by Adam Hartung | Dec 18, 2014 | Current Affairs, Defend & Extend, Food and Drink, Leadership, Lifecycle

It is that time of year when many of us celebrate with an alcoholic beverage. But increasingly in America, that beverage is not beer. Since 2008, American beer sales have fallen about 4%.

But that decline has not been equally applied to all brands. The biggest, old line brands have suffered terribly. Nearly gone are old brands like Milwaukee’s Best, which were best known for being low priced – and certainly not focused on taste. But the most hurt, based on volume declines, have been what were once the largest brands; Budweiser, Miller Lite and Miller High Life. These have lost more than a quarter of their volume, losing a whopping 13million barrels/year of demand. These 3 brand declines account for 6% reduction in the entire beer market.

The popular myth is that this has been due to the rise of craft beers. And there is no doubt, craft beer sales have done well. Sales are up 80%. Many articles (including the WSJ)tout the growth of craft beers, which are ostensibly more tasty and appealing, as being the reason old-line brands have declined. It is an easy explanation to accept, and has largely gone unchallenged. Even the brewer of Budweiser, Annheuser-Busch InBev, has reacted to this argument by taking the incredible action of dropping clydesdale horses from their ads after 81 years – in an effort to woo craft beer drinkers, which are thought to be younger and less sentimental about large horses.

This all makes sense. Too bad it’s the wrong conclusion – and the wrong actions being taken.

Realize that craft beer sales are up from a small base, and today ALL craft beer sales still account for only 7.6% of the market. In fact, ALL craft beers combined sell only the same volume as the now smaller Budweiser. The problem with Budweiser sales – and sales of other big name brand beers – is a change in demographics.

Drinkers of Budweiser and Lite are simply older. These brands rose to tremendous dominance in the 1970s. Many of those who loved this brand are simply older – or dead. Where a hard working fellow in his 30s or 40s might enjoy a six pack after work, today that Boomer (if still alive) is somewhere between late 50s and 70s. Now, a single beer, or maybe two, will suffice thank you very much. And, equally challenging for sales, today’s Boomer is more often drinking a hard liquor cocktail, and a glass of wine with dinner. Beer drinking has its place, but less often and in lower quantities.

Meanwhile, Hispanics are a growing demographic. Hispanics are the largest non-white population in America, at 54million, and represent over 17% of all Americans. With a growth rate of 2.1%, Hispanics are also one of the fastest growing demographic segments – and increasingly important given their already large size. Hispanics are truly becoming a powerful buying group in American economics.

