by Adam Hartung | Apr 27, 2017 | Investing, Mobile, Web/Tech

People love to watch tech stocks, because there is so much volatility. Just today (April 27, 2017) Alphabet beat expectations and its shares rose $34 (about 4%) after hours. GOOG is up 15.5% in 2017, and 31% for the year. But not all tech stocks do this well. Twitter, for example, had a nice increase of late — but TWTR is down 33% since peaking in early October, and it is down 69% from 10/2014 highs.

So how is an investor to know which tech stocks to own, and which to eschew?

They key, of course, is to watch trends. And to recognize who absolutely dominates those trends. When it comes to the rapidly growing world of social media, it is increasingly clear there is only one Goliath — and that is Facebook.

Felix Richter, Statista

Felix Richter, Statista

Snapchat created a lot of interest when it hit the scene. A darling of the most youthful set, it was growing very fast and had exceeded 100 million users by January 2016. By January 2017 Snapchat added another 60 million users — growing 60%. But since going public the stock has dropped about 10%. And according to Marketwatch only 12 analysts rank it a “buy” while 23 rank it a “hold,” “underweight” or “sell.”

Should you buy Snapchat? After all, Facebook dropped after its IPO

As the chart from Statista shows, in just eight months Instagram Stories has blown way past the user base of Snapchat. In April 2012 Facebook paid $1 billion for Instagram, then a popular photo-sharing app, which had no revenues. The idea was to leverage Facebook’s installed base to grow the app. Since September, 2013 Instagram has been adding 50 million users per quarter. Instagram now has 600 million active users and became one of the five most popular mobile apps in the world.

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

The Facebook App Ecosystem Totally Dominates Mobile. Chart reproduced courtesy of Felix Richter at Statista

Looking at Facebook, one has to marvel at how the company has kept users in its ecosystem. As the Statista chart shows, since 2016 Facebook has had four of the top five mobile app downloads. Now that Instagram Stories has blown past Snapchat, Facebook holds all four top positions.

Does anyone remember when Facebook purchased Beluga in 2011 for about $20 million? That is now Messenger, and it opened the door for sending pictures and video. Do you remember the $19 billion acquisition of WhatsApp — which had only $10 million in revenues? Both have added multiple capabilities, and now Messenger has 1 billion active users, and WhatsApp has 1.2 billion users.

In fiscal 2012 Facebook hit $1 billion in quarterly revenue, and ended the year with just over $4 billion in annual revenues. Q4 2016 exceeded $8.8 billion, and for the year $27.6 billion.

It is for good reason that almost twice as many analysts are skeptical of Snapchat’s future value as those who think it will go up.

Snapchat is competing with Facebook, a company that has shown time and again it can watch the trends and put in place products that initially meet, but then eventually exceed customer expectations. One might like to think Snapchat is a good David, putting up a good fight. But this time, investors are likely to be much better off betting on Goliath. Facebook still has a lot of opportunity to grow.

by Adam Hartung | Apr 24, 2017 | Newsletter Post

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Stop Throwing Your Company’s Resources Away

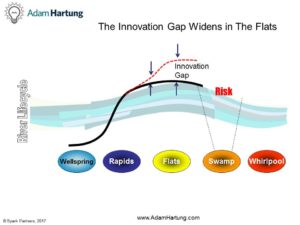

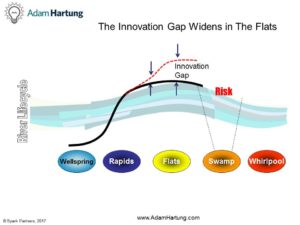

Is your organization stuck in the Flats of the River Lifecycle  while the Innovation Gap grows? Are you pouring your resources into doing more of what you’ve done, even though you aren’t achieving the results you want – and need? Are competitors outflanking you with innovations? Are your customers telling you everything is fine, then buying from competitors? OUCH!!!

while the Innovation Gap grows? Are you pouring your resources into doing more of what you’ve done, even though you aren’t achieving the results you want – and need? Are competitors outflanking you with innovations? Are your customers telling you everything is fine, then buying from competitors? OUCH!!!

You need to change how you use your resources. You need to figure out how to put more resources into new products and customers, and less into trying to defend & extend sales of current products to current customers.

You need to change how you use your resources. You need to figure out how to put more resources into new products and customers, and less into trying to defend &extend sales of current products to current customers.

