by Adam Hartung | Oct 26, 2016 | Growth Stall, Innovation, Investing, Leadership, Web/Tech

Apple AAPL -0.72% announced sales and earnings yesterday. For the first time in 15 years, ever since it rebuilt on a strategy to be the leader in mobile products, full year sales declined. After three consecutive down quarters, it was not unanticipated. And Apple’s guidance for next quarter was for investors to expect a 1% or 2% improvement in sales or earnings. That’s comparing to the disastrous quarter reported last January, which started this terrible year for Apple investors.

Yet, most analysts remain bullish on Apple stock. At a price/earnings (P/E) of 13.5, it is by far the cheapest tech stock. iPad sales are stagnant, iPhone sales are declining, Apple Watch sales dropped some 70% and Chromebook breakout sales caused a 20% drop in Mac Sales. Yet most analysts believe that something will improve and Apple will get its mojo back.

Only, the odds are against Apple. As I pointed out last January, Apple’s value took a huge hit because stagnating sales caused the company to completely lose its growth story. And, the message that Apple doesn’t know how to grow just keeps rolling along. By last quarter – July – I wrote Apple had fallen into a Growth Stall. And that should worry investors a lot.

Ten Deadly Sins Of Networking

Companies that hit growth stalls almost always do a lot worse before things improve – if they ever improve. Seventy-five percent of companies that hit a growth stall have negative growth for several quarters after a stall. Only 7% of companies grow a mere 6%. To understand the pattern, think about companies like Sears, Sony, RIM/Blackberry, Caterpillar Tractor. When they slip off the growth curve, there is almost always an ongoing decline.

And because so few regain a growth story, 70% of the companies that hit a growth stall lose over half their market capitalization. Only 5% lose less than 25% of their market cap.

Why? Because results reflect history, and by the time sales and profits are falling the company has already missed a market shift. The company begins defending and extending its old products, services and business practices in an effort to “shore up” sales. But the market shifted, either to a competitor or often a new solution, and new rev levels do not excite customers enough to create renewed growth. But since the company missed the shift, and hunkered down to fight it, things get worse (usually a lot worse) before they get better.

Think about how Microsoft MSFT -0.42% missed the move to mobile. Too late, and its Windows 10 phones and tablet never captured more than 3% market share. A big miss as the traditional PC market eroded.

Right now there is nothing which indicates Apple is not going to follow the trend created by almost all growth stalls. Yes, it has a mountain of cash. But debt is growing faster than cash now, and companies have shown a long history of burning through cash hoards rather than returning the money to shareholders.

Apple has no new products generating market shifts, like the “i” line did. And several products are selling less than in previous quarters. And the CEO, Tim Cook, for all his operational skills, offers no vision. He actually grew testy when asked, and his answer about a “strong pipeline” should be far from reassuring to investors looking for the next iPhone.

Will Apple shares rise or fall over the next quarter or year? I don’t know. The stock’s P/E is cheap, and it has plenty of cash to repurchase shares in order to manipulate the price. And investors are often far from rational when assessing future prospects. But everyone would be wise to pay attention to patterns, and Apple’s Growth Stall indicates the road ahead is likely to be rocky.

by Adam Hartung | Oct 21, 2016 | Boards of Directors, Finance, Investing

(AP Photo/Cliff Owen, File)

Wells Fargo’s CEO John Stumpf resigned last week. This week he also resigned from the boards of directors at Chevron and Target. For those two roles he was being paid something like $650,000 per year. The interesting question is, why was he on those boards at all? Wasn’t being the CEO and on the board at one of America’s biggest banks a full-time job? After all, he was paid $19.3 million in both 2015 and 2014. You would not have thought he needed a side job to make ends meet.

Which leads to the question, are America’s boards of directors actually staffed with the right people? Ostensibly the board is responsible for governing the corporation. Directors are responsible to insure management makes the right decisions for the long-term best interests of shareholders. And legislators’ have passed multiple laws, such as Sarbanes-Oxley and Dodd-Frank, to allow the regulators, primarily at the SEC (Securities and Exchange Commission), to put real teeth (and enforcement) into directors’ responsibilities.

According to the National Association of Corporate Directors (NACD) a sitting director should do a minimum of 200 hours of work on a board every year. For larger companies committee requirements on top of general board work could easily push this to nearly 300 hours. Thus, Mr. Stumpf should have been doing at least 500 hours of work for Chevron and Target – about 12.5 weeks, or three months. Do you think he actually spent this much time on these roles, given his full time job at Wells Fargo?

This also means that Mr. Stumpf only had nine months to actually work as CEO of Wells Fargo. Maybe that was why he was so unaware of the unethical behavior at the company he led? Why would a board think it is acceptable for a CEO to work only three-fourths of the year? Not many employees have the opportunity to draw full compensation yet take off so much time.

Either Mr. Stumpf wasn’t paying enough attention to Wells Fargo, or he wasn’t paying enough attention to Chevron and Target. Yet, he was being paid very, very handsomely for all those roles. How is that good governance for any one of the three companies?

CEOs serving on additional boards is a bit like electing a governor, who is paid to run the state, and then hearing that the governor is simultaneously going to do part time work for a company or perhaps an agency of a different state. Would any state accept that their governor, state CEO, be allowed to spend three months of every year working side jobs that have nothing to do with being governor? Yet, corporate CEOs regularly take on director roles for other corporations – which in no way benefits their company’s employees, or shareholders. Why?

Further, boards are dominated by sitting or former CEOs. Why? The world moves fast toda, and there are a wealth of skills boards need to effectively govern – far beyond having a room full of CEOs. IT skills, cyber security skills, social media skills, marketing and advertising skills, branding skills, global market skills, intellectual property skills – there is a long list of skills which would greatly improve board diversity, and thereby a board’s ability to govern effectively. So why is hiring so biased toward CEOs? NACD has been asking the same question as it promotes diversity in the boardroom.

Yet, there is one group that is making hay with all that board pay. Former regulators and members of Congress. These people are required to register if they become lobbyists, and they are forced to wait a year, or more, before they can do work for government contractors. But there is nothing which stops them from joining a board of directors.

There is nothing about being a Congressman or Senator which prepares these people for corporate governance, yet this is common practice as corporations seek ways to find influence without breaking the law. But is it worthwhile to investors to have directors that were prominent in government, but perhaps lacking competency for today’s fast-paced business world? Should a directorship and the compensation be a reward for previous government work – or should it be a position of great importance looking out for the interest of the corporation?

There are currently 64 former members of Congress serving on corporate boards. According to a Harvard and Boston University study, 44% of Senators, and 11% of Congress members have landed corporate board directorships since 1992. Their average compensation, per board, is $350,000. Much better than being in Congress. Especially for a part-time job.

Former Speaker John Boehner and famous cigarette smoker, just joined the tobacco company Reynolds America board – although that may be short-lived as British American Tobacco has offered to acquire Reynolds. Former Majority leader Eric Cantor, who was up for the Speaker job when losing his last election, is now on the board of a Wall Street firm, where he earned $2 million in 2015 for bringing in new business – making him the highest paid director in this group. Former Majority Leader Dick Gephardt has accumulated $10.8 million in director compensation since retiring from Congress in 2005.

