by Adam Hartung | Dec 30, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership

2015 was not short on bad decisions, nor bad outcomes. But there are 5 major leadership themes from 2015 that can help companies be better in 2016:

1 – Cost cutting, restructurings and stock buybacks do not increase company value – Dow/DuPont

1 – Cost cutting, restructurings and stock buybacks do not increase company value – Dow/DuPont

There was no shortage of financial engineering experiments in 2015 intended to increase short-term shareholder returns at the expense of long-term value creation. Companies continued borrowing money to buy back their own stock – spending more on repurchases than they made in profits.

Unfortunately, too many companies continue to increase earnings per share (EPS) via financial machinations rather than creating and introducing new products, or creating new markets.

In a grand show of value reducing financial re-engineering, 2015 is ending with the massive merger between Dow and DuPont. There is no intent of introducing new products or entering new markets via this merger. Rather, to the contrary, the plan is to merge these beasts, lay off tens of thousands of employees, cut the R&D staff, cut new product introductions and “rationalize” the company into 3 new businesses intended to be relaunched as new companies, with fewer products, less business development and less competition.

Massive cost cutting will weaken both companies, put thousands out of work and leave the marketplace with fewer new products. All just to create 3 new, different profit and loss statements in the hopes of improving the EPS and price to earnings (P/E) multiple. This story has become all too familiar the last few years, and the only winners are the bankers, who will make massive fees, and hedge fund managers that rapidly dump the stock in the terrible companies they leave behind.

2 – Doing more of the same is not innovative and does not create value – McDonald’s

McDonald’s has been losing market share to fast casual restaurants for over a decade. Yet, leadership insists on constantly maintaining its undying focus on the fast food success formula upon which the company was launched some 60 years ago.

As the number of customers continued declining, McDonalds kept closing more stores. Yet, sales per store remained weak even as the denominator grew smaller. Unwilling to actually update McDonald’s to make it fit modern trends, in 2015 leadership decided the path to growth was serving breakfast all-day. Really. It is still hard to believe. No new products, just the same McMuffins and sausage biscuits, but now offered for more hours.

Because of McDonald’s size and legacy the media covered this story heavily in 2015. Yet, as 2016 starts we all can look back and see that this was no story at all. Doing more of the same is not in any way innovative or revolutionary. Defending and extending an outdated success formula does not fix a company strategy that is out of date and rapidly losing relevancy.

3 – Hiring the wrong CEO is a BIG problem – Yahoo

We would like to think that Boards are really good at hiring CEOs. Unfortunately, we are regularly reminded they are not. The Board at Yahoo has spent a decade making bad CEO selections, and now the company’s core business is valueless.

In 2015 we saw that the decision by Yahoo’s board to hire a CEO based on political correctness (gender advantages), and limited experience with a well known company (a short Google career) rather than leadership capability could be deadly. Although Marissa Mayer was hired in 2012 amid much fanfare, we learned in 2015 that Yahoo is worth only the value of its Alibaba shareholdings, and no more. Yahoo as it was founded is now worth – nothing.

After 3 years of Mayer leadership it became clear that “there was no there, there” at Yahoo (to quote Gertrude Stein.) The value of the company’s “core” search and content accumulation businesses dropped to zero. Although 3 years have passed, practically no progress has been made toward developing a new business able to compete in the market shifted to social media and instant communications. Investors now realize Ms. Mayer has failed to grow future revenue and profits for the historical internet leader. Following a decade of incompetent CEOs, Yahoo has been left almost wholly irrelevant.

What was once Yahoo will soon be Alibaba USA, as the company gets rid of its old businesses – in some fashion, although who would want them is unclear – in order to allow shareholders to preserve their value in Alibaba stock purchased by Jerry Yang in 2005.

Yahoo has become irrelevant, replaced by its minority stake in Alibaba, largely due to a Board unable to identify and hire a competent CEO – ending with the wholly unqualified selection of Ms. Mayer, who will achieve at least a footnote in history for the outsized compensation package she received and the huge severance that will come her way, wildly out of proportion to her poor performance, when leaving Yahoo.

4 – Even 1 dumb leadership decision can devastate a company — Turing Pharmaceuticals and CEO Shkreli

In 2015 former hedge fund manager Martin Shkreli raised a lot of money, and obtained control of an anit-parasitic pharmaceutical product. Recognizing that his customers either paid up or died, and being young, naïve, enormously greedy and without much oversight he decided to raise product pricing 70-fold. This would leave his customers either dead, bankrupt or bankrupting the insurance companies paying for his product – but he infamously said he did not care.

Thumbing your nose at customers, and regulators, is never a good idea. And even if they could not roll back the price quickly, they could target the CEO and his company for further investigation. It didn’t take long until Mr. Shrkeli was indicted for stock manipulation, leaving Turing Pharmaceuticals in disrepair as it rapidly cut staff and tried to determine what it will do next. Now KaloBios Pharma, controlled by Turing, is forced to file bankruptcy.

Never forget that Al Capone did not go to prison for stealing, bribing police, bootlegging, number running, murder or other gangster behavior. He went to prison for tax evasion. The simple lesson is, when you think you are smarter than everyone else, can do whatever you want and thumb your nose at those with government powers you’ll soon find yourself under the microscope of investigation, and most likely in really big trouble. And in the desire to take down the unwise CEO corporations become mere fodder.

The pharma industry is a regular target of consumers and politicians. Now not only are the investors in Turing damaged by this foolishly incompetent CEO, but the entire industry will once again be under close scrutiny for its pricing practices. Arrogantly making brash decisions, based on ill-formed thinking and juvenile egotism, without careful, thoughtful consideration can create enormous damage.

5 – Putting short-term results above good business practice will hurt you very badly long-term – Volkswagen and Takata

VW cheated on its emissions tests. Takata sold deadly, exploding airbags. Both companies are large organizations with layers of management. How could judgemenetal errors so big, so costly and so deadly happen?

These outcomes did not happen because of just “one bad apple.” Cultural acceptance of lying takes years of leadership focused on short-term results, even when it means operating unethically or illegally, to be inculcated. It took years for layers of management to learn how to turn away from problems, falsify test results, fake outcomes, lie to customers and even lie to regulators. It took years to create a culture of tolerated deception and willful misrepresentation.

Unfortunately, the auto industry is a tough place to make money. There is a lot of regulation, and a lot of competition. When it becomes too hard to make money honestly, cheating can become far too easily accepted. Rather than trying to revolutionize the auto making process, or the product itself, it can be a lot easier to push managers all the way down to the front-line of procurement, manufacturing or sales to simply cheat.

“Make your numbers” becomes a mantra. If you want to keep your job, or even more importantly if you want to move up, do whatever it takes to tell those above you what they want to hear. And those above don’t ask too many questions, don’t try to figure out how results happen – just keep applying pressure to those below to do what’s necessary to make the numbers.

As VW and Takata showed us, eventually the company will be caught. And the consequences are severe. Now those companies, their customers, their employees and their shareholders are suffering. And industry regulations will tighten further to make it harder to cheat. Everyone loses when short-term results are the top goal, rather than building a sustainable long-term business.

Let’s hope for better leadership in 2016.

by Adam Hartung | Dec 19, 2015 | Books, Current Affairs, Ethics, Lifecycle

America’s middle class has been decimated. Ever since Ronald Reagan rewrote the tax code, dramatically lowering marginal rates on wealthy people and slashing capital gains taxes, America’s wealthy have been amassing even greater wealth, while the middle class has gone backward and the poor have remained poor. Losing 30% of their wealth, and for many most of their home equity, has left what were once middle class families actually closer to definitions of working poor than a 1950s-1960s middle class.

When Charles Dickens wrote “A Christmas Carole” he brought to life for readers the striking difference between those who “have” from those who “have not” in early England. If you had money England was a great place to be. If you relied on your labors then you were struggling to make ends meet, and regularly disappointing yourself and your family.

For a great many American’s that is the situation in 2015 USA.

