by Adam Hartung | Feb 18, 2015 | Current Affairs, Leadership

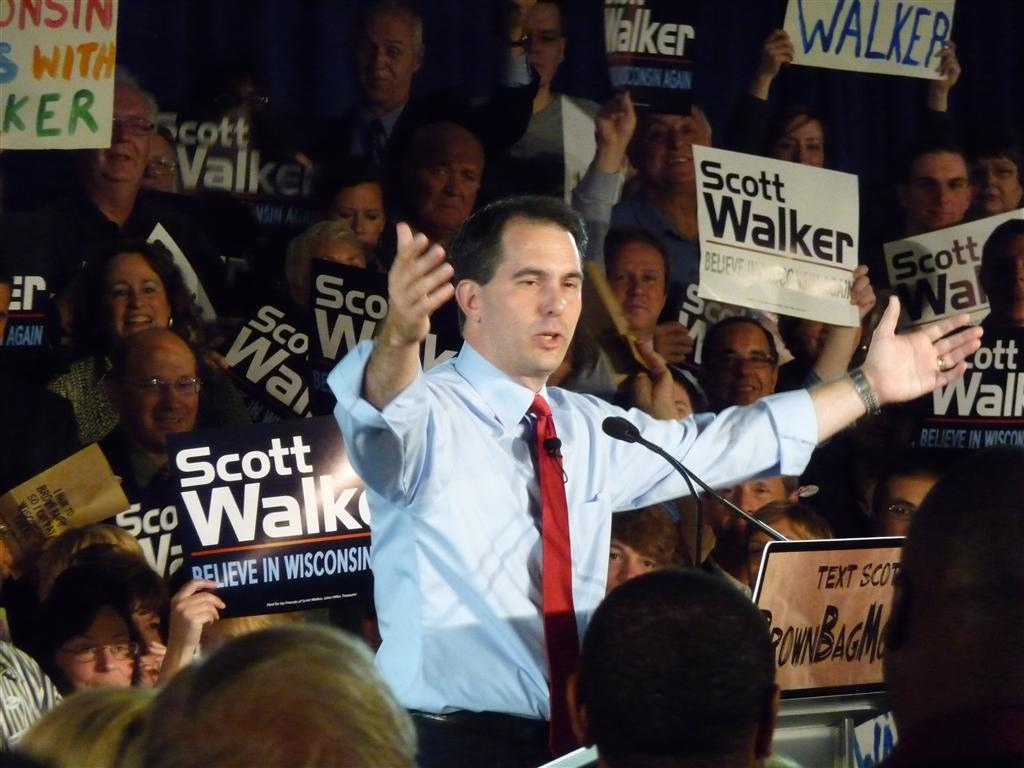

There has been a hullabaloo lately about Wisconsin Governor Walker’s lack of a degree. Some think this is a big deal, while others think almost nobody cares. In the end, we all should care about the formal education of any of our leaders. In government, business and elsewhere.

In Forbes magazine, 1998, famed management guru Peter Drucker wrote, “Get the assumptions wrong and everything that follows from them is wrong.” This is really important, because most leaders make most of their decisions based on assumptions. And many of those assumptions are based on how much, and how broad, that leader’s education.

We all make decisions on beliefs. It is easy to have incorrect beliefs. Early doctors believed that infections were due to bad blood, so they used bleeding as a cure-all for many wounds and illnesses. Untold millions of people died from this practice. A bad assumption, based on belief rather than formal study (in this case of the circulatory system) proved fatal.

In business, for thousands of years most sailors had no education about the curvature of the earth and its rotation the sun, thus they believed the world was flat and refused to sail further out to sea than the ability to keep their eyes on a shoreline. This limited trade, and delayed expansion into new markets.

Or, more recently, Steve Ballmer assumed that anyone using a smartphone would want a keyboard – because Blackberry dominated the market and had a keyboard. Thus he laughed at the iPhone launch. Oops. His assumption, and belief about the user experience, caused Microsoft to delay its entry into mobile markets and smartphones several years. Even though he had not studied smartphone user needs. Now Apple has half the smartphone market, while Blackberry and Microsoft each have less than 5%.

There are countless examples of bad decisions made when people use the wrong assumptions. At this time in Oklahoma, Texas and Colorado politicians are voting to refuse upgrading history education because the new curriculum is unacceptable to them. Their assumptions about America’s history are so strong that any factual evidence which might change those assumptions is so threatening that these politicians would prefer students be taught a fictitious history.

Our assumptions are built early in life. All through childhood our parents, aunts, uncles, religious leaders, mentors and teachers fill us with information. We process this information and build layers of assumptions. These assumptions help us to make decisions by allowing us to react based upon what we believe, rather than having to scurry around and do a research project every time a decision is required. Thus, the older we become the deeper these assumptions lie – and the more we rely on them as we undertake less and less education. As we age we decide based upon our beliefs, and less based upon any observable facts. Actually, we’ll often choose to ignore facts which indicate our assumptions and beliefs might be wrong (we call this a bias in others, and common sense when we do it ourselves.)

The more education you have, the more you can build assumptions that are likely to align with reality. It is no accident that the U.S. military uses education as a basis for promotions – rather than battlefield heroics. To move up requires officers go to war college and learn about history, politics, leadership and battles going back to long before the birth of Jesus. Good knowledge helps officers to be smarter about how to prepare for battle, organize for battle, conduct warfare, lead troops, treat a vanquished enemy and talk to the politicians for whom they work. Just look at the degrees amongst our military’s Colonels and General Officers and you find a plethora of masters and doctorate degrees. Education has long proven to be a superior warfare skill – especially when the enemy is operating on belief, guts and fight.

There are many accomplished people lacking degrees. But we should note they were successful very narrowly, and frequently in business. Steve Jobs, Bill Gates and Mark Zuckerberg are clearly high IQ people. But their success was based on founding a business at a time of technological revolution, and then building that business with zealousness. And the luck of being in the right place at the right time with a new piece of technology. They were/are not asked to be widely acclaimed in a broad spectrum of capabilities such as diplomacy, historical accuracy, legal limitations, cultural differences, the arts, scientific advances in multiple fields, warfare tactics, etc. They were not asked to develop a turnaround plan for a bankrupt auto manufacturer at the height of the Great Recession. For all their great wealth creation, they would not be what were once called “Renaissance men.”

When Governor Walker attacks the educated, and labels them as “elites,” it should be noted that their backgrounds often mean they have more points of view to evaluate, and are more considered about the various risks which are being created by taking any specific action. Many Harvard or Columbia MBAs could never be entrepreneurs because they see the many reasons a business would likely fail, and thus they are reticent to commit. Yet, that same wider knowledge allows them to be more thoughtful when evaluating the options and making decisions regarding opening new plants, negotiating with unions, expanding distribution and financing options.

Further, while it is true that you can be smart and not have a degree, the number of those who have degrees yet lack intelligence is a much, much smaller number. If one is to err in picking those you want to have advise you, or represent you, the degree(s) is not a bad first step toward identifying who is likely to provide the best insight and offer the most help.

Further, there is nothing about a degree which limits one’s ability to fight. Look at Senator Cruz from Texas. Senator Cruz’s politics seem to be somewhat aligned with Governor Walker’s, and he is widely acknowledged as a serious fighter, yet he boasts an undergraduate degree from Princeton as well as graduating from Harvard Law School. An educational background anyone would label as “elitist” and remarkably similar to President Obama’s – whose background Governor Walker has thoroughly maligned.

We expect our leaders to be widely read, and keenly aware of the complexities of life. We want our attorney’s to have law degrees and pass the bar exam. We want our physicians to have medical degrees and pass the Boards. Increasingly we want our business leaders to have MBAs. We understand that education informs our minds, and helps us develop assumptions for making good decisions. We should not belittle this, nor be accepting of someone who implies that lacking a formal education is meaningless.

by Adam Hartung | Feb 12, 2015 | Current Affairs, Disruptions, Innovation, Leadership, Web/Tech

Despite huge fanfare at launch, after a few brief months Google Glass is no longer on the market. The Amazon Fire Phone was also launched to great hype, yet sales flopped and the company recently took a $170M write off on inventory.

Fortune mercilessly blamed Fire Phone’s failure on CEO Jeff Bezos. The magazine blamed him for micromanaging the design while overspending on development, manufacturing and marketing. To Fortune the product was fatally flawed, and had no chance of success according to the article.

Similarly, the New York Times blasted Google co-founder and company leader Sergie Brin for the failure of Glass. He was held responsible for over-exposing the product at launch while not listening to his own design team.

