by Adam Hartung | Nov 6, 2015 | Current Affairs, General, Lifecycle, Web/Tech

“As goes GM, so goes the Nation” is attributed to Charles Wilson, CEO of GM, in Congressional hearings 1953. His viewpoint was that GM was so big, and so important, that the country’s economic fortunes were inherently dependent on a robust General Motors.

And this was not so far fetched in the Industrial era. 1940s-1960s America was a manufacturing king. Following WWII industrial products dominated the economy, and post-war U.S. manufacturers made products sold around the world as other economies rebuilt and recovered, or just started emerging. With manufacturing the jobs and economic value creator, and GM the largest manufacturer and non-government employer of its time, what was good for GM was generally good for America.

But that tie has clearly broken. GM filed bankruptcy in the summer of 2009. From 2007 to 2009 American employment fell from 121.5M to just over 110M. Last month jobs rose by 271,000, pushing employment to a fully recovered 122M jobs. However, GM and its manufacturing partners have struggled to recover, as this economic expansion has largely left them behind.

We’ve seen a wild shift in the country’s economic base. In 1900 America was an agrarian economy. Over half the population lived on farms. Fully 9 out of 10 working people had a job related to agriculture and food production. But automation changed this dramatically. By 2010, fewer than 1 in 100 people worked in farming or agriculture. Farm incomes are at a 9 year low, and the future direction is downward. Rural towns have disappeared as people moved to cities, concentrating over half the nation’s wealth in just its 20 largest cities.

WWII marked the shift from an agrarian to an industrial economy for America. It was the industrial economy that pulled America out of the1930s Great Depression. The industrial revolution ushered in all kinds of mechanical automation, and it was applied to doing everything as labor shortages forced innovation to meet rising defense challenges. And it was the industrial economy that pushed America to the top. It was the industrial economy which trained most of today’s business leaders.

But we’re no longer an industrial economy. Just as the agrarian economy vanished, so too is the manufacturing economy. Manufacturing jobs have been declining since 1970, and by 2010 they represent only 13% of workers and 15% of the country’s GDP (Gross Domestic Product).

But we’re no longer an industrial economy. Just as the agrarian economy vanished, so too is the manufacturing economy. Manufacturing jobs have been declining since 1970, and by 2010 they represent only 13% of workers and 15% of the country’s GDP (Gross Domestic Product).

By 2000 we had started the shift from an industrial to an information economy. Digital bits replaced machines as the source of wealth creation. By 2010 it was services, and the huge growth in digital services, that caused the jobs recovery. Services now represent 84% of all jobs, and 82% of the economy. (Economic statistics from FTPress division of Pearson Publishing.)

Today the 3 most valuable companies in America are Apple, Google and Microsoft. Number 6 is Facebook. Their value (and in the case of Apple, Google and Facebook rather rapid value explosion) has been due to understanding how to maximize the value of information. They don’t so much “make things” as they make life better through products which are purely ethereal – rather than something tangible.

Today the 3 most valuable companies in America are Apple, Google and Microsoft. Number 6 is Facebook. Their value (and in the case of Apple, Google and Facebook rather rapid value explosion) has been due to understanding how to maximize the value of information. They don’t so much “make things” as they make life better through products which are purely ethereal – rather than something tangible.

Today’s #1 valued retailer is Amazon, now worth more than Wal-mart. Amazon is largely a technology company, building its revenues by knowing more about the customer and what she wants, then matching that with the right products. All in a virtual shopping arena. No stores, salespeople and often no inventory needed. Its technology skills became so good the company has become the #1 provider of cloud services.

Tesla has done something everyone thought impossible. It has created a new auto company where many others failed (recall the DeLorean used in “Back to the Future”? Or the Bricklin?) But Tesla did this by building an entirely different car, one that is based on all new electric technology, that has far fewer moving parts, needs far less service, has better operating performance and actually bears little resemblance to the autos – or auto companies – of the past. Tesla is far more a technology company, designed for the information era, than what we would think of as a “car company.”

The ramifications of this are dramatic. Working class middle age white people are dying faster than any other demographic in America. Their death rates are up 22%, and continuing to increase precipitously. Cause: suicide, drugs and alcohol. This is the group that once found good paying jobs working machines in manufacturing. Now, untrained for the information era, they are unable to find work – even though demand for trained labor is outstripping supply.

Today’s growth companies, those powering the American economic engine, are filled with intellectual assets rather than physical assets. Apple, Google and Facebook (et.al.) are creating intellectual capital, and they need employees able to add to that capital base. it is not enough for job candidates to have a college degree any longer. Today’s job hunter has to be information savvy, digital savvy, tech savvy.

In the 1960s the gap widened dramatically between those in manufacturing and those in farming. By the 1970s farms were closing by the hundreds as value shifted out of agrarian production to industrial production. It was devastating to farm communities and farm families.

Today the gap is widening between those skilled in manufacturing or general knowledge and those with information-based skills. The former are seeing their dreams slip away, while the latter are making incomes at a young age that are hard to fathom. Cities like Detroit are crumbling, while San Francisco cannot supply enough housing for its workers. The shift to an information economy is fully in force, and change is accelerating. For those who make the shift much is to be gained, for those who do not there is much to lose.

by Adam Hartung | Oct 31, 2015 | Current Affairs, Games, In the Swamp, In the Whirlpool

I was born the 1950s. In my youth of the ’60s there was no doubt that the #1 sport in America was baseball. Almost every boy owned a bat, ball and glove and played baseball. When we went out for recess there was always a softball game somewhere on the playground.

Fathers told stories about how on the battlefields of WWII they would shout questions about baseball players and World Series statistics to each other to determine if the “other guy out there” was an American, or a German trying to sucker the Americans into the open. Baseball was so relevant every American was expected to know the details of players, games and series.

In that era, lots of baseball was played in the daytime, since the game and its parks preceded the era of great field lighting. Men regularly took off work to attend ball games, and it was considered fairly normal. People listened to baseball games on the radio at work.

And when the World Series came along, which was played around Labor Day, it was so beloved that people took TVs to work, hooked up makeshift antenna and watched the games. Even schools would set up a TV on the gymnasium stage and let the students watch the game — and some enterprising teachers would set up televisions in their classrooms and eschew teaching in favor of watching the series. It was even bigger than today’s Super Bowl, as pretty nearly everyone watched or listened to the World Series.

And when the World Series came along, which was played around Labor Day, it was so beloved that people took TVs to work, hooked up makeshift antenna and watched the games. Even schools would set up a TV on the gymnasium stage and let the students watch the game — and some enterprising teachers would set up televisions in their classrooms and eschew teaching in favor of watching the series. It was even bigger than today’s Super Bowl, as pretty nearly everyone watched or listened to the World Series.

No longer. World Series viewership has been on a decline for at least 40 years. According to Wikipedia, World Series viewership was about 35million in the 1986-1991 timeframe. By 1998-2005 viewership was down to averaging 20million – a 40% decline. By 2008-2014 viewership had declined to 12million -another 40% decline – or a loss of 2/3 the viewership in 25 years.

By comparison, regular season games in the NFL 2014 season averaged about 18million viewers, and 114million people watched the February, 2015 Superbowl – almost 10 times World Series viewership. Even the women’s FIFA World Cup soccer match last July drew 25million American viewers – twice the World Series.

Are you aware the World Series is happening now? I will forgive you if you didn’t know. Marketwatch.com headlined “This Is the Most Exciting World Series No One is Watching.” From what was the #1 sporting event in America, and possibly the world, 50 years ago the World Series has become nearly irrelevant for most people.

Why? Trends have made the World Series, and really baseball, obsolete.

