by Adam Hartung | Mar 22, 2017 | In the Whirlpool, Investing, Retail

(Photo by Scott Olson/Getty Images)

Traditional retailers just keep providing more bad news. Payless Shoes said it plans to file bankruptcy next week, closing 500 of its 4,000 stores. Most likely it will follow the path of Radio Shack, which hasn’t made a profit since 2011. Radio Shack filed bankruptcy and shut a gob of stores as part of its “turnaround plan.” Then in February Radio Shack filed its second bankruptcy — most likely killing the chain entirely this time.

Sears Holdings finally admitted it probably can’t survive as a going concern this week. Sears has lost over $10 billion since 2010 — when it last showed a profit — and owes over $4 billion to its creditors. Retail stocks cratered Monday as the list of retailers closing stores accelerated: Sears, KMart, Macy’s, Radio Shack, JCPenney, American Apparel, Abercrombie & Fitch, The Limited, CVS, GNC, Office Depot, HHGregg, The Children’s Place and Crocs are just some of the household names that are slowly (or not so slowly) dying.

None of this should be surprising. By the time CEO Ed Lampert merged KMart with Sears the trend to e-commerce was already pronounced. Anyone could build an excel spreadsheet that would demonstrate as online retail grew, brick-and-mortar retail would decline. In the low margin world of retail, profits would evaporate. It would be a blood bath. Any retailer with any weakness simply would not survive this market shift — and that clearly included outdated store concepts like Sears, KMart and Radio Shack which long ago were outflanked by on-line shopping and trendier storefronts.

Yet, not everyone is ready to give up on some retailers. Walmart, for example, still trades at $70 per share, which is higher than it traded in 2015 and about where it traded back in 2012. Some investors still think that there are brick-and-mortar outfits that are either immune to the trends, or will survive the shake-out and have higher profits in the future.

And that is why we have to be very careful about business myths. There are a lot of people that believe as markets shrink the ultimate consolidation will leave one, or a few, competitors who will be very profitable. Capacity will go away, and profits will return. In the end, they believe if you are the last buggy whip maker you will be profitable — so investors just need to pick who will be the survivor and wait it out. And, if you believe this, then you have justified owning Walmart.

Only, markets don’t work that way. As industries consolidate they end up with competitors who either lose money or just barely eke out a small profit. Think about the auto industry, airlines or land-line telecom companies.

Two factors exist which effectively forces all the profits out of these businesses and therefore make it impossible for investors to make money long-term.

First, competitive capacity always remains just a bit too much for the market need. Management, and often investors, simply don’t want to give up in the face of industry consolidation. They keep hoping to reach a rainbow that will save them. So capacity lingers and lingers — always pushing prices down even as costs increase. Even after someone fails, and that capacity theoretically goes away, someone jumps in with great hopes for the future and boosts capacity again. Therefore, excess capacity overhangs the marketplace forcing prices down to break-even, or below, and never really goes away.

Given the amount of retail real estate out there and the bargains being offered to anyone who wants to open, or expand, stores this problem will persist for decades in retail.

Second, demand in most markets keeps declining. Hopefuls project that demand will “stabilize,” thus balancing the capacity and allowing for price increases. Because demand changes aren’t linear, there are often plateaus that make it appear as if demand won’t go down more. But then something changes — an innovation, regulatory change, taste change — and demand takes another hit. And all the hope goes away as profits drop, again.

It is not a successful strategy to try being the “last man standing” in any declining market. No competitor is immune to these forces when markets shift. No matter how big, when trends shift and new forms of competition start growing every old-line company will be negatively affected. Whether fast, or slow, the value of these companies will continue declining until they eventually become worthless.

Nor is it successful long-term to try and segment the business into small groupings which management thinks can be protected. When Xerox brought to market photocopying, small offset press manufacturers (ABDick and Multigraphics ) said not to worry. Xeroxing might be OK in some office installations, but there were customer segments that would forever use lithography. Even as demand shrunk, well into the 1990s, they said that big corporations, industrial users, government entities, schools and other segments would forever need the benefits of lithography, so investors were safe. Today the small offset press market is a tiny fraction of its size in the 1960s. ABDick and Multigraphics both went through rounds of bankruptcies before disappearing. Xerography, its child desktop publishing, and its grandchild electronic screens, killed offset for almost all applications.

