by Adam Hartung | Mar 27, 2015 | Investing, Mobile, Software, Trends, Web/Tech

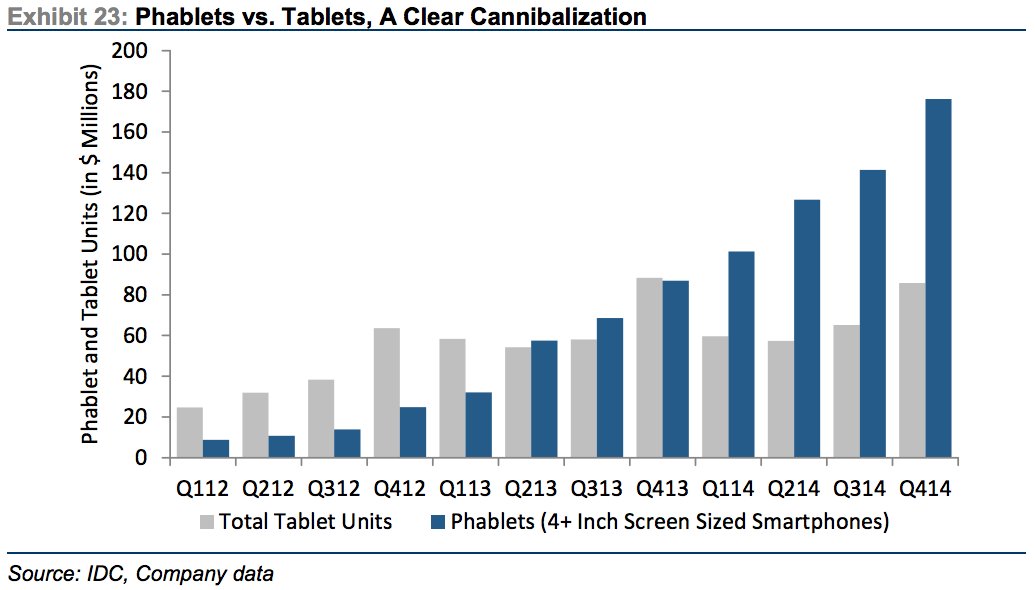

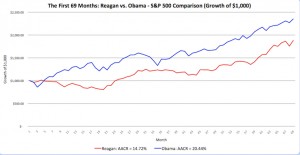

Phablets are a very hot, growing market. Phablets are those huge phones (greater than 4″ screen size) that some people carry around. From almost nothing in 2012, over the last 3 years the market has exploded:

Source: Jay Yarrow, Business Insider http://www.businessinsider.com/in-one-chart-heres-why-the-ipad-business-is-cratering-2015-3?utm_content=&utm_medium=email&utm_source=alerts&nr_email_referer=1

The original creator of this market data, Kulbinder Garcha of Credit Suisse, thinks this demonstrates cannibalization of tablet sales by phablets. And this is supposedly a bad thing for Apple.

But there is another way to look at this. By introducing and promoting a phablet (iPhone 6+ and Galaxy S6,) Apple and Samsung are growing users of mobile media and mobile apps. As the chart shows, growth in tablet sales was nothing compared to what happened when phablets came along. So people who didn’t buy a tablet, and maybe (likely?) wouldn’t, are buying phablets. The market is growing faster with phablets than had they not been introduced, and even if tablet sales shrink Apple and Samsung see revenues continue growing.

Who wins as phablet sales grow? Those who have phablet products in the market, and newer versions in the works.

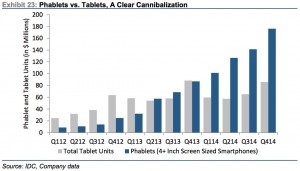

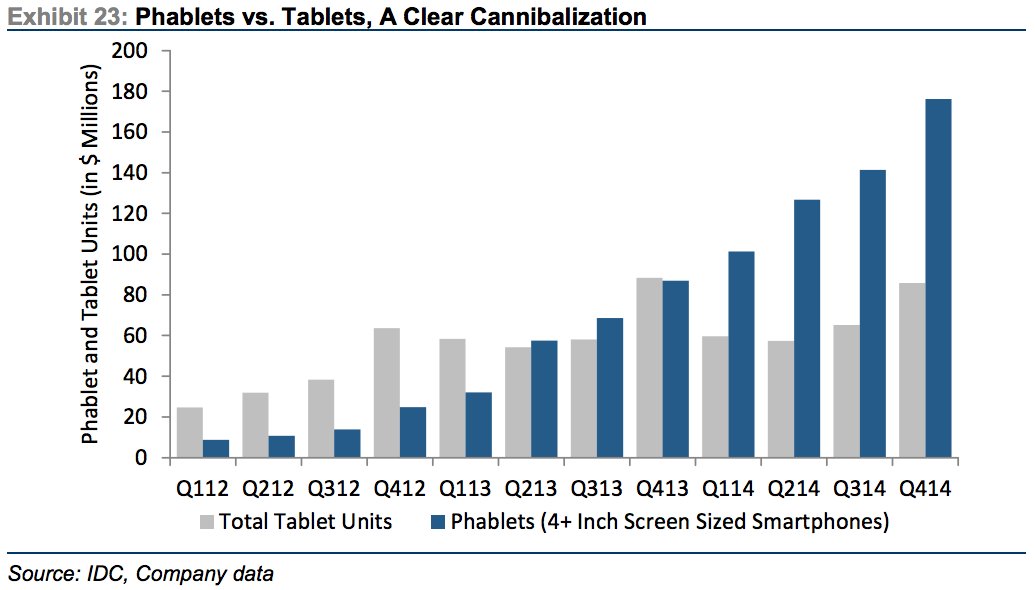

Source: Kantar WorldPanel and Seeking Alpha http://seekingalpha.com/article/3032926-microsoft-the-china-mobile-backed-lenovo-windows-10-smartphone-could-be-a-future-tailwind?ifp=0

As this chart shows, the companies who dominate smartphone sales are those who make Android-based products (#1 is Samsung) and Apple. Microsoft missed the mobile/smartphone trend, and even though it purchased Nokia it has never obtained anything close to double digit share in any market.

Unfortunately for Microsoft enthusiasts, and investors, Microsoft’s Windows10 product is focused first on laptop (PC) users, second on hybrid (products used as both a laptop and tablet), third tablets (primarily the slow-selling Microsoft Surface) and in a far, far trailing position smartphones.

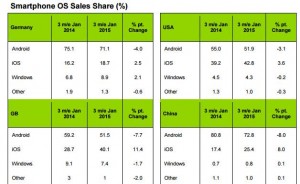

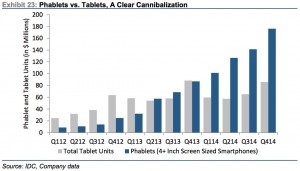

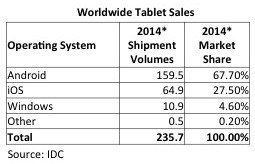

Source: IDC

As data from IDC shows, Surface sales are inconsequential. So the big loser from phablet cannibalization of tablets will be Microsoft. Given its very small user base, and the heavy losses Microsoft has taken on Surface, there is little revenue or cash flow to support an intense competitive effort in a shrinking market. Apple and Samsung will market hard to grow as many sales as possible, and likely will make the tablet products more affordable. Thus one should anticipate Microsoft’s very small tablet share would decline as tablet sales shrink.

This is the problem created when any business misses a major trend.

Microsoft missed the trend to mobile. They didn’t prepare for it in any of their major products, and they let new products, like music player Zune and Lumia phones, languish – and mostly die. By the time Microsoft reacted Apple and Samsung had enormous leads. Microsoft is still trying to play catch-up with its “core” Windows product.