Big Trend #1 – We’re out of time. The pace of life is far, far different today than it was in 1965. Laconic weekday afternoons lounging in a ballpark to watch a game are a thing of the past. The fact that baseball has no time limit is probably its most negative feature. Games are a minimum of 9 innings, but in case of a tie they can last many, many more. Further, if it rains the game is delayed, which can extend the time an hour or more. Thirdly, you have no idea how long an inning may take. 15 minutes, or an hour, all depending on a raft of variables that are impossible to predict.

Game 1 of this current series is a great example of the problem this creates. The game lasted 14 innings. There was a rain delay in the middle of the game. Overall, it was a 5 hour 9 minute event. While this set a new record for a World Series game length, it clearly demonstrates the problem of a sporting event which has no clock.

The most popular games are highly clock bound. Football and basketball not only have limits on the game length, there is a clock limiting the time between plays (or shots.) Soccer is timebound, and there are no time outs. In these games that have greatly grown popularity people know how long a game will take, and that is important.

Big Trend #2 – Action. When was the last time you played a board game, like Monopoly or Life? Do you even own one any longer? Today games are action intensive. In the 1960s a pinball machine was the closest thing anyone had to an “action game.” Look at any game today, via console, computer or mobile device, and there is action. Even Tetris had action to it, and that is nothing compared to the modern video game. People now like action.

Then there is baseball. A “perfect game” – the ultimate for this sport – happens when 21 people bat, and every one walks back to the dugout without reaching base. Quite literally, nothing happens. A pitcher and catcher play catch, while the batters watch. The next most vaunted game is a “no-hitter,” in which people reach base via a walk or an error – but it again reflects a lack of action in that no batter achieved a hit. The third most celebrated game is a “shutout,” meaning one team literally ended the game with a score of Zero. Goose egg.

Baseball is a game of very little action. A really good game often ends with each team having less than 10 hits. It is rare for there to be more than 2 home runs in a game, and often there are games with no home runs at all. Heck, even in golf at least the athletes are hitting the ball 60+ times apiece!

We live in a world today where people run for fun. Or ride bicycles. Where people join gyms to work out on treadmills, rowers, stationary bikes and weight machines. Nobody did this kind of thing in the 1960s. People today are active, and being active is a sign of health, vitality and well-being. Sedentary behaviors are frowned upon. There is no sport with less action than baseball (except maybe darts.)

Big Trend #3 – Globalization. Despite Mr. Donald Trump’s xenophobic appeal, globalization is an unstoppable trend. Our businesses and our lives are increasingly global, as it is doubtful any American goes a day without touching a product or service delivered from an offshore source. And unlikely most Americans live any given day without talking to someone born in a foreign country, or entertaining them with news, information, sports or programming from outside the USA.

There is no sport which makes this clearer than soccer. Due to its global appeal, 715million people watched the final game of the 2006 World Cup (55 times the World Series.) 909million people watched the final 2010 World Cup game (71.5 times the current World Series.) [note: FIFA has not published numbers for the 2014 final game in Brazil, but it is surely going to exceed 1B viewers.]

American impact? There were almost as many Americans (11million) that watched the first round match between the USA and Ghana in the 2014 World Cup as are now watching a World Series Game. And the 2014 World Cup final game had 17.3M U.S. viewers – 34% more than are watching the World Series this year.

Basketball has some international appeal, as there are leagues across Europe and some in South America. And my son was shocked at how much people watched and played basketball on his trip to China. And we see globalization reflected in the players names now in the NBA.

We also see globalization reflected in the NHL, which has many players from outside the USA. And viewership is growing for NHL Stanley Cup games, although it is still only about half the World Series. But given the trajectories of viewership, and the fact that hockey is both a timed sport as well as action-filled, Stanley Cup watchers could exceed World Series watchers in just a few years.

Simply put, baseball has never extended strongly beyond the USA and Japan. Lacking competitive teams and viewers outside the USA, as well as limited non-USA player recruitment, this “most American of sports” is off one of the country’s (and planet’s) major trends.

In short, the world moved and baseball did not change with the times. People don’t live today like they did in the 1930s-1960s. Trends are vastly different. New sports that were better linked to major trends, and which adapted to trends (by adding things like shot clocks and play clocks, for example) have gained viewers, while baseball has declined.

Baseball didn’t do anything wrong. It just didn’t adapt. And competitors have moved in. Just like happens in business — which, of course, is the reason we have professional sports – you either adapt or you become obsolete.

The World Series was once the most relevant sporting event on the globe. No longer. And lacking some major changes in the game, its ability to ever grow again is seriously questionable.

by Adam Hartung | Oct 25, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership, Web/Tech

This week McDonald’s and Microsoft both reported earnings that were higher than analysts expected. After these surprise announcements, the equities of both companies had big jumps. But, unfortunately, both companies are in a Growth Stall and unlikely to sustain higher valuations.

McDonald’s profits rose 23%. But revenues were down 5.3%. Leadership touted a higher same store sales number, but that is completely misleading.

McDonald’s leadership has undertaken a back to basics program. This has been used to eliminate menu items and close “underperforming stores.” With fewer stores, loyal customers were forced to eat in nearby stores – something not hard to do given the proliferation of McDonald’s sites. But some customers will go to competitors. By cutting stores and products from the menu McDonald’s may lower cost, but it also lowers the available revenue capacity. This means that stores open a year or longer could increase revenue, even though total revenues are going down.

Profits can go up for a raft of reasons having nothing to do with long-term growth and sustainability. Changing accounting for depreciation, inventory, real estate holdings, revenue recognition, new product launches, product cancellations, marketing investments — the list is endless. Further, charges in a previous quarter (or previous year) could have brought forward costs into an earlier report, making the comparative quarter look worse while making the current quarter look better.

Confusing? That’s why accounting changes are often called “financial machinations.” Lots of moving numbers around, but not necessarily indicating the direction of the business.

McDonald’s asked its “core” customers what they wanted, and based on their responses began offering all-day breakfast. Interpretation – because they can’t attract new customers, McDonald’s wants to obtain more revenue from existing customers by selling them more of an existing product; specifically breakfast items later in the day.

Sounds smart, but in reality McDonald’s is admitting it is not finding new ways to grow its customer base, or sales. The old products weren’t bringing in new customers, and new products weren’t either. As customer counts are declining, leadership is trying to pull more money out of its declining “core.” This can work short-term, but not long-term. Long-term growth requires expanding the sales base with new products and new customers.

Perhaps there is future value in spinning off McDonald’s real estate holdings in a REIT. At best this would be a one-time value improvement for investors, at the cost of another long-term revenue stream. (Sort of like Chicago selling all its future parking meter revenues for a one-time payment to bail out its bankrupt school system.) But if we look at the Sears Holdings REIT spin-off, which ostensibly was going to create enormous value for investors, we can see there were serious limits on the effectiveness of that tactic as well.

MIcrosoft also beat analysts quarterly earnings estimate. But it’s profits were up a mere 2%. And revenues declined 12% versus a year ago – proving its Growth Stall continues as well. Although leadership trumpeted an increase in cloud-based revenue, that was only an 8% improvement and obviously not enough to offset significant weakness in other markets:

It is a struggle to see the good news here. Office 365 revenues were up, but they are cannibalizing traditional Office revenues – and not fast enough to replace customers being lost to competitive products like Google OfficeSuite, etc.

Azure sales were up, but not fast enough to replace declining Windows sales. Further, Azure competes with Amazon AWS, which had remarkable results in the latest quarter. After adding 530 new features, AWS sales increased 15% vs. the previous quarter, and 78% versus the previous year. Margins also increased from 21.4% to 25% over the last year. Azure is in a growth market, but it faces very stiff competition from market leader Amazon.

We build our companies, jobs and lives around successful products and services. We want these providers to succeed because it makes our lives much easier. We don’t like to hear about large market leaders losing their strength, because it signals potentially difficult change. We want these companies to improve, and we will clutch at any sign of improvement.