So don’t be lured into false hopes by retailers who claim their segment is “protected.” Short-term things might not look bad. But the market has already shifted to e-commerce and this is just round one of change. More and more innovations are coming that will make the need for traditional stores increasingly unnecessary.

Many readers have expressed their disappointment in my chronic warnings about Walmart. But those warnings are no different than my warnings about Sears Holdings. It’s just that the timing may be different. Both companies have been over-investing in assets (brick-and-mortar stores) that are declining in value as they have attempted to defend and extend their old business model. Both radically under-invested in new markets which were cannibalizing their old business. And, in the end, both will end up with the same results.

And this is true for all retailers that depend on traditional brick-and-mortar sales for their revenues and profits — it’s only a matter of when things will go badly, not if. So traditional retail is nowhere that any investor wants to be.

by Adam Hartung | Aug 26, 2016 | In the Swamp, Investing, Retail, Trends

Photographer: Luke Sharrett/Bloomberg

Walmart is in more trouble than its leadership wants to acknowledge. Investors

need to realize that it is up to Jet.com to turn around the ailing giant. And

that is a big task for the under $1 billion company.

Relevancy Is Hard To Keep – Look At Sears

Nobody likes to think their business can disappear. What CEO wants to tell his investors or employees “we’re no longer relevant, and it looks like our customers are all going somewhere else for their solutions”? Unfortunately, most leadership teams become entrenched in the business model and deny serious threats to longevity, thus leading to inevitable failure as customers switch.

Gallery: “Walmart Goes Small”

In early September the Howard Johnson’s in Bangor, Maine will close. This will leave just one remaining HoJo in the USA. What was once an iconic brand with hundreds of outlets strung along the fast growing interstate highway system is now nearly dead. People still drive the interstate, but trends changed, fast food became a good substitute, and unable to update its business model this once great brand died.

AP Photo/Elise Amendola

Sears announced another $350 million quarterly loss this week. That makes $9 billion in accumulated losses the last several quarters. Since Chairman and CEO Ed Lampert took over, Sears and Kmart have seen same store sales decline every single quarter except one. Unable to keep its customers Mr. Lampert has been closing stores and selling assets to stem the cash drain. But to keep the company afloat his hedge fund, ESL, is loaning Sears Holdings SHLD -2.94% another $300 million. On top of the $500 million the company borrowed last quarter. That the once iconic company, and Dow Jones Industrial Average component, is going to fail is a foregone conclusion.

But most people still think this fate cannot befall the nearly $500 billion revenue behemoth Walmart. It’s simply too big to fail in most people’s eyes.

Walmart’s Crime Problem Is Another Telltale Sign Of Problems In The Business Model

Yet, the primary news about Walmart is not good. Bloomberg this week broke the news that one of the most crime-ridden places in America is the local Walmart store. One store in Tulsa, Oklahoma has had 5,000 police visits in the last five years, and four local stores have had 2,000 visits in the last year alone. Across the system, there is one violent crime in a Walmart every day. By constantly promoting its low cost strategy Walmart has attracted a class of customer that simply is more prone to committing crime. And policies implemented to hang onto customers, like letting them camp out overnight in the parking lots, serve to increase the likelihood of poverty-induced crime.

But this outcome is also directly related to Walmart’s business model and strategy. To promote low prices Walmart has automated more operations, and cut employees like greeters. Thus leadership brags about a 23% increase in sales/employee the last decade. But that has happened as the employment shrank by 400,000. Fewer employees in the stores encourages more crime.

In a real way Walmart has “outsourced” its security to local police departments. Experts say the cost to eliminate this security problem are about $3.2 billion – or about 20% of Walmart’s total profitability. Ouch! In a world where Walmart’s net margin of 3% is fully one-third lower than Target’s 4.6% the money just isn’t there any longer for Walmart to invest in keeping its stores safe.

With each passing month Walmart is becoming the “retailer of last resort” for people who cannot shop online. People who lack credit cards, or even bank accounts. People without the means, or capability, of shopping by computer, or paying electronically. People who have nowhere else to go to shop, due to poverty and societal conditions. Not exactly the ideal customer base for building a growing, profitable business.