But worse, because it is so far behind, Microsoft’s leaders are unable to forecast where the market will be in 3 years. Consequently they develop products for today’s market, like tablets (and their hybrid products,) which we now see will be obsolete as the market shifts to new products (like phablets.) Because Apple and Samsung already have the new products (phablets) they are prepared to cannibalize the old product sales (tablets) in order to overall grow the marketplace. But Microsoft has no phablet product, really no smartphone product, and will find itself most likely writing off more future Surface products as its tiny market share erodes to nothing.

So this trend to phablets continues to make a Microsoft comeback as a major personal technology competitor problematic. Windows 10 may be coming, but its relevance looks increasingly like that of new Blackberry models. There is little reason to care, because the products are years late and poorly positioned for leading edge customers. Further, developers will already be onto new competitive platforms long before the outdated Microsoft products make it to market. Without share you don’t capture developers, without developers you don’t have a robust app market, without apps you don’t capture customers, without customers you can’t build share — and that’s a terrible whirlpool Microsoft is captured within.

Be sure your business keeps its eyes on trends, and does not wait to react. Waiting can turn out to be deadly.

by Adam Hartung | Jan 14, 2015 | Investing, Retail, Trends

Retail sales fell .9% in December. Even excluding autos and gasoline, retail sales fell .3%. Further, November retail sales estimates were revised downward from an initial .7% gain to a meager .4%, and October sales advances were revised downward from a .5% gain to a mere .3%. Sales were down at electronic stores, clothing stores and department stores – all places we anticipated gains due to an improving economy, more jobs and more cash in consumer pockets.

Whoa, what’s happening? Wasn’t lower gasoline pricing going to free up cash for people to go crazy buying holiday gifts? Weren’t we all supposed to feel optimistic about our jobs, higher future wages and more money to spend after that horrible Great Recession thus leading us to splurge this holiday?

There were early signals that conventional wisdom was going to be wrong. Back on Black Friday (so named because it is supposedly the day when retailers turn a profit for the year) we learned sales came in a disappointing 11% lower than 2013. Barron’s analyzed press releases from Wal-Mart, and discerned that 2014 was a weaker Black Friday than 2013 and probably 2012. Simply put, fewer people went shopping on Black Friday than before, despite longer store hours, and they bought less.

So was this really a horrible holiday?

Retail store sales are only part of the picture. Increasingly, people are shopping on-line – and we all know it. According to ComScore, on-line sales made to users of PCs (this excludes mobile devices) were up 17% on Cyber Monday, in stark contrast to traditional brick-and-mortar. Exceeding $2B, it was the largest on-line retail day in history. The Day after Cyber Monday sales were up 27%, and the Green Monday (one week after Cyber Monday) sales were up 15% (all compared to year ago.) Overall, the week after Thanksgiving on-line sales rose 14%, and on Thanksgiving Day itself sales were up a whopping 32%. The week before Christmas (16th-21st) on-line sales surged 18%. According to IBM Digital Analytics the on-line November-December sales were up 13.9% vs. 2013.

The trend has never been more pronounced. Regardless of how much people are going to spend, they are spending less of it in traditional brick-and-mortar retail, and more of it on-line.

So, what about Wal-Mart? The chain remains mired in its traditional way of doing business. Even though same-store sales have been flat-to-down most of the last 2 years, and the number of full-line stores has declined in the USA, the chain remains committed quarter after quarter to defending its outdated success formula. Even in China, where Alibaba has demonstrated it can grow on-line ecommerce revenues more than 50%/year, Wal-Mart continues to try growing with a physical presence – even though it has been a tough, unsuccessful slog.

Yet, despite its bribery scandal in Mexico undertaken to prop up revenues, lawsuits due to over-worked, stressed truck drivers having accidents on double shifts killing and injuring people, and an inability to grow, Wal-Mart’s stock trades at near all-time highs. The stock has nearly doubled since 2011, even though the company is at odds with the primary retail, and demographic, trends.

On the other end of the spectrum is Amazon.com. Amazon is still growing revenues at over 20%/year. And introducing successful new publishing and internet service businesses, expanding same day delivery (and even one hour delivery) in urban markets like New York City, as well as expansion of its Prime service to include more original programming with famed director Woody Allen after winning the Golden Globe award for its original series Transparent.

However, several analysts were trash talking Amazon in 2014. 20% growth has them worried, given that the company once grew at 40%. Even though Amazon’s growth is a serious reason companies like Wal-Mart cannot grow. And there is the perennial lack of profitability – including a larger than expected loss in the second quarter ; a loss which included a $170M write-off on FirePhones which never really found a customer base. The latter item led to a Fast Company brutal lambasting of CEO Jeff Bezos as a micro-manager out-of-touch with customers.

This lack of analyst support has seriously hurt Amazon.com share performance. From 2010 to early 2014 the stock quadrupled in value from $100 to $400. But over the past year the stock has fallen back 25%. After dropping to $300/share in April, the stock has rallied but then retrenched no less than 3 times, and is now trading very close to its 52 week low. And, it shows no momentum, trading below its moving average.

Which is why investors in Wal-Mart should sell, and reinvest in Amazon.com.

All the trends point to Wal-Mart being overvalued. Its revenues show no signs of achieving any substantial growth. And, despite its sheer size, all retail trends are working against the behemoth. It has been trying to find a growth engine for 10 years, but nothing has come to fruition – including big investments in offshore markets. The company keeps trying to defend & extend its old success formula, thus creating a bigger and bigger gap between itself and future market success.

Simultaneously, Amazon.com continues to invest in major developing trends. From publishing to television programming to cloud/web services and even general retail, everything into which Amazon invests is growing. And even though this is a company with $100B in revenues, it is still growing at a remarkable 20%. While some analysts may wish the investment rate would slow, and that Amazon would never make mistakes (like Firephone,) the truth is that Amazon is putting money into projects which have pretty good odds of making sizable money as it helps change the game in multiple markets.

Think of investing like paddling a canoe. When you are investing against trends, it’s like paddling up the river. You can make progress, but it is hard. And, one little mistake and you easily slip backward. Lose any momentum at all and you could completely turn around and disappear (like happened to Circuit City, and now both Sears and JCPenney.) When you invest with the trends it is like paddling down the river. The trend, like a current, keeps you moving in the right direction. You can still make mistakes, but the odds are quite a lot higher you will make your destination easily, and with resources to spare. That’s why the sales results for December are important. The show traditional retailers are paddling up river, while on-line retailers are paddling down-river.

I don’t know if Wal-Mart’s stock value has peaked, but it is hard to understand why anybody would expect it to go higher. It could continue to rise, but there are ample reasons to expect investors will figure out how tough future profits will be for Wal-Mart and dispose of their positions. On the other hand, even though Amazon.com could continue to slide down further there are even more reasons to expect it will have great future quarters with revenue gains and – eventually – those long-sought-after profits that some analysts seek. Meanwhile, Amazon is investing in projects with internal rates of return far higher than most other companies because they are following major trends. Odds are pretty good that in a few years the trends will make investors happy they own Amazon, and dropped out of Wal-Mart.

by Adam Hartung | Sep 5, 2014 | Employment, Investing, Politics

The Bureau of Labor Statistics (BLS) just issued America’s latest jobs report covering August. And it’s a disappointment. The economy created an additional 142,000 jobs last month. After 6 consecutive months over 200,000, most pundits expected the string to continue, including ADP which just yesterday said 204,000 jobs were created in August. So, despite the lower than expected August jobs number, America will create about 2.5 million new jobs in 2014.