As investors we behave similarly. We were told large companies have vast customer bases, strong asset bases, well known brands, high switching costs, deep pockets – all things Michael Porter told us in the 1980s created “moats” protecting the business, keeping it protected from market shifts that could hurt sales and profits. As investors we want to believe that even though the giant company may slip, it won’t fall. Time and size is on its side we choose to believe, so we should simply “hang on” and “ride it out.” In the future, the company will do better and value will rise.

As a result we see that Growth Stall companies show a common valuation pattern. After achieving high valuation, their equity value stagnates. Then, hopes for a turn-around and recovery to new growth is stimulated by a few pieces of good news and the value jumps again. Only after a few years the short-term tactics are used up and the underlying business weakness is fully exposed. Then value crumbles, frequently faster than remaining investors anticipated.

McDonald’s valuation rose from $62/share in 2008 to reach record $100/share highs in 2011. But valuation then stagnated. It is only this last jump that has caused it to reach new highs. But realize, this is on a smaller number of stores, fewer products and declining revenues. These are not factors justifying sustainable value improvement.

Microsoft traded around $25/share from March, 2003 through November, 2011 – 8.5 years. When the CEO was changed value jumped to $48/share by October, 2014. After dipping, now, a year later Microsoft stock is again reaching that previous valuation ($50/share). Microsoft is now valued where it was in December, 2002 (which is half its all-time high.)

The jump in value of McDonald’s and Microsoft happened on short-term news regarding beating analysts earnings expectations for one quarter. The underlying businesses, however, are still suffering declining revenue. They remain in Growth Stalls, and the odds are overwhelming that their values will decline, rather than continue increasing.

by Adam Hartung | Oct 16, 2015 | Current Affairs, Defend & Extend, In the Swamp, Lifecycle

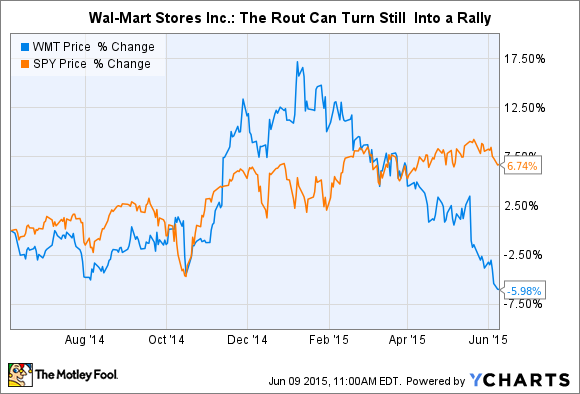

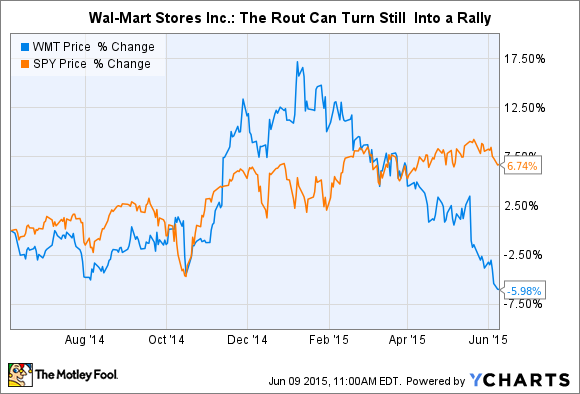

Wal-Mart market value took a huge drop on Wednesday. In fact, the worst valuation decline in its history. That decline continued on Thursday. Since the beginning of 2015 Wal-Mart has lost 1/3 of its value. That is an enormous ouch.

But, if you were surprised, you should not have been. The telltale signs that this was going to happen have been there for years. Like most stock market moves, this one just happened really fast. The “herd behavior” of investors means that most people don’t move until some event happens, and then everyone moves at once carrying out the implications of a sea change in thinking about a company’s future.

But, if you were surprised, you should not have been. The telltale signs that this was going to happen have been there for years. Like most stock market moves, this one just happened really fast. The “herd behavior” of investors means that most people don’t move until some event happens, and then everyone moves at once carrying out the implications of a sea change in thinking about a company’s future.

All the way back in October, 2010 I wrote about “The Wal-Mart Disease.” This is the disease of constantly focusing on improving your “core” business, while market shifts around you increasingly make that “core” less relevant, and less valuable. In the case of Wal-Mart I pointed out that an absolute maniacal focus on retail stores and low-cost operations, in an effort to be the low price retailer, was being made obsolete by on-line retailers who had costs that are a fraction of Wal-Mart’s expensive real estate and armies of employees.

At that time WMT was about $54/share. I recommended nobody own the stock.

In May, 2011 I reiterated this problem at Wal-Mart in a column that paralleled the retailer with software giant Microsoft, and pointed out that because of financial machinations not all earnings are equal. I continued to say that this disease would cripple Wal-Mart. Six months had passed, and the stock was about $55.

By February, 2012 I pointed out that the big reorganization at Wal-Mart was akin to re-arranging deck chairs on a sinking ship and said nobody should own the stock. It was up, however, trading at $61.

At the end of April, 2012 the Wal-Mart Mexican bribery scandal made the press, and I warned investors that this was a telltale sign of a company scrambling to make its numbers – and pushing the ethical (if not legal) envelope in trying to defend and extend its worn out success formula. The stock was $59.

Then in July, 2014 a lawsuit was filed after an overworked Wal-Mart truck driver ran into a car killing James McNair and seriously injuring comedian Tracy Morgan. Again, I pointed out that this was a telltale sign of an organization stretching to try and make money out of a business model that was losing its ability to sustain profits. Market shifts were making it ever harder to keep up with emerging on-line competitors, and accidents like this were visible cracks in the business model. But the stock was now $77. Most investors focused on short-term numbers rather than the telltale signs of distress.

In January, 2015 I pointed out that retail sales were actually down 1% for December, 2014. But Amazon.com had grown considerably. The telltale indication of a rotting traditional retail brick-and-mortar approach was showing itself clearly. Wal-Mart was hitting all time highs of around $87, but I reiterated my recommendation that investors escape the stock.

By July, 2015 we learned that the market cap of Amazon now exceeded that of Wal-Mart. Traditional retail struggles were apparent on several fronts, while on-line growth remained strong. Bigger was not better in the case of Wal-Mart vs. Amazon, because bigger blinded Wal-Mart to the absolute necessity for changing its business model. The stock had fallen back to $72.

Now Wal-Mart is back to $60/share. Where it was in January, 2012 and only 10% higher than when I first said to avoid the stock in 2010. Five years up, then down the roller coaster.

From October of 2010 through January, 2015 I looked dead wrong on Wal-Mart. And the folks who commented on my columns here at this journal and on my web site, or emailed me, were profuse in pointing out that my warnings seemed misguided. Wal-Mart was huge, it was strong and it would dominate was the feedback.

But I kept reiterating the point that long-term investors must look beyond short-term reported sales and earnings. Those numbers are subject to considerable manipulation by management. Further, short-term operating actions, like shorter hours, lower pay, reduced benefits, layoffs and gouging suppliers can all prop up short-term financials at the expense of recognizing the devaluation of the company’s long-term strategy.

Investors buy and hold. They hold until they see telltale signs of a company not adjusting to market shifts. Short-term traders will say you could have bought in 2010, or 2012, and held into 2014, and then jumped out and made a profit. But, who really can do that with forethought? Market timing is a fools game. The herd will always stay too long, then run out too late. Timers get trampled in the stampede more often than book gains.

In this week’s announcement Wal-Mart executives provided more telltale signs of their problems, and the fact that they don’t know how to fix them, and therefore won’t.

- Wal-Mart is going to spend $20B to buy back stock in order to prop up the price. This is the most obvious sign of a company that doesn’t know how to keep up its valuation by growing profits.

- Wal-Mart will spend $11B on sprucing up and opening stores. Really. The demand for retail space has been declining at 4-6%/year for a decade, and retail business growth is all on-line, yet Wal-Mart is still massively investing in its old “core” business.

