by Adam Hartung | Jan 29, 2021 | Growth Stall, Innovation, Investing, Strategy, Trends

On Friday, January 22, 2021 IBM announced sales and earnings results. Revenues had fallen 6.5%. The stock dropped 11%. IBM alone caused an otherwise up Dow Jones Industrial Average to decline. And, as the NASDAQ rose, largely due to tech stock improvement, IBM was the lone loser. The new CEO, in his role only 1 quarter, predictably asked for more time and investor confidence that the future would look better than the past. Investors justifiably lost confidence a long time ago.

Unfortunately, IBM’s recent performance was just a continuation of its long-term trend. Since 2000, IBM stock has gone nowhere – up a mere 5.7% in 21 years – while Apple (for example) is up some 14,000%. IBM was the 7th largest company on the S&P500 in 1976 when Apple was born. Now Apple’s revenues are 3x IBM’s, and its market capitalization is 20x higher!

A lot of blame must be laid on the former CEO, Virginia (Ginny) Rometty.  CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!

CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!

In 2012, just as Rometty was settling into her new desk, I said Steve Ballmer was the worst CEO in America (link 1). Little did I know he would be replaced with a new CEO that would turn around Microsoft and save the company, while Rometty would replace Ballmer as absolutely the worst CEO in the tech world – and tie herself with Immelt of GE as the worst CEO in all of America.

By 2014, it was clear that Rometty was altogether wrong as CEO, and I told investors to avoid IBM altogether. In 2 years, revenues had begun their declining trend, and she was constantly on the defensive. Instead of investing in cloud computing and other emerging technology solutions, Rometty was selling IBM’s business in China (because we all know that China was not a growth market – except someone forget to tell Apple and Facebook,) and the PC business. Simultaneously Rometty was cutting R&D spending. And she took on more debt. Where was all the money going? Not into growth investments – but rather into stock buybacks where IBM had become the poster child for financial machinations and share manipulation in order to enhance executive bonuses.

Despite IBM bragging about its one-off supercomputers and interesting artificial intelligence uses, there were no new commercial products helping customers build out trends. So IBM partnered with Apple to build “enterprise apps” in iOS in late 2014. This was doomed. IBM brought nothing to this game. IBM was now wholesale saying its development would be on platforms driving revenue growth for Apple – not IBM. IBM was admitting it had a lot of resources (still) and customers, but no idea where the marketplace was headed. So IBM would help Apple grow its user base. This was great for Apple, bad for Microsoft Surface sales, but absolutely horrible for IBM.

So by 2017, IBM was in an irrecoverable Growth Stall. Twenty quarters into the job, and twenty quarters of declining sales meant IBM was in a Growth Stall which predicted a horrible future. But despite the horrific sales and earnings performance, and the resulting horrific stock performance which in no way kept up with the overall market or industry leaders, Rometty was being granted ever more compensation by a ridiculously out of touch Board of Directors. She was being rewarded for manipulating the financials, not running a good business. She clearly needed to be fired. I said so, and told investors not to expect any gains as IBM continued to shrink.

By 2018, even the most long-term of long-term investors, Warren Buffet of Berkshire Hathaway, had given up on Rometty and IBM. As I said then the writing was on the wall by 2014, so why it took him so long was hard to understand. But it was quite clear, falling revenues would lead to lower valuations, regardless how much effort CEO Rometty put into “managing earnings.” The big shock was it took the Board 2 more years to finally get rid of her — one of the 2 worst performing CEOs in American’ capitalism.

Why do I bring up all these old blogs of mine? First, to demonstrate that it IS possible to make accurate business predictions. It is straightforward, once the key trends are identified, to see what companies are building out trends, and which are not. Those who ignore trends are doomed to do poorly, and you don’t want to own their stock. If you are running your business looking internally, and thinking about how to squeeze out a few more dimes of cost you are NOT doing the right thing. You must look externally and build on trends to GROW YOUR REVENUE!