One month variation does not change a trend

Even thought the plus-200k monthly string was broken (unless revised upward at a future date,) unemployment did continue to decline and is now reported at only 6.1%. Jobless claims were just over 300k; lowest since 2007. And that is great news.

Back in May, 2013 (15 months ago) the Dow was out of its recession doldrums and hitting new highs. I asked readers if Obama could, economically, be the best modern President? Through discussion of that question, the #1 issue raised by readers was whether the stock market was a good economic barometer for judging “best.” Many complained that the measure they were watching was jobs – and that too many people were still looking for work.

To put this week’s jobs report in economic perspective I reached out to Bob Deitrick, CEO of Polaris Financial Partners and author of “Bulls, Bears and the Ballot Box” (which I profiled in October, 2012 just before the election) for some explanation. Since then Polaris’ investor newsletters have consistently been the best predictor of economic performance. Better than all the major investment houses.

This is the best private sector jobs creation performance in American history

Bob Deitrick – “President Reagan has long been considered the best modern economic President. So we compared his performance dealing with the oil-induced recession of the 1980s with that of President Obama and his performance during this ‘Great Recession.’

Bob Deitrick – “President Reagan has long been considered the best modern economic President. So we compared his performance dealing with the oil-induced recession of the 1980s with that of President Obama and his performance during this ‘Great Recession.’

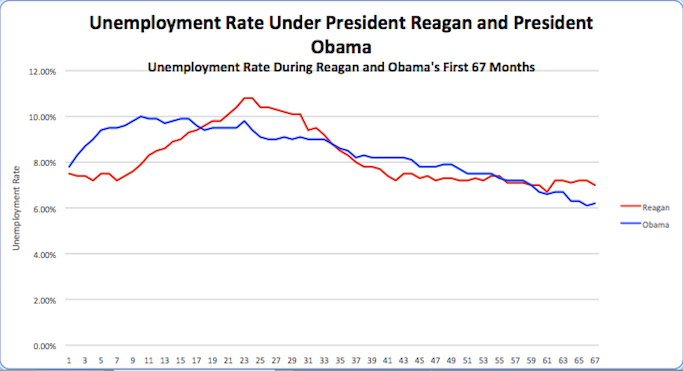

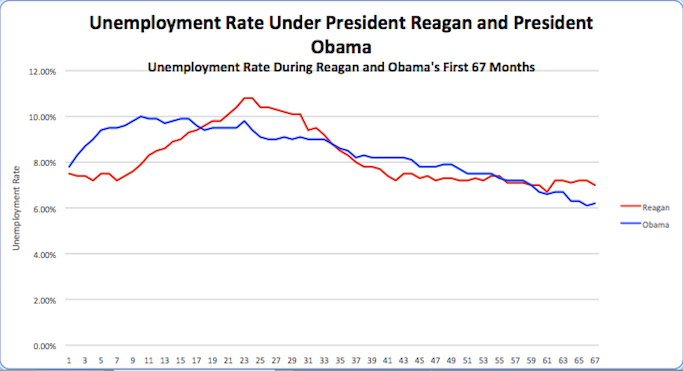

As this unemployment chart shows, President Obama’s job creation kept unemployment from peaking at as high a level as President Reagan, and promoted people into the workforce faster than President Reagan.

President Obama has achieved a 6.1% unemployment rate in his 6th year, fully one year faster than President Reagan did. At this point in his presidency, President Reagan was still struggling with 7.1% unemployment, and he did not reach into the mid-low 6% range for another full year. So, despite today’s number, the Obama administration has still done considerably better at job creating and reducing unemployment than did the Reagan administration.

We forecast unemployment will fall to around 5.4% by summer, 2015. A rate President Reagan was unable to achieve during his two terms.”

What about the Labor Participation Rate?

Much has been made about the poor results of the labor participation rate, which has shown more stubborn recalcitrance as this rate remains higher even as jobs have grown.

Source: Polaris Financial Partners Using BLS Data

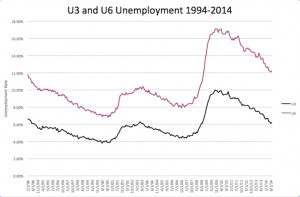

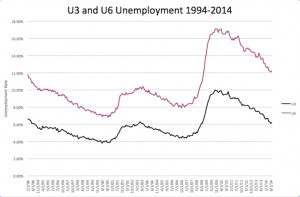

Bob Deitrick: “The labor participation rate adds in jobless part time workers and those in marginal work situations with those seeking full time work. This is not a “hidden” unemployment. It is a measure tracked since 1900 and called ‘U6.’ today by the BLS.

As this chart shows, the difference between reported unemployment and all unemployment – including those on the fringe of the workforce – has remained pretty constant since 1994.

Source: BLS Databases, Tables and Calculators by Subject – Labor Participation

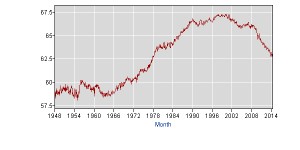

Labor participation is affected much less by short-term job creation, and much more by long-term demographic trends. As this chart from the BLS shows, as the Baby Boomers entered the workforce and societal acceptance of women working changed labor participation grew.

Now that ‘Boomers’ are retiring we are seeing the percentage of those seeking employment decline. This has nothing to do with job availability, and everything to do with a highly predictable aging demographic.

What’s now clear is that the Obama administration policies have outperformed the Reagan administration policies for job creation and unemployment reduction. Even though Reagan had the benefit of a growing Boomer class to ignite economic growth, while Obama has been forced to deal with a retiring workforce developing special needs. During the 8 years preceding Obama there was a net reduction in jobs in America. We now are rapidly moving toward higher, sustainable jobs growth.”

Economic growth, including manufacturing, is driving jobs

When President Obama took office America was gripped in an offshoring boom, started years earlier, pushing jobs to the developed world. Manufacturing was declining, and plants were closing across the nation.

This week the Institute for Supply Management (ISM) released its manufacturing report, and it surprised nearly everyone. The latest Purchasing Managers Index (PMI) scored 59, 2 points higher than July and about that much higher than prognosticators expected. This represents 63 straight months of economic expansion, and 25 consecutive months of manufacturing expansion.

New orders were up 3.3 points to 66.7, with 15 consecutive months of improvement and reaching the highest level since April, 2004 – 5 years prior to Obama becoming President. Not surprisingly, this economic growth provided for 14 consecutive months of improvement in the employment index. Meaning that the “grass roots” economy made its turn for the better just as the DJIA was reaching those highs back in 2013 – demonstrating that index is still the leading indicator for jobs that it has famously always been.

As the last 15 months have proven, jobs and economy are improving, and investors are benefiting

The stock market has converted the long-term growth in jobs and GDP into additional gains for investors. Recently the S&P has crested 2,000 – reaching new all time highs. Gains made by investors earlier in the Obama administration have further grown, helping businesses raise capital and improving the nest eggs of almost all Americans. And laying the foundation for recent, and prolonged job growth.

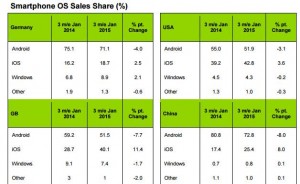

Source: Polaris Financial Partners

Bob Deitrick: While most Americans think they are not involved with the stock market, truthfully they are. Via their 401K, pension plan and employer savings accounts 2/3 of Americans have a clear vested interest in stock performance.

