by Adam Hartung | May 31, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Web/Tech

Information technology (IT) services company Computer Sciences Corporation (CSC) recently announced it is splitting into two separate companies. One will “focus” on commercial markets, the other will “focus” on government contracts. Ostensibly, as we’ve heard before, leadership would like investors, employees and customers to believe this is the answer for a company that has incurred a number of high profile failed contracts, a turnover in leadership, vast losses and declining revenue.

Oh boy.

After years of poor performance, and an investigation by the UK parliament into a failed contract for the National Health Services, in 2012 CSC brought in a new CEO. Like most new CEOs, his first action was to announce a massive cost-cutting program. That primarily meant vast layoffs. So out the door went thousands of people in order to hopefully improve the P&L.

Only a services company doesn’t have any hard assets. The CSC business requires convincing companies, or government agencies, to let them take over their data centers, or PC deployment, or help desk, or IT development, or application implementation – in other words to outsource some part (or all) of the IT work that could be done internally. Winning this work has been an effort to demonstrate you can hire better people, that are more productive, at lower cost than the potential client.

So when CSC undertook a massive layoff, service levels declined. It was unavoidable. Where before CSC had 10 people doing something (or 1,000) now they have 7 (or 700). It’s not hard to imagine what happens next. Morale declines as layoffs ensue, and the overworked remaining employees feel (and perhaps really are) overworked. People leave for better jobs with higher pay and less stress. Yet, the contract requirements remain, so clients often start complaining about performance, leading to more pressure on the remaining employees. A vicious whirlpool of destruction starts, as things just keep getting worse.

Immediately after taking the CEO job in 2012 Mike Lawrie declared a massive $4.3B loss. This allowed him to “bring forward” anticipated costs of the anticipated layoffs, cancelled contracts, etc. Most importantly, it allowed him to “cost shift” future costs into his first year in the job – the year in which he would not be fired, regardless how much he wrote off. This is a classic financial machination applied by “turnaround CEOs” in order to blame the last guy for not being truthful about how badly things were, while guaranteeing the end of the new guy’s first year would show a profit due to the huge cost shift.

True to expectations, after one year with Lawrie as CEO, CSC declared a $1B profit for fyscal 2013 (about 20% of the previous write-off.) But then fyscal 2014 returned to the previous norm, as profits shrunk to just $674M on about $12B revenues (~5% net margin.) For 4th quarter of fyscal 2015 revenues dropped another 12.6% – not hard to imagine given the layoffs and ensuing customer dissatisfaction. Most troubling, the commercial part of CSC, which represents 75% of revenue, saw all parts of the business decline between 15-20%, while the federal contracting (much harder to cancel) remained flat. This is not the trajectory of a turnaround.

CEO Lawrie blames the deteriorating performance on execution missteps. And he has promised to keep his eyes carefully on the numbers. Although he has admitted that he doesn’t really know when, or if, CSC will return to any sort of growth.

No wonder that for more than a year prior to this split CSC was unable to sell itself. Despite a lot of hard effort, no banker was able to put together a deal for CSC to be purchased by a competitor or a private banking (hedge fund) operation.

If none of the professionals in making splits and turnarounds were willing to take on this deal, why should individual investors? In this case, watching people walk away should be a clear indicator of how bad things are, and how clueless leadership is regarding a fix for the problems.

The real problem at CSC isn’t “execution.” The real problem is that the market has shifted substantially. For decades CSC’s outsourcing business was the norm. But today companies don’t need a lot of what CSC outsources. They are closing down those costly operations and replacing them with cloud services, cloud application development and implementation, mobile deployments and significant big data analytics. Or looking for new services to solve problems like cybersecurity threats. CSC quite simply hasn’t done anything in those markets, and it is far, far behind. It is a big dinosaur rapidly being overtaken by competitors moving more quickly to new solutions.

One of CSC’s biggest competitors is IBM, which itself has had a series of woes. However, IBM has very publicly set up a partnership with Apple and is moving rapidly to develop industry-specific software as a service (SaaS) offerings that are mobile and operate in the cloud. These targeted enterprise solutions in health care, finance and other industries are designed to make the services offered by CSC obsolete.

Although it may have had a huge client base of 1,000 customers. And CSC brags that 175 of the Fortune 500 buy some services from it, exactly what does CSC bring to the table to keep these customers? Years of cost cutting means the company has not invested in the kinds of solutions being offered by IBM and competitors such as Accenture, HP and Dell domestically – and WiPro, TCS (Tata Consulting Services,) Infosys and Cognizant offshore. Not to mention dozens of up-and-coming small competiters who are right on the market for targeted solutions with the latest technology such as 6D Gobal Technologies. CSC is still stuck in its 1980s consulting model, and skill set, in a world that is vastly different today.

CSC has no idea how to “focus” on clients. That would mean investing in modern solutions to rapidly changing client needs. CSC failed to do that 15 years ago when most outsourcing involved heavy use of offshore resources. And CSC has never caught up. Leadership overly relied on selling old services, and discounting. It’s model caused it to underbid projects, until the UK government almost shut the company down for its inability to deliver, and constantly hiding actual results.

CSC has no idea how to “focus” on clients. That would mean investing in modern solutions to rapidly changing client needs. CSC failed to do that 15 years ago when most outsourcing involved heavy use of offshore resources. And CSC has never caught up. Leadership overly relied on selling old services, and discounting. It’s model caused it to underbid projects, until the UK government almost shut the company down for its inability to deliver, and constantly hiding actual results.

Now CSC lacks any of the capabilities, people or skills to offer clients what they want. Its diffuse customer base is more a liability than a benefit, because these customers are “end of life” for the services CSC offers. Years of declining revenues demonstrate that as value declines, contracts are either allowed to go to very cheap offshore providers, lapse completely or cancelled early in order to shift client resources to more important projects where CSC cannot compete.

This split is just an admission that leadership has no idea what to do next. Customers are leaving, and revenues are declining. Margins, at 5%, are terrible and there is no money to invest in anything new. Some of the world’s best investors have looked at CSC deeply and chosen to walk away. For employees and individual investors it is time to admit that CSC has a limited future, and it is time to find far greener pastures.

by Adam Hartung | May 12, 2015 | Current Affairs, Leadership

NFL Commissioner Roger Goodall slammed Tom Brady and the New England Patriots today for what seemed, to many, like a pretty minor thing. Under-inflating balls to give the quarterback and receivers a small advantage would seem a far cry from the kind of offense causing you to suspend an MVP player for 4 games, fine the team owner $1M, and take away the coach’s #1 draft pick for 2016 and #4 draft pick for 2017.

But, largely, the Commissioner had little choice. And yes, he is making an example out of this situation.

In America the NFL is the sport. Where baseball was once “America’s game” that is no longer true. Today the NFL generates almost as much revenue as major league baseball (MLB) and the NBA combined. Players make more money than S&P 500 CEOs – and they are about the only people who do!

But the NFL has a raft of culture issues. First of all, it is really violent. The litany of players with lifetime injuries from football is remarkable. It seems like few who play in the NFL are able to go on to “regular lives” due to the remarkable stress the game puts on huge bodies colliding at remarkable speeds. There is no doubt that the game has led to many debilitating concussions, and players have been committing suicide at a surprising rate.

Remember “Bountygate?” From 2009 to 2011 the New Orleans Saints ownership and coaches paid players bonuses – “bounties” – if they injured an opposing player bad enough to have him removed from the game. This kind of thing was found to be endemic, and that some coaches had long promoted paying for injuring opposing players.

That is the kind of testosterone driven behavior that the NFL’s leadership realized was going to seriously damage the game, if not push it into legal regulation. While some fans (and in football, fan is truly short for fanatic) may have thought the practice a terrific reincarnation of Roman gladiator games, culturally this kind of behavior made the game less “family friendly” and likely to end up with ever more legal problems. The coaches were suspended, and the team lost draft picks.

Unfortunately, the NFL – despite its high pay – is nothing like baseball when it was the glory sport of America. In those days players had strict behavioral rules, and they could lose money – even their jobs – for simply getting drunk in public, or caught fornicating with someone other than their wife. Arguing with umpires caused multi-game suspensions, and fans sought out players with the quiet demeanor of Joe Dimaggio.

The NFL is rife with players struggling with criminal prosecution. Between January and July of 2013, 27 players were arrested. Between 2000 and 2013 two teams had 40 players arrested, and one had 35. The three least criminalistic teams in the league had 9 to 11 players put in handcuffs. It is a far too common sight on the news – NFL players handcuffed, or explaining to cameras why they were arrested. This is a big problem for a league that would like its players to be role models, and encourage mothers to allow their children to play the game – or go to games.

The Patriots have had their own problems. In 2007 coach Patriots’ Belichick was caught stealing signals from the New York Jets coaches. “Spygate” caused Commissioner Goodall to fine the coach $500,000 – the largest fine in history to that date. Additionally the team was stripped of its 2008 first round draft and fined $250,000. It was another example, like Bountygate, of a culture accepting of the notion that owners, coaches and players should “do whatever it takes to win,” and rules (or etiquette) be darned.

Then in 2013 Patriots’ player Aaron Hernandez was arrested for murder. Eventually he was arrested on two additional murder counts, and in just the last few months he was convicted on murder charges. As the news rolled out, we learned Mr. Hernandez had a long criminal record, including bar fights and shootings, going back to 2007. It appears as if the Patriots and the NFL turned a blind eye toward a very dangerous person – in order for the team to win more games. The “win at all costs” again appeared to be culturally dominant.