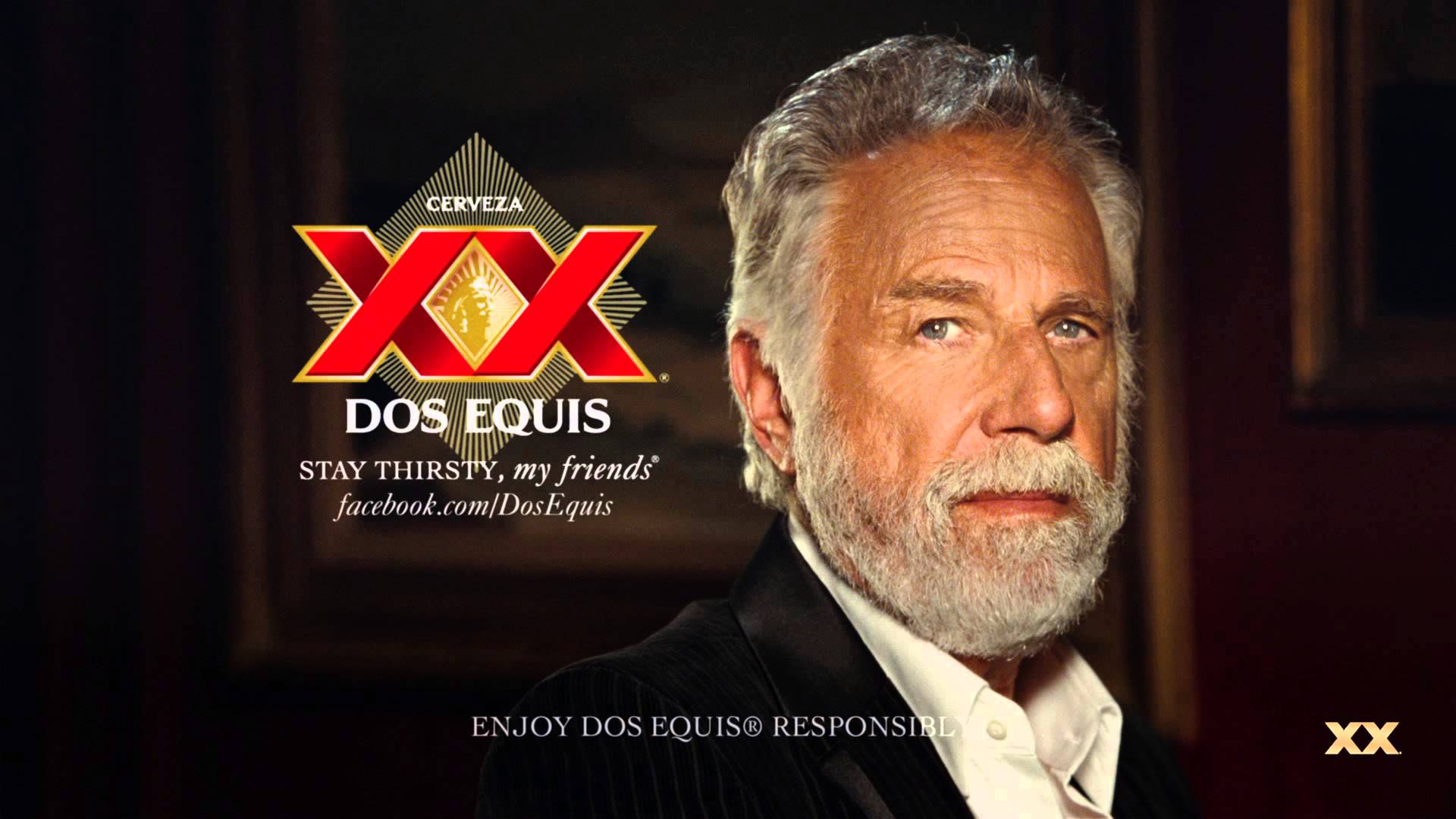

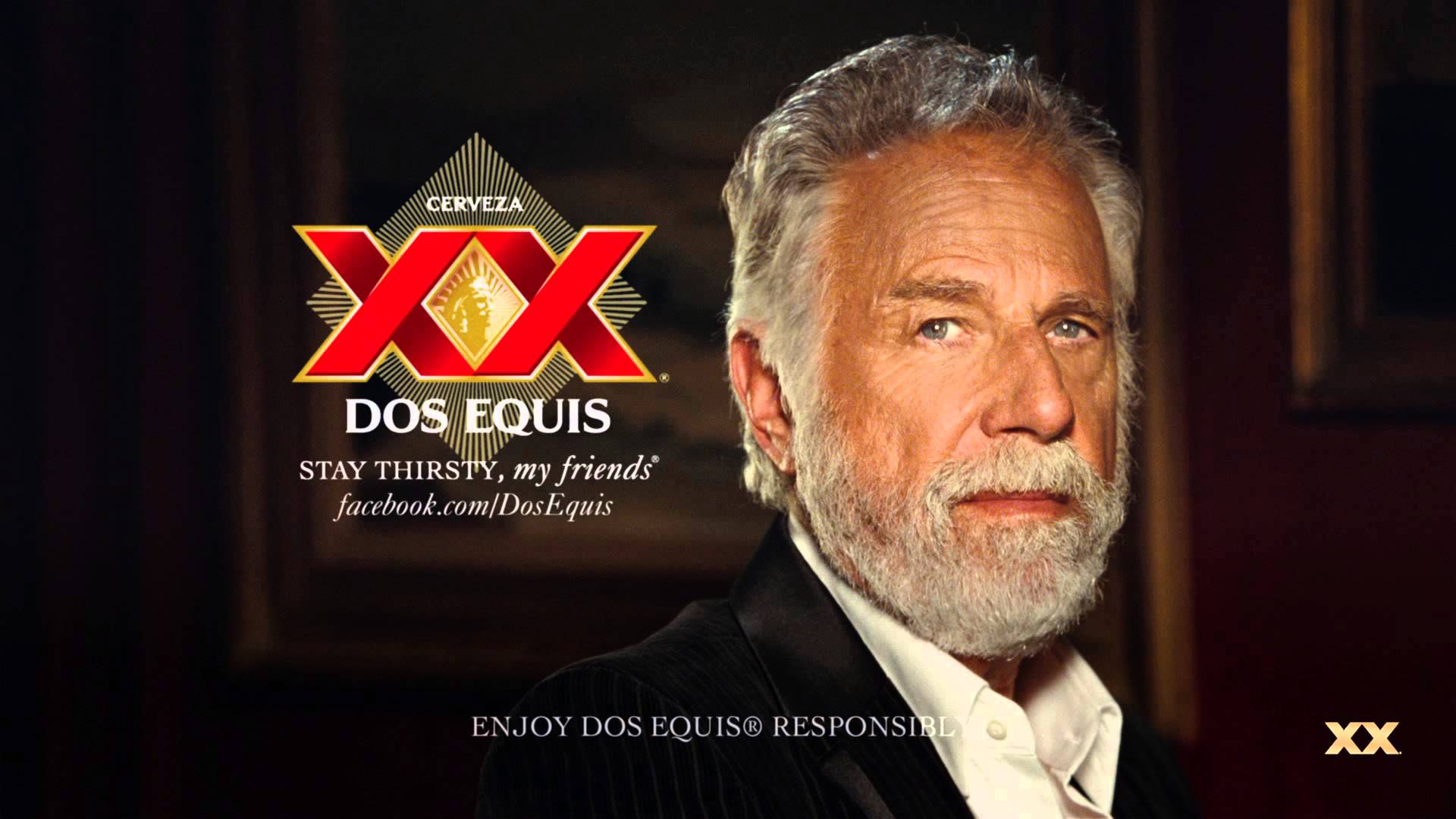

So, just as decline in Boomer population and consumption has hurt the once great beer brands, we can look at the growth in Hispanic demographics and see a link to sales of growing brands. Two significant (non-craft volume) beer brands that more than doubled sales since 2008 are Modelo Especial and Dos Equis. In fact, these were the 2 fastest growing brands in America, even though the first does no English language advertising at all, and the latter only lightly funds advertising with an iconic multi-year campaign. Together their sales total almost 5.4M barrels – which makes these 2 brands equal to 1/3 the ENTIRE craft beer marketplace. And growing 33% faster!

Chasing the myth of craft sales is doing nothing for InBev and MillerCoors as they try to defend and extend outdated brands. On the other hand, Heineken controls Dos Equis, and Constellation Brands controls Modello Especial. These two companies are squarely aligned with demographic trends, and well positioned for growth.

So, be careful the next time you hear some simple explanation for why a product or service is declining. The answer might sound appealing, but have little economic basis. Instead, it is much smarter to look at big trends and you’ll likely see why in the same market one product is growing, while another is declining. Trends – such as demographics – often explain a lot about what is happening, and lead you to invest much smarter.

by Adam Hartung | Dec 11, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television, Web/Tech

The trend toward the death of broadcast TV as we’ve known it keeps moving forward. This trend may not happen as fast as the death of desktop computers, but it is a lot faster than glacier melting.

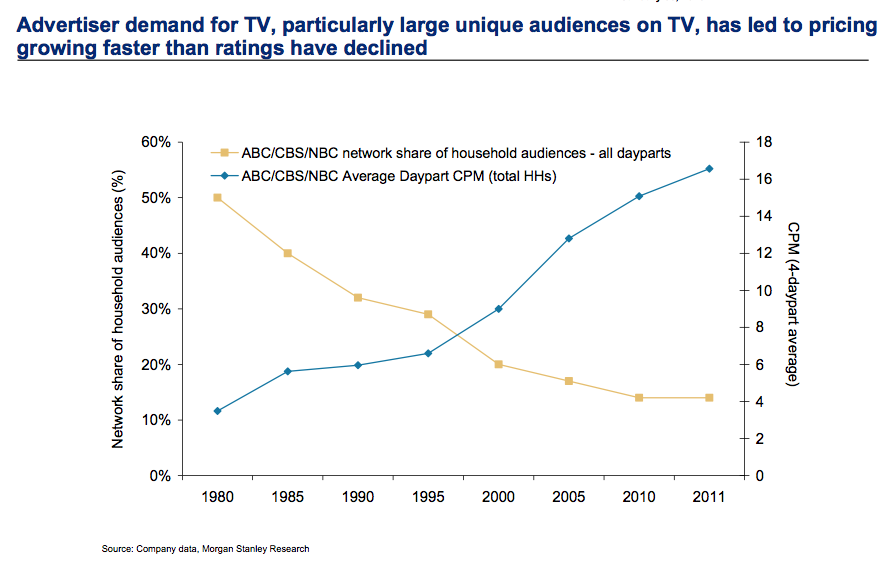

This television season (through October) Magna Global has reported that even the oldest viewers (the TV Generation 55-64) watched 3% less TV. Those 35-54 watched 5% less. Gen Xers (25-34) watched 8% less, and Millenials (18-24) watched a whopping 14% less TV. Live sports viewing is not even able to maintain its TV audience, with NFL viewership across all networks down 10-19%.

Everyone knows what is happening. People are turning to downloaded entertainment, mostly on their mobile devices. With a trend this obvious, you’d think everyone in the media/TV and consumer goods industries would be rethinking strategy and retooling for a new future.

But, you would be wrong. Because despite the obviousness of the trend, emotional ties to hoping the old business sticks around are stronger than logic when it comes to forecasting.

CBS predicted at the beginning of 2014 TV ad revenue would grow 4%. Oops. Now CBS’s lead forecaster is admitting he was way off, and adjusted revenues were down 1% for the year. But, despite the trend in viewer behavior and ad expenditures in 2014, he now predicts a growth of 2% for 2015.

That, my young friends, is how “hockey stick” forecasts are created. A lot of old assumptions, combined with a willingness to hope trends will be delayed, and you can ignore real data while promising people that the future will indeed look like the past – even when it defies common sense.

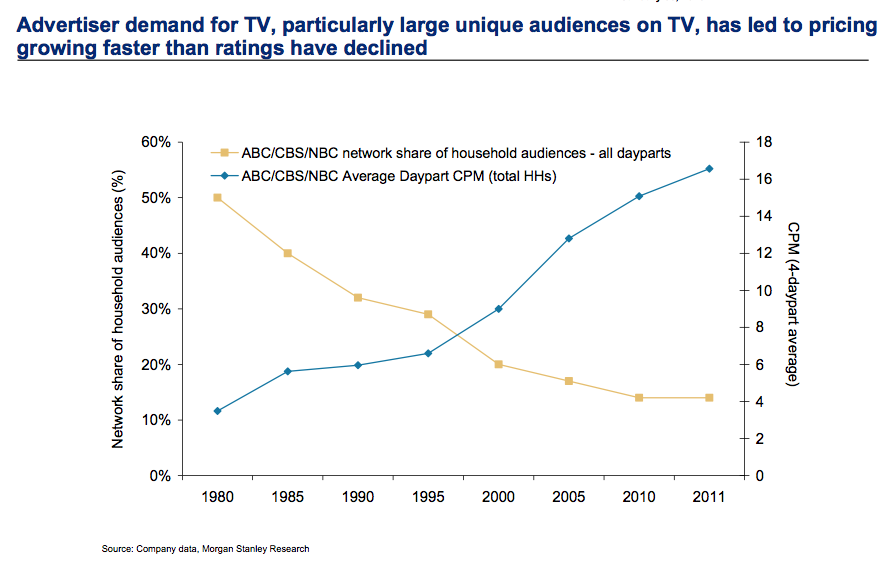

To compensate for fewer ads the networks have raised prices on all ads. But how long can that continue? This requires a really committed buyer (read more about CMO weaknesses below) who simply refuses to acknowledge the market has shifted and the dollars need to shift with it. That cannot last forever.