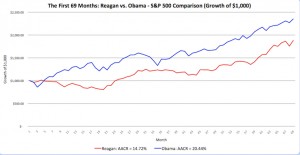

As this chart shows, over the first 67 months of their presidencies there is a clear “winner” from an investor’s viewpoint. A dollar invested when Reagan assumed the presidency would have yielded a staggering 190% return. Such returns were unheard of prior to his leadership.

However, it is undeniable that President Obama has surpassed the previous president. Investors have gained a remarkable 220% gain over the last 5.5 years! This level of investor growth is unprecedented by any administration, and has proven quite beneficial for everyone.

In 2009, with pension funds underfunded and most private retirement accounts savaged by the financial meltdown and Wall Street losses, Boomers and Seniors were resigned to never retiring. The nest egg appeared gone, leaving the ‘chickens’ to keep working. But now that the coffers have been reloaded increasingly people age 55 – 70 are happily discovering they can quit their old jobs and spend time with family, relax, enjoy hobbies or start new at-home businesses from their laptops or tablets. It is due to a skyrocketing stock market that people can now pursue these dreams and reduce the labor participation rates for ‘better pastures.”

Where myth meets reality

There is another election in just 8 weeks. Statistics will be bandied about. Monthly data points will be hotly contested. There will be a lot of rhetoric by candidates on all sides. But, understanding the prevailing trends is critical. Recognizing that first the economy, then the stock market and now jobs are all trending upward is important – even as all 3 measures will have short-term disappointments.

Although economic performance has long been a trademark issue for Republican candidates, there was once a Democratic candidate that won the presidency by focusing on the economy and jobs (Clinton,) and his popularity has never been higher! President Obama’s popularity is not high, and seems to fall daily. This seems incongruous with his incredible performance on the economy and jobs, which has outperformed his party predecessor – and every other modern President.

There are a lot of reasons voters elect a candidate. Jobs and the economy are just one category of factors. But, for those who place a high priority on jobs, economic performance and the markets the data clearly demonstrates which presidential administration has performed best. And shows a very clear trend one can expect to continue into 2015.

Economically, President Obama’s administration has outperformed President Reagan’s in all commonly watched categories. Simultaneously the current administration has reduced the debt, which skyrocketed under Reagan. Additionally, Obama has reduced federal employment, which grew under Reagan (especially when including military personnel,) and truly delivered a “smaller government.” Additionally, the current administration has kept inflation low, even during extreme international upheaval, failure of foreign economies (Greece) and a dramatic slowdown in the European economy.

by Adam Hartung | Mar 13, 2014 | Food and Drink, Investing, Leadership, Lock-in, Trends

Understanding trends is the most important part of planning.

Yet, most business planning focuses on internal operations and how to improve them, usually neglecting trends and changes in the external environment that threaten not only sales and profits but the business’ very existence.

Take Sbarro’s recent bankruptcy. That was easy to predict, especially since it’s the second time down for the restaurant chain. You have to wonder why leadership didn’t do something different to avoid this fate.

Traditional retail has been in decline for a decade. As consumers buy more stuff on-line, from a rash of retailers old and new, there is simply less stuff being bought at stores. It’s an obvious trend which affects everyone. But we see business leaders surprised by the trend, reacting with store closings and cost reductions, and we are surprised by the headlines:

Thousands of retail stores will close in 2014. It should surprise no one that physical retail traffic has been in dramatic decline. Large malls are shutting down, and being destroyed, as the old “anchor tenants” like Sears and JC Penney flail. Over 200 large malls (over 250,000 square feet) have vacancy rates exceeding 35%. Retail rental prices keep declining as the overbuilt, or under-demolished, retail square footage supply exceeds demand.

Business planning is about defending and extending the past.

Given this publicly available information, you would think a company with most of its revenue tightly linked to traditional retail would —- well —- change. Yet, Sbarro stuck with its business of offering low cost food to mall shoppers. Its leaders continued focusing on defending & extending its old business, improving operations, while trends are clearly killing the business.

Almost all business planning efforts begin by looking at recent history. Planning processes starts with a host of assumptions about the business as it has been, and then try projecting those assumptions forward. Sbarro began when malls were growing, and its plans were built on the assumption that malls thrive. Now malls are dying, but that is not even part of planning for the future. Planning remains fixated on execution of a strategy that is no longer viable .

No one can “fix” Sbarro – they have to change it. Radically. And that means planning for a future which looks nothing like the past. Planning needs to start by looking at trends, and developing future scenarios about what customers need. Regardless of what the business did in the past.

Planning should be about understanding trends and developing future scenarios.

For all businesses the important planning information is not sales, sales per store, product line offerings, cost of goods sold, labor cost, gross margin, rents, cleanliness scores, safety record, location, etc., etc. The important information is in marketplace trends. For Sbarro, what will be dining trends in the future? What kind of restaurant experience do people want not only in 2014, but in 2020? Or should the company move toward delivery? At-home food preparation?

Success only happens when we understand trends and build our business to deliver what people want in the future. The world moves very fast these days. Technologies, styles, fashions, tastes, regulations, prices, capabilities and behaviors all change very quickly. Tomorrow is far less likely to look like today than to look, in important ways, remarkably different.

Plan for the future, not from the past.

To succeed in today’s fast changing environment requires we plan for the future, not from the past. We have to understand trends, and create keen vision about what customers will want in the future so we can steer our business in the right direction. Before we even discuss execution we have to make sure we are going to give customers what they want – which will be aligned with trends.

Otherwise, you can have the best run operation in the country and still end up like Sbarro.

Connect with me on LinkedIn, Facebook and Twitter.

Links:

Radio Shack is a leader… in irrelevancy… and why that’s important for you

Old assumptions, and the CEO’s bias, is killing Sears

Winners shift with trends, losers don’t – understanding Sears’ decline

The CEO problem and the failure of JCPenney

The RIGHT way to implement planning to thrive in changing markets

How to plan like Virgin, Apple and Google

by Adam Hartung | Oct 18, 2012 | Investing, Trends

For some people this serves as a reminder to invest very, very cautiously. For others it is seen as market hiccups that present buying opportunities. For many it is an admonition to follow the investing advice of Mark Twain (although often attributed to Will Rogers) and pay more attention to the return of your money than the return on your money.

I’ve been investing for 30 years, and like most people I did it pretty badly. For the first 20 years the annual review with my Merrill Lynch stock broker sounded like “Kent, why is it I’m paying fees to you, yet would have done better if I simply bought the Dow Jones Industrial Average?” Across 20 years, almost every year, my “managed” account did more poorly than this collection of big, largely dull, corporations.

A decade ago I dropped my broker, changed my approach, and things have gone much, much better. Simply put I realized that everything I had been taught about investing, including my MBA, assured I would have, at best, returns no better than the overall market. If I used the collective wisdom, I was destined to perform no better than the collective market. Duh. And that is if I remained unemotional and disciplined – which I didn’t assuring I would do worse than the collective market!

Remember, I am not a licensed financial advisor. Below are the insights upon which I based my new investing philosophy. First, the 4 myths that I think steered me wrong, and then the 1 thing that has produced above-average returns, consistently.

Myth 1 – Equities are Risky

Somewhere, somebody came up with a fancy notion that physical things – like buildings – are less risky than financial assets like equities in corporations. Every homeowner in America now knows this is untrue. As does anybody who owns a car, or tractor or even a strip mall or manufacturing plant. Markets shift, and land and buildings – or equipment – can lose value amazingly quickly in a globally competitive world.

The best thing about equities is they can adapt to markets. A smart CEO leading a smart company can change strategy, and investments, overnight. Flexible, adaptable supply chains and distribution channels reduce the risk of ownership, while creating ongoing value. So equities can be the least risky investment option, if you keep yourself flexible and invest in flexible companies.