At the book’s outset, Mr. Ebenezer Scrooge felt that his wealth was all due to his own great skill. He gave himself 100% of the credit for amassing a fortune, and he felt that it was wrong of laborers, such as his bookkeeper Mr. Cratchit, to expect to pay when seeking a day off for Christmas.

Unfortunately, this sounds far too often like the wealthy and 1%ers. They feel as if their wealth is 100% due to their great intelligence, skill, hard work or conniving. And they don’t think they owe anyone anything as they work to keep unions at bay as they campaign to derail all employee bargaining. Nor do they think they should pay taxes on their wealth as many actively seek to destroy the role of government.

Meanwhile, there are employers today who have taken a page right out of Mr. Scrooge’s book of worklife desolation. Ever since President Reagan fired the Air Traffic Controllers Union employee rights have been on the downhill. Employers increasingly do not allow employees to have any say in their work hours or workplace conditions – such as Marissa Mayer eliminating work from home at Yahoo, yet expecting 3 year commitments from all managers.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.

Just as Mr. Scrooge objected to giving the 25th December as a paid holiday (picking his pocket once a year was his viewpoint,) many employers keep cutting sick leave and holidays – or, worse, they allow days off but expect employees to respond to texts, voice mails, emails and social media 24x7x365. “Take all the holiday you want, just respond within minutes to the company’s every need, regardless of day or time.”

Increasingly, those who “go to work” have less and less voice about their work. How many of you readers will check your work voice mail and/or email on Christmas Day? Is this not the modern equivalent of your employer, like Scrooge, treating you like a filcher if you don’t work on the 25th December? But, do you dare leave the smartphone, tablet or laptop alone on this day? Do you risk falling behind on your job, or angering your boss on the 26th if something happened and you failed to respond?

Like many with struggling economic uncertainty, Bob Cratchit had a very ill son. But Mr. Scrooge could not be bothered by such concerns. Mr. Scrooge had a business to run, and if an employee’s family was suffering then it was up to social services to take care of such things. If those social services weren’t up to standards, well it simply was not his problem. He wasn’t the government – although he did object to any and all taxes. And he had no value for the government offering decent prisons, or medical care to everyone.

Today, employers right and left have dropped employee health insurance, recommending employees go on the exchanges; even though these same employers do not offer any incremental income to cover the cost of exchange-based employee insurance. And many employers are cutting employee hours to make sure they are not able to demand health care coverage. And the majority of employers, and employer associations such as the Chamber of Commerce, want to eliminate the Affordable Care Act entirely, leaving their employees with no health care at all – as was the case for many prior to ACA passage.

Even worse, there are employers (especially in retail, fast food and other minimum wage environments) with employees earning so little pay that as employers they recommend their employees file for government based Medicaid in order to receive the bottom basics of healthcare. Employees are a necessity, but not if they are sick or if the employer has to help their families maintain good health.

But things changed for Mr. Scrooge, and we can hope they do for a lot more of America’s employers and wealthy elite.

Mr. Scrooge’s former partner, Mr. Jakob Marley, visits Mr. Scrooge in a dream and reminds him that, in fact, there was a lot more to his life, and wealth creation, than just Ebenezer’s toils. Those around him helped him become successful, and others in his life were actually very important to his happiness. He reminds Mr Scrooge that as he isolated himself in the search for ever greater wealth he gained money, but lost a lot of happiness.

Today we have some business leaders taking the cue from Mr. Marley, and speaking out to the Scrooges. In particular, we can be thankful for folks like Warren Buffet who consistently points out the great luck he had to be born with certain skills at this specific point in time. Mr. Buffett regularly credits his wealth creation with the luck to receive a good education, learning from academics such as Ben Graham, and having a great network of colleagues to help him invest.

Further, amplifying his role as a modern day Jacob Marley, Mr. Buffett recognizes the vast difference between his situation and those around him. He has pointed out that his secretary pays a higher percent of her income in taxes than himself, and he points out this is a remarkably unfair situation. Additionally, he makes it clear that for many wealth is a gift of birth – and “winning the ovarian lottery” does not make that wealthy person smarter, harder working or more valuable to society. Rather, just lucky.

What we need is for more wealthy Americans to have a vision of Christmas future – as it appeared to Mr. Scrooge. He saw how wealth inequality would worsen young Tiny Tim’s health, leaving him crippled and dying. He saw his employee Mr. Cratchet struggle and become ill. These visions scared him. Scared him so much, he offered a bounty upon his community, sharing his wealth.

Mr. Scrooge realized that great wealth, preserved just for him, was without merit. He was doomed to a future of being rich, but without friends, without a great world of colleagues and without the sharing of riches among everyone in order that all in society could be healthy and grow. Many would suffer, and die, if society overall did not take actions to share success.

These days we do have a few of these visionary 1%ers, such as Bill Gates, Warren Buffett and recently Mark Zuckerberg, who are either currently, or in the future, planning to disseminate their vast wealth for the good of mankind.

Yet, middle class Americans have been watching their dreams evaporate. Over the last 50 years America has changed, and they have been left behind. Hard work, well…….. it just doesn’t give people what it once did. Policy changes that favored the wealthy with Ayn Rand style tax programs have made the rich ever richer, supported the legal rights of big corporations and left the middle class with a lot less money and power. Incomes that did not come close to matching inflation, and home values that too often are more anchors than balloons have beset 2015’s strivers.

It will take more than philanthropic foundations and a few standout generous donors to rebuild America’s middle class. It will take policies that provide more (more safety nets, more health care, more education, more pension protection, more job protections and more political power) for those in the middle, and give them economic advantages today offered only wealthier Americans.

Let us hope that in 2016 we see a re-awakening of the need to undertake such rebuilding by policymakers, corporate leaders and the 1%. Let us hope this Christmas for a stronger, more robust, healthier and disparate, shared economy “for each and every one.”

by Adam Hartung | Dec 13, 2015 | In the Whirlpool, Innovation, Leadership

DuPont is one of America’s oldest corporations. Founded by Eleuthere Irenee duPont as a gunpowder manufacturer for the Revolutionary War, the company has long been one of America’s leading business institutions. From humble beginnings, DuPont became well known as a leader in Research & Development, a consistent leader in patent applications, and the inventor of products that proliferate in our lives from nylon to Teflon pans plastic bottles to Kevlar vests.

But in a series of fast actions during 2015, DuPont as it has been known is going away. And it is too bad the leadership wasn’t in place to save it. Now there will be a short-term bump to investors, but long-term cost cutting will decimate a once great innovation leader. When the bankers take over, it’s never pretty for employees, suppliers, customers or the local community.

But in a series of fast actions during 2015, DuPont as it has been known is going away. And it is too bad the leadership wasn’t in place to save it. Now there will be a short-term bump to investors, but long-term cost cutting will decimate a once great innovation leader. When the bankers take over, it’s never pretty for employees, suppliers, customers or the local community.

It has been a long time since DuPont was the kind of business leader that gathered attention like, say, Apple or Google. From dynamic roots, the company had become quite stodgy and unexciting. Many felt leadership was over-spending on overhead costs like R&D,product development and headquarters personnel.

Thus Trian Fund, led by activist investor Nelson Peltz, set its sites on DuPont, buying 2.7% of the shares and launching a proxy campaign to place its slate of directors on the Board. The objective? Slash R&D and other costs, sell some divisions, raise cash in a hurry and dress up the P&L for a higher short-term valuation.

These sort of attacks almost always work. But DuPont’s CEO, Ellen Kullman, dug in her heels and fought back. She aligned her Board, spent $15M making her case to shareholders, and in a surprising victory beat back Mr. Peltz keeping the board and management intact. In a great rarity, this May DuPont’s management convinced enough shareholders to back their efforts for improving the P&L via their own restructuring and cost improvements, planned divestitures and organic growth that existing leadership remained intact.