2nd, I have long preached that the #1 indicator of companies that are likely to succeed or fail lies in charting revenue growth. If revenues aren’t growing at 8-10%/year, then as an investor or company leader you need to worry. The company isn’t keeping up with inflation and general economic activity. Too few CEOs (and investors) pay enough attention to revenues. They are happy with lackluster sales while paying too much attention to expenses and managing earnings. That is never a winning strategy. If you don’t grow revenues you can’t grow cash.

3rd, you must consistently invest in innovation and new solutions that build on trends. All solutions become obsolete over time. It is imperative to constantly invest in new products, new offerings, that build on trends in order to keep revenues flowing your way. No company can succeed long unless it invests in innovation to keep itself current, and relevant with customers.

Along with Steve Ballmer and Jeffrey Immelt, Virginia Rometty will go down in history as one of the worst CEOs of this era. Like Immelt’s crushing of GE, Rometty led the demise of the once mighty IBM. You can do better. Keep your eyes on trends, focus on revenues and never stop innovating.

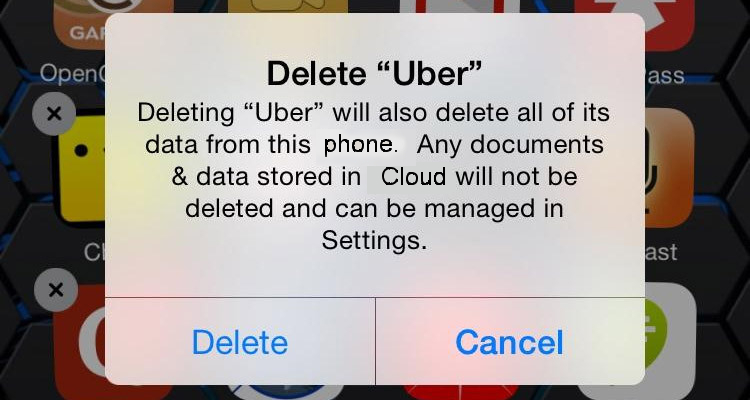

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jun 20, 2018 | Boards of Directors, Growth Stall, Investing, Manufacturing, Strategy

An American epoch has ended. General Electric was part of the first ever Dow Jones Index in 1896. When the Dow Jones Industrial Average was formed in 1907 GE was a participant. GE has been the only company to remain on the index. All other original companies long ago completely disappeared.

GE did so well because its leadership had been able to constantly change the company to keep it relevant, and growing. During the century prior to hiring Jeff Immelt as CEO GE went from light bulbs to generating electricity and making all kinds of electrical infrastructure equipment, electric locomotives, mainframe computers, medical equipment, computer services, financial services, entertainment…. The list is very long.

Although not all GE CEOs were great, the Board was able to place CEOs in office who could sense market shifts and make good decisions. GE leadership thoughtfully analyzed markets, and made investment decisions to sell businesses that were not growing. And they made investment decisions to invest in trends which created growth. One of the best of these was Jack Welch, who developed the nickname “Neutron Jack” for his willingness to jettison businesses that were not growing and leading their industry, while willingly investing in entirely new growth markets where trends showed high rates of return like financial services and entertainment – wildly “non-industrial” markets.

But CEO Immelt was completely tone-deaf to the outside world. He was wholly unable to understand how to lead a team that could make good investments. Instead under Immelt’s leadership GE over-invested in historical products where they were losing advantage but trying to “keep up.” Selling businesses that were growing but faced stiff competition, rather than investing in growth. And refusing to invest in new external growth opportunities that could keep revenues increasing – and drive a higher GE market capitalization.

All the way back in 2009 I pointed out that GE was in a Growth Stall, and had only a 7% chance of consistently growing at 2%. I warned investors. At the time I said GE had to go all-out on a growth strategy, or things would turn ugly. But a lot of investors, employees – and apparently the Board of Directors – were ready to blame the Growth Stall on the economy. And blame it on Welch, who had been gone for 8 years. And say GE was lucky Immelt saved the company from bankruptcy with a loan from Warren Buffett’s Berkshire Hathaway.

Say what? Saved the company? Why did Immelt, and the Board, let GE get into such terrible shape? It was time to replace the CEO, not double down on his failed strategy.