Hand-in-glove with this is recognizing that the best equities are not steeped in physical assets. Lots of land, buildings and equipment locks-in the P&L costs, even though competitors can obsolete those assets very quickly. And costs remain locked-in even though competition drives down prices. So investing in companies with lots of “hard” assets is riskier than investing in companies where the value lies in intellectual capital and flexibility.

Myth 2 – Invest Only In What You Know

This is profoundly ridiculous. We are humans. There is infinitely more we don’t know than what we do know. If we invest only in what we know we become horrifically non-diversified. And worse, just because we know something does not mean it is able to produce good returns – for anybody!

This was the mantra Warren Buffet used to turn down a chance to invest in Microsoft in 1980. Oops. Not that Berkshire Hathaway didn’t find other investments, but that sure was an easy one Mr. Buffett missed.

To invest smartly I don’t need to know a lot more than the really important trends. I don’t have to know electrical engineering, software engineering or be

an IT professional to understand that the desire to use digital mobile

products, and networks, is growing. I don’t have to be a bio-engineer to know that pharmaceutical solutions are coming very infrequently now, and the future is all in genetic developments and bio-engineered solutions. I don’t have to be a retail expert to know that the market for on-line sales is growing at a double digit rate, while brick-and-mortar retail is becoming a no-growth, dog-eat-margin competitive world (with all those buildings – see Myth 1 again.) I don’t have to be a utility expert to know that nobody wants a nuclear or coal plant nearby, so alternatives will be the long-term answer.

Investing in trends has a much, much higher probability of making good returns than investing in things that are not on major trends. Investing in what we know would leave most people broke; because lots of businesses have more competition than growth. Investing in businesses that are developing major trends puts the wind at your back, and puts time on your side for eventually making high returns.

Oh, and there are a lot fewer companies that invest in trends. So I don’t have to study nearly as many to figure out which have the best investment options, solutions and leadership.

Myth 3 – Dividends Are Important to Valuation

Dividends (or stock buybacks) are the admission of management that they don’t have anything high value into which they can invest, so they are giving me the money. But I am an investor. I don’t need them to give me money, I am giving them money so they will invest it to earn a rate of return higher than I can get on my own. Dividends are the opposite of what I want.

High dividends are required of some investments – like Real Estate Investment Trusts – which must return a percentage of cash flow to investors. But for everyone else, dividends (or stock buybacks) are used to manipulate the stock price in the short-term, at the expense of long-term value creation.

To make better than average returns we should invest in companies that have so many high return investment opportunities (on major trends) that the company really, really needs the cash. We invest in the company, which is a conduit for investing in high-return projects. Not paying a dividend.

Myth 4 – Long Term Investors Do Best By Purchasing an Index (or Giant Portfolio)

Go back to my introductory paragraphs. Saying you do best by doing average isn’t saying much, is it? And, honestly, average hasn’t been that good the last decade. And index investing leaves you completely vulnerable to the kind of “crashes” leading to this article – something every investor would like to avoid. Nobody invests to win sometimes, and lose sometimes. You want to avoid crashes, and make good rates of return.

Investors want winners. And investing in an index means you own total dogs – companies that almost nobody thinks will ever be competitive again – like Sears, HP, GM, Research in Motion (RIM), Sprint, Nokia, etc. You would only do that if you really had no idea what you are doing.

If you are buying an index, perhaps you should reconsider investing in equities altogether, and instead go buy a new car. You aren’t really investing, you are just buying a hodge-podge of stuff that has no relationship to trends or value cration. If you can’t invest in winners, should you be an investor?

1 Truth – Growing Companies Create Value

Not all companies are great. Really. Actually, most are far from great, simply trying to get by, doing what they’ve always done and hoping, somehow, the world comes back around to what it was like when they had high returns. There is no reason to own those companies. Hope is not a good investment theory.

Some companies are magnificent manipulators. They are in so many markets you have no idea what they do, or where they do it, and it is impossible to figure out their markets or growth. They buy and sell businesses, constantly confusing investors (like Kraft and Abbott.) They use money to buy shares trying to manipulate the EPS and P/E multiple. But they don’t grow, because their acquired revenues cost too much when bought, and have insufficient margin.

Most CEOs, especially if they have a background in finance, are experts at this game. Good for executive compensation, but not much good for investors. If the company looks like an acquisition whore, or is in confusing markets, and has little organic growth there is no reason to own it.

Companies that are developing major trends create growth. They generate internal projects which bring them more customers, higher share of wallet with their customers, and create new markets for new revenues where they have few, if any competition. By investing in trends they keep changing the marketplace, and the competition, giving them more opportunities to sell more, and generate higher margins.

Growing companies apply new technologies and new business practices to innovate new solutions solving new needs, and better solve old needs. They don’t compete head-on in gladiator style, lowering margins as they desperately seek share while cutting costs that kills innovation. Instead they ferret out new solutions which give them a unique market proposition, and allow them to produce lots of cash for adding to my cash in order to invest in even more new market opportunities.

If you had used these 4 myths, and 1 truth, what would your investments have been like since the year 2000? Rather than an index, or a manufacturer like GE, you would have bought Apple and Google. Remember, if you want to make money as an investor it’s not about how many equities you own, but rather owning equities that grow.

Growth hides a multitude of sins. If a company has high growth investors don’t care about free lunches for workers, private company planes, free iPhones for employees or even the CEO’s compensation. They aren’t trying to figure out if some acquisition is accretive, or if the desired synergies are findable for lowering cost. None of that matters if there is ample growth.

What an investor should care about, more than anything else, is whether or not there are a slew of new projects in the pipeline to keep fueling the growth. And if those projects are pursuing major trends. Keep your eye on that prize, and you just might avoid any future market crashes while improving your investment returns.

by Adam Hartung | Jul 14, 2011 | Investing, Leadership, Trends

When you go after competitors, does it more resemble a gladiator war – or a David vs. Goliath battle? The answer will likely determine your profitability. As a company, and as an investor.

After they achieve some success, most companies fall into a success formula – constantly tyring to improve execution. And if the market is growing quickly, this can work out OK. But eventually, competitors figure out how to copy your formula, and as growth slows many will catch you. Just think about how easily long distance companies caught the monopolist AT&T after deregulation. Or how quickly many competitors have been able to match Dell’s supply chain costs in PCs. Or how quickly dollar retailers – and even chains like Target – have been able to match the low prices at Wal-Mart.

These competitors end up in a gladiator war. They swing their price cuts, extended terms and other promotional weapons, leaving each other very bloody as they battle for sales and market share. Often, one or more competitors end up dead – like the old AT&T. Or Compaq. Or Circuit City. These gladiator wars are not a good thing for investors, because resources are chewed up in all the fighting, leaving no gains for higher dividends – nor any stock price appreciation. Like we’ve seen at Wal-Mart and Dell.

The old story of David and Goliath gives us a different approach. Instead of going “toe-to-toe” in battle, David came at the fight from a different direction – adopting his sling to throw stones while he remained safely out of Goliath’s reach. After enough peppering, he wore down the giant and eventually popped him in the head.

And that’s how much smarter people compete.

- When everyone was keen on retail stores to rent DVDs, Netflix avoided the gladiator war with Blockbuster by using mail delivery.

- While United, American, Continental, Delta, etc. fought each other toe-to-toe for customers in the hub-and-spoke airline wars (none making any money by the way) Southwest ferried people cheaply between smaller airports on direct flights. Southwest has made more money than all the “major” airlines combined.