- Wal-Mart will spend $1.1B on e-commerce. That is the proverbial “drop in the competitors bucket.” Amazon.com alone spent $8.9B in 2014 growing its on-line business.

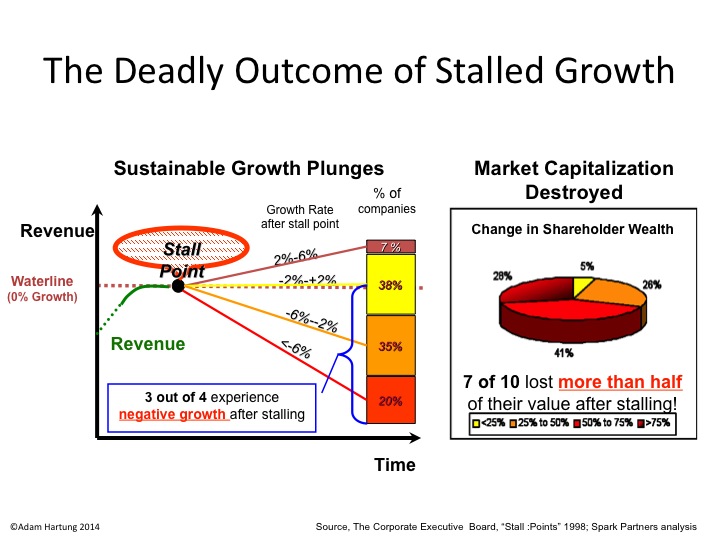

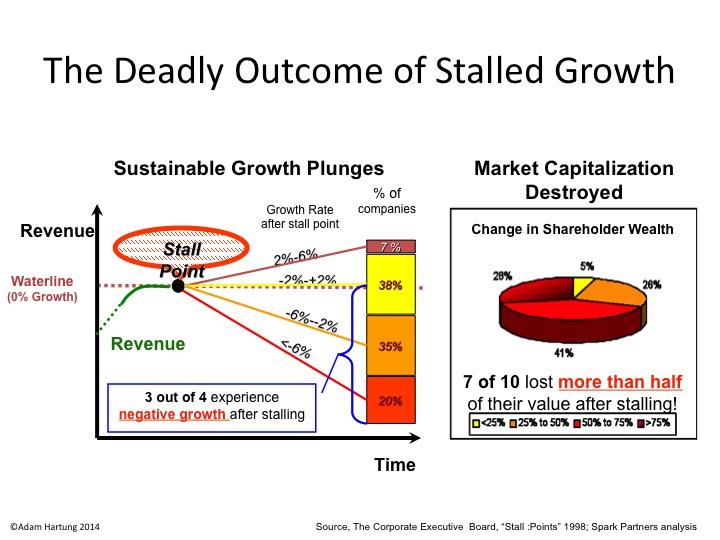

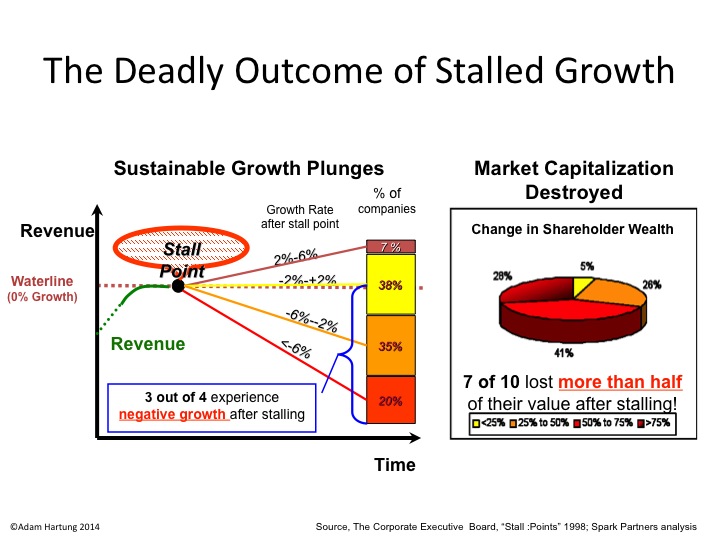

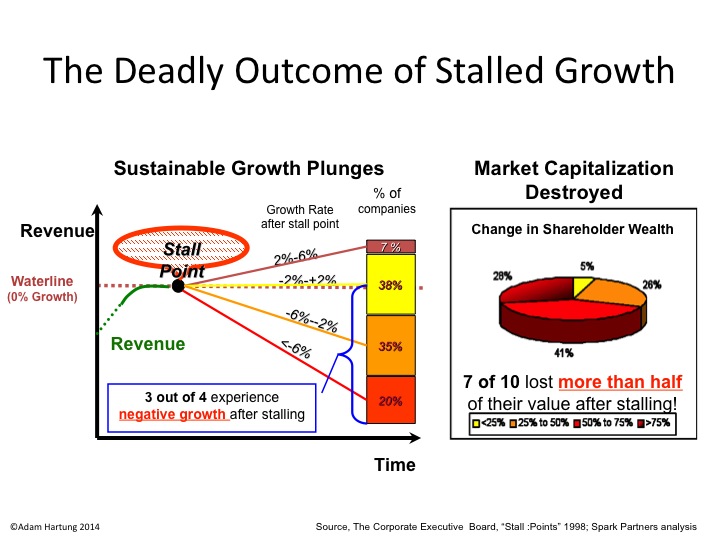

- Wal-Mart admits profits will decline in the next year. It is planning for a growth stall. Yet, we know that statistically only 7% of companies that have a growth stall ever go on to maintain a consistent growth rate of a mere 2%. In other words, Wal-Mart is projecting the classic “hockey stick” forecast. And investors are to believe it?

The telltale signs of an obsolete business model have been present at Wal-Mart for years, and continue.

In 2003 Sears Holdings was $25/share. In 2004 Sears bought K-Mart, and the stock was $40. I said don’t go near it, as all the signs were bad and the merger was ill-conceived. Despite revenue declines, consistent losses, a revolving door at the executive offices and no sign of any plan to transform the battered, outdated retail giant against growing on-line competition investors believed in CEO Ed Lampert and bid the stock up to $77 in early 2011. (I consistently pointed out the telltale signs of trouble and recommended selling the stock.)

By the end of 2012 it was clear Sears was irrelevant to holiday shoppers, and the stock was trading again at $40. Now, SHLD is $25 – where it was 12 years ago when Mr. Lampert started his machinations. Again, only a market timer could have made money in this company. For long-term investors, the signs were all there that this was not a place to put your money if you want to have capital growth for retirement.

There will be plenty who will call Wal-Mart a “value” stock and recommend investors “buy on weakness.” But Wal-Mart is no value. It is becoming obsolete, irrelevant – increasingly looking like Sears. The likelihood of Wal-Mart falling to $20 (where it was at the beginning of 1998 before it made an 18 month run to $50 more than doubling its value) is far higher than ever trading anywhere near its 2015 highs.

by Adam Hartung | Oct 5, 2015 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Twitter’s Board decided in July to oust the CEO, Dick Costolo, due to frustration over company profits. As I wrote at the time, Twitter had continued to add members, at a rate comparable to its social media competition. And it had grown revenues, while remaining the industry leader in revenue per active user.

But the concern was a lack of profits. Oh my, if rapid revenue growth but weak profits were a reason to fire a CEO, how does Jeff Bezos keep his job?

Anyway, Mr. Costolo was replaced by an original founder and former Twitter CEO Jack Dorsey on an interim basis. Four months later, after failing in its effort to find a suitable full-time CEO, the Board has made Mr. Dorsey the permanent CEO. While he simultaneously remains full time CEO of Square, a mobile payments processing company.

Anyway, Mr. Costolo was replaced by an original founder and former Twitter CEO Jack Dorsey on an interim basis. Four months later, after failing in its effort to find a suitable full-time CEO, the Board has made Mr. Dorsey the permanent CEO. While he simultaneously remains full time CEO of Square, a mobile payments processing company.