Six years ago, May, 2012, I published in Forbes “5 CEOs that Should Have Already Been Fired.” At the time I said Immelt was the 4th worst CEO in America. I cited the 2009 column, and pointed out things really weren’t any better in 2012 than in 2009. That column had well over 1million reads. There was no way GE’s board was not aware of the column, and the realization that Immelt was a horrible CEO.

The Board of #3 (Walmart) fired Mike Duke. And the Board of #1 (Microsoft) fired Steve Ballmer. There is no real board at #2 Sears (which will file bankruptcy soon enough) because the CEO is also the largest shareholder (via his hedge fund) and he controls all board decisions. He should have fired himself, but had too much ego. But the board of GE – well it did nothing. Even though GE almost went bankrupt under Immelt, and its value was being destroyed quarter after quarter it left him in place.

I revisited the performance of these five CEOs and their companies in August, 2014 and reminded hundreds of thousands of readers – which I’m sure included GE’s Board of Directors – that company revenues had declined every year since 2009. And this string of failures had caused the company’s value to decline by 2/3. Yet, the board did nothing to replace this horrific CEO.

By March, 2017 I was so exasperated I finally titled my column “GE Needs a New Strategy and a New CEO.” Again, I detailed all the things that went wrong. It took 7 more months before the Board pushed Immelt out. But the new CEO failed to offer a better strategy, continuing to promote the notion of selling businesses to raise cash to “fix” the broken businesses – without identifying any growth strategy at all.

The only thing that can “fix” GE – save it from being dismembered and sold off – is a growth strategy. I offered how the new CEO could undertake this effort in October, 2017. But the Board, still wholly incompetent, still isn’t listening. Nobody should be surprised that GE is now removed from the Dow, and the new CEO is clearly without a clue how to find a path back to relevancy.

Too bad for investors, employees, suppliers, customers and the communities where the GE businesses reside. This didn’t have to happen. But due to an incompetent Board of Directors, which did nothing to properly govern an incompetent CEO, it did. And there’s little doubt it won’t be long before GE meets the same end as DuPont.

by Adam Hartung | Jun 12, 2017 | Defend & Extend, Innovation, Leadership

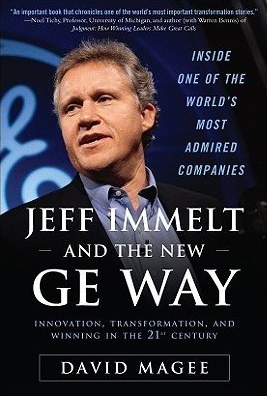

GE Chairman and CEO Jeff Immelt walks off stage after being interviewed during the Washington Ideas Forum at the Harmon Center for the Arts September 28, 2016 in Washington, DC. A proud Republican, Immelt said it would hurt the United States and cripple President Barack Obama — and the next president of the U.S. — not to agree to trade deals like theTrans Pacific Partnership (Photo by Chip Somodevilla/Getty Images)

Readers of this column know I’m not a fan of General Electric’s CEO, Jeffrey Immelt. In May, 2012 I listed CEO Immelt as the 4th worst CEO of a large publicly traded American company. Unfortunately, his continued tenure since then did nothing to help make GE a stronger, or more valuable company. GE’s lead director says this is the culmination of a transition plan first developed in 2011. One can only wonder why it took the board so incredibly long to replace the feckless CEO, and why they allowed GE’s leadership to continue destroying shareholder value.

The longer back you look, the worse Immelt’s performance appears.

Few company analysts can say they’ve followed a company for 3 years. Fewer yet can say 5 years. Nearly none can say a decade. Yet, CEO Immelt was in his job for 16 years – much longer than almost all business analysts or writers have followed GE. Therefore, their lack of long-term memory often leaves them unable to give a proper overview of the company’s fortunes under the long-lived CEO.

I have followed GE closely for almost 35 years. Ever since I graduated from HBS class of 1982 along with Mr. Immelt. Several fellow alumni worked at GE, and a large number of my BCG (Boston Consulting Group) colleagues joined GE in senior positions during the mid-1980s as GE grew exponentially. I have followed several of these alumni as the years passed allowing me to take the “long view” on GE’s performance, during Welch’s leadership and more recently since Mr. Immelt took the top job.

