decision.”

Robert Reich, Secretary of Labor for President Clinton, was a staunch supporter of unions. In his book “Locked in the Cabinet” he tells the story of visiting an auto plant in Oklahoma supporting the union and workers rights. He thought his support would incent the company’s leaders to negotiate more favorably with the union. Instead, the company closed the plant. Laid-off everyone. Oops. The unintended consequences of what he thought was an obvious move of support led to the worst possible outcome for the workers.

President Obama worked the Congress hard to create the Affordable Care Act, or Obamacare, for everyone in America. One intention was to make sure employers covered all their workers, so the law required that if an employer had health care for any workers he had to offer that health care to all employees who work over 30 hours per week. So almost all employers of part time workers suddenly said that none could work more than 30 hours. Those that worked 32 (4 days/week) or 36 suddenly had their hours cut. Now those lower-income people not only had no health care, but less money in their pay envelopes. Oops. Unintended consequence.

President Reagan and his wife launched the “War on Drugs.” How could that be a bad thing? Illegal drugs are dangerous, as is the supply chain. But now, some 30 years later, the Federal Bureau of Prisons reports that almost half (46.3% or over 85,000) inmates are there on drug charges. The USA now spends $51B annually on this drug war, which is about 20% more than is spent on the real war being waged with Afghanistan, Iraq and ISIS. There are now over 1.5M arrests each year, with 83% of those merely for possession. Oops. Unintended consequences. It seemed like such a good idea at the time.

This is why it is so important leaders take their time to make thoughtful decisions, often with the input of many other people. Because the quality of a decision is not measured by how one views it immediately. Rather, the value is decided over time as the opportunity arises to observe the unintended consequences, and their impact. The best decisions are those in which the future consequences are identified, discussed and made part of the planning – so they aren’t unintended and the “decider” isn’t running around saying “oops.”

As you listen to the politicians this cycle, keep in mind what would be the unintended consequences of implementing what they say:

- What would be the social impact, and transfer of wealth, from suddenly forgiving all student loans?

- What would be the consequences on trade, and jobs, of not supporting historical government trade agreements?

- What would be the consequences on national security of not supporting historically allied governments?

- What would be the long-term consequence not allowing visitors based on race, religion or sexual orientation?

- What would be the consequence of not repaying the government’s bonds?

- What would be the long-term impact on economic growth of higher regulations on banks – that already have seen dramatic increases in regulation slowing the recovery?

- What would be the long-term consequences on food production, housing and lifestyles of failing to address global warming?

Business leaders should follow the same practice. Every time a decision is necessary, is the best effort made to obtain all the information you could on the topic? Do you obtain input from your detractors, as well as admirers? Do you think through not only what is popular, but what will happen months into the future? Do you consider the potential reaction by your customers? Employees? Suppliers? Competitors?

There are very few “perfect decisions.” All decisions have consequences. Often, there is a trade-off between the good outcomes, and the bad outcomes. But the key is to know them all, and balance the interests and outcomes. Consider the consequences, good and bad, and plan for them. Only by doing that can you avoid later saying “oops.”

by Adam Hartung | Jul 15, 2016 | Defend & Extend, Entertainment, Games, Innovation, Lock-in, Mobile, Trends

Poke’Mon Go is a new sensation. Just launched on July 6, the app is already the #1 app in the world – and it isn’t even available in most countries. In less than 2 weeks, from a standing start, Nintendo’s new app is more popular than both Facebook and Snapchat. Based on this success, Nintendo’s equity valuation has jumped 90% in this same short time period.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

A bit of history

Nintendo launched the Wii in 2006 and it was a sensation. Gamers could do things not previously possible. Unit sales exceeded 20m units/year for 2006 through 2009. But Sony (PS4) and Microsoft (Xbox) both powered up their game consoles and started taking share from Nintendo. By 2011 Nintendo sale were down to 11.6m units, and in 2012 sales were off another 50%. The Wii console was losing relevance as competitors thrived.