Now we have “deflategate.” Coach Belichick again in the spotlight, apparently for trying more tricks to gain an advantage – even if unfair. As the investigation continued the question became “even if Tom Brady didn’t know why the balls were deflated, as someone who touched the ball on every play why didn’t he report the issue to his coaches? Why didn’t he take personal responsibility for what could well be a rule violation, and seek to find the true answer? Why didn’t he try to play by the rules, and take care of this issue?” Instead, it appeared he was more than happy to take advantage of the situation, even if it was against the rules. Again, win at all costs – including breaking the rules.

Unfortunately this is now moving into the stadium. In recent TV interviews several people have pooh-poohed the whole issue. “What’s the big deal? Really? All this fuss over something so small?” And the comment heard over and over in “man-on-the-street” interviews “if you get caught, you get penalized.” Really – not that Mr. Brady should have reported this situation and fixed it – but rather that he got caught is all that mattered. It’s OK to cheat, just don’t get caught.

The NFL has a culture issue. In some stadiums the language is so course, and the fans so rough, that minors should never attend. And, as we said in an earlier time, “unfit company for a lady.” Tied, unfortunately, to players and coaches who implement a culture of violence, cheating and doing whatever one must to win – rather than simply playing a game.

And that is where Commissioner Goodall has to take action. He leads the league. He is the “man at the top.” It is his job, as leader, to set the tone on culture. If the NFL is to be “America’s sport” it’s his job to set the cultural tone for the sport, and demonstrate good leadership for his business, the owners, the coaches and the players. If we want fans to be sportsmanlike, it has to start with the players and those who are part of the NFL.

So there is no choice but to make an example of Mr. Brady. He sensed there was a problem. But he would rather win, and be MVP, than be honest. Wow, what a role model. And Mr. Belichick, now in in controversy #2, leads us to question if anything matters to him other than winning a superbowl ring – even if it means hiring a gun-toting shooter who can’t stay out of bar fights. And the Commissioner, like many of us, has to wonder, what is going on in that Patriots’ organization that Mr. Robert Kraft owns? What cultural tone is he setting, as the man atop the team? Is his view “win at all costs” and the rules be darned?

The NFL has a culture problem. Commissioner Goodall has his hands full. He has to deal with individualistic owners, who are rich and very powerful in their local communities. He has fans that are often far more caring of their team winning than playing by the rules. And he has players that, too often, or a very short step from prison – or committing horrendous acts of violence on the field that can maim or kill another player. He has to take stiff action, when he can, if he is to make any difference at all in trying to keep this culture from going completely off the rails.

Learn more about my public speaking, Board involvement and growth consulting at www.AdamHartung.com, or connect with me on LinkedIn, Facebook and Twitter.

by Adam Hartung | May 8, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership

McDonald’s just had another lousy quarter. All segments saw declining traffic, revenues fell 11%. Profits were off 33%. Pretty well expected, given its established growth stall.

A new CEO is in place, and he announced is turnaround plan to fix what ails the burger giant. Unfortunately, his plan has been panned by just about everyone. Unfortunately, its a “me too” plan that we’ve seen far too often – and know doesn’t work:

- Reorganize to cut costs. By reshuffling the line-up, and throwing out a bunch of bodies management formerly said were essential, but now don’t care about, they hope to save $300M/year (out of a $4.5B annual budget.)

- Sell off 3,500 stores McDonald’s owns and operate (about 10% of the total.) This will further help cut costs as the operating budgets shift to franchisees, and McDonald’s book unit sales creating short-term, one-time revenues into 2018.

- Keep mucking around with the menu. Cut some items, add some items, try a bunch of different stuff. Hope they find something that sells better.

- Try some service ideas in which nobody really shows any faith, like adding delivery and/or 24 hour breakfast in some markets and some stores.

Needless to say, none of this sounds like it will do much to address quarter after quarter of sales (and profit) declines in an enormously large company. We know people are still eating in restaurants, because competitors like 5 Guys, Meatheads, Burger King and Shake Shack are doing really, really well. But they are winning primarily because McDonald’s is losing. Even though CEO Easterbrook said “our business model is enduring,” there is ample reason to think McDonald’s slide will continue.

Needless to say, none of this sounds like it will do much to address quarter after quarter of sales (and profit) declines in an enormously large company. We know people are still eating in restaurants, because competitors like 5 Guys, Meatheads, Burger King and Shake Shack are doing really, really well. But they are winning primarily because McDonald’s is losing. Even though CEO Easterbrook said “our business model is enduring,” there is ample reason to think McDonald’s slide will continue.

Possibly a slide into oblivion. Think it can’t happen? Then what happened to Howard Johnson’s? Bob’s Big Boy? Woolworth’s? Montgomery Wards? Size, and history, are absolutely no guarantee of a company remaining viable.

In fact, the odds are wildly against McDonald’s this time. Because this isn’t their first growth stall. And the way they saved the company last time was a “fire sale” of very valuable growth assets to raise cash that was all spent to spiffy up the company for one last hurrah – which is now over. And there isn’t really anything left for McDonald’s to build upon.

Go back to 2000 and McDonald’s had a lot of options. They bought Chipotle’s Mexican Grill in 1998, Donato’s Pizza in 1999 and Boston Market in 2000. These were all growing franchises. Growing a LOT faster, and more profitably, than McDonald’s stores. They were on modern trends for what people wanted to eat, and how they wanted to be served. These new concepts offered McDonald’s fantastic growth vehicles for all that cash the burger chain was throwing off, even as its outdated yellow stores full of playgrounds with seats bolted to the floors and products for 99cents were becoming increasingly not only outdated but irrelevant.

But in a change of leadership McDonald’s decided to sell off all these concepts. Donato’s in 2003, Chipotle went public in 2006 and Boston Market was sold to a private equity firm in 2007. All of that money was used to fund investments in McDonald’s store upgrades, additional supply chain restructuring and advertising. The “strategy” at that time was to return to “strategic focus.” Something that lots of analysts, investors and old-line franchisees love.

But look what McDonald’s leaders gave up via this decision to re-focus. McDonald’s received $1.5B for Chipotle. Today Chipotle is worth $20B and is one of the most exciting fast food chains in the marketplace (based on store growth, revenue growth and profitability – as well as customer satisfaction scores.) The value of all of the growth gains that occurred in these 3 chains has gone to other people. Not the investors, employees, suppliers or franchisees of McDonald’s.

We have to recognize that in the mid-2000s McDonald’s had the option of doing 180degrees opposite what it did. It could have put its resources into the newer, more exciting concepts and continued to fidget with McDonald’s to defend and extend its life even as trends went the other direction. This would have allowed investors to reap the gains of new store growth, and McDonald’s franchisees would have had the option to slowly convert McDonald’s stores into Donato’s, Chipotle’s or Boston Market. Employees would have been able to work on growing the new brands, creating more revenue, more jobs, more promotions and higher pay. And suppliers would have been able to continue growing their McDonald’s corporate business via new chains. Customers would have the benefit of both McDonald’s and a well run transition to new concepts in their markets. This would have been a win/win/win/win/win solution for everyone.

But it was the lure of “focus” and “core” markets that led McDonald’s leadership to make what will likely be seen historically as the decision which sent it on the track of self-destruction. When leaders focus on their core markets, and pull out all the stops to try defending and extending a business in a growth stall, they take their eyes off market trends. Rather than accepting what people want, and changing in all ways to meet customer needs, leaders keep fiddling with this and that, and hoping that cost cutting and a raft of operational activities will save the business as they keep focusing ever more intently on that old core business. But, problems keep mounting because customers, quite simply, are going elsewhere. To competitors who are implementing on trends.

The current CEO likes to describe himself as an “internal activist” who will challenge the status quo. But he then proves this is untrue when he describes the future of McDonald’s as a “modern, progressive burger company.” Sorry dude, that ship sailed years ago when competitors built the market for higher-end burgers, served fast in trendier locations. Just like McDonald’s 5-years too late effort to catch Starbucks with McCafe which was too little and poorly done – you can’t catch those better quality burger guys now. They are well on their way, and you’re still in port asking for directions.

McDonald’s is big, but when a big ship starts taking on water it’s no less likely to sink than a small ship (i.e. Titanic.) And when a big ship is badly steered by its captain it flounders, and sinks (i.e. Costa Concordia.) Those who would like to think that McDonald’s size is a benefit should recognize that it is this very size which now keeps McDonald’s from doing anything effective to really change the company. Its efforts (detailed above) are hemmed in by all those stores, franchisees, commitment to old processes, ingrained products hard to change due to installed equipment base, and billions spent on brand advertising that has remained a constant even as McDonald’s lost relevancy. It is now sooooooooo hard to make even small changes that the idea of doing more radical things that analysts are requesting simply becomes impossible for existing management.

And these leaders, frankly, aren’t even going to try. They are deeply wedded, committed, to trying to succeed by making McDonald’s more McDonald’s. They are of the company and its history. Not the CEO, or anyone on his team, reached their position by introducing a revolutionary new product, much less a new concept – or for that matter anything new. They are people who “execute” and work to slowly improve what already exists. That’s why they are giving even more decision-making control to franchisees via selling company stores in order to raise cash and cut costs – rather than using those stores to introduce radical change.

These are not “outside thinkers” that will consider the kinds of radical changes Louis V. Gerstner, a total outsider, implemented at IBM – changing the company from a failing mainframe supplier into an IT services and software company. Yet that is the only thing that will turn around McDonald’s. The Board blew it once before when it sold Chipotle, et.al. and put in place a core-focused CEO. Now McDonald’s has fewer resources, a lot fewer options, and the gap between what it offers and what the marketplace wants is a lot larger.

by Adam Hartung | Apr 30, 2015 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

Last week saw another slew of quarterly earnings releases. For long term investors, who hold stocks for years rather than months, these provide the opportunity to look at trends, then compare and contrast companies to determine what should be in their portfolio. It is worthwhile to compare the trends supporting the valuations of market leaders Google and Facebook.

