by Adam Hartung | Feb 7, 2017 | Investing, Trends

The vast majority of individual investors have no idea how to pick stocks. So they often let someone else invest for them, and pay a hefty fee of anywhere from 1% to 5% of their assets annually. Or they buy some sort of fund or portfolio index, where they pay the fund manager usually more than 1% of assets for managing the fund. In the worst case, they pay the financial advisor their fee, and then the advisor buys a fund for the investor – which has that investor paying anywhere from 2% to 8% or even 10% of assets annually for investment advice.

Yet, we know that few asset managers can beat “the market,” whether measured by the DJIA (Dow Jones Industrial Average) or the S&P 500. A study in Europe showed no active manager beat their benchmark over 10 years, and in the U.S. 80% to 90% of fund managers failed to do as well as their benchmarks. And there are studies showing that even if a manager beats their index, after accounting for management fees and costs the investors almost never beat the market.

Any individual could buy the market index by simply opening an on-line account at any discount brokerage, for a very small cost, and buying the exchange traded fund (ETF) for the Dow (DIA – often called “Diamonds”) or the S&P (SPDR – often called “Spiders”). Thus, individual investors can do as well as the “market” at very, very low cost. Most academics will tell investors to not try and beat the market, because the market is wildly inefficient and investors are always without full knowledge of the company, and thus buy these indices.

But most investors are lured by the notion of “beating the market” so they pay the high fees in order to – hopefully – have someone do a better job of investing. And they end up disappointed.

Investors can “beat the market,” but it requires a different approach to investing than fund managers use. And it is far more suited to individuals, with long-term horizons – and it avoids paying those outrageous financial services fees. To be a long-term high-return investor individuals simply need to invest in trends.

247wallst.com published an article stating the editors had seen a report published by Jefferies, sent to them by Bloomberg, which claimed that 20% of all the gains in the total stock market since 1924 (some 93 years) were created by a mere 14 stocks. This sort of blows up all academic theories about investing in portfolios, as it drives home that most market returns are driven by a small collection of companies. Individuals would be better off if they invested in just a few stocks, rather than all stocks. But this means you have to know which stocks to own.

You would think this might be hard, until you look at the list of 14. There is a striking pattern. All were simply the biggest, most powerful companies leading an important, large trend. So if you identified the trend, and invested in the largest company creating that trend, you would do really well. And because these are large companies, investors aren’t carrying the risk of small companies that could be competitively destroyed by larger players. Interestingly, identifying these trends and the large players really isn’t that hard. Nor is it hard to recognize when the trend is ending, and it is time to sell.

We can understand this by looking at the list of 14 not by how much market gain they created, but rather historically when the majority of those gains occurred.

People have enjoyed smoking tobacco since at least the 1500s. Long before anyone knew about the chemical affects and shortened lifespan people simply enjoyed the practice of smoking and the impact nicotine had on them. As tobacco spread from France to England, eventually it moved to the U.S. and was the first ever cash crop – grown in America for sale in Europe. For literally hundreds of years the trend toward tobacco consumption grew. So, it is easy to understand why investing in Phillip Morris, which was renamed Altria, was a good move. As long as people kept buying more cigarettes investing in the largest cigarette company was a good way to increase your returns.

For hundreds of years people used whale oil and similar animal products for candles and lanterns. Wood and coal were used for cooking. But then in 1859 oil was successfully found, and it changed the world. Oil was far cheaper to produce than animal or vegetable oils and burned more consistently at a higher temperature than those products, wood or coal. And that unleashed a trend toward hydrocarbon production leading to the birth of countless new products. It would not have been hard to see that this trend was going to be very valuable. Thus two other names on the list pop up, Exxon and Chevron. These companies are successors of the original Standard Oil founded by John Rockefeller – which created tremendous returns for investors for many years as oil consumption, and production, grew.

Hydrocarbons were a tremendous contributor to the industrial revolution, allowing manufacturers to use engines in new products, and to improve their manufacturing. One of the earliest, and soon biggest, manufacturers was General Electric, another big value producer on the list of 14. And one of the biggest industrial revolution gains was the automobile, where General Motors became by far the largest producer. Investors who put money into the industrial revolution and the trend toward making things – especially cars – came out very well by buying shares in these two companies.

As the industrial revolution grew the middle class emerged, enjoying a vast improvement in quality of life. This led to the trend of consumerism, as it was possible to make things much cheaper and distribute them wider. Three of the biggest companies that promoted this consumer trend were Johnson & Johnson, Proctor & Gamble and Coca-Cola. All were in different product markets, but all were very big leaders in the growth of consumer products for a 1900s world (especially post-WWII) where people had more money – and the desire to buy things. And all three did very well for their investors.

Soon a new trend emerged with the capability of electronics. First came the advent of instant, modern communications as the telephone emerged. Regardless the cost, there was high value in being able to communicate with someone “now” even if they were in a distant location. Investors in Alexander Bell’s AT&T did quite well as phones made their way across America and around the world.

Soon thereafter mechanical adding machines were greatly improved by using electronics – initially relays – to make tabulations and computations. IBM was an early developer of these machines for commercial use, and very quickly came to dominate the market for computers. It was not long before every company needed a computer, or at least access to use one, in order to compete. Investors in IBM were well rewarded for spotting this trend.

As the market for consumer goods exploded Sam Walton recognized the inefficiency of retail product distribution. He discovered that by owning more stores he could negotiate better with consumer goods manufacturers, purchase products more cheaply and sell them more cheaply. He created the trend toward mass retailing driven by efficiency, and he rapidly demonstrated the ability to drive competitors completely out of many retail markets. Investors who identified this trend toward low-cost retailing of a wide product array made considerable gains by purchasing Wal-Mart shares.

As computers became smaller the market expanded, leading to the development of ever smaller computers. Microsoft created software allowing multiple manufacturers to build machines with interoperability, allowing it to take a dominant position in the trend to computers so small every single person could have one – and indeed eventually felt they could not live without one. Microsoft investors made huge gains as the company practically monopolized this trend and created the personal compute marketplace.

It was Apple that first recognized the trend toward mobility being created by ever faster connection speeds. Mobility would allow for radical changes in how many product markets behaved, and investors who saw this mobility trend were amply rewarded for investing in Apple – the company that became synonymous with internet-enabled products.

And as computing mobility improved it created a trend toward buying at home rather than going to a store. Mail order had almost entirely disappeared, due to lack of timely product fulfillment. But with the internet as the interface, coupled with modern, highly efficient transportation services, Amazon was able to give a rebirth to shopping from home and the e-commerce trend exploded. Investors that recognized Amazon’s vastly lower cost retail model, coupled with the infinite prospects for product variety, have been rewarded for investing in the large on-line retailer.

