by Adam Hartung | Aug 6, 2014 | Defend & Extend, In the Whirlpool, Innovation, Lifecycle, Web/Tech

Remember the RAZR phone? Whatever happened to that company?

Motorola has a great tradition. Motorola pioneered the development of wireless communications, and was once a leader in all things radio – as well as made TVs. In an earlier era Motorola was the company that provided 2-way radios (and walkie-talkies for those old enough to remember them) not only for the military, police and fire departments, but connected taxies to dispatchers, and businesses from electricians to plumbers to their “home office.”

Motorola was the company that developed not only the thing in a customer’s hand, but the base stations in offices and even the towers (and equipment on those towers) to allow for wireless communication to work. Motorola even invented mobile telephony, developing the cellular infrastructure as well as the mobile devices. And, for many years, Motorola was the market share leader in cellular phones, first with analog phones and later with digital phones like the RAZR.

But that was the former Motorola, not the renamed Motorola Solutions of today. The last few years most news about Motorola has been about layoffs, downsizings, cost reductions, real estate sales, seeking tenants for underused buildings and now looking for a real estate partner to help the company find a use for its dramatically under-utilized corporate headquarters campus in suburban Chicago.

How did Motorola Solutions become a mere shell of its former self?

Unfortunately, several years ago Motorola was a victim of disruptive innovation, and leadership reacted by deciding to “focus” on its “core” markets. Focus and core are two words often used by leadership when they don’t know what to do next. Too often investment analysts like the sound of these two words, and trumpet management’s decision – knowing that the code implies cost reductions to prop up profits.

But smart investors know that the real implication of “focusing on our core” is the company will soon lose relevancy as markets advance. This will lead to significant sales declines, margin compression, draconian actions to create short-term P&L benefits and eventually the company will disappear.

Motorola’s market decline started when Blackberry used its server software to help corporations more securely use mobile devices for instant communications. The mobile phone transitioned from a consumer device to a business device, and Blackberry quickly grabbed market share as Motorola focused on trying to defend RAZR sales with price reductions while extending the RAZR platform with new gimmicks like additional colors for cases, and adding an MP3 player (called the ROKR.) The Blackberry was a game changer for mobile phones, and Motorola missed this disruptive innovation as it focused on trying to make sustaining improvements in its historical products.

Of course, it did not take long before Apple brought out the iPhone and with all those thousands of apps changed the game on Blackberry. This left Motorola completely out of the market, and the company abandoned its old platform hoping it could use Google’s Android to get back in the game. But, unfortunately, Motorola brought nothing really new to users and its market share dropped to nearly nothing.

The mobile phone business quickly overtook much of the old Motorola 2-way radio business. No electrician or plumber, or any other business person, needed the old-fashioned radios upon which Motorola built its original business. Even police officers used mobile phones for much of their communication, making the demand for those old-style devices rarer with each passing quarter.

But rather than develop a new game changer that would make it once again competitive, Motorola decided to split the company into 2 parts. One would be the very old, and diminishing, radio business still sold to government agencies and niche business applications. This business was profitable, if shrinking. The reason was so that leadership could “focus” on this historical “core” market. Even if it was rapidly becoming obsolete.

The mobile phone business was put out on its own, and lacking anything more than an historical patent portfolio, with no relevant market position, it racked up quarter after quarter of losses. Lacking any innovation to change the market, and desperate to get rid of the losses, in 2011 Motorola sold the mobile phone business – formerly the industry creator and dominant supplier – to Google. Again, the claim was this would allow leadership to even better “focus” on its historical “core” markets.

But the money from the Google sale was invested in trying to defend that old market, which is clearly headed for obsolescence. Profit pressures intensify every quarter as sales are harder to find when people have alternative solutions available from ever improving mobile technology.

As the historical market continued to weaken, and leadership learned it had under-invested in innovation while overspending to try to defend aging solutions, Motorola again cut the business substantially by selling a chunk of its assets – called its “enterprise business” – to a much smaller Zebra Technologies. The ostensible benefit was it would now allow Motorola leadership to even further “focus” on its ever smaller “core” business in government and niche market sales of aging radio technology.

But, of course, this ongoing “focus” on its “core” has failed to produce any revenue growth. So the company has been forced to undertake wave after wave of layoffs. As buildings empty they go for lease, or sale. And nobody cares, any longer, about Motorola. There are no news articles about new products, or new innovations, or new markets. Motorola has lost all market relevancy as its leaders used “focus” on its “core” business to decimate the company’s R&D, product development, sales and employment.

Retrenchment to focus on a core market is not a strategy which can benefit shareholders, customers, employees or the community in which a business operates. It is an admission that the leaders missed a major market shift, and have no idea how to respond. It is the language adopted by leaders that lack any vision of how to grow, lack any innovation, and are quickly going to reduce the company to insignificance. It is the first step on the road to irrelevancy.

Straight from Dr. Christensen’s “Innovator’s Dilemma” we now have another brand name to add to the list of those which were once great and meaningful, but now are relegated to Wikipedia historical memorabilia – victims of their inability to react to disruptive innovations while trying to sustain aging market positions – Motorola, Sears, Montgomery Wards, Circuit City, Sony, Compaq, DEC, American Motors, Coleman, Piper, Sara Lee………..

by Adam Hartung | Jul 28, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Web/Tech

Over the last couple of weeks big announcements from Apple, IBM and Microsoft have set the stage for what is likely to be Microsoft’s last stand to maintain any sense of personal technology leadership.

Custer Tries Holding Off An Unstoppable Native American Force

To many consumers the IBM and Apple partnership probably sounded semi-interesting. An app for airplane fuel management by commercial pilots is not something most people want. But what this announcement really amounted to was a full assault on regaining dominance in the channel of Value Added Resellers (VARs) and Value Added Dealers (VADs) that still sell computer “solutions” to thousands of businesses. Which is the last remaining historical Microsoft stronghold.

Think about all those businesses that use personal technology tools for things like retail point of purchase, inventory control, loan analysis in small banks, restaurant management, customer data collection, fluid control tracking, hotel check-in, truck routing and management, sales force management, production line control, project management — there is a never-ending list of business-to-business applications which drive the purchase of literally millions of devices and applications. Used by companies as small as a mom-and-pop store to as large as WalMart and JPMorganChase. And these solutions are bundled, sold, delivered and serviced by what is collectively called “the channel” for personal technology.

This “channel” emerged after Apple introduced the Apple II running VisiCalc, and businesses wanted hundreds of these machines. Later, bundling educational software with the Apple II created a near-monopoly for Apple channel partners who bundled solutions for school systems.

But, as the PC emerged this channel shifted. IBM pioneered the Microsoft-based PC, but IBM had long used a direct sales force. So its foray into personal computing did a very poor job of building a powerful sales channel. Even though the IBM PC was Time magazine’s “Man of the Year” in 1982, IBM lost its premier position largely because Microsoft took advantage of the channel opportunity to move well beyond IBM as a supplier.