Tom Ridge, who was a governor, house member and secretary of Homeland Security – but never a businessperson – raked in $1.4 million in director compensation last year. Even former Congressman and subsequently Secretary of Defense and director of the CIA Leon Panetta made almost $600,000 in director comp last year. These fellows are obviously well connected to government leaders, but do they have a clue about how to effectively implement regulations for corporate audit, compensation or nominating and governance committee roles? Are they hired to apply good governance for investors, or to be rainmakers for the company? Or just to give them a good retirement plan?

Boards exist to protect the rights of shareholders. But do they? The issues at Wells Fargo are an example of how ineffective a board can be at oversight, given that serious problems lasted there for at least five years, and whistle-blowers were terminated for specious reasons. And the Wells board paid the CEO almost $20 million per year, while letting him work a quarter or more of each year as a director for other companies. Hard to see how those directors were doing their job.

When companies do poorly employees, investors and analysts will ask “where was the board?” Increasingly it is clear that more should be asking “who is on the board?” Boards should not be stacked with folks that have lofty titles from previous positions, but which are irrelevant to the needs of that corporation and frequently lacking the qualifications to govern effectively. Target’s investors, for example, probably would have benefited far more by a director that understood networks and cyber crime than paying Mr. Stumpf for his part-time assistance away from Wells Fargo. And with oil prices at generational lows, how did Mr. Stumpf help Chevron prepare for a new world of lower oil demand and greater supplier anxiety in the Middle East?

Sarbanes-Oxley was passed after the outrage that occurred at Enron, where the company completely failed and yet the board said it had no idea of the company’s problems. When America’s financial services industry nearly melted down Dodd-Frank was passed to put more onus on directors to understand the financials and compensation practices of their companies. But, it will most likely take yet more legislation, and more regulation, if investors are to be protected by truly independent directors that are the right people, in the right job, and feel accountable for management oversight and company outcomes.

by Adam Hartung | Oct 13, 2016 | Boards of Directors, Ethics, Finance, Investing, Leadership

SAUL LOEB/AFP/Getty Images

Everyone knows what happened at Wells Fargo. For many years, possibly as far back as 2005, Wells Fargo leaders pushed employees to “cross-sell” products, like high profit credit cards, to customers. Eventually the company bragged it had an industry leading 6.7 products sold to every customer household. However, we now know that some two million of these accounts were fakes – created by employees to meet aggressive sales goals. And, unfortunately, costing unsuspecting customers quite a lot of fees.

We also know that Wells Fargo leadership knew about this practice for at least five years – and agreed to a $190 million fine. And the company apparently fired 5,300

Which begs the obvious question – if management knew this was happening, why did it continue for at least five years?

Let’s face it, if you owned a restaurant and you knew waiters were adding extras onto the bill, or tip, you would not only fire those waiters, but put in place procedures to stop the practice. But in this case we know that management at Wells Fargo was receiving big bonuses based upon this employee behavior. So they allowed it to continue, perhaps with a gloss of disdain, in order for the execs to make more money.

This is the modern, high-tech financial services industry version of putting employees in known dangerous jobs, like picking coal, in order to make more profit. A lot less bloody, for sure, but no less condemnable. Management was pushing employees to skirt the law, while wearing a fig-leaf of protection.

Ignorance is not excuse – especially for a well-paid CEO.

CEO Stumpf’s testified to Congress that he didn’t know the details of what was happening at the lower levels of his bank. He didn’t know bankers were expected to make 100 sales calls per day. When asked about how sales goals were implemented, he responded to Representative Keith Ellison “Congressman, I don’t know that level of detail.”

Really? Sounds amazingly like Bernie Ebbers at Worldcom. Or Jeff Skilling and Ken Lay at Enron. Men making millions of dollars from illegal activities, but claiming they were ignorant of what their own companies were doing. And if they didn’t know, there was no way the board of directors could know, so don’t blame them either.

Does anyone remember how Congress reacted to those please of ignorance? “No more.” Quickly the Sarbanes-Oxley act was passed, making not only top executives but Boards, and in particular audit chairs, responsible for knowing what happened in their companies. And later Dodd-Frank was passed strengthening these laws – particularly for financial services companies. Ignorance would no longer be an excuse.

Where was Wells Fargo’s compliance department?

Based on these laws every Board of Directors is required to establish a compliance officer to make sure procedures are in place to insure proper behavior by management. This compliance officer is required to report to the board that procedures exist, and that there are metrics in place to make sure laws, and ethics policies, are followed.

Additionally, every company is required to implement a whistle-blower hotline so that employees can report violations of laws, regulations, or company policies. These reports are to go either to the audit chair, or the company external legal counsel. If it is a small company, possibly the company general counsel who is bound by law to keep reports confidential, and report to the board. This was implemented, as law, to make sure employees who observed illegal and unethical management behavior, as happened at Worldcom, Enron and Tyco, could report on management and inform the board so Directors could take corrective action.

Which begs the first question “where the heck was Wells Fargo’s compliance office the last five years?” These were not one-off events. They were standard practice at Wells Fargo. Any competent Chief Compliance Officer had to know, after five-plus years of firings, that the practices violated multiple banking practice laws. He must have informed the CEO. He was, by law, supposed to inform the board. Who was the Chief Compliance Officer? What did he report? To whom? When? Why wasn’t action taken, by the board and CEO, to stop these banking practices?

Should regulators allow executives to fire whistle-blowers?

And about that whistle-blower hotline – apparently employees took advantage of it. In 2010, 2011, 2013 and more recently employees called the hotline, even wrote the Human Resources Department and the office of CEO John Stumpf to report unethical practices. Were their warnings held in anonymity? Were they rewarded for coming forward?

Quite to the contrary, one employee, eight days after logging a hotline call, was fired for tardiness. Another was fired days after sending an email to CEO Stumpf alerting him of aberrant, unethical practices. A Wells Fargo HR employee confirmed that it was common practice to find fault with employees who complained, and fire them. Employees who learned from Enron, and tried to do the right thing, were harassed and fired. Exactly 180 degrees contrary to what Congress ordered when passing recent laws.

None of this was a mystery to Wells Fargo leadership, or CEO Stumpf. CNNMoney reported the names of employees, actions they took and the decisively negative reactions taken by Wells Fargo on September 21. There is no way the Wells Fargo folks who prepared CEO Stumpf for his September 29 testimony were unaware. Yet, he replied to questions from Congress that he didn’t know, or didn’t remember, these events – or these people. In eight days these staffers could have unearthed any information – if it had been exculpatory. That Stumpf’s answer was another plea of ignorance only points to leadership’s plan of hiding behind fig leafs.

CEO Stumpf obviously knew the practices at Wells Fargo. So did all his direct reports. And likely two or three levels downs, at a minimum. Clearly, all the way to branch managers. Additionally, the compliance function was surely fully aware, as was HR, of these practices and chose not to solve the issues – but rather hide them and fire employees in an effort to eliminate credible witnesses from reporting wrongdoing by top leadership.

Where was the board of directors? Why didn’t the audit chair intervene?

It is the explicit job of the audit chair to know that the company is in compliance with all applicable laws. It is the audit chairs’ job to implement the Sarbanes-Oxley and Dodd-Frank regulations, and report any variations from regulations to the company auditors, general counsel, lead outside director and chairperson. Where was proper governance of Wells Fargo? Were the Directors doing their jobs, as required by law, in the post Enron, WorldCom, Tyco, Lehman, AIG world?

