by Adam Hartung | Dec 19, 2015 | Books, Current Affairs, Ethics, Lifecycle

America’s middle class has been decimated. Ever since Ronald Reagan rewrote the tax code, dramatically lowering marginal rates on wealthy people and slashing capital gains taxes, America’s wealthy have been amassing even greater wealth, while the middle class has gone backward and the poor have remained poor. Losing 30% of their wealth, and for many most of their home equity, has left what were once middle class families actually closer to definitions of working poor than a 1950s-1960s middle class.

When Charles Dickens wrote “A Christmas Carole” he brought to life for readers the striking difference between those who “have” from those who “have not” in early England. If you had money England was a great place to be. If you relied on your labors then you were struggling to make ends meet, and regularly disappointing yourself and your family.

For a great many American’s that is the situation in 2015 USA.

At the book’s outset, Mr. Ebenezer Scrooge felt that his wealth was all due to his own great skill. He gave himself 100% of the credit for amassing a fortune, and he felt that it was wrong of laborers, such as his bookkeeper Mr. Cratchit, to expect to pay when seeking a day off for Christmas.

Unfortunately, this sounds far too often like the wealthy and 1%ers. They feel as if their wealth is 100% due to their great intelligence, skill, hard work or conniving. And they don’t think they owe anyone anything as they work to keep unions at bay as they campaign to derail all employee bargaining. Nor do they think they should pay taxes on their wealth as many actively seek to destroy the role of government.

Meanwhile, there are employers today who have taken a page right out of Mr. Scrooge’s book of worklife desolation. Ever since President Reagan fired the Air Traffic Controllers Union employee rights have been on the downhill. Employers increasingly do not allow employees to have any say in their work hours or workplace conditions – such as Marissa Mayer eliminating work from home at Yahoo, yet expecting 3 year commitments from all managers.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.

Just as Mr. Scrooge objected to giving the 25th December as a paid holiday (picking his pocket once a year was his viewpoint,) many employers keep cutting sick leave and holidays – or, worse, they allow days off but expect employees to respond to texts, voice mails, emails and social media 24x7x365. “Take all the holiday you want, just respond within minutes to the company’s every need, regardless of day or time.”

Increasingly, those who “go to work” have less and less voice about their work. How many of you readers will check your work voice mail and/or email on Christmas Day? Is this not the modern equivalent of your employer, like Scrooge, treating you like a filcher if you don’t work on the 25th December? But, do you dare leave the smartphone, tablet or laptop alone on this day? Do you risk falling behind on your job, or angering your boss on the 26th if something happened and you failed to respond?

Like many with struggling economic uncertainty, Bob Cratchit had a very ill son. But Mr. Scrooge could not be bothered by such concerns. Mr. Scrooge had a business to run, and if an employee’s family was suffering then it was up to social services to take care of such things. If those social services weren’t up to standards, well it simply was not his problem. He wasn’t the government – although he did object to any and all taxes. And he had no value for the government offering decent prisons, or medical care to everyone.

Today, employers right and left have dropped employee health insurance, recommending employees go on the exchanges; even though these same employers do not offer any incremental income to cover the cost of exchange-based employee insurance. And many employers are cutting employee hours to make sure they are not able to demand health care coverage. And the majority of employers, and employer associations such as the Chamber of Commerce, want to eliminate the Affordable Care Act entirely, leaving their employees with no health care at all – as was the case for many prior to ACA passage.

Even worse, there are employers (especially in retail, fast food and other minimum wage environments) with employees earning so little pay that as employers they recommend their employees file for government based Medicaid in order to receive the bottom basics of healthcare. Employees are a necessity, but not if they are sick or if the employer has to help their families maintain good health.

But things changed for Mr. Scrooge, and we can hope they do for a lot more of America’s employers and wealthy elite.

