by Adam Hartung | Feb 7, 2015 | In the Rapids, Innovation, Leadership, Transparency, Web/Tech

Apple was a high flyer. As the stock hit $700, analysts predicted it would reach $1,000. Then Steve Jobs died. He so personified the company that many felt his death left Apple leaderless. So the stock lost 42% of its value dropping to $400.

Apple has now recaptured that lost value, and trades a bit above its former historic high. Apple is the most valuable publicly traded company in America, worth about $700B. For some perspective on just how large this valuation is, it roughly equals the combined values of Dow Jones Industrial Average stalwart, industry leading mega-companies Walmart ($281B #1 retailer,) GE ($242B #1 conglomerate,) McDonalds ($91B #1 restaurant,) and Dupont ($70B #1 chemical.)

Since Apple was on the edge of bankruptcy just 15 years ago, and its value has risen so far, so fast, many people question if it can go much higher. Yes, it’s had a great recent quarter. But can anyone expect this company to continue growing at this pace? Won’t smartphones be commoditized causing Apple to lose share, sales and profits to alternatives? And aren’t its new products like the iWatch sort of “faddish?”

Apple is actually leading another new marketplace development that may well be bigger than any previous market development (digital music, smartphones, tablets) which could well send its value much, much higher. This new market success revolves around developers, beacons, consumers, retailers and payments. Just like we didn’t know we wanted an iPod until we saw one, or an iPhone, new products that exploit the Internet of Things (IoT) is where Apple is again leading the creation of new products and markets.

Start with Apple’s developer ecosystem. No device has any value unless it has applications. Apple created the first smartphone developer network around iOS. Because Android implementations vary based on device manufacturer, Apple’s iOS remains by far the largest installed common device base in the USA, and globally. Thus, developers are attracted in the largest numbers to develop applications for iPhones and iPads running iOS before any other device. To have a sense of the size of this developer base, and the speed with which they develop for Apple products, when Apple launched its own software language for developers called Swift it was downloaded over 11million times in the first month. These developer companies, in total, captured over $25B in revenue just in the 4th quarter from AppStore sales.

Understandably, these developers are constantly creating new products which leverage the installed Apple mobile base. A base which continues to double every few months as globally people buy more iPhones (75million iPhone 6 and 6+ devices sold in the 4th quarter.) And a base growing internationally, as Apple just beat out Louis Vuitton and Hermes to become the #1 luxury brand in China. It is now a virtuous circle, where the more apps developers create the more people want iPhones, and the more iPhones people buy the more developers want to create new apps.

And this is not just consumer apps. Increasingly business systems are being built to use Apple products. Many of these are small to medium size developers and resellers. Additionally, in 2014 Apple and IBM joined forces to create IBM MobileFirst which is building enterprise applications for multiple industries which will allow people to do all their work on iPhones and iPads sold by IBM. Even though IBM has struggled of late, its enterprise application skills have long been a corporate strength, and the first wave of products rolled out in December.

Now focus on iBeacon. Beacons are small electronic devices which transmit a signal that can talk to a smartphone. These can cost anywhere from a few dollars to a nickel, depending upon what they do and signal range. Years ago Apple started developing beacons, and then optimized iOS 8 to selectively and efficiently pick up beacon signals and establish 2-way communications without dissipating the battery. Without a lot of fanfare to the general public, they began rolling out iBeacons several months ago.

Today there are millions of beacons in place. Miami airport uses them to help travelers find gates, food, etc. The New York Metropolitan Museum of Art and Guggenheim Museum use them for wayfinding, virtual guided tours and buying products. The Los Angeles Union Station and zoo, as well as the Orlando Seaworld, uses beacons to aid the customer experience, as this technology has become ready for prime time. Starbucks uses them to help loyal customers place orders. Retail applications are many, including finding products, couponing, product information, pricing and even purchase. Chain Store Age says that 2% of retailers had beacons installed in 2014, but that number will grow to 24% by end of 2015. A 12-fold increase in the installed base, at least.

Additionally, Facebook is now integrating beacons into the Facebook mobile app. This means iPhone users won’t need to download a museum or store app to communicate with beacons for their personal needs. Instead they can communicate via Facebook to find items, know what their friends think of the item, compare prices, etc. When the world’s largest social media platform incorporates beacons Mobile Marketer says this bridges digital and physical marketing, increases personalization in use of beacons, and beacons now accelerate the move to seamless mobile marketing and sales.

So, beacons and your idevice (including your iWatch or other wearable,) with the help of all those developers who are writing apps to bring you information, now make it possible for you to find your way around and learn more about things. And with ApplePay you can actually achieve the “last mile” of concluding the relationship between the business and consumer.

While mobile payment systems have been slow to get started, ApplePay has a lot more going for it. Firstly, it has the support of about all the major bank and card-issuing institutions because they see ApplePay as possibly lowering costs and increasing their revenue. Second, 78% of retailers think mobile pay is better and faster than their current point of sale systems. As a result, 43% of retailers plan to implement ApplePay by the end of 2015.

So, during 2015 we will be able to use beacons to find our way around, use beacons to identify services and products we want, and use beacons to tell us about the services and products either with apps from the location and retailer, or via Facebook mobile. Then we can buy those products immediately with ApplePay.

Even though Apple is a very highly valued company, it is again doing what made it such a big winner. Pioneering entirely new ways for consumers and businesses to get things done. New solutions are happening in all kinds of industries, pioneered by developers big and small. And when it comes to IoT, Apple products are at the center of the next big wave. Ancillary products, like watches and headphones, further support the use of Apple mobile products and the trend to IoT. Apple’s had a great run, but there is ample reason to believe that run has not stopped. There looks to be an entirely new wave of growth as Apple creates new products and solutions we didn’t even know we needed until they were in our hands.

by Adam Hartung | Jan 29, 2015 | Current Affairs, In the Whirlpool, Leadership, Web/Tech

This week Yahoo announced it is spinning off the last of its Alibaba holdings. This is a big deal, because it might well signal the end of Yahoo.

Yahoo created internet advertising. Yahoo was once the #1 home page for browsers across America. But the company has floundered for years, riddled with CEO problems, a contentious Board of Directors and no strategy for dealing with Google which overtook it in all markets.

To much fanfare the Board hired Marissa Mayer, a Google wunderkind we were told, in July, 2012 to mount a serious turnaround. And during her leadership the company’s stock value has tripled – from about $14.50/share to about $43.50. You would think investors would be thrilled and the company would be on the right track.