Sony and Microsoft both invested heavily in their competition. Even though both were unprofitable at the business, neither was ready to concede the market. In fall, 2014 Microsoft raised the competitive ante, spending $2.5B to buy the maker of popular game Minecraft. Nintendo was becoming a market afterthought.

Meanwhile, back in 2009 Nintendo had 70% of the handheld gaming market with its 3DS product. But people started carrying the more versatile smartphones that could talk, text, email, execute endless apps and even had a lot of games – like Tetrus. The market for handheld games pretty much disappeared, dealing Nintendo another blow.

Competitor strategic errors

Fortunately, the bitter “fight to the death” war between Sony and Microsoft kept both focused on their historical game console business. Both kept investing in making the consoles more powerful, with more features, supporting more intense, lifelike games. Microsoft went so far as to implement in Windows 10 the capability for games to be played on Xbox and PCs, even though the PC gaming market had not grown in years. These massive investments were intended to defend their installed base of users, and extend the platform to attract new growth to the traditional, nearly 4 decade old market of game consoles that extends all the way back to Atari.

Both companies did little to address the growing market for mobile gaming. The limited power of mobile devices, and the small screens and poor sound systems made mobile seem like a poor platform for “serious gaming.” While game apps did come out, these were seen as extremely limited and poor quality, not at all competitive to the Sony or Microsoft products. Yes, theoretically Windows 10 would make gaming possible on a Microsoft phone. But the company was not putting investment there. Mobile gaming was simply not serious, and not of interest to the two Goliaths slugging it out for market share.

Building on trends makes all the difference

Back in 2014 I recognized that the console gladiator war was not good for either big company, and recommended Microsoft exit the market. Possibly seeing if Nintendo would take the business in order to remove the cash drain and distraction from Microsoft. Fortunately for Nintendo, that did not happen.

Nintendo observed the ongoing growth in mobile gaming. While Candy Crush may have been a game ignored by serious gamers, it nonetheless developed a big market of users who loved the product. Clearly this demonstrated there was an under-served market for mobile gaming. The mobile trend was real, and it’s gaming needs were unmet.

Simultaneously Nintendo recognized the trend to social. People wanted to play games with other people. And, if possible, the game could bring people together. Even people who don’t know each other. Rather than playing with unseen people located anywhere on the globe, in a pre-organized competition, as console games provided, why not combine the social media elements of connecting with those around you to play a game? Make it both mobile, and social. And the basics of Poke’Mon Go were born.

Then, build out the financial model. Don’t charge to play the game. But once people are in the game charge for in-game elements to help them be more successful. Just as Facebook did in its wildly successful social media game Farmville. The more people enjoyed meeting other people through the game, and the more they played, the more they would buy in-app, or in-game, elements. The social media aspect would keep them wanting to stay connected, and the game is the tool for remaining connected. So you use mobile to connect with vastly more people and draw them together, then social to keep them playing – and spending money.

The underserved market is vastly larger than the over-served market

Nintendo recognized that the under-served mobile gaming market is vastly larger than the overserved console market. Those console gamers have ever more powerful machines, but they are in some ways over-served by all that power. Games do so much that many people simply don’t want to take the time to learn the games, or invest in playing them sitting in a home or office. For many people who never became serious gaming hobbyists, the learning and intensity of serious gaming simply left them with little interest.

But almost everyone has a mobile phone. And almost everyone does some form of social media. And almost everyone enjoys a good game. Give them the right game, built on trends, to catch their attention and the number of potential customers is – literally – in the billions. And all they have to do is download the app. No expensive up-front cost, not much learning, and lots of fun. And thus in two weeks you have millions of new users. Some are traditional gamers. But many are people who would never be a serious gamer – they don’t want a new console or new complicated game. People of all ages and backgrounds could become immediate customers.