Both these articles make the common mistake of blaming failed new products on (1) the product itself, and (2) some high level leader that was a complete dunce. In these stories, like many others of failed products, a leader that had demonstrated keen insight, and was credited with brilliant work and decision-making, simply “went stupid” and blew it. Really?

Unfortunately there are a lot of new products that fail. Such simplistic explanations do not help business leaders avoid a future product flop. But there are common lessons to these stories from which innovators, and marketers, can learn in order to do better in the future. Especially when the new products are marketplace disrupters; or as they are often called, “game changers.”

Do you remember Segway? The two wheeled transportation device came on the market with incredible fanfare in 2002. It was heralded as a game changer in how we all would mobilize. Founders predicted sales would explode to 10,000 units per week, and the company would reach $1B in sales faster than ever in history. But that didn’t happen. Instead the company sold less than 10,000 units in its first 2 years, and less than 24,000 units in its first 4 years. What was initially a “really, really cool product” ended up a dud.

There were a lot of companies that experimented with Segways. The U.S. Postal Service tested Segways for letter carriers. Police tested using them in Chicago, Philadelphia and D.C., gas companies tested them for Pennsylvania meter readers, and Chicago’s fire department tested them for paramedics in congested city center. But none of these led to major sales. Segway became relegated to niche (like urban sightseeing) and absurd (like Segway polo) uses.

Segway tried to be a general purpose product. But no disruptive product ever succeeds with that sort of marketing. As famed innovation guru Clayton Christensen tells everyone, when you launch a new product you have to find a set of unmet needs, and position the new product to fulfill that unmet need better than anything else. You must have a very clear focus on the product’s initial use, and work extremely hard to make sure the product does the necessary job brilliantly to fulfill the unmet need.

Nobody inherently needed a Segway. Everyone was getting around by foot, bicycle, motorcycle and car just fine. Segway failed because it did not focus on any one application, and develop that market as it enhanced and improved the product. Selling 100 Segways to 20 different uses was an inherently bad decision. What Segway needed to do was sell 100 units to a single, or at most 2, applications.

Segway leadership should have studied the needs deeply, and focused all aspects of the product, distribution, promotion, training, communications and pricing for that single (or 2) markets. By winning over users in the initial market Segway could have made those initial users very loyal, outspoken customers who would recommend the product again and again – even at a $4,000 price.

Segway should have pioneered an initial application market that could grow. Only after that could Segway turn to a second market. The first market could have been using Segway as a golfer’s cart, or as a walking assist for the elderly/infirm, or as a transport device for meter readers. If Segway had really focused on one initial market, developed for those needs, and won that market it would have started a step-wise program toward more applications and success. By thinking the general market would figure out how to use its product, and someone else would develop applications for specific market needs, Segway’s leaders missed the opportunity to truly disrupt one market and start the path toward wider success.

The Fire Phone had a great opportunity to grow which it missed. The Fire Phone had several features making it great for on-line shopping. But the launch team did not focus, focus, focus on this application. They did not keep developing apps, databases and ways of using the product for retailing so that avid shoppers found the Fire Phone superior for their needs. Instead the Fire Phone was launched as a mass-market device. Its retail attributes were largely lost in comparisons with other general purpose smartphones.

The Fire Phone had a great opportunity to grow which it missed. The Fire Phone had several features making it great for on-line shopping. But the launch team did not focus, focus, focus on this application. They did not keep developing apps, databases and ways of using the product for retailing so that avid shoppers found the Fire Phone superior for their needs. Instead the Fire Phone was launched as a mass-market device. Its retail attributes were largely lost in comparisons with other general purpose smartphones.

People already had Apple iPhones, Samsung Galaxy phones and Google Nexus phones. Simultaneously, Microsoft was pushing for new customers to use Nokia and HTC Windows phones. There were plenty of smartphones on the market. Another smartphone wasn’t needed – unless it fulfilled the unmet needs of some select market so well that those specific users would say “if you do …. and you need…. then you MUST have a FirePhone.” By not focusing like a laser on some specific application – some specific set of unmet needs – the “cool” features of the Fire Phone simply weren’t very valuable and the product was easy for people to pass by. Which almost everyone did, waiting for the iPhone 6 launch.

This was the same problem launching Google Glass. Glass really caught the imagination of many tech reviewers. Everyone I knew who put on Glass said it was really cool. But there wasn’t any one thing Glass did so well that large numbers of folks said “I have to have Glass.” There wasn’t any need that Glass fulfilled so well that a segment bought Glass, used it and became religious about wearing Glass all the time. And Google didn’t improve the product in specific ways for a single market application so that users from that market would be attracted to buy Glass. In the end, by trying to be a “cool tool” for everyone Glass ended up being something nobody really needed. Exactly like Segway.

Microsoft recently launched its Hololens. Again, a pretty cool gadget. But, exactly what is the target market for Hololens? If Microsoft proceeds down the road of “a cool tool that will redefine computing,” Hololens will likely end up with the same fate as Glass, Segway and Fire Phone. Hololens marketing and development teams have to find the ONE application (maybe 2) that will drive initial sales, cater to that application with enhancements and improvements to meet those specific needs, and create an initial loyal user base. Only after that can Hololens build future applications and markets to grow sales (perhaps explosively) and push Microsoft into a market leading position.

Microsoft recently launched its Hololens. Again, a pretty cool gadget. But, exactly what is the target market for Hololens? If Microsoft proceeds down the road of “a cool tool that will redefine computing,” Hololens will likely end up with the same fate as Glass, Segway and Fire Phone. Hololens marketing and development teams have to find the ONE application (maybe 2) that will drive initial sales, cater to that application with enhancements and improvements to meet those specific needs, and create an initial loyal user base. Only after that can Hololens build future applications and markets to grow sales (perhaps explosively) and push Microsoft into a market leading position.

All companies have opportunities to innovate and disrupt their markets. Most fail at this. Most innovations are thrown at customers hoping they will buy, and then simply dropped when sales don’t meet expectations. Most leaders forget that customers already have a way of getting their jobs done, so they aren’t running around asking for a new innovation. For an innovation to succeed launchers must identify the unmet needs of an application, and then dedicate their innovation to meeting those unmet needs. By building a base of customers (one at a time) upon which to grow the innovation’s sales you can position both the new product and the company as market leaders.

by Adam Hartung | Jan 29, 2015 | Current Affairs, In the Whirlpool, Leadership, Web/Tech

This week Yahoo announced it is spinning off the last of its Alibaba holdings. This is a big deal, because it might well signal the end of Yahoo.

Yahoo created internet advertising. Yahoo was once the #1 home page for browsers across America. But the company has floundered for years, riddled with CEO problems, a contentious Board of Directors and no strategy for dealing with Google which overtook it in all markets.

To much fanfare the Board hired Marissa Mayer, a Google wunderkind we were told, in July, 2012 to mount a serious turnaround. And during her leadership the company’s stock value has tripled – from about $14.50/share to about $43.50. You would think investors would be thrilled and the company would be on the right track.

Only almost all that value creation was due to a stock investment made in 2005 – when Jerry Yang invested $1B to buy 40% of Alibaba. And Alibaba in 2014 became the most valuable IPO in history.

Yahoo today is valued at about $46B. The Alibaba shares being spun out are valued at between $40B and $44B. Which means that after adjusting for the ownership in Yahoo Japan (valued at $2.3B) the core Yahoo ad and portal business is worth between $2B and $4.7B. With just over $1B shares outstanding, that puts a value on Yahoo’s core business of between $2.00-$4.70/share – or about 1/6 to 1/3 the value when Ms. Mayer became CEO.

A highest value of $4.7B for the operating business of Yahoo puts it on par with Groupon. And worth far less than competitors Google ($347B) and Facebook ($212B). Even upstart, and often maligned, social media companies Twitter ($24B) and LinkedIn ($27B) have valuations 5 times Yahoo.

Unfortunately, this latest leader and her team haven’t been any more effective at improving the company’s business than previous regimes. Under CEO Mayer Yahoo used gains from Alibaba’s valuation to invest about $2.1B in 49 outside companies – with $2B of that being acquisitions of technology companies Flurry ($200M), BrightRoll ($640M) and Tumblr ($1.1). Under the most optimistic view of Yahoo, leadership spent 40% of the company’s value in acquisitions that have made no difference to ad revenues or profits.

In fact, Yahoo’s business revenues, and profits, have declined for 6 consecutive quarters. Despite the CEO’s mandate that employees could no longer work from home. A kerfuffle that proved yet another management distraction, and apparently an effort to cut staff without it looking like a layoff.