Microsoft focused on building a very large network of developers creating an enormous variety of business-to-business applications on the Windows+Intel (Wintel) platform. Microsoft created training programs for developers to use its operating system and tools, while simultaneously cultivating manufacturers (such as Dell and Compaq) to build low cost machines to run the software. “Solution selling” was where VARs bundled what small businesses – and even many large businesses – needed by bringing together developer applications with manufacturer hardware.

It only took a few years for Microsoft to overtake Apple and IBM by dominating and growing the VAR channel. Apple did a poor job of creating a powerful developer network, preferring to develop everything users should want itself, so quickly it lacked a sufficient application base. IBM constantly tried to maintain its direct sales model (and upsell clients from PCs to more expensive hardware) rather than support the channel for developing applications or selling solutions based on PCs.

But, over the last several years Microsoft played “bet the company” on its launch of Windows 8. As mobile grew in hardware sales exponentially, and PC sales flattened (then declined,) Microsoft was tepid regarding any mobile offering. Under former CEO Steve Ballmer, Microsoft preferred creating an “all-in-one” solution via Win8 that it hoped would keep PC sales moving forward while slowly allowing its legions of Microsoft developers to build Win8 apps for mobile Surface devices — and what it further hoped would be other manufacturer’s tablets and phones running Win8.

This flopped. Horribly. Apple already had the “installed base” of users and mobile developers, working diligently to create new apps which could be released via its iTunes distribution platform. As a competitive offering, Google had several years previously launched the Android operating system, and companies such as HTC and Samsung had already begun building devices. Developers who wanted to move beyond Apple were already committed to Android. Microsoft was simply far too late to market with a Win8 product which gave developers and manufacturers little reason to invest.

Now Microsoft is in a very weak position. Despite much fanfare at launch, Microsoft was forced to take a nearly $1B write-off on its unsellable Surface devices. In an effort to gain a position in mobile, Microsoft previously bought phone maker Nokia, but it was simply far too late and without a good plan for how to change the Apple juggernaut.

Apple is now the dominant player in mobile, with the most users, developers and the most apps. Apple has upended the former Microsoft channel leadership position, as solution sellers are now offering Apple solutions to their mobile-hungry business customers. The merger with IBM brings even greater skill, and huge resources, to augmenting the base of business apps running on iOS and its devices (presently and in the future.) It provides encouragement to the VARs that a future stream of great products will be coming for them to sell to small, medium and even large businesses.

Caught in a situation of diminishing resources, after betting the company’s future on Windows 8 development and launch, and then seeing PC sales falter, Microsoft has now been forced to announce it is laying off 18,000 employees. Representing 14% of total staff, this is Microsoft’s largest reduction ever. Costs for the downsizing will be a massive loss of $1.1-$1.6B – just one year (almost to the day) after the huge Surface write-off.

Recognizing its extraordinarily weak market position, and that it’s acquisition of Nokia did little to build strength with developers while putting it at odds with manufacturers of other mobile devices, the company is taking some 12,000 jobs out of its Nokia division – ostensibly the acquisition made at a cost of $7.2B to blunt iPhone sales. Every other division is also suffering headcount reductions as Microsoft is forced to “circle the wagons” in an effort to find some way to “hold its ground” with historical business customers.

Today Apple is very strong in the developer community, already has a distribution capability with iTunes to which it is adding mobile payments, and is building a strong channel of VARs seeking mobile solutions. The IBM partnership strengthens this position, adds to Apple’s iOS developers, guarantees a string of new solutions for business customers and positions iOS as the platform of choice for VARs and VADs who will use iBeacon and other devices to help businesses become more capable by utilizing mobile/cloud technology.

Meanwhile, Microsoft is looking like the 7th Cavalry at the Little Bighorn. Microsoft is surrounded by competitors augmenting iOS and Android (and serious cloud service suppliers like Amazon,) resources are depleting as sales of “core” products stagnate and decline and write-offs mount, and watching as its “supply line” developer channel abandons Windows 8 for the competitive alternatives.

CEO Nadella keeps saying that that cloud solutions are Microsoft’s future, but how it will effectively compete at this late date is as unclear as the email announcement on layoffs Nokia’s head Stephen Elop sent to employees. Keeping its channel, long the source of market success for Microsoft, from leaving is Microsoft’s last stand. Unfortunately, Nadella’s challenge puts him in a position that looks a lot like General Custer.

by Adam Hartung | Jul 15, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership

Famed actor and comedian Tracy Morgan has filed a lawsuit against Walmart. He was seriously injured, and his companion and fellow comedian James McNair was killed, when their chauffeured vehicle was struck by a WalMart truck going too fast under the control of an overly tired driver.

It would be easy to write this off as a one-time incident. As something that was the mistake of one employee, and not a concern for management. Walmart is huge, and anyone could easily say “mistakes will happen, so don’t worry.” And as the country’s largest company (by sales and employees) Walmart is an easy target for lawsuits.

But that would belie a much more concerning situation. One that should have investors plenty worried.

Walmart isn’t doing all that well. It is losing customers, even as the economy recovers. For a decade Walmart has struggled to grow revenues, and same store sales have declined – only to be propped up by store closings. Despite efforts to grow offshore, attempts at international expansion have largely been flops. Efforts to expand into smaller stores have had mixed success, and are marginal at generating new revenues in urban efforts. Meanwhile, Walmart still has no coherent strategy for on-line sales expansion.

Unfortunately the numbers don’t look so good for Walmart, a company that is absolutely run by numbers. Every single thing that can be tracked in Walmart is tracked, and managed – right down the temperature in every facility (store, distribution hub, office) 24x7x365. When the revenue, inventory turns, margin, distribution costs, etc. aren’t going in the right direction Walmart is a company where leadership applies the pressure to employees, right down the chain, to make things better.

Unfortunately, a study by Northwestern University Kellogg School of Management has shown that when a culture is numbers driven it often leads to selfish, and unethical, behavior. When people are focused onto the numbers, they tend to stretch the ethical (and possibly legal) boundaries to achieve those numerical goals. A great recent example was the U.S. Veterans Administration scandal where management migrated toward lying about performance in order to meet the numerical mandates set by Secretary Shinseki.

Back in November, 2012 I pointed out that the Walmart bribery scandal in Mexico was a warning sign of big problems at the mega-retailer. Pushed too hard to create success, Walmart leadership was at least skirting with the law if not outright violating it. I projected these problems would worsen, and sure enough by November the bribery probe was extended to Walmart’s operations in Brazil, China and India.

We know from the many employee actions happening at Walmart that in-store personnel are feeling pressure to do more with fewer hours. It does not take a great leap to consider it possible (likely?) that distribution personnel, right down to truck drivers are feeling pressured to work harder, get more done with less, and in some instances being forced to cut corners in order to improve Walmart’s numbers.