David can beat Goliath if you use trends

In the Biblical story, smallish David beat the giant Goliath by using a sling. His new technology allowed him to compete from far enough away that Goliath couldn’t reach David. And David’s tool allowed for delivering a fatal blow without ever touching the giant. The trend toward using tools for hunting and fighting allowed the younger, smaller competitor to beat the incumbent giant.

In business trends are just as important. Any competitor can study trends, see what people want, and then expand their thinking to discover a new way to compete. Nintendo lost the console war, and there was little value in spending vast sums to compete with Sony and Microsoft toe-to-toe. Nintendo saw the mobile game market disintegrate as smartphones emerged. It could have become a footnote in history.

But, instead Nintendo’s leaders built on trends to deliver a product that filled an unmet need – a game that was mobile and social. By meeting that need Nintendo has avoided direct competition, and found a way to dramatically grow its revenues. This is a story about how any competitor can succeed, if they learn how to leverage trends to bring out new products for under-served customers, and avoid costly gladiator competition trying to defend and extend past products.

by Adam Hartung | Jul 13, 2016 | Employment, Leadership, Regulations, Trends

This week Starbucks and JPMorganChase announced they were raising the minimum pay of many hourly employees. For about 168,000 lowly paid employees, this is really good news. And both companies played up the planned pay increases as benefitting not only the employees, but society at large. The JPMC CEO, Jamie Dimon, went so far as to say this was a response to a national tragedy of low pay and insufficient skills training now being addressed by the enormous bank.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

Since 2014 there has been an undeniable trend toward raising the minimum wage, now set nationally at $7.25. Fourteen states actually raised their minimum wage starting in 2016 (Massachusetts, California, New York, Nebraska, Connecticut, Michigan, Hawaii, Colorado, Nebraska, Vermont, West Virginia, South Dakota, Rhode Island and Alaska.) Two other states have ongoing increases making them among the states with fastest growing minimum wages (Maryland and Minnesota.) And there are 4 additional states that promoters of a $15 minimum wage think will likely pass within months (Illinois, New Jersey, Oregon and Washington.) That makes 20 states raising the minimum wage, with 46.4% of the U.S. population. And they include 5 of the largest cities in the USA that have already mandated a $15 minimum wage (New York, Washington D.C., Seattle, San Francisco and Los Angeles.)

In other words, the minimum wage is going up. And decisively so in heavily populated states with big cities where Starbucks and JPMC have lots of employees. And the jigsaw puzzle of different state requirements is actually a threat to any sort of corporate compensation plan that would attempt to treat employees equally for common work. Simultaneously the unemployment rate keeps dropping – now below 5% – causing it to take longer to fill open positions than at any time in the last 15+ years. Simply put, to meet local laws, find and retain decent employees, and have any sort of equitable compensation across regions both companies had no choice but to take action to raise the pay for these bottom-level jobs.

Starbucks pointed out that this will increase pay by 5-15% for its 150,000 employees. But at least 8.5% of those employees had already signed a petition demanding higher pay. Time will tell if this raise is enough to keep the stores open and the coffee hot. However, the price increases announced the very next day will probably be more meaningful for the long term revenues and profits at Starbucks than this pay raise.

At JPMC the average pay increase is about $4.10/hour – from $10.15 to $12-$16.50/hour. Across all 18,000 affected employees, this comes to about $153.5million of incremental cost. Heck, the total payroll of these 18,000 employees is only $533.5M (after raises.) Let’s compare that to a few other costs at JPMC:

Wow, compared to these one-off instances, the recent pay raises seem almost immaterial. While there is probably great sincerity on the part of these CEOs for improving the well being of their employees, and society, the money here really isn’t going to make any difference to larger issues. For example, the JPMC CEO’s 2015 pay of $27M is about the same as 900 of these lowly paid employees. Thus the impact on the bank’s financials, and the impact on income inequality, is — well — let’s say we have at least added one drop to the bucket.