Meanwhile, us old folks can remember the days when Nielsen ratings determined what was programmed on TV, as well as what advertisers paid. Nielsen had a lock on measuring TV audience viewing, and wielded tremendous power in the media and CPG world.

But now AC Nielsen is struggling to remain relevant. With TV viewership down, time shifting of shows common and streaming growing like the proverbial weed Nielsen has no idea what entertainment the public watches. They don’t know what, nor when, nor where. Unwilling to move quickly to develop tools for catching all the second screen viewing, Nielsen has no plan for telling advertisers what the market really looks like – and the company looks to become a victim of changing markets.

Which then takes us to looking at those folks who actually buy ads that drive media companies. The Chief Marketing Officers (CMOs) of CPG companies. Surely these titans of industry are on top of these trends, and rapidly shifting their spending to catch the viewers with the most ads placed for the lowest cost.

You would wish.

Unfortunately, because these senior executives are in the oldest age groups, they are a victim of their own behavior. They still watch TV, so assume others must as well. If there is cyber-data saying they are wrong, well they simply discount that data. The Nielsen’s aren’t accurate, but these execs still watch the ratings “because it’s the best info we have” – a blatant untruth by the way. But Nielsen does conveniently reinforce their built in assumptions, and their hope that they won’t have to change their media spend plans any time soon.

Further, very few of these CMOs actually use social media. The vast majority watch their children, grandchildren and young employees use mobile devices constantly – and they bemoan all the activity on YouTube, Facebook, Instagram and Twitter – or for the most part even Linked-in. But they don’t actually USE these products. They don’t post information. They don’t set up and follow channels. They don’t connect with people, share information, exchange photos or tell stories on social media. Truthfully, they ignore these trends in their own lives. Which leaves them woefully inept at figuring out how to change their company marketing so it can be more relevant.

The trend is obvious. The answer, equally so. Any modern marketer should be an avid user of social media. Most network heads and media leaders are farther removed from social media than the Pope! They don’t constantly download entertainment, and exchanging with others on all the platforms. They can’t manage the use of these channels when they don’t have a clue how they work, or how other people use them, or understand why they are actually really valuable tools.

Are you using these modern tools? Are you actually living, breathing, participating in the trends? Or are you, like these outdated execs, biding your time wasting money on old programs while you look forward to retirement? And likely killing your company.

When trends emerge it is imperative we become part of that trend. You can’t simply observe it, because your biases will lead you to hope the trend reverts as you continue doing more of the same. A leader has to adopt the trend as a leader, be a practicing participant, and learn how that trend will make a substantial difference in the business. And then apply some vision to remain relevant and successful.

by Adam Hartung | Nov 12, 2014 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Leadership

We see it all too often. A successful business seems to lose its way. Somehow, after decades of success, its results soften, then tumble and the company becomes a victim of its competition. We scratch our heads and wonder, “why did that happen?”

Pizza Hut is well on its way to disappearing. Kind of like Pizza Inn, A&W and Howard Johnson’s. And that seems kind of remarkable considering the company at one time defined pizza for most Americans. From a fast growing franchise in the 1960s to a high profile acquisition by PepsiCo in the 1970s, to anchoring the Yum Brands spin out from PepsiCo in 1997, Pizza Hut just finished 8 straight quarters of declining same store sales. Pizza Hut was once a concept as hot as Apple Stores, but now it looks more like Sears. How could this happen?

When Pizza Hut was growing it locked in on its success formula. And one of the biggest Lock-ins was its name. Pizza Hut was a place where you ate pizza, and the buildings all looked the same with that hut-like red roof. At a time when few Americans outside the northeast ate pizza, this Wichita, Kansas founded (and headquartered until the 1990s) company told people what a pizzeria should look like, and what you should eat.

The company was ardent about controlling what franchisees served. No nachos, or other trendy foods, because they didn’t fit the pizza theme. No delivery, because good pizza required you eat it immediately from the oven. Pizza should be thick and hearty, even served in a deep dish so you have plenty of bread and feel really full. Whether anyone in Italy ever a pizza anything like this really did not matter.

And Pizza Hut would help guide customers as to what toppings they wanted — and usually there should be at least 3 – by offering pre-designed pizzas with names like “meat lovers,” “supreme,” “super supreme” or “veggie lover’s” so an uninformed clientele (originally prairie state, then midwestern, then expanding into the southwest and the south) could buy the product without a lot of fuss.

This success formula may sound cliche today, but it worked. And it worked really well for 30 years, then pretty well for another 10-15. But, eventually, doing the same thing over, and over, and over, and over had less appeal. Almost everyone in the country knew what a Pizza Hut was, what the stores looked like and what the product was like. Competitors came along by the dozens with all kinds of variations, and different kinds of service – like being in a mall, or delivering the product. Inevitably this competition led to price wars. To keep customers Pizza Hut had to lower its prices, even offering 2 pizzas for the price of one. Pizza Hut never lost track of its success formula, and never stopped doing what once made it great. But margins eroded, and then sales started declining.

Lots of people don’t care about Pizza Hut any more. They want an alternative. An alternative product, like California Pizza Kitchen or Wolfgang Pucks. Or an alternative to pizza altogether like the new “fast casual” chains such as Chipotle’s, Baja Fresh or Panera. For a whole raft of reasons, people decided that although they once ate Pizza Hut (even ate a LOT of it) they were going to eat something else.

But Pizza Hut was locked in. First, its name. Pizza. Hut. To fulfill the “brand promise” of that name everything about that store is pre-designed. From the outside to the inside tables to the equipment in the kitchen. 6,300 stores that are almost identical. Any change and you have to make 6,300 changes. Adding new product categories means reprinting 126,000 menus, changing 6,300 kitchen layouts, buying 6,300 new ovens, figuring out the service utensils for 6,300 wait staff. That’s lock-in. Making any change is so hard that the incentive is entirely toward improve what you’ve always done rather than doing something new.

Growth Stalls are Deadly

Eventually, like Pizza Hut, growth stalls. It only takes 2 quarters of declining sales to hit a growth stall, and when that happens less than 7% of businesses will ever again consistently grow at a meager 2%. Growth stalls tell us “hey, the market shifted. What you’re doing isn’t selling any more.”

But most management teams don’t think about a market shift, and instead react by trying to do more of the same. They treat this like its an operational problem. More quality campaigns, more money spent on advertising, more promotions, asking employees to work a little harder, more product for the same (or lower) price – more, better, faster, cheaper. But this doesn’t work, because the problem lies in a market shift away from your “core” that requires an entirely different strategy.

Because management is incented to ignore this shift as long as possible, the company soon becomes irrelevant. Customers know they’ve been going to competitors, and they start to realize it’s been a long time since they bought from that old supplier. They realize their interest in that old company and its products has simply gone away. They don’t pay attention to the ads. And they don’t have any interest in new product announcements. Actually, they find the company irrelevant. Even when the discounts are big, they don’t buy. They do business where they identify with the company and its products, even when those products cost more.