Only almost all that value creation was due to a stock investment made in 2005 – when Jerry Yang invested $1B to buy 40% of Alibaba. And Alibaba in 2014 became the most valuable IPO in history.

Yahoo today is valued at about $46B. The Alibaba shares being spun out are valued at between $40B and $44B. Which means that after adjusting for the ownership in Yahoo Japan (valued at $2.3B) the core Yahoo ad and portal business is worth between $2B and $4.7B. With just over $1B shares outstanding, that puts a value on Yahoo’s core business of between $2.00-$4.70/share – or about 1/6 to 1/3 the value when Ms. Mayer became CEO.

A highest value of $4.7B for the operating business of Yahoo puts it on par with Groupon. And worth far less than competitors Google ($347B) and Facebook ($212B). Even upstart, and often maligned, social media companies Twitter ($24B) and LinkedIn ($27B) have valuations 5 times Yahoo.

Unfortunately, this latest leader and her team haven’t been any more effective at improving the company’s business than previous regimes. Under CEO Mayer Yahoo used gains from Alibaba’s valuation to invest about $2.1B in 49 outside companies – with $2B of that being acquisitions of technology companies Flurry ($200M), BrightRoll ($640M) and Tumblr ($1.1). Under the most optimistic view of Yahoo, leadership spent 40% of the company’s value in acquisitions that have made no difference to ad revenues or profits.

In fact, Yahoo’s business revenues, and profits, have declined for 6 consecutive quarters. Despite the CEO’s mandate that employees could no longer work from home. A kerfuffle that proved yet another management distraction, and apparently an effort to cut staff without it looking like a layoff.

Meanwhile there have been big efforts to boost people going to the Yahoo portal. Such as hiring broadcaster Katie Couric to beef up the news section, and former New York Times tech columnist David Pogue to deepen tech coverage and New York Times Magazine political writer Matt Bai to draw in more readers. But these have done nothing to move the needle.

Consistently declining display advertising has left search ads a bigger, and more profitable, business. And while Yahoo’s CEO has been teasing ad agencies that she might begin another big brand campaign, including TV, to bring Yahoo more attention – and hopefully more advertisers – there is no evidence anyone cares as more and more dollars flow to “programmatic” ad buying where Google is king. In the digital ad marketplace Google has 31% share, Facebook 7.75% share and Yahoo a meager 2.36% share.

Soon there will be little left of the once mighty Yahoo. It has pretty much lost relevancy. Large investors are crying for a merger with AOL, whose inability to grow its portal, ad and media businesses has left its market cap at a mere $3.7B. But combining two companies that are market irrelevant, and declining, will probably have the same outcome as happened when merging KMart and Sears. The Yahoo growth stall remains intact, and revenues will decline along with profits as the market continues shifting to powerful and growing competitors Google, Facebook and other social media companies. Only now Yahoo’s leaders won’t have the Alibaba value mountain to hide behind

by Adam Hartung | Jan 22, 2015 | Current Affairs, Defend & Extend, Games, In the Swamp, Innovation, Leadership, Software, Web/Tech

Yesterday Microsoft conducted a pre-launch of Windows 10, demonstrating its features in an effort to excite developers and create some buzz before consumer launch later in 2015.

By and large, nobody cared. Were you aware of the event? Did you try to watch the live stream, offered via the Microsoft web site? Were you eager to read what people thought of the product? Did you look for reviews in the Wall Street Journal, USA Today and other general news outlets?

Microsoft really blew it with Windows 8 – which is the second most maligned Windows product ever, exceeded only by

Vista. But that wasn’t hard to predict, in June, 2012. Even then it was clear that Windows 8, and Surface tablets, were designed to defend and extend the installed Windows base, and as such the design precluded the opportunity to change the market and pull mobile users to Microsoft.

And, unfortunately, that is how Windows 10 has been developed. At the event’s start Microsoft played a tape driving home how it interviewed dozens and dozens of loyal Windows customers, asking them what they didn’t like about 8, and what they wanted in a Windows upgrade. That set the tone for the new product.

Microsoft didn’t seek out what would convert all those mobile users already on iOS or Android to throw away their devices and buy a Microsoft product. Microsoft didn’t ask its defected customers what it would take to bring them back, nor did it ask the over 50% of the market using Windows 7 or older products what it would take to get them to go to Windows mobile rather than an iPad or Galaxy tablet. Nope. Microsoft went to its installed base and asked them what they would like.

Imagine it’s 1975 and for two decades you have successfully made and sold small offset printing presses. Every single company of any size has one in their basement. But customers have started buying really simple, easy to use Xerox machines. Fewer admins are sending even fewer jobs to the print shop in the basement, as they choose to simply run off a bunch of copies on the Xerox machine. Of course these copies are more expensive than the print shop, and the quality isn’t as good, but the users find the new Xerox machines good enough, and they are simple and convenient.

What are you to do if you make printing presses? You probably need to find out how you can get into a new product that actually appeals to the users who no longer use the print shop. But, instead, those companies went to the print shop operators and asked them what they wanted in a new, small print machine. And then the companies upgraded their presses and other traditional printing products based upon what that installed base recommended. And it wasn’t long before their share of printing eroded to a niche of high-volume, and often color, jobs. And the commercial print market went to Xerox.

That’s what Microsoft did with Windows 10. It asked its installed base what it wanted in an operating system. When the problem isn’t the installed base, its the substitute product that is killing the company. Microsoft didn’t need input from its installed base of loyal users, it needed input from people who have quit using HP laptops in favor of iPads.

There are a lot of great new features in Windows 10. But it really doesn’t matter.

The well spoken presenters from Microsoft laid out how Windows 10 would be great for anyone who wants to go to an entirely committed Windows environment. To achieve Microsoft’s vision of the future every one of us will throw away our iOS and Android products and go to Windows on every single device. Really. There wasn’t one demonstration of how Windows would integrate with anything other than Windows. And there appeared on intention of making the future an interoperable environment. Microsoft’s view was we would use Windows on EVERYTHING.

Microsoft’s insular view is that all of us have been craving a way to put Windows on all our devices. We’ve been sitting around using our laptops (or desktops) and saying “I can’t wait for Microsoft to come out with a solution so I can throw away my iPhone and iPad. I can’t wait to tell everyone in my organization that now, finally, we have an operating system that IT likes so much that we want everyone in the company to get rid of all other technologies and use Windows on their tablets and phones – because then they can integrate with the laptops (that most of us don’t use hardly at all any longer.)”