Should CEO Stumpf be gone? Without a doubt. He should have been gone years ago, for failing to properly implement and enforce compliance. But he is not alone. The officers who condoned these behaviors should also be gone, as should all HR and other managers who failed to implement the regulations as Congress intended.

Additionally, the board of Wells Fargo has plenty of responsibility to shoulder. The board was not effective, and did not do its job. The directors, who were well paid, did not do enough to recognize improper behavior, implement and monitor compliance or take action.

There is a lot more blame here, and if Wells Fargo is to regain the public trust there need to be many more changes in leadership, and Board composition. It is time for the SEC to dig much deeper into the situation at Wells Fargo, and the leaders complicit in failing to follow the intent of Congress.

by Adam Hartung | Oct 7, 2016 | Defend & Extend, Scenario Planning

As I write this in 2016, Hurricane Matthew is crashing into Daytona Beach. It is a monster storm, and far from over. But there already is a great lesson we can learn.

Shockingly, after passing nearly half of Florida, including densely populated areas like Miami, Fort Lauderdale and Palm Beach, only one person has died. Even as northeastern Florida awaits Matthew’s fury, damage assessments are underway in south Florida. Even though 600,000 homes are without power, utility companies are already restoring power to over 50,000 homes, and that number is growing. The Florida highway system is open, with all roads passable and people are able to reach safety, while realistically expecting they may soon be able to return to their homes. By all accounts, damage is considerable. Yet, few lives were lost and repair is already underway – long before the storm is ending.

Photo by Drew Angerer/Getty Images

The lesson here is that scenario planning is incredibly valuable. Florida’s leaders have been preparing for this storm for years. The many agencies, federal, state, county and municipal, built their scenarios, and prepared action plans. They talked about “what if” various things happened, and thought through the impacts – and actions they would take.

The result is a remarkable demonstration of capability and leadership. Even as the storm progresses, continuing to put more people in harm’s way, the leaders are simultaneously helping those folks prepare and beginning the recovery for those dealing with Matthew’s aftermath.

Then, there’s Brexit. The British currency has fallen to 30-plus year lows. This morning a “flash crash” happened with the currency falling 10% in minutes. Even though the pound recovered much of that loss, the crash left traders and those who do international business shaken. This was just the latest reaction to the British vote to exit the EU.

JUSTIN TALLIS/AFP/Getty Images

This week people in all parts of the international business community were trying to figure out how to react to Prime Minister May’s speech saying Britain would seek a “hard exit.” This seems to imply a faster, more drastic break from Europe. But as David Buik, market commentator at Panmure Gordon & Co. said, “The media decided very quickly what interpretation to put on the term ‘hard Brexit,’ when most of us are none the wiser as to what Brexit means yet.”

The key word here is “reacting.” It is clear that almost nobody had any plans for undertaking Britain’s departure from the EU, even as the effort to create a vote, and implement a vote, occurred. While there was a lot of talk, nobody in government or business had a plan for what to do if the vote to leave actually passed. Now everyone is reacting, and the consequences are significant fear, uncertainty and doubt (FUD), and wild swings in everything from currency values to equity values and even real estate.

Proper scenario planning separates leaders from wanna-bes, and winners from losers. Those who consider what might happen, and prepare for events, inevitably do far, far better than those who react. Lacking a preparedness plan, based on careful consideration of “what-ifs,” it is impossible to implement good decision-making, because you have no idea what markers, or metrics, to watch – and no idea of what actions to take as those metrics vary.

I observed a scenario-planning meeting where the head of planning was asking questions – “what-if…regulations go in this direction…technology accomplishes this level of performance…customer adoption of a substitute increase.” After a series of these propositions were discussed, the CEO said “This seems to be a waste of time. We don’t know what will happen. What if pigs could fly?” Given a lack of facts about the future, he proposed building a future plan based upon the market as it existed at the time, and reacting to changes only after they occurred.

The planning lead responded, “Whether or not pigs will fly has very little to do with the future performance of our company. And that is why we aren’t discussing flying pigs. These variables in the scenarios could have a major impact on future performance, and if we prepare for them we most likely will improve competitiveness, sales and profits.”

Scenario planning is not a wild exercise of imaginary happenings. Scenario planning uses known trends to identify key variables which can be measured. By looking forward on the trend, it is possible to predict possible outcomes – and prepare.

For example, famously, the leadership of Apple in 2000 looked at the trend toward high-speed internet implementation, including WiFi. They started tracking high-speed implementation, and realized that as bandwidth expanded and improved the desire to work on-line would grow as well. They began preparing products for much greater on-line use (iMac) and products based on widely available, low cost internet access. The result was a shift from near bankruptcy to the most valuable traded equity in America in just one decade.

Planning systems are biased toward using historical data, and do not consider big changes. Leadership must constantly fight the urge to assume the future will look like the past, and invest time building scenario plans. Building the skill to predict the future, using trends to build scenarios and plans, is a hallmark of the most successful companies.

Florida’s leaders could have assumed another big hurricane would not hit their state, and simply waited to react when it happened. By thinking through possible outcomes, they have shown an amazing level of preparedness. In contrast, Britain’s leaders did not think through the impact of a British exit, pushed for a vote prematurely, and now are lurching from point to point, reacting to events, unprepared for any outcome – and trying to create and implement a plan “on the fly.”

How prepared is your company? How often do you discuss future scenarios, and actually plan for them? Or do you plan based on history, hoping the future will look like the past? Are you going to use scenarios to be effective in future markets?

Or are you going to wait for events to unfold, react and hope you don’t drown?

by Adam Hartung | Sep 30, 2016 | Immigration, Leadership, Lifecycle, Trends

I write about trends. Technology trends are exciting, because they can come and go fast – making big winners of some companies (Apple, Facebook, Tesla, Amazon) and big losers out of others (Blackberry, Motorola, Saab, Sears.) Leaders that predict technology trends can make lots of money, in a hurry, while those who miss these trends can fail faster than anyone expected.

But unlike technology, one of the most important trends is also the most predictable trend. That is demographics. Quite simply, it is easy to predict the population of most countries, and most states. And predict the demographic composition of countries by age, gender, ancestry, even religion. And while demographic trends are remarkably easy to predict very accurately, it is amazing how few people actually plan for them. Yet, increasingly, ignoring demographic trends is a bad idea.

Take for example the aging world population. Quite simply, in most of the world there have not been enough births to keep up with those who ar\e getting older. Fewer babies, across decades, and you end up with a population that is skewed to older age. And, eventually, a population decline. And that has a lot of implications, almost all of which are bad.

Look at Japan. Every September 19 the Japanese honor Respect for the Aged Day by awarding silver sake dishes to those who are 100 or older. In 1966, they gave out a few hundred. But after 46 straight years of adding centenarians to the population, including adding 32,000 in just the last year, there are over 65,000 people in Japan over 100 years old. While this is a small percentage, it is a marker for serious economic problems.

Over 25% of all Japanese are over 65. For decades Japan has had only 1.4 births per woman, a full third less than the necessary 2.1 to keep a population from shrinking. That means today there are only 3 people in Japan for every “retiree.” So a very large percentage of the population are no longer economically productive. They no longer are creating income, spending and growing the economy. With only 3 people to maintain every retiree, the national cost to maintain the ageds’ health and well being soon starts becoming an enormous tax, and economic strain.

