The Dow Jones Industrial Average has been around for about 100 years. It is 30 of the largest market capitalization companies in the USA.

Lots of people think “the Dow,” as it is often called, is the value of the market. This is pretty far from correct, as there are literally thousands of stocks traded on the NYSE and NASDAQ. Better gauges of the overall market would be the NYSE Composite, or the NASDAQ composite. Or even the Wilshire 5000. These much larger data sets are better reflections of the overall stock market.

Some investors, especially small investors or those with little financial training, confuse “the Dow” with the S&P 500. The latter is simply the 500 largest public companies reviewed and evaluated for credit worthiness by Standard & Poors. Obviously, with 500 stocks it is 14 times broader than “the Dow.” So many would say it is a better market indicator than the DJIA.

Yet, lots of people refer to the DJIA, with little understanding of how it is created – and what it really means.

Simply put, the founder of Dow Jones and Company wrote a series of articles form about 1880 to 1900 on investing and stocks. After his death, editors at Dow Jones thought it would be good to consolidate his thoughts into an investing theory, which they called the Dow Theory.

Simply put, they developed three indices based upon a subset of stocks. One was an index of industrial companies, which were largely in commodities like coal, cotton, sugar and tobacco. The second was an index of transportation companies (called the Dow Transports) which was initially loaded with railroads and ocean shippers. The third were the emerging utility companies (Dow Utilities) which were gas distributors and electricity generation/distribution companies.

The Dow Theory was to watch these 3 indices. If two started to move in tandem, up or down, then this was considered an indicator of where the overall market would move in short order. If all 3 move together then it was considered a very strong bullish, or bearish, sign. Dow Theory was the first effort at predicting future stock movements.

After 100 years of academic research, not a lot of people use Dow Theory any longer. It has been replaced with 1,001 different approaches to predicting stock movement. And as other approaches have been created, the Dow Transports and the Dow Utilities are largely forgotten.

But the DJIA still carries a lot of attention. It has changed dramatically over time. The editors at Dow Jones (publisher of the Wall Street Journal and other business publications) review the list and update it. After WWII they determined that Industrials were better represented by steel companies, auto companies and other large manufacturers. Thus they dropped older commodity companies, just as their shares declined, and added companies like GM.

As the economy changed over time, many changes were made to the DJIA. As financial services grew, big banks were added. As retail grew, huge retailers and consumer goods companies were added. As pharmaceuticals grew, they were added. As computer tech grew, large tech companies were added. Each time someone was added, someone was dropped. The only company from the original list is GE.

“The Dow” was continuously “rebalanced.” Thus, even though many companies that were once on the Dow are now completely gone, and many others are in bad shape. Former DJIA companies include: Kodak, Sears, Woolworths, International Harvester, General Motors, Chrysler, Johns-Manville, General Foods, National Steel, Loew’s Theatres.