Meanwhile there have been big efforts to boost people going to the Yahoo portal. Such as hiring broadcaster Katie Couric to beef up the news section, and former New York Times tech columnist David Pogue to deepen tech coverage and New York Times Magazine political writer Matt Bai to draw in more readers. But these have done nothing to move the needle.

Consistently declining display advertising has left search ads a bigger, and more profitable, business. And while Yahoo’s CEO has been teasing ad agencies that she might begin another big brand campaign, including TV, to bring Yahoo more attention – and hopefully more advertisers – there is no evidence anyone cares as more and more dollars flow to “programmatic” ad buying where Google is king. In the digital ad marketplace Google has 31% share, Facebook 7.75% share and Yahoo a meager 2.36% share.

Soon there will be little left of the once mighty Yahoo. It has pretty much lost relevancy. Large investors are crying for a merger with AOL, whose inability to grow its portal, ad and media businesses has left its market cap at a mere $3.7B. But combining two companies that are market irrelevant, and declining, will probably have the same outcome as happened when merging KMart and Sears. The Yahoo growth stall remains intact, and revenues will decline along with profits as the market continues shifting to powerful and growing competitors Google, Facebook and other social media companies. Only now Yahoo’s leaders won’t have the Alibaba value mountain to hide behind

by Adam Hartung | Jan 22, 2015 | Current Affairs, Defend & Extend, Games, In the Swamp, Innovation, Leadership, Software, Web/Tech

Yesterday Microsoft conducted a pre-launch of Windows 10, demonstrating its features in an effort to excite developers and create some buzz before consumer launch later in 2015.

By and large, nobody cared. Were you aware of the event? Did you try to watch the live stream, offered via the Microsoft web site? Were you eager to read what people thought of the product? Did you look for reviews in the Wall Street Journal, USA Today and other general news outlets?

Microsoft really blew it with Windows 8 – which is the second most maligned Windows product ever, exceeded only by

Vista. But that wasn’t hard to predict, in June, 2012. Even then it was clear that Windows 8, and Surface tablets, were designed to defend and extend the installed Windows base, and as such the design precluded the opportunity to change the market and pull mobile users to Microsoft.

And, unfortunately, that is how Windows 10 has been developed. At the event’s start Microsoft played a tape driving home how it interviewed dozens and dozens of loyal Windows customers, asking them what they didn’t like about 8, and what they wanted in a Windows upgrade. That set the tone for the new product.

Microsoft didn’t seek out what would convert all those mobile users already on iOS or Android to throw away their devices and buy a Microsoft product. Microsoft didn’t ask its defected customers what it would take to bring them back, nor did it ask the over 50% of the market using Windows 7 or older products what it would take to get them to go to Windows mobile rather than an iPad or Galaxy tablet. Nope. Microsoft went to its installed base and asked them what they would like.

Imagine it’s 1975 and for two decades you have successfully made and sold small offset printing presses. Every single company of any size has one in their basement. But customers have started buying really simple, easy to use Xerox machines. Fewer admins are sending even fewer jobs to the print shop in the basement, as they choose to simply run off a bunch of copies on the Xerox machine. Of course these copies are more expensive than the print shop, and the quality isn’t as good, but the users find the new Xerox machines good enough, and they are simple and convenient.

What are you to do if you make printing presses? You probably need to find out how you can get into a new product that actually appeals to the users who no longer use the print shop. But, instead, those companies went to the print shop operators and asked them what they wanted in a new, small print machine. And then the companies upgraded their presses and other traditional printing products based upon what that installed base recommended. And it wasn’t long before their share of printing eroded to a niche of high-volume, and often color, jobs. And the commercial print market went to Xerox.

That’s what Microsoft did with Windows 10. It asked its installed base what it wanted in an operating system. When the problem isn’t the installed base, its the substitute product that is killing the company. Microsoft didn’t need input from its installed base of loyal users, it needed input from people who have quit using HP laptops in favor of iPads.

There are a lot of great new features in Windows 10. But it really doesn’t matter.

The well spoken presenters from Microsoft laid out how Windows 10 would be great for anyone who wants to go to an entirely committed Windows environment. To achieve Microsoft’s vision of the future every one of us will throw away our iOS and Android products and go to Windows on every single device. Really. There wasn’t one demonstration of how Windows would integrate with anything other than Windows. And there appeared on intention of making the future an interoperable environment. Microsoft’s view was we would use Windows on EVERYTHING.

Microsoft’s insular view is that all of us have been craving a way to put Windows on all our devices. We’ve been sitting around using our laptops (or desktops) and saying “I can’t wait for Microsoft to come out with a solution so I can throw away my iPhone and iPad. I can’t wait to tell everyone in my organization that now, finally, we have an operating system that IT likes so much that we want everyone in the company to get rid of all other technologies and use Windows on their tablets and phones – because then they can integrate with the laptops (that most of us don’t use hardly at all any longer.)”

Microsoft even went out of its way to demonstrate how well Win10 works on 2-in-1 devices, which are supposed to be both a tablet and a laptop. But, these “hybrid” devices really don’t make any sense. Why would you want something that is both a laptop and a tablet? Who wants a hybrid car when you can have a Tesla? Who wants a vehicle that is both a pick-up and a car (once called the El Camino?) Microsoft thinks these are good devices, because Microsoft can’t accept that most of us already quit using our laptop and are happy enough with a tablet (or smartphone) alone!

Microsoft presenters repeatedly reminded us that Windows is evolving. Which completely ignores the fact that the market has been disrupted. It has moved from laptops to mobile devices. Yes, Windows has a huge installed base on machines that we use less and less. But Windows 10 pretends that there does not exist today an equally huge, and far more relevant, installed base of mobile devices that already has millions of apps people use every single day over and over. Microsoft pretended as if there is no world other than Windows, and that a more robuts Windows is something people can’t wait to use! We all can’t wait to go back to a exclusive Microsoft world, using Windows, Office, the new Spartan browser – and creating documents, spreadsheets and even presentations using Office, with those hundreds of complex features (anyone know how to make a pivot table?) on our phones!

Just like those printing press manufacturers were sure people really wanted documents printed on presses, and couldn’t wait to unplug those Xerox machines and return to the old way of doing things. They just needed presses to have more features, more capabilities, more speed!

The best thing in Windows 10 is Cortana, which is a really cool, intelligent digital assistant. But, rather than making Cortana a tool developers can buy to integrate into their iOS or Android app the only way a developer can use Cortana is if they go into this exclusive Windows-only world. That’s a significant request.

Microsoft made this mistake before. Kinect was a great tool. But the only way to use it, initially, was on an xBox – and still is limited to Windows. Despite its many superb features, Kinect didn’t develop anywhere near its potential. Cortana now suffers from the same problem. Rather than offering the tool so it can find its best use and markets, Microsoft requires developers and consumers buy into the Windows-exclusive world if you want to use Cortana.

Microsoft hasn’t yet figured out that it lost relevance years ago when it missed the move to mobile, and then launched Windows 8 and Surface to markets that didn’t really want those products. Now the market has gone mobile, and the leader isn’t Microsoft. Microsoft has to find a way to be relevant to the millions of people using alternative products, and the Windows 10 vision, which excludes all those competing devices, simply isn’t it.

There was lots of neat geeky stuff shown. Surface tablets using Windows 10 with an xBox app can now do real gaming, which looks pretty cool and helps move Microsoft forward in mobile gaming. That may be a product that sets Sony’s Playstation and Nintendo’s Wii on their heels. But that’s gaming, and historically not where Microsoft makes any money (nor for that matter does Sony or Nintendo.)

There is a new interactive whiteboard that integrates Skype and Windows tablets for digital enhancement of brainstorming meetings. But it is unclear how a company uses it when most employees already have iPhones or Samsung S5s or Notes. And for the totally geeky there was a demo of a holographic headset. But when it comes to disruptive products like this success requires finding really interesting applications that otherwise cannot be completed, and then the initial customers who have a really desperate need for that application who will become devoted users.

Launching such disruptive products has long been the bane of Microsoft’s existence. Microsoft thinks in mass market terms, and selling to its base. Not developing breakthrough applications and finding niche markets to launch new uses. Nor has Microsoft created a developer community aligned with that kind of work. They have long been taught to simply continue to do things that defend and extend the traditional base of product uses and customers.