Microsoft even went out of its way to demonstrate how well Win10 works on 2-in-1 devices, which are supposed to be both a tablet and a laptop. But, these “hybrid” devices really don’t make any sense. Why would you want something that is both a laptop and a tablet? Who wants a hybrid car when you can have a Tesla? Who wants a vehicle that is both a pick-up and a car (once called the El Camino?) Microsoft thinks these are good devices, because Microsoft can’t accept that most of us already quit using our laptop and are happy enough with a tablet (or smartphone) alone!

Microsoft presenters repeatedly reminded us that Windows is evolving. Which completely ignores the fact that the market has been disrupted. It has moved from laptops to mobile devices. Yes, Windows has a huge installed base on machines that we use less and less. But Windows 10 pretends that there does not exist today an equally huge, and far more relevant, installed base of mobile devices that already has millions of apps people use every single day over and over. Microsoft pretended as if there is no world other than Windows, and that a more robuts Windows is something people can’t wait to use! We all can’t wait to go back to a exclusive Microsoft world, using Windows, Office, the new Spartan browser – and creating documents, spreadsheets and even presentations using Office, with those hundreds of complex features (anyone know how to make a pivot table?) on our phones!

Just like those printing press manufacturers were sure people really wanted documents printed on presses, and couldn’t wait to unplug those Xerox machines and return to the old way of doing things. They just needed presses to have more features, more capabilities, more speed!

The best thing in Windows 10 is Cortana, which is a really cool, intelligent digital assistant. But, rather than making Cortana a tool developers can buy to integrate into their iOS or Android app the only way a developer can use Cortana is if they go into this exclusive Windows-only world. That’s a significant request.

Microsoft made this mistake before. Kinect was a great tool. But the only way to use it, initially, was on an xBox – and still is limited to Windows. Despite its many superb features, Kinect didn’t develop anywhere near its potential. Cortana now suffers from the same problem. Rather than offering the tool so it can find its best use and markets, Microsoft requires developers and consumers buy into the Windows-exclusive world if you want to use Cortana.

Microsoft hasn’t yet figured out that it lost relevance years ago when it missed the move to mobile, and then launched Windows 8 and Surface to markets that didn’t really want those products. Now the market has gone mobile, and the leader isn’t Microsoft. Microsoft has to find a way to be relevant to the millions of people using alternative products, and the Windows 10 vision, which excludes all those competing devices, simply isn’t it.

There was lots of neat geeky stuff shown. Surface tablets using Windows 10 with an xBox app can now do real gaming, which looks pretty cool and helps move Microsoft forward in mobile gaming. That may be a product that sets Sony’s Playstation and Nintendo’s Wii on their heels. But that’s gaming, and historically not where Microsoft makes any money (nor for that matter does Sony or Nintendo.)

There is a new interactive whiteboard that integrates Skype and Windows tablets for digital enhancement of brainstorming meetings. But it is unclear how a company uses it when most employees already have iPhones or Samsung S5s or Notes. And for the totally geeky there was a demo of a holographic headset. But when it comes to disruptive products like this success requires finding really interesting applications that otherwise cannot be completed, and then the initial customers who have a really desperate need for that application who will become devoted users.

Launching such disruptive products has long been the bane of Microsoft’s existence. Microsoft thinks in mass market terms, and selling to its base. Not developing breakthrough applications and finding niche markets to launch new uses. Nor has Microsoft created a developer community aligned with that kind of work. They have long been taught to simply continue to do things that defend and extend the traditional base of product uses and customers.

The really big miss for this meeting was understanding developer needs. Today developers have an enormous base of iOS and Android users to whom they can sell their products. Windows has less than 3% share in mobile devices. What developer would commit their resources to developing products for Windows 10, which has an installed base only in laptops and desktops? In other words, yesterday’s technology base? Especially when to obtain the biggest benefits of Windows 10 that developer has to find end use customers (companies or consumers) willing to commit 100% to Windows everywhere – even including their televisions, thermostats and other devices in our ever smarter buildings?

Windows 10 has a lot of cool features. But Microsoft made a big miss by listening to the wrong people. By assuming its installed base couldn’t wait for a Microsoft-exclusive solution, and by behaving as if the installed base of mobile devices either didn’t exist or didn’t matter, the company showed its hubris (once again.) If all it took to succeed were great products, the market would never have shifted from Macintosh computers to Windows machines in the 1990s. Microsoft simply doesn’t realize that it lacks the relevance to pull of its grand vision, and as such Windows 10 has almost no chance of stopping the Apple/Google/Samsung juggernaut.

by Adam Hartung | Jan 14, 2015 | Investing, Retail, Trends

Retail sales fell .9% in December. Even excluding autos and gasoline, retail sales fell .3%. Further, November retail sales estimates were revised downward from an initial .7% gain to a meager .4%, and October sales advances were revised downward from a .5% gain to a mere .3%. Sales were down at electronic stores, clothing stores and department stores – all places we anticipated gains due to an improving economy, more jobs and more cash in consumer pockets.

Whoa, what’s happening? Wasn’t lower gasoline pricing going to free up cash for people to go crazy buying holiday gifts? Weren’t we all supposed to feel optimistic about our jobs, higher future wages and more money to spend after that horrible Great Recession thus leading us to splurge this holiday?

There were early signals that conventional wisdom was going to be wrong. Back on Black Friday (so named because it is supposedly the day when retailers turn a profit for the year) we learned sales came in a disappointing 11% lower than 2013. Barron’s analyzed press releases from Wal-Mart, and discerned that 2014 was a weaker Black Friday than 2013 and probably 2012. Simply put, fewer people went shopping on Black Friday than before, despite longer store hours, and they bought less.

So was this really a horrible holiday?

Retail store sales are only part of the picture. Increasingly, people are shopping on-line – and we all know it. According to ComScore, on-line sales made to users of PCs (this excludes mobile devices) were up 17% on Cyber Monday, in stark contrast to traditional brick-and-mortar. Exceeding $2B, it was the largest on-line retail day in history. The Day after Cyber Monday sales were up 27%, and the Green Monday (one week after Cyber Monday) sales were up 15% (all compared to year ago.) Overall, the week after Thanksgiving on-line sales rose 14%, and on Thanksgiving Day itself sales were up a whopping 32%. The week before Christmas (16th-21st) on-line sales surged 18%. According to IBM Digital Analytics the on-line November-December sales were up 13.9% vs. 2013.