- While Hertz, Avis, National, Thrifty, etc. spent billions competing for rental car customers at airports Enterprise went into the local communities with small offices, and now has twice their revenues and much higher profitability.

- When internet popularity started growing in the 1990s Netscape traded axe hits wtih Microsoft and was destroyed. Another browser pioneer, Spyglass, transitioned from PCs to avoid Microsoft, and started making browsers for mobile phones, TVs and other devices creating billions for investors.

- While GM, Ford and Chrysler were in a grinding battle for auto customers, spending billions on new models and sales programs, Honda brought to market small motorcycles and very practical, reliable small cars. Honda is now very profitable in several major markets, while the old gladiators struggle to survive.

As an investor, we should avoid buying stocks of companies, and management teams that allow themselves to be drug into gladiator wars. No matter what promises they make to succeed, their success is uncertain, and will be costly to obtain. What’s worse, they could win the gladiator war only to find themselves facing David – after they are exhausted and resources are spent!

- Research in Motion became embroiled in battles with traditional cell phone manufacturers like Nokia and Ericdson, and now is late to the smartphone app market – and with dwindling resources.

- Motorola fought the gladiator war trying to keep Razr phones competitive, only to completely miss its early lead in smartphones. Now it has limited resources to develop its Android smart phone line.

- Is it smart for Google to take on a gladiator war in social media against Facebook, when it doesn’t seem to have any special tool for the battle? What will this cost, while it simultaneously fights Apple in Android wars and Microsoft for Chrome sales?

On the other hand, it’s smart to invest in companies that enter growth markets, but have a new approach to drive customer conversion. For example, Zip Car rents autos by the hour for urban users. Most cars are very high mileage, which appeals to customers, but they also are pretty inexpensive to buy. Their approach doesn’t take-on the traditional car rental company, but is growing quite handily.

This same logic applies to internal company investments as well. Far too often the corporate reource allocation process is designed to fight a gladiator war. Constantly spending to do more of the same. Projects become over-funded to fight battles considered “necessity,” while new projects are unfunded despite having the opportunity for much higher rates of return.

In 2000, Apple could have chosen to keep pouring money into the Mac. Instead it radically cut spending, reduced Mac platforms, and started looking for new markets where it could bring in new solutions. IPods, iTunes, IPhones, iPads and iCloud are now driving growth for the company – all new approaches that avoided gladiator battles with old market competitors. Very profitable growth. Apple has enough cash on hand to buy every phone maker, except Samsung – or Apple could buy Dell – if it wanted to. Apple’s market cap is worth more than Microsoft and Intel combined.

If you want to make more money, it’s best to avoid gladiator wars. They are great spectator events – but terrible places to be a participant. Instead, set your organization to find new ways of competing, and invest where you are doing what competitors are not. That will earn the greatest rate of return.

by Adam Hartung | Aug 14, 2009 | Innovation, Investing, Music

This weekend marks the 40th anniversary of Woodstock, the rock concert that everyone remembers – even though almost none of us were there. Amidst all the tributes this weekend, I was taken by how much the music industry has changed during those 40 years – and how this industry can help us realize the need we all have to be adaptable.

When Woodstock occurred most music was listened to an a long-playing vinyl album, sold through a record store. Wow, have things changed. From albums to 8-tracks to cassettes to CDs and now MP-3 players. In just 40 years we went through 4 different technologies, and made at least 2 (8-tracks and cassettes) obsolete. Nobody at Woodstock was thinking about that, but it's made a huge difference in who makes money.

When you bought music in 1969 you went to an independent record store. Or Musicland, a retailer with over 1,000 stores in shopping centers that exclusively sold records – and 8-tracks. Now we buy almost all our music on-line. Either ordering a CD from someplace like Amazon, or downloading the music directly into a player with no physical item being shipped. Mass merchandisers like KMart and WalMart eventually made record shops obsolete, and increasingly the mass merchandisers are of less importance. Musicland went bankrupt.

In 1969 the artists made practically nothing from a concert. Concerts existed as promotional events for the records. An artist signed a multi-album deal with a record label – like EMI. The label offered a studio and put together the album. They then packaged it, and shipped it to record stores. For this, the band members got almost nothing. Only if the album sold well did they get any cash. So the record label told the musicians to go on the road and play. The objective was to do concerts so people got turned on to your tunes and went to buy them at the store. The musician didn't make anything until the album sold – in high volume.

In 1969 promoters paid the record label for the musician to pay, and the record label paid the musician. A promoter could not hire a musician, even if the musician wanted to play, unless the label agreed. Any performance fees were deducted from album royalties, so from the label's point of view the event fee was irrelevant. Headliners – a band that was already famous and trying to stay that way – usually took a big fee, but it was just an advance on royalties. There would be lesser known bands, and the label barely gave them enough money for gas because they didn't know if the album would ever sell enough to be profitable. "On the road" was a bad thing as far as musicians were concerned.

Tickets to Woodstock cost $18, and the promoters lost money (of course, about 90% of the attendees didn't pay). That's about $100 in today's money. Most promoters lived a grand life, but in reality made little money. Some events profited, but a lot didn't. The fee to the labels were high, and audiences were often not large enough. Not to mention bands that no-showed or arrived stoned because they didn't care — remember they got paid little to nothing. So eventually a couple of bad concerts in a row sent the promoter to bankruptcy court once too often and he ended up snorting cocaine in trailer-park-city.

Today, going to a 3 day event costs over $250 for tickets – and the promoters expect to profit in the millions. The labels get a lot less, as many musicians negotiate their own contracts. But the prices are high enough that the musician is guaranteed a rate of return, and the promoter is as well. And the promoter usually insures all events just in case the musician no-shows are turns up stoned. Unprofitable events are rare.

Labels no longer run the show. Musicians now can negotiate much better single-album deals because distribution is far easier. Musicians can self-publish if they like, selling their own tunes off their own websites. This has meant that top performers make unbelievable sums – far more than their counterparts in 1969. The Carpenters used to have to beg for money for a new car, while their albums sold millions. Now, because they can guarantee the big audiences, all that money the label used to take, the musicians get. So tens of millions flow their way. If you have any doubt, look at the private jets and helicopters owned and flown by the lead drummer for Pink Floyd. Or about any rapper on late night MTV. It would make a corporate CEO envious.

And the company that makes the most money of all in music is Apple. They have the biggest distribution system, and sell the most music. They don't have any artists on contract, don't produce any music, and don't carry any inventory. They just run a server farm that collects money and sends out digital files.

Of course, it's still tough to be a new musician. But you no longer have to sell your soul to a label. You can produce your own music, using affordable gear in your basement that's better than Joan Baez had in 1969 at the EMI studio. And you can sell the tunes yourself. If you work hard at promotion, including working those promoters to give you a warm-up slot, you can capture all the revenue from your songs from your own web site, and sign up your own distribution groups. It's much more in your own hands. Of course, that also means the labels don't have the money they once did to create an Elvis, or Beatles, or Rare Earth. So it's a lot more up to you to earn that money, rather than hope you get lucky and lots of label backing.

I doubt Jimi Hendrix would recognize anything about the music industry today. Of course, given how stoned he liked to get it's hard to imagine Jimi Hendrix being alive today.