Google once again reported higher sales and profits. And that is a good thing. But, once again, the price of Google’s primary product declined. Revenues increased because volume gains exceeded the price decline, which indicates that the market for internet ads keeps growing. But this makes 15 straight quarters of price declines for Google. Due to this long series of small declines, the average price of Google’s ads (cost per click) has declined 70%* since Q3 2011!

Google once again reported higher sales and profits. And that is a good thing. But, once again, the price of Google’s primary product declined. Revenues increased because volume gains exceeded the price decline, which indicates that the market for internet ads keeps growing. But this makes 15 straight quarters of price declines for Google. Due to this long series of small declines, the average price of Google’s ads (cost per click) has declined 70%* since Q3 2011!

While this is a miraculous example of what economists call demand elasticity, one has to wonder how long growth will continue to outpace price degradation. At some point the marginal growth in demand may not equal the marginal decline in pricing. Should that happen, revenues will start going down rather than up.

Part of what drives this price/growth effect has been the creation of programmatic ad buying, which allows Google to place more ads in more specific locations for advertisers via such automated products as AdMob, AdExchange and DoubleClick Bid Manager. But such computerized ad buying relies on ever more content going onto the web, as well as ever more consumption by internet users.

Further, Google’s revenues are almost entirely search-based advertising, and Google dominates this category. But this is largely a PC-related sale. Today 67.5% of Google ad revenue is from PC searches, while only 32.5% is from mobile searches. Due to this revenue skew, and the fact that people do more mobile interaction via apps, messaging apps and social media than browser, search ad growth has fallen considerably. What was a 24% year over year growth rate in Q1 2012 has dropped to more like 15% for the last 8 quarters.

So while the market today is growing, and Google is making more money, it is possible to see that the growth is slowing. And Google’s efforts to create mobile ad sales outside of search has largely failed, as witnessed by the recent death of Google+ as competition for Twitter or Facebook. It is the market shift, to mobile, which creates the greatest threat to Google’s ability to grow; certainly at historical rates.

Simultaneously, Facebook’s announcements showed just how strongly it is continuing to dominate both social media and mobile, and thus generate higher revenues and profits with outstanding growth. The #1 site for social media and messenger apps is Facebook, by quite a large margin. But, Facebook’s 2014 acquisition of What’sApp is now #2. WhatsApp has doubled its monthly active users (MAUs) just since the acquisition, and now reaches 800million. Growth is clearly accelerating, as this is from a standing start in 2011.

Facebook Messenger at #3, just behind WhatsApp. And #5 is Instagram, another Facebook acquisition. Altogether 4 of the top 5 sites, and the ones with greatest growth on mobile, are Facebook. And they total over 3billion MAUs, growing at over 300million new MAUs/month. Thus Facebook has already emerged as the dominant force, with the most users, in the fast-growing, accelerating, mobile and app sectors. (Just as Google did in internet search a decade ago, beating out companies like Yahoo, Ask Jeeves, etc.)

Google is moving rapidly to monetize this user base. From nothing in early 2012, Facebook’s mobile revenue is now $2.5B/quarter and represents 67% of global revenue (the inverse of Google’s revenues.) Further, Facebook is now taking its own programmatic ad buying tool, Atlas, to advertisers in direct competition with Google. Only Atlas places ads on both social media and internet browser pages – a one-two marketing punch Google has not yet cracked.

Google’s $17.3B Q1 2015 revenue is 30 times the revenue of Facebook. There is no doubt Google is growing, and generating enormous profits. But, for long-term investors, growth is slowing and there is reason to be concerned about the long term growth prospects of Google as the market shifts toward more social and more mobile. Google has failed to build any substantial revenues outside of search, and has had some notable failures recently outside its core markets (Google + and Google Glass.) Just how long Google will continue growing, and just how fast the market will shift is unclear. Technology markets have shown the ability to shift a lot faster than many people expected, leaving some painful losers in their wake (Dell, HP, Sun Microsystems, Yahoo, etc.)

Meanwhile, Facebook is squarely positioned as the leader, without much competition, in the next wave of market growth. Facebook is monetizing all things social and mobile at a rapid clip, and wisely using acquisitions to increase its strength. As these markets continue on their well established trends it is hard to be anything other than significantly optimistic for Facebook long-term.

* 1x .93 x .88 x .84 x .85 x .94 x .96 x .94 x .93 x .89 x .91 x .94 x .98 x .97 x .95 x .93 = .295

by Adam Hartung | Apr 9, 2015 | Current Affairs, Defend & Extend, Innovation, Leadership

This week a self-driving car built by Delphi of England completed a 9 day trip from San Francisco to New York City. The car traveled 3,400 miles, and was fully automated for 99% of the trip.

Attention has again focused on self-driving cars. There are a handful of players entering the market today, including Apple. But the most famous company by far is Google, which has put over 700,000 autonomous miles on its vehicles since pioneering the concept after winning a DARPA challenge to build a functioning prototype in 2005. In fact, we’re so used to hearing about the Google self-driving car that many of have stopped asking “Why Google? They aren’t in the auto business.”

Of course the idea of a self-driving auto is as old as the Jetson’s (and if you don’t know who the Jetson’s are you are, that was a long time ago.) And nobody should be surprised to hear that prototypes have been on the drawing board for 5 decades. But I bet you didn’t know that DuPont was once seriously engaged in such development.

In 1986 DuPont was America’s largest and most noteworthy chemical company. The company was a pioneer in petrochemicals, and was considered the company that brought the world plastic – at a time when plastic was considered a great, new invention. A leader in films of all sorts, DuPont leadership saw the opportunity for electronics to replace film in applications such as printing (where films were used in high volume for platemaking and proofing) and healthcare (where xRays and MRIs were a large film users.) They conceived of a future time when computers and monitors – digitial products – could replace analog film, and they chose to create a new business unit called Electronic Imaging to pioneer developing these applications.

As the team started they expanded the definition of Electronic Imaging to include all sorts of applications for digital imaging – and using all kinds of technologies. The breadth of analysis, and product development, included non-destructive parts testing, infrared uses such as heads-up displays and inventory identification, and radar applications. Which led the team to using a radar for automating an automobile.

In 1987 DuPont invested in a small company out of San Diego that accomplished something never done before. Using a phased-array radar hooked up to the brakes of a van, they were able to have the car recognize objects in front of the van, calculate in real time the distance between the van and these forward objects, calculate the relative speed of both objects (whether one or both were stationary or moving) and then apply braking in order to maintain a safe distance. If the forward object stopped, then the van would come to a complete stop.

This was all done with discreet componentry, and the team realized future success required developing more specific electronics, including specialized integrated chips that could operate faster and be more error-free. So they drove the prototype from San Diego to Wilmington, DE with a person behind the wheel, but relying as much as possible on the automated system to do all braking. The team collected data on location, speed, weather, traffic conditions, and many other items during the journey and prepared to take the project forward, planning to eventually build a module which could be installed in vehicles as small as cars or as large as 18-wheelers, with enough intelligence to adjust for different vehicle designs and applications (in order to calibrate for different braking distances.)

Net/net they had a working prototype. The product was expected to reduce the number of accidents by assisting drivers with braking. Multi-car pile-ups would become a thing of the past. And this device could potentially allow for better traffic flow because automated braking would reduce – maybe eliminate! – rear-end collisions. This wasn’t a self-driving car, but it was self-braking car, which would be a first step toward the sort of Jetson’s-esque vision the young team imagined.

What happened?

It didn’t take long for the older, “wiser” leadership to shut down the project. Even though several executives participated in a controlled demonstration of the prototype in an enclosed DuPont parking lot, the conclusion was that this project demonstrated just how off-track the new Electronic Imaging Department had become, and that it was clear folks needed to be reigned in and budgets cut:

- This clearly had nothing to do with film or replacing film. DuPont was a chemical company, and to the extent it had any interest in electronics it was where they were applied to potentially cannibalize film sales. Products which were not closely aligned with historical products were simply not to be pursued.

- DuPont had no history in radar, analogue electronics or development of integrated circuits. Yes, DuPont had an Electronics Department, but they sold film for solder masking and other applications of semiconductor and electronics manufacturing. DuPont was a chemical company, not a computer company or electronics company and this division was not going to change this situation.

- This product was seen as carrying too much liability risk. What if it failed? What if the car ran over a child? The auto industry was seen as litigious, and DuPont had no interest in a product that could have the kind of liability this one would generate. Yes, there was an Auto Department, but it sold films for safety glass, plastic sheets used for molding inside panels, and surface coatings which could be painted on the inside and/or outside of the vehicle. But those did not have the kind of failure possibility of this active radar device. [“By the way” the vice-Chairman asked “could that radar fry someone’s innards at a crosswalk?”]

- The market is too limited. Who would really want an automatic braking system? Given what it might cost, only the most expensive cars could install it, and only the wealthiest customers could afford it. This product was destined for niche use, at best, and would never have widespread installation.

Poof, away went the automatic automobile braking project. Once this dagger had been thrown, within just a few months everything that wasn’t printing or medical – in fact anything that wasn’t tied to printing films, xRays and MRI – was gone. Within 2 years leadership decided that for some variant of the 4 issues above the entire Electronic Imaging division was a bad idea. DuPont would be better served if it stuck to its core business, and if it spent money defending and extending film sales rather than trying to cannibalize them.