And thus the results start to tumble horribly. Only by now management is so far removed from market trends that it has no idea how to regain relevancy. In Pizza Hut’s case, leadership is undertaking what they’d like to think is a brand overhaul that will change its position in customers’ minds. But, unfortunately, they are doing the ultimate in defend & extend management to try and save the old success formula.

Pizza Hut is introducing a maze of new ways to have its old product, in its old stores. 10 crust choices, 6 sauce choices, 22 of those pre-designed pizza offerings, 5 different liquids you can have dribbled over the pizza, and a rash of exotic new toppings – like banana. So now you can order your pizza 1,000 different ways (actually, more like 10,000.) Oh, and this is being launched with a big increase in traditional advertising. In other words, an insane implementation of what the company has always done; giving customers an American style pizza, in a hut, promoted on TV – even most likely buying what is now considered iconic – a Super Bowl ad.

Yum Brands investors have reasons to be concerned. Pizza Hut is really important to sales and earnings. But its leaders are intent on doing more of the same, even though the market has already shifted. The prognosis does not look good.

by Adam Hartung | Nov 3, 2014 | Current Affairs, In the Rapids, Leadership, Web/Tech

On April 15 Zebra Technologies announced its planned acquisition of Motorola’s Enterprise Device Business. This was remarkable because it represented a major strategic shift for Zebra, and one that would take a massive investment in products and technologies which were wholly new to the company. A gutsy play to make Zebra more relevant in its B-2-B business as interest in its “core” bar code business was declining due to generic competition.

Last week the acquisition was completed. In an example of Jonah swallowing the whale, Zebra added $2.5B to annual revenues on its old base of $1B (2.5x incremental revenue,) an additional 4,500 employees joined its staff of 2,500 and 69 new facilities were added. Gulp.

As CEO Anders Gustafsson told me, “after the deal was agreed to I felt like the dog that caught the car. ”

Fortunately Zebra has a plan, and it is all around growth. Acquisitions led by private equity firms, hedge funds or leveraged buyout partners are usually quick to describe the “synergies” planned for after the acquisition. Synergy is a code word for massive cost cutting (usually meaning large layoffs,) selling off assets (from buildings to product lines and intellectual property rights) and shutting down what the buyers call “marginal” businesses. This always makes the company smaller, weaker and less likely to survive as the new investors focus on pulling out cash and selling the remnants to some large corporation.

There is no growth plan.

But Zebra has publicly announced that after this $3.25B investment they plan only $150M of savings over 2 years. Which means Zebra’s management team intends to grow what they bought, not decimate it. What a novel, or perhaps throwback, idea.

Minimal cost cutting reflects a deal, as CEO Gustafsson told me, “envisioned by management, not by bankers.”

Zebra’s management knew the company was frequently pitching for new work in partnership with Motorola. The two weren’t competitors, but rather two companies working to move their clients forward. But in a disorganized, unplanned way because they were two totally different companies. Zebra’s team recognized that if this became one unit, better planning for clients, the products could work better together, the solutions more directly target customer needs and it would be possible to slingshot forward ahead of competitors to grow revenues.

As CEO since 2007, Anders Gustafsson had pushed a strategy which could grow Zebra, and move the company outside its historical core business of bar code printers and readers. The leadership considered buying Symbol Technology, but wasn’t ready and watched it go to Motorola.

Then Zebra’s team knuckled down on their strategy work. CEO Gustafsson spelled out for me the 3 trends which were identified to build upon:

- Mobility would continue to be a secular growth trend. And business customers needed products with capabilities beyond the generic smart phone. For example, the kind of integrated data entry and printing device used at a remote rental car return. These devices drive business productivity, and customers hunger for such solutions.

- From the days of RFID, where Zebra was an early player, had emerged automatic data capture – which became what now is commonly called “The Internet of Things” – and this trend too had far to extend. By connecting the physical and digital worlds, in markets like retail inventory management, big productivity boosts were possible in formerly moribund work that added cost but little value.

- Cloud-based (SaaS and growth of lightweight apps) ecosystems were going to provide fast growth environments. Client need for capability at the employee’s (or their customer’s) fingertips would grow, and those people (think distributors, value added resellers [VARs]) who build solutions will create apps, accessible via the cloud, to rapidly drive customer productivity.

With this groundwork, the management team developed future scenarios in which it became increasingly clear the value in merging together with Motorola devices to accelerate growth. According to CEO Gustafsson, “it would bring more digital voice to the Zebra physical voice. It would allow for more complete product offerings which would fulfill critical, macro customer trends.”

But, to pull this off required selling the Board of Directors. They are ultimately responsible for company investments, and this was – as described above – a “whopper.”

The CEO’s team spent a lot of time refining the message, to be clear about the benefits of this transaction. Rather than pitching the idea to the Board, they offered it as an opportunity to accelerate strategy implementation. Expecting a wide range of reactions, they were not surprised when some Directors thought this was “phenomenal” while others thought it was “fraught with risk.”

So management agreed to work with the Board to undertake a thorough due diligence process, over many weeks (or months it turned out) to ask all the questions. A key executive, who was a bit skeptical in her own right, took on the role of the “black hat” leader. Her job was to challenge the many ideas offered, and to be a chronic skeptic; to not let the team become enraptured with the idea and thereby sell themselves on success too early, and/or not consider risks thoroughly enough. By persistently undertaking analysis, education led the Board to agree that management’s strategy had merit, and this deal would be a breakout for Zebra.

Next came completing financing. This was a big deal. And the only way to make it happen was for Zebra to take on far more debt than ever in the company’s history. But, the good news was that interest rates are at record low levels, so the cost was manageable.

Zebra’s leadership patiently met with bankers and investors to overview the market strategy, the future scenarios and their plans for the new company. They over and again demonstrated the soundness of their strategy, and the cash flow ability to service the debt. Zebra had been a smaller, stable company. The debt added more dynamism, as did the much greater revenues. The requirement was to decide if the strategy was soundly based on trends, and had a high likelihood of success. Quickly enough, the large shareholders agreed with the path forward, and the financing was fully committed.

Now that the acquisition is complete we will all watch carefully to see if the growth machine this leadership team created brings to market the solutions customers want, so Zebra can generate the revenue and profits investors want. If it does, it will be a big win for not only investors but Zebra’s employees, suppliers and the communities in which Zebra operates.

The obvious question has to be, why didn’t Motorola do this deal? After all, they were the whale. It would have been much easier for people to understand Motorola buying Zebra than the gutsy deal which ultimately happened.

Answering this question requires a lot more thought about history. In 2006 Motorola had launched the Razr phone and was an industry darling. Newly minted CEO Ed Zander started partnering with Google and Apple rather than developing proprietary solutions like Razr. Carl Icahn soon showed up as an activist investor intent on restructuring the company and pulling out more cash. Quickly then-CEO Ed Zander was pushed out the door. New leadership came in, and Motorola’s new product introductions disappeared.

Under pressure from Mr. Icahn, Motorola started shrinking under direction of the new CEO. R&D and product development went through many cuts. New product launches simply were delayed, and died. The cellular phone business began losing money as RIM brought to market Blackberry and stole the enterprise show. Year after year the focus was on how to raise cash at Motorola, not how to grow.

After 4 years, Mr. Icahn was losing money on his position in Motorola. A year later Motorola spun out the phone business, and a year after that leadership paid Mr. Icahn $1.2B in a stock repurchase that saved him from losses. The CEO called this buyout of Icahn the “end of a journey” as Mr. Icahn took the money and ran. How this benefited Motorola is – let’s say unclear.