These 14 companies created 20% of all stock market gains across nearly a century. And each was the dominant competitor in a major trend. Several are no longer on the trend, and even a couple have filed bankruptcy (like AT&T and GM), thus it is easy to recognize why some have done far less well the last decade. The world changed and their business model which once produced excellent returns no longer does. But savvy investors should recognize when a trend has run its course, and drop that company in favor of investing in the leader of a major, new trend.

All investors should be long-term investors. Trying to be a market timer, and a trader, is a fool’s errand. To make high investment returns requires taking a long-term (multi-year) view – not monthly or quarterly. Therefore it is important that when investing in trends they be big trends. Trends that will have a large impact on every business – every person. Trends that can generate tremendous returns for many years.

Not everyone can be a stock picker. Therefore, most investors should probably have a goodly chunk of their money in an ETF. That can be done easily enough as described above. But, if you want to increase your returns to beat the market the key is to invest in companies that are large, and the leaders in a major trend.

What are the big trends today? There is no doubt “social” is a huge trend. How every business and person interacts is changing as the use of social tools increases. This is a global phenomenon, and it is a trend with many years left to extend its impact. Investing in the market leader – Facebook – shows good likelihood of obtaining the kind of returns created by the 14 companies discussed above.

What other trends can you identify that have years yet to go? If you can spot them, and invest in a dominant, large leader then you just may outperform nearly every active fund manager trying to get you to pay their fees.

by Adam Hartung | Jan 28, 2017 | Immigration, Leadership, Politics, Trends

(Photo: NICHOLAS KAMM/AFP/Getty Images)

“Get the assumptions wrong and nothing else matters” – Peter F. Drucker

President Donald Trump made it very clear last week that his administration intends to build a border wall between the U.S. and Mexico. And he intends to make Mexico pay for it. He is so adamant he is willing to risk U.S./Mexican relations, canceling a meeting with the Mexican president.

Unfortunately, this tempest is all because of a really bad idea. The wall is a bad idea because the assumptions behind this project are entirely false. Like far too many executives, President Trump is building a plan based on bad assumptions rather than obtaining the facts – even if they belie his assumptions – and developing a good solution. Making decisions, and investing, on bad assumptions is simply bad leadership.

The stated claim is Mexico is sending illegal immigrants across the border in droves. These illegal immigrants are Mexican ne’er do wells who are coming to America to live off government subsidies and/or commit criminal activity. The others are coming to steal higher paying jobs from American workers. America will create a h

Unfortunately, almost everything in that line of logic is untrue. And thus the purported conclusion will not happen.

1. Although it cannot be proven, analysts believe the majority (possibly vast majority) of illegal immigrants enter America by air. There are two kinds of illegal immigration. President Trump’s rhetoric focuses on “entries without inspection.” But most illegal immigrants actually arrive in America with a visa – and then simply don’t leave. These are called “overstays.” They come from Mexico, India, Canada, Europe, Asia, South America, Africa – all over the world. If you want to identify and reduce illegal immigration, you need to focus on identifying likely overstays and making sure they return. The wall does not address this.

3. More non-Mexicans than Mexicans were apprehended at the U.S. border – and the the number of Mexicans has been declining. From 1.6 million in 2000, by 2014 the number dwindled to 229,000 (a decline of 85%). If you want to stop illegal border immigrants into the U.S., the best (and least costly) policy would be to cooperate with Mexico to capture these immigrants as they flee Central America and find a solution for either housing them in Mexico or returning them to their country of origin. It is ridiculous to expect Mexico to pay for a wall when it is not Mexico’s citizens creating the purported illegal immigration problem on the border.

4. In 2015 over 43,000 Cubans illegally immigrated to the U.S. – about 20% as many as from Mexico. The cost of a wall is rather dramatically high given the weighted number of illegal immigrants from other countries.

5. The number of illegal immigrants living in the U.S. is actually declining. There are more Mexicans returning to live in Mexico than are illegally entering the U.S. Between 2009 and 2014 over 1 million illegal Mexican immigrants willingly returned to Mexico where working conditions had improved and they could be with family. In other words, there were more American jobs created by Mexicans returning to Mexico than “stolen” by new illegal immigrants entering the country. If the administration would like to stop illegal immigration the best way is to help Mexico create more high-paying jobs (say with a trade deal like NAFTA) so they don’t come to America, and those in America simply choose to go to Mexico.

6. Illegal immigrants are not “stealing” more jobs every year. Since 2006, the number of illegal immigrants working in the U.S. has stabilized at about 8 million. All the new job growth over the last decade has gone to legitimate American workers or legal immigrants working with proper papers. Illegal immigration is not the reason some Americans do not have jobs, and blaming illegal immigrants is a ruse for people who simply don’t want to work – or refuse to upgrade their skills to make themselves employable.

7. Illegal immigrants in the U.S. is not a rising group – in fact most illegal immigrants have been in the U.S. for over 10 years. In 2014, over 66% of all illegal immigrants had been in the U.S. for 10 years or more. Only 14% have been in the U.S. for 5 years or less. We don’t have a problem needing to stop new illegal immigrants (the ostensible reason for a wall). Rather, we have a need to reform immigration so all these long-term immigrants already in the workforce can be normalized and make sure they pay the necessary taxes.

8. The states where illegal immigration is growing are not on the Mexican border. The states with rising illegal immigration are Washington, Pennsylvania, New Jersey, Virginia, Massachusetts and Louisiana. Texas, New Mexico and Arizona have seen no significant, measurable increase in illegal immigrants. And California, Nevada, Illinois, Alabama, Georgia and South Carolina have seen their illegal immigrant population decline. A border wall does not address the growth of illegal immigrants, as to the extent illegal immigrants are working in the U.S. they are clearly not in the border states.

Good leaders get all the facts. They sift through the facts to determine problems, and develop solutions which address the problem.

Bad leaders jump to conclusions. They base their actions on outdated assumptions. They invest in the wrong places because they think they know everything, rather than making sure they know the situation as it really exists.

America’s “flood of illegal immigrants” problem is wildly overblown. Most illegal immigrants are people from advanced countries, often with an education, who overstay their visa limits. But few Americans seem to think they are a problem.

Most border crossing illegal immigrants today are minors from Central America simply trying to stay alive. They aren’t Mexican criminals, stealing jobs, or creating a crime spree. They are mostly starving.