The trend has never been more pronounced. Regardless of how much people are going to spend, they are spending less of it in traditional brick-and-mortar retail, and more of it on-line.

So, what about Wal-Mart? The chain remains mired in its traditional way of doing business. Even though same-store sales have been flat-to-down most of the last 2 years, and the number of full-line stores has declined in the USA, the chain remains committed quarter after quarter to defending its outdated success formula. Even in China, where Alibaba has demonstrated it can grow on-line ecommerce revenues more than 50%/year, Wal-Mart continues to try growing with a physical presence – even though it has been a tough, unsuccessful slog.

Yet, despite its bribery scandal in Mexico undertaken to prop up revenues, lawsuits due to over-worked, stressed truck drivers having accidents on double shifts killing and injuring people, and an inability to grow, Wal-Mart’s stock trades at near all-time highs. The stock has nearly doubled since 2011, even though the company is at odds with the primary retail, and demographic, trends.

On the other end of the spectrum is Amazon.com. Amazon is still growing revenues at over 20%/year. And introducing successful new publishing and internet service businesses, expanding same day delivery (and even one hour delivery) in urban markets like New York City, as well as expansion of its Prime service to include more original programming with famed director Woody Allen after winning the Golden Globe award for its original series Transparent.

However, several analysts were trash talking Amazon in 2014. 20% growth has them worried, given that the company once grew at 40%. Even though Amazon’s growth is a serious reason companies like Wal-Mart cannot grow. And there is the perennial lack of profitability – including a larger than expected loss in the second quarter ; a loss which included a $170M write-off on FirePhones which never really found a customer base. The latter item led to a Fast Company brutal lambasting of CEO Jeff Bezos as a micro-manager out-of-touch with customers.

This lack of analyst support has seriously hurt Amazon.com share performance. From 2010 to early 2014 the stock quadrupled in value from $100 to $400. But over the past year the stock has fallen back 25%. After dropping to $300/share in April, the stock has rallied but then retrenched no less than 3 times, and is now trading very close to its 52 week low. And, it shows no momentum, trading below its moving average.

Which is why investors in Wal-Mart should sell, and reinvest in Amazon.com.

All the trends point to Wal-Mart being overvalued. Its revenues show no signs of achieving any substantial growth. And, despite its sheer size, all retail trends are working against the behemoth. It has been trying to find a growth engine for 10 years, but nothing has come to fruition – including big investments in offshore markets. The company keeps trying to defend & extend its old success formula, thus creating a bigger and bigger gap between itself and future market success.

Simultaneously, Amazon.com continues to invest in major developing trends. From publishing to television programming to cloud/web services and even general retail, everything into which Amazon invests is growing. And even though this is a company with $100B in revenues, it is still growing at a remarkable 20%. While some analysts may wish the investment rate would slow, and that Amazon would never make mistakes (like Firephone,) the truth is that Amazon is putting money into projects which have pretty good odds of making sizable money as it helps change the game in multiple markets.

Think of investing like paddling a canoe. When you are investing against trends, it’s like paddling up the river. You can make progress, but it is hard. And, one little mistake and you easily slip backward. Lose any momentum at all and you could completely turn around and disappear (like happened to Circuit City, and now both Sears and JCPenney.) When you invest with the trends it is like paddling down the river. The trend, like a current, keeps you moving in the right direction. You can still make mistakes, but the odds are quite a lot higher you will make your destination easily, and with resources to spare. That’s why the sales results for December are important. The show traditional retailers are paddling up river, while on-line retailers are paddling down-river.

I don’t know if Wal-Mart’s stock value has peaked, but it is hard to understand why anybody would expect it to go higher. It could continue to rise, but there are ample reasons to expect investors will figure out how tough future profits will be for Wal-Mart and dispose of their positions. On the other hand, even though Amazon.com could continue to slide down further there are even more reasons to expect it will have great future quarters with revenue gains and – eventually – those long-sought-after profits that some analysts seek. Meanwhile, Amazon is investing in projects with internal rates of return far higher than most other companies because they are following major trends. Odds are pretty good that in a few years the trends will make investors happy they own Amazon, and dropped out of Wal-Mart.

by Adam Hartung | Jan 6, 2015 | Current Affairs, In the Rapids, Innovation, Leadership

Crude oil has dropped 50% in just 6 months. At under $50/barrel, gasoline is now selling for under $2/gallon in many places. This is a price rollback to 2008 prices – something almost no one expected in early 2014.

It is easy to jump to conclusions about what this will mean for sales of some products. And many analysts have been saying this is a terrible scenario for Tesla, which sells all electric cars. The theory is pretty simple, and goes something like this: People buy electric cars to save on petrol costs, so when petrol prices fall their interest in electric cars decline. With gasoline cheap again, nobody will want an electric car, so Tesla will do poorly.

But this is just an example of where common wisdom is completely wrong. And now that Tesla has lost about 1/3 of its value, due to this popular belief, it is offering investors a tremendous buying opportunity.

There are three big reasons we can expect Tesla to continue to do well, even if gasoline prices are low in the USA.

First, Teslas are great cars. Not simply great electric cars. So quickly we forget that Consumer Reports gave the Model S 99 out of a possible 100 points – the highest rating for an automobile ever. In 2013 Motor Trend had its first ever unanimous selection of the Best Car of the Year when all the judges selected the Model S. The Model S, and the Roadster before it, have won over customers not just because they use less petroleum – but rather because the speed, handling, acceleration, fit and detail, design and ride are considered extremely good – even when comparing with the likes of Mercedes and BMW – and when you don’t even consider it is an electric car.

It is a gross mis-assumption to say people buy Teslas because they are electric powered. People are buying Teslas because they are great cars which are fun to drive, perform well, look stylish, have low maintenance costs and very low operating costs. And they are more ecological in a world where people increasingly care about “going green.” In 2015 consumers will be able to choose not only the Roadster, and the fairly pricey Model S, but soon enough the smaller, and less expensive, Model 3 which is targeted squarely at BMW Series 3 customers. Teslas are designed to compete with all cars for consumer dollars, not just electric cars and not just on the basis of using less fuel.