The really big miss for this meeting was understanding developer needs. Today developers have an enormous base of iOS and Android users to whom they can sell their products. Windows has less than 3% share in mobile devices. What developer would commit their resources to developing products for Windows 10, which has an installed base only in laptops and desktops? In other words, yesterday’s technology base? Especially when to obtain the biggest benefits of Windows 10 that developer has to find end use customers (companies or consumers) willing to commit 100% to Windows everywhere – even including their televisions, thermostats and other devices in our ever smarter buildings?

Windows 10 has a lot of cool features. But Microsoft made a big miss by listening to the wrong people. By assuming its installed base couldn’t wait for a Microsoft-exclusive solution, and by behaving as if the installed base of mobile devices either didn’t exist or didn’t matter, the company showed its hubris (once again.) If all it took to succeed were great products, the market would never have shifted from Macintosh computers to Windows machines in the 1990s. Microsoft simply doesn’t realize that it lacks the relevance to pull of its grand vision, and as such Windows 10 has almost no chance of stopping the Apple/Google/Samsung juggernaut.

by Adam Hartung | Jan 6, 2015 | Current Affairs, In the Rapids, Innovation, Leadership

Crude oil has dropped 50% in just 6 months. At under $50/barrel, gasoline is now selling for under $2/gallon in many places. This is a price rollback to 2008 prices – something almost no one expected in early 2014.

It is easy to jump to conclusions about what this will mean for sales of some products. And many analysts have been saying this is a terrible scenario for Tesla, which sells all electric cars. The theory is pretty simple, and goes something like this: People buy electric cars to save on petrol costs, so when petrol prices fall their interest in electric cars decline. With gasoline cheap again, nobody will want an electric car, so Tesla will do poorly.

But this is just an example of where common wisdom is completely wrong. And now that Tesla has lost about 1/3 of its value, due to this popular belief, it is offering investors a tremendous buying opportunity.

There are three big reasons we can expect Tesla to continue to do well, even if gasoline prices are low in the USA.

First, Teslas are great cars. Not simply great electric cars. So quickly we forget that Consumer Reports gave the Model S 99 out of a possible 100 points – the highest rating for an automobile ever. In 2013 Motor Trend had its first ever unanimous selection of the Best Car of the Year when all the judges selected the Model S. The Model S, and the Roadster before it, have won over customers not just because they use less petroleum – but rather because the speed, handling, acceleration, fit and detail, design and ride are considered extremely good – even when comparing with the likes of Mercedes and BMW – and when you don’t even consider it is an electric car.

It is a gross mis-assumption to say people buy Teslas because they are electric powered. People are buying Teslas because they are great cars which are fun to drive, perform well, look stylish, have low maintenance costs and very low operating costs. And they are more ecological in a world where people increasingly care about “going green.” In 2015 consumers will be able to choose not only the Roadster, and the fairly pricey Model S, but soon enough the smaller, and less expensive, Model 3 which is targeted squarely at BMW Series 3 customers. Teslas are designed to compete with all cars for consumer dollars, not just electric cars and not just on the basis of using less fuel.

Second, the market for autos is global and gasoline isn’t cheap everywhere. Take for example Hong Kong, where gasoline still retails for $8.50/gallon (as of 31Dec. 2014.) Or in Paris or Munich where gasoline costs $5/gallon – even though the Euro’s value has shrunk to only $1.20. Outside the USA most developed countries have a lot more demand for oil than they have production (if they have any at all.)

Almost all of these countries offer incentives for buying electric cars. For example, in Hong Kong and Singapore the import tax on an auto can be 100-200% of the car’s price (literally double or triple the price due to import taxes.) But in these same countries the tax is greatly reduced, or eliminated entirely, for buying an electric car for policy reasons to promote lower oil consumption and cleaner city air. So a $100,000 Mercedes E class in Hong Kong will cost $200,000+, while a $100,000 Model S costs $100,000.

Further, outside the USA most countries heavily tax gasoline and diesel in order to discourage consumption and yield infrastructure funds. So even as oil prices go down, gasoline prices do not decline in lock-step with oil price declines. Consumers in these countries have a much greater demand than U.S. consumers for high mileage (and electric) cars almost regardless of crude oil prices. So thinking that low USA gasoline prices reduces demand for electric cars is actually quite myopic.

Third, do you really think oil prices will stay low forever? Oil is a commodity with incredible political impact. Pricing is based on much more than “supply and demand.” At any given time Aramco, or its lead partners such as Saudi Arabia and the UAE, can decide to simply pump more, or less fuel. Today they are happy to pump a lot of oil because it hurts countries with which they have a bone to pick – such as Russia (now almost out of bank reserves due to low oil prices) and Iran. And it helps USA consumers, reducing domestic interest in things like the Keystone Pipeline which could lessen long-term reliance on Aramco oil. And investing in risky development projects like the arctic ocean. Tomorrow these countries could decide to pump less, as they did in the mid-1970s, driving up prices and almost killing the U.S. economy.

Oil prices have a long history of instability. Like most commodities. That’s why a state economy like Texas, where they produce a lot of oil, could boom the last 4 years, while manufacturing states (like Wisconsin and Illinois) suffered. With oil back under $50/barrel drilling rigs will go into mothballs, oil leases will go undeveloped, fracking projects will be stalled and the economy of oil producing states will suffer. Like happened in the mid-1980s when Saudi Arabia once again began flooding the market with oil and exploration and production companies across Texas went out of business.

Most people are smart enough to realize you look at all aspects of owning a new car. There are a lot of reasons to buy Tesla automobiles. Not only are they good cars, but they are changing the sales model by eliminating those undesirable auto dealers most consumers hate. And they are offering charging stations in many locations to make refills painless. And you don’t have to change the oil, or do quite a bit of other maintenance. And you do less damage to the environment. It’s not simply a matter of the price of fuel.

It is always risky to oversimplify consumer behavior. Decisions are rarely based entirely on price. And, as Apple has shown with sales if iOS devices and Macs, people often buy more expensive products when they offer a better experience and brand. Long term investors know that when a stock is beaten down by a short-term reaction to a short-term phenomenon (such as this fast decline in oil prices) it often creates an opportunity to buy into a company with a great future potential for growth.

by Adam Hartung | Dec 18, 2014 | Current Affairs, Defend & Extend, Food and Drink, Leadership, Lifecycle

It is that time of year when many of us celebrate with an alcoholic beverage. But increasingly in America, that beverage is not beer. Since 2008, American beer sales have fallen about 4%.

But that decline has not been equally applied to all brands. The biggest, old line brands have suffered terribly. Nearly gone are old brands like Milwaukee’s Best, which were best known for being low priced – and certainly not focused on taste. But the most hurt, based on volume declines, have been what were once the largest brands; Budweiser, Miller Lite and Miller High Life. These have lost more than a quarter of their volume, losing a whopping 13million barrels/year of demand. These 3 brand declines account for 6% reduction in the entire beer market.

The popular myth is that this has been due to the rise of craft beers. And there is no doubt, craft beer sales have done well. Sales are up 80%. Many articles (including the WSJ)tout the growth of craft beers, which are ostensibly more tasty and appealing, as being the reason old-line brands have declined. It is an easy explanation to accept, and has largely gone unchallenged. Even the brewer of Budweiser, Annheuser-Busch InBev, has reacted to this argument by taking the incredible action of dropping clydesdale horses from their ads after 81 years – in an effort to woo craft beer drinkers, which are thought to be younger and less sentimental about large horses.

This all makes sense. Too bad it’s the wrong conclusion – and the wrong actions being taken.

Realize that craft beer sales are up from a small base, and today ALL craft beer sales still account for only 7.6% of the market. In fact, ALL craft beers combined sell only the same volume as the now smaller Budweiser. The problem with Budweiser sales – and sales of other big name brand beers – is a change in demographics.

Drinkers of Budweiser and Lite are simply older. These brands rose to tremendous dominance in the 1970s. Many of those who loved this brand are simply older – or dead. Where a hard working fellow in his 30s or 40s might enjoy a six pack after work, today that Boomer (if still alive) is somewhere between late 50s and 70s. Now, a single beer, or maybe two, will suffice thank you very much. And, equally challenging for sales, today’s Boomer is more often drinking a hard liquor cocktail, and a glass of wine with dinner. Beer drinking has its place, but less often and in lower quantities.

Meanwhile, Hispanics are a growing demographic. Hispanics are the largest non-white population in America, at 54million, and represent over 17% of all Americans. With a growth rate of 2.1%, Hispanics are also one of the fastest growing demographic segments – and increasingly important given their already large size. Hispanics are truly becoming a powerful buying group in American economics.