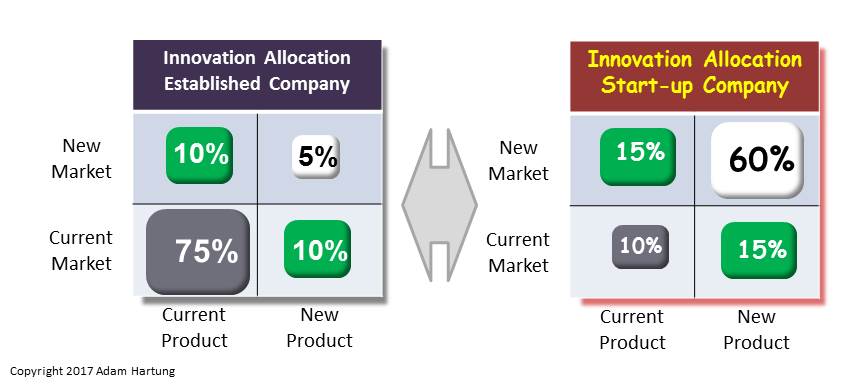

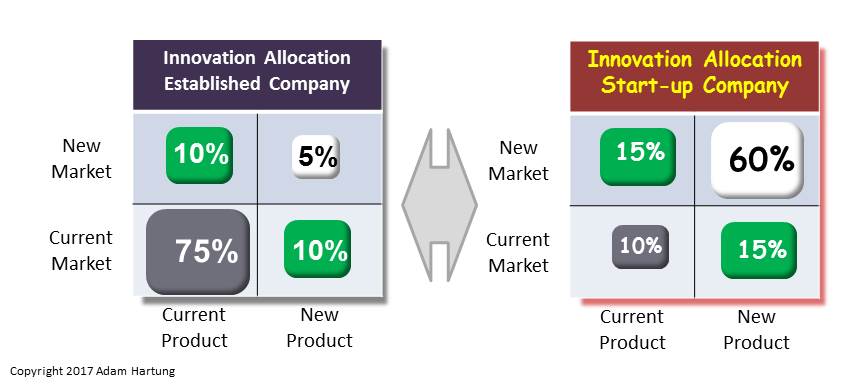

For established companies, the investment mix often looks like this.

But for start-ups would you be surprised to know their resources are allocated more like this?

Our experience taught us that when the Current/Current investment exceeds 40% the company is “Stuck in the Flats;” over-resourcing slow growth business while under-resourcing new opportunities. After the frenzied growth in the Rapids, it feels like a relief to reach the Flats – where leadership would love to cruise along on auto-pilot, fine-tuning a few things and watching costs. But, the drift into decline begins at that moment- because the focus shifts to internal process optimization at the expense of monitoring external market trends. (Click here for last month’s newsletter on the River.)

Remember, the Ansoff matrix doesn’t just apply to where you put the money. As the Bain alums wrote in “Time,Talent, Energy” (see my review here,) you can use the Ansoff matrix to manage your talented people. In the Flats, leadership puts the best people in the Existing/Existing corner – optimizing the OLD business. The unintended effect is to dry up the Wellspring of new ideas, and leave precious little talent available for focusing on new growth.

To remain on the growth curve, companies need to put their best people onto new efforts, including projects in the New/New corner! By moving more investment capital, and talent clusters, into other cells any company can keep the Wellspring flowing with ideas and find The Next Big thing.

“Knowing your purpose helps you in using all available resources in achieving your goals.”

Sunday Adelaja

Pastor and Author

Examine or audit your investment in innovation. Try to assess the investment in each cell of the Ansoff matrix. Be rigorous about your classification because your competitors may be innovating or “pivoting” just to survive. Look for an outside source to provide some objective feedback on investment of people, funds and assets. Don’t hesitate to ask for help in making your organization more adaptable, and your strategy embedded with options to pivot based on market shifts. You could start with an underperforming product or brand.

We are your experts at identifying trends, creating scenarios and building monitoring systems. We’ve done this kind of work for over 20 years, and bring a wealth of experience, and tools, to the task. You don’t have to go into scenario planning alone; we can be your coach and mentor to speed learning, and success.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Give us a call today, or send an email, so we can talk about how you can be a leader, rather than follower. Or check out the rest of the website to read up on what we do so we can create the right level of engagement for you.

Forbes Posts- Hartung on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Apr 21, 2017 | Boards of Directors, Investing, Leadership

When I was young, IBM dominated computing. In the tech world, when comparing platforms, everyone said, “Nobody ever got fired for buying IBM.” IBM was a standout role model for sales success, product leadership and investor returns.

Now, not so much. IBM’s stock fell almost 5% on Wednesday after the company reported “lackluster” results. For the week IBM lost about $20 per share – almost 12%. Quarterly revenue last quarter fell 3%, making 20 consecutive quarters of declining revenue for the once-dominant behemoth and Dow Jones Industrial Average (DJIA) component.