What’s worse, by 2060 demographers expect that 40% of Japanese will be 65+. Think about that – there will be almost as many over 65 as under 65. Who will cover the costs of maintaining this population? The country’s infrastructure? Japan’s defense from potentially being overtaken by neighbors, such as China? How does an economy grow when every citizen is supporting a retiree in addition to themselves?

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

This means that China’s aging population problem will not recover for several more decades. Today there are 5 workers for every retiree in China. But there are already more people exiting China’s workforce than entering it each year. We can easily predict there will be both an aging, and a declining, population in China for another 40 years. Thus, by 2040 (just 24 years away) there will be only 1.6 workers for each retiree. The median age will shift from 30 to 46, making China one of the planet’s oldest populations. There will be more people over age 65 in China than the entire populations of Germany, Japan, France and Britain combined!

While it is popular to discuss an emerging Chinese middle class, that phenomenon will be short-lived as the country faces questions like – who will take care of these aging people? Who will be available to work, and grow the economy? To cover health care costs? Continued infrastructure investment? Lacking immigration, how will China maintain its own population?

“OK,” American readers are asking, “that’s them, but what about us?” In 1970 there were about 20M age 65+ in the USA. Today, 50M. By 2050, 90M. In 1980 this was 11% of the population. But 2040 it will be over 20% (stats from Population Reference Bureau.)

While this is a worrisome trend, one could ask why the U.S. problem isn’t as bad as other countries? The answer is simply immigration. While Japan and China have almost no immigration, the U.S. immigrant population is adding younger people who maintain the workforce, and add new babies. If it were not for immigration, the U.S. statistics would look far more like Asian countries.

Think about that the next time it seems appealing to reduce the number of existing immigrants, or slow the number of entering immigrants. Without immigrants the U.S. would be unable to care for its own aging population, and simultaneously unable to maintain sufficient economic growth to maintain a competitive lead globally. While the impact is a big shift in the population from European ancestry toward Latino, Indian and Asian, without a flood of immigrants America would crush (like Japan and China) under the weight of its own aging demographics.

Like many issues, what looks obvious in the short-term can be completely at odds with a long-term solution. In this case, the desire to remove and restrict immigration sounds like a good idea to improve employment and wages for American citizens. And shutting down trade with China sounds like a positive step toward the same goals. But if we look at trends, it is clear that demographic shifts indicate that the countries that maximize their immigration will actually do better for their indigenous population, while improving international competitiveness.

Demographic trends are incredibly accurately predictable. And they have enormous implications for not only countries (and their policies,) but companies. Do your forward looking plans use demographic trends to plan for:

- maintaining a trained workforce?

- sourcing products from a stable, competitive country?

- having a workplace conducive to employees who speak English as a second language?

- a workplace conducive to religions beyond Christianity?

- investing in more capital to produce more with fewer workers?

- products that appeal to people not born in the USA?

- selling products in countries with growing populations, and economies?

- paying higher costs for more retirees who live longer?

Most planning systems, unfortunately, are backward-looking. They bring forward lots of data about what happened yesterday, but precious few projections about trends. Yet, we live in an ever changing world where trends create important, large shifts – often faster than anticipated. And these trends can have significant implications. To prepare everyone should use trends in their planning, and you can start with the basics. No trend is more basic than understanding demographics.

by Adam Hartung | Sep 23, 2016 | Disruptions, In the Rapids, Innovation, Leadership, Television, Web/Tech

In early August Tesla announced it would be buying SolarCity. The New York Times discussed how this combination would help CEO Elon Musk move toward his aspirations for greater clean energy use. But the Los Angeles Times took the companies to task for merging in the face of tremendous capital needs at both, while Tesla was far short of hitting its goals for auto and battery production.

Since then the press has been almost wholly negative on the merger. Marketwatch’s Barry Randall wrote that the deal makes no sense. He argues the companies are in two very different businesses that are not synergistic – and he analogizes this deal to GM buying Chevron. He also makes the case that SolarCity will likely go bankrupt, so there is no good reason for Tesla shareholders to “bail out” the company. And he argues that the capital requirements of the combined entities are unlikely to be fundable, even for its visionary CEO.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

But short-sellers are clearly not long-term investors. And there is a lot more ability for this deal to succeed and produce tremendous investor returns than anyone could ever glean from studying historical financial statements of both companies.

GM buying Chevron is entirely the wrong analogy to compare with Tesla buying SolarCity. Instead, compare this deal to what happened in the creation of television after General Sarnoff, who ran RCA, bought what he renamed NBC.

The world already had radio (just as we already have combustion powered cars.) The conundrum was that nobody needed a TV, especially when there were no TV programs. But nobody would create TV programs if there were no consumers with TVs. General Sarnoff realized that both had to happen simultaneously – the creation of both demand, and supply. It would only be by the creation, and promotion, of both that television could be a success. And it was General Sarnoff who used this experience to launch the first color televisions at the same time as NBC launched the first color programming – which fairly quickly pushed the industry into color.

Skeptics think Mr. Musk and his companies are in over their heads, because there are manufacturing issues for the batteries and the cars, and the solar panel business has yet to be profitable. Yet, the older among us can recall all the troubles with launching TV.

Early sets were not only expensive, they were often problematic, with frequent component failures causing owners to take the TV to a repairman. Often reception was poor, as people relied on poor antennas and weak network signals. It was common to turn on a set and have “snow” as we called it – images that were far from clear. And there was often that still image on the screen with the words “Technical Difficulties,” meaning that viewers just waited to see when programming would return. And programming was far from 24×7 – and quality could be sketchy. But all these problems have been overcome by innovation across the industry.

Yes, the evolution of electric cars will involve a lot of ongoing innovation. So judging its likely success on the basis of recent history would be foolhardy. Today Tesla sells 100% of its cars, with no discounts. The market has said it really, really wants its vehicles. And everybody who is offered electric panels with (a) the opportunity to sell excess power back to the grid and (b) financing, takes the offer. People enjoy the low cost, sustainable electricity, and want it to grow. But lacking a good storage device, or the inability to sell excess power, their personal economics are more difficult.

Electricity production, electricity storage (batteries) and electricity consumption are tightly linked technologies. Nobody will build charging stations if there are no electric cars. Nobody will build electric cars if there are not good batteries. Nobody will make better batteries if there are no electric cars. Nobody will install solar panels if they can’t use all the electricity, or store what they don’t immediately need (or sell it.)

This is not a world of an established marketplace, where GM and Chevron can stand alone. To grow the business requires a vision, business strategy and technical capability to put it all together. To make this work someone has to make progress in all the core technologies simultaneously – which will continue to improve the storage capability, quality and safety of the electric consuming automobiles, and the electric generating solar panels, as well as the storage capabilities associated with those panels and the creation of a new grid for distribution.

This is why Mr. Musk says that combining Tesla and SolarCity is obvious. Yes, he will have to raise huge sums of money. So did such early pioneers as Vanderbilt (railways,) Rockefeller (oil,) Ford (autos,) and Watson (computers.) More recently, Steve Jobs of Apple became heroic for figuring out how to simultaneously create an iPhone, get a network to support the phone (his much maligned exclusive deal with AT&T,) getting developers to write enough apps for the phone to make it valuable, and creating the retail store to distribute those apps (iTunes.) Without all those pieces, the ubiquitous iPhone would have been as successful as the Microsoft Zune.

