by Adam Hartung | Apr 25, 2018 | Entertainment, Film, Innovation, Investing, Retail

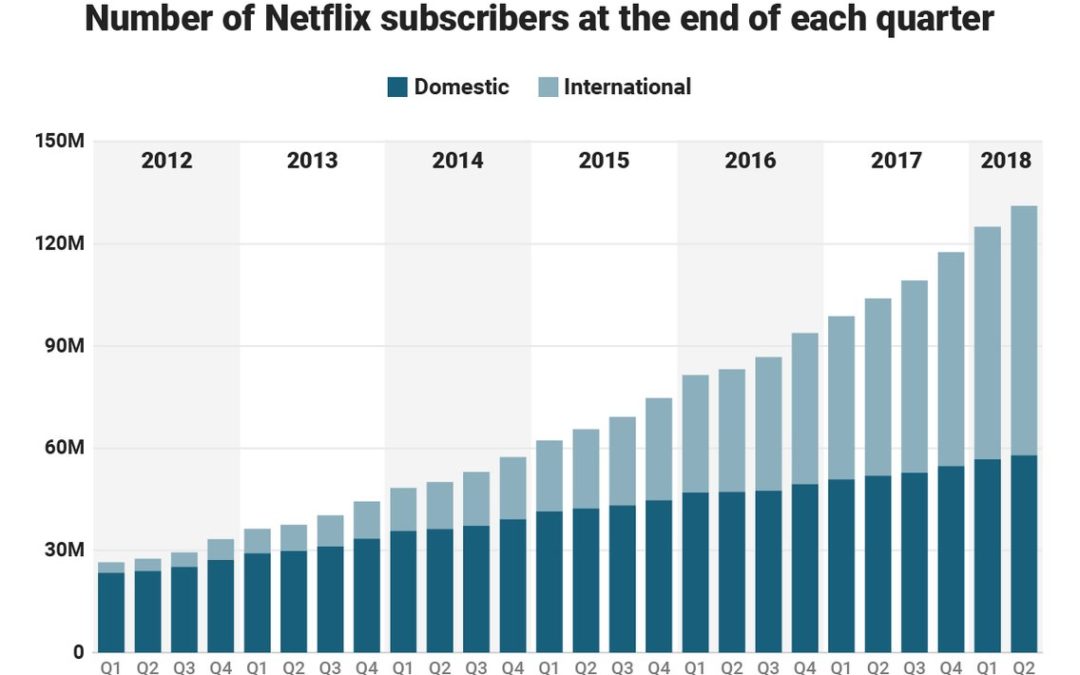

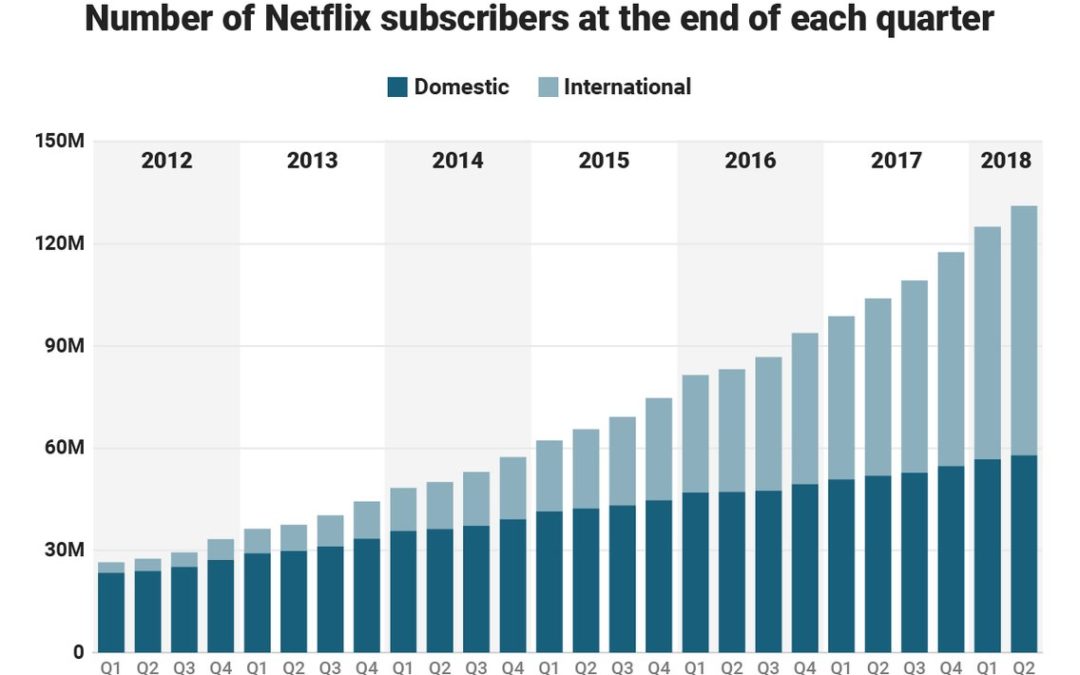

Netflix announced new subscriber numbers last week – and it exceeded expectations. Netflix now has over 130 million worldwide subscribers. This is up 480% in just the last 6 years – from under 30 million. Yes, the USA has grown substantially, more than doubling during this timeframe. But international growth has been spectacular, growing from almost nothing to 57% of total revenues. International growth the last year was 70%, and the contribution margin on international revenues has transitioned from negative in 2016 to over 15% – double the 4th quarter of 2017.

Accomplishing this is a remarkable story. Most companies grow by doing more of the same. Think of Walmart that kept adding stores. Then adding spin-off store brand Sam’s Club. Then adding groceries to the stores. Walmart never changed its strategy, leaders just did “more” with the old strategy. That’s how most people grow, by figuring out ways to make the Value Delivery System (in their case retail stores, warehouses and trucks) do more, better, faster, cheaper. Walmart never changed its strategy.

But Netflix is a very different story. The company started out distributing VHS tapes, and later DVDs, to homes via USPS, UPS and Fedex. It was competing with Blockbuster, Hollywood Video, Family Video and other traditional video stores. It won that battle, driving all of them to bankruptcy. But then to grow more Netflix invested far outside its “core” distribution skills and pioneered video streaming, competing with companies like DirecTV and Comcast. Eventually Netflix leaders raised prices on physical video distribution, cannibalizing that business, to raise money for investing in streaming technology. Streaming technology, however, was not enough to keep growing subscribers. Netflix leadership turned to creating its own content, competing with moviemakers, television and documentary producers, and broadcast television. The company now spends over $6B annually on content.