CEO of IBM Ginni Rometty (Photo by Neilson Barnard/Getty Images for New York Times)

The stock is still up from January 2016 lows of $125, and you might think this pullback is a buying opportunity. But you would be wrong. For long-term investors the stock has fallen from about $194 when CEO Ginni Rometty took control to the recent $160 — a 17.5% decline over five years. And that is after spending $9 billion on payouts (mostly share buybacks) to prop up the stock!

But because of its long-term “growth stall” the odds are almost a certainty things will continue to worsen for IBM.

(c) Adam Hartung and Spark Partners

(c) Adam Hartung and Spark Partners

Growth Stalls are Deadly Accurate Predictors of Future Value Declines

When a company has two consecutive declining quarters of revenue or earnings, or two consecutive quarters of revenue or earnings lower than the previous year, that company is in a “growth stall.” After stalling, 93% of companies will struggle to consistently grow a mere 2%. Seventy percent will lose more than half their market cap.

I made this same

call, to not own IBM, in May 2014. Then IBM had registered a stall on both the quarter-to-quarter metric, and on the year-over-year quarterly metric. IBM was clearly in a “growth stall” and showed no signs of turning around its fortunes. Now IBM has failed to grow quarterly revenue for

five years!Supported by the company PR and investor relations departments, optimists will claim there is reason to think things will improve. For example, in September 2015 IBM executive John Kelly predicted that Watson would be the next “huge engine” for growth. Today the Cognitive Computing segment that is Watson is about the same size it was then. In fact none of the five IBM segments are showing strong growth.

The reason a “growth stall” is such an accurate predictor of future bad results is its ability, in a very simple way, to describe when a company falls out of step with its customers/marketplace. The market went one way — in this case to mobile apps, mobile devices and cloud computing — while the company remained in outdated businesses and launched competitive offerings too late to catch the early market makers. At IBM, Cognitive has not become a big new market, while the historical Business Services and Systems segments keep shrinking, and Cloud Services is simply out-gunned by competitors like Amazon.

Rometty should be replaced by someone from outside IBM.

Meanwhile, the CEO keeps her job and even achieves pay raises! In 2016 IBM’s stock had dropped 36% since Rometty took the CEO position, yet the board of directors payed out the max bonus, leading the LA Times to headline “IBM’s CEO Writes a New Chapter on How To Turn Failure Into Wealth.” Last year the company share price bounced of its lows, but still far below what it was when she took the job, and in 2017 the Board increased her bonus from 2016! And the CEO will be granted a long-term pay incentive of $13.3 million in June (to be paid in 2020).

Like Immelt at GE, Rometty should be fired. If there were an updated list of the “5 Worst CEO’s Who Should Have Already Been Fired,” CEO Rometty surely deserves to be on it. And a new leader needs to implement an entirely new strategy if IBM is ever to regain its lost glory.

IBM’s stock may bounce around quite a bit. It’s shareholder base is very large. And really big investors, like pension funds and mutual funds, are very slow to dump their positions. But, eventually, everyone realizes that a shrinking company is not a value creation company, and they keep selling shares into any sign of strength. Big investors eventually recognize when a Board is unwilling to actually help lead a company, and unwilling to face down a bad CEO and replace her with someone more competently able to turn around a perennial terrible performer. So they start selling before the bottom falls out — like Sears and AT&T after they were removed from the DJIA.

There’s a lot more downside potential for IBM’s valuation.

In IBM’s case, the shares are at about $195 when the first data indicating a growth stall were evident (Q3 2012). They then peaked at $213 in March 2013. And it has been an ugly ride since. he “bounce” in 2016 from $125 to $180 was actually the best selling opportunity since September 2014 (just after I made the call to get out). At $160, IBM is down about 18% since the growth stall started (largely due to share buybacks) and revenues have kept dropping. According to “growth stall” analysis there is a 69% probability IBM’s shares will fall to $85 per share — or less — before the company fails, or starts a true, long-term recovery under new leadership.

by Adam Hartung | Apr 10, 2017 | Leadership, Transportation

Most readers of this column will already know that on Sunday, April 9, 2017 United Airlines forcibly removed a 69-year-old passenger from a flight, over his objections. United employees had Chicago Aviation Police board the plane, grab the passenger (who had a valid boarding pass) and drag him off the plane as if he were a hijacker. In the process the police banged his head on an armrest, leaving him battered and bloodied. When the passenger returned to the plane the police again forcibly manhandled him, restrained him and took him off the plane strapped onto a stretcher.