It is fair for investors to worry if Tesla can raise enough money to pull this off. But, we don’t know how creative Mr. Musk may become in organizing the resources and identifying investors. So far, Tesla has beaten all the skeptics who predicted failure based on price of the cars (Tesla has sold 100% of its production,) lack of range (now up to nearly 300 miles,) lack of charging network (Tesla built one itself) and charging time (now only 20 minutes.) It would be shortsighted to think that the creativity which has made Tesla a success so far will suddenly disappear. And thus remarkably thoughtless to base an analysis on the industry as it exists today, rather than how it might well look in 3, 5 and 10 years.

The combination of Tesla and SolarCity allows Tesla to have all the components to pursue greater future success. Investors with sufficient risk appetite are justified in supporting this merger because they will be positioned to receive the future rewards of this pioneering change in the auto and electric utility industries.

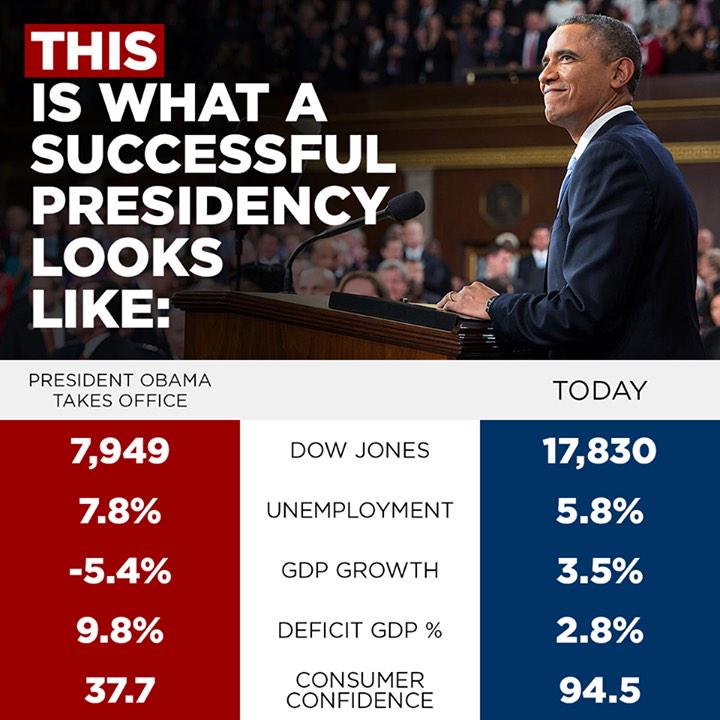

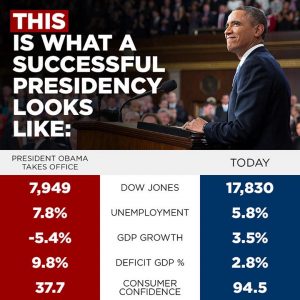

by Adam Hartung | Sep 16, 2016 | Leadership

Donald Trump has been campaigning on how poorly America’s economy is doing. Yet, the headlines don’t seem to align with that position. Today we learned that U.S. household net worth climbed by over $1trillion in the second quarter. Rising stock values and rising real estate values made up most of the gain. And owners’ equity in their homes grew to 57.1%, highest in over a decade. Simultaneously this week we learned that middle-class earnings rose for the first time since the Great Recession, and the poverty rate fell by 1.2 percentage points.

Gallup reminded us this month that the percentage of Americans who perceive they are “thriving” has increased consistently the last 8 years, from 48.9% to 55.4%. And Pew informed us that across the globe, respect for Americans has risen the last 8 years, doubling in many countries such as Britain, Germany and France – and reaching as high as 84% favorability in Isreal.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

I thought it would be a good idea to revisit the author of “Bulls, Bears and the Ballot Box,” Bob Deitrick. Bob contributed to my 2012 article on Democrats actually being better for the economy than Republicans, despite popular wisdom to the contrary.

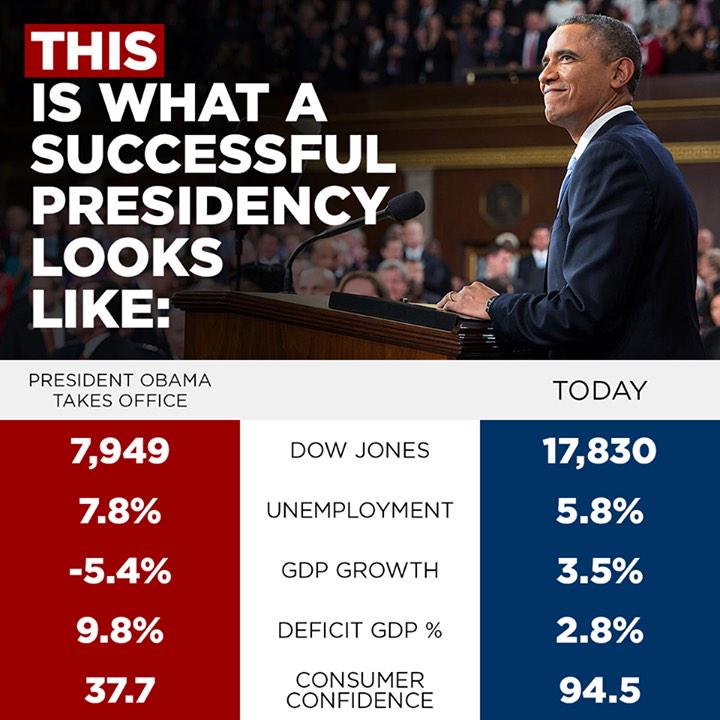

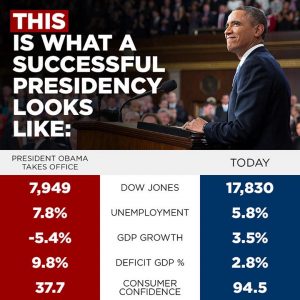

AH – Bob, there are a lot of people saying that the Obama Presidency was bad for the economy. Is that true?

Deitrick – To the contrary Adam, the Obama Presidency has economically been one of the best in modern history. Let’s start by comparing stock market performance, an indicator of investor sentiment about the economy using average annual compounded growth rates:

DJIA S&P 500 NASDAQ

Obama 11.1% 13.2% 17.7%

Bush -3.1% -5.6% -7.1%

Clinton 16.0% 15.1% 18.8%

Bush 4.8% 5.3% 7.5%

Reagan 11.0% 10.0% 8.8%

As you can see, Democrats have significantly outperformed Republicans. If you had $10,000 in an IRA, during the 16 years of Democratic administrations it would have grown to $72,539. During the 16 years of Republican administrations it would have grown to only $14,986. That is almost a 5x better performance by Democrats.

Obama’s administration has recovered all losses from the Bush crash, and gained more. Looking back further, we can see this is a common pattern. All 6 of the major market crashes happened under Republicans – Hoover (1), Nixon (2), Reagan (1) and Bush (2). The worst crash ever was the 58% decline which happened in 17 months of 2007-2009, during the Bush administration. But we’ve had one of the longest bull market runs in Presidential history under Obama. Consistency, stability and predictability have been recent Democratic administration hallmarks, keeping investors enthusiastic.