Think about those decisions. Netflix “pivoted” its strategy 3 times in one decade. Its “core” skill for growth changed from physical product distribution to network technology to content creation. From a “skills” perspective none of these have anything in common.

Could you do that? Would you do that?

How did Netflix do that? By focusing on its Value Proposition. By realizing that it’s Value Proposition was “delivering entertainment” Netflix realized it had to change its skill set 3 times to compete with market shifts. Had Netflix not done so, its physical distribution would have declined due to the emergence of Amazon.com, and eventually disappeared along with tapes and DVDs. Netflix would have followed Blockbuster into history. And as bandwidth expanded, and global networks grew, and dozens of providers emerged streaming purchased content profits would have become a bloodbath. Broadcasters who had vast libraries of content would sell to the cheapest streaming company, stripping Netflix of its growth. To continue growing, Netflix had to look at where markets were headed and redirect the company’s investments into its own content.

This is not how most companies do strategy. Most try to figure out one thing they are good at, then optimize it. They examine their Value Delivery System, focus all their attention on it, and entirely lose track of their Value Proposition. They keep optimizing the old Value Delivery System long after the market has shifted. For example, Walmart was the “low cost retailer.” But e-commerce allows competitors like Amazon.com to compete without stores, without advertising and frequently without inventory (using digital storefronts to other people’s inventory.) Walmart leaders were so focused on optimizing the Value Delivery System, and denying the potential impact of e-commerce, that they did not see how a different Value Delivery System could better fulfill the initial Walmart Value Proposition of “low cost.” The Walmart strategy never took a pivot – and now they are far, far behind the leader, and rapidly becoming obsolete.