The good news is that both companies realize they cannot fight trends. So they are taking actions to help shore up employment. That will serve them well competitively. And some folks are getting a long-desired pay raise. But neither action is going to address the real problems of income inequality.

by Adam Hartung | Jul 7, 2016 | Books, Entrepreneurship, Leadership, Marketing

Summer is here, and everyone needs a business book or two to read. I’m recommending The Founder’s Mentality – How To Overcome the Predictable Crises of Growth by two very senior partners and strategy practice heads at Bain & Company — Chris Zook and James Allen. Bain is one of the top three management consulting firms in the world, with 8,000 consultants in 55 offices, and has been ranked as one of the best places to work in America by Glass Ceiling.

Since both authors are still part of Bain, the book is somewhat bridled by their positions. No partner can bad mouth current or former clients, as it obviously could reveal confidential information — and it certainly isn’t good for finding new clients who would never want to risk being bad-mouthed by their consultant. So don’t expect a lambasting of poorly performing companies in this review of global cases. But after reviewing the work at their clients for over 20 years, and many other cases available via research, these fellows concluded that most companies lose the original founder’s mentality, get bound up in organizational complexity, and simply lose competitiveness due to the wrong internal focus. And they offer insights for how underperformers can regain a growth agenda.

Photo courtesy of Chris Zook

Moving From Mediocre To Good

I interviewed Chris Zook, and found him rather candid in his observations. When I asked why people should read The Founder’s Mentality I really liked his response, “Many people have read Good to Great. But, honestly, for many organizations the challenge today is simply to move from mediocre to good. They are struggling, and they need some straightforward advice on how to make progress toward growth when the situation likely appears almost impossible.”

You should read the book to understand the common root cause of corporate growth problems, and how a company can address those issues. This column offers some interesting thoughts from Chris about how to apply The Founder’s Mentality to eliminate unnecessary complexity and make your organization more successful.

Adam Hartung: What is the most critical step toward undoing needless, costly, time consuming complexity?

Chris Zook: The biggest problem is blockages built between the front line and the top staff. Honestly, the people at the top lose any sense of what is actually happening in the marketplace — what is happening with customers. 80% of the time successfully addressing this requires eliminating 30-40% of the staff. You need non-incremental change. Leaders have to get rid of managers wedded to past decisions, and intent on defending those decisions. Leaders have to get rid of those who focus on managing what exists, and find competent replacements who can manage a transition.

Hartung: Market shifts make companies non-competitive, why do you focus so much on internal organizational health?

Zook: You can’t respond to a market shift if the company is bound up in complex decision-making. Unless a leader attacks complexity, and greatly simplifies the decision-making process, a company will never do anything differently. Being aware of changes in the market is not enough. You have to internalize those changes and that requires reorganizing, and usually changing a lot of people. You won’t ever get the information from the front line to top management unless you change the internal company so that it is receptive to that information.

Hartung: You say simplification is critical to reversing a company’s stall-out. But isn’t focusing on the “core” missing market opportunities?

Zook: Analysts cheered Nardeli’s pro-growth actions at Home Depot. But the company stalled. The growth opportunities that external folks liked hearing about diverted attention from implementing what had made Home Depot great — the “orange army” of store employees that were so customer helpful. It is very, very hard to keep “growth projects” from diverting attention to good operations, and that’s why few founders are willing to chase those projects when someone brings them up for investment.

Hartung: You talk positively about Cisco and 3M, yet neither has done anything lately, in any market, to appear exemplary

Zook: It takes a long time to turn around a huge company. Cisco and 3M are still the largest in their defined markets, and profitable. Their long-term future is still to be determined, but so far they are making progress. Investors and market gurus look for turnarounds to happen fast, but that does not fit the reality of what it takes when these companies become very large.

Hartung: You talk about “Next Generation Leaders.” Isn’t that just more ageism? Aren’t you simply saying “out with the old leaders, you have to be young to “get it.”