But this victory was quite short-lived. By October, Ms. Kullman was forced out as CEO. A few days later the CFO reported quarterly profits that were only half the previous year. Sales had continued a history of declining in almost all divisions and across almost all geographic segments – with total revenue down to $5B from $7.5B a year ago. As it had done in July and previous quarters end-of-year projections were again lowered.

Net/net – CEO Kullman and management may have won the Trian battle, but they clearly lost the business war. Unable to actually profitably grow the company, the Board lost patience. They were willing to support management, but when that team could not produce the innovations to keep growing they were willing to accelerate cost cutting ($1B in 2015 alone) in order to prop up short-term stock valuation.

Now the newly placed transaction-oriented CEO of Dupont has cooked up a deal the bankers simply love. Merge DuPont with Saran Wrap and Ziploc inventor Dow Chemical, which itself has been the target of Third Point’s activist leader Dan Loeb (which Dow settled by giving Third Point 2 board seats rather than risk a proxy battle.) Then whack even more costs – some $3B – and lay off some 20,000 of the combined companies’ 110,000 employees. Then split the remaining operations into 3 new companies and spin those out publicly.

Sounds so good on paper. So simple. And think of the size of the investment banking and legal fees!!!! That will create some great partner bonuses in 2016!

Theoretically, this will create 3 companies that are more profitable, even though sales are not improving at all. Improved P&L’s will be projected into the future, and higher P/E (price to earnings) multiples on the stock should yield investors a very nice short-term gain. A one-time investor “Christmas present.”

But what will investors actually own? The lower cost companies will now be largely without R&D, new product development, internal patent departments, university research grant management programs, and many of the finance, marketing and sales personnel. Exactly how will future growth be assured? What will happen to these once-great sources of invention and innovation?

Nothing about this mega-transaction actually makes business better for anyone:

- The companies are no closer aligned with market trends than before. In fact, lacking people in innovation positions (product development, R&D and marketing) they are very likely to become even further removed from the leading trends that could create breakthrough products.

- Competition will be reduced short-term, so there will be less price pressure. But longer-term innovation will shift to smaller companies like Monsanto and Syngenta, or even companies currently not on the industry radar – as well as universities. These big companies will be removed from the leading edge of competition, the innovation edge, and will much more likely miss the next wave of products in all markets as new competitors emerge.

- There will be no resources to develop or manage new innovations that emerge internally, or externally. The much smaller staffs will have no bandwidth to explore new technologies, new products, new go-to-market channels or new ways of doing business. There will be no resources for white space teams to explore market shifts, consider major threats to their “core,” or develop potentially disruptive businesses that will generate future growth.

A very smart CFO once told me “when the finance guys are figuring out how to make money, rather than the business guys, you need to be very worried.” Clever transactions, like the one proposed between DuPont and Dow, do not replace great leadership. These are one-time events, and almost always leave the remaining assets weaker and less competitive than before.

Leadership requires understanding markets, managing innovation, creating new solutions, disrupting old businesses by launching new ones, and generating recurring profitable sales growth. Unfortunately, DuPont suffered from a lack of great leadership for several years, which left it vulnerable. Now the bankers are in charge, busy managing spreadsheets rather than products, customers and sales.

Don’t be confused. In no way does this merger and reorganization improve the competitiveness of these businesses. And for that reason, it will not offer a long-term value enhancement for shareholders. But even more obvious is the outcome negative outcome we can expect for employees, suppliers, customers and the communities in which these companies have operated. Bad leadership let the hyenas in, and they will pick the best meat off the bone for themselves first – leaving seriously damaged carcasses for everyone else.

by Adam Hartung | Dec 6, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Web/Tech

Marissa Mayer’s reign as head of Yahoo looks to be ending like her predecessors. With a serious flop. Only this may well be the last flop – and the end of the internet pioneer.

It didn’t have to happen this way, but an inability to manage Status Quo Risk doomed Ms. Mayer’s leadership – as it has too many others. And once again bad leadership will see a lot of people – investors, employees and even customers – pay the price.

Yahoo was in big trouble when Ms. Mayer arrived. Growth had stalled, and its market was being chopped up by Google and Facebook. It’s very relevancy was questionable as people no longer needed news consolidation sites – which had ended AOL, for example – and search had long gone to Google. The intense internet users were already clearly mobile social media fans, and Yahoo simply did not compete in that space.

In other words, Yahoo desperately needed a change of direction and an entirely new strategy the day Ms. Mayer showed up. Only, unfortunately, she didn’t provide either. Instead Ms. Meyer offered, at best, a series of fairly meaningless tactical actions. Changing Yahoo’s home page layout, cancelling the company’s work-from-home policy and hiring Katie Couric, amidst a string of small and meaningless acquisitions, were the business equivalent of fiddling while Rome burned. Tinkering with the tactics of an outdated success formula simply ignored the fact that Yahoo was already well on the road to irrelevancy and needed to change, dramatically, quickly.

The saving grace for Yahoo was when Alibaba went public. Suddenly a long-ago decision to invest in the Chinese company created a vast valuation increase for Yahoo. This was the opportunity of a lifetime to shift the business fast and hard into something new, different and much more relevant than the worn out Yahoo strategy. But, unfortunately, Ms. Mayer used this as a curtain to hide the crumbling former internet leader. She did nothing to make Yahoo relevant, as fights erupted over how to carve up the Alibaba windfall.

When it became public that Ms. Mayer had hired famed strategy firm McKinsey & Co. to decide what businesses to close in its next “restructuring” it lit up the internet with cries to possibly just get rid of the whole thing! After 3 years, and more than one layoff, it now appears that Ms. Mayer has no better idea for creating value out of Yahoo than doing another big layoff to, once again, improve “focus on core offerings.” Additional layoffs, after 3 years of declining sales, is not the way to grow and increase shareholder value.

Analysts are pointing out that Yahoo’s core business today is valueless. The company is valued at less than its remaining Alibaba stake. And this is not outrageous, since in the ad world Yahoo has become close to irrelevant. Nobody would build an on-line ad campaign ignoring Google or Facebook, and several other internet leaders. But ignoring Yahoo as a media option is increasingly common.

Investors are rightly worried that the IRS will take much of the remaining Alibaba value as taxes in any spinoff, leaving them with far less money. Giving up on the CEO, and its increasingly irrelevant “core business” they are asking if it wouldn’t be smarter to sell what we think of as Yahoo to Softbank so the Japanese company can obtain the rest of Yahoo Japan it does not already own. Ostensibly then Yahoo as it is known in the USA could simply start to disappear – like AOL and all the other on-line news consolidators.

It really did not have to happen this way. Yahoo’s troubles were clearly visible, and addressable. But CEO Mayer simply chose to keep doing more of the same, making small improvements to Yahoo’s site and search tool. By keeping Yahoo aligned with its historical Status Quo risk of irrelevance, obsolescence and failure grew quarter-by-quarter.

It really did not have to happen this way. Yahoo’s troubles were clearly visible, and addressable. But CEO Mayer simply chose to keep doing more of the same, making small improvements to Yahoo’s site and search tool. By keeping Yahoo aligned with its historical Status Quo risk of irrelevance, obsolescence and failure grew quarter-by-quarter.

Now Status Quo Risk (the risk created by not adapting to shifting market needs) has most likely doomed Yahoo. Investors are no longer interested in waiting for a turn-around. They want their Alibaba valuation, and they could care less about Yahoo’s CEO, employees or customers. Many have given up on Ms. Mayer, and simply want an exit strategy so they can move on.

Ms. Mayer’s leadership has shown us some important leadership lessons:

- Hiring an executive from Google (or another tech company) does not magically mean success will emerge. Like Ron Johnson from Apple to JCP, Ms. Mayer showed that even tech execs often lack an ability to understand market trends and the skills to adapt an organization.

- It is incredibly easy for a new leader to buy into an historical success formula and keep tweaking it, rather than doing the hard work of creating a new strategy and adapting. The lure of focusing on tactics and hoping the strategy will take care of itself is remarkably easy fall into. But investors need to realize that tactics do not fix an outdated success formula.