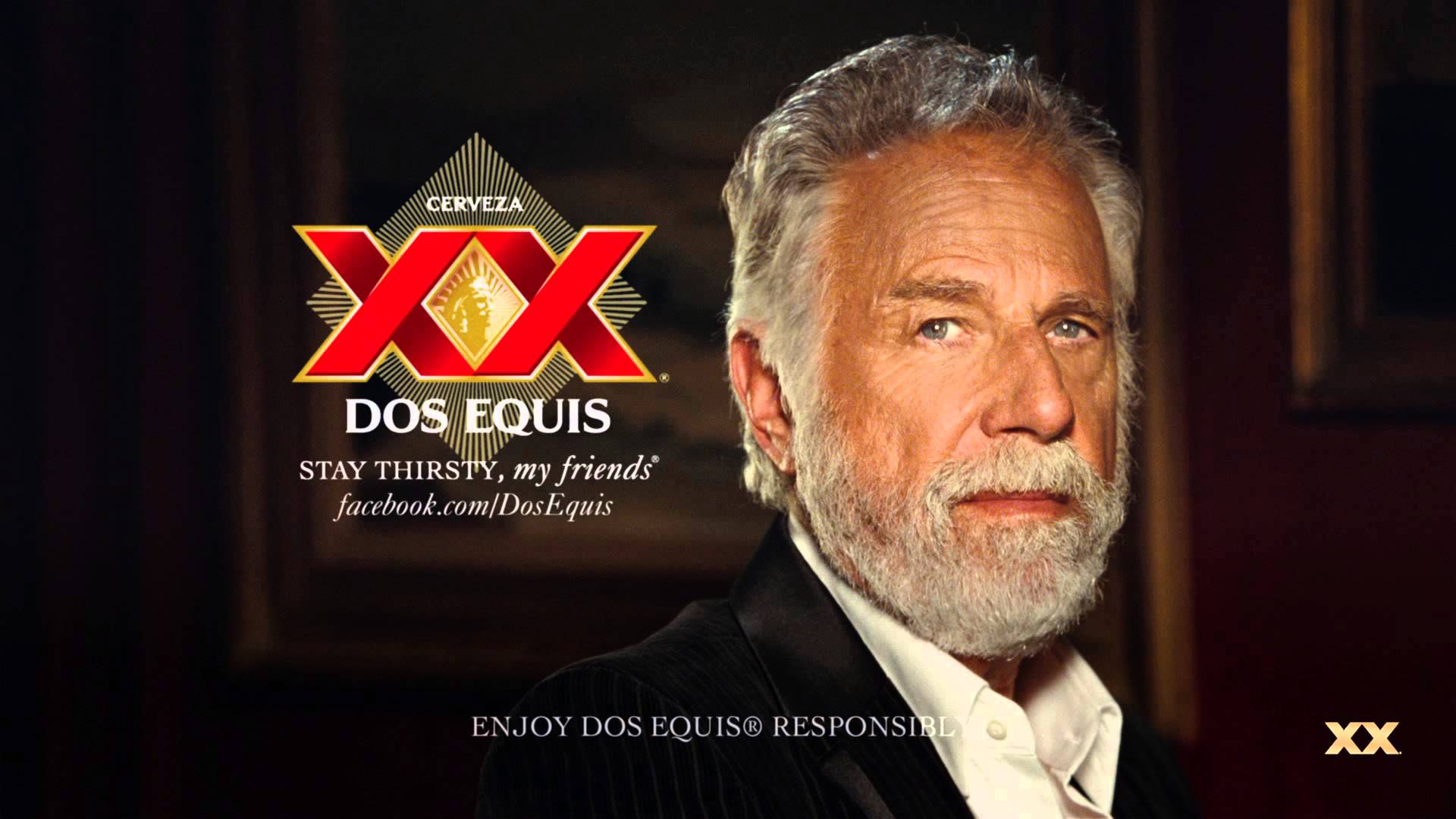

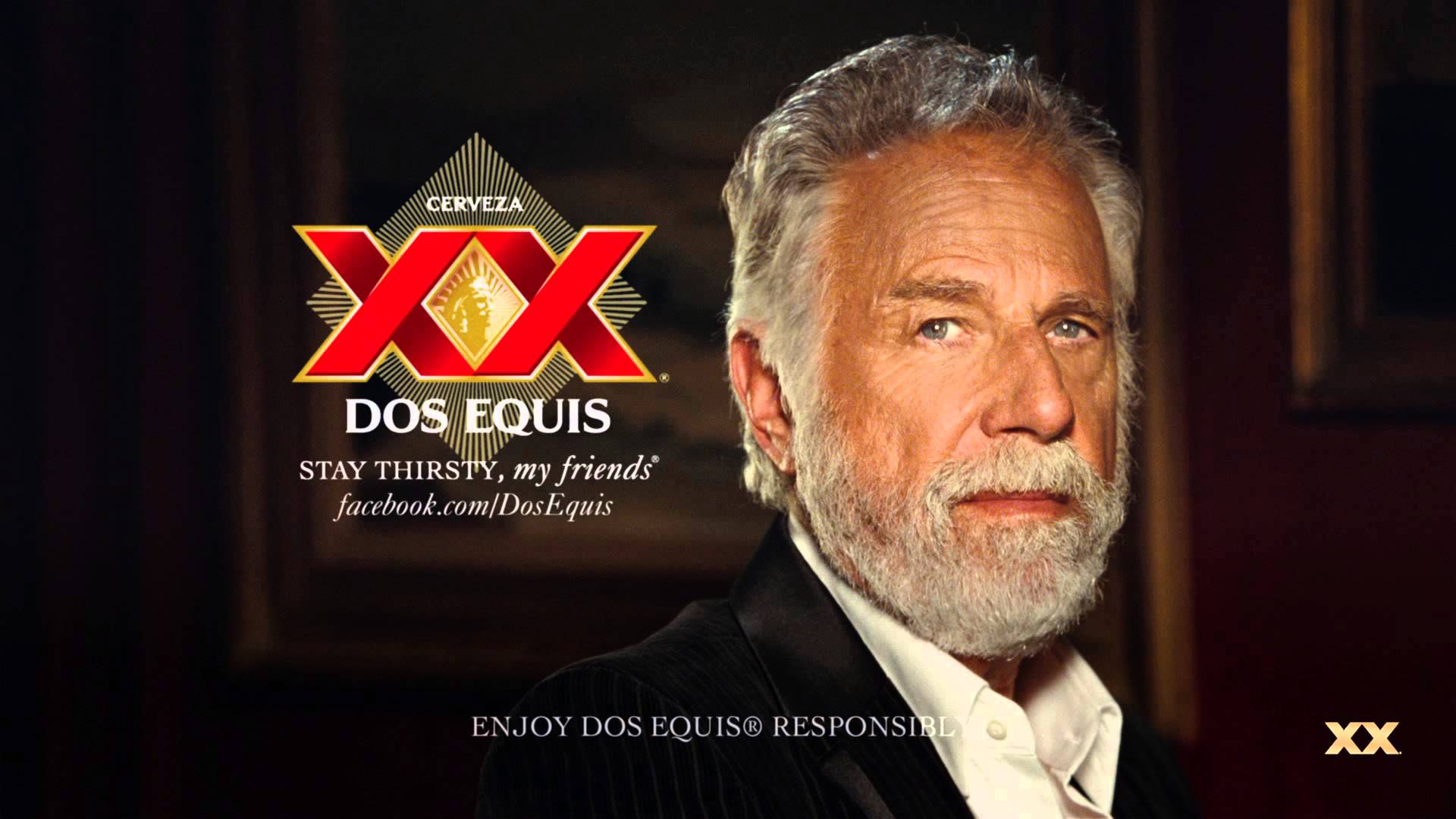

So, just as decline in Boomer population and consumption has hurt the once great beer brands, we can look at the growth in Hispanic demographics and see a link to sales of growing brands. Two significant (non-craft volume) beer brands that more than doubled sales since 2008 are Modelo Especial and Dos Equis. In fact, these were the 2 fastest growing brands in America, even though the first does no English language advertising at all, and the latter only lightly funds advertising with an iconic multi-year campaign. Together their sales total almost 5.4M barrels – which makes these 2 brands equal to 1/3 the ENTIRE craft beer marketplace. And growing 33% faster!

Chasing the myth of craft sales is doing nothing for InBev and MillerCoors as they try to defend and extend outdated brands. On the other hand, Heineken controls Dos Equis, and Constellation Brands controls Modello Especial. These two companies are squarely aligned with demographic trends, and well positioned for growth.