I was very pleased to include a positive case study of GE’s business practices in my book “Create Marketplace Distruption – How to Stay Ahead of the Competition” (Financial Times Press, 2007.) CEO Welch used a number of internal processes to help GE leaders identify disruptive opportunities to change industries – whether markets where GE already competed or new markets. He relentlessly encouraged entering new businesses where GE could bring something new to the game, and he put GE’s money to good use growing revenues, and market cap, enormously. No other CEO in American history made as much value for shareholders as Jack Welch. His leadership pushed GE to the top position in most industries, and his relentless focus on growth helped even rank-and-file employees build million dollar IRAs to go with well funded pension and retiree benefit plans.

GE’s performance could not have changed more dramatically than it has under Mr. Immelt. But there are now a number of apologists who would say GE’s smaller size, and lower valuation, are due to market conditions which were out of Mr. Immelt’s control. They contend CEO Immelt was a good steward of the company during difficult market conditions, and the results of his tenure – notably lower revenues, lower valuation, fewer markets, fewer employees and lower community involvement – are not his fault. They argue he did a good job, all things considered.

Balderdash. Immelt was a terrible CEO

There is an overall reluctance to say bad things about any huge American icon, and its CEO. After all, columnists and analysts who are non-congratulatory don’t usually get called by the company to be consultants, or advisors. Or to be on the board. And publishers of columnists who say negative things about big companies and their execs risk having ad dollars moved to more favorable journals, and often unfriendly relationships with their ad departments and agencies. So it is far easier, and more acceptable, to sugar coat bad strategy, bad leadership and bad results.

But we should move beyond that bias. Mr. Immelt was the CEO of the ONLY company on the Dow Jones Industrial Average (DJIA) to have been on that list since it was created. He inherited the most successful company at creating shareholder value during the 1980s and 1990s. He surely should be held to the highest of comparative bars.

Those who say CEO Immelt was “set up to fail” are somehow making the case that Immelt would have been more successful if he had inherited a company with a bad brand image, weak history, and inadequate performance. They are rewriting history to say Jack Welch was not a good CEO, and his outsized gains destined GE to do poorly under his successor. That simply defies the facts – and logic.

Looking at the last 16 years of “difficult times,” when GE has struggled under Immelt’s leadership, one should ask “why did so many other companies do so well?” After all, the DJIA has more than doubled. The S&P 500 has almost doubled. The Russell 2000 has almost tripled. Overall, far more companies have gone up in value than down. Why were Immelt’s circumstances so difficult that all of those CEOs did so much better? They dealt with the same financial meltdown, same Great Recession, same increase in regulations, same federal reserve, same government administration – yet they were able to adapt their companies, grow and increase value.

Yes, GE was huge in financial services when Immelt took the reigns, and financial services saw a major crash. But look at the performance of JPMorganChase under CEO Jamie Dimon (also a classmate of Mr. Immelt.) JPM is stronger today than ever, growing and gaining market share and increasing its value to shareholders. Prior to the crash, in spring 2007, GE was trading at $41/share, and now it is $29 – a decline of ~30%. Back then JPM was trading at $53, and now it is $93 – a gain of ~75%. There obviously was a strategy to adapt to market conditions and do well. Just not at GE.

Immelt reacted to market events, poorly, rather than having a prepared, proactive strategy

Let’s not rewrite history. Prior to the banking crash CEO Immelt was more than happy for GE to be in the “easy money” world of finance. Welch had created GE Capital, and Immelt had furthered its growth when lending was easy and profitable. And he supported the enormous growth in GE’s real estate division. When this industry faced the crash, GE faced a near-bankruptcy not because of Welch, but because of Immelt’s leadership during the over 6 years he had been CEO. If there were risks in the system CEO Immelt had ample time to re-arrange the portfolio, reduce lending, offload financial assets and reduce exposure to real estate and mortgages. But Immelt did not do those things. He did not prepare for a reversal in the markets, and he did not prepare the balance sheet for a significant change of events. It was his leadership that left GE exposed.