Competitors Relentlessly Pick Away At Walmart’s Sales And Profits

To maintain revenues the last several years Walmart has invested heavily in transitioning to superstores which offer a large grocery section. But now Kroger KR -0.5%, Walmart’s no. 1 grocery competitor, is taking aim at the giant retailer, slashing prices on 1,000 items. Just like competition from the “dollar stores” has been attacking Walmart’s general merchandise aisles. Thus putting even more pressure on thinning margins, and leaving less money available to beef up security or entice new customers to the stores.

And the pressure from e-commerce is relentless. As detailed in the Wall Street Journal, Walmart has been selling online for about 15 years, and has a $14 billion online sales presence. But this is only 3% of total sales. And growth has been decelerating for several quarters. Last quarter Walmart’s e-commerce sales grew 7%, while the overall market grew 15% and Amazon ($100 billion revenues) grew 31%. It is clear that Walmart.com simply is not attracting enough customers to grow a healthy replacement business for the struggling stores.

Thus the acquisition of Jet.com.

The hope is that this extremely unprofitable $1 billion online retailer will turn around Walmart’s fortunes. Imbue it with much higher growth, and enhanced profitability. But will Walmart make this transition. Is leadership ready to cannibalize the stores for higher electronic sales? Are they willing to make stores smaller, and close many more, to shift revenues online? Are they willing to suffer Amazon-like profits (or losses) to grow? Are they willing to change the Walmart brand to something different, while letting Jet.com replace Walmart as the dominant brand? Are they willing to give up on the past, and let new leadership guide the company forward?

If they do then Walmart could become something very different in the future. If they really realize that the market is shifting, and that an extreme change is necessary in strategy and tactics then Walmart could become something very different, and remain competitive in the highly segmented and largely online retail future. But if they don’t, Walmart will follow Sears into the whirlpool, and end up much like Howard Johnson’s.

by Adam Hartung | Jul 7, 2016 | Books, Entrepreneurship, Leadership, Marketing

Summer is here, and everyone needs a business book or two to read. I’m recommending The Founder’s Mentality – How To Overcome the Predictable Crises of Growth by two very senior partners and strategy practice heads at Bain & Company — Chris Zook and James Allen. Bain is one of the top three management consulting firms in the world, with 8,000 consultants in 55 offices, and has been ranked as one of the best places to work in America by Glass Ceiling.

Since both authors are still part of Bain, the book is somewhat bridled by their positions. No partner can bad mouth current or former clients, as it obviously could reveal confidential information — and it certainly isn’t good for finding new clients who would never want to risk being bad-mouthed by their consultant. So don’t expect a lambasting of poorly performing companies in this review of global cases. But after reviewing the work at their clients for over 20 years, and many other cases available via research, these fellows concluded that most companies lose the original founder’s mentality, get bound up in organizational complexity, and simply lose competitiveness due to the wrong internal focus. And they offer insights for how underperformers can regain a growth agenda.

Photo courtesy of Chris Zook

Moving From Mediocre To Good

I interviewed Chris Zook, and found him rather candid in his observations. When I asked why people should read The Founder’s Mentality I really liked his response, “Many people have read Good to Great. But, honestly, for many organizations the challenge today is simply to move from mediocre to good. They are struggling, and they need some straightforward advice on how to make progress toward growth when the situation likely appears almost impossible.”

You should read the book to understand the common root cause of corporate growth problems, and how a company can address those issues. This column offers some interesting thoughts from Chris about how to apply The Founder’s Mentality to eliminate unnecessary complexity and make your organization more successful.

Adam Hartung: What is the most critical step toward undoing needless, costly, time consuming complexity?

Chris Zook: The biggest problem is blockages built between the front line and the top staff. Honestly, the people at the top lose any sense of what is actually happening in the marketplace — what is happening with customers. 80% of the time successfully addressing this requires eliminating 30-40% of the staff. You need non-incremental change. Leaders have to get rid of managers wedded to past decisions, and intent on defending those decisions. Leaders have to get rid of those who focus on managing what exists, and find competent replacements who can manage a transition.