So, be careful the next time you hear some simple explanation for why a product or service is declining. The answer might sound appealing, but have little economic basis. Instead, it is much smarter to look at big trends and you’ll likely see why in the same market one product is growing, while another is declining. Trends – such as demographics – often explain a lot about what is happening, and lead you to invest much smarter.

by Adam Hartung | Dec 11, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television, Web/Tech

The trend toward the death of broadcast TV as we’ve known it keeps moving forward. This trend may not happen as fast as the death of desktop computers, but it is a lot faster than glacier melting.

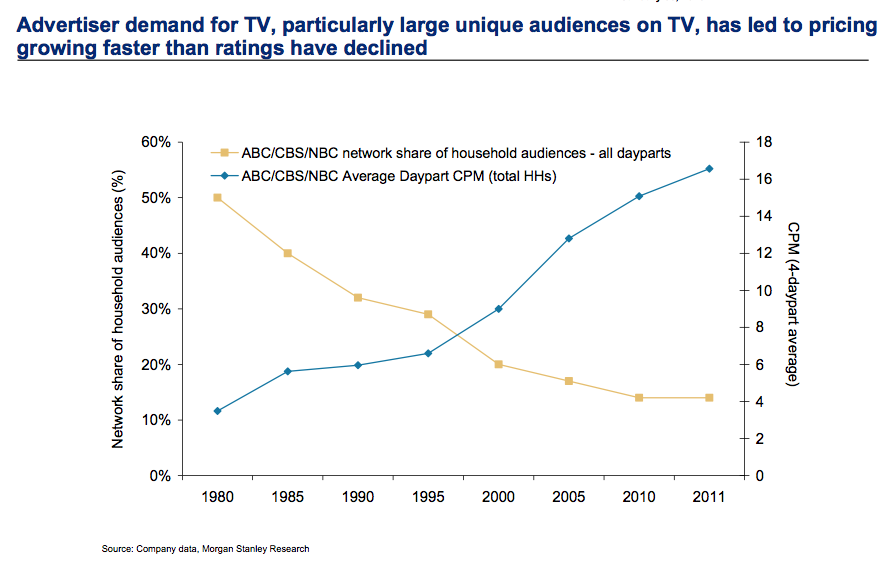

This television season (through October) Magna Global has reported that even the oldest viewers (the TV Generation 55-64) watched 3% less TV. Those 35-54 watched 5% less. Gen Xers (25-34) watched 8% less, and Millenials (18-24) watched a whopping 14% less TV. Live sports viewing is not even able to maintain its TV audience, with NFL viewership across all networks down 10-19%.

Everyone knows what is happening. People are turning to downloaded entertainment, mostly on their mobile devices. With a trend this obvious, you’d think everyone in the media/TV and consumer goods industries would be rethinking strategy and retooling for a new future.

But, you would be wrong. Because despite the obviousness of the trend, emotional ties to hoping the old business sticks around are stronger than logic when it comes to forecasting.

CBS predicted at the beginning of 2014 TV ad revenue would grow 4%. Oops. Now CBS’s lead forecaster is admitting he was way off, and adjusted revenues were down 1% for the year. But, despite the trend in viewer behavior and ad expenditures in 2014, he now predicts a growth of 2% for 2015.

That, my young friends, is how “hockey stick” forecasts are created. A lot of old assumptions, combined with a willingness to hope trends will be delayed, and you can ignore real data while promising people that the future will indeed look like the past – even when it defies common sense.

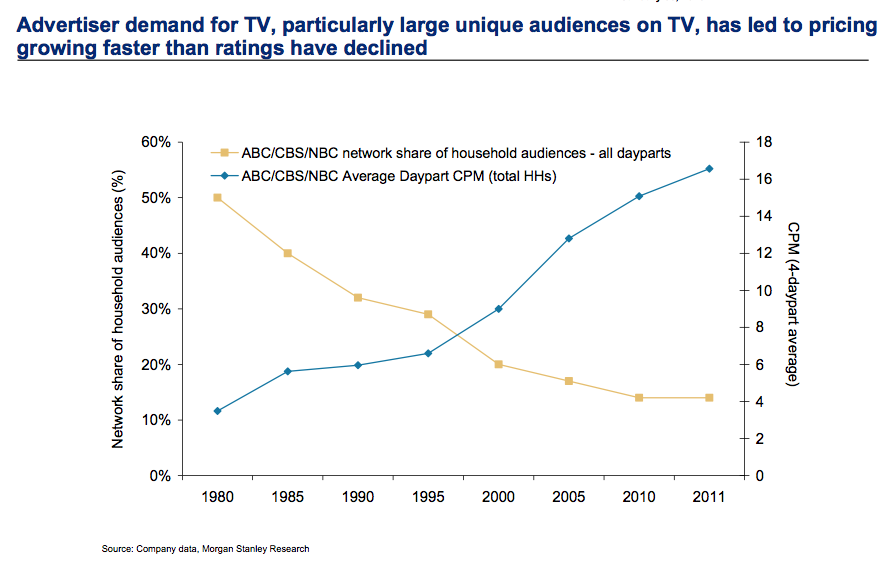

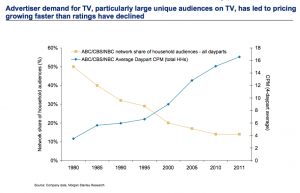

To compensate for fewer ads the networks have raised prices on all ads. But how long can that continue? This requires a really committed buyer (read more about CMO weaknesses below) who simply refuses to acknowledge the market has shifted and the dollars need to shift with it. That cannot last forever.

Meanwhile, us old folks can remember the days when Nielsen ratings determined what was programmed on TV, as well as what advertisers paid. Nielsen had a lock on measuring TV audience viewing, and wielded tremendous power in the media and CPG world.

But now AC Nielsen is struggling to remain relevant. With TV viewership down, time shifting of shows common and streaming growing like the proverbial weed Nielsen has no idea what entertainment the public watches. They don’t know what, nor when, nor where. Unwilling to move quickly to develop tools for catching all the second screen viewing, Nielsen has no plan for telling advertisers what the market really looks like – and the company looks to become a victim of changing markets.

Which then takes us to looking at those folks who actually buy ads that drive media companies. The Chief Marketing Officers (CMOs) of CPG companies. Surely these titans of industry are on top of these trends, and rapidly shifting their spending to catch the viewers with the most ads placed for the lowest cost.

You would wish.

Unfortunately, because these senior executives are in the oldest age groups, they are a victim of their own behavior. They still watch TV, so assume others must as well. If there is cyber-data saying they are wrong, well they simply discount that data. The Nielsen’s aren’t accurate, but these execs still watch the ratings “because it’s the best info we have” – a blatant untruth by the way. But Nielsen does conveniently reinforce their built in assumptions, and their hope that they won’t have to change their media spend plans any time soon.

Further, very few of these CMOs actually use social media. The vast majority watch their children, grandchildren and young employees use mobile devices constantly – and they bemoan all the activity on YouTube, Facebook, Instagram and Twitter – or for the most part even Linked-in. But they don’t actually USE these products. They don’t post information. They don’t set up and follow channels. They don’t connect with people, share information, exchange photos or tell stories on social media. Truthfully, they ignore these trends in their own lives. Which leaves them woefully inept at figuring out how to change their company marketing so it can be more relevant.

The trend is obvious. The answer, equally so. Any modern marketer should be an avid user of social media. Most network heads and media leaders are farther removed from social media than the Pope! They don’t constantly download entertainment, and exchanging with others on all the platforms. They can’t manage the use of these channels when they don’t have a clue how they work, or how other people use them, or understand why they are actually really valuable tools.

Are you using these modern tools? Are you actually living, breathing, participating in the trends? Or are you, like these outdated execs, biding your time wasting money on old programs while you look forward to retirement? And likely killing your company.

When trends emerge it is imperative we become part of that trend. You can’t simply observe it, because your biases will lead you to hope the trend reverts as you continue doing more of the same. A leader has to adopt the trend as a leader, be a practicing participant, and learn how that trend will make a substantial difference in the business. And then apply some vision to remain relevant and successful.

by Adam Hartung | Nov 28, 2014 | Current Affairs, Innovation, Leadership, Web/Tech

Last week I gave 1,000 VHS video tapes to Goodwill Industries. These had been accumulated through 30 years of home movie watching, including tapes purchased for entertaining my 3 children.