Second, the market for autos is global and gasoline isn’t cheap everywhere. Take for example Hong Kong, where gasoline still retails for $8.50/gallon (as of 31Dec. 2014.) Or in Paris or Munich where gasoline costs $5/gallon – even though the Euro’s value has shrunk to only $1.20. Outside the USA most developed countries have a lot more demand for oil than they have production (if they have any at all.)

Almost all of these countries offer incentives for buying electric cars. For example, in Hong Kong and Singapore the import tax on an auto can be 100-200% of the car’s price (literally double or triple the price due to import taxes.) But in these same countries the tax is greatly reduced, or eliminated entirely, for buying an electric car for policy reasons to promote lower oil consumption and cleaner city air. So a $100,000 Mercedes E class in Hong Kong will cost $200,000+, while a $100,000 Model S costs $100,000.

Further, outside the USA most countries heavily tax gasoline and diesel in order to discourage consumption and yield infrastructure funds. So even as oil prices go down, gasoline prices do not decline in lock-step with oil price declines. Consumers in these countries have a much greater demand than U.S. consumers for high mileage (and electric) cars almost regardless of crude oil prices. So thinking that low USA gasoline prices reduces demand for electric cars is actually quite myopic.

Third, do you really think oil prices will stay low forever? Oil is a commodity with incredible political impact. Pricing is based on much more than “supply and demand.” At any given time Aramco, or its lead partners such as Saudi Arabia and the UAE, can decide to simply pump more, or less fuel. Today they are happy to pump a lot of oil because it hurts countries with which they have a bone to pick – such as Russia (now almost out of bank reserves due to low oil prices) and Iran. And it helps USA consumers, reducing domestic interest in things like the Keystone Pipeline which could lessen long-term reliance on Aramco oil. And investing in risky development projects like the arctic ocean. Tomorrow these countries could decide to pump less, as they did in the mid-1970s, driving up prices and almost killing the U.S. economy.

Oil prices have a long history of instability. Like most commodities. That’s why a state economy like Texas, where they produce a lot of oil, could boom the last 4 years, while manufacturing states (like Wisconsin and Illinois) suffered. With oil back under $50/barrel drilling rigs will go into mothballs, oil leases will go undeveloped, fracking projects will be stalled and the economy of oil producing states will suffer. Like happened in the mid-1980s when Saudi Arabia once again began flooding the market with oil and exploration and production companies across Texas went out of business.

Most people are smart enough to realize you look at all aspects of owning a new car. There are a lot of reasons to buy Tesla automobiles. Not only are they good cars, but they are changing the sales model by eliminating those undesirable auto dealers most consumers hate. And they are offering charging stations in many locations to make refills painless. And you don’t have to change the oil, or do quite a bit of other maintenance. And you do less damage to the environment. It’s not simply a matter of the price of fuel.

It is always risky to oversimplify consumer behavior. Decisions are rarely based entirely on price. And, as Apple has shown with sales if iOS devices and Macs, people often buy more expensive products when they offer a better experience and brand. Long term investors know that when a stock is beaten down by a short-term reaction to a short-term phenomenon (such as this fast decline in oil prices) it often creates an opportunity to buy into a company with a great future potential for growth.

by Adam Hartung | Dec 31, 2014 | General, In the Rapids, Transparency

Results, results, results. We frequently hear that we should focus on results.

More often than not, focusing on results is a waste of time. Because it is looking in the rear view mirror, rather than the windshield.

Someone asked me today what I thought of Janet Yellen as head of the Federal Reserve. I found this hard to answer. Even though Chairperson Yellen has been in the job since February, her job as lead policy setter has almost no short term ramifications. It takes quarters – not months – to see the results of those policy decisions. Even after a year in office, it is very difficult to render an opinion on her performance as Fed leader. The fantastic 5% growth in the U.S. economy last quarter has much more to do with what happened before she took office – in fact years of policy setting before she took office – than what has happened since she became the top Fed governor.

We often forget what the word “results” means. It is the outcome of previous decisions. Results tell us something about decisions that happened in the past. Sometimes, far into the past. We all can remember companies where looking backward all looked well, right up until the company fell off a cliff. Circuit City. Brachs Candy. Sun Microsystems.

Further, “results” are impacted dramatically by things outside the control of management, such as:

- Changes in interest rates (or no changes when they remain low)

- Changes in oil prices (which have been dramatically lower the last 6 months)

- Changes in investor expectations and the overall stock market (which has been on a record-setting bull run)

- Inflation expectations (which remain at historical lows)

- Expectations about labor rates (which remain low, despite trends toward higher minimum wages)

- Technology advances (including rapid mobile growth in apps, beacons, payments, etc.)

We too often forget that last quarter’s (or even last year’s) results are due to decisions made months before. Gloating, or apologizing, about those results has little meaning. Results, no matter how recent, are meaningless when looking forward. Decisions made long ago caused those results. “Results” are actually unimportant when investing for the future.

What really matters are the decisions being made today which can cause future results to be wildly different – better or worse. What we need to focus upon are these current decisions and their ability to create future results:

- What are the goals being set for next year – or better yet for 2020?

- What are the trends upon which goals are being set? How are future goals aligned to major trends?

- What are the future expected scenarios, and how are goals being set to align with those scenarios?

- Who will be the likely future competitors, and how are goals being set make sure we the organization is prepared to compete with the right companies?

Far too often management will say “we just had great results. We plan to continue executing on our plans, and investors should expect similar future results.” But that makes no sense. The world is a fast changing place. Past results are absolutely not any indicator of future performance.

For 2015, and beyond, investors (and employees, suppliers and communities sponsoring companies) should resolve to hold management far more accountable for its future goals, and the process used to set those goals. Amazon.com maintains a valuation far higher than its historical indicates it should primarily because it is excellent at communicating key trends it watches, future scenarios it expects and how the company plans to compete as it creates those future scenarios.

In the 1981 Burt Reynolds’ movie “Cannonball Run” a character begins a trans-country auto race by ripping the rear view mirror from his car and throwing it out the window. “What’s behind me is not important” he proudly states. This should be the 2015 resolution of investors, and all leaders. Past results are not important. What matters are plans for the future, and future goals. Only by focusing on those can we succeed in creating growth and better results in the future.

by Adam Hartung | Dec 24, 2014 | Defend & Extend, Disruptions

The Twelve Days of Christmas refers to an ancient festive season which begins on December 25. Colonial Americans modified this a bit by creating wreaths which they hung on neighbors’ doors on December 24 in anticipation of starting the festival of twelve days, which historically included feasts and celebrations.