As I said in my last column on this subject, investors better beware.

Facebook is tearing up the social media market. It has grown to be not only #1 in active monthly users, but at 1.5B monthly active users (MSUs) the site has 5 times the number of users that Twitter has. By adding a slew of new features and functions Facebook has become more valuable to its users – and advertisers.

According to Statista, simultaneously Facebook has grown Facebook Messenger to 700M MSUs, acquired WhatsApp with 800M MSUs and Instagram with 400M MSUs. By constantly expanding the ecosphere Facebook now has 3.4B MSUs – over 10 times the number of Twitter. Facebook is so dominant that even muscular Google, with all its resources, abandoned its efforts to compete with the juggernaut by killing Google+ (which had 300M MSUs) earlier in 2015.

Twitter had great organic growth numbers, but unlike competitors it does not dominate any particular category of social media. Linked in, with only 100M MSUs dominates business networking, and bosts a user base that skews older and more professional. Pinterest and Instagram are battling it out for leadership in photo sharing. But it is unclear how one would describe a social growth category that Twitter dominates.

I actively use Twitter. But among my peers I am the exception. When I ask people over 40 if they use Twitter I regularly hear “I don’t get it. It all looks completely chaotic. Why would I want to follow people on Twitter, and why would I want to post.” This sounds a lot like what people said of Facebook and Linked in 5 years ago. But those companies found their connection with users and people now “get it.”

So the question is whether Mr. Dorsey will make Twitter into a site that is ubiquitous, at least for one category. Can he make the product so useful that users can’t live without it, and that continues drawing in massive new numbers of users?

Twitter has not changed much at all since it was founded. It still depends on users to sign on, start tweeting, and search out others a user wants to follow. And that means follow for some reason other than that person is a celebrity or politician that simply can’t stop spouting off. The Twitter user has to hunt for like minded individuals, find a way to connect with folks who are informative to their needs and then create a dialogue — and all with pretty much the same character limits and shrunken link technology available many years ago.

Apple floundered as a manufacturer of niche PCs. The returning CEO, Steve Jobs, resurrected the company by putting all his money on mobile. It wasn’t an improved Mac that turned around Apple, but rather the launch of the iPod and iTunes, followed by the iPhone and the iPad. The way Apple stole the thunder from previously dominant Microsoft was by creating new products built on the mobile trend that led to explosive growth.

Mr. Costolo left Twitter in far better shape than Apple was in when Mr. Jobs retook the reins. But will Mr. Dorsey be able to launch a series of new products that can create an Apple-like growth explosion?

Square, where Mr. Dorsey ostensibly spends half his time, is preparing to go public. But, even though it is currently considered by many the leader in its marketplace, Square is looking down the barrel of ApplePay – a technology on every iPhone that could make it obsolete. Then there’s also Google Wallet that is on all the other smartphones. Plus well funded outfits like PayPal and Mastercard. Square will need a very competent, capable and visionary CEO to guide its development competing with these – and other – well funded and powerful companies. Square will need to add features, functions and benefits if it is create long-term value.

A lot of new products are needed by two relatively small companies in short order if they are to survive. Success will not happen by cutting costs in either. It will require intensive product development with very rapid product cycles that bring in millions upon millions of new users.

Twitter was once a disruptive innovator. Now it is hard to recognize any innovation at Twitter. Does Mr. Dorsey get it? And if he does, can he do it? And do it twice, simultaneously?

by Adam Hartung | Sep 22, 2015 | Current Affairs, Disruptions, In the Rapids, Innovation

A recent analyst took a look at the impact of electric vehicles (EVs) on the demand for oil, and concluded that they did not matter. In a market of 95million barrels per day production, electric cars made a difference of 25,000 to 70,000 barrels of lost consumption; ~.05%.

You can’t argue with his arithmetic. So far, they haven’t made any difference.

But then he goes on to say they won’t matter for another decade. He forecasts electric vehicle sales grow 5-fold in one decade, which sounds enormous. That is almost 20% growth year over year for 10 consecutive years. Admittedly, that sounds really, really big. Yet, at 1.5million units/year this would still be only 5% of cars sold, and thus still not a material impact on the demand for gasoline.

But then he goes on to say they won’t matter for another decade. He forecasts electric vehicle sales grow 5-fold in one decade, which sounds enormous. That is almost 20% growth year over year for 10 consecutive years. Admittedly, that sounds really, really big. Yet, at 1.5million units/year this would still be only 5% of cars sold, and thus still not a material impact on the demand for gasoline.

This sounds so logical. And one can’t argue with his arithmetic.

But one can argue with the key assumption, and that is the growth rate.

Do you remember owning a Walkman? Listening to compact discs? That was the most common way to listen to music about a decade ago. Now you use your phone, and nobody has a walkman.

Remember watching movies on DVDs? Remember going to Blockbuster, et.al. to rent a DVD? That was common just a decade ago. Now you likely have shelved the DVD player, lost track of your DVD collection and stream all your entertainment. Bluckbuster, infamously, went bankrupt.

Do you remember when you never left home without your laptop? That was the primary tool for digital connectivity just 6 years ago. Now almost everyone in the developed world (and coming close in the developing) carries a smartphone and/or tablet and the laptop sits idle. Sales for laptops have declined for 5 years, and a lot faster than all the computer experts predicted.

Markets that did not exist for mobile products 10 years ago are now huge. Way beyond anyone’s expectations. Apple alone has sold over 48million mobile devices in just 3 months (Q3 2015.) And replacing CDs, Apple’s iTunes was downloading 21million songs per day in 2013 (surely more by now) reaching about 2billion per quarter. Netflix now has over 65million subscribers. On average they stream 1.5hours of content/day – so about 1 feature length movie. In other words, 5.85billion streamed movies per quarter.

What has happened to old leaders as this happened? Sony hasn’t made money in 6 years. Motorola has almost disappeared. CD and DVD departments have disappeared from stores, bankrupting Circuit City and Blockbuster, and putting a world of hurt on survivors like Best Buy.

The point? When markets shift, they often shift a lot faster than anyone predicts. 20%/year growth is nothing. Growth can be 100% per quarter. And the winners benefit unbelievably well, while losers fall farther and faster than we imagine.

Tesla was barely an up-and-comer in 2012 when I said they would far outperform GM, Ford and Toyota. The famous Bob Lutz, a long-term widely heralded auto industry veteran chastised me in his own column “Tesla Beating Detroit – That’s Just Nonsense.”

Mr. Lutz said I was comparing a high-end restaurant to McDonald’s, Wendy’s and Pizza Hut, and I was foolish because the latter were much savvier and capable than the former. He should have used as his comparison Chipotle, which I predicted would be a huge winner in 2011. Those who followed my advice would have made more money owning Chipotle than any of the companies Mr. Lutz preferred.

The point? Market shifts are never predicted by incumbents, or those who watch history. The rate of change when it happens is so explosive it would appear impossible to achieve, and far more impossible to sustain. The trends shift, and one market is rapidly displaced by another.

While GM, Ford and Toyota struggle to maintain their mediocrity, Tesla is winning “best car” awards one after another – even “breaking” Consumer Reports review system by winning 103 points out of a maximum 100, the independent reviewer liked the car so much. Tesla keeps selling 100% of its production, even at its +$100K price point.

So could the market for EVs wildly grow? BMW has announced it will make all models available as electrics within 10 years, as it anticipates a wholesale market shift by consumers promoted by stricter environmental regulations. Petroleum powered car sales will take a nosedive.

The International Energy Agency (IEA) points out that EVs are just .08% of all cars today. And of the 665,000 on the road, almost 40% are in the USA, where they represent little more than a rounding error in market share. But there are smaller markets where EV sales have strong share, such as 12% in Norway and 5% in the Netherlands.