Mr. Scrooge’s former partner, Mr. Jakob Marley, visits Mr. Scrooge in a dream and reminds him that, in fact, there was a lot more to his life, and wealth creation, than just Ebenezer’s toils. Those around him helped him become successful, and others in his life were actually very important to his happiness. He reminds Mr Scrooge that as he isolated himself in the search for ever greater wealth he gained money, but lost a lot of happiness.

Today we have some business leaders taking the cue from Mr. Marley, and speaking out to the Scrooges. In particular, we can be thankful for folks like Warren Buffet who consistently points out the great luck he had to be born with certain skills at this specific point in time. Mr. Buffett regularly credits his wealth creation with the luck to receive a good education, learning from academics such as Ben Graham, and having a great network of colleagues to help him invest.

Further, amplifying his role as a modern day Jacob Marley, Mr. Buffett recognizes the vast difference between his situation and those around him. He has pointed out that his secretary pays a higher percent of her income in taxes than himself, and he points out this is a remarkably unfair situation. Additionally, he makes it clear that for many wealth is a gift of birth – and “winning the ovarian lottery” does not make that wealthy person smarter, harder working or more valuable to society. Rather, just lucky.

What we need is for more wealthy Americans to have a vision of Christmas future – as it appeared to Mr. Scrooge. He saw how wealth inequality would worsen young Tiny Tim’s health, leaving him crippled and dying. He saw his employee Mr. Cratchet struggle and become ill. These visions scared him. Scared him so much, he offered a bounty upon his community, sharing his wealth.

Mr. Scrooge realized that great wealth, preserved just for him, was without merit. He was doomed to a future of being rich, but without friends, without a great world of colleagues and without the sharing of riches among everyone in order that all in society could be healthy and grow. Many would suffer, and die, if society overall did not take actions to share success.

These days we do have a few of these visionary 1%ers, such as Bill Gates, Warren Buffett and recently Mark Zuckerberg, who are either currently, or in the future, planning to disseminate their vast wealth for the good of mankind.

Yet, middle class Americans have been watching their dreams evaporate. Over the last 50 years America has changed, and they have been left behind. Hard work, well…….. it just doesn’t give people what it once did. Policy changes that favored the wealthy with Ayn Rand style tax programs have made the rich ever richer, supported the legal rights of big corporations and left the middle class with a lot less money and power. Incomes that did not come close to matching inflation, and home values that too often are more anchors than balloons have beset 2015’s strivers.

It will take more than philanthropic foundations and a few standout generous donors to rebuild America’s middle class. It will take policies that provide more (more safety nets, more health care, more education, more pension protection, more job protections and more political power) for those in the middle, and give them economic advantages today offered only wealthier Americans.

Let us hope that in 2016 we see a re-awakening of the need to undertake such rebuilding by policymakers, corporate leaders and the 1%. Let us hope this Christmas for a stronger, more robust, healthier and disparate, shared economy “for each and every one.”

by Adam Hartung | May 30, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Sports, Web/Tech

Anyone who reads my column knows I’ve been no fan of Steve Ballmer as CEO of Microsoft. On multiple occasions I chastised him for bad decisions around investing corporate funds in products that are unlikely to succeed. I even called him the worst CEO in America. The Washington Post even had difficulty finding reputable folks to disagree with my argument.