Zook: Next Generation Leadership is not about age. It’s about mentality. It’s about being young, and flexible, in your thinking. What’s core to a company may well not be what a previous leader thinks, and a Next Gen Leader will dig out what’s core. For example, at Marvel the core was not comics. It was the raft of stories, all of which had the potential to be repurposed. Next Gen Leaders are using new eyes, dialed in with clarity to discover what is in the company that can be reused as the core for future growth. You don’t have to be young to do that, just mentally agile. Unfortunately, there aren’t nearly as many of these agile leaders as there are those stuck in the old ways of thinking.

Hartung: Give me your take on some big companies that aren’t in your book, but that are in the news today and on the minds of leaders and investors. Apply The Founder’s Mentality to these companies:

Microsoft

Zook: Did well due to its monopoly. Lost its Founder’s Mentality. Now suffering low growth rates relative to its industry, and in the danger zone of a growth stall-out. They have to refocus. Leadership needs to regain the position of attracting developers to their platform rather than being raided for developers by competitive platforms.

Apple

Zook: Jobs implemented The Founder’s Mentality brilliantly. Apple got close to its customers again with the retail stores, a great move to learn what customers really wanted, liked and would buy. But where will they turn next? Apple needs to make a big bet, and focus less on upgrades. They need to be thinking about a possible stall-out. But will Apple’s current leadership make that next big bet?

WalMart

Zook: One of the greatest founder-led companies of all time. Walton’s retail insurgency was unique, clear and powerful. Things appear to be a bit stale now, and the company would benefit from a refocusing on the insurgency mission, and taking it into renewal of the distribution system and all the stores.”

It’s been almost a decade since I wrote Create Marketplace Disruption – How To Stay Ahead of the Competition. In it I detailed how companies, in the pursuit of best practices build locked-in decision-making systems that perpetuate the past rather than prepare for the future. The Founder’s Mentality provides several case studies in how organizations, especially large ones, can attack that lock-in to rediscover what made them great and set a chart for a better future. Put it on your reading list for the next plane flight, or relaxation time on your holiday.

by Adam Hartung | Jun 27, 2016 | Finance, Trends

I’m a believer in Disruptive Innovation. For almost 100 years economists have been writing about “Creative Destruction,” in which new technologies come along making old technologies — and the companies built on them — obsolete. In the last 20 years, largely thanks to the initial insights of the faculty at Harvard Business School, we’ve seen a dramatic increase in understanding how new companies use new technologies to disrupt markets and wipe out the profitability of companies that were once clearly successful. In a large way, we’ve come to accept that Disruptive Innovation is good, and the concomitant creative destruction of the old players leads to more rapid growth for the economy, increasing jobs and the wherewithal of everyone.

But, not really everyone. The trickle to lots of people can be a long time coming. When market shifts happen, and people lose jobs to new competitors — domestic or offshore — they only know that their life, at least short term, is a lot worse. As they struggle to pay a mortgage, and find a new job, they often learn their skills are outdated. There are jobs, but these folks are not qualified. As they take lesser jobs, their incomes dwindle, and they may well lose their homes. And their healthcare.

Economists call this workplace transition “temporary economic dislocation.” Fancy term. They claim that eventually folks do enter the workplace who are properly trained, and those folks make more money than the workers associated with the previous, now inferior, technology.

That’s great for economists. But terrible for the folks who lost their jobs. As someone once said “a recession is when your neighbor loses his job. A depression is when you lose your job.” And for a lot of people, the market shift from an industrial economy to an information economy has created severe economic depression in their lives.

A person learns to be a printer, or a printing plate maker, in the 1970s when they are 20-something. Good job, makes a great wage. Secure, as printing demand just keeps rising. But then along comes the internet with PDF and JPEG documents that people read on a screen, and folks simply quit needing, or wanting, printed documents. In 2016, now age 50-something, this printer or plate-maker no longer has a job. Demand is down, and its really easy to send the printing to some offshore market like Thailand, Brazil or India where printing is cheaper.