Hartung: Market shifts make companies non-competitive, why do you focus so much on internal organizational health?

Zook: You can’t respond to a market shift if the company is bound up in complex decision-making. Unless a leader attacks complexity, and greatly simplifies the decision-making process, a company will never do anything differently. Being aware of changes in the market is not enough. You have to internalize those changes and that requires reorganizing, and usually changing a lot of people. You won’t ever get the information from the front line to top management unless you change the internal company so that it is receptive to that information.

Hartung: You say simplification is critical to reversing a company’s stall-out. But isn’t focusing on the “core” missing market opportunities?

Zook: Analysts cheered Nardeli’s pro-growth actions at Home Depot. But the company stalled. The growth opportunities that external folks liked hearing about diverted attention from implementing what had made Home Depot great — the “orange army” of store employees that were so customer helpful. It is very, very hard to keep “growth projects” from diverting attention to good operations, and that’s why few founders are willing to chase those projects when someone brings them up for investment.

Hartung: You talk positively about Cisco and 3M, yet neither has done anything lately, in any market, to appear exemplary

Zook: It takes a long time to turn around a huge company. Cisco and 3M are still the largest in their defined markets, and profitable. Their long-term future is still to be determined, but so far they are making progress. Investors and market gurus look for turnarounds to happen fast, but that does not fit the reality of what it takes when these companies become very large.

Hartung: You talk about “Next Generation Leaders.” Isn’t that just more ageism? Aren’t you simply saying “out with the old leaders, you have to be young to “get it.”

Zook: Next Generation Leadership is not about age. It’s about mentality. It’s about being young, and flexible, in your thinking. What’s core to a company may well not be what a previous leader thinks, and a Next Gen Leader will dig out what’s core. For example, at Marvel the core was not comics. It was the raft of stories, all of which had the potential to be repurposed. Next Gen Leaders are using new eyes, dialed in with clarity to discover what is in the company that can be reused as the core for future growth. You don’t have to be young to do that, just mentally agile. Unfortunately, there aren’t nearly as many of these agile leaders as there are those stuck in the old ways of thinking.

Hartung: Give me your take on some big companies that aren’t in your book, but that are in the news today and on the minds of leaders and investors. Apply The Founder’s Mentality to these companies:

Microsoft

Zook: Did well due to its monopoly. Lost its Founder’s Mentality. Now suffering low growth rates relative to its industry, and in the danger zone of a growth stall-out. They have to refocus. Leadership needs to regain the position of attracting developers to their platform rather than being raided for developers by competitive platforms.

Apple

Zook: Jobs implemented The Founder’s Mentality brilliantly. Apple got close to its customers again with the retail stores, a great move to learn what customers really wanted, liked and would buy. But where will they turn next? Apple needs to make a big bet, and focus less on upgrades. They need to be thinking about a possible stall-out. But will Apple’s current leadership make that next big bet?

WalMart

Zook: One of the greatest founder-led companies of all time. Walton’s retail insurgency was unique, clear and powerful. Things appear to be a bit stale now, and the company would benefit from a refocusing on the insurgency mission, and taking it into renewal of the distribution system and all the stores.”

It’s been almost a decade since I wrote Create Marketplace Disruption – How To Stay Ahead of the Competition. In it I detailed how companies, in the pursuit of best practices build locked-in decision-making systems that perpetuate the past rather than prepare for the future. The Founder’s Mentality provides several case studies in how organizations, especially large ones, can attack that lock-in to rediscover what made them great and set a chart for a better future. Put it on your reading list for the next plane flight, or relaxation time on your holiday.

by Adam Hartung | May 20, 2016 | E-Commerce, Investing, Retail, Trends

WalMart announced 1st quarter results on Thursday, and the stock jumped almost 10% on news sales were up versus last year. It was only $1.1B on $115B, about 1%, but it was UP! Same store sales were also up 1%, but analysts pointed out that was largely due to lower prices to hold competitors at bay.

While investors cheered the news, at the higher valuation WalMart is still only worth what it was in June, 2012 (just under $70/share.) From then through August, 2015 WalMart traded at a higher valuation – peaking at $90 in January, 2015. Subsequent fears of slower sales had driven the stock down to $56.50 by November, 2015. So this is a recovery for crestfallen investors the last year, but far from new valuation highs.