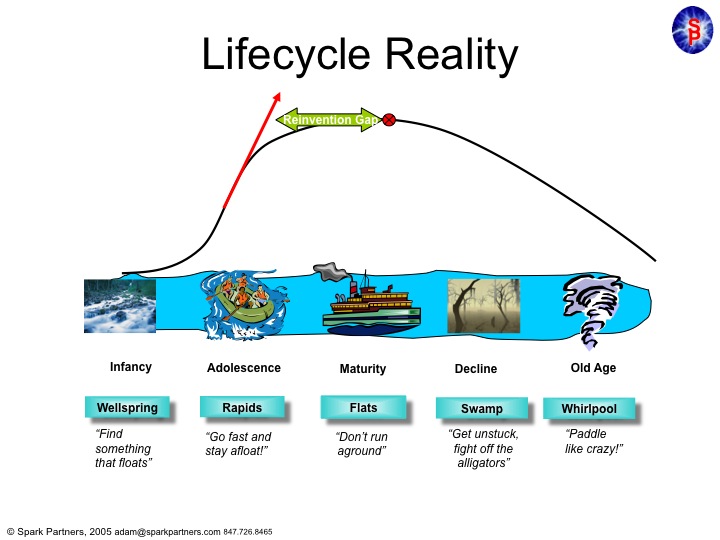

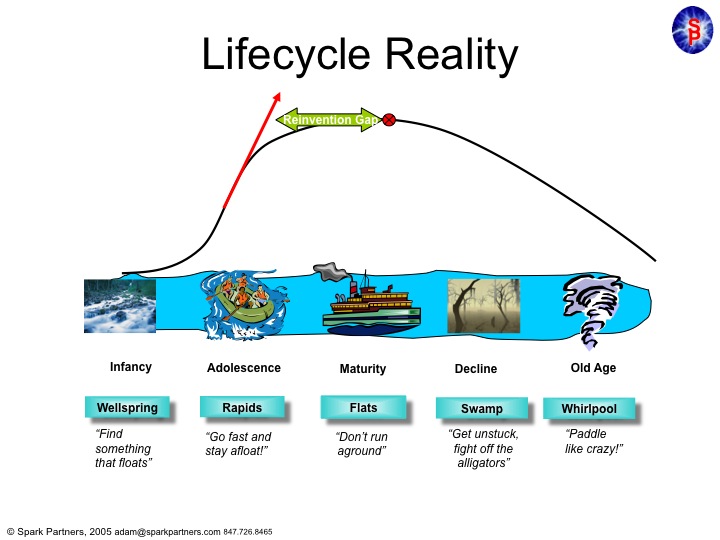

Unfortunately, Microsoft suffered under Mr. Ballmer. And Windows 8, as well as the Surface tablet, have come nowhere close to what was expected for their sales – and their ability to keep Microsoft relevant in a fast changing personal technology marketplace. In almost all regards, Mr. Ballmer was simply a terrible leader, largely because he had no understanding of business/product lifecycles.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Under Mr. Gates leadership Microsoft single-handedly overtook the original PC innovator – Apple – and left it a niche company on the edge of bankruptcy in little over a decade.

Mr. Gates kept Microsoft’s growth constantly in the double digits by not only making superior operating system software, but by pushing the company into application software which dominated the desktop (MS Office.) And when the internet came along he had the vision to be out front with Internet Explorer which crushed early innovator, and market maker, Netscape.

But then Mr. Gates turned the company over to Mr. Ballmer. And Mr. Ballmer was a leader lacking vision, or innovation. Instead of pushing Microsoft into new markets, as had Mr. Gates, he allowed the company to fixate on constant upgrades to the products which made it dominant – Windows and Office. Instead of keeping Microsoft in the Rapids of growth, he offered up a leadership designed to simply keep the company from going backward. He felt that Microsoft was a company that was “mature” and thus in need of ongoing enhancement, but not much in the way of real innovation. He trusted the market to keep growing, indefinitely, if he merely kept improving the products handed him.

As a result Microsoft stagnated. A “Reinvention Gap” developed as Vista, Windows 7, then Windows 8 and one after another Office updates did nothing to develop new customers, or new markets. Microsoft was resting on its old laurels – monopolistic control over desktop/laptop markets – without doing anything to create new markets which would keep it on the old growth trajectory of the Gates era.

Things didn’t look too bad for several years because people kept buying traditional PCs. And Ballmer famously laughed at products like Linux or Unix – and then later at entertainment devices, smart phones and tablets – as Microsoft launched, but then abandoned products like Zune, Windows CE phones and its own tablet. Ballmer kept thinking that all the market wanted was a faster, cheaper PC. Not anything really new.