So what happens if Tesla’s new lower priced cars, and international expansion, creates a sea change like the iPod, iPhone and iPad? What happens if people can’t get enough of EVs? What happens if international markets take off, due to tougher regulations and higher petrol costs? What happens if people start thinking of electric cars as mainstream, and gasoline cars as old technology — like two-way radios, VCRs, DVD players, low-definition picture tube TVs, land line telephones, fax machines, etc?

What if demand for electric cars starts doubling each quarter, and grows to 35% or 50% of the market in 10 years? If so, what happens to Tesla? Apple was a nearly bankrupt, also ran, tiny market share company in 2000 before it made the world “i-crazy.” Now it is the most valuable publicly traded company in the world.

Already awash in the greatest oil inventory ever, crude prices are down about 60% in the last year. Oil companies have already laid-off 50,000 employees. More cuts are planned, and defaults expected to accelerate as oil companies declare bankruptcy.

It is not hard to imagine that if EVs really take off amidst a major market shift, oil companies will definitely see a precipitous decline in demand that happens much faster than anticipated.

To little Tesla, which sold only 1,500 cars in 2010 could very well be positioned to make an enormous difference in our lives, and dramatically change the fortunes of its shareholders — while throwing a world of hurt on a huge company like Exxon (which was the most valuable company in the world until Apple unseated it.)

[Note: I want to thank Andreas de Vries for inspiring this column and assisting its research. Andreas consults on Strategy Management in the Oil & Gas industry, and currently works for a major NOC in the Gulf.]

by Adam Hartung | Sep 11, 2015 | Current Affairs, Defend & Extend, In the Swamp, Leadership

Jeff Smisek, CEO of United Continental Holdings, was fired this week. It appears he was making deals with public officials (specifically the Chairman of the Port Authority of New York and New Jersey) to keep personally favored flights of politicians in the air, even when unprofitable, in a quid-pro-quo exchange for government subsidies to move a taxiway and better airport transit.

Wow, horse-trading of the kind that put the governor of Illinois in the penitentiary.

But you have to ask yourself, couldn’t you see it coming? Or are we just so used to lousy leadership that we think there’s no end to it?

But you have to ask yourself, couldn’t you see it coming? Or are we just so used to lousy leadership that we think there’s no end to it?

United has been beset with a number of problems. Since Mr. Smisek organized the merger of Continental (his former employer) with United, creating the world’s largest airline at the time, things have not gone well. Since announcing the merger in 2010, more has gone wrong than right at United:

The merged airline didn’t start in a great position. It was in 2009 that a budding musician watched United baggage handlers destroy his guitar, leading to a series of videos on bad customer service that took to the top of YouTube and iTunes and his book on the culture of customer abuse at United underscored a major PR nightmare.

How could things seem to constantly become worse? It was clear that at the top, United’s leadership cared only about cost control (ironically code named Project Quality.) Operational efficiency was seen as the only strategy, and it did not matter how much this strategy disaffected employees, suppliers or customers. In 2013 United ranked dead last in the quality ranking of all airlines by Wichita State University, and the airline replied by saying it really didn’t care.

The power of thinking that if you focus on pennies and nickels the quarters and dollars will take care of themselves is strong. It encourages you be very focused on details, even myopic, and operate your business very narrowly. And it can set you up to make really dumb mistakes, like possibly trading airline flights for construction subsidies.

Focus, focus, focus often leads to being blind, blind, blind to the world around you.

There were ample signs of all the things going wrong at United, and the need for a change. The open question is why it took a criminal investigation into bribing government officials for the airline’s Board to fire the CEO? Bad performance apparently didn’t matter? Do you have to be an accused lawbreaker to be shown the door?

The story broke in February, so the Board has had a few months to find a replacement CEO. Mr. Oscar Munoz will now take the reigns. But one has to wonder if he is up for the challenges. As a former railroad President, his world of relationships was much smaller than the millions of customers and 84,000 employees at United.

United’s top brass has a serious need “to get over itself.” United’s internal focus, driven by costs, has disenfranchised its brand embassadors, its customer base, and many industry analysts.

United needs to become a lot clearer about what customers really need and want. Years of overly simplistic “all customers care about is price” has commoditized United’s approach to air travel. Customers have been smart enough to see through lower seat prices, only to be stuck with seat assignment and baggage fees raising total trip cost. And charging for everything on the plane, including cheesy TV shows, has customers wondering just how far from Spirit Airlines’ approach United would drift before someone reminded leadership what their customers want and why they used to choose United.

Unfortunately, it is a bit unsettling that CEO Munoz said his first action will be to take 90 days “traveling the system and listening and talking to our people and working with our management team.” Sounds like a lot more internal focus. Spending more time talking to customers at United’s hubs, and seeing how they are treated from check-in to baggage, might do him a lot more good.

United became big via acquisition. That is much different than building an airline, like say Southwest did. Growth via purchase is not the same as growth via loyal customers and an attractive brand proposition. United has clearly lost its way. It has a lot of problems to solve, but first among them should be understanding what customers want. Then designing the model to profitably deliver it.

by Adam Hartung | Aug 27, 2015 | In the Rapids, Innovation, Investing, Leadership, Web/Tech

As market volatility reached new highs this week, CNBC began talking about something called “FANG Investing.” Most commentators showed great displeasure in the fact that prior to the recent downturn high growth companies such as Facebook, Amazon, Netflix and Google (FANG) had performed much better than all the major market indices. And, in the short burst of recent recovery these companies again seemed to be doing much better.

Coined by “CNBC Mad Money” host Jim Cramer, he felt that FANG investing was bad for investors. He said he preferred seeing a much larger group of companies would go up in value, thus representing a much more stable marketplace.

Coined by “CNBC Mad Money” host Jim Cramer, he felt that FANG investing was bad for investors. He said he preferred seeing a much larger group of companies would go up in value, thus representing a much more stable marketplace.

Sound like Wall Street gobblygook? Good. Because as an individual investor why should you care about a stable market? What you should care about is your individual investments going up in value. And if yours go up and all others go down what difference does it make?

Most financial advisers today actually confuse investors much more than help them. And nowhere is this more true than when discussing risk. All financial advisers (brokers in the old days) ask how much risk you want as an investor. If you’re smart you say “none.” Why would you want any risk? You want to make money.

Only this is the wrong answer, because most investors don’t understand the question – because the financial adviser’s definition of risk is nothing like yours.

To a broker investment risk is this bizarre term called “beta,” created by economists. They defined risk as the degree to which a stock does not move with the market index. If the S&P down 5%, and the stock goes down 5%, then they see no difference between the stock and the “market” so they say it has no risk. If the S&P goes up 3% and the stock goes up 3%, again, no risk.

But if a stock trades based on its own investor expectation, and does not track the market index, then it is considered “high beta” and your broker will say it is “high risk.” So let’s look at Apple the last 5 years. If you had put all your money into Apple 5 years ago you would be up over 200% – over 4x. Had you bought the S&P 500 Index you would be up 80%. Clearly, investing in Apple would have been better. But your adviser would say that is “high risk.” Why? Because Apple did not move with the S&P. It did much better. It is therefore considered high beta, and high risk.

You buy that?

Thus, brokers keep advising investors buy funds of various kinds. Because the investors says she wants low risk, they try to make sure her returns mirror the indices. But it begs the question, why don’t you just buy an electronic traded fund (ETF) that mirrors the S&P or Dow, and quit paying those fund fees and broker fees? If their approach is designed to have you do no better than the average, why not stop the fees and invest in those things which will exactly give you the average?

Anyway, what individual investors want is high returns. And that has nothing to do with market indices or how a stock moves compares to an index. It has to do with growth.