President Trump has “whipped up” a lot of popular anxiety with his claims about illegal Mexican immigrants and the need to build a border wall. Interestingly, the state with the longest Mexican border is Texas – and of its 38 congressional members (36 in Congress, 2 in the Senate and 25 Republican) not one (not one) supports building the wall. The district with the longest border (800 miles) is represented by Republican Will Hurd, who said “building a wall is the most expensive and least effective way to secure the border.”

Good leaders do not make decisions on bad assumptions. Good leaders don’t rely on “alternative facts.” Good leaders carefully study, dig deeply to find facts, analyze those facts to determine if there is a problem – and then understand that problem deeply. Only after all that do they invest resources on plans that address problems most effectively for the greatest return.

by Adam Hartung | Jan 24, 2017 | Leadership, Politics

(Photo by Shawn Thew-Pool/Getty Images)

Professor John Kotter (Konosuke Matsushita Professor of Leadership HBS) penned Power and Influence (1985, Free Press) after teaching his course of the same name at the Harvard Business School. The one thing he found clear, as did his students (of which I was one), was that a person can be powerful and have influence, but that does not make them a leader. Leaders understand how to create and use both power and influence. But merely having access to either, or both, does not make a person a leader.

One of my mentors, Colonel Carl Bernard, famed leader of U.S. Special Forces in Laos and Vietnam during the 1960s, met an executive at DuPont in the mid-1980s who had been given a large organization but was struggling. Col. Bernard was asked to review this fellow and offer his leadership insights so this fellow’s peers could help him be a better corporate leader. After a few meetings with this exec, alone and in groups, Col. Bernard concluded, “DuPont can give him resources, and access to the CEO, but that man could not lead a Boy Scout troop. Best they close the business now before he causes too much trouble. There’s nothing I can do for him.” Two years later, and tremendous turmoil later, DuPont did close that business, fired him and wrote off everything the company had invested.

Last Friday, Donald Trump was sworn in as president of the United States. He now has the most powerful job in the free world and unparalleled influence. But, he’s not yet proven himself a leader. His accomplishments to date have all been executive orders – issued unilaterally. To achieve the title “leader,” he has to prove people will follow him.

President Trump did not win the popular vote, and he assumes his new job with the lowest approval rating of any first-term president ever elected. Numbers alone do not imply that the country is ready to call him its leader.

Historically, a president has had to screw up in office to have such low popularity. But on Saturday millions of demonstrators took to the streets of Washington, Los Angeles, Chicago, Minneapolis and other cities to protest a president who had yet to do anything in his new role. Far more demonstrated than attended the inauguration, which had about half the attendees as Barack Obama’s first inauguration. It took Lyndon Johnson years to create the animosity which lead to demonstrators chanting, “Hey, hey LBJ, how many kids did you kill today?” (referencing his escalation of the Vietnam War).

Business school thought leaders, and business executives, have been studying leadership for at least six decades, and they have discovered there are consistencies in how to encourage followership. Roger Ferguson, CEO of TIAA-CREF,

said leadership is about inspiring people. He teaches that this is done by

• demonstrating expertise – which Trump has yet to do as a politician,

• making yourself appealing – which Trump has missed by deriding those who speak out against him,

• showing empathy for others – a trait so far missing in Trump’s tweets, or comments about detractors

• and showing the fortitude of being the calm in the storm – the opposite of Trump, who’s fiery rhetoric creates more storms than it calms.

In 2013, fellow Forbes contributor Mike Myatt offered his insights into how one should lead those who don’t want to follow, tips that should be very interesting to the unpopular President Trump:

• Be consistent. This seems the antithesis of Trump, who favors inconsistency and campaigned that as President he intended to be inconsistent.

• Focus on what’s important. Reading Trump’s tweets, it is clear he struggles to separate the important from the meaningless

• Make respect a priority. Should we talk about Trump’s references to women? Or his comments about war heroes like John McCain?

• Know what’s in it for the other guy. Trump likes to brag about taking advantage of others in his business dealings, and showing blatant disregard for the concerns of others. Recommending African-Americans vote for him because “what have you got to lose” does not demonstrate knowledge of that constituency’s needs.

• Demonstrate clarity of purpose. Firstly, what does it mean to “make America great again?” It would be nice to know what that slogan even means. Second, if Trump is the President for “those of you left behind,” as he referenced in his inauguration speech, can he tell us who is in that group? Am I included? Are you? How do you know who’s in this group he now represents? And who’s not?

Americans frequently confuse position with leadership. Many CEOs are treated laudably, even after they have destroyed shareholder value, destroyed thousands of jobs, stripped suppliers of money and resources, doomed local economies with shuttered facilities and left their positions with millions of dollars despite a terrible performance. These CEOs demonstrated they had power and influence. But many are despised by their former employees, investors, bankers, suppliers and community connections. They did not demonstrate they were leaders.

Despite his great wealth, which has bought him substantial power and influence, Americans have yet to see if President Trump can lead. He has never been a commissioned or non-commissioned officer in a military organization. He has never led a substantial corporation with large employment. He has never led a substantial non-profit or religious organization. Contrarily, he has largely been the head of hundreds of small businesses (by employee standards) many of which he has closed or bankrupted, often leaving people unemployed, his investors losing money and communities (such as Atlantic City) worse off from his real estate dealings.

I prefer to write about corporate leaders and market leaders. But for a while now, almost all the news has been about Mr. Trump. Now President Trump, who has not previously led even a Boy Scout troop. One wonders of Col. Bernard would think he could.

“The greatest leader is not necessarily the one who does the greatest things. He is the one that gets the people to do the greatest things” – Ronald Reagan

by Adam Hartung | Jan 16, 2017 | Economy, Politics, Trends

Trend analysis is the most critical part of planning.

Some trends are hard to spot, because people think they are just a fad. Many folks think electric cars fit that category.

Other trends are hard to accept because they imply a big shift in how we live or work – or how we run our business. Scores of IT people who have written me over the years saying mobile devices on common networks (telecom to AWS) will never replace PCs connected to server farms. The implications of this trend are severely negative related to demand for their skills, so they ignore it.

But every plan should be built on trends, because these forecasts are critical for decision-making. It’s the future that matters, not the past. Too often plans are built on history, when trends clearly indicate that things are going to change, and old assumptions are outdated.

Demographic trends are easy to forecast, and important.

While some trends are hard to forecast, some trends are really easy to spot and forecast. And the easiest trend to understand is demographics. If you don’t use any other trends in your planning, you should have demographic trends at the core of your assumptions.

Take for example the movement of people across the United States. Ever since the wagon train people have been moving west. And, like my friend Buckley Brinkman (executive director and CEO of the Wisconsin Center for Manufacturing and Productivity) likes to say, “ever since the invention of air conditioning people have been moving south.” Yet, I’m startled how few organizations plan for this shift and adjust their strategies and tactics to be more successful.