It was startling to realize how many of these I had bought, and also surprising to learn they were basically valueless. Not because the content was outdated, because many are still popular titles. But rather because today the content someone wants can be obtained from a streaming download off Amazon or Netflix more conveniently than dealing with these tapes and a mechanical media player.

It isn’t just a shift in technology that made those tapes obsolete. Rather, a major trend has shifted. We don’t really seek to “own” things any more. We’ve become a world of “renters.”

The choice between owning and renting has long been an option. We could rent video tapes, and DVDs. But even though we often did this, most Boomers also ended up buying lots of them. Boomers wanted to own things. Owning was almost always considered better than renting.

Boomers wanted to own their cars, and often more than one. Auto renting was only for business trips. Boomers wanted to own their houses, and often more than one. Why rent a summer home, when, if you could afford it, you could own one. Rent a boat? Wouldn’t it be better to own your own boat (even if you only use it 10 times/year?)

Now we think very, very differently. I haven’t watched a movie on any hard media in several years. When I find time for video entertainment, I simply download what I want, enjoy it and never think about it again. A movie library seems – well – unnecessary.

As a Boomer, there’s all those CDs, cassette tapes (yes, I have them) and even hundreds of vinyl records I own. Yet, I haven’t listened to any of them in years. It’s far easier to simply turn on Pandora or Spotify – or listen to a channel I’ve constructed on YouTube. I really don’t know why I continue to own those old media players, or the media.

Since the big real estate meltdown many people are finding home ownership to be not as good as renting. Why take such a huge risk, paying that mortgage, if you don’t have to?

That this is a trend is even clearer generationally. Younger people really don’t see the benefit of home ownership, not when it means taking on so much additional debt. Home ownership costs are so high that it means giving up a lot of other things. And what’s the benefit? Just to say you own your home?

Where Boomers couldn’t wait to own a car, young people are far less likely. Especially in, or near, urban areas. The cost of auto ownership, including maintenance, insurance and parking, becomes really expensive. Compared with renting a ZipCar for a few hours when you really need a car, ownership seems not only expensive, but a downright hassle.

And technology has followed this trend. Once we wanted to own a PC, and on that PC we wanted to own lots of data – including movies, pictures, books – anything that could be digitized. And we wanted to own software applications to capture, view, alter and display that data. The PC was something that fit the Boomer mindset of owning your technology.

But that is rapidly becoming superfluous. With a mobile device you can keep all your data in a cloud. Data you want to access regularly, or data you want to rent. There’s no reason to keep the data on your own hard drive when you can access it 24×7 everywhere with a mobile device.

And the same is true for acting on the data. Software as a service (SaaS) apps allow you to obtain a user license for $10-$20/user, or $.99, or sometimes free. Why spend $200 (or a lot more) for an application when you can accomplish your task by simply downloading a mobile app?

So I no longer want to own a VCR player (or DVD player for that matter) to clutter up my family room. And I no longer want to fill a closet with tapes or cased DVDs. Likewise, I no longer want to carry around a PC with all my data and applications. Instead, a small, easy to use mobile device will allow me to do almost everything I want.

It is this mega trend away from owning, and toward a simpler lifestyle, that will end the once enormous PC industry. When I can do all I really want to do on my connected device – and in fact often do more things because of those hundreds of thousands of apps – why would I accept the size, weight, complexity, failure problems and costs of the PC?

And, why would I want to own something like Microsoft Office? It is a huge set of applications which contain dozens (hundreds?) of functions I never use. Wouldn’t life be much simpler, easier and cheaper if I acquire the rights to use the functionality I need, when I need it?

There was a time I couldn’t imagine living without my media players, and those DVDs, CDs, tapes and records. But today, I’m giving lots of them away – basically for recycling. While we still use PCs for many things today, it is now easy to visualize a future where I use a PC about as often as I now use my DVD player.

In that world, what happens to Microsoft? Dell? Lenovo?

The implications of this are far-reaching for not only our personal lives, and personal technology suppliers, but for corporate IT. Once IT managed mainframes. Then server farms, networks and thousands of PCs. What will a company need an IT department to do if employees use their own mobile devices, across common networks, using apps that cost a few bucks and store files on secure clouds?

If corporate technology is reduced to just operating some “core” large functions like accounting, how big – or strategic – is IT? The “T” (technology) becomes irrelevant as people focus on gathering and analyzing information. But that’s not been the historical training for IT employees.

Further, if Salesforce.com showed us that even big corporations can manage something as critical as their customer information in a SaaS environment on mobile devices, is it not possible to imagine accounting and supply chain being handled the same way? If so, what role will IT have at all?

The trend toward renting rather than owning is monumental. It affects every business. But in an ironic twist of fate, it may dramatically reduce the focus on IT that has been so critical for the Boomer generation.

by Adam Hartung | Nov 19, 2014 | Current Affairs, Leadership

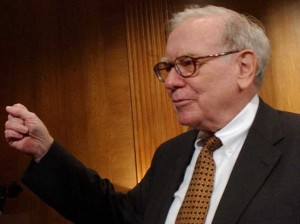

Warren Buffett is the famous head of Berkshire Hathaway. Famous because he has made himself a billionaire several times over, and made his investors excellent returns.

Berkshire Hathaway doesn’t really make anything. Rather, it owns companies that make things, or supply services. So when you buy a share of BRK you are actually buying a piece of the companies it owns, and a piece of the over $116B it invests in equities of other public companies from the cash flow of its owned entities.

Over the last decade the value of a share of BRK has increased 149%. Pretty darn good, considering the DJIA (Dow Jones Industrial Average) has only increased 64%, and the S&P 500 69%, in the same time period. So for long-term investors, putting your money with Mr. Buffett would have done more than twice as good as buying one of these leading indices.

For this reason, many investors recommend looking at what Berkshire Hathaway buys in its equity portfolio, and then buying those same stocks. On the face of it, seems smart. “Invest like Warren Buffet” one might say.

But that would be a bad idea. Berkshire Hathaway’s value has little to do with the publicly traded equities it owns. In fact, those holdings may well be a damper on BRKs valuation.

Of that giant portfolio, 4 equities make up 58% of the total holdings. Let’s look at how those have done the last decade:

- American Express (AXP,) about 10% of the portfolio, is up 83%

- Coke (KO,) about 15% of the portfolio, is up 109%

- IBM (IBM,) about 10% of the portfolio, is up 64%

- Wells Fargo (WFC,) nearly 25% of the portfolio) is up 71%

Note – not one of these stocks is up anywhere near as much as Berkshire Hathaway. There is no mathematical formula which one can use to multiply the gains on these stocks and interpret that into an overall value increase of 149%!

There are several other large, well known companies in the Berkshire Hathaway portfolio which have large (millions of shares being held) but lesser percentage positions:

- ExxonMobil (XOM) up 86%

- General Electric (GE) down <26%>

- Proctor & Gamble (PG) up 61%

- USBancorp (USB) up 40%

- USG (USG) down <30%>

- UPS up 24%

- Verizon up 38%

- Walmart up 61%

This is not to say that Berkshire Hathaway has owned all these stocks for 10 years. And, this is not all the portfolio. But it is well known that Mr. Buffett is a long-term investor who eschews short-term trading. And, these are at least randomly representative of the portfolio holdings. So by buying and selling shares at different times, and using various trading strategies, BRK’s returns could be somewhat better than the performance of these stocks. But, again, there is no arithmetic which exists that can turn the returns on these common stocks into the 149% gain which Berkshire Hathaway has achieved.

Simply put, Berkshire Hathaway makes money by doing things that no individual investor could ever accomplish. The cash flow is so enormous that Mr. Buffett is able to make deals that are not available to you, me or any other investor with less than $1B (or more likely $10B.)

When the banks looked ready to melt down in 2008 GE was in a world of hurt for money to shore up problems in its GE Capital unit. When GE went out to raise $12B via a common stock sale it turned to Mr. Buffett to lead the investment. And he did, taking a $6B position. For being so gracious, in addition to GE shares Berkshire Hathaway was able to buy $3B in preferred shares with a guaranteed dividend of 10%! Additionally, Mr. Buffett was given warrants allowing him to buy up to $3B of GE shares for a fixed price of $22.25 per share regardless of the price at which GE was trading. These are what are called “sweeteners” in the financial trade. They greatly reduce the risk on the common stock purchase, and simultaneously dramatically improve the returns.

These “sweeteners” are not available to us average, ordinary investors. And this is critical to understand. Because if someone thought that Mr. Buffett made all that money by being a good stock picker, that someone would be operating on the wrong assumption. Mr. Buffett is a very good deal maker who gets a lot more when making his investments than we get. He can do that because he can move so much money, so quickly. Faster even than any large bank.