Growth is a wonderful thing. When a company grows it can write off big mistakes and nobody cares. It can overpay employees, give them free massages and lunches, and nobody cares. It can trade some of its stock for a tiny company, implying that company is worth a vast amount, in order to obtain new products it can push to its customers, and nobody cares. Growth hides a multitude of sins, and provides investors with the opportunity for higher valuations.

On the other hand, nobody ever cost cut a company into prosperity. Layoffs, killing products, shutting down businesses and selling assets does not create revenue growth. It causes the company to shrink, and the valuation to decline.

That’s why it is lower risk to invest in FANG stocks than those so-called low-risk portfolios. Companies like Facebook, Amazon, Netflix, Google — and Apple, EMC, Ultimate Software, Tesla and Qualcomm just to name a few others — are growing. They are firmly tied to technologies and products that are meeting emerging needs, and they know their customers. They are doing things that increase long-term value.

McDonald’s was a big winner for investors in the 1960s and 1970s as fast food exploded with the baby boomer generation. But as the market shifted McDonald’s sold off its investments in trend-linked brands Boston Market and Chipotle. Now its revenue has stalled, and its value is in decline as it shuts stores and lays off employees.

Thirty years ago GE tied its plans to trends in medical technology, financial services and media, and it grew tremendously making fortunes for its investors. In the last decade it has made massive layoffs, shut down businesses and sold off its appliance, financial services and media businesses. It is now smaller, and its valuation is smaller.

Caterpillar tied itself to the massive infrastructure growth in Asia and India, and it grew. But as that growth slowed it did not move into new businesses, so its revenues stalled. Now its value is declining as it lays off employees and shuts down business units.

Risk is tied to the business and its future expectations. Not how a stock moves compared to an index. That’s why investing in high growth companies tied to trends is actually lower risk than buying a basket of stocks — even when that basket is an index like DIA or SPY. Why should you own the low-or no-growth dogs when you don’t have to? How is it lower risk to invest in a struggling McDonald’s, GE or Caterpillar or some basket that contains them than investing in companies demonstrating tremendous revenue growth?

Good fishermen go where the fish are. Literally. Anybody can cast out a line and hope. But good fisherman know where the fish are, and that’s where they invest their bait. As an investor, don’t try to fish the ocean (the index.) Be smart, and put your money where the fish are. Invest in companies that leverage trends, and you’ll lower your risk of investment failure while opening the door to superior returns.

by Adam Hartung | Aug 6, 2015 | In the Rapids, Innovation, Leadership, Web/Tech

Would you like to triple your revenue next year? And have plans to keep tripling it – or more – every year into the future?

Of course you would. But is your business positioned for such explosive growth? Are you in growth markets, creating new products with new technologies that meet unmet needs and have the potential to completely change your business? Or are you stuck doing the same thing you’ve always done, a litle better, faster and cheaper in hopes you can just maintain your position?

If you’re constantly looking at your “core” markets and solutions, and you know those aren’t going to grow fast, what keeps you from changing to make your company a high growth winner?

First, most people don’t try. Leaders say it all the time, “I’m so busy running a business I don’t have time to chase rainbows. Sure technology is changing, but I don’t understand it, nor know how to use it. I’m better off investing in what I know than trying to chase trends.” That’s often followed by dragging out the old saw, usually attributed to Warren Buffet, of “don’t invest in what you don’t know – and I don’t know anything about trends.” The comfort, and ease, of repeating what you’ve always done allows lethargy to set in – so you keep doing more and more of what you’ve always done, over and again, hoping for a different result. It’s been attributed to Albert Einstein that such behavior is the very definition of insanity.

Everyone is busy. We live in a “culture of busy.” Years of layoffs and cost reductions have left most leaders simply struggling to keep up with making and selling last year’s solution. Constant busy-ness becomes a convenient excuse to not take the time to look at trends, evaluate new opportunities or consider doing things entirely differently. Busy, busy, busy – until someone knocks your business off its blocks and then you have all kinds of time on your hands.

For those who overcome these 2 built-in biases, the opportunities today are extra-ordinary. It is possible to slingshot into leadership positions with new solutions, literally from out of nowhere. If you take the time and try. Listen, and just do it – to steal from a popular ad campaign.

ikeGPS was started in 2003 as a government/military funded products research company. Focusing on the technology of lasers and cameras, they won contracts to develop and prototype new solutions with technology mostly buried in universities and labs. It was a good business, made money for the founders, and was intellectually stimulating. If not growing very fast or showing much potential of growing.

Eventually ikeGPS started making products with lasers and cameras for finding physical assets. This turned out to be quite beneficial for electric utilities, which have to maintain some 200,000 power poles in the U.S alone. EPC (Engineering, Procurement and Construction) companies like Black & Veatch, Bechtel. Burns & McDonel , FMC and Foster Wheeler had a need to find big physical things, then measure their size and location between each other and major points. For utility company suppliers like GE laser cameras for asset location were a handy, if slow growing business. Good, solid, reliable revenues, but not something that was going to create a $100M company.

So the Managing Director, Glenn Milnes, and Chief Marketing Officer, Jeff Ross, set about to see what they could do to become a $100M business. Not because anything in their history said they could do so. Rather because they wanted to make their company a bigger, faster growing and lot more valuable entity.

The first thing they identified was the trend to mobile devices. They noticed darn near everyone has one, and they were using them for all kinds of interesting things. There were thousands and thousands of apps, but none that really took advantage of the cameras to do much measuring, or integrated lasers. While they didn’t know anything about mobile operating systems, or much about the kinds of cameras in mobile phones or the software used for popular mobile camera uses – they could see a trend.

What if they could take their knowledge about lasers and cameras and figure out how to make mobile phones a lot more powerful? Could they apply what they knew into markets where they had no experience, using technologies with which they had no experience? Would it work, or waste their time? If it worked, what would they make? If they made something, who would buy it?

Despite these great questions, they wanted ikeGPS to grow, and they decided to take the cash flow from their solid, but low growth historical business and plow it into development of a new product. So they took to internal company brainstorming to see what they might do. And they came up with the very clever idea of making an add-on device that construction workers, like concrete installers, pavers, carpenters, masons and such, could use with their mobile phones to replace tape measures. Something that would be simple, easy to use, work with the phones in their pockets and be a lot more accurate than decades-old technology.

So they went to the lab and built it. They started design in October, 2013, and a year later they had a product ready to launch. – Spike! They took it to social media, Google adwords, all the low-cost ad tools available to small business today. They also went to industry trade shows, bought some ads in industry trade magazines and ads on industry specific sites. Things were OK, but it was a slow slog.

So they went to the lab and built it. They started design in October, 2013, and a year later they had a product ready to launch. – Spike! They took it to social media, Google adwords, all the low-cost ad tools available to small business today. They also went to industry trade shows, bought some ads in industry trade magazines and ads on industry specific sites. Things were OK, but it was a slow slog.

As they were preparing to launch Spike they thought, “why don’t we reach for outsiders to gain some input on this product. Let’s hear what others might have to say.” So they launched a Kickstarter campaign, offering investors the product to try. Via this route they gained the eyes and ears of early adopters.

This was when the surprise happened. The earliest adopters, and biggest fans of laser measuring via mobile devices weren’t in the construction business. They were signage companies. ikeGPS listened to their feedback, and realized they could tweek Spike to be very relevant for folks in signage. The made themselves accessible to these early adopters, and turned a few into fanatical loyalists.

With this early success, they began to downplay construction and seek signage companies. Across 2 months they placed about $20k (not millions, thousands) in ads in the 4 largest publishers to the signage industry. This led to on-line product sales, and smashing reviews.

So then they made overtures to the large franchisors of signage related shops – with retail names like Fast Sign, Sign-o-Rama, Alphagraphics, Speedy Sign, Sign World, etc — in companies like Franchise Services and Alliance Franchise. Within 6 months of launch they had stopped chasing construction customers and were full-tilt developing signage companies, to great success. Even sign supply companies llke Reece Sign saw the benefit of promoting (and even reselling) these new laser camera add-ons for mobile devices to stimulate sales and move sign design and creation into the 21st century.