As GE shares fell to $7 Immelt made a famous deal with Berkshire Hathaway’s CEO Warren Buffet to increase GE’s capital base in order to stave off demise. And this deal saved GE. But this was an extremely sweet deal for Buffett, giving Berkshire very good interest (10%) on the preferred shares and warrants allowing Buffett to buy future shares of GE at a fixed price. Berkshire made a profit, over and above the interest, of $260M on the deal, and overall at least $1.2B. By being prepared Buffett saved GE and made a lot of money. GE’s investors paid the price for a CEO that was unprepared.

But the changes brought about by the crash, and Dodd-Frank, were more than CEO Immelt could manage. Thus GE exited the business selling many assets at fire sale prices. This “turn tale and run” strategy was sold to the public as a way for GE to “focus” on its “core manufacturing business.” Rather, it was a failure of leadership to understand how to manage this business to future success in changed markets. Where Welch’s GE had grasped for disruption as opportunity, Immelt’s GE gasped at disruption and fled, destroying billions in GE value.

Immelt could not grow GE’s businesses, so he divested GE of many.

GE was to be the “industrial internet giant.” GE was to be a leader in the internet-of-things (IoT) where sensors, the cloud and remote devices created greater productivity. And, to be sure, companies like Apple, Google and Samsung have made huge gains in this market. Even small companies, like Nest, were able to jump on this technology shift with new products for the residential market. But name one market where GE is the dominant IoT player. During 16 years the internet and remote services markets have exploded, yet GE is not the market leader. Rather it is barely recognized.

Rather than growing GE with disruptive innovations and visionary products in emerging technology markets, Immelt’s GE was primarily shrinking via divestitures. In dismantling GE Capital he eliminated the lending and real estate operations. After decades as a leader in appliances, that division was sold. Welch built the extremely successful entertainment division around NBC/Universal, which Immelt sold.

The water business that was to be a world leader under Immelt’s vision, likewise sold – and largely to make sure GE could close the deal on selling its oil & gas unit. Even the famed electrical distribution business, going back to the start of GE, is now close to being sold.

And what happened to all this money? Well, about $50B went into share buybacks – which ostensibly would help shareholders. Only it didn’t, because GE is still worth less than when buybacks started. So the money just disappeared. At least Immelt could have paid it to shareholders as a dividend – but then that would not have boosted his bonuses.

GE’s website says Mr. Immelt wanted to create a “simpler, more valuable industrial company.” Mr. Immelt is definitely leaving behind a simpler, much smaller and weaker company. The brand is gone from consumer products, and severely tarnished in commercial products. GE lacks a great product pipeline, and even a strong development pipeline due to the rampant divestitures. When Mr. Flannery takes over as CEO he will not inherit a powerhouse company. He will inherit a company that is shrinking and rudderless, and disconnected from most growth markets with almost no product, technology or brand advantages. And he will report to the Chairman that created this mess, Mr. Immelt.

The most likely outcome is that Mr. Peltz and his firm, Trian Partners, will buy more GE shares and seek directorships on the board. Then, in a move not unlike the deaths of DuPont and Dow, there will be a massive cost cutting effort to bring expenses in-line with the shrunken GE business. R&D will be discontinued, as will product development. Support groups will be shredded. Customer service will be downsized. Then the remaining pieces will be sold off to buyers, or taken public, leaving GE a dismantled piece of history.

While that may work for the capital markets, and some short-term investors will share in the higher valuation, what about the people? People who dedicated their careers to GE, and are pensioners or current employees? What about cities and counties where GE has been a major employer, and civic contributor? What about customers that bought GE industrial products, only to see those products dropped due to low profitability, or little growth opportunity? What about suppliers that invested in developing new technologies or products for GE to take to market? What will happen to the people who once relied on GE as America’s largest diversified industrial company?

These people all have an ax to grind with the very wealthy, and now departing, CEO Immelt. He inherited what may well have been the most successful company on earth. He leaves behind a far weaker company that may not survive.

CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!

CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!