Exactly how much the highest levels of Walmart knows about any one incident is impossible to gauge at this time. However, what should concern investors is whether the long-term culture of Walmart – obsessed about costs and making the numbers – has created a situation where all through the ranks people are feeling the need to walk closer to ethical, and possibly legal, lines. While it may be that no manager told the driver to drive too fast or work too many hours, the driver might have felt the pressure from “higher up” to get his load to its destination at a certain time – or risk his job, or maybe his boss’s.

If this is a widespread cultural issue – look out! The legal implications could be catastrophic if customers, suppliers and communities discover widespread unethical behavior that went unchecked by top echelons. The C suite executives don’t have to condone such behavior to be held accountable – with costs that can be exorbitant. Just ask the leaders at JPMorganChase and Citibank who are paying out billions for past transgressions.

Worse, we cannot expect the marketplace pressures to ease up any time soon for Walmart. Competitors are struggling mightily. JCPenney cannot seem to find anyone to take the vacant CEO job as sales remain below levels of several years ago, and the chain is most likely going to have to close several dozen (or hundreds) of stores. Sears/KMart has so many closed and underperforming stores that practically every site is available for rent if anyone wants it. And in the segment which is even lower priced than Walmart, the “dollar stores,” direct competitor Family Dollar saw 3rd quarter profits fall another 33% as too many stores and too few customer wreak financial havoc and portend store closings.

So the market situation is not improving for Walmart. As competition has intensified, all signs point to a leadership which tried to do “more, better, faster, cheaper.” But there is no way to maintain the original Walmart strategy in the face of the on-line competitive onslaught which is changing the retail game. Walmart has continued to do “more of the same” trying to defend and extend its old success formula, when it was a disruptive innovator that stole its revenues and cut into profits. Now all signs point to a company which is in grave danger of over-extending its success formula to the point of unethical, and potentially illegal, behavior.

If that doesn’t scare the heck out of Walmart investors I can’t imagine what would.

by Adam Hartung | Jul 8, 2014 | Current Affairs, Food and Drink, In the Whirlpool, Leadership

Crumbs Bake Shop – a small chain of cupcake shops, almost totally unknown outside of New York City and Washington, DC – announced it was going out of business today. Normally, this would not be newsworthy. Even though NASDAQ traded, Crumbs small revenues, losses and rapidly shrinking equity made it economically meaningless. But, it is receiving a lot of attention because this minor event signals to many people the end of the “cupcake trend” which apparently was started by cable TV show “Sex and the City.”

However, there are actually 2 very important lessons all of us can learn from the rise, and fall, of Crumbs Bake Shop:

1 – Don’t believe in the myth of passion when it comes to business

Many management gurus, and entrepreneurs, will tell you to go into business following something about which you are passionate. The theory goes that if you have passion you will be very committed to success, and you will find your way to success with diligence, perseverance, hard work and insight driven by your passion. Passion will lead to excellence, which will lead to success.

And this is hogwash.

Customers don’t care about your passion. Customers care about their needs. Rather than being a benefit, passion is a negative because it will cause you to over-invest in your passion. You will “never say die” as you keep trying to make success out of an idea that has no chance. Rather than investing your resources into something that fulfills people’s needs, you are likely to invest in your passion until you burn through all your resources. Like Crumbs.

The founders of Crumbs had a passion for cupcakes. But, they had no way to control an onslaught of competitors who could make different variations of the product. All those competitors, whether isolated cupcake shops or cupcakes offered via kiosks or in other shops, meant Crumbs was in a very tough fight to maintain sales and make money. It’s not you (and your passion) that controls your business destiny. Nor is your customers. Rather, it is your competition.

When there are lots of competitors, all capable of matching your product, and of offering countless variations of your product, then it is unlikely you can sustain revenues – or profits. There are many industries where cutthroat competition means profits are fleeting, or downright elusive. Airlines come to mind. Magazines. And many retail segments. It doesn’t matter how much passion you have, when there are too many competitors it’s a lousy business.

2 – Trends really do matter

Cupcakes were a hot product for a while. And that’s great. But it wasn’t hard to imagine that the trend would shift, and cupcakes would be displaced by something else. Whatever profits you might have when you sit on a trend, those profits evaporate fast when the trend shifts and all competitors are fighting for sales in a declining market.

Remember Mrs. Field’s cookies? In the 1980s an attractive cook and her investment banker husband built a business on soft, chewy, warm cookies sold in malls and retail streets across America. It seemed nobody could get enough of those chocolate chip cookies.

But then, one day, we did. We’d collectively had enough cookies, and we simply quit buying them. Mrs. Fields (and other cookie brand) stores were rapidly replaced with pretzels and other foodstuffs.

Or look at Krispy Kreme donuts. In the 1990s people went crazy for them, often lining up at stores waiting for the neon sign to come on saying “hot donuts”. The company exploded into 400 stores as the stock flew like a kite. But then, in a very short time, people had enough donuts. There were a lot more donut shops than necessary, and Krispy Kreme went bankrupt.

So it wasn’t hard to predict that shifting food tastes would eventually put an end to cupcake sales growth. Yet, Crumbs really didn’t prepare for trends to change. Despite revenue and profit problems, the leadership did not admit that cupcake sales had peaked, the market was going to decline, competition would become even more intense and Crumbs would need to find another business if it was to survive.

Few trends move as fast as tastes in sweets. But, trends do affect all businesses. Once we bought cameras (and film,) but now we use phones – too bad for Kodak. Once we used copiers, now we use email – too bad for Xerox. Once we watched TV, now we download from Netflix or Amazon – too bad for NBC, ABC, CBS and Comcast. Once we went to stores, now we order on-line – too bad for Sears. Once we used PCs, now we use mobile devices – too bad for Microsoft. These trends did not affect these companies as fast as shifting tastes affected Crumbs, but the importance of understanding trends and preparing for change is a constant part of leadership.

So Crumbs Bake Shop failure was one which could have been avoided. Leadership needed to overcome its passion for cupcakes and taken a much larger look at customer needs to find alternative products. It wasn’t hard to identify that some diversification was going to be necessary. And that would have been much easier if they had put in place a system to track trends, observing (and admitting) that their “core” market was stalled and they needed to move into a new trend category.

by Adam Hartung | Jun 19, 2014 | Current Affairs, Disruptions, In the Swamp, Leadership, Web/Tech

Yesterday Amazon launched its new Kindle Fire smartphone.

“Ho-hum” you, and a lot of other people, said. “Why?” “What’s so great about this phone?”

The market is dominated by Apple and Samsung, to the point we no longer care about Blackberry – and have pretty much forgotten about all the money spent by Microsoft to buy Nokia and launch Windows 8. The world doesn’t much need a new smartphone maker – as we’ve seen with the lack of excitement around Google/Motorola’s product launches. And, despite some gee-whiz 3D camera and screen effects, nobody thinks Amazon has any breakthrough technology here.

But that would be completely missing the point. Amazon probably isn’t even thinking of competing heads-up with the 2 big guns in the smartphone market. Instead, Amazon’s target is everyone in retail. And they should be scared to death. As well as a lot of consumer products companies.