And he was dead wrong. The Reinvention Gap emerged to the public when Apple came along with the iPod, iTunes, iPhone and iPad. These changed the game on Microsoft, and no longer was it good enough to simply have a better edition of an outdated technology. As PC sales began declining it was clear that Ballmer’s leadership had left the company in the Swamp, fighting off alligators and swatting at mosquitos with no strategy for how it would regain relevance against all these new competitors.

So the Board pushed him out, and demoted Gates off the Chairman’s throne. A big move, but likely too late. Fewer than 7% of companies that wander into the Swamp avoid the Whirlpool of demise. Think Univac, Wang, Lanier, DEC, Cray, Sun Microsystems (or Circuit City, Montgomery Wards, Sears.) The new CEO, Satya Nadella, has a much, much more difficult job than almost anyone thinks. Changing the trajectory of Microsoft now, after more than a decade creating the Reinvention Gap, is a task rarely accomplished. So rare we make heros of leaders who do it (Steve Jobs, Lou Gerstner, Lee Iacocca.)

So what will happen at the Clippers?

Critically, owning an NBA team is nothing like competing in the real business world. It is a closed marketplace. New competitors are not allowed, unless the current owners decide to bring in a new team. Your revenues are not just dependent upon you, but are even shared amongst the other teams. In fact your revenues aren’t even that closely tied to winning and losing. Season tickets are bought in advance, and with so many games away from home a team can do quite poorly and still generate revenue – and profit – for the owner. And this season the Indiana Pacers demonstrated that even while losing, fans will come to games. And the Philadelphia 76ers drew crowds to see if they would set a new record for the most consecutive games lost.

In America the major sports only modestly overlap, so you have a clear season to appeal to fans. And even if you don’t make it into the playoffs, you still share in the profits from games played by other teams. As a business, a team doesn’t need to win a championship to generate revenue – or make a profit. In fact, the opposite can be true as Wayne Huizenga learned owning the Championship winning Florida Marlins baseball team. He payed so much for the top players that he lost money, and ended up busting up the team and selling the franchise!

In short, owning a sports franchise doesn’t require the owner to understand lifecycles. You don’t have to understand much about business, or about business competition. You are protected from competitors, and as one of a select few in the club everyone actually works together – in a wholly uncompetitive way – to insure that everyone makes as much money as possible. You don’t even have to know anything about managing people, because you hire coaches to deal with players, and PR folks to deal with fans and media. And as said before whether or not you win games really doesn’t have much to do with how much money you make.

Most sports franchise owners are known more for their idiosyncrasies than their business acumen. They can be loud and obnoxious all they want (with very few limits.) And now that Mr. Ballmer has no investors to deal with – or for that matter vendors or cooperative parties in a complex ecosystem like personal technology – he doesn’t have to fret about understanding where markets are headed or how to compete in the future.

When it comes to acting like a person who knows little about business, but has a huge ego, fiery temper and loves to be obnoxious there is no better job than being a sports franchise owner. Mr. Ballmer should fit right in.

by Adam Hartung | Dec 28, 2009 | Current Affairs, In the Rapids, Innovation, Leadership

I was intrigued when I read on the Harvard Business Review web site “Do we celebrate the wrong CEOs?” The article quickly pointed out that many of the best known CEOs – and often named as most respected – didn’t come close to making the list of the top 100 best performing CEOs. Some of those on Barron’s list of top 30 most respected that did not make the cut as best performing include Immelt of GE, Dimon of JPMorganChase, Palmesano of IBM and Tillerson of ExxonMobil. It did seem striking that often business people admire those who are at the top of organizations, regardless of their performance.