AH – But what about corporate profits?

Deitrick – During the 8 years of Reagan’s administration, the best for a Republican, corporate profits grew 26.82%. During the last 8 years corporate profits grew 55.79%. It’s hard to see how Mr. Trump identifies poor business conditions in America during Obama’s administration.

AH – What about jobs?

Deitrick – Since the recession ended in September, 2010 America has created 14,226,00 new jobs. All in, including the last 2 years of the Great Recession, Obama had a net increase in jobs of 10,545,000. Compare this to the 8 years of George W. Bush, who created 1,348,000 jobs and you can see which set of policies performed best.

AH – What about the wonkish stuff, like debt creation? Many people are very upset at the large amount of debt added the last 8 years.

Deitrick – All debt has to be compared to the size of the base. Take for example a mortgage. Is a $1million mortgage big? To many it seems huge. But if that mortgage is on a $5million house, it is only 20% of the asset, so not that large. Likewise, if the homeowner makes $500,000 a year it is far less of an issue (2x income) than if the homeowner made $50,000/year (20x income.)

The Reagan administration really started the big debt run-up. During his administration national debt tripled – increased 300%. This was an astounding increase in debt. And the economy was much smaller then than today, so the debt as a percent of GDP doubled – from 31.1% to 62.2%%. This was the greatest peacetime debt increase in American history.

During the Obama administration total debt outstanding increased by 63.5% – which is just 20% of the debt growth created during the Reagan administration. As a percent of GDP the debt has grown by 28% – just about a quarter of the 100% increase during Reagan’s era. Today we have an $18.5trillion economy, 4 to 6 times larger than the $3-$5trillion economy of the 1980s. Thus, the debt number may appear large, but it is nothing at all as important, or an economic drag, as the debt added by Republican Reagan.

Digging into the details of the Obama debt increase (for the wonks,) out of a total of $8.5trillion added 70% was created by 2 policies implemented by Republican Bush. Ongoing costs of the Afghanistan war has accumulated to $3.6trillion, and $2.9trillion came from the Bush tax cuts which continued into 2003. Had these 2 Republican originated policies not added drastically to the country’s operating costs, debt increases would have been paltry compared to the size of the GDP. So it hasn’t been Democratic policies, like ACA (Affordable Care Act), or even the American Reinvestment and Recovery Act which has led to home values returning to pre-crisis levels, that created recent debt, but leftover activities tied to Republican Bush’s foray into Afghanistan and Republican policies of cutting taxes (mostly for the wealthy.)

Since Reagan left office the U.S. economy has grown by $13.5trillion. 2/3 of that (67%) happened during Clinton and Obama (Democrats) with only 1/3 happening during Bush and Bush (Republicans.)

AH – What about public sentiment? Listening to candidate Trump one would think Americans are extremely unhappy with President Obama.

Deitrick – The U.S. Conference Board’s Consumer Confidence Index was at a record high 118.9 when Democrat Clinton left office. Eight years later, ending Republican Bush’s administration, that index was at a record low 26.8. Today that index is at 101.1. Perhaps candidate Trump should be reminded of Senator Daniel Patrick Moynihan’s famous quote “everyone is entitled to his own opinion, but not to his own facts.”

Candidate Trump’s rhetoric makes it sound like Americans live in a crime-filled world – all due to Democrats. But FBI data shows that violent crime has decreased steadily since 1990 – from 750 incidents per 100,000 people to about 390 today. Despite the rhetoric, Americans are much safer today than in the past. Interestingly, however, violent crime declined 10.2% in the second Bush’s 8 year term. But during the Clinton years violent crime dropped 34%, and during the Obama administration violent crime has dropped 17.8%. Democratic policies of adding federal money to states and local communities has definitely made a difference in crime.

Despite the blistering negativity toward ACA, 20million Americans are insured today that weren’t insured previously. That’s almost 6.25% of the population now with health care coverage – a cost that was previously born by taxpayers at hospital emergency rooms.

AH – Final thoughts?

Deitrick – We predicted that the Obama administration would be a great boon for Americans, and it has. Unfortunately there are a lot of people who obtain media coverage due to antics, loud voices, and access obtained via wealth that have spewed false information. When one looks at the facts, and not just opinions, it is clear that like all administrations the last 90 years Democrats have continued to be far better economic stewards than Republicans.

It is important people know the facts. For example, it would have kept an investor in this great bull market – rather than selling early on misplaced fear. It would have helped people to understand that real estate would regain its lost value. And understand that the added debt is not a great economic burden, especially at the lowest interest rates in American history.

[Author’s note: Bob Deitrick is CEO of Polaris Financial Partners, a private investment firm in suburban Columbus, Ohio. His firm uses economic and political tracking as part of its analysis to determine the best investments for his customers – and is proud to say they have remained long in the stock market throughout the Obama administration gains. For more on their analysis and forecasts contact PolarsFinancial.net]

by Adam Hartung | Sep 14, 2016 | Immigration, In the Rapids, Innovation, Telecom, Trends

I’m amazed about Americans’ debate regarding immigration. And all the rhetoric from candidate Trump about the need to close America’s borders.

I was raised in Oklahoma, which prior to statehood was called The Indian Territory. I was raised around the only real Native Americans. All the rest of us are immigrants. Some voluntarily, some as slaves. But the fact that people want to debate whether we allow people to become Americans seems to me somewhat ridiculous, since 98% of Americans are immigrants. The majority within two generations.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

And almost since the beginning, immigrants have been not only abused but scammed. Those who have resources frequently took advantage of the newcomers that did not. And this persists. Immigrants that lack a social security card are unable to obtain a driver’s license, unable to open bank accounts, unable to apply for credit cards, unable to even sign up for phone service. Thus they remain at the will of others to help them, which creates the opportunity for scamming.

Take for example an immigrant trying to make a phone call to his relatives back home. For most immigrants this means using a calling card. Only these cards are often a maze of fees, charges and complex rules that result in much of the card’s value being lost. A 10-minute call to Ghana can range from $2.86 to $8.19 depending on which card you use. This problem is so bad that the FCC has fined six of the largest card companies for misleading consumers about calling cards. They continue to advise consumers about fraud. And even Congress has held hearings on the problem.

One outcome of immigrants’ difficulties has been the ingenuity and innovativeness of Americans. To this day around the world people marvel at how clever Americans are, and how often America leads the world in developing new things. As a young country, and due to the combination of resources and immigrants’ tough situation, America frequently is first at developing new solutions to solve problems – many of which are problems that clearly affect the immigrant population.

So, back to that phone call. Some immigrants can use Microsoft Skype to talk with their relatives, using the Internet rather than a phone. But this requires the people back home have a PC and an internet connection. Both of which could be dicey. Another option would be to use something like Facebook’s WhatsApp, but this requires the person back home have either a PC or mobile device, and either a wireless connection or mobile coverage. And, again, this is problematic.

But once again, ingenuity prevails. A Romanian immigrant named Daniel Popa saw this problem, and set out to make communications better for immigrants and their families back home. In 2014 he founded QuickCall.com to allow users to make a call over wireless technology, but which can then interface with the old-fashioned wired (or wireless) telecom systems around the world. No easy task, since telephone systems are a complex environment of different international, national and state players that use a raft of different technologies and have an even greater set of complicated charging systems.