From July 1, 2015 to July 1, 2016 the seven fastest growing states were western. And of 50 states, only eight lost population.

Growth is sublime, decline is disastrous.

Bruce Henderson, founder of the Boston Consulting Group, used to say that if you want to hunt or farm you’re far better off in the Amazon than you are in the Arctic. Basically, where there are resources, and lots of growth, it’s a lot easier to succeed.

For business, this means that if you want to grow your business – whether you’re installing HVAC systems or building a state-of-the-art battery manufacturing plant – you’ll find it relatively easier in faster growing states. It doesn’t mean there is no competition, but it does mean that growth makes it easier for competitors to succeed.

Contrastingly, there were eight states that lost population in this same 12 months.

This means that competition is intensifying in these states. As people move out there are fewer customers to buy what each business sells, so these companies have to fight harder, and price lower, to grow – or even maintain. As the population declines taxes have to go up because there are fewer taxpayers to cover government costs. These states become less desirable places for business.

The businesses in Illinois, for example, are in the middle of a bare-knuckle brawl over the state budget that has gone on for two years. The Governor and the legislature cannot agree on how to manage costs, or revenues. Bond ratings have been slashed as costs to borrow have gone up. Several services have been shut down, and student costs at universities have gone up while programs have been gutted or discontinued.

Governor Rauner (R – IL) has repeatedly said he wants Illinois to be more like Indiana, its neighbor to the east. Perversely people apparently are listening, because Illinois is shrinking, while Indiana grew a healthy 0.31%. For residents remaining in Illinois this worsens a host of maladies:

• the state’s jobs situation struggles as the number of paying jobs declines, making it harder to recruit new talent, or even keep its own university graduates;

• Illinois’ pension problems worsen, as there are fewer people paying into the pension funds while those drawing out funds keep increasing;

• Illinois is unable to fund schools properly, especially Chicago, due to less income – forcing up property taxes;

• taxes keep rising due to fewer people and businesses (when adding property taxes, sales taxes and income taxes Illinois is now the highest tax state in the country);

• new highways are being built with federal funds, but other infrastructure is in trouble, as city, county and state roads are pothole ridden. Trains and subways become outdated and fall into disrepair. And one-time budget Hail Mary’s, like Chicago selling its parking structures and meters in order to balance the budget for one year, strip citizens of future revenues while they watch parking (and other) service costs skyrocket;

• and Chicago has suffered the lowest real estate recovery rate of the top 30 major U.S. cities –not even returning to prices in 2008.

Growth solves a multitude of sins.

Just like a rising tide raises all boats, growth creates more growth. More people increases demand for everything, which increases business sales, which increases jobs and wages, which increases the value of real estate and household wealth, which increases tax revenue, which allows offering more services to make a state even more appealing.

On the other hand, shrinking can become like the whirlpool over a drain. As the problems increase more people decide to leave, making the problems worsen. As more people go, there are fewer people left behind to make things better. Jobs go away, wages fall, demand drops, real estate prices drop, infrastructure projects stop, services stop and yet taxes have to be raised on the fewer remaining residents.

Few trends are more important for planning than understanding demographics. Demographics affect demand for everything, and planning for changes offers businesses the opportunity to be in the right place, at the right time, to be more successful. And, demographic trends are some of the easiest to predict:

• population size

• average age, and sizes of age groups

• average income, and sizes of income groups

• ethnicity

• religion

Plans should be based on trends, not history. Understanding trends, and their trajectory, can help you be in the right market, at the right time, with the right product in order to succeed. There are lots of trends, but one that is fairly obvious, and incredibly important, is simply understanding demographics. Is this built into your planning system?

by Adam Hartung | Jan 6, 2017 | Advertising, Innovation, Marketing, Mobile, Trends, Web/Tech

It’s been over a decade since the Internet transformed print media.

Very quickly the web’s ability to rapidly disseminate news, and articles, made newspapers and magazines obsolete. Along with their demise went the ability for advertisers to reach customers via print. What was once an “easy buy” for the auto or home section of a paper, or for magazines targeting your audience, simply disappeared. Due to very clear measuring tools, unlike print, Internet ads were far cheaper and more appealing to advertisers – so that’s where at least some of the money went.

In 2012 Google surpassed all print media in generating ad revenue. Source Statista courtesy of NewspaperDeathWatch.com

While this trend was easy enough to predict, few expected the unanticipated consequences.

1. First was the trend to automated ad buying. Instead of targeting the message to groups, programmatic buying tools started targeting individuals based upon how they navigated the web. The result was a trolling of web users, and ad placements in all kinds of crazy locations.

Heaven help the poor soul who looks for a credenza without turning off cookies. The next week every site that person visits, whether it be a news site, a sports site, a hobby site – anywhere that is ad supported – will be ringed with ads for credenzas. That these ads in no way connect to the content is completely lost. Like a hawker who won’t stop chasing you down the street to buy his bad watches, the web surfer can’t avoid the onslaught of ads for a product he may well not even want.

2. Which led to the next unanticipated consequence, the rising trend of bad – and even fake – journalism.

Now anybody, without any credentials, could create their own web site and begin publishing anything they want. The need for accuracy is no longer as important as the willingness to do whatever is necessary to obtain eyeballs. Learning how to “go viral” with click-bait keywords and phrases became more critical than fact checking. Because ads are bought by programs, the advertiser is no longer linked to the content or the publisher, leaving the world awash in an ocean of statements – some accurate and some not. Thus, what were once ads that supported noteworthy journals like the New York Times now support activistpost.com.

3. The next big trend is the continuing rise of paid entertainment sites that are displacing broadcast and cable TV.

Netflix is now spending $6 billion per year on original content. According to SymphonyAM’s measurement of viewership, which includes streaming as well as time-shifted viewing, Netflix had the no. 1 most viewed show (Orange is the New Black) and three of the top four most viewed shows in 2016.

Increasingly, purchased streaming services (Netflix, Hulu, et.al.) are displacing broadcast and cable, making it harder for advertisers to reach their audience on TV. As Barry Diller, founder of Fox Broadcasting, said at the Consumer Electronics Show, people who can afford it will buy content – and most people will be able to afford it as prices keep dropping. Soon traditional advertisers will “be advertising to people who can’t afford your goods.”

4. And, lastly, there is the trend away from radio.

Radio historically had an audience of people who listened to their favorite programming at home or in their car. But according to BuzzAngle that too is changing quickly. Today the trend is to streaming audio programming, which jumped 82.6% in 2016, while downloading songs and albums dropped 15-24%. With Apple, Amazon and Google all entering the market, streaming audio is rapidly displacing real-time radio.