I was delighted when HBR put out the full article “The Best Performing CEOs in the World.” And it is indeed an academic exercise of great value. The authors looked at CEOs who came into their jobs either just before 2000, or during the decade, and the results they obtained for shareholders. There were 1,999 leaders who fit the timeframe. As has held true for a long time in the marketplace, the top 100 accounted for the vast majority of wealth creation – meaning if you were invested with them you captured most of the decade’s return – while the bulk of CEOs added little value and a great chunk created negative returns. (It does beg the question – why do Boards of Directors keep on CEOs who destroy shareholder value – like Barnes of Sara Lee, for example? It would seem something is demonstrably wrong when CEOs remain in their jobs, usually with multi-million dollar compensation packages, when year after year performance is so bad.)

The list of “Top 50 CEOs” is available on the HBR website. This group created 32% average gains every year! They created over $48.2B of value for investors. Comparatively, the bottom 50 had negative 20% annual returns, and lost over $18.3B. As an investor, or employee, it is much, much better to be with the top 5% than to be anywhere else on the list. However, only 5 of the top best performers were on the list of top 50 highest paid — demonstrating again that CEO pay is not really tied to performance (and perhaps at least part of the explanation for why business leaders are less admired now than the previous decade.)

Consistent among the top 50 was the ability to adapt. Especially the top 10. Steve Jobs of Apple was #1, a leader and company I’ve blogged about several times. As readers know, Apple went from a niche producer of PCs to a leader in several markets completely unrelated to PCs under Mr. Jobs leadership. His ability to keep moving his company back into the growth Rapids by rejecting “focus on the core” and instead using White Space to develop new products for growth markets has been a model well worth following. And in which to be invested.

Similarly, the leaders of Cisco, Amazon, eBay and Google have been listed here largely due to their willingness to keep moving into new markets. Cisco was profiled in my book Create Marketplace Disruption for its model of Disruption that keeps the company constantly opening White Space. Amazon went from an obscure promoter of non-inventoried books to the leader in changing how books are sold, to the premier on-line retailer of all kinds of products, to the leader in digitizing books and periodicals with its Kindle launch. eBay has to be given credit for doing much more than creating a garage sale – they are now the leader in independent retailing with eBay stores. And their growth of PayPal is on the vanguard of changing how we spend money – eliminating checks and making digital transactions commonplace. Of course Google has moved from a search engine to a leader in advertising (displacing Yahoo!) as well as offering enterprise software (such as Google Wave), cloud applications to displace the desktop applications, and emerging into the mobile data/telephony marketplace with Android. All of these company leaders were willing to Disrupt their company’s “core” in order to use White Space that kept the company constantly moving into new markets and GROWTH.

We can see the same behavior among other leaders in the top 10 not previously profiled here. Samsung has moved from a second rate radio/TV manufacturer to a leader in multiple electronics marketplaces and the premier company in rapid product development and innovation implementation. Gilead Sciences is a biopharmaceutical company that has returned almost 2,000% to investors – while the leaders of Merck and Pfizer have taken their companies the opposite direction. By taking on market challenges with new approaches Gilead has used flexibility and adaptation to dramatically outperform companies with much greater resources — but an unwillingness to overcome their Lock-ins.

Three names not on the list are worth noting. Jack Welch was a great Disruptor and advocate of White Space (again, profiled in my book). But his work was in the 1990s. His replacement (Mr. Immelt) has fared considerably more poorly – as have investors – as the rate of Disruption and White Space has fallen off a proverbial cliff. Even though much of what made GE great is still in place, the willingness to Defend & Extend, as happened in financial services, has increased under Mr. Immelt to the detriment of investors.

Bill Gates and Warren Buffett are now good friends, and also not on the list. Firstly, they created their investor fortunes in previous decades as well. But in their cases, they remained as leaders who moved into the D&E world. Microsoft has become totally Locked-in to its Gates-era Success Formula, and under Steve Ballmer the company has done nothing for investors, employees — or even customers. And Berkshire Hathaway has spent the last decade providing very little return to shareholders, despite all the great press for Mr. Buffett and his success in previous eras. Each year Mr. Buffett tells investors that what worked for him in previous years doesn’t work any more, and they should not expect previous high rates of return. And he keeps proving himself right. Until both Microsoft and Berkshire Hathaway undertake significant Disruptions and implement considerably more White Space we should not expect much for investors.