But left in Icahn’s wake was a culture of cut and shred, rather than invest. After 90 years of invention, from Army 2-way radios to police radios, from AM car radios to home televisions, the inventor analog and digital cell towers and phones, there was no more innovation at Motorola. Motorola had become a company where the leaders, and Board, only thought about how to raise cash – not deploy it effectively within the corporation. There was very little talk about how to create new markets, but plenty about how to retrench to ever smaller “core” markets with no sales growth and declining margins. In September of this year long-term CEO Greg Brown showed no insight for what the company can become, but offered plenty of thoughts on defending tax inversions and took the mantle as apologist for CEOs who use financial machinations to confuse investors.

Investors today should cheer the leadership, in management and on the Board, at Zebra. Rather than thinking small, they thought big. Rather than bragging about their past, they figured out what future they could create. Rather than looking at their limits, they looked at the possibilities. Rather than giving up in the face of objections, they studied the challenges until they had answers. Rather than remaining stuck in their old status quo, they found the courage to become something new.

Bravo.

by Adam Hartung | Oct 28, 2014 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, Leadership, Lock-in, Television

I’m a “Boomer,” and my generation could have been called the Coke generation. Our parents started every day with a cup of coffee, and they drank either coffee or water during the day. Most meals were accompanied by either water, or iced tea.

But our generation loved Coca-Cola. Most of our parents limited our consumption, much to our frustration. Some parents practically refused to let the stuff in the house. In progressive homes as children we were usually only allowed one, or at most two, bottles per day. We chafed at the controls, and when we left home we started drinking the sweet cola as often as we could.

It didn’t take long before we supplanted our parent’s morning coffee with a bottle of Coke (or Diet Coke in more modern times.) We seemingly could not get enough of the product, as bottle size soared from 8 ounces to 12 to 16 and then quarts and eventually 2 liters! Portion control was out the window as we created demand that seemed limitless.

Meanwhile, Americans exported our #1 drink around the world. From 1970 onward Coke was THE iconic American brand. We saw ads of people drinking Coke in every imaginable country. International growth seemed boundless as people from China to India started consuming the irresistible brown beverage.

My how things change. Last week Coke announced third quarter earnings, and they were down 14%. The CEO admitted he was struggling to find growth for the company as soda sales were flat. U.S. sales of carbonated beverages have been declining for a decade, and Coke has not developed a successful new product line – or market – to replace those declines.

Coke is a victim of changing customer preferences. Once a company that helped define those preferences, and built the #1 brand globally, Coke’s leadership shifted from understanding customers and trends in order to build on those trends towards defending & extending sales of its historical product. Instead of innovating, leadership relied on promotion and tactics which had helped the brand grow 30 years ago. They kept to their old success formula as trends shifted the market into new directions.

Coke began losing its relevancy. Trends moved in a new direction. Healthfulness led customers to decide they wanted a less calorie rich, nutritionally starved drink. And concerns grew over “artificial” products, such as sweeteners, leading customers away from even low calorie “diet” colas.

Meanwhile, younger generations started turning to their own new brands. And not just drinks. Instead of holding a Coke, increasingly they hold an iPhone. Where once it was hip to hang out at the Coke machine, or the fountain stand, now people would rather hang out at a Starbucks or Peet’s Coffee. Where once Coke was identified and matched the aspirations of the fast growing Boomer class, now it is replaced with a Prada handbag or other accessory from an LVMH branded luxury product.

Where once holding a Coke was a sign of being part of all that was good, now the product is largely passe. Trends have moved, and Coke didn’t. Coke leadership relied too much on its past, and failed to recognize that market shifts could affect even the #1 global brand. Coke leaders thought they would be forever relevant, just do more of what worked before. But they were wrong.

Unfortunately, CEO Muhtar Kent announced a series of changes that will most likely further hurt the Coca-Cola company rather than help it.

First, and foremost, like almost all CEOs facing an earnings problem the company will cut $3B in costs. The most short-term of short-term actions, which will do nothing to help the company find its way back toward being a prominent brand-leading icon. Cost cuts only further create a “hunker-down” mindset which causes managers to reduce risk, rather than look for breakthrough products and markets which could help the company regain lost ground. Cost cutting will only further cause remaining management to focus on defending the past business rather than finding a new future.

Second, Coca-Cola will sell off its bottlers. Interestingly, in the 1980s CEO Roberto Goizueta famously bought up the distributorships, and made a fortune for the company doing so. By the year 2000 he was honored, along with Jack Welch of GE, as being one of the top 2 CEOs of the century for his ability to create shareholder value. But now the current CEO is selling the bottling operations – in order to raise cash. Once again, when leadership can’t run a business that makes money they often sell off assets to generate cash and make the company smaller – none of which benefits shareholders.

Third, fire the Chief Marketing Officer. Of course, somebody has to be blamed! The guy who has done the most to bring Coca-Cola’s brand out of traditional advertising and promote it in an integrated manner across all media, including managing successful programs for the Olympics and World Cup, has to be held accountable. What’s missing in this action is that the big problem is leadership’s fixation with defending its Coke brand, rather than finding new growth businesses as the market moves away from carbonated soft drinks. And that is a problem that requires the CEO and his entire management team to step up their strategy efforts, not just fire the leader who has been updating the branding mechanisms.

Coca-Cola needs a significant strategy shift. Leadership focused too long on its aging brands, without putting enough energy into identifying trends and figuring out how to remain relevant. Now, people care a lot less about Coke than they did. They care more about other brands, like Apple. Globally. Unless there is a major shift in Coke’s strategy the company will continue to weaken along with its primary brand. That market shift has already happened, and it won’t stop.

For Coke to regain growth it needs a far different future which aligns with trends that now matter more to consumers. The company must bring forward products which excite people ,and with which they identify. And Coke’s leaders must move much harder into understanding shifts in media consumption so they can make their new brands as visible to newer generations as TV made Coke visible to Boomers.

Coke is far from a failed company, but after a decade of sales declines in its “core” business it is time leadership realizes takes this earnings announcement as a key indicator of the need to change. And not just simple things like costs. It must fundamentally change its strategy and markets or in another decade things will look far worse than today.

by Adam Hartung | Oct 6, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Web/Tech

Hewlett Packard is splitting in two. Do you find yourself wondering why? You aren’t alone.

Hewlett Packard is nearly 75 years old. One of the original “silicone valley companies,” it started making equipment for engineers and electronic technicians long before computers were every day products. Over time HP’s addition of products like engineering calculators moved it toward more consumer products. And eventually HP became a dominant player in printers. All of these products were born out of deep skills in R&D, engineering and product development. HP had advantages because its products were highly desirable and unique, which made it nicely profitable.

But along came a CEO named Carly Fiorina, and she decided HP needed to grow much bigger, much more quickly. So she bought Compaq, which itself had bought Digital Equipment, so HP could sell Wintel PCs. PCs were a product in which HP had no advantage. PC production had always been an assembly operation of other companies’ intellectual property. It had been a very low margin, brutally difficult place to grow unless one focused on cost lowering rather than developing intellectual capital. It had nothing in common with HP’s business.

To fight this new margin battle HP replaced Ms. Fiorina with Mark Hurd, who recognized the issues in PC manufacturing and proceeded to gut R&D, product development and almost every other function in order to push HP into a lower cost structure so it could compete with Dell, Acer and other companies that had no R&D and cultures based on cost controls. This led to internal culture conflicts, much organizational angst and eventually the ousting of Mr. Hurd.

But, by that time HP was a company adrift with no clear business model to help it have a sustainably profitable future.

Now HP is 4 years into its 5 year turnaround plan under Meg Whitman’s leadership. This plan has made HP much smaller, as layoffs have dominated the implementation. It has weakened the HP brand as no important new products have been launched, and the gutted product development capability is still no closer to being re-established. And PC sales have stagnated as mobile devices have taken center stage – with HP notably weak in mobile products. The company has drifted, getting no better and showing no signs of re-developing its historical strengths.