Declining free content will affect all consumers and advertisers.

Thus, the assault on advertisers which began with the demise of print continues. This will impact all consumers, as free content increasingly declines. Because of these trends, users will have a lot more options, but simultaneously they will have to be much more aware of the source of their content, and actively involved in selecting what they read, listen to and view. They can’t rely on the platforms (Facebook, etc.) to manage their content. It will require each person select their sources.

Meanwhile, consumer goods companies and anyone who depends on advertising will have to change their success formulas due to these trends. Built-in audiences – ready made targets – are no longer a given. Costs of traditional advertising will go up, while its effectiveness will go down. As the old platforms (print, TV, radio) die off these companies will be forced to lean much, much heavier on social media (Facebook, Snapchat, etc.) and sites like YouTube as the new platforms to push their product message to potential customers.

There will be big losers, and winners, due to these trends.

These market shifts will favor those who aggressively commit early to new communications approaches, and learn how to succeed. Those who dally too long in the old approach will lose awareness, and eventually market share. Lack of ad buying scale benefits, which once greatly favored the very large consumer goods companies (Kraft, P&G, Nestle, Coke, McDonalds) means it will be harder for large players to hold onto dominance. Meanwhile, the easy access and low cost of new platforms means more opportunities will exist for small market disrupters to emerge and quickly grow.

And these trends will impact the fortunes of media and tech companies for investors The decline in print, radio and TV will continue, hurting companies in all three media. When Gannet tried to buy Tronc the banks balked at the price, killing the deal, fearing that forecasted revenues would not materialize.

Just as print distributors have died off, cable’s role as a programming distributor will decline as customers opt for bandwidth without buying programming. Thus trends put the growth prospects of companies such as Comcast and DirecTV/AT&T at peril, as well as their valuations.

Privatized content will benefit Netflix, Amazon and other original content creators. While traditionalists question the wisdom of spending so much on original content, it is clearly the trend and attracts customers. And these trends will benefit streaming services that deliver paid content, like Apple, Amazon and Google. It will benefit social media networks (Facebook and Alphabet) who provide the new platforms for reaching audiences.

Media has changed dramatically from the business it was in 2000. And that change is accelerating. It will impact everyone, because we all are consumers, altering what we consume and how we consume it. And it will change the role, placement and form of advertising as the platforms shift dramatically. So the question becomes, is your business (and your portfolio) ready?

by Adam Hartung | Dec 30, 2016 | Economy, Innovation, Leadership, Manufacturing

2016 was an election year, and Americans were inundated with talk. Unfortunately, a lot of it was pure hubris.

President-elect Donald Trump inspired people to “make America great again.” In doing so, he developed the theme that the reason America wasn’t so great had to do with too much work being done offshore, rather than onshore. And that there were far too many immigrants, which harmed the economy and the country. This became rather popular with a significant voting block, led in particular by white males – and within that group those lacking higher education. These people expressed, with their votes and with their words at many rallies, that they were economically depressed by America’s policies allowing work to be completed by people not born in America.

Oh, if it was only so simple.

Any time something is manufactured offshore there is a cost to supply the raw materials, often the equipment, and frequently the working capital. These are added costs, not incurred by U.S. manufacturing. The reason manufacturing jobs went offshore had everything to do with (1) Americans unwilling to work at jobs for the pay offered, and (2) an unwillingness for Americans to invest in their skill sets so they could do the work.

Although they are easy targets. Instead, those Americans should blame themselves for not knuckling down and working harder to make themselves more competitive.

Since the 1980s America has lost some five million manufacturing jobs (from about 17.5 million to 12.5million). That sounds terrible, until you realize that the amount of goods manufactured in America is near an all-time. While it may sound backwards, the honest truth is that automation has greatly improved the output of plant and equipment with less labor. between 1985 and 2009. As the Great Recession has abated, output is again back to all-time highs. It just doesn’t take nearly as many people as it once did.

But it does take much smarter, better trained people.

Manufacturing today isn’t about sweat shops. Not in the USA, and not in Mexico, China or India. The plants in all these countries are equally high-tech, sophisticated and automated. Just look at the images of workers at the Chinese Foxconn plants, or the Mexican auto parts plants, and you’ll see something that could just as easily be in the USA. The reality is that those plants are in those countries because the workers in those countries train themselves to be very productive, and they make great products at very high quality.

And don’t blame regulations and unions for creating offshoring.

For almost all U.S. companies, their offshore plants comply with the U.S. regulations. Most require the same level of safety and working conditions globally.

Union membership has been declining for 75 years. Fifty years ago one in three workers was in a union. Today, it’s less than one in 10. In 2015 the Bureau of Labor reported that only 6.7% of private sector workers were unionized – an all time modern era low. Unions are almost unimportant today. It hasn’t been union obstructionism that has driven jobs oversees – it’s largely been an inability to hire qualified workers.

Much was made the last few years of a lower labor participation rate. Many Trump followers said that the Obama administration was failing to create jobs, so people stayed home. But that simply was not true. While the economy was recovering, the unemployment rate fell to its lowest level since the super-heated economy of 2001. To find this low level of unemployment prior to that you have to go all the way back to 1970!

There are plenty of jobs. The issue is getting people trained to do the work.

And here is the real rub. You can’t sit home complaining and moping, you have to study hard and train. Before today’s level of computerization and automation, when work was a lot more manual, it didn’t matter how much education you had, nor how well you could read and do math and science. But today, work is not manual. It takes minimal manual skill to operate equipment. Today it takes computer programming skills, engineering skills and math skills.

The Organization for Economic Cooperation and Development (OECD) does an annual Program for International Student Assessment (PISA) study. This looks at test scores across the world to see where students fair best. Of course, economically displaced Americans are sure that Americans are at the top of these test results – because it is easy to assume so.

Americans are in the bottom half of the planet’s educational performance .

The 2015 results are here, and in reading, science and math America doesn’t even crack the top 10. In fact, the poorest 10% of Vietnamese students did better than the average American teen. In all three categories, the USA scored below the global average. American’s are not above average – they are now below average.

American’s have simply gotten lazy. For far too long, when somebody did poorly Americans have blamed the teacher, blamed the test, blamed the “system” — blamed everyone and everything except the person themselves. It has become unacceptable to tell someone they are doing a below-average job. It is unacceptable to tell someone their skills don’t match up to the needs of the job. Instead,

Instead of forcing people to work hard – really hard – and expecting that each and every person will work hard to compete in a global economy – just to keep up – the expectation has developed that hard work is not necessary, and everyone should do really well. Instead of thinking that hard mental effort, ongoing education and additional training are the minimal acceptable standards to maintaining a job, it is expected that high paying jobs should just be there for everyone – even if they lack the skills to perform. American no longer want to admit that someone is being outperformed.