This has been a tough decade for far too many investors and employees. As we end the year, the list of television programs bemoaning how badly the decade has gone is long. Show after show laments the poor performance of the stock market, as well as employers. We end the year with official unemployment north of 10%, and unofficial unemployment some say near 20%. But what this HBR report us is that it is possible to have a good decade. We need leaders who are willing to look to the future for their planning (not the past), obsess about competitors to discover market shifts, be willing to Disrupt old Success Formulas by attacking Lock-in, and using White Space to keep the company in the growth Rapids. When businesses overcome old notions of “best practice” that keeps them trying to Defend & Extend then business performs marvelously well. It’s just too bad so few leaders and companies are willing to follow The Phoenix Principle.

by Adam Hartung | Nov 5, 2009 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership, Music, Web/Tech

$150billion. That's a lot of money. And that's how much shareholder value has increased at Apple since Steve Jobs returned as CEO. Can you think of any other CEO that has aided shareholder wealth so much? Do any of the cost cutting CEOs in manufacturing companies, financial services firms, or media companies see their share prices rising like Apple's?

Fortune has declared this "The Decade of Steve" in its latest publication at Money.CNN.com. Such over-the-top statements are by nature intended to sell magazines (or draw page hits). But the writer makes the valid point that very few leaders impact their industry like Apple has the computer industry, under Jobs leadership (but not under other leaders.) Yet, under his leadership Apple has also had a dramatic impact on the restructuring of two other industries – music and mobile phones/computing. And a company Mr. Jobs founded, Pixar, had a major impact on restructuring the movie business (Pixar was sold to Disney, and has played a significant role in the value increase of that company.) So with Mr. Jobs as leader, no less than 4 industries have been dramatically changed – and huge value created for shareholders.

No cost-cutting CEO, no "focus on the core" CEO, no "execution" CEO can claim to have made the kind of industry changes that have occurred through businesses led by Steve Jobs. And none of those CEO profiles can say they have created the shareholder value Mr. Jobs has created. Not even Bill Gates or Steve Ballmer can claim to have added any value this decade – as Microsoft's value is now less than it was when the millenia turned. Despite the relative size difference between the market for PCs and Macs (about 10 to 1) today Apple has more cash and marketable securities than the entire value of the historically supply-chain driven Dell Corporation.

Mr. Jobs is constantly pushing his organization to focus on the future, about what the markets will want, rather than the past and what the company has made. It was a decade ago that Apple created its "digital lifestyle" scenario of the future, which opened Apple's organization to being much more than Macs. Jobs obsesses about competitors and forces his employees to do the same, to make sure Apple doesn't grow complacent he pushes all products to have leading edge components. Mr. Jobs embraces Disruption, doesn't fear seeing it in his company, doesn't mind it amongst his people, and works to create it in his markets. And he makes sure Apple constantly keeps White Space projects open and working to see what works with customers – testing and trying new things all the time in the marketplace.

Following these practices, Apple pulled itself away from the Whirlpool and returned to the Rapids of Growth. Almost bankrupt, it wasn't financial re-engineering that saved Apple it was launching new products that met emerging needs. Apple showed any company can turn itself around if it follows the right steps.

As companies are struggling with value, people should look to Apple (and Google). Value is not created by cost cutting and waiting for the recession to end. Value is created by seeking innovations and creating an organization that can implement them. Especially Disruptive ones. Whether he's the CEO of the decade or not I can't answer. But saying he's one heck of a good role model for what leaders should be doing to create value in their companies is undoubtfully true.

by Adam Hartung | Aug 4, 2009 | Innovation, Investing, Leadership, Software

A typical headline from last week read "Microsoft, Yahoo to Begin Joint Assault on Google". After a year of negotiating, the behemoth Microsoft finally came up with an accord to get some Yahoo technology in order to be more effective with its search engine product. "Microsoft to Tap 400 Yahoo Workers in Partnership" is the Marketwatch headline today trumpeting the plan to bring Yahoo engineers to Microsoft.