DuPont liked competing in the oceans where it had long competed. Venturing beyond those oceans was simply too risky. Today, 25 years later, DuPont is about 1/3 the size it was when its leaders launched the ill-fated Electronic Imaging division.

Google obviously has a different way of looking at the opportunity for automating automobile operation. Since winning the DARPA competition Google has spent a goodly sum building and testing ways to automate driving. And it has even gone so far as lobbying to make self-driving cars legal, which they now are in 4 states. Pessimists remain, but every quarter more people are thinking that self-driving cars will be here sooner than we might have imagined. This week’s cross-country achievement fuels speculation that the reality could be just around the corner.

Google seems happy to compete in new oceans. It dominates search, where its share is attacked every day by the likes of Yahoo and Microsoft. But simultaneously Google has invested far outside its core market, including software for PCs (Chrome) and mobile devices (Android), hardware (Nexus phones), media (Blogger, YouTube), payments (Wallet) and even self-driving cars. To what extent these, and dozens of other non-core products/services, will pay off for investors is yet to be determined. But at least Google’s leadership is able to overcome the desire to restrict the company’s options and look for future markets.

Which kind of organization is yours? Do you find reasons to kill new projects, or are you willing to experiment at creating new markets which might create dramatic growth?

by Adam Hartung | Apr 2, 2015 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

Microsoft launched its new Surface 3 this week, and it has been gathering rave reviews. Many analysts think its combination of a full Windows OS (not the slimmed down RT version on previous Surface tablets,) thinness and ability to operate as both a tablet and a PC make it a great product for business. And at $499 it is cheaper than any tablet from market pioneer Apple.

Meanwhile Apple keeps promoting the new Apple Watch, which was debuted last month and is scheduled to release April 24. It is a new product in a market segment (wearables) which has had very little development, and very few competitive products. While there is a lot of hoopla, there are also a lot of skeptics who wonder why anyone would buy an Apple Watch. And these skeptics worry Apple’s Watch risks diverting the company’s focus away from profitable tablet sales as competitors hone their offerings.

Looking at these launches gives a lot of insight into how these two companies think, and the way they compete. One clearly lives in red oceans, the other focuses on blue oceans.

Blue Ocean Strategy (Chan Kim and Renee Mauborgne) was released in 2005 by Harvard Business School Press. It became a huge best-seller, and remains popular today. The thesis is that most companies focus on competing against rivals for share in existing markets. Competition intensifies, features blossom, prices decline and the marketplace loses margin as competitors rush to sell cheaper products in order to maintain share. In this competitively intense ocean segments are niched and products are commoditized turning the water red (either the red ink of losses, or the blood of flailing competitors, choose your preferred metaphor.)

On the other hand, companies can choose to avoid this margin-eroding competitive intensity by choosing to put less energy into red oceans, and instead pioneer blue oceans – markets largely untapped by competition. By focusing beyond existing market demands companies can identify unmet needs (needs beyond lower price or incremental product improvements) and then innovate new solutions which create far more profitable uncontested markets – blue oceans.

Obviously, the authors are not big fans of operational excellence and a focus on execution, but instead see more value for shareholders and employees from innovation and new market development.

If we look at the new Surface 3 we see what looks to be a very good product. Certainly a product which is competitive. The Surface 3 has great specifications, a lot of adaptability and meets many user needs – and it is available at what appears to be a favorable price when compared with iPads.

But …. it is being launched into a very, very red ocean.

The market for inexpensive personal computing devices is filled with a lot of products. Don’t forget that before we had tablets we had netbooks. Low cost, scaled back yet very useful Microsoft-based PCs which can be purchased at prices that are less than half the cost of a Surface 3. And although Surface 3 can be used as a tablet, the number of apps is a fraction of competitive iOS and Android products – and the developer community has not yet embraced creating new apps for Windows tablets. So Surface 3 is more than a netbook, but also a lot more expensive.

Additionally, the market has Chromebooks which are low-cost devices using Google Chrome which give most of the capability users need, plus extensive internet/cloud application access at prices less than a third that of Surface 3. In fact, amidst the Microsoft and Apple announcements Google announced it was releasing a new ChromeBit stick which could be plugged into any monitor, then work with any Bluetooth enabled keyboard and mouse, to turn your TV into a computer. And this is expected to sell for as little as $100 – or maybe less!

This is classic red ocean behavior. The market is being fragmented into things that work as PCs, things that work as tablets (meaning run apps instead of applications,) things that deliver the functionality of one or the other but without traditional hardware, and things that are a hybrid of both. And prices are plummeting. Intense competition, multiple suppliers and eroding margins.

Ouch. The “winners” in this market will undoubtedly generate sales. But, will they make decent profits? At low initial prices, and software that is either deeply discounted or free (Google’s cloud-based MSOffice competitive products are free, and buyers of Surface 3 receive 1 year free of MS365 Office in the cloud, as well as free upgrade to Windows 10,) it is far from obvious how profitable these products will be.

Amidst this intense competition for sales of tablets and other low-end devices, Apple seems to be completely focused on selling a product that not many people seem to want. At least not yet. In one of the quirkier product launch messages that’s been used, Apple is saying it developed the Apple Watch because its other innovative product line – the iPhone – “is ruining your life.”

Apple is saying that its leaders have looked into the future, and they think today’s technology is going to move onto our bodies. Become far more personal. More interactive, more knowledgeable about its owner, and more capable of being helpful without being an interruption. They see a future where we don’t need a keyboard, mouse or other artificial interface to connect to technology that improves our productivity.

Right. That is easy to discount. Apple’s leaders are betting on a vision. Not a market. They could be right. Or they could be wrong. They want us to trust them. Meanwhile, if tablet sales falter….. if Surface 3 and ChromeBit do steal the “low end” – or some other segment – of the tablet market…..if smartphone sales slip….. if other “forward looking” products like ApplePay and iBeacon don’t catch on……

This week we see two companies fundamentally different methods of competing. Microsoft thinks in relation to its historical core markets, and engaging in bloody battles to win share. Microsoft looks at existing markets – in this case tablets – and thinks about what it has to do to win sales/share at all cost. Microsoft is a red ocean competitor.

Apple, on the other hand, pioneers new markets. Nobody needed an iPod… folks were happy enough with Sony Walkman and Discman. Everybody loved their Razr phones and Blackberries… until Apple gave them an iPhone and an armload of apps. Netbook sales were skyrocketing until iPads came along providing greater mobility and a different way of getting the job done.

Apple’s success has not been built upon defending historical markets. Rather, it has pioneered new markets that made existing markets obsolete. Its success has never looked obvious. Contrarily, many of its products looked quite underwhelming when launched. Questionable. And it has cannibalized its own products as it brought out new ones (remember when iPods were so new there was the iPod mini, iPod nano and iPod Touch? After 5 years of declining iPod sale Apple has stopped reporting them.) Apple avoids red oceans, and prefers to develop blue ones.

Which company will be more successful in 2020? Time will tell. But, since 2000 Apple has gone from nearly bankrupt to the most valuable publicly traded company in the USA. Since 1/1/2001 Microsoft has gone up 32% in value. Apple has risen 8,000%. While most of us prefer the competition in red oceans, so far Apple has demonstrated what Blue Ocean Strategy authors claimed, that it is more profitable to find blue oceans. And they’ve shown us they can do it.