In 1988 Nike set the company on a growth trajectory with their trademarked phrase “Just Do It.” Just get up off the couch and do it. Quit complaining about being out of shape – just do it.

And that’s my wish for America in 2017. Quit blaming foreigners for working harder at school than we do. Quit blaming immigrants for being better trained, and harder working, than Americans. Quit pretending like the problem with the labor participation rate is some kind of problem created by the government. Quit finger-pointing and blaming someone else for being better than us.

Instead, get up off the couch and do it. Go back to school and study hard – harder than the competition. Grades matter. Learn geometry, trigonometry and calculus so you can make things – or operate equipment that makes things. Gain some engineering skills so you can learn to program, in order to improve productivity with a mobile device – or even a personal computer. Become facile in more than one language so you can operate and compete in a global economy.

Hey Americans, instead of blaming everyone else for workers lacking a job, or a higher income, quit talking about the problems. If you want to “make America great again” quit complaining and just do it.

by Adam Hartung | Dec 23, 2016 | Advertising, Marketing, Trends, Web/Tech

‘Tis the season of holiday giving. We hunt for just the right gift, for just the right person, to make sure they know we care about them. This act of matching a gift to the person has tremendous importance, because it demonstrates care from the giver about the recipient.

Once advertising was like that. Marketers built brands with loving care. They worked very hard to know the target for their brand (and product) and they carefully crafted every nuance of the brand – imagery, typography, colors, images, sounds – even spokespeople (famous or created) to project that brand properly for the intended customers. We’ve seen great brand images over time, from Tony the Tiger promoting cereal to start your day to Ronald McDonald bringing a family together.

SAUL LOEB/AFP/Getty Images

Ad placement delivered the brand’s gift to the customer.

And, once upon a time, how that brand was placed in front of targeted customers was every bit as crafted as the brand itself. Marketers worked with ad agencies to make sure newspaper, magazine, billboard location, radio show or TV program matched the brand. The brand was considered linked not just to the medium, but to the message that medium projected. Want to sell a muscle car, you promoted it via media focused on sports, DIY projects, men’s health – a positive connection between the media’s message/content and the advertiser’s goal for the brand.

And marketers knew that if they put their brand with the right media content, in front of their targets, it would lead to brand identification, brand enhancement, and sales growth. The objective wasn’t how many people saw the ads, but putting the ad in front of the right people, associated with the right content, to build on the brand’s value, and make the products more appealing to target buyers. Placement led to sales.

Just like finding the right gift is important for the holidays, matching the gift to the recipient, finding the right ad placement was very important to the customer. It was an act of diligence on the part of the advertiser to demonstrate to target customers “hey, I know you. I get where you’re coming from. I connect with you.”

Then the internet changed everything.

In the old days marketers really didn’t know how many people connected with their ads post-placement. There were raw numbers on readers/listeners/viewers, but nothing specific. There was a lot of trust by the marketer that “owned” brand placed in working with the ad agencies to link the brand to the right media – the right content – so that brand would flourish and product sales would grow.

Yes, ads were measured for their appeal, how well they were remembered and audience coverage. But these metrics, and especially raw volume numbers, were each just one piece of how to craft the brand and deliver the message. It was reaching the right people that mattered, and that required people to make media decisions – and that required really knowing the content tied to the ad being placed.

Marketers clearly understood that customers knew the product paid for those ads to promote that content. Customers linked the brand and the content, and thus it was important to make sure they matched. The content had to be right for the ad to have its intended affect.

But in the internet age, all that caring about customers, branding and links to the right content began disappearing. Instead, ad decisions were dominated by metrics – “how many placements did my ad receive?” “how many people saw my ad?” “how many people clicked on my ad?” “how many page views does this web site generate?” “how many page views does this writer/blogger generate?” The brand was being lost – the customer was being lost – in identifying how many people saw the ad, and whether or not they clicked on it, and where they went after the ad was presented on the web page.

And, the worst of all, “Do we have the information to know who this internet surfer is, follow them, and deliver ads to them as they cross pages and web sites?” At this point, content no longer mattered. If some page viewer was known to be looking for a desk, ads for desks would be placed on page after page the reader (potential customer) visited — regardless the content!

Marketers allowed their brands to be disconnected from the content entirely – ouch.

In the era of programmatic ad buying, content no longer matters. Follow the target, hammer on them with ads, even if the brand is positioned first next to information on weather, and next on a site about buying inexpensive baby clothes, and next on a site about high end power tools.

The care and crafting of ad buying, which was crucial to brand building and demonstrating customers really mattered to those who created and crafted the products, and brand, was lost.

In 2016, we saw the ultimate in forgetting brand value while programmatically placing ads. “Fake news” emerged. And marketers started to see their ads next to those fake (often invented and totally false) stories, just like they would be placed next to legitimate information. The breakdown between content and brand was complete. In the unbridled pursuit of “eyeballs” brands were paying for the worst any media could offer – not journalism or legitimate content, but outright crap.

The election served to demonstrate this in an entirely new way. People went to websites, formerly considered “fringe,” such as Breitbart, to find out information on candidates and their supporters. And there would be ads. The ad was following the eyeballs, no longer the content. Family product ads, such as for cereal, were suddenly appearing next to content that was in no way associated with the marketer’s goal for that brand image.

And by being content independent, these programmatic ads were not just harming the brands – they supported bad journalism, and bad content.

“Click bait” became ever more important. With no people involved in ad buying, ads were no longer were tied to content so there was no “editorial” management of how the ad was placed. What those smart ad buyers once did, helping to build the brand, was lost. Now, any writer who could figure out how to use the right key words – and often outrageous content (of any kind) – was able to pull eyeballs. If s/he could pull eyeballs – regardless of the content – they pulled ads. And that pulled dollars.

Media brand value was dramatically lost – and journalism suffered.

In other words, you no longer needed the credibility of a brand like NBC, Wall Street Journal, ESPN, Forbes, etc. to obtain ads. Those old media brands worked hard to make edited content, reliable content, available to readers – and something a brand marketer could understand and use to build her customer base. But now all a publisher/producer needed was something that brought in eyeballs – and often the more outrageous, more salacious, more demeaning, more hostile, more ridiculous the content the more eyeballs were attracted (like watching a train wreck).

And the more this pulled ad money to non-journalistic, bad content, and away from legitimate content providers that focused on building their brand, the more it hurt journalism and marketing. What a decade ago seemed like a possible fear came true in 2016. Unharnessed media access by everyone was proven to lead to the growth of bad journalism as funds for good research, writing, editing and masthead curating was lost to those who demonstrated merely the ability to pull eyeballs.