Better known is the song “The Twelve Days of Christmas” which is believed to have started as a French folk rhyme, then later published in 1780 England. The song commemorates the twelve days of Christmas by offering ever grander gifts on each day of the holiday season.

So, it being Christmas Eve I am stealing this idea completely and offering my list of the 12 gifts investors would like to receive this holiday season from the companies into which they invest:

- Stop waxing eloquently about what you did last year or quarter. Yesterday has come and gone. Tell me about the future.

- Tell me about important trends that are going to impact your business. Is it demographics, aging population, the ecology movement, digitization, regulatory change, organic foods, mobility, mobile payments, nanotech, biotech… ? What are the critical trends that will impact your business going forward?

- Tell me your future scenarios. How will these trends change the way your customers and your company will behave? What are your most likely scenarios (and don’t try to be creative in an effort to preserve the status quo!)

- Tell me how the game will change for your industry over the next 1, 3, and 5 years. How will things be different for the industry, based on the trends and scenarios. The world is a fast changing place, and I want to know how this will change your industry.

- Tell me about the customers you lost last year. I gain no value from hearing about, or from, your favorite customers that love what currently do. Instead, bring me info on the customers who are buying alternative products, changing their behaviors, in ways that might impact sales. Even if these changes are only a small percentage of revenue.

- Tell me who the competitors are that are trying to change the game. Don’t tell me that these companies will fail. Tell me who the folks are that are really trying to do something new and different.

- Tell me about the fringe competitors. The ones you constantly say do not matter because they are small, or not part of the historical industry, or from some distant location where you don’t now compete. Tell me about the companies doing the new things which are seen as remote and immaterial, but are nibbling at the edges of the market.

- Tell me how you are reacting to potential game changers in your market. What are your plans to deal with disruptive competitors and disruptive innovations affecting your way of doing business? Other than working harder, faster, cheaper and planning to do better, what are you planning to do differently?

- Tell me how you intend to be a market game changer. Tell me what you intend to do that aligns with trends and leads the company toward fulfilling future scenarios as a market leader.

- Tell me what projects you are undertaking to experiment with new forms of competition, attracting new customers and creating new markets. Tell me about your teams that are working in white space to discover new opportunities.

- Tell me how you will disrupt your own organization so the constant effort to enhance the old success formula doesn’t kill any effort to do something new and different. How will you keep these experimental white space teams from being killed, or simply starved of resources, by the organizational inertia to defend and extend the status quo.

- Tell me the goals of these project teams, and how they will be nurtured and supplemented, as well as evaluated, to lead the company in new directions. Don’t just tell me that you will measure sales or profits, but rather real goals that measure market learning and ability to understand new customer behaviors.

If investors had this transparency, rather than merely reams and reams of historical data, just imagine how much smarter we could all invest.

Happy Holidays!

by Adam Hartung | Dec 18, 2014 | Current Affairs, Defend & Extend, Food and Drink, Leadership, Lifecycle

It is that time of year when many of us celebrate with an alcoholic beverage. But increasingly in America, that beverage is not beer. Since 2008, American beer sales have fallen about 4%.

But that decline has not been equally applied to all brands. The biggest, old line brands have suffered terribly. Nearly gone are old brands like Milwaukee’s Best, which were best known for being low priced – and certainly not focused on taste. But the most hurt, based on volume declines, have been what were once the largest brands; Budweiser, Miller Lite and Miller High Life. These have lost more than a quarter of their volume, losing a whopping 13million barrels/year of demand. These 3 brand declines account for 6% reduction in the entire beer market.

The popular myth is that this has been due to the rise of craft beers. And there is no doubt, craft beer sales have done well. Sales are up 80%. Many articles (including the WSJ)tout the growth of craft beers, which are ostensibly more tasty and appealing, as being the reason old-line brands have declined. It is an easy explanation to accept, and has largely gone unchallenged. Even the brewer of Budweiser, Annheuser-Busch InBev, has reacted to this argument by taking the incredible action of dropping clydesdale horses from their ads after 81 years – in an effort to woo craft beer drinkers, which are thought to be younger and less sentimental about large horses.

This all makes sense. Too bad it’s the wrong conclusion – and the wrong actions being taken.

Realize that craft beer sales are up from a small base, and today ALL craft beer sales still account for only 7.6% of the market. In fact, ALL craft beers combined sell only the same volume as the now smaller Budweiser. The problem with Budweiser sales – and sales of other big name brand beers – is a change in demographics.

Drinkers of Budweiser and Lite are simply older. These brands rose to tremendous dominance in the 1970s. Many of those who loved this brand are simply older – or dead. Where a hard working fellow in his 30s or 40s might enjoy a six pack after work, today that Boomer (if still alive) is somewhere between late 50s and 70s. Now, a single beer, or maybe two, will suffice thank you very much. And, equally challenging for sales, today’s Boomer is more often drinking a hard liquor cocktail, and a glass of wine with dinner. Beer drinking has its place, but less often and in lower quantities.

Meanwhile, Hispanics are a growing demographic. Hispanics are the largest non-white population in America, at 54million, and represent over 17% of all Americans. With a growth rate of 2.1%, Hispanics are also one of the fastest growing demographic segments – and increasingly important given their already large size. Hispanics are truly becoming a powerful buying group in American economics.

So, just as decline in Boomer population and consumption has hurt the once great beer brands, we can look at the growth in Hispanic demographics and see a link to sales of growing brands. Two significant (non-craft volume) beer brands that more than doubled sales since 2008 are Modelo Especial and Dos Equis. In fact, these were the 2 fastest growing brands in America, even though the first does no English language advertising at all, and the latter only lightly funds advertising with an iconic multi-year campaign. Together their sales total almost 5.4M barrels – which makes these 2 brands equal to 1/3 the ENTIRE craft beer marketplace. And growing 33% faster!

Chasing the myth of craft sales is doing nothing for InBev and MillerCoors as they try to defend and extend outdated brands. On the other hand, Heineken controls Dos Equis, and Constellation Brands controls Modello Especial. These two companies are squarely aligned with demographic trends, and well positioned for growth.