Do you know your Value Proposition? Is it clear – written on the wall somewhere? Or long ago did you stop thinking about your Value Proposition in order to focus your intention on optimizing your Value Delivery System?

That fundamental strategy flaw is killing companies right and left – Radio Shack, Toys-R-Us and dozens of other retailers. Who needs maps when you have smartphone navigation? Smartphones put an end to Rand McNally. Who needs an expensive watch when your phone has time and so much more? Apple Watch sales in 2017 exceeded the entire Swiss watch industry. Who needs CDs when you can stream music? Sony sales and profits were gutted when iPods and iPhones changed the personal entertainment industry. (Anyone remember “boom boxes” and “Walkman”?)

I’ve been a huge fan of Netflix. In 2010, I predicted it was the next Apple or Google. When the company shifted strategy from delivering physical entertainment to streaming in 2011, and the stock tanked, I made the case for buying the stock. In 2015 when the company let investors know it was dumping billions into programming I again said it was strategically right, and recommended Netflix as a good investment. And I redoubled my praise for leadership when the “double pivot” to programming was picking up steam in 2016. You don’t have to be mystical to recognize a winner like Netflix, you just have to realize the company is using its strategy to deliver on its Value Proposition, and is willing to change its Value Delivery System because “core strength” isn’t important when its time to change in order to meet new market needs.

by Adam Hartung | Mar 9, 2015 | Current Affairs, In the Rapids, Leadership, Television

The Netflix hit series “House of Cards” was released last night. Most media reviewers and analysts are expecting huge numbers of fans will watch the show, given its tremendous popularity the last 2 years. Simultaneously, there are already skeptics who think that releasing all episodes at once “is so last year” when it was a newsworthy event, and no longer will interest viewers, or generate subscribers, as it once did. Coupled with possible subscriber churn, some think that “House of Cards” may have played out its hand.

So, the success of this series may have a measurable impact on the valuation of Netflix. If the “House of Cards” download numbers, which are up to Netflix to report, aren’t what analysts forecast many may scream for the stock to tumble; especially since it is on the verge of reaching new all-time highs. The Netflix price to earnings (P/E) multiple is a lofty 107, and with a valuation of almost $29B it sells for just under 4x sales.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

Since Netflix started trading in 2002, it has risen from (all numbers adjusted) $8.5 to $485. That is a whopping 57x increase. That is approximately a 40% compounded rate of return, year after year, for 13 years!

But it has not been a smooth ride. After starting (all numbers rounded for easier reading) at $8.50 in May, 2002 the stock dropped to $3.25 in October – a loss of over 60% in just 5 months. But then it rallied, growing to $38.75, a whopping 12x jump, in just 14 months (1/04!) Only to fall back to $9.80, a 75% loss, by October, 2004 – a mere 9 months later. From there Netflix grew in value by about 5.5x – to $55/share – over the next 5 years (1/10.) When it proceeded to explode in value again, jumping to $295, an almost 6-fold increase, within 18 months (7/11). Only to get creamed, losing almost 80% of its value, back down to $63.85, in the next 4 months (11/11.) The next year it regained some loss, improving in value by 50% to $91.35 (12/12,) only to again explode upward to $445 by February, 2014 a nearly 5-fold increase, in 14 months. Two months later, a drop of 25% to $322 (4/14). But then in 4 months back up to $440 (8/14), and back down 4 months later to $341 (12/14) only to approach new highs reaching $480 last week – just 2 months later.

That is the definition of volatility.