Those who have benefited from this shift think programmatic ad buying is great. To them if people want to read from their site, look at their photos, cartoons and other images, or watch videos then these site owners claim there is no reason that advertisers should complain. “If people want this content, then why shouldn’t we be paid to create it. This is a monetized democracy of the media putting the customer in control.”

But that is simply not true. Customers link the brand message to the content on the screen. And there should be care taken to make sure that content and the brand message link. And that’s where programmatic ad buying is failing everyone.

Net/net, we need people involved in ad placement. Just as we care about the gifts we give at holidays, it takes a personal touch to make that selection work. It takes people to craft the delivery of ads.

Hopefully in 2017, the lessons of 2016 will become very clear, causing marketers and advertisers to rely far less on programmatic, and get people involved in ad placement once again. For the good of brands and for decent content.

Happy Holidays!

by Adam Hartung | Dec 22, 2016 | Newsletter Post, Trends

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Happy Holidays and gifts for my loyal readers!

This is my last newsletter of 2016 and I have seen a strong growth in new subscribers to the email newsletter, follows on my Forbes blog and in visits to my website.

Thank you!

We have covered many topics around my passion- business growth through innovation. In my presentations around the world this year, there has been one common challenge to growth- how to best target limited resources to maximize returns. The best answer to identifying opportunities for disruptive innovation has been to look beyond the past internal and even industry trends and watch the trends outside the company, its current competitors and even the industry.

Disruptive innovation is so named because it often exists quietly on the fringes of the market, deep inside customers or in another market until it is suddenly “discovered.” Mountain bikes, snowboarding, Walkman, etc. are examples of the technology curve meeting the market demand curve to produce an “overnight success”. In celebrity circles it’s a performer perfecting his or her craft for years until preparation meets opportunity and just the right role catapults them to fame.

Here are the gifts:

Start the new year with a better insight on your Trend IQ, and a good understanding on how prepared you are to grow in 2017.

Click this link taking you to my web site. Then take the Poll on what trends you are following, and how you obtain trend information. Next, download the TrendIQ Evaluation. Fill out the questions and use that as a mini audit on your use of trends in planning.

Happy Holidays to you and your families! And we wish you a Merry Christmas!

Adam Hartung

“Ships go sailing far across the sea,

Trusting starlight to get where they need to be…

When it seems we have lost our way,

We find ourselves again on Christmas Day! Believe….”

“Believe”, Josh Groban, Polar Express

Don’t hesitate to ask for help in making your organization more adaptable, and your strategy embedded with options to change based on market shifts. Forecasting those key trends will help tell you plan your innovation allocations for the next year.

We are your experts at identifying trends, creating scenarios and building external, market monitoring systems. We’ve done this kind of work for over 20 years, and bring a wealth of experience, and tools, to the task. You don’t have to go into scenario planning alone; we can be your coach and mentor to speed learning, and success.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Give us a

call today, or send an email, so we can talk about how you can be a leader, rather than follower, in 2017 and beyond. Or check out the rest of the

website to read up on what we do so we can create the right level of engagement for you.

Forbes Posts- Hartung on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Dec 17, 2016 | Defend & Extend, Investing, Retail, Trends

Sears recently announced it is closing another big batch of stores. Yawn. Who cares? Sears losses since 2010 are nearly $10 billion, with a $.75 billion loss in just the third quarter. As revenue fell another 13% overall and comparable store sales declined 7.4% investors have fled the stock for years.

Five years ago Sears had 3,510 stores. Now it has 1,687. It has 750 with leases expiring in the next five years and CFO Jason Hollar has said 550 of those are short-term enough they will let those close.

What’s striking about this statement is that Sears is a perfect candidate to file bankruptcy, renegotiate those leases, and start with a new plan for the future. Unless it has no plan. Lacking a plan to make its business successful and return those stores to profitability, the CFO is admitting the company has no choice but to keep shrinking assets as Sears simply disappears. Investors should view Sears as a microcosm of trends in traditional brick-and-mortar retailing across the industry. The business is shrinking. Fast

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

Just look at retail employment. Amidst another strong jobs report for November, retail employment actually shrank. This previously only happened in recessions – and 2016 is definitely not a recession year. And all the losses were in traditional store retailing. Kohl’s said it is hiring almost 13% fewer seasonal workers, and Macy’s says it is hiring 2.4% fewer.

Of course, Amazon seasonal hiring is up 20%.

In January, 2015 I wrote how the trend to e-commerce had taken hold, and traditional retailing would never again be the same. For the 2014 holiday season online retail grew 17%, but brick-and-mortar sales actually declined. This was a pivotal event. It clearly indicated a sea change in the marketplace, and it was clear valuations would be shifting accordingly. Surprising many, but not those who really understood the trends and market shifts, six months later (July, 2015) Amazon’s market cap exceeded that of much larger Wal-Mart.

ALL trends (including mobile use) reinforce on-line growth, brick and mortar decline.

The 2016 holiday season is further reinforcing this trend. The National Retail Federation reported that on black Friday 99 million people went to stores. 108.5million shopped online. Black Friday online sales jumped 21.6%.

And this . E-commerce apps are making the on-line experience constantly better. On Thanksgiving day 70% of all on-line retail traffic was mobile, and for the first time ever 53% of on-line orders were from mobile devices – exceeding the orders placed on PCs. With this kind of access, and easy shopping, the need to travel to physical stores accelerates their decline.

Sears is beyond rescue. Unfortunately, there are a number of retailers already so challenged by the on-line competition that they are “the walking dead.” They will falter, and fail, just like the former Dow Jones Industrial retailing giant. They will not make the shift to on-line effectively. They are unwilling to dramatically change their business model, unwilling to cannibalize store sales to create an aggressively competitive on-line business. Expect bad things at JCPenney, Kohl’s, Pier 1 – and weakness at giants Wal-Mart and even Target.