Amazon’s new Kindle Fire smartphone

Apple’s iPod and iPhones have some 400,000 apps. But most people don’t use over a dozen or so daily. Think about what you do on your phone:

- Talk, texting and email

- Check the weather, road conditions, traffic

- Listen to music, or watch videos

- Shopping (look for products, prices, locations, specs, availability, buy)

Now, you may do several other things. But (maybe not in priority,) these are probably the top 4 for 90% of people.

If you’re Amazon, you want people to have a great shopping experience. A GREAT experience. You’ve given folks terrific interfaces, across multiple platforms. But everything you do with an app on iPhones or Samsung phones involves negotiating with Apple or Google to be in their store – and giving them revenue. If you could bypass Apple and Google – a form of retail “middleman” in Amazon’s eyes – wouldn’t you?

Amazon has already changed retail markedly. Twenty years ago a retailer would say success relied on 2 things:

- Store location and layout. Be in the right place, and be easy to shop.

- Merchandise the goods well in the store, and have them available.

Amazon has killed both those tenets of retail. With Amazon there is no store – there is no location. There are no aisles to walk, and no shelves to stock. There is no merchandising of products on end caps, within aisles or by tagging the product for better eye appeal. And in 40%+ cases, Amazon doesn’t even stock the inventory. Availability is based upon a supplier for whom Amazon provides the storefront and interface to the customer, sending the order to the supplier for a percentage of the sale.

And, on top of this, the database at Amazon can make your life even easier, and less time consuming, than a traditional store. When you indicate you want item “A” Amazon is able to show you similar products, show you variations (such as color or size,) show you “what goes with” that product to make sure you buy everything you need, and give you different prices and delivery options.

Many retailers have spent considerably training employees to help customers in the store. But it is rare that any retail employee can offer you the insight, advice and detail of Amazon. For complex products, like electronics, Amazon can provide detail on all competitive products that no traditional store could support. For home fix-ups Amazon can provide detailed information on installation, and the suite of necessary ancillary products, that surpasses what a trained Home Depot employee often can do. And for simple products Amazon simply never runs out of stock – so no asking an aisle clerk “is there more in the back?”

And it is impossible for any brick-and-mortar retailer to match the cost structure of Amazon. No stores, no store employees, no cashiers, 50% of the inventory, 5-10x the turns, no “obsolete inventory,” no inventory loss – there is no way any retailer can match this low cost structure. Thus we see the imminent failure of Radio Shack and Sears, and the chronic decline in mall rents as stores go empty.

Some retailers have tried to catch up with Amazon offering goods on-line. But the inventory is less, and delivery is still often problematic. Meanwhile, as they struggle to become more digital these retailers are competing on ground they know precious little about. It is becoming commonplace to read about hackers stealing customer data and wreaking havoc at Michaels Stores and Target. Thus on-line customers have far more faith in Amazon, which has 2 decades of offering secure transactions and even offers cloud services secure enough to support major corporations and parts of the U.S. government.

And Amazon, so far, hasn’t even had to make a profit. It’s lofty price/earnings multiple of 500 indicates just how little “e” there is in its p/e. Amazon keeps pouring money into new ways to succeed, rather than returning money to shareholders via stock buybacks or dividends. Or dumping it into chronic store remodels, or new store construction.

Today, you could shop at Amazon from your browser on any laptop, tablet or phone. Or, if you really enjoy shopping on-line you can now obtain a new tablet or phone from Amazon which makes your experience even better. You can simply take a picture of something you want, and your new Amazon smartphone will tell you how to buy it on-line, including price and delivery. No need to leave the house. Want to see the product in full 360 degrees? You have it on your 3D phone. And all your buying experience, customer reviews, and shopping information is right at your fingertips.

Amazon is THE game changer in retail. Kindle was a seminal product that has almost killed book publishers, who clung way too long to old print-based business models. Kindle Fire took direct aim at traditional retailers, from Macy’s to Wal-Mart, in an effort to push the envelope of on-line shopping. And now the Kindle Fire smartphone puts all that shopping power in your palm, convenient with your other most commonplace uses such as messaging, fact finding, listening or viewing.

This is not a game changing smartphone in comparison with iPhone 5 or Galaxy S 5. But, as another salvo in the ongoing war for controlling the retail marketplace this is another game changer. It continues to help everyone think about how they shop today, and in the future. For anyone in retail, this may well be seen as another important step toward changing the industry forever, and making “every day low prices” an obsolete (and irrelevant) retail phrase. And for consumer goods companies this means the need to distribute products on-line will forever change the way marketing and selling is done – including who makes how much profit.

by Adam Hartung | May 30, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Sports, Web/Tech

Anyone who reads my column knows I’ve been no fan of Steve Ballmer as CEO of Microsoft. On multiple occasions I chastised him for bad decisions around investing corporate funds in products that are unlikely to succeed. I even called him the worst CEO in America. The Washington Post even had difficulty finding reputable folks to disagree with my argument.

Unfortunately, Microsoft suffered under Mr. Ballmer. And Windows 8, as well as the Surface tablet, have come nowhere close to what was expected for their sales – and their ability to keep Microsoft relevant in a fast changing personal technology marketplace. In almost all regards, Mr. Ballmer was simply a terrible leader, largely because he had no understanding of business/product lifecycles.

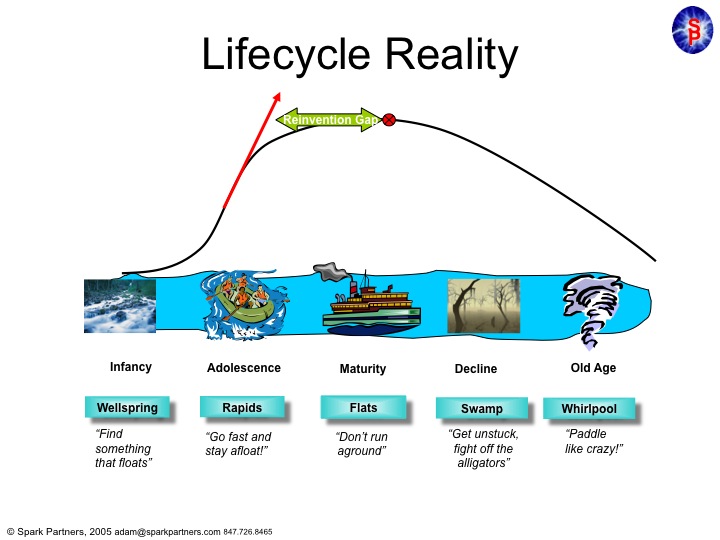

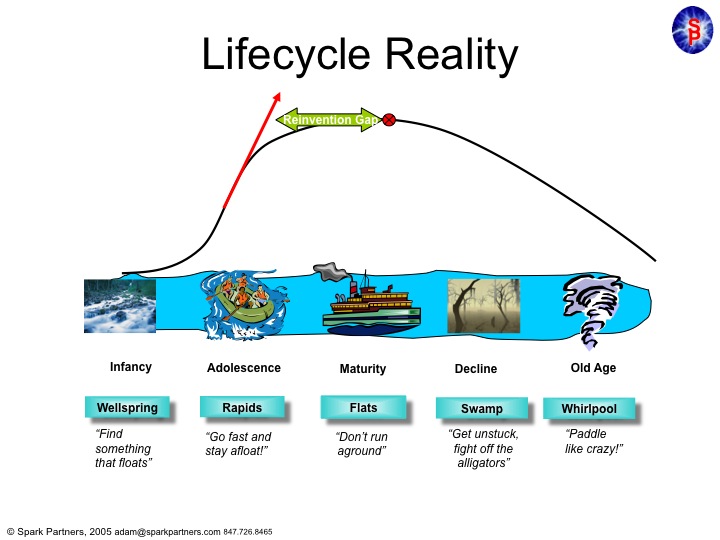

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Under Mr. Gates leadership Microsoft single-handedly overtook the original PC innovator – Apple – and left it a niche company on the edge of bankruptcy in little over a decade.