All so the airline could board a flight attendant that needed to reach the plane’s destination in order to make her next working flight. In other words, United’s front line management chose to not only inconvenience a paying customer, but physically abuse that customer so the airline would maintain its operating crew schedule.

After, the company CEO Oscar Munoz apologized for “re-accomodating” customers. Since about 40,000 people are “re-accomodated” — or bumped from oversold flights — annually, the CEO’s apology covers the 3,675 United customers bumped in 2016. But, he did not apologize for United employees taking action that directly led to the physical abuse of a customer.

Most of us would not believe this story if it were part of a fictional movie. How could it be possible for a front-line employee to think it is acceptable to forcibly eject a paying customer already on the plane?How could it be possible that a CEO would be so uncaring as to not apologize for a clear, horrific lapse in judgement by someone on his management team? Whatever the situation, every action taken by United merely served to make the situation worse. How could a company so large be so mismanaged — from the bottom to the top?

Blame “Operational Excellence”

That is the problem with CEOs, and leadership teams, that focus on “operational excellence” as a strategy. They become so focused on efficiency, cost cutting and business operations that they forget about customers — or anything else. All that matters is keeping the business operating, while trying to keep costs as low as absolutely possible. Management, from bottom to top, is rewarded for operational performance, while all other metrics are ignored. Including customer satisfaction.

In “operationally excellent” companies the focus on low costs is driven by a desire to keep prices low. The perception among management is that customers care only about price, so there is no reason to track anything other than costs. If they keep costs (and prices) low customers will be happy, regardless of anything else in the customer’s experience.

United Has Abused Customers For Years

This is not the first time United has had this kind of problem. In 2009 Canadian musician Dave Carroll became a sensation after producing a series of YouTube videos that chronicled his experience after United baggage handlers destroyed his guitar. The baggage handlers clearly did not care about his guitar. Nor did the gate agents, the baggage department or the customer service department. After many, many calls United personnel simply decided Mr. Caroll’s broken guitar would not be compensated — even though they broke it — and he should just “get over it.”

In 2013, United came in dead last in the Airline Quality Rating. United’s response (as I detailed in a 2013 Forbes column) was simply that “they did not care.” Quite literally, lowering cost was more important that being dead last in customer satisfaction.

In 2016, United fired its CEO after discovering he was bribing government officials to obtain favorable treatment at New Jersey and New York airports. The pressure to lower cost in the “operationally excellent” strategy was so paramount that judgement falters not only at low levels, but all the way up to the CEO.

Operational Excellence Hurt WalMart As Well As United

United isn’t alone in its failures due to operational excellence focus. WalMart has been the victim of bad management judgment for the same reason. Remember in July, 2014 when a WalMart truck driver who had been awake for 24 hours hit a car in New Jersey killing comedian James McNair and seriously injuring comedian Tracy Morgan? That driver had been on the road longer than he should, with insufficient sleep, in his effort to meet operational deadlines – and was charged with aggravated manslaughter, second-degree vehicular homicide and 8 counts of third-degree aggravated assault charges.

This happened just two years after investors learned WalMart was accused of bribing Mexican government officials to keep costs low there — bribery that caused the departure of the WalMart Mexico president, and eventually Walmart’s CEO. In both cases, at the top and at the front line, judgment was impaired by leadership’s focus on operational efficiency.

Unfortunately, too many business leaders put too much energy into operational excellence. They focus on cutting costs, improving operations, and trying to offer low price as the primary reason customers should do business with them. They quickly lose sight of customer needs, wants and wishes as they overly simplify their business’ offering into price. And this leads to bad decision-making all the way from the CEO to the front line manager — who will drive customers away in his effort to meet operational metrics and goals.

Once Locked In Operational Excellence Is A Hard Strategy, And Culture, To Change

United clearly needs a cultural change. But will it make one? Given the CEO’s reaction to this incident, it appears highly unlikely. Locked in to viewing his company operationally, Munoz appears to have lost common sense when it comes to customers – and running the business in a way that can lead to long-term profitability. Herb Kelleher, founder of Southwest Airlines, and Richard Branson, founder of Virgin Airlines, knew there was more to a successful airline than flight schedules and cheap fuel purchases. So far United’s leadership has failed to see the obvious.

by Adam Hartung | Apr 8, 2017 | Economy, Employment

The Labor Department March jobs report came out last week, and it disappointed a lot of people. At 98,000 new jobs, the number was about half what economists predicted. Simultaneously, the report revised January and February down a combined 38,000 jobs. Retail workers lost 30,000 jobs in March, which combined with February means 56,000 retailers lost jobs in just two months. There was ample disappointment to go around.