Unfortunately, this is likely to be just a blip up in a longer-term ongoing valuation decline for WalMart. And that value will be captured by those who understand the most important, undeniable trend in retail.

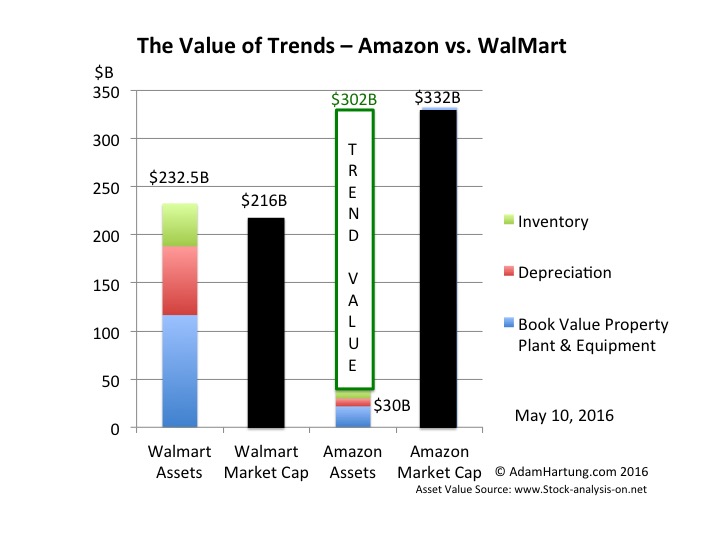

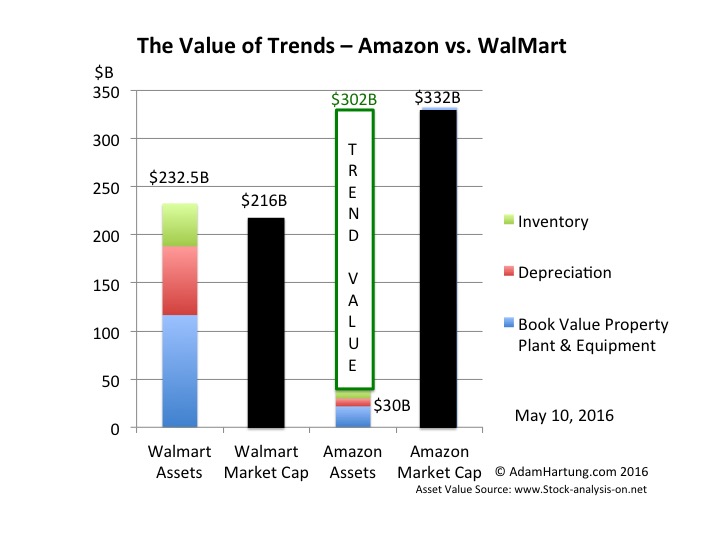

(c) AdamHartung.com Data Sources: Yahoo Finance and www.trend-stock-analysis-on.net

Although the numbers for WalMart’s valuation are a bit better than when the associated chart was completed last week, as you can see WalMart’s assets are greater than the company’s total valuation. This is because the return on its assets, today and projected, are so low that WalMart must borrow money in order to make them overall worthwhile. And the fact that on the balance sheet, at book value, the assets appear to be some $50B lower due to depreciation, and the difference be cost and market value.

This is because WalMart competes almost entirely in the intensely competitive and asset-dense market of traditional brick-and-mortar retail. This requires a lot of land, buildings, shelves and inventory. And that market is barely growing. Maybe 1-2%/year.

Compare t his with Amazon. Amazon has about $30B of assets. Yet its valuation is over $330B. So Amazon captures an extra value of $300B by competing in the asset sparse market of on-line retailing where it needs little land, few buildings, far less shelving and a lot less inventory. And it is competing in a market the Commerce Department says is growing at 15%/year.