Netflix is a disruptive innovator. And, simply put, stock analysts don’t know how to value disruptive innovators. Because their focus is all on historical numbers, and then projecting those historicals forward. As a result, analysts are heavily biased toward expecting incumbents to do well, and simultaneously being highly skeptical of any disruptive company. Disruptors challenge the old order, and invalidate the giant excel models which analysts create. Thus analysts are very prone to saying that incumbents will remain in charge, and that incumbents will overwhelm any smaller company trying to change the industry model. It is their bias, and they use all kinds of historical numbers to explain why the bigger, older company will project forward well, while the smaller, newer company will stumble and be overwhelmed by the entrenched competitor.

And that leads to volatility. As each quarter and year comes along, analysts make radically different assumptions about the business model they don’t understand, which is the disruptor. Constantly changing their assumptions about the newer kid on the block, they make mistake after mistake with their projections and generally caution people not to buy the disruptor’s stock. And, should the disruptor at any time not meet the expectations that these analysts invented, then they scream for shareholders to dump their holdings.

Netflix first competed in distribution of VHS tapes and DVDs. Netflix sent them to people’s homes, with no time limit on how long folks could keep them. This model was radically different from market leader Blockbuster Video, so analysts said Blockbuster would crush Netflix, which would never grow. Wrong. Not only did Blockbuster grow, but it eventually drove Blockbuster into bankruptcy because it was attuned to trends for convenience and shopping from home.

As it entered streaming video, analysts did not understand the model and predicted Netflix would cannibalize its historical, core DVD business thus undermining its own economics. And, further, much larger Amazon would kill Netflix in streaming. Analysts screamed to dump the stock, and folks did. Wrong. Netflix discovered it was a good outlet for syndication, created a huge library of not only movies but television programs, and grew much faster and more profitably than Amazon in streaming.

Then Netflix turned to original programming. Again, analysts said this would be a huge investment that would kill the company’s financials. And besides that people already had original programming from historical market leaders HBO and Showtime. Wrong. By using analysis of what people liked from its archive, Netflix leadership hedged its bets and its original shows, especially “House of Cards” have been big hits that brought in more subscribers. HBO and Showtime, which have depended on cable companies to distribute their programming, are now increasingly becoming additional programming on the Netflix distribution channel.

Investors should own Netflix because the company’s leadership, including CEO Reed Hastings, are great at disruptive innovation. They identify unmet customer needs and then fulfill those needs. Netflix time and again has demonstrated it can figure out a better way to give certain user segments what they want, and then expand their offering to eat away at the traditional market. Once it was retail movie distribution, increasingly it is becoming cable distribution via companies like ComCast, AT&T and Time Warner.

And investors must be long-term. Netflix is an example of why trading is a bad idea – unless you do it for a living. Most of us who have full time day jobs cannot try timing the ups and downs of stock movements. For us, it is better to buy and hold. When you’re ready to buy, buy. Don’t wait, because in the short term there is no way to predict if a stock will go up or down. You have to buy because you are ready to invest, and you expect that over the next 3, 5, 7 years this company will continue to drive growth in revenues and profits, thus expanding its valuation.

Netflix, like Apple, is a company that has mastered the skills of disruptive innovation. While the competition is trying to figure out how to sustain its historical position by doing the same thing better, faster and cheaper Netflix is figuring out “the next big thing” and then delivering it. As the market shifts, Netflix is there delivering on trends with new products – and new business models – which push revenues and profits higher.

That’s why it would have been smart to buy Netflix any time the last 13 years and simply held it. And odds are it will continue to drive higher valuations for investors for many years to come. Not only are HBO, Showtime and Comcast in its sites, but the broadcast networks (ABC, CBS, NBC) are not far behind. It’s a very big media market, which is shifting dramatically, and Netflix is clearly the leader. Not unlike Apple has been in personal technology.

by Adam Hartung | Nov 22, 2013 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Television

Do you really think in 2020 you’ll watch television the way people did in the 1960s? I would doubt it.

In today’s world if you want entertainment you have a plethora of ways to download or live stream exactly what you want, when you want, from companies like Netflix, Hulu, Pandora, Spotify, Streamhunter, Viewster and TVWeb. Why would you even want someone else to program you entertainment if you can get it yourself?