Take, for example, the recent deal for Berkshire Hathaway to acquire the Duracell battery business from P&G. Where most of us (individuals or corporations) would have to fork over the $3B that P&G wanted, Berkshire Hathaway can simply give back P&G shares it has long held. By exchanging those shares for Duracell, Berkshire avoids paying any tax on the stock gains – thus using P&G shares in its portfolio as a currency to buy the battery business with pre-tax dollars rather than the after-tax dollars the rest of us would have to put up. In a nutshell, that saves at least 35%. But, beyond that, the deal also allows P&G to sell Duracell without having to pay tax on the assets from their end of the transaction, saving P&G 35% as well. To make the same deal, any other buyer would have been required to pay a lot more money.

Acquiring Duracell Berkshire gets 100% of another slow-growth but very good cash flow company (like Dairy Queen, Burlington Northern Rail, etc.) and does so at a very favorable price. This deal adds more cash flow to BRK, more assets to BRK, and has nothing to do with whether or not the stocks in its public equity portfolio are outperforming the DJIA or S&P.

This in no way diminishes Berkshire Hathaway, or Mr. Buffett. But it points out that many people have very bad assumptions when it comes to understanding how Mr. Buffett, or rather Berkshire Hathaway, makes money. Berkshire Hathaway is not a mutual fund, and no investor can make a fortune by purchasing common shares in the companies where Mr. Buffett invests.

Berkshire Hathaway is an extremely complicated company, and deep in its core it is an institution that has a tremendous understanding of financial instruments, financial markets, tax laws and risk. It has long owned insurance companies, and its leaders understand actuarial tables as well as how to utilize complex financial instruments and sophisticated tax opportunities to reduce risk, and raise returns, on deals that no one else could make.

By maximizing cash flow from its private holdings the Berkshire Hathaway constantly maintains a very large cash pool (currently some $60B) which it can move very, very quickly to make deals nobody, other than some of the largest private equity pools, could obtain.

The process by which Berkshire Hathaway decides to buy, hold or sell any security is unique to Berkshire Hathaway. The size of its transactions are enormous, and where we as individuals buy shares by the hundreds (the old “round lot,”) Berkshire buys millions. What stocks Berkshire Hathaway chooses to buy, hold or sell has much more to do with the unique situation of Berkshire Hathaway than stock price forecasts for those companies.

It is a myth for an individual investor to think they could invest like Mr. Buffett, and trying to emulate his returns by emulating the Berkshire portfolio is simply unwise.

by Adam Hartung | Nov 12, 2014 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Leadership

We see it all too often. A successful business seems to lose its way. Somehow, after decades of success, its results soften, then tumble and the company becomes a victim of its competition. We scratch our heads and wonder, “why did that happen?”

Pizza Hut is well on its way to disappearing. Kind of like Pizza Inn, A&W and Howard Johnson’s. And that seems kind of remarkable considering the company at one time defined pizza for most Americans. From a fast growing franchise in the 1960s to a high profile acquisition by PepsiCo in the 1970s, to anchoring the Yum Brands spin out from PepsiCo in 1997, Pizza Hut just finished 8 straight quarters of declining same store sales. Pizza Hut was once a concept as hot as Apple Stores, but now it looks more like Sears. How could this happen?

When Pizza Hut was growing it locked in on its success formula. And one of the biggest Lock-ins was its name. Pizza Hut was a place where you ate pizza, and the buildings all looked the same with that hut-like red roof. At a time when few Americans outside the northeast ate pizza, this Wichita, Kansas founded (and headquartered until the 1990s) company told people what a pizzeria should look like, and what you should eat.

The company was ardent about controlling what franchisees served. No nachos, or other trendy foods, because they didn’t fit the pizza theme. No delivery, because good pizza required you eat it immediately from the oven. Pizza should be thick and hearty, even served in a deep dish so you have plenty of bread and feel really full. Whether anyone in Italy ever a pizza anything like this really did not matter.

And Pizza Hut would help guide customers as to what toppings they wanted — and usually there should be at least 3 – by offering pre-designed pizzas with names like “meat lovers,” “supreme,” “super supreme” or “veggie lover’s” so an uninformed clientele (originally prairie state, then midwestern, then expanding into the southwest and the south) could buy the product without a lot of fuss.

This success formula may sound cliche today, but it worked. And it worked really well for 30 years, then pretty well for another 10-15. But, eventually, doing the same thing over, and over, and over, and over had less appeal. Almost everyone in the country knew what a Pizza Hut was, what the stores looked like and what the product was like. Competitors came along by the dozens with all kinds of variations, and different kinds of service – like being in a mall, or delivering the product. Inevitably this competition led to price wars. To keep customers Pizza Hut had to lower its prices, even offering 2 pizzas for the price of one. Pizza Hut never lost track of its success formula, and never stopped doing what once made it great. But margins eroded, and then sales started declining.

Lots of people don’t care about Pizza Hut any more. They want an alternative. An alternative product, like California Pizza Kitchen or Wolfgang Pucks. Or an alternative to pizza altogether like the new “fast casual” chains such as Chipotle’s, Baja Fresh or Panera. For a whole raft of reasons, people decided that although they once ate Pizza Hut (even ate a LOT of it) they were going to eat something else.

But Pizza Hut was locked in. First, its name. Pizza. Hut. To fulfill the “brand promise” of that name everything about that store is pre-designed. From the outside to the inside tables to the equipment in the kitchen. 6,300 stores that are almost identical. Any change and you have to make 6,300 changes. Adding new product categories means reprinting 126,000 menus, changing 6,300 kitchen layouts, buying 6,300 new ovens, figuring out the service utensils for 6,300 wait staff. That’s lock-in. Making any change is so hard that the incentive is entirely toward improve what you’ve always done rather than doing something new.

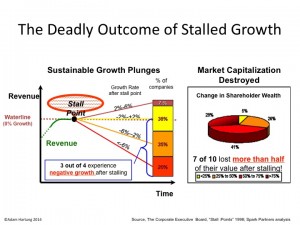

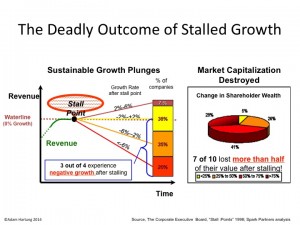

Growth Stalls are Deadly

Eventually, like Pizza Hut, growth stalls. It only takes 2 quarters of declining sales to hit a growth stall, and when that happens less than 7% of businesses will ever again consistently grow at a meager 2%. Growth stalls tell us “hey, the market shifted. What you’re doing isn’t selling any more.”

But most management teams don’t think about a market shift, and instead react by trying to do more of the same. They treat this like its an operational problem. More quality campaigns, more money spent on advertising, more promotions, asking employees to work a little harder, more product for the same (or lower) price – more, better, faster, cheaper. But this doesn’t work, because the problem lies in a market shift away from your “core” that requires an entirely different strategy.

Because management is incented to ignore this shift as long as possible, the company soon becomes irrelevant. Customers know they’ve been going to competitors, and they start to realize it’s been a long time since they bought from that old supplier. They realize their interest in that old company and its products has simply gone away. They don’t pay attention to the ads. And they don’t have any interest in new product announcements. Actually, they find the company irrelevant. Even when the discounts are big, they don’t buy. They do business where they identify with the company and its products, even when those products cost more.

And thus the results start to tumble horribly. Only by now management is so far removed from market trends that it has no idea how to regain relevancy. In Pizza Hut’s case, leadership is undertaking what they’d like to think is a brand overhaul that will change its position in customers’ minds. But, unfortunately, they are doing the ultimate in defend & extend management to try and save the old success formula.

Pizza Hut is introducing a maze of new ways to have its old product, in its old stores. 10 crust choices, 6 sauce choices, 22 of those pre-designed pizza offerings, 5 different liquids you can have dribbled over the pizza, and a rash of exotic new toppings – like banana. So now you can order your pizza 1,000 different ways (actually, more like 10,000.) Oh, and this is being launched with a big increase in traditional advertising. In other words, an insane implementation of what the company has always done; giving customers an American style pizza, in a hut, promoted on TV – even most likely buying what is now considered iconic – a Super Bowl ad.

Yum Brands investors have reasons to be concerned. Pizza Hut is really important to sales and earnings. But its leaders are intent on doing more of the same, even though the market has already shifted. The prognosis does not look good.