- Youth is not the answer. Ms. Mayer was young, and identified with the youthfulness of Google and internet users. But, in the end, she woefully lacked the strategy and leadership skills necessary to turn around the deeply troubled Yahoo. Young, new and fresh is no substitute for critical thinking and knowing how to lead.

- Boards give CEOs too much time to fail. It was clear within months Ms. Mayer had no strategy for making Yahoo relevant. Yet, the Board did not recognize its mistake and replace the CEOs. There still are not sufficient safeguards to make sure Boards act when CEOs fail to lead effectively.

- CEOs too often have too much hubris. Ms. Mayer went from college to a rapid career acceleration in largely staff positions to CEO of Yahoo and a Board member of Wal-Mart. It is easy to develop hubris, and an over-abundance of self-confidence. Then it is easy to require your staff agree with you, and pledge so support you (as Ms. Mayer recently did.) All of this indicates a leader running on hubris rather than critical thinking, open discourse and effective decision-making. Hubris is not just a weakness of white male leaders.

Could there have been a different outcome. Of course. But for Yahoo’s employees, suppliers, customers and investors the company hired a string of CEOs that simply were not up to the job of redirecting the company into competitiveness. Each one fell victim to trying to maintain the Status Quo. And, unfortunately, Ms. Mayer will be seen as the most recent – and possibly last – CEO to lead Yahoo into failure. Ms. Mayer simply was not up to the job – and now a lot of people will pay the price.

by Adam Hartung | Nov 25, 2015 | Innovation, Leadership, Transparency

No. You’re not seeing things. These are goats in trees.

No. You’re not seeing things. These are goats in trees.

These goats love the fruit growing on argon trees west of Marrakesh, Morocco. They don’t care so much for the nut inside, so they spit it out. People gather those nuts and make them into argon oil highly valued for food and in beauty products.

I was startled by these goats. It was, at the very least, mentally disruptive. As I thought about the experience, I realized there were leadership lessons to be learned from these tree climbing goats:

- These goats don’t chase low hanging fruit. What they want is up in the trees, and the challenge did not stop them. It takes extraordinary measures to accomplish what they want, but they invested in the effort to be extraordinary. Once they learned to climb trees, something they easily could say was “not their core strength,” they left behind what was on the ground for the riches of success. These goats prove that if what you want is in the trees, you have to go for it. One should not settle for less. No leader should stay so focused on the past that they can’t figure out new ways to compete, and succeed.

- Once they became known for doing extraordinary things, people flocked to be next to these goats. People want to be near goats that are unusual, and in some way better than other goats. By seeking the extraordinary, and accomplishing the extraordinary, these goats merely need to “do their thing” and people are attracted to them. People will feed these goats, and even pay their shepherds to be next to them and take photos. Being extraordinary creates a winning situation that feeds on itself, creating additional wins – including attracting people to you.

- Because of their willingness to do something extraordinary, these goats have control over their shepherds. In a real way, the shepherds need the goats much more than the goats need the shepherds. The power wielded by tree climbing goats is not from being brutal, or micromanaging, or being “charismatic.” They simply developed their power via their willingness to do something extraordinary — something their shepherds will not do. Something most people will not do. Simultaneously, the goats share their wealth with the shepherds. While they receive lots of their favorite foods, the shepherds receive payments. The goats have a symbiotic, sharing relationship with their handlers, and the people who visit and feed them, where everyone wins.

Here’s the bottom line:

No matter what you are doing, strive for the extraordinary. You are not limited by “core strengths,” nor your past. If you can visualize a goal you can seek that goal and you can work to accomplish that goal. You can be extraordinary if you are willing to break out of your old self-definition and try. These goats didn’t become successful tree climbers in one day, but by accomplishing their goal over time they became quite extraordinary.

It is good to be extraordinary. Don’t just go for the low-hanging fruit, or what is easy. Innovate. Be disruptive. The path may not be easy, or obvious, but the payoff can be as extraordinary as the accomplishment.

So what’s stopping you from being extraordinary? What locks you in to your definition of your old “self?” What goal can you set, and work to accomplish, that will set you apart and demonstrate you are extraordinary, and a leader someone should admire?

by Adam Hartung | Nov 18, 2015 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Leadership, Web/Tech

Microsoft recently announced it was offering Windows 10 on xBox, thus unifying all its hardware products on a single operating system – PCs, mobile devices, gaming devices and 3D devices. This means that application developers can create solutions that can run on all devices, with extensions that can take advantage of inherent special capabilities of each device. Given the enormous base of PCs and xBox machines, plus sales of mobile devices, this is a great move that expands the Windows 10 platform.

Only it is probably too late to make much difference. PC sales continue falling – quickly. Q3 PC sales were down over 10% versus a year ago. Q2 saw an 11% decline vs year ago. The PC market has been steadily shrinking since 2012. In Q2 there were 68M PCs sold, and 66M iPhones. Hope springs eternal for a PC turnaround – but that would seem increasingly unrealistic.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone.

By January, 2013 sales results were showing the abysmal failure of Windows 8 to slow the wholesale shift into mobile devices. Ballmer had played “bet the company” on Windows 8 and the returns were not good. It was the failure of Windows 8, and the ill-fated Surface tablet which became a notorious billion dollar write-off, that set the stage for the rapid demise of PCs.

And that demise is clear in the ecosystem. Microsoft has long depended on OEM manufacturers selling PCs as the driver of most sales. But now Lenovo, formerly the #1 PC manufacturer, is losing money – lots of money – putting its future in jeopardy. And Dell, one of the other top 3 manufacturers, recently pivoted from being a PC manufacturer into becoming a supplier of cloud storage by spending $67B to buy EMC. The other big PC manufacturer, HP, spun off its PC business so it could focus on non-PC growth markets.

And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.

And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.

Which means for Microsoft to grow it desperately needs Windows 10 to succeed on devices other than PCs. But here Microsoft struggles, because it long eschewed its “channel suppliers,” who create vertical market applications, as it relied on OEM box sales for revenue growth. Microsoft did little to spur app development, and rather wanted its developers to focus on installing standard PC units with minor tweaks to fit vertical needs.

Today Apple and Google have both built very large, profitable developer networks. Thus iOS offers 1.5M apps, and Google offers 1.6M. But Microsoft only has 500K apps largely because it entered the world of mobile too late, and without a commitment to success as it tried to defend and extend the PC. Worse, Microsoft has quietly delayed Project Astoria which was to offer tools for easily porting Android apps into the Windows 10 market.

Microsoft realized it needed more developers all the way back in 2013 when it began offering bonuses of $100,000 and more to developers who would write for Windows. But that had little success as developers were more keen to achieve long-term sales by building apps for all those iOS and Android devices now outselling PCs. Today the situation is only exacerbated.

By summer of 2014 it was clear that leadership in the developer world was clearly not Microsoft. Apple and IBM joined forces to build mobile enterprise apps on iOS, and eventually IBM shifted all its internal PCs from Windows to Macintosh. Lacking a strong installed base of Windows mobile devices, Microsoft was without the cavalry to mount a strong fight for building a developer community.

In January, 2015 Microsoft started its release of Windows 10 – the product to unify all devices in one O/S. But, largely, nobody cared. Windows 10 is lots better than Win8, it has a great virtual assistant called Cortana, and it now links all those Microsoft devices. But it is so incredibly late to market that there is little interest.

Although people keep talking about the huge installed base of PCs as some sort of valuable asset for Microsoft, it is clear that those are unlikely to be replaced by more PCs. And in other devices, Microsoft’s decisions made years ago to put all its investment into Windows 8 are now showing up in complete apathy for Windows 10 – and the new hybrid devices being launched.

AM Multigraphics and ABDick once had printing presses in every company in America, and much of the world. But when Xerox taught people how to “one click” print on a copier, the market for presses began to die. Many people thought the installed base would keep these press companies profitable forever. And it took 30 years for those machines to eventually disappear. But by 2000 both companies went bankrupt and the market disappeared.