Additionally, we increasingly live in a world unaccepting of one-way communication. We want to not only receive what entertains us, but share it with others, comment on it and give real-time feedback. The days when we willingly accepted having information thrust at us are quickly dissipating as we demand interactivity with what comes across our screen – regardless of size.

These 2 big trends (what I want, when I want; and 2-way over 1-way) have already changed the way we accept entertaining. We use USB drives and smartphones to provide static information. DVDs are nearly obsolete. And we demand 24×7 mobile for everything dynamic.

Yet, the CEO of Charter Cable company wass surprised to learn that the growth in cable-only customers is greater than the growth of video customers. Really?

It was about 3 years ago when my college son said he needed broadband access to his apartment, but he didn’t want any TV. He commented that he and his 3 roommates didn’t have any televisions any more. They watched entertainment and gamed on screens around his apartment connected to various devices. He never watched live TV. Instead they downloaded their favorite programs to watch between (or along with) gaming sessions, picked up the news from live web sites (more current and accurate he said) and for sports they either bought live streams or went to a local bar.

To save money he contacted Comcast and said he wanted the premier internet broadband service. Even business-level service. But he didn’t want TV. Comcast told him it was impossible. If he wanted internet he had to buy TV. “That’s really, really stupid” was the way he explained it to me. “Why do I have to buy something I don’t want at all to get what I really, really want?”

Then, last year, I helped a friend move. As a favor I volunteered to return her cable box to Comcast, since there was a facility near my home. I dreaded my volunteerism when I arrived at Comcast, because there were about 30 people in line. But, I was committed, so I waited.

The next half-hour was amazingly instructive. One after another people walked up to the window and said they were having problems paying their bills, or that they had trouble with their devices, or wanted a change in service. And one after the other they said “I don’t really want TV, just internet, so how cheaply can I get it?”

These were not busy college students, or sophisticated managers. These were every day people, most of whom were having some sort of trouble coming up with the monthly money for their Comcast bill. They didn’t mind handing back the cable box with TV service, but they were loath to give up broadband internet access.

Again and again I listened as the patient Comcast people explained that internet-only service was not available in Chicagoland. People had to buy a TV package to obtain broad-band internet. It was force-feeding a product people really didn’t want. Sort of like making them buy an entree in order to buy desert.

As I retold this story my friends told me several stories about people who banned together in apartments to buy one Comcast service. They would buy a high-powered router, maybe with sub-routers, and spread that signal across several apartments. Sometimes this was done in dense housing divisions and condos. These folks cut the cost for internet to a fraction of what Comcast charged, and were happy to live without “TV.”

But that is just the beginning of the market shift which will likely gut cable companies. These customers will eventually hunt down internet service from an alternative supplier, like the old phone company or AT&T. Some will give up on old screens, and just use their mobile device, abandoning large monitors. Some will power entertainment to their larger screens (or speakers) by mobile bluetooth, or by turning their mobile device into a “hotspot.”

And, eventually, we will all have wireless for free – or nearly so. Google has started running fiber cable in cities including Austin, TX, Kansas City, MO and Provo, Utah. Anyone who doesn’t see this becoming city-wide wireless has their eyes very tightly closed. From Albuquerque, NM to Ponca City, OK to Mountain View, CA (courtesy of Google) cities already have free city-wide wireless broadband. And bigger cities like Los Angeles and Chicago are trying to set up free wireless infrastructure.

And if the USA ever invests in another big “public works infrastructure” program will it be to rebuild the old bridges and roads? Or is it inevitable that someone will push through a national bill to connect everyone wirelessly – like we did to build highways and the first broadcast TV.

So, what will Charter and Comcast sell customers then?

It is very, very easy today to end up with a $300/month bill from a major cable provider. Install 3 HD (high definition) sets in your home, buy into the premium movie packages, perhaps one sports network and high speed internet and before you know it you’ve agreed to spend more on cable service than you do on home insurance. Or your car payment. Once customers have the ability to bypass that “cable cost” the incentive is already intensive to “cut the cord” and set that supplier free.