So now HP will split into two different companies. Following the old adage “if you can’t dazzle ’em with brilliance, baffle ’em with bulls**t.” When all else fails, and you don’t know how to actually lead a company, then split it into pieces, push off the parts to others to manage and keep at least one CEO role for yourself.

Let’s not forget how this mess was created. It was a former CEO who decided to expand the company into an entirely different and lower margin business where the company had no advantage and the wrong business model. And another that destroyed long-term strengths in innovation to increase short-term margins in a generic competition. And then yet a third who could not find any solution to sustainability while pushing through successive rounds of lay-offs.

This was all value destruction created by the persons at the top. “Strategic” decisions made which, inevitably, hurt the organization more than helped it. Poorly thought through actions which have had long-term deleterious repercussions for employees, suppliers, investors and the communities in which the businesses operate.

The game of musical chairs has been very good for the CEOs who controlled the music. They were paid well, and received golden handshakes. They, and their closest reports, did just fine. But everyone else….. well…..

by Adam Hartung | Sep 30, 2014 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership, Web/Tech

Will the new Apple Pay product, revealed on iPhone 6 devices, succeed? There have been many entries into the digital mobile payments business, such as Google Wallet, Softcard (which had the unfortunate initial name of ISIS,) Square and Paypal. But so far, nobody has really cracked the market as Americans keep using credit cards, cash and checks.

But that looks like it might change, and Apple has a pretty good chance of making Apple Pay a success.

First, a look at some critical market changes. For decades we all thought credit card purchases were secure. But that changed in 2013, and picked up steam in 2014. With regularity we’ve heard about customer credit card data breaches at various retailers and restaurants. Smaller retailers like Shaw’s, Star Markets and Jewel caused some mild concern. But when top tier retailers like Target and Home Depot revealed security problems, across millions of accounts, people really started to notice. For the first time, some people are thinking an alternative might be a good idea, and they are considering a change.

In other words, there is now an underserved market. For a long time people were very happy using credit cards. But now, they aren’t as happy. There are people, still a minority, who are actively looking for an alternative to cash and credit cards. And those people now have a need that is not fully met. That means the market receptivity for a mobile payment product has changed.

Second let’s look at how Paypal became such a huge success fulfilling an underserved market. When people first began on-line buying transactions were almost wholly credit cards. But some customers lacked the ability to use credit cards. These folks had an underserved need, because they wanted to buy on-line but had no payment method (mailing checks or cash was risky, and COD shipments were costly and not often supported by on-line vendors.) Paypal jumped into that underserved market.

Quickly Paypal tied itself to on-line vendors, asking them to support their product. They went less to people who were underserved, and mostly to the infrastructure which needed to support the product. By encouraging the on-line retailers they could expand sales with Paypal adoption, Paypal gathered more and more sites. The 2002 acquisition by eBay was a boon, as it truly legitimized Paypal in minds of consumers and smaller on-line retailers.

After filling the underserved market, Paypal expanded as a real competitor for credit cards by adding people who simply preferred another option. Today Paypal accounts for $1 of every $6 spent on-line, a dramatic statistic. There are 153million Paypal digital wallets, and Paypal processes $203B of payments annually. Paypal supports 26 currencies, is in 203 markets, has 15,000 financial institution partners – all creating growth last year of 19%. A truly outstanding success story.

Back to traditional retail. As mentioned earlier, there is an underserved market for people who don’t want to use cash, checks or credit cards. They seek a solution. But just as Paypal had to obtain the on-line retailer backing to acquire the end-use customer, mobile payment company success relies on getting retailers to say they take that company’s digital mobile payment product.

Here is where Apple has created an advantage. Few end-use customers are terribly aware of retail beacons, the technology which has small (sometimes very small) devices placed in a store, fast food outlet, stadium or other environment which sends out signals to talk to smartphones which are in nearby proximity. These beacons are an “inside retail” product that most consumer don’t care about, just like they don’t really care about the shelving systems or price tag holders in the store.

Launched with iOS 7, Apple’s iBeacon has become the leader in this “recognize and push” technology. Since Apple installed Beacons in its own stores in December, 2013 tens of thousands of iBeacons have been installed in retailers and other venues. Macy’s alone installed 4,000 in 2014. Increasingly, iBeacons are being used by retailers in conjunction with consumer goods manufacturers to identify who is shopping, what they are buying, and assist them with product information, coupons and other purchase incentives.

Thus, over the last year Apple has successfully been courting the retailers, who are the infrastructure for mobile payments. Now, as the underserved payment issue comes to market it is natural for retailers to turn to the company with which they’ve been working on their “infrastructure” products.

Apple has an additional great benefit because it has by far the largest installed base of smartphones, and its products are very consistent. Even though Android is a huge market, and outsells iOS, the platform is not consistent because Android on Samsung is not like Android on Amazon’s Fire, for example. So when a retailer reaches out for the alternative to credit cards, Apple can deliver the largest number of users. Couple that with the internal iBeacon relationship, and Apple is really well positioned to be the first company major retailers and restaurants turn to for a solution – as we’ve already seen with Apple Pay’s acceptance by Macy’s, Bloomingdales, Duane Reed, McDonald’s Staples, Walgreen’s, Whole Foods and others.

This does not guarantee Apple Pay will be the success of Paypal. The market is fledgling. Whether the need is strong or depth of being underserved is marked is unknown. How consumers will respond to credit card use and mobile payments long-term is impossible to gauge. How competitors will react is wildly unpredictable.

But, Apple is very well positioned to win with Apple Pay. It is being introduced at a good time when people are feeling their needs are underserved. The infrastructure is primed to support the product, and there is a large installed base of users who like Apple’s mobile products. The pieces are in place for Apple to disrupt how we pay for things, and possibly create another very, very large market. And Apple’s leadership has a history of successfully managing disruptive product launches, as we’ve seen in music (iPod,) mobile phones (iPhone) and personal technology tools (iPad.)

by Adam Hartung | Sep 25, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Innovation, Sports, Web/Tech

Few businesses fail in a fiery, quick downfall. Most linger along for years, not really mattering to anyone – including customers, suppliers or even investors. They exist, but they aren’t relevant.

When a company is relevant customers are eager for new product releases, and excited to talk to salespeople. Media want to report on the company, its products and its leaders. Investors want to hear about what the company will do next to drive revenues and increase profits.

But when a company loses relevancy, that all disappears. Customers quit paying attention to new products, and salespeople are not given the time of day. The company begs for coverage of its press releases, but few media outlets pay attention because writing about that company produces few readers, or advertisers. Investors lose hope for big gains, and start looking for ways to sell the stock or debt without taking too big a loss, or further depressing valuations.

In short, when a company loses relevancy it is on the downward slope to failure. It may take a long time, but lacking market relevancy the company has practically no hope of increasing revenues or profits, or of creating many new and exciting jobs, or of being a great customer for suppliers. Losing relevancy means the company is headed out of business, it’s just a matter of time. Think Howard Johnson’s, ToysRUs, Sears, Radio Shack, Palm, Hostess, Samsonite, Pierre Cardin, Woolworth’s, International Harvester, Zenith, Sony, Rand McNally, Encyclopedia Britannica, DEC — you get the point.

Many people may not be aware that Microsoft made an exclusive deal with the NFL to provide Surface tablets for coaches and players to use during games, replacing photographs, paper and clipboards for reviewing on-field activities and developing plays. The goal was to up the prestige of Surface, improve its “cool” factor, while showing capabilities that might encourage more developers to write apps for the product and more businesses to buy it.