What’s he or she to do now? Go back to school you may say. But to learn how to do what? Say it’s on-line (or digital) document production. OK, but since everyone in the 20s has been practicing this for over a decade it takes years to actually be competitive. And then, what’s the pay for a starting digital graphic artist? A lot less than what they made as a printer. And who’s going to hire the 58-62 year old digital graphic artist, when there are millions of well trained 20 somethings who seem to be quicker, and more attuned to what the publishers want (especially when the boss ordering the work is 35-42, and really uncomfortable giving orders and feedback to someone her parents’ age.) Oh, and when you look around there are millions of immigrants who are able to do the work, and willing to do it for a whole lot less than anyone native born to your country.

Source: Master Investor UK

In England last week these disaffected people made it a point to show their country’s leadership that their livelihoods were being “creatively destroyed.” How were they to keep up their standard of living with the flood of immigrants? And with the wealth of the country constantly shifting from the middle class to the wealthy business leaders and bankers? While folks who have done well the last 25 years voted overwhelmingly to remain in the EU (such as those who live in what’s called “The City”), those in the suburbs and outlying regions voted overwhelmingly to leave. Sort of like their income gains, and jobs, left.

To paraphrase the famous line from the movie Network, “they were mad as Hell and they weren’t going to take it any longer.” Simply put, if they couldn’t participate in the wonderful economic growth of EU participation, they would take it away from those who did. The point wasn’t whether or not the currency might fall 10% or more, or whether stocks on the UK exchange would be routed. After all, these folks largely don’t go to Europe or America, so they don’t care that much what the Euro or dollar costs. And they don’t own stocks, because they aren’t rich enough to do so, so what does it hurt them if equities fall? If this all puts a lot of pain on the wealthy – well just maybe that is what they really wanted.

America is seeing this in droves. It’s called the Donald Trump for President campaign. While unemployment is a remarkably low 5%, there are a lot of folks who are working for less money, or simply out of work entirely, because they don’t know how to get a job. They may laugh at Robert DiNero as a retired businessman now working for free in “The Intern.” But they really don’t think it’s funny. They can’t afford to work for free. They need more income to pay higher property taxes, sales taxes, health care and the costs of just about everything else. And mostly they know they are rapidly being priced out of their lifestyle, and their homes, and figuring they’ll be working well into their 70s just to keep from falling into poverty.

These people hate President Obama. They don’t care if the stock market has soared during his Presidency – they don’t own stocks (and if they do in a 401K or similar program they don’t care because it does them no good today.) They don’t care that he’s created more jobs than anyone since Reagan or Roosevelt, because they see their jobs gone, and they blame him if their recent college graduate doesn’t have a well-paying job. They don’t care if we are closing in on universal health care, because all they see is that health care is becoming ever more expensive – and often beyond their ability to pay. For them, their personal America is not as good as they expected it to be – and they are very, very angry. And the President is a very identifiable symbol they can blame.

Creative Destruction, and disruptive innovations, are great for the winners. But they can be wildly painful to the losers. And when the disruptions are as big, and frequent, as what’s happened the last 30 years – globalized economy, nationwide and international super banks, outsourcing, offshoring and the entirety of the Internet of Things – it has left a lot of people really concerned about their future. As they see the top 1% live opulent lifestyles, they struggle to keep a 12 year old car running and pay the higher license plate fees. They really don’t care if the economy is growing, or the dollar is strong, or if unemployment is at near-record lows. They know they are on the losing end of the stick. For them, well, America really isn’t all that great anymore.

So, hungry for revenge, they are happy to kill the goose for dinner that laid the golden eggs. They will take what they can, right now, and they don’t care if the costs are astronomical.

Despite their hard times, does this not sound at the least petty, and short-sighted? Doesn’t it seem rather selfish to damn everyone just because your situation isn’t so good?