Mr. Gates kept Microsoft’s growth constantly in the double digits by not only making superior operating system software, but by pushing the company into application software which dominated the desktop (MS Office.) And when the internet came along he had the vision to be out front with Internet Explorer which crushed early innovator, and market maker, Netscape.

But then Mr. Gates turned the company over to Mr. Ballmer. And Mr. Ballmer was a leader lacking vision, or innovation. Instead of pushing Microsoft into new markets, as had Mr. Gates, he allowed the company to fixate on constant upgrades to the products which made it dominant – Windows and Office. Instead of keeping Microsoft in the Rapids of growth, he offered up a leadership designed to simply keep the company from going backward. He felt that Microsoft was a company that was “mature” and thus in need of ongoing enhancement, but not much in the way of real innovation. He trusted the market to keep growing, indefinitely, if he merely kept improving the products handed him.

As a result Microsoft stagnated. A “Reinvention Gap” developed as Vista, Windows 7, then Windows 8 and one after another Office updates did nothing to develop new customers, or new markets. Microsoft was resting on its old laurels – monopolistic control over desktop/laptop markets – without doing anything to create new markets which would keep it on the old growth trajectory of the Gates era.

Things didn’t look too bad for several years because people kept buying traditional PCs. And Ballmer famously laughed at products like Linux or Unix – and then later at entertainment devices, smart phones and tablets – as Microsoft launched, but then abandoned products like Zune, Windows CE phones and its own tablet. Ballmer kept thinking that all the market wanted was a faster, cheaper PC. Not anything really new.

And he was dead wrong. The Reinvention Gap emerged to the public when Apple came along with the iPod, iTunes, iPhone and iPad. These changed the game on Microsoft, and no longer was it good enough to simply have a better edition of an outdated technology. As PC sales began declining it was clear that Ballmer’s leadership had left the company in the Swamp, fighting off alligators and swatting at mosquitos with no strategy for how it would regain relevance against all these new competitors.

So the Board pushed him out, and demoted Gates off the Chairman’s throne. A big move, but likely too late. Fewer than 7% of companies that wander into the Swamp avoid the Whirlpool of demise. Think Univac, Wang, Lanier, DEC, Cray, Sun Microsystems (or Circuit City, Montgomery Wards, Sears.) The new CEO, Satya Nadella, has a much, much more difficult job than almost anyone thinks. Changing the trajectory of Microsoft now, after more than a decade creating the Reinvention Gap, is a task rarely accomplished. So rare we make heros of leaders who do it (Steve Jobs, Lou Gerstner, Lee Iacocca.)

So what will happen at the Clippers?

Critically, owning an NBA team is nothing like competing in the real business world. It is a closed marketplace. New competitors are not allowed, unless the current owners decide to bring in a new team. Your revenues are not just dependent upon you, but are even shared amongst the other teams. In fact your revenues aren’t even that closely tied to winning and losing. Season tickets are bought in advance, and with so many games away from home a team can do quite poorly and still generate revenue – and profit – for the owner. And this season the Indiana Pacers demonstrated that even while losing, fans will come to games. And the Philadelphia 76ers drew crowds to see if they would set a new record for the most consecutive games lost.

In America the major sports only modestly overlap, so you have a clear season to appeal to fans. And even if you don’t make it into the playoffs, you still share in the profits from games played by other teams. As a business, a team doesn’t need to win a championship to generate revenue – or make a profit. In fact, the opposite can be true as Wayne Huizenga learned owning the Championship winning Florida Marlins baseball team. He payed so much for the top players that he lost money, and ended up busting up the team and selling the franchise!

In short, owning a sports franchise doesn’t require the owner to understand lifecycles. You don’t have to understand much about business, or about business competition. You are protected from competitors, and as one of a select few in the club everyone actually works together – in a wholly uncompetitive way – to insure that everyone makes as much money as possible. You don’t even have to know anything about managing people, because you hire coaches to deal with players, and PR folks to deal with fans and media. And as said before whether or not you win games really doesn’t have much to do with how much money you make.

Most sports franchise owners are known more for their idiosyncrasies than their business acumen. They can be loud and obnoxious all they want (with very few limits.) And now that Mr. Ballmer has no investors to deal with – or for that matter vendors or cooperative parties in a complex ecosystem like personal technology – he doesn’t have to fret about understanding where markets are headed or how to compete in the future.

When it comes to acting like a person who knows little about business, but has a huge ego, fiery temper and loves to be obnoxious there is no better job than being a sports franchise owner. Mr. Ballmer should fit right in.

by Adam Hartung | May 16, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lifecycle, Web/Tech

IBM had a tough week this week. After announcing earnings on Wednesday IBM fell 2%, dragging the Dow down over 100 points. And as the Dow reversed course to end up 2% on the week, IBM continued to drag, ending down almost 3% for the week.

Of course, one bad week – even one bad earnings announcement – is no reason to dump a good company’s stock. The short term vicissitudes of short-term stock trading should not greatly influence long-term investors. But in IBM’s case, we now have 8 straight quarters of weaker revenues. And that HAS to be disconcerting. Managing earnings upward, such as the previous quarter, looks increasingly to be a short-term action, intended to overcome long-term revenues declines which portend much worse problems.

This revenue weakness roughly coincides with the tenure of CEO Virginia Rometty. And in interviews she increasingly is defending her leadership, and promising that a revenue turnaround will soon be happening. That it hasn’t, despite a raft of substantial acquisitions, indicates that the revenue growth problems are a lot deeper than she indicates.

CEO Rometty uses high-brow language to describe the growth problem, calling herself a company steward who is thinking long-term. But as the famous economist John Maynard Keynes pointed out in 1923, “in the long run we are all dead.” Today CEO Rometty takes great pride in the company’s legacy, pointing out that “Planes don’t fly, trains don’t run, banks don’t operate without much of what IBM does.”