by Adam Hartung | Mar 23, 2015 | Current Affairs

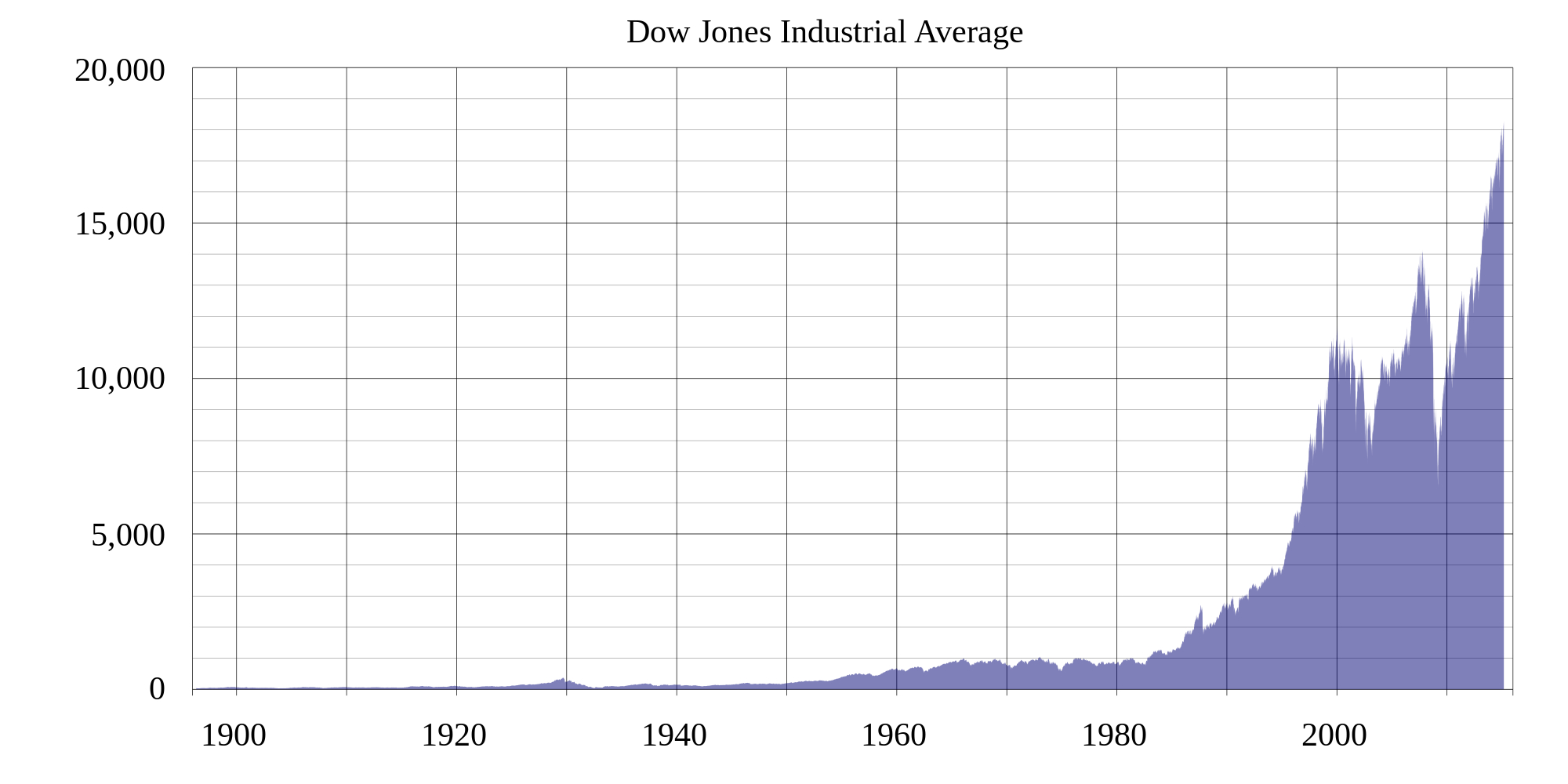

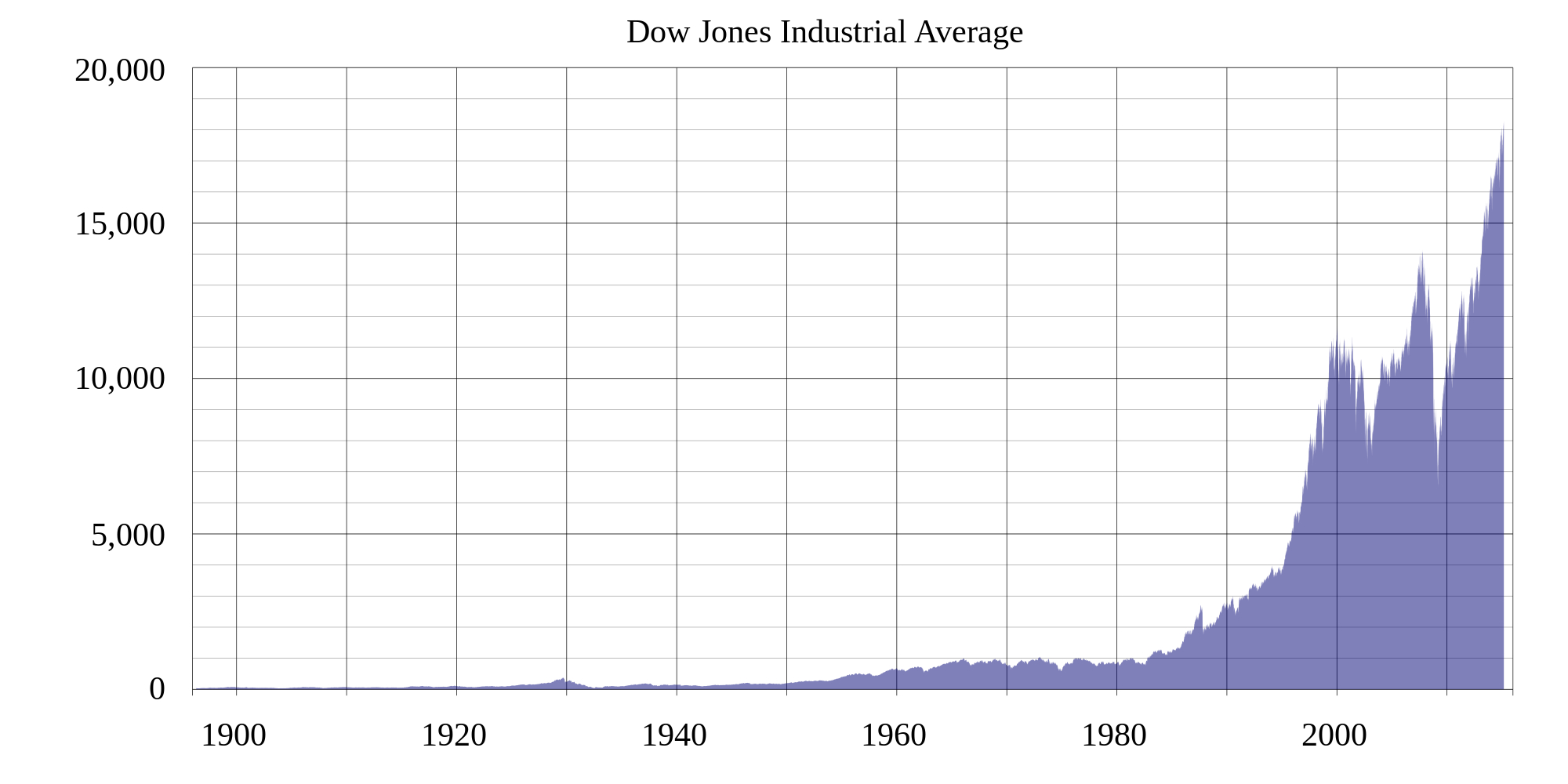

The Dow Jones Industrial Average has been around for about 100 years. It is 30 of the largest market capitalization companies in the USA.

Lots of people think “the Dow,” as it is often called, is the value of the market. This is pretty far from correct, as there are literally thousands of stocks traded on the NYSE and NASDAQ. Better gauges of the overall market would be the NYSE Composite, or the NASDAQ composite. Or even the Wilshire 5000. These much larger data sets are better reflections of the overall stock market.

Some investors, especially small investors or those with little financial training, confuse “the Dow” with the S&P 500. The latter is simply the 500 largest public companies reviewed and evaluated for credit worthiness by Standard & Poors. Obviously, with 500 stocks it is 14 times broader than “the Dow.” So many would say it is a better market indicator than the DJIA.

Yet, lots of people refer to the DJIA, with little understanding of how it is created – and what it really means.

Simply put, the founder of Dow Jones and Company wrote a series of articles form about 1880 to 1900 on investing and stocks. After his death, editors at Dow Jones thought it would be good to consolidate his thoughts into an investing theory, which they called the Dow Theory.

Simply put, they developed three indices based upon a subset of stocks. One was an index of industrial companies, which were largely in commodities like coal, cotton, sugar and tobacco. The second was an index of transportation companies (called the Dow Transports) which was initially loaded with railroads and ocean shippers. The third were the emerging utility companies (Dow Utilities) which were gas distributors and electricity generation/distribution companies.

The Dow Theory was to watch these 3 indices. If two started to move in tandem, up or down, then this was considered an indicator of where the overall market would move in short order. If all 3 move together then it was considered a very strong bullish, or bearish, sign. Dow Theory was the first effort at predicting future stock movements.

After 100 years of academic research, not a lot of people use Dow Theory any longer. It has been replaced with 1,001 different approaches to predicting stock movement. And as other approaches have been created, the Dow Transports and the Dow Utilities are largely forgotten.

But the DJIA still carries a lot of attention. It has changed dramatically over time. The editors at Dow Jones (publisher of the Wall Street Journal and other business publications) review the list and update it. After WWII they determined that Industrials were better represented by steel companies, auto companies and other large manufacturers. Thus they dropped older commodity companies, just as their shares declined, and added companies like GM.

As the economy changed over time, many changes were made to the DJIA. As financial services grew, big banks were added. As retail grew, huge retailers and consumer goods companies were added. As pharmaceuticals grew, they were added. As computer tech grew, large tech companies were added. Each time someone was added, someone was dropped. The only company from the original list is GE.

“The Dow” was continuously “rebalanced.” Thus, even though many companies that were once on the Dow are now completely gone, and many others are in bad shape. Former DJIA companies include: Kodak, Sears, Woolworths, International Harvester, General Motors, Chrysler, Johns-Manville, General Foods, National Steel, Loew’s Theatres.

Thus, the DJIA has had a great upward run for over 100 years. Because it isn’t “the market.” Rather, it is a handful of stocks selected by some of the very top leaders in business. These leaders constantly look to keep the index in growth sectors, while eliminating declining sectors. And removing companies that do really badly – like GM, which filed bankruptcy. In other words, this is an index of the very largest – and some would say safest – companies in America that have a growth capability.

Which is why it is so hard for individual investors – and even pros – to outperform the DJIA. While they tinker around with investments in individual “hot” stocks, and shorting “losers,” overall they rarely can do as well as the DJIA. For all their rebalancing and predicting, only 1 in 4 (or 1 in 5) beat the DJIA in the short term. Long term, only 2 out 2,862 funds have consistently beat the DJIA.

So, by adding Apple the editors are again setting up the DJIA for future growth. AT&T was removed, for the second time. In 2004 it was taken out as AT&T faced bankruptcy. Southwestern Bell bought the AT&T name, and it was added back again. Now it is gone – probably for good – because telecom simply doesn’t have the growth of other sectors like mobile devices.

This is one of the few investment opportunities where “the little guy” gets a tremendous break. Anyone can buy the DJIA. By purchasing Diamonds (Symbol DIA) anyone can buy the DJIA index. You don’t have to do any individual stock buys, nor track changes and do rebalancing. You don’t even have to deal with stock dividends, splits, etc. because the pros will do all of that for you. And, you can buy Diamonds via a low cost on-line broker like e-Trade or ScotTrade and your transaction costs are minimal – less than what you’d pay a mutual fund manager (who is unlikely to do as well as your Diamonds.)