But this new virtual phone network, which links the internet to the traditional telecom system, is a blessing for any immigrant who needs to contact someone in a rural, or poor, location that still depends on phone service. If the person on the other end can access a WiFi system, then the calls are free. If the connection is to a phone system then the WiFi interface on the American end makes the call much cheaper – and performs far, far better than any other technology. QuickCall has built the carrier relationships around the world to make the connections far more seamless, and the quality far higher.

But like all disruptive innovations, the initial market (immigrants) is just the early adopter with a huge need. Being able to lace together an internet call to a phone system is pretty powerful for a lot of other users. Travelers heading to a remote location, like Micronesia, Africa or much of South America — and even Eastern Europe – can lower the cost of planning their trip and connect with locals by using QuickCall.com. And for most Americans traveling in non-European locations their cell phone service from Sprint, Verizon, AT&T or another carrier simply does not work well (if at all) and is very expensive when they arrive. QuickCall.com solves that problem for these travelers.

Small businesspeople who have suppliers, or customers, in these locations can use QuickCall.com to connect with their business partners at far lower cost. Businesses can even have their local partners obtain a local phone number via QuickCall.com and they can drive the cost down further (potentially to zero). This makes it affordable to expand the offshore business, possibly even establishing small scale customer support centers at the local supplier, or distributor, location.

In The Innovator’s Dilemma Clayton Christensen makes the case that disruptive innovations develop by targeting a customer with an unmet need. Usually the innovation isn’t as good as the current “standard,” and is also more costly. Today, making an international call through the phone system is the standard, and it is fairly cheap. But this solution is often unavailable to immigrants, and thus QuickCall.com fills their unmet need, and at a cost substantially lower than the infamous calling cards, and with higher quality than a pure WiFi option.

But now that it is established, and expanding to more countries – including developed markets like the U.K. – the technology behind QuickCall.com is becoming more mainstream. And its uses are expanding. And it is reducing the need for people to have international calling service on their wired or wireless phone because the available market is expanding, the quality is going up, and the cost is going down. Exactly the way all disruptive innovations grow, and thus threaten the entrenched competition.

The end-game may be some form of Facebook in-app solution. But that depends on Facebook or one of its competitors seizing this opportunity quickly, and learning all QuickCall.com already knows about the technology and customers, and building out that network of carrier relationships. Notice that Skype was founded in 2003, and acquired by Microsoft in 2011, and it still doesn’t have a major presence as a telecom replacement. Will a social media company choose to make the investment and undertake developing this new solution?

As small as QuickCall.com is – and even though you may have never heard of it – it is an example of a disruptive innovation that has been successfully launched, and is successfully expanding. It may seem like an impossibility that this company, founded by an immigrant to solve an unmet need of immigrants, could actually change the way everyone makes international calls. But, then again, few of us thought the iPhone and its apps would cause us to give up Blackberries and quit carrying our PCs around.

America is known for its ingenuity and innovations. We can thank our heritage as immigrants for this, as well as the immigrant marketplace that spurs new innovation. America’s immigrants have the need to succeed, and the unmet needs that create new markets for launching new solutions. For all those conservatives who fear “European socialism,” they would be wise to realize the tremendous benefits we receive from our immigrant population. Perhaps these naysayers should use QuickCall.com to connect with a few more immigrants and understand the benefits they bring to America.

by Adam Hartung | Aug 31, 2016 | Economy, Employment

(Photo: AP Photo/Mel Evans)

Tuesday, New Jersey Governor Chris Christie vetoed legislation which would have raised the state’s minimum wage to $15 per hour over five years. The current rate is $8.38, and he felt it was too big an increase, too fast.

Of course the governor makes quite a bit more than the minimum wage. And although he vetoed the legislation because he is “pro-business” he has never run a business and really has no idea what the economic impact of a higher minimum wage would be on New Jersey. He assumes because it would cost more to pay low-wage workers that it would harm businesses who are contributors to his re-election. Happy Labor Day all you minimum wage workers.

What he does not consider is the ability for those businesses to pass along those higher wages by raising prices. When everyone has to pay more then it becomes possible for everyone to raise prices. Simultaneously, the low income people who make more money, and spend 100% of what they make, pass along the higher wages in increased consumption which increases business revenues. So an argument can be made that a higher minimum wage could help businesses to have happier employees who spend more and actually improve the economy overall, and for their business.

Remember

Henry Ford and his $5 day? In 1914, by cutting work hours and doubling pay Ford greatly motivated his workforce, reducing turnover and training cost. Simultaneously he improved the ability of his workers to spend more and thus grow sales for many businesses. He was just one company, but his higher pay was so successful that it caused other companies to pay more, and everyone benefited. Many historians think of this as an important event in the birth of the American middle class.

The other contributor to the growth of the middle class was unions. By WWI unions had become far more prevalent in the U.S. Unions improved working conditions, fought for the abolition of child labor, eliminated employer discrimination, improved benefits like health care and allowed employees to negotiate for higher wages. By banding together in unions employees were able to negotiate with their employer much more powerfully than for each employee to negotiate individually.

In 1928, the height of the “Gilded Age” of America, the bottom 90% of Americans earned 50.7% of the nation’s income, while the top 1% earned 23.9%. Affects of the Great Depression, and increased unionization, changed this so that by 1944 the bottom 90% was earning 67.5% of the income, while the income of the top 1% had plummeted to 11.3%.

Of course, unions and their bosses were far from perfect. Over time union clout grew, and management increasingly caved to union demands in order to avoid debilitating strikes. Some companies were drowned in worker demands, and became unproductive with feather-bedded workers and work rules that seriously harmed productivity. Meanwhile, rampant corruption among union leadership led to intense mob involvement and increased crime. Which led to a lot less support for unions among Americans — often even among the workers who were union members.

In 1979, four years after famed union leader Jimmy Hoffa disappeared after a dust-up with the mob, 34% of American workers were unionized. Today only 10% are unionized, and a large percentage of those are in government positions like teaching, law enforcement, firefighting, postal service, etc. Thirty-eight percent of workers without a college degree were unionized in 1979. Today, 11% are unionized.

And today, we have returned to the Gilded Age. Union dislike has led to implementing Right to Work laws in several states, which makes it far easier for private employers to avoid, or eliminate, unions. And changes in jobs from largely factory line work to far more desk-related (shifting from manufacturing to tech and health care) has made it less easy to find common ground among workers for unionizing. Additionally, sharp cuts in progressive income taxes, which were replaced by dramatic increases in regressive sales and property taxes, coupled with a huge increase in social security and other worker taxes has transformed America’s income portrait. Once again (2012) the top 1% take home 22.5% of America’s income, while the bottom 90% take home only 50.7%.

This dramatic shift in incomes is very prevalent in today’s election contests. There is ample talk about the displaced workers, under-employed workers and hidden unemployment. It is clear there are a lot of very wealthy people who have a lot of power to affect elections — including one candidate who won his party’s candidacy without even raising external funds! Simultaneously, there are a lot of very angry, frustrated people who want significant change — and express an aggressive dislike for the candidates of both major parties.

What is clear is that America prospered when the disparity between rich and poor was not as it is today. There was a greater sense of commonality, even as people disagreed on policies, when workers could identify with the heads of their companies and the bankers. Today, the difference between the haves and have-nots is so great that a large percentage of Americans believe they can only retire if they hit the lottery!