The trend to on-line sales is extremely important, as it has entirely different customer acquisition and retention requirements, and very different ways of competing. Amazon understands those trends, and continues to lead its rivals. Today on-line retail is 10.5% of all non-restaurant, non-bar retail. And that 15% growth rate accounts for 60% of ALL the growth in this retail segment. Amazon keeps advancing, growing as fast (or faster) than the industry average, especially in key categories. Meanwhile, despite its vast resources and best efforts WalMart admitted its on-line sales growth is only 7% – half the segment growth rate – and its growth is decelerating.

By understanding this one trend – a very big, important, powerful trend – Amazon captures more value than the current value of ALL the Walmart stores, distribution centers and their contents. With all those assets WalMart can only convince investors it is worth about $200B. With about 13% of the assets used by WalMart, Amazon convinces investors it is worth 33% more than WalMart – over $330B. That’s $300B of value created just by knowing where the market is headed, and how to deliver for customers in that future market.

Yes, Amazon has other businesses, such as AWS cloud services and tech products in tablets, smartphones and smart speakers. But these too (some not nearly as successful as others, mind you) are very much on trends. WalMart once dominated retail technology with its massive computer systems and enormous databases. But WalMart limited itself to using its technology to defend & extend its core traditional retail business via store forecasts, optimized distribution and extensive pricing schemes. Amazon is monetizing its technology prowess by, again, leveraging trends and making its services and products available to others.

How does this apply to you? When someone asks “If you could have anything you want, what would you ask for?” most of us would start with health, happiness, peace and similar intangibles for us, our families and mankind. But if forced to make a tangible selection, we would ask for an asset. Buildings, equipment, cash. Yet, as WalMart and Amazon show us, those assets are only as valuable as what you do with them. And thus, it is more valuable to understand the trends, and how to use assets wisely for greatest value, than it is to own a pile of assets.

So the really important question is “Do you know what trends are going to be important to your business, and are you implementing a strategy to leverage those key trends?” If you are trying to protect your assets, you will likely be overwhelmed by the trend leader. But if you really understand the trends and are ready to act on them, you could be the one to capture the most value in your marketplace, and likely without adding a lot more costly assets.

by Adam Hartung | Feb 24, 2016 | Defend & Extend, In the Swamp, Leadership

Walmart announced quarterly financial results last week, and they were not good. Sales were down $500million vs the previous year, and management lowered forecasts for 2016. And profits were down almost 8% vs. the previous year. The stock dropped, and pundits went negative on the company.

But if we take an historical look, despite how well WalMart’s value has done between 2011 and 2014, there are ample reasons to forecast a very difficult future. Sailors use small bits of cloth tied to their sails in order to get early readings on the wind. These small bits, called telltales, give early signs that good sailors use to plan their navigation forward. If we look closely at events at WalMart we can see telltales of problems destined to emerge for the retailing giant:

1 – In March, 2008 WalMart sued a brain damaged employee. The employee was brain damaged by a truck accident. WalMart’s insurance paid out $470,000 in health care cost. The employee’s family sued the trucking company, at their own expense, and won a $417,000 verdict for lost future wages, pain and suffering and future care needs. Then, WalMart decided it would sue the employee to recover the health care costs it had previously paid. As remarkable as this seems, it is a great telltale. It demonstrates a company so focused on finding ways to cut costs, and so insensitive to its employees and the plight of its customers that it loses all common sense. Not to mention the questionable ethics of this action, it at the very least demonstrates blatant disregard for the PR impact of its actions. It shows a company where management feels it is unquestionable, and a believe its brand is untouchable.

1 – In March, 2008 WalMart sued a brain damaged employee. The employee was brain damaged by a truck accident. WalMart’s insurance paid out $470,000 in health care cost. The employee’s family sued the trucking company, at their own expense, and won a $417,000 verdict for lost future wages, pain and suffering and future care needs. Then, WalMart decided it would sue the employee to recover the health care costs it had previously paid. As remarkable as this seems, it is a great telltale. It demonstrates a company so focused on finding ways to cut costs, and so insensitive to its employees and the plight of its customers that it loses all common sense. Not to mention the questionable ethics of this action, it at the very least demonstrates blatant disregard for the PR impact of its actions. It shows a company where management feels it is unquestionable, and a believe its brand is untouchable.