I think most investors are fools to try timing the market. Most people have jobs far removed from financial services and analyzing companies. Even more people have little academic training in how to analyze financial statements, company reports, projections and market opportunities. Heck, if the pros who do this full time can’t beat the DJIA, do most of us have any chance at all?

The DJIA has had a great run the last several years. Investing in the DJIA has outperformed about all other investments, with the best growth rate compared to highly cyclical commodities like gold, or real estate and certainly bonds. And because it isn’t “the market,” but rather a carefully selected basket of large cap stocks, it offers investors the greatest probability of long-term gains with least risk and volatility.

Adding Apple to the DJIA shows that the folks at Dow Jones are keeping their eyes on the proverbial ball. It should encourage investors. And, if you want to share in the growth of equities without having to spend all your free time doing research – or paying high fees – simply buying DIA is a great option.

by Adam Hartung | Mar 10, 2015 | Current Affairs, Defend & Extend, Leadership, Lock-in

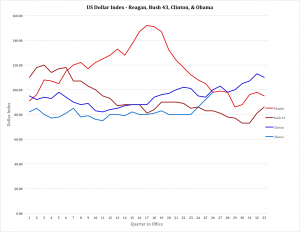

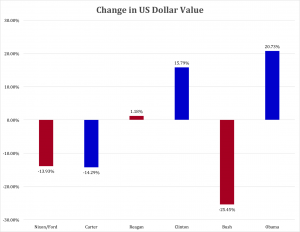

This week marks the 6th anniversary of the stock market’s bull run, with the S&P up 206%. Only 3 other times since WWII have equities had such a prolonged, sustained growth series. Simultaneously, last week saw yet another month with over 200,000 non-farm jobs created, making the current rate of jobs growth the best in 15 years. And, in a move that has taken some by surprise, the U.S. dollar is hitting highs against foreign currencies that have not been seen in over 12 years.

It is a rare economic trifecta, and demonstrates America is doing better than all other developed countries.

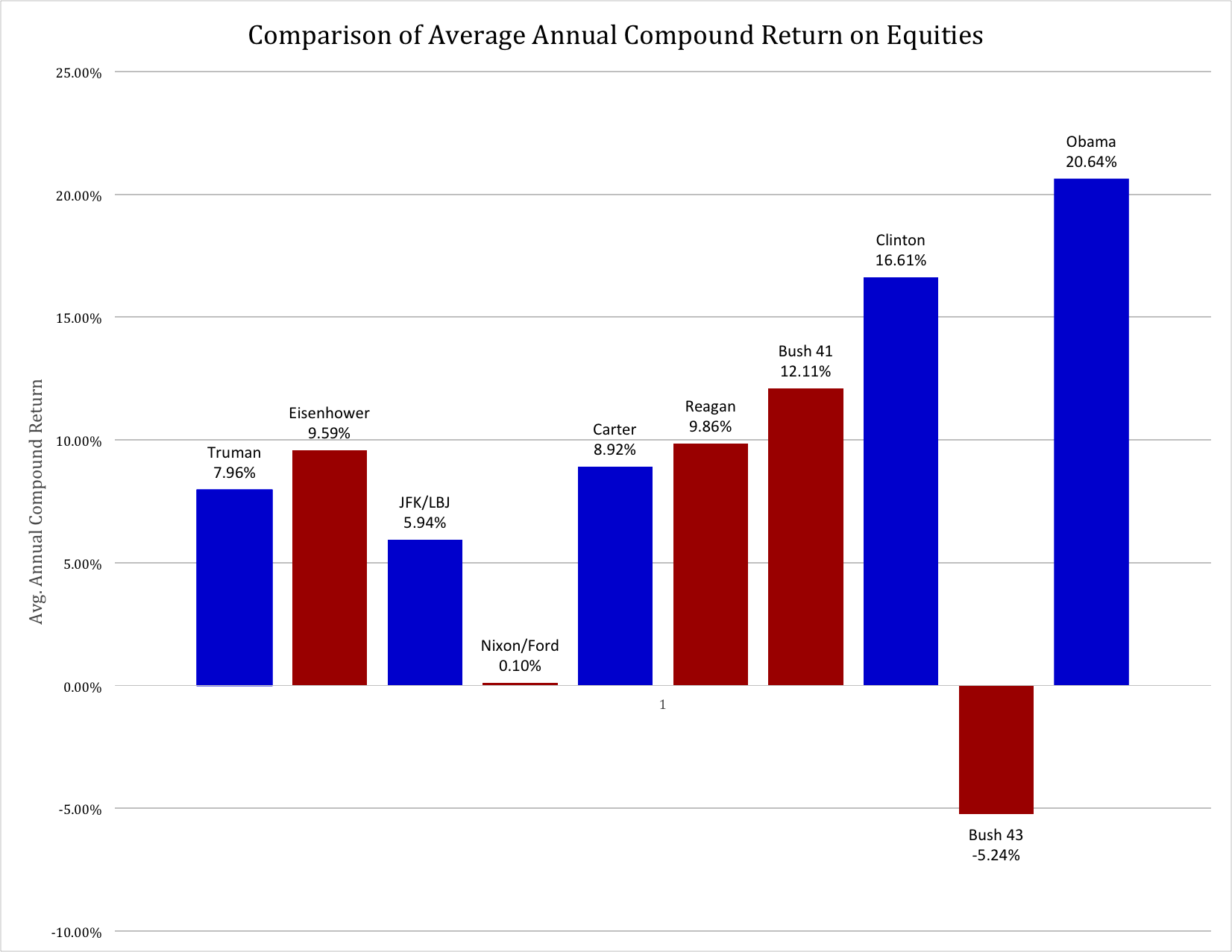

It seemed an appropriate time to re-interview Bob Deitrick, Managing Director of Polaris Financial Partners, and author of “Bulls, Bears and the Ballot Box” to obtain his take on the economy. Mr. Deitrick’s book reviewed America’s economic performance under each President since the creation of the Federal Reserve, and in direct opposition to conventional wisdom concluded presidents from the Democratic party were better economic stewards than Republican presidents. When published in 2012 Mr. Deitrick predicted that the economy would continue to do well under President Obama, and so far he’s been proven correct.

AH: Since we discussed “Obama’s Miracle Market” in January, 2014 stocks have continued to rise. Has this bull run surprised you, and do you think it will continue?

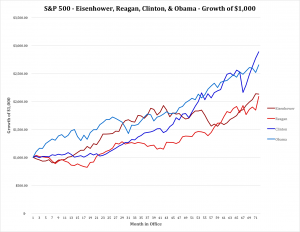

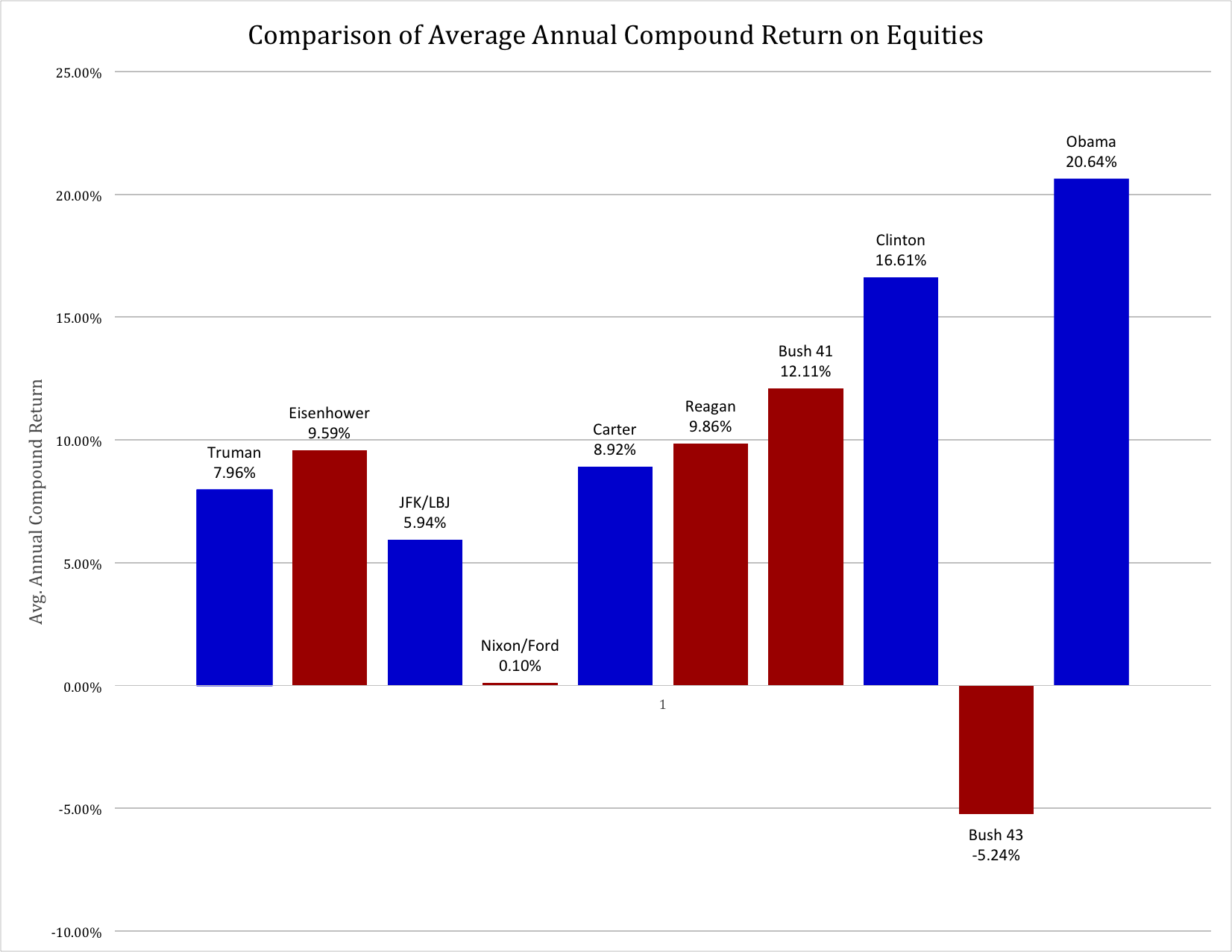

Bob Deitrick: No it has not surprised us. Looking across history since Hoover, Democrats in the White House have generally presided over good stock market gains. Since Clinton was elected, Democratic administrations have done remarkably well, with both Clinton and Obama outperforming the best Republican presidents which were Eisenhower and Reagan.