Some folks will think that government policy really doesn’t matter that much. That actions like Brexit won’t stop they improvements coming from innovation. They think all will work out OK. They so long for a return to a previous time, when they perceived things were much better, that they are ready to stop the merry-go-round for everyone.

And they can do this. Brexit will create a Depression for the UK. The economy not only won’t grow, it will shrink. Probably for another decade. There will be fewer jobs, meaning less wealth for everyone. Those with assets will ride it out. Those who already struggled will struggle more. Lacking investment funds, private and public, there will be less investment in infratructure and the means of production, making life harder for everyone. There will be less, if any, money to invest in innovation, so there will be fewer new products to enjoy, and fewer improvements in lifestyle and productivity. The currency will be lower, so there will be fewer imports, making the cost of everything go up. In short, it will be very, painful, and costly, for everyone now that those who felt left out of the economic expansion have had their day at the polls.

Growth is a great thing. Growth creates jobs, a better lifestyle, higher productivity, more income and more wealth for everyone. But growth is NOT a given. Policies, and government actions, can stop growth dead in its tracks. The innovations we’ve all been fascinated by, and made part of our everyday lives, from smartphones to autos that last hundreds of thousands of miles and tens of years, to low cost air conditioning, to electricity nearly everywhere, to miracle drugs and gene-based bio-pharmaceuticals that have extended our lives by 30%+ in just one generation — all of these things can come to a screeching, terrible halt.

All it takes to stop the gains of innovation are policies that try to return us to a previous time. In the process of making our countries great again, we can absolutely destroy them. It is impossible to go back in time. It is not impossible to kill the means of economic growth. All we have to do is focus on constructing walls instead of creating jobs, protecting industries instead of free trade, and wrapping ourselves in the flag of sovereignty instead of collaborating globally to maximize growth. By focusing on ourselves we can absolutely hurt a lot of other people.

The politicians getting attention now are those espousing a return to some bygone era. Those who denounce the gains of innovation, and offer pity to those who’ve struggled with market disruptions. But these are not the leaders who will help people improve their lives. Those who focus on promoting innovation, attacking the concentration of wealth at the top, providing more incentives to infrastructure development, and mobilizing resources for training and new job creation can make life better for everyone.

Let’s hope everyone watches what happens in the UK last week, this week and going forward learn the long-term lesson of short-term thinking. Let’s hope that we can return to favoring growth, even a the cost of disruption and creative destruction.

by Adam Hartung | Jun 14, 2016 | Defend & Extend, Investing, Leadership, Web/Tech

Microsoft is buying Linked-In, and we should expect this to be a disaster.

It is clear why Linked-in agreed to be purchased. As revenues have grown, gross margins have dropped precipitously, and the company is losing money. And LInked-in still receives 2/3 of its revenue from recruiting ads (the balance is almost wholly subscription fees,) unable to find a wider advertiser base to support growth. Although membership is rising, monthly active users (MAUs, the most important gauge of social media growth) is only 9% – like Twitter, far below the 40% plus rate of Facebook and upcoming networks. With only 106M MAUs, Linked in is 1/3 the size of Twitter, and 1/15th the size of Facebook. And its $1.5B Lynda acquisition is far, far, far from recovering its investment – or even demonstrating viability as a business.

Even though the price is below the all-time highs for LNKD investors, Microsoft’s offer is far above recent trading prices and a big windfall for them.

But for Microsoft investors, this is a repeat of the pattern that continues to whittle away at their equity value.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

But the world changed. Today PC sales continue their multi-year, accelerating decline, while some markets (such as education) are shifting to Chromebooks for low cost desktop/laptop computing, growing their sales and share. Meanwhile, mobile devices have been the growth market for years. Networks are largely public (rather than private) and storage is primarily in the cloud – and supplied by Amazon. Solutions are spread all around, from Google Drive to apps of every flavor and variety. People spend less computing cycles creating documents, spreadsheets and presentations, and a lot more cycles either searching the web or on Facebook, Instagram, WhatsApp, YouTube and Snapchat.