Things change. We sometimes don't see them, because it's like watching the grass grow. You don't notice differences unless you compare two snapshots in time. Then we can see just how much things change. If you want to be a winner, you have to learn to shift with these changes. Only those who make the shifts survive. Just ask Barry Gordy, the one-time founder of Motown who saw his billion dollar business disappear. Now a footnote in history. For all of us to avoid becoming similar footnotes, the moral is to be ever vigilant about identifying and adapting to market shifts.

by Adam Hartung | Aug 4, 2009 | Innovation, Investing, Leadership, Software

A typical headline from last week read "Microsoft, Yahoo to Begin Joint Assault on Google". After a year of negotiating, the behemoth Microsoft finally came up with an accord to get some Yahoo technology in order to be more effective with its search engine product. "Microsoft to Tap 400 Yahoo Workers in Partnership" is the Marketwatch headline today trumpeting the plan to bring Yahoo engineers to Microsoft.

Will it make a difference? If we look at the trend, it looks doubtful (slide courtesy Silicon Alley Insider):

Of course, lots of folks think this isn't a very good idea. (Cartoon Courtesy DenverPost.com):

As John Dvorak pointed out in his column: "Microsoft and Yahoo Bring Google Good News." After all, the Google's competitors just went from 2 to 1 – a 50% reduction. What's more, the remaining player is not known for expertise in internet technology – merely its money hoard. Moreover, when it used its money hoard in the past it has rarely (never?) resulted in a success. No wonder BusinessWeek headlined "Microsoft and Yahoo: Too Little, Too Late, Too Hyped."

What's more intriguing to me is what this deal says about Microsoft. The company has already missed the market shift in search and ad placement. Search is "yesterday's news". Microsoft is still trying to fight the last war, not the next one. As it has done far too often, Microsoft remained Locked-in to its old Success Formula — all about the desktop and personal computing. It has not been part of the market shift to new applications and new ways of personal automation. That has been going to RIM, Apple, Oracle and other players. Microsoft has sat on its market share in the old market, piled up cash, but not taken the actions to be a winner in the next market – the next battle for growth. Now it's joint venture with Yahoo will strip out engineers, attempt to convert them to Microsoft ways of thinking, and put them into battle with not only the largest player in search and on-line ad placement – but the only one making money. And the one introducing new technologies and products on a regular basis.

Someone asked me last week "Who's the next GM?" I think they meant "who's the next big bankruptcy." But the better question here is "Who's the giant company that everyone thinks is competitively insurmountable, but at great risk of falling from market leadership into the Whirlpool – and eventual bankruptcy?" To that I say keep your eyes on Microsoft.

The comparisons between Microsoft and GM are striking:

- Early market leaders

- Developed near monopolies

- Challenged by the trust busters

- Created very high growth rates and huge cash hoards

- Considered a great place to work, with great longevity

- Bought up competitors

- Bought up technologies, and often never took them to market

- Became arrogant to customers

- Implemented a strong Success Formula that everyone was expected to follow

- Strong leaders that kept the companies "focused"

- Dominated their local geography as employers

- Tended to talk a lot about their past, and how what they've previously accomplished

- Tended to ignore competitors

- Avoided Disruptions – late to market with every product. Tried using marketing and money to succeed rather than being first with great products and solutions

- Never allowed White Space to develop anything new

This joint venture is not White Space. Microsoft may want to be in Search and ad sales, but the company is still relying on its old business to "carry it through." They have ignored Google and other competitors, and are trying to use the old Success Formula to compete with a much nimbler and more market-attuned competitor. They have ignored Disruptive innovations, and not developed any new solutions themselves. They have refused to allow White Space to develop new solutions for shifting market needs – instead trying to push the market to buy their solutions based on old ways of doing business. Don't forget that MSN and it's search engine have been in the market since the beginning – it's not like they just woke up to discover the market existed. Rather, they just started hinting that maybe, after 15 years of failing, they aren't doing the right things.

If you still own Microsoft stock, I predict a really bumpy ride. They won't go bankrupt soon. But GM spent 30 years going sideways for investors before finally going bankrupt. That looks like the future at Microsoft. If you're a vendor, expect poor returns to create a procurement environment intending to suck all profits out of your business. If you're a customer, expect "me too" products that are late, expensive and at best "lowest common denominator" in appearance and performance. If you're an employee, expect increased turnover, lot of infighting, increased internal politics, promotions based on reinforcing the status quo rather than results, and few opportunities for personal growth.

Employees, vendors and investors of Microsoft should read the free ebook "The Fall of GM: What Went Wrong and How To Avoid Its Mistakes." Everyone who has to deal with shifting markets needs to.

by Adam Hartung | May 18, 2009 | Books, Culture, Economy, Investing, Lifecycle, Phoenix

Twelve years in the making.

As professional business consultant with almost 30 years experience, Adam Hartung is all too familiar with a common malady among today’s businesses. Regardless of how much the leaders and organizations are struggling to grow revenues and profits they cannot seem to break out of below-expectation performance. Even when hiring top advisors, consultants and employees, results do not respond as expected. They seem stuck, and unable to make changes which will lead to superb performance.

Why? This question which sparked a more than 12 year analysis to determine the root of—and the solution to—the problem. Geoffrey Moore encouraged Adam to put his findings into a book, which he now endorses on the cover. The principles now covered in Create Marketplace Disruption have been affirmed as “fresh and much needed” by Tom Peters, and “a revolutionary message” by Malcolm Gladwell. Bill Gates’ co-author, Collins Hemingway, considers Create Marketplace Disruption a must read, as he details in the Foreword.

Business leadership has not yet made the transition from management in the industrial economy to management in the information economy. While much has been written about an information economy it has yet to fundamentally affect how leaders manage their organizations. True, computer technology has unleashed new business models and methods of competition. Yet most leaders are still using management techniques which were taught in the 1970s and developed for the industrial economy.

To a large degree, the current disconnect is to be expected. The Russian economist Kondratiev demonstrated that economies move on a particularly long wave of approximately 75 years. He postulated that this was due to major changes in technology which took a very long time to reach adoption, massive use, decline and eventual replacement by another important new technology. Initially, the technology is used merely to improve existing processes and speed existing competitive models as we have seen with computer technology. Eventually, the full impact of the new technology creates new methods of competition which obviates the old, ushering in new rates of productivity and new methods of growth. We are at this fulcrum today.

For decades companies have prospered through “Defend and Extend” (D&E) Management—establishing a Success Formula, then improving and protecting it against competitors. In the Industrial Economy this worked well because size, economies of scale, and entry barriers were important. But today, due primarily to the emergence of information transparency, Success Formulas are being duplicated practically overnight—robbing companies of their competitive advantage. Practicing D&E Management in this environment is a prescription for failure, and yet that is what almost every company, large and small, is doing. And how most leaders are trying to get ahead.

In the three year period ending in 2003, bankruptcies of public companies increased 855% over the three year period ending just five years prior, and for companies with assets over a billion dollars the increase was an astounding 1,750%. To reverse this trend, companies must turn conventional wisdom on its head. Instead of looking to their Success Formulas as the solution to their problems, companies must learn to see their Success Formulas as the source of their problems. Companies must embrace the Phoenix Principle and become both willing and able to reinvent their Success Formulas… over and over again.

In recent years, Adam Hartung met with hundreds of senior executives. Almost every business leader sang the same sad refrain: every quarter of every year is a brutal struggle to make their numbers. Most admit that they don’t really know what to do to make things any better—nothing they have tried has made a sustainable difference. Historical tactics, including mergers and acquisitions, extensive cost-cutting, streamlining processes, outsourcing, and various quality programs have made little or no impact on competitiveness.

Well-meaning but increasingly outdated advice from business gurus such as Jim Collins and Larry Bossidy to focus on execution and optimize the core business are only making matters worse. Create Marketplace Disruption uses The Phoenix Principle to rebut the “optimize and execute” message while providing simple but powerful models that explain why so many companies are struggling to such an extent. The author illustrates with many convincing examples and case studies how the inevitable consequence of D&E Management has been lock-in to outdated Success Formulas leading to worsening performance. This has resulted in a vicious cycle of cost-cutting and profit erosion, eventually leading to failure.