Will it make a difference? If we look at the trend, it looks doubtful (slide courtesy Silicon Alley Insider):

Of course, lots of folks think this isn't a very good idea. (Cartoon Courtesy DenverPost.com):

As John Dvorak pointed out in his column: "Microsoft and Yahoo Bring Google Good News." After all, the Google's competitors just went from 2 to 1 – a 50% reduction. What's more, the remaining player is not known for expertise in internet technology – merely its money hoard. Moreover, when it used its money hoard in the past it has rarely (never?) resulted in a success. No wonder BusinessWeek headlined "Microsoft and Yahoo: Too Little, Too Late, Too Hyped."

What's more intriguing to me is what this deal says about Microsoft. The company has already missed the market shift in search and ad placement. Search is "yesterday's news". Microsoft is still trying to fight the last war, not the next one. As it has done far too often, Microsoft remained Locked-in to its old Success Formula — all about the desktop and personal computing. It has not been part of the market shift to new applications and new ways of personal automation. That has been going to RIM, Apple, Oracle and other players. Microsoft has sat on its market share in the old market, piled up cash, but not taken the actions to be a winner in the next market – the next battle for growth. Now it's joint venture with Yahoo will strip out engineers, attempt to convert them to Microsoft ways of thinking, and put them into battle with not only the largest player in search and on-line ad placement – but the only one making money. And the one introducing new technologies and products on a regular basis.

Someone asked me last week "Who's the next GM?" I think they meant "who's the next big bankruptcy." But the better question here is "Who's the giant company that everyone thinks is competitively insurmountable, but at great risk of falling from market leadership into the Whirlpool – and eventual bankruptcy?" To that I say keep your eyes on Microsoft.

The comparisons between Microsoft and GM are striking:

- Early market leaders

- Developed near monopolies

- Challenged by the trust busters

- Created very high growth rates and huge cash hoards

- Considered a great place to work, with great longevity

- Bought up competitors

- Bought up technologies, and often never took them to market

- Became arrogant to customers

- Implemented a strong Success Formula that everyone was expected to follow

- Strong leaders that kept the companies "focused"

- Dominated their local geography as employers

- Tended to talk a lot about their past, and how what they've previously accomplished

- Tended to ignore competitors

- Avoided Disruptions – late to market with every product. Tried using marketing and money to succeed rather than being first with great products and solutions

- Never allowed White Space to develop anything new

This joint venture is not White Space. Microsoft may want to be in Search and ad sales, but the company is still relying on its old business to "carry it through." They have ignored Google and other competitors, and are trying to use the old Success Formula to compete with a much nimbler and more market-attuned competitor. They have ignored Disruptive innovations, and not developed any new solutions themselves. They have refused to allow White Space to develop new solutions for shifting market needs – instead trying to push the market to buy their solutions based on old ways of doing business. Don't forget that MSN and it's search engine have been in the market since the beginning – it's not like they just woke up to discover the market existed. Rather, they just started hinting that maybe, after 15 years of failing, they aren't doing the right things.

If you still own Microsoft stock, I predict a really bumpy ride. They won't go bankrupt soon. But GM spent 30 years going sideways for investors before finally going bankrupt. That looks like the future at Microsoft. If you're a vendor, expect poor returns to create a procurement environment intending to suck all profits out of your business. If you're a customer, expect "me too" products that are late, expensive and at best "lowest common denominator" in appearance and performance. If you're an employee, expect increased turnover, lot of infighting, increased internal politics, promotions based on reinforcing the status quo rather than results, and few opportunities for personal growth.

Employees, vendors and investors of Microsoft should read the free ebook "The Fall of GM: What Went Wrong and How To Avoid Its Mistakes." Everyone who has to deal with shifting markets needs to.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.