Yet, the cable companies really don’t seem to see it. They remain unimpressed at how much customers dislike their service. And respond very slowly despite how much customers complain about slow internet speeds. And even worse, customer incredulous outcries when the cable company slows down access (or cuts it) to streaming entertainment or video downloads are left unheeded.

Cable companies say the problem is “content.” So they want better “programming.” And Comcast has gone so far as to buy NBC/Universal so they can spend a LOT more money on programming. Even as advertising dollars are dropping faster than the market share of old-fashioned broadcast channels.

Blaming content flies in the face of the major trends. There is no shortage of content today. We can find all the content we want globally, from millions of web sites. For entertainment we have thousands of options, from shows and movies we can buy to what is for free (don’t forget the hours of fun on YouTube!)

It’s not “quality programming” which cable needs. That just reflects industry deafness to the roar of a market shift. In short order, cable companies will lack a reason to exist. Like land-line phones, Philco radios and those old TV antennas outside, there simply won’t be a need for cable boxes in your home.

Too often business leaders become deaf to big trends. They are so busy executing on an old success formula, looking for reasons to defend & extend it, that they fail to evaluate its relevancy. Rather than listen to market shifts, and embrace the need for change, they turn a deaf ear and keep doing what they’ve always done – a little better, with a little more of the same product (do you really want 650 cable channels?,) perhaps a little faster and always seeking a way to do it cheaper – even if the monthly bill somehow keeps going up.

But execution makes no difference when you’re basic value proposition becomes obsolete. And that’s how companies end up like Kodak, Smith-Corona, Blackberry, Hostess, Continental Bus Lines and pretty soon Charter and Comcast.

by Adam Hartung | Sep 19, 2013 | Current Affairs, In the Swamp, Innovation, Leadership, Television, Web/Tech

Apple announced the new iPhones recently. And mostly, nobody cared.

Remember when users waited anxiously for new products from Apple? Even the media became addicted to a new round of Apple products every few months. Apple announcements seemed a sure-fire way to excite folks with new possibilities for getting things done in a fast changing world.

But the new iPhones, and the underlying new iPhone software called iOS7, has almost nobody excited.

Instead of the product launches speaking for themselves, the CEO (Tim Cook) and his top product development lieutenants (Jony Ive and Craig Federighi) have been making the media rounds at BloombergBusinessWeek and USAToday telling us that Apple is still a really innovative place. Unfortunately, their words aren't that convincing. Not nearly as convincing as former product launches.

CEO Cook is trying to convince us that Apple's big loss of market share should not be troubling. iPhone owners still use their smartphones more than Android owners, and that's all we should care about. Unfortunately, Apple profits come from unit sales (and app sales) rather than minutes used. So the chronic share loss is quite concerning.

Especially since unit sales are now growing barely in single digits, and revenue growth quarter-over-quarter, which sailed through 2012 in the 50-75% range, have suddenly gone completely flat (less than 1% last quarter.) And margins have plunged from nearly 50% to about 35% – more like 2009 (and briefly in 2010) than what investors had grown accustomed to during Apple's great value rise. The numbers do not align with executive optimism.

For industry aficianados iOS7 is a big deal. Forbes Haydn Shaughnessy does a great job of laying out why Apple will benefit from giving its ecosystem of suppliers a new operating system on which to build enhanced features and functionality. Such product updates will keep many developers writing for the iOS devices, and keep the battle tight with Samsung and others using Google's Android OS while making it ever more difficult for Microsoft to gain Windows8 traction in mobile.

And that is good for Apple. It insures ongoing sales, and ongoing profits. In the slog-through-the-tech-trench-warfare Apple is continuing to bring new guns to the battle, making sure it doesn't get blown up.

But that isn't why Apple became the most valuable publicly traded company in America.