But things could not have gone worse during the NFL’s launch. Because over and again, announcers kept calling the Surface tablets iPads. Announcers saw the tablet format and simply assumed these were iPads. Or, worse, they did not realize there was any tablet other than the iPad. As more and more announcers made this blunder it became increasingly clear that Apple not only invented the modern tablet marketplace, but that it’s brand completely dominates the mindset of users and potential buyers. iPad has become synonymous with tablet for most people.

In a powerful way, this demonstrates the lack of relevancy Microsoft now has in the personal technology marketplace. Fewer and fewer people are buying PCs as they rely increasingly on mobile devices. Practically nobody cares any more about new releases of Windows or Office. In fact, the American Customer Satisfaction Index reported people think Apple is now considered the best PC maker (the Macintosh.) HP was near the bottom of the list, with Dell, Acer and Toshiba not faring much better.

And in mobile devices, Apple is clearly the king. In its first weekend of sales the new iPhone 6 and 6Plus sold 10million units, blasting past any previous iPhone model launch – and that was without any sales in China and several other markets. The iPhone 4 was considered a smashing success, but iPhone 4 sales of 1.7million units was only 17% of the newest iPhone – and the 9million iPhone 5 sales included China and the lower-priced 5C. In fact, more units could have been sold but Apple ran out of supply, forcing customers to wait. People clearly still want Apple mobile devices, as sales of each successive version brings in more customers and higher sales.

There are many people who cannot imagine a world without Microsoft. And the vast majority of people would think that predicting Microsoft’s demise is considerably premature given its size and cash hoard. But, that looks backward at what Microsoft was, and the assets it previously created, rather than looking forward.

Just how fast can lost relevancy impact a company? Look no further than Blackberry (formerly Research in Motion.) Blackberry was once totally dominant in smartphones. But in the second quarter of last year Apple sold 32.5million units, while Blackberry sold only 1.5million (which was still more than Microsoft sold.)

The complete lack of relevancy was exposed last week when Blackberry launched its new Passport phone alongside Apple’s iPhone 6 actions. While the press was full of articles about the new iPhone, were you even aware of Blackberry’s most recent effort? Did you recall seeing press coverage? Did you read any product reviews? And while Apple was selling record numbers, Blackberry analysts were wondering if the Passport could find a niche with “nostalgic customers” that would sell enough units to keep the company’s hardware unit alive. Reviewers now compare Passport to the market standard, which is the iPhone – and still complain that its use of apps is “confusing.” In a world where most people use their own smartphone, the only reason most people could think of to use a Passport was if their employer told them they were forced to.

Like with Radio Shack, most people have to be reminded that Blackberry still exists. In just a few years Blackberry’s loss of relevancy has made the company and its products a backwater. Now it is quite clear that Microsoft is entering a similar situation. Windows 8 was a weak launch and did nothing to slow the shift to mobile. Microsoft missed the mobile market, and its mobile products are achieving no traction. Even where it has an exclusive use, such as this NFL application, people don’t recognize its products and assume they are the products of the market leader. Microsoft really has become irrelevant in its historical “core” personal technology market – and that should scare its employees and investors a lot.

by Adam Hartung | Sep 17, 2014 | Current Affairs, Disruptions, In the Whirlpool, Leadership, Lock-in

Sony was once the leader in consumer electronics. A brand powerhouse who’s products commanded a premium price and were in every home. Trinitron color TVs, Walkman and Discman players, Vaio PCs. But Sony has lost money for all but one quarter across the last 6 years, and company leaders just admitted the company will lose over $2B this year and likely eliminate its dividend.

McDonald’s created something we now call “fast food.” It was an unstoppable entity that hooked us consumers on products like the Big Mac, Quarter Pounder and Happy Meal. An entire generation was seemingly addicted to McDonald’s and raised their families on these products, with favorable delight for the ever cheery, clown-inspired spokesperson Ronald McDonald. But now McDonald’s has hit a growth stall, same-store sales are down and the Millenial generation has turned its nose up creating serious doubts about the company’s future.

Radio Shack was the leader in electronics before we really had a consumer electronics category. When we still bought vacuum tubes to repair radios and TVs, home hobbyists built their own early versions of computers and video games worked by hooking them up to TVs (Atari, etc.) Radio Shack was the place to go. Now the company is one step from bankruptcy.

Sears created the original non-store shopping capability with its famous catalogs. Sears went on to become a Dow Jones Industrial Average component company and the leading national general merchandise retailer with powerhouse brands like Kenmore, Diehard and Craftsman. Now Sears’ debt has been rated the lowest level junk, it hasn’t made a profit for 3 years and same store sales have declined while the number of stores has been cut dramatically. The company survives by taking loans from the private equity firm its Chairman controls.

How in the world can companies be such successful pioneers, and end up in such trouble?

Markets shift. Things in the world change. What was a brilliant business idea loses value as competitors enter the market, new technologies and solutions are created and customers find they prefer alternatives to your original success formula. These changed markets leave your company irrelevant – and eventually obsolete.

Unfortunately, we’ve trained leaders over the last 60 years how to be operationally excellent. In 1960 America graduated about the same number of medical doctors, lawyers and MBAs from accredited, professional university programs. Today we still graduate about the same number of medical doctors every year. We graduate about 6 times as many lawyers (leading to lots of jokes about there being too many lawyers.) But we graduate a whopping 30 times as many MBAs. Business education skyrocketed, and it has become incredibly normal to see MBAs at all levels, and in all parts, of corporations.

The output of that training has been a movement toward focusing on accounting, finance, cost management, supply chain management, automation — all things operational. We have trained a veritable legion of people in how to “do things better” in business, including how to measure costs and operations in order to make constant improvements in “the numbers.” Most leaders of publicly traded companies today have a background in finance, and can discuss the P&L and balance sheets of their companies in infinite detail. Management’s understanding of internal operations and how to improve them is vast, and the ability of leaders to focus an organization on improving internal metrics is higher than ever in history.

But none of this matters when markets shift. When things outside the corporation happen that makes all that hard work, cost cutting, financial analysis and machination pretty much useless. Because today most customers don’t really care how well you make a color TV or physical music player, since they now do everything digitally using a mobile device. Nor do they care for high-fat and high-carb previously frozen food products which are consistently the same because they can find tastier, fresher, lighter alternatives. They don’t care about the details of what’s inside a consumer electronic product because they can buy a plethora of different products from a multitude of suppliers with the touch of a mobile device button. And they don’t care how your physical retail store is laid out and what store-branded merchandise is on the shelves because they can shop the entire world of products – and a vast array of retailers – and receive deep product reviews instantaneously, as well as immediate price and delivery information, from anywhere they carry their phone – 24×7.

“Get the assumptions wrong, and nothing else matters” is often attributed to Peter Drucker. You’ve probably seen that phrase in at least one management, convention or motivational presentation over the last decade. For Sony, McDonald’s, Radio Shack and Sears the assumptions upon which their current businesses were built are no longer valid. The things that management assumed to be true when the companies were wildly profitable 2 or 3 decades ago are no longer true. And no matter how much leadership focuses on metrics, operational improvements and cost cutting – or even serving the remaining (if dwindling) current customers – the shift away from these companies’ offerings will not stop. Rather, that shift is accelerating.

It has been 80 years since Harvard professor Joseph Schumpeter described “creative destruction” as the process in which new technologies obsolete the old, and the creativity of new competitors destroys the value of older companies. Unfortunately, not many CEOs are familiar with this concept. And even fewer ever think it will happen to them. Most continue to hope that if they just make a few more improvements their company won’t really become obsolete, and they can turn around their bad situation.

For employees, suppliers and investors such hope is a weak foundation upon which to rely for jobs, revenues and returns.

According to the management gurus at McKinsey, today the world population is getting older. Substantially so. Almost no major country will avoid population declines over next 20 years, due to low birth rates. Simultaneously, better healthcare is everywhere, and every population group is going to live a whole lot (I mean a WHOLE LOT) longer. Almost every product and process is becoming digitized, and any process which can be done via a computer will be done by a computer due to almost free computation. Global communication already is free, and the bandwidth won’t stop growing. Secrets will become almost impossible to keep; transparency will be the norm.