Those who focus on Windows 10 and “universal windows apps” are correct in their assessment of product features, functions and benefits. But, it probably doesn’t matter. When Microsoft’s leadership missed the mobile market a decade ago it set the stage for a long-term demise. Now that Apple dominates the platform space with its phones and tablets, followed by a group of manufacturers selling Android devices, developers see that future sales rely on having apps for those products. And Windows 10 is not much more relevant than Blackberry.

by Adam Hartung | Nov 14, 2015 | Current Affairs, Leadership, Sports

This week saw two big stories develop around the big money in college sports. It makes one wonder, when did sports become more important than academics in American universities – and why?

The first story was how the football team at the University of Missouri was able to fire the university President. Ongoing racial tensions, and some horrible acts of aggression, had been problematic at Mizzou, leading to a student hunger strike. But the President remained uninvolved and taciturn on the topic.

Until the football team threatened to strike. Within 48 hours the President was booted out, allowing the team to play this Saturday and keep the big money flowing.

Separately, the NCAA shut down a web site set up by the family of LSU running back Leonard Fournette to sell merchandise plugging his catch phrase. The concern was ostensibly whether the family received discounted services in creating the site due to the player’s popularity. But more important was whether anyone other than LSU and the NCAA was going to make any money off a college football player.

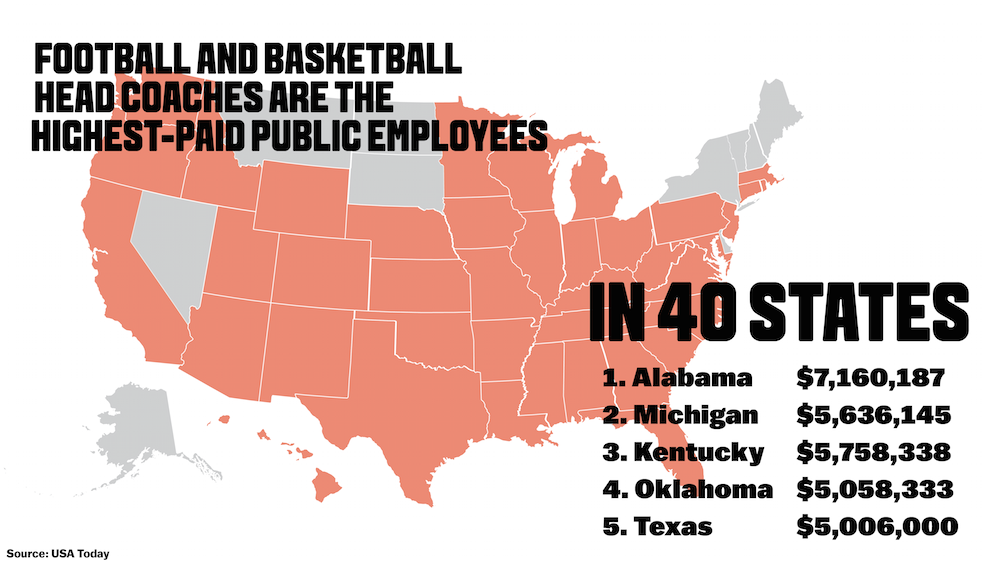

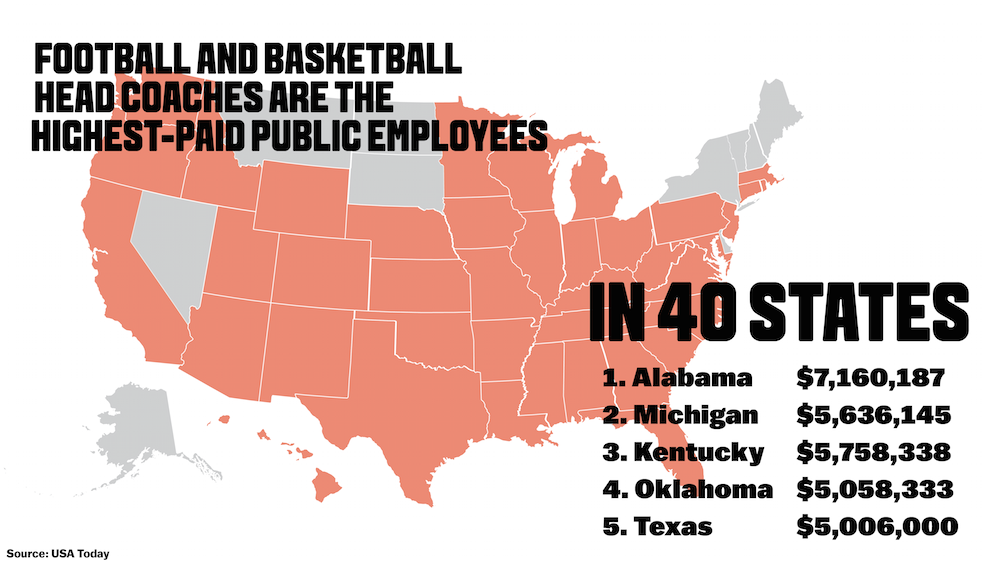

The USA is the only country where university coaches make multi-million dollar salaries. Elsewhere, one must coach a professional team to earn such sums. And the USA is the only country where alumni donations for sports are greater than alumni donations for academics. And the USA is the only country where college sport venues (coliseums nonetheless) consume as much, or more, capital budget than the entire balance of the university. And the USA is the only place where more money is spent to recruit and retain athletes than the brightest academic minds.

The USA is the only country where university coaches make multi-million dollar salaries. Elsewhere, one must coach a professional team to earn such sums. And the USA is the only country where alumni donations for sports are greater than alumni donations for academics. And the USA is the only country where college sport venues (coliseums nonetheless) consume as much, or more, capital budget than the entire balance of the university. And the USA is the only place where more money is spent to recruit and retain athletes than the brightest academic minds.

The United States is the only country where sports have become more important than academics at many (most?) major universities. Around the world, colleges are about education first, foremost and pretty much entirely. Sports are left to professionals. How did Americans turn their universities into sports leagues rather than institutions for research and learning?

Blame it on the NFL and the NBA.

Prior to the rise of both major sports leagues, college athletics were not that important. Sure there were teams, but they were very clearly for fun. Players had to take a full regimen of classes, and they were expected to pass those classes. Players were students first, and athletes just for the pleasure. Athletes were expected to obtain a degree in 4 years, then move on to professional lives. Sure, there were alumni booster clubs supporting athletes, and some schools (especially in the south) were notoriously crazy routing for their home teams, but the school was more about education than playing ball.

Years ago professional sports was dominated by baseball in America and soccer pretty much everywhere else. Baseball and soccer both developed “farm systems” by which the professional teams created other teams that recruited and trained young players. And in northern climates hockey developed similar farm systems.

Often starting well before players finished high school (or its equivalent outside the USA) recruiters would approach athletes and their parents to ask if they could place the youth into their training program. Players would improve their skills level by level, moving up through different teams until they reached the top level of performance. In American baseball, for example, these “farm teams” run 4 levels deep, and when a player makes it to the top it’s called “reaching the show.”

The cost of identifying, recruiting and training athletes for baseball, and soccer, has always been carried by the professional franchises.

But the rise of the NFL and the NBA changed this dramatically. By relying on colleges to do the recruiting and first level of training, they could avoid an incredible amount of cost. An “unholy alliance” was born between the NCAA and the professional leagues. The professionals would not create “farm systems.”

Instead, universities would act as the recruiters and developers of “pre-professional” athletes. These athletes would be called “amateurs” and thus receive no compensation for playing, nor would they receive compensation for promoting the school, nor would they be able to receive compensation for using their likeness, personality or any individually created brand elements. The schools would receive 100% of any revenues related to the athletes and other branded elements of college sports.