We became addicted to a company that brought us things which were great, even when we didn't know we wanted them – much less think we needed them. We were happy with CDs and Walkmen until we discovered much smaller, lighter iPods and 99cent iTunes. We were happy with our Blackberries until we learned the great benefits of apps, and all the things we could do with a simple smartphone. We were happy working on laptops until we discovered smaller, lighter tablets could accomplish almost everything we couldn't do on our iPhone, while keeping us 24×7 connected to the cloud (that we didn't even know or care about before,) allowing us to leave the laptop at the office.

Now we hear about upgrades. A better operating system (sort of sounds like Microsoft talking, to be honest.) Great for hard core techies, but what do users care? A better Siri; which we aren't yet sure we really like, or trust. A new fingerprint reader which may be better security, but leaves us wondering if it will have Siri-like problems actually working. New cheaper color cases – which don't matter at all unless you are trying to downgrade your product (sounds sort of like P&G trying to convince us that cheaper, less good "Basic" Bounty was an innovation.)

More (upgrades) Better (voice interface, camera capability, security) and Cheaper (plastic cases) is not innovation. It is defending and extending your past success. There's nothing wrong with that, but it doesn't excite us. And it doesn't make your brand something people can't live without. And, while it keeps the battle for sales going, it doesn't grow your margin, or dramatically grow your sales (it has declining marginal returns, in fact.)

And it won't get your stock price from $450-$475/share back to $700.

We all know what we want from Apple. We long for the days when the old CEO would have said "You like Google Glass? Look at this……. This will change the way you work forever!!"

We've been waiting for an Apple TV that let's us bypass clunky remote controls, rapidly find favorite shows and helps us avoid unwanted ads and clutter. But we've been getting a tease of Dick Tracy-esque smart watches.

From the world's #1 tech brand (in market cap – and probably user opinion) we want something disruptive! Something that changes the game on old companies we less than love like Comcast and DirecTV. Something that helps us get rid of annoying problems like expensive and bad electric service, or routers in our basements and bedrooms, or navigation devices in our cars, or thumb drives hooked up to our flat screen TVs —- or doctor visits. We want something Game Changing!

Apple's new CEO seems to be great at the Sustaining Innovation game. And that pretty much assures Apple of at least a few more years of nicely profitable sales. But it won't keep Apple on top of the tech, or market cap, heap. For that Apple needs to bring the market something big. We've waited 2 years, which is an eternity in tech and financial markets. If something doesn't happen soon, Apple investors deserve to be worried, and wary.

by Adam Hartung | Dec 10, 2012 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television

Remember when almost everyone read a daily newspaper?

Newspaper readership peaked around 2000. Since then printed media has declined, as readers shifted on-line. Magazines have folded, and newspapers have disappeared, quit printing, dramatically cut page numbers and even more dramatically cut staff.

Amazingly, almost no major print publisher prepared for this, even though the trend was becoming clear in the late 1990s.

Newspapers are no longer a viable business. While industry revenue grew for

almost 2 centuries, it collapsed in a mere decade.

Chart Source: BusinessInsider.com

This market shift created clear winners, and losers. On-line news sites like Marketwatch and HuffingtonPost were clear winners. Losers were traditional newspaper companies such as Tribune Corporation, Gannett, McClatchey, Dow Jones and even the New York Times Company. And investors in these companies either saw their values soar, or practically disintegrate.

In 2012 it is equally clear that television is on the brink of a major transition. Fewer people are content to have their entertainment programmed for them when they can program it themselves on-line. Even though the number of television channels has exploded with pervasive cable access, the time spent watching television is not growing. While simultaneously the amount of time people spend looking at mobile internet displays (tablets, smartphones and laptops) is growing at double digit rates.

Chart Source: Silicone Alley Insider Chart of the Day 12/5/12

It would be easy to act like newspaper defenders and pretend that television as we've known it will not change. But that would be, at best, naive. Just look around at broadband access, the use of mobile devices, the convenience of mobile and the number of people that don't even watch traditional TV any more (especially younger people) and the trend is clear. One-way preprogrammed advertising laden television is not a sustainable business.

So, now is the time to prepare. And change your business to align with impending new realities.

Losers, and winners, will be varied – and not entirely obvious. Firstly, a look at those trying to maintain the status quo, and likely to lose the most.