Throughout history income inequality has led to national overthrow, ouster of government heads, and riots. The French overturned their monarchy and became a republic when their king and queen ignored the impoverished. Filipinos threw out the Marcos regime. And home-grown American terrorists are often disenchanted with lifestyles far from their expectations.

There is clearly a need to find ways to reduce income inequality. It is incumbent upon leaders to seek out ways to improve the lives of their constituents, including their customers, suppliers and employees. And one, small act that any governor can do is simply abandon old assumptions about the horribleness of minimum wage laws – and unions as responsible for a currently weak economy — and instead take action to put a few more dollars into the hands of those who work, yet have the least.

Most Americans, including white collar workers and executives, will take the day off next Monday to celebrate Labor Day. This national holiday was created by labor unions in the 1880s, and made a national holiday in 1894 after the U.S. Army and U.S. Marshal’s Service killed multiple workers at the Pullman strike. Labor Day was instituted as a celebration of the American worker, and the economic and social achievements they accomplished. It is a time to honor those who work hard, often for not enough pay, and yet make America great.

Happy Labor Day!

by Adam Hartung | Aug 29, 2016 | Finance, Investing, Politics

(Photo: AP Photo/Andrew Harnik, File)

Last weekend, the Federal Reserve Board’s leadership met to discuss the future of America’s monetary policy. Reports out of that meeting, like reports from all Fed meetings, are long, tedious, and pretty much say nothing. Every analyst tries to interpret from the governors’ statements what might happen next. And because the Fed leadership is so vague, and so academic, the analysts inevitably never guess right.

This bothers a lot of people. There are those who want a lot more “transparency” from the Fed – meaning they want much clearer signals as to what is intended, and usually specifics as to intended actions and a timeline. Because the Fed’s meetings are so cloaked and opaque, some congress members actually want to do away with the Fed, or regulate it a lot more closely.

But for most of us, most of the time, the Fed is pretty much immaterial. When the Fed matters is when there are big swings in the economy, which happen quickly. Then their action is crucial.

Why Small Changes In Interest Rates Don’t Really Matter To Most Of Us

Take the debate right now over a quarter point rise in interest rates. How does this affect most people? Not much. If you have credit card debt, or a car loan, your interest rate is set by the financial institution. And you may hear people talk about zero interest rates, but you know your rate is a whopping amount higher than that. And you know that a quarter point change in the Federal Funds rate will not affect the interest on those loans.

Where you’ll see a difference is in a mortgage. But here, is a quarter point really important?

When I graduated business school in 1982 and wanted to buy my first home the interest rate on an annual, variable rate loan was 18.5%. My first house cost just about $100,000 so the interest was $18,500/year. Today, mortgages are around 3.5%, fixed for anywhere from 3 to 7 years. $18,500 in interest now funds a $525,000 mortgage! If interest rates go to 3.75% – which has many analysts so concerned for the economy – the home value associated with interest of $18,500 is $500,000. Probably within the negotiating range of the buyer.

So you have to borrow a LOT of money for this quarter point to matter. And it does matter to CEOs and CFOs of companies that lead corporations on the S&P 500, or those running huge REITs (Real Estate Investment Trusts) that have enormous debts. But that is not most of us. For most of us, that quarter point difference will not have any impact on our lives.

So Why Do People Pay So Much Attention To The Fed?

The Fed was originally created barely 100 years ago (1913) to try to create a more stable monetary system. But this didn’t work too well in the beginning, which led to the Great Depression. And then, to make matters worse, the conservative bent of the Fed coupled with its fixation on stable interest rates led it to actually cut the money supply as the economy was tanking. This led to a collapse in the value of goods and services, particularly real estate, and the loss of millions of jobs greatly worsening the Great Depression.

It was the depression which really caused economists to focus on studying Fed actions and the economic repercussions. A group of economists, most notably Milton Friedman at the University of Chicago, started saying that the Fed shouldn’t focus on interest rates, but rather on the supply of money. These folks were called “monetarists” and they said interest rates should float, and economists should focus on stable prices.

The 1970s – “Easy Money” Inflation

As we moved into the 1970s, and as Fed Governors kept trying to control interest rates, they found themselves creating more and more money to keep rates low, and in return prices skyrocketed. “Easy money” as they called it allowed ratcheting upward incomes, big pay raises, higher prices for commodities and inflation. Another monetarist leader, Paul Volcker, was named head of the Fed. He rapidly moved to contract the money supply, allowing those 18.5% mortgage rates to develop. Yet, this did stabilize prices and eventually rates lowered, moving down constantly from 1980 to the near zero rates of today for Treasury Bonds and other very large, low risk borrowers.

When the Great Recession hit the Fed leadership, led by Ben Bernanke, remembered the lessons of the Great Depression. As they saw real estate values tumble they were aware of the domino effect this would have on bank failures, and then business failures, just as they had occurred in the 1930s. So they flooded the market with additional currency to keep failures to a minimum, and ease the real estate collapse. This sent interest rates plummeting to the record low levels of the last few years.

Policy Must Address The Current Situation, Not Be Biased By Historical Memories

Yet, people keep worrying about inflation. Those who lived through the 1970s and saw the damage done by inflation are still fearful of it. So they scream loudly about their fear that the last 8 years of monetary ease will create massive future inflation. They want the Fed to be much tighter with money saying that all this cash will someday create inflation down the road. Their view of history is guiding their analysis. Their bias is a fear that “easy money” once caused a problem, so surely it will cause a problem again.

But economists who study prices keep saying that there are currently no signs of price escalation – that wages have not moved up appreciably in a decade, home values are barely where they were a decade ago. Commodity prices are not escalating, in fact many (like oil) are at historically low prices. The dollar is stronger because, relatively speaking, the USA economy is doing better than the rest of the developed world. As long as prices and wages remain without high gains, there is little reason to tighten money, and little reason to feel a higher interest rate is needed.

Further, past monetary increases will not cause future inflation, because monetary policy only affects what is happening now. “Easy money” today can only create inflation today, not in 3 years. And inflation is almost nowhere to be seen.

Ignore Fed “Fine Tuning.” Pay Attention When A Crisis Hits. Otherwise, It’s Up To The Politicians

The big thing to remember is that small changes in policy, such as those that might affect a quarter point change in rates, is “fine tuning” the money supply. And that has pretty nearly no affect on most of us. Where as citizens we should care about the Fed is when big changes happen. We don’t want mistakes like happened in the 1930s, because that hurt everyone. But we do want fast action to deal with a crisis like the falling real estate values and bank collapses that were happening a decade ago.

Remember, it was when the Fed targeted interest rates that the USA economy got into so much trouble. First in the Great Depression, and then in the inflationary 1970s. But when the Fed targeted prices, such as in the 1980s and the mid-2000s, it did exactly what it was created to do, maintain a stable money supply.

So don’t worry about whether analysts think interest rates are going to change a quarter point, or even a half point, in the next year. The big economic question facing us is not a Fed question, but rather “what will it take to increase investment so that we can create more jobs, and provide higher wages leading to a higher standard of living for everyone?” And that is not a question for the Fed to answer. That is up to the economic policy makers in the legislature and the White House.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce. Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.