2 – In March, 2010 AdAge ran a column about WalMart being “stuck in the middle” and effectively becoming the competitive “bulls-eye” of retailing. After years of focusing on its success formula, “dollar store” competition was starting to undermine it on cost and price at the low end, while better merchandise and store experience boxed WalMart from higher end competitors – that often weren’t any more expensive. This was the telltale sign of a retailer that had focused on beating up its suppliers for years, cutting them out of almost all margin, without thinking about how it might need to change its business model to grow as competitors chopped up its traditional marketplace.

3 – In October, 2010 Fortune ran an article profiling then-CEO Mike Duke. It described an executive absolutely obsessive about operational minutia. Banana pricing, underwear inventory, cereal displays – there was no detail too small for the CEO. Another telltale of a company single-mindedly focused on execution, to the point of ignoring market shifts created by changing consumer tastes, improvements at competitors and the rapid growth of on-line retailing. There was no strategic thinking happening at WalMart, as executives believed there would never be a need to change the strategy.

4 – In April, 2012 WalMart found itself mired in a scandal regarding bribing Mexican government officials in its effort to grow sales. WalMart had never been able to convert its success formula into a growing business in any international market, but Mexico was supposedly its breakout. However, we learned the company had been paying bribes to obtain store sites and hold back local competitors. A telltale of a company where pressure to keep defending and extending the old business was so great that very highly placed executives do the unethical, and quite likely the illegal, to make the company look like it is performing better.

5 – In July, 2014 a WalMart truck driver hits a car seriously injuring comedian Tracy Morgan and killing his friend. While it could be taken as a single incident, the truth was that the driver had been driving excessive hours and excessive miles, not complying with government mandated rest periods, in order to meet WalMart distribution needs. This telltale showed how the company was stressed all the way down into the heralded distribution environment to push, push, push a bit harder to do more with less in order to find extra margin opportunities. What once was successful was showing stress at the seams, and in this case it led to a fatal accident by an employee.

6 – In January, 2015 we discovered traditional brick-and-mortar retail sales fell 1% from the previous year. The move to on-line shopping was clearly a force. People were buying more on-line, and less in stores. This telltale bode very poorly for all traditional retailers, and it would be clear that as the biggest WalMart was sure to face serious problems.

7 – In July, 2015 Amazon’s market value exceeds WalMart’s. Despite being quite a bit smaller, Amazon’s position as the on-line retail leader has investors forecasting tremendous growth. Even though WalMart’s value was not declining, its key competition was clearly being forecast to grow impressively. The telltale implies that at least some, if not a lot, of that growth was going to eventually come directly from the world’s largest traditional retailer.

8 – In January, 2016 we learn that traditional retail store sales declined in the 2015 holiday season from 2014. This was the second consecutive year, and confirmed the previous year’s numbers were the start of a trend. Even more damning was the revelation that Black Friday sales had declined in 2013, 2014 and 2015 strongly confirming the trend away from Black Friday store shopping toward Cyber Monday e-commerce. A wicked telltale for the world’s largest store system.

9 – In January, 2016 we learned that WalMart is reacting to lower sales by closing 269 stores. No matter what lipstick one would hope to place on this pig, this telltale is an admission that the retail marketplace is shifting on-line and taking a toll on same-store sales.

10 – We now know WalMart is in a Growth Stall. A Growth Stall occurs any time a company has two consecutive quarters of lower sales versus the previous year (or two consecutive declining back-to-back quarters.) In the 3rd quarter of 2015 Walmart sales were $117.41B vs. same quarter in 2014 $119.00B – a decline of $1.6B. Last quarter WalMart sales were $129.67B vs. year ago same quarter sales of $131.56B – a decline of $1.9B. While these differences may seem small, and there are plenty of explanations using currency valuations, store changes, etc., the fact remains that this is a telltale of a company that is already in a declining sales trend. And according to The Conference Board companies that hit a Growth Stall only maintain a mere 2% growth rate 7% of the time – the likelihood of having a lower growth rate is 93%. And 95% of stalled companies lose 25% of their market value, while 69% of companies lose over half their value.

WalMart is huge. And its valuation has actually gone up since the Great Recession began. It’s valuation also rose from 2011- 2014 as Amazon exploded in size. But the telltale signs are of a company very likely on the way downhill.

1 –

1 –