Looking at the S&P 500, Clinton and Obama have performed about the same with about a 17% annual rate of return through the first 62 months of office. Which is 70% better than the approximate 10% return of Republicans.

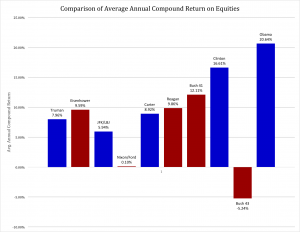

It is worth noting that when we take a broader gauge of equities (which we used in the book,) including the more volatile NASDAQ index and the highly selective Dow Jones Industrial Average, then the market’s performance during the Obama administration is unchallenged. The last 6 years generated compound annual returns of 22.5% (including dividend reinvestment) which is the best improvement in equities of all time.

It is also worth noting that the collapse of equities has happened 3 times since 1900, and all under Republican administrations – Hoover, Nixon/Ford, Bush 43. Even Carter had a rising equities market, and the Clinton + Obama years were unparalleled.

We agree with many other analysts that this bull market is not complete. We think the stock markets are only at the half way point in a secular bull cycle which will last, in total, 8 to 12 years.

AH: It was 6 months ago when you pointed out that President Obama outperformed President Reagan on jobs growth. At that time there were many, many naysayers. Yet, August’s numbers were later revised upward to over 200,000 and every month since has continued with strong jobs growth – some nearly 300,000. Are you surprised by the strength in jobs creation, and do you think it will stall?

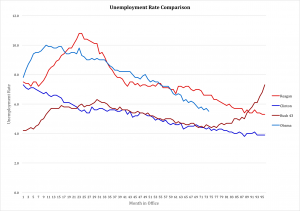

Bob Deitrick: Both Reagan and Obama inherited a bad jobs marketplace. Both of them saw unemployment spike into double digits early in their presidencies. And both created jobs programs that brought down the percentage of people unemployed. Obama had a lesser spike than Reagan, and during the last 5 years unemployment rate fell faster than it did under Reagan.

Both Democrats, Obama and Clinton, had big decreases in unemployment due to their policies. From peak to trough in this current administration unemployment has fallen by 5.5 percentage points, a decline of 81%. Clinton oversaw unemployment decline of 3.1 percentage points, or 73%. Both Democrats followed Bush Republican presidencies which had seen unemployment increase! During Bush 41 unemployment rose by 2 percentage points (5.4% to 7.3%,) and during Bush 43 unemployment nearly doubled from 4.2% to 8.3%. Not even the Carter presidency had unemployment increases anywhere close to the 12 years of Bush presidency.

Both Democrats, Obama and Clinton, had big decreases in unemployment due to their policies. From peak to trough in this current administration unemployment has fallen by 5.5 percentage points, a decline of 81%. Clinton oversaw unemployment decline of 3.1 percentage points, or 73%. Both Democrats followed Bush Republican presidencies which had seen unemployment increase! During Bush 41 unemployment rose by 2 percentage points (5.4% to 7.3%,) and during Bush 43 unemployment nearly doubled from 4.2% to 8.3%. Not even the Carter presidency had unemployment increases anywhere close to the 12 years of Bush presidency.

It is also worth noting that when comparing Obama and Reagan, Reagan undertook the largest increase in non-wartime deficit spending ever. He essentially used a form of “New Deal” debt spending on infrastructure and defense to stimulate jobs production. President Obama has been able to reduce the size of the annual deficit every year since taking office, in reality shrinking the amount of money spent by the government while simultaneously creating these new jobs. The only other president to accomplish this feat was Clinton, who actually balanced the budget during his presidency.

We believe the economy is very strong, and along with other analysts think the jobs recovery will remain intact. With less war spending, lower oil prices, more people covered by insurance, and higher minimum wages consumers will continue to spend and the economy will grow. New technology products will bring more people into the workforce, and manufacturing will continue its renaissance. We expect that unemployment will continue falling toward 4.4% by summer of 2016, returning the economy to non-wartime full employment.

AH: For years many talk show hosts and guests have been declaring that the Fed was flooding the markets with cash and setting the stage for rampant inflation which would ruin the dollar and the U.S. economy. But in the last few months the dollar has rallied to rates we haven’t seen since the 1990s. Did this surprise you, and do you think the dollar will remain strong?

Bob Deitrick: We were not surprised. Ben Bernanke ranks right up there with the first ever Federal Reserve Chairman Marriner Eccles at knowing what to do to keep the American economy from collapsing in the wake of the country’s second depression. Only by re-inflating the economy with more cash, and keeping interest rates low, did America avoid a horrible repeat of the 1930s.

As a result of Democratic policies America re-invested in growth, which allowed companies to invest in plant and equipment and create new jobs, while lowering the deficit. This happened simultaneously with opposite policies being implemented in Europe and Japan (so called “austerity”) which has caused their economies to weaken. And slowed demand from Europe has reduced growth rates in China and India, all leading global investors to return to the U.S. dollar as a safe haven. It is because of our economic strength that the dollar is returning to rates we have not seen since the Clinton presidency.

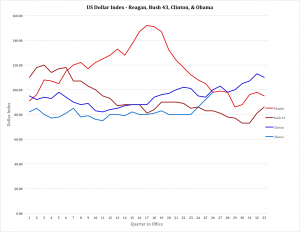

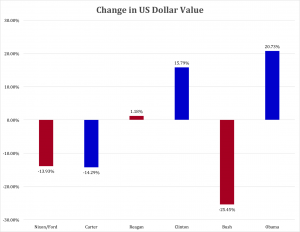

Many people recall the huge increase in the dollar’s value toward the middle of the Reagan presidency. However, as the U.S. deficits, and total debt, skyrocketed the dollar plummeted. By the time Reagan left office the dollar was worth almost the same as when he entered office.

And the combination of lower taxes plus costs for waging war in the middle east sent the U.S. debt exploding again under Bush 43. What had been a balanced budget under Clinton, which had pushed the dollar almost back to post-war highs, was destroyed causing the dollar to plummet 25%.

The dollar is now up 21% against a basket of world currencies. Given ongoing European weakness and the never-ending fight over austerity we see no reason to think the Euro will make a comeback any time soon. Rather, we predict the strong U.S. economy, especially with oil prices likely to remain low (and priced in dollars,) the U.S. dollar will continue to rally. It could well go back to Clinton-era highs and possibly approach the values during Reagan’s presidency. Should this happen it would be a record improvement in the dollar by any modern administration.

AH: Any concluding comments?

Bob Deitrick: I have voted for both Republicans and Democrats, and think of myself as a centrist. Most people, by definition, are centrists. I long believed that the GOP was the party which was best for the economy. But I could tell something wasn’t adding up during the Bush 43 presidency, so I chose to research the performance of both parties.

The GOP has created an illusion that it is a better economic steward by promoting itself as the party with the better business acumen, frequently touting elected officials from business schools and with MBAs rather than law degrees. The GOP, and the media leaders who identify with the GOP, tell Americans every chance they can that Republicans are the party of financial acuity and have the policies to create economic prowess. Yet we found through our research that these claims were little more than myth. In the modern era, post Great Depression and with a strong Federal Reserve in place, Democratic administrations have been far better stewards of the economy and caretakers of the government’s wallet.

We have coached investors to be in this equity market, and remain long, since early in the Obama administration. We have continued to remain long, and coach investors that in our opinion this remains the best course. We see the economy growing due to a balanced approach to jobs creation, spending and taxation. Were there less partisanship, such as occurred during the Reagan era when the Democrat party controlled the Congress while Republicans controlled the administration, it might be possible for the economy to grow even more quickly.

by Adam Hartung | Mar 9, 2015 | Current Affairs, In the Rapids, Leadership, Television

The Netflix hit series “House of Cards” was released last night. Most media reviewers and analysts are expecting huge numbers of fans will watch the show, given its tremendous popularity the last 2 years. Simultaneously, there are already skeptics who think that releasing all episodes at once “is so last year” when it was a newsworthy event, and no longer will interest viewers, or generate subscribers, as it once did. Coupled with possible subscriber churn, some think that “House of Cards” may have played out its hand.

So, the success of this series may have a measurable impact on the valuation of Netflix. If the “House of Cards” download numbers, which are up to Netflix to report, aren’t what analysts forecast many may scream for the stock to tumble; especially since it is on the verge of reaching new all-time highs. The Netflix price to earnings (P/E) multiple is a lofty 107, and with a valuation of almost $29B it sells for just under 4x sales.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

Since Netflix started trading in 2002, it has risen from (all numbers adjusted) $8.5 to $485. That is a whopping 57x increase. That is approximately a 40% compounded rate of return, year after year, for 13 years!