But powerful as that legacy has been, in markets that move as fast as digital technology any company can be displaced very fast. Just ask the leadership at Sun Microsystems that once owned the telecom and enterprise markets for servers – before almost disappearing and being swallowed by Oracle in just 5 years (after losing $200B in market value.) Or ask former CEO Steve Ballmer at Microsoft, who’s delays at entering mobile have left the company struggling for relevancy as PC sales flounder and Windows 8 fails to recharge historical markets.

CEO Rometty may take pride in her earnings management. But we all know that came from large divestitures of the China business, and selling the PC and server business. As well as significant employee layoffs. All of which had short-term earnings benefits at the expense of long-term revenue growth. Literally $6B of revenues sold off just during her leadership.

Which in and of itself might be OK – if there was something to replace those lost sales. (Even if they didn’t have any profits – because at least we have faith in Amazon creating future profits as revenues zoom.)

What really worries me about IBM are two things that are public, but not discussed much behind the hoopla of earnings, acquisitions, divestitures and all the talk, talk, talk regarding a new future.

CNBC reported (again, this week,) that 121 companies in the S&P 500 (27.5%) cut R&D in the first quarter. And guess who was on the list? IBM, once an inveterate leader in R&D has been reducing R&D spending. The short-term impact? Better quarterly earnings. Long term impact????

The Washington Post reported this week about the huge sums of money pouring out of corporations into stock buybacks rather than investing in R&D, new products, new capacity, enhanced marketing, sales growth, etc. $500B in buybacks this year, 34% more than last year’s blistering buyback pace, flowed out of growth projects. To make matters worse, this isn’t just internal cash flow going for buybacks, but companies are actually borrowing money, increasing their debt levels, in order to buy their own stock!

And the Post labels as the “poster child” for this leveraged stock-propping behavior…. IBM. IBM

“in the first quarter bought back more than $8 billion of its own stock, almost all of it paid for by borrowing. By reducing the number of outstanding shares, IBM has been able to maintain its earnings per share and prop up its stock price even as sales and operating profits fall.

The result: What was once the bluest of blue-chip companies now has a debt-to-equity ratio that is the highest in its history. As Zero Hedge put it, IBM has embarked on a strategy to “postpone the day of income statement reckoning by unleashing record amounts of debt on what was once upon a time a pristine balance sheet.”

In the case of IBM, looking beyond the short-term trees at the long-term forest should give investors little faith in the CEO or the company’s future growth prospects. Much is being hidden in the morass of financial machinations surrounding acquisitions, divestitures, debt assumption and stock buybacks. Meanwhile, revenues are declining, and investments in R&D are falling. This cannot bode well for the company’s long-term investor prospects, regardless of the well scripted talking points offered last week.

by Adam Hartung | Apr 15, 2014 | Current Affairs, In the Rapids, Leadership, Transparency

Zebra Technologies is a company most people don’t recognize. Yet, I bet every product you buy has the product on which they specialize.

Since 1982 Zebra has been the leader in bar code printers and readers. Zebra was a pioneer in the application of bar codes for tracking pallets through warehouses, items used in a manufacturing line, shipment tracking and other uses for manufacturing and supply chain management. As the market leader Zebra Technologies developed its own software (ZPL) for printing barcodes, and made robust printing and reading machines that were the benchmark for rugged, heavy duty applications at companies from Caterpillar, to UPS and FedEx, to WalMart.

Although the company dabbled in RFID technology for product tracking, and is considered a leader in that market, the new technology really never “took off” due to higher costs compared with the boring, but effective and remarkably cheap, bar code. So Zebra plodded away making ever better, smaller, cheaper, faster bar code printers. It may not have been exciting, like the nondescript headquarters in far-suburban Chicago, but it met the market needs. Zebra was an excellent operational company that was delivering on its focus.

Even if it was, well …… boring.

But, like all markets, the bar code market began shifting. Generic software companies, like Microsoft, produced drivers that would work from a cheap PC to allow

cheap generic printers, like those from HP, to print bar codes. These were cheap enough to be considered disposable. Not a good thing for the better, but more expensive, market leader. Competitive, non-proprietary software and hardware leads to lower prices and margin compression. It’s a differentiation stealer.

Worse, lots of customers stopped caring much about bar codes altogether. Zebra’s customers realized bar codes were everywhere. Nothing new was really happening. When it came to delivering on the promise of really efficient, accurate and low cost supply chain management the bar code had a place. But no longer an exciting one. When your product is boring discussions with customers easily slip toward price rather than new products. And when you’re talking about price, and how to keep existing business, relevancy is at risk. You become a target for a new competitor to come along and steal your thunder (and profits) by relegating your product to generic-doom while taking the high rode of delivering more value by changing the game.

So hand it to Zebra’s leadership team that they observed the risk of staying focused on their status quo, and took action to change the game themselves. Today Zebra announced it is buying the enterprise device business of Motorola. And this is a big bet. At a price of $3.5B, Zebra is spending an amount nearly equal to its existing net worth. And it is borrowing $3.25B – almost the whole cost – greatly increasing the company’s debt ratios. That is a gutsy move.

Yet, in this one move Zebra will nearly triple its revenues.

This decision is not without risk. The acquired Motorola business has seen declining revenues – like a $500M decline in the last year (roughly 25%.) With many products built on Microsoft software, customers have been shifting to other solutions. Exactly how the old technologies will integrate with new ones in the Motorola lines is not clear. And even less clear is how a combined company will bring together old-line printer/scanners using proprietary software with the diverse, and honestly pricey, products that Motorola enterprise has been selling, to offer more competitive solutions.

Yet, investors should be encouraged. Doing nothing would spell disaster for Zebra. It is a company that needs to re-invent itself for today’s pressing business needs — which have little in common with the top needs 30 years ago (or even 10 years ago.) In October, Zebra launched Zatar, a Web-based software that allows companies to deploy and manage devices and sensors connected to the Internet. In December Zebra purchased a company (Hart) for its cloud-based software to manage inventory. Now Zebra is looking to use these integration tools to bring together all kinds of devices the new company will manufacture to help companies achieve an entirely new level of efficiency and capability in today’s real-time manufacturing and logistics world.

We should admire CEO Anders Gustaffson’s leadership team for recommending such bold action. And the company’s Chairman and Board for approving it. Of course “there’s many a slip twixt the cup and the lip,” but at least Zebra’s investors, employees, suppliers and customers can now see that Zebra is really holding a viable cup, and that it is putting together a serious effort to provide better delivery to buyers lips.

This is a play to grow the company by following the trend to “the internet of things” with new solutions that are potential game changers. And there’s no way you can win unless you’re in the game. With these acquisitions, there is no doubt that what was mostly a manufacturing company – Zebra – is now “in the game” for doing new things with new technologies.

This is a play to grow the company by following the trend to “the internet of things” with new solutions that are potential game changers. And there’s no way you can win unless you’re in the game. With these acquisitions, there is no doubt that what was mostly a manufacturing company – Zebra – is now “in the game” for doing new things with new technologies.

This does beg some questions: What is your company doing to be a game changer? Are you resting on the laurels of strong historical sales – and maybe a strong historical market position? Do you recognize that your market is shifting, and it is undercutting historical strengths? Are you relying on operational excellence, while new technologies are threatening your obsolescence?