These trends matter. To every single business. And many of these trends are making immediate impacts in 2015. All will make a meaningful impact on practically every single business by 2020. And these trends change the assumptions upon which every business – certainly every business founded prior to 2000 – demonstrably.

Are you changing your assumptions, and your business, to compete in the future? If not, you could soon look at your results and see what the leaders at Sony, McDonald’s, Radio Shack and Sears are seeing today. That would be a shame.

by Adam Hartung | Aug 29, 2014 | Current Affairs, In the Whirlpool, Leadership

It’s Labor Day, and a time when we naturally think about our jobs.

When it comes to jobs creation, no role is more critical than the CEO. No company will enter into a growth phase, selling more product and expanding employment, unless the CEO agrees. Likewise, no company will shrink, incurring job losses due to layoffs and mass firings, unless the CEO agrees. Both decisions lay at the foot of the CEO, and it is his/her skill that determines whether a company adds jobs, or deletes them.

Over 2 years ago (5 May, 2012) I published “The 5 CEOs Who Should Be Fired.” Not surprisingly, since then employment at all 5 of these companies has lagged economic growth, and in all but one case employment has shrunk. Yet, 3 of these CEOs remain in their jobs – despite lackluster (and in some cases dismal) performance. And all 5 companies are facing significant struggles, if not imminent failure.

#5 – John Chambers at Cisco

In 2012 it was clear that the market shift to public networks and cloud computing was forever changing the use of network equipment which had made Cisco a modern growth story under long-term CEO Chambers. Yet, since that time there has been no clear improvement in Cisco’s fortunes. Despite 2 controversial reorganizations, and 3 rounds of layoffs, Cisco is no better positioned today to grow than it was before.

Increasingly, CEO Chambers’ actions reorganizations and layoffs look like so many machinations to preserve the company’s legacy rather than a clear vision of where the company will grow next. Employee morale has declined, sales growth has lagged and although the stock has rebounded from 2012 lows, it is still at least 10% short of 2010 highs – even as the S&P hits record highs. While his tenure began with a tremendous growth story, today Cisco is at the doorstep of losing relevancy as excitement turns to cloud service providers like Amazon. And the decline in jobs at Cisco is just one sign of the need for new leadership.

#4 Jeff Immelt at General Electric

When CEO Immelt took over for Jack Welch he had some tough shoes to fill. Jack Welch’s tenure marked an explosion in value creation for the last remaining original Dow Jones Industrials component company. Revenues had grown every year, usually in double digits; profits soared, employment grew tremendously and both suppliers and investors gained as the company grew.

But that all stalled under Immelt. GE has failed to develop even one large new market, or position itself as the kind of leading company it was under Welch. Revenues exceeded $150B in 2009 and 2010, yet have declined since. In 2013 revenues dropped to $142B from $145B in 2012. To maintain revenues the company has been forced to continue selling businesses and downsizing employees every year. Total employment in 2014 is now less than in 2012.

Yet, Mr. Immelt continues to keep his job, even though the stock has been a laggard. From the near $60 it peaked at his arrival, the stock faltered. It regained to $40 in 2007, only to plunge to under $10 as the CEO’s over-reliance on financial services nearly bankrupted the once great manufacturing company in the banking crash of 2009. As the company ponders selling its long-standing trademark appliance business, the stock is still less than half its 2007 value, and under 1/3 its all time high. Where are the jobs? Not GE.

#3 Mike Duke at Wal-Mart

Mr. Duke has left Wal-Mart, but not in great shape. Since 2012 the company has been rocked by scandals, as it came to light the company was most likely bribing government officials in Mexico. Meanwhile, it has failed to defend its work practices at the National Labor Relations Board, and remains embattled regarding alleged discrimination of female employees. The company’s employment practices are regularly the target of unions and those supporting a higher minimum wage.

The company has had 6 consecutive quarters of declining traffic, as sales per store continue to lag – demonstrating leadership’s inability to excite people to shop in their stores as growth shifts to dollar stores. The stock was $70 in 2012, and is now only $75.60, even though the S&P 500 is up about 50%. So far smaller format city stores have not generated much attention, and the company remains far behind leader Amazon in on-line sales. WalMart increasingly looks like a giant trapped in its historical house, which is rapidly delapidating.

One big question to ask is who wants to work for WalMart? In 2013 the company threatened to close all its D.C. stores if the city council put through a higher minimum wage. Yet, since then major cities (San Francisco, Chicago, Los Angeles, Seattle, etc.) have either passed, or in the process of passing, local legislation increasing the minimum wage to anywhere from $12.50-$15.00/hour. But there seems no response from WalMart on how it will create profits as its costs rise.

#2 Ed Lampert at Sears

Nine straight quarterly losses. That about says it all for struggling Sears. Since the 5/2012 column the CEO has shuttered several stores, and sales continue dropping at those that remain open. Industry pundits now call Sears irrelevant, and the question is looming whether it will follow Radio Shack into oblivion soon.

CEO Lampert has singlehandedly destroyed the Sears brand, as well as that of its namesake products such as Kenmore and Diehard. He has laid off thousands of employees as he consolidated stores, yet he has been unable to capture any value from the unused real estate. Meanwhile, the leadership team has been the quintessential example of “a revolving door at headquarters.” From about $50/share 5/2012 (well off the peak of $190 in 2007,) the stock has dropped to the mid-$30s which is about where it was in its first year of Lampert leadership (2004.)

Without a doubt, Mr. Lampert has overtaken the reigns as the worst CEO of a large, publicly traded corporation in America (now that Steve Ballmer has resigned – see next item.)

#1 Steve Ballmer at Microsoft

In 2013 Steve Ballmer resigned as CEO of Microsoft. After being replaced, within a year he resigned as a Board member. Both events triggered analyst enthusiasm, and the stock rose.

However, Mr. Ballmer left Microsoft in far worse condition after his decade of leadership. Microsoft missed the market shift to mobile, over-investing in Windows 8 to shore up PC sales and buying Nokia at a premium to try and catch the market. Unfortunately Windows 8 has not been a success, especially in mobile where it has less than 5% share. Surface tablets were written down, and now console sales are declining as gamers go mobile.

As a result the new CEO has been forced to make layoffs in all divisions – most substantially in the mobile handset (formerly Nokia) business – since I positioned Mr. Ballmer as America’s worst CEO in 2012. Job growth appears highly unlikely at Microsoft.

“CEOs – From Makers to Takers”

Forbes colleague Steve Denning has written an excellent column on the transformation of CEOs from those who make businesses, to those who take from businesses. Far too many CEOs focus on personal net worth building, making enormous compensation regardless of company performance. Money is spent on inflated pay, stock buybacks and managing short-term earnings to maximize bonuses. Too often immediate cost savings, such as from outsourcing, drive bad long-term decisions.

CEOs are the ones who determine how our collective national resources are invested. The private economy, which they control, is vastly larger than any spending by the government. Harvard professor William Lazonick details how between 2003 and 2012 CEOs gave back 54% of all earnings in share buybacks (to drive up stock prices short term) and handed out another 37% in dividends. Investors may have gained, but it’s hard to create jobs (and for a nation to prosper) when only 9% of all earnings for a decade go into building new businesses!

There are great CEOs out there. Steve Jobs and his replacement Tim Cook increased revenues and employment dramatically at Apple. Jeff Bezos made Amazon into an enviable growth machine, producing revenues and jobs. These leaders are focused on doing what it takes to grow their companies, and as a result the jobs in America.

It’s just too bad the 5 fellows profiled above have done more to destroy value than create it.