Giant consumer goods and retail companies benefitted from the domination of television. Only huge companies like P&G, Kraft, GM and Target could afford to lay out billions of dollars for television ads to build, and defend, a brand. But what advantage will they have when TV budgets no longer control brand building? They will become extremely vulnerable to more innovative companies that have better products and move on fast lifecycles. Their size, hierarchy and arcane business practices will lead to huge problems. Imagine a raft of new Hostess Brands experiences.

Even as the trends have started changing these companies have continued pumping billions into the traditional TV networks as they spend to defend their brand position. This has driven up the value of companies like CBS, Comcast (owns NBC) and Disney (owns ABC) over the last 3 years substantially. But don't expect that to last forever. Or even a few more years.

Just like newspaper ad spending fell off a cliff when it was clear the eyeballs were no longer there, expect the same for television ad spending. As giant advertisers find the cost of television harder and harder to justify their outlays will eventually take the kind of cliff dive observed in the chart (above) for newspaper advertising. Already some consumer goods and ad agency executives are alluding to the fact that the rate of return on traditional TV is becoming sketchy.

So far, we've seen little at the companies which own TV networks to demonstrate they are prepared for the floor to fall out of their revenue stream. While some have positions in a few internet production and delivery companies, most are clearly still doing their best to defend & extend the old business – just like newspaper owners did. Just as newspapers never found a way to replace the print ad dollars, these television companies look very much like businesses that have no apparent solution for future growth. I would not want my 401K invested in any major network company.

And there will be winners.

For smaller businesses, there has never been a better time to compete. A company as small as Tesla or Fisker can now create a brand on-line at a fraction of the old cost. And that brand can be as powerful as Ford, and potentially a lot more trendy. There are very low entry barriers for on-line brand building using not only ad words and web page display ads, but also using social media to build loyal followers who use and promote a brand. What was once considered a niche can become well known almost overnight simply by applying the new dynamics of reaching customers on-line, and increasingly via mobile. Look at the success of Toms Shoes.

Zappos and Amazon have shown that with almost no television ads they can create powerhouse retail brands. The new retailers do not compete just on price, but are able to offer selection, availability and customer service at levels unachievable by traditional brick-and-mortar retailers. They can suggest products and prices of things you're likely to need, even before you realize you need them. They can educate better, and faster, than most retail store employees. And they can offer great prices due to less overhead, along with the convenience of shipping the product right into your home.

And as people quit watching preprogrammed TV, where will they go for content? Anybody streaming will have an advantage – so think Netflix (which recently contracted for all the Disney content,) Amazon, Pandora, Spotify and even AOL. But, this will also benefit those companies providing content access such as Apple TV, Google TV, YouTube (owned by Google) to offer content channels and the increasingly omnipresent Facebook will deliver up not only friends, but content — and ads.

As for content creation, the deep pockets of traditional TV production companies will likely disappear along with their ability to control distribution. That means fewer big-budget productions as risk goes up without revenue assurances.

But that means even more ability for newer, smaller companies to create competitive content seeking audiences. Where once a very clever, hard working Seth McFarlane (creator of Family Guy) had to hardscrabble with networks to achieve distribution, and live in fear of a single person controlling his destiny, in the future these creative people will be able to own their content and capture the value directly as they build a direct audience. A phenomenon like George Lucas will be more achievable than ever before as what might look like chaos during transition will migrate to a much more competitive world where audiences, rather than network executives, will decide what content wins – and loses.

So, with due respects to Don McLean, will today be the day TV Died? We will only know in historical context. Nobody predicted newspapers had peaked in 2000, but it was clear the internet was changing news consumption behavior. And we don't know if TV viewership will begin its rapid decline in 2013, or in a couple more years. But the inevitable change is clear – we just don't know exactly when.

So it would be foolish to not think that the industry is going to change dramatically. And the impact on advertising will be even more profound, much more profound, than it was in print. And that will have an even more profound impact on American society – and how business is done.

What are you doing to prepare?