After making this switch, they initial launch sold 1,200 units at $500/unit retail . But better yet, contracts for promotion and reselling has the company convinced they will blow far beyond their projection of 4,000 units in the first year.But they did not simply forget about construction. The idea was still sound, but clearly the market had not developed. So they asked themselves, “if we listened to sign guys and they told us what to do, could we listen to construction guys for advice?”

They pursued finding out more about construction, and learned the market was dominated by brand names. Few products were bought without a strong brand name – and most products are purchased through the very large home improvement chains such as Home Depot, Lowe’s, Menard’s and others. But that would be a nearly impossible task, at extremely high cost, for little ikeGPS. So they pursued finding a partner which knew the industry.

In early 2015 ideGPS announced that Stanley Black&Decker would brand and sell Spike via traditional retail. The product should be on shelves before the end of year, and substantial additional sales volumes are expected.

In 2013 100% of ikeGPS revenues were in their traditional government/military and utility markets with their bespoke device. In just one year they developed a mobile device, and launched it. In 2015 1/3 or more of their $10.5 estimated revenue will be from Spike, and they expect to at a minimum triple revenues in 2016. And they think that rate of growth is sustainable into future years.

ikeGPS shows that it IS possible to move beyond historical markets and create new products for break-out growth. You aren’t stuck in old businesses with no hope of growth. if you want to grow, and reap the rewards of growth, you can. You have to

- Want to do it

- Take time to do it

- Pay attention to trends, and support obvious trend growth

- Learn about new technologies and how you can apply them. Start with the trend technologies first, then see how to apply something new. Don’t start by trying to push what you know onto another platform. Be ethnocentric in product development, not egocentric.

- Brainstorm how to meet unmet needs

- Listen to early sales results, and go where the need is highest/selling is easiest

- Don’t forget to learn from what did not work, and see if you can overcome early weaknesses.

by Adam Hartung | Aug 2, 2015 | Current Affairs, In the Rapids, In the Swamp, Leadership, Web/Tech

eBay was once a game changer. When the internet was very young, and few businesses provided ecommerce, eBay was a pioneer. From humble beginnings selling Pez dispensers, eBay grew into a powerhouse. Things we used to sell via garage sale we could now list on eBay. Small businesses could create stores on eBay to sell goods to customers they otherwise would never reach. And collectors as well as designers suddenly discovered all kinds of products they formerly could not find. eBay sales exploded, as traditional retail started it slide downward.

To augment growth eBay realized those selling needed a simple way to collect money from people who lacked a credit card. Many customers simply had no card, or didn’t trust giving out the information across the web. So eBay bought fledgling PayPal for $1.5B in 2002, in order to grease the wheels for faster ecommerce growth. And it worked marvelously.

But times have surely changed. Now eBay and Paypal have roughly the same revenue. About $8B/year each. eBay has run into stiff competition, as CraigsList has grown to take over the “garage sale” and small local business ecommerce. Simultaneously, powerhouse Amazon has developed its storefront business to a level of sophistication, and ease of use, that makes it viable for businesses from smallest to largest to sell products on-line. And far more companies have learned they can go it alone with internet sales, using search engine optimization (SEO) techniques as well as social media to drive traffic directly to their stores, bypassing storefronts entirely.

eBay was a game changer, but now is stuck in practices that have become far less relevant. The result has been 2 consecutive quarters of declining revenue. By definition that puts eBay in a growth stall, and fewer than 7% of companies ever recover from a growth stall to consistently increase revenue by a mere 2%/year. Why not? Because once in a growth stall the company has already missed the market shift, and competition is taking customers quickly in new directions. The old leader, like eBay, keeps setting aggressive targets for its business, and tells everyone it will find new customers in remote geographies or vertical markets. But it almost never happens – because the market shift is making their offering obsolete.

eBay was a game changer, but now is stuck in practices that have become far less relevant. The result has been 2 consecutive quarters of declining revenue. By definition that puts eBay in a growth stall, and fewer than 7% of companies ever recover from a growth stall to consistently increase revenue by a mere 2%/year. Why not? Because once in a growth stall the company has already missed the market shift, and competition is taking customers quickly in new directions. The old leader, like eBay, keeps setting aggressive targets for its business, and tells everyone it will find new customers in remote geographies or vertical markets. But it almost never happens – because the market shift is making their offering obsolete.

On the other hand, Paypal has blossomed into a game changer in its own right. Not only does it support cash and credit card transactions for the growing legions of on-line shoppers, but it is providing full payment systems for providers like Uber and AirBnB. It’s tools support enterprise transactions in all currencies, including emerging bitcoin, and even provides international financial transactions as well as working capital for businesses.

Paypal is increasingly becoming a threat to traditional banks. Today most folks use a bank for depositing a pay check, and making payments. There are loans, but frequently that is shopped around irrespective of where you bank. Much like your credit cards, which most people acquire for their benefits rather than a relationship with the issuing bank. If customers increasingly make payments via Paypal, and borrow money via operations like Quicken Loans (a division of Intuit,) why do you need a bank? Discover Services, which now does offer cash deposits and loans on top of credit card services, has found that it can grow substantially by displacing traditional banks.

Paypal is today at the forefront of digital payments processing. It is a fast growing market, which will displace many traditional banks. And emerging competitors like Apple Pay and Google Wallet will surely change the market further – while aiding its growth. How it will shake out is unclear. But it is clear that Paypal is growing its revenue at 60% or greater since 2012, and at over 100%/quarter the last 2 quarters.

Paypal is now valued at about $47B. That is roughly the same as the #5 bank in America (according to assets) Bank of New York Mellon, and number 8 massive credit card issuer Capital One, as well as #9 PNC Bank – and over 50% higher valuation than #10 State Street. It is also about 50% higher than Intuit and Discover. Based on its current market leadership and position as likely game changer for the banking sector, Paypall is selling for about 8 times revenue. If its revenue continues to grow at 100%/quarter, however, revenues will reach over $38B in a year making the Price/Revenue multiple of today only 1.25.

Meanwhile, eBay is valued at about $34B. Given that all which is left in eBay is an outdated on-line ecommerce conglomerator, stuck in a growth stall, that valuation is far harder to justify. It is selling at about 4.25x revenue. But if revenues continue declining, as they have for 2 consecutive quarters, this multiple will expand. And values will be harder and harder to justify as investors rely on hope of a turnaround.

eBay was a game changer. But leadership became complacent, and now it is very likely overvalued. Just as Yahoo became when its value relied on its holdings of Alibaba rather as its organic business shrank. Meanwhile Paypal is the leader in a rapidly growing market that is likely to change the face of not just how we pay, but how we do personal and business finance. There is no doubt which is more valuable today, and likely to be in the future.

But we’re no longer an industrial economy. Just as the agrarian economy vanished, so too is the manufacturing economy. Manufacturing jobs have been declining since 1970, and by 2010 they represent only 13% of workers and 15% of the country’s GDP (Gross Domestic Product).

But we’re no longer an industrial economy. Just as the agrarian economy vanished, so too is the manufacturing economy. Manufacturing jobs have been declining since 1970, and by 2010 they represent only 13% of workers and 15% of the country’s GDP (Gross Domestic Product). Today the 3 most valuable companies in America are Apple, Google and Microsoft. Number 6 is Facebook. Their value (and in the case of Apple, Google and Facebook rather rapid value explosion) has been due to understanding how to maximize the value of information. They don’t so much “make things” as they make life better through products which are purely ethereal – rather than something tangible.

Today the 3 most valuable companies in America are Apple, Google and Microsoft. Number 6 is Facebook. Their value (and in the case of Apple, Google and Facebook rather rapid value explosion) has been due to understanding how to maximize the value of information. They don’t so much “make things” as they make life better through products which are purely ethereal – rather than something tangible.