So, be careful the next time you hear some simple explanation for why a product or service is declining. The answer might sound appealing, but have little economic basis. Instead, it is much smarter to look at big trends and you’ll likely see why in the same market one product is growing, while another is declining. Trends – such as demographics – often explain a lot about what is happening, and lead you to invest much smarter.

by Adam Hartung | Dec 11, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television, Web/Tech

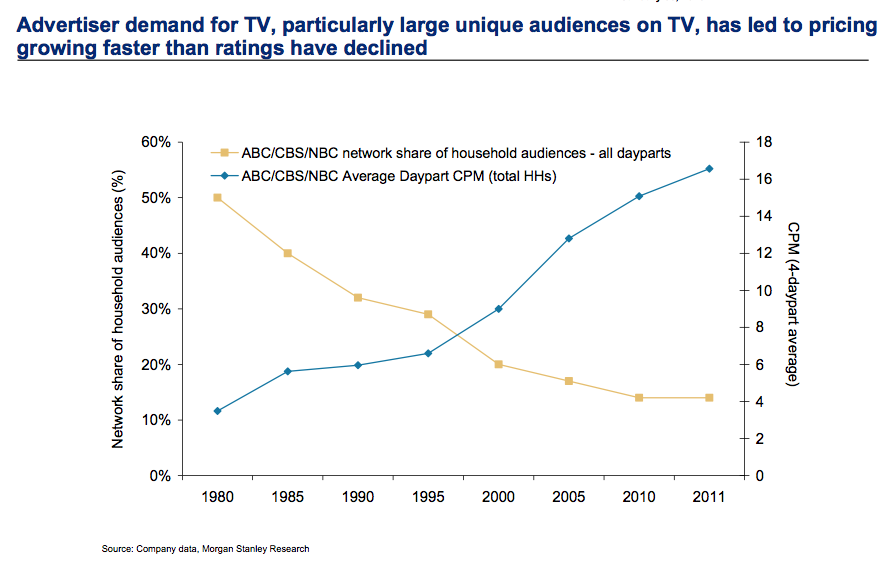

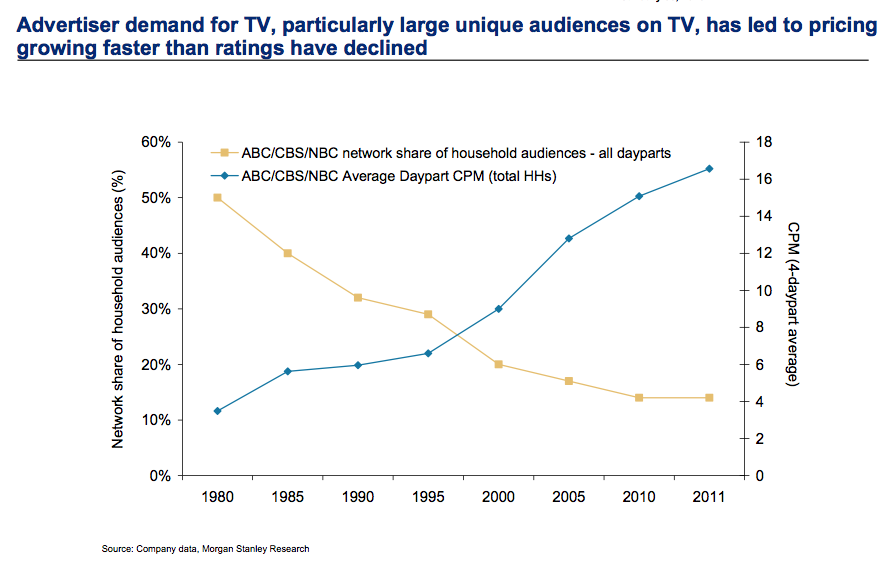

The trend toward the death of broadcast TV as we’ve known it keeps moving forward. This trend may not happen as fast as the death of desktop computers, but it is a lot faster than glacier melting.

This television season (through October) Magna Global has reported that even the oldest viewers (the TV Generation 55-64) watched 3% less TV. Those 35-54 watched 5% less. Gen Xers (25-34) watched 8% less, and Millenials (18-24) watched a whopping 14% less TV. Live sports viewing is not even able to maintain its TV audience, with NFL viewership across all networks down 10-19%.

Everyone knows what is happening. People are turning to downloaded entertainment, mostly on their mobile devices. With a trend this obvious, you’d think everyone in the media/TV and consumer goods industries would be rethinking strategy and retooling for a new future.

But, you would be wrong. Because despite the obviousness of the trend, emotional ties to hoping the old business sticks around are stronger than logic when it comes to forecasting.

CBS predicted at the beginning of 2014 TV ad revenue would grow 4%. Oops. Now CBS’s lead forecaster is admitting he was way off, and adjusted revenues were down 1% for the year. But, despite the trend in viewer behavior and ad expenditures in 2014, he now predicts a growth of 2% for 2015.

That, my young friends, is how “hockey stick” forecasts are created. A lot of old assumptions, combined with a willingness to hope trends will be delayed, and you can ignore real data while promising people that the future will indeed look like the past – even when it defies common sense.

To compensate for fewer ads the networks have raised prices on all ads. But how long can that continue? This requires a really committed buyer (read more about CMO weaknesses below) who simply refuses to acknowledge the market has shifted and the dollars need to shift with it. That cannot last forever.

Meanwhile, us old folks can remember the days when Nielsen ratings determined what was programmed on TV, as well as what advertisers paid. Nielsen had a lock on measuring TV audience viewing, and wielded tremendous power in the media and CPG world.

But now AC Nielsen is struggling to remain relevant. With TV viewership down, time shifting of shows common and streaming growing like the proverbial weed Nielsen has no idea what entertainment the public watches. They don’t know what, nor when, nor where. Unwilling to move quickly to develop tools for catching all the second screen viewing, Nielsen has no plan for telling advertisers what the market really looks like – and the company looks to become a victim of changing markets.

Which then takes us to looking at those folks who actually buy ads that drive media companies. The Chief Marketing Officers (CMOs) of CPG companies. Surely these titans of industry are on top of these trends, and rapidly shifting their spending to catch the viewers with the most ads placed for the lowest cost.

You would wish.

Unfortunately, because these senior executives are in the oldest age groups, they are a victim of their own behavior. They still watch TV, so assume others must as well. If there is cyber-data saying they are wrong, well they simply discount that data. The Nielsen’s aren’t accurate, but these execs still watch the ratings “because it’s the best info we have” – a blatant untruth by the way. But Nielsen does conveniently reinforce their built in assumptions, and their hope that they won’t have to change their media spend plans any time soon.