It did not take long for colleges to realize there is BIG MONEY in fan-crazed athletics. Just like the NFL and NBA, colleges could create brand franchises around their athletic programs, and top players. The value of a top athlete to the university could be measured in millions of dollars, far more than the grant raising ability of top research professors with long-standing academic programs tied to industry.

It did not take long for colleges to realize there is BIG MONEY in fan-crazed athletics. Just like the NFL and NBA, colleges could create brand franchises around their athletic programs, and top players. The value of a top athlete to the university could be measured in millions of dollars, far more than the grant raising ability of top research professors with long-standing academic programs tied to industry.

Suddenly, it was worth great value to a college to recruit a “student” who possibly could barely read and write. Who cared if that student ever graduated? That wasn’t his purpose. Who cared if this “student” had limited respect for women’s rights, or otherwise struggled to behave like a “gentleman and a scholar” What mattered was whether he could play ball – whether he could bring in the fans and all those merchandise dollars.

For many university leaders the allure of the BIG MONEY was simply too hard to ignore. The BIG MONEY for the university was by building a brand around semi-professional athletics. Not academics. The old non-profit approach of running a school was replaced by the very much for-profit business of college athletics. Winning ball games replaced winning research grants, or even Nobel prizes, as the measure of a successful university.

And that is what we’re now seeing in the news. The Mizzou trustees weren’t all that concerned about swastika’s made of feces, nor student hunger strikes, or name calling of professors. That was just “campus life.” But if the football team doesn’t play – OMG, that’s a crisis!! The former has little impact on university economics, the latter could be catastrophic.

It is doubtful anyone is willing to separate athletics out of America’s universities. But not recognizing the corruption this has done to the original academic purpose of these institutions is turning a blind eye to the obvious. For far too many universities job #1 is about running a sports franchise. And oh, by the way, there are faculty and students and all that other stuff out there – but that’s for the academics to worry about. We’re here to make money off sports teams.

And the biggest winners of all are the owners of NFL and NBA franchises, who get a farm system at no cost. Thanks to the financial corruption of modern university leadership. More is the sadness for America, when ball teams matter more than great research and education.

by Adam Hartung | Nov 6, 2015 | Current Affairs, General, Lifecycle, Web/Tech

“As goes GM, so goes the Nation” is attributed to Charles Wilson, CEO of GM, in Congressional hearings 1953. His viewpoint was that GM was so big, and so important, that the country’s economic fortunes were inherently dependent on a robust General Motors.

And this was not so far fetched in the Industrial era. 1940s-1960s America was a manufacturing king. Following WWII industrial products dominated the economy, and post-war U.S. manufacturers made products sold around the world as other economies rebuilt and recovered, or just started emerging. With manufacturing the jobs and economic value creator, and GM the largest manufacturer and non-government employer of its time, what was good for GM was generally good for America.

But that tie has clearly broken. GM filed bankruptcy in the summer of 2009. From 2007 to 2009 American employment fell from 121.5M to just over 110M. Last month jobs rose by 271,000, pushing employment to a fully recovered 122M jobs. However, GM and its manufacturing partners have struggled to recover, as this economic expansion has largely left them behind.

We’ve seen a wild shift in the country’s economic base. In 1900 America was an agrarian economy. Over half the population lived on farms. Fully 9 out of 10 working people had a job related to agriculture and food production. But automation changed this dramatically. By 2010, fewer than 1 in 100 people worked in farming or agriculture. Farm incomes are at a 9 year low, and the future direction is downward. Rural towns have disappeared as people moved to cities, concentrating over half the nation’s wealth in just its 20 largest cities.

WWII marked the shift from an agrarian to an industrial economy for America. It was the industrial economy that pulled America out of the1930s Great Depression. The industrial revolution ushered in all kinds of mechanical automation, and it was applied to doing everything as labor shortages forced innovation to meet rising defense challenges. And it was the industrial economy that pushed America to the top. It was the industrial economy which trained most of today’s business leaders.

But we’re no longer an industrial economy. Just as the agrarian economy vanished, so too is the manufacturing economy. Manufacturing jobs have been declining since 1970, and by 2010 they represent only 13% of workers and 15% of the country’s GDP (Gross Domestic Product).

But we’re no longer an industrial economy. Just as the agrarian economy vanished, so too is the manufacturing economy. Manufacturing jobs have been declining since 1970, and by 2010 they represent only 13% of workers and 15% of the country’s GDP (Gross Domestic Product).

By 2000 we had started the shift from an industrial to an information economy. Digital bits replaced machines as the source of wealth creation. By 2010 it was services, and the huge growth in digital services, that caused the jobs recovery. Services now represent 84% of all jobs, and 82% of the economy. (Economic statistics from FTPress division of Pearson Publishing.)

Today the 3 most valuable companies in America are Apple, Google and Microsoft. Number 6 is Facebook. Their value (and in the case of Apple, Google and Facebook rather rapid value explosion) has been due to understanding how to maximize the value of information. They don’t so much “make things” as they make life better through products which are purely ethereal – rather than something tangible.

Today the 3 most valuable companies in America are Apple, Google and Microsoft. Number 6 is Facebook. Their value (and in the case of Apple, Google and Facebook rather rapid value explosion) has been due to understanding how to maximize the value of information. They don’t so much “make things” as they make life better through products which are purely ethereal – rather than something tangible.

Today’s #1 valued retailer is Amazon, now worth more than Wal-mart. Amazon is largely a technology company, building its revenues by knowing more about the customer and what she wants, then matching that with the right products. All in a virtual shopping arena. No stores, salespeople and often no inventory needed. Its technology skills became so good the company has become the #1 provider of cloud services.

Tesla has done something everyone thought impossible. It has created a new auto company where many others failed (recall the DeLorean used in “Back to the Future”? Or the Bricklin?) But Tesla did this by building an entirely different car, one that is based on all new electric technology, that has far fewer moving parts, needs far less service, has better operating performance and actually bears little resemblance to the autos – or auto companies – of the past. Tesla is far more a technology company, designed for the information era, than what we would think of as a “car company.”

The ramifications of this are dramatic. Working class middle age white people are dying faster than any other demographic in America. Their death rates are up 22%, and continuing to increase precipitously. Cause: suicide, drugs and alcohol. This is the group that once found good paying jobs working machines in manufacturing. Now, untrained for the information era, they are unable to find work – even though demand for trained labor is outstripping supply.

Today’s growth companies, those powering the American economic engine, are filled with intellectual assets rather than physical assets. Apple, Google and Facebook (et.al.) are creating intellectual capital, and they need employees able to add to that capital base. it is not enough for job candidates to have a college degree any longer. Today’s job hunter has to be information savvy, digital savvy, tech savvy.

In the 1960s the gap widened dramatically between those in manufacturing and those in farming. By the 1970s farms were closing by the hundreds as value shifted out of agrarian production to industrial production. It was devastating to farm communities and farm families.

Today the gap is widening between those skilled in manufacturing or general knowledge and those with information-based skills. The former are seeing their dreams slip away, while the latter are making incomes at a young age that are hard to fathom. Cities like Detroit are crumbling, while San Francisco cannot supply enough housing for its workers. The shift to an information economy is fully in force, and change is accelerating. For those who make the shift much is to be gained, for those who do not there is much to lose.

by Adam Hartung | Oct 31, 2015 | Current Affairs, Games, In the Swamp, In the Whirlpool

I was born the 1950s. In my youth of the ’60s there was no doubt that the #1 sport in America was baseball. Almost every boy owned a bat, ball and glove and played baseball. When we went out for recess there was always a softball game somewhere on the playground.

Fathers told stories about how on the battlefields of WWII they would shout questions about baseball players and World Series statistics to each other to determine if the “other guy out there” was an American, or a German trying to sucker the Americans into the open. Baseball was so relevant every American was expected to know the details of players, games and series.

In that era, lots of baseball was played in the daytime, since the game and its parks preceded the era of great field lighting. Men regularly took off work to attend ball games, and it was considered fairly normal. People listened to baseball games on the radio at work.