But Microsoft’s leadership still would like to capture that old world. They still hope to put the genie back in the bottle, and have everyone live and work entirely on Microsoft. And somehow they have deluded themselves into thinking that buying Linked-in will allow them to return to the “good old days.”

Microsoft has not done a good job of integrating its own solutions like Office 365, Skype, Sharepoint and Dynamics into a coherent, easy to use, and to some extent mobile, solution. Yet, somehow, investors are expected to believe that after buying Linked-in the two companies will integrate these solutions into the LInked-in social platform, enabling vastly greater adoption/use of Office 365 and Dynamics as they are tied to Linked-in Sales Navigator. Users will be thrilled to have their personal information analyzed by Microsoft big data tools, then sold to advertisers and recruiters. Meanwhile, corporations will come back to Microsoft in droves as they convert Linked-in into a comprehensive project management tool that uses Lynda to educate employees, and 365 to push materials to employees – and allow document collaboration – all across their mobile devices.

Do you really believe this? It might run on the Powerpoint operating system, but this vision will take an enormous amount of code integration. And with Linked-in operated as separate company within Microsoft, who is going to do this integration? This will involve a lot of technical capability, and based on previous performance it appears both companies lack the skills necessary to pull it off. How this mysterious, magical integration will happen is far, far from obvious, or explained in the announcement documents. Sounds a lot more like vaporware than a straightforward software project.

And who thinks that today’s users, from individuals to corporations, have a need for this vision? While it may sound good to Microsoft, have you heard Linked-in users saying they want to use 365 on Linked in? Or that they’ll continue to use Linked-in if forced to buy 365? Or that they want their personal information data mined for advertisers? Or that they desire integration with Dynamics to perform Linked-in based CRM? Or that they see a need for a social-network based project management tool that feeds up training documents or collaborative documents? Are people asking for an integrated, holistic solution from one vendor to replace their current mobile devices and mobile solutions that are upgraded by multiple vendors almost weekly?

And, who really thinks Microsoft is good at acquisition integration? Remember aQuantive? In 2007 Microsoft spent $6B (an 85% premium to market price) to purchase this digital ad agency in order to build its business in the fast growing digital ad space. Don’t feel bad if you don’t remember, because in 2012 Microsoft wrote it off. Of course, there was the buy-it-and-write-it-off pattern repeated with Nokia. Microsoft’s success at taking “bold moves” to expand beyond its core business has been nothing less than horrible. Even the $1.2B acquisition of Yammer in 2012 to make Sharepoint more collaborative and usable has been unsuccessful, even though rolled out for free to 365 users. Yammer is adding nothing to Microsoft’s sales or value as competitor Slack has reaped the growth in corporate messaging.

The only good news story about Microsoft acquisitions is that they missed spending $44B to buy Yahoo – which is now on the market for $5B. Whew, thank goodness that one got away!

Microsoft’s leadership primed the pump for this week’s announcement by having the Chairman talk about investing outside of the company’s core a couple of weeks ago. But the vast majority of analysts are now questioning this giant bet, at a price so high it will lower Microsoft’s earnings for 2 years. Analysts are projecting about a $2B revenue drop for $90B Microsoft next year, and this $26B acquisition will deliver only a $3B bump. Very, very expensive revenue replacement.

Despite all the lingo, Microsoft simply cannot seem to escape its past. Its acquisitions have all been designed to defend and extend its once great history – but now outdated. Customers don’t want the past, they are looking to the future. And no matter how hard they try, Microsoft’s leaders simply appear unable to define a future that is not tightly linked to the company’s past. So investors should expect Linked-In’s future to look a lot like aQuantive. Only this one is going to be the most painful yet in the long list of value transfer from Microsoft investors to the investors of acquired companies.

The show was led by 2 engineers who worked together on the tests and props. Interestingly,

The show was led by 2 engineers who worked together on the tests and props. Interestingly,

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.