Further, very few of these CMOs actually use social media. The vast majority watch their children, grandchildren and young employees use mobile devices constantly – and they bemoan all the activity on YouTube, Facebook, Instagram and Twitter – or for the most part even Linked-in. But they don’t actually USE these products. They don’t post information. They don’t set up and follow channels. They don’t connect with people, share information, exchange photos or tell stories on social media. Truthfully, they ignore these trends in their own lives. Which leaves them woefully inept at figuring out how to change their company marketing so it can be more relevant.

The trend is obvious. The answer, equally so. Any modern marketer should be an avid user of social media. Most network heads and media leaders are farther removed from social media than the Pope! They don’t constantly download entertainment, and exchanging with others on all the platforms. They can’t manage the use of these channels when they don’t have a clue how they work, or how other people use them, or understand why they are actually really valuable tools.

Are you using these modern tools? Are you actually living, breathing, participating in the trends? Or are you, like these outdated execs, biding your time wasting money on old programs while you look forward to retirement? And likely killing your company.

When trends emerge it is imperative we become part of that trend. You can’t simply observe it, because your biases will lead you to hope the trend reverts as you continue doing more of the same. A leader has to adopt the trend as a leader, be a practicing participant, and learn how that trend will make a substantial difference in the business. And then apply some vision to remain relevant and successful.

by Adam Hartung | Nov 28, 2014 | Current Affairs, Innovation, Leadership, Web/Tech

Last week I gave 1,000 VHS video tapes to Goodwill Industries. These had been accumulated through 30 years of home movie watching, including tapes purchased for entertaining my 3 children.

It was startling to realize how many of these I had bought, and also surprising to learn they were basically valueless. Not because the content was outdated, because many are still popular titles. But rather because today the content someone wants can be obtained from a streaming download off Amazon or Netflix more conveniently than dealing with these tapes and a mechanical media player.

It isn’t just a shift in technology that made those tapes obsolete. Rather, a major trend has shifted. We don’t really seek to “own” things any more. We’ve become a world of “renters.”

The choice between owning and renting has long been an option. We could rent video tapes, and DVDs. But even though we often did this, most Boomers also ended up buying lots of them. Boomers wanted to own things. Owning was almost always considered better than renting.

Boomers wanted to own their cars, and often more than one. Auto renting was only for business trips. Boomers wanted to own their houses, and often more than one. Why rent a summer home, when, if you could afford it, you could own one. Rent a boat? Wouldn’t it be better to own your own boat (even if you only use it 10 times/year?)

Now we think very, very differently. I haven’t watched a movie on any hard media in several years. When I find time for video entertainment, I simply download what I want, enjoy it and never think about it again. A movie library seems – well – unnecessary.

As a Boomer, there’s all those CDs, cassette tapes (yes, I have them) and even hundreds of vinyl records I own. Yet, I haven’t listened to any of them in years. It’s far easier to simply turn on Pandora or Spotify – or listen to a channel I’ve constructed on YouTube. I really don’t know why I continue to own those old media players, or the media.

Since the big real estate meltdown many people are finding home ownership to be not as good as renting. Why take such a huge risk, paying that mortgage, if you don’t have to?

That this is a trend is even clearer generationally. Younger people really don’t see the benefit of home ownership, not when it means taking on so much additional debt. Home ownership costs are so high that it means giving up a lot of other things. And what’s the benefit? Just to say you own your home?

Where Boomers couldn’t wait to own a car, young people are far less likely. Especially in, or near, urban areas. The cost of auto ownership, including maintenance, insurance and parking, becomes really expensive. Compared with renting a ZipCar for a few hours when you really need a car, ownership seems not only expensive, but a downright hassle.

And technology has followed this trend. Once we wanted to own a PC, and on that PC we wanted to own lots of data – including movies, pictures, books – anything that could be digitized. And we wanted to own software applications to capture, view, alter and display that data. The PC was something that fit the Boomer mindset of owning your technology.

But that is rapidly becoming superfluous. With a mobile device you can keep all your data in a cloud. Data you want to access regularly, or data you want to rent. There’s no reason to keep the data on your own hard drive when you can access it 24×7 everywhere with a mobile device.

And the same is true for acting on the data. Software as a service (SaaS) apps allow you to obtain a user license for $10-$20/user, or $.99, or sometimes free. Why spend $200 (or a lot more) for an application when you can accomplish your task by simply downloading a mobile app?

So I no longer want to own a VCR player (or DVD player for that matter) to clutter up my family room. And I no longer want to fill a closet with tapes or cased DVDs. Likewise, I no longer want to carry around a PC with all my data and applications. Instead, a small, easy to use mobile device will allow me to do almost everything I want.

It is this mega trend away from owning, and toward a simpler lifestyle, that will end the once enormous PC industry. When I can do all I really want to do on my connected device – and in fact often do more things because of those hundreds of thousands of apps – why would I accept the size, weight, complexity, failure problems and costs of the PC?

And, why would I want to own something like Microsoft Office? It is a huge set of applications which contain dozens (hundreds?) of functions I never use. Wouldn’t life be much simpler, easier and cheaper if I acquire the rights to use the functionality I need, when I need it?

There was a time I couldn’t imagine living without my media players, and those DVDs, CDs, tapes and records. But today, I’m giving lots of them away – basically for recycling. While we still use PCs for many things today, it is now easy to visualize a future where I use a PC about as often as I now use my DVD player.

In that world, what happens to Microsoft? Dell? Lenovo?

The implications of this are far-reaching for not only our personal lives, and personal technology suppliers, but for corporate IT. Once IT managed mainframes. Then server farms, networks and thousands of PCs. What will a company need an IT department to do if employees use their own mobile devices, across common networks, using apps that cost a few bucks and store files on secure clouds?

If corporate technology is reduced to just operating some “core” large functions like accounting, how big – or strategic – is IT? The “T” (technology) becomes irrelevant as people focus on gathering and analyzing information. But that’s not been the historical training for IT employees.

Further, if Salesforce.com showed us that even big corporations can manage something as critical as their customer information in a SaaS environment on mobile devices, is it not possible to imagine accounting and supply chain being handled the same way? If so, what role will IT have at all?

The trend toward renting rather than owning is monumental. It affects every business. But in an ironic twist of fate, it may dramatically reduce the focus on IT that has been so critical for the Boomer generation.