Or — are you thinking like the leaders at Zebra Technologies and taking bold action to be the industry game-changing leader, even if it means stretching your financials, your management team and the technology?

Most of us would rather be in the former, than the latter, I think.

by Adam Hartung | Apr 8, 2014 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership

“Car dealers are idiots” said my friend as she sat down for a cocktail.

It was evening, and this Vice President of a large health care equipment company was meeting me to brainstorm some business ideas. I asked her how her day went, when she gave the response above. She then proceeded to tell me she wanted to trade in her Lexus for a new, small SUV. She had gone to the BMW dealer, and after being studiously ignored for 30 minutes she asked “do the salespeople at this dealership talk to customers?” Whereupon the salespeople fell all over themselves making really stupid excuses like “we thought you were waiting for your husband,” and “we felt you would be more comfortable when your husband arrived.”

My friend is not married. And she certainly doesn’t need a man’s help to buy a car.

She spent the next hour using her iPhone to think up every imaginable bad thing she could say about this dealer over Twitter and Facebook using various interesting hashtags and @ references.

Truthfully, almost nobody likes going to an auto dealership. Everyone can share stories about how they were talked down to by a salesperson in the showroom, treated like they were ignorant, bullied by salespeople and a slow selling process, overcharged compared to competitors for service, forced into unwanted service purchases under threat of losing warranty coverage – and a slew of other objectionable interactions. Most Americans think the act of negotiating the purchase of a new car is loathsome – and far worse than the proverbial trip to a dentist. It’s no wonder auto salespeople regularly top the list of least trusted occupations!

When internet commerce emerged in the 1990s, buying an auto on-line was the #1 most desired retail transaction in emerging customer surveys. And today the vast majority of Americans, especially Millennials, use the web and social media to research their purchase before ever stepping foot in the dreaded dealership.

Tesla heard, and built on this trend. Rather than trying to find dealers for its cars, Tesla decided it would sell them directly from the manufacturer. Which created an uproar amongst dealers who have long had a cushy “almost no way to lose money” business, due to a raft of legal protections created to support them after the great DuPont-General Motors anti-trust case.

When New Jersey regulators decided in March they would ban Tesla’s factory-direct dealerships, the company’s CEO, Elon Musk, went after Governor Christie for supporting a system that favors the few (dealers) over the customer. He has threatened to use the federal courts to overturn the state laws in favor of consumer advocacy.

It would be easy to ignore Tesla’s position, except it is not alone in recognizing the trend. TrueCar is an on-line auto shopping website which received $30M from Microsoft co-founder Paul Allen’s venture fund. After many state legal challenges TrueCar now claims to have figured out how to let people buy on-line with dealer delivery, and last week filed papers to go public. While this doesn’t eliminate dealers, it does largely take them out of the car-buying equation. Call it a work-around for now that appeases customers and lawyers, even if it doesn’t actually meet consumer desires for a direct relationship with the manufacturer.

Apple’s direct-to-consumer retail stores were key to saving the company

Distribution is always a tricky question for any consumer good. Apple wanted to make sure its products were positioned correctly, and priced correctly. As Apple re-emerged from near bankruptcy with new music products in the early 2000’s Apple feared electronic retailers would discount the product, be unable to feature Apple’s advantages, and hurt the brand which was in the process of rebuilding. So it opened its own stores, staffed by “geniuses” to help customers understand the brand positioning and the products’ advantages. Those stores are largely considered to have been a turning point in helping consumers move from a world of Microsoft-based laptops, Sony music products and Blackberry mobile devices to new iDevices and resurging Macintosh popularity – and sales levels.

Attacking regulations sounds – and is – a daunting task. But, when regulations support a minority of people outside the public good there is reason to expect change. American’s wanted a more pristine society, so in 1920 the 18th Amendment was passed prohibiting alcohol. However, after a decade in which rampant crime developed to support illegal alcohol production Americans passed the 21st Amendment in 1933 to repeal prohibition. What seemed like a good idea at first turned out to have more negatives than positives.

Auto dealer regulations hurt competition, and consumers

Today Americans do not need a protected group of dealers to save them from big, bad auto companies. To the contrary, forced distribution via protected dealers inhibits competition because it keeps new competitors from entering the U.S. market. Small production manufacturers, and large ones in countries like India, are effectively blocked from reaching American customers because they lack a dealer base and existing dealers are uninterested in taking the risks inherent in taking these new products to market. Likewise, starting up an auto company is fraught with distribution risks in the USA, leaving Tesla the only company to achieve any success since the dealer protection laws were passed decades ago.

And that’s why Tesla has a very good chance of succeeding. The trends all support Americans wanting to buy directly from manufacturers. At the very least this would force dealers to justify their existence, and profits, if they want to stay in business. But, better yet, it would create greater competition – as happened in the case of Apple’s re-emergence and impact on personal technology for entertainment and productivity.

Litigating to fight a trend might work for a while. Usually those in such a position are large political contributors, and use both the political process as well as legal precedent to protect their unjustified profits. NADA (National Automobile Dealers Association) is a substantial organization with very large PAC money to use across Washington. The Association can coordinate election contributions at national and state levels, as well as funding for judge elections and contributions for legal defense.

But, trends inevitably win out. Today Millennials are true on-line shoppers. They have no patience for traditional auto dealer shenanigans. After watching their parents, and grandparents, struggle for fairness with dealers they are eager for a change. As are almost all the auto buyers out there. And they are supported by consumer advocates long used to edgy tactics of auto dealers well known for skirting ethics and morality when dealing with customers. Those seeking change just need someone positioned to lead the legal effort.

Tesla wins because it uses trends to be a game changer

Tesla has shown it is well attuned to trends and what customers want. When other auto companies eschewed Tesla’s first entry as a 2-passenger sports car using laptop batteries, Tesla proceeded to sell out the product at a price much higher competitive gas-powered cars. When other auto companies thought a $70,000 electric sedan would never appeal to American buyers, Tesla again showed it understood the market best and sold out production. When industry pundits, and traditional auto company execs, said it was impossible to build a charging grid to support users driving up the coast, or cross-country, Tesla built the grid and demonstrated its functionality.

Now Tesla is the right company, in the right place, to change not only the autos Americans drive, but how Americans buy them. It’s rarely smart to refuse a trend, and almost always smart to support it. Tesla looks to be positioning itself as much smarter than older, larger auto companies once again.

by Adam Hartung | Apr 1, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Web/Tech

“Hope springs eternal in the human breast” (Alexander Pope)

As it does for most investors. People do not like to accept the notion that a business will lose relevancy, and its value will fall. Especially really big companies that are household brand names. Investors, like customers, prefer to think large, established companies will continue to be around, and even do well. It makes everyone feel better to have a optimistic attitude about large, entrenched organizations.

And with such optimism investors have cheered Microsoft for the last 15 months. After a decade of trading up and down around $26/share, Microsoft stock has made a significant upward move to $41 – a new decade-long high. This price has people excited Microsoft will reach the dot.com/internet boom high of $60 in 2000.