D&E Management causes managers to behave as if their organizations are exempt from market and competitive shifts which can make their Success Formula obsolete. Many managers cling to the myth of business perpetuity as a rationalization for their mature companies to use continuous improvement as a way to create, then maintain, above average returns—even when the evidence overwhelmingly indicates otherwise. The hard truth is that the techniques Michael Porter published for competing in the 1980s no longer generate sustainable competitive advantage. Entry barriers are now exit barriers, supplier and customer leverage are short-lived, and focus on product innovation and cost reduction is far less likely to create success than implementing alternative business models.

Business leaders must embrace a new model for managing based on The Phoenix

Principle. This entails rethinking the traditional approach to organizational lifecycle management in several ways, including making profits in the growth stage, planning on very short periods of competitive advantage, and exiting businesses much quicker than before. The Phoenix Principle emphasizes leaders’ responsibility for disrupting existing Success Formulas in order to experiment with new and innovative profit opportunities. While agreeing with author Clayton Christensen on many points, the author confronts Clayton’s claim that established companies cannot compete against, nor implement, disruptive technologies. Instead, the author demonstrates a process whereby any organization can most definitely enhance innovation, growth and change, including installing a culture of continuous renewal through new processes and changes in the employee mix.

Create Marketplace Disruption provides readers with hope that even the most locked-in organizations can renew themselves. Through a four-phase approach backed up with solid examples, business managers will learn how to reinvent locked-in Success Formulas at the individual, work team, business function, operating unit and company levels. This book provides the vernacular and practical “how to” information to undertake the “Re-Imagining” recommended by Tom Peters. Additionally, the author introduces readers to breakthrough thinking, which is the ability to challenge and change assumptions at the individual level. Readers are given powerful tools for transforming Locked-in behaviors, and developing new solutions for today’s dynamic business competition in the Information Economy.

This book will help beleaguered business managers understand why their organizations are struggling, why their actions not only aren’t helping but are contributing to the problem, and how leaders and individuals can Disrupt and reinvent their Locked-in Success Formulas to generate significant breakthroughs in performance.

by Adam Hartung | Mar 5, 2009 | Investing, Trends, Uncategorized

I've never met anyone who says they speculate in the stock market. My colleagues always say they are investors; people who know what they were doing and savvy about the market. But, reality is that most people speculate. Because they don't invest on underlying business value. Instead, they rely on words from "gurus" and follow trends. That, unfortunately, is speculating.

Back on 12/21/08 (just a couple of months ago) the DJIA was at 8960, the S&P 918. Looking at The Chicago Tribune for that day, the primary recommendation by analysts for 2009 was "Keep an eye on long-term horizons" and "weather out the storm". The markets were down, but don't panic. Famed investment maven Elaine Garzarelli recommended if you had $10k in cash to invest $2k in tech stocks, $2k in Citigroup Preferred, $2k in GE and $2k in an income-oriented fund. Then put $2k into a short fund to hedge your risks! She couldn't have been more dead wrong on the only two named companies – GE and C. Both are at modern, or all time, lows. Don Phillip, managing director at Morningstar, recommended investing all $10K in equities because "they've taken an unprecedented hit and are very cheap."

When you hear investment gurus, on TV or elsewhere, tell you to "stay the course, the market always recovers" they are basing their opinions on history – not the future. This isn't last year, or the last recession, or the last economy. Will all economies eventually recover? Maybe not. Will the U.S. economy recover in your lifetime? Not assured – Japan has been in a recession for over a decade! Does that mean American companies will be the ones to lead the world in the next upmarket? Not assured. These "gurus" have been dead wrong for almost a year – and at the most important time in your investment history. If they were so wrong for the last year, why are they still on TV? Why are you listening?

In the short term, stock markets are driven by momentum. When most people are buying, the markets keep going up. Even for individual stocks. Sears had no reason to go up in value after being acquired by Ed Lampert's KMart corporation. Sears and Kmart were overleveraged, earning below-market rates of return, and with assets that had long lost their luster. But because Jim Cramer of CNBC Mad Money fame knew and liked Mr. Lampert he kept talking up the stock. Other hedge fund operators thought Mr. Lampert had been clever in the past, so they guessed he knew something they didn't and they speculated in his investment. The value went up 10x – and then came down 90%. Wild ride – but in the history of markets unless you are a speculator, you should never have invested in Sears. When you hear "don't be a market timer" remember that the only way to make money in Sears was to be a market timer – you had to buy and sell at the right time because the company wasn't able to increase its value. Sears' Success Formula was out of date, and there was no sign of a plan for the future, nor obsession about market changes and competitors, nor willingness to Disrupt old behaviors nor White Space. From the beginning this was a bad investment, and it has remained that way.

Today the market remains driven by momentum. Who wants to say they are buying stocks when the major averages keep falling? What CEO wants to say he's optimistic when it's popular to present "caution"? Who wants to discuss opportunities for markets in 2015 being 3x bigger when right now demand for industrial products like cars is down 20-40%? When momentum is up, you can't find a pessimistic CEO. Nor a pessimistic investor. So the likewise is equally true.

Reality is that there are good investments today, and bad. If a business is firmly locked into the industrial economy, such as GM and Ford, making the same products in much the same way to sell to pretty much the same customers, but with new competitors entering from all around - those companies are not good investments. Regardless of the rate of economic growth or debt availability. Their Lock-in to outdated Success Formulas means that their rates of return will not improve, even if overall economic growth does. Markets have shifted, and keep shifting. Businesses that were not profitable in the old market aren't going to suddenly be better competitors in a future market. Just the opposite is more likely. Even if they survive in a foxhole for a year or two, when they come out the market will be filled with new competitors just as vicious as the old ones.

But there are businesses positioning themselves for the markets of tomorrow. Apple with its iPod, iTunes, iPhone is an example. Google with its near monopoly on internet ad placement and management as well as search. And companies that are moving toward new markets rather than remaining frozen in the old model and exacerbating weaknesses with cost cutting. Like Domino's pizza.

GM will never again be a great car company. So what's new? That was clear in 1980 when Chairman Roger Smith said the company had a limited future in autos operating as it always had. That doesn't mean GM couldn't again be a growing, healthy company if new management sent the company in search of new markets with growth opportunities. Like Singer getting out of sewing machines to be a defense contractor in the 1980s. By purchasing an old-fashioned mortgage bank, and an old fashioned investment bank/retail brokerage, Bank of America is not strengthening its position for future markets. Instead, it is fighting the last war. But any company can change its competitive position if it chooses to focus on, and invest in, new markets. And those who do it NOW will be first into the new markets and able to change competitive position. When markets shift, those who move to the new competitiveness first gain the advantage. And their position is reinforced by competitors who dive for cover through cost cuts not tied to business repositioning.

Why is GM still on the DJIA? They should have been removed years ago. That's how the Dow intelligentsia keeps the average always going up – by taking off companies like Sears and replacing them with companies that are more closely linked to where markets are going (at the time, Home Depot). If we swapped out GM for Google, and Kraft for Apple, the numbers on the DJIA would be considerably better than we see today. And if you want to make money as an investor, you have to do the same thing. You have to dump companies that are unwilling to break out of Lock-in to outdated business models and invest in companies who are heading full force into future markets. In all markets there are good investments. But you have to find the companies that plan for the future, not the past – obsess about competitors – are not afraid to Disrupt themselves and markets – and utilize White Space to test new products and services that can create growth no matter what the economy.