But, if we take a longer-term view the trend is much more pronounced, and we can easily see that overall the jobs market is very, very healthy – forcing employers to raise wages.

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

As the chart above indicates, America has recreated almost all the jobs lost in the Great Recession (chart courtesy of Kriston McIntosh of The Hamilton Project – Brookings). Almost 10 million jobs were lost between 2008 and 2010 as the financial crisis wiped out banks, and lending. That was a staggering decline of about 420,000 jobs per month.

Because businesses were loath to re-invest following the economic meltdown, the rate of job creation has been considerably slower than the speed with which executives laid off employees. However, since the end of 2011 the U.S. has been adding jobs at the rate of over 200,000 per month – a dramatic growth in job creation over an extraordinarily long-term period. Literally, unprecedented.

And, if we average the job creation rate the first three months of 2017 it comes to 178,000 per month. At this lower pace the jobs market will have fully recovered within the next four months (by August, 2017). This jobs growth rate may be less than the last six years, but it is far more than is necessary to maintain employment rates – including population gains.

We see this very healthy improvement in the jobs situation in other statistics. Those in part-time positions seeking full-time positions fell to the lowest in several years at 8.9%. And, unemployment declined to 4.5% from 4.7% – a clear indication that there were more people finding work than losing work, pulling more people into the workforce for yet another month. At 4.5%, this is the lowest unemployment rate in a decade.

Net/net, America is rapidly approaching “

full employment” – a term that means everyone who wants a job either has one, or is intentionally looking for a job and reasonably expects to find one in three months. Or, in other words, if you know somebody complaining they can’t find a job it is either because they aren’t really trying, or they are picky about what they want to do, or they can find a job but won’t take it because they want higher pay.

And hourly pay continues to rise, increasing 2.7% versus March, 2016. This is less than in good times, when pay tends to rise at 3-4%/year – but the fact that pay is going up means the labor market is tightening. And as the economy reaches higher levels of employment, and lower levels of unemployment, companies will have to pay more to find new workers – and increase wages on current workers to keep them from leaving. Thus, it is a surety that pay will rise throughout 2017, and probably into the foreseeable future.

Whether you liked President Obama or not, the policies of the last six years allowed America to escape the Great Recession. Today 78.5% of all working age people are in the workforce – that is the highest labor participation rate of working age people since 2008 – indicating a complete recovery from the job collapse.

Thus, it is time for changes in economic policy. To keep calling for job creation is, classically, “fighting the last war.” Even as government is reducing employment, and some industries (like traditional retail) are collapsing employment, there are other parts of the economy growing jobs. Amazon.com, for example, has announced it will be adding 100,000 U.S. jobs by the middle of 2018.

For President Trump to claim there are 100 million people in the USA looking for work is an impossibility. There are only 325 million people in America, and 26.4% of those are between under the age of 17 and over 65 – so 86 million. That only leaves 239 million people of working age in the country. We know that of those at least 78.5% are employed – which is 188 million. Thus, at its maximum, there are only 51 million people who could be looking for work. But we know that many are not because of ill-health, or simply choice. According to the Labor Department, there are about 5 million people looking for work in the U.S. at this time, which is just about the same number of job openings.

It’s time to get over the constant complaining about a job shortage. And here’s what this means for you:

1. After a long decade of stagnation, we can expect everyone to receive higher pay.

2. Job mobility will improve. If you don’t like your current job you can probably find another one.

3. Employers will have to stop burning out employees and do more to keep them as unemployment rates decline.

4. Immigration will be less of an issue, because America will need people to fill jobs (many employers are already complaining about changes to H1-B visa rules).

5. Employers will pay more for employee training and retraining.

6. People 30 and younger have struggled to build careers and start families during the recovery. Expect that situation to reverse.

7. More jobs, more money, a faster growing economy is better for tax receipts. This will relieve stress on government budgets.

8. Higher real estate prices. Some markets are already back to pre-recession levels, yet others have languished. Expect across the board increases.

9. Interest rates will go up (from record lows). Lock-in your mortgage now. Adjust your portfolio from bonds to stocks.

10. Expect the dollar to remain strong, so imports will be cheap and exporting will continue to be more difficult. It’s a good time to visit foreign destinations, and it will be a struggle to attract international tourists.

Look beyond short-term numbers. Month-to-month, even quarter-to-quarter, numbers often yield little analytical value. Look at the long-term trend. Then make sure you, and your business, are ready. Don’t keep fighting the last war, prepare to capture the next opportunity.

Felix Richter, Statista

Felix Richter, Statista

Felix Richter, Statista

Felix Richter, Statista Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

(c) Adam Hartung and Spark Partners

(c) Adam Hartung and Spark Partners

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director