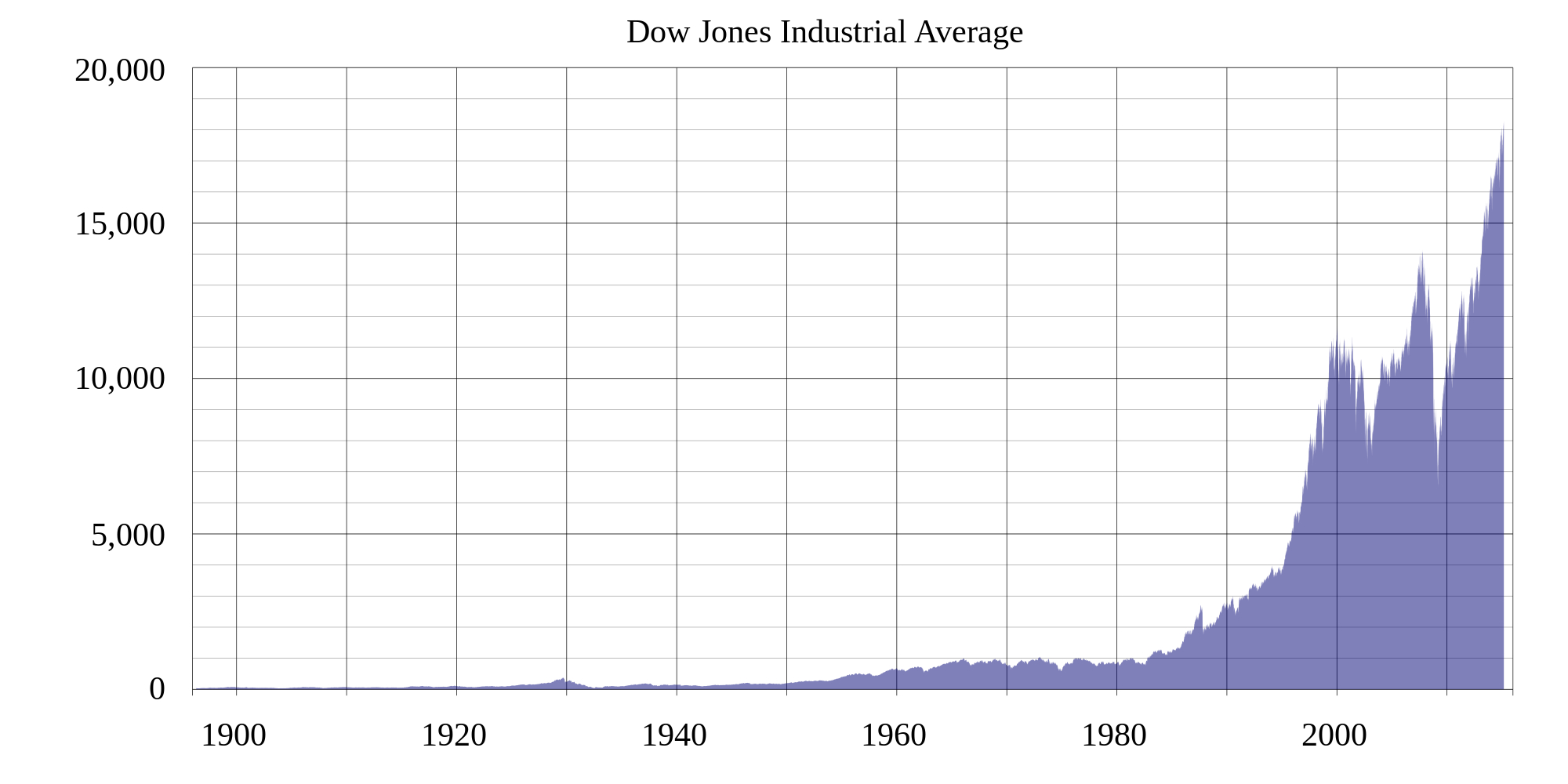

Thus, the DJIA has had a great upward run for over 100 years. Because it isn’t “the market.” Rather, it is a handful of stocks selected by some of the very top leaders in business. These leaders constantly look to keep the index in growth sectors, while eliminating declining sectors. And removing companies that do really badly – like GM, which filed bankruptcy. In other words, this is an index of the very largest – and some would say safest – companies in America that have a growth capability.

Which is why it is so hard for individual investors – and even pros – to outperform the DJIA. While they tinker around with investments in individual “hot” stocks, and shorting “losers,” overall they rarely can do as well as the DJIA. For all their rebalancing and predicting, only 1 in 4 (or 1 in 5) beat the DJIA in the short term. Long term, only 2 out 2,862 funds have consistently beat the DJIA.

So, by adding Apple the editors are again setting up the DJIA for future growth. AT&T was removed, for the second time. In 2004 it was taken out as AT&T faced bankruptcy. Southwestern Bell bought the AT&T name, and it was added back again. Now it is gone – probably for good – because telecom simply doesn’t have the growth of other sectors like mobile devices.

This is one of the few investment opportunities where “the little guy” gets a tremendous break. Anyone can buy the DJIA. By purchasing Diamonds (Symbol DIA) anyone can buy the DJIA index. You don’t have to do any individual stock buys, nor track changes and do rebalancing. You don’t even have to deal with stock dividends, splits, etc. because the pros will do all of that for you. And, you can buy Diamonds via a low cost on-line broker like e-Trade or ScotTrade and your transaction costs are minimal – less than what you’d pay a mutual fund manager (who is unlikely to do as well as your Diamonds.)

I think most investors are fools to try timing the market. Most people have jobs far removed from financial services and analyzing companies. Even more people have little academic training in how to analyze financial statements, company reports, projections and market opportunities. Heck, if the pros who do this full time can’t beat the DJIA, do most of us have any chance at all?

The DJIA has had a great run the last several years. Investing in the DJIA has outperformed about all other investments, with the best growth rate compared to highly cyclical commodities like gold, or real estate and certainly bonds. And because it isn’t “the market,” but rather a carefully selected basket of large cap stocks, it offers investors the greatest probability of long-term gains with least risk and volatility.

Adding Apple to the DJIA shows that the folks at Dow Jones are keeping their eyes on the proverbial ball. It should encourage investors. And, if you want to share in the growth of equities without having to spend all your free time doing research – or paying high fees – simply buying DIA is a great option.