After discovering that Windows 8, and the Surface tablet, were nowhere near reaching sales expectations after Christmas 2012 – and that PC sales were declining faster than expected – investors were cheered in 2013 to hear that CEO Steve Ballmer would resign. After much speculation, insider Satya Nadella was named CEO, and he quickly made it clear he was refocusing the company on mobile and cloud. This started the analysts, and investors, on their recent optimistic bent.

CEO Nadella has cut the price of Windows by 70% in order to keep hardware manufacturers on Windows for lower cost machines, and he announced the company’s #1 sales and profit product – Office – was being released on iOS for iPad users. Investors are happy to see this action, as they hope that it will keep PC sales humming. Or at least slow the decline in sales while keeping manufacturers (like HP) in the Microsoft Windows fold. And investors are likewise hopeful that the long awaited Office announcement will mean booming sales of Office 365 for all those Apple products in the installed base.

But, there’s a lot more needed for Microsoft to succeed than these announcements. While Microsoft is the world’s #1 software company, it is still under considerable threat and its long-term viability remains unsure.

Windows is in a tough spot. After this price decline, Microsoft will need to increase sales volume by 2.5X to recoup lost profits. Meanwhile, Chrome laptops are considerably cheaper for customers and more profitable for manufacturers. And whether this price cut will have any impact on the decline in PC sales is unclear, as users are switching to mobile products for ease-of-use reasons that go far beyond price. Microsoft has taken an action to defend and extend its installed base of manufacturers who have been threatening to move, but the impact on profits is still likely to be negative and PC sales are still going to decline.

Meanwhile, the move to offer Office on iOS is clearly another offer to defend the installed Office marketplace, and unlikely to create a lot of incremental revenue and profit growth. The PC market has long been much bigger than tablets, and almost every PC had Office installed. Shrinking at 12-14% means a lot less Windows Office is being sold. And, In tablets iOS is not 100% of the market, as Android has substantial share. Offering Office on iOS reaches a lot of potential machines, but certainly not 100% as has been the case with PCs.

Further, while there are folks who look forward to running Office on an iOS device, Office is not without competition. Both Apple and Google offer competitive products to Office, and the price is free. For price sensitive users, both individuals and corporations, after 4 years of using competitive products it is by no means a given they all are ready to pay $60-$100 per device per year. Yes, there will be Office sales Microsoft did not previously have, but whether it will be large enough to cover the declining sales of Office on the PC is far from clear. And whether current pricing is viable is far, far from certain.

While these Microsoft products are the easiest for consumers to understand, Nadella’s move to make Microsoft successful in the mobile/cloud world requires succeeding with cloud products sold to corporations and software-as-service providers. Here Microsoft is late, and facing substantial competition as well.

Just last week Google cut the price of its Compute Engine cloud infrastructure (IaaS) platform and App Engine cloud app platform (PaaS) products 30-32%. Google cut the price of its Cloud Storage and BigQuery (big data analytics) services by 68% and 85% as it competes headlong for customers with Amazon. Amazon, which has the first-mover position and large customers including the U.S. federal government, cut prices within 24 hours for its EC2 cloud computing service by 30%, and for its S3 storage service by over 50%. Amazon also reduced prices on its RDS database service approximately 28%, and its Elasticache caching service by over 33%.

To remain competitive, Microsoft had to react this week by chopping prices on its Azure cloud computing products 27%-35%, reducing cloud storage pricing 44%-65%, and whacking prices on its Windows and Linux memory-intensive computing products 27%-35%. While these products have allowed the networking division formerly run by now CEO Nadella to be profitable, it will be increasingly difficult to maintain old profit levels on existing customers, and even a tougher problem to profitably steal share from the early cloud leaders – even as the market grows.

While optimism has grown for Microsoft fans, and the share price has moved distinctly higher, it is smart to look at other market leaders who obtained investor favorability, only to quickly lose it.

Blackberry was known as RIM (Research in Motion) in June, 2007 when the iPhone was launched. RIM was the market leader, a near monopoly in smart phones, and its stock was riding high at $70. In August, 2007, on the back of its dominant status, the stock split – and moved on to a split adjusted $140 by end of 2008. But by 2010, as competition with iOS and Android took its toll RIM was back to $80 (and below.) Today the rechristened company trades for $8.

Sears was once the country’s largest and most successful retailer. By 2004 much of the luster was coming off when KMart purchased the company and took its name, trading at only $20/share. Following great enthusiasm for a new CEO (Ed Lampert) investors flocked to the stock, sure it would take advantage of historical brands such as DieHard, Kenmore and Craftsman, plus leverage its substantial real estate asset base. By 2007 the stock had risen to $180 (a 9x gain.) But competition was taking its toll on Sears, despite its great legacy, and sales/store started to decline, total sales started declining and profits turned to losses which began to stretch into 20 straight quarters of negative numbers. Meanwhile, demand for retail space declined, and prices declined, cutting the value of those historical assets. By 2009 the stock had dropped back to $40, and still trades around that value today — as some wonder if Sears can avoid bankruptcy.

Best Buy was a tremendous success in its early years, grew quickly and built a loyal customer base as the #1 retail electronics purveyor. But streaming video and music decimated CD and DVD sales. On-line retailers took a huge bite out of consumer electronic sales. By January, 2013 the stock traded at $13. A change of CEO, and promises of new formats and store revitalization propped up optimism amongst investors and by November, 2014 the stock was at $44. However, market trends – which had been in place for several years – did not change and as store sales lagged the stock dropped, today trading at only $25.

Microsoft has a great legacy. It’s products were market leaders. But the market has shifted – substantially. So far new management has only shown incremental efforts to defend its historical business with product extensions – which are up against tremendous competition that in these new markets have a tremendous lead. Microsoft so far is still losing money in on-line and gaming (xBox) where it has lost almost all its top leadership since 2014 began and has been forced to re-organize. Nadella has yet to show any new products that will create new markets in order to “turn the tide” of sales and profits that are under threat of eventual extinction by ever-more-capable mobile products.

While optimism springs eternal long-term investors would be smart to be skeptical about this recent improvement in the stock price. Things could easily go from mediocre to worse in these extremely competitive global tech markets, leaving Microsoft optimists with broken dreams, broken hearts and broken portfolios.

Update: On April 2 Microsoft announced it is providing Windows for free to all manufacturers with a 9″ or smaller display. This is an action to help keep Microsoft competitive in the mobile marketplace – but it does little for Microsoft profitability. Android from Google may be free, but Google’s business is built on ad sales – not software sales – and that’s dramatically different from Microsoft that relies almost entirely on Windows and Office for its profitability

Update: April 3 CRN (Computer Reseller News) reviewed Office products for iOS – “We predict that once the novelty of “Office for iPad” wears off, companies will go back to relying on the humble, hard-working third parties building apps that are as stable, as handsome and far more capable than those of Redmond. It’s not that hard to do.”