But it has not been a smooth ride. After starting (all numbers rounded for easier reading) at $8.50 in May, 2002 the stock dropped to $3.25 in October – a loss of over 60% in just 5 months. But then it rallied, growing to $38.75, a whopping 12x jump, in just 14 months (1/04!) Only to fall back to $9.80, a 75% loss, by October, 2004 – a mere 9 months later. From there Netflix grew in value by about 5.5x – to $55/share – over the next 5 years (1/10.) When it proceeded to explode in value again, jumping to $295, an almost 6-fold increase, within 18 months (7/11). Only to get creamed, losing almost 80% of its value, back down to $63.85, in the next 4 months (11/11.) The next year it regained some loss, improving in value by 50% to $91.35 (12/12,) only to again explode upward to $445 by February, 2014 a nearly 5-fold increase, in 14 months. Two months later, a drop of 25% to $322 (4/14). But then in 4 months back up to $440 (8/14), and back down 4 months later to $341 (12/14) only to approach new highs reaching $480 last week – just 2 months later.

That is the definition of volatility.

Netflix is a disruptive innovator. And, simply put, stock analysts don’t know how to value disruptive innovators. Because their focus is all on historical numbers, and then projecting those historicals forward. As a result, analysts are heavily biased toward expecting incumbents to do well, and simultaneously being highly skeptical of any disruptive company. Disruptors challenge the old order, and invalidate the giant excel models which analysts create. Thus analysts are very prone to saying that incumbents will remain in charge, and that incumbents will overwhelm any smaller company trying to change the industry model. It is their bias, and they use all kinds of historical numbers to explain why the bigger, older company will project forward well, while the smaller, newer company will stumble and be overwhelmed by the entrenched competitor.

And that leads to volatility. As each quarter and year comes along, analysts make radically different assumptions about the business model they don’t understand, which is the disruptor. Constantly changing their assumptions about the newer kid on the block, they make mistake after mistake with their projections and generally caution people not to buy the disruptor’s stock. And, should the disruptor at any time not meet the expectations that these analysts invented, then they scream for shareholders to dump their holdings.

Netflix first competed in distribution of VHS tapes and DVDs. Netflix sent them to people’s homes, with no time limit on how long folks could keep them. This model was radically different from market leader Blockbuster Video, so analysts said Blockbuster would crush Netflix, which would never grow. Wrong. Not only did Blockbuster grow, but it eventually drove Blockbuster into bankruptcy because it was attuned to trends for convenience and shopping from home.

As it entered streaming video, analysts did not understand the model and predicted Netflix would cannibalize its historical, core DVD business thus undermining its own economics. And, further, much larger Amazon would kill Netflix in streaming. Analysts screamed to dump the stock, and folks did. Wrong. Netflix discovered it was a good outlet for syndication, created a huge library of not only movies but television programs, and grew much faster and more profitably than Amazon in streaming.

Then Netflix turned to original programming. Again, analysts said this would be a huge investment that would kill the company’s financials. And besides that people already had original programming from historical market leaders HBO and Showtime. Wrong. By using analysis of what people liked from its archive, Netflix leadership hedged its bets and its original shows, especially “House of Cards” have been big hits that brought in more subscribers. HBO and Showtime, which have depended on cable companies to distribute their programming, are now increasingly becoming additional programming on the Netflix distribution channel.

Investors should own Netflix because the company’s leadership, including CEO Reed Hastings, are great at disruptive innovation. They identify unmet customer needs and then fulfill those needs. Netflix time and again has demonstrated it can figure out a better way to give certain user segments what they want, and then expand their offering to eat away at the traditional market. Once it was retail movie distribution, increasingly it is becoming cable distribution via companies like ComCast, AT&T and Time Warner.

And investors must be long-term. Netflix is an example of why trading is a bad idea – unless you do it for a living. Most of us who have full time day jobs cannot try timing the ups and downs of stock movements. For us, it is better to buy and hold. When you’re ready to buy, buy. Don’t wait, because in the short term there is no way to predict if a stock will go up or down. You have to buy because you are ready to invest, and you expect that over the next 3, 5, 7 years this company will continue to drive growth in revenues and profits, thus expanding its valuation.

Netflix, like Apple, is a company that has mastered the skills of disruptive innovation. While the competition is trying to figure out how to sustain its historical position by doing the same thing better, faster and cheaper Netflix is figuring out “the next big thing” and then delivering it. As the market shifts, Netflix is there delivering on trends with new products – and new business models – which push revenues and profits higher.

That’s why it would have been smart to buy Netflix any time the last 13 years and simply held it. And odds are it will continue to drive higher valuations for investors for many years to come. Not only are HBO, Showtime and Comcast in its sites, but the broadcast networks (ABC, CBS, NBC) are not far behind. It’s a very big media market, which is shifting dramatically, and Netflix is clearly the leader. Not unlike Apple has been in personal technology.

by Adam Hartung | Mar 9, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership

Best Buy, the venerable electronics retailer, is hitting 52 week highs. Coming off a low of $24 in April, 2014 the current price of about $40 is a 67% increase in just 10 months. Analysts are now cheering investors to own the stock, with Marketwatch pronouncing that the last bearish analyst has thrown in the towel.

If you are a trader, perhaps you want to consider this stock. But if you aren’t an investment professional, and you buy and hold stocks for years, then Best Buy is not a stock you should own.

The bullish case for owning Best Buy is based on recovering sales per store, and recovering earnings, after a reduction in the number of stores, and employees, lowered costs. Further, with Radio Shack now in bankruptcy sales are showing an uptick as customers swing over. And that is expected to continue as Sears closes more stores on its marches toward bankruptcy. Additionally, it is hoped that lower gasoline prices will allow consumers to spend more on electronics and appliances at Best Buy.

But, this completely ignores the trend toward on-line retail sales, and the long-term deleterious impact this trend will have on Best Buy. According to the U.S. Census Bureau, on-line sales as a percent of all retail have grown from less than 2.4% in 2005 to over 7.6% by end of 2014 – more than tripling! But more critical to this discussion, all retail sales includes automobiles, lumber, groceries – lots of things where there is little or no online volume.

As most folks know, the number one category for online sales is computers and consumer electronics, which consistently accounts for about 20% of ALL online retail. In fact, about 25% of all consumer electronics are sold online. So the growth in online retail is disproportionately in the Best Buy wheelhouse. The segment where Best Buy competes against streamlined online retailers such as NewEgg.com, ThinkGeek.com and the ever-dominant Amazon.com.

So while in the short term some traditional retail customers will now shift demand to Best Buy, this is not unlike the revenue “bounce” Best Buy received when Circuit City failed. Short term up, but the long term trend continued hammering away at Best Buy’s core market.

This is a big deal because the marginal economic impact of this shift is horrific to Best Buy. In traditional retail most costs are “fixed,” meaning they can’t be changed much month to month. The cost of real estate, store maintenance, utilities and staff cannot be easily adjusted – unless there is a decision to close a gob of stores. Thus losing even a few sales, what economists call “marginal” sales, wreaks havoc on earnings.

Back in 2010 and 2011 Best Buy made a net income (’12 and ’13 were losses) of about 2.6% – or about $2.60 on every $100 revenue. Cost of Goods sold is about 75% of revenue. So on $100 of revenue, $25 is available to cover fixed costs. If revenue falls by just $10, Best Buy loses $2.50 of margin to cover fixed costs. Remember, however, that the net income is only $2.60. So losing 10% of revenue ($10 out of the $100) means Best Buy loses $2.50 of contribution to fixed costs, and that is deducted from net income of $2.60, leaving Best Buy with a meager 10cents of profitability. A 10% loss of revenue wipes out 96% of profits!

Now you know why retailers who lose even a small part of their sales are suddenly closing stores right and left.

Looking forward, online retail sales are forecast to grow by another 57%, reaching 11% of total retail by 2018. But, as we know, this is disproportionately going to be driven by consumer electronics. Which means that while sales for Best Buy stores are up short term, long term they will plummet. That means there will be more store closings, and layoffs as sales shrink. And, increasingly Best Buy will have to compete head-to-head online against entrenched, leading competitors who have been stealing market share for 10+ years.

If you want to trade on the short-term uptick in revenue, and return to slight profitability, then hold your breath and see if you can outsmart the market by picking the right time, and price, for buying and selling Best Buy. But, if you like to invest in strong companies you expect to grow for another 5 years without having to be a market timer, then avoid Best Buy.

Quite simply, it is never a good idea to bet against a long term trend. Short term aberrations will happen, and it may look like the trend has changed. But the trend to online commerce is picking up steam, not reducing. If you want to invest in retail, you want to invest in those companies that demonstrate they can capture the customer’s revenue in the growing, online marketplace.

CSC has no idea how to “focus” on clients. That would mean investing in modern solutions to rapidly changing client needs. CSC failed to do that 15 years ago when most outsourcing involved heavy use of offshore resources. And CSC has never caught up. Leadership overly relied on selling old services, and discounting. It’s model caused it to underbid projects, until the UK government almost shut the company down for its inability to deliver, and constantly hiding actual results.

CSC has no idea how to “focus” on clients. That would mean investing in modern solutions to rapidly changing client needs. CSC failed to do that 15 years ago when most outsourcing involved heavy use of offshore resources. And CSC has never caught up. Leadership overly relied on selling old services, and discounting. It’s model caused it to underbid projects, until the UK government almost shut the company down for its inability to deliver, and constantly hiding actual results.