And when the World Series came along, which was played around Labor Day, it was so beloved that people took TVs to work, hooked up makeshift antenna and watched the games. Even schools would set up a TV on the gymnasium stage and let the students watch the game — and some enterprising teachers would set up televisions in their classrooms and eschew teaching in favor of watching the series. It was even bigger than today’s Super Bowl, as pretty nearly everyone watched or listened to the World Series.

And when the World Series came along, which was played around Labor Day, it was so beloved that people took TVs to work, hooked up makeshift antenna and watched the games. Even schools would set up a TV on the gymnasium stage and let the students watch the game — and some enterprising teachers would set up televisions in their classrooms and eschew teaching in favor of watching the series. It was even bigger than today’s Super Bowl, as pretty nearly everyone watched or listened to the World Series.

No longer. World Series viewership has been on a decline for at least 40 years. According to Wikipedia, World Series viewership was about 35million in the 1986-1991 timeframe. By 1998-2005 viewership was down to averaging 20million – a 40% decline. By 2008-2014 viewership had declined to 12million -another 40% decline – or a loss of 2/3 the viewership in 25 years.

By comparison, regular season games in the NFL 2014 season averaged about 18million viewers, and 114million people watched the February, 2015 Superbowl – almost 10 times World Series viewership. Even the women’s FIFA World Cup soccer match last July drew 25million American viewers – twice the World Series.

Are you aware the World Series is happening now? I will forgive you if you didn’t know. Marketwatch.com headlined “This Is the Most Exciting World Series No One is Watching.” From what was the #1 sporting event in America, and possibly the world, 50 years ago the World Series has become nearly irrelevant for most people.

Why? Trends have made the World Series, and really baseball, obsolete.

Big Trend #1 – We’re out of time. The pace of life is far, far different today than it was in 1965. Laconic weekday afternoons lounging in a ballpark to watch a game are a thing of the past. The fact that baseball has no time limit is probably its most negative feature. Games are a minimum of 9 innings, but in case of a tie they can last many, many more. Further, if it rains the game is delayed, which can extend the time an hour or more. Thirdly, you have no idea how long an inning may take. 15 minutes, or an hour, all depending on a raft of variables that are impossible to predict.

Game 1 of this current series is a great example of the problem this creates. The game lasted 14 innings. There was a rain delay in the middle of the game. Overall, it was a 5 hour 9 minute event. While this set a new record for a World Series game length, it clearly demonstrates the problem of a sporting event which has no clock.

The most popular games are highly clock bound. Football and basketball not only have limits on the game length, there is a clock limiting the time between plays (or shots.) Soccer is timebound, and there are no time outs. In these games that have greatly grown popularity people know how long a game will take, and that is important.

Big Trend #2 – Action. When was the last time you played a board game, like Monopoly or Life? Do you even own one any longer? Today games are action intensive. In the 1960s a pinball machine was the closest thing anyone had to an “action game.” Look at any game today, via console, computer or mobile device, and there is action. Even Tetris had action to it, and that is nothing compared to the modern video game. People now like action.

Then there is baseball. A “perfect game” – the ultimate for this sport – happens when 21 people bat, and every one walks back to the dugout without reaching base. Quite literally, nothing happens. A pitcher and catcher play catch, while the batters watch. The next most vaunted game is a “no-hitter,” in which people reach base via a walk or an error – but it again reflects a lack of action in that no batter achieved a hit. The third most celebrated game is a “shutout,” meaning one team literally ended the game with a score of Zero. Goose egg.

Baseball is a game of very little action. A really good game often ends with each team having less than 10 hits. It is rare for there to be more than 2 home runs in a game, and often there are games with no home runs at all. Heck, even in golf at least the athletes are hitting the ball 60+ times apiece!

We live in a world today where people run for fun. Or ride bicycles. Where people join gyms to work out on treadmills, rowers, stationary bikes and weight machines. Nobody did this kind of thing in the 1960s. People today are active, and being active is a sign of health, vitality and well-being. Sedentary behaviors are frowned upon. There is no sport with less action than baseball (except maybe darts.)

Big Trend #3 – Globalization. Despite Mr. Donald Trump’s xenophobic appeal, globalization is an unstoppable trend. Our businesses and our lives are increasingly global, as it is doubtful any American goes a day without touching a product or service delivered from an offshore source. And unlikely most Americans live any given day without talking to someone born in a foreign country, or entertaining them with news, information, sports or programming from outside the USA.

There is no sport which makes this clearer than soccer. Due to its global appeal, 715million people watched the final game of the 2006 World Cup (55 times the World Series.) 909million people watched the final 2010 World Cup game (71.5 times the current World Series.) [note: FIFA has not published numbers for the 2014 final game in Brazil, but it is surely going to exceed 1B viewers.]

American impact? There were almost as many Americans (11million) that watched the first round match between the USA and Ghana in the 2014 World Cup as are now watching a World Series Game. And the 2014 World Cup final game had 17.3M U.S. viewers – 34% more than are watching the World Series this year.

Basketball has some international appeal, as there are leagues across Europe and some in South America. And my son was shocked at how much people watched and played basketball on his trip to China. And we see globalization reflected in the players names now in the NBA.

We also see globalization reflected in the NHL, which has many players from outside the USA. And viewership is growing for NHL Stanley Cup games, although it is still only about half the World Series. But given the trajectories of viewership, and the fact that hockey is both a timed sport as well as action-filled, Stanley Cup watchers could exceed World Series watchers in just a few years.

Simply put, baseball has never extended strongly beyond the USA and Japan. Lacking competitive teams and viewers outside the USA, as well as limited non-USA player recruitment, this “most American of sports” is off one of the country’s (and planet’s) major trends.

In short, the world moved and baseball did not change with the times. People don’t live today like they did in the 1930s-1960s. Trends are vastly different. New sports that were better linked to major trends, and which adapted to trends (by adding things like shot clocks and play clocks, for example) have gained viewers, while baseball has declined.

Baseball didn’t do anything wrong. It just didn’t adapt. And competitors have moved in. Just like happens in business — which, of course, is the reason we have professional sports – you either adapt or you become obsolete.

The World Series was once the most relevant sporting event on the globe. No longer. And lacking some major changes in the game, its ability to ever grow again is seriously questionable.

by Adam Hartung | Oct 25, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership, Web/Tech

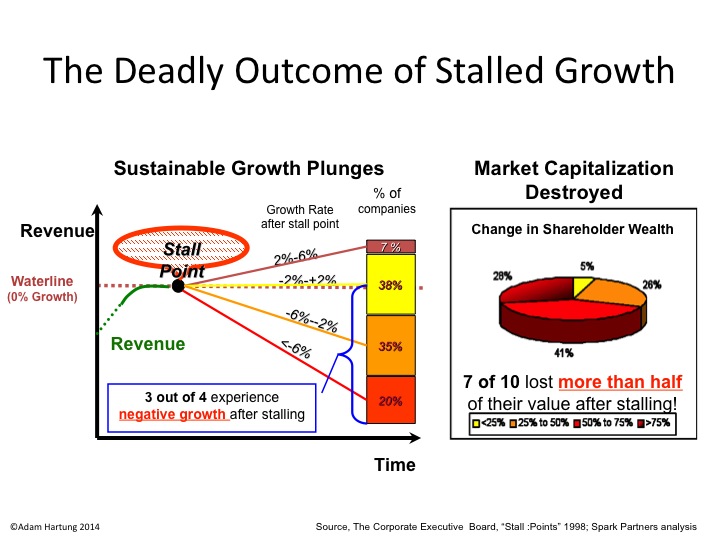

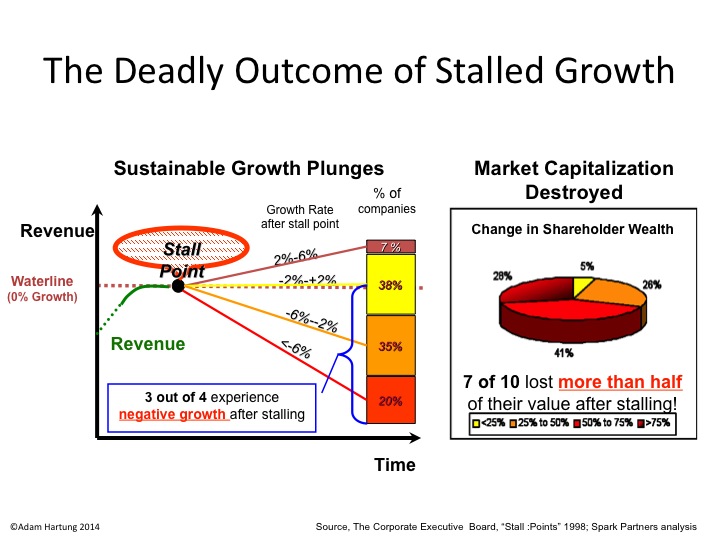

This week McDonald’s and Microsoft both reported earnings that were higher than analysts expected. After these surprise announcements, the equities of both companies had big jumps. But, unfortunately, both companies are in a Growth Stall and unlikely to sustain higher valuations.