Christmas used to be the time when investors in traditional retail cheered. Results for the quarter could create great gains in stock values. But that time is long gone – passed during the 2014 inflection when traditional started declining while e-commerce continued double digit growth. One can understand the Scrooge-like mentality of those investors, who dread seeing the shift in customers, and valuation, away from their companies and toward the Amazon’s who embrace trends and market shifts.

by Adam Hartung | Dec 6, 2016 | Disruptions, Innovation, Investing, Leadership, Retail

(Photo by Spencer Platt/Getty Images)

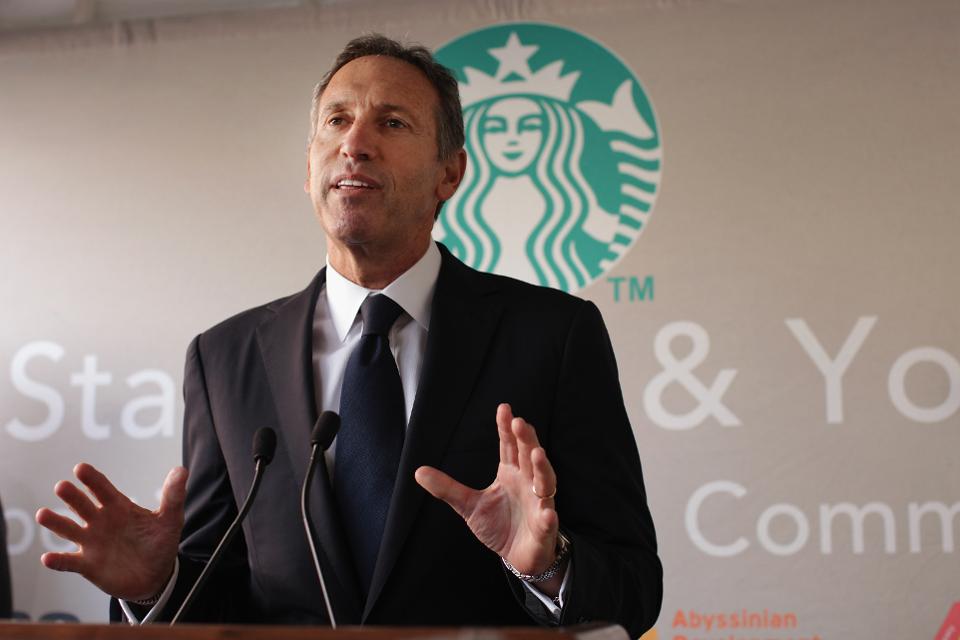

But, is it right to hand-wring over Schultz’s departure as CEO? After all, things have not been pretty for investors since Mr. Jobs turned over Apple to his hand-picked successor Tim Cook. However, could this change mean something better is in store for shareholders?

First, let’s address the very – and Starbucks was saved only by Mr. Schultz returning with his tremendous creativity and servant leadership. While it is great propaganda for making the Schultz as hero story more appealing, it isn’t exactly accurate.

Starting in 1982, Howard Schultz built Starbucks from four stores to over 2,800 (and over $2 billion revenue) in 16 years. That was a tremendous success. And he is to be lauded. But when he left,

Starbucks had only 35o stores outside the USA. It was an American phenomenon, a place to buy and drink coffee, with every store company owned, every employee company trained, and not an ounce of variability in the business model. Not exactly diversified. At the time, the stock traded for roughly (split adjusted) $4 per share.

His successor, Orin Smith, far outperformed Mr. Schultz, more than tripling the chain to over 9,000 stores and expanding revenue to over $5 billion in just four years! He expanded the original model internationally, began adding many new varieties of coffee and other drinks, and even added food. These enhancements were tremendously successful at bringing in additional revenue, even if the average store revenue fell as smaller stores were added in places like airports, hotels and entertainment venues.

In 2005, Jim Donald replaced Mr. Smith. By 2007 (in just teo years) he added a staggering additional 4,000 stores. He expanded the menu. And he even branched out to selling branded Starbucks coffee on airplanes, in hotels and even retailed in grocery stores. Further, he launched a successful international coffee liqueur under the Starbucks brand. And he moved the company into entertainment, creating an artist representation company and even producing movies (Akeelah and the Bee) which won multiple awards.

In 2007 Starbucks fourth quarter saw 22% revenue increase, and for the year 21% growth. Comparable store sales grew 5%. International margins expanded, and net earnings grew over 19% from $564 million to $673 million.

Starbucks’ stock, from 2000 when Mr. Schultz departed into 2006 rose 375%, from $4 to just under $19 per share. Not the ruination that some seem to think was happening.

But Mr. Schultz did not like the diversification, even if it produced more revenue and profit. He joined the chorus of analysts that beat down the P/E ratio, and the stock price, as the company expanded beyond its “core” coffee store business.

When the Great Recession hit, and people realized they could live without $4 per cup of coffee and a $50 per day habit, revenues plummeted, as they did for many restaurants and retailers. Mr. Schultz seized the opportunity to return to his old job as CEO. That the downturn in Starbucks had far more to do with the greatest economic debacle since the 1930s was overlooked as Mr. Schultz blamed everything on the previous CEO and his leadership team – firing them all.

Since 2012 Starbucks has returned to doing what it did prior to 2000 – opening more stores. Growing from 17,000 to 25,000 stores. Refocused on its very easy to understand, if dated, business model analysts loved the simpler company and bid up the P/E to over 30 – creating a trough (2008) to peak (2016) increase in adjusted stock price from $4 to $60 – an incredible 15 times!

But, more realistically one should compare the price today to that of 2006, before the entire market crashed and analysts turned negative on the profitable Starbucks diversification and business model expansion. That gain is a more modest 300% – basically a tripling over a decade – far less a gain for investors than happened under the 2000-2006 era of Mr. Schultz’s successors.

Mr. Schultz succeeded in returning Starbucks to its “core.” But now he’s leaving a much more vulnerable company. As my fellow Forbes contributor Richard Kestenbaum has noted, retail success requires innovation. Starbucks is now almost everywhere, leaving little room for new store expansion. Yet it has abandoned other revenue opportunities pioneered under Messrs. Smith and Donald. And competition has expanded dramatically – both via direct coffee store competitors and the emergence of new gathering spots like smoothie stores, tech stores and fast casual restaurants that are attracting people away from a coffee addiction.

At some point Starbucks and its competition will saturate the market. And tastes will change. And when that happens, growth will be a lot harder to find. As McDonald’s and WalMart have learned, . Exciting new competitors emerge, like Starbucks once was, and Amazon.com is increasingly today.

Mr. Schultz has said he is vastly more confident in this change of leadership than he was the last time he left – largely because he feels this hand-picked team (as if he didn’t pick the last team, by the way) will continue to remain tightly focused on defending and extending Starbucks “core” business. This approach sounds all too familiar – like Jobs selection of Cook – and the risks for investors are great.

A focus on the core has real limits. Diminishing returns do apply. And P/E compression (from the very high 30+ today) could cause Starbucks to lose any investor upside, possibly even cause the stock to decline. If Mr. Schultz’s departure was opening the door for more innovation, new business expansion and a change to new trends that sparked growth one could possibly be excited. But there is real reason for concern – just as happened at Apple.

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)