McDonald’s profits rose 23%. But revenues were down 5.3%. Leadership touted a higher same store sales number, but that is completely misleading.

McDonald’s leadership has undertaken a back to basics program. This has been used to eliminate menu items and close “underperforming stores.” With fewer stores, loyal customers were forced to eat in nearby stores – something not hard to do given the proliferation of McDonald’s sites. But some customers will go to competitors. By cutting stores and products from the menu McDonald’s may lower cost, but it also lowers the available revenue capacity. This means that stores open a year or longer could increase revenue, even though total revenues are going down.

Profits can go up for a raft of reasons having nothing to do with long-term growth and sustainability. Changing accounting for depreciation, inventory, real estate holdings, revenue recognition, new product launches, product cancellations, marketing investments — the list is endless. Further, charges in a previous quarter (or previous year) could have brought forward costs into an earlier report, making the comparative quarter look worse while making the current quarter look better.

Confusing? That’s why accounting changes are often called “financial machinations.” Lots of moving numbers around, but not necessarily indicating the direction of the business.

McDonald’s asked its “core” customers what they wanted, and based on their responses began offering all-day breakfast. Interpretation – because they can’t attract new customers, McDonald’s wants to obtain more revenue from existing customers by selling them more of an existing product; specifically breakfast items later in the day.

Sounds smart, but in reality McDonald’s is admitting it is not finding new ways to grow its customer base, or sales. The old products weren’t bringing in new customers, and new products weren’t either. As customer counts are declining, leadership is trying to pull more money out of its declining “core.” This can work short-term, but not long-term. Long-term growth requires expanding the sales base with new products and new customers.

Perhaps there is future value in spinning off McDonald’s real estate holdings in a REIT. At best this would be a one-time value improvement for investors, at the cost of another long-term revenue stream. (Sort of like Chicago selling all its future parking meter revenues for a one-time payment to bail out its bankrupt school system.) But if we look at the Sears Holdings REIT spin-off, which ostensibly was going to create enormous value for investors, we can see there were serious limits on the effectiveness of that tactic as well.

MIcrosoft also beat analysts quarterly earnings estimate. But it’s profits were up a mere 2%. And revenues declined 12% versus a year ago – proving its Growth Stall continues as well. Although leadership trumpeted an increase in cloud-based revenue, that was only an 8% improvement and obviously not enough to offset significant weakness in other markets:

It is a struggle to see the good news here. Office 365 revenues were up, but they are cannibalizing traditional Office revenues – and not fast enough to replace customers being lost to competitive products like Google OfficeSuite, etc.

Azure sales were up, but not fast enough to replace declining Windows sales. Further, Azure competes with Amazon AWS, which had remarkable results in the latest quarter. After adding 530 new features, AWS sales increased 15% vs. the previous quarter, and 78% versus the previous year. Margins also increased from 21.4% to 25% over the last year. Azure is in a growth market, but it faces very stiff competition from market leader Amazon.

We build our companies, jobs and lives around successful products and services. We want these providers to succeed because it makes our lives much easier. We don’t like to hear about large market leaders losing their strength, because it signals potentially difficult change. We want these companies to improve, and we will clutch at any sign of improvement.

As investors we behave similarly. We were told large companies have vast customer bases, strong asset bases, well known brands, high switching costs, deep pockets – all things Michael Porter told us in the 1980s created “moats” protecting the business, keeping it protected from market shifts that could hurt sales and profits. As investors we want to believe that even though the giant company may slip, it won’t fall. Time and size is on its side we choose to believe, so we should simply “hang on” and “ride it out.” In the future, the company will do better and value will rise.

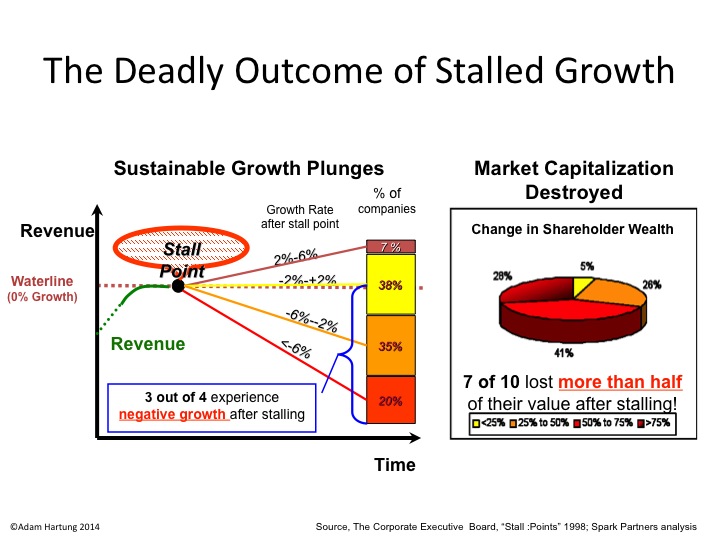

As a result we see that Growth Stall companies show a common valuation pattern. After achieving high valuation, their equity value stagnates. Then, hopes for a turn-around and recovery to new growth is stimulated by a few pieces of good news and the value jumps again. Only after a few years the short-term tactics are used up and the underlying business weakness is fully exposed. Then value crumbles, frequently faster than remaining investors anticipated.

McDonald’s valuation rose from $62/share in 2008 to reach record $100/share highs in 2011. But valuation then stagnated. It is only this last jump that has caused it to reach new highs. But realize, this is on a smaller number of stores, fewer products and declining revenues. These are not factors justifying sustainable value improvement.

Microsoft traded around $25/share from March, 2003 through November, 2011 – 8.5 years. When the CEO was changed value jumped to $48/share by October, 2014. After dipping, now, a year later Microsoft stock is again reaching that previous valuation ($50/share). Microsoft is now valued where it was in December, 2002 (which is half its all-time high.)

The jump in value of McDonald’s and Microsoft happened on short-term news regarding beating analysts earnings expectations for one quarter. The underlying businesses, however, are still suffering declining revenue. They remain in Growth Stalls, and the odds are overwhelming that their values will decline, rather than continue increasing.

1 – Cost cutting, restructurings and stock buybacks do not increase company value – Dow/DuPont

1 – Cost cutting, restructurings and stock buybacks do not increase company value – Dow/DuPont

But in a series of fast actions during 2015, DuPont as it has been known is going away. And it is too bad the leadership wasn’t in place to save it. Now there will be a short-term bump to investors, but long-term cost cutting will decimate a once great innovation leader. When the bankers take over, it’s never pretty for employees, suppliers, customers or the local community.

But in a series of fast actions during 2015, DuPont as it has been known is going away. And it is too bad the leadership wasn’t in place to save it. Now there will be a short-term bump to investors, but long-term cost cutting will decimate a once great innovation leader. When the bankers take over, it’s never pretty for employees, suppliers, customers or the local community.